UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2014

|

Commission

File Number

|

|

Exact Name of Registrant as Specified in its Charter,

State or Other Jurisdiction of Incorporation,

Address of Principal Executive Offices, Zip Code

and Telephone Number (Including Area Code)

|

|

I.R.S. Employer

Identification Number

|

|

|

|

|

|

|

|

333-147019,

333-182599, and

333-179941-01

|

|

PROSPER MARKETPLACE, INC.

a Delaware corporation

101 Second Street, 15th Floor

San Francisco, CA 94105

Telephone: (415)593-5400

|

|

73-1733867

|

|

|

|

|

|

|

|

333-179941

|

|

PROSPER FUNDING LLC

a Delaware limited liability company

101 Second Street, 15th Floor

San Francisco, CA 94105

Telephone: (415)593-5479

|

|

45-4526070

|

Indicate by check mark whether each registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days.

|

Prosper Marketplace, Inc.

|

Yesx No ¨

|

|

Prosper Funding LLC

|

Yesx No ¨

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Prosper Marketplace, Inc.

|

Yesx No ¨

|

|

Prosper Funding LLC

|

Yesx No ¨

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

Large

Accelerated

Filer

|

|

Accelerated

Filer

|

|

Non-

Accelerated

Filer

|

|

Smaller

Reporting

Company

|

|

|

|

|

|

|

|

|

|

|

Prosper Marketplace, Inc.

|

o

|

|

o

|

|

o

|

|

x

|

|

|

|

|

|

|

|

|

|

|

Prosper Funding LLC

|

o

|

|

o

|

|

o

|

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Prosper Marketplace, Inc. | Yes¨ No x |

| Prosper Funding LLC | Yes¨ No x |

Prosper Funding LLC meets the conditions set forth in General Instruction H(1)(a) and (b) of Form 10-Q and is therefore filing this Form 10-Q with the reduced disclosure format specified in General Instruction H(2) of Form 10-Q.

|

Registrant

|

|

Number of Shares of Common

Stock of the Registrant

Outstanding at May 6, 2014

|

|

Prosper Marketplace, Inc.

|

|

13,840,624

($.01 par value)

|

|

Prosper Funding LLC

|

|

None

|

THIS COMBINED FORM 10-Q IS SEPARATELY FILED BY PROSPER MARKETPLACE, INC. AND PROSPER FUNDING LLC. INFORMATION CONTAINED HEREIN RELATING TO ANY INDIVIDUAL REGISTRANT IS FILED BY SUCH REGISTRANT ON ITS OWN BEHALF. EACH REGISTRANT MAKES NO REPRESENTATION AS TO INFORMATION RELATING TO THE OTHER REGISTRANT.

|

Page No.

|

||

|

PART I. FINANCIAL INFORMATION

|

1

|

|

|

1

|

||

|

2

|

||

|

3

|

||

|

4

|

||

|

5

|

||

|

Schedule 1

|

||

|

26

|

||

|

27

|

||

|

28

|

||

|

29

|

||

|

Item 2.

|

39

|

|

|

Item 3.

|

63

|

|

|

Item 4.

|

63

|

|

|

PART II.

|

OTHER INFORMATION

|

|

|

Item 1.

|

64

|

|

|

Item 1A.

|

64

|

|

|

Item 2.

|

64

|

|

|

Item 3.

|

64

|

|

|

Item 4.

|

64

|

|

|

Item 5.

|

64

|

|

|

Item 6.

|

64

|

|

|

65

|

||

|

66

|

||

This Quarterly Report on Form 10-Q includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). Forward-looking statements include all statements that do not relate solely to historical or current facts, and can generally be identified by the use of words such as “may,” “believe,” “will,” “expect,” “project,” “estimate,” “intend,” “anticipate,” “plan,” “continue” or similar expressions. In particular, information appearing under “Prosper Marketplace, Inc. Notes to Condensed Consolidated Financial Statements,” “Prosper Funding LLC Notes to Condensed Financial Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” includes forward-looking statements. Forward-looking statements inherently involve many risks and uncertainties that could cause actual results to differ materially from those projected in these statements. Where, in any forward-looking statement, Prosper Funding LLC (“Prosper Funding”) or Prosper Marketplace, Inc. (“PMI” and, collectively with Prosper Funding, the “Registrants”) expresses an expectation or belief as to future results or events, such expectation or belief is based on the current plans and expectations of Prosper Funding and PMI’s respective managements, expressed in good faith and is believed to have a reasonable basis. Nevertheless, there can be no assurance that the expectation or belief will result or be achieved or accomplished. In this Quarterly Report, the unsecured, consumer loans originated through the platform are referred to as “Borrower Loans”, and the borrower payment dependent notes issued through the platform, whether issued by PMI or Prosper Funding, are referred to as “Notes”. The following include some but not all of the factors that could cause actual results or events to differ materially from those anticipated:

|

·

|

the performance of the Notes, which, in addition to being speculative investments, are special, limited obligations that are not guaranteed or insured;

|

|

·

|

Prosper Funding’s ability to make payments on the Notes, including in the event that borrowers fail to make payments on the corresponding Borrower Loans;

|

|

·

|

the reliability of the information about borrowers that is supplied by borrowers;

|

|

·

|

Prosper Funding and PMI’s ability to service the Borrower Loans, and their ability or the ability of a third party debt collector to pursue collection against any borrower, including in the event of fraud or identity theft;

|

|

·

|

credit risks posed by the credit worthiness of borrowers and the effectiveness of the Registrants’ credit rating systems;

|

|

·

|

actions by some borrowers to defraud lender members and risks associated with identity theft;

|

|

·

|

Prosper Funding and PMI’s limited operational history and lack of significant historical performance data about borrower performance;

|

|

·

|

the impact of current economic conditions on the performance of the Notes and loss rates of the Notes;

|

|

·

|

payments by borrowers on the loans in light of the facts that the loans do not impose restrictions on borrowers and do not include cross-default provisions;

|

|

·

|

Prosper Funding and PMI’s compliance with applicable local, state and federal law, including the Investment Advisers Act of 1940, the Investment Company Act of 1940 and other laws;

|

|

·

|

potential efforts by state regulators or litigants to characterize Prosper Funding or PMI, rather than WebBank, as the lender of the loans originated through the platform;

|

|

·

|

the application of federal and state bankruptcy and insolvency laws to borrowers and to Prosper Funding and PMI;

|

|

·

|

the impact of borrower delinquencies, defaults and prepayments on the returns on the Notes;

|

|

·

|

the lack of a public trading market for the Notes and any inability to resell the Notes on the Note Trader platform;

|

|

·

|

the federal income tax treatment of an investment in the Notes and the PMI Management Rights;

|

|

·

|

Prosper Funding and PMI’s ability to prevent security breaches, disruptions in service, and comparable events that could compromise the personal and confidential information held on their data systems, reduce the attractiveness of the platform or adversely impact their ability to service loans;

|

|

·

|

the resolution of pending litigation involving PMI, including any state or federal securities litigation; and

|

|

·

|

Prosper Funding’s ability to compete successfully in the peer-to-peer and consumer lending industry.

|

There may be other factors that may cause actual results to differ materially from the forward-looking statements in this Quarterly Report on Form 10-Q. Prosper Funding and PMI can give no assurances that any of the events anticipated by the forward-looking statements will occur or, if any of them does, what impact they will have on Prosper Funding or PMI’s results of operations and financial condition. You should carefully read the factors described in the “Risk Factors” section of the Registrants’ Annual Report on Form 10-K, filed with the Securities and Exchange Commission (“SEC”) on March 31, 2014, for a description of certain risks that could, among other things, cause Prosper Funding and PMI’s actual results to differ from these forward-looking statements.

All forward-looking statements speak only as of the date of this Quarterly Report on Form 10-Q and are expressly qualified in their entirety by the cautionary statements included in this Quarterly Report on Form 10-Q. Prosper Funding and PMI undertake no obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

WHERE YOU CAN FIND MORE INFORMATION

The Registrants file annual, quarterly and current reports and other information with the SEC. You can inspect, read and copy these reports and other information at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You can obtain information regarding the operation of the SEC’s Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that makes available reports, proxy statements and other information regarding issuers that file electronically.

Prosper Marketplace, Inc.

(Unaudited)

(in thousands, except for share and per share amounts)

|

|

March 31,

2014

|

December 31,

2013 *

|

||||||

|

Assets

|

||||||||

|

Cash and cash equivalents

|

$

|

12,975

|

$

|

18,339

|

||||

|

Restricted cash

|

16,662

|

15,473

|

||||||

|

Accounts receivable

|

182

|

218

|

||||||

|

Loans held for investment

|

4,071

|

3,917

|

||||||

|

Borrower loans receivable at fair value

|

238,672

|

226,238

|

||||||

|

Property and equipment, net

|

3,510

|

3,396

|

||||||

|

Prepaid and other assets

|

1,153

|

708

|

||||||

|

Total Assets

|

$

|

277,225

|

$

|

268,289

|

||||

|

|

||||||||

|

Liabilities and Stockholders' Equity

|

||||||||

|

Accounts payable and accrued liabilities

|

$

|

8,179

|

$

|

6,737

|

||||

|

Class action settlement liability

|

8,000

|

10,000

|

||||||

|

Notes at fair value

|

238,115

|

226,794

|

||||||

|

Repurchase liability for unvested restricted stock awards

|

516

|

609

|

||||||

|

Repurchase and indemnification obligation

|

101

|

32

|

||||||

|

Total Liabilities

|

254,911

|

244,172

|

||||||

|

|

||||||||

|

Commitments and contingencies (see Note 10)

|

||||||||

|

|

||||||||

|

Stockholders' Equity

|

||||||||

|

Convertible preferred stock – Series A '13, A-1 '13 and B '13 ($0.01 par value; 27,274,068 shares authorized, issued and outstanding as of March 31, 2014 and December 31, 2013, respectively). (Aggregate liquidation preference of $96 as of March 31, 2014 and December 31, 2013, respectively).

|

273

|

273

|

||||||

|

Common stock ($0.01 par value; 41,487,465 shares authorized; 13,756,613 issued and outstanding as of March 31, 2014; and 41,487,465 shares authorized; 13,720,214 issued and outstanding as of December 31, 2013).

|

92

|

75

|

||||||

|

Additional paid - in capital

|

128,486

|

128,140

|

||||||

|

Less: treasury stock

|

(291

|

)

|

(291

|

)

|

||||

|

Accumulated deficit

|

(106,246

|

)

|

(104,080

|

)

|

||||

|

Total Stockholders' Equity

|

22,314

|

24,117

|

||||||

|

Total Liabilities and Stockholders' Equity

|

$

|

277,225

|

$

|

268,289

|

||||

The number of shares issued and outstanding reflects a 10-for-1 reverse stock split effected by the Company on October 29, 2013.

The accompanying notes are an integral part of these condensed consolidated financial statements.

* Derived from the Company’s audited consolidated financial statements.

Prosper Marketplace, Inc.

(Unaudited)

(in thousands, except for share and per share amounts)

|

|

Three Months Ended March 31,

|

|||||||

|

|

2014

|

2013

|

||||||

|

Revenues

|

||||||||

|

Origination fees

|

$

|

8,701

|

$

|

1,571

|

||||

|

Interest income on borrower loans

|

10,109

|

7,727

|

||||||

|

Interest expense on notes

|

(9,269

|

)

|

(7,326

|

)

|

||||

|

Rebates and promotions

|

(361

|

)

|

(274

|

)

|

||||

|

Other revenues

|

696

|

147

|

||||||

|

Total Revenues

|

9,876

|

1,845

|

||||||

|

|

||||||||

|

Cost of Revenues

|

||||||||

|

Cost of services

|

(525

|

)

|

(482

|

)

|

||||

|

Provision for repurchase and indemnification obligation

|

(62

|

)

|

(127

|

)

|

||||

|

Net Revenues

|

9,289

|

1,236

|

||||||

|

|

||||||||

|

Expenses

|

||||||||

|

Compensation and benefits

|

3,901

|

2,505

|

||||||

|

Marketing and advertising

|

5,986

|

1,572

|

||||||

|

Depreciation and amortization

|

363

|

206

|

||||||

|

Professional services

|

176

|

688

|

||||||

|

Facilities and maintenance

|

445

|

312

|

||||||

|

Loss on impairment of fixed assets

|

215

|

1

|

||||||

|

Other

|

668

|

327

|

||||||

|

Total Expenses

|

11,754

|

5,611

|

||||||

|

Loss Before Other Income and Expenses

|

(2,465

|

)

|

(4,375

|

)

|

||||

|

|

||||||||

|

Other Income and Expenses

|

||||||||

|

Interest income

|

1

|

-

|

||||||

|

Change in fair value on borrower loans, loans held for investment and notes, net

|

298

|

176

|

||||||

|

Total Other Income and Expenses

|

299

|

176

|

||||||

|

|

||||||||

|

Loss Before Income Taxes

|

(2,166

|

)

|

(4,199

|

)

|

||||

|

Provision for income taxes

|

-

|

-

|

||||||

|

Net Loss

|

$

|

(2,166

|

)

|

$

|

(4,199

|

)

|

||

|

|

||||||||

|

Net loss per share – basic and diluted

|

$

|

(0.32

|

)

|

$

|

(0.77

|

)

|

||

|

Weighted – average shares - basic and diluted net loss per share

|

6,868,153

|

5,480,849

|

||||||

The weighted average number of shares and the net loss per share reflect a 10-for-1 reverse stock split effected by the Company on October 29, 2013.

The accompanying notes are an integral part of these condensed consolidated financial statements.

Prosper Marketplace, Inc.

(Unaudited)

(in thousands, except for share and per share amounts)

|

Preferred Stock

|

Common Stock

|

Treasury Stock

|

Additional

|

|||||||||||||||||||||||||||||||||

|

Paid-In

|

Accumulated

|

|||||||||||||||||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

Shares

|

Amount

|

Capital

|

Deficit

|

Total

|

||||||||||||||||||||||||||||

|

Balance as of January 1, 2014

|

27,274,068 | $ | 273 | 13,902,478 | $ | 75 | (182,264 | ) | $ | (291 | ) | $ | 128,140 | $ | (104,080 | ) | $ | 24,117 | ||||||||||||||||||

|

Exercise of vested stock options

|

- | - | 2,566 | - | - | - | 4 | - | 4 | |||||||||||||||||||||||||||

|

Exercise of nonvested stock options

|

- | - | 20,750 | - | - | - | - | - | ||||||||||||||||||||||||||||

|

Repurchase of restricted stock

|

- | - | (3,992 | ) | - | - | - | - | - | |||||||||||||||||||||||||||

|

Restricted stock vested

|

- | - | 17,075 | 17 | 87 | 104 | ||||||||||||||||||||||||||||||

|

Stock-based compensation expense

|

- | - | - | - | - | - | 255 | - | 255 | |||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | - | (2,166 | ) | (2,166 | ) | |||||||||||||||||||||||||

|

Balance as of March 31, 2014

|

27,274,068 | $ | 273 | 13,938,877 | $ | 92 | (182,264 | ) | $ | (291 | ) | $ | 128,486 | $ | (106,246 | ) | $ | 22,314 | ||||||||||||||||||

The number of shares reflects a 10-for-1 reverse stock split effected by the Company on October 29, 2013

The accompanying notes are an integral part of these condensed consolidated financial statements.

Prosper Marketplace, Inc.

(Unaudited)

(in thousands, except for share and per share amounts)

|

|

For the Three Months Ended March 31,

|

|||||||

|

|

2014

|

2013

|

||||||

|

Cash flows from operating activities:

|

||||||||

|

Net loss

|

$

|

(2,166

|

)

|

$

|

(4,199

|

)

|

||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||

|

Change in fair value of borrower loans

|

(332

|

)

|

(461

|

)

|

||||

|

Change in fair value of loans held for investment

|

2

|

(2

|

)

|

|||||

|

Change in fair value of notes

|

32

|

288

|

||||||

|

Depreciation and amortization

|

363

|

206

|

||||||

|

Provision for repurchase and indemnification obligation

|

69

|

99

|

||||||

|

Stock-based compensation expense

|

255

|

53

|

||||||

|

Loss on impairment of fixed assets

|

215

|

1

|

||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Restricted cash

|

(1,189

|

)

|

139

|

|||||

|

Accounts receivable

|

36

|

(304

|

)

|

|||||

|

Prepaid and other assets

|

(445

|

)

|

(313

|

)

|

||||

|

Accounts payable and accrued liabilities

|

1,442

|

(1,180

|

)

|

|||||

|

Repurchase liability for unvested restricted stock awards

|

(105

|

)

|

–

|

|||||

|

Class action settlement liability payment

|

(2,000

|

)

|

–

|

|||||

|

Net cash used in operating activities

|

(3,823

|

)

|

(5,673

|

)

|

||||

|

|

||||||||

|

Cash flows from investing activities:

|

||||||||

|

Origination of borrower loans held at fair value

|

(166,608

|

)

|

(33,943

|

)

|

||||

|

Repayment of borrower loans held at fair value

|

32,642

|

24,360

|

||||||

|

Proceeds from sale of borrower loans held at fair value

|

121,864

|

–

|

||||||

|

Purchases of property and equipment

|

(692

|

)

|

(497

|

)

|

||||

|

Maturities of short term investments

|

–

|

1,000

|

||||||

|

Repayments of loans held for investment at fair value and credit losses

|

100

|

30

|

||||||

|

Origination of loans held for investment at fair value

|

(28,858

|

)

|

(43

|

)

|

||||

|

Proceeds from sale of loans held for investment at fair value

|

28,602

|

–

|

||||||

|

Net cash used in investing activities

|

(12,950

|

)

|

(9,093

|

)

|

||||

|

|

||||||||

|

Cash flows from financing activities:

|

||||||||

|

Proceeds from issuance of notes held at fair value

|

44,199

|

33,943

|

||||||

|

Payment of notes held at fair value

|

(32,910

|

)

|

(24,131

|

)

|

||||

|

Proceeds from issuance of convertible preferred stock

|

–

|

20,000

|

||||||

|

Proceeds from early exercise of stock options

|

12

|

–

|

||||||

|

Proceeds from restricted stock vested

|

104

|

–

|

||||||

|

Proceeds from exercise of vested stock options

|

4

|

73

|

||||||

|

Issuance costs of convertible preferred stock

|

- |

(101

|

)

|

|||||

|

Net cash provided by financing activities

|

11,409

|

29,784

|

||||||

|

|

||||||||

|

Net (decrease) increase in cash and cash equivalents

|

(5,364

|

)

|

15,018

|

|||||

|

Cash and cash equivalents at beginning of the period

|

18,339

|

2,300

|

||||||

|

Cash and cash equivalents at end of the period

|

$

|

12,975

|

$

|

17,318

|

||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

Prosper Marketplace, Inc.

(Unaudited)

|

1.

|

Organization and Business

|

Prosper Marketplace, Inc. (“PMI”) was incorporated in the state of Delaware on March 22, 2005. PMI developed a peer-to-peer online credit platform (the “platform”) and prior to February 1, 2013, owned the proprietary technology that made operation of the platform possible. Prior to February 1, 2013, PMI also operated the platform, facilitated the origination of unsecured, consumer loans by WebBank, an FDIC-insured, Utah-chartered industrial bank, through the platform and issued and sold borrower payment dependent notes corresponding to those loans.

The platform is designed to allow lender members to invest money in borrower members in an open transparent marketplace, with the aim of allowing both lender members and borrower members to profit financially as well as socially. The Company believes peer-to-peer lending represents a new model of consumer lending, where individuals and institutions can earn the interest spread of a traditional consumer lender but must also assume the credit risk of a traditional lender. The platform was launched to the public in 2006 and had attracted over two million members and facilitated approximately one billion in Borrower Loans as of March 31, 2014.

A borrower member who wishes to obtain a loan through the platform must post a loan listing, or listing, on the platform. Listings are allocated to one of two lender member funding channels: (i) the first channel allows lender members to commit to purchase Notes, the payments of which are dependent on the payments made on the corresponding Borrower Loan (the “Note Channel”); and (ii) the second channel allows lender members to commit to purchase 100% of a Borrower Loan directly from the Company (the “Whole Loan Channel”).

On February 1, 2013, PMI transferred ownership of the platform, including all of the rights related to the operation of the platform, as well as all then-outstanding Borrower Loans, to its wholly-owned subsidiary, Prosper Funding LLC (“Prosper Funding” and, collectively with PMI, the “Company” or the “Registrants”). At that same time, Prosper Funding assumed all of PMI’s obligations with respect to all then-outstanding Notes. Since February 1, 2013, all Notes issued and sold through the platform are issued and sold by Prosper Funding. Pursuant to a Loan Account Program Agreement between PMI and WebBank, PMI manages the operation of the platform, as agent of WebBank, in connection with the submission of loan applications by potential borrowers, the making of related loans by WebBank and the funding of such loans by WebBank. On February 1, 2013, Prosper Funding entered into an Administration Agreement with PMI in its capacity as licensee, corporate administrator, loan platform administrator and loan and note servicer, pursuant to which PMI provides certain back office support, loan platform administration and loan and note servicing to Prosper Funding.

Prosper Funding formed Prosper Asset Holdings LLC (“PAH”) in November 2013 as a limited liability company with the sole equity member being Prosper Funding. PAH was formed to purchase Borrower Loans from Prosper Funding and sell the Borrower Loans to third parties.

As reflected in the accompanying condensed consolidated financial statements, the Company has incurred net losses and negative cash flows from operations since inception. An accumulated deficit of $106,246 was incurred as of March 31, 2014. At March 31, 2014, the Company had $12,975 in cash and cash equivalents. Since its inception, the Company has financed its operations primarily through equity financing from various sources. The Company is dependent upon raising additional capital or debt financing to fund its current operating plan. Failure to obtain sufficient debt and equity financings and, ultimately, to achieve profitable operations and positive cash flows from operations could adversely affect the Company’s ability to achieve its business objectives and continue as a going concern. Further, there can be no assurances as to the availability or terms upon which the required financing and capital might be available. On May 1, 2014, the Company entered into a Series C Preferred Stock Purchase Agreement with certain new investors (collectively, the “Series C Share Purchasers”), pursuant to which the Company will issue and sell to such Series C Share Purchasers, either directly or through certain of their respective affiliates, 4,880,954 shares of the Company’s Series C preferred stock for an aggregate purchase price of $70,075. See Note 13, Subsequent Events, for additional information.

|

2.

|

Summary of Significant Accounting Policies

|

Basis of Presentation

The unaudited interim condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“US GAAP”) and disclosure requirements for interim financial information and the requirements of Rule 8-03 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by US GAAP for complete financial statements. The unaudited interim condensed consolidated financial statements should be read in conjunction with the audited financial statements and notes thereto for the year ended December 31, 2013. The balance sheet at December 31, 2013 has been derived from the audited financial statements at that date. Management believes these unaudited interim condensed consolidated financial statements reflect all adjustments, including those of a normal recurring nature, which are necessary for a fair presentation of the results for the interim periods presented. The results of operations for the interim periods are not necessarily indicative of the results that may be expected for the full year of any other interim period.

The accompanying interim condensed consolidated financial statements include the accounts of PMI and its wholly-owned subsidiary, Prosper Funding. All intercompany balances and transactions between Prosper Funding and PMI have been eliminated in consolidation.

Use of Estimates

The preparation of the interim condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make certain estimates, judgments and assumptions that affect the reported amounts of assets and liabilities and the related disclosures at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. These estimates, judgments and assumptions include but are not limited to the following: valuation of Borrower Loans and associated Notes, valuation of servicing rights, valuation allowance on deferred tax assets, repurchase and indemnification obligation, stock-based compensation expense, and contingent liabilities. The Company bases its estimates on historical experience from all Borrower Loans, and on various other assumptions that it believes to be reasonable under the circumstances. Actual results could differ from those estimates.

Certain Risks and Concentrations

In the normal course of its business, the Company encounters two significant types of risk: credit and regulatory. Financial instruments that potentially subject the Company to significant concentrations of credit risk consist primarily of cash, cash equivalents, and restricted cash. The Company places cash, cash equivalents, and restricted cash with high-quality financial institutions and is exposed to credit risk in the event of default by these institutions to the extent the amount recorded on the balance sheet exceeds federally insured amounts. The Company performs periodic evaluations of the relative credit standing of these financial institutions and has not sustained any credit losses from instruments held at these financial institutions.

To the extent that Borrower Loan payments are not made, servicing income will be reduced. A group of Notes corresponding to a particular Borrower Loan is wholly dependent on the repayment of such Borrower Loan. As a result, the Company does not bear the risk on such Borrower Loan.

The Company is subject to various regulatory requirements. The failure to appropriately identify and address these regulatory requirements could result in certain discretionary actions by regulators that could have a material effect on the Company's consolidated financial position and results of operations (See Note 10—Commitments and Contingencies—Securities Law Compliance).

Cash and Cash Equivalents

All highly liquid investments with stated maturities of three months or less from date of purchase are classified as cash equivalents. Cash equivalents are recorded at cost, which approximates fair value. Cash and cash equivalents include various unrestricted deposits with highly rated financial institutions in checking, money market and short-term certificate of deposit accounts.

Restricted Cash

Restricted cash consists primarily of cash deposits held as collateral as required for loan funding and servicing activities.

Borrower Loans and Notes

Through the Note Channel, the Company issues Notes and purchases Borrower Loans from WebBank, and holds the Borrower Loans until maturity. The obligation to repay a series of Notes funded through the Note Channel is conditioned upon the repayment of the associated Borrower Loan. Borrower Loans and Notes funded through the Note Channel are carried on the Company’s condensed consolidated balance sheets as assets and liabilities, respectively. The Company has adopted the provisions of ASC Topic 825, Financial Instruments. ASC Topic 825 permits companies to choose to measure certain financial instruments and certain other items at fair value on an instrument-by-instrument basis with unrealized gains and losses on items for which the fair value option has been elected reported in earnings. The fair value election, with respect to an item, may not be revoked once an election is made. In applying the provisions of ASC Topic 825, the recorded assets and liabilities are measured using the fair value option in a way that separates these reported fair values from the carrying values of similar assets and liabilities measured with a different measurement attribute. A specific allowance account is not recorded relating to the Borrower Loans and Notes in which the Company has elected the fair value option, but rather the Company estimates the fair value of such Borrower Loans and Notes using discounted cash flow methodologies adjusted for the historical payment, loss and recovery rates. An account is considered to be a loss, or charged-off, when it reaches more than 120 days past due. The aggregate fair value of the Borrower Loans and Notes funded through the Note Channel are reported as separate line items in the assets and liabilities sections of the accompanying balance sheets using the methods described in ASC Topic 820, Fair Value Measurements and Disclosures—See Fair Value Measurement.

Borrower Loans Sold Directly to Third Party Purchasers

For Borrower Loans sold to unrelated third party purchasers on a servicing retained basis through the Whole Loan Channel, a gain or loss is recorded on the sale date. In order to calculate the gain or loss, the Company first determines whether the terms of the servicing arrangement with the purchaser results in a net servicing asset (i.e., when contractual/expected servicing revenues adequately compensate the Company) or a net servicing liability (i.e., when contractual/expected servicing revenues do not adequately compensate the Company). When contractual/expected servicing revenues do not adequately compensate the Company, a portion of the gross proceeds of the Borrower Loans sold on a servicing retained basis through the Whole Loan Channel are allocated to the recording of a net servicing liability. Conversely, when contractual/expected servicing revenues provide more than adequate compensation to the Company, the excess servicing compensation is allocated to the gross proceeds of the Borrower Loans sold and results in the recording of a net servicing asset. The Company estimates the fair value of the loan servicing asset or liability considering the contractual servicing fee revenue, adequate compensation for the Company's servicing obligation, the current principal balances of the Borrower Loans and projected servicing revenues given projected defaults and prepayments (if significant) over the remaining lives of the Borrower Loans. The Company recorded a gain on sale of whole loans of $356 and $0 for the three months ended March 31, 2014 and 2013, respectively, which was included in other revenues on the condensed consolidated statements of operations. At March 31, 2014 and December 31, 2013, the Company recorded $689 and $144 as a servicing asset related to these loans, which is included in Borrower loans receivable at fair value on the condensed consolidated balance sheets.

Loans Held for Investment

Loans held for investment are primarily comprised of Borrower Loans held for short durations and are recorded at cost which approximates fair value. For Borrower Loans held long term, the fair value is estimated using discounted cash flow methodologies based upon a set of valuation assumptions similar to those of other Borrower Loans, which are set forth in Note 2— Fair Value Measurement.

Fair Value Measurement

The Company adopted ASC Topic 820, Fair Value Measurements and Disclosures, on January 1, 2008, which provides a framework for measuring the fair value of assets and liabilities. ASC Topic 820 also provides guidance regarding a fair value hierarchy, which prioritizes information used to measure fair value and the effect of fair value measurements on earnings and provides for enhanced disclosures determined by the level within the hierarchy of information used in the valuation. ASC Topic 820 applies whenever other standards require (or permit) assets or liabilities to be measured at fair value but does not expand the use of fair value in any new circumstances.

ASC Topic 820 defines fair value in terms of the price that would be received upon the sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The price used to measure the fair value is not adjusted for transaction costs while the cost basis of certain financial instruments may include initial transaction costs. Under ASC Topic 820, the fair value measurement also assumes that the transaction to sell an asset occurs in the principal market for the asset or, in the absence of a principal market, the most advantageous market for the asset. The principal market is the market in which the reporting entity would sell or transfer the asset with the greatest volume and level of activity for the asset. In determining the principal market for an asset or liability under ASC Topic 820, it is assumed that the reporting entity has access to the market as of the measurement date. If no market for the asset exists or if the reporting entity does not have access to the principal market, the reporting entity should use a hypothetical market.

Under ASC Topic 820, assets and liabilities carried at fair value on the balance sheets are classified among three levels based on the observability of the inputs used to determine fair value:

Level 1 — The valuation is based on quoted prices in active markets for identical instruments.

Level 2 — The valuation is based on observable inputs such as quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant assumptions are observable in the market.

Level 3 — The valuation is based on unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the instrument. Level 3 valuations are typically performed using pricing models, discounted cash flow methodologies, or similar techniques, which incorporate management’s own estimates of assumptions that market participants would use in pricing the instrument or valuations that require significant management judgment or estimation.

Fair value of financial instruments are determined based on the fair value hierarchy established in ASC Topic 820, which requires an entity to maximize the use of quoted prices and observable inputs and to minimize the use of unobservable inputs when measuring fair value. Various valuation techniques are utilized, depending on the nature of the financial instrument, including the use of market prices for identical or similar instruments, or discounted cash flow models. When possible, active and observable market data for identical or similar financial instruments are utilized. Alternatively, fair value is determined using assumptions that management believes a market participant would use in pricing the asset or liability.

Financial instruments consist principally of Cash and cash equivalents, Restricted cash, Borrower loans receivable, Loans held for investment, Accounts payable and accrued liabilities, and Notes. The estimated fair values of Cash and cash equivalents, Restricted cash, Accounts payable and accrued liabilities approximate their carrying values because of their short term nature.

The following tables present the assets and liabilities measured at fair value on a recurring basis at March 31, 2014 and December 31, 2013:

|

March 31, 2014

|

Level 1

|

Level 2

|

Level 3

|

Fair

Value

|

||||||||||||

|

Assets

|

||||||||||||||||

|

Borrower loans receivable

|

$

|

-

|

$

|

-

|

$

|

238,672

|

$

|

238,672

|

||||||||

|

Certificates of deposit & restricted cash

|

15,320

|

1,342

|

-

|

16,662

|

||||||||||||

|

Loans held for investment

|

-

|

-

|

4,071

|

4,071

|

||||||||||||

|

Liabilities

|

||||||||||||||||

|

Notes

|

$

|

-

|

$

|

-

|

$

|

238,115

|

$

|

238,115

|

||||||||

|

December 31, 2013

|

Level 1

|

Level 2

|

Level 3

|

Fair

Value

|

||||||||||||

|

Assets

|

||||||||||||||||

|

Borrower loans receivable

|

$

|

-

|

$

|

-

|

$

|

226,238

|

$

|

226,238

|

||||||||

|

Certificates of deposit & restricted cash

|

14,032

|

1,441

|

-

|

15,473

|

||||||||||||

|

Loans held for investment

|

-

|

-

|

3,917

|

3,917

|

||||||||||||

|

Liabilities

|

||||||||||||||||

|

Notes

|

$

|

-

|

$

|

-

|

$

|

226,794

|

$

|

226,794

|

||||||||

Property and Equipment

Property and equipment consists of computer equipment, office furniture and equipment, and software purchased or developed for internal use. Property and equipment are stated at cost, less accumulated depreciation and amortization, and are computed using the straight-line method based upon estimated useful lives of the assets, which range from three to seven years, commencing once the asset is placed in service. Expenditures are capitalized for replacements and betterments and recognized as expense amounts for maintenance and repairs as incurred.

Earned Vacations

The Company has a flexible vacation plan for its employees under which employees are entitled to take vacations for such periods of time that do not interfere with the orderly performance of their job responsibilities. Accordingly, no accrual for unpaid vacation pay has been included in the condensed consolidated financial statements.

Internal Use Software and Website Development

Internal use software costs and website development costs are accounted for, in accordance with ASC Topic 350-40, Internal Use Software, and ASC Topic 350-50, Website Development Costs. In accordance with ASC Topic 350-40 and 350-50, the costs to develop software for the website and other internal uses are capitalized when management has authorized and committed project funding, preliminary development efforts are successfully completed, and it is probable that the project will be completed and the software will be used as intended. Capitalized software development costs primarily include software licenses acquired, fees paid to outside consultants, and salaries and payroll related costs for employees directly involved in the development efforts.

Costs incurred prior to meeting these criteria, together with costs incurred for training and maintenance, are expensed. Costs incurred for upgrades and enhancements that are considered to be probable to result in additional functionality are capitalized. Capitalized costs are included in property and equipment and amortized to expense using the straight-line method over their expected lives. Software assets are evaluated for impairment whenever events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. Recoverability of software assets to be held and used is measured by a comparison of the carrying amount of the asset to the future net undiscounted cash flows expected to be generated by the asset. If such software assets are considered to be impaired, the impairment to be recognized is the excess of the carrying amount over the fair value of the software asset.

Repurchase and Indemnification Obligation

Under the terms of the Notes, the Lender Registration Agreements between the Company and lender members who participate in the Note Channel, and the loan purchase agreements between the Company and lender members that participate in the Whole Loan Channel, the Company may, in certain circumstances, become obligated to repurchase a Note or Borrower Loan from a lender member or indemnify a lender member against loss on a Note. Generally, these circumstances include the occurrence of verifiable identity theft, the failure to properly follow loan listing or bidding protocols, or a violation of the applicable federal, state, or local lending laws. The indemnification and repurchase obligation is estimated based on historical experience. The Company accrues a provision for the repurchase and indemnification obligation when the Notes or Borrower Loans are issued. Indemnified or repurchased Notes and repurchased Borrower Loans associated with violations of federal, state, or local lending laws or verifiable identity theft are written off at the time of repurchase or at the time an indemnification payment is made.

Revenue Recognition

Revenue is recognized in accordance with ASC Topic 605, Revenue Recognition. Under ASC Topic 605, revenue is recognized when persuasive evidence of an arrangement exists, services have been rendered, the price of the services is fixed and determinable, and collectability is reasonably assured.

Origination Fees

The Company earns an origination fee upon the successful closing of all Borrower Loans issued through the platform. WebBank charges the origination fee and the Company receives payments from WebBank equal to the origination fee as compensation for its loan origination activities on behalf of WebBank. The borrower receives an amount equal to the loan amount net of the loan origination fee. The loan origination fee is determined by the term and credit grade of the loan, and ranges from 1.00% to 5.00% of the original principal amount. Since the Company accounts for Borrower Loans, Loans held for investment and Notes at fair value, origination fees are not deferred but are recognized at origination of the Borrower Loan, and direct costs to originate Borrower Loans are recorded as expenses as incurred.

Loan Servicing Fees

Loan servicing revenue includes monthly loan servicing fees and non-sufficient funds (“NSF”) fees. Loan servicing fees are accrued daily based on the current outstanding loan principal balance of the Borrower Loans, but are not recognized until payment is received due to the uncertainty of collection of Borrower Loan payments. NSF fees are charged to borrowers on the first failed payment of each billing period. NSF fees are charged to the borrower and collected and recognized immediately.

Interest Income on Borrower Loans Receivable and Interest Expense on Notes

The Company recognizes interest income on Borrower Loans funded through the Note Channel and interest expense on the corresponding Notes using the accrual method based on the stated interest rate to the extent the Company believes it to be collectable. Below is a table which summarizes the gross interest income and expense for the three months ended March 31, 2014 and 2013.

|

|

Three months ended

March 31,

|

|||||||

|

|

2014

|

2013

|

||||||

|

Interest income on Borrower Loans

|

$

|

10,109

|

$

|

7,727

|

||||

|

Interest expense on Notes

|

(9,269

|

)

|

(7,326

|

)

|

||||

|

Net interest income

|

$

|

840

|

$

|

401

|

||||

Marketing and Advertising Expense

Under the provisions of ASC Topic 720, Other Expenses, the costs of advertising are expensed as incurred. Marketing and advertising costs were $5,986 and $1,572 for the three months ended March 31, 2014 and 2013, respectively.

Rebate and Promotional Expenses

Rebates and promotions are accounted for in accordance with ASC Topic 605, Revenue Recognition. From time to time, rebates and promotions are offered to borrower and lender members. These rebates and promotions are recorded as an offset to revenue if a particular rebate or promotion is earned upon the origination of the Borrower Loan. Rebates and promotions have in the past been in the form of cash back and other incentives paid to borrower and lender members.

Stock-Based Compensation

Stock-based compensation for employees is accounted for using fair-value-based accounting in accordance with ASC Topic 718, Stock Compensation. ASC Topic 718 requires companies to estimate the fair value of stock-based awards on the date of grant using an option-pricing model. The stock-based compensation related to awards that are expected to vest is amortized using the straight line method over the vesting term of the stock-based award, which is generally four years. Expected forfeitures of unvested options are estimated at the time of grant such that expense is recorded only for those stock-based awards that are expected to vest.

Options have been granted to purchase shares of common stock to nonemployees in exchange for services performed, which the Company accounts for in accordance with the provisions of ASC Topic 505-50, Equity-Based Payments to Non-Employees. Because ASC Topic 505 requires that nonemployee equity awards be recorded at their fair value, the Black-Scholes model is used to estimate the fair value of options granted to nonemployees at each vesting date until performance is complete to determine the appropriate charge for the services provided. The volatility of the Company’s common stock was based on comparative company volatility.

Net Loss Per Share

Net loss per share is computed in accordance with ASC Topic 260, Earnings Per Share. Under ASC Topic 260, basic net loss per share is computed by dividing net loss per share available to common shareholders by the weighted average number of common shares outstanding for the period and excludes the effects of any potentially dilutive securities. Diluted earnings per share, if presented, would include the dilution that would occur upon the exercise or conversion of all potentially dilutive securities into common stock using the “treasury stock” and/or “if converted” methods as applicable. At March 31, 2014, there were outstanding convertible preferred stock, warrants and options convertible into 27,274,068, 218,810 and 4,355,564 common shares, respectively, which may dilute future earnings per share. At March 31, 2013, there were outstanding convertible preferred stock, warrants and options convertible into 18,985,334, 218,810 and 919,668 common shares, respectively, which may dilute future earnings per share. The weighted average number of shares and the loss per share reflect a 10-for-1 reverse stock split effected by the Company on October 29, 2013. By reporting a net loss for the three months ended March 31, 2014 and 2013, potentially dilutive securities are excluded from the computation of net loss per share, as their effect would be antidilutive.

Income Taxes

The asset and liability method is used to account for income taxes as codified in ASC Topic 740, Income Taxes. Under this method, deferred income tax assets and liabilities are based on the differences between the financial statements and tax bases of assets and liabilities that will result in taxable or deductible amounts in the future based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized.

Under ASC Topic 740, the Company’s policy to include interest and penalties related to gross unrecognized tax benefits within its provision for income taxes did not change. U.S. Federal, California and other state income tax returns are filed. The Company is currently not undergoing any income tax examinations. Due to the net operating loss, generally all tax years remain open.

Comprehensive Income

There is no comprehensive income (loss) other than the net income (loss) disclosed in the condensed consolidated statements of operations.

Recent Accounting Pronouncements

The Company does not expect the adoption of recently issued accounting pronouncements to have a material impact on the results of operations, financial position or cash flows.

|

3.

|

Borrower Loans and Notes Held at Fair Value

|

As observable market prices are not available for the Borrower Loans and Notes funded through the Note Channel, or for similar assets and liabilities, the Company believes such Borrower Loans and Notes should be considered Level 3 financial instruments under ASC Topic 820. In a hypothetical transaction as of the measurement date, the Company believes that differences in the principal marketplace in which such Borrower Loans are originated and the principal marketplace in which it might offer such Borrower Loans for sale may result in differences between the originated amount of the Borrower Loans and their fair value as of the transaction date. For Borrower Loans funded through the Note Channel, the fair value is estimated using discounted cash flow methodologies based upon valuation assumptions including prepayment speeds, roll rates, recovery rates and discount rates based on the perceived credit risk within each credit grade.

The obligation to pay principal and interest on any series of Notes is equal to the loan payments, if any, that are received on the corresponding Borrower Loan, net of its servicing fee. The fair value election for Notes and Borrower Loans funded through the Note Channel allows both the assets and the related liabilities to receive similar accounting treatment for expected losses which is consistent with the subsequent cash flows to lender members that are dependent upon borrower payments. As such, the fair value of the Notes is approximately equal to the fair value of the Borrower Loans funded through the Note Channel, adjusted for the servicing fee and the timing of borrower payments subsequently disbursed to Note holders. Any unrealized gains or losses on such Borrower Loans and Notes for which the fair value option has been elected is recorded as a separate line item in the statement of operations. The effective interest rate associated with a series of Notes is less than the interest rate earned on the corresponding Borrower Loan due to the servicing fee. See further discussion in this note for a roll-forward and further discussion of the significant assumptions used to value Borrower Loans and Notes funded through the Note Channel.

The fair value of the Borrower Loans and Notes funded through the Note Channel is estimated using discounted cash flow methodologies based upon a set of valuation assumptions. The primary cash flow assumptions used to value such Borrower Loans and Notes include default rates derived from historical performance and discount rates applied to each credit grade based on the perceived credit risk of each credit grade. The obligation to pay principal and interest on any series of Notes is equal to the loan payments, if any, received on the corresponding Borrower Loan, net of the servicing fee. As such, the fair value of the Notes is approximately equal to the fair value of the Borrower Loans funded through the Note Channel, adjusted for the servicing fee and the timing of borrower payments subsequently disbursed to the Note holders. The effective interest rate associated with a series of Notes will be less than the interest rate earned on the corresponding Borrower Loan due to the servicing fee.

Key economic assumptions and the sensitivity of the current fair value to immediate adverse changes in those assumptions at March 31, 2014 for Borrower Loans and Notes funded through the Note Channel are presented in the following table:

|

|

Borrower Loans

|

Notes

|

||||||

|

Discount rate assumption:

|

9.74

|

%*

|

9.74

|

%*

|

||||

|

Resulting fair value from:

|

||||||||

|

100 basis point increase

|

$

|

233,350

|

$

|

230,482

|

||||

|

200 basis point increase

|

230,441

|

227,604

|

||||||

|

Resulting fair value from:

|

||||||||

|

100 basis point decrease

|

$

|

239,350

|

$

|

236,409

|

||||

|

200 basis point decrease

|

242,441

|

239,478

|

||||||

|

|

||||||||

|

|

||||||||

|

Default rate assumption:

|

6.90

|

%*

|

6.90

|

%*

|

||||

|

Resulting fair value from:

|

||||||||

|

10% higher default rates

|

$

|

233,757

|

$

|

230,863

|

||||

|

20% higher default rates

|

230,776

|

227,932

|

||||||

|

Resulting fair value from:

|

||||||||

|

10% lower default rates

|

$

|

238,792

|

$

|

235,879

|

||||

|

20% lower default rates

|

241,274

|

238,306

|

||||||

* Represents weighted average assumptions considering all credit grades.

The changes in Level 3 assets measured at fair value on a recurring basis are as follows:

|

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

|

||||||||||||||||

|

|

Borrower Loans

|

Notes

|

Loans Held for

Investment

|

Total

|

||||||||||||

|

Balance at January 1, 2014

|

$

|

226,238

|

$

|

(226,794

|

)

|

$

|

3,917

|

$

|

3,361

|

|||||||

|

Originations

|

166,608

|

(44,199

|

)

|

28,858

|

151,267

|

|||||||||||

|

Principal repayments and credit losses

|

(32,642

|

)

|

32,910

|

(100

|

)

|

168

|

||||||||||

|

Borrower loans sold to third parties

|

(121,864

|

)

|

- |

(28,602

|

)

|

(150,466

|

)

|

|||||||||

|

Change in fair value on borrower loans and notes

|

332

|

(32

|

)

|

-

|

300

|

|||||||||||

|

Change in fair value of loans held for investment

|

-

|

-

|

(2

|

)

|

(2

|

)

|

||||||||||

|

Balance at March 31, 2014

|

$

|

238,672

|

$

|

(238,115

|

)

|

$

|

4,071

|

$

|

4,628

|

|||||||

| Fair Value Measurements Using Significant Unobservable Inputs (Level 3) | ||||||||||||||||

|

|

Borrower Loans

|

Notes

|

Loans Held for

Investment

|

Total

|

||||||||||||

|

Balance at January 1, 2013

|

$

|

166,900

|

$

|

(167,478

|

)

|

$

|

175

|

$

|

(403

|

)

|

||||||

|

Originations

|

33,943

|

(33,943

|

)

|

42

|

42

|

|||||||||||

|

Principal repayments and credit losses

|

(24,360

|

)

|

24,131

|

(31

|

)

|

(260

|

)

|

|||||||||

|

Change in fair value on borrower loans and notes

|

461

|

(288

|

)

|

-

|

173

|

|||||||||||

|

Change in fair value of loans held for investment

|

-

|

-

|

2

|

2

|

||||||||||||

|

Balance at March 31, 2013

|

$

|

176,944

|

$

|

(177,578

|

) |

$

|

190

|

$

|

(444

|

)

|

||||||

The changes in fair value would directly impact the change in fair value on Borrower Loans, Loans held for investment and Notes in the condensed consolidated statements of operations.

Due to the recent origination of the Borrower Loans and Notes funded through the Note Channel, the change in fair value attributable to instrument-specific credit risk is immaterial. Of the 88,670 Borrower Loans originated from July 13, 2009 to March 31, 2014, 271 Borrower Loans were 90 days or more delinquent, which related to an aggregate principal amount of $1,649 and a fair value of $211 as of March 31, 2014.

|

4.

|

Loans Held for Investment

|

For the three months ended March 31, 2014 and 2013, a total of $28,858 and $42 of Borrower Loans originated through the platform as Loans held for investment. For the three months ended March 31, 2014 and 2013, $28,602 and $0 of these Borrower Loans were sold to an unrelated third party through the Whole Loan Channel. Loans held for investment on the condensed consolidated balance sheets as of March 31, 2014 and December 31, 2013 was $4,071 and $3,917, respectively. When a Borrower Loan has been funded by the Company in whole, or in part, the portion of the borrower’s monthly loan payment that corresponds to the percentage of the Borrower Loan that is funded is retained. In these cases, interest income is recorded on these Borrower Loans.

The fair value adjustment on these Loans held for investment was $(2) and $2, which is included in other income and expenses for the three months ended March 31, 2014 and 2013, respectively. Payments received on these Borrower Loans were $95 and $27 for the three months ended March 31, 2014 and 2013, respectively. Loans held for investment which were charged-off amounted to $5 and $3 for the three months ended March 31, 2014 and 2013, respectively.

|

5.

|

Repurchase and Indemnification Obligation

|

For the three months ended March 31, 2014 and 2013, the provision for repurchase and indemnification obligation was $62 and $127, respectively. The balance of the Repurchase and indemnification obligation as of March 31, 2014 and December 31, 2013, was $101 and $32, respectively.

|

6.

|

Net Loss Per Share

|

The Company computes net loss per share in accordance with ASC Topic 260. Under ASC Topic 260, basic net loss per share is computed by dividing net loss per share available to common stockholders by the weighted average number of common shares outstanding for the period and excludes the effects of any potentially dilutive securities. Diluted earnings per share, if presented, would include the dilution that would occur upon the exercise or conversion of all potentially dilutive securities into common stock using the “treasury stock” and/or “if converted” methods as applicable. The weighted average number of shares and the loss per share reflect a 10-for-1 reverse stock split effected by the Company on October 29, 2013.

The Company uses the two-class method to compute net loss per share because the Company has issued securities, other than common stock, that contractually entitle the holders to participate in dividends and earnings of the Company. The two-class method requires earnings for the period to be allocated between common stock and participating securities based upon their respective rights to receive distributed and undistributed earnings. Prior to their conversion to common shares, each series of the Company’s convertible preferred stock was entitled to participate on an as-if-converted basis in distributions, when and if declared by the board of directors (“Board of Directors”), that were made to common stockholders and as a result these shares were considered participating securities. During the three months ended March 31, 2014, certain shares issued as a result of the early exercise of stock options, which are subject to a repurchase right by the Company, were entitled to receive non-forfeitable dividends during the vesting period and as a result were considered participating securities.

Under the two-class method, for periods with net income, basic net income per common share is computed by dividing the net income attributable to common stockholders by the weighted average number of shares of common stock outstanding during the period. Net income attributable to common stockholders is computed by subtracting from net income the portion of current year earnings that the participating securities would have been entitled to receive pursuant to their dividend rights had all of the year’s earnings been distributed. No such adjustment to earnings is made during periods with a net loss, as the holders of the participating securities have no obligation to fund losses. Diluted net loss per common share is computed under the two-class method by using the weighted average number of shares of common stock outstanding, plus, for periods with net income attributable to common stockholders, the potential dilutive effects of stock options and warrants. In addition, the Company analyzes the potential dilutive effect of the outstanding participating securities under the “if-converted” method when calculating diluted earnings per share, in which it is assumed that the outstanding participating securities convert into common stock at the beginning of the period. The Company reports the more dilutive of the approaches (two class or “if-converted”) as its diluted net income per share during the period. Due to net losses for the three months ended March 31, 2014 and 2013, basic and diluted loss per share were the same, as the effect of potentially dilutive securities would have been anti-dilutive.

Due to losses attributable to the Company’s common shareholders for each of the periods below, the following potentially dilutive shares are excluded from the diluted net loss per share calculation because they were anti-dilutive under the treasury stock method, in accordance with ASC Topic 260:

|

|

Three Months

ended March 31

|

Year ended

December 31

|

||||||

|

|

2014

|

2013

|

||||||

|

Excluded Securities:

|

(shares)

|

(shares)

|

||||||

|

Convertible preferred stock issued and outstanding

|

27,274,068

|

27,274,068

|

||||||

|

Stock options issued and outstanding

|

4,355,564

|

938,585

|

||||||

|

Unvested stock options exercised

|

20,750

|

6,499,463

|

||||||

|

Warrants issued and outstanding

|

218,810

|

218,810

|

||||||

|

Total common stock equivalents excluded from diluted net loss per common share computation

|

31,869,192

|

34,930,926

|

||||||

The number of shares issued and outstanding reflect a 10-for-1 reverse stock split effected by the Company on October 29, 2013.

|

7.

|

Stockholders’ Equity

|

Preferred Stock

Under the Company's certificate of incorporation, preferred stock is issuable in series, and the Company’s Board of Directors is authorized to determine the rights, preferences, and terms of each series.

In January 2013, the Company issued and sold 13,868,152 shares of new Series A (“Series A”) preferred stock in a private placement at a purchase price of $1.44 per share for $19,841, net of issuance costs. In connection with that sale, the Company issued 5,117,182 shares at par value $0.01 per share of Series A-1 (“Series A-1”) convertible preferred stock to the holders of shares of the Company’s preferred stock that was outstanding immediately prior to the sale (“Old Preferred Shares”) in consideration for such stockholders participating in the sale. In connection with the new Series A sale, Old Preferred Shares were converted into shares of common stock at a ratio of 1:1 if the holder of the Old Preferred Shares participated in the new Series A sale or at a 10:1 ratio if the holder of the Old Preferred Shares did not so participate. In addition, each such participating holder received a share of new Series A-1 preferred stock for every dollar of liquidation preference associated with an Old Preferred Share held by such holder. Each share of Series A-1 preferred stock has a liquidation preference of $1.00 and converts into common stock at a ratio of 1,000,000:1. These securities were sold in reliance on the exemption from the registration requirements of the Securities Act set forth in Section 4(2) of the Securities Act and Regulation D promulgated thereunder regarding sales by an issuer not involving a public offering.

In September 2013, the Company issued and sold 8,288,734 shares of new Series B (“Series B”) preferred stock in a private placement at a purchase price of $3.02 per share for approximately $24,930, net of issuance costs.

|

Convertible

Preferred Stock

|

Par

Value

|

Authorized, Issued and

Outstanding shares as of

March 31, 2014

|

Liquidation Preference

|

|||||||||

|

New Series A

|

$

|

0.01

|

13,868,152

|

$

|

20,000

|

|||||||

|

Series A-1

|

0.01

|

5,117,182

|

51,172

|

|||||||||

|

New Series B

|

0.01

|

8,288,734

|

25,000

|

|||||||||

|

|

27,274,068

|

$

|

96,172

|

|||||||||

The number of shares issued and outstanding reflect a 10-for-1 reverse stock split effected by the Company on October 29, 2013.

Dividends

Dividends on shares of the new Series A and new Series B preferred stock are payable only when, as, and if declared by the Board of Directors. No dividends will be paid with respect to the common stock until any declared dividends on the new Series A preferred stock and new Series B preferred stock have been paid or set aside for payment to the new Series A preferred stockholders and the new Series B preferred stockholders. After payment of any such dividends, any additional dividends or distributions will be distributed among all holders of common stock and preferred stock in proportion to the number of shares of common stock that would be held by each such holder if all shares of preferred stock were converted to common stock at the then effective conversion rate. To date, no dividends have been declared on any of the Company’s preferred stock or common stock, and there are no dividends in arrears at March 31, 2014.

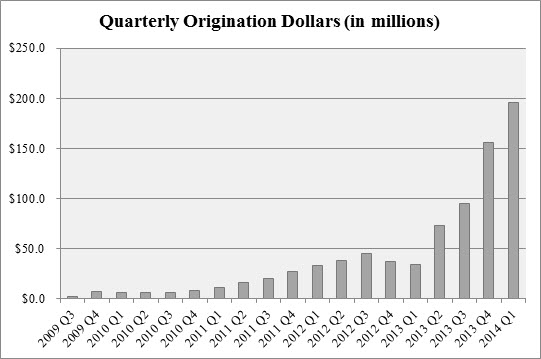

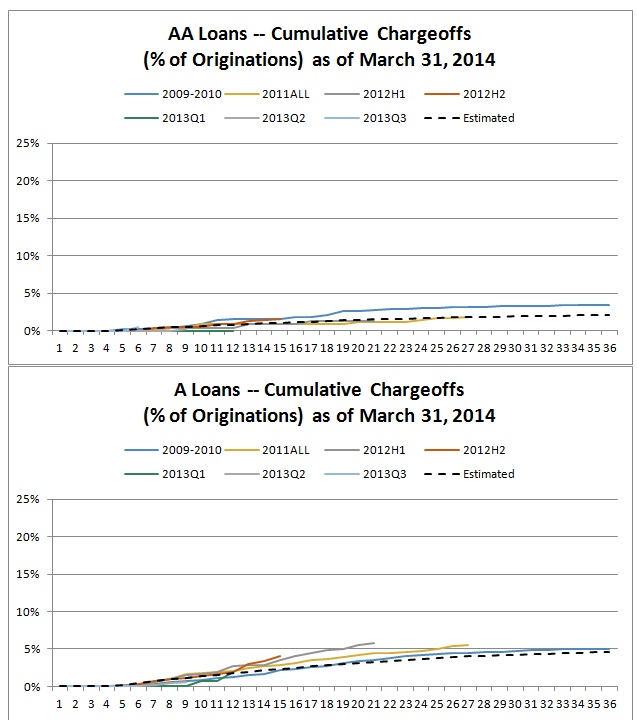

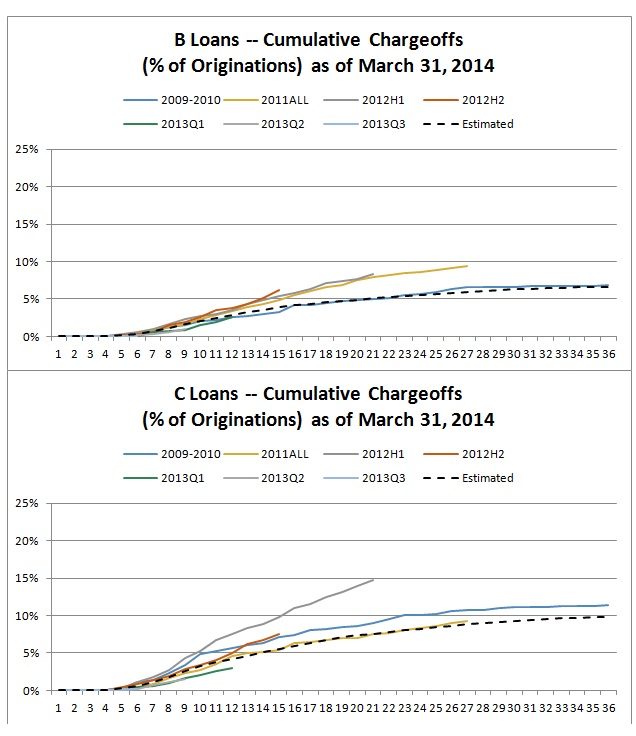

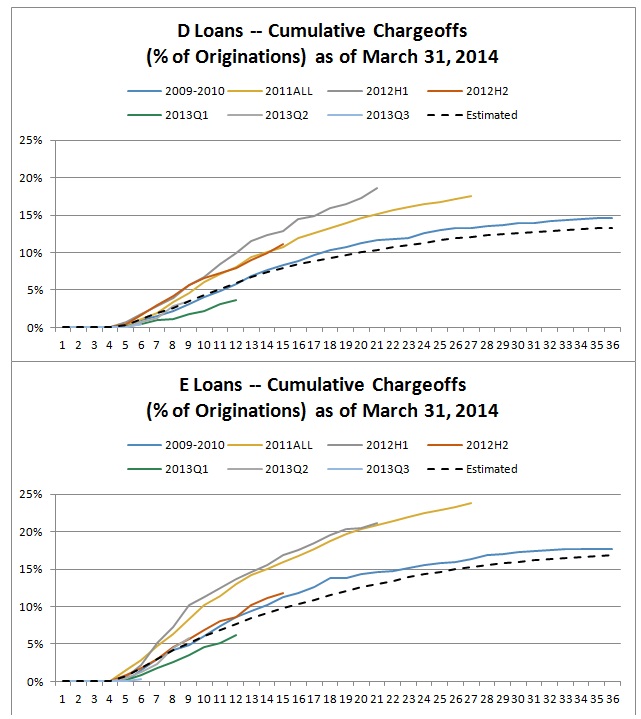

Conversion