Use these links to rapidly review the document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2013 | ||

Or | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

Commission File Number: 001-33783

THOMPSON CREEK METALS COMPANY INC.

(Exact name of registrant as specified in its charter)

British Columbia, Canada (State or other jurisdiction of incorporation or organization) | 98-0583591 (I.R.S. Employer Identification No.) | |

26 West Dry Creek Circle, Suite 810, Littleton, CO (Address of principal executive offices) | 80120 (Zip code) | |

(303) 761-8801 | ||

(Registrant's telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered: | |||

Common Stock, no par value | New York Stock Exchange | |||

Tangible Equity Units | New York Stock Exchange | |||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment of this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |||

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes o No ý

As of February 17, 2014, there were 171,463,409 shares of the registrant's common stock, no par value, outstanding.

As of June 30, 2013, the last day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the registrant's common equity held by non-affiliates was approximately $517 million, based on the closing price of the registrant's common stock on such date as reported on the New York Stock Exchange. For purposes of this calculation, shares of common stock held by executive officers, directors and holders of greater than 10% of the registrant's outstanding common stock are assumed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference from the registrant's definitive proxy statement for the 2014 annual meeting of stockholders to be filed no later than 120 days after the end of the registrant's fiscal year ended December 31, 2013.

Thompson Creek Metals Company Inc.

INDEX TO FORM 10-K

Page | ||

2

Use these links to rapidly review the document

Statement Regarding Forward-Looking Information

Certain statements in this report (including information incorporated by reference) are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and applicable Canadian securities legislation, and are intended to be covered by the safe harbors provided by these regulations. These forward-looking statements can, in some cases, be identified by the use of terms such as "believe," "project," "expect," "anticipate," "estimate," "intend," "strategy," "future," "opportunity," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," and similar expressions. Our forward-looking statements may include, without limitation, statements with respect to:

• | future financial or operating performance of the Company or its subsidiaries and its projects; |

• | the availability of, and terms and costs related to, future borrowing, debt repayment and financing; |

• | future inventory, production, sales, cash costs, capital expenditures and exploration expenditures; |

• | expected concentrate and recovery grades; |

• | estimates of mineral reserves and resources, including estimated mine life and annual production; |

• | projected timing to ramp-up to design capacity at Mt. Milligan Mine; |

• | the projected development of our development properties and future exploration at our operations; |

• | future concentrate shipment dates and shipment sizes; |

• | future operating plans and goals; |

• | future ability to attract and retain qualified and experienced personnel; and |

• | future molybdenum, copper and gold prices. |

Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in Item 1A, Risk Factors and elsewhere in this report. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

PART I

In this report, references to “we,” “our” and “us” mean Thompson Creek Metals Company Inc. together with our subsidiaries, unless the context otherwise requires. All dollar amounts in this report are expressed in United States dollars (“$”), unless otherwise indicated. Canadian currency is denoted as “C$.” Financial information is presented in accordance with accounting principles generally accepted in the United States (“US GAAP”). References to “Notes” refer to the Notes to Consolidated Financial Statements included in Item 8 herein.

ITEMS 1. AND 2. BUSINESS AND PROPERTIES

GENERAL

Thompson Creek Metals Company Inc. is a diversified, North American mining company. We operate a copper and gold mine, two primary molybdenum mines, and a metallurgical roasting facility. Our Mt. Milligan Mine (“Mt. Milligan Mine”) is an open pit copper-gold mine and concentrator in British Columbia, Canada; our Thompson Creek Mine (“TC Mine”) is an open-pit molybdenum mine and concentrator in Idaho, USA; our Endako Mine is an open-pit molybdenum mine, concentrator and roaster in British Columbia, Canada (in which we own a 75% joint venture interest) (“Endako Mine”); and our metallurgical roasting facility in Pennsylvania, USA (the “Langeloth Facility”) roasts molybdenum concentrate and other metals for us and for third party customers. As of the date hereof, we plan to put TC Mine on care and maintenance when the mining of Phase 7 is completed, which is expected to be in the fourth quarter of 2014. We intend to preserve the assets at TC Mine while it is on care and maintenance to enable us to re-commence operations if and when molybdenum market conditions improve and we continue to evaluate potential economically viable options for Phase 8.

Our principal assets are our ore reserves. At December 31, 2013, the consolidated proven and probable reserve for Mt. Milligan Mine totaled 2.1 billion pounds of contained copper and 6.0 million ounces of contained gold. At December 31, 2013, the consolidated proven and probable reserves for TC Mine and Endako Mine totaled 197.9 million pounds of contained molybdenum, with 62% of these reserves from TC Mine and 38% from Endako Mine (stated on a 100% basis). Detailed information regarding our reserves is provided below in “Mineral Reserves.”

3

We also have a copper, molybdenum and silver exploration property located in British Columbia, Canada (the “Berg Property”) and a gold exploration property located in Nunavut, Canada (the “Maze Lake Property”). In October 2013, we relinquished our option to develop the Davidson exploration property located in British Columbia, Canada that we had held since 2005.

The following map sets forth the locations of our mines, metallurgical facility, exploration properties and corporate office:

See Note 23 for more information about our operating segments.

Our corporate headquarters are in Littleton, Colorado, USA. We are a corporation governed by the Business Corporations Act (British Columbia). We were organized in 2000 as a corporation under the laws of Ontario, Canada, and were continued as a corporation under the laws of British Columbia, Canada in 2008. In October 2006, we acquired Thompson Creek Metals Company USA, then a privately-held company incorporated and headquartered in the United States, and in so doing acquired TC Mine, Endako Mine and the Langeloth Facility. In October 2010, we acquired Terrane Metals Corp. (“Terrane”), an exploration and development company incorporated and headquartered in British Columbia, Canada, and in so doing acquired the Mt. Milligan development project and the Berg and Maze Lake Properties.

OUR PRODUCTS

Copper

General

We produced 10.9 million pounds of copper in concentrate in 2013 containing 10.4 million pounds of payable copper. In September 2013, the first copper-gold concentrate was produced at Mt. Milligan Mine, with start-up and commencement of production as of that date. Production from Mt. Milligan Mine is in the form of saleable concentrate that is sold to smelters for further treatment and refining and to merchants who transact with smelters. In 2013, 2% of our product sales were attributable to copper.

Copper Uses

Copper is a malleable and ductile element that is an excellent conductor of heat and electricity as well as being corrosion-resistant and antimicrobial. Refined copper is incorporated into wire and cable products for use in the construction, electric utility, communications and transportation industries. Copper is also used in industrial equipment and machinery, consumer products and a variety of other electrical and electronic applications and is also used to make brass. Copper substitutes include aluminum, plastics, stainless steel and fiber optics. Refined, or cathode, copper is also an internationally traded commodity.

4

According to the Copper Development Association Inc., a trade association, copper’s world-wide end-use markets in 2012 (and their estimated shares of total consumption) were:

• | Building construction—43% |

• | Electrical and electronic products—20% |

• | Transportation equipment—18% |

• | Consumer and general products—12% |

• | Industrial machinery and equipment—7% |

Copper Supply

A combination of current mine production and recycled scrap material make up the annual copper supply.

Copper Price

Copper is an internationally traded commodity, and its prices are determined by the major metals exchanges: the London Metal Exchange (“LME”), the Shanghai Futures Exchange and the COMEX division of the New York Mercantile Exchange. Prices on these exchanges generally reflect the worldwide balance of copper supply and demand and can be volatile and cyclical. In general, demand for copper reflects the rate of underlying world economic growth, particularly in industrial production and construction.

The following table shows the high, low and average daily LME spot copper prices in US dollars per pound over the past ten years:

Year | High | Low | Average |

2004 | $1.49 | $1.06 | $1.30 |

2005 | 2.11 | 1.39 | 1.67 |

2006 | 3.99 | 2.05 | 3.05 |

2007 | 3.76 | 2.40 | 3.23 |

2008 | 4.07 | 1.25 | 3.15 |

2009 | 3.33 | 1.38 | 2.34 |

2010 | 4.42 | 2.76 | 3.42 |

2011 | 4.62 | 3.05 | 4.00 |

2012 | 3.96 | 3.30 | 3.61 |

2013 | 3.75 | 3.01 | 3.32 |

On February 17, 2014, the copper closing price on the LME was $3.27 per pound.

Gold

General

We produced 21,107 ounces of gold in concentrate in 2013 containing 20,374 ounces of payable gold. In September 2013, the first copper-gold concentrate was produced at Mt. Milligan Mine, with start-up and commencement of production as of that date. Production from Mt. Milligan Mine is in the form of saleable concentrate that is sold to smelters for further treatment and refining and to merchants who transact with smelters. In 2013, 1% of our product sales were attributable to gold.

Gold Uses

Gold generally is used for fabrication or investment. Fabricated gold has a variety of end uses, including jewelry, electronics, dentistry, industrial and decorative uses, medals, medallions and official coins. Gold investors buy gold bullion, official coins and jewelry.

Gold Supply

A combination of current mine production, recycling and draw-down of existing gold stocks held by governments, financial institutions, industrial organizations and private individuals make up the annual world-wide gold supply.

Gold Price

The price of gold is volatile and is affected by numerous factors. Factors affecting the market for gold include the sale or purchase of gold by various central banks and financial institutions, inflation, recession, fluctuation in the relative values of the

5

US dollar and foreign currencies, changes in global and regional gold demand and political and economic conditions throughout the world.

The following table presents the high, low and average London P.M. fixed prices for gold per ounce on the London Bullion Market in US dollars over the past ten years:

Year | High | Low | Average |

2004 | $454 | $375 | $410 |

2005 | 537 | 411 | 445 |

2006 | 725 | 525 | 604 |

2007 | 841 | 608 | 695 |

2008 | 1,011 | 713 | 872 |

2009 | 1,213 | 810 | 972 |

2010 | 1,421 | 1,058 | 1,225 |

2011 | 1,895 | 1,319 | 1,572 |

2012 | 1,792 | 1,540 | 1,669 |

2013 | 1,694 | 1,195 | 1,418 |

On February 17, 2014, the gold closing price on the London Bullion Market was $1,327 per ounce.

Copper and Gold Sales

We are party to three concentrate sales agreements for the sale of copper-gold concentrate produced at Mt. Milligan Mine. Pursuant to these agreements, we have agreed to sell an aggregate of approximately 85% of the copper-gold concentrate produced at Mt. Milligan Mine during 2013 and 2014 and an aggregate of approximately 120,000 dry metric tons in each of the two calendar years thereafter. Under one of the agreements, we have the option to sell to the counterparty, and the counterparty has the obligation to purchase from us, up to 40,000 dry metric tons of additional concentrate per year during each of 2015 and 2016. Pricing under these concentrate sales agreements will be determined by reference to specified published reference prices during the applicable quotation periods. Payment for the concentrate will be based on the price for the agreed copper and gold content of the parcels delivered, less smelting and refining charges and certain other deductions, if applicable. The copper smelting and refining charges will be negotiated in good faith and agreed by the parties for each contract year based on terms generally acknowledged as industry benchmark terms. The gold refining charges are as specified in the agreements.

In three separate transactions that were consummated in 2010, 2011 and 2012, we committed to sell an aggregate of 52.25% of the refined gold production from Mt. Milligan Mine to a subsidiary of Royal Gold, Inc. (“Royal Gold”). We received upfront cash payments totaling $781.5 million, and Royal Gold agreed to pay $435 per ounce, or the prevailing market rate if lower than $435 per ounce, when the gold is delivered. We used the funds we received from Royal Gold in our purchase of Terrane and in the construction of Mt. Milligan Mine. For more information about these transactions, see Note 10.

Molybdenum

General

We produced 29.9 million pounds of molybdenum in 2013. We are a significant molybdenum supplier to the global steel and chemicals sectors. We currently source molybdenum from our two primary mines and from purchased molybdenum concentrates. Our principal products are molybdic oxide (also known as roasted molybdenum concentrate) and ferromolybdenum. In 2013, these two commodity products collectively accounted for approximately 75% of our molybdenum sales. Other products we produce include high soluble technical oxide, pure molybdenum trioxide and high purity molybdenum disulfide. In 2013, 97% of our product sales were attributable to molybdenum.

Molybdenum Uses

Molybdenum is an industrial metal principally used for metallurgical applications as a ferro-alloy in steels where high strength, temperature-resistant or corrosion-resistant properties are sought. The addition of molybdenum enhances the strength, toughness and wear- and corrosion-resistance in steels when added as an alloy. Molybdenum is used in major industries including chemical and petro-chemical processing, oil and gas for drilling and pipelines, power generation, automotive and aerospace. Molybdenum is also widely used in non-metallurgical applications such as petroleum catalysts, lubricants, flame-retardants in plastics, water treatment and as a pigment.

6

According to the International Molybdenum Association, a trade association, the world-wide end-use markets for mined molybdenum ore (not scrap material recycled by chemical processes or re-smelting) in 2012 (and their estimated share of total consumption) were:

• | Construction steel—43% |

• | Stainless steel—22% |

• | Chemicals—12% |

• | Tool and high-speed steel—8% |

• | Cast iron—8% |

• | Molybdenum metal—5% |

• | Super alloys—3% |

Molybdenum Supply

A combination of current mine production and recycled scrap material make up the annual molybdenum supply. Molybdenum is mined from both primary mines, ones that contain only molybdenum as an economic mineral, and as a by-product from certain copper mines.

Molybdenum Price

Molybdenum prices are determined by transacting parties rather than by a metals exchange. Reference prices for molybdenum are available in several publications, including Platts Metals Week, Ryan’s Notes and Metal Bulletin. Molybdenum prices generally reflect the worldwide balance of molybdenum supply and demand and can be volatile and cyclical. In general, demand for molybdenum reflects the rate of underlying world economic growth, particularly in industrial production and construction.

The table below shows the high, low and average prices quoted in Platts Metals Week for molybdenum in US dollars per pound for the last 10 years:

Molybdenum (Dealer oxide Platts Metals Week) | ||||||

Year | High | Low | Average | |||

2004 | $33.25 | $7.20 | $16.20 | |||

2005 | 40.00 | 24.00 | 31.98 | |||

2006 | 28.40 | 20.50 | 24.75 | |||

2007 | 34.25 | 24.30 | 30.00 | |||

2008 | 34.00 | 8.25 | 28.94 | |||

2009 | 18.30 | 7.70 | 11.08 | |||

2010 | 18.60 | 11.75 | 15.72 | |||

2011 | 18.00 | 12.60 | 15.49 | |||

2012 | 14.78 | 10.90 | 12.74 | |||

2013 | 12.00 | 9.08 | 10.30 | |||

On February 17, 2014, the average molybdenum price quoted in Platts Metals Week was $9.74 per pound.

MINES

The tables below set forth certain operating and production data for each of the periods indicated:

7

Summary operational statistics

Years Ended December 31, | ||||||||||

2013 | 2012 | 2011 | 2010 | 2009 | ||||||

Copper | ||||||||||

Payable production (000's lb) | 10,352 | — | — | — | — | |||||

Cash cost ($/payable lb produced) - By-Product (1) | $7.76 | — | — | — | — | |||||

Cash cost ($/payable lb produced) - Co-Product (1) | $5.36 | — | — | — | — | |||||

Gold | ||||||||||

Payable production (troy oz) | 20,374 | — | — | — | — | |||||

Cash cost ($/payable troy oz produced) - Co-Product (1) | $1,456 | — | — | — | — | |||||

Molybdenum - Produced | ||||||||||

TC Mine | ||||||||||

Production (000's lb) | 20,889 | 16,238 | 21,368 | 25,071 | 17,813 | |||||

Cash cost ($/lb produced) | $4.57 | $8.06 | $6.66 | $5.20 | $5.72 | |||||

Endako Mine (75%) | ||||||||||

Production (000's lb) | 9,056 | 6,191 | 6,977 | 7,506 | 7,447 | |||||

Cash cost ($/lb produced) | $10.93 | $15.42 | $11.86 | $8.89 | $6.13 | |||||

Total molybdenum production (2) | 29,945 | 22,429 | 28,345 | 32,577 | 25,260 | |||||

Total average cash cost ($/lb produced) (1) | $6.49 | $10.09 | $7.94 | $6.07 | $5.84 | |||||

Molybdenum - Processed | ||||||||||

Langeloth Facility | ||||||||||

Molybdenum Sold from Purchased Product (000's lb) | 5,054 | 10,542 | 8,245 | 7,855 | 4,683 | |||||

Toll Roasted and Upgraded Molybdenum Processed (000's lb) | 3,782 | 6,296 | 7,071 | 5,703 | 3,841 | |||||

Roasted Metal Products Processed (000's lb) | 17,784 | 12,153 | 17,090 | 18,334 | 10,030 | |||||

_______________________________________________________________________________

(1) | See “Non-GAAP Financial Measures” for the definition and reconciliation of these non-GAAP measures. |

(2) | Mined production pounds reflected are molybdenum oxide and high performance molybdenum disulfide ("HPM") from our share of production from our mines but excludes molybdenum processed from purchased products. |

Properties net book value

At December 31, 2013, the net book values of our properties were as follows:

Property | Net Book Value |

(US$ millions) | |

Mt. Milligan | $2,242.8 |

TC Mine | 40.6 |

Endako | 115.6 |

Berg property | 36.6 |

Maze Lake property | 2.9 |

Langeloth Facility | 88.6 |

Corporate and other | 10.9 |

Total | $2,538.0 |

8

Mt. Milligan Mine

General

Mt. Milligan Mine is a conventional truck-shovel open-pit copper and gold mine and concentrator with a 66,000 ton per day design capacity copper flotation processing plant. Mt. Milligan Mine has an estimated life of approximately 22 years (based on a copper price of $1.60 per pound and a gold price of $690 per ounce) and estimated average annual production of 81 million pounds of copper and 194,500 ounces of gold, each in concentrate, over the life of the mine.

In October 2010, we acquired the Mt. Milligan development project as part of our acquisition of Terrane, and began construction shortly thereafter. On August 15, 2013, the phased start-up of the mine operation began with the first feed to the concentrator. In September 2013, the first copper-gold concentrate was produced at the mine. Mt. Milligan Mine reached commercial production as of February 18, 2014, defined as operation of the mill at 60% design capacity mill throughput for 30 days.

Mt. Milligan Mine is located within the Omenica Mining Division in North Central British Columbia, Canada, approximately 95 miles northwest of Prince George, 50 miles north of Fort St. James and 60 miles west of Mackenzie. Mt. Milligan Mine is accessible by commercial air carrier to Prince George, British Columbia, then by vehicle from the east via Mackenzie on the Finlay Philip Forest Service Road and the North Philip Forest Service Road, and from the west via Fort St. James on the North Road and Rainbow Forest Service Road. Road travel to the Mt. Milligan property site is 482 miles from Prince Rupert and 158 miles from Prince George. The forestry-based communities of Mackenzie and Fort St. James are within daily commuting distance of the Mt. Milligan site, and both of these communities are serviced by rail. The infrastructure at Mt. Milligan Mine includes a concentrator, a tailings storage facility and reclaim water ponds, an administrative building and change house, a truckshop/warehouse, a permanent operations residence, a first aid station, an emergency vehicle storage, a laboratory and sewage and water treatment facilities. The power supply is provided by B.C. Hydro via a 57-mile hydroelectric power line. We transport concentrate from the mine site to Mackenzie via truck, and from there transport it by railway to the port of Vancouver for shipment to customers.

Mt. Milligan Mine includes 100 claims and one mining lease with a combined area of 114,339 acres. The single mining lease that was issued to Terrane on September 9, 2009, expires on September 9, 2029, and requires a lease payment of approximately $100,000, due annually on September 9. Mineral claims are subject to exploration expenditure obligations, or we may choose to pay annual fees to the Province in lieu of exploration expenditures. All mineral claims are in good standing and expiry dates range from September 2014 to December 2014. We expect to renew such mineral claims in the ordinary course.

A 2% net smelter return royalty, commencing in the third year of commercial production, is payable to a previous owner of the property. The royalty holder, H.R.S. Resources Corp. (successor in interest to Richard Haslinger), has the right to receive annual advances of C$20,000, first payable on or before December 31, 1994, and on each anniversary after the first advance until the commencement of commercial production, which payments have been maintained. We have a right of first refusal on any proposed disposition of the net smelter return royalty by H.R.S. Resources Corp.

9

We have also agreed to make certain payments to a First Nation over the course of the life of mine. We do not consider the amounts of these payments to be material to our business. The terms of the agreement under which we have agreed to make these payments are confidential.

As described above, in three separate transactions that were consummated in 2010, 2011 and 2012, we committed to sell an aggregate of 52.25% of the refined gold production from Mt. Milligan Mine to Royal Gold. For more information about these transactions, see Note 10.

History

Limited exploration activity on Mt. Milligan was first recorded in 1937. In 1984, prospector Richard Haslinger and BP Resources Canada Limited located claims on the site. In 1986, Lincoln Resources Inc. ("Lincoln") optioned the claims and in 1987 completed a diamond drilling program that led to the discovery of significant copper-gold mineralization. In 1991, Placer Development Ltd. (which became Placer Dome Inc.) ("Placer") acquired Lincoln's interest in the Mt. Milligan property, resumed exploration drilling, completed a pre-feasibility study and applied for provincial and federal approvals to develop the project. These approvals expired in 2003. Barrick Gold Corporation purchased Placer in 2006 and sold its Canadian assets to Goldcorp Inc., which then in turn sold its interest in Mt. Milligan to Atlas Cromwell. Atlas Cromwell then changed its name to Terrane Metals Corp. In October 2010, we acquired Terrane and the Mt. Milligan project.

Geology, Deposit Types and Mineralization

Mt. Milligan Mine is a tabular, near-surface, alkalic copper-gold porphyry deposit that measures some 1.6 miles north-south, 1 mile east-west and is more than 1,300 feet thick. It consists of two principal deposits, the Main deposit and Southern Star deposit. The Main deposit includes four contiguous zones: MBX, WBX, DWBX and 66, all of which are spatially associated with the MBX monzonite stock and Rainbow Dyke. The Southern Star deposit is centered on a monzonite stock of the same name and is some 1,640 feet south of the Main deposit.

Mineralization consists primarily of chalcopyrite with lesser bornite and magnetite in areas of potassic alteration, and pyrite in areas of propylitic alteration. In the main deposit, mineralization is best developed in areas of potassic alteration, where copper and gold grades are related to chalcopyrite and pyrite. High gold values are found in each deposit, mostly associated with pyrite, but the highest gold grades are found in the 66 zone and are related mainly to pyrite mineralization.

Exploration

An 18,339-ft core drilling program was completed in 2011 to follow-up previous holes drilled into the footwall of the WBX and other stocks, where potential copper-gold mineralization was indicated at depth. A total of eight holes were drilled, testing primarily for down-faulted blocks of mineralized rock below the western portion of the current deposit and pit limits. An additional 2,845 feet of core was drilled in ten holes to provide new samples for metallurgical test work. There was no exploration activity at Mt. Milligan in 2013. We have no definitive exploration drilling program planned for 2014.

Thompson Creek Mine (TC Mine)

General

10

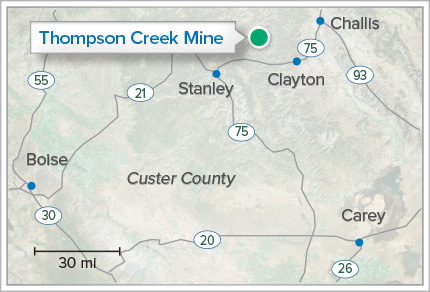

TC Mine is an open-pit molybdenum mine and concentrator located approximately 30 miles southwest of the town of Challis, Idaho, USA, with an estimated mine life of approximately 8 years (based on a molybdenum price of $10.00 per pound). TC Mine is accessible by commercial air carrier into the cities of Idaho Falls, Sun Valley and Boise, Idaho. Vehicle access to the mine is available by highway and gravel roads from each of these cities.

The TC Mine land holdings are comprised of 1,589 patented and unpatented lode, mill site and placer claims along with fee owned property totaling approximately 24,600 acres. All current ore reserves are located on patented mineral claims and are not expected to be subject to any US federal government royalties that may be enacted in the future. Approximately 50% of the mineral claims are located within the boundaries of the Salmon-Challis National Forest, with the remaining 50% located within the perimeter of land managed by the United States Bureau of Land Management. Annual assessment fees, totaling approximately $150,000, were made to the United States Bureau of Land Management in 2013 to maintain 1,097 unpatented mining claims at TC Mine through August 2014. We also paid state and county property taxes of $766,000 in 2013. Currently there is no mining taking place on property that requires the payment of a royalty.

The TC Mine operation consists of an open-pit mine, ore crusher and conveyer system, mill and concentrator, tailings and containment dam, an administrative building, a truckshop/warehouse and support facilities. Open-pit mining began at TC Mine in 1983. Material mined from TC Mine is treated at a processing plant on site, and concentrate material is transported to our Langeloth Facility. Electric power is provided to the site by the Salmon River Electric Co-op through a 24.7 mile 230 kV power line to the South Butte Substation, then by a 2.6 mile 69 kV line to the mill site. Both of these lines are owned by TC Mine. Fresh water for TC Mine is pumped from the Salmon River.

As of the date hereof, given declines in molybdenum prices and projected operating costs at TC Mine for 2015 and thereafter, in October 2012, we suspended waste stripping activity associated with Phase 8. Since that time, the molybdenum market has continued to weaken and, as a result, we decided to put TC Mine on care and maintenance when the mining of Phase 7 is completed, which is expected to be in the fourth quarter of 2014. We intend to preserve the assets at TC Mine while it is on care and maintenance to enable us to re-commence operations if and when molybdenum market conditions improve. We continue to evaluate potential economically viable options for Phase 8.

History

The TC Mine deposit was discovered in 1968 by Cyprus Mines Corporation ("Cyprus"). Surface exploration, diamond and reverse circulation drilling were done by Cyprus. Cyprus started construction of the mine in 1981, with full production beginning in 1983 and continuing until 1992 when operations were suspended due to depressed molybdenum prices. In 1993, we purchased the mine and resumed operations in 1994, which have continued to the present. The mine operated continuously from 1994 through the present, however, production was reduced during 2008 and 2009 due to reduced demand for molybdenum during that period.

Geology, Deposit Types and Mineralization

The TC Mine porphyry molybdenum deposit is located near the structural intersection of two geologic provinces: continental, arc-related intrusive rocks of the late Cretaceous Idaho Batholith (the "Idaho Batholith") are exposed to the west of the mine, while complexly deformed Paleozoic metasedimentary rocks are dominant to the east. The Idaho Batholith is a multi-phase, long-lived intrusion with a granitic to granodioritic composition. Paleozoic metasedimentary rocks form the wall-rock portions of the TC Mine deposit. Historic mining within the district was associated with syngenetic stratiform base-, precious-metal (i.e. lead-silver) mineralization which is locally developed in the Paleozoic units. The majority of the TC Mine molybdenum deposit is hosted within igneous rocks of the TC Mine intrusive complex, with minor amounts found within adjacent metasediments.

The TC Mine deposit is classified as an intrusive-hosted molybdenum porphyry system. Porphyry molybdenum deposits are divided into two subtypes: Climax-type and Quartz Monzonite (Endako)-type. TC Mine belongs to the Quartz Monzonite category. In contrast to the rift-related (extensional) Climax-type deposits, the Quartz Monzonite-type deposits are formed by subduction-related (compressional) processes. Molybdenum mineralization at TC Mine is primarily hosted in a composite granodiorite-quartz monzonite stock of Cretaceous age (i.e. TC Mine intrusive complex). This composite stock intruded carbonaceous and locally limy argillite (i.e. metasediments) of the Mississippian Copper Basin Formation. Where it is in contact with the TC Mine intrusive complex, the argillite has been contact-metamorphosed to hornfels and locally to skarn. The intrusive and sedimentary rocks are unconformably overlain by the Eocene Challis Volcanics, a post-mineral sequence of andesite to rhyodacite tuffs, flows and agglomerates. Locally, the volcanic cover is up to 1,000 feet thick. These volcanic rocks fill valleys and depressions in the paleotopography around the TC Mine site.

Exploration

11

On-site 2013 exploration activities around and peripheral to the TC Mine infrastructure consisted of surface mapping and rock sampling. During 2013, a drilling permit was approved by the United States Forest Service for exploration drilling of targets identified within the Bruno Creek drainage east of the current mine infrastructure. There were no exploration activities performed on the off-site Long Canyon and Little Fall Creek properties in 2013.

Annual assessment fees, totaling approximately $90,000, were made to the United States Bureau of Land Management in 2013 to maintain 631 unpatented lode mining claims at both the Long Canyon and Little Fall Creek properties through August 2014.

On-site exploration activities in the TC Mine area in 2014 are expected to be minimal and may include surface mapping, rock sampling and target identification. No exploration work other than routine claim maintenance is planned for the off-site Long Canyon and Little Fall Creek properties in 2014.

Endako Mine

General

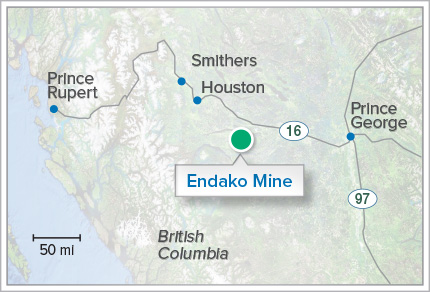

Endako Mine is an open-pit molybdenum mine, concentrator and roaster located approximately 100 miles west of Prince George, British Columbia, Canada, with an estimated mine life of approximately 3.5 years (based on a molybdenum price of $10.00 per pound).

Endako Mine is accessible by commercial air carrier to Prince George, British Columbia, then by vehicle west on a paved highway for approximately 100 miles, then south on the Endako Mine road for an additional 6.8 miles. In March 2012, we completed a mill expansion project at Endako Mine. The expansion project included the construction of a new mill to replace the previous mill constructed in the 1960’s. The new mill is designed to process 55,000 tons of ore per day compared to 31,000 tons per day in the old mill. The previous 45-year old mill at the site has been shut down and is currently on care and maintenance.

Endako Mine is operated as a joint venture (the "Endako Mine Joint Venture") between Thompson Creek Mining Ltd. ("TCML"), one of our subsidiaries, which holds a 75% interest, and Sojitz Moly Resources, Inc. (“Sojitz”), a subsidiary of Sojitz Corporation, which holds the remaining 25% interest. See "Endako Mine Joint Venture" below for further details regarding the Endako Mine Joint Venture.

The property is currently comprised of a contiguous group of 81 mineral tenures containing 56 claims and 25 leases, covering approximately 32,509 acres. In addition, the Endako Mine Joint Venture holds surface rights to a portion of the mine site area. The mineral leases are subject to annual fees, and the mineral claims are subject to exploration expenditure obligations. We may choose to pay annual fees to the province in lieu of exploration expenditures. All mineral claims are in good standing, and expiry dates range from March 2017 to February 2023. We expect to renew such mineral claims in the ordinary course.

Endako Mine deposit is divided into four named areas: Northwest, Denak West, Denak East and Endako. Mining is in progress or has occurred in the Endako and both Denak areas. The Northwest zone is yet to be produced. The property contains

12

processing facilities, waste dumps and tailings disposal areas. There are no royalties, back-in rights, encumbrances on title or other agreements, other than the agreement governing the Endako Mine Joint Venture. The infrastructure at Endako Mine includes a 55,000 ton per day concentrator, a 40,000 to 45,000 pound per day roaster (and an additional non-operating roaster), tailings and reclaim water ponds, a crushing plant, an administrative building, a truckshop/warehouse, a change house, a first aid station, a laboratory, a garage and other shops. The power supply of the site is provided by a 5.3 mile, 69 kV power line owned by B.C. Hydro from a nearby substation. Water for the milling process is re-circulated from the tailings facility while make-up water is pumped from François Lake, located nearby.

In an effort to reduce costs at Endako Mine, we ceased mining new ore at the Mine in the third quarter of 2012 and began exclusively processing stockpiled ore. We resumed mining of new ore during the second quarter of 2013 and are now processing both mined and stockpiled material. In early 2013, we also ceased roasting at Endako Mine, and instead transported Endako’s concentrate via truck and rail to our Langeloth Facility for roasting and delivery to customers.

History

The Endako Mine deposit was discovered in 1927 by local hunters. Minor underground exploration work took place in subsequent years. In 1962, R&P Metals Corporation Ltd. began a diamond drilling program to evaluate the discovery and, based on the exploration results, incorporated a company named Endako Mines Ltd. Canadian Exploration Limited, a wholly owned subsidiary of Placer, entered into an option agreement with Endako Mines Ltd. in August 1962 and continued exploration on the property.

In March 1964, Placer decided to place the property into production. Production commenced in June 1965 at a plant capacity of approximately 10,000 tons per day (combined concentrator and roaster). Expansions in 1967 and improvements in 1980 increased the concentrator capacity. In 1982, the mine and concentrator were closed due to low molybdenum prices, but the roaster continued to operate, processing molybdenum concentrates from other operations on a toll basis.

The mine and mill were re-opened in 1986, and by 1989 production reached approximately 31,000 tons per day. In June 1997, the parties to the Endako Mine Joint Venture purchased Endako Mine from Placer.

Geology, Deposit Types and Mineralization

The Endako Mine deposit is located within the intermontane morphology/tectonic belt of British Columbia, Canada. The Endako Mine molybdenite deposit is hosted in the Endako quartz monzonite intrusive, a phase of the middle to late Jurassic François Lake Intrusions that form a large composite batholith. The deposit is genetically associated with the terminal stages of magmatic activity, represented by intrusion of the Casey monzogranite.

Molybdenite is the primary metallic mineral on the Endako Mine property. Minor pyrite, magnetite and chalcopyrite, and traces of sphalerite, bornite, specularite and scheelite are also present. Single occurrences of beryl and bismuthinite have been reported. Molybdenite occurs in two types of veins. Large veins (up to 4 feet wide) contain laminae and fine disseminations of molybdenite. The second vein type occurs as stockworks adjacent to the major veins in the form of fine fracture-fillings and veinlets of quartz-molybdenite. Pyrite is most abundant along the southern margin of the zone of molybdenum mineralization.

Exploration

No exploration activities were completed in 2013, and no exploration activities are planned for 2014, on the Endako Mine land tenure. In order to allow mining in the areas we refer to as the Denak West Extension, we have filed a claim to lease application with the British Columbia Mineral Titles Branch. The application, filed on November 7, 2013, requests the conversion of 24 mineral claims to a mining lease.

Endako Mine Joint Venture

The Endako Mine Joint Venture was formed on June 12, 1997 pursuant to the terms of the Exploration, Development and Mine Operating Agreement between TCML and Sojitz (the "Endako Mine Joint Venture Agreement"). We have been appointed manager of the Endako Mine Joint Venture with overall management responsibility for operations. As manager, we prepare annual budgets and production plans and submit them to Sojitz for approval. In the event Sojitz rejects any or all of a proposed budget or production plan, the parties are required to work to develop a mutually acceptable budget and production plan. As manager, we manage, direct and control Endako Mine, provided that each of the following actions requires the approval of both us and Sojitz: (i) disposition of all or a substantial portion of the Endako Mine assets; (ii) contracts with affiliates over $500,000 or sales of product to our affiliates or affiliates of Sojitz; (iii) compensation for management of the business; (iv) modification of the Endako Mine Joint Venture Agreement; (v) any change in business purpose; (vi) any modifications or replacements to the production plan for Endako Mine; (vii) investment in other companies; (viii) any borrowing by the joint venture or loan to any third party or any guarantee; (ix) changes in the manager, other than by reasons of default; and (x) except in the case of emergency or unexpected expenditures, a discretionary capital expenditure in excess of $1.0 million. Our and Sojitz's

13

participating interests in the joint venture are currently 75% and 25%, respectively; those interests may be recalculated under certain circumstances set forth in the Endako Mine Joint Venture Agreement.

OTHER OPERATING PROPERTIES

Langeloth Metallurgical Facility

Our wholly-owned Langeloth Facility is located in Langeloth, Pennsylvania, approximately 25 miles west of Pittsburgh, on land we own in fee simple. The facility receives molybdenum disulfide concentrate from TC Mine, Endako Mine and from third party producers that is either purchased for processing and re-sale or that is toll converted to finished products for third parties. The facility produces and sells ammonium perrhenate and rhenium metal pellets as well as sulfuric acid all recovered as by-products of processing the molybdenum disulfide. In addition, the Langeloth Facility calcines other metal containing materials from various third-party operations.

Four multiple-hearth furnaces are used for the conversion (roasting) of molybdenum disulfide concentrate into technical grade molybdenum oxide. These four roasters have the annual capacity to process 35 million pounds of molybdenum contained in concentrates. The molybdenum oxide can be sold as a finished product to customers or can be upgraded at the facility to molybdenum oxide briquettes, pure molybdenum trioxide powder or various sizes of ferromolybdenum products. Two furnaces are used to calcine non-hazardous metal containing materials that contain metals other than molybdenum.

The plant has been and continues to be upgraded by an ongoing capital improvement program. Further, an acid plant shutdown occurs approximately every other year to refurbish acid plant process equipment. Following an extended 7 week shutdown in 2012, there was no shutdown in 2013, nor one planned for 2014.

EXPLORATION PROPERTIES

Berg Property

In October 2010, we acquired the Berg property as part of the Terrane acquisition. The Berg property is a copper, molybdenum, and silver exploration property that is located in the Omineca Mining Division within the Tahtsa Ranges of west-central British Columbia, Canada approximately 52 miles southwest of Houston and 14 miles northwest of the Huckleberry Mine. The Berg property is comprised of 113 mineral claims and one mining lease centered at 53° 48' North Latitude and 127° 26' West Longitude for a total of approximately 110,190 acres.

The Berg property is 100% owned by us with a 1% net smelter return royalty held by Royal Gold on eight of the mineral claims and one mining lease, including those which host the deposit on the Berg property. All mineral claims and the mining lease are in good standing and good to dates ranging from June 2014 to November 2021. Mineral claims are subject to exploration expenditure obligations, or we may choose to pay annual fees to the province in lieu of exploration expenditures. We expect to renew such mineral claims and mining lease in the ordinary course.

Drilling on the property was initiated by Kennecott in 1965, and this led to the delineation of two main mineralized zones. In 1972, exploration and development of the Berg property were taken over by another owner under agreement with Kennecott, and by 1980, a total of 119 diamond drill holes for 66,036 feet had been completed on the Berg property. In 2007 and 2008, Terrane carried out diamond drill programs totaling 75,290 feet in 60 holes designed to confirm the results of previous work and define the resource with infill and step-out drilling, particularly below the historic resource, and provide fresh material for metallurgical test work. In 2011, we commissioned additional exploration and drilling delineation to support an advanced scoping study. The 2011 drilling program included 10,678 meters of drilling (35,024 feet). In 2013 no new drilling or field investigations were completed; however, we continued to maintain environmental baseline monitoring programs that were previously in progress. In 2014, certain environmental monitoring programs will continue, no additional drilling or field work is anticipated at this time.

Maze Lake Property

The Maze Lake property is an early-stage gold exploration project located in the Kivalliq District of Nunavut in Canada, 56 miles southwest of Rankin Inlet and 28 miles west of Whale Cove, both on Hudson Bay. An interest in the property was acquired by Terrane following the discovery of an 18 mile long gold trend that was identified by regional till sampling in 2000. The Maze Lake property consists of property covered by three Inuit Owned Lands Mineral Exploration Agreements with a total area of 30,663 acres. Such Agreements allow us to terminate our interest in the property at any time.

In 2008, Terrane formed a joint venture (the "MLJV") with Laurentian Goldfields Ltd. to explore and develop the Maze Lake property. Upon formation of the MLJV, Terrane contributed its Maze Lake mining interests to the MLJV in return for a 43% interest in the MLJV. We acquired Terrane's interest in the MLJV in October 2010 as part of the Terrane acquisition. In

14

June 2013, we acquired Laurentian Goldfields Ltd.’s interest in the MLJV, granted a 1% net smelter return royalty to Laurentian Goldfields Ltd., and terminated the MLJV.

The Mineral Exploration Agreements are in good standing, with the next annual holding fee of $49,636 being due April 1, 2014 and the annual assessment work or payment of assessment work deficiency in the amount of $162,329 being due June 30, 2014. In 2013, no drilling or field investigations were completed on the property. In 2014, we expect to complete remediation work on the property to remove certain barrels and other property relating to past exploration work. No additional drilling or field work is planned.

SOURCES AND AVAILABILITY OF RAW MATERIALS

Our mining operations require significant energy, principally electricity, diesel and natural gas. Most of our energy is obtained from third parties under long-term contracts. Our mining operations also require significant quantities of water for mining, ore processing and related support facilities. Although we believe we have sufficient water rights to conduct our mining operations, the loss of water rights for any of our mines, in whole or in part, or shortages of water to which we have rights, could require us to curtail or shut down mining operations. For a further discussion of risks and legal proceedings associated with the availability of water, refer to Item 1A. "Risk Factors" and Item 3. "Legal Proceedings."

COMPETITION

The mining industry is intensely competitive. Our competitive position is based on the quality and grade of our mineral reserves, our ability to manage our costs compared to other producers throughout the world, our ability to maintain our financial integrity through the lows of the metal price cycles, and our ability to manage our customer relationships. Our costs are governed to a large extent by the location, grade and nature of our mineral reserves, our input costs including energy, labor and equipment, and our operating and management skills. The metals markets are cyclical, and our ability to maintain our competitive position over the long term is based on our ability to manage our costs, acquire and develop quality deposits, and hire and retain a skilled workforce. Our substantial indebtedness will limit our ability to significantly grow our business in the near term. While we intend to continue to grow our business through our exploration program and through future acquisitions in the long term, many of our competitors possess more financial, technical and other resources than we do.

Until we began producing concentrate from Mt. Milligan Mine in late 2013, we exclusively mined molybdenum, and were thus subject to unique competitive advantages and disadvantages related to the price of molybdenum. With the completion of Mt. Milligan Mine, we have diversified into production of copper and gold as well as molybdenum, and are thus less sensitive to fluctuations in the price of molybdenum.

EMPLOYEES

As of December 31, 2013, we employed approximately 1,240 people (approximately 780 in Canada and 460 in the United States).

Approximately 75% of employees at the Langeloth Facility are members of the International Union, United Automobile, Aerospace and Agricultural Implement Workers of America union through its Local 1311. In January 2013, a new labor agreement was reached with the union at the Langeloth Facility to cover the period from March 11, 2013 through March 11, 2016. Approximately 75% of Endako Mine's employees are members of the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union through its Local 1-424. In January 2014, a labor agreement was reached with the union at Endako Mine for the period from April 1, 2013 to March 31, 2015. We believe that our relations with all of our employees are good.

ENVIRONMENTAL MATTERS

Our mining and exploration activities are subject to extensive federal, provincial, state and local laws, regulations and permits governing protection of the environment. Among other things, our Canadian operations must comply with authorizations issued under the provincial Mines Act and the Environmental Management Act. We also implement Fish Habitat Compensation Plans at Mt. Milligan Mine under the Fisheries Act and the Metal Mining Effluent Regulations. In the United States, TC Mine has permits issued under the federal Clean Water Act and Clean Air Act. Our tailings storage facility at TC Mine is governed by an Idaho statute administered by the Idaho Department of Water Resources. Our primary permits at the Langeloth Metallurgical Facility are issued under the federal Clean Water Act and Clean Air Act, both of which are implemented in Pennsylvania by the state Department of Environmental Protection.

Our policy is to conduct business in a way that safeguards public health and the environment. We believe that our operations are in compliance with applicable environmental laws and regulations in all material respects. Regular monitoring and compliance with periodic reporting requirements are integral components of all our environmental permits and authorizations. In Canada, we also conduct Environmental Effects Monitoring, which is a cyclical receiving-environment

15

monitoring program to assess the potential effects of effluent on the fish population, fish tissue and the benthic invertebrate community.

From time to time, we have sought modifications of our Plan of Operations for TC Mine, the Mines Act permits for our Canadian operations or other environmental permits and authorizations. In these instances, we have been required to prepare detailed baseline studies and environmental analyses under the National Environmental Policy Act in the United States and comparable provisions of Canadian law. There is no assurance that such modifications of our permits and authorizations will be granted by the administrative agencies and ministries. Even if approved, the authorizations may include terms and conditions that adversely affect our ability to operate effectively or economically.

The costs associated with implementation and compliance with environmental requirements are substantial and possible future legislation and regulations could cause additional operating expense, capital expenditures, restrictions and delays in the development and continued operation of our properties, the extent of which cannot be predicted with certainty. In the context of environmental permitting, including approval of reclamation plans and compliance with long-term, post-reclamation obligations, we are required to comply with known standards and regulations, which may entail significant costs.

Estimated future reclamation costs are based primarily on legal and regulatory requirements. As of December 31, 2013, we have provided financial assurance for reclamation costs of approximately $42.4 million at TC Mine, $14.4 million at Endako Mine (of which our 75% share is approximately $10.8 million) and $28.2 million for Mt. Milligan. Environmental laws and regulations generally have become more stringent and restrictive during the life of our operations. Our reclamation obligations and the related financial assurances we are required to provide likely will increase over time.

In addition to statutory and regulatory compliance, we are developing plans and programs to promote sustainability in our business and are committed to building long-term relationships with the communities in which we operate. At Mt. Milligan Mine, we have implemented a Community Sustainability Committee, by which we meet quarterly with representatives of the local communities and First Nations. We have also prepared and implemented an Environmental, Health and Safety Management System that is intended to comply with ISO 14001:2004 and OHSAS 18001.

For a further discussion of risks associated with environmental matters, refer to Item 1A. "Risk Factors."

MINERAL RESERVES

Our proven and probable mineral reserves have been estimated in accordance with the definitions of such terms adopted by the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") and incorporated in National Instrument 43-101 ("NI 43-101") by Canadian securities regulatory authorities. Technical reports have been filed regarding the disclosure of mineral reserves for our material properties as required by NI 43-101; namely Mt. Milligan Mine, TC Mine and Endako Mine. The proven and probable mineral reserves are those tonnages contained within economically optimized pits, configured using current and predicted mining and processing methods and related operating costs and performance parameters. Mineral reserve estimates reflect our reasonable expectation that all necessary permits and approvals will be obtained and maintained. We believe that our proven and probable mineral reserves are equivalent to proven and probable reserves as defined by the Securities and Exchange Commission's (the "SEC") Industry Guide 7. See the Glossary of Terms below for an explanation of mining terms used in this report.

The estimation of mineral reserves is constrained to an economically optimized pit based on all operating costs, including the costs to mine. Since all material lying within the optimized pit will be mined, the cut-off grade used in determining mineral reserves is estimated based on the material that, having been mined, is economic to transport and process without regard to primary mining costs (i.e., mining costs that were appropriately applied at the economic optimization stage).

The QA/QC controls program used in connection with the estimation of our mineral reserves consists of regular insertion and analysis of blanks and standards to monitor laboratory performance.

16

The following tables set forth the estimated copper and gold mineral reserves for Mt. Milligan as of December 31, 2013:

Proven and Probable Copper Mineral Reserves at December 31, 2013(1)

Property | Category | Short Tons | Metric Tonnes | Copper Grade | Contained Copper | |||||

(millions) | (millions) | (%Cu) | (millions of pounds) | |||||||

Mt. Milligan | Proven—Mine | 298.3 | 270.7 | 0.210 | 1,251 | |||||

Proven—Stockpile | 0.2 | 0.2 | 0.149 | 0.5 | ||||||

Probable—Mine | 227.8 | 206.6 | 0.186 | 846 | ||||||

Probable—Stockpile | — | — | — | — | ||||||

Proven + Probable | 526.3 | 477.5 | 0.199 | 2,098 | ||||||

Total | Proven | 1,252 | ||||||||

Probable | 846 | |||||||||

Proven + Probable | 2,098 | |||||||||

Proven and Probable Gold Mineral Reserves at December 31, 2013(1)

Property | Category | Short Tons | Gold Grade | Metric Tonnes | Gold Grade | Contained Gold | ||||||

(millions) | (ounces per ton) | (millions) | (gram per tonne) | (millions of ounces) | ||||||||

Mt. Milligan | Proven—Mine | 298.3 | 0.013 | 270.7 | 0.437 | 3.81 | ||||||

Proven—Stockpile | 0.2 | 0.018 | 0.2 | 0.604 | 0.003 | |||||||

Probable—Mine | 227.8 | 0.009 | 206.6 | 0.322 | 2.14 | |||||||

Probable—Stockpile | — | — | — | — | — | |||||||

Proven + Probable | 526.3 | 0.011 | 477.5 | 0.388 | 5.95 | |||||||

Total | Proven | 3.81 | ||||||||||

Probable | 2.14 | |||||||||||

Proven + Probable | 5.95 | |||||||||||

_______________________________________________________________________________

(1) The mineral reserve estimates for Mt. Milligan Mine were prepared by Robert Clifford, our Director of Mine Engineering, who is a Qualified Person under NI 43-101. The mineral reserve estimates were prepared using optimized pit shells at a $4.10/t NSR cut-off value, metal prices of $1.60/lb copper, $690/oz gold and an exchange rate of C$1.00/US$0.85, and incorporate estimated costs for milling, plant services, tailing services and general and administrative charges. The mineral reserve estimates are based on the cost and price assumptions included in a NI 43-101 technical report prepared for Terrane entitled "Technical Report—Feasibility Update Mt. Milligan Property—Northern BC" dated October 13, 2009 and filed on SEDAR on October 13, 2011. Mill recoveries vary by rock type and region but average 84.1% copper and 71.4% gold. Anticipated losses resulting from beneficiation average 4.9% copper and 3.5% gold.

The following table sets forth the estimated molybdenum mineral reserves for TC Mine and Endako Mine as of December 31, 2013:

17

Proven and Probable Molybdenum Reserves at December 31, 2013 (1)

Mine | Category | Short Tons | Metric Tonnes | Molybdenum Grade | Contained Molybdenum | |||||

(millions) | (millions) | (%Mo) | (millions of pounds) | |||||||

TC Mine | Proven—Mine | 39.9 | 36.2 | 0.080 | 63.9 | |||||

Proven—Stockpile | 5.2 | 4.7 | 0.082 | 8.5 | ||||||

Probable—Mine | 35.9 | 32.6 | 0.069 | 49.7 | ||||||

Probable—Stockpile | — | — | — | — | ||||||

Proven + Probable | 81.0 | 73.5 | 0.075 | 122.1 | ||||||

Endako Mine | Proven—Mine | 25.1 | 22.8 | 0.061 | 30.7 | |||||

Proven—Stockpile | 8.6 | 7.8 | 0.039 | 6.7 | ||||||

Probable—Mine | 21.1 | 19.2 | 0.058 | 24.6 | ||||||

Probable—Stockpile | 17.7 | 16.0 | 0.039 | 13.8 | ||||||

Proven + Probable | 72.5 | 65.8 | 0.052 | 75.8 | ||||||

Total | Proven | 109.8 | ||||||||

Probable | 88.1 | |||||||||

Proven + Probable | 197.9 | |||||||||

_______________________________________________________________________________

(1) | The mineral reserve estimates for TC Mine and Endako Mine were prepared by the TC Mine and Endako Mine staff, respectively, under the supervision of Robert Clifford, our Director of Mine Engineering, who is a Qualified Person under NI 43-101. The mineral reserve estimates utilized a cut-off grade of 0.030% molybdenum ("Mo") and an average long-term molybdenum price of $10.00 per pound. The mineral reserve for Endako Mine is stated on a 100% basis; we own 75% of Endako Mine. Mill recoveries vary by rock type and region but average 88.3% at TC Mine and 77.3% at Endako Mine. Anticipated losses resulting from beneficiation average 1% at both TC Mine and Endako Mine. |

Reconciliation of Year-End 2013 and 2012 Proven and Probable Copper Mineral Reserves (1)

Contained Copper | Pounds | |||

(millions of pounds) | (% of opening) | |||

December 31, 2012 | 2,124 | 100% | ||

Depletion (2) | (26.0) | (1)% | ||

Revisions and additions | — | — | ||

December 31, 2013 | 2,098 | 99% | ||

_______________________________________________________________________________

(1) | The figures incorporated in the table above were prepared by Robert Clifford, our Director of Mine Engineering, who is a Qualified Person under NI 43-101. |

(2) | Depletion of mineral reserves reflects removal of in-situ pit reserves. |

Reconciliation of Year-End 2013 and 2012 Proven and Probable Gold Mineral Reserves (1)

Contained Gold | Ounces | |||

(millions of ounces) | (% of opening) | |||

December 31, 2012 | 6.03 | 100% | ||

Depletion (2) | (0.08) | (1)% | ||

Revisions and additions | — | — | ||

December 31, 2013 | 5.95 | 99% | ||

_______________________________________________________________________________

18

(1) | The figures incorporated in the table above were prepared by Robert Clifford, our Director of Mine Engineering, who is a Qualified Person under NI 43-101. |

(2) | Depletion of mineral reserves reflects removal of in-situ pit reserves. |

Reconciliation of Year-End 2013 and 2012 Proven and Probable Molybdenum Mineral Reserves (1)

TC Mine | Endako Mine | |||||||||

Property | Contained Molybdenum | Pounds | Contained Molybdenum | Pounds | ||||||

(millions of pounds) | (% of opening) | (millions of pounds) | (% of opening) | |||||||

December 31, 2012 | 203.3 | 100% | 312.6 | 100% | ||||||

Depletions (2) | (22.7) | (11)% | (16.2) | (5)% | ||||||

Revisions (3) | (58.5) | (29)% | (220.6) | (71)% | ||||||

December 31, 2013 | 122.1 | 60% | 75.8 | 24% | ||||||

_______________________________________________________________________________

(1) | The figures incorporated in the table above were prepared by Robert Clifford, our Director of Mine Engineering, who is a Qualified Person under NI 43-101. |

(2) | Depletion of mineral reserves reflects both removal of in-situ pit reserves and drawdown of stockpile reserves. |

(3) | Revisions reflect changes due to economic model updates and optimizations. All of the revisions are attributable to the recalculation of our molybdenum reserves utilizing an average long-term molybdenum price of $10 per pound. The reserves reflected in our Annual Report on Form 10-K for the year ended December 31, 2012 utilized a long-term molybdenum price of $12 per pound. |

Reconciliation of Mineral Reserves Under NI 43-101 and Under SEC Industry Guide 7

As mineral reserves are reported under both NI 43-101 and SEC Industry Guide 7 standards, it is possible for mineral reserve figures to vary between the two standards due to the differences in reporting requirements under each standard. For example, NI 43-101 has a minimum requirement that mineral reserves be supported by a pre-feasibility study, whereas SEC Industry Guide 7 requires support from a detailed feasibility study that demonstrates that economic extraction is justified.

For our mineral reserves at December 31, 2013, there is no difference between the mineral reserves as disclosed under NI 43-101 and those disclosed under SEC Industry Guide 7, and therefore no reconciliation is provided.

NON-RESERVES—MEASURED AND INDICATED MINERAL RESOURCES

Cautionary note to US investors concerning estimates of measured and indicated mineral resources

This section uses the terms "measured mineral resources" and "indicated mineral resources." We advise US investors that, while those terms are recognized and required by Canadian regulations, the SEC does not recognize them. US investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into mineral reserves.

The measured and indicated mineral resources which are reported herein do not include that part of our mineral resources that have been converted to proven and probable mineral reserves as shown above. Measured and indicated mineral resources have been estimated in accordance with the definitions of such terms adopted by the CIM and incorporated in NI 43-101. We have filed technical reports regarding the disclosure of mineral resources for TC Mine and Endako Mine, Mt. Milligan, and the Berg property. Measured and indicated mineral resources are equivalent to mineralized material as such term is defined in SEC Industry Guide 7. See the Glossary of Terms below for an explanation of mining terms used in this report.

The total measured and indicated mineral resources for all properties have been estimated at variable economic cut-off grades based on the metal prices provided below, and on economic parameters deemed realistic. The economic cut-off grades for mineral resources are lower than those for mineral reserves and are indicative of the fact that the mineral resource estimates include material that may become economic under more favorable conditions, including increases in metal prices.

19

The following tables summarize our estimated non-reserves—measured and indicated mineral resources at December 31, 2013:

Measured and Indicated Copper Mineral Resources at December 31, 2013

Measured | Indicated | Measured & Indicated | ||||||||||||||||

Property | Short Tons | Metric Tonnes | Copper Grade | Short Tons | Metric Tonnes | Copper Grade | Short Tons | Metric Tonnes | Copper Grade | |||||||||

(millions) | (millions) | (%) | (millions) | (millions) | (%) | (millions) | (millions) | (%) | ||||||||||

Mt. Milligan (1) | 66.9 | 60.7 | 0.13 | 182.4 | 165.5 | 0.15 | 249.3 | 226.2 | 0.14 | |||||||||

Berg Property (2) | 58.8 | 53.3 | 0.48 | 499.0 | 452.7 | 0.28 | 557.8 | 506.0 | 0.30 | |||||||||

Total 2013 | 125.7 | 114.0 | 0.29 | 681.4 | 618.2 | 0.24 | 807.1 | 732.2 | 0.25 | |||||||||

Measured and Indicated Gold Mineral Resources at December 31, 2013 (Imperial)

Measured | Indicated | Measured & Indicated | ||||||||||

Property | Short Tons | Gold Grade | Short Tons | Gold Grade | Short Tons | Gold Grade | ||||||

(millions) | (oz/ton) | (millions) | (oz/ton) | (millions) | (oz/ton) | |||||||

Mt. Milligan (1) | 66.9 | 0.006 | 182.4 | 0.006 | 249.3 | 0.006 | ||||||

Measured and Indicated Gold Mineral Resources at December 31, 2013 (Metric)

Measured | Indicated | Measured & Indicated | ||||||||||

Property | Metric Tonnes | Gold Grade | Metric Tonnes | Gold Grade | Metric Tonnes | Gold Grade | ||||||

(millions) | (gram/tonne) | (millions) | (gram/tonne) | (millions) | (gram/tonne) | |||||||

Mt. Milligan (1) | 60.7 | 0.214 | 165.5 | 0.200 | 226.2 | 0.204 | ||||||

Measured and Indicated Molybdenum Mineral Resources at December 31, 2013

Measured | Indicated | Measured & Indicated | ||||||||||||||||

Property | Short Tons | Metric Tonnes | Molybdenum Grade | Short Tons | Metric Tonnes | Molybdenum Grade | Short Tons | Metric Tonnes | Molybdenum Grade | |||||||||

(millions) | (millions) | (%) | (millions) | (millions) | (%) | (millions) | (millions) | (%) | ||||||||||

TC Mine (3) | 27.8 | 25.2 | 0.064 | 31.4 | 28.5 | 0.062 | 59.2 | 53.7 | 0.063 | |||||||||

Endako Mine (3) | 56.1 | 50.9 | 0.050 | 64.5 | 58.5 | 0.052 | 120.6 | 109.4 | 0.051 | |||||||||

Berg Property (2) | 58.8 | 53.3 | 0.030 | 499.0 | 452.7 | 0.038 | 557.8 | 506.0 | 0.037 | |||||||||

Total 2013 | 142.7 | 129.4 | 0.044 | 594.9 | 539.7 | 0.041 | 737.6 | 669.1 | 0.042 | |||||||||

Measured and Indicated Silver Mineral Resources at December 31, 2013 (Imperial)

Measured | Indicated | Measured & Indicated | ||||||||||

Property | Short Tons | Silver Grade | Short Tons | Silver Grade | Short Tons | Silver Grade | ||||||

(millions) | (oz/ton) | (millions) | (oz/ton) | (millions) | (oz/ton) | |||||||

Berg Property (2) | 58.8 | 0.131 | 499.0 | 0.108 | 557.8 | 0.110 | ||||||

Measured and Indicated Silver Mineral Resources at December 31, 2013 (Metric)

Measured | Indicated | Measured & Indicated | ||||||||||

Property | Metric Tonnes | Silver Grade | Metric Tonnes | Silver Grade | Metric Tonnes | Silver Grade | ||||||

(millions) | (gram/tonne) | (millions) | (gram/tonne) | (millions) | (gram/tonne) | |||||||

Berg Property (2) | 53.3 | 4.5 | 452.7 | 3.7 | 506.0 | 3.8 | ||||||

_______________________________________________________________________________

20

(1) | The mineral resource estimate for Mt. Milligan Mine was prepared by Robert Clifford, our Director of Mine Engineering, who is a Qualified Person under NI 43-101. The mineral resource estimates were prepared using optimized pit shells at a $4.10/t NSR cut-off value, metal prices of $2.00/lb copper, $800/oz gold and an exchange rate of C$1.00/US$0.85, and incorporate estimated costs for milling, plant services, tailing services and general and administrative charges. The mineral resource estimate is based on the cost and price assumptions included in a NI 43-101 technical report prepared for Terrane entitled "Technical Report—Feasibility Update Mt. Milligan Property—Northern BC" dated October 13, 2009 and filed on SEDAR on October 13, 2011. |

(2) | The mineral resource estimate for the Berg property was approved by Robert Clifford, our Director of Mine Engineering who is a Qualified Person under NI 43-101, and is reflected in a NI 43-101 technical report prepared for Terrane entitled "2009 Mineral Resource Estimate on the Berg Copper Molybdenum Silver Property, Tahtsa Range, British Columbia" dated June 26, 2009 and filed on SEDAR on October 13, 2011. The mineral resource estimate for the Berg property was prepared using a 0.30% copper equivalent cut-off, with copper equivalency defined using metal prices of $1.60/lb copper, $10/lb molybdenum, and $10/oz silver, taking into account forecast metallurgical recoveries. Resources are reported to a maximum depth of 450 meters (1,476.38 feet) below surface. |

(3) | The mineral resource estimates for TC Mine and Endako Mine were prepared by the TC Mine and Endako Mine staff, respectively, under the supervision of Robert Clifford, our Director of Mine Engineering, who is a Qualified Person under NI 43-101. The mineral resource estimates utilized a cut-off grade of 0.025% Mo and an average long-term molybdenum price of $12.00 per pound. |

NON-RESERVES—INFERRED MINERAL RESOURCES

Cautionary note to US investors concerning estimates of inferred mineral resources

This section uses the term "inferred mineral resources." We advise US investors that while this term is recognized and required by Canadian regulations, the SEC does not recognize it. "Inferred mineral resources" have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of inferred mineral resources will ever be converted into mineral reserves. In accordance with Canadian rules, estimates of inferred mineral resources cannot form the basis of feasibility or other economic studies. US investors are cautioned not to assume that part or all of the inferred mineral resources exists, or is economically or legally mineable.

Inferred mineral resources have been estimated in accordance with the definitions of such terms adopted by the CIM and incorporated in NI 43-101. We have filed technical reports regarding the disclosure of mineral resources for TC Mine and Endako Mine, Mt. Milligan, and the Berg property. See the Glossary of Terms below for an explanation of mining terms used in this report.

The following tables summarize estimated non-reserves—inferred mineral resources as of December 31, 2013:

Inferred Mineral Resources—Copper

Property | Short Tons | Metric Tonnes | Copper Grade | |||

(millions) | (millions) | (%) | ||||

Mt. Milligan (1) | 23.0 | 20.9 | 0.15 | |||

Berg Property (2) | 159.4 | 144.6 | 0.23 | |||

Inferred Mineral Resources—Gold

Property | Short Tons | Gold Grade | Metric Tonnes | Gold Grade | ||||

(millions) | (oz/ton) | (millions) | (gram/tonne) | |||||

Mt. Milligan (1) | 23.0 | 0.006 | 20.9 | 0.202 | ||||

Inferred Mineral Resources—Molybdenum

21

Property | Short Tons | Metric Tonnes | Molybdenum Grade | |||

(millions) | (millions) | (%) | ||||

TC Mine (3) | 0.6 | 0.5 | 0.044 | |||

Endako Mine (3) | 4.0 | 3.6 | 0.053 | |||

Berg Property (2) | 159.4 | 144.6 | 0.033 | |||

Inferred Mineral Resources—Silver

Property | Short Tons | Silver Grade | Metric Tonnes | Silver Grade | ||||

(millions) | (oz/ton) | (millions) | (gram/tonne) | |||||

Berg Property (2) | 159.4 | 0.073 | 144.6 | 2.5 | ||||

_______________________________________________________________________________

(1) | The inferred mineral resource estimate for Mt. Milligan Mine was prepared by Robert Clifford, our Director of Mine Engineering, who is a Qualified Person under NI 43-101. The inferred mineral resource estimates were prepared using optimized pit shells at a $4.10/t NSR cut-off value, metal prices of $2.00/lb copper, $800/oz gold and an exchange rate of C$1.00/US$0.85, and incorporate estimated costs for milling, plant services, tailing services and general and administrative charges. The inferred mineral resource estimate is based on the cost and price assumptions included in a NI 43-101 technical report prepared for Terrane entitled "Technical Report—Feasibility Update Mt. Milligan Property—Northern BC" dated October 13, 2009 and filed on SEDAR on October 13, 2011. |

(2) | The inferred mineral resource estimate for the Berg property was approved by Robert Clifford, our Director of Mine Engineering who is a Qualified Person under NI 43-101, and is reflected in a NI 43-101 technical report prepared for Terrane entitled "2009 Mineral Resource Estimate on the Berg Copper Molybdenum Silver Property, Tahtsa Range, British Columbia" dated June 26, 2009 and filed on SEDAR on October 13, 2011. The inferred mineral resource estimate for the Berg property is reported using a 0.30% copper equivalent cut-off, with copper equivalency defined using metal prices of $1.60/lb copper, $10/lb molybdenum, and $10/oz silver, taking into account forecast metallurgical recoveries. Resources are reported to a maximum depth of 450 meters (1,476.38 feet) below surface. |

(3) | The inferred mineral resource estimates for TC Mine and Endako Mine were prepared by the TC Mine and Endako Mine staff, respectively, under the supervision of Robert Clifford, our Director of Mine Engineering, who is a Qualified Person under NI 43-101. The inferred mineral resource estimates utilized a cut-off grade of 0.025% Mo and an average long-term molybdenum price of $12.00 per pound. |

22

GLOSSARY OF TERMS

SEC Industry Guide 7 Definitions