As Filed with the Securities and Exchange Commission on April 24, 2015

1933 Act File No. 002-21600

1940 Act File No. 811-01209

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

[

|

X

|

]

|

||

|

Pre-Effective Amendment No.

|

[

|

]

|

|||

|

Post-Effective Amendment No.

|

69

|

[

|

X

|

]

|

|

and/or

|

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

|

[

|

X

|

]

|

||

|

Amendment No.

|

55

|

[

|

X

|

]

|

|

(Check appropriate box or boxes.)

BRIDGES INVESTMENT FUND, INC.

(Exact name of Registrant as Specified in Charter)

8401 West Dodge Road, 256 Durham Plaza

Omaha, Nebraska 68114

(Address of Principal Executive Office) (Zip Code)

(402) 397-4700

Registrant’s Telephone Number, including Area Code

Edson L. Bridges III

8401 West Dodge Road, 256 Durham Plaza

Omaha, Nebraska 68114

(Name and Address of Agent for Service)

Copy to:

|

Dennis Fogland, Esq.

|

|

Baird Holm LLP

|

|

1500 Woodmen Tower

|

|

Omaha, Nebraska 68102

|

It is proposed that this filing will become effective (check appropriate box)

|

[

|

]

|

immediately upon filing pursuant to paragraph (b)

|

|

|

[

|

X

|

]

|

on April 30, 2015 pursuant to paragraph (b)

|

|

[

|

]

|

60 days after filing pursuant to paragraph (a)(1)

|

|

|

[

|

]

|

on (date) pursuant to paragraph (a)(1)

|

|

|

[

|

]

|

75 days after filing pursuant to paragraph (a)(2)

|

|

|

[

|

]

|

on (date) pursuant to paragraph (a)(2) of Rule 485.

|

If appropriate, check the following box:

|

[

|

]

|

This post-effective amendment designates a new effective date for a previously filed post- effective amendment.

|

Explanatory Note:

|

This post-effective amendment No. 69 to the Registration Statement of Bridges Investment Fund, Inc. (the “Fund”) is being filed for the purpose of adding the audited financial statements and certain related financial information for the fiscal year ended December 31, 2014. This Prospectus conforms to the Summary Prospectus Rule as set forth in 17 CFR Parts 230, 232, 239 and 274.

|

[BRIDGES INVESTMENT FUND, INC. LOGO]

Ticker: BRGIX

PROSPECTUS

April 30, 2015

Capital Stock

The primary investment objective of the Fund is long-term capital appreciation.

As with all mutual funds, these securities have not been approved or disapproved by the Securities and Exchange Commission, nor has the Commission passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

| Page No. | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 2 | |

| 2 | |

| 2 | |

| 3 | |

| 5 | |

| 5 | |

| 6 | |

| 6 | |

| 6 | |

| 6 | |

| 8 | |

| 9 | |

| 10 | |

| 10 | |

| 10 | |

| 11 | |

| 11 | |

| 11 | |

| 11 | |

| 12 | |

| 12 | |

| 12 | |

| 12 | |

| 15 | |

| 16 | |

| 16 | |

| 17 | |

| 17 | |

| 18 | |

| 18 | |

| 18 | |

| 18 |

SUMMARY SECTION

Investment Objective: Bridges Investment Fund, Inc. (the “Fund”) seeks long-term capital appreciation, with a secondary objective of generating a modest amount of current income.

Fees and Expenses of the Fund: This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees

(fees paid directly from your investment)

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price)

|

None

|

|

|

Maximum Deferred Sales Charge (Load) on Reinvested Dividends and other Distributions

|

None

|

|

|

Redemption Fee (as a percentage of amount redeemed)

|

None

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

Management Fees

|

0.50%

|

|

|

Distribution (12b-1) Fees

|

None

|

|

|

Other Expenses

|

0. 30 %

|

|

|

Acquired Fund Fees and Expenses(1)

|

0.02%

|

|

|

Total Annual Fund Operating Expenses(1)

|

0. 82 %

|

|

|

(1) Acquired Fund Fees and Expenses are indirect fees and expenses that funds incur from investing in the shares of other mutual funds. Please note that the amount of Total Annual Fund Operating Expenses shown in the above table may differ from the Ratio of Net Expenses to Average Net Assets included in the “Financial Highlights” section of the statutory prospectus which reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses.

|

||

Example: This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of these periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

$84

|

$262

|

$455

|

$1,014

|

Portfolio Turnover: The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 13.6 % of the average value of its portfolio.

Principal Investment Strategies of the Fund: The Fund seeks to achieve its investment objectives by investing primarily in a diversified portfolio of common stocks, which Fund management believes offers the potential for increased earnings and dividends over time. Normally, such equity securities will represent 60% or more of the Fund’s net assets. However, the overall asset allocation is set by Fund management’s determination of the most attractive risk adjusted return opportunities available in both equity and fixed income securities.

The equity investment approach of Bridges Investment Management, Inc. (“BIM” or the “Adviser”) emphasizes owning companies in the Fund which it believes offer the best potential for above-average, long-term capital appreciation. The Adviser’s equity investment process focuses on identifying companies which have accelerating revenues, earnings growth, strong dividend growth potential, free cash flow growth, expanding margins and strong balance sheets. Market capitalization or company size is a result of this investment approach rather than an active investment consideration. Historically, the Fund has primarily owned securities in larger companies, although at any time, the Fund may own securities in small, medium, or large size companies. The Fund may also invest in common stocks which the Adviser believes may be cyclically depressed or undervalued, and therefore, may offer potential for capital appreciation.

In pursuing these principal investment objectives, the Fund may invest up to 15% of its total assets in U.S. dollar-denominated securities of foreign issuers traded on U.S. exchanges, and up to 20% of its total assets in American Depositary Receipts (“ADRs”) traded on U.S. exchanges or in the U.S. over-the-counter market.

In addition, to generate current income, as part of its principal strategy, the Fund may acquire investment grade corporate bonds, debentures, U.S. Treasury bonds and notes, and preferred stocks. Historically, such fixed income securities have not constituted more than 40% of the market value of the Fund’s portfolio. Two considerations drive the Adviser’s maturity strategy with respect to fixed income securities. First, the Adviser will generally manage the weighted average life of the Fund’s fixed income portfolio given its perception of where value lies at any point in time on the yield curve. Second, the Adviser will manage the weighted average life of the Fund’s fixed income portfolio based on its intermediate to longer-term outlook for interest rates at any point in time.

The allocation of Fund investments among common stocks and other equity securities and bonds and other debt securities (including U.S. Treasury securities) is based on the Adviser’s judgments about the potential returns and risks of each class. The Adviser considers a number of factors when making these allocations, including economic conditions and monetary factors, inflation and interest levels and trends, and fundamental factors (such as price/earnings ratios or growth rates) of individual companies in which the Fund invests.

Principal Risks of Investing in the Fund: The risks associated with an investment in the Fund can increase during times of significant market volatility. There is the risk that you could lose all or a portion of your investment in the Fund. The following risks could affect the value of your investment:

Market Risk: The prices of the stocks in which the Fund invests may decline for a number of reasons such as changing economic, political or market conditions. The price declines may be steep, sudden and/or prolonged.

Interest Rate Risk: The market value of bonds and other debt securities generally declines when interest rates rise. This risk is greater for bonds with longer maturities.

Credit Risk: The risk of investments in bonds and debt securities whose issuers may not be able to make interest and principal payments. In turn, issuers’ inability to make payments may lower the credit quality of the security and lead to greater volatility in the price of the security.

Asset Allocation Risk: The risk that asset allocation to a particular strategy does not reflect actual market movement or the effect of economic conditions. The Fund’s performance may be affected by the Adviser’s ability to anticipate correctly the relative potential returns and risks of the types of assets in which the Fund invests.

Small and Medium Capitalization Risk: Investing in securities of small and medium capitalization companies may involve greater volatility than investing in larger and more established companies because small and medium capitalization companies can be subject to more abrupt or erratic share price changes than larger, more established companies.

Foreign Securities and ADR Risk: Investing in foreign issuer securities and ADRs may involve risks in addition to the risks in domestic investments, including less regulatory oversight and less publicly-available information, less stable governments and economies, and non-uniform accounting, auditing and financial reporting standards.

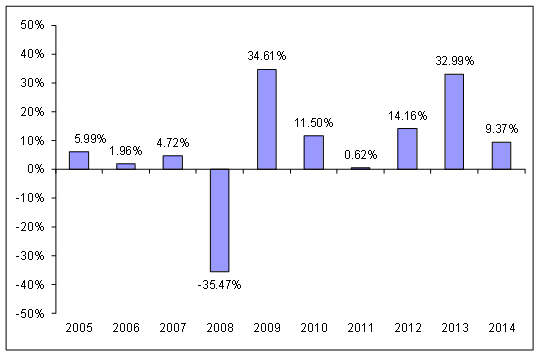

Performance: The following bar chart and table provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and how the Fund’s average annual returns over time compare with those of a broad measure of market performance, as well as indices that reflect the market sectors in which the Fund invests. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

Total Return for the Calendar Years Ended December 31

The Fund’s highest and lowest returns for a calendar quarter during the 10 year period shown on the bar chart are a return of 17.28% for the quarter ended June 30, 2009, and -23.33% for the quarter ended December 31, 2008.

Average Annual Total Returns

(for the periods ended December 31, 2014 )

|

Past One

Year

|

Past Five

Years

|

Past Ten

Years

|

|

|

Return Before Taxes

|

9.37%

|

13.25%

|

6.24%

|

|

Return After Taxes on Distributions

|

8.34%

|

12.76%

|

5.83%

|

|

Return After Taxes on Distributions and Sale of Fund Shares

|

6.12%

|

10.60%

|

5.02%

|

|

Russell 1000® Growth Index

(reflects no deduction for fees, expenses or taxes)

|

13.05%

|

15.81%

|

8.49%

|

|

S&P 500® Index

(reflects no deduction for fees, expenses or taxes)

|

13.69%

|

15.45%

|

7.67%

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”).

Management:

Investment Adviser: Bridges Investment Management, Inc. is the investment adviser for the Fund.

Portfolio Managers: Mr. Edson L. Bridges III, CFA, President and Chief Executive Officer of the Adviser, has served as the portfolio manager of the Fund since 1997. Mr. Brian M. Kirkpatrick, CFA, Senior Vice President, Director of Research, and Chief Compliance Officer of the Adviser, has served as a portfolio manager of the Fund since 2006.

Purchase and Sale of Fund Shares: Investors may purchase Fund shares by mail (Bridges Investment Fund, c/o U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, WI 53201-0701), or by telephone at 1-866-934-4700. You may redeem your shares of the Fund directly at any time by sending a letter of instruction signed by all account holders. Redemptions by telephone are permitted only if investors receive prior authorization. Transactions will only occur on days the New York Stock Exchange is open. Investors who wish to purchase or redeem Fund shares through a financial intermediary should contact the financial intermediary directly for information relative to the purchase or sale of Fund shares. The minimum initial amount of investment in the Fund is $1,000 for all accounts.

Tax Information: The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Such tax-deferred arrangements may be taxed later upon withdrawal of monies from those arrangements.

MORE INFORMATION ABOUT THE FUND’S PRINCIPAL

INVESTMENT STRATEGIES, INVESTMENT OBJECTIVES,

PRINCIPAL RISKS AND

DISCLOSURE OF PORTFOLIO HOLDINGS

PRINCIPAL INVESTMENT STRATEGIES AND INVESTMENT OBJECTIVES

Fund Objective

The Fund’s primary investment objective is long-term capital appreciation, with a secondary objective of generation of a modest amount of current income.

The Fund’s investment objective is not a fundamental policy and may be changed by the Fund’s Board of Directors without a shareholder vote upon prior written notice to Fund shareholders. However, the Fund’s objective has remained consistent since commencement of the Fund in 1963.

Bridges Investment Management, Inc. serves as the Fund’s investment adviser.

There is no assurance that the Fund will achieve its objectives.

Principal Investment Strategies

The Fund seeks to achieve its investment objectives by investing primarily in a diversified portfolio of common stocks, which Fund management believes offers the potential for increased earnings and dividends over time. Normally, such equity securities will represent 60% or more of the Fund’s net assets. However, the overall asset allocation is set by Fund management’s determination of the most attractive risk adjusted return opportunities available in both equity and fixed income securities. During the past five years, the total invested by the Fund in equity securities has been at least 90% in each year.

The Adviser’s equity investment approach emphasizes owning companies in the Fund which it believes offer the best potential for above-average, long-term capital appreciation. The Adviser’s

equity investment process focuses on identifying companies which have accelerating revenues, earnings growth, strong dividend growth potential, free cash flow growth, expanding margins and strong balance sheets. Market capitalization or company size is a result of this investment approach rather than an active investment consideration. Historically, the Fund has primarily owned securities in larger companies, although at any time, the Fund may own securities in small, medium, or large size companies. The Fund considers small companies to be those with market capitalizations under $1 billion, medium size companies to be those with market capitalizations of $1 billion to $5 billion, and large companies to be those with market capitalizations in excess of $5 billion. The Fund may also invest in common stocks which the Adviser believes may be cyclically depressed or undervalued, and therefore, may offer potential for capital appreciation.

In pursuing these principal investment objectives, the Fund may invest up to 15% of its total assets in U.S. dollar-denominated securities of foreign issuers traded on U.S. exchanges, and up to 20% of its total assets in ADRs traded on U.S. exchanges or in the U.S. over-the-counter market.

In addition, to generate current income, as part of its principal strategy, the Fund may acquire investment grade corporate bonds, debentures, U.S. Treasury bonds and notes, and preferred stocks. Historically, such fixed income securities have not constituted more than 40% of the market value of the Fund’s portfolio. Investment grade corporate bonds and preferred stocks are those securities which carry, at the time of purchase, a minimum rating of Baa from Moody’s Investors Service®, Inc. (“Moody’s”) or BBB from Standard & Poor’s® (“S&P”). During the past three years, the total invested by the Fund in debt and preferred stocks has been less than 5% in each year.

Two considerations drive the Adviser’s maturity strategy with respect to fixed income securities. First, the Adviser will generally manage the weighted average life of the Fund’s fixed income portfolio given its perception of where value lies at any point in time on the yield curve. Second, the Adviser will manage the weighted average life of the Fund’s fixed income portfolio based on its intermediate to longer-term outlook for interest rates at any point in time. Over time, the Fund’s weighted average maturity will usually range between 5 and 12 years, with a shorter average maturity reflecting a more conservative posture (i.e., interest rates are near trend low points and expected to rise) or, alternatively, a longer weighted average maturity reflecting a more constructive posture (i.e., interest rates are near trend high points and may be expected to decline). These fixed income policy decisions are made in response to assessments as to the future direction of interest rates.

Convertible debentures and convertible preferred stocks usually carry a rating that is below investment grade for fixed income securities. For the purpose of managing the Fund’s portfolio within the investment policy guidelines, these convertible securities are accorded the status of equities because they may be converted into common stock at the election of the holder. Accordingly, these assets do not fall within the Fund restrictions described in this section limiting the investment of Fund assets to normally no more than 40% in fixed income securities.

The allocation of Fund investments among common stocks and other equity securities and bonds and other debt securities (including U.S. Treasury securities) is based on the Adviser’s judgments about the potential returns and risks of each type of security. The Adviser considers a number of factors when making these allocations, including economic conditions and monetary factors, inflation and interest levels and trends, and fundamental factors (such as price/earnings ratios or growth rates) of individual companies in which the Fund invests.

Under unusual economic or financial market circumstances, the Fund may significantly increase the portion of Fund assets held in cash or U.S. government securities for temporary defensive purposes, and as a result, may not achieve its investment objectives. The Fund may maintain positions in cash or U.S. government securities (generally U.S. Treasury securities) for as long as such unusual market conditions exist, and the normal limitation that not more than 40% of the Fund’s assets be invested in fixed income securities will not apply. In addition, in such circumstances, the Fund may invest in certain exchange-traded funds, the performance of which is intended to correspond, either positively or negatively, to the performance of a designated benchmark index (such as the S&P 500 Index), as a hedge against market volatility and a significant market decrease or increase. If the Fund takes a temporary defensive position, it may not be able to meet the stated investment objectives.

Except for temporary defensive positions, Fund investments will be made with the expectation that the securities will be held for the long-term. The Adviser will not purchase securities with a view toward rapid turnover for capital gains. However, the Adviser may sell securities for short-term or long-term capital gains or losses if new information becomes available or changes in market conditions indicate that selling a security is advisable.

In addition to the investment objectives and policies disclosed above, the Fund adheres to certain other investment policy and selection restrictions which are set forth in the SAI.

PRINCIPAL RISKS OF INVESTING IN THE FUND

There are risks associated with an investment in the Fund. There is no assurance the Fund will achieve its investment objectives, and the Fund could lose money. It is important that investors closely review and understand these risks before investing in the Fund. These and other risks are described below.

Market Risk

The value of the Fund’s investments will vary from day-to-day and will reflect, to some degree, general market conditions, interest rates, and national and global political and economic conditions. The Fund’s performance will also be affected by the earnings of companies it invests in, as well as changes in market expectations of such earnings. In the short-term, stock prices and the value of the Fund can fluctuate significantly in response to these factors.

Interest Rate Risk

Fixed income securities are sensitive to changes in interest rates. Generally, the prices of fixed income securities will fall when interest rates rise and rise when interest rates fall. Longer maturity issues can be more sensitive to interest rate changes, meaning the longer the maturity of the issue, the greater the impact a change in interest rates could have on the issue’s price. In addition, short-term and long-term rates do not necessarily move in the same amount or in the same direction. Short-term issues tend to react to changes in short-term interest rates, and long-term issues tend to react to changes in long-term rates.

Credit Risk

The Fund could lose money if the issuer of a bond or other debt security held by the Fund is unable to meet its financial obligations or goes bankrupt. Credit risk applies to most debt issues but generally is not a factor for U.S. government securities. Adverse changes in the financial condition of an issuer could lower the credit quality of the security, leading to greater volatility in the price of that security.

Asset Allocation Risk

The Fund’s performance will also be affected by the Adviser’s ability to anticipate correctly the relative potential returns and risks of the types of assets in which the Fund invests. As an example, the Fund’s investment performance would suffer if a major portion of its assets were allocated to stocks during a market decline, and its relative investment performance would suffer to the extent that a smaller portion of the Fund’s assets were allocated to stocks during a period of rising stock market prices.

Small and Medium Capitalization Risk

Compared to large capitalization companies, small and medium capitalization companies are more likely to have more limited product lines, fewer capital resources, and more limited management depth. In addition, securities of small and medium capitalization companies are more likely to experience greater price volatility and sharper swings in market values, have limited market trading liquidity, which at times may make it more difficult to sell these securities, especially at prices the Adviser believes appropriate, and offer greater potential for losses.

Foreign Securities and ADR Risk

Investments in securities of foreign issuers and ADRs may involve risks which are in addition to those inherent in domestic investments. Foreign companies may not be subject to the same regulatory requirements of U.S. companies and, as a consequence, there may be less publicly available information about such companies. Also, foreign companies may not be subject to uniform accounting, auditing and financial reporting standards and requirements comparable to those applicable to U.S. companies. Foreign governments and foreign economies often are less stable than the U.S. Government and the U.S. economy.

The Fund discloses its complete portfolio holdings within 60 days of the most recent quarter end in its Annual Report and Semi-Annual Report to Fund shareholders and in the quarterly holdings report filed with the Securities and Exchange Commission (“SEC”) on Form N-Q. The Annual and Semi-Annual Reports are available by contacting the Fund c/o U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, Wisconsin, 53202 or on the Fund’s website at www.bridgesfund.com. In addition, the Fund discloses its quarter end holdings on its website at www.bridgesfund.com under “Fund Info” within 4 business days after the quarter end. The quarter end holdings for the Fund will remain posted on the Fund’s website until updated with the next quarter end’s holdings. Portfolio holdings information posted on the Fund’s website may be separately provided to any person commencing the day after it is first published on the website. A further description of the Fund’s policies and procedures with respect to the disclosure of the Fund’s portfolio securities is available in the Fund’s SAI.

MANAGEMENT OF THE FUND

Investment Adviser

Bridges Investment Management, Inc. provides investment services to the Fund and manages the investments of the Fund’s assets in a manner it believes is consistent with its investment objectives, policies, and restrictions. BIM renders portfolio investment securities advice to individuals, personal trusts, pension, and profit sharing accounts, IRA rollovers, charitable organizations and foundations, corporations, and other account classifications. BIM is located at 8401 West Dodge Road, 256 Durham Plaza, Omaha, Nebraska 68114.

BIM has served as the Fund’s investment adviser since April 2004 when it replaced an affiliated entity, Bridges Investment Counsel, Inc. (“BIC”), which managed the Fund since its inception in 1963. Edson L. Bridges III, who has been responsible for the day-to-day management of the Fund’s portfolio since April 11, 1997, is President of BIM.

Under an Investment Advisory Agreement (“Advisory Agreement”) between the Fund and BIM, the Fund pays BIM fees at an annualized rate of 0.50% of the Fund’s average net assets. In addition, the Fund pays BIM an annual fee not to exceed $42,000 for providing administrative services to the Fund. These fees are the only compensation received by BIM from the Fund. The annual fee may be adjusted from time-to-time by the Fund’s Board of Directors. Under its Advisory Agreement with the Fund, BIM pays, among other things, the costs of maintaining the registration of shares of the Fund under federal and applicable state securities laws.

A discussion regarding the basis for the Board of Director’s approval of the Advisory Agreement is available in the Fund’s Annual Report to shareholders for the year ended December 31, 2014 .

Portfolio Managers

Mr. Edson L. Bridges III, CFA, President, Chief Executive Officer and Chief Investment Officer of the Fund and President, Chief Executive Officer and director of BIM, is responsible for the day-to-day operation of the Fund’s portfolio. Mr. Bridges dedicates his professional efforts towards securities research and portfolio management for BIM and BIC. Mr. Bridges has been employed in these areas of responsibility for all clients, including the Fund, for more than 31 years.

Mr. Brian M. Kirkpatrick, CFA, Executive Vice President of the Fund and Senior Vice President, Director of Research, Chief Compliance Officer and director of BIM, is a portfolio manager of the Fund and is capable of assuming the role of lead portfolio manager in instances where his decisions would be needed. Mr. Kirkpatrick has served as the Vice President of the Fund for the past 16 years and has more than a 20-year career with BIC.

Investment selections made by BIM for the Fund are predicated upon research into general economic trends, studies of financial markets, and industry and company analyses. The firm obtains its security analysis information from several financial research organizations, which restrict the release of their reports primarily to institutional users such as banks, insurance companies, investment counselors, and trust companies.

The Fund’s SAI provides additional information about the Portfolio Managers’ compensation, other accounts managed by the Portfolio Managers and the Portfolio Managers’ ownership in the Fund.

FUND SHAREHOLDER INFORMATION

Capital Structure of Fund

The Fund’s capital structure consists of 100 million authorized shares (par value of $0.0001 per share). Of the 100 million shares authorized, 50 million shares are specifically designated as common shares for the Fund, and 50 million shares are reserved for issuance as additional series. The 50 million shares designated as Fund shares have equal rights as to voting, redemption, dividends, and liquidation, with cumulative voting for the election of directors. The Fund shares are redeemable on written demand of the holder and are transferable and have no preemptive or conversion rights and are not subject to assessment. Fractional shares have the same rights proportionately as full shares. The Fund is not authorized to issue any preferred stock or other senior securities.

Valuing Fund Shares

Shares of the Fund are purchased and redeemed at the net asset value (“NAV”) per share next determined following receipt of your order by the Fund or its authorized agent. The Fund calculates its NAV at the close of daily trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern time (3:00 p.m. Central time), each day the NYSE is open for trading. The NAV of the Fund is obtained by dividing the value of the Fund’s net assets by the total number of shares outstanding.

The calculation of the Fund’s net assets is based on the current market value for its portfolio securities. The Fund normally obtains market values for its securities from Interactive Data Corporation (“IDC”) which uses reported last sales prices, current market quotations or valuations from computerized “matrix” systems that derive values based on comparable securities. Securities for which IDC does not provide a market value, IDC provides a market value that in the judgment of the Adviser does not represent fair value, or the Adviser believes is stale, will be valued at fair value under procedures adopted by the Fund’s Board of Directors. Repurchase agreements, demand notes, and government and retail money-market funds shall be valued at amortized cost on the day of valuation, unless the Adviser determines that the use of amortized cost valuation on such day is not appropriate (in which case such instrument shall be valued at fair value under procedures adopted by the Fund’s Board of Directors).

Fair Value Pricing

The Fund will fair value a security pursuant to procedures developed by the Board of Directors when reliable market quotations are not readily available, the Fund’s pricing service does not provide a valuation, the Fund’s pricing service provides a valuation that in the judgment of the Adviser does not represent fair value or if a security’s value has been materially affected by events occurring after the close of the exchange or market on which the security is principally traded. The Fund may also fair value a security if the Fund or the Adviser believes that the market price is stale.

There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s NAV. In the case of fair valued portfolio securities, lack of information and uncertainty as to the significance of information may lead to a conclusion that a prior valuation is the best indication of a portfolio security’s present value. Fair valuations generally remain unchanged until new information becomes available. Consequently, changes in the fair valuation of portfolio securities may be less frequent and of greater magnitude than changes in the price of portfolio securities valued by an independent pricing service or based on market quotations.

INVESTING IN THE FUND

Account Options

The Fund has several account options available including:

|

·

|

Uniform Transfers (Gifts) to Minor accounts;

|

|

·

|

Accounts for individuals, corporations or partnerships;

|

|

·

|

SIMPLE IRAs;

|

|

·

|

Traditional IRAs;

|

|

·

|

Roth IRAs;

|

|

·

|

Coverdell Educational Savings Accounts; and

|

|

·

|

Simplified Employee Pension (“SEPs”).

|

Persons who have access to the Fund’s office in Omaha, Nebraska, may obtain the appropriate disclosure document, applicable forms or receive additional assistance regarding account options at that location, may visit the Fund’s website at www.bridgesfund.com, or may contact the Fund at 1-866-934-4700.

Minimum Investment

The Board of Directors of the Fund has established a minimum of $1,000 for an initial investment. The Fund, at its discretion, may waive this minimum. Once the minimum initial investment of $1,000 has been made, you may choose to use the Fund’s Automatic Investment Plan (described below) for subsequent investments.

Purchasing Shares

Shares of the Fund are purchased at the NAV per share next determined following the receipt of your order in proper form by the Fund or its authorized agent. Proper form means that your purchase is complete and contains all necessary information including supporting documentation (such as Account Applications, trust documents, beneficiary designations, proper signatures and signature guarantees where applicable, etc.) and is accompanied by sufficient funds to pay for your investment. Persons who have access to the Fund’s office in Omaha, Nebraska, may receive assistance regarding whether your purchase is in proper form at the location indicated below, or you may contact the Fund at 1-866-934-4700.

Nancy K. Dodge, Treasurer and CCO

8401 West Dodge Road

256 Durham Plaza

Omaha, Nebraska 68114

402-397-4700

E-mail to: fund@bridgesinv.com

By Mail:

Initial Purchases

To purchase Fund shares you must complete and sign the Account Application, which is sent with this Prospectus, or may be obtained from the offices of the Fund, from the Fund’s transfer agent, U.S. Bancorp Fund Services, LLC (the “Transfer Agent”), or on the Fund’s website at www.bridgesfund.com. Please review the Account Application for detailed information for executing and completing a purchase of shares of the Fund. The completed Account Application and a check made payable to Bridges Investment Fund, Inc. or other means of payment to the Fund should be sent to the Transfer Agent as indicated below:

|

By Mail

|

By Overnight Or Express Mail

|

||

|

Bridges Investment Fund, Inc.

c/o U.S. Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, WI 53201-0701

|

Bridges Investment Fund, Inc.

c/o U.S. Bancorp Fund Services, LLC

615 East Michigan Street, 3rd floor

Milwaukee, WI 53202

|

The Fund and the Transfer Agent do not consider the U.S. Postal Service or other independent delivery services to be its agents. Therefore, deposit in the mail or with such services, or receipt at the U.S. Bancorp Fund Services, LLC’s post office box of applications, purchase orders or redemption requests does not constitute receipt by the Transfer Agent of the Fund.

With respect to purchases of Fund shares, the following conditions will apply:

|

(1)

|

All of your purchases must be made in U.S. dollars, and the check(s) must be drawn on U.S. banks.

|

|

(2)

|

No third party checks will be accepted.

|

|

(3)

|

The Fund does not accept currency, money orders, U.S. Treasury checks, traveler’s checks, credit card checks or starter checks to purchase Fund shares.

|

|

(4)

|

If your purchase transaction is cancelled due to nonpayment, or your check does not clear, you will be held responsible for any loss the Fund or the Adviser incur and you will be subject to a returned check fee of $25. This $25 returned check fee will be redeemed from your account.

|

|

(5)

|

The Fund is unable to accept post dated checks or any conditional order or payment.

|

Subsequent Purchases

Subsequent investments may be made in the same manner as an initial purchase, but you need not include supporting documentation. There is no minimum amount required in order to make a subsequent investment in the Fund unless you enroll in the Automatic Investment Plan. When making a subsequent investment, use the return remittance portion of your statement, or indicate on the face of your check the name of the Fund, the exact title of the account, your address, and your Fund account number.

By Bank Wire Transfer:

Shares may be purchased by check or bank wire transfer. Wired funds must be received prior to 4:00 p.m. Eastern Time (3:00 p.m. Central Time) to receive that day’s NAV. The Fund and U.S. Bank, N.A. are not responsible for the consequences of delays resulting from the banking or Federal Reserve wire system, or from incomplete wiring instructions.

Initial Investment

To make an initial purchase by wire:

|

·

|

Call Bridges Investment Fund, Inc. at 1-866-934-4700 to make arrangements with a telephone service representative to submit your completed Account Application via mail, overnight delivery or facsimile.

|

|

·

|

Upon receipt of your Account Application, your account will be established and a service representative will contact you within 24 hours to provide an account number and wiring instructions.

|

|

·

|

You may then contact your bank to initiate the wire using the instructions you were given.

|

Subsequent Investments

Before sending your wire, please contact the Fund at 1-866-934-4700 to advise them of your intent to wire. This will ensure prompt and accurate credit upon receipt of your wire.

|

·

|

Contact your bank to initiate the wire using the following instructions:

|

U.S. Bank, N.A.

777 East Wisconsin Avenue

Milwaukee, WI 53202

ABA No. 075000022

For credit to U.S. Bancorp Fund Services, LLC

Account Number. 112-952-137

For further credit to the Bridges Investment Fund, Inc.

(Your name)

(Your account number)

|

·

|

Your bank may charge a fee for such service.

|

Purchase Through a Broker

You can purchase shares at the NAV through a broker that has a relationship with the Distributor. Quasar Distributors, LLC (“Quasar” or “Distributor”) will serve as the distributor of the Fund’s shares. The Distributor is located at 615 East Michigan Street, Milwaukee, WI 53202.

If you buy shares through a broker, the broker is responsible for forwarding your order to the Transfer Agent in a timely manner. If you place an order with a broker that has a relationship with the Distributor and/or the Fund by 3:00 p.m. (Central time) on a day when the NYSE is open for regular trading, you will receive that day’s price and be invested in the Fund that day. You may add to an account established through any broker either by contacting your broker or the Transfer Agent by using one of the methods above. Your broker may charge a fee for processing purchases of the Fund’s shares.

Automatic Investment Plan

The Fund’s Automatic Investment Plan is available to existing shareholders of the Fund or new shareholders that satisfy the Fund’s minimum initial investment of $1,000.

New shareholders electing to participate in the Fund’s Automatic Investment Plan should complete the Automatic Investment Plan section on the Account Application. Existing shareholders should contact the Fund to obtain instructions for adding this option to a previously established account. All participants will be required to provide a voided check to initiate an Automatic Investment Plan.

After the initial minimum investment is met, the minimum amount required for each subsequent investment under the Automatic Investment Plan is $100. In order to participate in the Automatic Investment Plan, your bank must be a member of the Automated Clearing House (“ACH”) network. You will be assessed a $25 fee if the automatic purchase cannot be made due to insufficient funds, stop payment, or for any other reason. You may terminate your participation in the Fund’s Automatic Investment Plan at any time by calling the Fund at 1-866-934-4700, by written instruction to the Fund, or by calling the Transfer Agent. Any request for termination must be received at least five days prior to the effective date of the next withdrawal. In addition, if you redeem your account in full, any Automatic Investment Plan currently in effect for the account will be terminated.

Persons who are accessible to the Fund’s office in Omaha, Nebraska, may receive assistance in setting up an Automatic Investment Plan at that location, or you may contact the Fund at 1-866-934-4700.

Inactivity Period

Under certain circumstances, your mutual fund account may be subject to state escheatment laws, and your account may be transferred to the appropriate state if the Fund cannot locate you, or in certain states, if no activity occurs in the account within the time period specified by law. The Fund and the Transfer Agent will not be liable to shareholders or their representatives for good faith compliance with the escheatment laws.

Additional Account Policies

To help government agencies fight the funding of terrorism and money laundering activities, federal law requires all financial institutions, including the Fund, to obtain, verify, and record information that identifies each person who opens an account. As requested on your Account Application, you must supply your name, date of birth, social security number, permanent street address and other information that will allow identification of persons opening an account. Mailing addresses containing only a P.O. Box will not be accepted. Federal law prohibits the Fund and other financial institutions from opening accounts unless the minimum identifying information described above is received, and the Fund can verify the identity of the new account owner. The Fund may be required to delay the opening of a new account, not open a new account, close an existing account or take other steps deemed reasonable if the Fund is unable to verify the identity of a person opening an account with the Fund. Please contact the Transfer Agent at 1-866-934-4700 if you need additional assistance when completing your application.

Keep in mind that if we do not verify the identity of a customer through reasonable means, the account will be rejected or the customer will not be allowed to perform a transaction in the account until such information is received. The Fund may also reserve the right to close the account within five business days if clarifying information/documentation is not received.

It is the policy of the Fund not to accept orders for Fund shares under circumstances or in amounts considered to be disadvantageous to existing shareholders, and the Fund reserves the right to suspend the offering of shares for a period of time. Account Applications will only be accepted from residents of states in which the Fund shares have been registered or otherwise qualified for offer and sale.

Shares of the Fund have not been registered for sale outside of the United States. The Fund generally does not sell shares to investors residing outside of the United States, even if they are United States citizens or lawful permanent residents, except to investors with United States military APO or FPO addresses.

Household Delivery of Shareholder Documents

In an effort to decrease costs, the Fund intends to reduce the number of duplicate prospectuses and Annual and Semi-Annual Reports you receive by sending only one copy of each to those addresses shared by two or more accounts and to shareholders we reasonably believe are from the same family or household. Once implemented, if you would like to discontinue householding for your accounts, please call the Fund toll-free at 1-866-934-4700 to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies thirty days after receiving your request. This policy does not apply to account statements.

SELLING SHARES OF THE FUND

You may redeem your shares of the Fund directly at any time by sending a letter of instruction signed by all account holders to:

Bridges Investment Fund, Inc.

c/o U.S. Bancorp Fund Services, LLC

P.O.Box 701

Milwaukee, Wisconsin 53201-0701.

Shares of the Fund will be redeemed at the NAV per share next determined following the receipt of your letter of instruction in proper form by the Fund or its authorized agent. Proper form means that your letter of instruction is complete, contains all necessary information including supporting documentation (additional documentation is required for the redemption of shares by corporations, financial intermediaries, fiduciaries, surviving joint owners, and shares held in retirement plan accounts) and has been signed by all account holders. Persons who have access to the Fund’s office in Omaha, Nebraska, may seek and receive assistance at that location to complete redemption transactions or you may contact the Fund at 1-866-934-4700.

Signature Guarantees

Signature guarantees, from either Medallion program members or non-Medallion program members, are required for all requests to redeem shares with a value of more than $50,000 or if the redemption proceeds are to be mailed to an address other than that shown in your account registration. A signature guarantee will also be required for the following:

|

·

|

If ownership is being changed on your account;

|

|

·

|

If redemption proceeds are payable or sent to any person, address or bank account not on record; and/or

|

|

·

|

If a change of address request has been received by the Transfer Agent within the last 30 calendar days.

|

The Fund and/or the Transfer Agent may require a signature guarantee in other instances based on the circumstances relative to the particular situation. Non-financial transactions including establishing or modifying certain services on an account may require a signature guarantee, signature verification from a Signature Validation Program member, or other acceptable form of authentication from a financial institution source. The Fund reserves the right to waive any signature requirement at its discretion.

Signature guarantees will generally be accepted from domestic banks, brokers, dealers, credit unions, national securities exchanges, registered securities associations, clearing agencies and savings associations, as well as participants in the New York Stock Exchange Medallion Signature Program and the Securities Transfer Agents Medallion Program (“STAMP”). The signature(s) should be in the name(s) of the stockholder as shown on the stock transfer records maintained by U.S. Bancorp Fund Services, LLC for the Fund. NOTARIZED SIGNATURES ARE NOT GUARANTEED SIGNATURES AND WILL NOT BE ACCEPTED BY THE FUND.

Sale Proceeds

In most instances, payment for shares redeemed will be made within one or two days, but not later than seven days from the time the Fund receives your written request in proper form. For investments that have been made by check, payment for redemptions may be delayed until the Fund is reasonably satisfied that the purchase payment has been collected, which may take up to 15 calendar days.

The Fund sends checks for redemption proceeds via regular mail. The Fund will send redemption checks by overnight or priority mail upon request and at investor’s expense. The Fund will also wire redemption proceeds to your bank upon request for a $15 wire fee. The Fund will normally wire redemption proceeds to your bank the next business day after receiving the redemption request in proper form, which may include a signature guarantee. You are also responsible for any fee that your bank may charge for receiving wires.

Redemptions Through a Broker

You may redeem shares at the NAV through a broker that has a relationship with the Distributor. If you sell shares through a broker, the broker is responsible for forwarding your order to the Transfer Agent in a timely manner. If you place an order with a broker that has a relationship with the Distributor and/or the Fund by 3:00 p.m. (Central time) on a day when the NYSE is open for regular trading, you will receive that day’s price. Generally, payment is directed to your brokerage account normally within three business days after a broker places your redemption order. Your broker may charge a fee for processing redemption requests.

Additional Redemption Policies

Redemption privileges and payments may be suspended during periods when the NYSE is closed (other than weekends and holiday closings) or trading thereon is restricted, or for any period during which an emergency exists as a result of which (a) disposal by the Fund of securities owned by it is not reasonably practicable, or (b) it is not reasonably practicable for the Fund to fairly determine the value of its net assets, or for such other periods as the SEC may by order permit for the protection of the shareholders of the Fund. The SEC shall determine when trading on the NYSE is restricted and when an emergency exists.

In addition, shareholders who have an IRA or other retirement plan must indicate on their redemption request whether to withhold federal income tax. Redemption requests failing to indicate an election not to have tax withheld will generally be subject to 10% withholding.

FREQUENT TRADING OR MARKET TIMING

The Fund is not designed to serve as a vehicle for frequent trading in response to short-term fluctuations in the securities markets. Accordingly, the Fund’s Board of Directors has adopted policies and procedures that are designed to deter such excessive or short-term trading. The Fund generally defines frequent trading or market timing as engaging in more than four transactions out of the Fund within a rolling 12 month period, excluding redemptions made pursuant to a systematic withdrawal plan or to satisfy required minimum distributions on retirement accounts. The size of transactions also may be taken into account. Frequent trading of Fund shares may lead to, among other things, dilution in the value of Fund shares held by long-term shareholders, interference with the efficient management of the Fund’s portfolio and increased brokerage and administrative costs.

Investors are subject to these policies whether they are a direct shareholder of the Fund or they invest in the Fund indirectly through a financial intermediary such as a broker-dealer, a bank, an investment adviser or an administrator or trustee of a tax-deferred retirement plan that maintains an “Omnibus Account” with the Fund for trading on behalf of its customers.

Furthermore, due to the complexity involved in identifying abusive trading activity and the volume of shareholder transactions the Fund handles, there can be no assurance that the Fund’s efforts will identify all trades or trading practices that may be considered abusive. The ability of the Fund to apply its market timing policy to investors investing through financial intermediaries is dependent on the receipt of information necessary to identify transactions by the underlying investors and the financial intermediary’s cooperation in implementing the policy. Investors seeking to engage in excessive short-term trading practices may deploy a variety of strategies to avoid detection, and despite the efforts of the Fund to prevent excessive short-term trading, there is no assurance that the Fund or its agents will be able to identify those shareholders or curtail their trading practices.

If suspicious trading patterns are detected in an Omnibus Account, the Fund will request information from the financial intermediary concerning trades placed in the Omnibus Account. The Fund will use this information to monitor trading in the Fund and to attempt to identify shareholders in the Omnibus Account engaged in trading that is inconsistent with the market timing policy or otherwise not in the best interests of the Fund. In considering an investor’s trading activity, the Fund may consider, among other factors, the investor’s trading history, both directly and, if known, through intermediaries, in the Fund. If the Fund detects such activity, then the Fund may request that the financial intermediary take action to prevent the particular investor or investors from engaging in frequent or short-term trading. If inappropriate trading recurs, the Fund may refuse all future purchases from the Omnibus Account, including those of plan participants not involved in the inappropriate activity.

There may be limitations on the ability of financial intermediaries to impose restrictions on the trading practices of their clients. As a result, the Fund’s ability to monitor and discourage abusive trading practices in an Omnibus Account may be limited.

Under no circumstances will the Fund, the Adviser or the distributor enter into any agreements with any investor to encourage, accommodate or facilitate excessive or short-term trading in the Fund.

DISTRIBUTIONS AND TAXES

Distributions

The Fund will distribute to shareholders substantially all of the net income and net capital gains (collectively “distributions”), if any, realized from the sale of securities. Dividends will be paid on or about the last business day of March, June, September and December. Shareholders will be advised as to the source or sources of each distribution. A year-end payment of capital gains, if any amounts are earned between November 1 and October 31 in any given year, will be paid on or before December 31 to meet a special requirement of the Tax Reform Act of 1986 (“1986 Act”). The Fund must declare a dividend amount payable before January 31 of the next year on December 31 in order to remit at least 98% of the net investment income for the calendar year to comply with the provisions of the 1986 Act. The amount of any distributions will depend upon and vary with changes in interest rates, dividend yields, investment selections of the Fund and many other unpredictable factors.

Distributions Options

The Fund offers the following options with respect to distributions, if any, on shares held by you in the Fund.

|

(1)

|

Reinvestment Option: You may elect to have all dividends and capital gains distributions automatically reinvested at the NAV in additional shares of the Fund. If you do not indicate a choice on the Account Application, you will be assigned this option. Shares purchased under this option are entered on the stock transfer records maintained by the Transfer Agent. Written notice will be sent to shareholders electing this option showing the shareholder’s holdings in the Fund after the reinvestment, as well as the dollar amount of the dividend or capital gains reinvestment and the NAV in effect for the purchases.

|

|

(2)

|

Cash Option: You may elect to be sent a check for all Fund dividend and capital gain distributions, or alternatively, you may reinvest dividends and receive capital gains in cash. You may elect your distribution option by checking the appropriate box on the Account Application. Cash distribution checks are typically mailed to shareholders within two days, but not later than seven days after payment.

|

You may change your previously selected distribution option from time to time by written instruction or by calling the Transfer Agent of the Fund. Option changes should be submitted to the Transfer Agent of the Fund at least five days prior to the record date of the distribution. If you elect to receive distributions and/or capital gains paid in cash and the U.S. Postal Service cannot deliver the check or if a check remains outstanding for six months, the Fund reserves the right to reinvest the distribution check in your account at the Fund’s current NAV, and to reinvest all subsequent distributions.

Tax Consequences

The following discussion of taxes is for general information only. You should consult with your own tax adviser about the particular federal, state and local tax consequences to you of investing in the Fund.

The Fund has complied with special provisions of the Internal Revenue Code pertaining to investment companies so that the Fund will not pay federal income taxes on amounts it distributes to shareholders, although shareholders will be taxed on distributions they receive. As a shareholder, you are subject to federal income tax on distribution of investment income and on short-term capital gains which are treated as ordinary income. Other capital gain distributions will be taxable to you at different maximum rates, depending upon their source and other factors. Dividends are taxable either as ordinary income, or, if so designated by the Fund, and provided that certain holding period and other requirements are met by both the Fund and the shareholder, taxable as “qualified dividend income” to individual shareholders at a maximum 23.8% U.S. federal income tax rate (which includes the 3.8% Medicare surcharge). Dividends and distributions are generally taxable regardless of whether you take payment in cash or reinvest them to buy additional Fund shares.

The Fund may be required to withhold federal income tax at a rate of 28% (backup withholding) from dividend payments, distributions, and redemption proceeds if you failed to furnish and certify that the Social Security or Tax Identification Number you provided is correct, and that you are not subject to backup withholding. The certification is included as part of the account application form.

There may be tax consequences to you upon the redemption (sale) of your Fund shares. You generally have a capital gain or loss from a disposition of shares. The amount of gain or loss and the tax rate will depend primarily upon how much you paid for your shares, the redemption (sale) price, and how long you held the shares.

Shareholders who are tax-exempt entities with respect to federal and state income taxes will not be subject to tax on the income and capital gains distributions from the Fund. If you invest through a tax-deferred retirement account, such as an IRA, you generally will not have to pay tax on dividends until they are distributed from the account. These accounts are subject to complex tax rules, and you should consult your tax adviser about investment through a tax-deferred account.

The Fund, through semi-annual shareholder reports, will inform you of the amount and generic nature of such income and capital gains. U.S. Bancorp Fund Services, LLC, through the annual Form 1099 or its substitute equivalent, will provide a report for each individual account within an appropriate time frame after the close of the Fund’s fiscal year.

INQUIRIES

Shareholder inquiries for information or assistance in handling administrative matters should be directed to either:

|

Bridges Investment Fund, Inc.

c/o U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, Wisconsin 53202

1-866-934-4700

|

OR

|

Bridges Investment Fund, Inc.

Nancy K. Dodge, Treasurer and CCO

8401 West Dodge Road

256 Durham Plaza

Omaha, Nebraska 68114

402-397-4700

E-mail to: fund@bridgesinv.com

|

INDEX DESCRIPTIONS

Please note that you cannot invest directly in an index, although you may invest in the underlying securities represented in the index. Index returns are adjusted to reflect the reinvestment of dividends on securities in the index, but do not reflect fees, expenses or taxes.

The Russell 1000® Growth Index is an unmanaged composite of stocks that measures the performance of the stocks of companies with higher price-to-book ratios and higher forecasted growth values from a universe of the 1,000 largest U.S. companies based on total market capitalization.

The S&P 500® Index is a broadly based unmanaged composite of 500 stocks which is widely recognized as representative of price changes for the equity market in general.

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the Fund’s financial performance for the past five years. Certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that an investor would have earned or lost on an investment in the Fund (assuming reinvestment of all dividends and distributions). The information for the years ended December 31, 2014, 2013, and 2012 has been audited by the Fund’s independent registered public accounting firm, Cohen Fund Audit Services, Ltd., whose report, along with the Fund’s financial statements, is included in the Annual Report, which is available upon request or at the Fund’s website at www.bridgesfund.com. Information for the fiscal years ended December 31, 2011, and 2010 was audited by the Fund’s prior independent registered public accounting firm.

| Years Ended December 31 | |||||||

|

2014

|

2013

|

2012

|

2011

|

2010

|

|||

|

Net Asset Value, Beginning of Period

|

$47.17

|

$36.95

|

$32.55

|

$32.51

|

$29.28

|

||

|

Income from investment operations:

|

|||||||

|

Net investment income1

|

0.26

|

0.24

|

0.21

|

0.16

|

0.14

|

||

|

Net realized and unrealized gain on investments

|

4.11

|

11.85

|

4.40

|

0.04

|

3.22

|

||

|

Total from investment operations

|

4.37

|

12.09

|

4.61

|

0.20

|

3.36

|

||

|

Less distributions to shareholders:

|

|||||||

|

From net investment income

|

(0.27)

|

(0.24)

|

(0.21)

|

(0.16)

|

(0.13)

|

||

|

From net realized gains

|

(1.71)

|

(1.63)

|

--

|

--

|

--

|

||

|

Total distributions

|

(1.98)

|

(1.87)

|

(0.21)

|

(0.16)

|

(0.13)

|

||

|

Net asset value, end of period

|

$49.56

|

$47.17

|

$36.95

|

$32.55

|

$32.51

|

||

|

Total return

|

9.37%

|

32.99%

|

14.16%

|

0.62%

|

11.50%

|

||

|

Supplemental data and ratios:

|

|||||||

|

Net Assets, end of period (in thousands)

|

$122,102

|

$110,156

|

$83,361

|

$73,779

|

$75,014

|

||

|

Ratio of net expenses to average net assets

|

0.80%

|

0.85%

|

0.88%

|

0.88%

|

0.90%

|

||

|

Ratio of net investment income to average net assets

|

0.55%

|

0.57%

|

0.58%

|

0.47%

|

0.42%

|

||

|

Portfolio turnover rate

|

13.6%

|

12.0%

|

17.0%

|

26.6%

|

26.3%

|

||

1Net investment income per share is calculated using the ending balances prior to consideration or adjustment for permanent book-to-tax differences.

PRIVACY POLICY NOTICE

Protecting your privacy is important to Bridges Investment Fund, Inc. and our employees. We want you to understand what information we collect and how we use it. In order to provide our shareholders with a broad range of financial products and services as effectively and conveniently as possible, we use technology to manage and maintain shareholder information. The following policy serves as a standard for all Bridges Investment Fund, Inc. employees for the collection, use, retention, and security of nonpublic personal information.

What Information We Collect

In order to serve you better, we may collect nonpublic personal information about you from the following sources:

|

Ÿ

|

Information we receive from you in connection with opening an account or establishing and maintaining a shareholder relationship with us, whether in writing or oral;

|

|

Ÿ

|

Information about your transactions with us or our affiliates; and

|

|

Ÿ

|

Information we receive from third parties such as your accountants, attorneys, life insurance agents, family members, financial institutions, custodians, trustees and credit bureaus.

|

“Nonpublic personal information” is nonpublic information about you that we obtain in connection with providing a financial product or service to you. For example, nonpublic personal information includes the contents of your application, account balance, transaction history and the existence of a relationship with us.

What Information We Disclose

We do not disclose any nonpublic personal information about you to anyone, except as permitted by law. We are permitted to disclose nonpublic personal information about you to other third parties in certain circumstances. For example, we may disclose nonpublic personal information about you to third parties to assist us in servicing your account with us.

If you decide to close your account(s) or become an inactive shareholder, we will adhere to the privacy policies and practices as described in this notice.

|

Our Security Procedures

|

We also take steps to safeguard shareholder information. We restrict access to your personal and account information to those who need to know that information to provide products and services to you. Violators of these standards will be subject to disciplinary measures. We maintain physical, electronic, and procedural safeguards that comply with federal standards to guard your nonpublic personal information.

BRIDGES INVESTMENT FUND, INC.

8401 West Dodge Road

256 Durham Plaza

Omaha, Nebraska 68114

(402) 397-4700

PROSPECTUS

April 30, 2015

Capital Stock

Additional information about the Fund and its investment policies is contained in the Fund’s SAI. The SAI is incorporated into this Prospectus by reference (meaning it is legally a part of this Prospectus). A current SAI is on file with the SEC.

Additional information about the Fund’s investments is available in the Annual and Semi-Annual Reports to shareholders. In the Fund’s Annual Report, you will find a discussion of market conditions and investment strategies that significantly affected the Fund’s performance during its last fiscal year.

You may receive free copies of the SAI, the Annual and Semi-Annual Reports, request other information about the Fund, and receive answers to your questions about the Fund by accessing the Fund’s website at www.bridgesfund.com or contacting:

|

Bridges Investment Fund, Inc.

c/o U.S. Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, Wisconsin 53201-701

1-866-934-4700

|

OR

|

Bridges Investment Fund, Inc.

Nancy K. Dodge, Treasurer and CCO

8401 West Dodge Road

256 Durham Plaza

Omaha, Nebraska 68114

402-397-4700

E-mail to: fund@bridgesinv.com

|

Further information about the Fund (including the SAI) can also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call 1-202-551-8090 for information about the operations of the Public Reference Room. Reports and other information about the Fund are also available on the EDGAR database on the SEC’s Website (http://www.sec.gov) or copies can be obtained, upon payment of a duplicating fee, by writing the SEC’s Public Reference Section, Washington, D.C. 20549-1520, or by sending an e-mail to publicinfo@sec.gov.

SEC File No. 811-01209

BRIDGES INVESTMENT FUND, INC.

Ticker: BRGIX

8401 West Dodge Road

256 Durham Plaza

Omaha, Nebraska 68114

(402) 397-4700

(866) 934-4700

April 30, 2015

Capital Stock

This Statement of Additional Information (“SAI”) dated April 30, 2015 is not a Prospectus. It should be read in conjunction with the Prospectus of the Bridges Investment Fund, Inc. (the “Fund”) dated April 30, 2015. This SAI is incorporated by reference into the Fund’s Prospectus. In other words, it is legally part of the Fund’s Prospectus. The financial statements for the Fund for the year ended December 31, 2014, are herein incorporated by reference to the Fund’s Annual Report to shareholders dated December 31, 2014. To receive a copy of the Prospectus or Annual or Semi-Annual Reports to shareholders, without charge, visit the Fund’s website at www.bridgesfund.com, or write or call the Fund at the address or telephone number written above.

TABLE OF CONTENTS

| Page No. | |

|

3

|

|

|

3

|

|

|

3

|

|

|

4

|

|

|

7

|

|

|

7

|

|

|

8

|

|

|

9

|

|

|

10

|

|

|

11

|

|

|

12

|

|

|

12

|

|

|

13

|

|

|

14

|

|

|

15

|

|

|

16

|

|

|

17

|

|

|

20

|

|

|

21

|

|

|

22

|

|

|

22

|

|

|

22

|

|

|

23

|

|

|

23

|

|

|

24

|

|

|

26

|

|

|

26

|

|

|

27

|

|

|

28

|

|

|

28

|

|

|

28

|

|

|

29

|

|

|

30

|

|

|

30

|

|

|

30

|

|

|

31

|

|

|

31

|

|

|

31

|

|

|

33

|

FUND HISTORY AND CLASSIFICATION

The Fund is a Nebraska corporation organized on March 20, 1963 and is registered with the Securities and Exchange Commission (“SEC”) as an open-end, diversified investment management company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund commenced investment operations on July 1, 1963, and shares of Capital Stock were first sold to the general public on December 7, 1963. The Fund has conducted its business continuously since that year.

INVESTMENT POLICIES, STRATEGIES AND RISKS

The sections below describe, in greater detail than in the Fund’s Prospectus, some of the different types of investments which may be made by the Fund and the different investment practices in which the Fund may engage.

Equities

Common Stocks

The Fund may invest in common stocks. Common stocks represent the residual ownership interest in the issuer and are entitled to the income and increase in the value of the assets and business of the entity after all of its obligations and preferred stock are satisfied. Common stocks generally have voting rights. Common stocks fluctuate in price in response to many factors including historical and prospective earnings of the issuer, the value of its assets, general economic conditions, interest rates, investor perceptions and market liquidity.

Convertible Securities

The Fund may invest in convertible securities. Convertible securities include corporate bonds, notes and preferred stock that can be converted into or exchanged for a prescribed amount of common stock of the same or a different issue within a particular period of time at a specified price or formula. A convertible security entitles the holder to receive interest paid or accrued on debt or dividends paid on preferred stock until the convertible security matures or is redeemed, converted or exchanged. While no securities investment is without some risk, investments in convertible securities generally entail less risk than the issuer’s common stock, although the extent to which such risk is reduced depends in large measure upon the degree to which the convertible security sells above its value as a fixed income security. The market value of convertible securities tends to decline as interest rates increase and, conversely, to increase as interest rates decline. While convertible securities generally offer lower interest or dividend yields than nonconvertible debt securities of similar quality, they do enable the investor to benefit from increases in the market price of the underlying common stock. Convertible securities are accorded the status of equities by the Fund because they may be converted into common stock at the election of the holder.

Fixed-Income Securities

The Fund may invest in a wide range of fixed-income securities.

The Fund may invest in investment grade corporate bonds, debentures, U.S. Treasury bonds and notes, and preferred stocks. Investment grade securities are those rated BBB or better by Standard & Poor’s® (“S&P®”), or Baa or better by Moody’s Investors Service®, Inc. (“Moody’s”). Subject to the limitation below, the Fund may also invest in lower-rated or high yield debt securities (commonly known as “junk bonds”), and the Fund may purchase bonds, debentures, and preferred stocks which have one or more interest or dividend payments in arrears, but, nevertheless, offer prospects of resuming the payment of the arrearage plus the current income rate. Such securities may offer a significant price improvement from a depressed level, thereby creating a capital gain potential similar to the advancement possible for common stock selections. The risk of owning this type of security is that income payments will not be resumed or that the principal will never be repaid.

Corporate Debt Securities

Corporate debt securities are fixed-income securities issued by businesses to finance their operations, although corporate debt instruments may also include bank loans to companies. Notes, bonds, debentures and commercial paper are the most common types of corporate debt securities, with the primary difference being their maturities and secured or unsecured status. Commercial paper has the shortest term and is usually unsecured. The broad category of corporate debt securities includes debt issued by domestic companies of all kinds, including those with small-, mid- and large-capitalizations. Corporate debt may be rated investment grade or below investment grade and may carry variable or floating rates of interest.