UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2018

Commission File Number 333-146934

| NORTHERN MINERALS & EXPLORATION LTD. |

| (Exact name of registrant as specified in its charter) |

| Nevada | 98-0557171 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

| 1889 FM 2088, Quitman, Texas | 75783 | |

| (Address of principal executive offices) | (Zip Code) |

| (254) 631-2093 |

| (Registrant’s telephone number, including area code) |

| (Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☐ YES ☒ NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☐ YES ☒ NO

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act ☐ YES ☒ NO

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. As of November 9, 2018, the issuer had 48,436,818 common shares issued and outstanding.

NORTHERN MINERALS & EXPLORATION LTD.

FORM 10-K

For the Year ended July 31, 2018

TABLE OF CONTENTS

i

ITEM 1. DESCRIPTION OF BUSINESS

Our Corporate History and Background

We were incorporated on December 11, 2006 under the laws of the State of Nevada.

We were originally a company involved in the placing of strength testing amusement gaming machines called Boxers in venues such as bars, pubs and nightclubs in the Seattle area, in the State of Washington. We acquired one Boxer that had been placed in Lynnwood, Washington. However, the machine was de-commissioned as it needed material repairs. We were not able to secure sufficient capital for these repairs and our management decided to change our business focus to on oil and gas and mineral exploration. On July 12, 2013, the stockholders approved an amendment to change the name of the Company from Punchline Resources Ltd. to Northern Mineral & Exploration Ltd. FINRA approved the name change on August 13, 2013.

Northern Minerals & Exploration Ltd. (the “Company”) is an emerging natural resource company operating in oil and gas production in central Texas and exploration for gold and silver in northern Nevada.

On November 22, 2017, the Company created a wholly owned subsidiary, Kathis Energy LLC (“Kathis”), a duly formed Limited Liability Company formed in the State of Texas, for the purpose of conducting oil and gas drilling programs in Texas.

On December 14, 2017, Kathis Energy, LLC and other Limited Partners, created Kathis Energy Fund 1, LP, a duly formed Limited Partnership formed in the State of Texas, created for the purpose of raising funds from investors for its drilling projects.

On May 7, 2018, the Company created a wholly owned subsidiary, ENMEX Operations LLC (“ENMEX”), a duly formed Limited Liability Company in the State of Quintana Roo, Mexico for the purpose of conducting business in Mexico in prospective real estate development projects. There has been no activity from inception to date.

Forward-Looking Statements

This report on Form 10-K contains certain forward-looking statements. All statements other than statements of historical fact are “forward-looking statements” for purposes of these provisions, including any projections of earnings, revenues, or other financial items; any statements of the plans, strategies, and objectives of management for future operation; any statements concerning proposed new products, services, or developments; any statements regarding future economic conditions or performance; statements of belief; and any statement of assumptions underlying any of the foregoing. Such forward-looking statements are subject to inherent risks and uncertainties, and actual results could differ materially from those anticipated by the forward-looking statements.

These forward-looking statements involve significant risks and uncertainties, including, but not limited to, the following: competition, promotional costs and the risk of declining revenues. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of a number of factors. These forward-looking statements are made as of the date of this filing, and we assume no obligation to update such forward-looking statements. The following discusses our financial condition and results of operations based upon our unaudited financial statements which have been prepared in conformity with accounting principles generally accepted in the United States. It should be read in conjunction with our financial statements and the notes thereto included elsewhere herein.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States Dollars (US$) and all references to “common shares” refer to the common shares in our capital stock.

As used in this quarterly report, the terms “we”, “us”, “our” and “our company” mean Northern Minerals & Exploration Ltd. formerly known as Punchline Resources Ltd., unless otherwise indicated.

1

Current Business

ENMEX Operations LLC – Wholly owned Subsidiary - Pemer Bacalar – Resort Development Project

During the quarter ended October 31, 2017, the Company entered into a Letter of Intent with Pemer Bacalar SAPI DE CV on September 22, 2017 to examine the opportunity of acquiring ownership in approximately 61 acres (“Property”) on a freshwater lagoon near the community of Bacalar, Mexico in the state of Quintana Roo for the purpose of entering into a joint venture for the potential development of the Property into a resort. On November 16, 2017, the Company entered into a Memorandum of Understanding (“MOU”) in order to further conduct due diligence toward this potential project. An amended MOU was entered into on April 13, 2018 setting forth the conditions for entering into a definitive agreement with Pemer Bacalar. As of July 31, 2018, the Company is still conducting its due diligence.

Coleman County, Texas – Three well rework/re-completion project

On October 14, 2014, we entered into an agreement to acquire the 206.5 acre J.E. Richey oil and gas lease. This lease area has six known productive formations. The existing three wells on the lease are fully equipped. Beginning in May 2015 we started conducting operations on the three wells to place them back into production. The rework/re-completion was completed on July 28, 2015 and production of oil and gas was established. Additional work was conducted on J. E. Richey lease during the fiscal year ended July 31, 2018. See Item 2 Properties for additional information

Coleman County, Texas – J. E. Richey #2A -Proposed New Well:

The Company has sold working interest in a 20 acre tract on the J.E. Richey Lease to drill a new well near the ARCO Richey #2 well. This well initially was completed in the Lower Ellenburger in 1982 coming in at 19 barrels per day. Following depletion of the Lower Ellenburger the well was re-completed in the Upper Ellenburger with an initial production rate of 2,535 MCF per day. Subsequently the well was re-completed in the Gray Sand, which came in at 45 barrels per day on a light acid job and no sand frac was conducted. The well only produced for a limited amount of time from the Gray Sand when a hole came in the casing above the cement at 1100 feet caused by a corrosive formation known as the Coleman Junction and the well was shut in. This well was plugged due to casing problems in the well on December 28, 2017. See Item 2 Properties for additional information

Kathis Energy LLC – Wholly owned Subsidiary:

The Company created a wholly owned subsidiary, Kathis Energy LLC (“Kathis”), on November 22, 2017 for the purpose of conducting oil and gas drilling programs in Texas. The Company agreed to assign to Kathis the Olson and Guy Ranch leases in exchange for $126,500. Kathis is seeking to raise drilling funds to drill up to 8 wells. As of July 31, 2018, Kathis has raised $125,000 and is continuing to seek funding for its drilling program. As of the date of this report no wells have been drilled. Kathis has additional information regarding its drilling program on its website www.kathisenergy.com See Item 2 Properties for additional information

Jones County, Texas – Palo Pinto Reef project

During the fiscal year ended July 31, 2016 the Company acquired the Olson lease covering 160 acres in Jones County, Texas. This lease is 1.5 miles from the Strand Palo Pinto Reef Field which was discovered in 1940 and has produced 1,700,000 barrels of oil from 8 wells or 212,500 barrels of oil per well. The structure map on the Palo Pinto shows a large buildup in the Palo Pinto Reef across the southern portion of the lease. See Item 2 Properties for additional information

Shackelford County, Texas – Guy Ranch Project:

During the fiscal year ended July 31, 2016 the Company acquired 692-acres divided into two tracts Guy Ranch Lease in Shackelford County. The Guy Ranch lease is located in the southern part of Shackelford County. The Ranch has 32 wind turbines on it representing it is at a structurally higher elevation. The principal targets for this drilling prospect is the Patio (aka Palo Pinto Sand) and Morris Sands the area is also know to be productive from three other formations on the Guy Ranch acreage. See Item 2 Properties for additional information

Riverside Prospects, Runnels County, Texas

On October 20, 2017 the Company entered into an exclusive option agreement with Murphree Oil Company to acquire drilling prospects on four leases in Runnels County near the City of Ballinger, known as the Riverside Prospects. During the quarter ended April 30, 2018, the Company, through its wholly owned subsidiary, Kathis Energy LLC, (“Kathis”) paid the lease bonuses for extending the oil and gas lease period on 548.76 acres covering the Riverside Prospects. This acreage consists of 4 leases in a well established area where oil and gas production was discovered during 1978 – 1983. See Item 2 Properties for additional information

2

89 Guy #4 Well – Cased Hole:

On April 16, 2018, Kathis Energy acquired the 89 Guy Well #4 located on a 20-acre tract on the Guy Ranch property in Shackelford County, Texas. The well is an abandoned cased well that was drilled in October 2010 and completed in the Patio Sand at the interval of 3,144’ - 3,154’. The interval perforated (3,144 – 3,154’) is above the best productive part of the formation. See Item 2 Properties for additional information

McClure 2B Gas Well – Producing:

On February 6, 2018 the Company acquired the McClure # 2B producing gas well on a 40-acre oil & gas lease located in Palo Pinto County near the Community of Graford, Texas. The McClure 2B well is completed in the Strawn in the interval 2,882’ to 2,940’ and has produced in excess of 70 million cubic feet of natural gas. See Item 2 Properties for additional information

Carter & Foster Wells – Producing:

During the fiscal year ended July 31, 2018 the Company acquired the Carter and Foster wells located west of the Community of Atwell, Texas in Callahan County. The Carter lease consists of 40 acres and has one well. The Foster lease has 10 acres around each well of the three wells, all of which are fully equipped with surface and subsurface equipment. All four wells are completed in the Palo Pinto Limestone formation at approximately 1,900 feet. See Item 2 Properties for additional information

Reeves Lease – Acreage – Palo Pinto Reef Prospect:

In August 2018, subsequent to the end of the fiscal year ended July 31, 2018, the Company paid for the geological prospecting fees for a Palo Pinto Reef prospect in Jones County. The Reeves lease covers 160 acres and is located near Noodle, Texas in Jones County. The projected depth of the Palo Pinto Reef is 4,300’. See Item 2 Properties for additional information

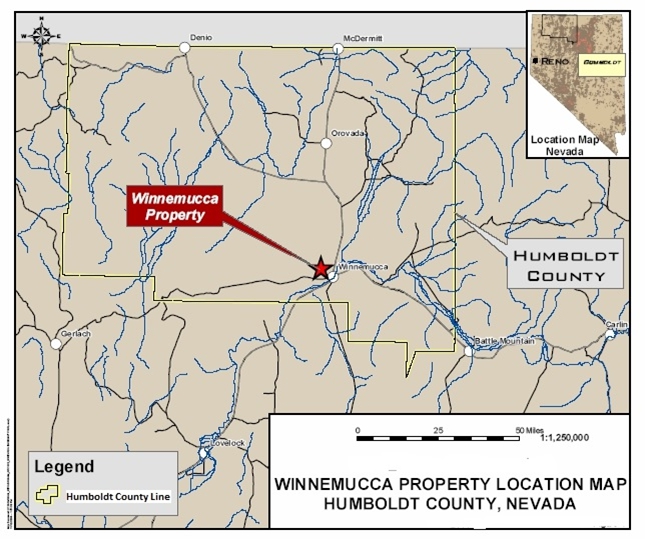

Winnemucca Mountain Property

On September 14, 2012, our company entered into an option agreement (as amended and restated on November 15, 2012, February 1, 2013 and August 26, 2013) with AHL Holdings Ltd., a Nevada corporation, and Golden Sands Exploration Inc., a company incorporated under the laws of British Columbia, Canada, wherein we acquired an option to purchase a revised 80% interest in and to certain mining claims from AHL Holdings and Golden Sands, which claims form the Winnemucca Mountain Property in Humboldt County, Nevada. This Winnemucca Mountain property is currently comprised of 138 unpatented mining claims covering an area of approximately 2,700 acres.

On July 23, 2018, the Company entered into a New Option Agreement with AHL Holding Ltd & Golden Sands Exploration Inc. (“Optionors”). This agreement provided for the payment of $25,000 and the issuance of 3,000,000 shares of the Company’s common stock. The Company issued the shares and made the payment of $25,000 per the agreement on July 31, 2018. The second payment of $25,000 per the terms of the agreement was to be paid when it was due on August 31, 2018. The Company is in default of the terms of the July 23, 2018 agreement. The Company at the time of this filing is in discussions seek a mutual agreement and or settlement with the Optionors to proceed forward with the Winnemucca Property. Item 2 Properties for additional information

Mining Sector

Competition

We are a mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

3

Compliance with Government Regulation

The operation of mines is governed by both federal and state laws. The Empress Property and the Winnemucca Property are administered by the United States Department of Interior, Bureau of Land Management (“BLM”) in Nevada. In general, the federal laws that govern mining claim location and maintenance and mining operations on Federal Lands, including the Empress Property and Winnemucca Property, are administered by the BLM. Additional federal laws, such as those governing the purchase, transport or storage of explosives, and those governing mine safety and health, also apply.

The State of Nevada likewise requires various permits and approvals before mining operations can begin, although the state and federal regulatory agencies usually cooperate to minimize duplication of permitting efforts. Among other things, a detailed reclamation plan must be prepared and approved, with bonding in the amount of projected reclamation costs. The bond is used to ensure that proper reclamation takes place, and the bond will not be released until that time. The Nevada Division of Environmental Protection (NDEP) is the state agency that administers the reclamation permits, mine permits and related closure plans on the project. Local jurisdictions may also impose permitting requirements, such as conditional use permits or zoning approvals.

Mining activities at the Properties are also subject to various environmental laws, both federal and state, including but not limited to the federal National Environmental Policy Act, CERCLA (as defined below), the Resource Recovery and Conservation Act, the Clean Water Act, the Clean Air Act and the Endangered Species Act, and certain Nevada state laws governing the discharge of pollutants and the use and discharge of water. Various permits from federal and state agencies are required under many of these laws. Local laws and ordinances may also apply to such activities as waste disposal, road use and noise levels.

We are committed to fulfilling our requirements under applicable environmental laws and regulations. These laws and regulations are continually changing and, as a general matter, are becoming more restrictive. Our policy is to conduct our business in a manner that safeguards public health and mitigates the environmental effects of our business activities. To comply with these laws and regulations, we have made, and in the future may be required to make, capital and operating expenditures.

The Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended (CERCLA), imposes strict, joint, and several liability on parties associated with releases or threats of releases of hazardous substances. Liable parties include, among others, the current owners and operators of facilities at which hazardous substances were disposed or released into the environment and past owners and operators of properties who owned such properties at the time of such disposal or release. This liability could include response costs for removing or remediating the release and damages to natural resources. We are unaware of any reason why our properties would currently give rise to any potential liability under CERCLA. We cannot predict the likelihood of future liability under CERCLA with respect to our properties or surrounding areas that have been affected by historic mining operations.

Under the Resource Conservation and Recovery Act (RCRA) and related state laws, mining companies may incur costs for generating, transporting, treating, storing, or disposing of hazardous or solid wastes associated with certain mining-related activities. RCRA costs may also include corrective action or clean up costs.

Mining operations may produce air emissions, including fugitive dust and other air pollutants, from stationary equipment, such as crushers and storage facilities, and from mobile sources such as trucks and heavy construction equipment. All of these sources are subject to review, monitoring, permitting, and/or control requirements under the federal Clean Air Act and related state air quality laws. Air quality permitting rules may impose limitations on our production levels or create additional capital expenditures in order to comply with the permitting conditions. Under the federal Clean Water Act and delegated state water-quality programs, point-source discharges into “Waters of the State” are regulated by the National Pollution Discharge Elimination System (NPDES) program. Section 404 of the Clean Water Act regulates the discharge of dredge and fill material into “Waters of the United States,” including wetlands. Stormwater discharges also are regulated and permitted under that statute. All of those programs may impose permitting and other requirements on our operations.

The National Environmental Policy Act (NEPA) requires an assessment of the environmental impacts of “major” federal actions. The “federal action” requirement can be satisfied if the project involves federal land or if the federal government provides financing or permitting approvals. NEPA does not establish any substantive standards. It merely requires the analysis of any potential impact. The scope of the assessment process depends on the size of the project. An “Environmental Assessment” (EA) may be adequate for smaller projects. An “Environmental Impact Statement” (EIS), which is much more detailed and broader in scope than an EA, is required for larger projects. NEPA compliance requirements for any of our proposed projects could result in additional costs or delays.

4

The Endangered Species Act (ESA) is administered by the U.S. Fish and Wildlife Service of the U.S. Department of Interior. The purpose of the ESA is to conserve and recover listed endangered and threatened species and their habitat. Under the ESA, “endangered” means that a species is in danger of extinction throughout all or a significant portion of its range. The term “threatened” under such statute means that a species is likely to become endangered within the foreseeable future. Under the ESA, it is unlawful to “take” a listed species, which can include harassing or harming members of such species or significantly modifying their habitat. We currently are unaware of any endangered species issues at our projects that would have a material adverse effect on our operations. Future identification of endangered species or habitat in our project areas may delay or adversely affect our operations.

U.S. federal and state reclamation requirements often mandate concurrent reclamation and require permitting in addition to the posting of reclamation bonds, letters of credit or other financial assurance sufficient to guarantee the cost of reclamation. If reclamation obligations are not met, the designated agency could draw on these bonds or letters of credit to fund expenditures for reclamation requirements. Reclamation requirements generally include stabilizing, contouring and re-vegetating disturbed lands, controlling drainage from portals and waste rock dumps, removing roads and structures, neutralizing or removing process solutions, monitoring groundwater at the mining site, and maintaining visual aesthetics. We are committed to maintaining all of our financial assurance and reclamation obligations.

We believe that we are currently in compliance with the statutory and regulatory provisions governing our operations. We hold or will hold all necessary permits and other authorizations to the extent that our current or future claims and the associated operations require them. During the initial phases of our exploration program there will not be any significant disturbances to the land or environment and hence, no government approval is required.

However, we may do business and own properties in a number of different geographical areas and are therefore subject to the jurisdictions of a large number of different authorities at different countries. We plan to comply with all statutory and regulatory provisions governing our current and future operations. However, these regulations may increase significant costs of compliance to us, and regulatory authorities also could impose administrative, civil and criminal penalties for non-compliance. At this time, it is not possible to accurately estimate how laws or regulations would impact our future business. We also can give no assurance that we will be able to comply with future changes in the statutes and regulations.

As we do not know the extent of the exploration program that we will be undertaking, we cannot estimate the cost of the remediation and reclamation that will be required. Hence, it is impossible at this time to assess the impact of any capital expenditures on earnings or our competitive position in the event that a potentially economic deposit is discovered.

If we are successful in identifying a commercially viable ore body and we are able to enter into commercial production, due to the increased environmental impact, the cost of complying with permit and environmental laws will be greater than in the previous phases.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Oil & Gas Sector

Competition

The petroleum industry is highly competitive. Many of the oil and gas exploration companies with whom we compete have greater financial and technical resources than we do. Accordingly, these competitors may be able to spend greater amounts on acquisitions of properties of merit and on exploration. In addition, they may be able to afford greater geological expertise in the targeting and exploration of resource properties. This competition could result in our competitors having resource properties of greater quality and interest to prospective investors who may finance additional exploration, and to senior exploration companies that may purchase resource properties or enter into joint venture agreements with junior exploration companies. This competition could adversely impact our ability to finance property acquisitions and further exploration.

5

We compete with other exploration and early stage operating companies for financing from a limited number of investors prepared to make investments in junior companies exploring for conventional and unconventional oil and gas resources. The presence of competing oil and gas exploration companies, both major and independent, may impact our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the properties under investigation, and the price of the investment offered to investors.

Governmental Regulation

Our business is affected by numerous laws and regulations, including energy, environmental, conservation, tax and other laws and regulations relating to the oil and natural gas industry. We have developed internal procedures and policies to ensure that our operations are conducted in full and substantial environmental regulatory compliance.

Failure to comply with any laws and regulations may result in the assessment of administrative, civil and/or criminal penalties, the imposition of injunctive relief or both. Moreover, changes in any of these laws and regulations could have a material adverse effect on business. In view of the many uncertainties with respect to current and future laws and regulations, including their applicability to us, we cannot predict the overall effect of such laws and regulations on our future operations.

We believe that our operations comply in all material respects with applicable laws and regulations and that the existence and enforcement of such laws and regulations have no more restrictive an effect on our operations than on other similar companies in the oil and natural gas industry.

Pricing and Marketing of Natural Gas

In the US, historically, the sale of natural gas in interstate commerce has been regulated pursuant to the Natural Gas Act of 1938, or the NGA, the Natural Gas Policy Act of 1978, or the NGPA, and regulations promulgated thereunder by the Federal Energy Regulatory Commission, or the FERC. In 1989, Congress enacted the Natural Gas Wellhead Decontrol Act, or the Decontrol Act. The Decontrol Act removed all NGA and NGPA price and non-price controls affecting wellhead sales of natural gas effective January 1, 1993 and sales by producers of natural gas are uncontrolled and can be made at market prices. The natural gas industry historically has been heavily regulated and from time to time proposals are introduced by Congress and the FERC and judicial decisions are rendered that impact the conduct of business in the natural gas industry. We cannot assure you that the less stringent regulatory approach recently pursued by the FERC and Congress will continue.

Pricing and Marketing of Oil

In the US, sales of crude oil, condensate and natural gas liquids are not regulated and are made at negotiated prices. Effective January 1,1995, the FERC implemented regulations establishing an indexing system for transportation rates for oil that allowed for an increase in the cost of transporting oil to the purchaser.

Royalties and Incentives

The royalty regime is a significant factor in the profitability of oil, natural gas and natural gas liquids production. In the US, all royalties are determined by negotiations between the mineral owner and the lessee.

Environmental

Like the oil and natural gas industry in general, our properties are subject to extensive and changing federal, state and local laws and regulations designed to protect and preserve natural resources and the environment. The recent trend in environmental legislation and regulation in the oil and natural gas industry is generally toward stricter standards, and this trend is likely to continue. These laws and regulations often require a permit or other authorization before construction or drilling commences and for certain other activities; limit or prohibit access, especially in wilderness areas with endangered or threatened plant or animal species; impose restrictions on construction, drilling and other exploration and production activities; regulate air emissions, wastewater and other production and waste streams from our operations; impose substantial liabilities for pollution that may result from our operations; and require the reclamation of certain lands.

6

The permits required for many of our operations are subject to revocation, modification and renewal by issuing authorities. Governmental authorities have the power to enforce compliance with their regulations, and violations are subject to fines, compliance orders, and other enforcement actions. We are not aware of any material noncompliance with current applicable environmental laws and regulations, and we have no material commitments for capital expenditures to comply with existing environmental requirements, however, given the complex regulatory requirements applicable to our operations, and the rapidly changing nature of environmental laws in our industry, we cannot predict our future exposure concerning such matters, and our future costs to achieve compliance, or remedy potential violations, could be significant. Our operations require permits and are regulated under environmental laws, and current or future noncompliance with such laws, as well as changes to existing laws or interpretations thereof, could have a significant impact on us, as well as the oil and natural gas industry in general.

Waste Disposal and Contamination Issues

The federal Comprehensive Environmental Response, Compensation and Liability Act and comparable state laws may impose strict and joint and several liability on owners and operators of contaminated sites and on persons who disposed of or arranged for the disposal of hazardous substances found at such sites. Under these and other laws, the government, neighboring landowners and other third parties may recover the costs of responding to soil and groundwater contamination and threatened releases of hazardous substances, and seek recovery for related natural resources damages, personal injury and property damage. Some of our properties have been used for exploration and production activities for a number of years by third parties, and such properties could result in unknown cleanup liabilities for us.

The federal Resource Conservation and Recovery Act (the “RCRA”) and comparable state statutes govern the management, storage, treatment and disposal of solid waste and hazardous waste and authorize imposition of substantial fines and penalties for noncompliance. Although RCRA classifies certain oil field wastes as “non-hazardous” (for example, the waters produced from hydraulic fracturing operations), such wastes could be reclassified as hazardous wastes in the future, thereby making them subject to more stringent handling and disposal requirements which could have a material impact on us.

Water Regulation

The federal Clean Water Act (the “CWA”), the federal Safe Drinking Water Act (the “SWDA”) and analogous state laws restrict the discharge of wastewater and other pollutants into surface waters or underground wells and the construction of facilities in wetland areas without a permit. Federal regulations also require certain owners or operators of facilities that store or otherwise handle oil, such as us, to prepare and implement spill prevention, control countermeasure and response plans relating to the possible discharge of oil into surface waters. In addition, the Oil Pollution Act (the “OPA”) contains numerous requirements relating to the prevention of and response to oil spills into waters of the United States. For onshore and offshore facilities that may affect waters of the United States, the OPA requires an operator to demonstrate financial responsibility. Regulations are currently being developed or considered under federal and state laws concerning oil pollution prevention and other matters that may impose additional regulatory burdens on us.

These and similar state laws also govern the management and disposal of produced waters from the extraction process. Currently, wastewater associated with oil and natural gas production is prohibited from being directly discharged to waterways and other waters of the U.S. While some of the wastewater is reused or re-injected, a significant amount still requires proper disposal. As a result, some wastewater is transported to third-party treatment plants. In October 2011, citing concerns that third-party treatment plants may not be properly equipped to handle wastewater from shale gas operations, the United States Environmental Protection Agency (the “EPA”) announced that it will consider federal pre-treatment standards for these wastewaters. We cannot predict the EPA’s future actions in this regard, but future regulation of our produced waters or other waste streams could have a material impact on us.

Air Emissions and Climate Change

The federal Clean Air Act (“CAA”) imposes permit requirements and operational restrictions on certain sources of emissions used in our operations. In July 2011, the EPA published proposed New Source Performance Standards (“NSPS”) and National Emissions Standards for Hazardous Air Pollutants (“NESHAPs”) that would, if adopted, amend existing NSPS and NESHAP standards for oil and natural gas facilities and create new NSPS standards for oil and natural gas production, transmission and distribution facilities. Importantly, these standards would include standards for hydraulically fractured wells. The standards would apply to newly drilled and fractured wells as well as existing wells that are refractured. A court has directed the EPA to issue final rules by April 1, 2012. In a report issued in late 2011, the Shale Gas Production Subcommittee of the Department of Energy (the “DOE Shale Gas Subcommittee”) called on the EPA to complete the rulemaking quickly and recommended expanding the shale gas emission sources to be covered by the new rules. The DOE Shale Gas Subcommittee also encouraged states to take similar action, and included several other recommendations for studying and reducing air emissions from shale gas production activities. Because the EPA’s regulations have not yet been finalized, we cannot at this time predict the impact they may have on our financial condition or results of operation.

7

The issue of climate change has received increasing regulatory attention in recent years. The EPA has issued regulations governing carbon dioxide, methane and other greenhouse gas (“GHG”) emissions citing its authority under the CAA Several of these regulations have been challenged in litigation that is currently pending before the federal D.C. Circuit Court of Appeals. In December 2011, the EPA issued amendments to a final rule issued in 2010 requiring reporting of GHG emissions from the oil and natural gas industry. Under this rule, we are obligated to report to the EPA certain GHG emissions from our operations. We do not expect that the costs of this new reporting will be material to us. In a late 2011 report, the DOE Shale Gas Subcommittee recommended that the EPA expand reporting requirements for GHG emissions from shale gas emission sources and include methane in reporting requirements. More generally, several proposals to regulate GHG emissions have been proposed in the U.S. Congress, and various states have taken steps to regulate GHG emissions. The adoption and implementation of regulations or legislation imposing restrictions or other regulatory obligations on emissions of GHGs from oil and natural gas operations could require us to obtain permits or allowances for our GHG emissions, install new pollution controls, increase our operational costs, limit our operations or adversely affect demand for the oil and natural gas produced from our lands.

Regulation of Hydraulic Fracturing

Our industry uses hydraulic fracturing to recover oil and natural gas in deep shale and other previously inaccessible subsurface geological formations. Hydraulic fracturing (or “fracking”) is a process to significantly increase production in drilled wells by creating or expanding cracks, or fractures, in underground formations by injecting water, sand and other additives into formations at high pressures. Like others in our industry, we may use this process as a means to increase the productivity of our wells. Although hydraulic fracturing has been an accepted practice in the oil and natural gas industry for many years, its use has dramatically increased in the last decade, and concerns over its potential environmental effects have received increasing attention from regulators and the public.

Under the Safe Drinking Water Act (“SDWA”), the EPA is prohibited from regulating the injection of fracking fluids through its underground injection control program, except in limited circumstances (for example, the EPA has asserted that it has authority to regulate when diesel is a component of the fluids). Waters produced from fracking operations must be disposed of in accordance with federal and state regulations. As discussed above, the EPA has announced an intention to propose pre-treatment standards for produced waters that are to be disposed of at third-party wastewater treatment plants. Separately, the EPA is studying the effects of fracking on drinking water as a result of Congressional and public concern over fracking’s potential to impact groundwater supplies, and the EPA has indicated that it expects to issue its findings later this year.

In that regard, the EPA recently issued a study indicating that contamination may have resulted from certain fracking operations in Wyoming. The operator of the wells has challenged the EPA’s findings, contending that other activities may be to blame for contaminated groundwater in the area, but the EPA’s findings can be expected to draw increased attention to potential groundwater impacts from fracking. In late 2011, the DOE Shale Gas Subcommittee recommended further study and coordination of federal, state and local efforts to determine and monitor potential groundwater impacts from fracking activities.

Other federal agencies, including the DOE, the Department of Interior, and the US Congress, are also investigating the potential impacts of fracking. In addition, bills have been introduced in the US. Congress to amend the SWDA to allow the EPA to regulate the injection of fracking fluids, which could require our and similar operations to meet federal permitting and financial assurance requirements, adhere to certain construction and testing specifications, fulfill monitoring, reporting, and recordkeeping obligations, and meet plugging and abandonment requirements. In addition, the federal Bureau of Land Management is developing draft regulations that would require companies drilling on federal land to disclose details of chemical additives, test the integrity of wells and report on water use and waste management. In November 2011, the EPA announced that it would solicit public input on possible reporting requirements for chemicals used in fracking under the authority of the federal Toxic Substances Control Act.

States, which traditionally have been the primary regulators of exploration and production wells, are also considering or have recently adopted, or may in the future adopt, additional regulations governing fracking activities. For example, North Dakota recently adopted regulations, effective April 1, 2012, to require disclosure of the chemical components of hydraulic fracturing fluids. We believe that compliance with any new reporting requirements will not have a material adverse impact on us. Nonetheless, these disclosures could make it easier for third parties who oppose fracking to initiate legal proceedings based on allegations that chemicals used in fracking could contaminate groundwater.

8

In addition, concerns have been raised about the potential for fracking to cause earthquakes through the disposal of produced waters into Class II underground injection control (“UIC”). The EPA’s current regulatory requirements for such wells do not require the consideration of seismic impacts when issuing permits. Some environmentalists have asked the EPA to consider reversing an exemption that excludes such wastewaters from hazardous waste rules, which would subject the wastes to more stringent management and disposal requirements. We cannot predict the EPA’s future actions in this regard. Certain states, such as Ohio, where earthquakes have been alleged to be linked to fracking activities, have proposed regulations that would require mandatory reviews of seismic data and related testing and monitoring as part of the future permitting process for UIC wells. In addition, certain other states, including New York, New Jersey and Vermont have sought to place moratoria on fracking or subject it to more stringent permitting and well construction and testing requirements. Additionally, several cities in the State of Colorado voted in November 2013 to ban or restrict fracking activities within their city limits.

Research and Development Expenditures

We have not incurred any research and development expenditures over the past two fiscal years.

Employees

As of July 31, 2018, we do not have any employees. Our four officers, Ivan Webb, Noel Schaefer, Victor Miranda and Roger Autrey act as consultants. Mr. Autrey was appointed Secretary on September 19, 2013. Mr. Schaefer was appointed as Chief Operating Officer on July 6, 2018. Mr. Miranda was appointed as Chief Financial Officer on July 6, 2018. Mr. Webb was appointed as Chief Executive Officer on July 6, 2018. Subsequent to the end of the fiscal year Mr. Autrey resigned as the Company secretary and Mr. Robert Campbell was appointed to fill the office as Secretary of the Company. There were no disagreements between the Company and Mr. Autrey.

We engage contractors from time to time to consult with us on specific corporate affairs or to perform specific tasks in connection with our exploration programs.

Subsidiaries

On November 22, 2017, the Company created a wholly owned subsidiary, Kathis Energy LLC (“Kathis”), a duly formed Limited Liability Company formed in the State of Texas, for the purpose of conducting oil and gas drilling programs in Texas.

On December 14, 2017, Kathis Energy, LLC and other Limited Partners, created Kathis Energy Fund 1, LP, a duly formed Limited Partnership formed in the State of Texas, created for the purpose of raising funds from investors for its drilling projects.

On May 7, 2018, the Company created a wholly owned subsidiary, ENMEX Operations LLC (“ENMEX”), a duly formed Limited Liability Company in the State of Quintana Roo, Mexico for the purpose of conducting business in Mexico in prospective real estate development projects.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark.

Risks Related To Our Overall Business Operations

We have a limited operating history with significant losses and expect losses to continue for the foreseeable future.

We have yet to establish any history of profitable operations. As at July 31, 2018, we have an accumulated deficit of $2,392,496 and total stockholders’ deficit of $557,374. We began generating revenues in October 2015. We expect that our revenues will not be sufficient to sustain our operations for the foreseeable future. Our profitability will require our investments in oil and gas properties to become cash flow positive and/or the successful commercialization of our mining properties. We may not be able to successfully obtain a positive cash flow from our oil and gas investments or through commercializing our mining properties or ever become profitable.

9

There is doubt about our ability to continue as a going concern due to recurring losses from operations, accumulated deficit and insufficient cash resources to meet our business objectives, all of which means that we may not be able to continue operations.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with the financial statements for the years ended July 31, 2018 and 2017, respectively, with respect to their doubt about our ability to continue as a going concern. As discussed in Note 3 to our financial statements for the year ended July 31, 2018, we have generated operating losses since inception, and our cash resources are insufficient to meet our planned business objectives, which together raises doubt about our ability to continue as a going concern.

We may not be able to conduct successful operations in the future.

The results of our operations will depend, among other things, upon our ability to develop and market our properties. Furthermore, our proposed operations may not generate income sufficient to meet operating expenses or will generate income and capital appreciation, if any, at rates lower than those anticipated or necessary to sustain ourselves. Our operations may be affected by many factors, some known by us, some unknown, and some which are beyond our control. Any of these problems, or a combination thereof, could have a materially adverse effect on our viability as an entity and might cause the investment of our shareholders to be impaired or lost.

To fully develop our business plan, we will need additional financing.

For the foreseeable future, we expect to rely principally upon external financing, although we have raised limited private placement and debt instrument funds during the past fiscal year and will be required to do so in the future. We cannot guarantee the success of this plan. We believe that from time to time, we may have to obtain additional financing in order to conduct our business in a manner consistent with our proposed operations. There can be no guaranty that additional funds will be available when, and if, needed. If we are unable to obtain financing, or if its terms are too costly, we may be forced to curtail proposed expansion of operations until such time as alternative financing may be arranged, which could have a materially adverse impact on our operations and our shareholders’ investment.

We lack working capital.

We currently lack the capital necessary to independently sustain our operations. Management is actively negotiating financing through accredited investors and other sources to meet its short term working capital needs and is negotiating long term capital options. There can be no guaranty that additional funds will be available. If we are unable to obtain financing, or if its terms are too costly, we may be forced to curtail proposed expansion of operations until such time as alternative financing may be arranged, which could have a materially adverse impact on our operations and our shareholders’ investment.

We have limited human resources necessary to expand operations.

We have a small staff of skilled developers and supplement our human resource needs through sub-contracting. We are planning to acquire additional resources internally thereby reducing the use of sub-contractors and increasing direct control over our operations. If we are unable to acquire additional resources internally we will be forced to use sub-contractors that may or may not be available to work when and where we need them thereby limiting our ability to expand operations as we intend.

Our ultimate success will be dependent upon management.

Our success is dependent upon the decision making of our directors and our executive officers, who are Noel Schaefer, Victor Miranda and Ivan Webb. These individuals intend to commit as much time as necessary to our business. The loss of any or all of these individuals could have a materially adverse impact on our operations. We currently do not have not key man life insurance on the lives of any of these officers and directors.

10

We may not be able to secure additional financing to meet our future capital needs due to changes in general economic conditions.

We anticipate needing significant capital to conduct further exploration and development needed to bring our existing oil and gas and mining properties into production and/or to continue to seek out appropriate joint venture partners or buyers for certain mining properties. We may use capital more rapidly than currently anticipated and incur higher operating expenses than currently expected, and we may be required to depend on external financing to satisfy our operating and capital needs. We may need new or additional financing in the future to conduct our operations or expand our business. Any sustained weakness in the general economic conditions and/or financial markets in the United States or globally could adversely affect our ability to raise capital on favorable terms or at all. From time to time we have relied, and may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. If we raise additional funds by issuing debt, we may be subject to debt covenants, which could place limitations on our operations including our ability to declare and pay dividends. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

Our properties are in the exploration stage. There is no assurance that we can establish the existence of any mineral resource on any of our properties in commercially exploitable quantities. Until we can do so, we can earn very little revenues from operations and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral resource in a commercially exploitable quantity, our business could fail.

Despite exploration work on our mineral properties, we have not established that our properties have sufficient mineral reserve to justify a mining operation, and there can be no assurance that we will be able to do so. If we do not, our business could fail.

A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 (which can be viewed over the Internet at http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a “reserve” that meets the requirements of the Securities and Exchange Commission’s Industry Guide 7 is extremely remote; in all probability our mineral resource properties do not contain any ‘reserve’ and any funds that we spend on exploration will probably be lost.

Even if we do eventually discover a mineral reserve on any of our properties, there can be no assurance that we will be able to develop any of our properties into a producing mine and extract those resources. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral resource. If we cannot exploit any mineral resource that we might discover on any of our properties, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could fail.

We believe that we are in compliance with all material laws and regulations that currently apply to our activities but there can be no assurance that we can continue to remain in compliance. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

11

If we establish the existence of a mineral resource on any of our properties in a commercially exploitable quantity, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the resource, and our business could fail.

If we do discover mineral resources in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the resource, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a major deposit, there can be no assurance that any discovered resource will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which would have an adverse impact on our company.

Mineral exploration, development and production involve many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations will be subject to all the hazards and risks inherent in the exploration for mineral resources and, if we discover a mineral resource in commercially exploitable quantity, our operations could be subject to all of the hazards and risks inherent in the development and production of resources, including liability for pollution, cave-ins or similar hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence would have a material adverse impact on our company.

Mineral prices are subject to dramatic and unpredictable fluctuations.

We expect to derive revenues, if any, either from the sale of our mineral resource properties or from the extraction and sale of ore. The price of those commodities has fluctuated widely in recent years, and is affected by numerous factors beyond our control, including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and therefore the economic viability of any of our exploration properties and projects, cannot accurately be predicted.

The mining industry is highly competitive and there is no assurance that we will continue to be successful in acquiring mineral claims. If we cannot continue to acquire properties to explore for mineral resources, we may be required to reduce or cease operations.

The mineral exploration, development, and production industry is largely un-integrated. We compete with other exploration companies looking for mineral resource properties. While we compete with other exploration companies in the effort to locate and acquire mineral resource properties, we will not compete with them for the removal or sales of mineral products from our properties if we should eventually discover the presence of them in quantities sufficient to make production economically feasible. Readily available markets exist worldwide for the sale of mineral products. Therefore, we will likely be able to sell any mineral products that we identify and produce.

In identifying and acquiring mineral resource properties, we compete with many companies possessing greater financial resources and technical facilities. This competition could adversely affect our ability to acquire suitable prospects for exploration in the future. Accordingly, there can be no assurance that we will acquire any interest in additional mineral resource properties that might yield reserves or result in commercial mining operations.

Risks Associated With Our Mining Industry

The development and operation of our mining projects involve numerous uncertainties.

Mine development projects, including our planned projects, typically require a number of years and significant expenditures during the development phase before production is possible.

Development projects are subject to the completion of successful feasibility studies, issuance of necessary governmental permits and receipt of adequate financing. The economic feasibility of development projects is based on many factors such as:

| ● | estimation of reserves; |

| ● | anticipated metallurgical recoveries; |

| ● | future gold and silver prices; and |

| ● | anticipated capital and operating costs of such projects. |

12

Our mine development projects may have limited relevant operating history upon which to base estimates of future operating costs and capital requirements. Estimates of proven and probable reserves and operating costs determined in feasibility studies are based on geologic and engineering analyses.

Any of the following events, among others, could affect the profitability or economic feasibility of a project:

| ● | unanticipated changes in grade and tonnage of material to be mined and processed; |

| ● | unanticipated adverse geotechnical conditions; |

| ● | incorrect data on which engineering assumptions are made; |

| ● | costs of constructing and operating a mine in a specific environment; |

| ● | availability and cost of processing and refining facilities; |

| ● | availability of economic sources of power; |

| ● | adequacy of water supply; |

| ● | adequate access to the site; |

| ● | unanticipated transportation costs; |

| ● | government regulations (including regulations relating to prices, royalties, duties, taxes, restrictions on production, quotas on exportation of minerals, as well as the costs of protection of the environment and agricultural lands); |

| ● | fluctuations in metal prices; and |

| ● | accidents, labor actions and force majeure events. |

Any of the above referenced events may necessitate significant capital outlays or delays, may materially and adversely affect the economics of a given property, or may cause material changes or delays in our intended exploration, development and production activities. Any of these results could force us to curtail or cease our business operations.

Mineral exploration is highly speculative, involves substantial expenditures, and is frequently non-productive.

Mineral exploration involves a high degree of risk and exploration projects are frequently unsuccessful. Few prospects that are explored end up being ultimately developed into producing mines. To the extent that we continue to be involved in mineral exploration, the long-term success of our operations will be related to the cost and success of our exploration programs. We cannot assure you that our mineral exploration efforts will be successful. The risks associated with mineral exploration include:

| ● | the identification of potential economic mineralization based on superficial analysis; |

| ● | the quality of our management and our geological and technical expertise; and |

| ● | the capital available for exploration and development. |

Substantial expenditures are required to determine if a project has economically mineable mineralization. It may take several years to establish proven and probable reserves and to develop and construct mining and processing facilities. Because of these uncertainties, our current and future exploration programs may not result in the discovery of reserves, the expansion of our existing reserves or the further development of our mines.

13

The price of gold and silver are highly volatile and a decrease in the price of gold or silver would have a material adverse effect on our business.

The profitability of mining operations is directly related to the market prices of metals. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations of metals from the time development of a mine is undertaken to the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop one or more of our mining properties at a time when the price of metals makes such exploration economically feasible and, subsequently, incur losses because the price of metals decreases. Adverse fluctuations of the market prices of metals may force us to curtail or cease our business operations.

Mining risks and insurance could have an adverse effect on our profitability.

Our operations are subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as unusual or unexpected geological formations, environmental pollution, personal injuries, flooding, cave-ins, changes in technology or mining techniques, periodic interruptions because of inclement weather and industrial accidents. Although maintenance of insurance to ameliorate some of these risks is part of our proposed exploration program associated with those mining properties we have an interest in, such insurance may not be available at economically feasible rates or in the future be adequate to cover the risks and potential liabilities associated with exploring, owning and operating our properties. Either of these events could cause us to curtail or cease our business operations.

We face significant competition in the mineral exploration industry.

We compete with other mining and exploration companies possessing greater financial resources and technical facilities than we do in connection with the acquisition of exploration properties and leases on prospects and properties and in connection with the recruitment and retention of qualified personnel. Such competition may result in our being unable to acquire interests in economically viable gold and silver exploration properties or qualified personnel.

Our applications for exploration permits may be delayed or may be denied in the future.

Exploration activities usually require the granting of permits from various governmental agencies. For exploration drilling on unpatented mineral claims, a drilling plan must be filed with the Bureau of Land Management or the United States Forest Service, which may then take several months or more to grant the requested permit. Depending on the size, location and scope of the exploration program, additional permits may also be required before exploration activities can be undertaken. Prehistoric or Indian grave yards, threatened or endangered species, archeological sites or the possibility thereof, difficult access, excessive dust and important nearby water resources may all result in the need for additional permits before exploration activities can commence. With all permitting processes, there is the risk that unexpected delays and excessive costs may be experienced in obtaining required permits or the refusal to grant required permits may not be granted at all, all of which may cause delays and unanticipated costs in conducting planned exploration activities. Any such delays or unexpected costs in the permitting process could result in serious adverse consequences to the price of our stock and to the value of your investment.

Risks Associated With Our Oil & Gas Industry

A substantial or extended decline in oil and natural gas prices or demand for oil and gas products may adversely affect our business, financial condition, cash flow, liquidity or results of operations and our ability to meet our capital expenditure obligations and financial commitments and to implement our business strategy.

The price we receive for our oil and natural gas production will heavily influence our revenue, profitability, access to capital, and future rate of growth. Recent extremely high prices have affected the demand for oil and gas products, and that demand has declined on a worldwide basis. If the decline in demand continues, the ability to command higher prices for oil and gas products will be endangered. Oil and natural gas are commodities, and, therefore, their prices are subject to wide fluctuations in response to relatively minor changes in supply and demand. Historically, the markets for oil and natural gas have been volatile. These markets will likely continue to be volatile in the future. The prices we receive for our production, and the levels of our production, and the revenue we will receive, depend on numerous factors beyond our control. These factors include the following:

| ● | changes in global supply and demand for oil and natural gas; |

| ● | the actions of the Organization of Petroleum Exporting Countries (“OPEC”) and other organizations and government entities; |

| ● | the price and quantity of imports of foreign oil and natural gas; |

14

| ● | political conditions and events worldwide, including rules concerning production and environmental protection, and political instability in countries with significant oil production such as the Congo and Venezuela, all affecting oil-producing activity; |

| ● | the level of global oil and natural gas exploration and production activity; |

| ● | the short and long term levels of global oil and natural gas inventories; |

| ● | weather conditions; |

| ● | technological advances affecting the exploitation for oil and gas, and related advances for energy consumption; and |

| ● | the price and availability of alternative fuels. |

Lower oil and natural gas prices may not only decrease our revenues but may also reduce the amount of oil and natural gas that we can produce economically. A substantial or extended decline in oil or natural gas prices is likely to materially and adversely affect our future business, financial condition, results of operations, liquidity or ability to finance planned capital expenditures.

We plan to conduct exploration, exploitation and production operations, which present additional unique operating risks.

There are additional risks associated with oil and gas investment which involve production and well operations and drilling. These risks include, among others, substantial cost overruns and/or unanticipated outcomes that may result in uneconomic projects or wells. Cost overruns could materially reduce the funds available to the Company, and cost overruns are common in the oil and gas industry. Moreover, drilling expense and the risk of mechanical failure can be significantly increased in wells drilled to greater depths and where one is more likely to encounter adverse conditions such as high temperature and pressure.

We may not be able to control operations of the wells we acquire.

We may not be able to acquire the operations for properties that we invest in. As a result, we may have limited ability to exercise influence over the operations for these properties or their associated costs. Our dependence on another operator and other working interest owners for these projects and our limited ability to influence operations and associated costs could prevent the realization of our targeted returns on capital in drilling or acquisition activities. The success and timing of development and exploitation activities on properties operated by others depend upon a number of factors that will be largely outside of our control, including:

| ● | the timing and amount of capital expenditures; |

| ● | the availability of suitable drilling rigs, drilling equipment, production and transportation infrastructure and qualified operating personnel; |

| ● | the operator’s expertise and financial resources; |

| ● | approval of other participants in drilling wells; and |

| ● | selection of technology. |

15

We may not be successful in identifying or developing recoverable reserves.

Our future success depends upon our ability to acquire and develop oil and gas reserves that are economically recoverable. Proved reserves will generally decline as reserves are depleted, except to the extent that we can replace those reserves by exploration and development activities or acquisition of properties contain exploration, drilling and recompletion programs or other replacement activities. Our current strategy includes increasing our reserve base through development, exploitation, exploration and acquisition. There can be no assurance that our planned development and exploration projects or acquisition activities will result in significant additional reserves or that we will have continuing success drilling productive wells at economical values in terms of their finding and development costs. Furthermore, while our revenues may increase if oil and gas prices increase significantly, finding costs for additional reserves have increased during the last few years. It is possible that product prices will decline while the Company is in the middle of executing its plans, while costs of drilling remain high. There can be no assurance that we will replace reserves or replace our reserves economically.

Our future oil & gas activities may not be successful.

Oil and gas activities are subject to many risks, including the risk that no commercially productive reservoirs will be encountered. There can be no assurance that new wells drilled by us will be productive or that we will recover all or any portion of our investment. Drilling for oil and gas may involve unprofitable efforts, not only from dry wells, but from wells that are productive but do not produce sufficient net revenues to return a profit after drilling, operating and other costs. The cost of drilling, completing and operating wells is often uncertain, and the cost associated with these activities has risen significantly during the past year. Our drilling operations may be curtailed, delayed or canceled as a result of numerous factors, many of which are beyond our control, including economic conditions, mechanical problems, title problems, weather conditions, governmental requirements and shortages or delays in the delivery of equipment and services. Our future oil and gas activities may not be successful and, if unsuccessful, such failure may have a material adverse effect on our future results of operations and financial condition.

Our operations are subject to risks associated with drilling or producing and transporting oil and gas.

Our operations are subject to hazards and risks inherent in drilling or producing and transporting oil and gas, such as fires, natural disasters, explosions, encountering formations with abnormal pressures, blowouts, cratering, pipeline ruptures and spills, any of which can result in the loss of hydrocarbons, environmental pollution, personal injury claims and other damage to our properties.

The lack of availability or high cost of drilling rigs, fracture stimulation crews, equipment, supplies, insurance, personnel and oil field services could adversely affect our ability to execute our exploration and development plans on a timely basis and within our budget.

Our industry is cyclical and, from time to time, there is a shortage of drilling rigs, fracture stimulation crews, equipment, supplies, key infrastructure, insurance or qualified personnel. During these periods, the costs and delivery times of rigs, equipment and supplies are substantially greater. In addition, the demand for, and wage rates of, qualified crews rise as the number of active rigs and completion fleets in service increases. If increasing levels of exploration and production result in response to strong prices of oil and natural gas, the demand for oilfield services will likely rise, and the costs of these services will likely increase, while the quality of these services may suffer. If the lack of availability or high cost of drilling rigs, equipment, supplies, insurance or qualified personnel were particularly severe in Texas, we could be materially and adversely affected because our operations and properties are concentrated in Texas at the present time.

Compliance with government regulations may require significant expenditures.