Table of Contents

As filed with the Securities and Exchange Commission on March 8, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PROSHARES TRUST II

(Exact name of registrant as specified in its charter)

| Delaware | 6221 | 87-6284802 | ||

| (State of Organization) | (Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

7501 Wisconsin Avenue

Suite 1000E

Bethesda, Maryland 20814

(240) 497-6400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael L. Sapir

c/o ProShare Capital Management LLC

7501 Wisconsin Avenue

Suite 1000E

Bethesda, Maryland 20814

(240) 497-6400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| James C. Munsell Kenny S. Terrero c/o Sidley Austin LLP 787 Seventh Avenue New York, New York 10019 |

Richard F. Morris c/o ProShare Capital Management LLC 7501 Wisconsin Avenue Suite 1000E Bethesda, MD 20814 |

Approximate date of commencement of proposed sale to the public:

As promptly as practicable after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

ProShares Ultra Bloomberg Crude Oil

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company |

☐ |

|||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

ProShares UltraShort Bloomberg Crude Oil

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company |

☐ |

|||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

ProShares Ultra Gold

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company |

☐ |

|||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

ProShares Ultra Silver

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company |

☐ |

|||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

ProShares UltraShort Euro

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company |

☐ |

|||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

ProShares Ultra VIX Short Term Futures ETF

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company |

☐ |

|||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

ProShares Short VIX Short-Term Futures ETF

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company |

☐ |

|||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

ProShares VIX Short Term Futures ETF

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company |

☐ |

|||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee | ||

| ProShares Ultra Bloomberg Crude OilCommon Units of Beneficial Interest |

$5,678,328,106(2) | $630,518(2) | ||

| ProShares UltraShort Bloomberg Crude Oil Common Units of Beneficial Interest |

$2,165,329,020(3) | $248,129(3) | ||

| ProShares Ultra GoldCommon Units of Beneficial Interest |

$246,598,845(4) | $25,593(4) | ||

| ProShares Ultra SilverCommon Units of Beneficial Interest |

$1,202,878,714(5) | $121,130(5) | ||

| ProShares UltraShort EuroCommon Units of Beneficial Interest |

$1,863,573,310(6) | $187,662(6) | ||

| ProShares Ultra VIX Short Term Futures ETFCommon Units of Beneficial Interest |

$6,913,084,508(7) | $801,226(7) | ||

| ProShares Short VIX Short Term Futures ETFCommon Units of Beneficial Interest |

$4,190,504,596(8) | $485,679(8) | ||

| ProShares VIX Short Term Futures ETF Common Units of Beneficial Interest |

$1,721,389,887(9) | $192,714(9) | ||

| TOTAL |

$23,981,686,986 | $2,692,651 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(d) under the Securities Act of 1933, as amended (“1933 Act”). |

| (2) | Pursuant to the provisions of Rule 415(a)(6) under the 1933 Act, the Registrant carries forward the value of the unsold Common Units of Beneficial Interest relating to ProShares Ultra Bloomberg Crude Oil from the Registrant’s Registration Statement on Form S-3, as amended (File No. 333-220688), which was initially filed with the Securities and Exchange Commission (the “SEC”) on February 1, 2018) (the “Prior S-3 Registration Statement”) ($3,778,328,106, the “Unsold Securities”), for which the issuer has paid the associated registration fees to the SEC ($400,238). Pursuant to Rule 415(a)(6), the offering of the Unsold Securities of ProShares Ultra Bloomberg Crude Oil covered by the Prior S-3 Registration Statement will be deemed terminated as of the date of effectiveness of this Registration Statement. Additionally, pursuant to Rule 457(p) under the 1933 Act, the registrant is hereby offsetting the remaining amount of the registration fee due in connection with the registration of additional Common Units of Beneficial Interest relating to ProShares Ultra Bloomberg Crude Oil by allocating a portion ($230,280) of the credit received from the registration fee previously paid ($551,460) in connection with unsold Common Units of Beneficial Interest relating to ProShares Short VIX Short-Term Futures ETF previously registered under the Prior S-3 Registration Statement. |

| (3) | Pursuant to the provisions of Rule 415(a)(6) under the 1933 Act, the Registrant carries forward the value of the unsold Common Units of Beneficial Interest relating to ProShares UltraShort Bloomberg Crude Oil from the Prior S-3 Registration Statement ($1,365,329,845, the “Unsold Securities”), for which the issuer has paid the associated registration fees to the SEC ($151,169). Pursuant to Rule 415(a)(6), the offering of the Unsold Securities of ProShares UltraShort Bloomberg Crude Oil covered by the Prior S-3 Registration Statement will be deemed terminated as of the date of effectiveness of this Registration Statement. Additionally, pursuant to Rule 457(p) under the 1933 Act, the registrant is hereby offsetting the remaining amount of the registration fee due in connection with the registration of additional Common Units of Beneficial Interest relating to ProShares UltraShort Bloomberg Crude Oil by allocating a portion ($96,960) of the credit received from the registration fee previously paid ($551,460) in connection with unsold Common Units of Beneficial Interest relating to ProShares Short VIX Short-Term Futures ETF previously registered under the Prior S-3 Registration Statement. |

| (4) | Pursuant to the provisions of Rule 415(a)(6) under the 1933 Act, the Registrant carries forward the value of the unsold Common Units of Beneficial Interest relating to ProShares Ultra Gold from the Registrant’s Prior S-3 Registration Statement ($246,598,845, the “Unsold Securities”) for which the Registrant has paid the associated registration fees to the SEC ($25,593). No additional ProShares Ultra Gold Common Units of Beneficial Interest are being registered concurrently with the filing of this Registration Statement. Pursuant to Rule 415(a)(6), the offering of the Unsold Securities of ProShares Ultra Gold covered by the Prior S-3 Registration Statement will be deemed terminated as of the date of effectiveness of this Registration Statement. |

| (5) | Pursuant to the provisions of Rule 415(a)(6) under the 1933 Act, the Registrant carries forward the value of the unsold Common Units of Beneficial Interest relating to ProShares Ultra Silver from the Registrant’s Prior S-3 Registration Statement ($1,202,878,714, the “Unsold Securities”) for which the Registrant has paid the associated registration fees to the SEC ($121,130). No additional ProShares Ultra Silver Common Units of Beneficial Interest are being registered concurrently with the filing of this Registration Statement. Pursuant to Rule 415(a)(6), the offering of the Unsold Securities of ProShares Ultra Silver covered by the Prior S-3 Registration Statement will be deemed terminated as of the date of effectiveness of this Registration Statement. |

| (6) | Pursuant to the provisions of Rule 415(a)(6) under the 1933 Act, the Registrant carries forward the value of the unsold Common Units of Beneficial Interest relating to ProShares UltraShort Euro from the Registrant’s Prior S-3 Registration Statement ($1,863,573,310, the “Unsold Securities”) for which the Registrant has paid the associated registration fees to the SEC ($187,662). No additional ProShares UltraShort Euro Common Units of Beneficial Interest are being registered concurrently with the filing of this Registration Statement. Pursuant to Rule 415(a)(6), the offering of the Unsold Securities of ProShares UltraShort Euro covered by the Prior S-3 Registration Statement will be deemed terminated as of the date of effectiveness of this Registration Statement. |

| (7) | Pursuant to the provisions of Rule 415(a)(6) under the 1933 Act, the Registrant carries forward the value of the unsold Common Units of Beneficial Interest relating to ProShares Ultra VIX Short Term Futures ETF from the Registrant’s Prior S-3 Registration Statement ($6,913,084,508, the “Unsold Securities”) for which the Registrant has paid the associated registration fees to the SEC ($801,226). No additional ProShares Ultra VIX Short Term Futures ETF Common Units of Beneficial Interest are being registered concurrently with the filing of this Registration Statement. Pursuant to Rule 415(a)(6), the offering of the Unsold Securities of ProShares Ultra VIX Short Term Futures ETF covered by the Prior S-3 Registration Statement will be deemed terminated as of the date of effectiveness of this Registration Statement. |

| (8) | Pursuant to Rule 457(p) under the Securities Act of 1933, the registrant is hereby offsetting the entire amount of the registration fee due hereunder by allocating a portion of the registration fee previously paid in connection with the Prior S-3 Registration Statement associated with a portion the unsold Common Units of Beneficial Interest relating to ProShares Short VIX Short Term Futures ETF Common ($485,679). |

| (9) | Pursuant to the provisions of Rule 415(a)(6) under the 1933 Act, the Registrant carries forward the value of the unsold Common Units of Beneficial Interest relating to ProShares VIX Short-Term Futures ETF from the Prior S-3 Registration Statement ($1,221,389,887, the “Unsold Securities”), for which the issuer has paid the associated registration fees to the SEC ($132,114). Pursuant to Rule 415(a)(6), the offering of the Unsold Securities of ProShares VIX Short-Term Futures ETF covered by the Prior S-3 Registration Statement will be deemed terminated as of the date of effectiveness of this Registration Statement. Additionally, pursuant to Rule 457(p) under the 1933 Act, the registrant is hereby offsetting the remaining amount of the registration fee due in connection with the registration of additional Common Units of Beneficial Interest relating to ProShares VIX Short-Term Futures ETF by allocating a portion ($60,600) of the credit received from the registration fee previously paid ($551,460) in connection with unsold Common Units of Beneficial Interest relating to ProShares Short VIX Short-Term Futures ETF previously registered under the Prior S-3 Registration Statement. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

PROSHARES TRUST II

Common Units of Beneficial Interest

|

Title of Securities to be Registered |

Benchmark |

Proposed Maximum Aggregate Offering Price Per Fund |

||||

| ProShares Ultra Bloomberg Crude Oil (UCO) | Bloomberg WTI Crude Oil SubindexSM | $ | 3,778,328,106 | |||

| ProShares UltraShort Bloomberg Crude Oil (SCO) | Bloomberg WTI Crude Oil SubindexSM | $ | 1,365,329,020 | |||

| ProShares Ultra Gold (UGL) | Bloomberg Gold SubindexSM | $ | 246,598,845 | |||

| ProShares Ultra Silver (AGQ) | Bloomberg Silver SubindexSM | $ | 1,202,878,714 | |||

| ProShares UltraShort Euro (EUO) | The U.S. dollar price of the euro | $ | 1,863,573,310 | |||

ProShares Trust II (the “Trust”) is a Delaware statutory trust organized into separate series. The Trust may from time to time offer to sell common units of beneficial interest (“Shares”) of any or all of the series of the Trust listed above (each, a “Fund” and collectively, the “Funds”) or other series of the Trust. Shares represent units of fractional undivided beneficial interest in and ownership of a series of the Trust. Each Fund’s Shares will be offered on a continuous basis. The Shares of each Fund are listed for trading on NYSE Arca, Inc. (the “Exchange”) under the ticker symbols shown above next to each Fund’s name. Please note that the Trust has series other than the Funds.

Each of the Funds is “geared” which means that each has an investment objective to seek daily investment results, before fees and expenses, that correspond either to a multiple (2x) or an inverse multiple (-2x) of the performance of a benchmark for a single day, not for any other period. A “single day” is measured from the time a Fund calculates its respective net asset value (“NAV”) to the time of the Fund’s next NAV calculation. The NAV calculation times for the Funds typically range from 7:00 a.m. to 4:00 p.m. (Eastern Time); please see the section entitled “Summary—Creation and Redemption Transactions” for additional details on the NAV calculation times for the Funds.

In order to achieve its investment objective, each of the Funds intends to invest in financial instruments (“Financial Instruments”) in the manner and to the extent described herein. Financial Instruments are instruments whose value is derived from the value of an underlying asset, rate or benchmark (such asset, rate or benchmark, a “Reference Asset”) and include futures contracts, swap agreements, forward contracts and other instruments. The Funds will not invest directly in any commodities or currencies.

The ProShares Ultra Bloomberg Crude Oil (the “Ultra Crude Oil Fund”) and the ProShares UltraShort Bloomberg Crude Oil (the “UltraShort Crude Oil Fund”) may be collectively referred to herein as the “Oil Funds.” The ProShares Ultra Gold (the “Ultra Gold Fund”) and the ProShares Ultra Silver (the “Ultra Silver Fund) may be collectively referred to herein as the “Precious Metals Funds.” The Precious Metals Funds and the Ultra Crude Oil Fund may be referred to herein as an “Ultra Fund” or “Ultra Funds.” The ProShares UltraShort Euro (the “UltraShort Euro Fund”) and may be referred to herein as the “Currency Fund.” The Currency Fund and the UltraShort Crude Oil Fund may be referred to herein as an “UltraShort Fund” or the “UltraShort Funds.”

Table of Contents

INVESTING IN THE SHARES INVOLVES SIGNIFICANT RISKS. PLEASE REFER TO “RISK FACTORS” BEGINNING ON PAGE 5.

THE FUNDS PRESENT SIGNIFICANT RISKS NOT APPLICABLE TO OTHER TYPES OF FUNDS. THE FUNDS ARE NOT APPROPRIATE FOR ALL INVESTORS. THE FUNDS USE LEVERAGE AND ARE RISKIER THAN SIMILARLY BENCHMARKED EXCHANGE-TRADED FUNDS THAT DO NOT USE LEVERAGE. AN INVESTOR SHOULD ONLY CONSIDER AN INVESTMENT IN A FUND IF HE OR SHE UNDERSTANDS THE CONSEQUENCES OF SEEKING DAILY LEVERAGED OR DAILY INVERSE LEVERAGED INVESTMENT RESULTS, INCLUDING THE IMPACT OF COMPOUNDING ON FUND PERFORMANCE.

THE RETURN OF A FUND FOR A PERIOD LONGER THAN A SINGLE DAY IS THE RESULT OF ITS RETURN FOR EACH DAY COMPOUNDED OVER THE PERIOD AND USUALLY WILL DIFFER IN AMOUNT AND POSSIBLY EVEN DIRECTION FROM THE FUND’S STATED MULTIPLE TIMES THE RETURN OF THE FUND’S BENCHMARK FOR THE SAME PERIOD. THESE DIFFERENCES CAN BE SIGNIFICANT.

THE FUNDS’ INVESTMENTS MAY BE ILLIQUID AND/OR HIGHLY VOLATILE AND THE FUNDS MAY EXPERIENCE LARGE LOSSES FROM BUYING, SELLING OR HOLDING SUCH INVESTMENTS. AN INVESTOR IN ANY OF THE FUNDS COULD POTENTIALLY LOSE THE FULL PRINCIPAL VALUE OF HIS/HER INVESTMENT WITHIN A SINGLE DAY.

SHAREHOLDERS WHO INVEST IN THE FUNDS SHOULD ACTIVELY MANAGE AND MONITOR THEIR INVESTMENTS, AS FREQUENTLY AS DAILY.

Each Ultra Fund seeks daily investment results, before fees and expenses, that correspond to two times (2x) the performance of its benchmark for a single day, not for any other period. Each UltraShort Fund seeks daily investment results, before fees and expenses, that correspond to two times the inverse (-2x) of the performance of its benchmark for a single day, not for any other period. The return of a Fund for a period longer than a single day is the result of its return for each day compounded over the period and usually will differ in amount and possibly even direction from the Fund’s stated multiple times the return of the Fund’s benchmark for the same period. These differences can be significant. Daily compounding of a Fund’s investment returns can dramatically and adversely affect its longer-term performance, especially during periods of high volatility. Volatility has a negative impact on Fund returns and the volatility of a Fund’s benchmark may be at least as important to the Fund’s return as the return of the Fund’s benchmark.

Each of the Funds uses leverage and should produce returns for a single day that are more volatile than that of its respective benchmark. For example, the return for a single day of an Ultra Fund with a 2x multiple should be approximately two times as volatile for a single day as the return of a fund with an objective of matching the same benchmark. The return for a single day of an UltraShort Fund with a -2x multiple should be approximately two times as volatile for a single day as the inverse of the return of a fund with an objective of matching the same benchmark.

Each Fund will distribute to shareholders a Schedule K-1 that will contain information regarding the income and expenses of the Fund.

NEITHER THE TRUST NOR ANY FUND IS A MUTUAL FUND OR ANY OTHER TYPE OF INVESTMENT COMPANY AS DEFINED IN THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED (THE “1940 ACT”), AND NEITHER IS SUBJECT TO REGULATION THEREUNDER. SHAREHOLDERS DO NOT HAVE THE PROTECTIONS ASSOCIATED WITH OWNERSHIP OF SHARES IN AN INVESTMENT COMPANY REGISTERED UNDER THE 1940 ACT. SEE RISK FACTOR ENTITLED “SHAREHOLDERS DO NOT HAVE THE PROTECTIONS ASSOCIATED WITH OWNERSHIP OF SHARES IN AN INVESTMENT COMPANY REGISTERED UNDER THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED (THE “1940 ACT”).” IN PART ONE OF THIS PROSPECTUS FOR MORE INFORMATION.

Table of Contents

Each Fund continuously offers and redeems its Shares in blocks of 50,000 Shares (each such block, a “Creation Unit”). Only Authorized Participants (as defined herein) may purchase and redeem Shares from a Fund and then only in Creation Units. An Authorized Participant is an entity that has entered into an Authorized Participant Agreement with the Trust and ProShare Capital Management LLC (the “Sponsor”). Shares are offered to Authorized Participants in Creation Units at each Fund’s respective NAV. Authorized Participants may then offer to the public, from time to time, Shares from any Creation Unit they create at a per-Share market price. The form of Authorized Participant Agreement and the related Authorized Participant Procedures Handbook set forth the terms and conditions under which an Authorized Participant may purchase or redeem a Creation Unit. Authorized Participants will not receive from any Fund, the Sponsor, or any of their affiliates, any fee or other compensation in connection with their sale of Shares to the public. An Authorized Participant may receive commissions or fees from investors who purchase Shares through their commission or fee-based brokerage accounts.

These securities have not been approved or disapproved by the United States Securities and Exchange Commission (the “SEC”) or any state securities commission nor has the SEC or any state securities commission passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

March , 2019

Table of Contents

The Shares are neither interests in nor obligations of the Sponsor, Wilmington Trust Company, or any of their respective affiliates. The Shares are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

This Prospectus has two parts: the offered series disclosure and the general pool disclosure. These parts are bound together and are incomplete if not distributed together to prospective participants.

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT COMMODITY INTEREST TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED TO THIS POOL, AT PAGES 46 THROUGH 47, AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGES 45 THROUGH 46.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGES 4 THROUGH 27.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

SWAPS TRANSACTIONS, LIKE OTHER FINANCIAL TRANSACTIONS, INVOLVE A VARIETY OF SIGNIFICANT RISKS. THE SPECIFIC RISKS PRESENTED BY A PARTICULAR SWAP TRANSACTION NECESSARILY DEPEND UPON THE TERMS OF THE TRANSACTION AND YOUR CIRCUMSTANCES. IN GENERAL, HOWEVER, ALL SWAPS TRANSACTIONS INVOLVE SOME COMBINATION OF MARKET RISK, CREDIT RISK, COUNTERPARTY CREDIT RISK, FUNDING RISK, LIQUIDITY RISK, AND OPERATIONAL RISK.

HIGHLY CUSTOMIZED SWAPS TRANSACTIONS IN PARTICULAR MAY INCREASE LIQUIDITY RISK, WHICH MAY RESULT IN A SUSPENSION OF REDEMPTIONS. HIGHLY LEVERAGED TRANSACTIONS MAY EXPERIENCE SUBSTANTIAL GAINS OR LOSSES IN VALUE AS A RESULT OF RELATIVELY SMALL CHANGES IN THE VALUE OR LEVEL OF AN UNDERLYING OR RELATED MARKET FACTOR. IN EVALUATING THE RISKS AND CONTRACTUAL OBLIGATIONS ASSOCIATED WITH A PARTICULAR SWAP TRANSACTION, IT IS IMPORTANT TO CONSIDER THAT A SWAP TRANSACTION MAY, IN CERTAIN INSTANCES, BE MODIFIED OR TERMINATED ONLY BY MUTUAL CONSENT OF THE ORIGINAL PARTIES AND SUBJECT TO AGREEMENT ON INDIVIDUALLY NEGOTIATED TERMS. THEREFORE, IT MAY NOT BE POSSIBLE FOR THE COMMODITY POOL OPERATOR TO MODIFY, TERMINATE, OR OFFSET THE POOL’S OBLIGATIONS OR THE POOL’S EXPOSURE TO THE RISKS ASSOCIATED WITH A TRANSACTION PRIOR TO ITS SCHEDULED TERMINATION DATE.

-i-

Table of Contents

THIS PROSPECTUS DOES NOT INCLUDE ALL OF THE INFORMATION OR EXHIBITS IN THE REGISTRATION STATEMENT OF THE TRUST. INVESTORS CAN READ AND COPY THE ENTIRE REGISTRATION STATEMENT AT THE PUBLIC REFERENCE FACILITIES MAINTAINED BY THE SEC IN WASHINGTON, D.C.

THE TRUST WILL FILE QUARTERLY AND ANNUAL REPORTS WITH THE SEC. INVESTORS CAN READ AND COPY THESE REPORTS AT THE SEC PUBLIC REFERENCE FACILITIES IN WASHINGTON, D.C. PLEASE CALL THE SEC AT 1—800—SEC—0330 FOR FURTHER INFORMATION.

THE FILINGS OF THE TRUST ARE POSTED AT THE SEC WEBSITE AT WWW.SEC.GOV.

REGULATORY NOTICES

NO DEALER, SALESMAN OR ANY OTHER PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION NOT CONTAINED IN THIS PROSPECTUS, AND, IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE TRUST, ANY OF THE FUNDS, THE SPONSOR, THE AUTHORIZED PARTICIPANTS OR ANY OTHER PERSON.

THIS PROSPECTUS DOES NOT CONSTITUTE AN OFFER OR SOLICITATION TO SELL OR A SOLICITATION OF AN OFFER TO BUY, NOR SHALL THERE BE ANY OFFER, SOLICITATION, OR SALE OF THE SHARES IN ANY JURISDICTION IN WHICH SUCH OFFER, SOLICITATION, OR SALE IS NOT AUTHORIZED OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE ANY SUCH OFFER, SOLICITATION, OR SALE.

AUTHORIZED PARTICIPANTS MAY BE REQUIRED TO DELIVER A PROSPECTUS WHEN TRANSACTING IN SHARES. SEE “PLAN OF DISTRIBUTION” IN PART TWO OF THIS PROSPECTUS.

-ii-

Table of Contents

PROSHARES TRUST II

| Page | ||

| PART ONE OFFERED SERIES DISCLOSURE | ||

| 1 | ||

| 1 | ||

| 2 | ||

| 2 | ||

| 2 | ||

| 2 | ||

| 3 | ||

| 3 | ||

| 4 | ||

| 4 | ||

| 5 | ||

| 30 | ||

| 30 | ||

| 30 | ||

| 30 | ||

| 32 | ||

| 32 | ||

| 32 | ||

| 33 | ||

| 34 | ||

| 35 | ||

| 35 | ||

| 35 | ||

| 35 | ||

| 36 | ||

| Performance of the Offered Commodity Pools Operated by the Commodity Pool Operator |

46 | |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

51 | |

| 51 | ||

| 51 | ||

| 53 | ||

| 55 | ||

| 56 | ||

-iii-

Table of Contents

| Page | ||

| PART TWO GENERAL POOL DISCLOSURE | ||

| Performance of the Other Commodity Pools Operated by the Commodity Pool Operator |

66 | |

| 85 | ||

| 85 | ||

| 85 | ||

| 86 | ||

| 88 | ||

| 89 | ||

| 89 | ||

| 89 | ||

| Description of the Shares; the Funds; Certain Material Terms of the Trust Agreement |

89 | |

| 90 | ||

| 90 | ||

| 90 | ||

| 91 | ||

| 91 | ||

| 94 | ||

| 95 | ||

| 95 | ||

| 95 | ||

| Possible Repayment of Distributions Received by Shareholders |

95 | |

| 95 | ||

| 95 | ||

| 96 | ||

| 96 | ||

| 97 | ||

| 97 | ||

| 97 | ||

| 97 | ||

| 98 | ||

| 98 | ||

| 98 | ||

| 98 | ||

| The Securities Depository; Book-Entry Only System; Global Security |

98 | |

| 99 | ||

| 99 | ||

| 101 | ||

| 101 | ||

| 101 | ||

| 102 | ||

| 102 | ||

-iv-

Table of Contents

| Page | ||

| 102 | ||

| 102 | ||

| 103 | ||

| 103 | ||

| 104 | ||

| 104 | ||

| 104 | ||

| 104 | ||

| 105 | ||

| 105 | ||

| 105 | ||

| 105 | ||

| 106 | ||

| 106 | ||

| 106 | ||

| 106 | ||

| 106 | ||

| 106 | ||

| 107 | ||

| 108 | ||

| 108 | ||

| 136 | ||

| 136 | ||

| Litigation and Regulatory Disclosure Relating to Swap Counterparties |

137 | |

| A-1 | ||

-v-

Table of Contents

OFFERED SERIES DISCLOSURE

Investors should read the following summary together with the more detailed information in this Prospectus before investing in Shares of any of the Funds, including the information under the caption “Risk Factors,” and all exhibits to this Prospectus and the information incorporated by reference in this Prospectus, including the financial statements and the notes to those financial statements in the Trust’s Annual Report on Form 10-K, and the Quarterly Reports on Form 10-Q, and Current Reports, if any, on Form 8-K. Please see the section entitled “Incorporation by Reference of Certain Documents” in Part Two of this Prospectus.

For ease of reference, any references throughout this Prospectus to various actions taken by any or all of the Funds are actually actions taken by the Trust on behalf of such Funds.

Definitions used in this Prospectus can be found in the Glossary of Defined Terms in Appendix A and throughout this Prospectus.

Important Information About the Funds

THE FUNDS PRESENT SIGNIFICANT RISKS NOT APPLICABLE TO OTHER TYPES OF FUNDS. THE FUNDS ARE NOT APPROPRIATE FOR ALL INVESTORS. THE FUNDS USE LEVERAGE AND ARE RISKIER THAN SIMILARLY BENCHMARKED EXCHANGE-TRADED FUNDS THAT DO NOT USE LEVERAGE. AN INVESTOR SHOULD ONLY CONSIDER AN INVESTMENT IN A FUND IF HE OR SHE UNDERSTANDS THE CONSEQUENCES OF SEEKING DAILY LEVERAGED OR DAILY INVERSE LEVERAGED INVESTMENT RESULTS, INCLUDING THE IMPACT OF COMPOUNDING ON FUND PERFORMANCE.

THE RETURN OF A FUND FOR A PERIOD LONGER THAN A SINGLE DAY IS THE RESULT OF ITS RETURN FOR EACH DAY COMPOUNDED OVER THE PERIOD AND USUALLY WILL DIFFER IN AMOUNT AND POSSIBLY EVEN DIRECTION FROM THE FUND’S STATED MULTIPLE TIMES THE RETURN OF THE FUND’S BENCHMARK FOR THE SAME PERIOD. THESE DIFFERENCES CAN BE SIGNIFICANT.

THE FUNDS’ INVESTMENTS MAY BE ILLIQUID AND/OR HIGHLY VOLATILE AND THE FUNDS MAY EXPERIENCE LARGE LOSSES FROM BUYING, SELLING OR HOLDING SUCH INVESTMENTS. AN INVESTOR IN ANY OF THE FUNDS COULD POTENTIALLY LOSE THE FULL PRINCIPAL VALUE OF HIS/HER INVESTMENT WITHIN A SINGLE DAY.

SHAREHOLDERS WHO INVEST IN THE FUNDS SHOULD ACTIVELY MANAGE AND MONITOR THEIR INVESTMENTS, AS FREQUENTLY AS DAILY.

Each Ultra Fund seeks daily investment results, before fees and expenses, that correspond to two times (2x) the performance of its benchmark for a single day, not for any other period. Each UltraShort Fund seeks daily investment results, before fees and expenses, that correspond to two times the inverse (-2x) of the performance of its benchmark for a single day, not for any other period. The return of a Fund for a period longer than a single day is the result of its return for each day compounded over the period and usually will differ in amount and possibly even direction from the Fund’s stated multiple times the return of the Fund’s benchmark for the same period. These differences can be significant. Daily compounding of a Fund’s investment returns can dramatically and adversely affect its longer-term performance especially during periods of high volatility.

Volatility has a negative impact on Fund performance and the volatility of a Fund’s benchmark may be at least as important to the Fund’s return as the return of the Fund’s benchmark. Each of the Funds uses leverage and should produce returns for a single day that are more volatile than that of its benchmark. For example, the return for a single day of an Ultra Fund with a 2x multiple should be approximately two times as volatile for a single day as the return of a fund with an objective of matching the same benchmark. The return for a single day of an UltraShort Fund with a -2x multiple should be approximately two times as volatile for a single day as the inverse of the return of a fund with an objective of matching the same benchmark.

-1-

Table of Contents

Each Fund is listed below along with its respective benchmark:

| Fund Name |

Benchmark | |

| ProShares Ultra Bloomberg Crude Oil | Bloomberg WTI Crude Oil SubindexSM | |

| ProShares UltraShort Bloomberg Crude Oil | Bloomberg WTI Crude Oil SubindexSM |

| Fund Name |

Benchmark | |

| ProShares Ultra Gold | Bloomberg Gold SubindexSM | |

| ProShares Ultra Silver | Bloomberg Silver SubindexSM |

| Fund Name |

Benchmark | |

| ProShares UltraShort Euro | The U.S. dollar price of the euro |

Each “Ultra Fund” seeks daily investment results, before fees and expenses, that correspond to two times (2x) the performance of its benchmark for a single day. Each “UltraShort Fund” seeks daily investment results, before fees and expenses, that correspond to two times the inverse (-2x) of the performance of its benchmark for a single day. The Funds do not seek to achieve their stated objective over a period greater than a single day. A “single day” is measured from the time the Fund calculates its net asset value (“NAV”) to the time of the Fund’s next NAV calculation.

Each Fund seeks to engage in daily rebalancing to position its portfolio so that its exposure to its benchmark is consistent with its daily investment objective. The impact of changes to the value of a Fund’s benchmark each day will affect whether such Fund’s portfolio needs to be rebalanced. For example, if an UltraShort Fund’s benchmark has risen on a given day, net assets of such Fund should fall. As a result, inverse exposure will need to be decreased. Conversely, if an UltraShort Fund’s benchmark has fallen on a given day, net assets of such Fund should rise. As a result, inverse exposure will need to be increased. For Ultra Funds, the Fund’s long exposure will need to be increased on days when such Fund’s benchmark rises and decreased on days when such Fund’s benchmark falls. The time and manner in which a Fund rebalances its portfolio may vary from day to day at the discretion of the Sponsor depending upon market conditions and other circumstances.

DAILY REBALANCING AND THE COMPOUNDING OF EACH DAY’S RETURN OVER TIME MEANS THAT THE RETURN OF EACH FUND FOR A PERIOD LONGER THAN A SINGLE DAY WILL BE THE RESULT OF EACH DAY’S RETURNS COMPOUNDED OVER THE PERIOD, WHICH WILL VERY LIKELY DIFFER FROM TWO TIMES (2X) OR TWO TIMES THE INVERSE (-2X) OF THE RETURN OF THE FUND’S BENCHMARK FOR THE SAME PERIOD. A FUND WILL LOSE MONEY IF ITS BENCHMARK’S PERFORMANCE IS FLAT OVER TIME, AND IT IS POSSIBLE FOR A FUND TO LOSE MONEY OVER TIME REGARDLESS OF THE PERFORMANCE OF ITS BENCHMARK, AS A RESULT OF DAILY REBALANCING, THE BENCHMARK’S VOLATILITY, COMPOUNDING, AND OTHER FACTORS.

Each of the Funds intends to invest in Financial Instruments to gain the appropriate exposure to its benchmark in the manner and to the extent described herein. “Financial Instruments” are instruments whose value is derived from the value of an underlying asset, rate or benchmark (such asset, rate or benchmark, a “Reference Asset”) and include futures contracts, swap agreements, forward contracts, and other instruments.

-2-

Table of Contents

In seeking to achieve the Funds’ investment objectives, the Sponsor uses a mathematical approach to investing. Using this approach, the Sponsor determines the type, quantity and mix of Financial Instruments that the Sponsor believes, in combination, should produce daily returns consistent with the Funds’ objectives.

The Funds are not actively managed by traditional methods (e.g., by effecting changes in the composition of a portfolio on the basis of judgments relating to economic, financial and market conditions with a view toward obtaining positive results under all market conditions). Each Fund seeks to remain fully invested at all times in Financial Instruments and money market instruments that, in combination, provide exposure to its underlying benchmark consistent with its investment objective, even during periods in which the benchmark is flat or moving in a manner that may cause the value of the Fund to decline.

The Sponsor has the power to change a Fund’s investment objective, benchmark or investment strategy, and may liquidate a Fund at any time, without shareholder approval, subject to applicable regulatory requirements.

ProShare Capital Management LLC, a Maryland limited liability company, serves as the Trust’s Sponsor and commodity pool operator. The principal office of the Sponsor and the Funds is located at 7501 Wisconsin Avenue, East Tower, 10th Floor, Bethesda, Maryland 20814. The telephone number of the Sponsor and each of the Funds is (240) 497-6400.

Purchases and Sales in the Secondary Market

The Shares of each Fund are listed on NYSE Arca, Inc. (the “Exchange”) under the ticker symbols shown on the front cover of this Prospectus. Secondary market purchases and sales of Shares are subject to ordinary brokerage commissions and charges.

Creation and Redemption Transactions

Only an Authorized Participant may purchase (i.e., create) or redeem Shares with the Funds. Authorized Participants may purchase or redeem Shares only in blocks of 50,000 Shares (each such block, a “Creation Unit”) in the Funds. An “Authorized Participant” is an entity that has entered into an Authorized Participant Agreement with the Trust and the Sponsor. Creation Units are offered to Authorized Participants at each Fund’s NAV. Creation Units in a Fund are expected to be created when there is sufficient demand for Shares in such Fund that the market price per Share is at a premium to the NAV per Share. Authorized Participants will likely sell such Shares to the public at prices that are expected to reflect, among other factors, the trading price of the Shares of such Fund and the supply of and demand for the Shares at the time of sale. Similarly, it is expected that Creation Units in a Fund will be redeemed when the market price per Share of such Fund is at a discount to the NAV per Share. The Sponsor expects that the exploitation of such arbitrage opportunities by Authorized Participants and their clients will tend to cause the public trading price of the Shares to track the NAV per Share of a Fund over time. Retail investors seeking to purchase or sell Shares on any day effect such transactions in the secondary market at the market price per Share, rather than in connection with the creation or redemption of Creation Units.

A creation transaction, which is subject to acceptance by SEI Investments Distribution Co. (“SEI” or the “Distributor”), generally takes place when an Authorized Participant deposits a specified amount of cash (unless as provided otherwise in this Prospectus) in exchange for a specified number of Creation Units. Similarly, Shares can be redeemed only in Creation Units, generally for cash (unless as provided otherwise in this Prospectus). Except when aggregated in Creation Units, Shares are not redeemable. The prices at which creations and redemptions occur are based on the next calculation of the NAV after an order is received in proper form, as described in the Authorized Participant Agreement and the related Authorized Participant Procedures Handbook. The manner by which Creation Units are purchased and redeemed is governed by the terms of this Prospectus, the Authorized Participant Agreement and Authorized Participant Procedures Handbook. Creation and redemption orders are not effective until accepted by the Distributor and may be rejected or revoked as described herein. By placing a purchase order, an Authorized Participant agrees to deposit cash (unless as provided otherwise in this Prospectus) with the Bank of New York Mellon (“BNYM”, the “Custodian”, the “Transfer Agent” and the “Administrator”), acting in its capacity as custodian of the Funds.

-3-

Table of Contents

Creation and redemption transactions must be placed each day with SEI by the create/redeem cut-off time (stated below) to receive that day’s NAV. The cut-off time may be earlier if, for example, the Exchange or other exchange material to the valuation or operation of such Fund closes before such cut-off time. Because the primary trading session for the commodities and/or futures contracts underlying certain of the Funds have different closing (or fixing) times than U.S. Equity markets, the create/redeem cut-off time and NAV calculation time for each Fund may differ, See the section herein entitled “Net Asset Value” for additional information about the NAV calculations.

| Fund |

Create/Redeem Cut-off |

NAV Calculation Time | ||

| ProShares Ultra Silver (AGQ) |

1:00 p.m. (Eastern Time) | 1:25 p.m. (Eastern Time) | ||

| ProShares Ultra Gold (UGL) |

1:00 p.m. (Eastern Time) | 1:30 p.m. (Eastern Time) | ||

| ProShares Ultra Bloomberg Crude Oil (UCO) |

2:00 p.m. (Eastern Time) | 2:30 p.m. (Eastern Time) | ||

| ProShares UltraShort Bloomberg Crude Oil (SCO) |

2:00 p.m. (Eastern Time) | 2:30 p.m. (Eastern Time) | ||

| ProShares UltraShort Euro (EUO) |

3:00 p.m. (Eastern Time) | 4:00 p.m. (Eastern Time) |

A Fund will be profitable only if returns from the Fund’s investments exceed its “breakeven amount.” Estimated breakeven amounts are set forth in the table below. The estimated breakeven amounts represent the estimated amount of trading income that each Fund would need to achieve during one year to offset the Fund’s estimated fees, costs and expenses, net of any interest income earned by the Fund on its investments. Estimated amounts do not represent actual results, which may be different. It is not possible to predict whether a Fund will break even at the end of the first twelve months of an investment or any other period. See “Charges—Breakeven Table,” beginning on page 51, for more detailed tables showing Breakeven Amounts.

| Fund Name |

Breakeven Amount (% Per Annum of Average Daily NAV)* |

Assumed Selling Price Per Share* |

Breakeven Amount ($ for the Assumed Selling Price Per Share)* |

|||||||||

| ProShares Ultra Bloomberg Crude Oil** |

0.00 | % | $ | 15.00 | 0.00 | |||||||

| ProShares UltraShort Bloomberg Crude Oil** |

0.00 | % | $ | 20.00 | 0.00 | |||||||

| ProShares Ultra Gold** |

0.00 | % | $ | 35.00 | 0.00 | |||||||

| ProShares Ultra Silver** |

0.00 | % | $ | 25.00 | 0.00 | |||||||

| ProShares UltraShort Euro** |

0.00 | % | $ | 25.00 | 0.00 | |||||||

| * | The breakeven analysis set forth in this table assumes that the Shares have a constant NAV equal to the amount shown. This amount approximates the NAV of such Shares on February 28, 2019, rounded to the nearest $5 The actual NAV of each Fund differs and is likely to change on a daily basis. The numbers in this chart have been rounded to the nearest 0.01. |

| ** | Fees and expenses are less than the anticipated interest income; therefore, the net trading gains that would be necessary to offset such expenses would be zero. |

Please note that each Fund will distribute to shareholders a Schedule K-1 that will contain information regarding the income and expense items of the Fund. The Schedule K-1 is a complex form and shareholders may find that preparing tax returns may require additional time or may require the assistance of an accountant or other tax preparer, at an additional expense to the shareholder.

-4-

Table of Contents

Investing in the Funds involves significant risks not applicable to other types of investments. The Funds may be highly volatile and you could potentially lose the full principal value of your investment within a single day. Before you decide to purchase any Shares, you should consider carefully the risks described below together with all of the other information included in this Prospectus, as well as information found in documents incorporated by reference in this Prospectus.

These risk factors may be amended, supplemented or superseded from time to time by risk factors contained in any periodic report, prospectus supplement, post-effective amendment or in other reports filed with the SEC in the future.

The assets that the Funds invest in can be highly volatile and the Funds may experience sudden and large losses when buying, selling or holding such instruments; you can lose all of your investment within a single day.

Investments linked to commodity or currency markets can be highly volatile compared to investments in traditional securities and the Funds may experience sudden and large losses. These markets may fluctuate widely based on a variety of factors including changes in overall market movements, political and economic events, wars, acts of terrorism, natural disasters and changes in interest rates or inflation rates. High volatility may have an adverse impact on the performance of the Funds. An investor in any of the Funds could potentially lose the full principal value of his or her investment within a single day.

The use of leveraged or inverse leveraged positions could result in the total loss of an investor’s investment within a single day.

Each Fund utilizes leverage in seeking to achieve its investment objective and will lose more money in market environments adverse to its daily investment objective than funds that do not employ leverage. The use of leveraged and/or inverse leveraged positions could result in the total loss of an investor’s investment within a single day. The more a Fund invests in leveraged positions, the more this leverage will magnify any losses on those investments. A Fund’s investments in leveraged positions generally requires a small investment relative to the amount of investment exposure assumed. As a result, such investments may give rise to losses that far exceed the amount invested in those instruments.

For example, because the Ultra Funds and the UltraShort Funds offered hereby include a two times (2x) or a two times inverse (-2x) multiplier, a single-day movement in the benchmark for one of these Funds approaching 50% at any point in the day could result in the total loss or almost total loss of an investment in such Fund if that movement is contrary to the investment objective of the Fund. This would be the case with downward single-day or intraday movements in the underlying benchmark of an Ultra Fund or upward single day or intraday movements in the benchmark of an UltraShort Fund, even if the underlying benchmark maintains a level greater than zero at all times and even if the benchmark subsequently moves in an opposite direction, eliminating all or a portion of the prior adverse movement

Due to the compounding of daily returns, each Fund’s returns over periods longer than a single day will likely differ in amount and possibly even direction from the Fund’s stated multiple times the return of its benchmark for such period.

Each of the Funds is “geared” which means that each has an investment objective to seek daily investment results, before fees and expenses, that correspond either to two times (2x) or two times the inverse (-2x) of the performance of a benchmark for a single day, not for any other period. A single day is measured from the time a Fund calculates its respective NAV to the time of the Fund’s next NAV calculation. The NAV calculation times for the Funds typically range from 7:00 a.m. to 4:00 p.m. (Eastern Time); please see the section entitled “Summary—Creation and Redemption Transactions” for additional details on the NAV calculation times for the Funds. The return of a Fund for a period longer than a single day is the result of its return for each day compounded over the period, and usually will differ from two times (2x) or two times the inverse (-2x) of the return of the Fund’s benchmark for the same period. Compounding is the cumulative effect of applying investment gains and losses and income to the principal amount invested over time. Gains or losses experienced over a given period will increase or reduce the principal amount invested from which the subsequent period’s returns are calculated. The effects of compounding will likely cause the performance of the Fund to differ from a Fund’s stated multiple times the return of its benchmark for the same period. The effect of compounding becomes more pronounced as benchmark volatility and holding period increase.

-5-

Table of Contents

A Fund will lose money if its benchmark’s performance is flat over time, and it is possible for a Fund to lose money over time regardless of the performance of an underlying benchmark, as a result of daily rebalancing, the benchmark’s volatility, compounding and other factors. Longer holding periods, higher benchmark volatility, inverse exposure and greater leverage each affect the impact of compounding on a Fund’s returns. Daily compounding of a Fund’s investment returns can dramatically and adversely affect performance, especially during periods of high volatility. Volatility has a negative impact on Fund performance and the volatility of a Fund’s benchmark may be at least as important to a Fund’s return for a period as the return of the benchmark.

Each Ultra Fund or UltraShort Fund uses leverage and should produce returns for a single day that are more volatile than that of its benchmark. For example, the return for a single day of an Ultra Fund with a 2x multiple should be approximately two times as volatile for a single day as the return of a fund with an objective of matching the performance of the same benchmark. The return for a single day of an UltraShort Fund with a -2x multiple should be approximately two times as volatile for a single day as the inverse of the return of a fund with an objective of matching the same benchmark.

The Funds are not appropriate for all investors and present different risks than other funds. The Funds use leverage and are riskier than similarly benchmarked exchange-traded funds that do not use leverage. An investor should only consider an investment in a Fund if he or she understands the consequences of seeking daily leveraged or daily inverse leveraged investment results for a single day. Shareholders who invest in the Funds should actively manage and monitor their investments, as frequently as daily.

The hypothetical examples below illustrate how daily geared fund returns can behave for periods longer than a single day. Each involves a hypothetical fund XYZ that seeks returns that are two times (2x) the daily performance of benchmark XYZ, before fees and expenses. On each day, fund XYZ performs in line with its objective (two times (2x) the benchmark’s daily performance before fees and expenses). Notice that, in the first example (showing an overall benchmark loss for the period), over the entire seven-day period, the fund’s total return is more than two times the loss of the period return of the benchmark. For the seven-day period, benchmark XYZ lost 3.26% while fund XYZ lost 7.01% (versus -6.52% (or 2 x—3.26%)).

| Benchmark XYZ | Fund XYZ | |||||||||||||||

| Level | Daily Performance |

Daily Performance |

Net Asset Value |

|||||||||||||

| Start |

100.00 | $ | 100.00 | |||||||||||||

| Day 1 |

97.00 | -3.00 | % | -6.00 | % | $ | 94.00 | |||||||||

| Day 2 |

99.91 | 3.00 | % | 6.00 | % | $ | 99.64 | |||||||||

| Day 3 |

96.91 | -3.00 | % | -6.00 | % | $ | 93.66 | |||||||||

| Day 4 |

99.82 | 3.00 | % | 6.00 | % | $ | 99.28 | |||||||||

| Day 5 |

96.83 | -3.00 | % | -6.00 | % | $ | 93.32 | |||||||||

| Day 6 |

99.73 | 3.00 | % | 6.00 | % | $ | 98.92 | |||||||||

| Day 7 |

96.74 | -3.00 | % | -6.00 | % | $ | 92.99 | |||||||||

| Total Return |

-3.26 | % | -7.01 | % | ||||||||||||

-6-

Table of Contents

Similarly, in another example (showing an overall benchmark gain for the period), over the entire seven-day period, the fund’s total return is considerably less than two times (2x) that of the period return of the benchmark. For the seven-day period, benchmark XYZ gained 2.72% while fund XYZ gained 4.86% (versus 5.44% (or 2 x 2.72%)).

| Benchmark XYZ | Fund XYZ | |||||||||||||||

| Level | Daily Performance |

Daily Performance |

Net Asset Value |

|||||||||||||

| Start |

100.00 | $ | 100.00 | |||||||||||||

| Day 1 |

103.00 | 3.00 | % | 6.00 | % | $ | 106.00 | |||||||||

| Day 2 |

99.91 | -3.00 | % | -6.00 | % | $ | 99.64 | |||||||||

| Day 3 |

102.91 | 3.00 | % | 6.00 | % | $ | 105.62 | |||||||||

| Day 4 |

99.82 | -3.00 | % | -6.00 | % | $ | 99.28 | |||||||||

| Day 5 |

102.81 | 3.00 | % | 6.00 | % | $ | 105.24 | |||||||||

| Day 6 |

99.73 | -3.00 | % | -6.00 | % | $ | 98.92 | |||||||||

| Day 7 |

102.72 | 3.00 | % | 6.00 | % | $ | 104.86 | |||||||||

| Total Return |

2.72 | % | 4.86 | % | ||||||||||||

These effects are caused by compounding, which exists in all investments, but has a more significant impact in geared funds. In general, during periods of higher benchmark volatility, compounding will cause an Ultra Fund’s returns for periods longer than a single day to be less than two times (2x) the return of its benchmark (or less than two times the inverse (-2x) of the return of its benchmark for an UltraShort Fund). This effect becomes more pronounced as volatility increases. Conversely, in periods of lower benchmark volatility (particularly when combined with higher benchmark returns), an Ultra Fund’s returns over longer periods can be greater than two times (2x) the return of its benchmark (or greater than two times the inverse (-2x) of the return of its benchmark for an UltraShort Fund). Actual results for a particular period are also dependent on the magnitude of the benchmark return in addition to the benchmark volatility. Similar effects exist for the UltraShort Funds, and the significance of these effects may be even greater with such inverse leveraged funds.

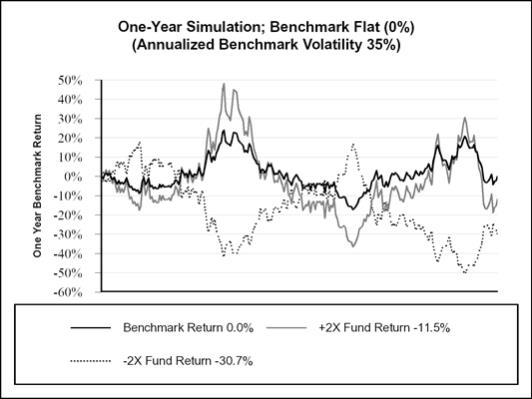

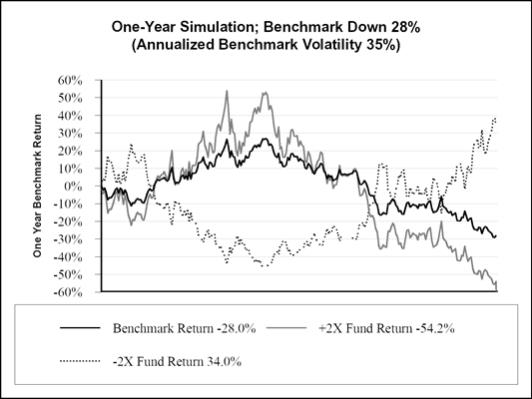

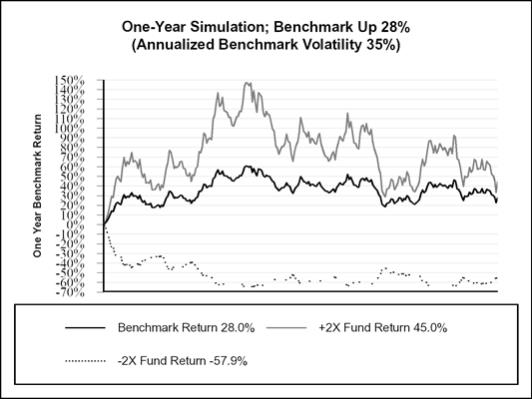

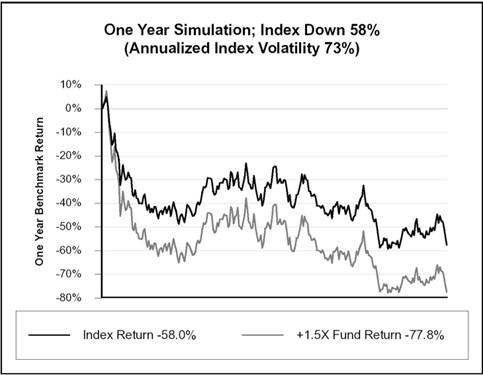

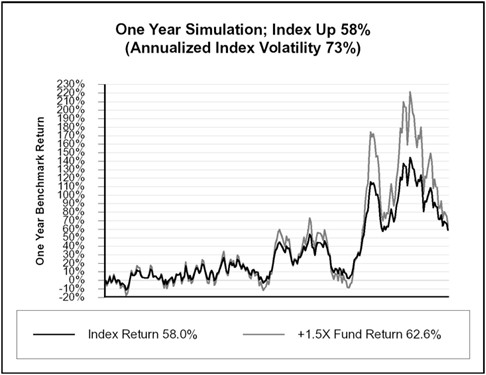

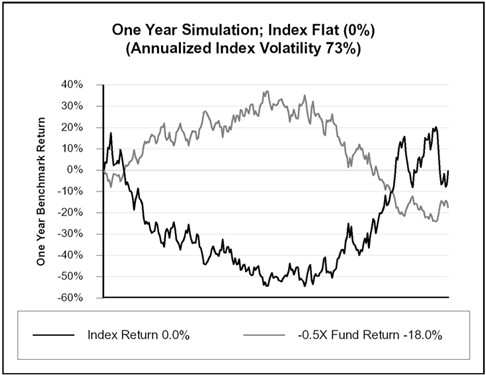

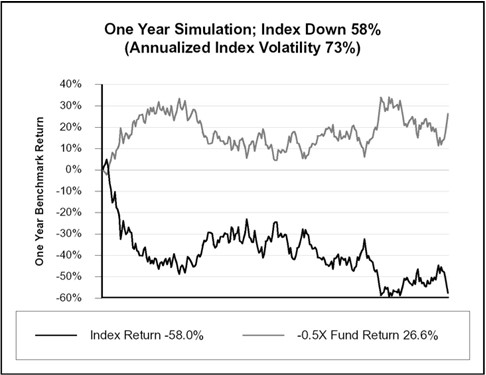

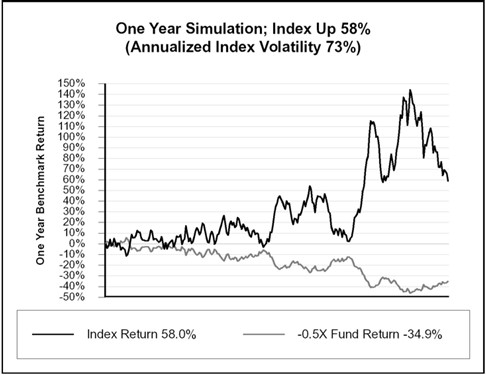

The graphs that follow illustrate this point. Each of the graphs shows a simulated hypothetical one-year performance of a benchmark compared with the performance of a geared fund that perfectly achieves its geared daily investment objective. The graphs demonstrate that, for periods greater than a single day, a geared fund is likely to underperform or overperform (but not match) the benchmark performance (or the inverse of the benchmark performance) times the multiple stated as the daily fund objective. Investors should understand the consequences of holding daily-rebalanced funds for periods longer than a single day and should actively manage and monitor their investments, as frequently as daily. A one-year period is used solely for illustrative purposes. Deviations from the benchmark return (or the inverse of the benchmark return) times the fund multiple can occur over periods as short as two days (each day as measured from NAV to NAV) and may also occur in periods of a single day, or even intra-day. To isolate the impact of daily leveraged or inverse leveraged exposure, these graphs assume: a) no fund expenses or transaction costs; b) borrowing/lending rates (to obtain required leveraged or inverse leveraged exposure) and cash reinvestment rates of zero percent; and c) the fund consistently maintaining perfect exposure (2x or -2x) as of the fund’s NAV time each day. If these assumptions were different, the fund’s performance would be different than that shown. If fund expenses, transaction costs and financing expenses greater than zero percent were included, the fund’s performance would also be different than shown. Each of the graphs also assumes a volatility rate of 35%, which is an approximate average of the five-year historical volatility rate of the most volatile benchmark referenced herein (the daily performance of Bloomberg WTI Crude Oil Subindex) as of December 31, 2018. A benchmark’s volatility rate is a statistical measure of the magnitude of fluctuations in its returns.

-7-

Table of Contents

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS. NO REPRESENTATION IS BEING MADE THAT ANY BENCHMARK OR FUND WILL OR IS LIKELY TO ACHIEVE GAINS OR LOSSES SIMILAR TO THOSE SHOWN OR WILL EXPERIENCE VOLATILITY SIMILAR TO THAT SHOWN. THE INFORMATION PROVIDED IN THE CHARTS BELOW IS FOR ILLUSTRATIVE PURPOSES ONLY.

The graph above shows a scenario where the benchmark, which exhibits day-to-day volatility, is flat or trendless over the year (i.e., provides a return of 0% over the course of the year), but the Ultra Fund (2x) and the UltraShort Fund (-2x) are both down.

-8-

Table of Contents

The graph above shows a scenario where the benchmark, which exhibits day-to-day volatility, is down over the year, but the Ultra Fund (2x) is down less than two times the benchmark and the UltraShort Fund (-2x) is up less than two times the inverse of the benchmark.

-9-

Table of Contents

The graph above shows a scenario where the benchmark, which exhibits day-to-day volatility, is up over the year, but the Ultra Fund (2x) is up less than two times the benchmark and the UltraShort Fund (-2x) is down more than two times the inverse of the benchmark.

-10-

Table of Contents

The historical five-year average volatility of the benchmarks utilized by the Funds ranges from 8.40% to 35.20%, as set forth in the table below.

| Benchmark |

Historical Five-Year Average Volatility Rate as of December 31, 2018 |

|||

| Bloomberg WTI Crude Oil SubindexSM |

35.20 | % | ||

| Bloomberg Gold SubindexSM |

13.38 | % | ||

| Bloomberg Silver SubindexSM |

22.92 | % | ||

| The U.S. dollar price of the euro |

8.40 | % | ||

Historical average volatility does not predict future volatility, which may be higher or lower than historical averages.

Fund performance for periods greater than a single day can be estimated given any set of assumptions for the following factors: a) benchmark volatility; b) benchmark performance; c) period of time; d) financing rates associated with leveraged exposure; and e) other Fund expenses. The tables below illustrate the impact of two factors that affect a geared fund’s performance: benchmark volatility and benchmark return. Benchmark volatility is a statistical measure of the magnitude of fluctuations in the returns of a benchmark and is calculated as the standard deviation of the natural logarithms of one plus the benchmark return (calculated daily), multiplied by the square root of the number of trading days per year (assumed to be 252). The tables show estimated fund returns for a number of combinations of benchmark volatility and benchmark return over a one-year period. To isolate the impact of daily leveraged or inverse leveraged exposure, these graphs assume: a) no fund expenses or transaction costs; b) borrowing/lending rates of zero percent (to obtain required leveraged or inverse leveraged exposure) and cash reinvestment rates of zero percent; and c) the fund consistently maintaining perfect exposure (2x or -2x) as of the fund’s NAV time each day. If these assumptions were different, the fund’s performance would be different than that shown. If fund expenses, transaction costs and financing expenses were included, the fund’s performance would be different than that shown. The first table below shows an example in which a geared fund has an investment objective to correspond (before fees and expenses) to two times (2x) the daily performance of a benchmark. The geared fund could incorrectly be expected to achieve a 20% return on a yearly basis if the benchmark return was 10%, absent the effects of compounding. However, as the table shows, with a benchmark volatility of 40%, such a fund would return 3.1%. In the charts below, shaded areas represent those scenarios where a geared fund with the investment objective described will outperform (i.e., return more than) the benchmark performance times the stated multiple in the fund’s investment objective; conversely, areas not shaded represent those scenarios where the fund will underperform (i.e., return less than) the benchmark performance times the multiple stated as the daily fund objective.

-11-

Table of Contents

Estimated Fund Return Over One Year When the Fund’s Objective is to Seek Daily Investment Results, Before Fees and Expenses, that Correspond to Two Times (2x) the Performance of a Benchmark for a Single Day.

| One Year | Two Times (2x) One Year |

Benchmark Volatility | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Benchmark Performance |

Benchmark Performance |

0% | 5% | 10% | 15% | 20% | 25% | 30% | 35% | 40% | 45% | 50% | 55% | 60% | 65% | 70% | ||||||||||||||||||||||||||||||||||||||||||||||||

| -60% |

-120 | % | -84.0 | % | -84.0 | % | -84.2 | % | -84.4 | % | -84.6 | % | -85.0 | % | -85.4 | % | -85.8 | % | -86.4 | % | -86.9 | % | -87.5 | % | -88.2 | % | -88.8 | % | -89.5 | % | -90.2 | % | ||||||||||||||||||||||||||||||||

| -55% |

-110 | % | -79.8 | % | -79.8 | % | -80.0 | % | -80.2 | % | -80.5 | % | -81.0 | % | -81.5 | % | -82.1 | % | -82.7 | % | -83.5 | % | -84.2 | % | -85.0 | % | -85.9 | % | -86.7 | % | -87.6 | % | ||||||||||||||||||||||||||||||||

| -50% |

-100 | % | -75.0 | % | -75.1 | % | -75.2 | % | -75.6 | % | -76.0 | % | -76.5 | % | -77.2 | % | -77.9 | % | -78.7 | % | -79.6 | % | -80.5 | % | -81.5 | % | -82.6 | % | -83.6 | % | -84.7 | % | ||||||||||||||||||||||||||||||||

| -45% |

-90 | % | -69.8 | % | -69.8 | % | -70.1 | % | -70.4 | % | -70.9 | % | -71.6 | % | -72.4 | % | -73.2 | % | -74.2 | % | -75.3 | % | -76.4 | % | -77.6 | % | -78.9 | % | -80.2 | % | -81.5 | % | ||||||||||||||||||||||||||||||||

| -40% |

-80 | % | -64.0 | % | -64.1 | % | -64.4 | % | -64.8 | % | -65.4 | % | -66.2 | % | -67.1 | % | -68.2 | % | -69.3 | % | -70.6 | % | -72.0 | % | -73.4 | % | -74.9 | % | -76.4 | % | -77.9 | % | ||||||||||||||||||||||||||||||||

| -35% |

-70 | % | -57.8 | % | -57.9 | % | -58.2 | % | -58.7 | % | -59.4 | % | -60.3 | % | -61.4 | % | -62.6 | % | -64.0 | % | -65.5 | % | -67.1 | % | -68.8 | % | -70.5 | % | -72.3 | % | -74.1 | % | ||||||||||||||||||||||||||||||||

| -30% |

-60 | % | -51.0 | % | -51.1 | % | -51.5 | % | -52.1 | % | -52.9 | % | -54.0 | % | -55.2 | % | -56.6 | % | -58.2 | % | -60.0 | % | -61.8 | % | -63.8 | % | -65.8 | % | -67.9 | % | -70.0 | % | ||||||||||||||||||||||||||||||||

| -25% |

-50 | % | -43.8 | % | -43.9 | % | -44.3 | % | -45.0 | % | -46.0 | % | -47.2 | % | -48.6 | % | -50.2 | % | -52.1 | % | -54.1 | % | -56.2 | % | -58.4 | % | -60.8 | % | -63.1 | % | -65.5 | % | ||||||||||||||||||||||||||||||||

| -20% |

-40 | % | -36.0 | % | -36.2 | % | -36.6 | % | -37.4 | % | -38.5 | % | -39.9 | % | -41.5 | % | -43.4 | % | -45.5 | % | -47.7 | % | -50.2 | % | -52.7 | % | -55.3 | % | -58.1 | % | -60.8 | % | ||||||||||||||||||||||||||||||||

| -15% |

-30 | % | -27.8 | % | -27.9 | % | -28.5 | % | -29.4 | % | -30.6 | % | -32.1 | % | -34.0 | % | -36.1 | % | -38.4 | % | -41.0 | % | -43.7 | % | -46.6 | % | -49.6 | % | -52.6 | % | -55.7 | % | ||||||||||||||||||||||||||||||||

| -10% |

-20 | % | -19.0 | % | -19.2 | % | -19.8 | % | -20.8 | % | -22.2 | % | -23.9 | % | -26.0 | % | -28.3 | % | -31.0 | % | -33.8 | % | -36.9 | % | -40.1 | % | -43.5 | % | -46.9 | % | -50.4 | % | ||||||||||||||||||||||||||||||||

| -5% |

-10 | % | -9.8 | % | -10.0 | % | -10.6 | % | -11.8 | % | -13.3 | % | -15.2 | % | -17.5 | % | -20.2 | % | -23.1 | % | -26.3 | % | -29.7 | % | -33.3 | % | -37.0 | % | -40.8 | % | -44.7 | % | ||||||||||||||||||||||||||||||||

| 0% |

0 | % | 0.0 | % | -0.2 | % | -1.0 | % | -2.2 | % | -3.9 | % | -6.1 | % | -8.6 | % | -11.5 | % | -14.8 | % | -18.3 | % | -22.1 | % | -26.1 | % | -30.2 | % | -34.5 | % | -38.7 | % | ||||||||||||||||||||||||||||||||

| 5% |

10 | % | 10.3 | % | 10.0 | % | 9.2 | % | 7.8 | % | 5.9 | % | 3.6 | % | 0.8 | % | -2.5 | % | -6.1 | % | -10.0 | % | -14.1 | % | -18.5 | % | -23.1 | % | -27.7 | % | -32.5 | % | ||||||||||||||||||||||||||||||||

| 10% |

20 | % | 21.0 | % | 20.7 | % | 19.8 | % | 18.3 | % | 16.3 | % | 13.7 | % | 10.6 | % | 7.0 | % | 3.1 | % | -1.2 | % | -5.8 | % | -10.6 | % | -15.6 | % | -20.7 | % | -25.9 | % | ||||||||||||||||||||||||||||||||

| 15% |

30 | % | 32.3 | % | 31.9 | % | 30.9 | % | 29.3 | % | 27.1 | % | 24.2 | % | 20.9 | % | 17.0 | % | 12.7 | % | 8.0 | % | 3.0 | % | -2.3 | % | -7.7 | % | -13.3 | % | -19.0 | % | ||||||||||||||||||||||||||||||||

| 20% |

40 | % | 44.0 | % | 43.6 | % | 42.6 | % | 40.8 | % | 38.4 | % | 35.3 | % | 31.6 | % | 27.4 | % | 22.7 | % | 17.6 | % | 12.1 | % | 6.4 | % | 0.5 | % | -5.6 | % | -11.8 | % | ||||||||||||||||||||||||||||||||

| 25% |

50 | % | 56.3 | % | 55.9 | % | 54.7 | % | 52.8 | % | 50.1 | % | 46.8 | % | 42.8 | % | 38.2 | % | 33.1 | % | 27.6 | % | 21.7 | % | 15.5 | % | 9.0 | % | 2.4 | % | -4.3 | % | ||||||||||||||||||||||||||||||||

| 30% |

60 | % | 69.0 | % | 68.6 | % | 67.3 | % | 65.2 | % | 62.4 | % | 58.8 | % | 54.5 | % | 49.5 | % | 44.0 | % | 38.0 | % | 31.6 | % | 24.9 | % | 17.9 | % | 10.8 | % | 3.5 | % | ||||||||||||||||||||||||||||||||

| 35% |

70 | % | 82.3 | % | 81.8 | % | 80.4 | % | 78.2 | % | 75.1 | % | 71.2 | % | 66.6 | % | 61.2 | % | 55.3 | % | 48.8 | % | 41.9 | % | 34.7 | % | 27.2 | % | 19.4 | % | 11.7 | % | ||||||||||||||||||||||||||||||||

| 40% |

80 | % | 96.0 | % | 95.5 | % | 94.0 | % | 91.6 | % | 88.3 | % | 84.1 | % | 79.1 | % | 73.4 | % | 67.0 | % | 60.1 | % | 52.6 | % | 44.8 | % | 36.7 | % | 28.5 | % | 20.1 | % | ||||||||||||||||||||||||||||||||

| 45% |

90 | % | 110.3 | % | 109.7 | % | 108.2 | % | 105.6 | % | 102.0 | % | 97.5 | % | 92.2 | % | 86.0 | % | 79.2 | % | 71.7 | % | 63.7 | % | 55.4 | % | 46.7 | % | 37.8 | % | 28.8 | % | ||||||||||||||||||||||||||||||||

| 50% |

100 | % | 125.0 | % | 124.4 | % | 122.8 | % | 120.0 | % | 116.2 | % | 111.4 | % | 105.6 | % | 99.1 | % | 91.7 | % | 83.8 | % | 75.2 | % | 66.3 | % | 57.0 | % | 47.5 | % | 37.8 | % | ||||||||||||||||||||||||||||||||

| 55% |

110 | % | 140.3 | % | 139.7 | % | 137.9 | % | 134.9 | % | 130.8 | % | 125.7 | % | 119.6 | % | 112.6 | % | 104.7 | % | 96.2 | % | 87.1 | % | 77.5 | % | 67.6 | % | 57.5 | % | 47.2 | % | ||||||||||||||||||||||||||||||||

| 60% |

120 | % | 156.0 | % | 155.4 | % | 153.5 | % | 150.3 | % | 146.0 | % | 140.5 | % | 134.0 | % | 126.5 | % | 118.1 | % | 109.1 | % | 99.4 | % | 89.2 | % | 78.6 | % | 67.8 | % | 56.8 | % | ||||||||||||||||||||||||||||||||

-12-

Table of Contents

Estimated Fund Return Over One Year When the Fund’s Objective is to Seek Daily Investment Results, Before Fees and Expenses, that Correspond to Two Times the Inverse (-2x) of the Performance of a Benchmark for a Single Day.

| One Year | Two Times Inverse (-2x) of One Year |

Benchmark Volatility | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Benchmark Performance |

Benchmark Performance |

0% | 5% | 10% | 15% | 20% | 25% | 30% | 35% | 40% | 45% | 50% | 55% | 60% | 65% |

70% | ||||||||||||||||||||||||||||||||||||||||||||||||

| -60% |

120 | % | 525.0 | % | 520.3 | % | 506.5 | % | 484.2 | % | 454.3 | % | 418.1 | % | 377.1 | % | 332.8 | % | 286.7 | % | 240.4 | % | 195.2 | % | 152.2 | % | 112.2 | % | 76.0 | % | 43.7 | % | ||||||||||||||||||||||||||||||||

| -55% |

110 | % | 393.8 | % | 390.1 | % | 379.2 | % | 361.6 | % | 338.0 | % | 309.4 | % | 277.0 | % | 242.0 | % | 205.6 | % | 169.0 | % | 133.3 | % | 99.3 | % | 67.7 | % | 39.0 | % | 13.5 | % | ||||||||||||||||||||||||||||||||

| -50% |

100 | % | 300.0 | % | 297.0 | % | 288.2 | % | 273.9 | % | 254.8 | % | 231.6 | % | 205.4 | % | 177.0 | % | 147.5 | % | 117.9 | % | 88.9 | % | 61.4 | % | 35.8 | % | 12.6 | % | -8.0 | % | ||||||||||||||||||||||||||||||||

| -45% |

90 | % | 230.6 | % | 228.1 | % | 220.8 | % | 209.0 | % | 193.2 | % | 174.1 | % | 152.4 | % | 128.9 | % | 104.6 | % | 80.1 | % | 56.2 | % | 33.4 | % | 12.3 | % | -6.9 | % | -24.0 | % | ||||||||||||||||||||||||||||||||

| -40% |

80 | % | 177.8 | % | 175.7 | % | 169.6 | % | 159.6 | % | 146.4 | % | 130.3 | % | 112.0 | % | 92.4 | % | 71.9 | % | 51.3 | % | 31.2 | % | 12.1 | % | -5.7 | % | -21.8 | % | -36.1 | % | ||||||||||||||||||||||||||||||||

| -35% |

70 | % | 136.7 | % | 134.9 | % | 129.7 | % | 121.2 | % | 109.9 | % | 96.2 | % | 80.7 | % | 63.9 | % | 46.5 | % | 28.9 | % | 11.8 | % | -4.5 | % | -19.6 | % | -33.4 | % | -45.6 | % | ||||||||||||||||||||||||||||||||

| -30% |

60 | % | 104.1 | % | 102.6 | % | 98.1 | % | 90.8 | % | 81.0 | % | 69.2 | % | 55.8 | % | 41.3 | % | 26.3 | % | 11.2 | % | -3.6 | % | -17.6 | % | -30.7 | % | -42.5 | % | -53.1 | % | ||||||||||||||||||||||||||||||||

| -25% |

50 | % | 77.8 | % | 76.4 | % | 72.5 | % | 66.2 | % | 57.7 | % | 47.4 | % | 35.7 | % | 23.1 | % | 10.0 | % | -3.2 | % | -16.0 | % | -28.3 | % | -39.6 | % | -49.9 | % | -59.1 | % | ||||||||||||||||||||||||||||||||

| -20% |

40 | % | 56.3 | % | 55.1 | % | 51.6 | % | 46.1 | % | 38.6 | % | 29.5 | % | 19.3 | % | 8.2 | % | -3.3 | % | -14.9 | % | -26.2 | % | -36.9 | % | -46.9 | % | -56.0 | % | -64.1 | % | ||||||||||||||||||||||||||||||||

| -15% |

30 | % | 38.4 | % | 37.4 | % | 34.3 | % | 29.4 | % | 22.8 | % | 14.7 | % | 5.7 | % | -4.2 | % | -14.4 | % | -24.6 | % | -34.6 | % | -44.1 | % | -53.0 | % | -61.0 | % | -68.2 | % | ||||||||||||||||||||||||||||||||

| -10% |

20 | % | 23.5 | % | 22.5 | % | 19.8 | % | 15.4 | % | 9.5 | % | 2.3 | % | -5.8 | % | -14.5 | % | -23.6 | % | -32.8 | % | -41.7 | % | -50.2 | % | -58.1 | % | -65.2 | % | -71.6 | % | ||||||||||||||||||||||||||||||||

| -5% |

10 | % | 10.8 | % | 10.0 | % | 7.5 | % | 3.6 | % | -1.7 | % | -8.1 | % | -15.4 | % | -23.3 | % | -31.4 | % | -39.6 | % | -47.7 | % | -55.3 | % | -62.4 | % | -68.8 | % | -74.5 | % | ||||||||||||||||||||||||||||||||

| 0% |

0 | % | 0.0 | % | -0.7 | % | -3.0 | % | -6.5 | % | -11.3 | % | -17.1 | % | -23.7 | % | -30.8 | % | -38.1 | % | -45.5 | % | -52.8 | % | -59.6 | % | -66.0 | % | -71.8 | % | -77.0 | % | ||||||||||||||||||||||||||||||||

| 5% |

-10 | % | -9.3 | % | -10.0 | % | -12.0 | % | -15.2 | % | -19.6 | % | -24.8 | % | -30.8 | % | -37.2 | % | -43.9 | % | -50.6 | % | -57.2 | % | -63.4 | % | -69.2 | % | -74.5 | % | -79.1 | % | ||||||||||||||||||||||||||||||||

| 10% |

-20 | % | -17.4 | % | -18.0 | % | -19.8 | % | -22.7 | % | -26.7 | % | -31.5 | % | -36.9 | % | -42.8 | % | -48.9 | % | -55.0 | % | -61.0 | % | -66.7 | % | -71.9 | % | -76.7 | % | -81.0 | % | ||||||||||||||||||||||||||||||||

| 15% |

-30 | % | -24.4 | % | -25.0 | % | -26.6 | % | -29.3 | % | -32.9 | % | -37.3 | % | -42.3 | % | -47.6 | % | -53.2 | % | -58.8 | % | -64.3 | % | -69.5 | % | -74.3 | % | -78.7 | % | -82.6 | % | ||||||||||||||||||||||||||||||||

| 20% |

-40 | % | -30.6 | % | -31.1 | % | -32.6 | % | -35.1 | % | -38.4 | % | -42.4 | % | -47.0 | % | -51.9 | % | -57.0 | % | -62.2 | % | -67.2 | % | -72.0 | % | -76.4 | % | -80.4 | % | -84.0 | % | ||||||||||||||||||||||||||||||||

| 25% |

-50 | % | -36.0 | % | -36.5 | % | -37.9 | % | -40.2 | % | -43.2 | % | -46.9 | % | -51.1 | % | -55.7 | % | -60.4 | % | -65.1 | % | -69.8 | % | -74.2 | % | -78.3 | % | -82.0 | % | -85.3 | % | ||||||||||||||||||||||||||||||||

| 30% |

-60 | % | -40.8 | % | -41.3 | % | -42.6 | % | -44.7 | % | -47.5 | % | -50.9 | % | -54.8 | % | -59.0 | % | -63.4 | % | -67.8 | % | -72.0 | % | -76.1 | % | -79.9 | % | -83.3 | % | -86.4 | % | ||||||||||||||||||||||||||||||||

| 35% |

-70 | % | -45.1 | % | -45.5 | % | -46.8 | % | -48.7 | % | -51.3 | % | -54.5 | % | -58.1 | % | -62.0 | % | -66.0 | % | -70.1 | % | -74.1 | % | -77.9 | % | -81.4 | % | -84.6 | % | -87.4 | % | ||||||||||||||||||||||||||||||||

| 40% |

-80 | % | -49.0 | % | -49.4 | % | -50.5 | % | -52.3 | % | -54.7 | % | -57.7 | % | -61.1 | % | -64.7 | % | -68.4 | % | -72.2 | % | -75.9 | % | -79.4 | % | -82.7 | % | -85.6 | % | -88.3 | % | ||||||||||||||||||||||||||||||||

| 45% |

-90 | % | -52.4 | % | -52.8 | % | -53.8 | % | -55.5 | % | -57.8 | % | -60.6 | % | -63.7 | % | -67.1 | % | -70.6 | % | -74.1 | % | -77.5 | % | -80.8 | % | -83.8 | % | -86.6 | % | -89.1 | % | ||||||||||||||||||||||||||||||||

| 50% |

-100 | % | -55.6 | % | -55.9 | % | -56.9 | % | -58.5 | % | -60.6 | % | -63.2 | % | -66.1 | % | -69.2 | % | -72.5 | % | -75.8 | % | -79.0 | % | -82.1 | % | -84.9 | % | -87.5 | % | -89.8 | % | ||||||||||||||||||||||||||||||||

| 55% |

-110 | % | -58.4 | % | -58.7 | % | -59.6 | % | -61.1 | % | -63.1 | % | -65.5 | % | -68.2 | % | -71.2 | % | -74.2 | % | -77.3 | % | -80.3 | % | -83.2 | % | -85.9 | % | -88.3 | % | -90.4 | % | ||||||||||||||||||||||||||||||||

| 60% |

-120 | % | -60.9 | % | -61.2 | % | -62.1 | % | -63.5 | % | -65.4 | % | -67.6 | % | -70.2 | % | -73.0 | % | -75.8 | % | -78.7 | % | -81.5 | % | -84.2 | % | -86.7 | % | -89.0 | % | -91.0 | % | ||||||||||||||||||||||||||||||||

The foregoing tables are intended to isolate the effect of benchmark volatility and benchmark performance on the return of leveraged or inverse leveraged funds. The Funds’ actual returns may be greater or less than the returns shown above.

Correlation Risks