UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended August 31, 2014

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from _________ to _________

Commission file number: 000-53461

MANTRA VENTURE

GROUP LTD.

(Exact name of registrant as specified in its

charter)

| British Columbia | 26-0592672 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

#562 – 800 15355 24th Avenue

Surrey,

British Columbia, Canada V4A 2H9

(Address of principal executive

offices) (zip code)

(604) 560-1503

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No[ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ]

No[X].

As of October 17, 2014, there were 70,717,692 shares of registrant’s common stock outstanding.

MANTRA VENTURE GROUP LTD.

INDEX

| PART I. | FINANCIAL INFORMATION | ||

| ITEM 1 | Financial Statements | ||

| Consolidated balance sheets as of August 31, 2014 (unaudited) and May 31, 2014 | 3 – 4 | ||

| Consolidated statements of operations for the three months ended August 31, 2014 and 2013 (unaudited) | 5 | ||

| Consolidated statements of cash flows for the three months ended August 31, 2014 and 2013 (unaudited) | 6 | ||

| Notes to consolidated financial statements (unaudited) | 7 – 16 | ||

| ITEM 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 18 – 24 | |

| ITEM 3. | Quantitative and Qualitative Disclosures about Market Risk | 25 | |

| ITEM 4. | Controls and Procedures | 26 | |

| PART II. | OTHER INFORMATION | ||

| ITEM 1. | Legal Proceedings | 27 | |

| ITEM 1A. | Risk Factors | 27 | |

| ITEM 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 27 | |

| ITEM 3. | Defaults Upon Senior Securities | 27 | |

| ITEM 4. | Mine Safety Disclosures | 27 | |

| ITEM 5. | Other Information | 27 | |

| ITEM 6. | Exhibits | 27 | |

| SIGNATURES | 29 | ||

2

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

The unaudited interim consolidated financial statements of Mantra Venture Group Ltd. (“we”, “us”, “our” and “our company”) follow. All currency references in this report are in US dollars unless otherwise noted.

MANTRA VENTURE GROUP LTD.

Consolidated balance sheets

(Expressed in U.S. dollars)

| August 31, | May 31, | |||||

| 2014 | 2014 | |||||

|

$ |

$ |

|||||

| (unaudited) | ||||||

| ASSETS | ||||||

| Current assets | ||||||

| Cash | 503,714 | 931,886 | ||||

| Amounts receivable | 47,456 | 163,591 | ||||

| Prepaid expenses and deposits | 507,412 | 504,697 | ||||

| Total current assets | 1,058,582 | 1,600,174 | ||||

| Restricted cash | 27,349 | 27,374 | ||||

| Property and equipment | 90,182 | 94,231 | ||||

| Intangible assets | 51,357 | 29,547 | ||||

| Total assets | 1,227,470 | 1,751,326 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||

| Current liabilities | ||||||

| Accounts payable and accrued liabilities | 658,636 | 715,053 | ||||

| Due to related parties | 83,699 | 159,994 | ||||

| Loans payable | 204,007 | 204,176 | ||||

| Obligations under capital lease | 16,383 | 8,246 | ||||

| Convertible debentures(net of discount of $6,705) | 140,617 | 164,660 | ||||

| Total current liabilities | 1,103,342 | 1,252,129 | ||||

| Obligations under capital lease | 9,721 | 19,856 | ||||

| Convertible debentures (net of discount of $160,208) | 21,792 | 16,640 | ||||

| Total liabilities | 1,134,855 | 1,288,625 | ||||

| Stockholders’ equity | ||||||

| Mantra Venture Group Ltd. stockholders’ equity | ||||||

| Preferred

stock Authorized: 20,000,000 shares, par value $0.00001 Issued and outstanding: Nil shares |

– | – | ||||

| Common

stock Authorized: 100,000,000 shares, par value $0.00001 Issued and outstanding: 70,692,692 (May 31, 2014 – 69,157,322) shares |

707 | 692 | ||||

| Additional paid-in capital | 10,132,483 | 9,679,880 | ||||

| Subscriptions receivable | (23,791 | ) | (1,791 | ) | ||

| Common stock subscribed | 84,742 | 216,391 | ||||

| Accumulated deficit | (9,966,654 | ) | (9,314,295 | ) | ||

| Total Mantra Venture Group Ltd. stockholders’ equity | 227,487 | 580,877 | ||||

| Non-controlling interest | (134,872 | ) | (118,176 | ) | ||

| Total stockholders’ equity | 92,615 | 462,701 | ||||

| Total liabilities and stockholders’ equity | 1,227,470 | 1,751,326 |

3

MANTRA VENTURE GROUP LTD.

Consolidated statements of

operations

(Expressed in U.S. dollars) |

(unaudited)

| Three Months | ||||||

| Three Months Ended | Ended | |||||

| August 31, | August 31, | |||||

| 2014 | 2013 | |||||

|

$ |

$ |

|||||

| Revenue | 55,230 | – | ||||

| Cost of goods sold | – | – | ||||

| Gross profit | 55,230 | – | ||||

| Operating expenses | ||||||

| Business development | 10,225 | – | ||||

| Consulting and advisory | 136,394 | 40,700 | ||||

| Depreciation and amortization | 9,984 | 7,524 | ||||

| Foreign exchange loss (gain) | (22,546 | ) | (13,700 | ) | ||

| General and administrative | 61,367 | 9,524 | ||||

| Management fees | 59,458 | 46,521 | ||||

| Professional fees | (2,943 | ) | 30,637 | |||

| Public listing costs | 13,055 | 1,069 | ||||

| Rent | 17,984 | 10,649 | ||||

| Research and development | 342,435 | 86,672 | ||||

| Shareholder communications and awareness | – | 240 | ||||

| Travel and promotion | 68,221 | 18,458 | ||||

| Wages and benefits | 12,917 | – | ||||

| Total operating expenses | 706,551 | 238,294 | ||||

| Loss before other expense | (651,321 | ) | (238,294 | ) | ||

| Other expense | ||||||

| Accretion of discounts on convertible debentures | (8,449 | ) | (9,014 | ) | ||

| Interest expense | (9,285 | ) | (13,508 | ) | ||

| Total other expense | (17,734 | ) | (22,522 | ) | ||

| Net loss for the period | (669,055 | ) | (260,816 | ) | ||

| Less: net loss attributable to the non-controlling interest | 16,696 | 13,053 | ||||

| Net loss attributable to Mantra Venture Group Ltd. | (652,359 | ) | (247,763 | ) | ||

| Net loss per share attributable to Mantra Venture Group Ltd. common shareholders, basic and diluted | (0.01 | ) | – | |||

| Weighted average number of shares outstanding used in the calculation of net loss attributable to Mantra Venture Group Ltd. per common share | 70,323,401 | 56,182,413 |

(The accompanying notes are an integral part of these consolidated financial statements)

4

MANTRA VENTURE GROUP LTD.

Consolidated statements of

cash flows

(Expressed in U.S. dollars)

(unaudited)

| Three Months | ||||||

| Three Months Ended | Ended | |||||

| August 31, | August 31, | |||||

| 2014 | 2013 | |||||

|

$ |

$ |

|||||

| Operating activities | ||||||

| Net loss | (669,055 | ) | (260,816 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||

| Accretion of discounts on convertible debentures | 8,449 | 9,014 | ||||

| Depreciation and amortization | 9,984 | 7,524 | ||||

| Foreign exchange loss (gain) | 755 | (2,298 | ) | |||

| Stock-based compensation | 223,091 | 38,200 | ||||

| Changes in operating assets and liabilities: | ||||||

| Amounts receivable | 116,135 | (32,051 | ) | |||

| Prepaid expenses and deposits | 3,165 | (22,799 | ) | |||

| Accounts payable and accrued liabilities | (56,417 | ) | 139,827 | |||

| Due to related parties | (76,295 | ) | (5,558 | ) | ||

| Net cash used in operating activities | (440,188 | ) | (128,957 | ) | ||

| Investing activities | ||||||

| Purchase of property and equipment | (5,330 | ) | (1,481 | ) | ||

| Investment in intangible assets | (22,415 | ) | – | |||

| Restricted cash | – | – | ||||

| Net cash used in investing activities | (27,745 | ) | (1,481 | ) | ||

| Financing activities | ||||||

| Repayment of capital lease obligations | (2,899 | ) | (1,793 | ) | ||

| Proceeds from loans payable | – | 18,000 | ||||

| Repayment of loan payable | (27,339 | ) | (4,813 | ) | ||

| Proceeds from issuance of common stock and subscriptions received | 69,999 | 123,727 | ||||

| Net cash provided by financing activities | 39,761 | 135,121 | ||||

| Change in cash | (428,172 | ) | 4,683 | |||

| Cash, beginning of period | 931,886 | 25,387 | ||||

| Cash, end of period | 503,714 | 30,070 | ||||

| Non-cash investing and financing activities: | ||||||

| Common stock issued to relieve common stock subscribed | 141,649 | – | ||||

| Common stock issued for pre-paid asset | 5,880 | – | ||||

| Supplemental disclosures: | ||||||

| Interest paid | 942 | 1,249 | ||||

| Income taxes paid | – | – |

(The accompanying notes are an integral part of these consolidated financial statements)

5

MANTRA VENTURE GROUP LTD.

Notes to the consolidated

financial statements

August 31, 2014

(Expressed in U.S. dollars)

(unaudited)

| 1. |

Basis of Presentation |

Mantra Venture Group Ltd. (the “Company”) was incorporated in the State of Nevada on January 22, 2007 to acquire and commercially exploit various new energy related technologies through licenses and purchases. On December 8, 2008, the Company continued its corporate jurisdiction out of the State of Nevada and into the province of British Columbia, Canada. The Company is in the business of developing and providing energy alternatives. The Company also provides marketing and graphic design services to help companies optimize their environmental awareness presence through the eyes of government, industry and the general public.

The accompanying unaudited consolidated interim financial statements of the Company should be read in conjunction with the consolidated financial statements and accompanying notes filed with the U.S. Securities and Exchange Commission in the Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2014. In the opinion of management, the accompanying financial statements reflect all adjustments of a recurring nature considered necessary to present fairly the Company’s financial position and the results of its operations and its cash flows for the periods shown.

The preparation of financial statements in accordance with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the amounts reported. Actual results could differ materially from those estimates. The results of operations and cash flows for the periods shown are not necessarily indicative of the results to be expected for the full year.

These unaudited consolidated financial statements financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has yet to acquire commercially exploitable energy related technology, and is unlikely to generate earnings in the immediate or foreseeable future. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of management to raise additional equity capital through private and public offerings of its common stock, and the attainment of profitable operations. As at August 31, 2014, the Company has accumulated losses of $9,966,654 since inception. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These consolidated financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Management requires additional funds over the next twelve months to fully implement its business plan. Management is currently seeking additional financing through the sale of equity and from borrowings from private lenders to cover its operating expenditures. There can be no certainty that these sources will provide the additional funds required for the next twelve months.

| 2. |

Significant Accounting Policies |

| (a) |

Principles of Consolidation |

These unaudited consolidated financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States. These unaudited consolidated financial statements include the accounts of the Company and its subsidiaries, Carbon Commodity Corporation, Climate ESCO Ltd., Mantra Energy Alternatives Ltd., Mantra China Inc., Mantra China Limited, Mantra Media Corp., Mantra NextGen Power Inc., and Mantra Wind Inc. All the subsidiaries are wholly-owned with the exception of Climate ESCO Ltd., which is 64.84%owned and Mantra Energy Alternatives Ltd., which is 89.09% owned. All inter- company balances and transactions have been eliminated.

| (b) |

Recent Accounting Pronouncements |

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

6

MANTRA VENTURE GROUP LTD.

Notes to the consolidated

financial statements

August 31, 2014

(Expressed in U.S. dollars)

(unaudited)

| 3. |

Restricted Cash |

Restricted cash represents cash pledged as security for the Company’s credit cards.

| 4. |

Property and Equipment |

| August 31, | May 31, | ||||||||||||

| 2014 | 2014 | ||||||||||||

| Accumulated | Net carrying | Net carrying | |||||||||||

| Cost | depreciation | value | value | ||||||||||

|

$ |

$ |

$ |

$ |

||||||||||

| Furniture and equipment | 2,496 | 83 | 2,413 | – | |||||||||

| Computer | 5,341 | 3,270 | 2,071 | 2,821 | |||||||||

| Research equipment | 111,802 | 60,787 | 51,015 | 51,030 | |||||||||

| Vehicles under capital lease | 68,340 | 33,657 | 34,683 | 40,380 | |||||||||

| 187,979 | 97,797 | 90,182 | 94,231 |

| 5. |

Intangible Assets |

| August 31, | May 31, | ||||||||||||

| 2014 | 2014 | ||||||||||||

| Accumulated | Net carrying | Net carrying | |||||||||||

| Cost | depreciation | value | value | ||||||||||

|

$ |

$ |

$ |

$ |

||||||||||

| Patents | 52,748 | 1,391 | 51,357 | 29,547 |

Estimated Amortization Expense:

|

$ |

||||

| For year ended May 31, 2015 | 2,118 | |||

| For year ended May 31, 2016 | 2,824 | |||

| For year ended May 31, 2017 | 2,824 | |||

| For year ended May 31, 2018 | 2,824 | |||

| For year ended May 31, 2019 | 2,824 |

| 6. |

Related Party Transactions |

| (a) |

During the three months ended August 31, 2014, the Company incurred management fees of $44,628 (2013 - $28,912) and rent of $Nil (2013 - $4,500) to the President of the Company. | |

| (b) |

During the three months ended August 31, 2014, the Company incurred management fees of $14,830(2013 - $14,456) to the spouse of the President of the Company. | |

| (c) |

During the three months ended August 31, 2014, the Company incurred research and development fees of $15,080 (2013 - $14,456management fees) to a director of the Company. | |

| (d) |

As at August 31, 2014, the Company owes a total of $87,074 (May 31, 2014 - $124,857) to the President of the Company and a company controlled by the President of the Company which is non-interest bearing, unsecured, and due on demand. |

7

MANTRA VENTURE GROUP LTD.

Notes to the consolidated

financial statements

August 31, 2014

(Expressed in U.S. dollars)

(unaudited)

| 6. |

Related Party Transactions (continued) |

| (e) |

As at August 31, 2014, the Company is owed $24,860 (May 31, 2014–owes $13,619) from the spouse of the President of the Company which is non-interest bearing, unsecured, and due on demand. | |

| (f) |

As at August 31, 2014, the Company owes $21,485 (May 31, 2014- $21,518) to an officer and a director of the Company, which is non-interest bearing, unsecured, and due on demand. |

| 7. |

Loans Payable |

| (a) |

As at August 31, 2014, the amount of $58,160 (Cdn$63,300) (May 31, 2014 - $58,251(Cdn$63,300)) is owed to a non-related party which is non-interest bearing, unsecured, and due on demand. | |

| (b) |

As at August 31, 2014, the amount of $17,500 (May 31, 2014 - $17,500) is owed to a non-related party which is non-interest bearing, unsecured, and due on demand. | |

| (c) |

As at August 31, 2014, the amount of $15,000 (May 31, 2014 - $15,000) is owed to a non-related party which is non-interest bearing, unsecured, and due on demand. | |

| (d) |

As at August 31, 2014, the amount of $17,361(Cdn$18,895) (May 31, 2014 – $17,387 (Cdn$18,895)) is owed to a non-related party, which is non-interest bearing, unsecured, and due on demand. | |

| (e) |

As at August 31, 2014, the amounts of $7,500 and $33,996 (Cdn$37,000) (May 31, 2014 - $7,500 and $34,048, (Cdn$37,000)) are owed to a non-related party which are non-interest bearing, unsecured, and due on demand. | |

| (f) |

As at August 31, 2014, the amount of $4,490 (May 31, 2013- $4,490) is owed to a non-related party which is non- interest bearing, unsecured, and due on demand. | |

| (g) |

In March 2012, the Company received $50,000 for the subscription of 10,000,000 shares of the Company’s common stock. During the year ended May 31, 2013, the Company and the subscriber agreed that the shares would not be issued and that the subscription would be returned. The subscription has been reclassified as a non-interest bearing demand loan until the funds are refunded to the subscriber. |

| 8. |

Obligations Under Capital Lease |

On July 31, 2012 and December 21, 2012, the Company entered into two agreements to lease two vehicles for three years each. The vehicle leases are classified as a capital leases. The following is a schedule by years of future minimum lease payments under capital leases together with the present value of the net minimum lease payments as of August 31, 2014:

| Year ending May 31: |

$ |

|||

| 2015 | 8,692 | |||

| 2016 | 20,853 | |||

| Net minimum lease payments | 29,545 | |||

| Less: amount representing interest payments | (3,441 | ) | ||

| Present value of net minimum lease payments | 26,104 | |||

| Less: current portion | (16,383 | ) | ||

| Long-term portion | 9,721 |

At the end of both leases, the Company has the option to purchase the vehicles for $9,000 each.

8

MANTRA VENTURE GROUP LTD.

Notes to the consolidated

financial statements

August 31, 2014

(Expressed in U.S. dollars)

(unaudited)

| 9. |

Convertible Debentures |

| (a) |

In October 2008, the Company issued three convertible debentures for total proceeds of $250,000 which bear interest at 10% per annum, are unsecured, and due one year from date of issuance. The unpaid amount of principal and accrued interest can be converted at any time at the holder’s option into 625,000 shares of the Company’s common stock at a price of $0.40 per share. The Company also issued 250,000 detachable, non-transferable share purchase warrants. Each share purchase warrant entitles the holder to purchase one additional share of the Company’s common stock for a period of two years from the date of issuance at an exercise price of $0.50 per share. |

In accordance with ASC 470-20, “Debt with Conversion and Other Options”, the Company determined that the convertible debentures contained no embedded beneficial conversion feature as the convertible debentures were issued with a conversion price higher than the fair market value of the Company’s common shares at the time of issuance.

In accordance with ASC 470-20, the Company allocated the proceeds of issuance between the convertible debt and the detachable share purchase warrants based on their relative fair values. Accordingly, the Company recognized the fair value of the share purchase warrants of $45,930 as additional paid-in capital and an equivalent discount against the convertible debentures. The Company had recorded accretion expense of $45,930, increasing the carrying value of the convertible debentures to $250,000.

On January 19, 2012, the Company entered into a settlement agreement with one of the debenture holders to settle a $50,000 convertible debenture and $122,535 in accounts payable and accrued interest with the debt holder. Pursuant to the agreement, the debt holder agreed to reduce the debt to Cdn$100,000 on the condition that the Company pays the amount of Cdn$2,500 per month for 40 months, beginning March 1, 2012 and continuing on the first day of each month thereafter.

On July 18, 2012, the Company entered into a settlement agreement with the $150,000 debenture holder. Pursuant to the settlement agreement, the lender agreed to extend the due date until April 11, 2013 and the Company agreed to pay $43,890 of accrued interest within five days of the agreement (paid), pay the accruing interest on a monthly basis (paid), and pay a $10,000 premium in addition to the $150,000 principal outstanding on April 11, 2013.On April 29, 2013, the Company entered into an amended settlement agreement whereby the lender agreed to extend the due date to September 15, 2013 and the Company agreed to pay $6,836 of interest for the period from April 1 to September 15, 2013 upon execution of the agreement (paid) and granted the lender 100,000 stock options exercisable at $0.12 per share for a period of two years.

On November 15, 2013, the Company entered into a second settlement agreement amendment. Pursuant to the second amendment, on November 15, 2013, the Company agreed to pay interest of $4,438 (paid) and commencing February 1, 2014, the Company would make monthly payments of $10,000 on the outstanding principal and interest.

The Company evaluated the modifications and determined that the creditor did not grant a concession. In addition, as the present value of the amended future cash flows had a difference of less than 10% of the cash flows of the original debt, it was determined that the original and new debt instruments are not substantially different. As a result, the modification was not treated as an extinguishment of the debt and no gain or loss was recognized. The Company recorded the fair value of $12,901 for the stock options as additional paid-in capital and a discount. During the year ended May 31, 2014, the Company repaid $40,000 of the debenture. As at May 31, 2014 the Company had accreted $12,901 of the discount bring the carrying value of the convertible debenture to $114,661.During the three months ended August 31, 2014, the Company repaid $27,339 decreasing the carrying value to $87,322.

9

MANTRA VENTURE GROUP LTD.

Notes to the consolidated

financial statements

August 31, 2014

(Expressed in U.S. dollars)

(unaudited)

| 9. |

Convertible Debentures (continued) |

| (b) |

On August 19, 2013, the Company issued a convertible debenture for total proceeds of $10,000, which bears interest at 10% per annum, is unsecured, and due two years from date of issuance. The unpaid amount of principal and accrued interest can be converted at the holder’s option into shares of the Company’s common stock at $0.04 per share at any time after the first anniversary of the notes. The Company recognized the intrinsic value of the embedded beneficial conversion feature of $10,000 as additional paid-in capital and reduced the carrying value of the convertible debenture to $nil. The carrying value will be accreted over the term of the convertible debenture up to its face value of $10,000. As at August 31, 2014, the carrying value of the convertible promissory note was $3,295. | |

| (c) |

On September 11, 2013, the Company issued a convertible debenture for total proceeds of $58,000, which bears interest at 10% per annum, is unsecured, and due two years from date of issuance. The unpaid amount of principal and accrued interest can be converted at the holder’s option into shares of the Company’s common stock at $0.04 per share at any time after the first anniversary of the notes. The Company recognized the intrinsic value of the embedded beneficial conversion feature of $58,000 as additional paid-in capital and reduced the carrying value of the convertible debenture to $nil. The carrying value will be accreted over the term of the convertible debenture up to its face value of $58,000. As at August 31, 2014, the carrying value of the convertible promissory note was $7,204. | |

| (d) |

On October 18, 2013, the Company issued a convertible debenture for total proceeds of $94,000, which bears interest at 10% per annum, is unsecured, and due two years from date of issuance. The unpaid amount of principal and accrued interest can be converted at the holder’s option into shares of the Company’s common stock at $0.04 per share at any time after the first anniversary of the notes. The Company recognized the intrinsic value of the embedded beneficial conversion feature of $94,000 as additional paid-in capital and reduced the carrying value of the convertible debenture to $nil. The carrying value will be accreted over the term of the convertible debenture up to its face value of $94,000. As at August 31, 2014, the carrying value of the convertible promissory note was $7,235. | |

| (e) |

On December 27, 2013, the Company issued three convertible debentures for total proceeds of $15,000, which bear interest at 10% per annum, are unsecured, and due two years from date of issuance. The unpaid amount of principal and accrued interest can be converted at the holder’s option into shares of the Company’s common stock at $0.04 per share at any time after the first anniversary of the notes. The Company recognized the intrinsic value of the embedded beneficial conversion features of $15,000 as additional paid-in capital and reduced the carrying value of the convertible debenture to $nil. The carrying value will be accreted over the term of the convertible debenture up to its face value of $15,000. As at August 31, 2014, the carrying value of the convertible promissory note was $5,182. | |

| (f) |

On February 4, 2014, the Company issued a convertible debenture for total proceeds of $15,000, which bears interest at 10% per annum, is unsecured, and due two years from date of issuance. The unpaid amount of principal and accrued interest can be converted at the holder’s option into shares of the Company’s common stock at $0.04 per share at any time after the first anniversary of the notes. The Company recognized the intrinsic value of the embedded beneficial conversion feature of $15,000 as additional paid-in capital and reduced the carrying value of the convertible debenture to $nil. The carrying value will be accreted over the term of the convertible debenture up to its face value of $15,000. As at August 31, 2014, the carrying value of the convertible promissory note was $2,171. |

10

MANTRA VENTURE GROUP LTD.

Notes to the consolidated

financial statements

August 31, 2014

(Expressed in U.S. dollars)

(unaudited)

| 10. |

Common Stock |

| (a) |

At August 31, 2014, the Company had received proceeds of $2,080 at $0.08 per unit for subscriptions for 26,000 units. Each unit consisted of one share of common stock and one-half of one share purchase warrant. Each whole share purchase warrant is exercisable at $0.20 per common share for a period of two years or five business days after the Company’s common stock trades at least one time per day on the FINRA Over-the-Counter Bulletin Board at a price at or above $0.40 per share for seven consecutive trading days. | |

| (b) |

At August 31, 2014, the Company had received proceeds of $32,625 for subscriptions for 140,500 shares of common stock upon the exercise of warrants. | |

| (c) |

As at August 31, 2014 the Company’s subsidiary, Mantra Energy Alternatives Ltd., had received subscriptions for 67,000 shares of common stock at Cdn$1.00 per share for proceeds of $66,277 (Cdn$67,000), which is included in common stock subscribed, net of the non-controlling interest portion of $7,231. | |

| (d) |

As at August 31, 2014, the Company’s subsidiary, Climate ESCO Ltd., had received subscriptions for 210,000 shares of common stock at $0.10 per share for proceeds of $21,000, which is included in common stock subscribed, net of the non-controlling interest portion of $7,384. | |

| (e) |

At August 31, 2014, the Company has included the fair value of $10,000 for 20,000 shares issuable pursuant to the consulting agreement described in Note 13(d). |

Stock transactions during the three months ended August 31, 2014:

| (f) |

On June 4, 2014, the Company issued 333,333 units at $0.30 per unit for proceeds of $100,000 included in common stock subscribed at May 31, 2014. Each unit consists of one share of common stock and one share purchase warrant. Each share purchase warrant is exercisable at $0.80 per common share for a period of three years or five business days after the Company’s common stock trades at least one time per day on the FINRA Over-the-Counter Bulletin Board at a price at or above $1.60 per share for seven consecutive trading days. At May 31, 2014, the proceeds of $100,000 were included in common stock subscribed. | |

| (g) |

On June 4, 2014, the Company issued 240,000 shares for proceeds of $61,625 upon the exercise of warrants. At May 31, 2014, the proceeds of $32,625 were included in common stock subscribed. | |

| (h) |

On June 4, 2014, the Company issued 500,000 shares with a fair value of $270,000 to a consultant for services. As at May 31, 2014, the Company recorded the fair value of the 500,000 shares issuable of $270,000 as $5 of subscriptions receivable and $269,995 as additional paid in capital. | |

| (i) |

On July 11, 2014, the Company issued 200,000 units at $0.30 per unit for proceeds of $60,000. Each unit consists of one share of common stock and one share purchase warrant. Each share purchase warrant is exercisable at $0.80 per common share for a period of three years or five business days after the Company’s common stock trades at least one time per day on the FINRA Over-the-Counter Bulletin Board at a price at or above $1.60 per share for seven consecutive trading days. | |

| (j) |

On June 30, and July 17, 2014, the Company issued 40,000 common shares with a fair value of $20,000 pursuant to the consulting agreement described in Note 13(d). | |

| (k) |

On July 10, 2014, the Company issued 60,037 common shares for the conversion of $5,000 of loans payable and $4,019 of accrued interest by a lender. At May 31, 2014, the shares were was included in common stock subscribed. | |

| (l) |

On August 22, 2014 the Company entered into an agreement with one consultant to procure investor relations services. Pursuant to the agreement the Company issued 12,000 shares of common stock to the consultant with a fair value of $5,880 which is included in prepaid expenses at August 31, 2014. |

11

MANTRA VENTURE GROUP LTD.

Notes to the consolidated

financial statements

August 31, 2014

(Expressed in U.S. dollars)

(unaudited)

| (m) |

On August 25, 2014 the Company issued 150,000 common shares to a director of the Company in exercise of options at an exercise price of $0.02 per share for aggregate proceeds of $3,000. |

| 11. |

Share Purchase Warrants |

The following table summarizes the continuity of share purchase warrants:

| Weighted average | |||||||

| Number of | exercise price | ||||||

| warrants | $ | ||||||

| (a) | (b) | ||||||

| Balance, May 31, 2014 | 9,818,402 | 0.29 | |||||

| Issued | 533,333 | 0.80 | |||||

| Exercised | (240,000 | ) | 0.26 | ||||

| Expired | (5,503,402 | ) | 0.23 | ||||

| Balance, August 31, 2014 | 4,608,337 | 0.40 |

As at August 31, 2014, the following share purchase warrants were outstanding:

| Exercise | |||||||

| Number of | price | ||||||

| warrants |

$ |

Expiry date | |||||

| 4,075,000 | 0.37 | April 10, 2019 | |||||

| 333,333 | 0.80 | June 4, 2017 | |||||

| 200,000 | 0.80 | July 11, 2017 | |||||

| 4,608,337 |

| 12. |

Stock Options |

On June 1, 2014, the Company granted 150,000 stock options exercisable at $0.02 per share for a period of two years to a director. The Company recorded the fair value of the options of $94,600as research and development fees.

On July 17, 2014, the Company granted 200,000 stock options exercisable at $0.30 per share for a period of two years to two consultants. The options vest 25% every six months following the date of grant. The Company recorded the fair value of the vested portion of the options of $9,590 as consulting fees.

On August 1, 2014, the Company granted 100,000 stock options each to two consultants. The options are exercisable at $0.10 per share for a period of two years. The Company recorded the fair value of the options of $88,900 as consulting fees.

The following table summarizes the continuity of the Company’s stock options:

| Weighted | Weighted average | Aggregate | |||||||||||

| average | remaining | intrinsic | |||||||||||

| Number | exercise price | contractual life | value | ||||||||||

| of options |

|

$ |

(years) |

$ |

|||||||||

| Outstanding, May 31, 2014 | 675,000 | 0.17 | |||||||||||

| Granted | 550,000 | 0.15 | |||||||||||

| Exercised | (150,000 | ) | 0.02 | ||||||||||

| Outstanding, August 31, 2014 | 1,075,000 | 0.18 | 1.34 | 396,250 | |||||||||

| Exercisable, August 31, 2014 | 875,000 | 0.15 | 1.21 | 346,250 |

12

MANTRA VENTURE GROUP LTD.

Notes to the consolidated

financial statements

August 31, 2014

(Expressed in U.S. dollars)

(unaudited)

| 12. |

Stock Options (continued) |

A summary of the changes of the Company’s non-vested stock options is presented below:

| Weighted Average | |||||||

| Number of | Grant Date | ||||||

| Non-vested stock options | Options | Fair Value | |||||

|

$ |

|||||||

| Non-vested at May 31, 2014 | – | – | |||||

| Granted | 550,000 | 0.47 | |||||

| Vested | (350,000 | ) | 0.53 | ||||

| Non-vested at August 31, 2014 | 200,000 | 0.38 |

As at August 31, 2014, there was $65,410 of unrecognized compensation cost related to non-vested stock option agreements. This cost is expected to be recognized over a weighted average period of 1.88 years.

Additional information regarding stock options as of August 31, 2014 is as follows:

| Exercise | |||||||

| Number of | price | ||||||

| options | $ | Expiry date | |||||

| 200,000 | 0.10 | May 7, 2015 | |||||

| 300,000 | 0.20 | July 1, 2015 | |||||

| 175,000 | 0.20 | April 28, 2015 | |||||

| 200,000 | 0.30 | July 17, 2016 | |||||

| 200,000 | 0.10 | August 1, 2016 | |||||

| 1,075,000 |

The fair values for stock options granted have been estimated using the Black-Scholes option pricing model assuming no expected dividends and the following weighted average assumptions:

| August 31, | August 31, | ||||||

| 2014 | 2013 | ||||||

| Risk-free Interest rate | 0.48% | 0.34% | |||||

| Expected life (in years) | 2.0 | 2.0 | |||||

| Expected volatility | 114% | 169% |

During the three month period ended August 31, 2014, the Company recorded stock-based compensation of $193,091 (2013 - $38,200) for stock options granted.

The weighted average fair value of the stock options granted for the three month period ended August 31, 2014, was $0.47(2013 - $0.13) per option.

13

MANTRA VENTURE GROUP LTD.

Notes to the consolidated

financial statements

August 31, 2014

(Expressed in U.S. dollars)

(unaudited)

| 13. |

Commitments and Contingencies |

| (a) |

On September 2, 2009, the Company entered into an agreement with a company to acquire a worldwide, exclusive license for the Mixed Reactant Flow-By Fuel Cell technology. The term of the agreement is for twenty years or the expiry of the last patent licensed under the agreement, whichever is later. The Company agreed to pay the licensor the following license fees: |

| • | an initial license fee of Cdn$10,000 payable in two installments: Cdn$5,000 upon execution of the agreement (paid) and Cdn$5,000 within thirty days of September 2, 2009 (paid); | |

| • | a further license fee of Cdn$15,000 (paid) to be paid within ninety days of September 2, 2009; and | |

| • | an annual license fee, payable annually on the anniversary of the date of the agreement as follows: |

| September 1, 2010 | Cdn$10,000 (paid) |

| September 1, 2011 | Cdn$20,000 (accrued) |

| September 1, 2012 | Cdn$30,000(accrued) |

| September 1, 2013 | Cdn$40,000 (accrued) |

| September 1, 2014 and each | Cdn$50,000 |

| successive | |

| anniversary |

The Company is to pay the licensor a royalty calculated as 2% of the gross revenue and 15% of any and all consideration directly or indirectly received by the Company from the grant of any sublicense rights. The Company will pay interest at a rate of 1% per month on any amounts past due. In addition, the Company is responsible for the timely payment of all future costs relating to patent expenses and any new or useful art, process, machine, manufacture or composition of matter arising out of any licensor improvements or joint improvements licensed under this agreement and identified by the licensor as potentially patentable. The Company must also invest a minimum of Cdn$250,000 in research and development directly associated with the technology.

| (b) |

On May 23, 2012, a former employee of the Company delivered a Notice of Application seeking judgment against the Company for approximately $55,000. The hearing of that Application took place on July 31, 2012, at which time the former employee obtained judgment in the approximate amount of $55,000. The Company did not defend the amount of the judgment and the amount is included in accounts payable, but claims a complete set-off on the basis that the former employee retains 1,000,000 shares of common stock of the Company as security for payment of the outstanding consulting fees owed to him. On August 31, 2012, the Company commenced a separate action against the former employee seeking a return of the 1,000,000 shares of common stock and a stay of execution of the judgment. That application is pending and has not yet been heard or determined by the court. The payment of the judgment claim of approximately $55,000 is dependent upon whether the former employee will first return the 1,000,000 shares of common stock noted above. The probable outcome of the Company’s claim for the return of the shares cannot yet be determined. | |

| (c) |

On October 10 and October 17, 2013, the Company’s subsidiary entered into two employment agreements. Pursuant to the agreements, the two employees will perform services for a term of one year for base remuneration of $65,000 per annum with an increase to $70,000 per annum. The agreements are subject to receipt of an Industrial Research & Development Fellowship from the Natural Sciences and Engineering Research Council of Canada (“NSERC”) grant (received on August 1, 2014). In addition, the Company granted to each employee 100,000 stock options exercisable at a price of $0.10 per share. These options are non-transferrable, vest immediately, and expire upon the earlier of 24 months, or upon termination of the employment agreements. |

14

MANTRA VENTURE GROUP LTD.

Notes to the consolidated

financial statements

August 31, 2014

(Expressed in U.S.

dollars)

(unaudited)

| 13. |

Commitments and Contingencies (continued) |

| (d) |

On March 1, 2014, the Company entered into an agreement with a consultant who will perform services for $7,250 a month for a period of one year. In addition, the Company issued 25,000 shares of common stock upon the execution of the agreement and must issue an additional 20,000 shares of common stock per month for the following 11 months. Refer to Note 10(e) and 10(i). | |

| (e) |

On March 1, 2014, the Company entered into an agreement with a consultant who will perform public relations services for €$3,500 a month for a period of one year. In addition, the Company issued 500,000 shares of common stock upon execution of the agreement. | |

| (f) |

On March 25, 2014, the Company entered into an agreement with a research and development firm who will design, engineer, and build an ERC Energy Demonstration unit for an estimated Cdn$360,000 over a period of approximately 24 weeks. The Company paid the initial deposit of Cdn$190,000, which will be applied to the last two invoices of the project. | |

| (g) |

On May 7, 2014, the Company entered into a two year office space lease commencing July 1, 2014. Pursuant to the lease, the Company is required to pay Cdn$2,683 plus taxes per month. In addition, on June 1, 2014, the Company entered into a two year office space lease commencing June 1, 2014. Pursuant to the lease, the Company is required to pay Cdn$1,240 plus taxes per month. The following is a schedule by years of future minimum lease payments under capital leases together with the present value of the minimum lease payments as of August31, 2014: |

| Period ending August 31: |

$ |

|||

| 2015 | 43,252 | |||

| 2016 | 34,904 | |||

| 78,156 |

| 14. |

Subsequent Events | |

| (a) |

On September 9, 2014, the Company entered into a consulting agreement with a two month term with a consultant. Pursuant to the agreement, the Company will pay $5,000 cash and issue 12,500 shares of common stock each month. The Company issued 25,000 common shares on October 10, 2014. | |

15

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Management's Discussion and Analysis of Financial Condition and Results of Operations includes a number of forward-looking statements that reflect Management's current views with respect to future events and financial performance. You can identify these statements by forward-looking words such as “may,” “will,” “expect,” “anticipate,” “believe,” “estimate” and “continue,” or similar words. Those statements include statements regarding the intent, belief or current expectations of us and members of our management team as well as the assumptions on which such statements are based. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risk and uncertainties, and that actual results may differ materially from those contemplated by such forward-looking statements.

Readers are urged to carefully review and consider the various disclosures made by us in this report and in our other reports filed with the Securities and Exchange Commission. Important factors currently known to Management could cause actual results to differ materially from those in forward-looking statements. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes in the future operating results over time. We believe that our assumptions are based upon reasonable data derived from and known about our business and operations. No assurances are made that actual results of operations or the results of our future activities will not differ materially from our assumptions. Factors that could cause differences include, but are not limited to, expected market demand for our products, fluctuations in pricing for materials, and competition.

Our unaudited consolidated financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States generally accepted accounting principles. The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this quarterly report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below and elsewhere in this quarterly report.

In this quarterly report, unless otherwise specified, all dollar amounts are expressed in United States dollars. All references to "US$" refer to United States dollars and all references to "common stock" refer to the common shares in our capital stock.

As used in this quarterly report, the terms “we”, “us”, “our” and “our company” mean Mantra Venture Group Ltd. and our wholly owned subsidiaries Carbon Commodity Corporation, Mantra China Inc., Mantra China Limited, Mantra Media Corp., Mantra NextGen Power Inc., and Mantra Wind Inc., as well as our majority owned subsidiary Climate ESCO Ltd. and Mantra Energy Alternatives Ltd., unless otherwise indicated.

Business Overview

We were incorporated in Nevada on January 22, 2007. On December 8, 2008 we continued our corporate jurisdiction out of the state of Nevada and into the Province of British Columbia, Canada. Our principal offices are located at 1562 128th Street, Surrey, British Columbia, V4A 3T7 Our Lab space is located at #202 3590 W41st Avenue, Vancouver, British Columbia V6N 3E6. Our telephone number is (604) 560-1503. Our fiscal year end is May 31.

We are building a portfolio of companies and technologies that mitigate negative environmental and health consequences that arise from the production of energy and the consumption of resources.

Our mission is to develop and commercialize alternative energy technologies and services to enable the sustainable consumption, production and management of resources on residential, commercial and industrial scales. We plan to develop or acquire technologies and services which include electrical power system monitoring technology, wind farm electricity generation, online retail of environmental sustainability solutions through a carbon reduction marketplace, and media solutions to promote awareness of corporate actions that support the environment. To carry out our business strategy we intend to acquire or license from third parties technologies that require further development before they can be brought to market. We also intend to develop such technologies ourselves, and we anticipate that to complete commercialization of some technologies we will enter into joint ventures, partnerships, or other strategic relationships with third parties who have expertise that we may require. We also plan to enter into formal relationships with consultants, contractors, retailers and manufacturers who specialize in the areas of environmental sustainability in order to carry out our online retail strategy.

We own a technology for the electro-reduction of carbon dioxide and have the exclusive global license for a mixed-reactant fuel cell. Since our inception, we have incurred operational losses and we have completed several rounds of financing to fund our operations.

16

We carry on our business through our subsidiary, Mantra Energy Alternatives Ltd. (“MEA”), through which we identify, acquire, develop and market technologies related to alternative energy production, greenhouse gas emissions reduction and resource consumption reduction.

We also have a number of inactive subsidiaries which we plan to engage in various business activities in the future.

Collaboration with Alstom (Switzerland) Ltd.

On June 24, 2013, MEA entered into an agreement with Alstom (Switzerland) Ltd. concerning the joint research and development projects relating to (1) a pilot plant for the conversion of carbon dioxide to formate at a Lafarge cement plant (the “Lafarge pilot project”); and (2) the development of processes for the conversion of carbon dioxide to other valuable chemicals.

Pursuant to the agreement with Alstom, MEA and Alstom will co-operate in one or more research and development projects related to MEA’s ERC technology. Prospective projects will be associated with the development of technologies and processes for the conversion of CO2 to chemical products and the investigation of the feasibility of scale-up and commercialization of these processes. Prior to undertaking any research and development project under the agreement, MEA and Alstom will mutually agree to special terms and conditions governing the purpose, aims and objectives of any such project, including technical descriptions, the designation of work phases and project managers, and the allocation of responsibilities and costs between the parties. The commencement of any work phase for any project will be at the sole discretion of Alstom.

Lafarge Pilot Project and Carbon Dioxide to Alternative Products

The agreement with Alstom will remain valid for the later of five years or the completion of the last active project, and may be extended at any time by the written agreement of both parties. The first joint research and development project under the agreement is the Lafarge pilot project, which plans for the design, construction, and installation of a pilot plant for the conversion of 100 kg/day carbon dioxide to formate, followed by a commercialization scale-up study. Alstom’s contribution to the Lafarge pilot plant project will be approximately Cdn$250,000 for in-kind services. A second integrated research and development project will study carbon dioxide conversion to alternative chemical products by electrochemical reduction, with a focus on catalyst materials and lifetime. Alstom’s contribution to the alternative products project will be approximately Cdn$190,375 for Phase 1. For Phases 2 through 4 Alstom’s planed, but not committed, contribution is estimated at Cdn$456.125 and the final amount of Phase 5 will be determined. Mantra and Alstom are actively seeking external funding to support the execution of the projects.

Effective March 25, 2014, our company, through our subsidiary MEA, entered into letter of engagement with BC Research Inc. pursuant to which BC Research has undertaken to design, engineer and build our company’s ERC demonstration unit. Based in Vancouver, British Columbia, BC Research is the technology commercialization and innovation center of NORAM Engineering and Constructors Ltd.

The BC Research facility houses a wet chemical laboratory and over 10,000 square feet of pilot plant space, and is where our company is performing its ongoing research and development work on ERC. BC Research has been engaged to engineer, design and build our ERC demonstration unit for the estimated cost of Cdn$360,000 (approximately $326,000). Engineering and design services for the project will be provided primarily by NORAM engineers and scientists. We have delivered the first installment payment of Cdn$190,000 to BC Research and project work has commenced. We may terminate the agreement at any time and will retain all prior-owned and new intellectual property related to the project.

Electro Reduction of Carbon Dioxide (“ERC”)

On November 2, 2007, MEA entered into a technology assignment agreement with 0798465 BC Ltd. whereby we acquired 100% ownership in and to a certain chemical process for the electro-reduction of carbon dioxide as embodied by and described in the following patent cooperation treaty application:

17

| Country |

Application Number |

File Date |

Status |

| Patent Cooperation Treaty (PCT) | W02207 | 10/13/2006 | PCT |

As of the date of this quarterly report, we have been awarded the following patents:

| Country | Patent Number | Patent Date | Name of Patent |

| India | 251493 | March 20, 2012 | “An Electrochemical Process for Reducing of Carbon Dioxide” |

| China |

ZL 2006 8

0037810.8 |

May 8, 2013 |

“Continuous Co-Current

Electrochemical Reduction of Carbon Dioxide” |

| Australia | 2012202601 | May 1, 2014 | “Continuous Co-Current Electrochemical Reduction of Carbon Dioxide” |

The reactor at the core of the chemical process, referred to as the electrochemical reduction of carbon dioxide (CO2), or ERC, has been proven functional through small scale prototype trials. ERC offers a possible solution to reduce the impact of CO2 on Earth’s environment by converting CO2 into chemicals with a broad range of commercial applications, including a fuel for a next generation of fuel cells. Powered by electricity, the ERC process combines captured carbon dioxide with water to produce materials, such as formic acid, formate salts, oxalic acid and methanol, that are conventionally obtained from the thermo-chemical processing of fossil fuels. However, while thermo-chemical reactions must be driven at relatively high temperatures that are normally obtained by burning fossil fuels, ERC operates at near ambient conditions and is driven by electric energy that can be taken from an electric power grid supplied by hydro, wind, solar or nuclear energy.

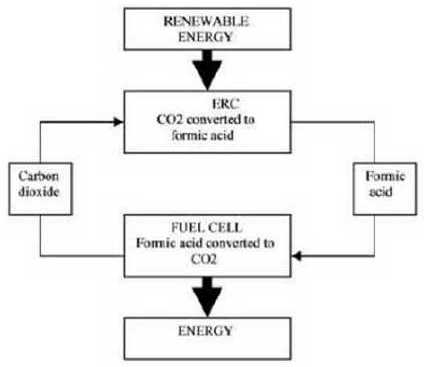

In fuel cells, liquid fuels are indirectly burned with air to form carbon dioxide and water, while generating electricity. This process is known as electrochemical combustion or electro-oxidation. The complementary nature of ERC and electro-oxidation makes it possible to use ERC in a regenerative fuel cell cycle, where carbon dioxide is converted to a fuel that is consumed in a fuel cell to regenerate carbon dioxide. As shown in the figure, the net energy input required in this cycle could be supplied from a renewable or non-fossil fuel source.

ERC has been shown to produce a range of compounds, including formic acid, formate salts, oxalic acid, and methanol. The efficiency for generation of each compound depends on the experimental conditions, most importantly the material of the cathode, which catalyzes the electrochemical reactions.

18

Until appropriate cathodes are found, some products of CO2 reduction (methanol, for instance) are obtained at efficiencies too low for practical use. Other products can be generated on known cathodes with high current yields that could support valuable practical processes. For example, formic acid has been obtained on tin cathodes with current yields above 80%. Formate salts and sodium bicarbonate are obtained at similarly high yields.

ERC Development to Date

We have retained one of the creators of the ERC technology, Professor Colin Oloman, as a member of our scientific advisory board, to further develop the carbon dioxide reduction process to achieve optimal results on a consistent basis. On June 1, 2008, we entered into a technology development and support agreement with Kemetco Research Inc., an integrated science, technology and innovation company. Pursuant to that agreement, we have established a research and development facility for the ERC in Vancouver, British Columbia, staffed by a dedicated research team provided by Kemetco.

We anticipate that commercialization of ERC will require us to develop reactors capable of processing not less than 100 tons of CO2 per day; however, there is no guarantee that we will successfully produce reactors of that size. Production of commercially viable ERC reactors will depend on continued research and development, successful testing of small scale ERC reactors, and securing of additional financing. At the conclusion of our current agreement and development program with Kemetco, an assessment will be made of the project’s progress and the next phase to be conducted.

Established and Emerging Market for ERC and By-Products:

The technology behind ERC can be applied to any scale commercial venture that outputs CO2 into the atmosphere. We anticipate that, once fully commercialized, we will be able to offer ERC as a CO2 management system to various industries, including steel, power generation and lumber.

The existing applications of ERC by-products include use as feedstock preservatives, de-icing solutions, and baking soda, among others. Sodium formate and formic acid, two of the main by-products of ERC, currently have an average market value of $1,200/ton, with approximately 720,000 tons of formic acid produced in 2009. The market for formic acid has experienced continual growth and demand over the past several years, mainly attributed to European and developing country demand for formic acid in silage, rising raw materials, energy and logistics costs, as well as animal feed preservative and Asian demand for formic acid in leather, rubber, food and pharmaceutical industries.

However, if the ERC process reaches market acceptance as a way to deal with CO2 emissions from industry facilities, it will likely lead to supply of formic acid in excess of current market demand. We have identified several potential future applications for formic acid, which may lead to an expansion in current market demand. The application we have identified and are currently focusing on is steel pickling.

Steel Pickling

Steel pickling is part of the finishing process in the production of certain steel products in which oxide and scale are removed from the surface of strip steel, steel wire, and other forms of steel, by dissolution in acid. A solution of either hydrochloric acid (HCl) or sulfuric acid is generally used to treat carbon steel products, while a combination of hydrofluoric and nitric acids is often used for stainless steel. Approximately five metric tons of HCl is used annually for pickling steel. We believe that formic acid, which can be produced as a product of ECR, could be a very attractive replacement for HCl in the steel pickling process, as it is an organic acid. Formic acid has many potential advantages over HCl in this application, including: less iron lost from the steel surface; improvement in final surface quality; and the elimination of corrosion inhibiting and neutralizing rinse processes to prevent rust development. In addition, formic acid is both bio-degradable and reusable which would allow water used in the picking process to be recycled more easily.

19

Results of Operations for the Three Month Periods Ended August 31, 2014 and August 31, 2013.

The following summary of our results of operations should be read in conjunction with our consolidated financial statements for the quarter ended August 31, 2014 which are included herein.

Revenues

Our operating results for three month periods ended August 31, 2014 and August 31, 2013 are summarized as follows:

| Difference Between | |||||||||

| Three Month Period | |||||||||

| Ended | |||||||||

| Three Months | Three Months | August 31, 2014 | |||||||

| Ended | Ended | and | |||||||

| August 31, 2014 | August 31, 2013 | August 31, 2013 | |||||||

| ($) | ($) | ($) | |||||||

| Revenue | $ | 55,230 | $ | Nil | $ | 55,230 | |||

| Operating expenses | $ | 706,551 | $ | 238,294 | $ | 468,257 | |||

| Other expenses | $ | (17,734 | ) | $ | (22,522 | ) | $ | 4,788 | |

| Net loss | $ | (669,055 | ) | $ | (260,816 | ) | $ | (408,239 | ) |

For the three months ended August 31, 2014 we generated $55,230 in revenues compared to revenues of $Nil generated during the same period in 2013. Revenues increased because we had not received any revenue from operations during the three months ended August 31, 2013. Over the last year, we increased operations and generated some revenue during the three month period ended August 31, 2014.

Expenses

Our operating expenses for the three month periods ended August 31, 2014 and August 31, 2013 are summarized as follows:

| Three Months Ended | ||||||

| August 31, | August 31, | |||||

| 2014 | 2013 | |||||

| ($) | ($) | |||||

| Business development | $ | 10,225 | $ | Nil | ||

| Consulting and advisory | $ | 136,394 | $ | 40,700 | ||

| Depreciation and amortization | $ | 9,984 | $ | 7,524 | ||

| Foreign exchange loss (gain) | $ | (22,546 | )) | $ | (13,700 | )) |

| General and administrative | $ | 61,367 | $ | 9,524 | ||

| Management fees | $ | 59,458 | $ | 46,521 | ||

| Professional fees | $ | (2,943 | ) | $ | 30,637 | |

| Public listing costs | $ | 13,055 | $ | 1,069 | ||

| Rent | $ | 17,984 | $ | 10,649 | ||

| Research and development | $ | 342,435 | $ | 86,672 | ||

| Shareholder communications and awareness | $ | Nil | $ | 240 | ||

| Travel and promotion | $ | 68,221 | $ | 18,458 | ||

| Wages and benefits | $ | 12,917 | $ | - | ||

For the three months ended August 31, 2014, we incurred total operating expenses of $706,551 compared to total operating expenses for the three months ended August 31, 2013 of $238,294. The $468,257 increase in operating expense during 2014 is primarily due to a $255,763 increase in research and development expenses, an increase of $95,694 expenses related to consulting and advisory services and an increase of $51,843 in general and administrative expenses related to approximately $25,000 of insurance purchased, whereas there was no insurance in 2013.

Net Loss

For the three months ended August 31, 2014 we incurred a net loss of $669,055 compared to a net loss of $260,816 for the same period in 2013.

20

Liquidity and Capital Resources

Working Capital

| At | At | |||||

| August 31, | May 31, | |||||

| 2014 | 2014 | |||||

| Current Assets | $ | 1,058,582 | $ | 1,600,174 | ||

| Current Liabilities | $ | 1,103,342 | $ | 1,252,129 | ||

| Working Capital (Deficit) | $ | (44,760 | ) | $ | 348,045 |

Cash Flows

| Nine Months | Nine Months | |||||

| Ended | Ended | |||||

| August 31, | August 31, | |||||

| 2014 | 2013 | |||||

| Net Cash Used In Operating Activities | $ | (440,188 | ) | $ | (128,957 | ) |

| Net Cash Used In Investing Activities | $ | (27,745 | ) | $ | (1,481 | ) |

| Net Cash Provided by Financing Activities | $ | 39,761 | $ | 135,121 | ||

| Change In Cash | $ | (428,172 | ) | $ | 4,683 |

As of August 31, 2014, we had $503,174 cash in our bank accounts and a working capital deficit of $44,760. As of August 31, 2014, we had total assets of $1,227,470 and total liabilities of $1,134,855.

We received net cash of $39,761 from financing activities for the three months ended August 31, 2014 compared to $135,121 for the same period in 2013. During the three months ended August 31, 2014, we raised $69,999 in cash from the issuance of our common stock and share subscriptions received, offset by repayment of capital lease obligations of $2,899 and repayment of loans payable of $27,339.

In the three months ended August 31, 2013, we raised cash of $123,727 from the issuance of our common stock and share subscriptions received and $18,000 from loans payable, offset by repayment of capital lease obligations of $1,793 and repayment of loans payable of $4,813.

We expect that our total expenses will increase over the next year as we increase our business operations. We have not been able to reach the break-even point since our inception and have had to rely on outside capital resources. We do not anticipate achieving significant revenues for the next year. Over the next 12 months, contingent upon raising the necessary funds, for which we do not currently have any commitments for, we plan to primarily concentrate on commercializing our ERC technology and associated projects.

| Description |

Estimated expenses ($) |

| Research and Development | 500,000 |

| Consulting Fees | 250,000 |

| Commercialization of ERC | 3,000,000 |

| Shareholder communication and awareness | 200,000 |

| Professional Fees | 300,000 |

| Wages and Benefits | 200,000 |

| Management Fees | 150,000 |

| Total | 4,600,000 |

21

In order to fully carry out our business plan, we need additional financing of approximately $4,600,000 for the next 12 months. In order to improve our liquidity, we intend to pursue additional equity financing from private placement sales of our equity securities or shareholders’ loans. We do not presently have sufficient financing to undertake our planned business activities. Issuances of additional shares will result in dilution to our existing shareholders.

We currently do not have any arrangements in place for the completion of any further private placement financings and there is no assurance that we will be successful in completing any further private placement financings. If we are unable to achieve the necessary additional financing, then we plan to reduce the amounts that we spend on our business activities and administrative expenses in order to be within the amount of capital resources that are available to us.

Settlement Agreement

On July 18, 2012, we entered into a settlement agreement with the holder of a $150,000 debenture holder, pursuant to which the holder agreed to extend the due date until April 11, 2013 and we paid $43,890 of accrued interest, agreed to pay the accruing interest on a monthly basis, and pay a $10,000 premium in addition to the $150,000 principal outstanding on April 11, 2013. On April 29, 2013, we entered into an amended settlement agreement whereby the holder agreed to extend the due date to September 15, 2013 and we paid $6,836 of interest for the period from April 1 to September 15, 2013 and issued the holder 100,000 stock options exercisable at $0.12 per share for a period of two years.

On November 15, 2013, we entered into a second settlement agreement amendment, pursuant to which we paid interest of $4,438 and agreed that commencing on February 1, 2014, we would make monthly payments of $10,000 on the outstanding principal and interest. During the three months ended August 31, 2014, we repaid $27,339, decreasing the carrying value to $87,322.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Inflation

The effect of inflation on our revenue and operating results has not been significant.

Critical Accounting Policies

Our consolidated financial statements are impacted by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete summary of these policies is included in note 2 of the notes to our financial statements. We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows, and which require the application of significant judgment by management.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Our company regularly evaluates estimates and assumptions related to allowance for doubtful accounts, the estimated useful lives and recoverability of long-lived assets, stock-based compensation, and deferred income tax asset valuation allowances. Our company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by our company may differ materially and adversely from our company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Stock-based Compensation

Our company records stock-based compensation in accordance with ASC 718, “Compensation – Stock Compensation”, using the fair value method. All transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable.

22

Our company uses the Black-Scholes option pricing model to calculate the fair value of stock-based awards. This model is affected by our company’s stock price as well as assumptions regarding a number of subjective variables. These subjective variables include, but are not limited to our company’s expected stock price volatility over the term of the awards, and actual and projected employee stock option exercise behaviors. The value of the portion of the award that is ultimately expected to vest is recognized as an expense in the consolidated statement of operations over the requisite service period.

Technology Development Revenue

Our company performs research and development services. Our company recognizes revenue under research contracts when a contract has been executed, the contract price is fixed and determinable, delivery of services or products has occurred, and collectability of the contract price is considered reasonably assured and can be reasonably estimated. Revenue is based on direct labor hours expended at contract billing rates plus other billable direct costs.

Recent Accounting Pronouncements

Our company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

ITEM 3 - QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not required under Regulation S-K for “smaller reporting companies.”

23

ITEM 4 - CONTROLS AND PROCEDURES

a) Evaluation of disclosure controls and procedures.

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, evaluated the effectiveness of our disclosure controls and procedures pursuant to Rule 13a-15 under the Securities Exchange Act of 1934 as of the end of the period covered by this Quarterly Report on Form 10-Q. In designing and evaluating the disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives. In addition, the design of disclosure controls and procedures must reflect the fact that there are resource constraints and that management is required to apply its judgment in evaluating the benefits of possible controls and procedures relative to their costs.

Based on our evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, as a result of the material weaknesses described below, as of August 31, 2014, our disclosure controls and procedures are not designed at a reasonable assurance level and are ineffective to provide reasonable assurance that information we are required to disclose in reports that we file or submit under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in SEC rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. The material weaknesses, which relate to internal control over financial reporting, that were identified are:

| a) |

Due to our small size, we do not have a proper segregation of duties in certain areas of our financial reporting process. The areas where we have a lack of segregation of duties include cash receipts and disbursements, approval of purchases and approval of accounts payable invoices for payment. This control deficiency, which is pervasive in nature, results in a reasonable possibility that material misstatements of the consolidated financial statements will not be prevented or detected on a timely basis; | |

| b) |

We do not have any independent directors. As a result, there is no effective independent oversight in the establishment and monitoring of required internal controls and procedures; | |

| c) |

We do not have any formally adopted internal controls surrounding its cash and financial reporting procedures. |

We are committed to improving our financial organization. We will look to increase our personnel resources and technical accounting expertise within the accounting function to resolve non-routine or complex accounting matters. In addition, when funds are available, we will take the following action to enhance our internal controls: Hiring additional knowledgeable personnel with technical accounting expertise to further support our current accounting personnel, which management estimates will cost approximately $100,000 per annum. As our operations are relatively small and we continue to have net cash losses each quarter, we do not anticipate being able to hire additional internal personnel until such time as our operations are profitable on a cash basis or until our operations are large enough to justify the hiring of additional accounting personnel. We currently engage an outside accounting firm to assist us in the preparation of our consolidated financial statements and anticipate doing so until we have a sufficient number of internal accounting personnel to achieve compliance. As necessary, we will engage consultants in the future in order to ensure proper accounting for our consolidated financial statements.

Due to the fact that our internal accounting staff consists solely of a Chief Financial Officer, additional personnel will also ensure the proper segregation of duties and provide more checks and balances within the department. Additional personnel will also provide the cross training needed to support us if personnel turn over issues within the department occur. We believe this will greatly decrease any control and procedure issues we may encounter in the future.

(b) Changes in internal control over financial reporting.

There were no changes in our internal control over financial reporting that occurred during the quarter ended August 31, 2014 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

24

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

We are currently not a party to any material legal proceedings or claims.

Item 1A. Risk Factors

Not required under Regulation S-K for “smaller reporting companies.”

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

During the quarter ended August 31, 2014, we sold an aggregate of 533,333 shares of common stock to two investors at a price of $0.30 per share for gross proceeds of $160,000.

During the quarter ended August 31, 2014, we issued an aggregate of 552,000 shares of common stock to two consultants in exchange for services rendered with an aggregate fair value of $295,880.

During the quarter ended August 31, 2014, we issued 60,037 shares of common stock in exchange for settlement of outstanding debt in the amount of $9,016.

During the quarter ended August 31, 2014, we issued 150,000 shares of common stock to one of our directors upon exercise of options at an exercise price of $0.02 per share, for gross proceeds of $3,000.