Filed by Oaktree Specialty Lending Corporation pursuant to Rule 425 under the Securities Act of 1933 and deemed filed under Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Oaktree Strategic Income II, Inc. File No. of Related Registration Statement: 333-267988 fourth quarter 2022 investor presentation nasdaq: ocsl

Forward Looking Statements & Legal Disclosures Some of the statements in this presentation constitute forward-looking statements because they relate to future events or our future performance or financial condition. The forward-looking statements contained in this presentation may include statements as to: our future operating results and distribution projections; the ability of Oaktree Fund Advisors, LLC (together with its affiliates, “Oaktree”) to reposition our portfolio and to implement Oaktree’s future plans with respect to our business; the ability of Oaktree and its affiliates to attract and retain highly talented professionals; our business prospects and the prospects of our portfolio companies; the impact of the investments that we expect to make; the ability of our portfolio companies to achieve their objectives; our expected financings and investments and additional leverage we may seek to incur in the future; the adequacy of our cash resources and working capital; the timing of cash flows, if any, from the operations of our portfolio companies; and the cost or potential outcome of any litigation to which we may be a party. In addition, words such as “anticipate,” “believe,” “expect,” “seek,” “plan,” “should,” “estimate,” “project” and “intend” indicate forward-looking statements, although not all forward-looking statements include these words. The forward-looking statements contained in this presentation involve risks and uncertainties. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the factors set forth in “Risk Factors” and elsewhere in our annual report on Form 10-K for the fiscal year ended September 30, 2022. Other factors that could cause actual results to differ materially include: the timing or likelihood of the two step- merger of Oaktree Strategic Income II, Inc. (“OSI2”) with and into us (the Mergers ) closing; the expected synergies and savings associated with the Mergers; the ability to realize the anticipated benefits of the Mergers, including the expected elimination of certain expenses and costs due to the Mergers; the percentage of OSI2 and our stockholders voting in favor of the proposals submitted for their approval; the possibility that competing offers or acquisition proposals will be made; the possibility that any or all of the various conditions to the consummation of the Mergers may not be satisfied or waived; risks related to diverting management’s attention from ongoing business operations; the risk that stockholder litigation in connection with the Mergers may result in significant costs of defense and liability; changes in the economy, financial markets and political environment; risks associated with possible disruption in our operations or the economy generally due to terrorism, war or other geopolitical conflict (including the current conflict between Russia and Ukraine), natural disasters or pandemics; future changes in laws or regulations (including the interpretation of these laws and regulations by regulatory authorities) and conditions in our operating areas, particularly with respect to business development companies or regulated investment companies; general considerations associated with the COVID-19 pandemic; and other considerations disclosed from time to time in our publicly disseminated documents and filings. We have based the forward-looking statements included in this presentation on information available to us on the date of this presentation, and we assume no obligation to update any such forward-looking statements. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Additional Information and Where to Find It In connection with the Mergers, OCSL has filed with the SEC a registration statement on Form N-14 (the “Registration Statement”) that includes a preliminary joint proxy statement of OCSL and OSI2 (the “Preliminary Joint Proxy Statement”), and OCSL and OSI2 plan to file with the SEC a definitive joint proxy statement (the “Joint Proxy Statement”) and mail to their respective stockholders the Joint Proxy Statement and the final prospectus of OCSL. The Joint Proxy Statement will contain, and the Registration Statement contains, important information about OSI2, OCSL, the Mergers and related matters. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. STOCKHOLDERS OF OSI2 AND OCSL ARE URGED TO READ THE JOINT PROXY STATEMENT AND REGISTRATION STATEMENT, AND OTHER DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT OSI2, OCSL, THE MERGERS AND RELATED MATTERS. Investors and security holders will be able to obtain the documents filed with the SEC free of charge at the SEC’s website, http://www.sec.gov and, for documents filed by OCSL, from OCSL’s website at http://www.oaktreespecialtylending.com. Participants in the Solicitation OSI2, its directors, certain of its executive officers and certain employees and officers of Oaktree and its affiliates may be deemed to be participants in the solicitation of proxies in connection with the Mergers. Information about the directors and executive officers of OSI2 is set forth in the Preliminary Joint Proxy Statement, which was filed by OCSL with the SEC on October 24, 2022. OCSL, its directors, certain of its executive officers and certain employees and officers of Oaktree and its affiliates may be deemed to be participants in the solicitation of proxies in connection with the Mergers. Information about the directors and executive officers of OCSL is set forth in the Preliminary Joint Proxy Statement, which was filed by OCSL with the SEC on October 24, 2022. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the OSI2 and OCSL stockholders in connection with the Mergers will be contained in the Joint Proxy Statement when such document becomes available. These documents may be obtained free of charge from the sources indicated above. No Offer or Solicitation This presentation is not, and under no circumstances is it to be construed as, a prospectus or an advertisement and the communication of this press release is not, and under no circumstances is it to be construed as, an offer to sell or a solicitation of an offer to purchase any securities in OSI2, OCSL or in any fund or other investment vehicle managed by Oaktree or any of its affiliates. 1

Forward Looking Statements & Legal Disclosures (continued) Calculation of Assets Under Management References to total assets under management or AUM represent assets managed by Oaktree and a proportionate amount of the AUM reported by DoubleLine Capital LP ( DoubleLine Capital ), in which Oaktree owns a 20% minority interest. Oaktree's methodology for calculating AUM includes (i) the net asset value (“NAV”) of assets managed directly by Oaktree, (ii) the leverage on which management fees are charged, (iii) undrawn capital that Oaktree is entitled to call from investors in Oaktree funds pursuant to their capital commitments, (iv) for collateralized loan obligation vehicles ( CLOs ), the aggregate par value of collateral assets and principal cash, (v) for publicly-traded business development companies, gross assets (including assets acquired with leverage), net of cash, and (vi) Oaktree's pro rata portion (20%) of the AUM reported by DoubleLine Capital. This calculation of AUM is not based on the definitions of AUM that may be set forth in agreements governing the investment funds, vehicles or accounts managed and is not calculated pursuant to regulatory definitions. Unless otherwise indicated, data provided herein are dated as of September 30, 2022. 2

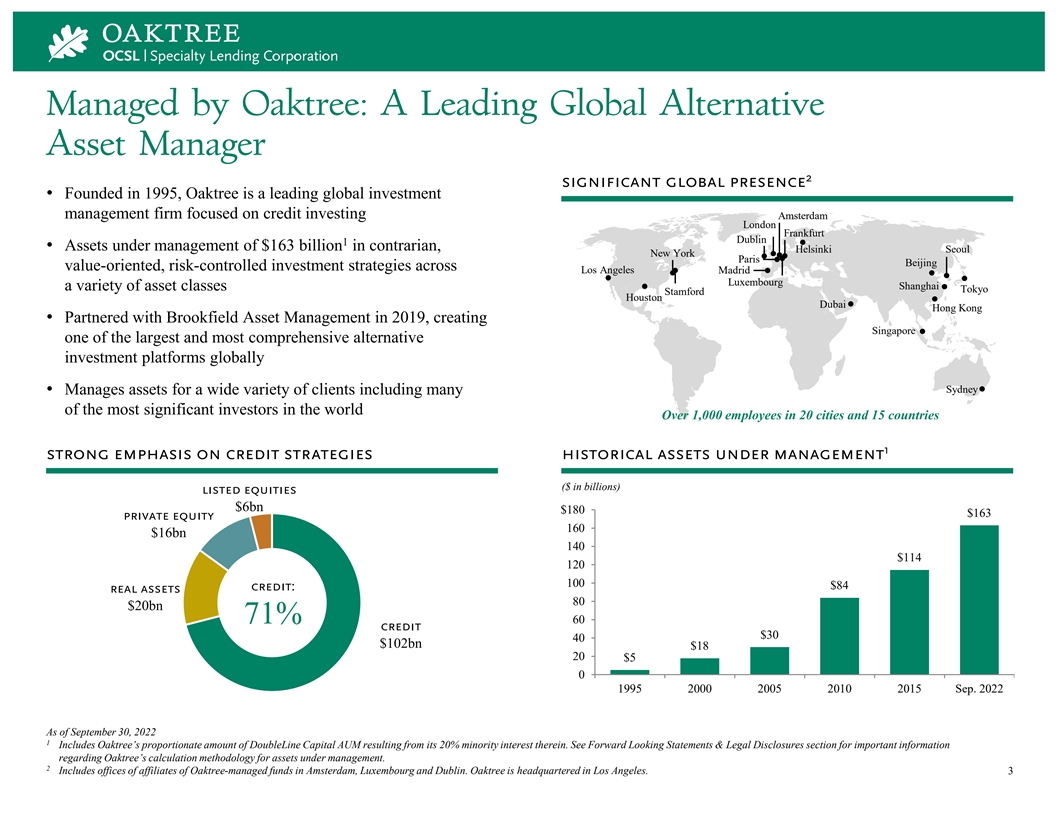

Managed by Oaktree: A Leading Global Alternative Asset Manager 2 significant global presence • Founded in 1995, Oaktree is a leading global investment management firm focused on credit investing Amsterdam London Frankfurt Dublin 1 • Assets under management of $163 billion in contrarian, Helsinki Seoul New York Paris Beijing value-oriented, risk-controlled investment strategies across Los Angeles Madrid Luxembourg Shanghai a variety of asset classes Tokyo Stamford Houston Dubai Hong Kong • Partnered with Brookfield Asset Management in 2019, creating Singapore one of the largest and most comprehensive alternative investment platforms globally Sydney • Manages assets for a wide variety of clients including many of the most significant investors in the world Over 1,000 employees in 20 cities and 15 countries 1 strong emphasis on credit strategies historical assets under management ($ in billions) listed equities $6bn $180 $163 private equity 160 $16bn 140 $114 120 100 $84 credit: real assets 80 $20bn 71% 60 credit $30 40 $102bn $18 20 $5 0 1995 2000 2005 2010 2015 Sep. 2022 As of September 30, 2022 1 Includes Oaktree’s proportionate amount of DoubleLine Capital AUM resulting from its 20% minority interest therein. See Forward Looking Statements & Legal Disclosures section for important information regarding Oaktree’s calculation methodology for assets under management. 2 Includes offices of affiliates of Oaktree-managed funds in Amsterdam, Luxembourg and Dublin. Oaktree is headquartered in Los Angeles. 3

Oaktree’s Investment Philosophy primacy of risk Rather than merely searching for prospective profits, we place the highest priority on preventing losses; control “If we avoid the losers, the winners will take care of themselves” – Howard Marks emphasis on A superior record is best built on a high batting average rather than a mix of brilliant successes and dismal failures consistency importance of It is only in less-efficient markets that hard work and skill are likely to produce superior investment results market inefficiency benefits of Our team members’ long-term experience and expertise in creative, efficient structuring and institutional specialization knowledge of bankruptcies and restructurings enables a focus on risk control that competitors tend to lack macro-forecasting not critical to A bottom-up investment approach based on proprietary, company-specific research is most productive investing disavowal of Bargains are purchased without reliance on predictions about the market’s future direction market timing The key tenets of Oaktree’s investment philosophy are strongly aligned with the interests of Oaktree Specialty Lending shareholders 4

The Oaktree Advantage significant scale & presence “all weather” credit manager • Oaktree’s roots are in credit, dating back to our • Over three decades of investment experience, 1 founders’ investing activities in 1978 in areas ranging from performing credit to 1 distressed debt, over multiple market cycles • $102 billion of credit-focused AUM • Over $33 billion invested in more than 550 • Deep and broad credit platform drawing from directly originated loans since 2005 more than 350 highly experienced investment professionals with significant • Active investor in periods of market strength origination, structuring and and distress underwriting expertise integrated investment disciplined credit approach underwriting process centered on risk control • Deep relationships with many sources of investment opportunities – private equity • Bottom-up, fundamental credit analysis at the sponsors, capital raising advisers and borrowers core of our value-driven investment approach • Expertise to structure comprehensive, flexible • Collaboration across teams of multi- and creative credit solutions for companies of disciplinary investment professionals drives all sizes across various industries superior investment insights • Capacity to invest in large deals and • Access to proprietary deal flow and frequent to sole underwrite transactions first look at investment opportunities As of September 30, 2022 1 This includes the investment team’s record achieved at TCW Group since their inception through the first quarter of 1995, at which time they commenced portfolio management at newly formed Oaktree. 5

Oaktree’s Extensive Origination Capabilities extensive, global credit platform to source deal flow dedicated • Strong market presence and established relationships with traditional sponsor channels sourcing & as well as with management teams, capital raising advisors and individual issuers origination team • Leverage Oaktree’s significant marketable securities presence to identify and create multi- centralized new lending opportunities disciplinary trading investment • Emphasis on proprietary deals: frequent “first look” opportunities, well positioned for desk strategies difficult and complex transactions • Established reputation as a “go-to” source for borrowers due to longstanding track record in direct lending ability to address a wide range of borrower needs • Capability to invest across the capital structure • Certainty to borrowers by seeking to provide fully underwritten finance commitments • Capacity to fund large loans • Expertise in performing credit, as well as restructuring and turnaround situations ocsl Oaktree’s extensive origination capabilities has led to greater ability to source quality investments 6

Experienced Management Team matt pendo chris mckown matt stewart, cfa armen panossian President CFO & Treasurer COO CEO & CIO • Managing Director, Head of Oaktree’s • Managing Director in fund accounting • Senior Vice President and investment • Managing Director, Co-Portfolio Corporate Development and Capital and reporting for Oaktree’s Strategic professional on Oaktree’s Strategic Credit Manager of Oaktree’s Strategic Credit Markets Credit strategy team Strategy and Oaktree’s Head of Performing Credit • Joined Oaktree in 2015 • Joined Oaktree in 2011 • Joined Oaktree in 2017 • Former CIO of TARP (Troubled Asset • Previously worked in the audit practice at • Previously worked in the leveraged • Joined Oaktree in 2007 as a senior Relief Program) of the U.S. Department KPMG, focusing on investment finance businesses of Stifel Nicolaus and member of its Distressed Debt investment team of the Treasury management and broker-dealer clients Knight Capital Group • Previously Portfolio Manager of • 30 years of investment banking • Began career in the restructuring advisory Oaktree’s U.S. Senior Loan group and led experience at leading Wall Street firms group at BDO Consulting launch of Oaktree’s CLO business • Experience investing across market cycles in performing and stressed asset classes 1 ocsl is supported by strategic credit team of 30 investment professionals and leverages oaktree’s first-class operational infrastructure significant experience highly integrated deep bench 1 30 investment professionals ; 370+ multi-disciplinary investment investment professionals, with a centralized senior investment professionals average trading desk and origination team professionals across the firm, including 2 18 years of investment experience 150+ managing directors 7 As of September 30, 2022 1 Includes seven members of Sourcing & Origination team, which is a shared resource. 2 Vice President level and above.

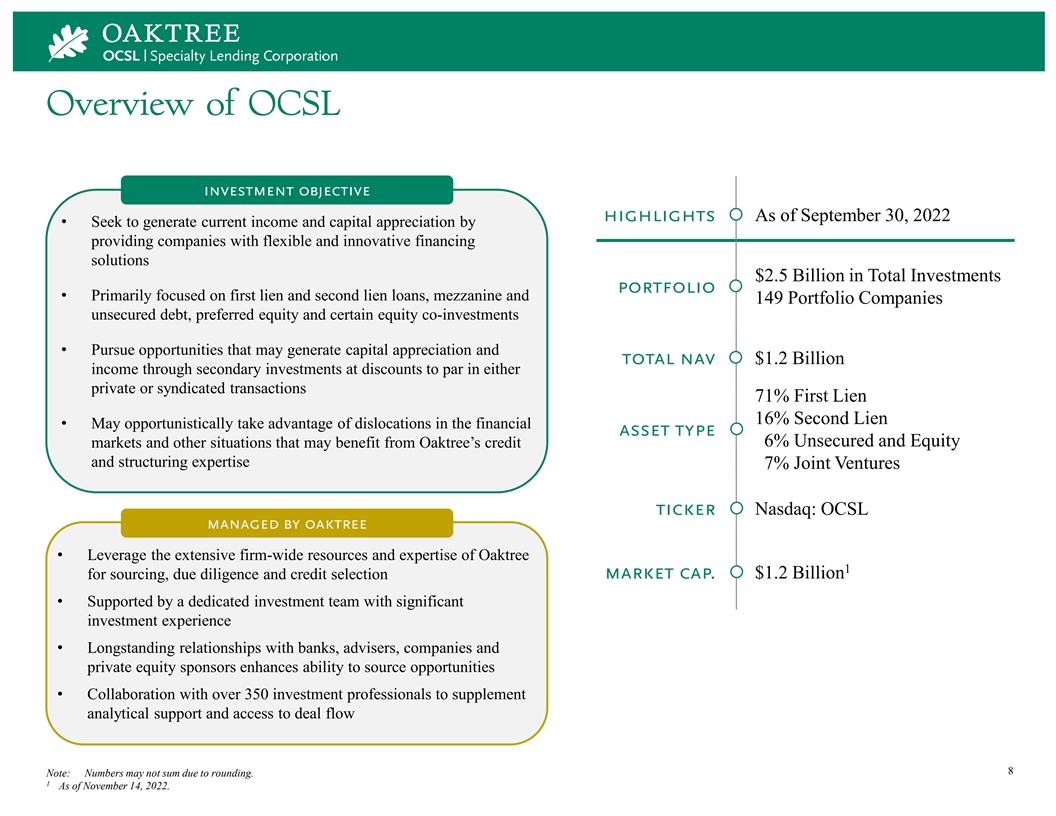

Overview of OCSL investment objective highlights As of September 30, 2022 • Seek to generate current income and capital appreciation by providing companies with flexible and innovative financing solutions $2.5 Billion in Total Investments portfolio • Primarily focused on first lien and second lien loans, mezzanine and 149 Portfolio Companies unsecured debt, preferred equity and certain equity co-investments • Pursue opportunities that may generate capital appreciation and total nav $1.2 Billion income through secondary investments at discounts to par in either private or syndicated transactions 71% First Lien 16% Second Lien • May opportunistically take advantage of dislocations in the financial asset type 6% Unsecured and Equity markets and other situations that may benefit from Oaktree’s credit and structuring expertise 7% Joint Ventures ticker Nasdaq: OCSL managed by oaktree • Leverage the extensive firm-wide resources and expertise of Oaktree 1 market cap. $1.2 Billion for sourcing, due diligence and credit selection • Supported by a dedicated investment team with significant investment experience • Longstanding relationships with banks, advisers, companies and private equity sponsors enhances ability to source opportunities • Collaboration with over 350 investment professionals to supplement analytical support and access to deal flow 8 Note: Numbers may not sum due to rounding. 1 As of November 14, 2022.

Positioned to Provide Attractive Risk-Adjusted Returns to Shareholders access to oaktree’s deep and broad credit platform ability to participate in proprietary investments diverse, high-quality senior secured floating rate loan portfolio supported by dedicated strategic credit team of 30 tenured investment 1 professionals conservative balance sheet, strong liquidity and flexible, low-cost liability structure positioned to benefit from continued interest rate increases As of September 30, 2022 9 1 Includes seven members of Sourcing & Origination team, which is a shared resource.

OCSL’s Areas of Focus primary focus on differentiated private credit transactions with a secondary emphasis on public debt markets primary focus secondary focus attractively priced private credit public credit • Bespoke, highly structured private • Leverage Oaktree’s presence in liquid investments in non-sponsor credit markets to uncover attractive companies that have unique needs, primary market new issuance or complex business models or specific discounted secondary opportunities business challenges ocsl • Examples include broadly syndicated • Focus on opportunities that are not loans, high yield bonds and structured well-trafficked by other lenders credit • Direct lending to businesses backed • Generally shorter hold periods and by sponsors that have demonstrated smaller positions relative to private industry expertise or value long-term credit investments partnerships 10 Note: Chart for illustrative purposes only and is not meant to be representative of the percentage of OCSL’s current or future portfolio that falls or will fall within each category.

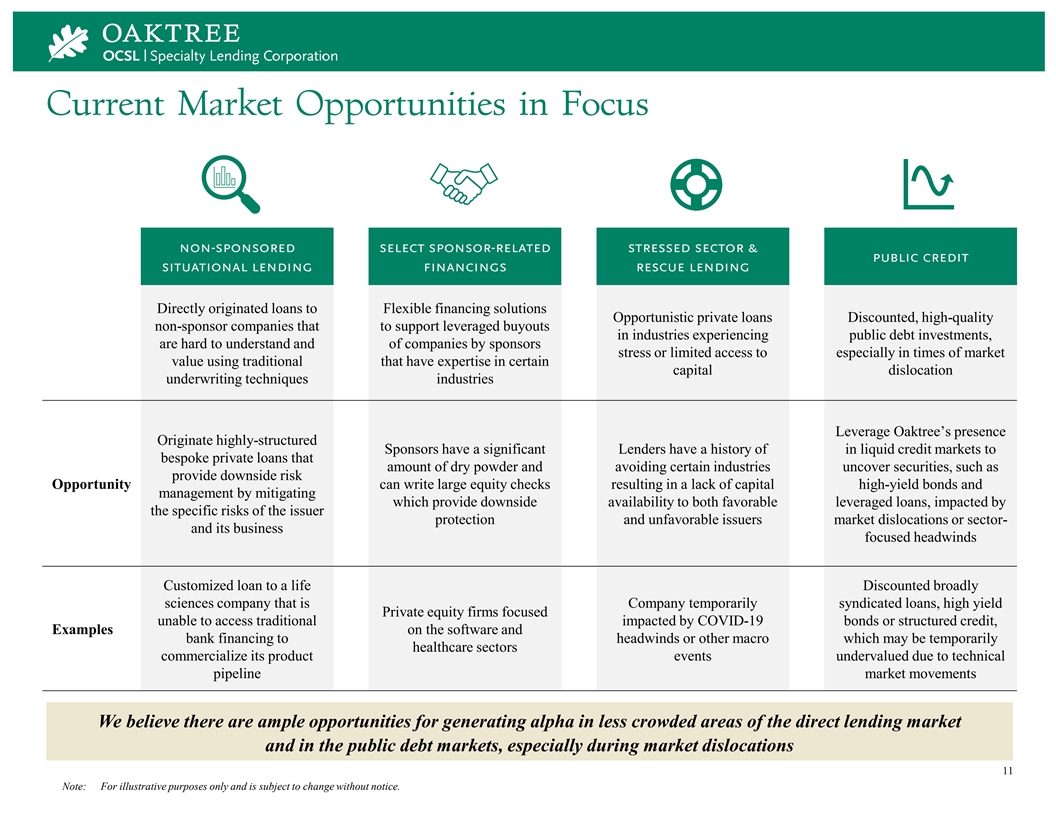

Current Market Opportunities in Focus non-sponsored select sponsor-related stressed sector & public credit situational lending financings rescue lending Directly originated loans to Flexible financing solutions Opportunistic private loans Discounted, high-quality non-sponsor companies that to support leveraged buyouts in industries experiencing public debt investments, are hard to understand and of companies by sponsors stress or limited access to especially in times of market value using traditional that have expertise in certain capital dislocation underwriting techniques industries Leverage Oaktree’s presence Originate highly-structured Sponsors have a significant Lenders have a history of in liquid credit markets to bespoke private loans that amount of dry powder and avoiding certain industries uncover securities, such as provide downside risk Opportunity can write large equity checks resulting in a lack of capital high-yield bonds and management by mitigating which provide downside availability to both favorable leveraged loans, impacted by the specific risks of the issuer protection and unfavorable issuers market dislocations or sector- and its business focused headwinds Customized loan to a life Discounted broadly sciences company that is Company temporarily syndicated loans, high yield Private equity firms focused unable to access traditional impacted by COVID-19 bonds or structured credit, Examples on the software and bank financing to headwinds or other macro which may be temporarily healthcare sectors commercialize its product events undervalued due to technical pipeline market movements We believe there are ample opportunities for generating alpha in less crowded areas of the direct lending market and in the public debt markets, especially during market dislocations 11 Note: For illustrative purposes only and is subject to change without notice.

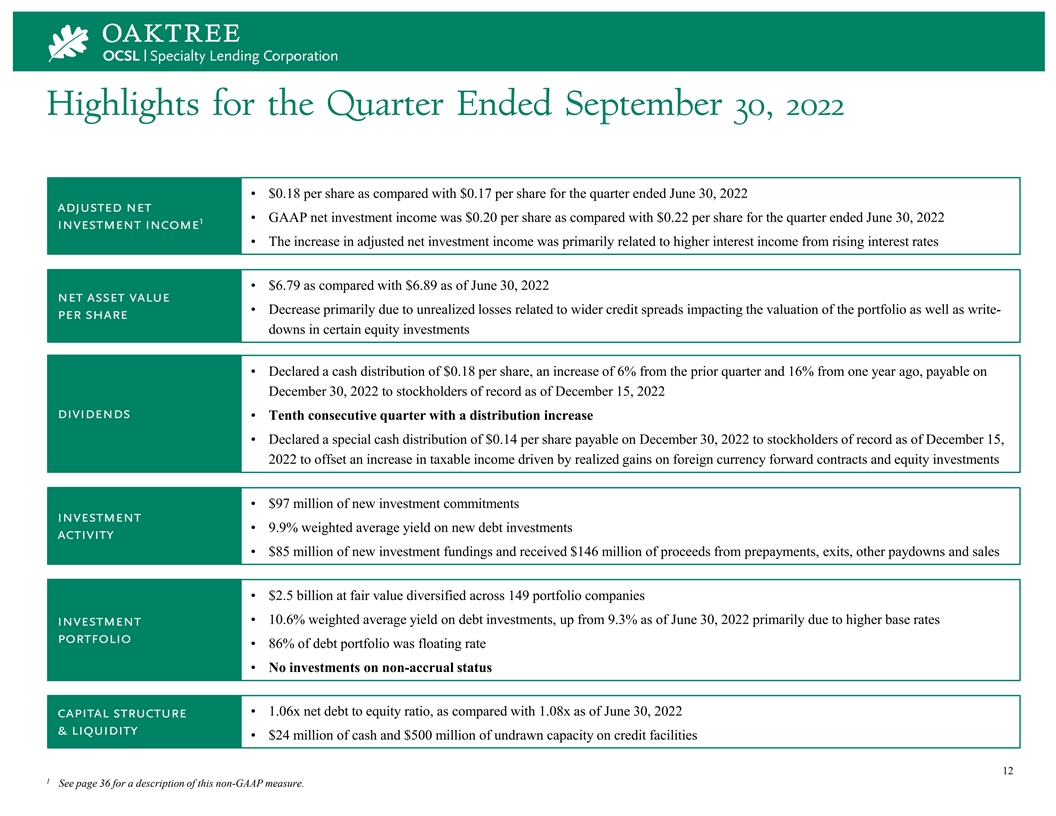

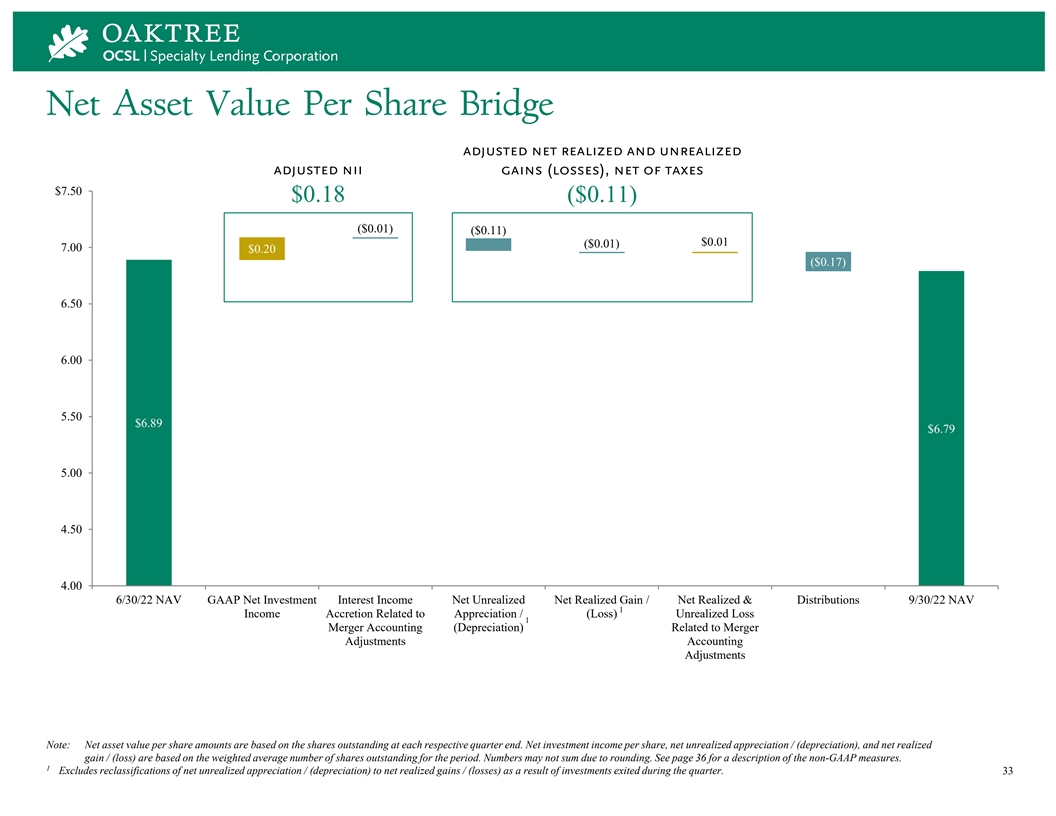

Highlights for the Quarter Ended September 30, 2022 • $0.18 per share as compared with $0.17 per share for the quarter ended June 30, 2022 adjusted net • GAAP net investment income was $0.20 per share as compared with $0.22 per share for the quarter ended June 30, 2022 1 investment income • The increase in adjusted net investment income was primarily related to higher interest income from rising interest rates • $6.79 as compared with $6.89 as of June 30, 2022 net asset value • Decrease primarily due to unrealized losses related to wider credit spreads impacting the valuation of the portfolio as well as write- per share downs in certain equity investments • Declared a cash distribution of $0.18 per share, an increase of 6% from the prior quarter and 16% from one year ago, payable on December 30, 2022 to stockholders of record as of December 15, 2022 dividends • Tenth consecutive quarter with a distribution increase • Declared a special cash distribution of $0.14 per share payable on December 30, 2022 to stockholders of record as of December 15, 2022 to offset an increase in taxable income driven by realized gains on foreign currency forward contracts and equity investments • $97 million of new investment commitments investment • 9.9% weighted average yield on new debt investments activity • $85 million of new investment fundings and received $146 million of proceeds from prepayments, exits, other paydowns and sales • $2.5 billion at fair value diversified across 149 portfolio companies • 10.6% weighted average yield on debt investments, up from 9.3% as of June 30, 2022 primarily due to higher base rates investment portfolio • 86% of debt portfolio was floating rate • No investments on non-accrual status • 1.06x net debt to equity ratio, as compared with 1.08x as of June 30, 2022 capital structure & liquidity • $24 million of cash and $500 million of undrawn capacity on credit facilities 12 1 See page 36 for a description of this non-GAAP measure.

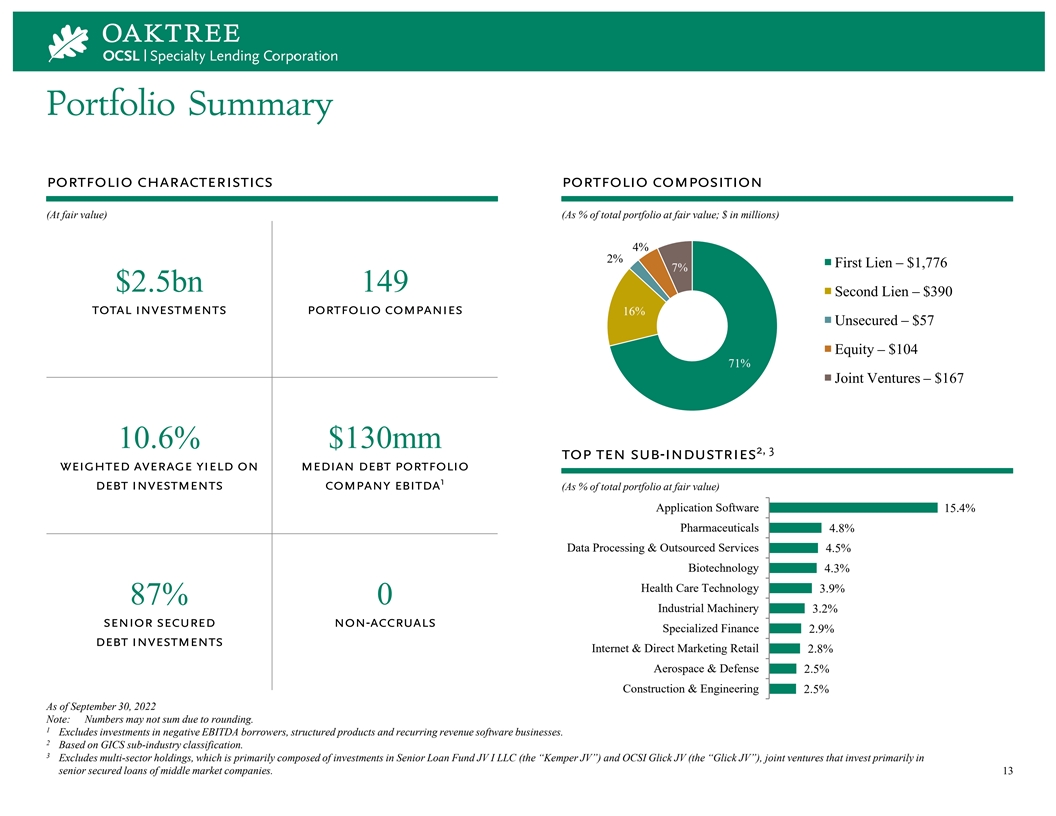

Portfolio Summary portfolio characteristics portfolio composition (At fair value) (As % of total portfolio at fair value; $ in millions) 4% 2% First Lien – $1,776 7% $2.5bn 149 Second Lien – $390 total investments portfolio companies 16% Unsecured – $57 Equity – $104 71% Joint Ventures – $167 10.6% $130mm 2, 3 top ten sub-industries weighted average yield on median debt portfolio 1 debt investments company ebitda (As % of total portfolio at fair value) Application Software 15.4% Pharmaceuticals 4.8% Data Processing & Outsourced Services 4.5% Biotechnology 4.3% Health Care Technology 3.9% 87% 0 Industrial Machinery 3.2% senior secured non-accruals Specialized Finance 2.9% debt investments Internet & Direct Marketing Retail 2.8% Aerospace & Defense 2.5% Construction & Engineering 2.5% As of September 30, 2022 Note: Numbers may not sum due to rounding. 1 Excludes investments in negative EBITDA borrowers, structured products and recurring revenue software businesses. 2 Based on GICS sub-industry classification. 3 Excludes multi-sector holdings, which is primarily composed of investments in Senior Loan Fund JV I LLC (the “Kemper JV”) and OCSI Glick JV (the “Glick JV”), joint ventures that invest primarily in senior secured loans of middle market companies. 13

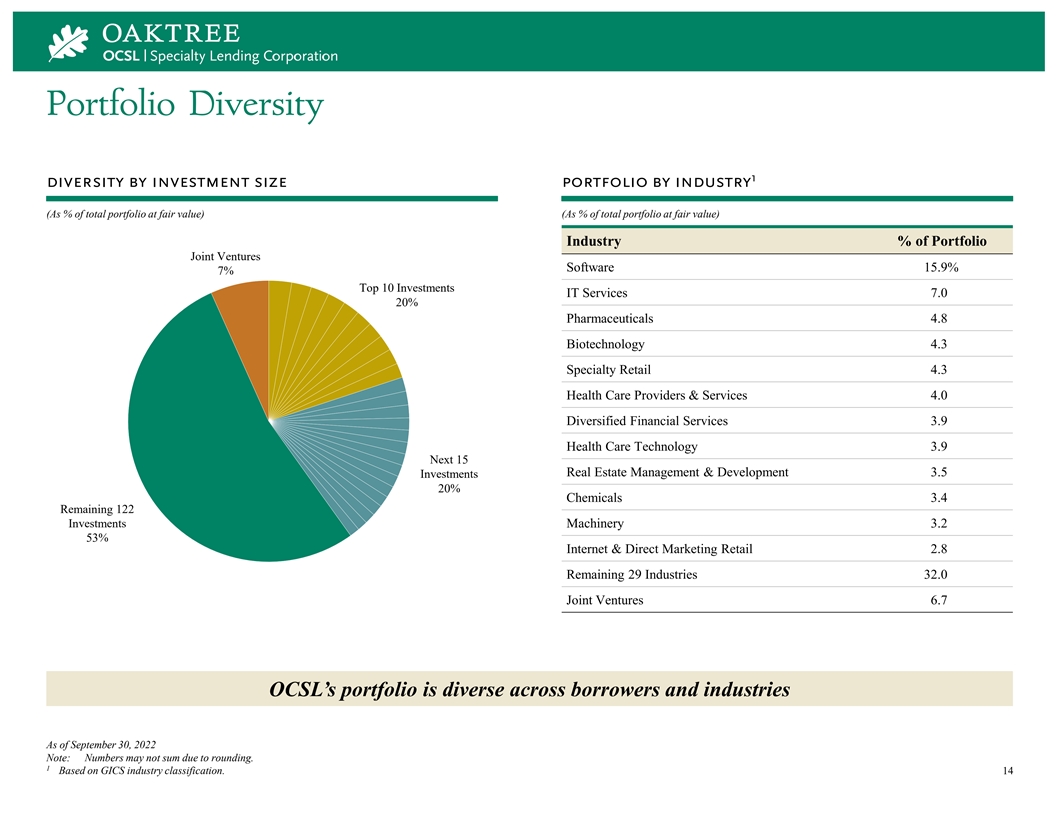

Portfolio Diversity 1 diversity by investment size portfolio by industry (As % of total portfolio at fair value) (As % of total portfolio at fair value) Industry % of Portfolio Joint Ventures Software 15.9% 7% Top 10 Investments IT Services 7.0 20% Pharmaceuticals 4.8 Biotechnology 4.3 Specialty Retail 4.3 Health Care Providers & Services 4.0 Diversified Financial Services 3.9 Health Care Technology 3.9 Next 15 Real Estate Management & Development 3.5 Investments 20% Chemicals 3.4 Remaining 122 Investments Machinery 3.2 53% Internet & Direct Marketing Retail 2.8 Remaining 29 Industries 32.0 Joint Ventures 6.7 OCSL’s portfolio is diverse across borrowers and industries As of September 30, 2022 Note: Numbers may not sum due to rounding. 1 Based on GICS industry classification. 14

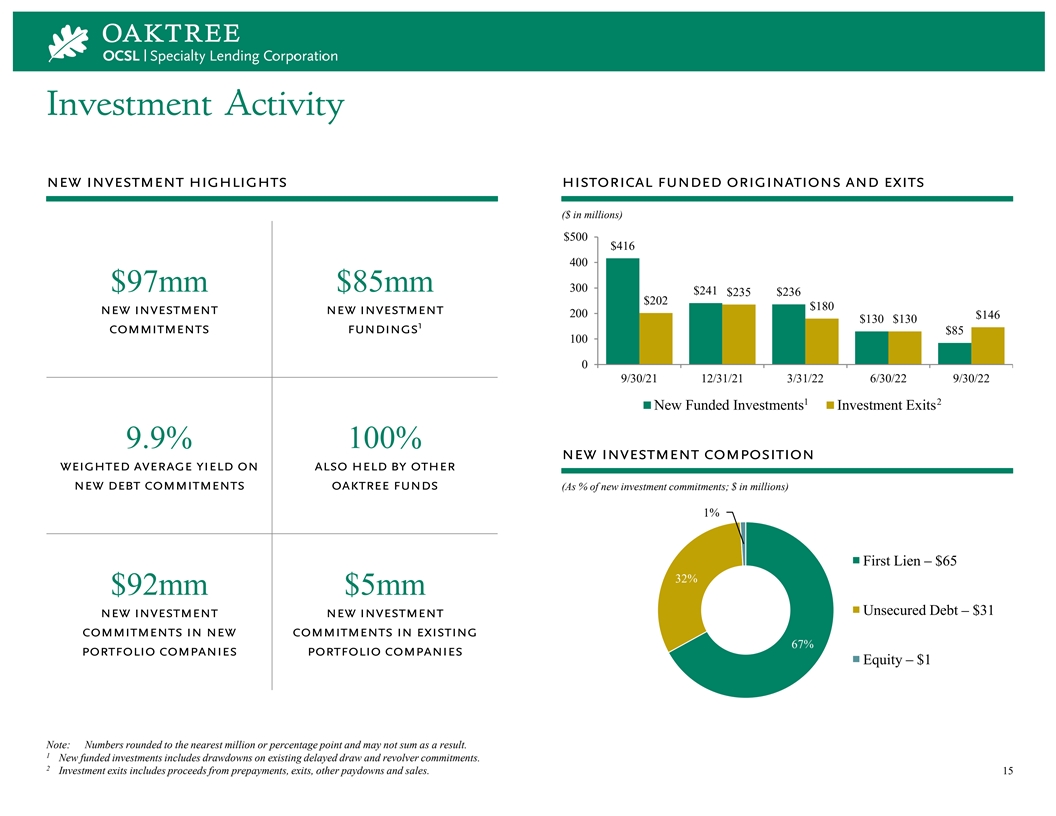

Investment Activity new investment highlights historical funded originations and exits ($ in millions) $500 $416 400 $97mm $85mm 300 $241 $235 $236 $202 $180 new investment new investment 200 $146 $130 $130 1 commitments fundings $85 100 0 9/30/21 12/31/21 3/31/22 6/30/22 9/30/22 1 2 New Funded Investments Investment Exits 9.9% 100% new investment composition weighted average yield on also held by other new debt commitments oaktree funds (As % of new investment commitments; $ in millions) 1% First Lien – $65 32% $92mm $5mm Unsecured Debt – $31 new investment new investment commitments in new commitments in existing 67% portfolio companies portfolio companies Equity – $1 Note: Numbers rounded to the nearest million or percentage point and may not sum as a result. 1 New funded investments includes drawdowns on existing delayed draw and revolver commitments. 2 Investment exits includes proceeds from prepayments, exits, other paydowns and sales. 15

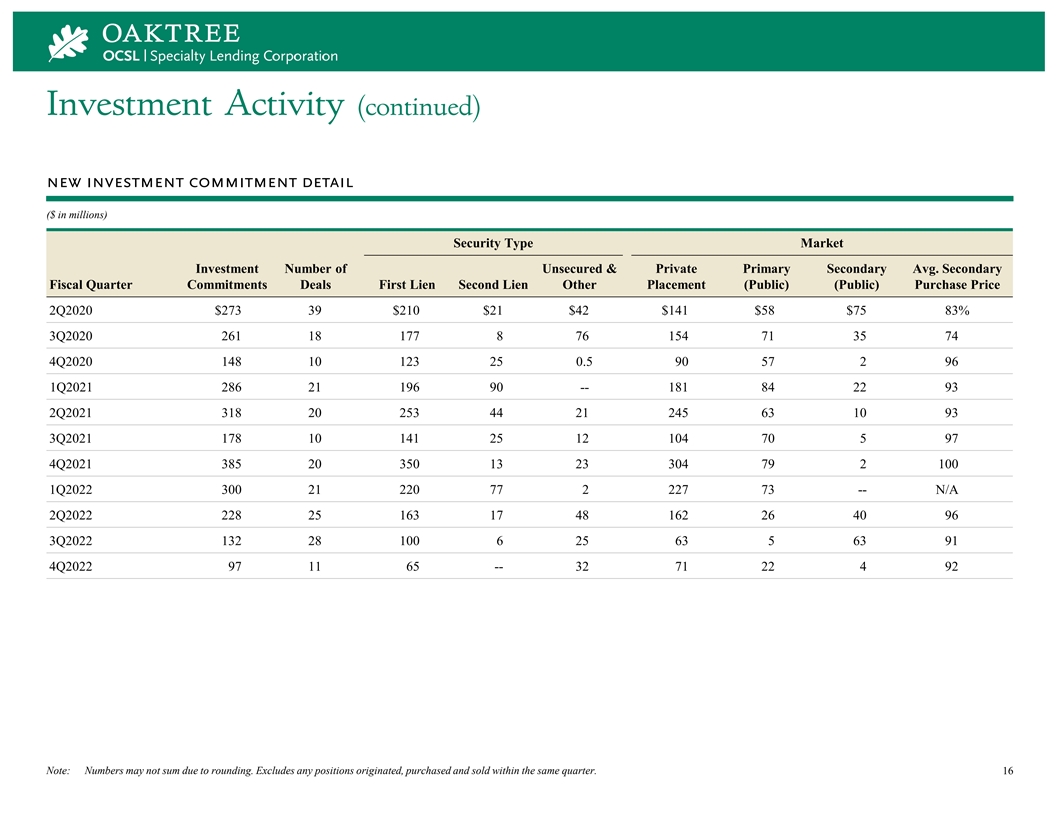

Investment Activity (continued) new investment commitment detail ($ in millions) Security Type Market Investment Number of Unsecured & Private Primary Secondary Avg. Secondary Fiscal Quarter Commitments Deals First Lien Second Lien Other Placement (Public) (Public) Purchase Price 2Q2020 $273 39 $210 $21 $42 $141 $58 $75 83% 3Q2020 261 18 177 8 76 154 71 35 74 4Q2020 148 10 123 25 0.5 90 57 2 96 1Q2021 286 21 196 90 -- 181 84 22 93 2Q2021 318 20 253 44 21 245 63 10 93 3Q2021 178 10 141 25 12 104 70 5 97 4Q2021 385 20 350 13 23 304 79 2 100 1Q2022 300 21 220 77 2 227 73 -- N/A 2Q2022 228 25 163 17 48 162 26 40 96 3Q2022 132 28 100 6 25 63 5 63 91 4Q2022 97 11 65 -- 32 71 22 4 92 Note: Numbers may not sum due to rounding. Excludes any positions originated, purchased and sold within the same quarter. 16

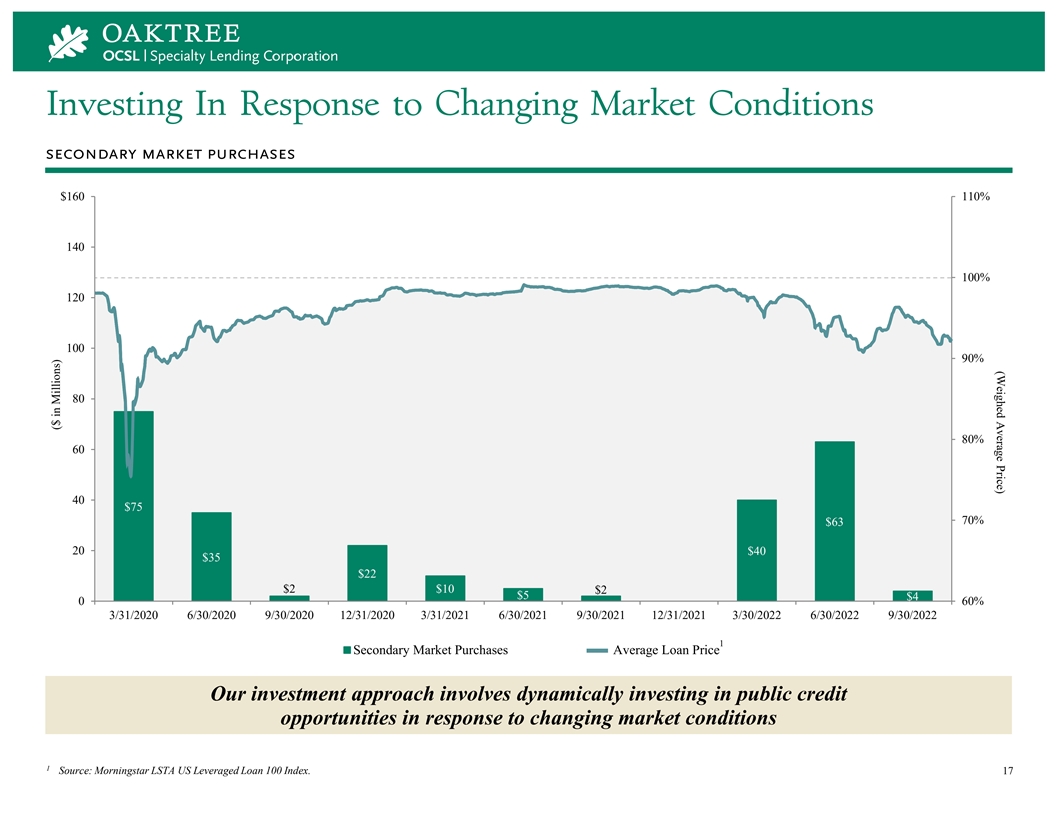

(Weighed Average Price) Investing In Response to Changing Market Conditions secondary market purchases $160 110% 140 100% 120 100 90% 80 80% 60 40 $75 70% $63 20 $40 $35 $22 $2 $10 $2 $5 $4 0 60% 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 6/30/2021 9/30/2021 12/31/2021 3/30/2022 6/30/2022 9/30/2022 1 Secondary Market Purchases Average Loan Price Our investment approach involves dynamically investing in public credit opportunities in response to changing market conditions 1 Source: Morningstar LSTA US Leveraged Loan 100 Index. 17 ($ in Millions)

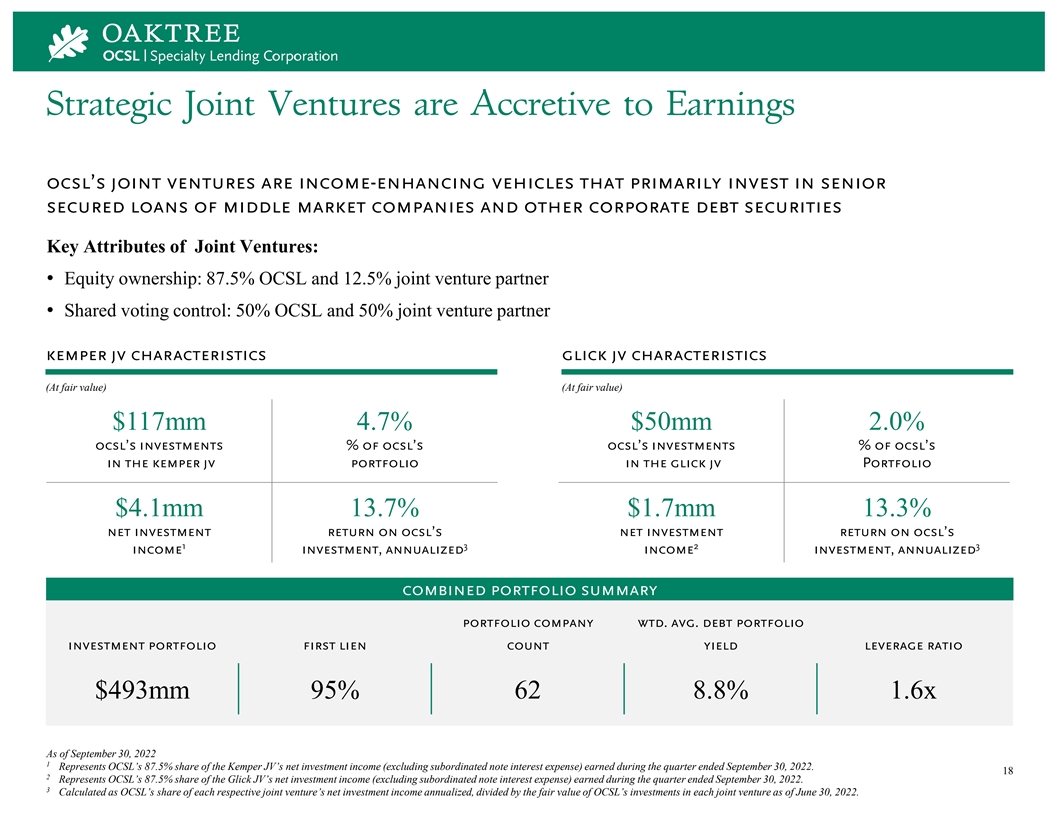

Strategic Joint Ventures are Accretive to Earnings ocsl’s joint ventures are income-enhancing vehicles that primarily invest in senior secured loans of middle market companies and other corporate debt securities Key Attributes of Joint Ventures: • Equity ownership: 87.5% OCSL and 12.5% joint venture partner • Shared voting control: 50% OCSL and 50% joint venture partner kemper jv characteristics glick jv characteristics (At fair value) (At fair value) $117mm 4.7% $50mm 2.0% ocsl’s investments % of ocsl’s ocsl’s investments % of ocsl’s in the kemper jv portfolio in the glick jv Portfolio $4.1mm 13.7% $1.7mm 13.3% net investment return on ocsl’s net investment return on ocsl’s 1 3 2 3 income investment, annualized income investment, annualized combined portfolio summary portfolio company wtd. avg. debt portfolio investment portfolio first lien count yield leverage ratio $493mm 95% 62 8.8% 1.6x As of September 30, 2022 1 Represents OCSL’s 87.5% share of the Kemper JV’s net investment income (excluding subordinated note interest expense) earned during the quarter ended September 30, 2022. 18 2 Represents OCSL’s 87.5% share of the Glick JV’s net investment income (excluding subordinated note interest expense) earned during the quarter ended September 30, 2022. 3 Calculated as OCSL’s share of each respective joint venture’s net investment income annualized, divided by the fair value of OCSL’s investments in each joint venture as of June 30, 2022.

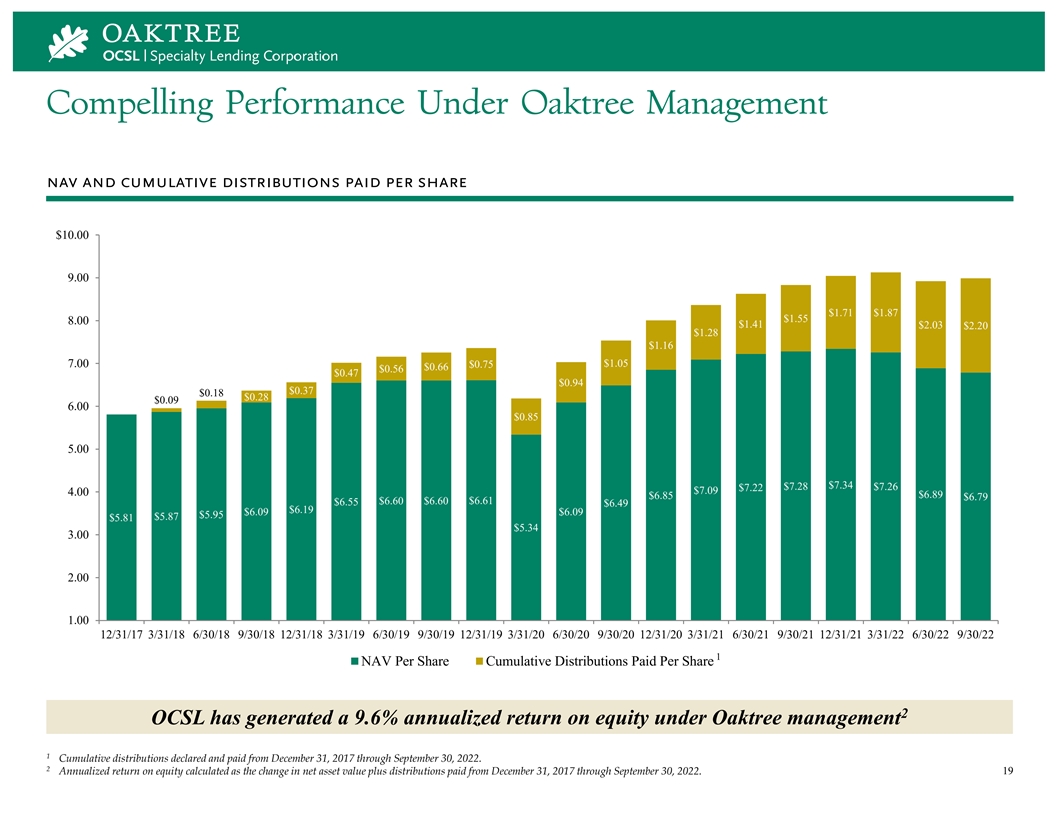

Compelling Performance Under Oaktree Management nav and cumulative distributions paid per share $10.00 9.00 $1.71 $1.87 $1.55 8.00 $1.41 $2.03 $2.20 $1.28 $1.16 $1.05 7.00 $0.75 $0.66 $0.56 $0.47 $0.94 $0.37 $0.18 $0.28 $0.09 6.00 $0.85 5.00 $7.34 $7.22 $7.28 $7.26 $7.09 4.00 $6.85 $6.89 $6.79 $6.60 $6.60 $6.61 $6.55 $6.49 $6.19 $6.09 $6.09 $5.95 $5.87 $5.81 $5.34 3.00 2.00 1.00 12/31/17 3/31/18 6/30/18 9/30/18 12/31/18 3/31/19 6/30/19 9/30/19 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 6/30/21 9/30/21 12/31/21 3/31/22 6/30/22 9/30/22 1 NAV Per Share Cumulative Distributions Paid Per Share 2 OCSL has generated a 9.6% annualized return on equity under Oaktree management 1 Cumulative distributions declared and paid from December 31, 2017 through September 30, 2022. 2 Annualized return on equity calculated as the change in net asset value plus distributions paid from December 31, 2017 through September 30, 2022. 19

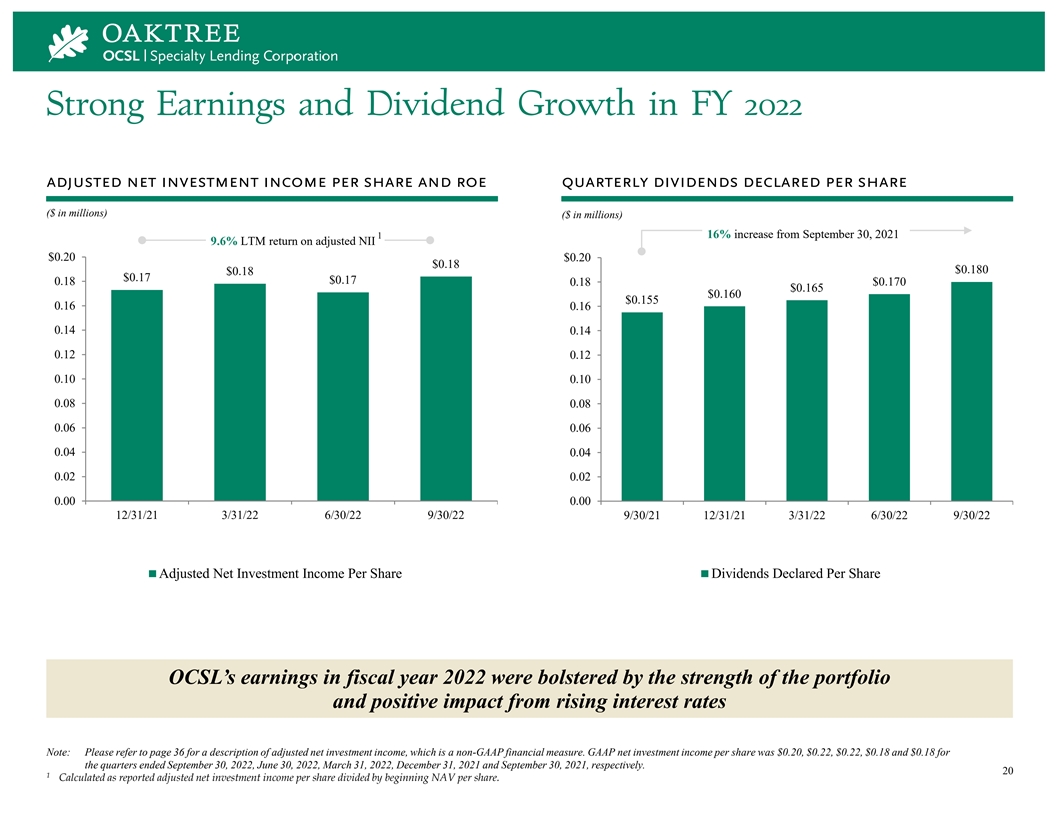

Strong Earnings and Dividend Growth in FY 2022 adjusted net investment income per share and roe quarterly dividends declared per share ($ in millions) ($ in millions) 1 16% increase from September 30, 2021 9.6% LTM return on adjusted NII $0.20 $0.20 $0.18 $0.180 $0.18 $0.17 $0.17 0.18 $0.170 0.18 $0.165 $0.160 $0.155 0.16 0.16 0.14 0.14 0.12 0.12 0.10 0.10 0.08 0.08 0.06 0.06 0.04 0.04 0.02 0.02 0.00 0.00 12/31/21 3/31/22 6/30/22 9/30/22 9/30/21 12/31/21 3/31/22 6/30/22 9/30/22 Adjusted Net Investment Income Per Share Dividends Declared Per Share OCSL’s earnings in fiscal year 2022 were bolstered by the strength of the portfolio and positive impact from rising interest rates Note: Please refer to page 36 for a description of adjusted net investment income, which is a non-GAAP financial measure. GAAP net investment income per share was $0.20, $0.22, $0.22, $0.18 and $0.18 for the quarters ended September 30, 2022, June 30, 2022, March 31, 2022, December 31, 2021 and September 30, 2021, respectively. 20 1 Calculated as reported adjusted net investment income per share divided by beginning NAV per share.

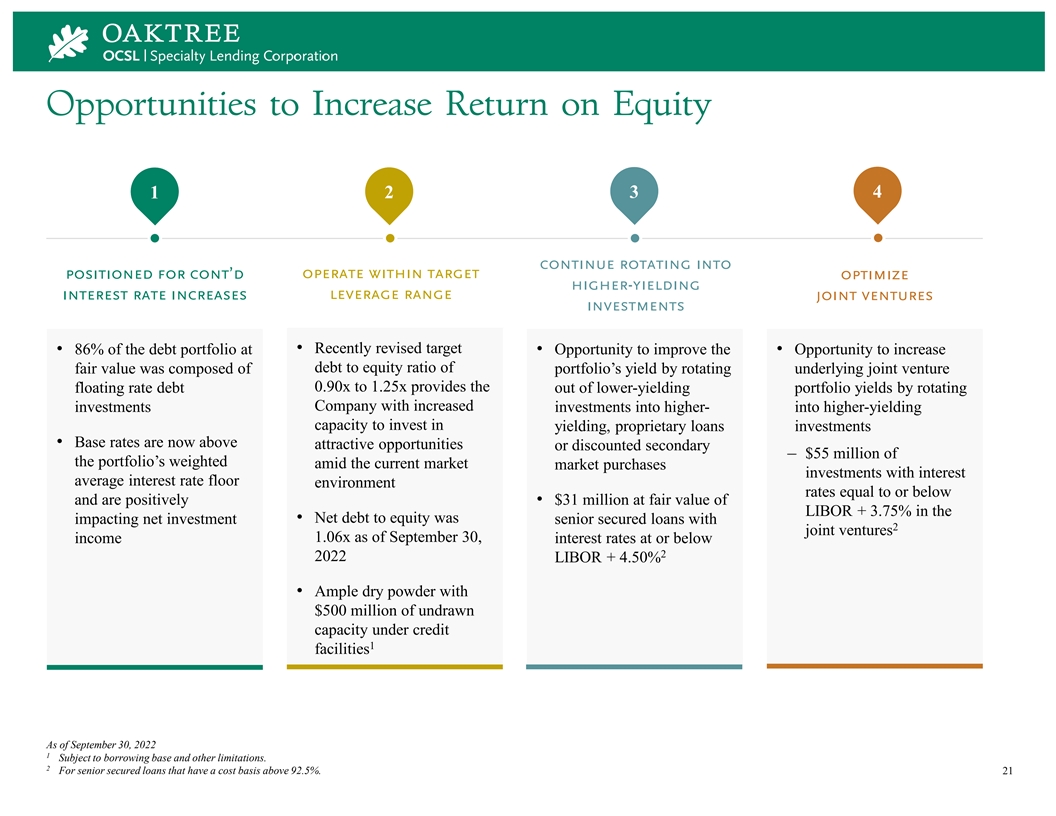

Opportunities to Increase Return on Equity 4 1 2 3 continue rotating into positioned for cont’d operate within target optimize higher-yielding leverage range interest rate increases joint ventures investments • Recently revised target • 86% of the debt portfolio at • Opportunity to improve the • Opportunity to increase debt to equity ratio of fair value was composed of portfolio’s yield by rotating underlying joint venture 0.90x to 1.25x provides the floating rate debt out of lower-yielding portfolio yields by rotating Company with increased investments investments into higher- into higher-yielding capacity to invest in yielding, proprietary loans investments • Base rates are now above attractive opportunities or discounted secondary – $55 million of the portfolio’s weighted amid the current market market purchases investments with interest average interest rate floor environment rates equal to or below and are positively • $31 million at fair value of LIBOR + 3.75% in the • Net debt to equity was impacting net investment senior secured loans with 2 joint ventures 1.06x as of September 30, income interest rates at or below 2 2022 LIBOR + 4.50% • Ample dry powder with $500 million of undrawn capacity under credit 1 facilities As of September 30, 2022 1 Subject to borrowing base and other limitations. 2 For senior secured loans that have a cost basis above 92.5%. 21

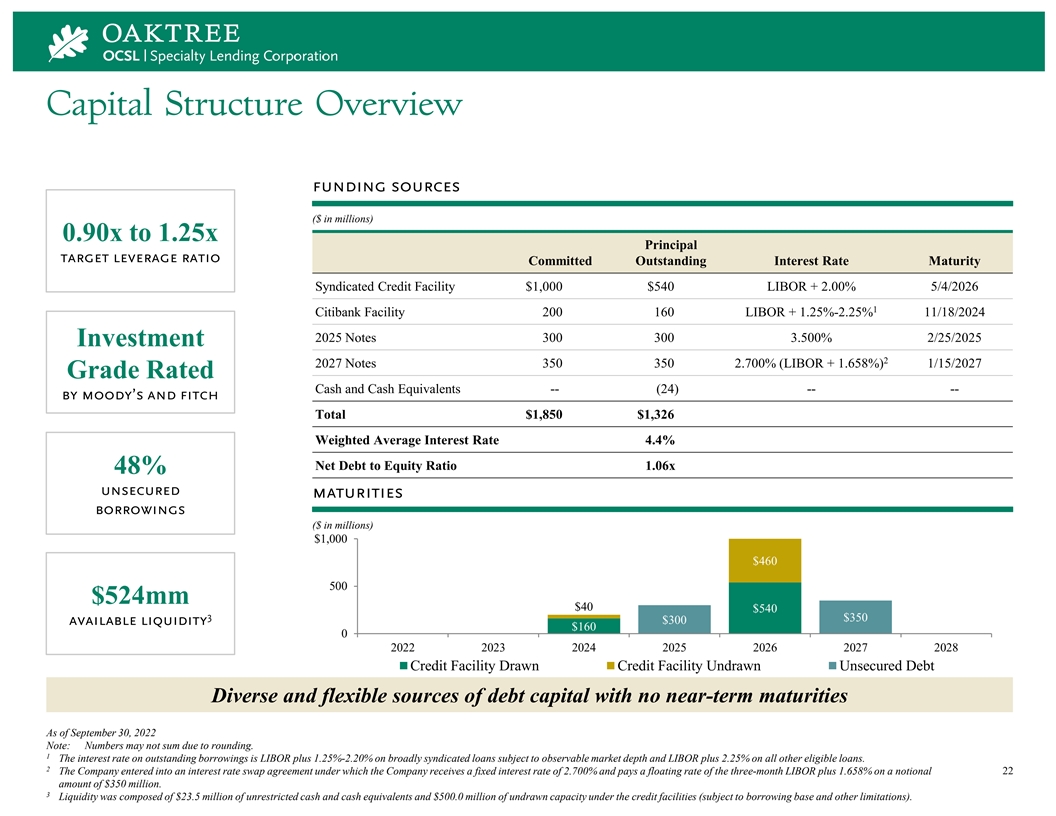

Capital Structure Overview funding sources ($ in millions) 0.90x to 1.25x Principal target leverage ratio Committed Outstanding Interest Rate Maturity Syndicated Credit Facility $1,000 $540 LIBOR + 2.00% 5/4/2026 1 Citibank Facility 200 160 LIBOR + 1.25%-2.25% 11/18/2024 2025 Notes 300 300 3.500% 2/25/2025 Investment 2 2027 Notes 350 350 2.700% (LIBOR + 1.658%) 1/15/2027 Grade Rated Cash and Cash Equivalents -- (24) -- -- by moody’s and fitch Total $1,850 $1,326 Weighted Average Interest Rate 4.4% Net Debt to Equity Ratio 1.06x 48% unsecured maturities borrowings ($ in millions) $1,000 $460 500 $524mm $40 $540 3 $350 $300 available liquidity $160 0 2022 2023 2024 2025 2026 2027 2028 Credit Facility Drawn Credit Facility Undrawn Unsecured Debt Diverse and flexible sources of debt capital with no near-term maturities As of September 30, 2022 Note: Numbers may not sum due to rounding. 1 The interest rate on outstanding borrowings is LIBOR plus 1.25%-2.20% on broadly syndicated loans subject to observable market depth and LIBOR plus 2.25% on all other eligible loans. 2 The Company entered into an interest rate swap agreement under which the Company receives a fixed interest rate of 2.700% and pays a floating rate of the three-month LIBOR plus 1.658% on a notional 22 amount of $350 million. 3 Liquidity was composed of $23.5 million of unrestricted cash and cash equivalents and $500.0 million of undrawn capacity under the credit facilities (subject to borrowing base and other limitations).

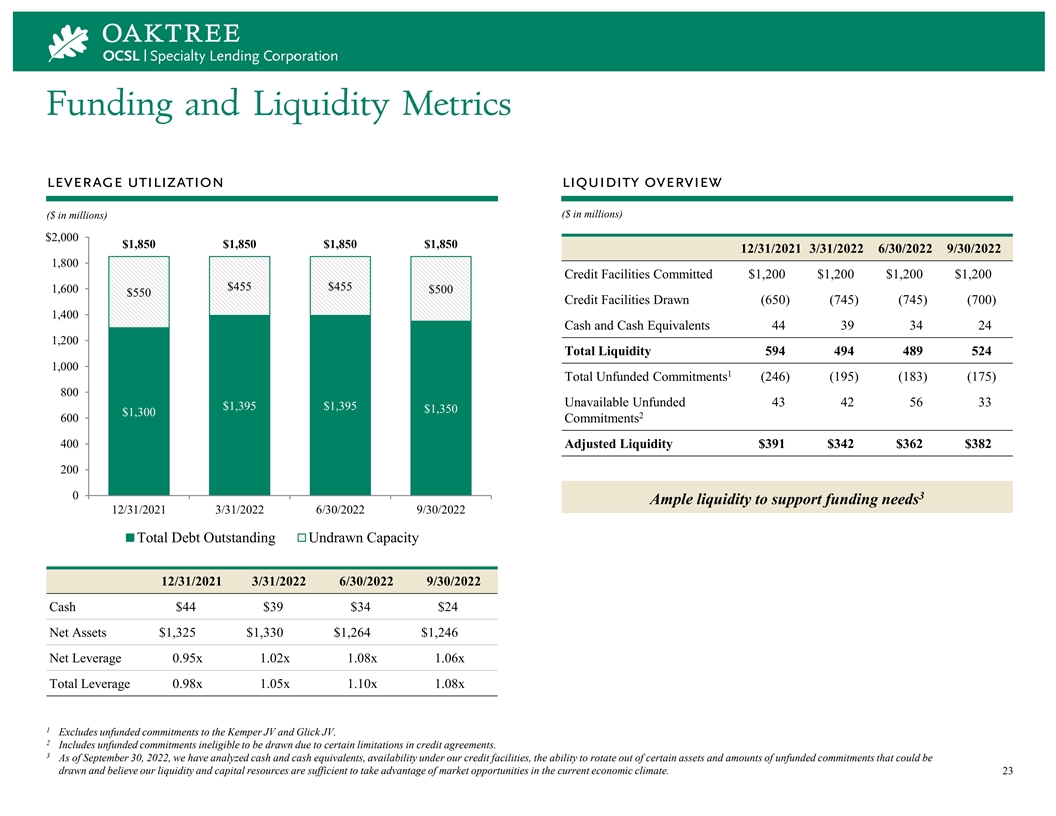

Funding and Liquidity Metrics leverage utilization liquidity overview ($ in millions) ($ in millions) $2,000 $1,850 $1,850 $1,850 $1,850 12/31/2021 3/31/2022 6/30/2022 9/30/2022 1,800 Credit Facilities Committed $1,200 $1,200 $1,200 $1,200 $455 $455 1,600 $500 $550 Credit Facilities Drawn (650) (745) (745) (700) 1,400 Cash and Cash Equivalents 44 39 34 24 1,200 Total Liquidity 594 494 489 524 1,000 1 Total Unfunded Commitments (246) (195) (183) (175) 800 Unavailable Unfunded 43 42 56 33 $1,395 $1,395 $1,350 $1,300 2 600 Commitments 400 Adjusted Liquidity $391 $342 $362 $382 200 0 3 Ample liquidity to support funding needs 12/31/2021 3/31/2022 6/30/2022 9/30/2022 Total Debt Outstanding Undrawn Capacity 12/31/2021 3/31/2022 6/30/2022 9/30/2022 Cash $44 $39 $34 $24 Net Assets $1,325 $1,330 $1,264 $1,246 Net Leverage 0.95x 1.02x 1.08x 1.06x Total Leverage 0.98x 1.05x 1.10x 1.08x 1 Excludes unfunded commitments to the Kemper JV and Glick JV. 2 Includes unfunded commitments ineligible to be drawn due to certain limitations in credit agreements. 3 As of September 30, 2022, we have analyzed cash and cash equivalents, availability under our credit facilities, the ability to rotate out of certain assets and amounts of unfunded commitments that could be drawn and believe our liquidity and capital resources are sufficient to take advantage of market opportunities in the current economic climate. 23

Appendix

Total Merger Consideration 1 merger consideration highlights illustrative example ($ and share amounts in millions, except per share data) Total merger consideration will be based on the net asset values of OCSL and OSI2 $18.50 $6.79 osi2 nav ocsl nav • OCSL to acquire 100% of OSI2 in a stock-for-stock per share per share transaction, with shares of OSI2 common stock to be exchanged for shares of OCSL common stock on a NAV-for-NAV basis 2.72x • Mergers will result in an ownership split of the combined company proportional to each of OCSL’s exchange ratio and OSI2’s respective net asset values • At closing, NAV used in determining the exchange ratio will reflect transaction expenses and any tax- (Total NAV and shares in millions) OSI2 OCSL Combined related distributions Total NAV $322 $1,246 $1,568 Shares Outstanding 17.4 183.4 230.7 NAV Per Share $18.50 $6.79 $6.79 Note: This select financial information of OSI2 is subject to the completion of OSI2’s financial closing procedures and is not a comprehensive statement of OSI2’s financial position, results of operations or cash flows for the year ended September 30, 2022. Final results may differ materially as a result of the completion of OSI2’s financial closing procedures, as well as any subsequent events, including the discovery of information affecting fair values of OSI2’s portfolio investments as of September 30, 2022, arising between the date hereof and the completion of OSI2’s financial statements and the filing of OSI2’s annual report on Form 10-K for the year then ended. The select financial information of OSI2 provided herein has been prepared by, and is the responsibility of, OSI2 management. Ernst & Young LLP, OSI2’s independent registered public accounting firm, has not audited, reviewed, compiled, or performed any procedures with respect to such select financial information. Accordingly, Ernst & Young LLP does not express an opinion or any other form of assurance with respect thereto. 25 1 Based on net asset values as of September 30, 2022. Net asset values do not include the impact of expenses related to the Mergers or any tax-related distributions. Final merger NAV will be determined within 48 hours prior to closing (excluding Sundays and Holidays).

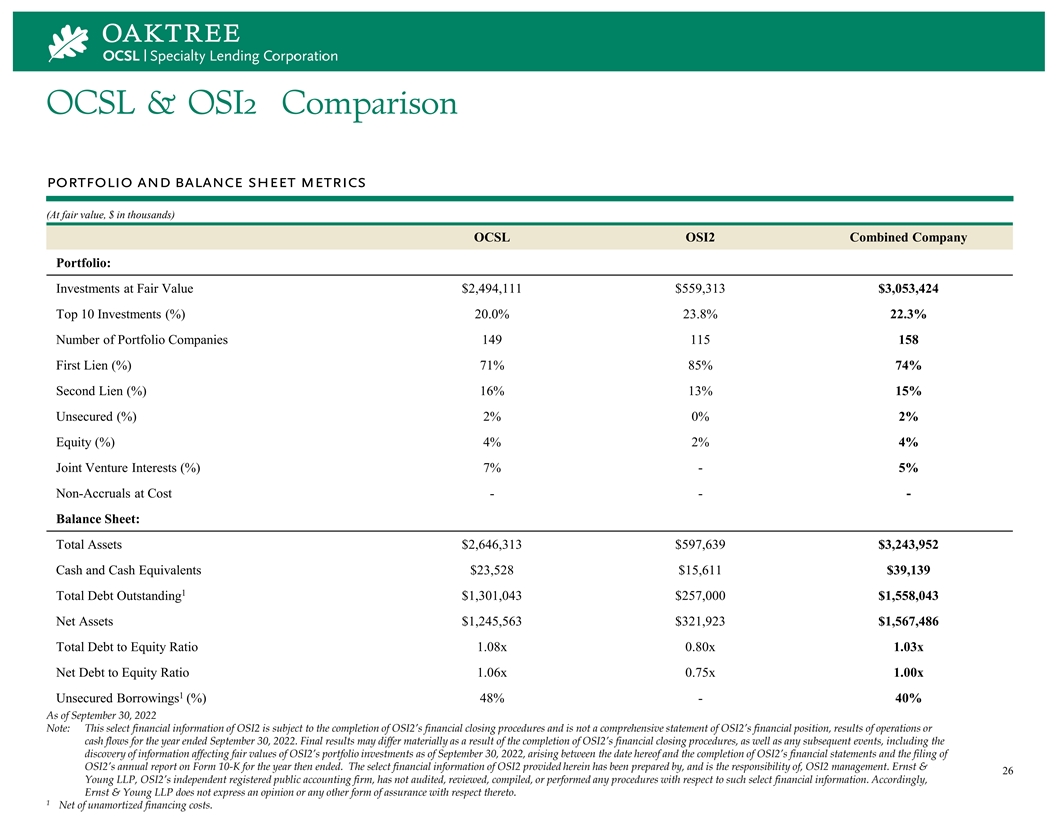

OCSL & OSI2 Comparison portfolio and balance sheet metrics (At fair value, $ in thousands) OCSL OSI2 Combined Company Portfolio: Investments at Fair Value $2,494,111 $559,313 $3,053,424 Top 10 Investments (%) 20.0% 23.8% 22.3% Number of Portfolio Companies 149 115 158 First Lien (%) 71% 85% 74% Second Lien (%) 16% 13% 15% Unsecured (%) 2% 0% 2% Equity (%) 4% 2% 4% Joint Venture Interests (%) 7% - 5% Non-Accruals at Cost - - - Balance Sheet: Total Assets $2,646,313 $597,639 $3,243,952 Cash and Cash Equivalents $23,528 $15,611 $39,139 1 Total Debt Outstanding $1,301,043 $257,000 $1,558,043 Net Assets $1,245,563 $321,923 $1,567,486 Total Debt to Equity Ratio 1.08x 0.80x 1.03x Net Debt to Equity Ratio 1.06x 0.75x 1.00x 1 Unsecured Borrowings (%) 48% - 40% As of September 30, 2022 Note: This select financial information of OSI2 is subject to the completion of OSI2’s financial closing procedures and is not a comprehensive statement of OSI2’s financial position, results of operations or cash flows for the year ended September 30, 2022. Final results may differ materially as a result of the completion of OSI2’s financial closing procedures, as well as any subsequent events, including the discovery of information affecting fair values of OSI2’s portfolio investments as of September 30, 2022, arising between the date hereof and the completion of OSI2’s financial statements and the filing of OSI2’s annual report on Form 10-K for the year then ended. The select financial information of OSI2 provided herein has been prepared by, and is the responsibility of, OSI2 management. Ernst & 26 Young LLP, OSI2’s independent registered public accounting firm, has not audited, reviewed, compiled, or performed any procedures with respect to such select financial information. Accordingly, Ernst & Young LLP does not express an opinion or any other form of assurance with respect thereto. 1 Net of unamortized financing costs.

Portfolio Progression Under Oaktree Management portfolio progression: september 30, 2017 vs. september 30, 2022 ($ in millions, at fair value) 9/30/2017 9/30/2022 balance sheet Investments at Fair Value $1,542 $2,494 Net Assets $868 $1,246 Net Leverage Ratio 0.70x 1.06x Weighted Average Interest Rate on Debt Outstanding 4.3% 4.4% Credit Ratings (Moody’s/S&P/Fitch) - / BB+ / - Baa3 / - / BBB- portfolio First Lien 53.9% 71.2% Second Lien 24.1% 15.7% Senior Secured Debt 78.0% 86.9% Unsecured Debt 6.1% 2.3% Equity & Limited Partnership Interests 7.2% 4.2% Joint Venture Interests 8.7% 6.7% 1 Median Debt Portfolio Company EBITDA $50 $130 non-core portfolio Total Non-Core Investments $893 $71 Number of Non-Core Debt Portfolio Companies 54 2 Non-Accruals % of Debt Portfolio 4.7% --% As of September 30, 2022 27 1 Excludes investments in negative EBITDA borrowers, structured products and recurring revenue software businesses.

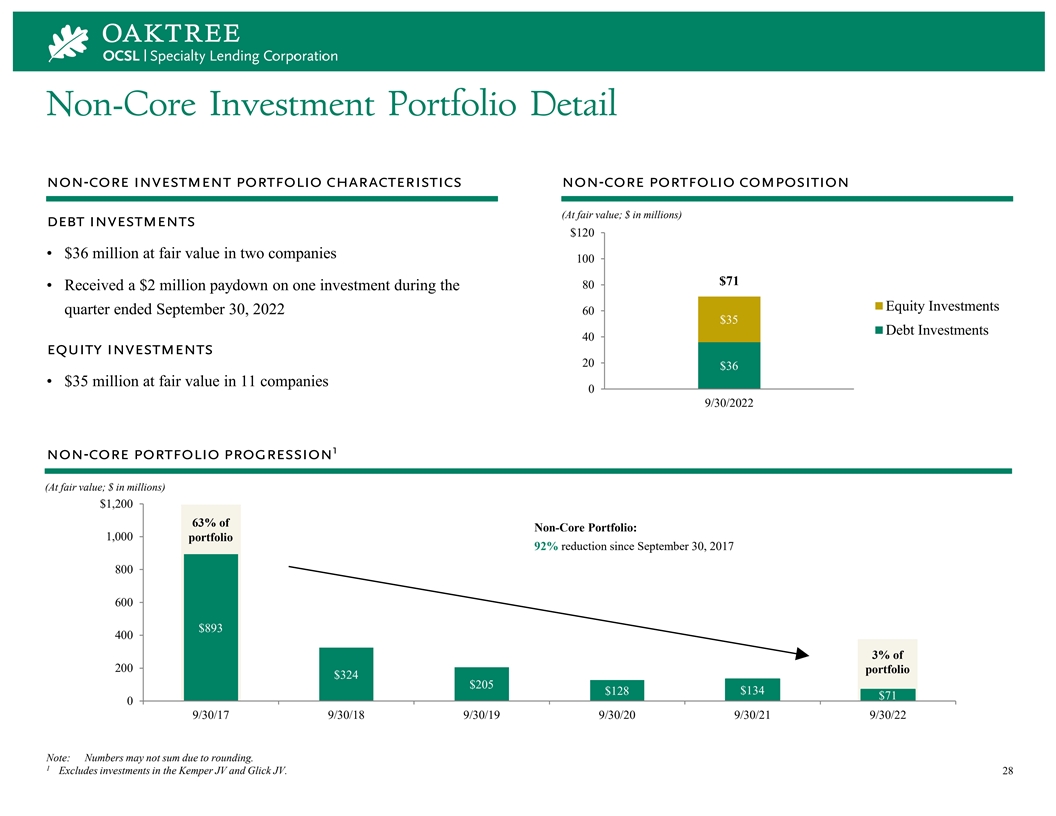

Non-Core Investment Portfolio Detail non-core investment portfolio characteristics non-core portfolio composition (At fair value; $ in millions) debt investments $120 • $36 million at fair value in two companies 100 $71 80 • Received a $2 million paydown on one investment during the Equity Investments quarter ended September 30, 2022 60 $35 Debt Investments 40 equity investments 20 $36 • $35 million at fair value in 11 companies 0 9/30/2022 1 non-core portfolio progression (At fair value; $ in millions) $1,200 63% of Non-Core Portfolio: 1,000 portfolio 92% reduction since September 30, 2017 800 600 $893 400 3% of 200 portfolio $324 $205 $128 $134 $71 0 9/30/17 9/30/18 9/30/19 9/30/20 9/30/21 9/30/22 Note: Numbers may not sum due to rounding. 1 Excludes investments in the Kemper JV and Glick JV. 28

Oaktree’s ESG Framework Oaktree has invested with a sensitivity to ESG considerations since the firm’s inception, a commitment first formalized in our Socially Responsible Investment policy in 2014 Oaktree is a signatory to the United Nations-supported Principles for Responsible Investment (“PRI”) and a supporter of the Task Force on Climate-Related Financial Disclosures (“TCFD”) Oaktree’s investment professionals are active participants in advancing ESG at the firm, both as part of the firm’s ESG Governance Committee and in each individual strategy our beliefs our approach • ESG considerations directly affect company fundamentals and • Oaktree’s ESG Governance Committee: investment outcomes, both positively and negatively ‒ Drives the firm’s approach to ESG matters ‒ Ensures ESG best practices are shared and applied in every • A focus on ESG throughout the investment lifecycle advances strategy our mission to deliver superior investment results with risk under control‒ Comprises senior professionals from investment strategies and non-investment areas • Engagement with company management can influence • Each strategy investment team: positive change ‒ Factors ESG risks and opportunities into its assessment of • ESG integration deepens our alignment with our stakeholders, prospective returns their beneficiaries and their collective long-term interests ‒ Manages portfolios in accordance with Oaktree’s SRI policy and the strategy’s distinct ESG implementation plan 29

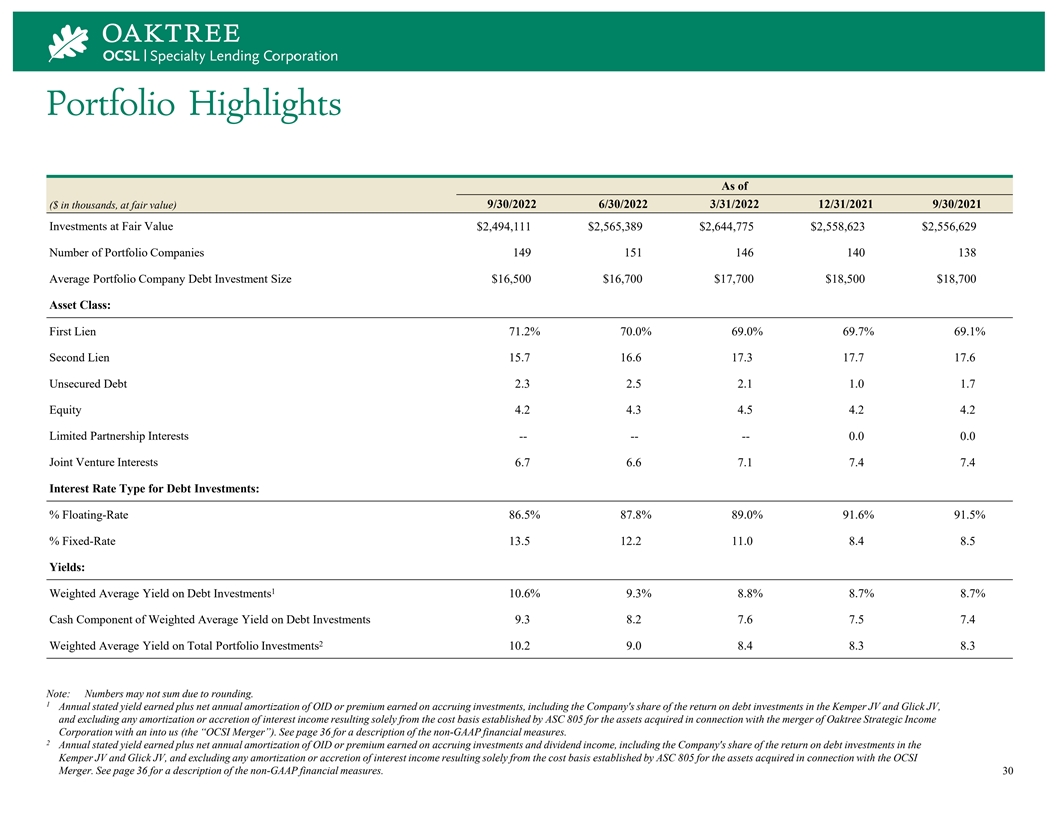

Portfolio Highlights As of ($ in thousands, at fair value) 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 Investments at Fair Value $2,494,111 $2,565,389 $2,644,775 $2,558,623 $2,556,629 Number of Portfolio Companies 149 151 146 140 138 Average Portfolio Company Debt Investment Size $16,500 $16,700 $17,700 $18,500 $18,700 Asset Class: First Lien 71.2% 70.0% 69.0% 69.7% 69.1% Second Lien 15.7 16.6 17.3 17.7 17.6 Unsecured Debt 2.3 2.5 2.1 1.0 1.7 Equity 4.2 4.3 4.5 4.2 4.2 Limited Partnership Interests -- -- -- 0.0 0.0 Joint Venture Interests 6.7 6.6 7.1 7.4 7.4 Interest Rate Type for Debt Investments: % Floating-Rate 86.5% 87.8% 89.0% 91.6% 91.5% % Fixed-Rate 13.5 12.2 11.0 8.4 8.5 Yields: 1 Weighted Average Yield on Debt Investments 10.6% 9.3% 8.8% 8.7% 8.7% Cash Component of Weighted Average Yield on Debt Investments 9.3 8.2 7.6 7.5 7.4 2 Weighted Average Yield on Total Portfolio Investments 10.2 9.0 8.4 8.3 8.3 Note: Numbers may not sum due to rounding. 1 Annual stated yield earned plus net annual amortization of OID or premium earned on accruing investments, including the Company's share of the return on debt investments in the Kemper JV and Glick JV, and excluding any amortization or accretion of interest income resulting solely from the cost basis established by ASC 805 for the assets acquired in connection with the merger of Oaktree Strategic Income Corporation with an into us (the “OCSI Merger”). See page 36 for a description of the non-GAAP financial measures. 2 Annual stated yield earned plus net annual amortization of OID or premium earned on accruing investments and dividend income, including the Company's share of the return on debt investments in the Kemper JV and Glick JV, and excluding any amortization or accretion of interest income resulting solely from the cost basis established by ASC 805 for the assets acquired in connection with the OCSI Merger. See page 36 for a description of the non-GAAP financial measures. 30

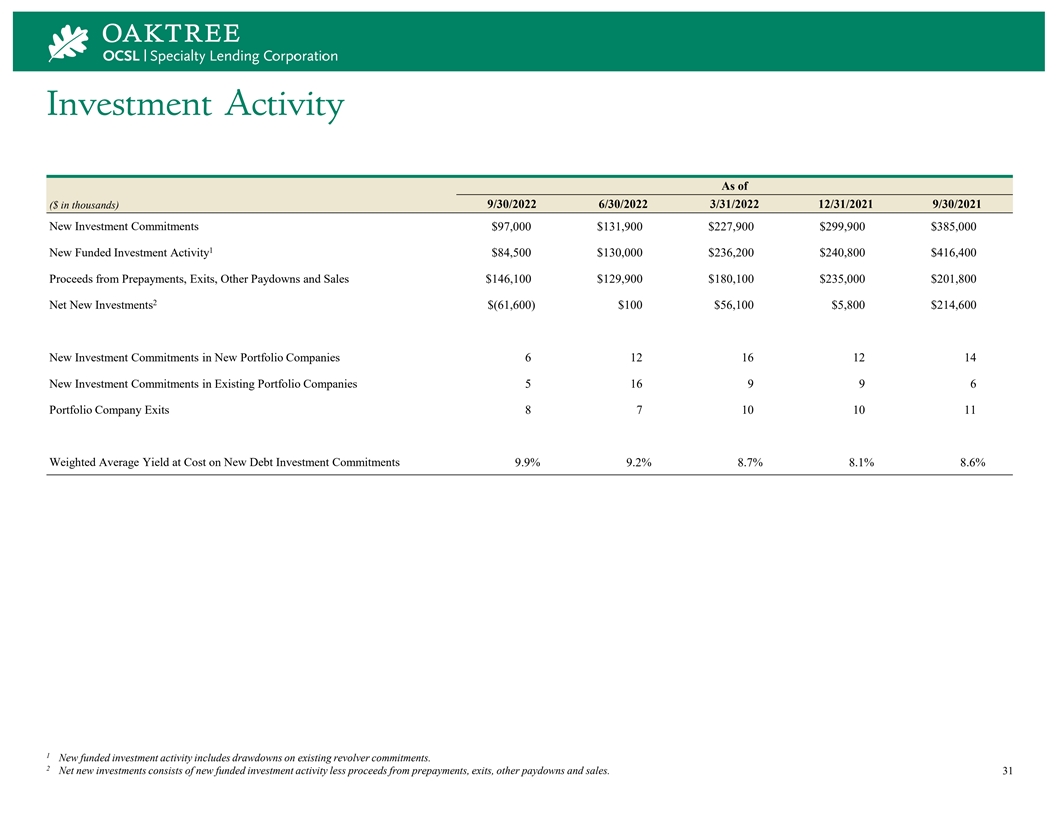

Investment Activity As of ($ in thousands) 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 New Investment Commitments $97,000 $131,900 $227,900 $299,900 $385,000 1 New Funded Investment Activity $84,500 $130,000 $236,200 $240,800 $416,400 Proceeds from Prepayments, Exits, Other Paydowns and Sales $146,100 $129,900 $180,100 $235,000 $201,800 2 Net New Investments $(61,600) $100 $56,100 $5,800 $214,600 New Investment Commitments in New Portfolio Companies 6 12 16 12 14 New Investment Commitments in Existing Portfolio Companies 5 16 9 9 6 Portfolio Company Exits 8 7 10 10 11 Weighted Average Yield at Cost on New Debt Investment Commitments 9.9% 9.2% 8.7% 8.1% 8.6% 1 New funded investment activity includes drawdowns on existing revolver commitments. 2 Net new investments consists of new funded investment activity less proceeds from prepayments, exits, other paydowns and sales. 31

Financial Highlights As of ($ and number of shares in thousands, except per share amounts) 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 GAAP Net Investment Income per Share $0.20 $0.22 $0.22 $0.18 $0.18 1 Adjusted Net Investment Income per Share $0.18 $0.17 $0.18 $0.17 $0.16 Net Realized and Unrealized Gains (Losses), Net of Taxes per Share $(0.12) $(0.43) $(0.14) $0.04 $0.02 1 Adjusted Net Realized and Unrealized Gains (Losses), Net of Taxes per Share $(0.11) $(0.41) $(0.12) $0.06 $0.05 Earnings (Loss) per Share $0.07 $(0.21) $0.08 $0.22 $0.20 1 Adjusted Earnings (Loss) per Share $0.07 $(0.21) $0.08 $0.22 $0.20 Distributions per Share $0.170 $0.165 $0.160 $0.155 $0.145 NAV per Share $6.79 $6.89 $7.26 $7.34 $7.28 Weighted Average Shares Outstanding 183,374 183,370 181,598 180,381 180,361 Shares Outstanding, End of Period 183,374 183,374 183,205 180,469 180,361 Investment Portfolio (at Fair Value) $2,494,111 $2,565,389 $2,644,775 $2,588,623 $2,556,629 Cash and Cash Equivalents $23,528 $34,306 $39,366 $43,765 $29,334 Total Assets $2,646,313 $2,689,378 $2,756,682 $2,699,939 $2,636,387 2 Total Debt Outstanding $1,301,043 $1,356,606 $1,363,660 $1,285,461 $1,268,743 Net Assets $1,245,563 $1,263,529 $1,330,376 $1,325,061 $1,312,823 Total Debt to Equity Ratio 1.08x 1.10x 1.05x 0.98x 0.97x Net Debt to Equity Ratio 1.06x 1.08x 1.02x 0.95x 0.95x 3 Weighted Average Interest Rate on Debt Outstanding 4.4% 3.2% 2.5% 2.3% 2.4% 1 See page 36 for a description of the non-GAAP measures. 2 Net of unamortized financing costs. 3 Includes effect of the interest rate swap agreement the Company entered into in connection with the issuance of the 2027 Notes. 32

Net Asset Value Per Share Bridge adjusted net realized and unrealized adjusted nii gains (losses), net of taxes $7.50 $0.18 ($0.11) ($0.01) ($0.11) $0.01 ($0.01) 7.00 $0.20 ($0.17) 6.50 6.00 5.50 $6.89 $6.79 5.00 4.50 4.00 6/30/22 NAV GAAP Net Investment Interest Income Net Unrealized Net Realized Gain / Net Realized & Distributions 9/30/22 NAV 1 Income Accretion Related to Appreciation / (Loss) Unrealized Loss 1 Merger Accounting (Depreciation) Related to Merger Adjustments Accounting Adjustments Note: Net asset value per share amounts are based on the shares outstanding at each respective quarter end. Net investment income per share, net unrealized appreciation / (depreciation), and net realized gain / (loss) are based on the weighted average number of shares outstanding for the period. Numbers may not sum due to rounding. See page 36 for a description of the non-GAAP measures. 1 Excludes reclassifications of net unrealized appreciation / (depreciation) to net realized gains / (losses) as a result of investments exited during the quarter. 33

Quarterly Statement of Operations For the three months ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 ($ in thousands) investment income Interest income $61,719 $54,728 $57,019 $55,450 $55,094 PIK interest income 6,011 5,178 4,674 4,663 4,960 Fee income 1,539 2,275 1,905 912 645 Dividend income 875 956 700 3,916 3,101 GAAP total investment income 70,144 63,137 64,298 64,941 63,800 Less: Interest income accretion related to merger accounting adjustments (2,173) (2,188) (4,008) (2,848) (5,571) Adjusted total investment income 67,971 60,949 60,290 62,093 58,229 expenses Base management fee 9,703 9,819 10,082 9,952 9,768 Part I incentive fee 6,986 6,497 6,704 6,457 6,015 Part II incentive fee -- (6,796) (3,746) 1,751 1,629 Interest expense 15,751 11,870 9,908 9,400 9,032 1 Other operating expenses 2,596 2,127 2,002 2,528 2,627 Total expenses 35,036 23,517 24,950 30,008 29,071 Reversal of fees waived (fees waived) (750) (750) (750) (750) (750) Net expenses 34,286 22,767 24,200 29,338 28,321 (Provision) benefit for taxes on net investment income -- -- -- (3,308) (2,437) GAAP net investment income 35,858 40,370 40,098 32,295 33,042 Less: Interest income accretion related to merger accounting adjustments (2,173) (2,188) (4,008) (2,848) (5,571) Add: Part II incentive fee -- (6,796) (3,746) 1,751 1,629 Adjusted net investment income $33,685 $31,386 $32,344 $31,198 $29,100 Note: See page 36 for a description of the non-GAAP measures. 1 Includes professional fees, directors fees, administrator expense and general and administrative expenses. 34

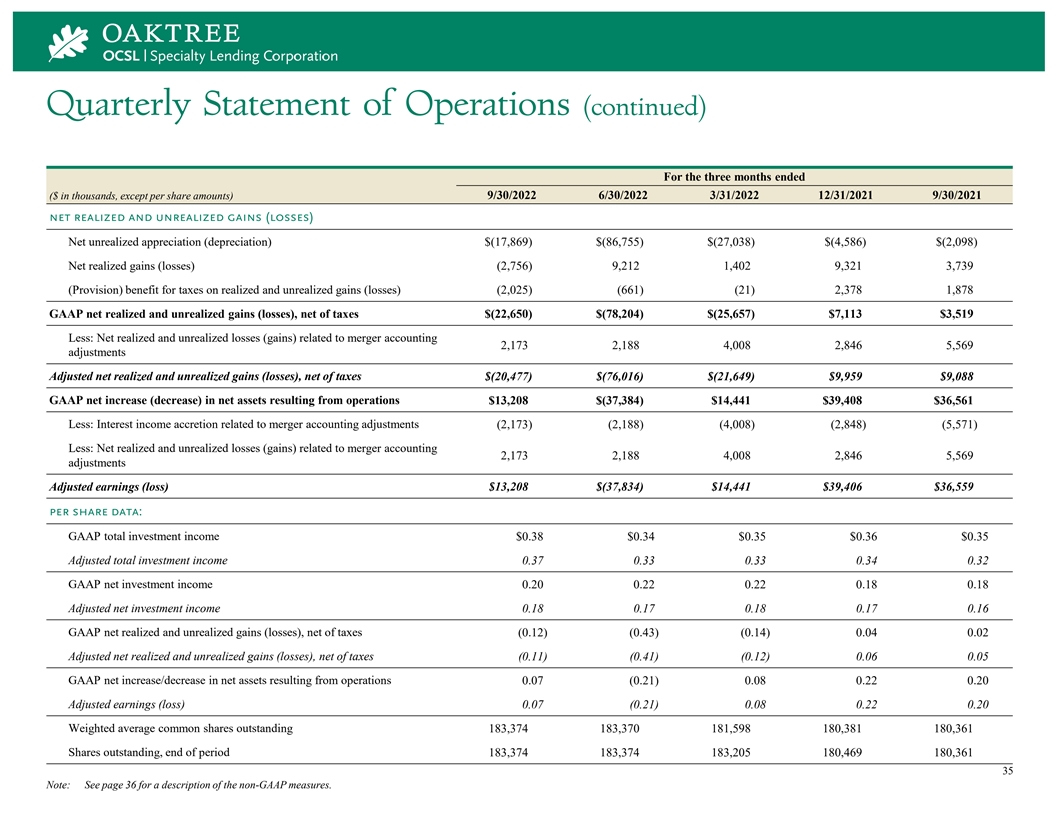

Quarterly Statement of Operations (continued) For the three months ended 9/30/2022 6/30/2022 3/31/2022 12/31/2021 9/30/2021 ($ in thousands, except per share amounts) net realized and unrealized gains (losses) Net unrealized appreciation (depreciation) $(17,869) $(86,755) $(27,038) $(4,586) $(2,098) Net realized gains (losses) (2,756) 9,212 1,402 9,321 3,739 (Provision) benefit for taxes on realized and unrealized gains (losses) (2,025) (661) (21) 2,378 1,878 GAAP net realized and unrealized gains (losses), net of taxes $(22,650) $(78,204) $(25,657) $7,113 $3,519 Less: Net realized and unrealized losses (gains) related to merger accounting 2,173 2,188 4,008 2,846 5,569 adjustments Adjusted net realized and unrealized gains (losses), net of taxes $(20,477) $(76,016) $(21,649) $9,959 $9,088 GAAP net increase (decrease) in net assets resulting from operations $13,208 $(37,384) $14,441 $39,408 $36,561 Less: Interest income accretion related to merger accounting adjustments (2,173) (2,188) (4,008) (2,848) (5,571) Less: Net realized and unrealized losses (gains) related to merger accounting 2,173 2,188 4,008 2,846 5,569 adjustments Adjusted earnings (loss) $13,208 $(37,834) $14,441 $39,406 $36,559 per share data: GAAP total investment income $0.38 $0.34 $0.35 $0.36 $0.35 Adjusted total investment income 0.37 0.33 0.33 0.34 0.32 GAAP net investment income 0.20 0.22 0.22 0.18 0.18 Adjusted net investment income 0.18 0.17 0.18 0.17 0.16 GAAP net realized and unrealized gains (losses), net of taxes (0.12) (0.43) (0.14) 0.04 0.02 Adjusted net realized and unrealized gains (losses), net of taxes (0.11) (0.41) (0.12) 0.06 0.05 GAAP net increase/decrease in net assets resulting from operations 0.07 (0.21) 0.08 0.22 0.20 Adjusted earnings (loss) 0.07 (0.21) 0.08 0.22 0.20 Weighted average common shares outstanding 183,374 183,370 181,598 180,381 180,361 Shares outstanding, end of period 183,374 183,374 183,205 180,469 180,361 35 Note: See page 36 for a description of the non-GAAP measures.

Non-GAAP Disclosures On March 19, 2021, the Company completed the Merger. The Merger was accounted for as an asset acquisition in accordance with the asset acquisition method of accounting as detailed in ASC 805-50, Business Combinations—Related Issues ( ASC 805 ). The consideration paid to OCSI’s stockholders was allocated to the individual assets acquired and liabilities assumed based on the relative fair values of the net identifiable assets acquired other than non-qualifying assets, which established a new cost basis for the acquired OCSI investments under ASC 805 that, in aggregate, was significantly lower than the historical cost basis of the acquired OCSI investments prior to the OCSI Merger. Additionally, immediately following the completion of the OCSI Merger, the acquired OCSI investments were marked to their respective fair values under ASC 820, Fair Value Measurements, which resulted in unrealized appreciation. The new cost basis established by ASC 805 on debt investments acquired will accrete over the life of each respective debt investment through interest income, with a corresponding adjustment recorded to unrealized appreciation on such investment acquired through its ultimate disposition. The new cost basis established by ASC 805 on equity investments acquired will not accrete over the life of such investments through interest income and, assuming no subsequent change to the fair value of the equity investments acquired and disposition of such equity investments at fair value, the Company will recognize a realized gain with a corresponding reversal of the unrealized appreciation on disposition of such equity investments acquired. On March 19, 2021, in connection with the closing of the OCSI Merger, OCSL entered into an amended and restated investment advisory agreement (the “A&R Advisory Agreement”) with Oaktree. The A&R Advisory Agreement amended and restated the existing investment advisory agreement, dated as of May 4, 2020, by and between the Company and Oaktree to (1) waive an aggregate of $6 million of base management fees otherwise payable to Oaktree in the two years following the closing of the OCSI Merger at a rate of $750,000 per quarter (with such amount appropriately prorated for any partial quarter) and (2) revise the calculation of the incentive fees to eliminate certain unintended consequences of the accounting treatment of the OCSI Merger on the incentive fees payable to Oaktree. The Company’s management uses the non-GAAP financial measures described above internally to analyze and evaluate financial results and performance and to compare its financial results with those of other business development companies that have not adjusted the cost basis of certain investments pursuant to ASC 805. The Company’s management believes Adjusted Total Investment Income , Adjusted Total Investment Income Per Share , Adjusted Net Investment Income and Adjusted Net Investment Income Per Share are useful to investors as an additional tool to evaluate ongoing results and trends for the Company without giving effect to the accretion income resulting from the new cost basis of the OCSI investments acquired in the OCSI Merger because these amounts do not impact the fees payable to Oaktree under the A&R Advisory Agreement, and specifically as its relates to Adjusted Net Investment Income and Adjusted Net Investment Income Per Share , without giving effect to Part II incentive fees. In addition, the Company’s management believes that “Adjusted Net Realized and Unrealized Gains (Losses), Net of Taxes”, “Adjusted Net Realized and Unrealized Gains (Losses), Net of Taxes Per Share”, “Adjusted Earnings (Loss)” and “Adjusted Earnings (Loss) Per Share” are useful to investors as they exclude the non-cash income/gain resulting from the OCSI Merger and used by management to evaluate the economic earnings of its investment portfolio. Moreover, these metrics align the Company's key financial measures with the calculation of incentive fees payable to Oaktree under with the A&R Advisory Agreement (i.e., excluding amounts resulting solely from the lower cost basis of the acquired OCSI investments established by ASC 805 that would have been to the benefit of Oaktree absent such exclusion). 36

contact us: visit us: Investor Relations oaktreespecialtylending.com Michael Mosticchio (212) 284-1900 ocsl-ir@oaktreecapital.com