UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2015

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________________ to ___________________

Commission File Number: 001-34711

| CHINA JO-JO DRUGSTORES, INC. |

| (Exact name of issuer as specified in its charter) |

| Nevada | 98-0557852 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

|

1st Floor, Yuzheng Plaza, No. 76, Yuhuangshan Road Hangzhou, Zhejiang Province People’s Republic of China |

310002 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code +86 (571) 88077078

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common stock, $0.001 par value | NASDAQ Capital Market |

Securities registered pursuant to section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every, Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large Accelerated Filer o | Accelerated Filer o | |

| Non-accelerated filer o | Smaller reporting company ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of September 30, 2014, the aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $17 million, based on a closing price of $1.94 per share of common stock as reported on the NASDAQ Stock Market on such date.

As of June 11, 2015, the registrant had 15,650,504 shares of common stock outstanding.

TABLE OF CONTENTS

TO ANNUAL REPORT ON FORM 10-K

FOR YEAR ENDED MARCH 31, 2015

| 2 |

Forward Looking Statements

This report contains forward-looking statements. All forward-looking statements are inherently uncertain as they are based on current expectations and assumptions concerning future events or future performance of the registrant. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. Forward-looking statements usually contain the words “estimate,” “anticipate,” “believe,” “expect,” or similar expressions, and are subject to numerous known and unknown risks and uncertainties. In evaluating such statements, prospective investors should carefully review various risks and uncertainties identified in this report, including the matters set forth under the captions “Risk Factors” and in the registrant’s other SEC filings. These risks and uncertainties could cause the registrant’s actual results to differ materially from those indicated in the forward-looking statements. The registrant undertakes no obligation to update or publicly announce revisions to any forward-looking statements to reflect future events or developments.

Although forward-looking statements in this report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “ Risks Relating to Our Business ” below, as well as those discussed elsewhere in this report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We file reports with the Securities and Exchange Commission (the “SEC”). You can read and copy any materials we file with the SEC at the SEC’s Public Reference Room located at 100 F. Street, NE, Washington, D.C. 20549, on official business days during the hours of 10 a.m. to 3 p.m. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including the registrant.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

| 3 |

| ITEM 1. | BUSINESS. |

Overview

We are a retailer and distributor of pharmaceutical and other healthcare products typically found in a retail pharmacy in the People’s Republic of China (“PRC” or “China”). Prior to acquiring Zhejiang Jiuxin Medicine Co., Ltd. (“Jiuxin Medicine”) in August 2011 (see “Our Corporate History and Structure - HJ Group” below), we were primarily a retail pharmacy operator. We currently have fifty nine (59) store locations under the store brand “Jiuzhou Grand Pharmacy” in Hangzhou.

We currently operate in four business segments in China: (1) retail drugstores, (2) online pharmacy, (3) wholesale business selling products similar to those we carry in our pharmacies, and (4) farming and selling herbs used for traditional Chinese medicine (“TCM”).

Our stores provide customers with a wide variety of pharmaceutical products, including prescription and over-the-counter (“OTC”) drugs, nutritional supplements, TCM, personal and family care products, and medical devices, as well as convenience products, including consumable, seasonal, and promotional items. Additionally, we have licensed doctors of both western medicine and TCM on site for consultation, examination and treatment of common ailments at scheduled hours. Three (3) stores have adjacent medical clinics offering urgent cares (to provide treatment for minor ailments such as sprains, minor lacerations, and dizziness that can be treated on an outpatient basis), TCM (including acupuncture, therapeutic massage, and cupping) and minor outpatient surgical treatments (such as suturing). Our stores vary in size, but presently average approximately 210 square meters. We attempt to tailor each store’s product offerings, physician access, and operating hours to suit the community where the store is located.

We operate our pharmacies (including the medical clinics) through the following companies in China that we control through contractual arrangements:

| ● | Hangzhou Jiuzhou Grand Pharmacy Chain Co., Ltd. (“Jiuzhou Pharmacy”), which we control contractually, operates our “Jiuzhou Grand Pharmacy” stores; |

| ● | Hangzhou Jiuzhou Clinic of Integrated Traditional and Western Medicine (General Partnership) (“Jiuzhou Clinic”), which we control contractually, operates one (1) of our two (2) medical clinics; and |

| ● | Hangzhou Jiuzhou Medical & Public Health Service Co., Ltd. (“Jiuzhou Service”), which we control contractually, operates our other medical clinics. |

We also retail OTC drugs and nutritional supplements through a website (www.dada360.com) that we operate through Zhejiang Shouantang Pharmaceutical Technology Co., Ltd. (“Shouantang Technology”), a wholly-owned subsidiary, and its subsidiary, Zhejiang Quannuo Internet Technology Co., Ltd. (“Quannuo Technology”). For the fiscal year ended March 31, 2015, retail revenue, including pharmacies, medical clinics accounted for approximately63.5% of our total revenue, while online pharmacy revenue accounted for 19.4% of our total revenue.

Since August 2011, we have operated a wholesale business through Zhejiang Jiuxin Medicine Co., Ltd. (“Jiuxin Medicine”), distributing third-party pharmaceutical products (similar to those carried by our pharmacies) primarily to trading companies throughout China. Jiuxin Medicine is wholly owned by Jiuzhou Pharmacy. For the fiscal year March 31, 2015, wholesale revenue accounted for approximately 17.1% of our total revenue.

We also have an herb farming business cultivating and wholesaling herbs used for TCM. This business is conducted through Hangzhou Qianhong Agriculture Development Co., Ltd. (“Qianhong Agriculture”), a wholly-owned subsidiary. During the fiscal year ended March 31, 2015, we generated no revenue from our herb farming business.

| 4 |

Throughout this report, we will sometimes refer to Jiuzhou Pharmacy, Jiuzhou Clinic and Jiuzhou Service, as well as the subsidiaries of Jiuzhou Pharmacy, collectively as “HJ Group.”

Our Corporate History and Structure

We were incorporated in Nevada on December 19, 2006, under the name “Kerrisdale Mining Corporation,” with a principal business objective to acquire and develop mineral properties. Although we had acquired certain mining claims, we were not operational.

On July 14, 2008, we amended our Articles of Incorporation to change our authorized capital stock from 75,000,000 shares of common stock, par value $0.001 per share, to 500,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share. The preferred stock is “blank check,” and our Board of Directors has the right to set its designations, preferences, limitations, privileges, qualifications, dividend, conversion, voting, and other special or relative rights.

On September 17, 2009, we acquired control of Renovation Investment (Hong Kong) Co., Ltd., a limited liability company incorporated in Hong Kong on September 2, 2008 (“Renovation”), pursuant to a share exchange agreement.

On September 24, 2009, we amended our Articles of Incorporation to change our name from “Kerrisdale Mining Corporation” to “China Jo-Jo Drugstores, Inc.”

On April 9, 2010, we implemented a 1-for-2 reverse stock split of our issued and outstanding shares of common stock and a proportional reduction of our authorized shares of common stock, by filing a Certificate of Change pursuant to Nevada Revised Statutes 78.209 with the Nevada Secretary of State on April 6, 2010. All share information in this report takes into account this reverse stock split.

On April 28, 2010, we completed a registered public offering of 3,500,000 shares of our common stock at a price of $5.00 per share, resulting in gross proceeds to us, prior to deducting underwriting discounts, commissions and offering expenses, of approximately $17,500,000.

Renovation

Renovation was formed by the owners of HJ Group as a special purpose vehicle to raise capital overseas, in accordance with requirements of China’s State Administration of Foreign Exchange (“SAFE”). SAFE issued the Notice on Relevant Issues Concerning Foreign Exchange Administration for Financing and Round-Trip Investment Undertaken by Domestic Residents Through Overseas Special-Purpose Vehicles (“Circular No. 75”) on October 21, 2005. To further clarify the implementation of Circular 75, on May 31, 2007, SAFE issued a supplementary official notice known as Hi ZhongFa [2007] No. 106 (“Circular 106”). Circular 75 and Circular 106 require the owners of any Chinese company to obtain SAFE’s approval before establishing any offshore holding company structure for foreign financing as well as subsequent acquisition matters in China. Accordingly, the owners of HJ Group submitted their applications to SAFE on July 25, 2008. On August 16, 2008, SAFE approved the applications, permitting these Chinese nationals to establish Renovation as an offshore, special purpose vehicle which was permitted to have foreign ownership and participate in foreign capital raising activities. After SAFE’s approval, the owners of HJ Group became holders of one hundred percent (100%) of Renovation’s issued and outstanding capital stock on September 2, 2008. See “Relevant PRC Regulations - SAFE Registration” below.

| 5 |

Jiuxin Management

Zhejiang Jiuxin Investment Management Co., Ltd. (“Jiuxin Management”) was organized in the PRC on October 14, 2008. Since all of its issued and outstanding capital stock is held by Renovation, a Hong Kong company, Jiuxin Management is deemed a “wholly foreign owned enterprise” (“WFOE”) under applicable PRC laws.

On February 27, 2012, Jiuxin Management, Shouantang Technology and our three (3) key personnel, Mr. Lei Liu, Mr. Chong’an Jin, and Ms. Li Qi (the “Key Personnel”), organized Zhejiang Jiuying Grand Pharmacy Co., Ltd. (“Jiuying Pharmacy”), with forty nine percent (49%) of its equity interests held by Jiuxin Management and Shouantang Technology, and the remaining fifty one percent (51%) held by the Key Personnel. In May 2012, the Key Personnel gave control of their fifty one percent (51%) ownership to Jiuxin Management through contractual arrangements, thereby giving us one hundred percent (100%) control of Jiuying Pharmacy’s business operations. Jiuying Pharmacy ceased operations as of December 31, 2012, and was dissolved on January 7, 2013.

Jiutong Medical

Hangzhou Jiutong Medical Technology Co., Ltd. (“Jiutong Medical”) was organized in the PRC on December 20, 2011. Like Jiuxin Management, Jiutong Medical is also deemed a WFOE because it is wholly owned by Renovation. In November 2013, Jiutong Medical acquired the right to use of a piece of land, on which we plan to establish a herb processing plant in the future. As of March 31, 2015, we have not started constructing the plant.

Shouantang Technology

Shouantang Technology was organized in the PRC on July 16, 2010. Like Jiuxin Management and Jiutong Medical, it is also deemed a WFOE because it is wholly owned by Renovation.

In November 2010, Shouantang Technology acquired one hundred percent (100%) of Quannuo Technology and its wholly-owned subsidiary, Hangzhou Quannuo Grand Pharmacy Co., Ltd. (“Hangzhou Quannuo”), pursuant to an equity ownership transfer agreement. Quannuo Technology was organized in the PRC on July 7, 2009, and Hangzhou Quannuo on July 8, 2010. Hangzhou Quannuo currently has no operations and has terminated its SAIClicnesein April 2015.

On August 1, 2012, Shouantang Technology dissolved TongluLydia Agriculture Development Co., Ltd. (“TongluLydia”), a wholly-owned subsidiary organized on June 24, 2011. Prior to its dissolution, TongluLydia did not have any operations.

On October 11, 2014, the Company, through Shouantang Technology, formed Shouantang Bio-technology Co., Ltd. (“Shouantang Bio”) by contributing $0.16 million (RMB1 million) as its register capital. ShouantangBio is formed to sell nutritional supplements under its own brand name, Shouantang.

Qianhong Agriculture

Qianhong Agriculture was organized in the PRC on August 10, 2010and is now carrying out our herb farming business. As of March 31, 2015,we have not harvested or sold any herbs.

Shouantang Health

Hangzhou Shouantang Health Management Co. Ltd. (“Shouantang Health”) was organized in the PRC on December 18, 2013.In April, 2015, Shouantang Health has been closed.

Sanhao Pharmacy

On October 9, 2014, the Company, through Jiuzhou Pharmacy, acquired Sanhao Grand Pharmacy Chain Co., Ltd. (“Sanhao Pharmacy”), a local drugstore chain located in Hangzhou, for $1.56 million (RMB9.6 million).In January 2015, eight stores of Sanhao Pharmacy with the qualification of Social Health Insurance ("SHI"), have been relocated to major resident areas with significant store improvements. The eight stores are now operating under the brand name “Jiuzhou Pharmacy”. Two stores without SHI license have been closed as of March 31, 2015. One store without SHI license is applying for closing with the local government. Sanhao Pharmacy will be terminated after all of its stores are closed.

HJ Group

Jiuzhou Pharmacy is a PRC limited liability company established on September 9, 2003 by the Key Personnel: Mr. Lei Liu (55%), Mr. Chong’an Jin (23%) and Ms. Li Qi (22%). Hangzhou Kuaileren Grand Pharmacy Co., Ltd. (“Kuaileren”), originally a subsidiary of Jiuzhou Pharmacy, was dissolved on April 9, 2011. Prior to its dissolution, Kuaileren operated a “Kuaileren Grand Pharmacy” store, which is now a “Jiuzhou Grand Pharmacy” store. On July 1, 2014, Mr. Chong’an Jin transferred all of his equity interests he held in Jiuzhou Pharmacy to Mr. Lei Liu and Ms. Li Qi. As a result, Mr. Lei Liu has held 61% and Ms. Li Qi has held 39% equity interests of Jiuzhou Pharmacy since then.

Jiuzhou Pharmacy currently has one subsidiary. Jiuxin Medicine, which was organized in the PRC on December 31, 2003. In April 2011, Jiuzhou Pharmacy entered into an equity ownership transfer agreement with the owners of Jiuxin Medicine, and its business license was transferred to Jiuzhou Pharmacy, although no consideration was paid. On August 25, 2011, the acquisition of Jiuxin Medicine was completed for RMB 30 million.

| 6 |

Jiuzhou Clinic is a PRC general partnership established on October 10, 2003 by the Key Personnel: Mr. Liu (39%), Mr. Jin (31%) and Ms. Qi (30%). Jiuzhou Clinic is a medical practice currently operating adjacent to the “Jiuzhou Grand Pharmacy” store in Daguan, providing primary, urgent, minor surgical, and traditional medical care services. Additionally, Jiuzhou Clinic’s physicians consult with and examine patients at other “Jiuzhou Grand Pharmacy” stores.

Jiuzhou Service is a PRC limited liability company established on November 2, 2005 by the Key Personnel: Mr. Liu (39%), Mr. Jin (31%) and Ms. Qi (30%). Jiuzhou Service is licensed as a healthcare management company and currently manages the medical clinic operating adjacent to the “Jiuzhou Grand Pharmacy” store in Wenhua, providing services similar to those at the Daguan clinic. Shouantang Health is a subsidiary of Jiuzhou Service that was established in December 2013 and was closed in April 2015.

We control HJ Group through contractual arrangements. See “Contractual Arrangements with HJ Group and the Key Personnel” below.

Contractual Arrangements with HJ Group and the Key Personnel

Our relationships with HJ Group and the Key Personnel are governed by a series of contractual arrangements that they have entered into with Jiuxin Management.

PRC regulations on foreign investment currently permit foreign companies to establish or invest in WFOEs or joint ventures that engage in wholesale or retail sales of pharmaceuticals in China. For retail sales, however, these regulations restrict the number and size of pharmacies that a foreign investor may own. If a chain operates more than thirty (30) stores and sells branded pharmaceutical products from different suppliers, a foreign investor may own only up to forty nine percent (49%) of such chain. The contractual arrangements with Jiuzhou Pharmacy enable us to bypass such restrictions, since neither we nor our subsidiaries own equity interests in Jiuzhou Pharmacy, while at the same time we retain control of its drugstore chain by virtue of the contractual arrangements.

Similarly, PRC regulations place certain restrictions on foreign ownership of medical practice. Foreign investors can only acquire ownership interests through a Sino-foreign joint venture and not through a WFOE. Since we do not have actual equity interests in Jiuzhou Clinic or Jiuzhou Service, and instead control these entities through contractual arrangements, such regulations do not apply to us or our structure.

Under PRC laws, Jiuxin Management, Jiuzhou Pharmacy, Jiuzhou Medical and Jiuzhou Clinic are each independent business entities not exposed or subject to the liabilities incurred by any of the other three (3) entities. The contractual arrangements constitute valid and binding obligations of the parties to such agreements. Each of the contractual arrangements, and the rights and obligations of the parties thereto, are enforceable and valid in accordance with the laws of the PRC. These contractual arrangements, as amended and in effect, include the following:

Consulting Services Agreement. Pursuant to certain exclusive consulting services agreements (the “Consulting Services Agreement”), Jiuxin Management has the exclusive right to provide Jiuzhou Pharmacy, Jiuzhou Medical and Jiuzhou Clinic with general business operation services, including advice and strategic planning, as well as consulting services related to their current and future operations (the “Services”). Additionally, Jiuxin Management owns the intellectual property rights developed or discovered through research and development, in the course of providing the Services, or derived from the provision of the Services. Jiuzhou Pharmacy, Jiuzhou Medical and Jiuzhou Clinic must each pay a quarterly consulting services fee in RMB to Jiuxin Management that is equal to its profits for such quarter. This agreement is in effect until and unless terminated by written notice of a party to the agreement in the event that: (a) a party becomes bankrupt, insolvent, is the subject of proceedings or arrangements for liquidation or dissolution, ceases to carry on business, or becomes unable to pay its debts as they become due; (b) Jiuxin Management terminates its operations; or (c) circumstances arise which would materially and adversely affect the performance or the objectives of the agreement. Jiuxin Management may also terminate the agreement with any of Jiuzhou Pharmacy, Jiuzhou Medical or Jiuzhou Clinic if one of them breaches the terms of the agreement, or without cause.

Operating Agreement. Pursuant to the operating agreement, Jiuxin Management agrees to guarantee the contractual performance by Jiuzhou Pharmacy, Jiuzhou Medical and Jiuzhou Clinic of their agreements with any third party. In return, the Key Personnel must appoint designees of Jiuxin Management to the boards of directors and senior management of Jiuzhou Pharmacy, Jiuzhou Medical and Jiuzhou Clinic. In addition, each of Jiuzhou Pharmacy, Jiuzhou Medical and Jiuzhou Clinic agrees to pledge its accounts receivable and all of its assets to Jiuxin Management. Moreover, without the prior consent of Jiuxin Management, Jiuzhou Pharmacy, Jiuzhou Medical and Jiuzhou Clinic cannot engage in any transactions that could materially affect their respective assets, liabilities, rights or operations, including, without limitation, incurrence or assumption of any indebtedness, sale or purchase of any assets or rights, incurrence of any encumbrance on any of their assets or intellectual property rights in favor of a third party, or transfer of any agreements relating to their business operations to any third party. They must also abide by corporate policies set by Jiuxin Management with respect to their daily operations, financial management and employment issues. The term of this agreement is from August 1, 2009 until the maximum period of time permitted by law. Jiuzhou Pharmacy, Jiuzhou Medical and Jiuzhou Clinic cannot terminate this agreement.

| 7 |

Equity Pledge Agreement. Pursuant to certain equity pledge agreements (the “Equity Pledge Agreement”), the Key Personnel have pledged all of their equity interests in Jiuzhou Pharmacy, Jiuzhou Medical and Jiuzhou Clinic to Jiuxin Management in order to guarantee these companies’ performance of their respective obligations under the Consulting Services Agreement. If these companies or the Key Personnel breach their respective contractual obligations, Jiuxin Management, as pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. The Key Personnel have also agreed that upon occurrence of any event of default, Jiuxin Management shall be granted an exclusive, irrevocable power of attorney to take actions in the place and stead of the Key Personnel to carry out the security provisions of this agreement, and to take any action and execute any instrument that Jiuxin Management may deem necessary or advisable to accomplish the purposes of this agreement. The Key Personnel agree not to dispose of the pledged equity interests or take any actions that would prejudice Jiuxin Management’s interests. This agreement will expire two (2) years after the obligations of Jiuzhou Pharmacy, Jiuzhou Medical and Jiuzhou Clinic under the Consulting Services Agreement have been fulfilled.

Option Agreement. Pursuant to the option agreement, the Key Personnel irrevocably grant Jiuxin Management or its designee an exclusive option to purchase, to the extent permitted under PRC law, all or part of their equity interests in Jiuzhou Pharmacy, Jiuzhou Medical and Jiuzhou Clinic for the cost of the initial contributions to the registered capital or the minimum amount of consideration permitted by applicable PRC law. Jiuxin Management or its designee has sole discretion to decide when to exercise the option, whether in part or in full. The term of this agreement is from August 1, 2009 until the maximum period of time permitted by law.

Proxy Agreement. Pursuant to the proxy agreement, the Key Personnel irrevocably grant a designee of Jiuxin Management the right to exercise the voting and other ownership rights of the Key Personnel in Jiuzhou Pharmacy, Jiuzhou Medical and Jiuzhou Clinic, including the rights to (i) attend any meeting of the Key Personnel (or participate by written consent in lieu of such meeting) in accordance with applicable laws and each company’s incorporating documents, (ii) sell or transfer all or any of the equity interests of the Key Personnel in these companies, and (iii) appoint and vote for the companies’ directors. The proxy agreement may be terminated by mutual consent of the parties or upon thirty (30) days’ written notice from Jiuxin Management.

Other than as pursuant to the foregoing contractual arrangements, Jiuzhou Pharmacy, Jiuzhou Medical and Jiuzhou Clinic cannot transfer any funds generated from their respective operations. The contractual arrangements were originally entered into on August 1, 2009, and amended on October 27, 2009.

| 8 |

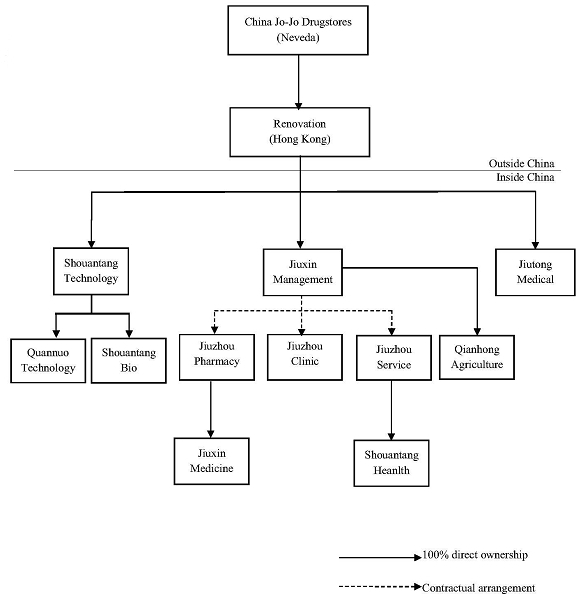

Our Current Corporate Structure

The following diagram illustrates our current corporate structure as of March 31, 2015:

| 9 |

The table below summarizes the status of the registered capital of our PRC subsidiaries and controlled companies as of the date of this report:

|

Entity Name |

Entity Type |

Registered Capital |

Registered Capital Paid |

Due Date for Unpaid Registered Capital | |||||

| Jiutong Medical | Subsidiary | USD 2,600,000 | USD 2,600,000 | N/A | |||||

| Jiuzhou Clinic | VIE | N/A | N/A | N/A | |||||

| Jiuzhou Pharmacy | VIE | RMB 5,000,000 | RMB 5,000,000 | N/A | |||||

| Jiuzhou Service | VIE | RMB 500,000 | RMB 500,000 | N/A | |||||

| Jiuxin Management | Subsidiary | USD 4,500,000 | USD 4,500,000 | N/A | |||||

| Jiuxin Medicine | VIE | RMB 10,000,000 | RMB 10,000,000 | N/A | |||||

| Qianhong Agriculture | Subsidiary | RMB 10,000,000 | RMB 10,000,000 | N/A | |||||

| Quannuo Technology | Subsidiary | RMB 10,000,000 | RMB 10,000,000 | N/A | |||||

| Shouantang Technology | Subsidiary | USD 11,000,000 | USD 11,000,000 | N/A | |||||

| ShouantangBio | Subsidiary | RMB 1,000,000 | RMB 1,000,000 | N/A |

Our Business

Pharmacies

We currently have fifty-nine (59) pharmacies throughout Hangzhou, the provincial capital of Zhejiang. Pharmacy sales accounted for approximately 76.6% of our retail revenue, and 63.5% of our total revenue, for the fiscal year ended March 31, 2015. We offer primarily third-party products at our pharmacies, including:

| ● | Approximately 1,270 prescription drugs (270 of which require a physician’s prescription and the rest requires customer personal information registration only), sales of which accounted for approximately 36.7% of our retail revenue for the fiscal year ended March 31, 2015; |

| ● | Approximately 1,400 OTC drugs, sales of which accounted for approximately 41.2% of our retail revenue for the fiscal year ended March 31, 2015; |

| ● | Approximately 450 nutritional supplements, including a variety of healthcare supplements, vitamin, mineral and dietary products, sales of which accounted for approximately 10.3% of our retail revenue for the fiscal year ended March 31, 2015; |

| ● | TCM, including drinkable herbal remedies and pre-packaged herbal mixtures for making soup, sales of which accounted for approximately 6.8% of our retail revenue for the fiscal year ended March 31, 2015; |

| 10 |

| ● | Sundry products (i.e., personal care products such as skin care, hair care and beauty products, convenience products such as soft drinks, packaged snacks, and other consumable, cleaning agents, stationeries, and seasonal and promotional items tailored to local consumer demand for convenience and quality), sales of which accounted for approximately 2.1% of our retail revenue for the fiscal year ended March 31, 2015; and |

| ● | Medical devices (i.e., family planning and birth control products, early pregnancy test products, portable electronic diagnostic apparatus, rehabilitation equipment, and surgical tools such as hemostats, needle forceps and surgical scissors), sales of which accounted for approximately 2.9% of our retail revenue for the fiscal year ended March 31, 2015. |

We favor retail locations in well-established residential communities with relatively concentrated consumer purchasing power, and evaluate potential store sites to assess consumer traffic, visibility and convenience. Depending on its size, each drugstore has between two (2) to twelve (12) pharmacists on staff, all of whom are properly licensed. We accept prescriptions only from licensed health care providers, and verify the validity, accuracy, and completeness of all prescriptions. We also ask all prescription customers to disclose their drug allergies, current medical conditions, and current medications. Each pharmacy also maintains a TCM counter staffed by licensed herbalists.

After opening, a location without SHI coverage may take up to one year to achieve our projected revenue goals for that particular location. Various factors influence individual store revenue including, but not limited to: location, nearby competition, local population demographics, square footage, and government insurance coverage.

All of our fifty-nine (59) drugstores are located in Hangzhou.

To enhance customer experience, we have licensed physicians available at several of “Jiuzhou Grand Pharmacy” locations for consultation, examination and treatment of common ailments at scheduled hours. In addition, our Daguan,Wenhua and Xiasha stores have adjoining medical clinics that provide urgent care (such as sprains, minor lacerations, and dizziness), TCM treatments (including acupuncture, therapeutic massage, moxibustion, and cupping), and minor outpatient surgical treatments (such as suturing).

To ensure quality and personal attention for patients, we employ only licensed doctors and certified nurses and technicians, and patient treatments at our three (3) clinics follow nationally established clinical practice guidelines from China’s Ministry of Health. We currently have thirty seven (37) physicians and twenty two (22) clinic staff. In-store consultations and examinations by our physicians are provided free-of-charge to ensure that customers are being prescribed and taking the appropriate medicines for their ailments, and to afford customers convenience.

We view our medical services as more consumer-driven than other health care specialties, because consumers requiring the types of medical services that we provide often seek treatment on their own accord. We have developed our medical services to respond to the public need for convenient access to medical consultations and/or care and the significant savings that we can provide as compared to a more traditional medical setting such as a hospital. Many of our patients often need immediate access to medical services, do not have a regular physician, or may lack suitable alternatives. Patient flow is derived from the physical presence of our drugstores, not from pre-existing doctor-patient relationships or referrals from other healthcare providers.

We generate limited revenue directly from our clinics.

| 11 |

Online Sales

Since May 2010, we have been retailing OTC drugs and nutritional supplements on the Internet at www.dada360.com. Our subsidiary Quannuo Technology operates and maintains the website pursuant to the Internet Pharmaceutical Transaction Service Qualification Certificate issued by the State Food and Drug Administration (the “SFDA”) of Zhejiang Province, which allows us to engage in online retail pharmaceutical sales throughout China. We have established payment methods with banks and online intermediaries such as Alipay, and are cooperating with business-to-consumer online vendors such as Taobao. By using Taobao’s platform, we can be exposed to a wider range of customers. Additionally, we sell products via our own website www.dada360.com.

Online sales accounted for approximately 23.4% of our retail revenue, and 19.4% of our total revenue, for the fiscal year ended March 31, 2015.

Wholesale

Since acquiring Jiuxin Medicine in August 2011, we have been distributing similar third-party products offered at our pharmacies primarily to drug distributors throughout China, including:

| ● | Approximately 599 prescription drugs, the sales of which accounted for approximately 58.9% of our wholesale revenue for the fiscal year ended March 31, 2015; |

| ● | Approximately 655 OTC drugs, the sales of which accounted for approximately 38.5% of our wholesale revenue for the fiscal year ended March 31, 2015; |

| ● | Approximately 42 nutritional supplements, the sales of which accounted for approximately 0.7% of our wholesale revenue for the fiscal year ended March 31, 2015; |

| ● | TCM products, the sales of which accounted for approximately 1.2% of our wholesale revenue for the fiscal year ended March 31, 2015; |

| ● | Sundry products, the sales of which accounted for approximately 0.6% of our wholesale revenue for the fiscal year ended March 31, 2015; and |

| ● | Medical devices, the sales of which accounted for approximately 0.1% of our wholesale revenue for the fiscal year ended March 31, 2015. |

Our initial wholesale strategy was to scale the size of Jiuxin Medicine’s business as quickly as possible through very competitive prices so that we could qualify to sell directly to hospital-affiliated pharmacies, which we estimate to represent over eighty percent (80%) sales of the pharmacies in China. However, that strategy has largely proven unprofitable, so we refocused our strategy on profitability starting in the third quarter of fiscal 2014. As local hospitals had stronger ties with their existing suppliers, during the year ended March 31, 2015, we had not been able to make significant progress. Wholesale revenue accounted for approximately 17.2% of our total revenue for the fiscal year ended March 31, 2015.

Herb Farming

From 2010 to the third quarter of fiscal 2013, we have been cultivating and harvested ten (10) types of herbs, such as fructusrubi (used in TCM to promote blood circulation), white atractylodes rhizome (used in TCM to treat physical and mental fatigue), atractylodesmacrocephala (used in TCM to control sweating), ginkgo seeds (used in TCM to treat asthma), and maidenhair trees used for TCM on approximately forty eight (48) acres of leased land in Lin’an approximately thirty (30) miles from Hangzhou.

We planted Ginkgo and maidenhair trees during the year ended March 31, 2013; A Ginkgo tree may have a growth period of up to twenty years before it is mature enough to harvest. Usually, the longer it grows, the more valuable it becomes. We plan to continue cultivating the trees in order to maximize their market value in the future. During the year ended March 31, 2015, we did not plant any other herbs that were ready to be harvested as of March 31, 2015. We anticipate that we will continue growing trees and start cultivating other herbs in the future.

| 12 |

Actual planting, cultivating and harvesting are done by local farmers organized and managed by the local village government. The farmers are compensated for their labor on an hourly basis. We also employ agricultural specialists under Qianhong Agriculture to monitor the farming activities. Harvested herbs are generally sold to a local vendor.

Herb farming revenue accounted for no revenue for the fiscal year ended March 31, 2015.

Our Customers

Retail Customers

For the fiscal year ended March 31, 2015, our pharmacies collectively served an average of approximately 12,000 customers per day. We periodically conduct qualitative customer surveys to help us build a stronger understanding of our market position and our customers’ purchasing habits.

Pharmacy customers pay by cash, debit or credit card, or medical insurance cards under Hangzhou and Zhejiang’s medical insurance programs. During the fiscal year ended March 31, 2015, approximately 25.7% of our pharmacy revenue came from cash sales, 57.7% from Hangzhou’s medical insurance cards (where most of our pharmacies are located), and 16.6% from debit and credit cards, Zhejiang’s medical insurance cards and other charge cards.

We maintain strict cash control procedures at our pharmacies. Our integrated information management system records the details of each sale, which we control from our headquarters. Depending on each location’s sales activities, cash may be deposited daily or several times per week in designated bank accounts.

For sales made to eligible participants in the national medical insurance program, we generally obtain payments from the relevant government social security bureaus on a monthly basis. See “Relevant PRC Regulations - Reimbursement under the National Medical Insurance Program.” According to relevant regulations, a drugstore must operate for at least one (1) year before it can apply to be licensed to accept Hangzhou’s medical insurance cards. As of the date of this report, fifty-six (56) of our fifty-nine (59) “Jiuzhou Grand Pharmacy” stores are licensed to accept medical insurance cards while two (3) will apply for approval in the near future. Those of our stores that accept medical insurance cards are designated as such by clear signage on their storefront windows.

Online Sales Customers

Our online customers mainly consist of consumers under thirty five (35) years of age. While our website is accessible throughout China, approximately forty percent (40%) of our online sales during the fiscal year ended March 31, 2015, were from Zhejiang and neighboring Jiangsu and Shanghai.

| 13 |

Wholesale Customers

Our wholesale customers are primarily third-party trading companies that purchase from us to resell to pharmacies throughout China. We also supply some hospitals and pharmacies, although they collectively make up less than 10.0% of our wholesale customers currently. HuaDong Pharmaceutical Co., Ltd. accounted for approximately 22.4% of our wholesale revenue, and 8.7% of our total revenue, for the fiscal year ended March 31, 2015. This customer is neither related to nor affiliated with us.

Herb Farming Customers

Our farming customers primarily include local herb vendors. For the fiscal year ended March, 31, 2015, we have not harvested or sold any herbs.

Marketing and Promotion

Our marketing and promotion efforts are focused on our retail segment, particularly our pharmacies, and our strategy is to build brand recognition, increase customer flow, build strong customer loyalty, maximize repetitive customer visits, and develop incremental revenue opportunities.

Our marketing department designs chain-wide marketing efforts while each store designs local promotions based on local demographics and market conditions. We also launch single store promotional campaigns and community activities in connection with the opening of new stores. Our store managers and staff are also encouraged to propose their own advertising and promotional plans, including holiday promotions, posters and billboards. In addition, we offer special discounts and gift promotions for selected merchandise periodically in conjunction with our suppliers’ marketing programs. We also provide ancillary services such as providing free blood pressure readings in our stores.

Many of our promotional programs are designed to encourage manufacturers to invest resources to market their brands within our stores. We charge manufacturers promotional fees in exchange for the right to promote and display their products in our stores during promotional periods. We also allow manufacturers and distributors to station salespeople in our stores to promote their products, for which we receive a fee. Since manufacturers provide purchasing incentives and information to help customers to make informed purchase decisions, we believe that manufacturer-led promotions improve our customers’ shopping experience. We work to maintain strong inventory positions for merchandise featured in our promotions, as we believe this increases the effectiveness of our spending on promotional activities.

We run advertisements periodically in selected newspapers to promote our brands and the products carried in our stores. Under our agreements with certain newspapers, we run one-page weekly or monthly advertisements, and the newspapers publish healthcare-related feature articles relating to our advertised products on or around the dates of our advertisements. We also promote our brands and products using billboards and radio and television commercials. Depending on our agreement with a particular manufacturer, advertising expenses are borne either by us, the manufacturer of the products being advertised, or are shared as a joint expense. Our advertisements are designed to promote our brands, our corporate image and the prices of products available for sale in our stores.

As part of our marketing campaign, we offer rewards cards to customers, which provide certain exclusive discounts. After a customer signs up for the rewards card, we communicate via the customer’s preferred method: e-mail, traditional mail or text messages. For the fiscal year ended March 31, 2015, approximately 72.0% of our customers used their rewards card to make purchases. We intend to further extend this program to enhance the customer experience and for customer retention.

Our clinic staff also regularly offers free seminars and outreach programs covering various health issues that are topical to the communities where our stores are located. Such events are designed not only to raise public health awareness, but to reach potential customers for our drugstores.

To promote our online business, we are cooperating with Taobao, the largest online vendor in China, to help raise awareness among potential customers. Taobao lists our products on their platform, which then directs consumers back to our website to make their purchases.

Logistics

We use Jiuxin Medicine’s resources to support our logistics needs in Hangzhou. Such resources include its 8,000 square meters facility located approximately seven (7) miles from our headquarters, which serves as our central distribution center. Jiuxin Medicine’s staff and vehicles make regular deliveries to our pharmacies and wholesale customers.

We employ third-party logistics companies for deliveries to our pharmacies and wholesale customers outside Hangzhou. We believe that reliable logistics providers are readily available and can be replaced without any material interruptions to our business.

| 14 |

Suppliers

We currently source retail products from approximately 400 suppliers, including trading companies and direct manufacturers. We source wholesale products from approximately 100 suppliers, including many of those that provide our retail products. For the fiscal year ended March 31, 2015, two (2) suppliers, HuaDong Pharmaceutical Co., Ltd.and Zhejiang Yingte Pharmaceutical Co. Ltd. accounted for more than ten percent (10.0%) of our total purchases and total purchase deposits. This supplier is neither related to nor affiliated with us.

We believe that competitive sources are readily available for substantially all of the products we require for our retail and wholesale businesses. As such, we believe that we can change suppliers without any material interruption to our business. To date, we have not experienced any significant difficulty in sourcing our requirements.

Quality Control

We place strong emphasis on quality control, which starts with procurement. In addition to their market acceptance and costs, we select products based on Good Manufacturing Practice and Good Supply Practice (“GSP”) compliance status of their suppliers. We also assess product quality based on the facilities and capabilities of its manufacturer, including technology, packaging and logistics. We conduct random quality inspections of each batch of products we procure, and replace any supplier who fails to pass such inspections.

We also enforce strict quality control measures at our distribution center. All products are screened upon their arrival, and those with evidence of defects or damages are immediately rejected. Products that pass the screening process are recorded and stored strictly according to each manufacturer’s temperature and other requirements. Products (for both our pharmacies and wholesale customers) are verified against the appropriate delivery orders prior to leaving the facility. We use vehicles with cold-temperature storage to make deliveries as necessary.

All of our pharmacy employees participate in a mandatory thirty six (36) hour training program regarding quality control annually, and we regularly dispatch quality inspectors to our stores to monitor the service quality of our staff.

Competition

The drugstore industry in China is intensely competitive, rapidly evolving and highly fragmented. We compete on the basis of store location, merchandise selection, prices and brand recognition. Many of our competitors include large, national drugstore chains that may have more financial resources, stronger brand strength, and management expertise than us, including China Nepstar Chain Drugstore Ltd., LBX Pharmacy, and TianTianHao Grand Pharmacy. Other competitors include local and independent drugstores and government-operated pharmacies, as well as discount stores, convenience stores, and supermarkets with respect to sundry and other non-medicinal products that we carry.

The wholesale pharmaceutical distribution industry in China is likewise competitive and highly fragmented. We compete with regional distributors, such as Zhengchen Pharmaceutical Co., Ltd. and Hangzhou Xiaoran Pharmaceutical Co., Ltd., as well as national operators such as Fengwoda Pharmaceutical Co., Ltd. and Jiuzhoutong Pharmaceutical Co., Ltd. These competitors have substantially greater logistics capacities and more financial resources, as well as more industry-relevant experience, than us.

| 15 |

The online pharmacy is an emerging business in China. We are competing with other online vendors that may be supported by major drugstore chains or initiated by smaller local drugstore chains. In order to compete effectively, we are cooperating with Taobao, the largest online vendor in China. We also put in significant efforts selecting products we believe are most suitable for online sales, such as those we have the exclusive right to sell.We have spent considerable efforts identifying popular products that can drive sales, while maintaining our attention on cost.In March 2015, we have signed an agreement to set up a joint venture, with a leading Pharmacy Benefit Management ("PBM") provider in China, which owns and operates Yikatong (the "E-Pharmacy-Card"), a popular pharmacy and health insurance benefit card with over 180,000 current users, who are customers insured with these large insurance companies. The joint venture agreement requires the PBM provider to direct the majority of its online E-Pharmacy-Card transactions to our official online pharmacy site. We expect the close cooperation with commercial insurance companies and active strategy on e-commerce platforms will drive up our online sales.

China’s herb market is highly specialized. As we have very limited experience in such market, we generally sell the majority of our harvested herbs to a local vendor.

Intellectual Property

We currently have the following trademarks registered with the Trademark Office of the SAIC:

| ● | “JiuzhouTongxin,” a Classes 5 and 35 trademark (for pharmaceuticals and advertisement) issued on February 14, 2011 and registered under Jiuzhou Pharmacy, that we plan to use to brand certain products that we may sell in our stores; |

| ● | “Jiuzhou,” a Class 44 trademark (for medical services) issued in June 2012 and registered under Jiuzhou Pharmacy, that we plan to use to brand our medical services; |

| ● | “Shouantang,” a Classes 5, 10, 30, 35 and 44 trademark (for pharmaceuticals, construction, food, advertisement and medical services) issued on October 2011 and registered under Jiuzhou Pharmacy, that we are using to brand certain products that we sell in our stores; and |

| ● | “Jinyuliangyan,” a Classes 29 trademark (for food and oil) issued in June 2011 and registered under Jiuzhou Pharmacy, that we are using to brand certain products that we sell in our stores; and |

We own and operate the following websites: www.dada360.com (for online sales), www.jiuzhou-drugstore.com (our corporate website used in China), and www.chinajojodrugstores.com (our English-language corporate website). We also own two (2) inactive domain names. We do not own any patents, nor do we have any pending patent applications, and we are not a beneficiary of any licenses, franchises, concessions or royalty agreements.

All of our employees are required to enter into written employment agreements with us, pursuant to which they are subject to confidentiality obligations.

| 16 |

Employees

As of March 31, 2015, we had 744 employees combined in our retail and wholesale operations, including 711 full-time and 33 part-time employees. The number of employees for each area of operations, and such employees as a percentage of our total workforce, are as follows:

| As of March 31, 2015 | ||||||||

| Employees | Percentage | |||||||

| Non-pharmacist store staff | 281 | 37.8 | % | |||||

| Pharmacists | 185 | 24.9 | % | |||||

| Management- non-pharmacists | 81 | 10.9 | % | |||||

| Physicians | 41 | 5.5 | % | |||||

| Non-physician clinic staff | 24 | 3.2 | % | |||||

| Wholesale - non-warehouse | 37 | 5.0 | % | |||||

| Wholesale - warehouse | 14 | 1.9 | % | |||||

| Online pharmacy - technicians | 48 | 6.5 | % | |||||

| Online pharmacy - non-technicians | 33 | 4.4 | % | |||||

| Total | 744 | 100.00 | % | |||||

We place strong emphasis on the quality of our employees at all levels, including in-store pharmacists and store staff who interact with our customers directly. We provide extensive training for newly recruited employees in the first three (3) months of their employment. The training is designed to encompass a number of areas, such as knowledge about our products and how best to interact with our customers. In addition, we regularly carry out training programs on medicinal information, nutritional information, and selling skills for our store staff and in-store pharmacists. We believe these programs have played an important role in strengthening the capabilities of our employees.

Various drug manufacturers also pay us to have their representatives in our drugstores, and accordingly, we train them in our store policies and procedures.

Relevant PRC Regulations

SAFE Registration

In October 2005, SAFE issued Circular 75. Circular 75 regulates foreign exchange matters in relation to the use of a special purpose vehicle by PRC residents to seek offshore equity financing and conduct “round trip investment” in China. The Key Personnel, who are PRC residents, are in compliance with Circular 75 and its implementing circulars.

Dividend Distribution

Under current applicable laws and regulations, each of our consolidated PRC entities, including WFOEs and domestic companies, may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, each of our consolidated PRC entities is required to set aside at least ten percent (10%) of its after-tax profit based on PRC accounting standards each year to its statutory surplus reserve fund until the accumulative amount of such reserve reaches fifty percent (50%) of its registered capital. These reserves are not distributable as cash dividends. As of March 31, 2015, the accumulated balance of our statutory reserve funds reserves amounted to $1.309 million, and the accumulated profits of our consolidated PRC entities that were available for dividend distribution amounted to $1.3 million.

| 17 |

Taxation

The current PRC Enterprise Income Tax Law (the “EIT Law”), and the implementation regulations for the EIT Law issued by China’s State Council, became effective as of January 1, 2008. Under the EIT Law, enterprises are classified as either resident or non-resident enterprises. An enterprise established outside of China with its “de facto management bodies” located within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the EIT Law defines a “de facto management body” as a managing body that in practice exercises “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise; however, it remains unclear whether the PRC tax authorities would deem our managing body as being located within China. Due to the relatively short history of the EIT Law and lack of applicable legal precedents, the PRC tax authorities determine the PRC tax resident treatment of entities organized under the laws of foreign jurisdictions on a case-by-case basis.

If the PRC tax authorities determine that we are a resident enterprise for PRC enterprise income tax purposes, a number of PRC tax consequences could follow. First, we may be subject to enterprise income tax at a rate of twenty five percent (25%) on our respective worldwide taxable income, as well as PRC enterprise income tax reporting obligations. Second, although the EIT Law provides that “dividends, bonuses and other equity investment proceeds between qualified resident enterprises” is exempted income, and the implementing rules of the EIT Law refer to “dividends, bonuses and other equity investment proceeds between qualified resident enterprises” as the investment proceeds obtained by a resident enterprise from its direct investment in another resident enterprise, it is still unclear whether the dividends we receive from Jiuxin Management would be classified as “dividends between qualified resident enterprises” and therefore qualify for tax exemption.

If we are treated as a non-resident enterprise under the EIT Law, then any dividends that we may receive from Jiuxin Management (assuming such dividends were considered sourced within the PRC) (i) may be subject to a five percent (5%) PRC withholding tax, provided that we own more than twenty five percent (25%) of the registered capital of Jiuxin Management incessantly within twelve (12) months immediately prior to obtaining such dividends from Jiuxin Management, and if the Arrangement between the Mainland of China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income (the “Arrangement”) is applicable, or (ii) if the Arrangement does not apply (i.e., because the PRC tax authorities may deem us to be a conduit not entitled to treaty benefits), may be subject to a ten percent (10%) PRC withholding tax. Similarly, if we are treated as a non-resident enterprise, and Renovation is treated as a resident enterprise, then any dividends that we receive from Renovation (assuming such dividends were considered sourced within the PRC) may be subject to a ten percent (10%) PRC withholding tax. Any such taxes on dividends could materially reduce the amount of dividends, if any, that we could pay to our shareholders.

Finally, the new “resident enterprise” classification could result in a situation in which a ten percent (10%) PRC tax is imposed on dividends we pay to our investors that are non-resident enterprises so long as such non-resident enterprise investors do not have an establishment or place of business in China or, despite the existence of such establishment of place of business in China, the relevant income is not effectively connected with such establishment or place of business in China, to the extent that such dividends have their sources within the PRC. Similarly, any gain realized on the transfer of our shares by such investors is also subject to a ten percent (10%) PRC income tax if such gain is regarded as income derived from sources within China. In such event, we may be required to withhold a ten percent (10%) PRC tax on any dividends paid to our investors that are non-resident enterprises. Our investors that are non-resident enterprises also may be responsible for paying PRC tax at a rate of ten percent (10%) on any gain realized from the sale or transfer of our common shares in certain circumstances. We would not, however, have an obligation to withhold PRC tax with respect to such gain.

Moreover, the State Administration of Taxation issued the Notice on Strengthening the Administration of Enterprise Income Tax on Share Transfer Income of Non-Resident Enterprises No. 698 (“Circular 698”) on December 10, 2009, which reinforces taxation on transfer of non-listed shares by non-resident enterprises through overseas holding vehicles. Circular 698 applies retroactively and was deemed to be effective as of January 2008. Pursuant to Circular 698, where (i) a foreign investor who indirectly holds equity interest in a PRC resident enterprise through an offshore holding company indirectly transfers equity interests in a PRC resident enterprise by selling the shares of the offshore holding company, and (ii) the offshore holding company is located in a jurisdiction where the effective tax rate is lower than twelve and a half percent (12.5%) or where the offshore income of its residents is not taxable, the foreign investor is required to provide the tax authority in charge of that PRC resident enterprise with certain relevant information within thirty (30) days of the transfer. The tax authorities in charge will evaluate the offshore transaction for tax purposes. In the event that the tax authorities determine that such transfer is abusing forms of business organization and there is no reasonable commercial purpose other than avoidance of PRC enterprise income tax, the tax authorities will have the power to conduct a substance-over-form re-assessment of the nature of the equity transfer. A reasonable commercial purpose may be established when the overall offshore structure is set up to comply with the requirements of supervising authorities of international capital markets. If the State Administration of Taxation’s challenge of a transfer is successful, they will deny the existence of the offshore holding company that is used for tax planning purposes. Since Circular 698 has a brief history, there is uncertainty as to its application.

| 18 |

General PRC Government Approval

As a wholesale distributor and retailer of pharmaceutical products, we are subject to regulation and oversight by different levels of the food and drug administration in China, in particular, the SFDA. The Drug Administration Law of the PRC, as amended, provides the basic legal framework for the administration of the production and sale of pharmaceutical products in China and governs the manufacturing, distributing, packaging, pricing, and advertising of pharmaceutical products in China. The corresponding implementation regulations set out detailed rules with respect to the administration of pharmaceuticals in China. We are also subject to other PRC laws and regulations that are applicable to business operators, retailers, and foreign-invested companies.

Distribution of Pharmaceutical Products

A distributor of pharmaceutical products must obtain a distribution permit from the relevant provincial- or designated municipal- or county-level SFDA. The grant of such permit is subject to an inspection of the distributor’s facilities, warehouses, hygienic environment, quality control systems, personnel, and equipment. The distribution permit is valid for five (5) years, and the holder must apply for renewal of the permit within six (6) months prior to its expiration. In addition, a pharmaceutical product distributor needs to obtain a business license from the relevant administration for industry and commerce prior to commencing its business. All of our consolidated entities that engage in the retail pharmaceutical business have obtained necessary pharmaceutical distribution permits, and we do not expect to face any difficulties in renewing these permits and/or certifications.

In addition, under the Supervision and Administration Rules on Pharmaceutical Product Distribution, promulgated by the SFDA on January 31, 2007, and effective May 1, 2007, a pharmaceutical product distributor is responsible for its procurement and sales activities and is liable for the actions of its employees or agents in connection with their conduct of distribution on behalf of the distributor. A retail distributor of pharmaceutical products is not allowed to sell prescription pharmaceutical products or Tier A OTC pharmaceutical products listed in the national or provincial medical insurance catalogs without the presence of a certified in-store pharmacist. See “Reimbursement under the National Medical Insurance Program.”

Restrictions on Foreign Ownership of Wholesale or Retail Pharmaceutical Business in China

PRC regulations on foreign investment currently permit foreign companies to establish or invest in WFOEs or joint ventures that engage in wholesale or retail sales of pharmaceuticals in China. For retail sales, these regulations restrict the number and size of pharmacies that a foreign investor may establish. If a foreign investor owns more than thirty (30) stores that sell a variety of branded pharmaceutical products sourced from different suppliers, the foreign investor’s ownership interests in the stores are limited to forty nine percent (49%).

In lieu of equity ownership, our WFOE, Jiuxin Management, has entered into contractual arrangements with Jiuzhou Pharmacy and the Key Personnel.

| 19 |

Good Supply Practice Standards

GSP standards regulate wholesale and retail pharmaceutical product distributors to ensure the quality of distribution of pharmaceutical products in China. All wholesale and retail pharmaceutical product distributors are required to apply for GSP certification within thirty (30) days after obtaining the drug distribution permit. The current applicable GSP standards require pharmaceutical product distributors to implement strict controls on the distribution of medicine products, including standards regarding staff qualifications, distribution premises, warehouses, inspection equipment and facilities, management, and quality control. Specifically, the warehouse must be able to store the pharmaceutical products at various required temperatures and humidity, and handle transport, warehouse entries, delivery, and billing by computerized logistics management systems. The GSP certificate is usually valid for five (5) years. Currently, Jiuzhou Pharmacy, and Jiuxin Medicine are all GSP certified.

Prescription Administration

Under the Rules on Administration of Prescriptions promulgated by the SFDA, effective May 1, 2007, doctors are required to include the chemical ingredients of the medicine they prescribe in their prescription and are not allowed to include brand names in their prescription. This regulation is designed to provide consumers with choices among different pharmaceutical products that contain the same chemical ingredients.

Advertisement of Pharmaceutical Products

Under the Advertising Law of PRC, the contents of an advertisement must be true, lawful, without falsehood, and must neither deceive nor mislead consumers. Accordingly, advertisement must be examined by the competent authority prior to its publication or broadcast through any form of media. In addition, advertisement of pharmaceutical products may only be based on a drug’s approved indication of use statement, and may not contain any assurance of a product’s efficiency, treatment efficiency, curative rate, or any other information prohibited by law. Advertisement for certain drugs should include an admonishment to seek a doctor’s advice before purchasing and application. Advertising is prohibited for certain drugs such as anesthetics and psychotropic drugs.

To further prevent misleading advertising of pharmaceutical products, the SAIC and the SFDA jointly promulgated the Standards for Examination and Publication of Advertisements of Pharmaceutical Products and Measures for Examination of Advertisement of Pharmaceutical Products in March 2007. Under these regulations, an approval must be obtained from the provincial level of food and drug administration before a pharmaceutical product may be advertised. In addition, once approved, an advertisement’s content may not be altered without further approval. Such approval, once obtained, is valid for one (1) year.

Product Liability and Consumers Protection

Product liability claims may arise if the products sold have any harmful effect on the consumers. The injured party may make a claim for damages or compensation. The General Principles of the Civil Law of the PRC, which became effective in January 1987, state that manufacturers and sellers of defective products causing property damage or injury shall incur civil liabilities for such damage or injuries.

The Product Quality Law of the PRC was enacted in 1993 and amended in 2000 to strengthen the quality control of products and protect consumers’ rights and interests. Under this law, manufacturers and distributors who produce or sell defective products may be subject to confiscation of earnings from such sales, revocation of business licenses, imposition of fines, and, in severe circumstances, may be subject to criminal liability.

The Administrative Measures for Drug Recalls was issued by the SFDA in December 2007, and covers two (2) types of drug recalls, namely voluntary recalls and compulsory recalls. Under such regulation, wholesalers are obliged to assist drug manufacturers with any drug recall. In addition, a wholesaler must immediately cease to sell any drug that the wholesaler learns has any safety issues, and must immediately notify the manufacturer or its supplier as well as report the matter to the SFDA.

The Law of the PRC on the Protection of the Rights and Interests of Consumers was promulgated on October 31, 1993 and became effective on January 1, 1994 to protect consumers’ rights when they purchase or use goods or services. All business operators must comply with this law when they manufacture or sell goods and/or provide services to customers. In extreme situations, pharmaceutical product manufacturers and distributors may be subject to criminal liability if their goods or services lead to the death or injuries of customers or other third parties.

The Tort Law of the PRC was promulgated on December 26, 2009 and came into force on July 1, 2010. The Tort Law provides that manufacturers and distributors who produce or sell defective products shall be responsible for the damage caused by the defective products.

| 20 |

Price Controls

The retail prices of some pharmaceutical products sold in China, primarily those included in the national and provincial medical insurance catalogs and those pharmaceutical products whose production or distribution are deemed to constitute monopolies, are subject to price controls in the form of fixed prices (for non-profit medical institutions) or price ceilings. Manufacturers or distributors cannot freely set or change the retail price of any price-controlled product above the applicable price ceiling or deviate from the applicable government-imposed price. The prices of medicines that are not subject to price controls are determined freely at the discretion of the respective pharmaceutical companies, subject to notification to the provincial pricing authorities.

The retail prices of medicines that are subject to price controls are administered by the Price Control Office of the National Development and Reform Commission (“NDRC”), and implemented by provincial and regional price control authorities. The retail price, once set, also effectively determines the wholesale price of that medicine. From time to time, the NDRC publishes and updates a list of medicines that are subject to price control. Provincial and regional price control authorities have discretion to authorize price adjustments based on local conditions and the the level of local economic development. Only the manufacturer of a medicine may apply for an increase in the retail price of the medicine, and it must either apply to the provincial price control authority where it is incorporated, if the medicine is provincially regulated, or to the NDRC, if the medicine is regulated by the NDRC.

Since May 1998, China’s central government has been ordering reductions in the retail prices of various pharmaceutical products. During the fiscal year ended March 31, 2015, several price reductions occurred and affected 1,951 different pharmaceutical products, which required us to make 2 price adjustments. Currently, 1,893 pharmaceutical products and OTC drugs we offer are subject to price controls.

The NDRC may grant premium pricing status to certain pharmaceutical products that are under price control. The NDRC may set the retail prices of pharmaceutical products that have obtained premium pricing status at a level that is significantly higher than comparable products.

Reimbursement under the National Medical Insurance Program

Eligible participants in the national medical insurance program, mainly consisting of urban residents, are entitled to purchase medicine when presenting their medical insurance cards in an authorized pharmacy, provided that the medicine they purchase has been included in the national or provincial medical insurance catalogs. Depending on relevant local regulations, authorized pharmacies can either (i) sell medicine on credit and obtain reimbursement from relevant government social security bureaus on a monthly basis, or (ii) receive payments from the participants at the time of their purchases, and the participants in turn obtain reimbursement from relevant government social security bureaus.

Medicine included in the national and provincial medical insurance catalogs is divided into two (2) tiers. Purchases of Tier A pharmaceutical products are generally fully reimbursable, except that certain Tier A pharmaceutical products are only reimbursable to the extent the medicine are used specifically for the stated purposes in the medical insurance catalogs. Purchasers of Tier B pharmaceutical products, which are generally more expensive than those in Tier A, are required to make a certain percentage of co-payments, with the remaining amount being reimbursable. The percentage of reimbursement for Tier B OTC products varies in different regions in the PRC. Factors that affect the inclusion of medicine in the medical insurance catalogs include whether the medicine is consumed in large volumes and commonly prescribed for clinical use in China and whether it is considered to be important in meeting the basic healthcare needs of the general public.

China’s Ministry of Labor and Social Security, together with other government authorities, has the power to determine every two (2) years which medicine are included in the national medical insurance catalog, under which of the two (2) tiers the included medicine falls, and whether an included medicine should be removed from the catalog.

| 21 |

Sales of Nutritional Supplements and other Food Products

A distributor of nutritional supplements and other food products must obtain a food circulation permit from its local Administration of Industry and Commerce. The grant of such permit is subject to an inspection of the distributor’s facilities, warehouses, hygienic environment, quality control systems, personnel, and equipment. The food circulation permit is valid for three (3) years, and the holder must apply for renewal of the certificate within thirty (30) days prior to its expiration. Currently, Jiuxin Medicine, Jiuzhou Pharmacy, and our drugstores all hold a valid Food Circulation Permit, except for our Lin’an store, which does not sell food products and therefore does not required to hold such a permit. We are in the process of renewing the permits for twelve (12) stores in Jiasnggan District that are expiring in 2015, and believe that there is no difficulty in renewing such permits.

Medical Practice

Healthcare providers in China are required to comply with many laws and regulations at the national and local government levels. The laws and regulations applicable to our medical practice include the following:

| ● | We must register with and maintain an operating license from the local public health authority for each clinic that we operate, each of which is subject to annual review by the public health authority; |

| ● | The Licensed Physician Act requires that we only hire PRC licensed physicians; |

| ● | All waste material from our clinics must be properly collected, sterilized, deposited, transported and disposed of, and we are required to keep records of the origin, type and amount of all waste materials that we generate for at least three (3) years; |

| ● | We must have at least three (3) physicians, five (5) nurses and one (1) technician on staff at each clinic; and |

| ● | We must establish and follow protocols to prevent medical malpractice, which require us to: (i) insure that patients are adequately informed before they consent to medical operations or procedures; (ii) maintain complete medical records which are available for review by the patient, physicians and the courts; (iii) voluntarily report any event of malpractice to a local government agency; and (iv) support and justify the medical services we provide in any administrative investigation or litigation. If we fail to comply with applicable laws and regulations, we could suffer penalties, including the loss of our license to operate. |

Interim Regulations on Administration of Sino-Foreign Joint Venture and Cooperative Medical Institutions

As per China’s commitments to the World Trade Organization, “foreign service suppliers are permitted to establish joint venture hospitals or clinics with local Chinese partners with quantitative limitations in line with China’s needs. Foreign majority ownership is permitted.” In accordance with the Interim Regulations on Administration of Sino-Foreign Joint Venture and Cooperative Medical Institutions issued jointly by the Ministry of Health (“MOH”) and the Ministry of Commerce (“MOFCOM”) in 2000, the Chinese party of Sino-foreign joint ventures and cooperative medical institutions shall hold no less than thirty percent (30%) of shares and legal rights or interest, which also mean foreign investors are allowed to hold a maximum stake of seventy percent (70%). Such regulations also specify that the establishment of Sino-foreign joint venture and cooperative medical institutions should be approved respectively by MOH and MOFCOM. In other words, foreigners are allowed to run hospitals or clinics in the form of equity or co-operative joint ventures with an equity interest of up to seventy percent (70%) and a duration for co-operation of up to twenty (20) years.

Internet Pharmaceutical Sales