UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

For the transition period from ____________ to ____________

Commission File No.

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of Principal Executive Offices)

Registrant’s Telephone Number:

Securities Registered pursuant to Section 12(b) of the Act:

Securities Registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 par value

(Title of class)

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by checkmark if the registrant is not

required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such

shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past

90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,’’ “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filed ☐ | Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of the last business day of the registrant’s most recently completed second fiscal quarter the registrant did not have any publicly traded securities.

As of March 30, 2022, there were

Documents Incorporated By Reference: None.

TABLE OF CONTENTS

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Annual Report”), contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws, which includes information relating to future events, future financial performance, financial projections, strategies, expectations, competitive environment and regulation. Words such as “may,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” and similar expressions, as well as statements in future tense, identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance or results will be achieved. Forward-looking statements are based on information we have when those statements are made or management’s good faith belief as of that time with respect to future events, and are subject to significant risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

| ● | the regulatory pathways that we may elect to utilize in seeking U.S. Food and Drug Administration, or FDA, European Medicines Agency, or EMA, and other regulatory approvals, if any; | |

| ● | obtaining (and the cost thereof) FDA and EMA approval of, or other regulatory action in Europe or the United States and elsewhere with respect to our product candidates; | |

| ● | the commercial launch and future sales of our product candidates and our advancement of product candidates for other indications in our pipeline; | |

| ● | the potential cost of our rheumatoid arthritis product candidate, or RA and RA product candidate, respectively, for patients; | |

| ● | our expectations regarding the timing of commencing clinical trials; | |

| ● | our expectations regarding the supply of the active pharmaceutical ingredient for our product candidates; | |

| ● | third-party payor reimbursement for our product candidates; | |

| ● | our estimates regarding anticipated expenses, capital requirements and our needs for additional financing; | |

| ● | completion and receiving favorable results of clinical trials for our product candidates; | |

| ● | the filing by us, and the subsequent issuance of patents to us, by the U.S. Patent and Trademark Office and other governmental patent agencies; | |

| ● | our expectations regarding the impact of the COVID-19 pandemic, including on our planned clinical trials, operations and financial position; |

The foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with that may cause our actual results to differ from those anticipated in our forward-looking statements. Please see “Item 1A. Risk Factors” for additional risks that could adversely impact our business and financial performance.

Moreover, new risks regularly emerge and it is not possible for our management to predict or articulate all the risks we face, nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements. All forward-looking statements included in this Annual Report are based on information available to us on the date of this Annual Report. Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above and throughout this Annual Report.

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in United States dollars. Except as otherwise indicated by the context, references in this Annual Report to “Raphael,” “Company”, “we,” “us” and “our” are references to Raphael Pharmaceutical Inc., a Nevada corporation, together with its consolidated subsidiaries.

ii

PART I

Item 1. Business.

History

Raphael Pharmaceutical Inc. was incorporated in the State of Nevada in May 2007 and was formerly known as Easy Energy, Inc. On May 14, 2021, Raphael Pharmaceutical Ltd., or Raphael Israel, an Israeli company, and Easy Energy, Inc., a Nevada corporation, completed a share exchange agreement, or the Share Exchange, pursuant to which the shareholders of Raphael Israel became the holders of 90% of the issued and outstanding share capital of Easy Energy, Inc., while Easy Energy, Inc.’s shareholders hold, following the share exchange, 10% of Easy Energy, Inc. On May 19, 2021, as agreed by the parties to the share exchange, Easy Energy, Inc. changed its name to Raphael Pharmaceutical Inc. Raphael Israel was incorporated in 2019 in the State of Israel and has focused to date on developing its lead product candidate for the treatment of rheumatoid arthritis, or RA. Easy Energy did not have any ongoing business or operations before the Share Exchange and following the Share Exchange we adopted Raphael Israel’s business plan.

Overview

We are a pharmaceutical drug research and development company focused on the discovery and clinical development of life-improving drug therapies based on cannabinoids, including cannabidiol, or CBD, oil. Unless indicated otherwise, we plan on using oil derived from CBD strains with low levels of Tetrahydrocannabinol, or THC. All references to the use of CBD in our product candidates refer to CBD strains with less than 0.3% of THC.

We are currently in the pre-clinical development stage for our lead product candidate, our RA product candidate for the treatment of RA. In addition, we are aiming to develop a pharmaceutical drug product for the treatment of hyper inflammatory syndrome inflammation related to COVID-19, or our COVID-19 product candidate, which may be based on data or studies related to our RA product candidate. We successfully completed a preclinical study for the RA product candidate at Rambam Hospital as well as a mice model trial.

On February 9, 2022, we filed an application for a clinical trial with the Medical Cannabis Unit of the Ministry of Health of Israel, or MOH. On February 16, 2022 we submitted an application with the Helsinki Committee at Rambam Hospital for a clinical trial in COVID-19 patients. The Company plans to submit such applications for our RA product during 2022.

Our goal is to become a leader in development of CBD oil-based pharmaceutical drug products for the treatment of indications in which we believe there is a high unmet medical need in a range of disorders, including those related to inflammation in the body, including RA and COVID-19.

In order to achieve our goal, we have and will continue to build an experienced team of senior executives and scientists, with experience in all facets of pharmaceutical research and development, drug formulation, clinical trial execution and regulatory submissions. We intend to leverage the knowledge of our team in order to complete the clinical trials needed to receive approvals of our product candidates from applicable regulatory authorities.

Initially, we intend to obtain FDA approvals for our product candidates. Upon obtaining FDA approvals, or in the event that we are not successful in obtaining such approvals, we intend to apply for EMA and other countries’ governmental regulatory agencies approvals for our product candidates. If we are successful in obtaining FDA approvals for our product candidates, we intend to enter into royalty agreements with GMP approved medical manufactures and distributors, having them using our medical formulas for the purpose of growing, cultivating, manufacturing, and distributing Raphael Pharmaceutical medical indications in their designated territories.

Our discovery platform currently focuses the use of CBD oil, one of the cannabinoids in cannabis plants, as the active pharmaceutical ingredient, or API, for our RA product candidate and COVID-19 product candidate. Research results published in 2018 (“Translational Investigation of the Therapeutic Potential of Cannabidiol (CBD): Toward a New Age”) has shown that there may be benefits to treading medical conditions, or their effects, with cannabinoids, and more specifically, with CBD, which may help reduce chronic pain by impacting endocannabinoid receptor activity, reducing inflammation and interacting with neurotransmitters. This research has also shown that CBD may have neuroprotective properties, and could have the ability to (i) reduce anxiety and depression, (ii) alleviate cancer-related symptoms, (iii) reduce acne and (iv) benefit heart health.

1

Over the last few years, pharmaceutical drug products that include parts of the cannabis plant have begun to receive regulatory approvals for use in patients suffering from certain disorders, as highlighted below.

| ● | Nabiximols, better known under the tradename Sativex, is a botanical mouth spray consisting of natural THC and CBD extracts, that received approval in the United Kingdom in 2010 for the alleviation of multiple sclerosis, or MS, symptoms like spasticity, pain and overactive bladder. |

| ● | Dronabinol, better known under the name Marinol, contains mainly THC and is a partial agonist of the cannabinoid receptor type 1, or CB1, in the nervous system and a partial agonist of the cannabinoid receptor type 2, or CB2, in the periphery that activates appetite, mood, cognition, memory and perception. Dronabinol received FDA-approval for use in United States in 1985 for treatment of anorexia in acquired immunodeficiency syndrome, or AIDS, patients and for the prevention of chemotherapy-induced nausea and vomiting, or CINV. A Lack of randomized controlled trials, or RCTs, makes a recommendation for usage of dronabinol as a third-line treatment for CINV difficult. Dronabinol in the form of an oral tablet is known under the trade name Namisol. It has high bioavailability and a long shelf life and is indicated for MS, chronic pain and behavioral disturbances in dementia patients. |

| ● | Nabilone, better known under the tradename Cesamet, contains primarily THC, is approved for use as an anti-emetic and adjunctive analgesic for neuropathic pain, CINV and treatment for anorexia in AIDS patients in Canada, Mexico, the UK and the United States. Its main usage today is as adjunct medicine for chronic pain management. |

In light of the past regulatory approvals for other pharmaceutical drug products and, more specifically, the potential beneficial effects of CBD and other parts of the cannabis plant, we believe that a drug discovery platform based on CBD may offer new and differentiated treatment options for patients. Prior regulatory approvals of other companies’ pharmaceutical drug products do not serve as an indication as to the ability or likelihood that we receive regulatory approval to commercialize any of our product candidates.

After two successful years of pre-clinical research and studies at the laboratories of Rambam Hospital, in January 2021, we commenced a pre-clinical trial in mice for our RA product candidate that we expect will take four to five months. Following the completion of this pre-clinical trial, we intend on submitting an Investigational New Drug, or IND, application to the FDA and MOH. See “Item 1. Business – Research and Clinical Development Strategy – Clinical Development Plan” for additional information on the ongoing pre-clinical trial and our planned clinical trial for our RA product candidate. In addition, with respect to our COVID-19 product candidate, our clinical research partners have been focused on the effect of cannabinoids and cannabis extracts on immune cells which induce acute inflammation. This study will begin in the pre-clinical level in immune cell models and, subject to positive results that exhibit downregulation of pro-inflammatory cytokines by cannabis extract, the study was completed successfully. Following the completion of the pre-clinical study, a mice model was conducted to analyze for acute inflammation, which resembles the immunopathology of COVID-19. The mice model was successfully completed and we have registered for a clinical trial in patients with the MOH.

As a pharmaceutical research and clinical development company we do not own or operate, and currently do not intend on creating an in-house team to manufacture and commercialize our pharmaceutical drug products, if any, that receive regulatory approval allowing for commercialization. We currently rely, and expect to continue to rely, on third parties for the manufacturing of our product candidates for preclinical and clinical testing, as well as for commercial manufacturing of any pharmaceutical drug products for which we may receive regulatory approval. Subject to the receipt of such regulatory approvals, we intend on cooperating with manufacturers and other third parties to manufacture and commercialize approved pharmaceutical drug products.

2

Product Pipeline

Currently, we have begun development for our RA and COVID-19 product candidates, which are in the pre-clinical stage.

Assuming that we successfully complete the clinical development of our RA and COVID-19 product candidates, we intend to then turn our attention to the clinical development of cannabinoid-based drug products for the treatment of certain oncology indications. Unlike our RA and COVID-19 product candidate, the use of our cannabinoid based drug products for the treatment of certain oncology indications will require specific dosing and potentially, a different regulatory pathway than our existing product candidates.

We intend to apply for MOH approval, as well as the FDA and EMA approvals right afterwards, subject to the completion of the applicable clinical trials, for our RA product candidate as well as our COVID-19 product candidate using the FDA’s regulatory pathway for drug products.

Indications and Market

Rheumatoid Arthritis

RA is an autoimmune disease of unknown cause characterized by inflammation in multiple joints, including synovial inflammation with hyperplasia. Inflammation is also associated with reduced hemoglobin (anemia) and reduced albumin and changes in levels of cholesterol and triglycerides. In addition to the inflammation associated with RA, studies, including a 2018 publication entitled, “Cartilage and bone damage in rheumatoid arthritis,” patients suffering from RA generally also suffer from chronic pain, fatigue, progressive joint damage, disability, hyperplasia, production of autoantibodies such as rheumatoid factor and anti–citrullinated protein antibody, cartilage damage and bone erosions.

Research has shown that in about 30% of RA patients, current conventional synthetic and biologic disease modifying anti-rheumatic drugs and targeting molecules may fail or induce only partial responses, both of which we believe are insufficient for patients suffering from RA. Using disease modified anti-rheumatic drugs, or DMARD, based treatments, as shown in a 2017 study from Sohita Dhillon, patients tend to report at follow-up meetings that pain relief is unsatisfactory and although there is an initial improvements in the average pain score, a plateau may be reached beyond which DMARDs are not able to resolve RA pain. As a result, we believe that RA patients need ongoing therapy as RA relapses are frequent. During RA flareups, patients experience acute and chronic pain, fatigue, sleep disturbances, and morning stiffness which significantly reduces their quality of life. Furthermore, damage is accumulated by long-term disease which also interferes with pain, fatigue and quality of life.

All types of pain (acute or chronic, widespread or local and nociceptive) have been reported in RA. Patients with RA may develop fibromyalgia, or FM, especially with long-term disease. Concomitant FM is a key factor for discordance between PRO and clinical outcomes in assessment of RA patients including in RCTs. Peripheral sensitization, induced by local inflammation or damage, and pain augmentation by the central nervous system, or CNS, both drives the pain problems in RA patients. Anxiety or depression, impaired sleep and fatigue all contribute to pain sensitization in RA patients. As noted in the study, “Tackling Pain Associated with Rheumatoid Arthritis: Proton-Sensing Receptors,” some RA patients have allodynia and peripheral neuropathies that contribute to refractory chronic pain.

We believe that clinical studies on the use of cannabinoids in rheumatic conditions, and particularly RA, are logically advocated as possible positive effectors of the inflammatory pathway of RA, as well as symptomatic pain relievers that may have the potential to also improve fatigue, sleep disorder and tolerability of DMARDs. Through our Sponsored Research Agreement (as further detailed below), we believe that we have arrived at an understanding as to how cannabinoids influence inflammation. Applying immune cells models in our pre-clinical research, we identified specific strains of cannabis which reduce the capacity of the immune cells to communicate during inflammation, thus decreasing their capacity to participate in chronic inflammation. For a deeper understanding of the mechanism in which cannabinoids effect inflammation, we developed a unique, real time-Polymerase chain reaction, or RT-PCR, method to identify 10 different receptors to cannabinoids, both in human and mice models. We believe that this technology will allow us to identify which cannabinoids receptors are participating in the downregulation of inflammation, which we believe will help us develop our RA product candidate.

3

In 2015 alone, research conducted by the NIH National Library of Medicine showed that RA affected about 24.5 million people as of 2015, which reflected between 0.5% and 1% of adults in the developed world, with an additional 5 to 50 per 100,000 people developing the condition each year. It is believed that onset is most frequent during middle age and women are affected 2.5 times as frequently as men. Further research indicates that RA resulted in 38,000 deaths in 2013, up from 28,000 deaths in 1990.

Hyperinflammatory Syndrome Related to COVID-19

Since the first emergence of COVID-19 in December 2019 in Wuhan, China, COVID-19 has spread across more than 200 countries across the world and over 112 million cases of the virus have been reported. Most patients develop only mild symptoms of COVID-19; however, some develop severe symptoms including dyspnea, hypoxia and lung involvement which requires hospitalization. Based on research, we believe that most of the severe COVID-19 symptoms are related to hyperinflammation caused by failure of resolution of the immunological response to the infection similar as observed in cytokine release syndrome. Treatments with anti-inflammatory or anti-viral drugs are still experimental or have not reduced mortality. Moreover, they are administered only to inpatients in a severe disease state. As a result of the foregoing, the necessity of finding new anti-inflammatory therapies that have the potential to prevent deterioration of the symptoms is heightened.

Research and Clinical Development Strategy

Research and clinical development of our pharmaceutical drug product candidates is our core business. We are currently focused on developing innovative cannabinoid-based medical indications that we aim to push through Phase 2A and Phase 2B approval from both the FDA and EMA.

The research efforts that have been conducted to date by the team at Rambam Med-Tech Ltd., or Rambam MT, are aimed at revealing the mechanism which structures the activity of cannabinoids in human cells and organs, while applying a variety of disease models. We are using our PCR method to identify different receptors to cannabinoids and which we believe will allow us to identify which cannabinoids receptors are participating in the downregulation of inflammation. We believe that this strategy will allow us to identify the cannabinoids components of a chosen strain in order to accurately administer cannabinoids targeted to the treatment of patients.

Research Agreement with Rambam MT

On July 17, 2019, we entered into a sponsored research agreement, or the Research Agreement, with Rambam MT, pursuant to which the Company agreed to fund a research project, to be performed by Rambam MD, with a research plan aimed at identifying the effects of different cannabis strains on the function of immune cells. On October 28, 2020, the Company and Rambam MT agreed to expand the research plan to study the anti-inflammatory activities of cannabis extracts in an RA mouse model. On February 15, 2021, the Company and Rambam MT agreed to further expand the research plan to study the effect of cannabis extracts on the immunopathology of the COVID-19 disease. The Sponsored Researched Agreement is for an initial term of 48 months.

Pursuant to the Research Agreement, we agreed to pay Rambam $1.4 million in four equal payments, due on the first day of August on each successive year from 2019 through 2022. Furthermore, in accordance with the terms of the Research Agreement, we and Rambam MT will have joint ownership of any IP created as a result of research programs covered by such agreement. In connection with the Research Agreement, Rambam MT agreed not to work, study or develop any technologies with other entities that compete with our work with Rambam MT for our COVID-19 product candidate or RA product candidate for a term of three and seven years, respectively, from the end of the parties’ collaboration with respect to the COVID-19 product candidate and seven years from the end of the term of the Research Agreement with respect to the RA product candidate.

Subject to commercial sales of any product candidate using the IP created as a part of the research covered by such agreement, we are required to pay Rambam MT a royalty in an amount equal to 6% of all net sales, subject to certain deductions, such as taxes paid by any purchaser, transportation and shipping costs, and other customary deductions.

4

As of December 31, 2021, the Company has made three of the four equal payments due pursuant to the Research Agreement, for a total amount of $1,050,000.

We and Rambam MT are currently focused on characterizing the activity of cannabinoids in RA and in hyperinflammatory syndrome related to COVID-19. RA is a long-term autoimmune disorder, and as such, the research conducted by Rambam MT has focused on identifying the effect of cannabinoids on inflammatory processes related to RA, while, with respect to our COVID-19 product candidate, their research has been focused on the effect of cannabinoids and cannabis extracts on immune cells which induce acute inflammation.

Pre-Clinical Studies for RA Product Candidate

In Vitro Study

Pursuant to the Research Agreement, the team at Rambam MT established a study in order to determine which cannabis strains extracts may affect inflammation. The lab applied an in vitro system, allowing them to screen a variety of cannabis derived oil extracts and their influence on cytokine secretion, which is a type of response to injury and infection in the body.

The researchers employed human THP1 cells, which can be induced to differentiate macrophages (specialized cells involved in the detection, phagocytosis and destruction of bacteria and other harmful organisms) and to secrete cytokines (which is aimed as serving as a bridge for cross-communication with other innate immune cells). Using this system, our partners from Rambam MT have established a variety of cannabinoids and studied their influence on pro-inflammatory and anti-inflammatory cytokines. Most interestingly the study has identified a non-psychoactive cannabis strain, which we refer to as “CAN1.” Our study showed that CAN1 reduced TNFα and IL-6 secretion but increased the secretion of the anti-inflammatory cytokine IL-10, while also reducing the secretion of the pro-inflammatory chemokine IL-8, as highlighted in Figure 1 below. Based on the results from this pre-clinical study, we believe that CAN1 strain, may be a potential anti-inflammatory agent with the ability to influence both activation and migration of cells during inflammation.

Figure 1. CAN1 downregulates pro-inflammatory cytokines (TNFα, IL-8, IL-6) and upregulates the anti-inflammatory counterpart IL-10.

5

The results in Figure 1 above reflect the results from our in vitro study of THP1 cells (0.25*10^6/ml) incubated with phorbol 12-myristate 13-acetate (PMA) (50 ng/ml) to induce THP1 cells to differentiate to macrophages. for 48 hours. Then, cells were washed twice with phosphate buffer saline (PBS) and treated with Can1 (1 µg/ml) in medium free serum for 24 hours. Then, cells were washed twice with PBS and incubated with LPS (Lipopolysaccharides) to induce cytokines secretion (1 µg/ml) overnight. Supernatants were collected and frozen. Levels of TNFα, IL-8, IL-6 and IL-10 were determined by the enzyme-linked immunosorbent assay (ELISA).

Pre-Clinical Study in Mice

In January 2021, we commenced a pre-clinical study in mice. Mice in our pre-clinical study are being treated with cannabis strains that we previously identified in our in vitro study and other prior research as potential candidates in the cell models. Following the treatment, we expect to examine the ability of the treatment to modulate the immune function, specifically in the case of chronic inflammation, in order to optimize treatment for RA.

This pre-clinical study is expected to be focused on the following results.

| ● | Aim 1: Evaluating the immune modulatory properties of different cannabis strains related to the immunopathology (i.e., the immune responses) in RA; |

| ● | Aim 2: Demonstrating the immunomodulatory properties of specific cannabis extracts on a mouse model for RA; |

| ● | Aim 3: Elucidating the mechanisms of action, or MOA, of cannabinoids that are involved in the regulation of inflammation in RA; and |

| ● | Aim 4: Establishing a phase 1 and 2 clinical trial experiment in compliance with FDA and EMA rules and regulations to study the effect of cannabis-based medical indication on RA. |

In addition, this pre-clinical study is expected to enable us to examine how we manufacture the API, the dosage design, analytical and bioanalytical method development and validation, metabolism and pharmacokinetics, toxicology, both safety and genetic toxicology and possibly safety pharmacology; and good manufacturing practice, or GMP, manufacture and documentation of drug product for use in clinical trials.

Aim 1. Evaluating the immune modulation properties of different cannabis strains

Rheumatic diseases, including RA, are characterized by chronic inflammation that affects the connective tissue or supporting structures of the body, most commonly the joints, but also tendons, ligaments, bones, and muscles, while certain rheumatic diseases can also have an adverse effect on certain organs. RA, the latter of which means “joint inflammation,” encompasses more than 100 different disorders, including, for example, join inflammation disorders, including RA, psoriatic arthritis, or PsA, systemic lupus erythematosus, or SLE, or lupus, gout and ankylosing spondylitis, or AS. Therefore, a major goal for therapies of rheumatic diseases is the application of agents with immune modulation properties with the ability to suppress effector autoimmune cells and to increase the activity of regulatory immune cells.

It is our belief, based on the research conducted by our partners, and that or our industry peers, that cannabinoids have immunomodulatory properties, although the exact effects are not fully comprehended. Together with the team at the Medical Cannabis Research and Innovation Center, we intend on working to identify and characterize the types of cannabis strains as well as specific cannabinoids with immune modulatory function that lie in the usage of cannabis in the treatment of rheumatic diseases. We aim to do this by evaluating the immune regulatory properties of different cannabis strains on a variety of subsets of immune cells including lymphocytes and myeloid cells, which we plan to have purified from the rodent model of rheumatic disease and from healthy humans or humans diagnosed with RA. For each isolated immune cell type, we expect to evaluate the impact of cannabis on a variety of functions, such as cytokine and chemokine secretion, proliferation and migration.

6

Aim 2. Demonstrating the immune modulatory properties of specific cannabis extract on mouse models for RA.

Cannabis is not an isolated substance; it contains a plethora of biologically active substances. The most common substances are THC and CBD. Today more than 140 cannabinoids are known to be expressed in the plant. In addition to cannabinoids, the plants contain flavonoids and terpenes. This greatly complicates our ability to understand the effects of cannabis on the physiology because the different substances may have different (and even contradictory) effects. Therefore, the use of different cannabis varieties with diverse ingredients may produce distinct and unexpected results.

In the current study, we expect to examine whether cannabis is a potential treatment for RA in the in vivo mouse model of RA. We expect to test particular inflammation markers, such as the cytokines tumor necrosis factor alpha, interferon gamma, monocyte chemoattractant protein-1, or MCP-1/CCL2 and Interleukin-6 during the onset of RA disease and investigate the effects of the different cannabis strains on particular inflammatory disease markers. We then intend on comparing the effects of cannabis strains with high CBD-concentrations to those with high THC-concentrations in order to be able to better understand the main effects of the major ingredients of each of CBD and THC. Furthermore, we intend on conducting a pharmacokinetic analysis of the cannabinoid profile in the mouse blood. To this end, we expect to expose mice to a chronic controlled administration of known doses of cannabis extracts from different strains. Following the exposure, we intend on measuring the effect of chronic exposure over time and doses on RA markers. We believe that this information, together with additional data that we collect from our clinical studies, will enable us to complete the clinical development of a cannabis-based treatment for patients with RA.

Aim 3. Elucidating the MOA of cannabinoids that are involved in the regulation of inflammation in RA.

Upon activation, it is the cannabinoid receptors, or CBrs, in the endocannabinoid system, or ECS, which initiate numerous regulatory functions in a mammal. CBrs have been found in a variety of species including human, monkey, pig, dog, rat and mouse. The discovery of membrane receptors found in the brain, central nervous system as well as peripheral tissues and organs that bind cannabimimetic compounds was a critical turning point that paved the way towards the pharmacological understanding of cannabis-derived compounds.

The most studied CBrs are CB1 and CB2; both belong to the G protein-coupled receptors (these cell surface receptors act like an inbox for messages in the form of light energy, peptides, lipids, sugars, and proteins), or GPCR, family. GPCRs constitute a large protein family of receptors that detect molecules outside the cell and activate internal signal transduction pathways and cellular responses. GPCRs, are called seven-transmembrane receptors because they pass through the cell membrane seven times. Heterotrimeric G proteins are activated by GPCRs and are made up of three subunits, α, β and γ. G proteins are divided into four main classes: Gαs, Gαi, Gαq and Gα12. These proteins are activated depending on the ability of the G protein α-subunit, or Gα, to cycle between an inactive guanosine diphosphate, or GDP, bound conformation and an active guanosine triphosphate, or GTP, bound conformation that can modulate the activity of downstream effector-proteins. Additional receptors have been shown to bind cannabinoids: G protein-coupled receptor 55, or GPR55, several transient receptor potential, or TRP, channels (TRPV1, TRPV2, TRPA1, TRPM8), and glycine receptors.

7

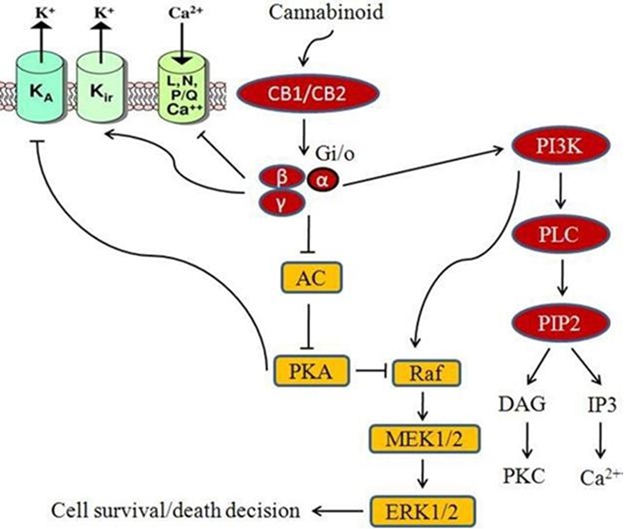

Figure 2. CB1 downstream signaling network. Adapted from Chakravarti et al., 2014

Since most of the biological properties related to phytocannabinoids, a type of natural cannabinoid, rely on their interactions with receptors of the endocannabinoid system, it is crucial to define which receptors are expressed and activated in the target cells. As a result, we have developed a system with the capacity to identify ten cannabinoid receptors simultaneously and measure their expression levels using quantitative real-time PCR. We have applied this method in examining cells of the immune system, and more specifically, in monocytes, before and after differentiation to macrophages, or after stimulation to secrete cytokines. Using this methodology, we were able to identify a differential expression pattern of the receptors under different conditions.

To obtain a deep understanding on the mechanism of action of the cannabis strains, we will apply our research system and establish a unique study to research the response of 10 different receptors to Cannabis in RA patients, which aims to identify the specific cannabinoids receptors on the cells of RA patients. The data from this study is expected to subsequently be used to set up a system for analyzing and matching the specific cannabis treatment to the specific cannabinoids receptors that are expressed in the patient’s cells. We believe that if cannabinoid treatments correspond to the receptors in the patient’s cells, the treatment may be more accurate for treating that specific patient’s RA symptoms.

8

Aim 4. Establish a Phase 1 & 2B clinical trial according to FDA rules and regulations to study the effect of cannabis-based medical indications on RA.

Our goal for the treatment of RA is to achieve disease remission or low disease activity, or LDA. LDA is measured with several assessment metrics that are intended to measure the effect of the treatment on a number of physical phenomena that are connected to RA. These metrics include, but are not limited to: (i) Disease Activity Score based on assessment of 28 joints, or DAS28, patient’s assessment, (ii) erythrocyte sedimentation rate (a common hematology test, and is a non-specific measure of inflammation) or C-reactive protein, or CRP, test, which is a blood test that measures the CRP in a person’s blood, (iii) SDAI and CDAI (Simple and Complex Disease Activity Indices) as compared to DAS28, (iv) patient’s and physician’s assessment, including global assessment scores, or PtGA and PhGA, respectively (v) pain visual analogue scale and (vi) health assessment questionnaire disability index, or HAQ-DI.

Clinical Development Plan for RA Product Candidate

We intend to utilize the knowledge and results that we obtain from our pre-clinical study to establish, initially a Phase 1 clinical trial, which we expect will take approximately 3 months, followed by a Phase 2 clinical trial to study the effect of cannabis-based medical intervention on RA, which we expect will take approximately 24 months, following which, we hope to receive FDA approval to allow for the commercialization of our RA product candidate. Specifically, we intend to study the changes in RA patients’ status after cannabis compounds were added to their stable conventional treatment. We currently plan that our partners at Rambam MT will carry out these trials at the Rambam Health Care Campus in Haifa, Israel.

Our hypothesis is that in patients with RA, the regular addition of cannabinoids in a defined dosage to basic treatment of RA might add to the patients’ quality of life. We intend to measure quality of life by scores for fatigue using the fatigue severity scale, pain using the visual analogue scale, the Pittsburgh Sleep Quality Index, PtGA, PhGA, HAQ-DI and the 6-Item Short Form Health Survey. We also propose that cannabinoids may influence the disease status. This may be measured by DAS28, SDAI, CDAI, CRP, ESR, albumin and Hb levels and also by levels of key cytokines and chemokines. As part of these clinical studies, we currently plan to assess changes in RA patients’ status after cannabis compounds were added to their stable conventional treatment.

Pre-Clinical Studies for Treatment of Hyperinflammatory Syndrome Related to COVID-19

We are studying the potential of cannabis extracts to downregulate the hyperinflammation and the immunopathology in COVID-19 patients. Our partners at Rambam MT have been conducting research on the use of cannabis to treat disorders with widespread inflammatory responses, such as RA and COVID-19. We hope that by decoding the cannabinoid mechanism of action during inflammatory storms, we can treat inflammation associated with COVID-19 where conventional drugs and other therapies have failed.

At the outbreak of the COVID-19 pandemic, members of the Rambam MT team directed their efforts and experience to join the world-wide battle against the COVID-19 pandemic. Their research found that cannabinoids contribute to the sophisticated fabric network of intercellular communications. Based on this research, we believe, that if we understand how cannabinoid components are used in intercellular communication, we can help influence this communication in the event of a disease, to disrupt it or empower the communication to convey desired messages.

In order to properly understand cannabis’ effects on COVID-19, the Rambam MT team compiled its Biobank database. In generating the Biobank database, the Rambam MT team found what they believed to be a safe way to separate the white blood cells, including the immune cells, from verified patients. We believe that this is crucial as blood samples are the most accessible resource for continuous sampling (allowing for the understanding of biological processes during the disease) and to develop vaccines and drugs for treatment of the condition.

In February 2021, we entered into an agreement with Rambam MT for investigation of CBD oil extracts as a potential treatment for COVID-19 related inflammation. In accordance therewith, the Rambam MT team is investigating the effect of cannabis extracts oil on the inflammation response of immune cells derived from COVID-19 patients as well as a deep study on the capacity of cannabis extract oil to reduce acute inflammation and lung inflammation in mouse models which resembles the immunopathology of COVID-19.

9

This study will begin in the pre-clinical level in immune cell models and, subject to positive results that exhibit downregulation of pro-inflammatory cytokines by cannabis extract, the study is expected to continue to a mouse model to analyze for acute inflammation, which resembles the immunopathology of COVID-19. We believe that our strategy to investigate the response of ex-vivo immune cells to cannabis extract together with the analysis of the in-vivo model for acute and lung inflammations, will allow us to identify the medical cannabis extracts, if any, that have the potential to treat patients with COVID-19 related hyperinflammatory syndrome.

Competition and Competitive Position

The pharmaceutical industry is characterized by rapidly advancing technologies and intense competition. While we believe that our knowledge, experience and scientific resources provide us with competitive advantages, we face potential competition from many different sources, including major pharmaceutical, specialty pharmaceutical and biotechnology companies, academic institutions and governmental agencies and public and private research institutions. Any product candidates for which we complete clinical development successfully and for which we receive marketing approval may compete with existing therapies and new therapies that may become available in the future.

Many of our competitors have far greater marketing and research capabilities than us. We also face potential competition from academic institutions, government agencies and private and public research institutions, among others, which may in the future develop products to treat those diseases that we currently or, in the future, seek to treat. All of these companies and institutions may have product candidates in development that are or may become superior to our RA product candidate or any other product candidate that we may seek to develop. Our commercial opportunity would be reduced significantly if our competitors develop and commercialize products that are safer, more effective, more convenient, have fewer side effects or are less expensive than our product candidates.

In addition, although our product candidates may, if approved, be considered advantageous to existing therapies, such as the use of corticosteroids and DMARDs for the treatment of RA, our target market may continue to use existing therapies.

However, we do believe, specifically with respect to our competitors not using cannabis in their pharmaceutical drug products that our use of, and experience with, cannabinoids provides us with a potential competitive advance. Our research has shown that the use of cannabinoids for the treatment of RA is justified based on its positive effect on pain, fatigue, sleep problems and its potential safety profile. Growing evidence on the anti-inflammatory effect of cannabinoids provide more strong ground for their use in the treatment of RA.

Although the use of any part of the cannabis plant in pharmaceutical drug products was once non-existent or minimal, in addition to approved pharmaceutical drug products that use parts of the cannabis plant (see “Item 1. Business – Overview” for additional information), we are aware that there is at least one plan for a multicenter randomized control trial on the use of medical cannabidiol in Danish patients with RA and Ankylosing Spondylitis (inflammatory joint and spine disease), as previously published in an issue of BMJ Open in 2019. As the medical benefits of cannabis become more well-known, we believe that we may face more competition from both new startup pharmaceutical and biotechnology companies and from well-funded and experienced organizations and it is therefore imperative that we face as few delays as possible in our pre and clinical development plan or we may otherwise face more competition.

10

The following table highlights the estimated cost that RA patients incur on an annual basis based on a 2017 report from the Canadian Agency for Drugs and Technologies in Health.

| Drug Product | Strength | Dose Form | Price ($) | Recommended Dose | Annual Drug Cost ($) | |||||

| Sarilumab (Kevzara) | 150 mg/1.14 mL 200 mg/1.14 mL |

Pre-filled syringe | 700.0000 | 200 mg SC every two weeks | 18,200 | |||||

| Abatacept SC (Orencia) | 125 mg/mL | Pre-filled syringe | 366.1000 | 125 mg weekly | 19,037 | |||||

| Abatacept IV (Orencia) | 250 mg/15 mL | Vial | 490.0500 | Patients < 60 kg: 500 mg Patients 60 to 100 kg: 750 mg Patients > 100 kg: 1,000 mg 500 to 1,000 mg at weeks 0, 2, and 4 then every 4 weeks |

Year 1: 20,582 Thereafter: 19,112 | |||||

| Adalimumab SC (Humira) | 40 mg/0.8 mL | Pre-filled syringe or pen | 769.9700 | 40 mg every other week | 20,019 | |||||

| Anakinra (Kineret) | 100 mg | Pre-filled syringe | 48.0571 | 100 mg daily | 17,493 | |||||

| Certolizumab pegol (Cimzia) | 200 mg/mL | Pre-filled syringe | 664.5100 | 400 mg at weeks 0, 2 and 4 then 200 mg every 2 weeks | Year 1: 19,271 Thereafter: 17,277 | |||||

| Etanercept (Enbrel) | 25 mg | Vial | 202.9300 | 50 mg weekly or two 25 mg doses on same day every week or every 3 or 4 days | 21,105 | |||||

| 50mg/mL | Pre-filled syringe or auto-injector | 405.9850 | 21,111 | |||||||

| Entanercept (Brenzys) | 50 mg/mL | Pre-filled syringe | 305.0000d | 50 mg weekly | 15,860 | |||||

| Golimumab SC (Simponi) | 50 mg/0.5 mL | Pre-filled syringe or auto-injector | 1,555.17 | 50 mg monthly | 18,662 | |||||

| Golimumab IV (Simponi) | 50 mg/4 mL | Vial | 849.5000b | 2 mg/kg at weeks 0 and 4, then every 8 weeks thereafter | Year 1:17,829 Thereafter: 16,565 | |||||

| Infliximab (Remicade) | 100 mg | Vial | 987.5600 | 3 mg/kg at weeks 0, 2, and 6, then every 8 weeks thereafter Depending on clinical response, dose can be increased to 10 mg/kg and/or up to every four weeks |

Year 1: 23,701 Thereafter: 19,257 10 mg/kg every 4 weeks: $102,706 annually | |||||

| Infliximab (Inflectra) | 100 mg | Vial | 525.0000 | Year 1: 12,600b Thereafter: 10,238b 10 mg/kg every 4 weeks: $54,600 annually15 | ||||||

| Rituximab (Rituxan) | 100 mg/10 mL 500 mg/50 mL |

Vial | 466.3200 2,331.61 |

A course consists of 1,000 mg infusions at weeks 0 and 2.

Reassess for retreatment at week 26, no sooner than 16 weeks after previous |

18,653 assumes 2 courses Per course: 9,326 | |||||

| Tocilizumab SC (Actemra) | 162 mg/0.9 mL | Pre-filled syringe | 355.0000 | Patients < 100 kg: 162 mg SC every two weeks, increasing to weekly based on clinical response. Patients ≥ 100 kg: 162 mg SC weekly |

Every two weeks: 9,230 Weekly: 18,460 | |||||

| Tocilizumab IV (Actemra) | 80 mg/4 mL 200 mg/10mL 400 mg/20 mL |

Vial | 180.8100 452.0300 904.0600 |

4 mg/kg every 4 weeks followed by an increase to 8 mg/kg based on clinical response | 4 mg/kg: 10,577 8 mg/kg: 17,629 | |||||

| Tofacitinib (Xeljanz) | 5 mg | Tablet | 23.5585 | 5 mg p.o. twice daily | 17,151 |

IV = intravenous; p.o. = orally; SC = subcutaneous.

11

Although there can be no guarantee, we believe that our RA product candidate, if approved for commercialization by regulators, will be available to patients at a lower price than that of other available treatments.

With respect to our development of a product candidate to treat inflammation associated with COVID-19, we will face competition from major pharmaceutical companies that have developed or that will develop vaccines, along with other companies and organizations that have or will develop therapies or pharmaceutical drug products aimed at treating the underlying symptoms of COVID-19.

Cultivation of our API

In October 2020, we entered into an engagement agreement with Way of Life Cannabis Ltd., or Wolc, pursuant to which, subject to its completing the Share Exchange, Raphael Israel is scheduled to be provided with up to 15 liters of CBD oil, from a strain of cannabis of our selection, during a term of 18 months, to be provided in two to three deliveries of between one to seven milliliters of CBD oil. In accordance with the agreement with Wolc, we have agreed to issue to certain persons affiliated with Wolc 3% of our issued and outstanding share capital as of the date of the Share Exchange, to be provided in three equal issuances; provided, however, that such persons may elect to receive a cash payment of $100,000 instead of any one issuance of our shares. In addition to the issuance of shares, we have also agreed to pay Wolc a royalty fee equal to 15% of net income royalties generated from sales of our pharmaceutical drug products that are developed at Rambam hospital in Israel.

At this time, we only require a limited amount of our API for our studies and trials and, to date, we have received oil extracted from high CBD strains, from Wolc in the amounts that we require in order to conduct our pre-clinical trials. Pursuant to our agreement with Wolc, pending FDA approval of any of our product candidates, Wolc is expected to transfer seeds used for the FDA-approved product candidate to growers in California, Colorado and Oklahoma. Wolc is a fully licensed Israeli cannabis company focused on growing, cultivating and manufacturing cannabis medical oil, located in Aviel, Israel. As an owner and operator of green houses for growing organic cannabis plants and a GMP manufacturing facility located in Netanya, Israel, we intend to utilize, pursuant to an agreement between the parties, Wolc for the growing and cultivation of the CBD oil needed for our product candidates.

We believe that our current agreement with Wolc will provide us with sufficient amounts of CBD oil in order to complete our clinical development and for initial sales of our pharmaceutical drug products. In the future, as our demand for pharmaceutical products grows, if ever, we may need to find additional partners that may provide us with sufficient amounts of CBD oil and/or amend or terminate our engagement with Wolc.

Manufacturing

We do not own or operate, and currently have no plans to establish, any manufacturing facilities for final manufacture. We currently rely, and expect to continue to rely, on third parties for the manufacture of our product candidates for preclinical and clinical testing, as well as for commercial manufacturing of any pharmaceutical drug products for which we receive regulatory approval.

12

Commercialization Plan

Subject to the receipt of regulatory approval to commercialize our pharmaceutical product candidates, our goal is to distribute our approved formulas to good manufacturing practice, or GMP, approved medical cannabis manufacturers and global medical cannabis distributors. Depending on the expertise of the distributors, we expect the licensing agreements to provide us with royalty-based payments for the sale of each of our approved pharmaceutical drug products. In Israel, pursuant to our agreement with Wolc, the parties are expected to negotiate an exclusive distribution agreement in Israel, pursuant to which Wolc will be the exclusive supplier of any approved pharmaceutical drug products of the Company in Israel.

Although we expect government regulation of pharmaceutical products derived from cannabis to develop over the next few years, we may be limited in the manner in which we commercialize our product candidates. We fully intend on being fully complaint with local and state-wide government regulations and therefore we expect to enter into licensing agreements with vendors only if such vendor may legally distribute our product candidate within the region for which they have obtained a license from us to sell our pharmaceutical product.

Intellectual Property

We do not currently have any patents, and currently rely on our know-how and trade secrets. However, subject to the completion of our pre-clinical trial for our RA product candidate, and prior to the completion of our clinical development plan, we intend on seeking patent protection in the United States and/or internationally for such product candidate and, potentially for other product candidates that we may seek to develop. Our policy is to pursue, maintain and defend patent rights developed internally and to protect the technology, inventions and improvements that are commercially important to the development of our business.

Governmental Regulation

Government authorities in the United States, at the federal, state and local levels, and in other countries and jurisdictions, including the EU, extensively regulate, among other things, the research, development, testing, manufacture, sales, pricing, reimbursement, quality control, approval, packaging, storage, recordkeeping, labeling, advertising, promotion, distribution, marketing, post-approval monitoring and reporting, and import and export of biopharmaceutical products. The processes for obtaining marketing approvals in the United States and in foreign countries and jurisdictions, along with compliance with applicable statutes and regulations and other regulatory authorities, require the expenditure of substantial time and financial resources.

We are a research and development company collaborating with our partners at Rambam MT to research and develop our COVID-19 and RA product candidates. We do not grow or cultivate cannabis and we have no physical connection to the raw cannabis materials, which is shipped directly to Rambam MT. Pre-clinical research, animal models and clinical trials are sponsored by us through our agreement with Rambam MT. Such research and trials are being done by Rambam MT’s medical team, researchers, doctors and professors.

We do not own or operate, and currently have no plans to establish, any manufacturing facilities for final manufacturing of our products. We do not distribute, and we have no plans to distribute, our products. Once we receive regulatory approval for our products, we intend to license to our future candidate partners the rights to commercialize our medical formulas. Our future candidate partners will be responsible for the manufacturing, distributing, promoting, and marketing of medical indications. We intend to engage with candidate partners that are GMP approved professionals, well established and experienced medical manufacturers and distributors in the U.S. and other countries.

Our future candidate partners will be entirely responsible and liable for regulatory compliance, including but not limited to cannabis growing and cultivation, GMP manufacturing, distribution, advertising and promotional regulations, marketing, labeling, post-market approval reporting and record keeping.

13

We intend to hire and train quality assurance professional that will inspect periodically the facilities of our future candidate partners as well as the methods of production, marketing and distribution under applicable governmental regulatory guidelines.

U.S. Cannabis Market

The emergence of the legal cannabis sector in the United States, both for medical and adult use, has been rapid as more states adopt regulations for its production and sale. A majority of Americans now live in a state where cannabis is legal in some form and almost a quarter of the population lives in states in which both medical and recreational use is permitted as a matter of, and in accordance with, applicable state and local laws. According to Fortune Business Insights, the global legal marijuana market is anticipated to reach a value of US$97.35 billion by the end of 2026 from US$10.60 billion in 2018. The market is predicted to rise at a compounded annual growth rate of 32.6% during the period 2019 to 2026.

The use of cannabis and cannabis derivatives to treat or alleviate the symptoms of a wide variety of chronic conditions, while not recognized by the FDA, has been accepted by a majority of citizens with a growing acceptance by the medical community. A review of the research, published in 2015 in the Journal of the American Medical Association, found solid evidence that cannabis can treat pain and muscle spasms. The pain component is particularly important, because other studies have suggested that cannabis can replace pain patients’ use of highly addictive, potentially deadly opiates. Although hemp, defined as cannabis and derivatives of cannabis with not more than 0.3% THC, has been descheduled from the Controlled Substances Act, the FDA has regulatory oversight over foods, drugs, cosmetics containing cannabis under the Food, Drug and Cosmetics Act of 1938. All references to the use of CBD in our product candidates refer to CBD strains with less than 0.3% of THC. It is possible that as the federal and state agencies legalize certain products, the FDA may issue rules and regulations, including good manufacturing practices related to the growth, cultivation, harvesting and processing of such products, even if they are not marketed as drugs. It is possible that the FDA would require that facilities where medical-use cannabis is grown to register with the FDA and comply with certain federally prescribed regulations, certifications, testing, or other requirements. The potential impact on the cannabis industry is uncertain and could include the imposition of new costs, requirements, and prohibitions.

Although we are not currently engaged and do not expect to be engaged in the production or distribution of medical marijuana products, the FDA has jurisdiction over our flower, oil, vape and edible products, among others. The FDA is currently taking action in the form of Warning Letters, but may also take more extreme enforcement such as recalls, disgorgement or penalties.

Polls conducted throughout the United States consistently show overwhelming support for the legalization of medical cannabis, together with strong majority support for the full legalization of recreational adult-use cannabis. According to a Pew Research Center survey, as of November 11, 2019, “Around nine-in-ten Americans favor legalization for recreational or medical purposes” and “Only 8% say it should not be legal.” These are large increases in public support over the past 40 years in favor of legal cannabis use.

As of the date of this Annual Report, cannabis is legal in some form in a total of 36 states, the District of Columbia, Guam, Puerto Rico and the U.S. Virgin Islands. On the recreational side, there are currently 15 states, plus the District of Columbia and four U.S. territories, in which the recreational sale of cannabis has been approved. These states include Oregon, Washington, Nevada, California, Colorado, Massachusetts, Michigan, Vermont, Alaska, Illinois, Maine, New Jersey, Arizona, South Dakota and Montana. With respect to medical marijuana, as more research centers study the effects of cannabis-based products in treating or addressing therapeutic needs, and assuming that research findings demonstrate that such products are effective in doing so, management believes that the size of the U.S. medical cannabis market will also continue to grow as more States expand their medical marijuana programs and new states legalize medical marijuana.

Notwithstanding that 36 states and the District of Columbia have now legalized adult-use and/or medical cannabis, cannabis remains illegal under U.S. federal law with cannabis listed as a Schedule I drug under the Controlled Substance Act, or CSA.

14

Government Regulation and Product Approval

We are a preclinical to early clinical stage pharmaceutical company that intends to engage third parties to test, register and license the rights to commercialize our products in the United States and other jurisdictions. Such third parties may be subject to extensive regulation by various regulatory authorities. The primary regulatory agency in the United States is the FDA and in Europe it is the EMA. Along with these two, there are other federal, state, and local regulatory agencies. In the United States, the Federal Food, Drug, and Cosmetic Act, or the FDCA, and its implementing regulations set forth, among other things, requirements for the research, testing, development, manufacture, quality control, safety, effectiveness, approval, labeling, storage, record keeping, reporting, distribution, import, export, advertising and promotion of our products. Although the discussion below focuses on regulation in the United States, we anticipate seeking approval for, and marketing of, our products in other countries.

Generally, our activities outside the United States will be subject to regulation that is similar in nature and scope as that imposed in the United States, although there can be important differences. Approval in the United States, Canada, or Europe does not assure approval by other regulatory agencies, although often test results from one country may be used in applications for regulatory approval in another country. Additionally, some significant aspects of regulation in Europe are addressed in a centralized way through the EMA but country specific regulation remains essential in many respects. A major difference in Europe, when compared to Canada and the United States, is with the approval process. In Europe, there are different procedures that can be used to gain marketing authorization in the European Union. The first procedure is referred to as the centralized procedure and requires that a single application be submitted to the EMA and, if approved, allows marketing in all countries of the European Union. The centralized procedure is mandatory for certain types of medicines and optional for others. The second procedure is referred to as national authorization and has two options; the first is referred to as the mutual recognition procedure and requires that approval is gained from one member state, after which a request is made to the other member states to mutually recognize the approval, whilst the second is referred to as the decentralized procedure which requires a member state to act as the reference member state through a simultaneous application made to other member states.

The process of obtaining regulatory marketing approvals and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations require the expenditure of substantial time and financial resources and may not be successful. See “Item 1A. Risk Factors” for additional information.

U.S. Government Regulation

The FDA is the main regulatory body that controls pharmaceuticals in the United States, and its regulatory authority is based in the FDCA. Pharmaceutical products are also subject to other federal, state and local statutes. A failure to comply explicitly with any requirements during the product development, approval, or post approval periods, may lead to administrative or judicial sanctions. These sanctions could include the imposition by the FDA or an Institutional Review Board of a hold on clinical trials, refusal to approve pending marketing applications or supplements, withdrawal of approval, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties or criminal prosecution.

The steps required before a new drug may be marketed in the United States generally include:

| ● | completion of preclinical studies, animal studies and formulation studies in compliance with the FDA’s GLP regulations; | |

| ● | submission to the FDA of an IND application to support human clinical testing in the United States; | |

| ● | approval by an IRB at each clinical site before each trial may be initiated; | |

| ● | performance of adequate and well-controlled clinical trials in accordance with federal regulations and with GCP regulations to establish the safety and efficacy of the investigational product candidate for each target indication; | |

| ● | submission of a new drug application, or NDA, to the FDA; | |

| ● | satisfactory completion of an FDA Advisory Committee review, if applicable; | |

| ● | satisfactory completion of an FDA inspection of the manufacturing facilities at which the investigational product candidate is produced to assess compliance with cGMP, and to assure that the facilities, methods and controls are adequate; and | |

| ● | FDA review and approval of the NDA. |

15

Clinical Trials and the FDA Approval Process

An IND is a request for authorization from the FDA to administer an investigational product candidate to humans. This authorization is required before interstate shipping and administration of any new drug product to humans in the United States that is not the subject of an approved NDA. A 30-day waiting period after the submission of each IND is required prior to the commencement of clinical testing in humans. If the FDA has neither commented on nor questioned the IND within this 30-day period, the clinical trial proposed in the IND may begin. Clinical trials involve the administration of the investigational product candidate to healthy volunteers or patients with the disease under study, under the supervision of qualified investigators following GCPs, an international standard intended to protect the rights and health of patients with the disease under study and define the roles of clinical trial sponsors, administrators and monitors. Clinical trials are conducted under protocols that detail the parameters to be used in monitoring safety, and the efficacy criteria to be evaluated. Each protocol involving testing on patients in the United States and subsequent protocol amendments must be submitted to the FDA as part of the IND. Rambam MT has not yet submitted an IND in the United States for any clinical programs.

The clinical investigation of an investigational product candidate is generally divided into three phases. Although the phases are usually conducted sequentially, they may overlap or some may be combined. The three phases of clinical investigation are as follows:

| ● | Phase I. Phase I includes the initial introduction of an investigation product candidate into humans. Phase I clinical trials may be conducted in patients with the target disease or condition, or in healthy volunteers. These studies are designed to evaluate the safety, metabolism, pharmacokinetics, or “PK”, and pharmacologic actions of the investigational product candidate in humans, the side effects associated with increasing doses, and if possible, to gain early evidence on effectiveness. During Phase I clinical trials, sufficient information about the investigational product candidate’s PK and pharmacological effects may be obtained to inform the design of Phase II clinical trials. The total number of participants included in Phase I clinical trials varies but is generally in the range of 20 to 80. We expect that it will take approximately 3 months for Rambam MT to complete Phase I. |

| ● | Phase II. Phase II includes the controlled clinical trials conducted to evaluate the effectiveness of the investigational product candidate for a particular indication(s) in patients with the disease or condition under study, to determine dosage tolerance and optimal dosage, and to identify possible adverse side effects and safety risks associated with the product candidate. Phase II clinical trials are typically well controlled, closely monitored, conducted in a limited subject population and usually involving no more than several hundred participants. Rambam MT is planning to divide Phase II into two parts: |

| ● | Phase IIa. Phase IIa will include a randomized, double-blind, placebo-controlled, multiple ascending dose study in Israel to determine the maximum CBD extract administered sublingually to assess the safety, tolerability, pharmacokinetics, pharmacodynamics and efficacy for at least 4 weeks in RA patients in the presence of concurrent active therapies, such as non-steroidal anti-inflammatory drugs, or NSAIDs, and steroids. We expect that Phase IIa will take approximately 6 months. | |

| ● | Phase IIb. Phase IIb will include IND submission for randomized, multi center double blinded, placebo-controlled dose response finding, or DRF, study for at least 12 weeks with either CBD extract or placebo administered sublingually in the presence of concurrent active therapies such as NSAIDs and steroids. This study will include 300-400 patients (80-100 patients per cohort) to study safety and efficacy of the product in active RA patients. We expect that Phase IIb will take approximately 18 months. |

| ● | Phase III. Phase III clinical trials are controlled clinical trials conducted in an expanded subject population at geographically dispersed clinical trial sites. They are performed after preliminary evidence suggesting effectiveness of the investigational product candidate has been obtained, are intended to further evaluate dosage, clinical effectiveness and safety, to establish the overall benefit-risk relationship of the product candidate, and to provide an adequate basis for drug approval. Phase III clinical trials usually involve several hundred to several thousand participants. In most cases, the FDA requires two adequate and well controlled Phase III clinical trials to demonstrate the efficacy of the drug. |

16

The decision to terminate development of an investigational product candidate may be made by either a health authority body, such as the FDA or IRB/ethics committees, or by a company for various reasons. The FDA may order the temporary, or permanent, discontinuation of a clinical trial at any time, or impose other sanctions, if it believes that the clinical trial either is not being conducted in accordance with FDA requirements or presents an unacceptable risk to the clinical trial patients. In some cases, clinical trials are overseen by an independent group of qualified experts organized by the trial sponsor or the clinical monitoring board. This group provides authorization for whether or not a trial may move forward at designated check points. These decisions are based on the limited access to data from the ongoing trial. The suspension or termination of development can occur during any phase of clinical trials if it is determined that the participants or patients are being exposed to an unacceptable health risk. In addition, there are requirements for the registration of ongoing clinical trials of Product Candidates on public registries and the disclosure of certain information pertaining to the trials as well as clinical trial results after completion.

New Drug Applications

In order to obtain approval to market a drug in the United States, a marketing application must be submitted to the FDA that provides data establishing the safety and effectiveness of the product candidate for the proposed indication. The application includes all relevant data available from pertinent preclinical studies and clinical trials, including negative or ambiguous results as well as positive findings, together with detailed information relating to the product’s chemistry, manufacturing, controls and proposed labeling, among other things. Data can come from company sponsored clinical trials intended to test the safety and effectiveness of a product, or from a number of alternative sources, including studies initiated by investigators. To support marketing approval, the data submitted must be sufficient in quality and quantity to establish the safety and effectiveness of the investigational product candidate to the satisfaction of the FDA. In most cases, the NDA must be accompanied by a substantial user fee; there may be some instances in which the user fee is waived. The FDA will initially review the NDA for completeness before it accepts the NDA for filing. The FDA has 60 days from its receipt of an NDA to determine whether the application will be accepted for filing based on the agency’s threshold determination that it is sufficiently complete to permit substantive review. After the NDA submission is accepted for filing, the FDA begins an in-depth review. The FDA has agreed to certain performance goals in the review of NDAs. Most such applications for standard review Product Candidates are reviewed within ten to twelve months. The FDA can extend this review by three months to consider certain late submitted information or information intended to clarify information already provided in the submission. The FDA reviews the NDA to determine, among other things, whether the proposed product is safe and effective for its intended use, and whether the product is being manufactured in accordance with cGMP. The FDA may refer applications for novel Product Candidates that present difficult questions of safety or efficacy to an advisory committee, typically a panel that includes clinicians and other experts, for review, evaluation and a recommendation as to whether the application should be approved and under what conditions. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions.

Before approving an NDA, the FDA will inspect the facilities at which the product is manufactured. The FDA will not approve the product unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. Additionally, before approving an NDA, the FDA will typically inspect one or more clinical sites to assure compliance with GCP. After the FDA evaluates the NDA and the manufacturing facilities, it issues either an approval letter or a complete response letter. A complete response letter generally outlines the deficiencies in the submission and may require substantial additional testing or information in order for the FDA to reconsider the application. If, or when, those deficiencies have been addressed to the FDA’s satisfaction in a resubmission of the NDA, the FDA will issue an approval letter. Notwithstanding the submission of any requested additional information, the FDA ultimately may decide that the application does not satisfy the regulatory criteria for approval.

An approval letter authorizes commercial marketing of the drug with specific prescribing information for specific indications. Product approval may require substantial post-approval testing and surveillance to monitor the drug’s safety or efficacy. Once granted, product approvals may be withdrawn if compliance with regulatory standards is not maintained or problems are identified following initial marketing.

17

Disclosure of Clinical Trial Information

Sponsors of clinical trials of certain FDA regulated products, including prescription drugs, are required to register and disclose certain clinical trial information (though not specifically required for Phase I trials) on a public website maintained by the U.S. National Institutes of Health, or “NIH”. Information related to the product, patient population, phase of investigation, study sites and investigator, and other aspects of the clinical trial is made public as part of the registration. Sponsors are also obligated to disclose the results of these trials after completion. Disclosure of the results of these trials can be delayed until the product or new indication being studied has been approved. Competitors may use this publicly available information to gain knowledge regarding the design and progress of our development programs.

Advertising and Promotion

The FDA and other federal regulatory agencies closely regulate the marketing and promotion of drugs through, among other things, standards and regulations for direct-to-consumer advertising, communications regarding unapproved uses, industry-sponsored scientific and educational activities, and promotional activities involving the Internet. A product cannot be commercially promoted before it is approved. After approval, product promotion can include only those claims relating to safety and effectiveness that are consistent with the labeling (package insert) approved by the FDA. Healthcare providers are permitted to prescribe drugs for “off-label” uses — that is, uses not approved by the FDA and, therefore, not described in the drug’s labeling — because the FDA does not regulate the practice of medicine. However, FDA regulations impose stringent restrictions on manufacturers’ communications regarding off-label uses.

Post-Approval Regulations