Exhibit 99.1

For further

information, please contact: Volker Braun, SVP Head of Global Investor Relations & ESG,

volker.braun@evotec.com, T. +49.(0)40.560 81-775, M. +49.(0)151.1940 5058, www.evotec.com

|

HALF-YEAR REPORT 2022 |

I. MANAGEMENT REPORT

| 4 | NEW AND EXTENDED ALLIANCES underline success of GROWTH STRATEGY |

| 4 | Acquisition expands capabilities and Expertise in cell therapy |

| 4 | Guidance for full-year 2022 refined |

HIGHLIGHTS

EVOTEC CONTINUES STRONG organic REVENUE GROWTH IN ALL BUSINESS AREAS and adds cGMP cell therapy manufacturing capabilities

| 4 | Group revenues increased by 24% to € 336.9 m (H1 2021: € 271.3 m) driven by strong demand for its base business; like-for-like revenue growth (excluding fx-effects) of 19% |

| 4 | Continued strong revenue growth momentum: Total EVT Execute (incl. intersegment) revenues up 26% to € 351.0 m (H1 2021: € 279.5 m); EVT Innovate revenues due to a strong growth in Q2 up 36% to € 78.0 m (H1 2021: € 57.3 m) |

| 4 | Total non-operating income (expense) of € (89.8) m (H1 2021: € 106.1 m) explained by the non-cash fair value adjustments of the equity investment in publicly listed Exscientia plc |

| 4 | The net income as of 30 June 2022 amounted to € (101.2) m (H1 2021: € 112.7 m), as a consequence of the loss from equity investments of € 97.7 m for Evotec’s 14 m shares in Exscientia plc |

new and extended alliances reflect success of growth strategy

| 4 | Several new integrated drug discovery collaborations signed, including INDiGO, CMC and DMPK agreements |

| 4 | New collaborations signed, based on unique, data-driven platforms with Almirall (dermatology), Boehringer Ingelheim (iPSC), Eli Lilly (E.MPD), Janssen (TargetAlloMod) and Sernova (iPSC) |

| 4 | Significant operational and scientific step-up of targeted protein degradation alliance with Bristol Myers Squibb (“BMS”) |

| 4 | Further outstanding progress in neuroscience collaboration with BMS |

| 4 | Just – Evotec Biologics: Just –Evotec Biologics is currently in its initial build up phase. Strategic investments into disruptive technology platform show good progress – foundation laid for accelerated growth; Multiple new development and manufacturing agreements, e.g., with Alpine Immune Sciences (after period-end) |

| 4 | Co-owned pipeline projects progressing well: Phase II start of BAY 2395840 (diabetic neuropathic pain), topline data from Phase Ia of EXS21546 (oncology), expansion with JingXin for EVT201 submission for approval in China, German Federal Ministry of Education and Research grant for EVT075 clinical development |

| 4 | Successful expansion of the EVOequity portfolio with new strategic equity stakes in several promising companies such as Centauri, IMIDomics, Sernova and Tubulis |

| 4 | Launch of Aurobac Therapeutics, joint venture with Boehringer Ingelheim and bioMérieux, to create the next generation of antimicrobials along with actionable diagnostics to fight Antimicrobial Resistance |

| 2 |

|

HALF-YEAR REPORT 2022 |

Corporate

| 4 | Effective May 2022, Dr Matthias Evers joins Management Board as Chief Business Officer (“CBO”), responsible for business development, digitalisation and strategy | |

| 4 | Signing of definitive agreement to acquire the cell technology company Rigenerand Srl, a leader in the field of cGMP manufacturing of cell therapies, which will operate as Evotec (Modena) Srl | |

| 4 | Annual General Meeting 2022: Approval of all proposed agenda items; Camilla Macapili Languille elected to the Supervisory Board |

Business Outlook for Full-Year 2022 refined and mid-term targets 2025 Confirmed

| 4 | Group revenues now expected to be in a range of € 715 – 735 m versus € 700 – 720 m previously (unchanged at € 690 – 710 m at constant exchange rates) (2021: € 618 m) | |

| 4 | Adjusted Group EBITDA expected to be unchanged in the range of € 105 – 120 m (new guidance range at constant exchange rates of € 85 – 100 m versus € 95 – 110 m previously) (2021: € 107 m) | |

| 4 | Unpartnered research and development expenses expected to be in a range of € 70 – 80 m (2021: € 58 m) | |

| 4 | Mid-term goals target revenue growth to > € 1,000 m, adjusted EBITDA of ≥ € 300 m and unpartnered research and development expenses of > € 100 m by 2025 |

The forecast takes in account – as far as possible – the current increased global uncertainties related to e.g. the COVID-19 pandemic and the war in Ukraine, resulting in uncertainty around the global price and supply situation for energy, other raw materials and supplies as well as logistics relevant to the business.

| 3 |

|

HALF-YEAR REPORT 2022 |

Financial Highlights

The following table provides an initial overview of the financial performance in the first half-year 2022 compared to the same period in 2021. More detailed information can be found from page 7 of this report.

Key figures of unaudited consolidated income statement & segment information

Evotec SE & subsidiaries – First half-year 2022 / 2021

| In k€ | Evotec Group H1 2022 | Evotec Group H1 2021 | ||||||

| Revenues1) | 336,875 | 271,302 | ||||||

| Intersegment revenues | – | – | ||||||

| Costs of revenue | (273,686 | ) | (215,000 | ) | ||||

| Gross profit | 63,189 | 56,302 | ||||||

| Gross margin in % | 18.8 | % | 20.8 | % | ||||

| R&D expenses2) | (36,838 | ) | (35,434 | ) | ||||

| SG&A expenses | (67,396 | ) | (46,383 | ) | ||||

| Impairment of intangible assets | – | (683 | ) | |||||

| Other operating income (expenses), net | 37,738 | 34,513 | ||||||

| Net operating income (loss) | (3,307 | ) | 8,315 |

1) Adjusted for negative exchange rate effects of € 15.2 m, Group revenues would have amounted to € 321.7 m

2) Includes unpartnered R&D expenses of € 33.3 m in H1 2022 (H1 2021: € 27.8 m)

3) Before changes in contingent consideration, income from bargain purchase and excluding impairments on goodwill, other intangible and tangible assets as well as the total non-operating result

The following table details Evotec’s segment revenues and operating income (loss) for the six months ended 30 June 2022

In T€ | EVT | EVT | Intersegment | Evotec

Group | ||||||||||||

| Revenues | 350,989 | 78,028 | (92.142 | ) | 336,875 | |||||||||||

| Operating result | 20,110 | (23,417 | ) | – | (3,307 | ) | ||||||||||

| 4 |

|

HALF-YEAR REPORT 2022 |

Operational Highlights

Note: In the wake of the Russian invasion of Ukraine, rising energy prices are significantly affecting Evotec. We have analysed related effects on our operations and results, and we are actively implementing measures to save energy in order to reduce the impact.

Evotec does not entertain any direct business relations with Russian companies and is therefore not directly affected on the revenue side.

Signing of further new and extended drug discovery and development agreements

In the first half-year of 2022, Evotec continued to further expand its operational activities based on its fully integrated R&D platform EVOiR&D and precision medicine platforms. The Company entered into new partnerships and extended existing alliances across the various stages of drug discovery and development, e.g.:

| · | New multi-target alliance with Almirall in the field of medical dermatology. The goal is to research and develop novel therapeutics for serious skin diseases, including immune-mediated inflammation such as atopic dermatitis and non-melanomatous skin cancer such as basal cell carcinoma. Based on Evotec's integrated platforms such as the AI/ML-driven EVOiR&D platform and their multimodality approach, both partners will bring drug targets into the discovery process. Besides other payments, we are eligible to receive success-based milestones of up to € 230 m per project, subject to scientific progress in the future. | |

| · | New target and drug discovery partnership with Boehringer Ingelheim, focusing on iPSC-based disease modelling for ophthalmologic disorders. Through phenotypic screening of human iPSC-derived cells, supported by its EVOpanOmics platform, Evotec aims to identify small molecules to modulate disease phenotypes, and then validate promising underlying targets for potential therapeutic interventions. | |

| · | Based on Evotec’s unique and extensive kidney disease patient database, Evotec entered into a new drug discovery collaboration with Lilly in the field of metabolic diseases. Under the terms of the three-year partnership, Evotec and Lilly aim to discover potential drug candidates for the treatment of diabetes and chronic kidney diseases from targets identified by Lilly or by Evotec. | |

| · | Strategic drug discovery collaboration with Janssen Pharmaceutica NV in the field of protein homeostasis. Evotec’s innovative TargetAlloMod platform will be evaluated to discover first-in-class novel mode of action therapeutic candidates. Besides other payments, Evotec may receive success-based milestones of up to € 210 m per project, subject to scientific progress in the future. | |

| · | Exclusive strategic partnership with Sernova for iPSC-based beta cell replacement therapy to advance a ‘functional cure’ for diabetes. The partnership leverages iPSC-based beta cells from Evotec’s QRbeta initiative and will be combined with Sernova’s proprietary Cell Pouch™, which is the leading implantable and scalable medical device in its class. |

Further progress in neuroscience and oncology collaborations with BMS

| · | Significant step-up of targeted protein degradation alliance with Bristol Myers Squibb, first signed in 2018. Both parties will leverage all of Evotec’s proprietary EVOpanOmics and EVOpanHunter platforms as well as AI/ML-based drug discovery and development platforms in generating a promising pipeline of molecular glue degraders. Based on the number of projects and potential success-based milestones linked to each project, the deal potential could amount to up to $ 5 bn, provided all projects are successful. In addition, we have already received an upfront payment of $ 200 m. | |

| · | Furthermore, Evotec and BMS expanded their neurodegeneration collaboration in early 2022. Under the expansion, BMS increases its access to a novel targeted protein degradation approach with a focus on selected targets that are relevant to a range of neurodegenerative conditions. |

| 5 |

|

HALF-YEAR REPORT 2022 |

Just – Evotec Biologics: Foundation laid, validation of new paradigm in biologics manufacturing

| · | Just-Evotec Biologics is currently in its build up and initial investment phase. Nevertheless multiple newly signed agreements and ongoing discussions underline the strategic potential of Just-Evotec Biologics. After period-end, Just – Evotec Biologics expanded a multi-year partnership with Alpine Immune Sciences (“Alpine”) for the development of a commercial process for Alpine’s Fc fusion protein ALPN-303, targeting systemic lupus erythematosus (“SLE”). Just – Evotec Biologics will leverage its data-driven technology platform to develop a commercial manufacturing process for ALPN-303. | |

| · | Initial investments made for platform expansion in Europe with ground-breaking ceremony of J.POD® at Evotec’s Campus Curie in Toulouse, France, planned for September 2022. J.POD® Toulouse (EU) will play a key role in addressing the need for therapeutic antibodies across multiple indications, including those related to infectious diseases such as COVID-19. | |

| · | Evotec will host a Capital Markets Day on 2 November 2022 in Redmond / Seattle to demonstrate its transformative, fully integrated biologics discovery to manufacturing technology platforms. |

Co-owned pipeline projects progressing well

| · | Bayer initiated a Phase II clinical trial to evaluate the safety and efficacy of BAY2395840 in patients with diabetic neuropathic pain, triggering a € 3 m milestone payment to Evotec. | |

| · | Exscientia reported top-line data from its Phase I healthy volunteer study of EXS-21546, a highly selective A2a receptor antagonist co-invented and developed through a collaboration between Exscientia and Evotec. | |

| · | Evotec is one of three companies receiving a highly competitive grant as part of a new initiative by the German Federal Ministry of Education and Research to support the clinical development of novel therapeutic candidates against COVID-19. Under the € 7.5 m grant, Evotec will use GMP material manufactured on its Just – Evotec Biologics manufacturing platform to initiate the clinical development of EVT075, a potentially highly potent immunomodulatory molecule. |

Successful expansion of the EVOequity portfolio with new equity stakes in several promising companies

Over the first half-year of 2022, Evotec continued to grow and diversify its EVOequity portfolio with several equity investments into highly promising companies.

| · | Investment in Centauri Therapeutics Limited’s Series A investment round. Centauri is an immunotherapy company focused on the treatment of infectious diseases. | |

| · | Investment in IMIDomics, Inc., a privately held global biotechnology company focused on the discovery and development of new targets and medicines for the treatment of patients with immune-mediated inflammatory diseases. | |

| · | Investment in Tubulis GmbH by participating in the company’s Series B financing round. Tubulis, based in Munich, specialises in the development of antibody drug conjugates by leveraging a set of proprietary technology platforms to develop these highly targeted therapeutics against solid tumours. | |

| · | Investment in Sernova Corp. in conjunction with the exclusive strategic partnership to develop an implantable iPSC-based beta cell replacement therapy for the treatment of insulin-dependent diabetes. | |

| · | Launch of Aurobac Therapeutics SAS, joint venture with Boehringer Ingelheim and bioMérieux to create the next generation of antimicrobials along with actionable diagnostics to fight Antimicrobial Resistance. | |

| · | Part of a consortium that launched CARMA FUND I Capital GmbH & Co. KG as a new vehicle for the implementation of promising early-stage life science projects. |

| 6 |

|

HALF-YEAR REPORT 2022 |

Signing of definitive agreement as of July 1, 2022, to acquire Rigenerand Srl, now Evotec (Modena) Srl

Evotec added significant capabilities and capacities for further long-term growth in the field of cell therapy by acquiring Rigenerand Srl, a cell technology company with leading edge in the field of cGMP manufacturing of cell therapies. Evotec’s cell therapy platform EVOcells encompasses the full end-to-end spectrum of activities from the discovery and development to the manufacturing of off-the-shelf iPSC-based cell therapy products. With a leading team of cell therapy experts, Evotec (Modena) Srl adds a high-quality cGMP manufacturing site to the EVOcells platform therefore adding capacity, critical expertise and capabilities to the important scale-up of complex cell-based therapies.

Report on the Financial Situation and Results

1. Results of operations

Group revenues in the reporting period went up by 24% or € 65.6 m to € 336.9 m (H1 2021: € 271.3 m). The increase is the continuation of a trend seen at the beginning of 2022. The substantial rise against the prior-year period is based on a strong performance of all business areas. Excluding the recognition of positive fx-effects, Group revenues grew by 19% to € 321.7 m. Growth of the base business was 26% from € 261.3 m in H1 2021 to € 330.1 m in the first six months of 2022. We recognised milestone, upfront and license payments of € 6.8 m (H1 2021: € 10.0 m). Just – Evotec Biologics delivered € 21.9 m during the six months ended 30 June 2022 (H1 2021: € 23.0 m). Growth of the base business of Just – Evotec Biologics (excluding the recognition of upfront payments from undisclosed partner in H1 2021 of € 5.2 m) was 23% compared to H1 2021.

Geographically, 41% of Evotec’s revenues were generated with European customers, 54% with customers in the USA and 5% with customers in the rest of the world. This compares to 43%, 53% and 4%, respectively, in the same period of the previous year.

The Costs of revenue during the six months ended 30 June 2022 amounted to € 273.7 m (H1 2021: € 215.0 m) yielding a gross margin of 18.8% (H1 2021: 20.8%). The increase was attributable to costs related to the strong growth of the overall business and the recognition of expenses related to expanding our precision medicine platforms as well as our next-generation biologics manufacturing facility in Redmond (US). Excluding effects related to the capacity build-up at Just – Evotec Biologics, total gross margin amounted to 27.3% vs. 24.6% during the same period last year. This progress is driven by a significantly improved profitability in the base business as the contribution from milestones, upfronts and licenses was € 2.8 m lower than in the previous year.

Total R&D expenses increased by € 1.4 m or 4% for the six months ended 30 June 2022 to € 36.8 m (H1 2021: € 35.4 m). The increase in unpartnered R&D expenses by 19.6% to € 33.3 m (H1 2021: € 27.8 m) is primarily related to the strategic expansion of our platform technologies whereas partnered R&D expenses further decreased as planned by 53% to € 3.5 m (H1 2021: € 7.6 m).

In comparison to the same period of 2021, SG&A expenses increased by € 21.0 m or 45% to € 67.4 m (H1 2021: € 46.4 m). Expanding our number of people to support the overall growth as well as professional fees for consulting services were the main drivers. Consulting costs were incurred due to the start of SAP implementation in 2022 and to M&A activities. SG&A expenses also went up due to facility-related expenses which included higher energy costs and also direct depreciation costs and allocated expenses for maintenance of facilities, predominantly the new J.POD® Redmond (US) manufacturing site as well as the Biopark in Toulouse. Lastly, year-over-year comparison through June is affected from being a publicly listed company in the US since November 2021.

| 7 |

|

HALF-YEAR REPORT 2022 |

Other net operating income and expenses totalled € 37.7 m (H1 2021: € 34.5 m). The increase mainly resulted from R&D tax credits (€ 19.3 m) mostly in France and Italy. Recharges of Sanofi for ID Lyon amounted to € 16.8 m (H1 2021: € 18.9 m).

The Total non-operating result of € (89.8) m (H1 2021: € 106.1 m) was mainly due to fair value adjustments to Evotec’s Exscientia plc equity position in both periods. Fair value adjustments were positive in the first six months of 2021 after Exscientia closed two financing rounds in H1 2021 prior to its NASDAQ-listing in H2 2021. In H1 2022, Exscientia's ordinary share price dropped by 45% from $ 19.76 at the end of 2021 to $ 10.89 as of 30 June 2022, which resulted in a non-cash loss from equity investments of € 97.7 m.

Adjusted Group EBITDA of the first six months 2022 totalled at € 33.6 m (H1 2021: € 36.2 m), which is the result of a well-balanced development of very favourable growth and profitability of our base business and preparations for future growth to which J.POD®s will make a valuable contribution in future. Besides capacity expansions, higher energy costs, overall inflation and recurring costs related to the listing in the U.S. resulted in first negative effects. These were largely compensated by a strong underlying operating performance.

The net income as of 30 June 2022 amounted to € (101.2) m (H1 2021: € 112.7 m), mainly as a consequence of the loss from equity investments of € 97.7 m for Evotec’s 14 m shares in Exscientia plc.

2. Progressing convergence of offering

All business areas continued their significant revenue growth in the first six months 2022. Total EVT Execute revenues (incl. intersegment revenues) increased by 26% to € 351.0 m (H1 2021: € 279.5 m), despite a decline of revenues of Just – Evotec Biologics. Growth was driven by a very strong base business. Intersegment revenues amounted to € 92.1 m (H1 2021: € 65.5 m), which is an indicator for the convergence of our offering based on our fully integrated platform. Intersegment sales are reflective of the progress of projects recognised within EVT Innovate where Evotec maintains rights to participate in the success of partnered projects in the future.

EVT Execute recorded costs of revenue of € 289.8 m in the first six months of 2022 (H1 2021: € 226.5 m), resulting in a gross margin of 17.4% (H1 2021: 19.0%) through ramp-up costs at our J.POD® facility in Redmond needed to facilitate future growth and profitability improvements based on manufacturing of clinical and commercial volumes of biologics. EVT Execute gross margin excluding Just – Evotec Biologics would have reached 25.3% in H1 2022, a 410-basis point improvement compared to 21.2% in the same period 2021. R&D expenses were € 2.6 m (H1 2021: € 1.0 m), SG&A expenses increased to € 54.1 m (H1 2021: € 37.2 m) in accordance with the overall group trend.

Adjusted EBITDA of the EVT Execute segment was € 54.7 m, 5% above the previous year level (H1 2021: € 51.9 m), despite the aforementioned impact related to the build-up of our J.POD® plant in Redmond (US).

EVT Innovate generated revenues of € 78.0 m (H1 2021: € 57.3 m). This increase of 36% was driven by higher base revenues from the collaboration with BMS, including the recent contract closed in the field of Targeted Protein Degradation on 10 May 2022.

| 8 |

|

HALF-YEAR REPORT 2022 |

The EVT Innovate segment incurred costs of revenue of € 68.3 m (H1 2021: € 48.0 m). Gross margin as a percent of revenue was 12.4%, a decrease of 3.9 percentage points compared with H1 2021 (16.3%), mainly related to lower revenues from milestones, upfronts and licenses. The EVT Innovate segment reported R&D expenses of € 42.0 m (H1 2021: € 40.5 m) which were in particular driven by higher expenses for proprietary projects and platform R&D. Expanded business development activities resulted in an increase of SG&A expenses to € 13.3 m (H1 2021: € 9.2 m). The EVT Innovate adjusted EBITDA reached € (21.1) m in H1 2022 (H1 2021: € (15.7) m).

3. Financing and financial position

Cash flow provided by operating activities in the first six months of 2022 amounted to € 240.6 m (H1 2021: € 41.1 m). This figure was positively influenced by the upfront payment of US$ 200 m received in May in connection with the BMS collaboration in the field of Targeted Protein Degradation. The fair value through profit and loss measurement effects concerning the long-term investments (H1 2022: € (97.7) m; H1 2021: € 116.1 m) have been removed here as a non-cash adjusting item.

Cash flow used in investing activities for the first six months of 2022 amounted to € 206.9 m (H1 2021: € 96.5 m). Capital expenditure on property, plant and equipment for site expansion – in particular both EU and US J.POD® facilities – amounted to € 81.4 m (H1 2021: € 72.6 m). Apart from these growth projects, capital expenditures include investments in Integrated Drug Discovery (IDD) capacities. Also included are investments in associated companies and other long-term investments in the first six months of 2022 in the amount of € 59.4 m (H1 2021: € 13.6 m). The increase of investments in equity holdings was mainly driven by the participation in Sernova Corp. and the acquisition of Rigenerand Srl.

Cash flow from financing activities were rather € (45.8) m for the first six month against € 12.5 m in H1 2021. The main reason was the € 35 m repayment of the 3-year tranche of the promissory note (“Schuldscheindarlehen”) in June.

Cash and cash equivalents were € 697.0 m as of 30 June 2022 (31 December 2021: € 699.3 m). In detail, the cash outflow from investing activities increased to € 206.9 m (H1 2021: € 96.5 m), which was more than off-set by the received pre-payments from the recent extension of partnership with BMS in protein degradation. Consequently, total Liquidity remained more or less stable amounting to € 887.9 m (31 December 2021: € 858.2 m).

4. Assets, liabilities and stockholders’ equity

Assets

Between 31 December 2021 and 3o June 2022, total assets increased slightly by € 58.5 m to € 2,293.7 m (31 December 2021: € 2,235.2 m).

Trade accounts receivable and accounts receivable from associated companies and other long-term investments decreased in the six months ended 30 June 2022 by € 25.0 m to € 109.7 m (31 December 2021: € 134.7 m). Consequently, Days Sales Outstanding (DSO) of 59 days is back in our target-range of 50 and 60 days (31 December 2021: 80 days).

Current tax receivables decreased from € 23.4 m as per 31 December 2021 to € 18.7 m as per 30 June 2022 mainly related to the refund of R&D tax credits in France offset by increased receivables relating to R&D tax credits in Italy.

Non-current tax receivables increased to € 67.2 m (31 December 2021: € 56.0 m) mainly due to receivables relating to R&D tax credits in France.

| 9 |

|

HALF-YEAR REPORT 2022 |

Prepaid expenses and other current assets increased by € 34.8 m to € 74.7 m (31 December 2021: € 39.9 m) mainly due to the payment of € 23 m concerning the acquisition of Rigenerand Srl as well as prepayments made in the beginning of the year for the full year, e. g. for licenses and maintenance.

Property, plant and equipment rose by € 74.9 m to € 559.5 m (31 December 2021: € 484.6 m) caused by capital expenditures for site expansion, exceeding depreciations.

Goodwill and intangibles declined by € 2.4 m compared with 31 December 2021, to € 286.0 m (31 December 2021: € 288.4 m), primarily due to straight-line amortisation of definite life intangibles and fx-effects.

Long-term investments amounted to € 212.0 m (31 December 2021: € 281.9 m). This decrease resulted mainly from the fair value adjustment to Evotec’s stake in Exscientia plc.

Liabilities

Trade accounts payable increased by € 8.3 m in the six months ended 30 June 2022 to € 80.9 m (31 December 2021: € 72.6 m) in accordance with the overall business growth.

Provisions decreased by € 7.9 m to € 31.4 m (31 December 2021: € 39.3 m) due to annual bonus payments in April.

Other current financial liabilities increased to € 23.2 m (31 December 2021: € 12.1 m) mainly due to foreign exchange forward valuations.

Current and non-current contract liabilities increased visibly by € 181.3 m to € 326.8 m (31 December 2021: € 145.5 m) due to the recognition of the upfront payments from BMS.

Net debt leverage ratio of (6.4)x adjusted EBITDA, excl. IFRS 16 effect and (3.8)x incl. IFRS 16 improved versus Q4 2021 with reference to the overall positive net cash position.

Stockholders’ equity

As of 30 June 2022, Evotec’s overall capital structure remained stable at a strong equity balance compared with the end of 2021. Total stockholders’ equity declined by € 102.2 m to € 1,275.5 m (31 December 2021: € 1,377.7 m) mainly resulting from the fair value adjustment of our Exscientia stake. Due to the exercise of stock options and Share Performance Awards, a total amount of 176,952,653 shares were issued and outstanding with a nominal value of € 1.00 per share as of 30 June 2022. Evotec’s equity ratio as of 3o June 2022 decreased accordingly to 55.6% (31 December 2021: 61.6%).

5. Human Resources

Employees

Headquartered in Hamburg, Germany, the Evotec Group employs 4,521 people globally as of 30 June 2022 (31 December 2021: 4,198 employees), which corresponds to a total increase of 8% compared to the prior year’s end. Overall, the number of employees grew by 323 in the first six months of 2022 (H1 2021: 342 employees).

Stock-based compensation

During the first half of 2022, 139,229 Share Performance and Restricted Awards from the total granted 382,784 Share Performance and Restricted Awards were given to the members of the Management Board. The remaining number of awards were given to other key employees.

| 10 |

|

HALF-YEAR REPORT 2022 |

During the first half-year 2022 344,458 shares were issued through the exercise of Share Performance Awards. As of 30 June 2022, the total number of Share Performance and Restricted Awards available for future exercise amounted to 1,457,733 (approximately 1.0% of shares in issue).

Share Performance and Restricted Awards have been accounted for under IFRS 2 using the fair value at the grant date.

With the exception of Dr Mario Polywka, the Supervisory Board of Evotec SE does not hold any stock options or Share Performance Awards.

Shareholdings of the Boards of Evotec SE as of 30 June 2022

| Shares | Stock options | Outstanding

Shares from vested SPA’s | Granted unvested SPA’s and RSA´s (total) | |||||||||||||

| Management Board | ||||||||||||||||

| Dr Werner Lanthaler | 1,514,826 | – | – | 211,370 | ||||||||||||

| Dr Cord Dohrmann | 188,926 | – | – | 82,441 | ||||||||||||

| Dr Matthias Evers | – | – | – | 39,353 | ||||||||||||

| Dr Craig Johnstone | 10,498 | – | – | 87,122 | ||||||||||||

| Enno Spillner | 51,655 | – | – | 42,488 | ||||||||||||

| Supervisory Board | ||||||||||||||||

| Prof. Dr Iris Löw-Friedrich | – | – | – | – | ||||||||||||

| Dr Mario Polywka | 11,938 | – | – | – | ||||||||||||

| Roland Sackers | – | – | – | – | ||||||||||||

| Kasim Kutay | – | – | – | – | ||||||||||||

| Dr Constanze Ulmer-Eilfort | – | – | – | – | ||||||||||||

| Dr Elaine Sullivan | – | – | – | – | ||||||||||||

| Camilla Macapili Languille | – | – | – | – | ||||||||||||

Pursuant to Article 19 of the European Market Abuse Regulation (“EU-Marktmissbrauchverordnung”), the above tables and information list the number of Company shares held and rights for such shares granted to each board member as of 30 June 2022 separately for each member of Evotec’s Management Board.

subsequent events after 30 june 2022

After period-end, with an effective date of 1 July 2022, Evotec acquired 100% of the shares in Rigenerand Srl, Medolla, Italy. The company will operate as Evotec (Modena) Srl going forward.

The acquisition expands Evotec’s cell therapy platform EVOcells by adding a dedicated, high-quality cGMP manufacturing site. Furthermore, the acquisition adds a great team of cell therapy cGMP manufacturing experts to Evotec.

The purchase price on the closing date amounted to € 23 m in cash.

| 11 |

|

HALF-YEAR REPORT 2022 |

RISKS AND OPPORTUNITIES MANAGEMENT

The risks and opportunities described in Evotec’s Annual Report 2021 on pages 60 to 73 remain mainly unchanged. At present, no risks have been identified that either individually or in combination could endanger the continued existence of Evotec SE. This interim report contains forward-looking statements concerning Evotec’s business, operations and financial performance and condition, as well as Evotec’s plans, objectives and expectations for Evotec’s business operations and financial performance and condition. Forward-looking statements are based on management’s beliefs and assumptions and on information currently available to management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to a variety of factors. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements. Such risks currently include, among other things, the war in Ukraine, uncertainty around global price and supply for energy, other raw materials and supplies as well as logistics relevant to the business. Additionally, the further course of the COVID-19 pandemic may influence Evotec’s business and operations. Compared with the 2021 Annual Report, the risk assessments relating to energy prices in particular, but also of the likelihood of an energy shortage, have significantly increased. Nevertheless, Evotec has shown remarkable resilience to all challenges so far and has been able to maintain almost full capacity at all times during the pandemic.

General Market and Healthcare environment

Global economic development: Entering a period of higher volatility

In the first half of 2022, the global economy continued to suffer from a series of global challenges. After more than two years of the COVID-19 pandemic, which already affected supply chains across the globe, the Russian Federation's invasion of Ukraine and its global impact on commodity markets, supply chains, inflation, and financial conditions have worsened the slowdown in global growth. Rising prices and volatility in energy markets, with improving activity in energy exporters is more than offset by headwinds in most other economies. Furthermore, agricultural commodity prices have increased significantly, leading to an increasing food insecurity and growing poverty in many emerging and developing economies (“EMDEs”).

In its forecast from June 2022, the World Bank expects the global growth to decline from 5.7% in 2021 to 2.9% in 2022, which is significantly lower than the 4.1% that was still anticipated in January. It is expected to settle around this level in 2023 and 2024; the per capita income in developing economies this year will be nearly 5% below the pre-pandemic trend.

As Russia’s attack on Ukraine coupled with sharply rising energy prices is curbing economic recovery in Germany, the ifo Institute has reduced its forecast for economic growth for Germany this year to 2.5%, down from the 3.1% estimated in March. For 2023, ifo now expects an acceleration to 3.7%. In 2022 the inflation rate is expected to reach 6.8%, its highest level since 1974. Consumer prices are also expected to rise at an above-average rate of 3.3 percent in 2023.

Trends in the pharmaceutical and biotechnology sector

There were no material changes to the overall trends in the pharmaceutical and biotechnology sector described in Evotec’s Annual Report 2021 on pages 35 to 39. Please see Evotec’s Annual Report 2021 for further information.

| 12 |

|

HALF-YEAR REPORT 2022 |

Financial Outlook

Guidance for full-year 2022 refined

In light of the material appreciation of the US-Dollar versus the Euro in the first half of 2022, Evotec raises its revenue outlook. Revenues are now expected to grow in the range of € 715-735 m (previously € 700–720 m). Revenue guidance adjusted for fx-effects remains unchanged at € 690-710 m. This assumption is based on current orders in hand, a strong base business compensating for slower revenues ramp up related to biologics manufacturing, foreseeable new contracts and the extension of contracts collaborations as well as prospective milestone payments.

Positive fx-effects mitigate unfavourable macro-economic developments such as significantly higher energy prices and inflation of e.g. material and logistics costs. Nevertheless, Evotec vigorously continues to increase expenses for promising R&D projects, the adoption of organisation structures to ensure sustainable growth and the ramp-up of the Just – Evotec Biologics business by further expanding its J.POD® capacities in the US and the construction of a second J.POD® in Europe (Toulouse, France).

In a highly volatile environment, Evotec keeps its outlook for adjusted EBITDA 2022 unchanged at a range of € 105-120 m. The outlook at constant fx-rates is adjusted to a range of € 85-100 m versus € 95-110 m, previously.

The outlook for unpartnered R&D expenses remains unchanged: Evotec’s activities are all related to R&D. Aside from the partnered and funded R&D, Evotec will continue to strongly invest in its own unpartnered R&D to further expand its long-term and sustainable pipeline of first-in-class projects and platforms. Evotec expects unpartnered R&D investments unchanged in this area between € 70 and 80 m in 2022.

| Guidance 2022 | Guidance 20221) at constant fx |

Actual

31 December 2021 | ||||

| Group

revenues (old) |

€ 715 - 735 m € 700 - 720 m |

€ 690 - 710 m | € 618 m | |||

| Unpartnered R&D expenses | € 70 - 80 m | - | € 58 m | |||

| Adjusted Group EBITDA2) (old) |

€ 105 - 120 m | € 85 - 100 m € 95 - 110 m |

€ 107 m |

1) 2021: USD/€ 1.18; €/GBP 0.86

2) EBITDA is defined as earnings before interest, taxes, depreciation and amortisation of intangibles. Adjusted EBITDA excludes changes of contingent considerations, income from bargain purchase and impairments on goodwill, other intangible and tangible assets as well as the total non-operating result

Unchanged mid-term targets

Evotec’s Management targets revenues growing to more than € 1,000 m and adjusted EBITDA reaching at least € 300 m by 2025. Furthermore, Evotec underlines once more its commitment to innovation and thus plans to increase investments in R&D to more than € 100 m by 2025.

| 13 |

|

HALF-YEAR REPORT 2022 |

FORWARD-LOOKING STATEMENTS

This half-year interim report contains forward-looking statements concerning future events. Words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “should,” “target,” “would” and variations of such words and similar expressions are intended to identify forward-looking statements. Such statements include comments regarding Evotec’s expectations for revenues, Adjusted Group EBITDA and unpartnered R&D expenses, as well as the anticipated impact from the Russian invasion of Ukraine. These forward-looking statements are based on the information available to, and the expectations and assumptions deemed reasonable by Evotec at the time these statements were made. No assurance can be given that such expectations will prove to have been correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates, which are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of Evotec. Factors that could cause actual results to differ are discussed under the heading "Risk Factors" in our Annual Report for the year ended December 31, 2021. Evotec expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Evotec’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

NON-IFRS METRICS

This interim report includes certain financial measures and metrics not based on IFRS, including Adjusted Group EBITDA. We define Adjusted EBITDA as net income (loss) adjusted for interest, taxes, depreciation and amortization of intangibles, impairments on goodwill and other intangible and tangible assets, total non-operating results and change in contingent consideration (earn-out).

Adjusted EBITDA should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with IFRS. Adjusted EBITDA is a non-IFRS measures presented as a supplemental measure of our performance. Adjusted EBITDA should not be considered as an alternative to net income as a measure of financial performance. Adjusted EBITDA is presented because it is a key metric used by our Management Board to assess our financial performance. Management believes Adjusted EBITDA is an appropriate measure of operating performance because it eliminates the impact of expenses that do not relate directly to the performance of the underlying business. Our definition of this non-IFRS financial measure may not be comparable to similarly titled measures of other companies, thereby, reducing the usefulness of our Adjusted EBITDA as a tool for comparison.

| 14 |

|

HALF-YEAR REPORT 2022 |

The following table shows the reconciliation of net income to Adjusted EBITDA

In T€ | Evotec

Group 6M 2022 | Evotec

Group 6M 2021 | ||||||

| Net income | (101.179 | ) | 112,717 | |||||

| Interest expense (net) | 5,796 | ) | 3,260 | |||||

| Tax expense | 8,110 | 1,708 | ||||||

| Depreciation of tangible assets | 32.833 | 22,651 | ||||||

| Amortization of intangible assets | 4.885 | 6,428 | ||||||

| EBITDA | (49,555 | ) | 146,764 | |||||

| Impairment of intangible assets | - | 683 | ||||||

| Impairment of goodwill | - | - | ||||||

| Measurement gains from investments | 97,718 | (116,148 | ) | |||||

| Share of loss of associates accounted for using the equity method | 7,628 | 9,818 | ||||||

| Impairment of financial assets | - | - | ||||||

| Other income from financial assets, net | - | 11 | ||||||

| Foreign currency exchange (loss) gain, net | (21,456 | ) | (3,089 | ) | ||||

| Other non-operating income, net | 76 | 60 | ||||||

| Change in contingent consideration (earn-out) | (775 | ) | (1,889 | ) | ||||

| Adjusted EBITDA | 33,636 | 36,188 | ||||||

| 15 |

|

HALF-YEAR REPORT 2022 |

The Evotec share

Performance of the Evotec share over the past six months

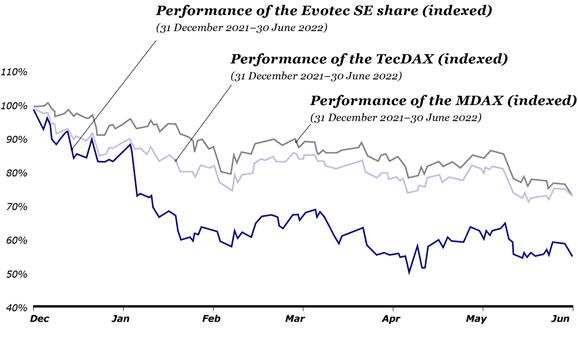

Supply chain issues and rising energy costs as a result of the Russian invasion into the Ukraine caused a macroeconomic slowdown from January to June 2022, leading to broad-based weakness in equity markets. The development was enforced by rising inflation concerns triggering actions of central banks in the U.S., UK, Australia and the European Union to increase benchmark interest rates.

Capital markets were negatively affected by the factors mentioned above and so was the Evotec share price. An additional fundamental catalyst on top of the overall downward trend in capital markets was the announcement of Bayer to discontinue the clinical development candidate eliapixant. The price of Evotec shares fell by 16 percentage points after our ad-hoc release related to the termination of clinical trials on 3 February 2022. While the relative performance prior and after the event was comparable to the broader market, Evotec shares underperformed its leading indices TecDAX and MDAX visibly during the first six months of 2022. Evotec shares, TecDAX and MDAX returned (46)%, (26)% and (26)% respectively.

| 16 |

|

HALF-YEAR REPORT 2022 |

Performance of Evotec’s ADRs at NASDAQ

Concerns about a possible recession as inflation remains around multi-decade high also weighed on the U.S. stocks. Markets thus finished one of the worst halves in decades. The NASDAQ Biotechnology index closed about 21% lower after six months versus 31 December 2021. The NASDAQ Composite Index saw major losses of around 30%, in the reporting period. Evotec’s ADRs even were about 50% lower not only as a consequence of the general sell-off in biotech but also due to the aforementioned decision of Bayer to discontinue the development of the investigational P2X3 receptor antagonist eliapixant.

| 17 |

|

HALF-YEAR REPORT 2022 |

II. UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Evotec SE and Subsidiaries

Consolidated interim statement of financial position as of 30 June 2022

| in k€ except share data | Note reference | as

of 30 June 2022 | as

of 31 December 2021 | |||||||||

| ASSETS | ||||||||||||

| Current assets: | ||||||||||||

| — Cash and cash equivalents | 696,992 | 699,326 | ||||||||||

| — Investments | 190,887 | 158,908 | ||||||||||

| — Trade accounts receivables | 105,272 | 132,078 | ||||||||||

| — Accounts receivables from associated companies and other long-term investments | 4,443 | 2,643 | ||||||||||

| — Inventories | 9 | 28,995 | 25,793 | |||||||||

| — Current tax receivables | 10 | 18,705 | 23,419 | |||||||||

| — Contract assets | 11 | 21,416 | 18,614 | |||||||||

| — Other current financial assets | 3,017 | 264 | ||||||||||

| — Prepaid expenses and other current assets | 12 | 74,738 | 39,895 | |||||||||

| Total current assets | 1,144,465 | 1,100,940 | ||||||||||

| Non-current assets: | ||||||||||||

| — Long-term investments | 13 | 199,545 | 268,793 | |||||||||

| — Long-term investments accounted for using the equity method | 13 | 12,503 | 13,068 | |||||||||

| — Property, plant and equipment | 14 | 559,531 | 484,597 | |||||||||

| — Intangible assets, excluding goodwill | 15 | 26,985 | 30,851 | |||||||||

| — Goodwill | 259,003 | 257,569 | ||||||||||

| — Deferred tax asset | 18,496 | 17,359 | ||||||||||

| — Non-current tax receivables | 10 | 67,225 | 55,966 | |||||||||

| — Other non-current financial assets | 5,111 | 5,148 | ||||||||||

| — Other non-current assets | 851 | 870 | ||||||||||

| Total non-current assets | 1,149,250 | 1,134,221 | ||||||||||

| Total assets | 2,293,715 | 2,235,161 | ||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||||

| Current liabilities: | ||||||||||||

| — Current loan liabilities | 16 | - | 36,136 | |||||||||

| — Current portion of lease obligations | 17 | 14,382 | 14,473 | |||||||||

| — Trade accounts payable | 80,893 | 72,598 | ||||||||||

| — Provisions | 18 | 31,425 | 39,260 | |||||||||

| — Contract liabilities | 21 | 133,968 | 112,061 | |||||||||

| — Deferred income | 19 | 16,155 | 14,718 | |||||||||

| — Current income tax payables | 8,645 | 10,596 | ||||||||||

| — Other current financial liabilities | 23,225 | 12,115 | ||||||||||

| — Other current liabilities | 20 | 11,863 | 12,559 | |||||||||

| Total current liabilities | 320,556 | 324,516 | ||||||||||

| Non-current liabilities: | ||||||||||||

| — Non-current loan liabilities | 16 | 325,888 | 326,344 | |||||||||

| — Long-term lease obligations | 17 | 142,858 | 135,964 | |||||||||

| — Deferred tax liabilities | 17,423 | 17,688 | ||||||||||

| — Provisions | 18,122 | 18,021 | ||||||||||

| — Contract liabilities | 21 | 192,863 | 33,476 | |||||||||

| — Deferred income | - | 1,000 | ||||||||||

| — Other non-current financial liabilities | 466 | 467 | ||||||||||

| Total non-current liabilities | 697,620 | 532,960 | ||||||||||

| Stockholders’ equity: | ||||||||||||

| —Share capital1) | 22 | 176,953 | 176,608 | |||||||||

| — Additional paid-in capital | 1,435,301 | 1,430,136 | ||||||||||

| — Accumulated other comprehensive income | (19,359 | ) | (12.638 | ) | ||||||||

| — Accumulated deficit | (317,356 | ) | (216,421 | ) | ||||||||

| Equity attributable to shareholders of Evotec SE | 1,275,539 | 1,377,685 | ||||||||||

| — Non-controlling interest | - | - | ||||||||||

| Total stockholders’ equity | 1,275,539 | 1,377,685 | ||||||||||

| Total liabilities and stockholders’ equity | 2,293,715 | 2,235,161 | ||||||||||

1) 176,952,653 and 176,608,195 shares issued and outstanding in 2022 and 2021, respectively

| 18 |

|

HALF-YEAR REPORT 2022 |

Evotec SE and Subsidiaries

Consolidated interim income statement for the six months ended 30 June 2022 and 30 June 2021

| in k€ except share and per share data | Note reference | Six months ended 30 June 2022 | Six months ended 30 June 2021 | Three months ended 30 June 2022 | Three months ended 30 June 2021 | |||||||||||||||

| Revenues | 8 | 336,875 | 271,302 | 172,203 | 138,217 | |||||||||||||||

| Costs of revenue | (273,686 | ) | (215,000 | ) | (141,308 | ) | (112,594 | ) | ||||||||||||

| Gross profit | 63,189 | 56,302 | 30,895 | 25,623 | ||||||||||||||||

| Operating income (expenses) | ||||||||||||||||||||

| — Research and development expenses | (36,838 | ) | (35,434 | ) | (18,725 | ) | (16,974 | ) | ||||||||||||

| — Selling, general and administrative expenses | (67,396 | ) | (46,383 | ) | (35,830 | ) | (25,189 | ) | ||||||||||||

| — Impairment of intangible assets | - | (683 | ) | - | (683 | ) | ||||||||||||||

| — Other operating income | 38,858 | 36,179 | 20,357 | 19,860 | ||||||||||||||||

| — Other operating expenses | (1,120 | ) | (1,666 | ) | (467 | ) | (1,100 | ) | ||||||||||||

| Total operating income (expenses) | (66,496 | ) | (47,987 | ) | (34,665 | ) | (24,086 | ) | ||||||||||||

| Net operating income (loss) | (3,307 | ) | 8,315 | (3,770 | ) | 1,537 | ||||||||||||||

| Non-operating income (expense) | ||||||||||||||||||||

| — Interest income | 2,021 | 1,041 | 1,232 | 539 | ||||||||||||||||

| — Interest expense | (7,817 | ) | (4,301 | ) | (3,667 | ) | (1,987 | ) | ||||||||||||

| — Measurement result from investments | 13 | (97,718 | ) | 116,148 | (34,914 | ) | 65,705 | |||||||||||||

| — Share of the result of associates accounted for using the equity method | 13 | (7,628 | ) | (9,818 | ) | (3,528 | ) | (3,903 | ) | |||||||||||

| — Other income from financial assets | - | 11 | - | 11 | ||||||||||||||||

| — Foreign currency exchange gain (loss), net | 21,456 | 3,089 | 20,746 | (1,887 | ) | |||||||||||||||

| — Other non-operating income | 7 | 20 | (352 | ) | 10 | |||||||||||||||

| — Other non-operating expense | (83 | ) | (80 | ) | (83 | ) | (40 | ) | ||||||||||||

| Total non-operating income (expense) | (89,762 | ) | 106,110 | (20,566 | ) | 58,448 | ||||||||||||||

| Income (loss) before taxes | (93,069 | ) | 114,425 | (24,336 | ) | 59,985 | ||||||||||||||

| — Current tax income (expense) | (6,792 | ) | (3,432 | ) | (2,985 | ) | (1,039 | ) | ||||||||||||

| — Deferred tax income (expense) | (1,318 | ) | 1,724 | (616 | ) | 1,069 | ||||||||||||||

| Total taxes | (8,110 | ) | (1,708 | ) | (3,601 | ) | 30 | |||||||||||||

| Net income (loss) | (101,179 | ) | 112,717 | (27,937 | ) | 60,015 | ||||||||||||||

| thereof attributable to: | ||||||||||||||||||||

| — Shareholders of Evotec SE | (101,179 | ) | 112,717 | (27,937 | ) | 60,015 | ||||||||||||||

| Weighted average shares outstanding | 176,702,653 | 164,209,236 | 176,702,653 | 164,330,394 | ||||||||||||||||

| Net income per share (basic) | (0,57 | ) | 0,69 | (0,16 | ) | 0.37 | ||||||||||||||

| Net income per share (diluted) | (0,57 | ) | 0,69 | (0,16 | ) | 0.37 | ||||||||||||||

| 19 |

|

HALF-YEAR REPORT 2022 |

Evotec SE and Subsidiaries

Consolidated interim statement of comprehensive income (loss) for the six months ended 30 June 2022 and 30 June 2021

| in k€ | Six months ended 30 June 2022 | Six months ended 30 June 2021 | Three months ended 30 June 2022 | Three months ended 30 June 2021 | ||||||||||||

| Net income (loss) | (101,179 | ) | 112,717 | (27,937 | ) | 60,015 | ||||||||||

| Accumulated other comprehensive income | ||||||||||||||||

| Items which are not re-classified to the income statement | ||||||||||||||||

| — Remeasurement of defined benefit obligation | - | 495 | - | 495 | ||||||||||||

| — Revaluation of investments | (4,112 | ) | - | (4,112 | ) | - | ||||||||||

| Items which may have to be re-classified to the income statement at a later date | ||||||||||||||||

| — Foreign currency translation | 10,364 | 12,449 | 7,244 | (3,035 | ) | |||||||||||

| — Revaluation and disposal of investments | (12,973 | ) | (435 | ) | (12,579 | ) | (78 | ) | ||||||||

| Other comprehensive income (loss) | (6,721 | ) | 12,509 | (9,447 | ) | (2,618 | ) | |||||||||

| Total comprehensive income (loss) | (107,900 | ) | 125,226 | (37,384 | ) | 57,397 | ||||||||||

| Total comprehensive income (loss) attributable to: | ||||||||||||||||

| — Shareholders of Evotec SE | (107,900 | ) | 125,226 | (37,384 | ) | 57,397 |

| 20 |

|

HALF-YEAR REPORT 2022 |

Evotec SE and Subsidiaries

Condensed consolidated interim statement of cash flows for the six months ended 30 June 2022 and 30 June 2021

| in k€ | Note reference | Six months ended 30 June 2022 | Six months ended 30 June 2021 | |||||||||

| Cash flow from operating activities: | ||||||||||||

| — Net income (loss) | (101,179 | ) | 112,717 | |||||||||

| — Adjustments to reconcile net income to net cash provided by operating activities | 163,178 | (72,100 | ) | |||||||||

| — Change in assets and liabilities | 178,608 | 488 | ||||||||||

| Net cash provided by operating activities | 240,607 | 41,105 | ||||||||||

| Cash flow from investing activities: | ||||||||||||

| — Purchase of current investments | (161,289 | ) | (19,993 | ) | ||||||||

| — Purchase of investments in affiliates, associated companies and other long-term investments | 13 | (59,413 | ) | (13,595 | ) | |||||||

| — Purchase of property, plant and equipment | (81,371 | ) | (72,573 | ) | ||||||||

| — Issue of convertible loans | (2,053 | ) | (2,959 | ) | ||||||||

| — Proceeds from sale of current investments | 97,270 | 12,663 | ||||||||||

| Net cash used in investing activities | (206,857 | ) | (96,457 | ) | ||||||||

| Cash flow from financing activities: | ||||||||||||

| — Proceeds from capital increase | 355 | - | ||||||||||

| — Proceeds from option exercise | 345 | 693 | ||||||||||

| — Proceeds from loans | - | 22,141 | ||||||||||

| — Repayment lease obligation | (10,967 | ) | (9,897 | ) | ||||||||

| — Repayment of loans | (35,538 | ) | (480 | ) | ||||||||

| Net cash provided by (used in) financing activities | (45,805 | ) | 12,457 | |||||||||

| Net increase in cash and cash equivalents | (12,055 | ) | (42,895 | ) | ||||||||

| — Exchange rate difference | 9,721 | 2,626 | ||||||||||

| — Cash and cash equivalents at beginning of period | 699,326 | 422,580 | ||||||||||

| Cash and cash equivalents at end of the period | 696,992 | 382,311 | ||||||||||

| 21 |

|

HALF-YEAR REPORT 2022 |

Evotec SE and Subsidiaries

Interim consolidated statement of changes in stockholders’ equity of the six months ended 30 June 2022 and 30 June 2021

| Share capital | Income and expense recognised in other comprehensive income | |||||||||||||||||||||||||||||||

| in k€ except share data | Shares | Amount | Additional paid-in capital | Foreign currency translation | Re- valuation reserve | Accumu- lated deficit | Stockholders’ equity attributable to the Share- holders of Evotec SE | Total stock- holders’ equity | ||||||||||||||||||||||||

| Balance at 1 January 2021 | 163,914,741 | 163,915 | 1,030,702 | (41,782 | ) | 4,260 | (434,249 | ) | 722,846 | 722,846 | ||||||||||||||||||||||

| — Exercised stock options | 693,495 | 693 | - | - | - | - | 693 | 693 | ||||||||||||||||||||||||

| — Stock option plan | - | - | 2,968 | - | - | - | 2,968 | 2,968 | ||||||||||||||||||||||||

| — Deferred and current tax on future deductible expenses | - | - | - | - | - | 841 | 841 | 841 | ||||||||||||||||||||||||

| Other comprehensive income | - | - | - | 12,449 | 60 | - | 12,509 | 12,509 | ||||||||||||||||||||||||

| Net income (loss) for the period | - | - | - | - | - | 112,717 | 112,717 | 112,717 | ||||||||||||||||||||||||

| Total comprehensive income (loss) | - | - | - | 12,449 | 60 | 112,717 | 125,226 | 125,226 | ||||||||||||||||||||||||

| Balance at 30 June 2021 | 164,608,236 | 164,608 | 1,033,670 | (29,333 | ) | 4,320 | (320,691 | ) | 852,574 | 852,574 | ||||||||||||||||||||||

| Balance at 1 January 2022 | 176,608,195 | 176,608 | 1,430,136 | (15,691 | ) | 3,053 | (216,421 | ) | 1,377,685 | 1,377,685 | ||||||||||||||||||||||

| — Exercised stock options | 344,458 | 345 | - | - | - | - | 345 | 345 | ||||||||||||||||||||||||

| — Stock option plan | - | - | 4,810 | - | - | - | 4,810 | 4,810 | ||||||||||||||||||||||||

| — Transaction costs | - | - | 355 | - | - | - | 355 | 355 | ||||||||||||||||||||||||

| — Deferred and current tax on future deductible expenses | - | - | - | - | - | 244 | 244 | 244 | ||||||||||||||||||||||||

| Other comprehensive income | - | - | - | 10,364 | (17,085 | ) | - | (6,721 | ) | (6,721 | ) | |||||||||||||||||||||

| Net income (loss) for the period | - | - | - | - | - | (101,179 | ) | (101,179 | ) | (101,179 | ) | |||||||||||||||||||||

| Total comprehensive income (loss) | - | - | - | 10,364 | (17,085 | ) | (100,935 | ) | (102,146 | ) | (107,900 | ) | ||||||||||||||||||||

| Balance at 30 June 2022 | 176,952,653 | 176,953 | 1,435,301 | (5,327 | ) | (14,032 | ) | (317,356 | ) | 1,275,539 | 1,275,539 | |||||||||||||||||||||

| 22 |

|

HALF-YEAR REPORT 2022 |

Notes to the unaudited Interim condensed consolidated financial statements

1. Basis of presentation

The accompanying unaudited interim condensed consolidated financial statements of Evotec have been prepared in accordance with IAS 34 on interim reporting in conjunction with International Financial Reporting Standards (IFRS) and their interpretations as issued by the International Accounting Standards Board (IASB), as adopted by the European Union (EU) and additionally as issued by the IASB. The interim consolidated financial statements have been prepared on cost basis, except for derivative financial instruments, which are measured at fair value as well as investments accounted for at fair value through other comprehensive income and long-term investments accounted for at fair value through profit and loss or through other comprehensive income. The accounting policies used to prepare interim information are the same as those used to prepare the audited consolidated financial statements for the year ended 31 December 2021. Income tax income and expenses are recognised in interim periods based on the best estimate of the weighted average annual income tax rate expected for the full financial year.

The interim consolidated financial statements do not include all of the information and footnotes required under IFRS for complete financial statements according to IAS 1. As a result, these interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto for the year ended 31 December 2021. In the opinion of the management, all adjustments, consisting of normal recurring adjustments, are necessary for a fair presentation have been included.

2. Impact of the COVID-19-pandemic and of the Russian invasion of Ukraine

The global COVID-19 pandemic only slightly impacted the business of Evotec so far. COVID-19-related delays of project execution within EVT Innovate still lead to lower milestone revenues. Additionally, Evotec as a precaution increased its inventory level to be prepared for any delivery delays.

In the wake of the Russian invasion of Ukraine, rising energy prices are affecting Evotec. The likely development of this cost increase is reflected in our guidance, and we are actively implementing measures to save energy in order to reduce the impact.

Evotec does not entertain any direct business relations with Russian companies and is therefore not directly affected on the revenue side.

3. Principles of consolidation

Aptuit (Switzerland) AG, Basel, Switzerland, was voluntarily liquidated as planned in the first half of the year, besides that no further changes in the consolidation scope took place.

4. Use of estimates

In the interim condensed consolidated financial statements for the six months ended 30 June 2022, the Company has used the same estimation processes as those used to prepare the audited consolidated financial statements for the year ended 31 December 2021.

Estimates and assumptions are reviewed on an ongoing basis. Actual results can differ from these estimates.

| 23 |

|

HALF-YEAR REPORT 2022 |

5. Recent pronouncements, adopted for the first time in 2022

The accounting policies adopted in the preparation of the interim condensed consolidated financial statements are consistent with those followed in the preparation of the Company’s annual consolidated financial statements for the year ended 31 December 2021.

6. Recent pronouncements, not yet adopted

For information about the recent pronouncements please refer to the consolidated financial statements for the year 2021.

7. Segment information

EVT Execute and EVT Innovate have been identified by the Management Board as operating segments. The segments’ key performance indicators are used monthly by the Management Board to evaluate the resource allocation as well as Evotec’s performance. Intersegment revenues are valued with a price comparable to other third-party revenues. The evaluation of each operating segment by the management is performed on the basis of revenues and adjusted EBITDA. For the EVT Innovate segment, R&D expenses are another key performance indicator.

The segment information for the first six months of 2022 is as follows:

| in k€ | EVT

Execute | EVT Innovate | Intersegment eliminations | Evotec

Group | ||||||||||||

| Revenues | 258,847 | 78,028 | – | 336,875 | ||||||||||||

| Intersegment revenues | 92,142 | – | (92,142 | ) | – | |||||||||||

| Costs of revenue | (289,752 | ) | (68,234 | ) | 84,391 | (273,685 | ) | |||||||||

| Gross profit | 61,237 | 9,704 | (7,751 | ) | 63,190 | |||||||||||

| Operating income (expenses) | ||||||||||||||||

| — Research and development expenses | (2,561 | ) | (42,028 | ) | 7,751 | (36,838 | ) | |||||||||

| — Selling, general and administrative expenses | (54,139 | ) | (13,258 | ) | – | (67,397 | ) | |||||||||

| — Other operating income | 16,659 | 22,199 | – | 38,858 | ||||||||||||

| — Other operating expenses | (1,086 | ) | (34 | ) | – | (1,120 | ) | |||||||||

| Total operating income (expenses) | (41,127 | ) | (33,121 | ) | 7,751 | (66,497 | ) | |||||||||

| Net operating income (loss) | 20,110 | (23,417 | ) | – | (3,307 | ) | ||||||||||

| — Interest result | – | – | – | (5,796 | ) | |||||||||||

| — Measurement result from investments | – | – | – | (97,718 | ) | |||||||||||

| — Share of the loss of associates accounted for using the equity method | – | – | – | (7,628 | ) | |||||||||||

| — Other income (expense) from financial assets, net | – | – | – | - | ||||||||||||

| — Foreign currency exchange gain (loss), net | – | – | – | 21,456 | ||||||||||||

| — Other non-operating income (expense), net | – | – | – | (76 | ) | |||||||||||

| Income before taxes | – | – | – | (93,069 | ) | |||||||||||

| EBITDA Adjusted | 54,689 | (21,053 | ) | – | 33,636 |

| 24 |

|

HALF-YEAR REPORT 2022 |

The EBITDA adjusted for the first six months 2022 is derived from net operating income (loss) as follows:

| in k€ | EVT Execute | EVT Innovate | Evotec Group | |||||||||

| Net operating income (loss) | 20,110 | (23,417 | ) | (3,307 | ) | |||||||

| plus depreciation of tangible assets | 30,554 | 2,279 | 32,833 | |||||||||

| plus amortisation of intangible assets | 4,800 | 85 | 4,885 | |||||||||

| less change in contingent consideration (earn-out) | 775 | - | 775 | |||||||||

| EBITDA Adjusted | 54,689 | (21,053 | ) | 33,636 | ||||||||

The restated segment information for the first six months of 2021 is as follows:

| in k€ | EVT Execute | EVT Innovate | Intersegment eliminations | Evotec Group | ||||||||||||

| Revenues | 213,998 | 57,304 | – | 271,302 | ||||||||||||

| Intersegment revenues | 65,543 | – | (65,543 | ) | – | |||||||||||

| Costs of revenue | (226,540 | ) | (47,965 | ) | 59,505 | (215,000 | ) | |||||||||

| Gross profit | 53,001 | 9,339 | (6,038 | ) | 56,302 | |||||||||||

| Operating income (expenses) | ||||||||||||||||

| — Research and development expenses | (986 | ) | (40,486 | ) | 6,038 | (35,434 | ) | |||||||||

| — Selling, general and administrative expenses | (37,171 | ) | (9,212 | ) | – | (46,383 | ) | |||||||||

| — Impairment of intangible assets | – | (683 | ) | – | (683 | ) | ||||||||||

| — Other operating income | 12,928 | 23,251 | – | 36,179 | ||||||||||||

| — Other operating expenses | (1,561 | ) | (105 | ) | – | (1,666 | ) | |||||||||

| Total operating income (expenses) | (26,790 | ) | (27,235 | ) | 6,038 | (47,987 | ) | |||||||||

| Net operating income (loss) | 26,211 | (17,896 | ) | – | 8,315 | |||||||||||

| — Interest result | – | – | – | (3,260 | ) | |||||||||||

| — Measurement result from investments | – | – | – | 116.148 | ||||||||||||

| — Share of the loss of associates accounted for using the equity method | – | – | – | (9,818 | ) | |||||||||||

| — Other income (expense) from financial assets, net | – | – | – | 11 | ||||||||||||

| — Foreign currency exchange gain (loss), net | – | – | – | 3,089 | ||||||||||||

| — Other non-operating income (expense), net | – | – | – | (60 | ) | |||||||||||

| Income before taxes | – | – | – | 114,425 | ||||||||||||

| EBITDA Adjusted | 51,886 | (15,698 | ) | – | 36,188 |

| 25 |

|

HALF-YEAR REPORT 2022 |

The EBITDA adjusted for the first six months of 2021 is derived from operating income (expense) as follows:

| in k€ | EVT Execute | EVT Innovate | Evotec Group | |||||||||

| Net operating income (loss) | 26,211 | (17,896 | ) | 8,315 | ||||||||

| plus depreciation of tangible assets | 21,028 | 1,623 | 22,651 | |||||||||

| plus amortisation of intangible assets | 6,387 | 41 | 6,428 | |||||||||

| plus impairment of intangible assets | - | 683 | 683 | |||||||||

| plus change in contingent consideration (earn-out) | (1,740 | ) | (149 | ) | (1,889 | ) | ||||||

| EBITDA Adjusted | 51,886 | (15,698 | ) | 36,188 |

8. Revenues

The following schedule shows a breakdown of the revenue Evotec recognised from contracts with customers for the first six months of 2022:

| in k€ | EVT Execute | EVT Innovate | Evotec Group | ||||||

| Revenues | |||||||||

| Service fees and FTE-based research payments | 236,717 | 74,799 | 311,516 | ||||||

| Recharges | 18,136 | 2,491 | 20,627 | ||||||

| Compound access fees | 230 | 444 | 674 | ||||||

| Milestone fees | 3,764 | - | 3,764 | ||||||

| Licence | - | 294 | 294 | ||||||

| Total | 258,847 | 78,028 | 336,875 | ||||||

| Timing of revenue recognition | |||||||||

| At a certain time | 21,900 | 2,491 | 24,391 | ||||||

| Over a period of time | 236,947 | 75,537 | 312,484 | ||||||

| Total | 258,847 | 78,028 | 336,875 | ||||||

| Revenues by region | |||||||||

| USA | 130,561 | 51,490 | 182,051 | ||||||

| Germany | 16,946 | 12,372 | 29,318 | ||||||

| France | 6,802 | 6,024 | 12,826 | ||||||

| United Kingdom | 57,420 | 4,278 | 61,698 | ||||||

| Others | 47,118 | 3,864 | 50,982 | ||||||

| Total | 258,847 | 78,028 | 336,875 |

Included in the revenues are revenues from contribution in the amount of k€ 5,269 (H1 2021: k€ 2,194).

| 26 |

|

HALF-YEAR REPORT 2022 |

The following schedule shows a breakdown of the revenue Evotec recognised from contracts with customers for the first six months of 2021:

| in k€ | EVT Execute | EVT Innovate | Evotec Group | ||||||

| Revenues | |||||||||

| Service fees and FTE-based research payments | 196,453 | 54,230 | 250,683 | ||||||

| Recharges | 14,790 | 754 | 15,544 | ||||||

| Compound access fees | 978 | – | 978 | ||||||

| Milestone fees | 1,777 | 2,320 | 4,097 | ||||||

| Total | 213,998 | 57,304 | 271,302 | ||||||

| Timing of revenue recognition | |||||||||

| At a point in time | 16,567 | 3,074 | 19,641 | ||||||

| Over time | 197,431 | 54,230 | 251,661 | ||||||

| Total | 213,998 | 57,304 | 271,302 | ||||||

| Revenues by region | |||||||||

| USA | 109,651 | 33,274 | 142,925 | ||||||

| Germany | 7,169 | 11,686 | 18,855 | ||||||

| France | 8,324 | 6,559 | 14,883 | ||||||

| United Kingdom | 44,515 | 2,661 | 47,176 | ||||||

| Others | 44,339 | 3,124 | 47,463 | ||||||

| Total | 213,998 | 57,304 | 271,302 |

9. Inventories

Increase in inventories is mainly driven by stockpiling at Just-Evotec Biologics Inc. in the US. The main materials in inventories are consumables, cell culture medias and purification resins.

10. Current tax receivables

The decrease in current tax receivables as of 30 June 2022 compared to 31 December 2021 is mainly attributable to a decrease in receivables related to a refund of R&D tax credits in France, offset by increased receivables relating to R&D tax credits in Italy.

The increase in non-current tax receivables is mainly due to R&D tax receivables in France.

11. Contract assets

Contract assets entirely consist of assets resulting from customer contracts. The increase of contract assets as of 30 June 2022 compared to 31 December 2021 is primarily due to a strong revenue month of June at Evotec International GmbH.

12. Prepaid expenses and other current assets

Prepaid expenses and other current assets as of 30 June 2022 increased compared to 31 December 2021 primarily due to the payment of € 23 m concerning the acquisition of Rigenerand Srl, with the effective date 1 July 2022 as well as prepayments made in the beginning of the year for the full year, e. g. for licenses and maintenance.

| 27 |

|

HALF-YEAR REPORT 2022 |

13. Investments accounted for using the equity method and other investments

The movement in the period of the long-term investments, both accounted for using the equity method and other investments, consist of the following:

| in k€ | 30 June 2022 | 31 Dec 2021 | ||||||

| Investments accounted for using the equity method | 12,503 | 13,068 | ||||||

| Other investments | 199,545 | 268,793 | ||||||

| 212,048 | 281,861 | |||||||

The development of long-term investments accounted for using the equity method in the first half of 2022 is shown below.

| in k€ | Curexsys GmbH | Breakpoint Therapeutics GmbH | Insignificant

investments |

Total | ||||||||

| Beginning of the period | 4,212 | 2,774 | 6,082 | 13,068 | ||||||||

| Additions | 2,563 | - | 4,622 | 7,185 | ||||||||

| Loss of the period | (1,556 | ) | (1,932 | ) | (4,262 | ) | (7,750 | ) | ||||

| End of the period 30 June 2022 | 5,219 | 842 | 6,442 | 12,503 |

The declining book-value of the long-term investments accounted for using the equity method compared to 31 December 2021 arose from additions of € 7.2 m with a concurrent accumulated loss 0f € 7.8 m in the period.

The additions in the first six months of 2022 relate to further investments in Autobahn Labs LLC, USA, Curexsys GmbH, Germany, Dark Blue Therapeutics LTD, UK, and Ouantro Therapeutics GmbH, Austria.

The development in the first half of 2022 of long-term investments measured at fair value in accordance with IFRS 9 is shown below:

| in k€ | 30 June 2022 | 31 Dec 2021 | ||||

| Beginning of the period | 268,793 | 19.289 | ||||

| Additions from the acquisition of shares | 32,161 | 6,647 | ||||

| Additions due to discontinuation of the use of equity method | - | 19,463 | ||||

| Adjustments at fair value affecting profit and loss | (97,718 | ) | 223,394 | |||

| Adjustments at fair value affecting OCI | (3,691 | ) | - | |||

| End of the period | 199,545 | 268,793 |

| 28 |

|

HALF-YEAR REPORT 2022 |

14. Property, plant and equipment

The increase of € 74.9 m in property, plant and equipment as of 30 June 2022 compared to 31 December 2021 mainly relates to an increase of € 46.8 m in prepayments and construction in progress, in particular related to prepayments for general contractors for the construction of the new J.POD® at Just-Evotec Biologics EU SAS, an increase in laboratory equipment at Evotec (France) SAS as well as a new laboratory at Evotec (UK) Ltd. Further additions of € 16.4 m mainly relate to the construction of the J.POD® production facility leading to an increase in buildings on third party land.

15. Intangible assets, excluding goodwill

The decrease in intangible assets, excluding goodwill of € 3.9 m to € 27.0 m as of 30 June 2022 mainly relates to the amortization of customer lists of € 3.4 m.

16. Current and non-current loan liabilities

The decrease in short- and long-term loan liabilities of € 36.6 m to € 325.9 m mainly relates to the repayment of the 3-year tranche of the promissory note of € 35 m.

17. Current and non-current lease liabilities

Compared to 31 December 2021, short- and long-term lease obligations increased amongst other due to foreign currency translation.

18. Current provisions

The decrease in current provisions as of 30 June 2022 in comparison with 31 December 2021 mainly relates to the payment of 2021 bonuses in the first quarter 2022.

19. Current deferred income

The increase in current deferred income as of 30 June 2022 in comparison with 31 December 2021 mainly relates to additional reimbursements (€ 1.4 m) received by the U.S. Department of Defense in context of the construction of the J.POD® production facility in Redmond, Washington, by the U.S. Department of Defense (“DOD”). The DOD awarded Just –Evotec Biologics an agreement worth $ 28.6 m for the production of monoclonal antibodies for use in the development of a treatment and prophylaxis for COVID-19. Under the agreement, the DOD will have access to future biomanufacturing capacity over a period of seven years in the J.POD® production facility.

20. Other current liabilities

Other current liabilities decreased from € 12.6 m as of 31 December 2021 to € 11.9 m as of 30 June 2022 by € 0.7 m.

21. Non-current contract liabilities

The increase in current and non-current contract liabilities of € 181.3 m to € 326.8 m (31 December 2021: € 145.5 m) mainly relates to the upfront payment in the first half of 2022 from Bristol Myers Squibb.

22. Stock-based compensation

In the first months ended 30 June 2022 139,229 of the 382,784 total granted Share Performance and Restricted Share Awards were given to the members of the Management Board. During the first half of 2022, 344,458 shares were issued through the exercise of Share Performance Awards which increased the stockholder's equity.

| 29 |

|

HALF-YEAR REPORT 2022 |

23. Fair values

The fair values of financial assets and liabilities, together with the carrying amounts shown in the balance sheet as of 30 June 2022 and 31 December 2021 are as follows:

| 30 June 2022 | 31 December 2021 | |||||||||||||||||

| in k€ | Classification according to IFRS 9 | Carrying amount | Fair value | Carrying amount | Fair value | |||||||||||||

| — Cash and cash equivalents | Amortised cost | 696,992 | 696,992 | 699,326 | 699,326 | |||||||||||||

| — Investments | Fair value through other comprehensive income | 190,887 | 190,887 | 158,908 | 158,908 | |||||||||||||

| — Long-term investments | Fair value through profit and loss | 188.167 | 188,167 | 268,793 | 268,793 | |||||||||||||

| — Long-term investments | Fair value through other comprehensive income | 11,378 | 11,378 | - | - | |||||||||||||

| — Trade accounts receivables | Amortised cost | 105,272 | 105,272 | 132,078 | 132,078 | |||||||||||||

| — Contract assets | Amortised cost | 21,416 | 21,416 | 18,614 | 18,614 | |||||||||||||

| — Other current financial assets | Amortised cost | 3,017 | 3,017 | 264 | 264 | |||||||||||||

| — Other non-current financial assets | Amortised cost | 5,111 | 5,111 | 5,148 | 5,148 | |||||||||||||

| — Current loan liabilities | Amortised cost | - | - | (36,136 | ) | (36,136 | ) | |||||||||||

| — Non-current loan liabilities | Amortised cost | (325,888 | ) | (327,727 | ) | (326,344 | ) | (336,412 | ) | |||||||||

| — Current portion of lease obligation | Amortised cost | (14,382 | ) | (14,382 | ) | (14,473 | ) | (14,473 | ) | |||||||||

| — Long-term of lease obligation | Amortised cost | (142,858 | ) | (142,858 | ) | (135,964 | ) | (135,964 | ) | |||||||||

| — Trade accounts payable | Amortised cost | (80,893 | ) | (80,893 | ) | (72,598 | ) | (72,598 | ) | |||||||||

| — Current contract liabilities | Amortised cost | (133,968 | ) | (133,968 | ) | (112,061 | ) | (112,061 | ) | |||||||||

| — Non-current contract liabilities | Amortised cost | (192,863 | ) | (192,863 | ) | (33,476 | ) | (33,476 | ) | |||||||||

| — Other current financial liabilities | Amortised cost | (1,744 | ) | (1,744 | ) | (3,550 | ) | (3,550 | ) | |||||||||

| — Other non-current financial liabilities | Amortised cost | (466 | ) | (466 | ) | (467 | ) | (467 | ) | |||||||||

| — Derivative financial instruments | Fair value through profit and loss | (25,905 | ) | (25,905 | ) | (9,344 | ) | (9,344 | ) | |||||||||

| — Contingent consideration | Fair value through profit and loss | (379 | ) | (379 | ) | (1,103 | ) | (1,103 | ) | |||||||||

| 464.681 | 462.841 | 537,615 | 527,547 | |||||||||||||||

| Unrecognised loss | 1,839 | 10,068 | ||||||||||||||||

| 30 |

|

HALF-YEAR REPORT 2022 |

The following tables allocate financial assets and financial liabilities as of 30 June 2022 and 31 December 2021, respectively to the three levels of the fair value hierarchy as defined in IFRS 13:

| 30 June 2022 | ||||||||||||||||

| in k€ | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Assets at fair value through other comprehensive income | 202,265 | – | – | 202,265 | ||||||||||||

| Assets at fair value through profit and loss | 147,149 | – | 41,019 | 188,167 | ||||||||||||

| Liabilities at fair value through other comprehensive income | – | – | – | – | ||||||||||||

| Liabilities at fair value through profit and loss | – | (25,905 | ) | (379 | ) | (26,284 | ) | |||||||||

|

31 December 2021 | ||||||||||||||||

| in k€ | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Assets at fair value through other comprehensive income | 158,908 | – | – | 158,908 | ||||||||||||

| Assets at fair value through profit and loss | 244,866 | – | 23,927 | 268,793 | ||||||||||||

| Liabilities at fair value through other comprehensive income | – | – | – | – | ||||||||||||

| Liabilities at fair value through profit and loss | – | (9,344 | ) | (1,103 | ) | (10,447 | ) | |||||||||

| 31 |

|

HALF-YEAR REPORT 2022 |