UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 20-F

(Mark One)

¨ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

¨ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report ____________________

For the transition period from __________ to __________.

Commission file number: 001-33765

AIRMEDIA GROUP INC.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant's name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

17/F, Sky Plaza

No. 46 Dongzhimenwai Street

Dongcheng District, Beijing 100027

The People's Republic of China

(Address of principal executive offices)

Richard Wu

Chief Financial Officer

AirMedia Group Inc.

17/F, Sky Plaza

No. 46 Dongzhimenwai Street

Dongcheng District, Beijing 10027

The People's Republic of China

Phone:+86 10 8460 8181

Email: richardwu@airmedia.net.cn

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class Ordinary shares, par value $0.001 per share* American Depositary Shares, each representing

|

Name of each exchange on which registered

The NASDAQ Stock Market LLC |

* Not for trading, but only in connection with the listing on the NASDAQ Global Market of American depositary shares, each representing two ordinary shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: 127,662,057 shares issued, with 119,942,413 shares outstanding and 7,719,644 shares in treasury stock, par value $0.001 per share, as of December 31, 2014.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Yes ¨ | No x |

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

| Yes ¨ | No x |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Yes x | No ¨ |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| Yes x | No ¨ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer ¨ | Accelerated Filer x | Non-Accelerated Filer ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP | x |

International Financial Reporting Standards as issued by the International Accounting Standards Board ¨

| Other | ¨ |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

| ¨ Item 17 | ¨ Item 18 |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Yes ¨ | No x |

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

AIRMEDIA GROUP INC.

Annual Report on Form 20-F

TABLE OF CONTENTS

| i |

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, in this annual report:

| · | "ADS" refers to our American depositary shares, each of which represents two ordinary shares; |

| · | "China" or "PRC" refers to the People's Republic of China, excluding, for the purpose of this annual report only, Hong Kong, Macau and Taiwan; |

| · | "ordinary shares" refers to our ordinary shares, par value US$0.001 per share; |

| · | "RMB" or "Renminbi" refers to the legal currency of China; |

| · | "U.S. dollars", "$", "US$" or "dollars" refers to the legal currency of the United States; |

| · | "VIEs" means our variable interest entities; and |

| · | "we", "us", "our", the "Company" or "AirMedia" refers to the combined business of AirMedia Group Inc., its consolidated subsidiaries, its VIEs and VIEs' subsidiaries. |

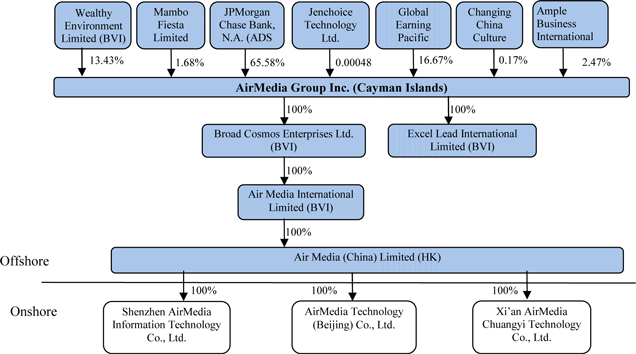

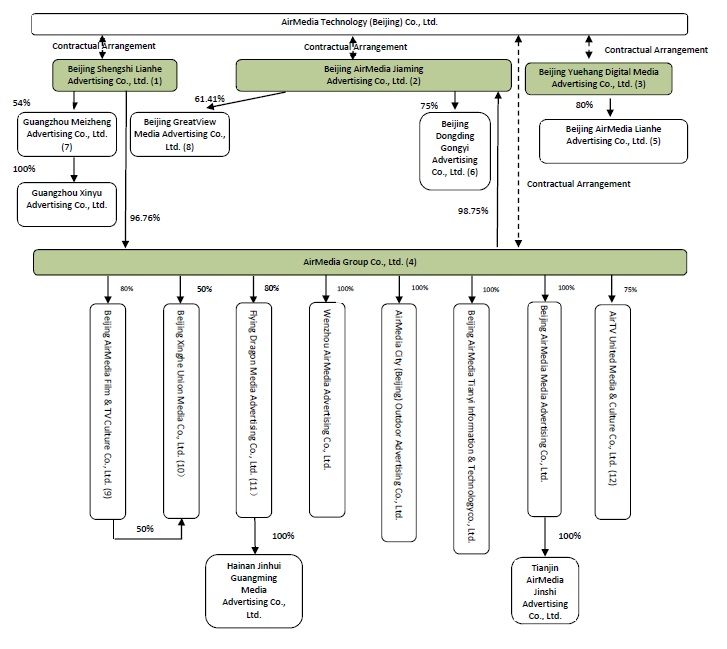

Although AirMedia does not directly or indirectly own any equity interests in its consolidated VIEs or their subsidiaries, AirMedia is the primary beneficiary of and effectively controls these entities through a series of contractual arrangements with these entities and their record owners. We have consolidated the financial results of these VIEs and their subsidiaries in our consolidated financial statements in accordance with the Generally Accepted Accounting Principles in the United States, or U.S. GAAP. See "Item 4. Information on the Company—C. Organizational Structure," "Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions" and "Item 3. Key Information—D. Risk Factors" for further information on our contractual arrangements with these parties.

FORWARD-LOOKING INFORMATION

This annual report on Form 20-F contains statements of a forward-looking nature. These statements are made under the "safe harbor provisions" of the U.S. Private Securities Litigation Reform Act of 1995.

You can identify these forward-looking statements by words or phrases such as "may", "will", "expect", "anticipate", "aim", "estimate", "intend", "plan", "believe", "likely to" or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include but are not limited to:

| · | our growth strategies; |

| · | our future business development, results of operations and financial condition; |

| · | our plans to expand our travel advertising network into additional locations, airports, airlines and areas outside of air travel; |

| · | our plans to expand our advertising network into other out-of-home advertising platforms such as billboards, light boxes and LED screens located at gas stations, large LED screens at selected airports and in-flight and on-train internet platforms; |

| · | competition in the advertising industry and the air and train travel advertising industries in China; |

| · | the expected growth in consumer spending, average income levels and advertising spending levels; |

| · | the growth of the air and train travel sectors in China; and |

| · | PRC governmental policies relating to the advertising industry. |

Also, forward-looking statements represent our estimates and assumptions only as of the date of this annual report. You should read this annual report and the documents that we referred and filed as exhibits to this report in their entirety and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

| 1 |

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

| A. | Selected Financial Data |

Selected Consolidated Financial Data

The following table represents our selected consolidated financial information. The selected consolidated statements of operations data for the years ended December 31, 2012, 2013 and 2014 and the consolidated balance sheet data as of December 31, 2013 and 2014 have been derived from our audited consolidated financial statements, which are included in this annual report. The selected consolidated statements of operations data for the years ended December 31, 2010 and 2011 have been derived from our audited financial statements for the relevant periods, which are not included in this annual report. The selected consolidated balance sheet data as of December 31, 2010, 2011 and 2012 have been derived from our audited financial statements for the relevant periods, which are not included in this annual report. Our consolidated financial statements are prepared and presented in accordance with U.S. GAAP.

These selected consolidated financial data below should be read in conjunction with, and are qualified in their entirety by reference to, our consolidated financial statements and related notes included elsewhere in this annual report and "Item 5. Operating and Financial Review and Prospects" below. Our historical results do not necessarily indicate results expected for any future periods.

| Years Ended December 31, | ||||||||||||||||||||

| 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||

| (In thousands of U.S. Dollars, except share, per share and per ADS data) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: | ||||||||||||||||||||

| Revenues: | ||||||||||||||||||||

| Air Travel Media Network | ||||||||||||||||||||

| Digital frames in airports | $ | 113,196 | $ | 126,539 | $ | 137,342 | $ | 152,346 | $ | 138,527 | ||||||||||

| Digital TV screens in airports | 28,905 | 21,937 | 13,731 | 14,110 | 13,286 | |||||||||||||||

| Digital TV screens on airplanes | 27,564 | 26,734 | 26,612 | 16,160 | 16,212 | |||||||||||||||

| Traditional media in airports | 48,418 | 73,535 | 83,478 | 64,845 | 56,723 | |||||||||||||||

| Other revenues in air travel | 4,063 | 6,416 | 7,346 | 9,183 | 6,395 | |||||||||||||||

| Gas Station Media Network | 3,664 | 12,873 | 14,217 | 12,726 | 11,164 | |||||||||||||||

| Other Media | 10,650 | 9,787 | 10,239 | 7,146 | 13,564 | |||||||||||||||

| Total revenues | 236,460 | 277,821 | 292,965 | 276,516 | 255,871 | |||||||||||||||

| Business tax and other sales tax | (5,955 | ) | (7,197 | ) | (6,223 | ) | (4,250 | ) | (3,390 | ) | ||||||||||

| Net revenues | 230,505 | 270,624 | 286,742 | 272,266 | 252,481 | |||||||||||||||

| Cost of revenues | (197,908 | ) | (244,470 | ) | (250,606 | ) | (244,673 | ) | (235,835 | ) | ||||||||||

| Gross profit | 32,597 | 26,154 | 36,136 | 27,593 | 16,646 | |||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Selling and marketing (including share-based compensation of $2,424, $1,422, $859, nil and $144 in 2010, 2011, 2012, 2013 and 2014, respectively) | (18,112 | ) | (18,238 | ) | (17,995 | ) | (20,069 | ) | (25,067 | ) | ||||||||||

| General and administrative (including share-based compensation of $5,547, $3,192, $2,643, $1,251 and $1,215 in 2010, 2011, 2012, 2013 and 2014, respectively) | (24,646 | ) | (22,004 | ) | (21,842 | ) | (25,723 | ) | (26,337 | ) | ||||||||||

| Impairment of goodwill | — | (1,003 | ) | (20,611 | ) | — | — | |||||||||||||

| Impairment of intangible assets | (1,000 | ) | (656 | ) | (9,583 | ) | — | — | ||||||||||||

| Total operating expenses | (43,758 | ) | (41,901 | ) | (70,031 | ) | (45,792 | ) | (51,404 | ) | ||||||||||

| Loss from operations | (11,161 | ) | (15,747 | ) | (33,895 | ) | (18,199 | ) | (34,758 | ) | ||||||||||

| Interest income | 694 | 1,242 | 1,355 | 1,213 | 1,340 | |||||||||||||||

| Gain on remeasurement of fair value of cost and equity method investments (net) | 919 | — | — | — | — | |||||||||||||||

| Other income, net | 940 | 1,848 | 2,770 | 3,822 | 2,214 | |||||||||||||||

| Loss before income taxes | (8,608 | ) | (12,657 | ) | (29,770 | ) | (13,164 | ) | (31,204 | ) | ||||||||||

| Income tax benefits/ (expenses) | 735 | (266 | ) | (2,493 | ) | 1,713 | (430 | ) | ||||||||||||

| Loss

before share of loss on equity method investments | (7,873 | ) | (12,923 | ) | (32,263 | ) | (11,451 | ) | (31,634 | ) | ||||||||||

| Share of income/(loss) on equity method investments | 290 | 243 | 22 | (69 | ) | (192 | ) | |||||||||||||

| Net loss | (7,583 | ) | (12,680 | ) | (32,241 | ) | (11,520 | ) | (31,826 | ) | ||||||||||

| Less: Net (loss)/ income

attributable to noncontrolling interests | (2,666 | ) | (3,084 | ) | 487 | (894 | ) | (6,131 | ) | |||||||||||

| Net loss attributable to AirMedia Group Inc.'s shareholders | $ | (4,917 | ) | $ | (9,596 | ) | $ | (32,728 | ) | $ | (10,626 | ) | $ | (25,695 | ) | |||||

| Net loss attributable to AirMedia Group Inc.'s shareholders per ordinary share—basic | $ | (0.04 | ) | $ | (0.07 | ) | $ | (0.26 | ) | $ | (0.09 | ) | $ | (0.22 | ) | |||||

| Net loss attributable to AirMedia Group Inc.'s shareholders per ordinary share—diluted | $ | (0.04 | ) | $ | (0.07 | ) | $ | (0.26 | ) | $ | (0.09 | ) | $ | (0.22 | ) | |||||

| Net loss attributable to AirMedia Group Inc.'s shareholders per ADS—basic(1) | $ | (0.07 | ) | $ | (0.15 | ) | $ | (0.53 | ) | $ | (0.18 | ) | $ | (0.43 | ) | |||||

| Net loss attributable to AirMedia Group Inc.'s shareholders per ADS—diluted(1) | $ | (0.07 | ) | $ | (0.15 | ) | $ | (0.53 | ) | $ | (0.18 | ) | $ | (0.43 | ) | |||||

| Weighted average shares used in calculating net loss per ordinary share—basic | 131,252,115 | 129,537,955 | 124,269,245 | 120,386,635 | 119,304,773 | |||||||||||||||

| Weighted average shares used in calculating net loss per ordinary share—diluted | 131,252,115 | 129,537,955 | 124,269,245 | 120,386,635 | 119,304,773 | |||||||||||||||

| (1) | Each ADS represents two ordinary shares. |

| 2 |

The following table presents a summary of our consolidated balance sheet data as of December 31, 2010, 2011, 2012, 2013 and 2014:

| As of December 31, | ||||||||||||||||||||

| 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||

| (In thousands of U.S. Dollars) | ||||||||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||||

| Cash | $ | 106,505 | $ | 112,734 | $ | 73,634 | $ | 59,652 | $ | 67,437 | ||||||||||

| Total assets | 347,186 | 361,468 | 343,867 | 402,791 | 395,597 | |||||||||||||||

| Total liabilities | 70,470 | 91,410 | 104,432 | 111,448 | 126,725 | |||||||||||||||

| Total AirMedia Group Inc.'s shareholders' equity | 275,668 | 272,148 | 241,876 | 270,966 | 248,736 | |||||||||||||||

| Noncontrolling interests | 1,048 | (2,090 | ) | (2,441 | ) | 20,377 | 20,136 | |||||||||||||

| Total equity | $ | 276,716 | $ | 270,058 | $ | 239,435 | $ | 291,343 | $ | 268,872 | ||||||||||

Exchange Rate Information

Our reporting and financial statements are expressed in the U.S. dollar, which is the reporting and functional currency of our Cayman Islands parent company. However, substantially all of the revenues and expenses of our consolidated operating subsidiaries and VIEs are denominated in RMB. The conversion of RMB into U.S. dollars in this annual report is based on the noon buying rate in The City of New York for cable transfers of RMB as certified for customs purposes by the Federal Reserve Bank of New York. Unless otherwise noted, all translations from RMB to U.S. dollars and from U.S. dollars to RMB in this annual report were made at a rate of RMB6.2046 to US$1.00, the noon buying rate in effect as of December 31, 2014. We make no representation that any RMB or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or RMB, as the case maybe, at any particular rate, the rates stated below, or at all. The Chinese government imposes control over its foreign currency reserves in part through direct regulation of the conversion of RMB into foreign exchange. On April 17, 2015, the noon buying rate was RMB6.1976 to US$1.00.

The following table sets forth information concerning exchange rates between the RMB and the U.S. dollar for the periods indicated. These rates are provided solely for your convenience and are not necessarily the exchange rates that we used in this annual report or will use in the preparation of our periodic reports or any other information to be provided to you.

| 3 |

| Noon Buying Rate (1) | ||||||||||||||||

| Period-End | Average (2) | Low | High | |||||||||||||

| Period | (RMB per US$1.00) | |||||||||||||||

| 2010 | 6.6000 | 6.7603 | 6.8330 | 6.6000 | ||||||||||||

| 2011 | 6.2939 | 6.4475 | 6.6364 | 6.2939 | ||||||||||||

| 2012 | 6.2301 | 6.2990 | 6.3879 | 6.2221 | ||||||||||||

| 2013 | 6.0537 | 6.1412 | 6.2438 | 6.0537 | ||||||||||||

| 2014 | 6.2046 | 6.1704 | 6.2591 | 6.0402 | ||||||||||||

| October | 6.1124 | 6.1251 | 6.1385 | 6.1107 | ||||||||||||

| November | 6.1429 | 6.1249 | 6.1429 | 6.1117 | ||||||||||||

| December | 6.2046 | 6.1886 | 6.2256 | 6.1490 | ||||||||||||

| 2015 | ||||||||||||||||

| January | 6.2495 | 6.2181 | 6.2535 | 6.1870 | ||||||||||||

| February | 6.2695 | 6.2518 | 6.2695 | 6.2399 | ||||||||||||

| March | 6.1990 | 6.2343 | 6.2741 | 6.1955 | ||||||||||||

| April (through April 17, 2015) | 6.1976 | 6.2010 | 6.2152 | 6.1976 | ||||||||||||

| (1) | The exchange rates reflect the noon buying rates as set forth in the H.10 statistical release of the Federal Reserve Board. |

| (2) | Annual averages are calculated from the average of the exchange rates on the last day of each month during the period. |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

An investment in our capital stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this annual report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our capital stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

We have incurred net losses in the past and may incur losses in the future.

We have incurred net losses for certain periods in the past. We pay concession fees to airports for placing and operating our digital displays, to airlines for placing our programs on their digital TV screens, to airports and gas stations for placing and operating our advertisements on traditional media platforms such as light boxes and billboards, and to train administration authorities for Wi-Fi system installation and operation rights. These fees constitute a significant part of our cost of revenues and are mostly fixed under the concession rights contracts with an escalation clause; payments are usually due three or six months in advance. However, our revenues may fluctuate significantly from period to period for various reasons. For instance, when new concession rights contracts are signed during a period, additional concession fees are incurred immediately, but it may take some time for us to create revenues from these concession rights contracts because it takes time to find advertisers for the time slots and locations made available under these new contracts. If our revenues decrease in a given period, we may be unable to reduce our cost of revenues as a significant part of our cost of revenues is fixed, which could materially and adversely affect our business and results of operations and lead to a net loss for that period.

We have a limited operating history, which may make it difficult for you to evaluate our business and prospects.

We began our business operations in August 2005. Our limited operating history may not provide a meaningful basis for you to evaluate our business, financial performance and prospects. It is also difficult to evaluate the viability of our air travel advertising network because we do not have sufficient experience to address the risks frequently encountered by early stage companies using new forms of advertising media and entering new and rapidly evolving markets. Certain members of our senior management team have worked together for only a relatively short period of time and it may be difficult for you to evaluate their effectiveness, on an individual or collective basis, and their ability to address future challenges to our business. Because of our limited operating history, we may not be able to:

| · | preserve our market position in the air travel advertising market in China; |

| 4 |

| · | manage our relationships with airports, airlines and railway authorities to retain existing concession rights contracts and obtain new concession rights contracts on commercially advantageous terms or at all; |

| · | retain existing and acquire new advertisers and third party content providers; |

| · | secure a sufficient number of low-cost hardware for our advertising business from our suppliers; |

| · | manage our expanding operations, including effectively integrating acquired businesses; |

| · | successfully expand into other advertising media platforms, including traditional media platforms in airports, gas station media platforms, outdoor media platforms and in-flight media platforms; |

| · | successfully expand into other non-advertising business, including in-flight and on-train internet business; |

| · | respond to competitive market conditions; |

| · | respond to changes in the PRC regulatory regime; |

| · | maintain adequate control of our costs and expenses; or |

| · | attract, train, motivate and retain qualified personnel. |

If advertisers or the viewing public do not accept, or lose interest in, our air travel advertising network, we may be unable to generate sufficient cash flow from our operating activities and our business and results of operations could be materially and adversely affected.

The market for air travel advertising network in China is relatively new and its potential is uncertain. We compete for advertising spending with many forms of more established advertising media such as television, print media, Internet and other types of out-of-home advertising. Our success depends on the acceptance of our air travel advertising network, including our in-flight media platforms, by advertisers and their interest in this medium as a part of their advertising strategies. In this annual report, the term "advertisers" refer to the ultimate brand-owners whose brands and products are being publicized by our advertisements, including both advertisers that purchase advertisements directly from us and advertisers that do so through third-party advertising agencies. Our advertisers may elect not to use our services if they believe that consumers are not receptive to our media network or that our network is not a sufficiently effective advertising medium. If consumers find our network to be disruptive or intrusive, airports and airplane companies may refuse to allow us to operate our air travel advertising network in airports or to place our programs on airplanes, and our advertisers may reduce spending on our network.

Air travel advertising is a relatively new concept in China and in the advertising industry generally. If we are not able to adequately track air traveler responses to our programs, in particular track the demographics of air travelers most receptive to air travel advertising, we will not be able to provide sufficient feedback and data to existing and potential advertisers to help us generate demand and determine pricing. Without improved market research, advertisers may reduce their use of air travel advertising and instead turn to more traditional forms of advertising that have more established and proven methods of tracking the effectiveness of advertisements.

Demand for our advertising services and the resulting advertising spending by our advertisers may fluctuate from time to time, and our advertisers may reduce the money they spend to advertise on our network for any number of reasons. If a substantial number of our advertisers lose interest in advertising on our media network for these or other reasons or become unwilling to purchase advertising time slots or locations on our network, we will be unable to generate sufficient revenues and cash flow to operate our business, and our business and results of operations could be materially and adversely affected.

We may be adversely affected by a significant or prolonged economic downturn in the level of consumer spending in the industries and markets served by our customers.

Our business is affected by the demand for our advertising time slots from our customers, which is determined by the level of business activity and economic condition of our customers. The level of business activity of our customers is in turn determined by the level of consumer spending in the markets our customers serve. Therefore, our businesses and earnings are affected by general business and economic conditions in China and abroad.

In 2014, the top three industries that advertise on our network were automobile, high-end food and beverages and domestic electric appliances based on revenues derived from advertisers in these industries. Any significant or prolonged slowdown or decline of the economy of China, countries like Japan or the overall global economy will affect consumers' disposable income and consumer spending in these industries, and lead to a decrease in demand for our services. Furthermore, the campaign launched by the Chinese government to curb waste by officials may also lead to decrease in demand for products of our key customers and in turn adversely affect demand for our services.

| 5 |

We derive a significant portion of our revenues from the provision of air travel advertising services. A contraction in the air travel advertising industry in China may materially and adversely affect our business and results of operations.

Substantially all of our historical revenues have been and a significant portion of our expected future revenues will be generated from the provision of air travel advertising services, in particular through the display of advertisements on stand-alone digital frames and mega-size LED screens located in airports. Most of our traditional advertising media platforms, such as billboards and painted advertisements on gate bridges and light boxes, and other displays, such as logo displays, are located in or near airports. A contraction in air travel advertising industry in China could have a material adverse effect on our business and results of operations.

If we are unable to carry out our operations as specified in existing concession rights contracts, retain or renew existing concession rights contracts or to obtain new concession rights contracts on commercially advantageous terms, we may be unable to maintain or expand our network coverage and our costs may increase significantly in the future.

Our ability to generate revenues from advertising sales depends largely upon our ability to provide a large air travel advertising network for the display of advertisements. However, we cannot assure you that we will be able to carry out our operations as specified in our concession rights contracts, and any failure to perform may damage our relationships with advertisers and advertising agencies and materially and negatively affect our business.

We may also be unable to retain or renew concession rights contracts when they expire. Most of our concession rights contracts to operate advertising media in airports and on airplanes typically have terms ranging from one to five years, with no automatic renewal provisions. As of December 31, 2014, we had in total approximately 51 concession rights contracts to be renewed in the next twelve months, with aggregated concession fees of approximately $433 million. We cannot assure you that we will be able to renew any or all of these contracts when they expire, and the terms of any renewal may not be commercially advantageous to us. The concession fees that we incur under our concession rights contracts comprise a significant portion of our cost of revenues, but airports and airlines tend to increase concession fees overtime, so as some of our concession rights contracts terminate, we may experience a significant increase in our costs of revenues when we renew these contracts. If we cannot pass increased concession costs onto our advertisers through rate increases, our earnings and our results of operations could be materially and adversely affected. In addition, many of our concession rights contracts to operate in airports and on airplanes contain provisions granting us certain exclusive concession rights. We cannot assure you that we will be able to retain these exclusivity provisions when we renew these contracts. If we were to lose exclusivity, our advertisers may decide to advertise with our competitors or otherwise reduce their spending on our network and we may lose market share.

Certain concession rights contracts allow the airports to terminate the contracts unilaterally without any compensation in certain circumstances. We cannot assure you that our concession rights contracts will not be terminated, whether with or without justification. In addition, most of our concession rights contracts were entered into with the advertising companies operated by or advertising agencies hired by airports or airline companies, and not with the airports or airline companies directly. Although these advertising companies and agents have generally assured us in writing that they have the rights to operate advertising media in airports or on airplanes and all of them have performed their contractual obligations, we cannot assure you that airports or airline companies will not challenge or revoke the contractual concession rights granted to us by their advertising companies or agents; if such challenges or revocations occur, our revenues and results of operations could be materially and adversely affected.

If we fail to perform under existing concession rights contracts, retain existing concession rights contracts or obtain new concession rights contracts on commercially advantageous terms, we may be unable to maintain or expand our network coverage and our costs may increase significantly in the future.

A significant portion of our revenues has been derived from the five largest airports in China. If any of these airports experiences a material business disruption or if there are changes in our arrangements with these airports, we may incur substantial losses of revenues.

We derived a significant portion of our total revenues in 2014 from the five largest airports in China: Beijing Capital International Airport, Guangzhou Baiyun International Airport, Shanghai Pudong International Airport, Shanghai Hongqiao Airport, and Chengdu Shuangliu International Airport. A material business disruption, major construction or renovation or natural disaster affecting any of the airports in our network could negatively affect our advertising media in such airport or materially limit where we can place our advertising media.

We expect these abovementioned airports to continue to contribute a significant portion of our revenues in the foreseeable future. If there were a material business disruption in any of these airports, we would likely lose a substantial amount of revenues.

| 6 |

We depend on third-party program producers to provide the non-advertising content that we include in our programs. Failure to obtain high-quality content on commercially reasonable terms could materially reduce the attractiveness of our network, harm our reputation and materially and adversely affect our business and results of operations.

The programs on the majority of our digital TV screens include both advertising and non-advertising content. Third-party content providers such as Travel Channel, Jiangsu TV, Enlight Media, and Youku Tudou and various other television stations and television production companies have contracts with us to provide the majority of the non-advertising content played over our network, particularly on TV screens on aircrafts. For example, in January 2014, we formed a strategic partnership with an affiliate of China Radio International to obtain internet TV contents from China International Broadcasting Network to be broadcasted on our airport digital TV screens. There is no assurance that we will be able to renew these contracts, enter into substitute contracts to obtain similar contents or obtain non-advertising content on satisfactory terms, or at all. In addition, some of the third-party content providers that currently do not charge us for their content may do so in the future. To make our programs more attractive, we must continue to secure contracts with these and other third-party content providers. If we fail to obtain a sufficient amount of high-quality content on a cost-effective basis, advertisers may find advertising on our network unattractive and may not wish to purchase advertising time slots or locations on our network, which would materially and adversely affect our business and results of operations.

One or more of our advertising agencies could engage in activities that are harmful to our reputation in the industry and to our business.

We engage third-party advertising agencies to help source advertisers from time to time. These third-party advertising agencies assist us in identifying and introducing advertisers to us. In return, we pay fees to these advertising agencies if they generate advertising revenues for us. Fees that we paid to these third-party agencies are calculated based on a pre-set percentage of revenues generated from the advertisers introduced to us by the third-party agencies and are paid when payments are received from the advertisers. Our contractual arrangements with these advertising agencies do not provide us with control or oversight over their everyday business activities, and one or more of these agencies may engage in activities that violate PRC laws and regulations governing the advertising industry and related non-advertising content, or other laws and regulations. If our agencies violate PRC advertising or other laws or regulations, it could harm our reputation in the industry and have detrimental effects on our business operations.

If we are unable to attract advertisers to purchase advertising time on our advertising network, we will be unable to maintain or increase our advertising fees, which could materially and adversely affect our ability to grow our profits.

We believe our advertisers choose to advertise on our network in part based on the size of our network, the desirability of the locations where we have placed our digital frames, digital TV screens, light boxes and billboards and the attractiveness of our network content. The fees we charge for advertisements on our network depend on the size and quality of our network and advertiser demand. If we fail to maintain or increase the number of our displays, solidify our brand name and reputation as a quality air travel advertising provider, or obtain high-quality non-advertising content at commercially reasonable prices, advertisers may be unwilling to purchase time on our network or to pay the levels of advertising fees we require to grow our profits.

When our current advertising network of digital frames, digital TV screens, mega-size LEDs, light boxes and LED screens becomes saturated in the major airports, airlines, gas stations and other locations where we operate, we may be unable to offer additional time slots or locations to satisfy all of our advertisers' needs, which could hamper our ability to generate higher levels of revenues and profitability over time.

When our network of digital frames, digital TV screens, mega-size LEDs, light boxes and LED screens becomes saturated in any particular airport, airline, gas stations and other locations where we operate, we may be unable to offer additional advertising time slots or locations to satisfy all of our advertisers' needs. We would need to increase our advertising rates for advertising in such airports, airlines or other locations to increase our revenues. However, advertisers may be unwilling to accept rate increases, which could hamper our ability to generate higher levels of revenues over time. In particular, the utilization rates of our advertising time slots and locations in the five largest airports and on the three largest airlines in China are higher than those in other network airports or on other airlines, and saturation or oversaturation of digital frames and digital TV screens in these airports or airlines could have a material adverse effect on our growth prospects.

Our strategy of expanding our advertising network by building new air travel media platforms and expanding into traditional media may not succeed, and our failure to do so could materially reduce the attractiveness of our network and harm our business, reputation and results of operations.

Our air travel advertising network primarily consists of standard digital frames, digital TV screens, and traditional media. Our growth strategy includes broadening our service offerings by continuing to increase our digital media network coverage and expanding our traditional media to become a comprehensive air travel advertising provider in China.

| 7 |

In addition, we intend to build a nationwide advertising platform of mega-size LEDs in selected airports in China, which may require capital expenditures on equipment and installations if we choose to purchase new LEDs with cash prepayments. As part of our strategic efforts to become a one-stop provider for advertising, we may continue to expand in the traditional media area as opportunities present themselves and we could also incur significant costs in installing new light boxes or maintaining existing ones.

A large amount of our concession rights contracts contain exclusive concession rights that grant us exclusivity with respect to digital frames, digital TV screens and mega-size LEDs. By entering and expanding into traditional advertising media platforms inside airports, we may face competition from other companies that are already in these areas. We also have limited experience working in these areas. It is uncertain how these businesses will perform. Our failure to expand our air travel advertising network to introduce new platforms and into new areas could materially reduce the attractiveness of our network and materially and adversely affect our business and results of operations.

If we do not succeed in our expansion into the business of outdoor media advertising, our future results of operations and growth prospects may be materially and adversely affected.

Our growth strategy also includes expansion into other media outside of airports, such as gas station LED sreens and other out-of-home media type.

As we are still in the developing stage in the gas station media advertising and outdoor media advertising market, it may take us an extended period of time to ramp up revenues from these businesses. However, under all of our existing concession rights agreements regarding our gas station and outdoor media displays, we are required to pay periodic, fixed concession fees for the media platforms regardless of revenues. We may also incur significant costs in maintaining and upgrading our gas station and outdoor traditional media platforms such as billboards, which are more vulnerable to weather and other accidental damages than indoor displays.

Although we are using best efforts to comply with all relevant laws and regulations and to obtain all necessary certificates, registrations and approvals for the advertising media platforms we operate, including actively consulting with every relevant local government authority in every city in which we operate to ascertain the legal requirements for our business operations in the area and continually monitoring local government announcements for any relevant updates in such requirements, due to the complexity of local laws and regulations across China governing outdoor media advertising platforms, there can be no assurance that we will be able to obtain or have all of the necessary approvals which we do not currently hold in a timely manner, or at all. Any delay or failure in obtaining the necessary approvals may materially and adversely affect our expansion into the business of outdoor media advertising.

We began to implement changes in the sales management team for our gas station advertising business in mid-year 2011. We also began to implement changes in the operational model and structure of our gas station advertising business in the second half of 2011 with the intention of accelerating growth and profitability. We may experience significant obstacles and challenges as we move forward with our strategy.

For each new business into which we enter, we may face competition from existing leading providers in that business; the same applies in the cases of gas station media advertising and outdoor media advertising markets. If we cannot successfully address the foregoing new challenges and compete effectively against the existing leading players in the field of gas station and outdoor media advertising, we may not be able to develop a sufficiently large advertiser base, recover costs incurred for developing and marketing our new business, and eventually achieve profitability from these businesses, and our future results of operations and growth prospects may be materially and adversely affected.

If advertising registration certificates are not obtained for our airport advertising operations where such registration certificates are deemed to be required, we may be subject to administrative sanctions, including the discontinuation of our advertisements at airports where the required advertising registration is not obtained.

Applicable PRC regulations promulgated by the State Administration for Industry and Commerce, or the SAIC, specify that advertisements placed inside or outside of the "departure halls" of airports are considered outdoor advertisements and must be registered with local SAIC offices by "advertising distributors." According to the Outdoor Advertising Registration Administrative Regulations, or the Outdoor Regulations, which were issued by the SAIC and became effective on July 1, 2006, if we fail to comply with such requirements, we may be ordered by the local SAIC office to (1) forfeit the relevant advertising income, (2) pay an administrative fines of up to RMB30,000 and (3) register the advertisements within a set period. If we fail to register these advertisements within the required timeframe, the relevant local SAIC office may require us to discontinue the relevant advertisements where the required advertising registration has not been obtained. We understand that these Outdoor Regulations apply to our operations, and intend to register with the relevant local SAIC offices if requested by the local SAIC offices or any specific airport authorities; so far we have registered and received outdoor advertising licenses for our advertisements in Beijing Capital International Airport, Shanghai Pudong International Airport, Shanghai Hongqiao Airport, Shenyang Taoxian International Airport and Changchun Longjia International Airport, and our registrations have been approved by the SAIC offices in four other cities and provinces where we have operations for our advertisements in the airports of those regions. However, we cannot assure you that we will obtain all applicable registration certificates in compliance with the outdoor advertisement provisions due to the uncertainty in the implementation and enforcement of the regulations promulgated by the SAIC. If we are found to be in violation of the Outdoor Regulations, we may be subject to any or all of the penalties set forth above, including forfeiture of relevant income and the payment of administrative fines.

| 8 |

If we fail to obtain approvals for the inclusion of non-advertising content in our programs broadcast in digital TV screens on airplanes, we may be unable to continue to include such non-advertising content in our programs, which may cause our revenues to decline and our business and prospects to deteriorate.

Most of the digital TV screens in our network include programs that consist of both advertising content and non-advertising content. The State Administration of Radio, Film and Television, or the SARFT, issued a circular which stated that displaying audio-video programs such as television news, films and television shows, sports, technology and entertainment through public audio-video systems located in automobiles, buildings, airports, bus or train stations, shops, banks, hospitals and other outdoor public systems must be approved by the SARFT.

The relevant authority in China has not promulgated any implementation rules on the procedure of applying for the requisite approval pursuant to this circular. We intend to obtain such approval for our non-advertising content, but we cannot assure you that we will be able to obtain such approval in compliance with this circular, or at all. In January 2014, we entered into a strategic partnership with China Radio International Oriental Network (Beijing) Co., Ltd, or CRION, which manages the internet TV business of China International Broadcasting Network, to operate the CIBN-AirMedia channel to broadcast network TV programs to air travelers in China. According to the terms of the cooperation arrangement with CRION, during the cooperation period from 2014 to 2024, CRION shall obtain and, from time to time, be responsible for obtaining any approval, license and consent regarding the regulation of broadcasting and television from relevant authorities. We believe that CRION has obtained the necessary approvals, licenses and consents. However, there is no assurance that CRION will be able to maintain the requisite approval or we will be able to renew the contract with CRION when it expires. If the requisite approval is not obtained, we will be required to eliminate non-advertising content from the programs displayed on our digital TV screens and advertisers may find our network less attractive and be unwilling to purchase advertising time slots and locations on our network, which may in turn cause our revenues to decline and our business and prospects to deteriorate.

Because we rely on third-party advertising agencies to help obtain advertisers, if we fail to maintain stable business relations with key third-party agencies or to attract additional agencies on competitive terms, our business and results of operations could be materially and adversely affected.

We engage third-party advertising agencies to help obtain advertisers from time to time. We do not have long-term or exclusive agreements with these advertising agencies, including our key third-party advertising agencies, and cannot assure you that we will continue to maintain stable business relations with them. Furthermore, the fees we pay to these third-party advertising agencies constitute a significant portion of our cost of revenues. If we fail to retain key third-party advertising agencies or to attract additional advertising agencies, we may not be able to retain existing advertisers or attract new advertisers or advertising agencies, or the fees we pay them may have to significantly increase. If any of the above happens, our business and results of operations could be materially and adversely affected.

A limited number of advertisers have historically accounted for a significant portion of our revenues and this dependence may reoccur in the future, which would make us more vulnerable to the loss of major advertisers or delays in payments from these advertisers.

A limited number of advertisers historically accounted for a significant portion of our revenues. Our top five advertisers collectively accounted for approximately 32.7%, 26.0% and 28.8% of our total revenues in the years ended December 31, 2012, 2013 and 2014, respectively. Our largest advertisers have changed from year to year primarily because of our limited operating history and rapid growth, broadened advertiser base and increased sales. However, given our limited operating history and the rapid growth of our competition, we cannot assure you that we will not be dependent on a small number of advertisers in the future.

If we fail to sell our services to one or more of our major advertisers in any particular period, or if a major advertiser purchases fewer of our services, fails to purchase additional advertising time on our network, or cancels some or all of its purchase orders with us, our revenues could decline and our operating results could be adversely affected. The dependence on a small number of advertisers could leave us more vulnerable to payment delays from these advertisers. We are required under some of our concession rights contracts to make prepayments and although we do receive some prepayments from advertisers, there is typically a lag between the time of our prepayment of concession fees and the time that we receive payments from our advertisers. As our business expands and revenues grow, we have experienced and may continue to experience an increase in our accounts receivable. If any of our major advertisers are significantly delinquent with its payments, our liquidity and financial conditions may be materially and adversely affected.

| 9 |

If we are unable to adapt to changing advertising trends and the technology needs of advertisers and consumers, we will not be able to compete effectively and we will be unable to increase or maintain our revenues, which may materially and adversely affect our business and results of operations.

The market for air travel advertising requires us to continuously identify new advertising trends and the technological needs of both advertisers and consumers, which may require us to develop new formats, features and enhancements for our advertising network. We currently play advertisements on digital frames through wireless networks and on digital TV screens on our network airplanes mostly through video tapes. We may be required to incur development and acquisition costs to keep pace with new technology needs, but we may not have the financial resources necessary to fund and implement future technological innovations or to replace obsolete technology. We may also fail to respond to changing technology needs altogether.

We must be able to quickly and cost-effectively expand into additional advertising media and platforms beyond digital frames and digital TV screens if advertisers find these additional media and platforms to be more attractive and cost-effective. In addition, as the advertising industry is highly competitive and fragmented with many advertising agencies existing and emerging from time to time, we must closely monitor the trends in the advertising agency community. We must maintain strong relationships with leading advertising agencies to ensure that we are reaching the leading advertisers and are responsive to the needs of both the advertising agencies and the advertisers.

If we fail to define, develop and introduce new formats, features and technologies on a timely and cost-effective basis, advertising demand for our advertising network may decrease and we may not be able to compete effectively or attract advertisers, which may materially and adversely affect our business and results of operations.

We face significant competition in the PRC advertising industry, and if we do not compete successfully against new and existing competitors, we may lose our market share, and our profits may be reduced.

We face significant competition in the PRC advertising industry. We compete for advertisers primarily on the basis of network size and coverage, location, price, program quality, the range of services offered and brand recognition. We compete for advertising dollars spent in the air travel advertising industry. We also compete for overall advertising spending with other alternative advertising media, such as Internet, street facilities, billboard and public transport advertising, and with traditional advertising media such as newspapers, television, magazines and radio. While we enjoy a large share of the market of the digital frames and digital TV screens on airplanes, we compete and will continue to compete with other media advertising platforms for which we do not have exclusivity, including billboards and light boxes. We may also face competition from new entrants into air travel advertising in the future.

Significant competition could reduce our operating margins and profitability and lead to a loss of market share. Some of our existing and potential competitors may have competitive advantages such as significantly greater brand recognition, a longer history in the out-of-home advertising industry and financial, marketing or other resources, and may be able to mimic and adopt our business model. In addition, several of our competitors have significantly larger advertising networks than we do, which gives them an ability to reach a larger number of overall potential consumers and which may make them less susceptible than we are to downturns in particular advertising sectors, such as air travel. Moreover, significant competition will provide advertisers with a wider range of media and advertising service alternatives, which could lead to lower prices and decreased revenues, gross margins and profits focus. We cannot assure you that we will be able to successfully compete against new or existing competitors, and failure to compete may reduce for existing market share and profits.

Our results of operations are subject to fluctuations in the demand for air travel. A decrease in the demand for air travel may make it difficult for us to sell our advertising time slots and locations.

Our results of operations are directly linked to the demand for air travel, which fluctuates greatly from period to period, and is subject to seasonality due to holiday travel and weather conditions as well as many other factors, including the following:

| · | Downturns in the economy. Business travel is one of the primary drivers of the air travel industry and it tends to increase in times of economic growth and decrease in times of economic slowdown. A decrease in air passengers in China could lead to lower advertiser spending on our air travel advertising network. |

| · | Plane crashes or other accidents. An aircraft crash or other accident, such as those in 2014 involving certain Asian-based airlines, could create a public perception that air travel is not safe or reliable, which could result in air travelers being reluctant to fly. Significant aircraft delays due to capacity constraints, weather conditions or mechanical problems could also reduce demand for air travel, especially for shorter domestic flights. |

If the demand for air travel decreases for any of these or other reasons, advertisers may be reluctant to advertise on our network and we may be unable to sell our advertising time slots or locations or charge premium prices.

| 10 |

If we fail to manage our growth effectively, we may not be able to take advantage of market opportunities, execute our expansion strategies or meet the demands of our advertisers.

We have experienced a period of rapid growth and expansion that has placed, and continues to place, significant strain on our management personnel, systems and resources. We must continue to expand our operations to meet the demands of advertisers for broader and more diverse network coverage. To accommodate our growth, we anticipate that we will need to implement a variety of new and upgraded operational and financial systems, procedures and controls, including the improvement of our accounting and other internal management systems, all of which require substantial management efforts.

We will also need to continue to expand, train, manage and motivate our workforce as well as manage our relationships with airports, airlines, gas stations and other locations where we have concession rights to displays and third-party non-advertising content providers. We must add sales and marketing offices and personnel to service relationships with new airports, gas stations and other locations that we aim to add as part of our network. As we add new digital frames, digital TV screens and other media platforms, we will incur greater maintenance costs to maintain our equipment.

All of these endeavors will require substantial managerial efforts and skill, and incur additional expenditures. We cannot assure you that we will be able to manage our growth effectively, and we may not be able to take advantage of market opportunities, execute our expansion strategies or meet the demands of our advertisers.

Past and future acquisitions may have an adverse effect on our ability to manage our business.

We have acquired and may continue to acquire businesses, technologies, services or products which are complementary to our core air travel advertising network business in the future. Past and future acquisitions may expose us to potential risks, including risks associated with:

| · | the integration of new operations, services and personnel; |

| · | unforeseen or hidden liabilities; |

| · | the diversion of resources from our existing business and technology; or |

| · | failure to achieve the intended objectives of our acquisitions. |

Any of these potential risks could have a material and adverse effect on our ability to manage our business, our revenues and net income.

We may need to raise additional debt or sell additional equity securities to make future acquisitions. The raising of additional debt funding by us, if required, would increase debt service obligations and may lead to additional operating and financing covenants, or liens on our assets, that would restrict our operations. The sale of additional equity securities could cause additional dilution to our shareholders.

Our acquisition strategy also depends on our ability to obtain necessary government approvals. See "– Risks Related to Doing Business in China – The M&A Rule sets forth complex procedures for acquisitions conducted by foreign investors which could make it more difficult to pursue growth through acquisitions."

Our quarterly and annual operating results are difficult to predict and have fluctuated and may continue to fluctuate significantly from period to period.

Our quarterly and annual operating results are difficult to predict and have fluctuated and may continue to fluctuate significantly from period to period based on the seasonality of air travel, consumer spending and corresponding advertising trends in China. Air travel and advertising spending in China generally tend to increase during major national holidays in October and tend to decrease during the first quarter of each year. Air travel and advertising spending in China is also affected by certain special events and related government measures. As a result, you may not be able to rely on period-to-period comparisons of our operating results as an indication of our future performance. Other factors that may cause our operating results to fluctuate include a deterioration of economic conditions in China and potential changes to the regulation of the advertising industry in China. If our revenues for a particular quarter are lower than we expect, we may be unable to reduce our operating costs and expenses for that quarter by a corresponding amount, and it would harm our operating results for that quarter relative to our operating results for other quarters.

| 11 |

Our business depends substantially on the continuing efforts of our senior executives and other key employees, and our business may be severely disrupted if we lose their services.

Our future success heavily depends upon the continued services of our senior executives and other key employees. We rely on their industry expertise, their experience in business operations and sales and marketing, and their working relationships with our advertisers, airports and airlines, and relevant government authorities.

If one or more of our senior executives and other key employees were unable or unwilling to continue in their present positions, we might not be able to replace them easily or at all. If any of our senior executives and other key employees joins a competitor or forms a competing company, we may lose advertisers, suppliers, key professionals and staff members. Each of our executive officers and other key employees has entered into an employment agreement with us which contains non-competition provisions. However, if any dispute arises between any of our executive officers and other key employees and us, we cannot assure you the extent to which any of these agreements could be enforced in China, where most of these executive officers and other key employees reside, in light of the uncertainties with China's legal system. See "—Risks Related to Doing Business in China—Uncertainties with respect to the PRC legal system could limit the legal protections available to us or result in substantial costs and the diversion of resources and management attention."

Failure to maintain an effective system of internal control over financial reporting and effective disclosure controls and procedures could have a material and adverse effect on the trading price of our ADSs.

We are subject to reporting obligations under the U.S. securities laws. The SEC, as required by Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, adopted rules requiring every public company to include a management report on such company's internal control over financial reporting in its annual report, which must also contain management's assessment of the effectiveness of the company's internal control over financial reporting. In addition, an independent registered public accounting firm must attest to the effectiveness of the company's internal control over financial reporting. SEC rules also require every public company to include a management report containing management's assessment of the effectiveness of such company's disclosure controls and procedures in its annual report.

Our management has concluded that our internal control over financial reporting and disclosure controls and procedures were effective as of December 31, 2014. Our independent registered public accounting firm has issued an audit report stating that we maintained, in all material respects, effective internal control over financial reporting as of December 31, 2014. However, if we fail to maintain effective internal control over financial reporting in the future, our management and our independent registered public accounting firm may not be able to conclude that we have effective internal control over financial reporting. This could negatively affect the reliability of our financial information and reduce investors' confidence in our reported financial information, which in turn could result in lawsuits being filed against us by our shareholders, otherwise harm our reputation or negatively impact the trading price of our ADSs. Furthermore, we have incurred and anticipate that we will continue to incur considerable costs and use significant management time and other resources in an effort to comply with Section 404 of the Sarbanes-Oxley Act and other requirements of the Sarbanes-Oxley Act.

We may need additional capital which, if obtained, could result in dilution or significant debt service obligations. We may not be able to obtain additional capital on commercially reasonable terms, which could adversely affect our liquidity and financial position.

We may require additional cash resources due to changed business conditions or other future developments. If our current resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain a credit facility. The sale of convertible debt securities or additional equity securities could result in additional dilution to our shareholders. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations and liquidity.

In addition, our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

| · | investors' perception of, and demand for, securities of alternative advertising media companies; |

| · | conditions of the market; |

| · | our future results of operations, financial condition and cash flows; and |

| · | PRC governmental regulation of foreign investment in advertising services companies in China. |

We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all. Any failure to raise additional funds on favorable terms could have a material adverse effect on our liquidity and financial condition.

| 12 |

Compliance with PRC advertising laws and regulations may be difficult and could be costly, and failure to comply could subject us to government sanctions.

As an air travel advertising service provider, we are obligated under PRC laws and regulations to monitor the advertising content shown on our network for compliance with applicable law. Violation of these laws or regulations may result in penalties, including fines, confiscation of advertising fees, orders to cease dissemination of the offending advertisements and orders to publish advertisements correcting the misleading information. In case of serious violations, the PRC authorities may revoke our license for advertising business operations. In general, the advertisements shown on our network have previously been broadcast over public television networks and have been subjected to internal review and verification by such networks, but we are still required to independently review and verify these advertisements for content compliance before displaying them. In addition, if a special government review is required for certain product advertisements before they are shown to the public, we are required to confirm that such review has been performed and approval obtained. For advertising content related to certain types of products and services, such as food products, alcohol, cosmetics, pharmaceuticals and medical procedures, we are required to confirm that the advertisers have obtained requisite government approvals, including review of operating qualifications, proof of quality inspection of the advertised products, government pre-approval of the contents of the advertisement and filing with local authorities.

We endeavor to comply with such requirements through means such as requesting relevant documents from the advertisers. However, we cannot assure you that each advertisement that an advertiser provides to us and which we include in our network programs is in full compliance with all relevant PRC advertising laws and regulations or that such supporting documentation and government approvals provided to us are complete. Although we employ qualified advertising inspectors who are trained to review advertising content for compliance with relevant PRC laws and regulations, the content standards in the PRC are less certain and less clear than those in more developed countries such as the United States and we cannot assure you that we will always be able to properly review all advertising content to comply with the PRC standards imposed on us with certainty.

We may be subject to, and may expend significant resources in defending against government actions and civil suits based on the content we provide through our advertising network.

Because of the nature and content of the information displayed on our network, civil claims may be filed against us for fraud, defamation, subversion, negligence, copyright or trademark infringement or other violations. Offensive and objectionable content and legal standards for defamation and fraud in China are less defined than in other more developed countries and we may not be able to properly screen out unlawful content. If consumers find the content displayed on our network to be offensive, airports, airlines or gas stations where we have our media may seek to hold us responsible for any consumer claims or may terminate their relationships with us.

In addition, if the security of our content management system is breached and unauthorized images, text or audio sounds are displayed on our network, viewers or the PRC government may find these images, text or audio sounds to be offensive, which may subject us to civil liability or government censure despite our efforts to ensure the security of our content management system. Any such event may also damage our reputation. If our advertising viewers do not believe our content is reliable or accurate, our business model may become less appealing to viewers in China and our advertisers may be less willing to place advertisements on our network.

We may be subject to intellectual property infringement claims, which may force us to incur substantial legal expenses and, if determined adversely against us, may materially and adversely affect our business.

Our commercial success depends to a large extent on our ability to operate without infringing the intellectual property rights of third parties. We cannot assure you that our displays or other aspects of our business do not or will not infringe patents, copyrights or other intellectual property rights held by third parties. We may become subject to legal proceedings and claims from time to time relating to the intellectual property of others in the ordinary course of our business. If we are found to have violated the intellectual property rights of others, we may be enjoined from using such intellectual property, incur licensing fees or be forced to develop alternatives. In addition, we may incur substantial expenses and diversion of management time in defending against these third-party infringement claims, regardless of their merit. Successful infringement or licensing claims against us may result in substantial monetary liabilities, which may materially and adversely affect our business.

We face risks related to natural disasters, health epidemics and other outbreaks, which could significantly disrupt our operations.

Our business could be materially and adversely affected by natural disasters or the outbreak of health epidemic. Any such occurrences could cause severe disruption to our daily operations, and may even require a temporary closure of our facilities. In August 2014, a strong earthquake hit part of Yunnan province in south, and resulted in significant casualties and property damage. While we did not suffer any loss or experience any significant increase in cost resulting from these earthquakes, if a similar disaster were to occur in the future affecting Beijing or another city where we have major operations in China, our operations could be materially and adversely affected due to loss of personnel and damages to property. In addition, any outbreak of avian flu, severe acute respiratory syndrome (SARS), influenza A (H1N1), H7N9, Ebola, or other adverse public health epidemic in China may have a material and adverse effect on our business operations. These occurrences could require the temporary closure of our offices or prevent our staff from traveling to our customers’ offices to provide services. Such closures could severely disrupt our business operations and adversely affect our results of operations. These occurrences could reduce air and train travelling in China and adversely affect the results of operations of our related business.

| 13 |

RISKS RELATED TO OUR CORPORATE STRUCTURE

If the PRC government finds that the agreements that establish the structure for operating our China business do not comply with PRC governmental restrictions on foreign investment in the advertising industry and in the operating of non-advertising content, our business could be materially and adversely affected.

Substantially all of our operations are conducted through contractual arrangements with our consolidated VIEs in China: AirMedia Group Co., Ltd, or AM Advertising, Beijing Shengshi Lianhe Advertising Co., Ltd., or Shengshi Lianhe, Beijing AirMedia Jiaming Advertising Co., Ltd. (formerly known as Beijing AirMedia UC Advertising Co., Ltd.), or Jiaming Advertising, and Beijing Yuehang Digital Media Advertising Co., Ltd., or AM Yuehang. Although the Foreign-invested Advertising Enterprise Management Regulations, or the Foreign-invested Advertising Regulations, which became effective on October 1, 2008, currently permit 100% foreign ownership of companies that provide advertising services, subject to approval by relevant PRC government authorities, these regulations also require any foreign entities that establish a wholly owned advertising company must have at least three years of direct operations in the advertising industry outside of China. In addition, the Foreign Investment Industrial Guidance Catalogue (revised in 2015), which became effective on April 10, 2015, stated that television program production and operation companies fall into the category of a prohibited foreign investment industry. We believe that these regulations apply to our business and are therefore carrying out the portions of our business that involve the production of non-advertising content through our VIEs. Our wholly owned Hong Kong subsidiary AM China, the 100% shareholder of AM Technology, Shenzhen AM and Xi'an AM, has been operating an advertising business in Hong Kong since 2008, and thus it is allowed to directly invest in advertising business in China. In December 2014, we transferred 100% equity interest in Shenzhen AM to AM China to provide advertising services in China directly. We are in the process of revising the scope of business of Shenzhen AM to include advertising. Once the business scope of Shenzhen AM is revised, we intend to gradually shift our advertising business to Shenzhen AM, and thus to gradually reduce our reliance on the current VIE structure. Our advertising business is currently primarily provided through our contractual arrangements with our four consolidated VIEs in China. These entities directly operate our advertising network, enter into concession rights contracts and sell advertising time slots and locations to our advertisers. We have contractual arrangements with these VIEs pursuant to which we, through AM Technology, provide technical support and consulting services to these entities. We also have agreements with our VIEs and each of their shareholders that provide us with the substantial ability to control these entities. In April 2015, however, we entered into an agreement with Shenzhen Liantronics, Co., Ltd., or Liantronics, an unrelated third party to transfer 5% interest of AM Advertising to Liantronics, and we cannot guarantee you that Liantronics, as a third party unrelated to us, would enter into similar VIE arrangements with us. For a description of these contractual arrangements, see “Item 4. Information on the Company—C. Organizational Structure” and “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions—Contractual Arrangements."

In the opinion of Commerce & Finance Law Offices, our PRC counsel, the VIE arrangements between AM Advertising and our consolidated VIEs are in compliance with PRC law and are valid, binding and legally enforceable. However, uncertainties in the PRC legal system could limit our ability to enforce these contractual arrangements and if the shareholders of the VIEs were to reduce their interest in us, their interests may diverge from ours and that may potentially increase the risk that they would seek to act contrary to the contractual terms, for example by influencing the VIEs not to pay the service fees when required to do so.

Our ability to control the VIEs also depends on the power of attorney AM Technology has to vote on all matters requiring shareholder approval in the VIEs. As noted above, we believe this power of attorney is legally enforceable but may not be as effective as direct equity ownership.

In addition, if the PRC government were to find that the VIE arrangements do not comply with PRC governmental restrictions on foreign investment in the advertising industry and in the operating of non-advertising content, or if the legal structure and contractual arrangements were found to be in violation of any other existing PRC laws and regulations, the PRC government could:

| · | revoke the business and operating licenses of the our PRC subsidiaries and affiliates; |

| · | discontinue or restrict the our PRC subsidiaries' and affiliates' operations; |