Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended |

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| ☒ | Accelerated Filer | ☐ | ||||

| Non-Accelerated Filer | ☐ | Smaller Reporting Company | ||||

| Emerging Growth Company | ||||||

Fund |

Aggregate Market Value of the Fund’s Units Held by Non-Affiliates as of June 30, 2020 |

Number of Outstanding Units as of February 11, 2021 |

||||||

ProShares Short Euro |

$ | |||||||

ProShares Short VIX Short-Term Futures ETF |

||||||||

ProShares Ultra Bloomberg Crude Oil |

||||||||

ProShares Ultra Bloomberg Natural Gas |

||||||||

ProShares Ultra Euro |

||||||||

ProShares Ultra Gold |

||||||||

ProShares Ultra Silver |

||||||||

ProShares Ultra VIX Short-Term Futures ETF |

||||||||

ProShares Ultra Yen |

||||||||

ProShares UltraShort Australian Dollar |

||||||||

ProShares UltraShort Bloomberg Crude Oil |

||||||||

ProShares UltraShort Bloomberg Natural Gas |

||||||||

ProShares UltraShort Euro |

||||||||

ProShares UltraShort Gold |

||||||||

ProShares UltraShort Silver |

||||||||

ProShares UltraShort Yen |

||||||||

ProShares VIX Mid-Term Futures ETF |

||||||||

ProShares VIX Short-Term Futures ETF |

||||||||

Page |

||||

| 3 | ||||

| 23 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 54 | ||||

| 59 | ||||

| 89 | ||||

| 104 | ||||

| 111 | ||||

| 111 | ||||

| 112 | ||||

| 113 | ||||

| 116 | ||||

| 116 | ||||

| 116 | ||||

| 117 | ||||

| 118 | ||||

| 118 | ||||

| 119 | ||||

| 273 | ||||

Item 1. |

Business. |

| Index |

Bloomberg Ticker Symbol |

|||

| S&P 500 VIX Short-Term Futures Index |

SPVXSP | |||

| S&P 500 VIX Mid-Term Futures Index |

SPVXMPID | |||

| Underlying Benchmark |

Create/Redeem Cutoff* |

NAV Calculation Time |

||||||

| Silver |

1:00 p.m. (Eastern Time | ) | 1:25 p.m. (Eastern Time | ) | ||||

| Gold |

1:00 p.m. (Eastern Time | ) | 1:30 p.m. (Eastern Time | ) | ||||

| S&P 500 VIX Short-Term Futures Index** |

2:00 p.m. (Eastern Time | ) | 4:00 p.m. (Eastern Time | ) | ||||

| S&P 500 VIX Mid-Term Futures Index** |

2:00 p.m. (Eastern Time | ) | 4:00 p.m. (Eastern Time | ) | ||||

| Bloomberg Commodity Balanced WTI Crude Oil Index SM |

2:00 p.m. (Eastern Time | ) | 2:30 p.m. (Eastern Time | ) | ||||

| Bloomberg Natural Gas Subindex SM |

2:00 p.m. (Eastern Time | ) | 2:30 p.m. (Eastern Time | ) | ||||

| Australian dollar |

3:00 p.m. (Eastern Time | ) | 4:00 p.m. (Eastern Time | ) | ||||

| Euro |

3:00 p.m. (Eastern Time | ) | 4:00 p.m. (Eastern Time | ) | ||||

| Yen |

3:00 p.m. (Eastern Time | ) | 4:00 p.m. (Eastern Time | ) | ||||

| * | Although the Funds’ shares may continue to trade on secondary markets subsequent to the calculation of the final NAV, these times represent the final opportunity to transact in creation or redemption units for the year ended December 31, 2020. |

| ** | Effective Monday, October 26, 2020, the Chicago Futures Exchange (a subsidiary of the Chicago Board Options Exchange) changed the settlement time for the VIX futures contracts in which the Funds invest from 4:15 p.m. (Eastern Time) to 4:00 p.m. (Eastern Time). Please see Note 8 of the Notes to Financial Statements of this Form 10-K for more information. |

| • | it determines that the purchase order is not in proper form; |

| • | the Sponsor believes that the purchase order would have adverse tax consequences to a Fund or its shareholders; |

| • | the order would be illegal; or |

| • | circumstances outside the control of the Sponsor make it, for all practical purposes, not feasible to process creations of Creation Units. |

| Fund |

NAV Calculation Time | |

| ProShares UltraShort Silver* and ProShares Ultra Silver |

1:25 p.m. (Eastern Time) | |

| ProShares UltraShort Gold* and ProShares Ultra Gold |

1:30 p.m. (Eastern Time) | |

| ProShares UltraShort Bloomberg Crude Oil and ProShares Ultra Bloomberg Crude Oil |

2:30 p.m. (Eastern Time) | |

| ProShares UltraShort Bloomberg Natural Gas and ProShares Ultra Bloomberg Natural Gas |

2:30 p.m. (Eastern Time) | |

| ProShares Short Euro, ProShares UltraShort Euro and ProShares Ultra Euro |

4:00 p.m. (Eastern Time) | |

| ProShares UltraShort Australian Dollar |

4:00 p.m. (Eastern Time) | |

| ProShares UltraShort Yen and ProShares Ultra Yen |

4:00 p.m. (Eastern Time) | |

| ProShares VIX Short-Term Futures ETF*, ProShares Ultra VIX Short-Term Futures ETF* and |

||

| ProShares Short VIX Short-Term Futures ETF* |

4:00 p.m. (Eastern Time) | |

| ProShares VIX Mid-Term Futures ETF* |

4:00 p.m. (Eastern Time) |

| * | Effective Monday, October 26, 2020, the Chicago Futures Exchange (a subsidiary of the Chicago Board Options Exchange) changed the settlement time for the VIX futures contracts in which the Funds invest from 4:15 p.m. (Eastern Time) to 4:00 p.m. (Eastern Time). Please see Note 8 of the Notes to the Financial Statements of this Form 10-K for more information. |

| • | initial SEC registration fees and SEC and FINRA filing fees; |

| • | costs of preparing, printing (including typesetting), amending, supplementing, mailing and distributing the Trust’s Registration Statements, the exhibits thereto and the related prospectuses; |

| • | the costs of qualifying, printing (including typesetting), amending, supplementing and mailing sales materials used in connection with the offering and issuance of the Shares; and |

| • | accounting, auditing and legal fees (including disbursements related thereto) incurred in connection therewith. |

Item 1A. |

Risk Factors. |

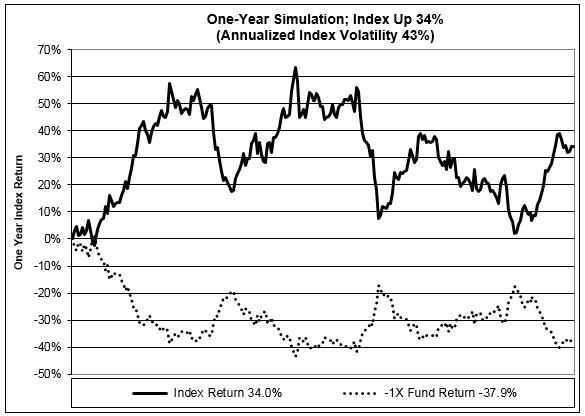

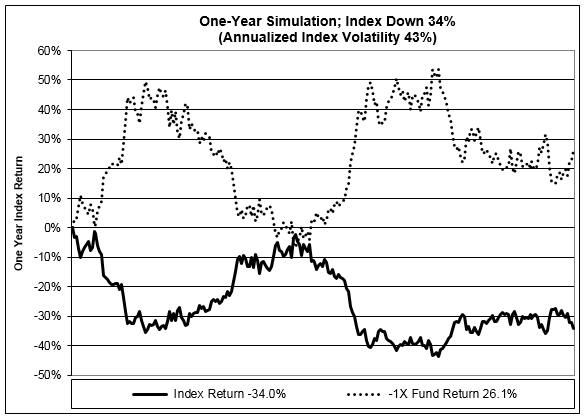

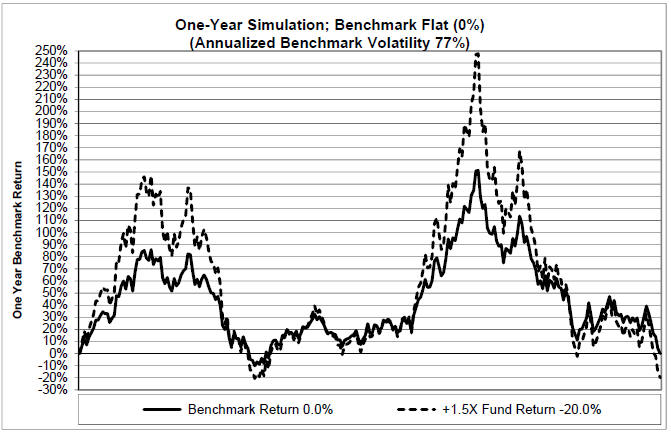

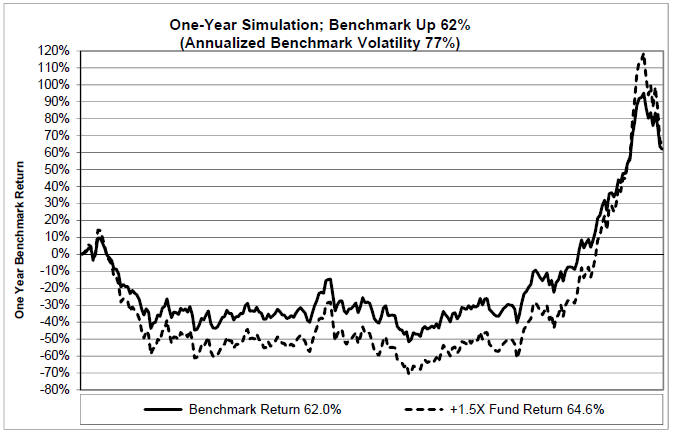

| • | Due to the compounding of daily returns, the Geared Funds’ returns over periods longer than a single day will likely differ in amount and possibly even direction from the Geared Fund multiple times the benchmark return for the period. |

| • | Correlation risks specific to the Geared Funds may arise because the Geared Funds seek to rebalance their portfolios daily to keep daily exposure consistent with their investment objectives to achieve a high degree of daily correlation with their applicable underlying benchmarks. |

| • | The use of leveraged, inverse and/or inverse leveraged positions could result in the total loss of an investor’s investment within a single day. |

| • | A number of factors may have a negative impact on the price of commodities, such as oil, gold, silver and gas, and the price of Financial Instruments based on such commodities. |

| • | Intraday price/performance of Geared Funds will likely differ from the Fund’s stated daily multiple times the performance of its Benchmark for such day. |

| • | The Currency Funds are subject to a number of risks impacting the value of non-U.S. currencies and the value of Financial Instruments based on such currencies. For example, European financial markets and the value of the euro have experienced significant volatility, in part related to unemployment, budget deficits and economic downturns. In addition, the euro could be abandoned in the future by countries that have already adopted its use. |

| • | The Precious Metals Funds do not hold gold or silver bullion. Rather, the Precious Metals Funds use Financial Instruments to gain exposure to gold and silver bullion. Using Financial Instruments to obtain exposure to gold or silver bullion may cause tracking error and subject the Precious Metals Funds to the effects of contango and backwardation. |

| • | The Natural Gas Funds are linked to an index comprised of natural gas futures contracts, and are not directly linked to the “spot” price of natural gas. Natural Gas futures contracts may perform very differently from the spot price of natural gas. |

| • | The Oil Funds are linked to an index comprised of crude oil futures contracts, and are not directly linked to the “spot” price of crude oil. Oil futures contracts may perform very differently from the spot price of crude oil. |

| • | In April 2020, the market for crude oil futures contracts experienced a period of “extraordinary contango” (the spot price for a commodity is significantly lower than the price of the futures contract in that commodity) that resulted in a negative price in the May 2020 WTI crude oil futures contract. If all or a significant portion of the futures contracts held by the Oil Funds at a future date were to reach a negative price, investors in any such Fund could lose their entire investment. |

| • | The VIX Funds are benchmarked to a VIX Futures Index. They are not benchmarked to the VIX or actual realized volatility of the S&P 500. |

| • | VIX futures contracts can be highly volatile and the Funds may experience sudden and large losses when buying, selling or holding such instruments. |

| • | The level of the VIX has historically reverted to a long-term mean level and is subject to sudden and unexpected reversions to its mean. Accordingly, investors should not expect the VIX Funds to retain any appreciation in value over extended periods of time. |

| • | There is no guarantee that a Fund will achieve its investment objective or that the returns of a Fund will correlate to the returns of its index times its stated multiple. There may be circumstances that could prevent a Fund from being operated in a manner consistent with its investment objective and principal investment strategies. |

| • | The assets that the Funds invest in can be highly volatile and the Funds may experience large losses when buying, selling or holding such instruments; you can lose of your investment within a single day. |

| • | Each Fund seeks to achieve its investment objective even during periods when the performance of the Fund’s benchmark is flat of when the benchmark is moving in a manner that may cause the value of the Fund to decline. |

| • | The value of the Shares of the Funds relates directly to the value of, and realized profit or loss from, the Financial Instruments and other assets held by that Fund. Fluctuations in the price of these Financial Instruments or assets could materially adversely affect an investment in such Fund’s Shares. |

| • | Margin requirements and position limits applicable to futures contracts and swaps may limit a Fund’s ability to achieve sufficient exposure and prevent a Fund from achieving its investment objective. |

| • | Possible illiquid markets may cause or exacerbate losses; the large size of the positions the Funds may acquire increases these risks. |

| • | The Funds may be subject to significant and sustained losses from rolling futures positions. |

| • | It may not be possible to gain exposure to the benchmarks using exchange-traded Financial Instruments in the future. |

| • | Fees are charged regardless of a Fund’s returns and may result in depletion of assets. |

| • | For the Funds linked to a benchmark, changes implemented by the benchmark provider that affect the composition and valuation of the benchmark could adversely affect the value of Fund Shares and an investment in a Fund Shares. |

| • | The particular benchmark used by a Fund may underperform other asset classes and may underperform other indices or benchmarks based upon the same underlying Reference Asset. |

| • | The Funds may be subject to counterparty risks. |

| • | Historical correlation trends between Fund benchmarks and other asset classes may not continue or may reverse, limiting or eliminating any potential diversification or other benefit from owning a Fund. |

| • | The lack of active trading markets for any of the Shares of the Funds may result in losses on investors’ investments at the time of disposition of such Shares. |

| • | A Fund may change its investment objective, benchmark or strategies and may liquidate at a time that is disadvantageous to shareholders. |

| • | Investors may be adversely affected by redemption or creation orders that are subject to postponement, suspension or rejection under certain circumstances. |

| • | The NAV per Share may not correspond to the market price per Share. |

| • | Investors may be adversely affected by an overstatement or understatement of a Fund’s NAV due to the valuation method employed or errors in the NAV calculation. |

| • | Purchases of a Fund’s creation units may be suspended if the Fund issues all of its currently remaining registered shares – this may have a negative impact on the trading price and liquidity of Fund shares |

| • | Regulatory and exchange position limits or accountability levels may restrict the creation of Creation Units and have a negative impact on operation of the Trust. |

| • | The number of underlying components included in a Fund’s benchmark may impact volatility, which could adversely affect an investment in the Shares. |

| • | The liquidity of the Shares may also be affected by the withdrawal from participation of Authorized Participants, which could adversely affect the market price of the Shares. |

| • | Shareholders that are not Authorized Participants may only purchase or sell their Shares in secondary trading markets, and the conditions associated with trading in secondary markets may adversely affect investors’ investment in the Shares. |

| • | The applicable Exchange may halt trading in the Shares of a Fund which would adversely impact investors’ ability to sell Shares. |

| • | Shareholders do not have the protections associated with ownership of shares in an investment company registered under the 1940 Act. |

| • | Shareholders do not have the rights enjoyed by investors in certain other vehicles and may be adversely affected by a lack of statutory rights and by limited voting and distribution rights. |

| • | The value of the Shares will be adversely affected if the Funds are required to indemnify Wilmington Trust Company (the “Trustee”) and/or the Sponsor. |

| • | Although the Shares of the Funds are limited liability investments, certain circumstances such as bankruptcy of a Fund will increase a shareholder’s liability. |

| • | Failure of the FCMs to segregate assets may increase losses in the Funds. |

| • | A court could potentially conclude that the assets and liabilities of one Fund are not segregated from those of another Fund and may thereby potentially expose assets in a Fund to the liabilities of another Fund. |

| • | The discontinuance of LIBOR could cause or contribute to market volatility and could affect the market value and/or liquidity of the Funds’ investments. |

| • | Due to the increased use of technologies, intentional and unintentional cyber-attacks pose operational and information security risks. |

| • | Trading on exchanges outside the United States is generally not subject to U.S. regulation and may result in different or diminished investor protections. |

| • | Competing claims of intellectual property rights may affect the Funds and an investment in the Shares. |

| • | Shareholders’ tax liability may exceed cash distributions on the Shares. |

| • | The U.S. Internal Revenue Service (“IRS”) could adjust or reallocate items of income, gain, deduction, loss and credit with respect to the Shares if the IRS does not accept the assumptions or conventions utilized by the Fund. |

| • | Shareholders will receive partner information tax returns on Schedule K-1, which could increase the complexity of tax returns. |

| • | Shareholders of each Fund may recognize significant amounts of ordinary income and short-term capital gain. |

| • | A Fund could be treated as a corporation for federal income tax purposes, which may substantially reduce the value of Shares. |

| • | Changes in U.S. federal income tax law could affect an investment in the Shares. |

| • | The Funds and the Sponsor are subject to extensive legal and regulatory requirements. Regulatory changes or actions, including the implementation of new legislation, may alter the operations and profitability of the Funds. |

| • | Investors cannot be assured of the Sponsor’s continued services, the discontinuance of which may be detrimental to the Funds. |

| • | The term “Matching VIX Fund” refers to ProShares VIX Short-Term Futures ETF and ProShares VIX Mid-Term Futures ETF; |

| • | The term “Geared VIX Fund” refers to ProShares Ultra VIX Short-Term Futures ETF and ProShares Short VIX Short-Term Futures ETF; |

| • | The term “VIX Fund” refers to each Geared VIX Fund and each Matching VIX Fund; |

| • | The term “Geared Fund” refers to ProShares UltraShort Bloomberg Crude Oil, ProShares UltraShort Bloomberg Natural Gas, ProShares UltraShort Gold, ProShares UltraShort Silver, ProShares Short Euro, ProShares UltraShort Australian Dollar, ProShares UltraShort Euro, ProShares UltraShort Yen, ProShares Ultra Bloomberg Crude Oil, ProShares Ultra Bloomberg Natural Gas, ProShares Ultra Gold, ProShares Ultra Silver, ProShares Ultra Euro and ProShares Ultra Yen, and each Geared VIX Fund; |

| • | The term “Natural Gas Fund” refers to ProShares UltraShort Bloomberg Natural Gas and ProShares Ultra Bloomberg Natural Gas ; |

| • | The term “Oil Fund” refers to ProShares UltraShort Bloomberg Crude Oil and ProShares Ultra Bloomberg Crude Oil; |

| • | The term “Precious Metal Fund” refers to ProShares UltraShort Gold, ProShares UltraShort Silver, ProShares Ultra Gold and ProShares Ultra Silver; and |

| • | The term “Currency Fund” refers to ProShares Short Euro, ProShares UltraShort Australian Dollar, ProShares UltraShort Euro, ProShares UltraShort Yen, ProShares Ultra Euro and ProShares Ultra Yen. |

Benchmark XYZ |

Fund XYZ |

|||||||||||||||

Level |

Daily Performance |

Daily Performance |

Net Asset Value |

|||||||||||||

| Start |

100.00 | $ | 100.00 | |||||||||||||

| Day 1 |

97.00 | -3.00 | % | -6.00 | % | 94.00 | ||||||||||

| Day 2 |

99.91 | 3.00 | % | 6.00 | % | 99.64 | ||||||||||

| Day 3 |

96.91 | -3.00 | % | -6.00 | % | 93.66 | ||||||||||

| Day 4 |

99.82 | 3.00 | % | 6.00 | % | 99.28 | ||||||||||

| Day 5 |

96.83 | -3.00 | % | -6.00 | % | 93.32 | ||||||||||

| Day 6 |

99.73 | 3.00 | % | 6.00 | % | 98.92 | ||||||||||

| Day 7 |

96.74 | -3.00 | % | -6.00 | % | 92.99 | ||||||||||

| |

|

|

|

|||||||||||||

| Total Return |

-3.26 |

% |

-7.01 |

% |

||||||||||||

| |

|

|

|

|||||||||||||

Benchmark XYZ |

Fund XYZ |

|||||||||||||||

Level |

Daily Performance |

Daily Performance |

Net Asset Value |

|||||||||||||

| Start |

100.00 | $ | 100.00 | |||||||||||||

| Day 1 |

103.00 | 3.00 | % | 6.00 | % | 106.00 | ||||||||||

| Day 2 |

99.91 | -3.00 | % | -6.00 | % | 99.64 | ||||||||||

| Day 3 |

102.91 | 3.00 | % | 6.00 | % | 105.62 | ||||||||||

| Day 4 |

99.82 | -3.00 | % | -6.00 | % | 99.28 | ||||||||||

| Day 5 |

102.81 | 3.00 | % | 6.00 | % | 105.24 | ||||||||||

| Day 6 |

99.73 | -3.00 | % | -6.00 | % | 98.92 | ||||||||||

| Day 7 |

102.72 | 3.00 | % | 6.00 | % | 104.86 | ||||||||||

| |

|

|

|

|||||||||||||

| Total Return |

2.72 |

% |

4.86 |

% |

||||||||||||

| |

|

|

|

|||||||||||||

| Index |

Identifier |

Historical Five-Year Average Volatility Rate As of December 31, 2020 |

||||||

| S&P 500 VIX Short-Term Futures Index |

SPVXSP | 77.10 | % | |||||

| S&P 500 VIX Mid-Term Futures Index |

SPVXMPID | 36.41 | % | |||||

| Bloomberg Commodity Balanced WTI Crude Oil Index SM |

BCBCLI | 36.42 | % | |||||

| Bloomberg Natural Gas Subindex SM |

BCOMNG | 42.53 | % | |||||

| Bloomberg Gold Subindex SM |

BCOMGC | 14.64 | % | |||||

| Bloomberg Silver Subindex SM |

BCOMSI | 27.79 | % | |||||

| The US dollar price of the euro |

USDEUR | 7.05 | % | |||||

| The US dollar price of the Japanese yen |

USDJPY | 8.65 | % | |||||

| The US dollar price of the Australian dollar |

USDAUD | 9.52 | % | |||||

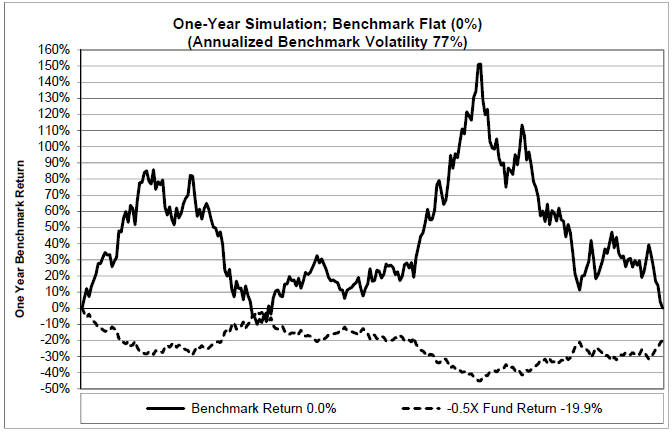

| Index Volatility |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| One Year Index Performance |

One-Half the Invers (-0.5x) One Year Index Performance |

0% | 5% | 10% | 15% | 20% | 25% | 30% | 35% | 40% | 45% | 50% | 55% | 60% | 65% | 70% | 75% | |||||||||||||||||||||||||||||||||||||||||||||||||||

| -60% |

30.0 | % | 58.1 | % | 58.0 | % | 57.5 | % | 56.8 | % | 55.8 | % | 54.5 | % | 52.9 | % | 51.0 | % | 48.9 | % | 46.6 | % | 44.0 | % | 41.2 | % | 38.1 | % | 34.9 | % | 31.6 | % | 28.0 | % | ||||||||||||||||||||||||||||||||||

| -55% |

27.5 | % | 49.1 | % | 48.9 | % | 48.5 | % | 47.8 | % | 46.9 | % | 45.6 | % | 44.1 | % | 42.4 | % | 40.4 | % | 38.2 | % | 35.7 | % | 33.1 | % | 30.2 | % | 27.2 | % | 24.0 | % | 20.7 | % | ||||||||||||||||||||||||||||||||||

| -50% |

25.0 | % | 41.4 | % | 41.3 | % | 40.9 | % | 40.2 | % | 39.3 | % | 38.1 | % | 36.7 | % | 35.1 | % | 33.2 | % | 31.1 | % | 28.8 | % | 26.3 | % | 23.6 | % | 20.7 | % | 17.7 | % | 14.5 | % | ||||||||||||||||||||||||||||||||||

| -45% |

22.5 | % | 34.8 | % | 34.7 | % | 34.3 | % | 33.7 | % | 32.8 | % | 31.7 | % | 30.4 | % | 28.8 | % | 27.0 | % | 25.0 | % | 22.8 | % | 20.4 | % | 17.8 | % | 15.1 | % | 12.2 | % | 9.2 | % | ||||||||||||||||||||||||||||||||||

| -40% |

20.0 | % | 29.1 | % | 29.0 | % | 28.6 | % | 28.0 | % | 27.2 | % | 26.1 | % | 24.8 | % | 23.3 | % | 21.6 | % | 19.7 | % | 17.5 | % | 15.3 | % | 12.8 | % | 10.2 | % | 7.4 | % | 4.5 | % | ||||||||||||||||||||||||||||||||||

| -35% |

17.5 | % | 24.0 | % | 23.9 | % | 23.6 | % | 23.0 | % | 22.2 | % | 21.2 | % | 19.9 | % | 18.5 | % | 16.8 | % | 15.0 | % | 12.9 | % | 10.7 | % | 8.4 | % | 5.9 | % | 3.2 | % | 0.4 | % | ||||||||||||||||||||||||||||||||||

| -30% |

15.0 | % | 19.5 | % | 19.4 | % | 19.1 | % | 18.5 | % | 17.7 | % | 16.8 | % | 15.6 | % | 14.2 | % | 12.6 | % | 10.8 | % | 8.8 | % | 6.7 | % | 4.4 | % | 2.0 | % | -0.5 | % | -3.2 | % | ||||||||||||||||||||||||||||||||||

| -25% |

12.5 | % | 15.5 | % | 15.4 | % | 15.0 | % | 14.5 | % | 13.8 | % | 12.8 | % | 11.6 | % | 10.3 | % | 8.7 | % | 7.0 | % | 5.1 | % | 3.1 | % | 0.9 | % | -1.4 | % | -3.9 | % | -6.5 | % | ||||||||||||||||||||||||||||||||||

| -20% |

10.0 | % | 11.8 | % | 11.7 | % | 11.4 | % | 10.9 | % | 10.1 | % | 9.2 | % | 8.1 | % | 6.8 | % | 5.3 | % | 3.6 | % | 1.8 | % | -0.2 | % | -2.3 | % | -4.6 | % | -7.0 | % | -9.5 | % | ||||||||||||||||||||||||||||||||||

| -15% |

7.5 | % | 8.5 | % | 8.4 | % | 8.1 | % | 7.6 | % | 6.9 | % | 6.0 | % | 4.9 | % | 3.6 | % | 2.1 | % | 0.5 | % | -1.2 | % | -3.2 | % | -5.2 | % | -7.4 | % | -9.7 | % | -12.2 | % | ||||||||||||||||||||||||||||||||||

| -10% |

5.0 | % | 5.4 | % | 5.3 | % | 5.0 | % | 4.5 | % | 3.8 | % | 3.0 | % | 1.9 | % | 0.7 | % | -0.7 | % | -2.3 | % | -4.0 | % | -5.9 | % | -7.9 | % | -10.0 | % | -12.3 | % | -14.6 | % | ||||||||||||||||||||||||||||||||||

| -5% |

2.5 | % | 2.6 | % | 2.5 | % | 2.2 | % | 1.7 | % | 1.1 | % | 0.2 | % | -0.8 | % | -2.0 | % | -3.4 | % | -4.9 | % | -6.6 | % | -8.4 | % | -10.4 | % | -12.4 | % | -14.6 | % | -16.9 | % | ||||||||||||||||||||||||||||||||||

| 0% |

0.0 | % | 0.0 | % | -0.1 | % | -0.4 | % | -0.8 | % | -1.5 | % | -2.3 | % | -3.3 | % | -4.5 | % | -5.8 | % | -7.3 | % | -8.9 | % | -10.7 | % | -12.6 | % | -14.7 | % | -16.8 | % | -19.0 | % | ||||||||||||||||||||||||||||||||||

| 5% |

-2.5 | % | -2.4 | % | -2.5 | % | -2.8 | % | -3.2 | % | -3.9 | % | -4.7 | % | -5.6 | % | -6.8 | % | -8.1 | % | -9.5 | % | -11.1 | % | -12.9 | % | -14.7 | % | -16.7 | % | -18.8 | % | -21.0 | % | ||||||||||||||||||||||||||||||||||

| 10% |

-5.0 | % | -4.7 | % | -4.7 | % | -5.0 | % | -5.5 | % | -6.1 | % | -6.9 | % | -7.8 | % | -8.9 | % | -10.2 | % | -11.6 | % | -13.2 | % | -14.9 | % | -16.7 | % | -18.6 | % | -20.7 | % | -22.8 | % | ||||||||||||||||||||||||||||||||||

| 15% |

-7.5 | % | -6.7 | % | -6.8 | % | -7.1 | % | -7.5 | % | -8.1 | % | -8.9 | % | -9.8 | % | -10.9 | % | -12.2 | % | -13.6 | % | -15.1 | % | -16.7 | % | -18.5 | % | -20.4 | % | -22.4 | % | -24.5 | % | ||||||||||||||||||||||||||||||||||

| 20% |

-10.0 | % | -8.7 | % | -8.8 | % | -9.1 | % | -9.5 | % | -10.1 | % | -10.8 | % | -11.7 | % | -12.8 | % | -14.0 | % | -15.4 | % | -16.9 | % | -18.5 | % | -20.2 | % | -22.1 | % | -24.0 | % | -26.1 | % | ||||||||||||||||||||||||||||||||||

| 25% |

-12.5 | % | -10.6 | % | -10.6 | % | -10.9 | % | -11.3 | % | -11.9 | % | -12.6 | % | -13.5 | % | -14.6 | % | -15.8 | % | -17.1 | % | -18.6 | % | -20.1 | % | -21.9 | % | -23.7 | % | -25.6 | % | -27.6 | % | ||||||||||||||||||||||||||||||||||

| 30% |

-15.0 | % | -12.3 | % | -12.4 | % | -12.6 | % | -13.0 | % | -13.6 | % | -14.3 | % | -15.2 | % | -16.2 | % | -17.4 | % | -18.7 | % | -20.1 | % | -21.7 | % | -23.4 | % | -25.1 | % | -27.0 | % | -29.0 | % | ||||||||||||||||||||||||||||||||||

| 35% |

-17.5 | % | -13.9 | % | -14.0 | % | -14.3 | % | -14.7 | % | -15.2 | % | -15.9 | % | -16.8 | % | -17.8 | % | -18.9 | % | -20.2 | % | -21.6 | % | -23.2 | % | -24.8 | % | -26.5 | % | -28.4 | % | -30.3 | % | ||||||||||||||||||||||||||||||||||

| 40% |

-20.0 | % | -15.5 | % | -15.6 | % | -15.8 | % | -16.2 | % | -16.7 | % | -17.4 | % | -18.3 | % | -19.3 | % | -20.4 | % | -21.7 | % | -23.0 | % | -24.5 | % | -26.2 | % | -27.9 | % | -29.7 | % | -31.6 | % | ||||||||||||||||||||||||||||||||||

| 45% |

-22.5 | % | -17.0 | % | -17.0 | % | -17.3 | % | -17.7 | % | -18.2 | % | -18.9 | % | -19.7 | % | -20.7 | % | -21.8 | % | -23.0 | % | -24.4 | % | -25.9 | % | -27.4 | % | -29.1 | % | -30.9 | % | -32.7 | % | ||||||||||||||||||||||||||||||||||

| 50% |

-25.0 | % | -18.4 | % | -18.4 | % | -18.7 | % | -19.0 | % | -19.6 | % | -20.2 | % | -21.1 | % | -22.0 | % | -23.1 | % | -24.3 | % | -25.7 | % | -27.1 | % | -28.7 | % | -30.3 | % | -32.1 | % | -33.9 | % | ||||||||||||||||||||||||||||||||||

| 55% |

-27.5 | % | -19.7 | % | -19.8 | % | -20.0 | % | -20.4 | % | -20.9 | % | -21.5 | % | -22.3 | % | -23.3 | % | -24.4 | % | -25.6 | % | -26.9 | % | -28.3 | % | -29.8 | % | -31.4 | % | -33.2 | % | -35.0 | % | ||||||||||||||||||||||||||||||||||

| 60% |

-30.0 | % | -20.9 | % | -21.0 | % | -21.2 | % | -21.6 | % | -22.1 | % | -22.8 | % | -23.6 | % | -24.5 | % | -25.5 | % | -26.7 | % | -28.0 | % | -29.4 | % | -30.9 | % | -32.5 | % | -34.2 | % | -36.0 | % | ||||||||||||||||||||||||||||||||||

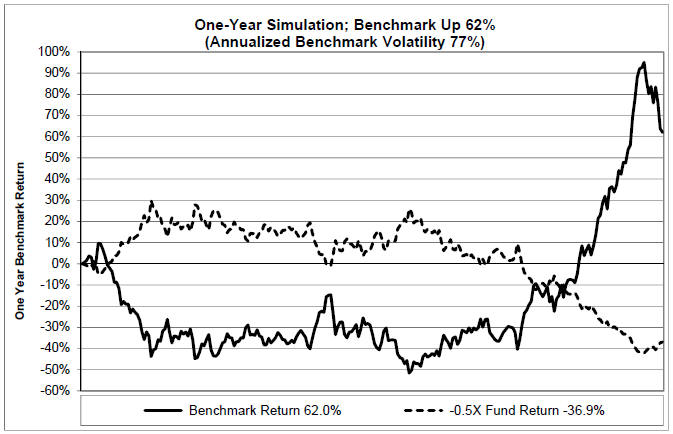

| Benchmark Volatility |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| One Year Benchmark Performance |

Inverse(-1x) of One Year Benchmark Performance |

0% | 5% | 10% | 15% | 20% | 25% | 30% | 35% | 40% | 45% | 50% | 55% | 60% | 65% | 70% | ||||||||||||||||||||||||||||||||||||||||||||||||

| -60% |

60 | % | 150.0 | % | 149.4 | % | 147.5 | % | 144.4 | % | 140.2 | % | 134.9 | % | 128.5 | % | 121.2 | % | 113.0 | % | 104.2 | % | 94.7 | % | 84.7 | % | 74.4 | % | 63.9 | % | 53.2 | % | ||||||||||||||||||||||||||||||||

| -55% |

55 | % | 122.2 | % | 121.7 | % | 120.0 | % | 117.3 | % | 113.5 | % | 108.8 | % | 103.1 | % | 96.6 | % | 89.4 | % | 81.5 | % | 73.1 | % | 64.2 | % | 55.0 | % | 45.6 | % | 36.1 | % | ||||||||||||||||||||||||||||||||

| -50% |

50 | % | 100.0 | % | 99.5 | % | 98.0 | % | 95.6 | % | 92.2 | % | 87.9 | % | 82.8 | % | 76.9 | % | 70.4 | % | 63.3 | % | 55.8 | % | 47.8 | % | 39.5 | % | 31.1 | % | 22.5 | % | ||||||||||||||||||||||||||||||||

| -45% |

45 | % | 81.8 | % | 81.4 | % | 80.0 | % | 77.8 | % | 74.7 | % | 70.8 | % | 66.2 | % | 60.9 | % | 54.9 | % | 48.5 | % | 41.6 | % | 34.4 | % | 26.9 | % | 19.2 | % | 11.4 | % | ||||||||||||||||||||||||||||||||

| -40% |

40 | % | 66.7 | % | 66.3 | % | 65.0 | % | 63.0 | % | 60.1 | % | 56.6 | % | 52.3 | % | 47.5 | % | 42.0 | % | 36.1 | % | 29.8 | % | 23.2 | % | 16.3 | % | 9.2 | % | 2.1 | % | ||||||||||||||||||||||||||||||||

| -35% |

35 | % | 53.8 | % | 53.5 | % | 52.3 | % | 50.4 | % | 47.8 | % | 44.5 | % | 40.6 | % | 36.1 | % | 31.1 | % | 25.6 | % | 19.8 | % | 13.7 | % | 7.3 | % | 0.8 | % | -5.7 | % | ||||||||||||||||||||||||||||||||

| -30% |

30 | % | 42.9 | % | 42.5 | % | 41.4 | % | 39.7 | % | 37.3 | % | 34.2 | % | 30.6 | % | 26.4 | % | 21.7 | % | 16.7 | % | 11.3 | % | 5.6 | % | -0.3 | % | -6.4 | % | -12.5 | % | ||||||||||||||||||||||||||||||||

| -25% |

25 | % | 33.3 | % | 33.0 | % | 32.0 | % | 30.4 | % | 28.1 | % | 25.3 | % | 21.9 | % | 18.0 | % | 13.6 | % | 8.9 | % | 3.8 | % | -1.5 | % | -7.0 | % | -12.6 | % | -18.3 | % | ||||||||||||||||||||||||||||||||

| -20% |

20 | % | 25.0 | % | 24.7 | % | 23.8 | % | 22.2 | % | 20.1 | % | 17.4 | % | 14.2 | % | 10.6 | % | 6.5 | % | 2.1 | % | -2.6 | % | -7.6 | % | -12.8 | % | -18.1 | % | -23.4 | % | ||||||||||||||||||||||||||||||||

| -15% |

15 | % | 17.6 | % | 17.4 | % | 16.5 | % | 15.0 | % | 13.0 | % | 10.5 | % | 7.5 | % | 4.1 | % | 0.3 | % | -3.9 | % | -8.4 | % | -13.1 | % | -17.9 | % | -22.9 | % | -27.9 | % | ||||||||||||||||||||||||||||||||

| -10% |

10 | % | 11.1 | % | 10.8 | % | 10.0 | % | 8.6 | % | 6.8 | % | 4.4 | % | 1.5 | % | -1.7 | % | -5.3 | % | -9.3 | % | -13.5 | % | -17.9 | % | -22.5 | % | -27.2 | % | -31.9 | % | ||||||||||||||||||||||||||||||||

| -5% |

5 | % | 5.3 | % | 5.0 | % | 4.2 | % | 2.9 | % | 1.1 | % | -1.1 | % | -3.8 | % | -6.9 | % | -10.3 | % | -14.0 | % | -18.0 | % | -22.2 | % | -26.6 | % | -31.0 | % | -35.5 | % | ||||||||||||||||||||||||||||||||

| 0% |

0 | % | 0.0 | % | -0.2 | % | -1.0 | % | -2.2 | % | -3.9 | % | -6.1 | % | -8.6 | % | -11.5 | % | -14.8 | % | -18.3 | % | -22.1 | % | -26.1 | % | -30.2 | % | -34.5 | % | -38.7 | % | ||||||||||||||||||||||||||||||||

| 5% |

-5 | % | -4.8 | % | -5.0 | % | -5.7 | % | -6.9 | % | -8.5 | % | -10.5 | % | -13.0 | % | -15.7 | % | -18.8 | % | -22.2 | % | -25.8 | % | -29.6 | % | -33.6 | % | -37.6 | % | -41.7 | % | ||||||||||||||||||||||||||||||||

| 10% |

-10 | % | -9.1 | % | -9.3 | % | -10.0 | % | -11.1 | % | -12.7 | % | -14.6 | % | -16.9 | % | -19.6 | % | -22.5 | % | -25.8 | % | -29.2 | % | -32.8 | % | -36.6 | % | -40.4 | % | -44.3 | % | ||||||||||||||||||||||||||||||||

| 15% |

-15 | % | -13.0 | % | -13.3 | % | -13.9 | % | -15.0 | % | -16.5 | % | -18.3 | % | -20.5 | % | -23.1 | % | -25.9 | % | -29.0 | % | -32.3 | % | -35.7 | % | -39.3 | % | -43.0 | % | -46.7 | % | ||||||||||||||||||||||||||||||||

| 20% |

-20 | % | -16.7 | % | -16.9 | % | -17.5 | % | -18.5 | % | -19.9 | % | -21.7 | % | -23.8 | % | -26.3 | % | -29.0 | % | -31.9 | % | -35.1 | % | -38.4 | % | -41.9 | % | -45.4 | % | -48.9 | % | ||||||||||||||||||||||||||||||||

| 25% |

-25 | % | -20.0 | % | -20.2 | % | -20.8 | % | -21.8 | % | -23.1 | % | -24.8 | % | -26.9 | % | -29.2 | % | -31.8 | % | -34.7 | % | -37.7 | % | -40.9 | % | -44.2 | % | -47.6 | % | -51.0 | % | ||||||||||||||||||||||||||||||||

| 30% |

-30 | % | -23.1 | % | -23.3 | % | -23.8 | % | -24.8 | % | -26.1 | % | -27.7 | % | -29.7 | % | -31.9 | % | -34.5 | % | -37.2 | % | -40.1 | % | -43.2 | % | -46.3 | % | -49.6 | % | -52.9 | % | ||||||||||||||||||||||||||||||||

| 35% |

-35 | % | -25.9 | % | -26.1 | % | -26.7 | % | -27.6 | % | -28.8 | % | -30.4 | % | -32.3 | % | -34.5 | % | -36.9 | % | -39.5 | % | -42.3 | % | -45.3 | % | -48.3 | % | -51.5 | % | -54.6 | % | ||||||||||||||||||||||||||||||||

| 40% |

-40 | % | -28.6 | % | -28.7 | % | -29.3 | % | -30.2 | % | -31.4 | % | -32.9 | % | -34.7 | % | -36.8 | % | -39.1 | % | -41.7 | % | -44.4 | % | -47.2 | % | -50.2 | % | -53.2 | % | -56.2 | % | ||||||||||||||||||||||||||||||||

| 45% |

-45 | % | -31.0 | % | -31.2 | % | -31.7 | % | -32.6 | % | -33.7 | % | -35.2 | % | -37.0 | % | -39.0 | % | -41.2 | % | -43.7 | % | -46.3 | % | -49.0 | % | -51.9 | % | -54.8 | % | -57.7 | % | ||||||||||||||||||||||||||||||||

| 50% |

-50 | % | -33.3 | % | -33.5 | % | -34.0 | % | -34.8 | % | -35.9 | % | -37.4 | % | -39.1 | % | -41.0 | % | -43.2 | % | -45.6 | % | -48.1 | % | -50.7 | % | -53.5 | % | -56.3 | % | -59.2 | % | ||||||||||||||||||||||||||||||||

| 55% |

-55 | % | -35.5 | % | -35.6 | % | -36.1 | % | -36.9 | % | -38.0 | % | -39.4 | % | -41.0 | % | -42.9 | % | -45.0 | % | -47.3 | % | -49.8 | % | -52.3 | % | -55.0 | % | -57.7 | % | -60.5 | % | ||||||||||||||||||||||||||||||||

| 60% |

-60 | % | -37.5 | % | -37.7 | % | -38.1 | % | -38.9 | % | -40.0 | % | -41.3 | % | -42.9 | % | -44.7 | % | -46.7 | % | -49.0 | % | -51.3 | % | -53.8 | % | -56.4 | % | -59.0 | % | -61.7 | % | ||||||||||||||||||||||||||||||||

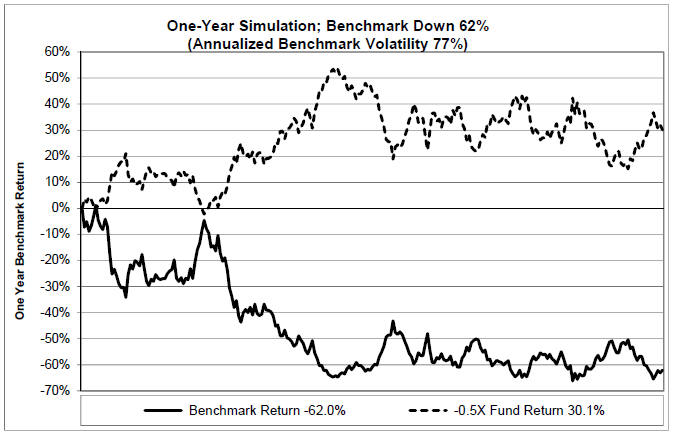

| Benchmark Volatility |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| One Year Benchmark Performance |

Two Times Inverse(-2x) of One Year Benchmark Performance |

0% | 5% | 10% | 15% | 20% | 25% | 30% | 35% | 40% | 45% | 50% | 55% | 60% | 65% | 70% | ||||||||||||||||||||||||||||||||||||||||||||||||

| -60% |

120 | % | 525.0 | % | 520.3 | % | 506.5 | % | 484.2 | % | 454.3 | % | 418.1 | % | 377.1 | % | 332.8 | % | 286.7 | % | 240.4 | % | 195.2 | % | 152.2 | % | 112.2 | % | 76.0 | % | 43.7 | % | ||||||||||||||||||||||||||||||||

| -55% |

110 | % | 393.8 | % | 390.1 | % | 379.2 | % | 361.6 | % | 338.0 | % | 309.4 | % | 277.0 | % | 242.0 | % | 205.6 | % | 169.0 | % | 133.3 | % | 99.3 | % | 67.7 | % | 39.0 | % | 13.5 | % | ||||||||||||||||||||||||||||||||

| -50% |

100 | % | 300.0 | % | 297.0 | % | 288.2 | % | 273.9 | % | 254.8 | % | 231.6 | % | 205.4 | % | 177.0 | % | 147.5 | % | 117.9 | % | 88.9 | % | 61.4 | % | 35.8 | % | 12.6 | % | -8.0 | % | ||||||||||||||||||||||||||||||||

| -45% |

90 | % | 230.6 | % | 228.1 | % | 220.8 | % | 209.0 | % | 193.2 | % | 174.1 | % | 152.4 | % | 128.9 | % | 104.6 | % | 80.1 | % | 56.2 | % | 33.4 | % | 12.3 | % | -6.9 | % | -24.0 | % | ||||||||||||||||||||||||||||||||

| -40% |

80 | % | 177.8 | % | 175.7 | % | 169.6 | % | 159.6 | % | 146.4 | % | 130.3 | % | 112.0 | % | 92.4 | % | 71.9 | % | 51.3 | % | 31.2 | % | 12.1 | % | -5.7 | % | -21.8 | % | -36.1 | % | ||||||||||||||||||||||||||||||||

| -35% |

70 | % | 136.7 | % | 134.9 | % | 129.7 | % | 121.2 | % | 109.9 | % | 96.2 | % | 80.7 | % | 63.9 | % | 46.5 | % | 28.9 | % | 11.8 | % | -4.5 | % | -19.6 | % | -33.4 | % | -45.6 | % | ||||||||||||||||||||||||||||||||

| -30% |

60 | % | 104.1 | % | 102.6 | % | 98.1 | % | 90.8 | % | 81.0 | % | 69.2 | % | 55.8 | % | 41.3 | % | 26.3 | % | 11.2 | % | -3.6 | % | -17.6 | % | -30.7 | % | -42.5 | % | -53.1 | % | ||||||||||||||||||||||||||||||||

| -25% |

50 | % | 77.8 | % | 76.4 | % | 72.5 | % | 66.2 | % | 57.7 | % | 47.4 | % | 35.7 | % | 23.1 | % | 10.0 | % | -3.2 | % | -16.0 | % | -28.3 | % | -39.6 | % | -49.9 | % | -59.1 | % | ||||||||||||||||||||||||||||||||

| -20% |

40 | % | 56.3 | % | 55.1 | % | 51.6 | % | 46.1 | % | 38.6 | % | 29.5 | % | 19.3 | % | 8.2 | % | -3.3 | % | -14.9 | % | -26.2 | % | -36.9 | % | -46.9 | % | -56.0 | % | -64.1 | % | ||||||||||||||||||||||||||||||||

| -15% |

30 | % | 38.4 | % | 37.4 | % | 34.3 | % | 29.4 | % | 22.8 | % | 14.7 | % | 5.7 | % | -4.2 | % | -14.4 | % | -24.6 | % | -34.6 | % | -44.1 | % | -53.0 | % | -61.0 | % | -68.2 | % | ||||||||||||||||||||||||||||||||

| -10% |

20 | % | 23.5 | % | 22.5 | % | 19.8 | % | 15.4 | % | 9.5 | % | 2.3 | % | -5.8 | % | -14.5 | % | -23.6 | % | -32.8 | % | -41.7 | % | -50.2 | % | -58.1 | % | -65.2 | % | -71.6 | % | ||||||||||||||||||||||||||||||||

| -5% |

10 | % | 10.8 | % | 10.0 | % | 7.5 | % | 3.6 | % | -1.7 | % | -8.1 | % | -15.4 | % | -23.3 | % | -31.4 | % | -39.6 | % | -47.7 | % | -55.3 | % | -62.4 | % | -68.8 | % | -74.5 | % | ||||||||||||||||||||||||||||||||

| 0% |

0 | % | 0.0 | % | -0.7 | % | -3.0 | % | -6.5 | % | -11.3 | % | -17.1 | % | -23.7 | % | -30.8 | % | -38.1 | % | -45.5 | % | -52.8 | % | -59.6 | % | -66.0 | % | -71.8 | % | -77.0 | % | ||||||||||||||||||||||||||||||||

| 5% |

-10 | % | -9.3 | % | -10.0 | % | -12.0 | % | -15.2 | % | -19.6 | % | -24.8 | % | -30.8 | % | -37.2 | % | -43.9 | % | -50.6 | % | -57.2 | % | -63.4 | % | -69.2 | % | -74.5 | % | -79.1 | % | ||||||||||||||||||||||||||||||||

| 10% |

-20 | % | -17.4 | % | -18.0 | % | -19.8 | % | -22.7 | % | -26.7 | % | -31.5 | % | -36.9 | % | -42.8 | % | -48.9 | % | -55.0 | % | -61.0 | % | -66.7 | % | -71.9 | % | -76.7 | % | -81.0 | % | ||||||||||||||||||||||||||||||||

| 15% |

-30 | % | -24.4 | % | -25.0 | % | -26.6 | % | -29.3 | % | -32.9 | % | -37.3 | % | -42.3 | % | -47.6 | % | -53.2 | % | -58.8 | % | -64.3 | % | -69.5 | % | -74.3 | % | -78.7 | % | -82.6 | % | ||||||||||||||||||||||||||||||||

| 20% |

-40 | % | -30.6 | % | -31.1 | % | -32.6 | % | -35.1 | % | -38.4 | % | -42.4 | % | -47.0 | % | -51.9 | % | -57.0 | % | -62.2 | % | -67.2 | % | -72.0 | % | -76.4 | % | -80.4 | % | -84.0 | % | ||||||||||||||||||||||||||||||||

| 25% |

-50 | % | -36.0 | % | -36.5 | % | -37.9 | % | -40.2 | % | -43.2 | % | -46.9 | % | -51.1 | % | -55.7 | % | -60.4 | % | -65.1 | % | -69.8 | % | -74.2 | % | -78.3 | % | -82.0 | % | -85.3 | % | ||||||||||||||||||||||||||||||||

| 30% |

-60 | % | -40.8 | % | -41.3 | % | -42.6 | % | -44.7 | % | -47.5 | % | -50.9 | % | -54.8 | % | -59.0 | % | -63.4 | % | -67.8 | % | -72.0 | % | -76.1 | % | -79.9 | % | -83.3 | % | -86.4 | % | ||||||||||||||||||||||||||||||||

| 35% |

-70 | % | -45.1 | % | -45.5 | % | -46.8 | % | -48.7 | % | -51.3 | % | -54.5 | % | -58.1 | % | -62.0 | % | -66.0 | % | -70.1 | % | -74.1 | % | -77.9 | % | -81.4 | % | -84.6 | % | -87.4 | % | ||||||||||||||||||||||||||||||||

| 40% |

-80 | % | -49.0 | % | -49.4 | % | -50.5 | % | -52.3 | % | -54.7 | % | -57.7 | % | -61.1 | % | -64.7 | % | -68.4 | % | -72.2 | % | -75.9 | % | -79.4 | % | -82.7 | % | -85.6 | % | -88.3 | % | ||||||||||||||||||||||||||||||||

| 45% |

-90 | % | -52.4 | % | -52.8 | % | -53.8 | % | -55.5 | % | -57.8 | % | -60.6 | % | -63.7 | % | -67.1 | % | -70.6 | % | -74.1 | % | -77.5 | % | -80.8 | % | -83.8 | % | -86.6 | % | -89.1 | % | ||||||||||||||||||||||||||||||||

| 50% |

-100 | % | -55.6 | % | -55.9 | % | -56.9 | % | -58.5 | % | -60.6 | % | -63.2 | % | -66.1 | % | -69.2 | % | -72.5 | % | -75.8 | % | -79.0 | % | -82.1 | % | -84.9 | % | -87.5 | % | -89.8 | % | ||||||||||||||||||||||||||||||||

| 55% |

-110 | % | -58.4 | % | -58.7 | % | -59.6 | % | -61.1 | % | -63.1 | % | -65.5 | % | -68.2 | % | -71.2 | % | -74.2 | % | -77.3 | % | -80.3 | % | -83.2 | % | -85.9 | % | -88.3 | % | -90.4 | % | ||||||||||||||||||||||||||||||||

| 60% |

-120 | % | -60.9 | % | -61.2 | % | -62.1 | % | -63.5 | % | -65.4 | % | -67.6 | % | -70.2 | % | -73.0 | % | -75.8 | % | -78.7 | % | -81.5 | % | -84.2 | % | -86.7 | % | -89.0 | % | -91.0 | % | ||||||||||||||||||||||||||||||||

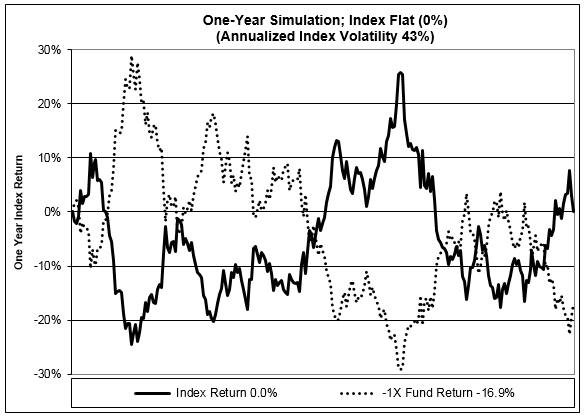

| Index Volatility | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| One Year Index Performance |

One and One-Half Times (1.5x) One Year Index Performance |

0% | 5% | 10% | 15% | 20% | 25% | 30% | 35% | 40% | 45% | 50% | 55% | 60% | 65% | 70% | 75% | |||||||||||||||||||||||||||||||||||||||||||||||||||

| -60% |

-90.0 | % | -74.7 | % | -74.7 | % | -74.8 | % | -74.9 | % | -75.1 | % | -75.3 | % | -75.5 | % | -75.8 | % | -76.2 | % | -76.6 | % | -77.0 | % | -77.4 | % | -77.9 | % | -78.4 | % | -78.9 | % | -79.5 | % | ||||||||||||||||||||||||||||||||||

| -55% |

-82.5 | % | -69.8 | % | -69.8 | % | -69.9 | % | -70.1 | % | -70.3 | % | -70.5 | % | -70.8 | % | -71.2 | % | -71.6 | % | -72.0 | % | -72.5 | % | -73.1 | % | -73.6 | % | -74.2 | % | -74.9 | % | -75.6 | % | ||||||||||||||||||||||||||||||||||

| -50% |

-75.0 | % | -64.6 | % | -64.7 | % | -64.8 | % | -64.9 | % | -65.2 | % | -65.5 | % | -65.8 | % | -66.2 | % | -66.7 | % | -67.2 | % | -67.8 | % | -68.4 | % | -69.1 | % | -69.8 | % | -70.6 | % | -71.4 | % | ||||||||||||||||||||||||||||||||||

| -45% |

-67.5 | % | -59.2 | % | -59.2 | % | -59.4 | % | -59.6 | % | -59.8 | % | -60.2 | % | -60.6 | % | -61.0 | % | -61.6 | % | -62.2 | % | -62.9 | % | -63.6 | % | -64.4 | % | -65.2 | % | -66.1 | % | -67.0 | % | ||||||||||||||||||||||||||||||||||

| -40% |

-60.0 | % | -53.5 | % | -53.6 | % | -53.7 | % | -53.9 | % | -54.2 | % | -54.6 | % | -55.1 | % | -55.6 | % | -56.2 | % | -56.9 | % | -57.7 | % | -58.5 | % | -59.4 | % | -60.3 | % | -61.3 | % | -62.4 | % | ||||||||||||||||||||||||||||||||||

| -35% |

-52.5 | % | -47.6 | % | -47.6 | % | -47.8 | % | -48.0 | % | -48.4 | % | -48.8 | % | -49.3 | % | -49.9 | % | -50.6 | % | -51.4 | % | -52.3 | % | -53.2 | % | -54.2 | % | -55.3 | % | -56.4 | % | -57.6 | % | ||||||||||||||||||||||||||||||||||

| -30% |

-45.0 | % | -41.4 | % | -41.5 | % | -41.7 | % | -41.9 | % | -42.3 | % | -42.8 | % | -43.4 | % | -44.1 | % | -44.8 | % | -45.7 | % | -46.7 | % | -47.7 | % | -48.8 | % | -50.0 | % | -51.3 | % | -52.6 | % | ||||||||||||||||||||||||||||||||||

| -25% |

-37.5 | % | -35.0 | % | -35.1 | % | -35.3 | % | -35.6 | % | -36.0 | % | -36.6 | % | -37.2 | % | -38.0 | % | -38.8 | % | -39.8 | % | -40.9 | % | -42.0 | % | -43.3 | % | -44.6 | % | -46.0 | % | -47.4 | % | ||||||||||||||||||||||||||||||||||

| -20% |

-30.0 | % | -28.4 | % | -28.5 | % | -28.7 | % | -29.0 | % | -29.5 | % | -30.1 | % | -30.8 | % | -31.7 | % | -32.6 | % | -33.7 | % | -34.8 | % | -36.1 | % | -37.5 | % | -38.9 | % | -40.5 | % | -42.1 | % | ||||||||||||||||||||||||||||||||||

| -15% |

-22.5 | % | -21.6 | % | -21.7 | % | -21.9 | % | -22.3 | % | -22.8 | % | -23.4 | % | -24.2 | % | -25.2 | % | -26.2 | % | -27.4 | % | -28.6 | % | -30.0 | % | -31.5 | % | -33.1 | % | -34.8 | % | -36.5 | % | ||||||||||||||||||||||||||||||||||

| -10% |

-15.0 | % | -14.6 | % | -14.7 | % | -14.9 | % | -15.3 | % | -15.9 | % | -16.6 | % | -17.5 | % | -18.5 | % | -19.6 | % | -20.9 | % | -22.3 | % | -23.8 | % | -25.4 | % | -27.1 | % | -29.0 | % | -30.9 | % | ||||||||||||||||||||||||||||||||||

| -5% |

-7.5 | % | -7.4 | % | -7.5 | % | -7.8 | % | -8.2 | % | -8.8 | % | -9.6 | % | -10.5 | % | -11.6 | % | -12.8 | % | -14.2 | % | -15.7 | % | -17.3 | % | -19.1 | % | -21.0 | % | -22.9 | % | -25.0 | % | ||||||||||||||||||||||||||||||||||

| 0% |

0.0 | % | 0.0 | % | -0.1 | % | -0.4 | % | -0.8 | % | -1.5 | % | -2.3 | % | -3.3 | % | -4.5 | % | -5.8 | % | -7.3 | % | -8.9 | % | -10.7 | % | -12.6 | % | -14.7 | % | -16.8 | % | -19.0 | % | ||||||||||||||||||||||||||||||||||

| 5% |

7.5 | % | 7.6 | % | 7.5 | % | 7.2 | % | 6.7 | % | 6.0 | % | 5.1 | % | 4.0 | % | 2.8 | % | 1.3 | % | -0.3 | % | -2.0 | % | -3.9 | % | -6.0 | % | -8.2 | % | -10.5 | % | -12.9 | % | ||||||||||||||||||||||||||||||||||

| 10% |

15.0 | % | 15.4 | % | 15.3 | % | 14.9 | % | 14.4 | % | 13.7 | % | 12.7 | % | 11.5 | % | 10.2 | % | 8.7 | % | 6.9 | % | 5.0 | % | 3.0 | % | 0.8 | % | -1.5 | % | -4.0 | % | -6.6 | % | ||||||||||||||||||||||||||||||||||

| 15% |

22.5 | % | 23.3 | % | 23.2 | % | 22.9 | % | 22.3 | % | 21.5 | % | 20.5 | % | 19.2 | % | 17.8 | % | 16.1 | % | 14.3 | % | 12.3 | % | 10.1 | % | 7.7 | % | 5.3 | % | 2.6 | % | -0.1 | % | ||||||||||||||||||||||||||||||||||

| 20% |

30.0 | % | 31.5 | % | 31.3 | % | 31.0 | % | 30.3 | % | 29.5 | % | 28.4 | % | 27.1 | % | 25.6 | % | 23.8 | % | 21.8 | % | 19.7 | % | 17.4 | % | 14.9 | % | 12.2 | % | 9.4 | % | 6.5 | % | ||||||||||||||||||||||||||||||||||

| 25% |

37.5 | % | 39.8 | % | 39.6 | % | 39.2 | % | 38.6 | % | 37.7 | % | 36.5 | % | 35.1 | % | 33.5 | % | 31.6 | % | 29.5 | % | 27.2 | % | 24.8 | % | 22.1 | % | 19.3 | % | 16.3 | % | 13.2 | % | ||||||||||||||||||||||||||||||||||

| 30% |

45.0 | % | 48.2 | % | 48.1 | % | 47.7 | % | 47.0 | % | 46.0 | % | 44.8 | % | 43.3 | % | 41.6 | % | 39.6 | % | 37.4 | % | 35.0 | % | 32.3 | % | 29.5 | % | 26.5 | % | 23.3 | % | 20.0 | % | ||||||||||||||||||||||||||||||||||

| 35% |

52.5 | % | 56.9 | % | 56.7 | % | 56.3 | % | 55.5 | % | 54.5 | % | 53.2 | % | 51.7 | % | 49.8 | % | 47.7 | % | 45.4 | % | 42.8 | % | 40.0 | % | 37.0 | % | 33.9 | % | 30.5 | % | 27.0 | % | ||||||||||||||||||||||||||||||||||

| 40% |

60.0 | % | 65.7 | % | 65.5 | % | 65.0 | % | 64.3 | % | 63.2 | % | 61.8 | % | 60.2 | % | 58.2 | % | 56.0 | % | 53.5 | % | 50.8 | % | 47.9 | % | 44.7 | % | 41.4 | % | 37.8 | % | 34.1 | % | ||||||||||||||||||||||||||||||||||

| 45% |

67.5 | % | 74.6 | % | 74.4 | % | 73.9 | % | 73.1 | % | 72.0 | % | 70.6 | % | 68.8 | % | 66.8 | % | 64.4 | % | 61.8 | % | 59.0 | % | 55.9 | % | 52.6 | % | 49.0 | % | 45.3 | % | 41.4 | % | ||||||||||||||||||||||||||||||||||

| 50% |

75.0 | % | 83.7 | % | 83.5 | % | 83.0 | % | 82.2 | % | 81.0 | % | 79.5 | % | 77.6 | % | 75.5 | % | 73.0 | % | 70.3 | % | 67.3 | % | 64.0 | % | 60.5 | % | 56.8 | % | 52.9 | % | 48.8 | % | ||||||||||||||||||||||||||||||||||

| 55% |

82.5 | % | 93.0 | % | 92.8 | % | 92.3 | % | 91.4 | % | 90.1 | % | 88.5 | % | 86.6 | % | 84.3 | % | 81.7 | % | 78.9 | % | 75.7 | % | 72.3 | % | 68.6 | % | 64.7 | % | 60.6 | % | 56.3 | % | ||||||||||||||||||||||||||||||||||

| 60% |

90.0 | % | 102.4 | % | 102.2 | % | 101.6 | % | 100.7 | % | 99.4 | % | 97.7 | % | 95.7 | % | 93.3 | % | 90.6 | % | 87.6 | % | 84.3 | % | 80.7 | % | 76.8 | % | 72.7 | % | 68.4 | % | 63.9 | % | ||||||||||||||||||||||||||||||||||

| Benchmark Volatility | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| One Year Benchmark Performance |

Two Times (2x) One Year Benchmark Performance |

0% | 5% | 10% | 15% | 20% | 25% | 30% | 35% | 40% | 45% | 50% | 55% | 60% | 65% | 70% | ||||||||||||||||||||||||||||||||||||||||||||||||

| -60% |

-120 | % | -84.0 | % | -84.0 | % | -84.2 | % | -84.4 | % | -84.6 | % | -85.0 | % | -85.4 | % | -85.8 | % | -86.4 | % | -86.9 | % | -87.5 | % | -88.2 | % | -88.8 | % | -89.5 | % | -90.2 | % | ||||||||||||||||||||||||||||||||

| -55% |

-110 | % | -79.8 | % | -79.8 | % | -80.0 | % | -80.2 | % | -80.5 | % | -81.0 | % | -81.5 | % | -82.1 | % | -82.7 | % | -83.5 | % | -84.2 | % | -85.0 | % | -85.9 | % | -86.7 | % | -87.6 | % | ||||||||||||||||||||||||||||||||

| -50% |

-100 | % | -75.0 | % | -75.1 | % | -75.2 | % | -75.6 | % | -76.0 | % | -76.5 | % | -77.2 | % | -77.9 | % | -78.7 | % | -79.6 | % | -80.5 | % | -81.5 | % | -82.6 | % | -83.6 | % | -84.7 | % | ||||||||||||||||||||||||||||||||

| -45% |

-90 | % | -69.8 | % | -69.8 | % | -70.1 | % | -70.4 | % | -70.9 | % | -71.6 | % | -72.4 | % | -73.2 | % | -74.2 | % | -75.3 | % | -76.4 | % | -77.6 | % | -78.9 | % | -80.2 | % | -81.5 | % | ||||||||||||||||||||||||||||||||

| -40% |

-80 | % | -64.0 | % | -64.1 | % | -64.4 | % | -64.8 | % | -65.4 | % | -66.2 | % | -67.1 | % | -68.2 | % | -69.3 | % | -70.6 | % | -72.0 | % | -73.4 | % | -74.9 | % | -76.4 | % | -77.9 | % | ||||||||||||||||||||||||||||||||

| -35% |

-70 | % | -57.8 | % | -57.9 | % | -58.2 | % | -58.7 | % | -59.4 | % | -60.3 | % | -61.4 | % | -62.6 | % | -64.0 | % | -65.5 | % | -67.1 | % | -68.8 | % | -70.5 | % | -72.3 | % | -74.1 | % | ||||||||||||||||||||||||||||||||

| -30% |

-60 | % | -51.0 | % | -51.1 | % | -51.5 | % | -52.1 | % | -52.9 | % | -54.0 | % | -55.2 | % | -56.6 | % | -58.2 | % | -60.0 | % | -61.8 | % | -63.8 | % | -65.8 | % | -67.9 | % | -70.0 | % | ||||||||||||||||||||||||||||||||

| -25% |

-50 | % | -43.8 | % | -43.9 | % | -44.3 | % | -45.0 | % | -46.0 | % | -47.2 | % | -48.6 | % | -50.2 | % | -52.1 | % | -54.1 | % | -56.2 | % | -58.4 | % | -60.8 | % | -63.1 | % | -65.5 | % | ||||||||||||||||||||||||||||||||

| -20% |

-40 | % | -36.0 | % | -36.2 | % | -36.6 | % | -37.4 | % | -38.5 | % | -39.9 | % | -41.5 | % | -43.4 | % | -45.5 | % | -47.7 | % | -50.2 | % | -52.7 | % | -55.3 | % | -58.1 | % | -60.8 | % | ||||||||||||||||||||||||||||||||

| -15% |

-30 | % | -27.8 | % | -27.9 | % | -28.5 | % | -29.4 | % | -30.6 | % | -32.1 | % | -34.0 | % | -36.1 | % | -38.4 | % | -41.0 | % | -43.7 | % | -46.6 | % | -49.6 | % | -52.6 | % | -55.7 | % | ||||||||||||||||||||||||||||||||

| -10% |

-20 | % | -19.0 | % | -19.2 | % | -19.8 | % | -20.8 | % | -22.2 | % | -23.9 | % | -26.0 | % | -28.3 | % | -31.0 | % | -33.8 | % | -36.9 | % | -40.1 | % | -43.5 | % | -46.9 | % | -50.4 | % | ||||||||||||||||||||||||||||||||

| -5% |

-10 | % | -9.8 | % | -10.0 | % | -10.6 | % | -11.8 | % | -13.3 | % | -15.2 | % | -17.5 | % | -20.2 | % | -23.1 | % | -26.3 | % | -29.7 | % | -33.3 | % | -37.0 | % | -40.8 | % | -44.7 | % | ||||||||||||||||||||||||||||||||

| 0% |

0 | % | 0.0 | % | -0.2 | % | -1.0 | % | -2.2 | % | -3.9 | % | -6.1 | % | -8.6 | % | -11.5 | % | -14.8 | % | -18.3 | % | -22.1 | % | -26.1 | % | -30.2 | % | -34.5 | % | -38.7 | % | ||||||||||||||||||||||||||||||||

| 5% |

10 | % | 10.3 | % | 10.0 | % | 9.2 | % | 7.8 | % | 5.9 | % | 3.6 | % | 0.8 | % | -2.5 | % | -6.1 | % | -10.0 | % | -14.1 | % | -18.5 | % | -23.1 | % | -27.7 | % | -32.5 | % | ||||||||||||||||||||||||||||||||

| 10% |

20 | % | 21.0 | % | 20.7 | % | 19.8 | % | 18.3 | % | 16.3 | % | 13.7 | % | 10.6 | % | 7.0 | % | 3.1 | % | -1.2 | % | -5.8 | % | -10.6 | % | -15.6 | % | -20.7 | % | -25.9 | % | ||||||||||||||||||||||||||||||||

| 15% |

30 | % | 32.3 | % | 31.9 | % | 30.9 | % | 29.3 | % | 27.1 | % | 24.2 | % | 20.9 | % | 17.0 | % | 12.7 | % | 8.0 | % | 3.0 | % | -2.3 | % | -7.7 | % | -13.3 | % | -19.0 | % | ||||||||||||||||||||||||||||||||

| 20% |

40 | % | 44.0 | % | 43.6 | % | 42.6 | % | 40.8 | % | 38.4 | % | 35.3 | % | 31.6 | % | 27.4 | % | 22.7 | % | 17.6 | % | 12.1 | % | 6.4 | % | 0.5 | % | -5.6 | % | -11.8 | % | ||||||||||||||||||||||||||||||||

| 25% |

50 | % | 56.3 | % | 55.9 | % | 54.7 | % | 52.8 | % | 50.1 | % | 46.8 | % | 42.8 | % | 38.2 | % | 33.1 | % | 27.6 | % | 21.7 | % | 15.5 | % | 9.0 | % | 2.4 | % | -4.3 | % | ||||||||||||||||||||||||||||||||

| 30% |

60 | % | 69.0 | % | 68.6 | % | 67.3 | % | 65.2 | % | 62.4 | % | 58.8 | % | 54.5 | % | 49.5 | % | 44.0 | % | 38.0 | % | 31.6 | % | 24.9 | % | 17.9 | % | 10.8 | % | 3.5 | % | ||||||||||||||||||||||||||||||||

| 35% |

70 | % | 82.3 | % | 81.8 | % | 80.4 | % | 78.2 | % | 75.1 | % | 71.2 | % | 66.6 | % | 61.2 | % | 55.3 | % | 48.8 | % | 41.9 | % | 34.7 | % | 27.2 | % | 19.4 | % | 11.7 | % | ||||||||||||||||||||||||||||||||

| 40% |

80 | % | 96.0 | % | 95.5 | % | 94.0 | % | 91.6 | % | 88.3 | % | 84.1 | % | 79.1 | % | 73.4 | % | 67.0 | % | 60.1 | % | 52.6 | % | 44.8 | % | 36.7 | % | 28.5 | % | 20.1 | % | ||||||||||||||||||||||||||||||||

| 45% |

90 | % | 110.3 | % | 109.7 | % | 108.2 | % | 105.6 | % | 102.0 | % | 97.5 | % | 92.2 | % | 86.0 | % | 79.2 | % | 71.7 | % | 63.7 | % | 55.4 | % | 46.7 | % | 37.8 | % | 28.8 | % | ||||||||||||||||||||||||||||||||

| 50% |

100 | % | 125.0 | % | 124.4 | % | 122.8 | % | 120.0 | % | 116.2 | % | 111.4 | % | 105.6 | % | 99.1 | % | 91.7 | % | 83.8 | % | 75.2 | % | 66.3 | % | 57.0 | % | 47.5 | % | 37.8 | % | ||||||||||||||||||||||||||||||||

| 55% |

110 | % | 140.3 | % | 139.7 | % | 137.9 | % | 134.9 | % | 130.8 | % | 125.7 | % | 119.6 | % | 112.6 | % | 104.7 | % | 96.2 | % | 87.1 | % | 77.5 | % | 67.6 | % | 57.5 | % | 47.2 | % | ||||||||||||||||||||||||||||||||

| 60% |

120 | % | 156.0 | % | 155.4 | % | 153.5 | % | 150.3 | % | 146.0 | % | 140.5 | % | 134.0 | % | 126.5 | % | 118.1 | % | 109.1 | % | 99.4 | % | 89.2 | % | 78.6 | % | 67.8 | % | 56.8 | % | ||||||||||||||||||||||||||||||||

| • | Significant increases or decreases in the available supply of a physical commodity due to natural or technological factors. Natural factors would include depletion of known cost-effective sources for natural gas, silver, gold or oil or the impact of severe weather or other natural events on the ability to produce or distribute the commodity. Technological factors, such as increases in availability created by new or improved extraction, refining and processing equipment and methods or decreases caused by failure or unavailability of major refining and processing equipment (for example, shutting down or constructing natural gas processing plants), also materially influence the supply of the commodity. General economic conditions in the world or in a major region, such as population growth rates, periods of civil unrest, government austerity programs, or currency exchange rate fluctuations may affect prices of underlying commodities. |

| • | In regard to the Oil Funds, the exploration and production of crude oil are uncertain processes with many risks. The cost of drilling, completing and operating wells for crude oil is often uncertain, and a number of factors can delay or prevent operations or production of crude oil, including (1) unexpected drilling conditions, (2) pressure or irregularities in formations, (3) equipment failures or repairs, (4) fires or other accidents, (5) adverse weather conditions, (6) pipeline ruptures, spills or other supply disruptions, and (7) shortages or delays in the availability of extraction or delivery equipment. |

| • | Significant increases or decreases in the demand for natural gas, silver, gold or oil due to natural or technological factors. Natural factors would include such events as unusual climatological conditions impacting the demand for natural gas, silver, gold or oil. Technological factors may include such developments as substitutes or new uses for particular commodities. |

| • | A significant change in the attitude of speculators and investors towards natural gas, silver, gold or oil or in the hedging activities of commodity producers. Should the speculative community take a negative or positive view towards natural gas, silver, gold or oil, or if there is an increase or decrease in the level of hedge activity of commodity producing companies, countries and/or organizations, such action could cause a change in world prices of any given commodity. |

| • | Large purchases or sales of physical commodities by the official sector. Governments and large institutions have large commodities holdings or may establish major commodities positions. For example, a significant portion of the aggregate world precious metals holdings is owned by governments, central banks and related institutions. Similarly, nations with centralized or nationalized energy production organizations may control large physical quantities of certain commodities. The purchase or sale by one of these institutions in large amounts could potentially cause a change in prices for that commodity. |

| • | With regard to the Oil Funds, nations with centralized or nationalized oil production and organizations such as the Organization of Petroleum Exporting Countries (OPEC) control large physical qualities of crude oil. The purchase or sale by one of these institutions in large amounts could potentially cause a change in prices for that commodity. Tension between the governments of the United States and oil exporting nations, civil unrest and sabotage, the ability of members of OPEC to agree upon and maintain oil prices and production levels, and fluctuations in the reserve capacity of crude oil could impact future oil prices. |

| • | Political activity such as imposition of regulations or entry into trade treaties, as well as political disruptions caused by societal breakdown, insurrection, terrorism, sabotage and/or war may greatly influence prices of particular commodities. |

| • | With regard to the Natural Gas Funds, the demand for natural gas correlates closely with general economic growth rates. The occurrence of recessions or other periods of low or negative economic growth will typically have a direct adverse impact on natural gas demand and natural gas prices. The supply and demand for natural gas may also be impacted by changes in interest rates, inflation, and other local or regional market conditions, as well as by the development of alternative energy sources. |

| • | The recent proliferation of commodity-linked products and their unknown effect on the commodity markets. |

| • | With regard to the Oil and Natural Gas Funds, competition from clean power companies, fluctuations in the supply and demand of alternative energy fuels, energy conservation, changes in consumer preferences regarding the use of renewable energy sources to replace fossil fuels, and tax and other government regulations can significantly affect the prices of oil and natural gas. |

| • | Debt level and trade deficit of the relevant foreign countries; |

| • | Inflation rates of the United States and the relevant foreign countries and investors’ expectations concerning inflation rates; |

| • | Interest rates of the United States and the relevant foreign countries and investors’ expectations concerning interest rates; |

| • | Investment and trading activities of mutual funds, hedge funds and other market participants; |

| • | Global or regional political, economic or financial events and situations; |

| • | Sovereign action to set or restrict currency conversion; |

| • | Monetary policies and other related activities of central banks within the U.S. and other relevant non-U.S. markets; |

| • | Overall growth and performance of the economies of the relevant countries; and |

| • | Non-U.S. financial markets may be closed on a day when U.S. domestic markets are open for trading. As a result, liquidity and/or pricing may be affected by the absence of trading in a specific currency. |

| • | Prevailing market prices and forward volatility levels of the U.S. stock markets, the S&P 500, the equity securities included in the S&P 500 and prevailing market prices of options on the S&P 500, the VIX, options on the VIX, the relevant VIX futures contracts, or any other financial instruments related to the S&P 500 and the VIX or VIX futures contracts; |

| • | Interest rates, and investors’ expectations concerning interest rates; Inflation rates and investors’ expectations concerning inflation rates; |

| • | Economic, financial, political, regulatory, geographical, judicial and other events that affect the level of the Mid-Term VIX Futures Index or the market price or forward volatility of the U.S. stock markets, the equity securities included in the S&P 500, the S&P 500, the VIX or the relevant futures or option contracts on the VIX; |

| • | Supply and demand as well as hedging activities in the listed and OTC equity derivatives markets; |

| • | The level of margin requirements; |

| • | The position limits imposed by futures exchanges and any position or risk limits imposed by FCMs and swap counterparties; |

| • | Disruptions in trading of the S&P 500, futures contracts on the S&P 500 or options on the S&P 500; and |

| • | The level of contango or backwardation in the VIX futures contract market. |

| • | Prevailing market prices and forward volatility levels of the U.S. stock markets, the S&P 500, the equity securities included in the S&P 500 and prevailing market prices of options on the S&P 500, the VIX, options on the VIX, the relevant VIX futures contracts, or any other financial instruments related to the S&P 500 and the VIX or VIX futures contracts; |

| • | Interest rates, and investors’ expectations concerning interest rates; |

| • | Inflation rates and investors’ expectations concerning inflation rates; |

| • | Economic, financial, political, regulatory, geographical, biological or judicial events that affect the level of the Mid-Term VIX Index or the market price or forward volatility of the U.S. stock markets, the equity securities included in the S&P 500, the S&P 500, the VIX or the relevant futures or option contracts on the VIX; |

| • | Supply and demand as well as hedging activities in the listed and OTC equity derivatives markets; |

| • | Disruptions in trading of the S&P 500, futures contracts on the S&P 500 or options on the S&P 500; |

| • | The level of contango or backwardation in the VIX futures contract market; |

| • | The position limits imposed by FCMs; and |

| • | The level of margin requirements. |

Item 1B. |

Unresolved Staff Comments. |

Item 2. |

Properties. |

Item 3. |

Legal Proceedings. |

Item 4. |

Mine Safety Disclosures. |

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

a) |

The Shares of each Fund that has commenced investment operations are listed in the accompanying table. The dates the Shares of each Fund began trading, their symbols and their primary listing exchange are indicated below: |

| Fund |

Commencement of Operations |

Ticker Symbol |

Name of each exchange on which registered | |||

| ProShares Short Euro |

June 26, 2012 | EUFX | NYSE Arca | |||

| ProShares Short VIX Short-Term Futures ETF |

October 3, 2011 | SVXY | Cboe BZX Exchange | |||

| ProShares Ultra Bloomberg Crude Oil |

November 25, 2008 | UCO | NYSE Arca | |||

| ProShares Ultra Bloomberg Natural Gas |

October 4, 2011 | BOIL | NYSE Arca | |||

| ProShares Ultra Euro |

November 25, 2008 | ULE | NYSE Arca | |||

| ProShares Ultra Gold |

December 3, 2008 | UGL | NYSE Arca | |||

| ProShares Ultra Silver |

December 3, 2008 | AGQ | NYSE Arca | |||

| ProShares Ultra VIX Short-Term Futures ETF |

October 3, 2011 | UVXY | Cboe BZX Exchange | |||

| ProShares Ultra Yen |

November 25, 2008 | YCL | NYSE Arca | |||

| ProShares UltraShort Australian Dollar |

July 17, 2012 | CROC | NYSE Arca | |||

| ProShares UltraShort Bloomberg Crude Oil |

November 25, 2008 | SCO | NYSE Arca | |||

| ProShares UltraShort Bloomberg Natural Gas |

October 4, 2011 | KOLD | NYSE Arca | |||

| ProShares UltraShort Euro |

November 25, 2008 | EUO | NYSE Arca | |||

| ProShares UltraShort Gold |

December 3, 2008 | GLL | NYSE Arca | |||

| ProShares UltraShort Silver |

December 3, 2008 | ZSL | NYSE Arca | |||

| ProShares UltraShort Yen |

November 25, 2008 | YCS | NYSE Arca | |||

| ProShares VIX Mid-Term Futures ETF |

January 3, 2011 | VIXM | Cboe BZX Exchange | |||

| ProShares VIX Short-Term Futures ETF |

January 3, 2011 | VIXY | Cboe BZX Exchange |

| Fund |

Number of Holders |

|||

| ProShares Short Euro |

284 | |||

| ProShares Short VIX Short-Term Futures ETF |

18,230 | |||

| ProShares Ultra Bloomberg Crude Oil |

190,267 | |||

| ProShares Ultra Bloomberg Natural Gas |

8,893 | |||

| ProShares Ultra Euro |

876 | |||

| ProShares Ultra Gold |

13,996 | |||

| ProShares Ultra Silver |

35,938 | |||

| ProShares Ultra VIX Short-Term Futures ETF |

89,226 | |||

| ProShares Ultra Yen |

256 | |||

| ProShares UltraShort Australian Dollar |

352 | |||

| ProShares UltraShort Bloomberg Crude Oil |

13,261 | |||

| ProShares UltraShort Bloomberg Natural Gas |

2,227 | |||

| ProShares UltraShort Euro |

6,020 | |||

| ProShares UltraShort Gold |

2,212 | |||

| ProShares UltraShort Silver |

3,079 | |||

| ProShares UltraShort Yen |

1,363 | |||

| ProShares VIX Mid-Term Futures ETF |

5,390 | |||

| ProShares VIX Short-Term Futures ETF |

32,550 | |||

| Total Trust: |

424,420 |

|||

b) |

Not applicable. |

| Title of Securities Registered |

Amount Registered as of December 31, 2020 |

Shares Sold For the Three Months Ended December 31, 2020 |

Sale Price of Shares Sold For the Three Months Ended December 31, 2020 |

Shares Sold For the Year Ended December 31, 2020 * |

Sale Price of Shares Sold For the Year Ended December 31, 2020 * |

|||||||||||||||

| ProShares Short Euro |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 205,213,786 | 50,000 | $ | 2,158,158 | 50,000 | $ | 2,158,158 | ||||||||||||

| ProShares Short VIX Short-Term Futures ETF |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 3,978,471,529 | 1,200,000 | $ | 47,006,284 | 27,050,000 | $ | 961,417,953 | ||||||||||||

| ProShares Ultra Bloomberg Crude Oil |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 3,510,785,278 | 11,150,000 | $ | 298,167,194 | 120,812,000 | $ | 3,910,951,510 | ||||||||||||

| ProShares Ultra Bloomberg Natural Gas |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 805,639,097 | 10,850,000 | $ | 263,854,683 | 16,685,000 | $ | 457,281,516 | ||||||||||||

| ProShares Ultra Euro |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 188,930,413 | 50,000 | $ | 777,870 | 250,000 | $ | 3,616,577 | ||||||||||||

| ProShares Ultra Gold |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 669,108,699 | 350,000 | $ | 23,524,105 | 3,500,000 | $ | 227,961,338 | ||||||||||||

| ProShares Ultra Silver |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 1,173,264,974 | 3,200,000 | $ | 142,877,572 | 13,500,000 | $ | 582,867,657 | ||||||||||||

| ProShares Ultra VIX Short-Term Futures ETF |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 5,388,427,775 | 76,500,000 | $ | 1,083,367,660 | 154,050,000 | $ | 3,359,993,617 | ||||||||||||

| ProShares Ultra Yen |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 201,792,144 | — | $ | — | — | $ | — | ||||||||||||

| ProShares UltraPro 3x Crude Oil ETF |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | — | ** | — | $ | — | 184,600,000 | $ | 414,019,676 | |||||||||||

| ProShares UltraPro 3x Short Crude Oil ETF |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | — | ** | — | $ | — | 2,850,000 | $ | 59,484,110 | |||||||||||

| ProShares UltraShort Australian Dollar |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 159,935,804 | — | $ | — | — | $ | — | ||||||||||||

| ProShares UltraShort Bloomberg Crude Oil |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 1,365,702,348 | 10,850,000 | $ | 156,181,703 | 37,500,000 | $ | 893,616,857 | ||||||||||||

| Title of Securities Registered |

Amount Registered as of December 31, 2020 |

Shares Sold For the Three Months Ended December 31, 2020 |

Sale Price of Shares Sold For the Three Months Ended December 31, 2020 |

Shares Sold For the Year Ended December 31, 2020 * |

Sale Price of Shares Sold For the Year Ended December 31, 2020 * |

|||||||||||||||

| ProShares UltraShort Bloomberg Natural Gas |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 577,760,462 | 1,850,000 | $ | 71,740,159 | 6,250,000 | $ | 270,470,683 | ||||||||||||

| ProShares UltraShort Euro |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 517,682,464 | 150,000 | $ | 3,508,807 | 1,500,000 | $ | 37,753,355 | ||||||||||||

| ProShares UltraShort Gold |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 246,880,625 | 550,000 | $ | 17,947,820 | 1,650,000 | $ | 56,542,664 | ||||||||||||

| ProShares UltraShort Silver |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 821,006,255 | 1,600,000 | $ | 12,954,212 | 13,700,000 | $ | 135,806,096 | ||||||||||||

| ProShares UltraShort Yen |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 494,648,731 | 50,000 | $ | 3,431,362 | 150,000 | $ | 11,238,107 | ||||||||||||

| ProShares VIX Mid-Term Futures ETF |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 388,788,698 | 125,000 | $ | 4,788,456 | 2,375,000 | $ | 90,654,600 | ||||||||||||

| ProShares VIX Short-Term Futures ETF |

||||||||||||||||||||

| Common Units of Beneficial Interest |

$ | 1,124,376,303 | 9,000,000 | $ | 141,815,008 | 26,325,000 | $ | 484,607,638 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||||

| Total Trust: |

127,525,000 |

$ |

2,274,101,053 |

612,797,000 |

$ |

11,960,442,112 |

||||||||||||||

| * | The operations include the activity of ProShares UltraPro 3x Crude Oil ETF through April 3, 2020, and ProShares UltraPro 3x Short Crude Oil ETF through April 13, 2020, the date of liquidation, respectively. |

| ** | The liquidated funds’ shares were de-registered prior to March 31, 2020. |

c) |

From October 1, 2020 through December 31, 2020, the number of Shares redeemed and average price per Share for each Fund were as follows: |

| Fund |

Total Number of Shares Redeemed |

Average Price Per Share |

||||||

| ProShares Short Euro |

||||||||

| 10/01/20 to 10/31/20 |

— | $ | — | |||||

| 11/01/20 to 11/30/20 |

— | $ | — | |||||

| 12/01/20 to 12/31/20 |

— | $ | — | |||||

| ProShares Short VIX Short-Term Futures ETF |

||||||||

| 10/01/20 to 10/31/20 |

800,000 | $ | 36.25 | |||||

| 11/01/20 to 11/30/20 |

— | $ | — | |||||

| 12/01/20 to 12/31/20 |

— | $ | — | |||||

| ProShares Ultra Bloomberg Crude Oil |

||||||||

| 10/01/20 to 10/31/20 |

6,250,000 | $ | 28.66 | |||||

| 11/01/20 to 11/30/20 |

16,750,000 | $ | 28.74 | |||||

| 12/01/20 to 12/31/20 |

4,950,000 | $ | 34,82 | |||||

| ProShares Ultra Bloomberg Natural Gas |

||||||||

| 10/01/20 to 10/31/20 |

1,150,000 | $ | 39.17 | |||||

| 11/01/20 to 11/30/20 |

1,300,000 | $ | 29.39 | |||||

| 12/01/20 to 12/31/20 |

3,200,000 | $ | 21.65 | |||||

| ProShares Ultra Euro |

||||||||

| 10/01/20 to 10/31/20 |

— | $ | — | |||||

| 11/01/20 to 11/30/20 |

50,000 | $ | 14.99 | |||||

| 12/01/20 to 12/31/20 |

— | $ | — | |||||

| ProShares Ultra Gold |

||||||||

| 10/01/20 to 10/31/20 |

— | $ | — | |||||

| 11/01/20 to 11/30/20 |

350,000 | $ | 65.09 | |||||

| 12/01/20 to 12/31/20 |

100,000 | $ | 66.39 | |||||

| ProShares Ultra Silver |

||||||||

| 10/01/20 to 10/31/20 |

1,100,000 | $ | 45,59 | |||||

| 11/01/20 to 11/30/20 |

1,400,000 | $ | 43,49 | |||||

| 12/01/20 to 12/31/20 |

700,000 | $ | 46,83 | |||||

| ProShares Ultra VIX Short-Term Futures ETF |

||||||||

| 10/01/20 to 10/31/20 |

10,200,000 | $ | 21.41 | |||||

| 11/01/20 to 11/30/20 |

200,000 | $ | 12.32 | |||||

| 12/01/20 to 12/31/20 |

3,850,000 | $ | 11.92 | |||||

| ProShares Ultra Yen |

||||||||

| 10/01/20 to 10/31/20 |

— | $ | — | |||||

| 11/01/20 to 11/30/20 |

— | $ | — | |||||

| 12/01/20 to 12/31/20 |

— | $ | — | |||||

| ProShares UltraShort Australian Dollar |

||||||||

| 10/01/20 to 10/31/20 |

— | $ | — | |||||

| 11/01/20 to 11/30/20 |

— | $ | — | |||||

| 12/01/20 to 12/31/20 |

50,000 | $ | 48.04 | |||||

| ProShares UltraShort Bloomberg Crude Oil |

||||||||

| 10/01/20 to 10/31/20 |

2,350,000 | $ | 17.54 | |||||

| 11/01/20 to 11/30/20 |

2,150,000 | $ | 15.17 | |||||

| 12/01/20 to 12/31/20 |

2,850,000 | $ | 12.61 | |||||

| ProShares UltraShort Bloomberg Natural Gas |

||||||||

| 10/01/20 to 10/31/20 |

600,000 | $ | 32.47 | |||||

| 11/01/20 to 11/30/20 |

1,100,000 | $ | 38.10 | |||||

| 12/01/20 to 12/31/20 |

850,000 | $ | 50.86 | |||||

| Fund |

Total Number of Shares Redeemed |

Average Price Per Share |

||||||

| ProShares UltraShort Euro |

||||||||

| 10/01/20 to 10/31/20 |

150,000 | $ | 24,80 | |||||

| 11/01/20 to 11/30/20 |

350,000 | $ | 24,10 | |||||

| 12/01/20 to 12/31/20 |

100,000 | $ | 22,54 | |||||

| ProShares UltraShort Gold |

||||||||

| 10/01/20 to 10/31/20 |

350,000 | $ | 31.65 | |||||

| 11/01/20 to 11/30/20 |

200,000 | $ | 31.34 | |||||

| 12/01/20 to 12/31/20 |

200,000 | $ | 33.46 | |||||

| ProShares UltraShort Silver |

||||||||

| 10/01/20 to 10/31/20 |

800,000 | $ | 8.93 | |||||

| 11/01/20 to 11/30/20 |

1,600,000 | $ | 8.54 | |||||

| 12/01/20 to 12/31/20 |

300,000 | $ | 8.50 | |||||

| ProShares UltraShort Yen |

||||||||

| 10/01/20 to 10/31/20 |

— | $ | — | |||||

| 11/01/20 to 11/30/20 |

— | $ | — | |||||

| 12/01/20 to 12/31/20 |

50,000 | $ | 69,20 | |||||

| ProShares VIX Mid-Term Futures ETF |

||||||||

| 10/01/20 to 10/31/20 |

— | $ | — | |||||

| 11/01/20 to 11/30/20 |

450,000 | $ | 37.12 | |||||

| 12/01/20 to 12/31/20 |

200,000 | $ | 36.44 | |||||

| ProShares VIX Short-Term Futures ETF |

||||||||

| 10/01/20 to 10/31/20 |

925,000 | $ | 22.13 | |||||

| 11/01/20 to 11/30/20 |

— | $ | — | |||||

| 12/01/20 to 12/31/20 |

350,000 | $ | 14.26 | |||||

Item 6. |

Selected Financial Data. |

PROSHARES SHORT EURO |

||||||||||||||||||||

Year Ended December 31, 2020 |

Year Ended December 31, 2019 |

Year Ended December 31, 2018 |

Year Ended December 31, 2017 |

Year Ended December 31, 2016 |

||||||||||||||||

| Total assets |

$ | 4,195,360 | $ | 2,289,155 | $ | 8,631,926 | $ | 8,041,728 | $ | 15,859,440 | ||||||||||

| Total shareholders’ equity at end of period |

4,191,955 | 2,282,195 | 8,619,686 | 7,991,880 | 15,770,088 | |||||||||||||||

| Net investment income (loss) |

(16,777 | ) | 176,251 | 44,457 | (37,627 | ) | (122,728 | ) | ||||||||||||

| Net realized and unrealized gain (loss) |

(231,621 | ) | 1,002,978 | 583,349 | (1,461,940 | ) | 553,281 | |||||||||||||

| Net income (loss) |

(248,398 | ) | 1,179,229 | 627,806 | (1,499,567 | ) | 430,553 | |||||||||||||

| Net increase (decrease) in net asset value per share |

(3.72 | ) | 2.54 | 3.14 | (5.10 | ) | 1.28 | |||||||||||||

Year Ended December 31, 2020 |

Year Ended December 31, 2019 |

Year Ended December 31, 2018 |

Year Ended December 31, 2017 |

Year Ended December 31, 2016 |

||||||||||||||||

| Total assets |

$ | 410,810,068 | $ | 284,649,062 | $ | 360,341,566 | $ | 816,337,770 | $ | 228,630,598 | ||||||||||

| Total shareholders’ equity at end of period |

409,371,468 | 284,437,179 | 344,596,263 | 770,163,871 | 228,075,387 | |||||||||||||||

| Net investment income (loss) |

(5,269,562 | ) | 1,162,163 | (2,209,355 | ) | (5,373,544 | ) | (5,396,850 | ) | |||||||||||

| Net realized and unrealized gain (loss) |

(74,517,945 | ) | 150,375,598 | (1,917,289,617 | ) | 924,694,573 | 419,316,869 | |||||||||||||

| Net income (loss) |

(79,787,507 | ) | 151,537,761 | (1,919,498,972 | ) | 919,321,029 | 413,920,019 | |||||||||||||

| Net increase (decrease) in net asset value per share |

(24.20 | ) | 23.26 | (466.84 | ) | 326.74 | 80.83 | |||||||||||||

Year Ended December 31, 2020 |

Year Ended December 31, 2019 |

Year Ended December 31, 2018 |

Year Ended December 31, 2017 |

Year Ended December 31, 2016 |

||||||||||||||||

| Total assets |

$ | 907,133,181 | $ | 310,368,837 | $ | 441,765,830 | $ | 534,325,767 | $ | 962,419,733 | ||||||||||

| Total shareholders’ equity at end of period |

902,739,250 | 309,844,582 | 368,399,654 | 524,445,526 | 933,731,860 | |||||||||||||||

| Net investment income (loss) |

(11,023,311 | ) | 3,864,584 | 3,022,808 | (1,379,461 | ) | (6,631,380 | ) | ||||||||||||

| Net realized and unrealized gain (loss) |

(548,084,672 | ) | 253,585,147 | (139,204,737 | ) | 35,389,465 | 225,050,768 | |||||||||||||

| Net income (loss) |

(559,107,983 | ) | 257,449,731 | (136,181,929 | ) | 34,010,004 | 218,419,388 | |||||||||||||

| Net increase (decrease) in net asset value per share |

(472.85 | ) | 182.77 | (265.16 | ) | 8.24 | (45.49 | ) | ||||||||||||

Year Ended December 31, 2020 |

Year Ended December 31, 2019 |

Year Ended December 31, 2018 |

Year Ended December 31, 2017 |

Year Ended December 31, 2016 |

||||||||||||||||

| Total assets |

$ | 181,072,788 | $ | 45,196,991 | $ | 17,951,294 | $ | 67,524,849 | $ | 44,767,860 | ||||||||||

| Total shareholders’ equity at end of period |

169,800,371 | 45,160,205 | 14,617,440 | 63,268,950 | 43,203,386 | |||||||||||||||

| Net investment income (loss) |

(939,900 | ) | 162,388 | 96,319 | (233,762 | ) | (384,486 | ) | ||||||||||||

| Net realized and unrealized gain (loss) |

(44,174,934 | ) | (24,707,604 | ) | 3,545,801 | (36,107,690 | ) | 13,794,133 | ||||||||||||

| Net income (loss) |

(45,114,834 | ) | (24,545,216 | ) | 3,642,120 | (36,341,452 | ) | 13,409,647 | ||||||||||||

| Net increase (decrease) in net asset value per share |