Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-54295

INREIT Real Estate Investment Trust

(Exact name of registrant as specified in its charter)

| North Dakota | 90-0115411 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| 1711 Gold Drive South, Suite 100 Fargo, North Dakota |

58103 | |

| (Address of principal executive offices) | (Zip Code) | |

(701) 353-2720

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and formal fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Shares of Beneficial Interest

(Title of Class)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. ¨ Yes x No

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by checkmark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | x | |||

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the common shares of beneficial interest held by non-affiliates as of June 30, 2013 was approximately $63,517,998, computed by reference to the price at which the common shares was last sold as of such date. The common shares of beneficial interest are not listed on any national exchange or over-the-counter market or quoted on any national securities market.

Indicate the number of shares outstanding of each of the issuer’s classes of common shares, as of the latest practicable date.

| Class |

Outstanding at March 24, 2014 | |

| Common Shares of Beneficial Interest, $0.01 par value per share | 5,403,973.0153 |

Documents Incorporated by Reference: Portions of INREIT’s Proxy Statement for its 2014 Annual Meeting of Shareholders, which INREIT intends to file with the Securities and Exchange Commission within 120 days after the end of INREIT’s fiscal year ended December 31, 2013, are incorporated by reference into Part III (Items 10, 11, 12, 13 and 14) of this Annual Report on Form 10-K to the extent described herein. If INREIT does not file its Proxy Statement on or before 120 days after the end of its 2013 fiscal year, INREIT will file the required information in an amendment to this Annual Report on Form 10-K.

Table of Contents

INREIT Real Estate Investment Trust

| PAGE | ||||

| 2 | ||||

| 7 | ||||

| 29 | ||||

| 30 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 39 | ||||

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

39 | |||

| Item 7A. Quantitative and Qualitative Disclosures about Market Data |

52 | |||

| 52 | ||||

| Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

52 | |||

| 52 | ||||

| 53 | ||||

| Item 10. Trustees, Executive Officers and Corporate Governance |

53 | |||

| Item 11. Executive Compensation |

53 | |||

| Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

53 | |||

| Item 13. Certain Relationships and Related Transactions, and Trustee Independence |

53 | |||

| Item 14. Principal Accountant Fees and Services |

53 | |||

| 54 | ||||

| 55 | ||||

| Reports of Independent Registered Public Accounting Firms and Financial Statements |

F-2 | |||

Table of Contents

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements included in this Annual Report on Form 10-K and the documents incorporated into this document by reference contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements include statements regarding our plans and objectives, including, among other things, our future financial condition, anticipated capital expenditures, anticipated dividends and other matters. Forward-looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” or the negative of such terms and other comparable terminology. These statements are only predictions and are not historical facts. Actual events or results may differ materially.

The forward-looking statements included herein are based on our current expectations, plans, estimates and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Any of the assumptions underlying the forward-looking statements contained herein could be inaccurate. Although we believe the expectations reflected in such forward-looking statements are based on reasonable assumptions, we cannot assure readers that the forward-looking statements included in this filing will prove to be accurate. The accompanying information contained in this Annual Report on Form 10-K, including, without limitation, the information set forth under the section entitled “Risk Factors” in Item 1A, identifies important additional factors that could materially adversely affect actual results and performance. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results.

1

Table of Contents

GENERAL

INREIT Real Estate Investment Trust (“we,” “us,” “our,” “Company” or “INREIT”) is a real estate investment trust (“REIT”), formed in North Dakota as an unincorporated business trust on December 3, 2002. References in this Annual Report on Form 10-K to the “Company,” “INREIT,” “we,” “us,” or “our” include consolidated subsidiaries, unless the context indicates otherwise. We were formed for the purpose of investing in a diversified portfolio primarily of commercial properties (such as retail, office and medical) and multi-family dwellings (such as apartment buildings and senior assisted or independent living centers). As a REIT, we are not subject to U.S. federal income taxation as long as we satisfy certain requirements, principally relating to the nature of our income, the level of our dividends and other factors. At December 31, 2013, we owned directly or through our operating partnership, 122 properties in eleven states.

UPREIT Structure

We operate as an Umbrella Partnership Real Estate Investment Trust, which is a REIT that holds all or substantially all of its assets through a partnership which the REIT controls as general partner. Therefore, we conduct substantially all of our investment activities and hold all or substantially all of our assets through our operating partnership INREIT Properties, LLLP. We control the operating partnership as the general partner and own approximately 28.7% of the operating partnership as of December 31, 2013. For purposes of satisfying the asset and income tests for qualification as a REIT for tax purposes, our proportionate shares of the assets and income of our operating partnership are deemed to be our assets and income.

Operating Partnership

Our operating partnership, INREIT Properties, LLLP, was formed as a North Dakota limited liability limited partnership on April 25, 2003 to acquire, own and operate properties on our behalf. The operating partnership holds a diversified portfolio of commercial properties and multi-family dwellings located principally in the upper and central Midwest United States.

Since our formation, our focus has consisted of owning and operating income-producing real estate properties. In 2006, we held 23 total properties approximating $56 million in total assets. Between 2007 and 2013, we focused extensively on strengthening the multifamily component of our portfolio, acquiring properties directly or through UPREIT transactions. A majority of these multifamily properties were located in North Dakota. By the end of 2013, our portfolio has grown to 122 properties, approximating $448.3 million in total assets, which includes assets held for sale, and book equity, including noncontrolling interests, of approximately $197.2 million as of December 31, 2013. As of December 31, 2013, our portfolio contained approximately 5,947 apartment units and 1,404,412 square feet of leasable commercial space.

As of December 31, 2013, approximately 63.1% of the properties were apartment communities located primarily in North Dakota with others located in Minnesota and Nebraska. Most multi-family dwelling properties are leased to a variety of tenants under short-term leases.

As of December 31, 2013, approximately 36.9% of the properties were comprised of office, retail and medical commercial properties located primarily in North Dakota with others located in Arkansas, Colorado, Iowa, Louisiana, Michigan, Mississippi, Minnesota, Nebraska, Texas and Wisconsin. Most commercial properties are leased to a variety of tenants under long-term leases.

2

Table of Contents

OUR PEOPLE

We do not have any employees. Instead, we rely on our external Advisor to conduct our day-to-day affairs.

Our Advisor

Our external Advisor is INREIT Management, LLC, a North Dakota limited liability company formed on November 14, 2002. Our Advisor is responsible for managing our day-to-day affairs and for identifying, acquiring and disposing investments on our behalf. The Advisor is owned in part by Kenneth Regan, a trustee and our Chief Executive Officer, and by an entity controlled by James Wieland, also one of our trustees. In addition, Messrs. Regan and Wieland serve on the Board of Governors of the Advisor. From 2007 to 2013, our Advisor’s staff increased in number and expertise, growing from 4 to 9 full-time employees including a president, chief accounting officer, controller, accountant and finance manager.

Our Board of Trustees and Executive Officers

We operate under the direction of our Board of Trustees, the members of which are accountable to us and our shareholders as fiduciaries. In addition, the Board has a specific fiduciary duty to supervise our relationship with the Advisor, and evaluates the performance of and fees paid to the Advisor on an annual basis prior to renewing the Advisory Agreement with the Advisor. The Advisory Agreement was approved by the Board of Trustees (including all the independent trustees) on March 28, 2013, effective January 1, 2013. Our Board of Trustees has provided investment guidance for the Advisor to follow, and must approve each investment recommended by the Advisor. Currently, we have nine members on our board, seven of whom are independent of our Advisor. Our trustees are elected annually by our shareholders.

Although we have executive officers, we do not have any paid employees. Our President, Chief Executive Officer, Chief Accounting Officer, Treasurer and Secretary are also officers, employees, owners or governors of our Advisor. Among others, such executive officers oversee our Advisor’s day-to-day operations with respect to us. However, when doing so, such executive officers are acting on behalf of our Advisor in performing the Advisor’s obligations under the Advisory Agreement. Generally, the only services performed by our executive officers in their capacity as our executive officers are those required by law or regulation, such as executing documents as required by North Dakota law and providing certifications required by the federal securities laws. The Advisor is paid a management fee, acquisition fee, disposition fee, financing fee, and development fee, as applicable. For additional information regarding these fees see Note 15 to the financial statements.

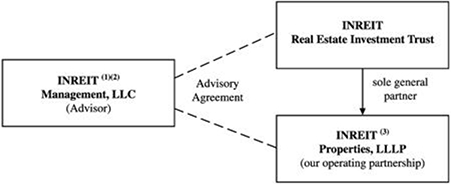

Organizational Structure

The following chart shows our structure:

| (1) | The Advisor is owned in part by our Chief Executive Officer and Trustee Mr. Kenneth P. Regan (33.00%), by Wieland Investments, LLLP, an entity controlled by our Trustee Mr. James S. Wieland (33.00%) and by our President Bradley J. Swenson (5%). In addition, Mr. Regan serves as the Chief Executive Officer and Chairman of the Board of the Advisor, and Messrs. Wieland and Swenson serve on the Board of Governors of the Advisor. |

| (2) | The Advisor serves as both our and our operating partnership’s advisor. The Advisor does not own any of our shares. Messrs. Regan and Wieland beneficially own approximately 2.4% and 1.6%, respectively, of our shares as of December 31, 2013. |

| (3) | We control the operating partnership as the general partner, and own approximately 28.7% of the operating partnership as of December 31, 2013. Mr. Regan and Mr. Wieland beneficially owned and had voting power over approximately 12.5% and 9.8%, respectively, of the operating partnership as of December 31, 2013. |

3

Table of Contents

OUR CORE INVESTMENT OBJECTIVES AND STRATEGY

Investment Objectives

Our primary investment objectives are to:

| • | acquire quality real estate properties or interests in real estate properties that can provide stable cash flow for distribution to our shareholders, preservation of capital and realization of long-term capital appreciation upon the sale of such properties; |

| • | offer an investment option in which the value of the common shares is correlated to real estate as an asset class rather than traditional asset classes such as stocks and bonds; and |

| • | provide a hedge against inflation through use of month-to-month rentals or short-term and long-term lease arrangements with rental properties tenants. |

We may change our investment objectives only with the approval of holders of a majority of the outstanding common shares.

Investment Strategy

Our investment strategy is primarily to acquire and hold a diverse portfolio of:

| • | commercial real estate properties or portfolios or real estate properties in various sectors, including multi-family residential, senior housing, retail, office, medical and other commercial properties, including restaurants, primarily located in the central corridor of the contiguous 48 states; and |

| • | ownership interests in real estate properties in various sectors, including multi-family residential, senior housing, retail, office, medical and other commercial properties located in these markets. |

The majority of our acquisitions are located in or near metropolitan areas. However, there is no limitation on the geographic areas in which we may acquire targeted investments.

We may acquire portfolios of real estate properties held by individual owners and real estate properties held by funds, including hedge funds. We anticipate such property owners will primarily sell the properties in exchange for limited partnership interests of the operating partnership.

We may make investments alone or together with other investors, including with affiliates of the Advisor, through holding company structures or joint ventures, real estate partnerships, tenant-in-common deals, REITs or other collective investment vehicles.

Investment Guidance

Our Board of Trustees has provided investment guidance to the Advisor to direct our investment strategy. Changes to our investment guidance must be approved by our Board. The Advisor has been authorized to execute (1) commercial real estate property acquisitions and dispositions and (2) investments in other real estate related assets, in each case so long as such investments are approved by our Board. Our Board will at all times have ultimate oversight over our investments and may change from time to time the scope of authority delegated to our Advisor with respect to acquisition and disposition transactions.

Currently, our investment guidance is that our real estate investments be allocated approximately as follows:

| • | up to 50% in multi-family and apartment properties; |

| • | up to 20% in commercial office properties; |

| • | up to 10% in retail properties; |

| • | up to 10% in medical properties; |

| • | up to 10% in industrial properties; and |

| • | up to 5% in restaurant properties. |

4

Table of Contents

Despite our intentions, the actual percentage of our portfolio invested in each investment type may fluctuate above or below such levels due to factors such as a large inflow of capital (including from additional capital raises or sales of investments), lack of attractive investment opportunities in an investment type or an increase in anticipated cash requirements (including repayment of outstanding debt obligations or REIT dividend requirements).

Investments in Real Estate Properties

Our investment guidance provides we will primarily invest in existing or newly constructed real estate properties and interests in real estate properties in a multiple of sectors, including multi-family residential and senior housing properties, retail, office, medical, industrial, and restaurant properties by acquiring direct ownership or ownership interests through equity interests or other joint venture structures. We may also invest in other real estate property types, including undeveloped land or other development opportunities if the land is acquired for the purpose of producing rental or other operating income and either development or construction is in process or development or construction is planned to commence on the land within one year. We primarily invest in real estate properties with existing rent and expense schedules or newly constructed properties with predictable cash flows or in which a seller agrees to provide certain minimum income levels. We concentrate our efforts on real estate properties located primarily in North Dakota, the central corridor of the contiguous 48 states and in or near metropolitan areas.

Investments in Real Estate Related Assets

Our guidelines provide we may invest in real estate related assets. These assets include securities of other companies engaged in real estate activities, mortgage-backed securities and conventional mortgage loans. However, to date, our investment in such assets have been nominal. We may increase such investments in the future, but do not anticipate such investment amounts to be material.

Investments in Cash, Cash Equivalents and Other Short-Term Investments

We may invest in cash, cash equivalents and other short-term investments. Consistent with the rules applicable to qualification as a REIT, such investments may include investments in the following: money market instruments; short-term debt instruments, such as commercial paper, certificates of deposit, bankers’ acceptances, repurchase agreements, interest-bearing time deposits and corporate debt securities; corporate asset-backed securities; and U.S. government or government agency securities. However, to date, our investment in such assets have been nominal, and we do not expect to increase such investments in the near future.

SEGMENT DATA

We report our results in two reportable segments: residential and commercial properties. Our residential properties include multi-family and assisted senior living properties. Our commercial properties include retail, office, industrial, restaurant and medical properties. We assess and measure operating results based on net operating income (“NOI”), which we define as total real estate segment revenues less real estate expenses (which consist of real estate taxes, property management fees, utilities, repairs and maintenance, insurance and direct administrative costs). We believe NOI is an important measure of operating performance even though it should not be considered an alternative to net income or cash flow from operating activities. NOI is unaffected by financing, depreciation, amortization, legal and professional fees and other general and administrative expenses.

COMPETITION

Our properties are located in highly competitive real estate markets. The number of competitive properties in a particular area could have a material adverse effect on our ability to lease space and the amount of rent we can charge at our properties. We compete with many property owners, such as corporations, limited partnerships, individual owners, other real estate investment trusts, insurance companies and pension funds.

5

Table of Contents

Our competition also consists of other owners and developers of multifamily and commercial properties who are trying to attract tenants to their properties. We also compete with other real estate investors such as individuals, partnerships, corporations and other REITs to acquire properties that meet our investment objectives. This competition influences our ability to acquire properties and the prices that we may pay for those properties. We do not have a dominant position in any of the markets in which we operate and many of our competitors have greater financial and other resources than us and may have substantially more operating experience than either us or our Advisor. We believe, however, that the diversity of our investments, the experience and abilities of our management, the quality of our assets and the financial strength of many of our commercial tenants affords us some competitive advantages that have in the past, and should in the future, allow us to operate our business successfully despite the competitive nature of our business.

Generally, there are multi-family and other similar commercial properties within relatively close proximity to each of our properties. Regarding our retail properties, in addition to competitor retail properties, we and our tenants face increasing competition from outlet malls, internet shopping websites, discount shopping clubs, catalog companies, direct mail and telemarketing.

ENVIRONMENTAL MATTERS AND GOVERNMENT REGULATION

As an owner of real estate, we are subject to various environmental laws, rules and regulations adopted by various governmental bodies or agencies. These laws and regulations generally govern wastewater discharges, air emissions, the operation and removal of underground and above-ground storage tanks, the use, storage, treatment, transportation and disposal of solid hazardous materials, the remediation of contaminated property associated with the disposal of solid and hazardous materials and other health and safety-related concerns. Under these laws, a current or previous owner or operator of real estate may be liable for the costs of removal or remediation of certain hazardous or toxic substances released at a property, and may be held liable to a governmental entity or to third parties for property damage or personal injuries and for investigation and clean-up costs incurred in connection with any contamination. We could be subject to liability in the form of fines or damages for noncompliance with these laws and regulations, and some environmental laws create a lien on a contaminated site in favor of the government for damages and costs it incurs in connection with the contamination. Some of these laws and regulations may impose joint and several liability on resident, owners or operators for the costs of investigation or remediation of contaminated properties, regardless of fault or the legality of the original disposal. In addition, the presence of these substances, or the failure to properly remediate these substances, may adversely affect our ability to sell or rent the property or to use the property as collateral for future borrowing. Compliance with new or more stringent laws or regulations or stricter interpretation of existing laws may require material expenditures by us.

In addition we are subject to many other laws and governmental regulations applicable to our properties, and changes in the laws and regulations, or in their interpretation by agencies and the courts, occur frequently. Under the Americans with Disabilities Act of 1990 (the “ADA”), all places of public accommodation are required to meet certain federal requirements related to access and use by disabled persons. The Fair Housing Amendments Act of 1988 (the “FHAA”) requires apartment communities first occupied after March 13, 1991, to be accessible to the handicapped and prohibits housing discrimination based upon familial status, which is commonly referred to as age-based discrimination. The Housing for Older Persons Act (HOPA) provides age-based discrimination exceptions for housing developments qualifying as housing for older persons. Non-compliance with ADA, FHAA or HOPA could result in the imposition of fines, awards of damages to private litigants, payment of attorneys’ fees and other costs to plaintiffs, substantial litigation costs and substantial costs of remediation. We believe our properties which are subject to ADA, FHAA and/or HOPA are substantially in compliance with their present requirements.

Compliance with these laws, rules and regulations has not had a material adverse effect on our business, assets, or results of operations, financial condition and ability to pay dividends. We do not believe our existing portfolio as of December 31, 2013 will require us to incur material expenditures to comply with these laws and regulations. However, we cannot assure that future laws, ordinances or regulations will not impose any material liability, or that the current environmental condition of our properties will not be affected by the operations of tenants, by the existing condition of the land, by operations in the vicinity of the properties, such as the presence of underground storage tanks, or by the activities of unrelated third parties.

6

Table of Contents

AVAILABLE INFORMATION

We electronically file our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy and information statements and all amendments to these filings with the Securities and Exchange Commission (“SEC”). The public may read and copy any materials filed by us with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549, on official business days during the operation of 10:00 am to 3:00 pm. The public may obtain information on the operation of the Public Reference Room by calling the SEC at (800)-SEC-0330. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically.

We will make these reports available, free of charge, by responding to requests addressed to 1711 Gold Drive South, Suite 100, Fargo, North Dakota 58103. You may also request reports by calling the telephone number (701) 353-2720. Additionally, we maintain an internet site at www.inreit.com, which includes the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports. These reports are available as soon as reasonably practicable after such material is electronically filed or furnished to the SEC. This reference to our website is not intended to incorporate information found on the website into this filing.

Risks Related to INREIT Real Estate Investment Trust

Common shares of beneficial interest represent an investment in equity only, and not a direct investment in our assets. Therefore, common shareholders will hold only an indirect interest in our assets.

The common shares of beneficial interest represent an equity interest only in us, not in any of our assets or the real estate or real estate related investments made by our operating partnership. We will have no substantial assets other than our equity interest in the operating partnership. Neither the Advisor nor any of its managers or affiliates have any obligation with respect to the payment of dividends to our shareholders or the return of capital investments made to us by the shareholders.

Income will be received primarily from the leasing and resale of investments, which is subject to market and economic changes. If income is insufficient to meet our capital needs, our ability to carry out our business plans could be adversely affected.

Our purpose is to acquire and hold our real estate investments as long-term investments before we resell the investments to maximize anticipated appreciation for our shareholders. The primary income that will be generated by us will be the profits, if any, from the operation or holding of the real estate and real estate related investments and upon the resale of the investments. If circumstances arise which cause an investment to remain at its current value or decrease in value, we may generate less income than anticipated.

We may raise additional funds in the future to fund our capital needs, which may not be available on acceptable terms if at all.

We may need to raise additional capital in the future in order to fulfill our business plans. The timing and amount of our future capital needs will depend on a number of factors, including the revenue generated by the operation of our real estate investments, when and if the properties will appreciate in value, the resale price of the properties and other real estate related investments, our future operating expenses and required capital outlays. There can be no assurance additional financing will be available when needed on terms favorable to us, if at all.

Further, we may be required to raise additional capital and sell additional securities in the future on terms which are more favorable to those investors than the terms under which our current shareholders purchased their common shares. If adequate funds are not available or are not available on acceptable terms, our ability to fund our current business plans and to acquire additional real estate and real estate related investments would be significantly limited. Such limitation could have a material adverse effect on our results.

7

Table of Contents

Our success is based on continuing to locate and hold suitable real estate investments, and failure of our Advisor to locate additional suitable properties or the unsuccessful operation of our existing real estate investments could adversely affect our operations and our ability to pay dividends.

Our ability to achieve our investment objectives and to pay dividends to our shareholders is dependent upon the performance of our Advisor in locating suitable investments and appropriate financing arrangements for us as well as on the successful management of our properties after acquisition. We currently own, through the operating partnership, the properties described under Item 2 – Properties.

We cannot be sure our Advisor will be successful in continuing to obtain suitable investments on financially attractive terms, or be certain that operation of the properties will avoid the risks attendant to real estate acquisitions, such as:

| • | The risk properties may not perform in accordance with expectations, including projected occupancy and rental rates; |

| • | The risk we may have underestimated the cost of improvements required to bring an acquired property up to standards established for its intended use or its intended market position. |

Our Board of Trustees may have to make expedited decisions on whether to invest in certain properties or real estate-related assets, including prior to receipt of detailed information on the investment.

In the current real estate market, our Board of Trustees may frequently be required to make expedited decisions in order to effectively compete for the acquisition of desirable properties and other real estate-related assets. In such cases, our Advisor and Board of Trustees may not have access to detailed information regarding investment properties, such as physical characteristics, environmental matters, zoning regulations or other local conditions affecting the investment property, at the time of making an investment decision to pay a non-refundable deposit and to proceed with an acquisition. In addition, the actual time period during which our Advisor will be allowed to conduct due diligence may be limited. Therefore, there can be no assurance our Advisor and Board of Trustees will have knowledge of all circumstances that may adversely affect an investment.

We face competition from other real estate investors for suitable properties, and may not be successful in our attempts to acquire desirable properties.

The commercial and multi-family real estate industries are highly competitive, and we face competition for investment opportunities. These competitors may be real estate developers, real estate financing entities, real estate investment trusts, mutual funds, hedge funds, investment banking firms, institutional investors and other entities or investors that acquire real estate and may have substantially greater financial resources than we do. These entities or investors may be able to accept more risk than our Board of Trustees believes is in our best interests. This competition may limit the number of suitable investment opportunities offered to us. This competition also may increase the bargaining power of property owners seeking to sell to us, making it more difficult for us to acquire properties or interests in properties. In addition, we believe competition from entities organized for purposes similar to ours may increase in the future.

We may change our investment and operational policies without shareholder consent, and such changes could increase our exposure to additional risks.

Generally, the Board of Trustees may change our investment and operational policies, including our policies with respect to investments, acquisitions, growth, operations, indebtedness, capitalization and distributions, at any time without the consent of our shareholders, which could result in our making investments different from, and possibly riskier than, investments made in the past. A change in our investment policies may, among other things, increase our exposure to interest rate risk, default risk and commercial real estate market fluctuations, all of which could materially affect our ability to achieve our investment objectives.

8

Table of Contents

There can be no assurance dividends will be paid or increase over time.

There are many factors that can affect the availability and timing of cash dividends to our shareholders. Dividends will be based principally on cash available from our real estate and real estate related investments. The amount of cash available for dividends will be affected by many factors, such as our ability to acquire profitable real estate investments and successfully manage our real estate properties and our operating expenses. We can give no assurance we will be able to pay or maintain dividends or that dividends will increase over time. Our actual results may differ significantly from the assumptions used by our Board of Trustees in establishing the dividend rate to our shareholders.

We may pay dividends from sources other than our cash flow from operations, which could subject us to additional risks.

We are permitted to pay distributions from any source. If we fund dividends from cash flow from operations or working capital, we will have less funds available for investment in real estate and real estate related investments and our shareholders’ overall return may be reduced. Actual cash available for dividends may vary substantially from the estimates of our Board of Trustees. Because we may receive income from interest or rents at various times during our fiscal year, dividends paid may not reflect our income earned in that particular dividend period. In these instances, we may obtain third party financing to fund our dividends, causing us to incur additional interest expense. We may also fund such dividends from the sale of assets or additional securities. Any of these actions could potentially negatively affect future results of operations.

Dividends may include a return of capital, and shareholders may be required to recognize capital gain on distributions.

Dividends payable to shareholders may include a return of capital. To the extent dividends exceed cash flow from operations, a shareholder’s basis in our shares will be reduced and, to the extent dividends exceed a shareholder’s basis, the shareholder may recognize capital gain and be required to make tax payments.

We depend on certain executive officers and trustees, and the loss of such persons may delay or hinder our ability to carry out our investment strategies.

Our future success substantially depends on the active participation of James Wieland, one of our trustees, Kenneth Regan, our Chief Executive Officer and a trustee, and Bradley J. Swenson, our President. Messrs. Wieland and Regan are also governors and owners of the Advisor; and Mr. Swenson is also the President and a governor of the Advisor. Messrs. Wieland and Regan have over 30 years of extensive experience each in the commercial real estate industry, and have been instrumental in setting our strategic direction, operating our business and arranging necessary financing, and through the Advisor, in locating desirable real estate investments and where serving as property manager, managing our properties. Losing the services of Messrs. Wieland, Regan, or Swenson could have a material adverse effect on our ability to successfully carry out our investment strategies and achieve our investment objectives. There can be no guarantee they will remain affiliated with us.

Our systems may not be adequate to support our growth, and our failure to successfully oversee our portfolio of real estate investments could adversely affect our results of operation.

There can be no assurance we will be able to adapt our management, administrative, accounting and operational systems, or hire and retain sufficient staff, to support any growth we may experience. Our failure to successfully oversee our current and future real estate investments or developments could have a material adverse effect on our results of operation and financial condition and our ability to pay dividends to our shareholders.

Risks Related to Our Structure

There are limitations on ownership of our common shares of beneficial interest, which could discourage a takeover transaction even if it is beneficial to our shareholders.

Our Amended Declaration of Trust provides no person may own more than 9.9% of our outstanding common shares of beneficial interest. Even if a shareholder did not acquire more than 9.9% of our shares, the shareholder may become subject to such restrictions if redemptions by other shareholders cause the holdings to exceed 9.9% of our outstanding shares. This limitation may have the effect of delaying, deferring or preventing a transaction or a change in control of us, including an extraordinary transaction (such as a merger, tender offer or sale of all or substantially all of our assets) that might provide a premium price for our shareholders, even if it would be in the best interest of our shareholders. The ownership limits and restrictions on transferability will continue to apply until our Board of Trustees determines it is no longer in our best interest to continue to qualify or seek to qualify as a REIT.

9

Table of Contents

Our shareholders may experience dilution if we or our operating partnership issues additional securities.

Our shareholders do not have preemptive rights to any shares issued by us in the future. If we sell additional shares in the future to raise capital, issue additional shares pursuant to a dividend reinvestment plan or issue shares in exchange for limited partnership units pursuant to our exchange rights under the LLLP Agreement of our operating partnership, our shareholders will experience dilution of their equity investment in us. In addition, if our operating partnership sells additional securities or issues additional securities in connection with a property acquisition transaction, we would, and indirectly our shareholders would, experience dilution in its equity position in the operating partnership.

Our shareholders have limited control over our operation, and the Board of Trustees has the sole power to appoint and terminate the Advisor.

Our Board of Trustees has the sole authority to determine our major policies, including our policies regarding financing, growth, investment strategies, debt capitalization, REIT qualification, distribution, and to take certain actions including acquiring or disposing of real estate and real estate related investments, dividend declaration and the election or removal of the Advisor. Our shareholders do not have the right to remove the Advisor, but have the right to elect and remove trustees. Under the Amended Declaration of Trust, our trustees may not do the following without the approval of the holders of a majority of the outstanding common shares of beneficial interest:

| • | Amend the Amended Declaration of Trust, except for amendments which do not adversely affect the rights, preference and privileges of shareholders; |

| • | Sell all or substantially all of our assets other than in the ordinary course of business or in connection with a liquidation and dissolution; |

| • | Conduct a merger or other reorganization of the trust; or |

| • | Dissolve or liquidate us. |

In addition, the shareholders have the right, without the concurrence of the Board of Trustees, to terminate the trust and liquidate our assets or amend the Amended Declaration of Trust.

Shareholders have no role in determining our investments and must rely on our Advisor and oversight by the Board of Trustees.

For future acquisitions identified by our Advisor, the Board of Trustees has the authority to approve such investment acquisitions without shareholder approval. Therefore, shareholders will not be able to evaluate the terms of future investment acquisitions, their economic merit or other relevant financial data before we acquire such investments. The shareholders must rely entirely on the oversight of our Board of Trustees, the management ability of our Advisor and the performance of the property managers.

We may issue common shares of beneficial interest with more favorable terms than the outstanding shares without shareholder approval.

Under our Amended Declaration of Trust, our Board of Trustees has the authority to establish more than one class or series of shares and to fix the relative preferences and rights regarding conversion, voting powers, restrictions, limitations as to dividends and other distributions, and terms or conditions of redemption of such different classes or series without shareholder approval. Thus, our Board could authorize the issuance of a class or series of shares with terms and conditions that could have priority as to dividends and amounts payable upon liquidation over the rights of the holders of our outstanding common shares of beneficial interest. Such class or series of shares could also have the effect of delaying, deferring or preventing a change in control of us, including an extraordinary transaction (such as a merger, tender offer or sale of all or substantially all of our assets) that might otherwise provide a premium price to holders of our shares, even if it would be in the best interest of our shareholders.

10

Table of Contents

Shareholders could incur current tax liability on dividends they elect to reinvest in our shares, and may have to use separate funds to pay their tax liability

Shareholders that participate in our dividend reinvestment plan will be deemed to have received, and for income tax purposes will be taxed on, the amount reinvested in shares to the extent the amount reinvested was not a tax-free return of capital. In addition, our shareholders will be treated for tax purposes as having received an additional dividend to the extent the shares are purchased at a discount to fair market value. As a result, unless shareholders are a tax-exempt entity, they may have to use funds from other sources to pay their tax liability on the value of the shares received.

Our trustees, officers, Advisor and its affiliates have limited liability to us and our shareholders, and may have the right to be indemnified under certain conditions.

Our Amended Declaration of Trust provides that our trustees, officers, Advisor and its affiliates will not be held liable for any loss or liability suffered by us if: (1) the trustee, officer, Advisor or its affiliate determines in good faith its actions or inactions were in our best interest, (2) such actions were taken on behalf of us and (3) such liability or loss was not the result of: (a) negligence or misconduct by a trustee (other than an independent trustee), the Advisor or its affiliate or (b) gross negligence or willful misconduct by an independent trustee. Moreover, we are required to indemnify our trustees, officers, the Advisor and its affiliates, subject to limitations stated in the Amended Declaration of Trust. As a result, we and our shareholders have limited rights against our trustees, officers, the Advisor and its affiliates, which could reduce our and our shareholders’ recovery from these persons. In addition, we may be obligated to fund the defense costs incurred by such parties in some cases, which would decrease the cash otherwise available for dividends to our shareholders.

There may be conflicts of interest between us and our shareholders on one side and our operating partnership and its limited partners on the other side.

Our trustees and officers have duties to us and our shareholders in connection with their management of us. At the same time, we, as general partner will have fiduciary duties to our operating partnership and its limited partners in connection with the management of the operating partnership. Our duties as general partner of the operating partnership may come into conflict with the duties of our trustees and officers to us and our shareholders. The LLLP Agreement of our operating partnership expressly limits our liability for monetary damages by providing we will not be liable for losses sustained, liabilities incurred or benefits not derived if we acted in good faith. In addition, our operating partnership is required to indemnify us and our trustees and officers from and against any and all claims arising from operations of our operating partnership, unless it is established: (1) the act or omission was material and committed in bad faith or was the result of active and deliberate dishonesty; (2) the indemnified party received an improper personal benefit in money, property or services; or (3) in the case of a criminal proceeding, the indemnified person had reasonable cause to believe the act or omission was unlawful. The LLLP Agreement also provides that we will not be held responsible for any misconduct or negligence on the part of any agent appointed by us in good faith.

If we are deemed to be an investment company under the Investment Company Act, our shareholders’ investment return may be reduced.

We are not registered as an investment company under the Investment Company Act of 1940, as amended (“Investment Company Act”) based on exceptions we believe are available to us. If we were obligated to register as an investment company, we would have to comply with a variety of substantive requirements under the Investment Company Act. Registration as an investment company would be costly, would subject us to a host of complex regulations, and would divert the attention of management from the conduct of our business. If the SEC or a court of competent jurisdiction were to find we are required, but in violation of the Investment Company Act had failed, to register as an investment company, possible consequences include, but are not limited to, the following: (i) the SEC could apply to a district court to enjoin the violation; (ii) our shareholders could sue us and recover any damages caused by the violation; (iii) any contract to which we are party made in, or whose performance involves a violation of the Investment Company Act would be unenforceable by any party to the contract unless a court were to find that under the circumstances enforcement would produce a more equitable result than non-enforcement and would not be inconsistent with the purposes of the Investment Company Act; and (iv) criminal and civil actions could be brought against us. Should we be subjected to any or all of the foregoing, we would be materially and adversely affected.

11

Table of Contents

There is no public trading market for our shares, nor do we expect one to develop, which may negatively impact a shareholders ability to sell their shares and the price at which shares may be sold.

There is no public market for the shares and no assurance one may develop. In addition, the price shareholders may receive for the sale of their shares is likely to be less than the proportionate value of our investments. If our shareholders are able to find a buyer for their shares, they may have to sell them at a substantial discount from the price they purchased the shares. Consequently, shareholders may not be able to liquidate their investments in the event of emergency or for any other reason. Therefore, shareholders should consider our securities as illiquid and a long-term investment and should be prepared to hold their shares for an indefinite period of time.

The estimated value of our common stock is based on a number of assumptions and estimates that may not be accurate and is also subject to a number of limitations.

The current estimated value of our common stock equals $14.00 per share. The methodology used by our board to determine this value was based on estimates of the value of our real estate investments, cash and other assets and debt and other liabilities as of a date certain and no subsequent valuation has been undertaken by us. The valuation process involves a number of estimates, assumptions and subjective judgments that may not be accurate and complete. Further, different parties using different assumptions and estimates could derive a different estimated value per share, which could be significantly different from our estimated value per share. The estimated value per share may not represent current market values or fair values as determined in accordance with U.S. generally accepted accounting principles. The estimated value of our real estate assets used in the analysis may not necessarily represent the value we would receive or accept if the assets were marketed for sale. Further, acquisitions and dispositions of properties will have an effect on the value of our estimated price per share, which is not reflected in the current estimated price. Moreover, the estimated per share value of the common stock does not reflect a liquidity discount for the fact that the shares are not currently traded on a public market, a discount for the non-assumability or prepayment obligations associated with certain loans and other costs that may be incurred in connection with the sale of assets. As a result a shareholder should not rely on the estimated value per share as being an accurate measure of the then-current value of the shares of our common stock in making a decision to buy or sell shares of our common stock, including whether to reinvest dividends by participating in the dividend reinvestment plan and whether to request redemption pursuant to our share redemption program.

Shareholders may not be able to have their shares redeemed under the Share Redemption Plan, and if shareholders do redeem their shares, they will not receive the current value of the shares.

We have adopted a share redemption plan. However, our Board of Trustees can limit, suspend, terminate or amend the plan at any time without shareholder approval, and there is no assurance we will have sufficient funds available at the time of any request to honor a redemption request for cash. Shares redeemed under this plan may be purchased at a discount to the current price of the shares or to the price paid for such shares by the shareholder. Therefore, shareholders may not receive the amount they paid for the shares and may receive less by selling their shares back to us than they would receive if they were to sell their shares to other buyers.

There will be transfer restrictions on the shares, and we do not plan to register the shares for resale.

Other than shares issued under our dividend reinvestment plan, we have not registered our shares under federal or state securities laws, but rather we have sold the shares in reliance on exemptions under applicable federal and state securities laws Therefore, the shares may be “restricted securities” and may not be resold unless they are subsequently registered under the Securities Act and applicable state securities laws or pursuant to exemption from such registration requirements or may have other transfer restrictions based on the exemption relied on for the sale of the shares. We are not obligated to, nor do we currently plan to, register any shares for resale.

12

Table of Contents

Risks Related to Our Status as a REIT and Related Federal Income Tax Matters

If we fail to continue to qualify as a REIT, we would incur additional tax liabilities that would adversely affect our operations and our ability to make distributions and could result in a number of other negative consequences.

Although our management believes we are organized, have operated, and will be able to continue to be organized and to operate in such a manner to qualify as a real estate investment trust (REIT), as that term is defined under the Internal Revenue Code, we may not have been organized, may not have operated, or may not be able to continue to be organized or to operate in a manner to have qualified or remain qualified as a REIT. Qualification as a REIT involves the application of highly technical and complex Internal Revenue Code provisions for which there are only limited judicial or administrative interpretations. Even a technical or inadvertent mistake could endanger our REIT status.

The determination that we qualify as a REIT requires an ongoing analysis of various factual matters and circumstances, some of which may not be within our control, regarding our organization and ownership, distributions of our income and the nature and diversification of our income and assets. The fact we hold substantially all of our assets through our operating partnership and our ongoing reliance on factual determinations, such as determinations related to the valuation of our assets, further complicates the application of the REIT requirements for us.

If we lose our REIT qualification, we will face income tax consequences that will reduce substantially our available cash for dividends and investments for each of the years involved because:

| • | We would be subject to federal corporate income taxation on our taxable income, including any applicable alternative minimum tax, and could be subject to increased state and local taxes; |

| • | We would not be allowed a deduction for dividends paid to shareholders in computing our taxable income; and |

| • | Unless we are entitled to relief under applicable statutory provisions, we could not elect to be taxed as a REIT for four taxable years following the year during which we were disqualified. |

The increased taxes could reduce the value of the shares as well as cash available for dividends to shareholders and investments in additional assets. In addition, if we fail to continue to qualify as a REIT, we will not be required to pay dividends to shareholders. Our failure to continue to qualify as a REIT also could impair our ability to expand our business and to raise capital.

As a REIT, we may be subject to tax liabilities that reduce our cash flow.

Even if we continue to qualify as a REIT for federal income tax purposes, we may be subject to federal and state taxes on our income or property, including the following:

| • | To continue to qualify as a REIT, we must distribute annually at least 90% of our REIT taxable income (which is determined without regard to the dividends-paid deduction or net capital gains) to our shareholders. If we satisfy the distribution requirement but distribute less than 100% of our REIT taxable income, we will be subject to corporate income tax on the undistributed income. In such situation, shareholders will be treated as having received the undistributed income and having paid the tax directly, but tax-exempt shareholders, such as charities or qualified pension plans, will receive no benefit from any deemed tax payments. |

| • | We may be subject to state and local taxes on our income or property, either directly or indirectly, because of the taxation of our operating partnership or of other entities through which we indirectly own our assets. |

| • | If we have net income from the sale of foreclosure property we hold primarily for sale to customers in the ordinary course of business or other non-qualifying income from foreclosure property, we must pay a tax on that income at the highest corporate income tax rate. |

| • | If we sell a property, other than foreclosure property, we hold primarily for sale to customers in the ordinary course of business, our gain will be subject to the 100% “prohibited transaction” tax. |

| • | We will be subject to a 4% nondeductible excise tax on the amount, if any, by which the distributions we pay in any calendar year are less than the sum of 85% of our ordinary income, 95% of our capital gain net income, and 100% of our undistributed income from prior years. |

13

Table of Contents

We may be forced to borrow funds on a short-term basis, to sell assets or to issue securities to meet the REIT minimum distribution requirement or for working capital purposes.

To qualify as a REIT, in general, we must distribute to our shareholders at least 90% of our net taxable income each year, excluding capital gains. However, we could be required to include earnings in our net taxable income before we actually receive the related cash. If we do not have sufficient cash to make the necessary dividends to preserve our REIT status for any year or to avoid taxation, we may need to borrow funds, to sell assets or to issue additional securities even if the then-prevailing market conditions are not favorable for such actions.

To the extent dividends to our shareholders had been made in anticipation of qualifying as a REIT, we might be required to borrow funds, to sell assets or to issue additional securities to pay the applicable tax if we lose our REIT qualification and are subject to increased taxes.

In addition, we will require a minimum amount of cash to fund our daily operations. Due to the REIT distribution requirements, we may be forced to make distributions when we otherwise would use the cash to fund our working capital needs. Therefore, we may be forced to borrow funds, to sell assets or to issue additional securities at certain times for our working capital needs.

If our operating partnership does not qualify as a partnership, its income may be subject to taxation, and we would no longer qualify as a REIT.

The Internal Revenue Code classifies “publicly traded partnerships” as associations taxable as corporations (rather than as partnerships), unless substantially all of their taxable income consists of specified types of passive income. We structured our operating partnership to be classified as a partnership for federal income tax purposes. However, no assurance can be given the IRS will not challenge our position or will classify our operating partnership as a “publicly traded partnership” for federal income tax purposes. To minimize this risk, we have placed certain restrictions on the transfer and/or redemption of partnership units in the Agreement of Limited Liability Limited Partnership of our operating partnership (“LLLP Agreement”). If the IRS would assert successfully our operating partnership should be treated as a “publicly traded partnership” and substantially all of the operating partnership’s gross income did not consist of the specified types of passive income, the Internal Revenue Code would treat the operating partnership as an association taxable as a corporation. In such event, we would cease to qualify as a REIT. In addition, the imposition of a corporate tax on the operating partnership would reduce the amount of distributions the operating partnership could make to us and, in turn, reduce the amount of cash available to us to pay dividends to our shareholders.

We have transfer restrictions on our shares that may limit offers to acquire substantial amounts of the trust’s shares at a premium.

To qualify as a REIT, our shares must be beneficially owned by 100 or more persons and no more than 50% of the value of our issued and outstanding shares may be owned directly or indirectly by five or fewer individuals. Currently, our Amended Declaration of Trust prohibits transfers of our shares that would result in (1) our shares being beneficially owned by fewer than 100 persons, (2) five or fewer individuals, including natural persons, private foundations, specified employee benefit plans and trusts, and charitable trusts, owning more than 50% of our shares, applying broad attribution rules imposed by the federal income tax laws, or (3) before our shares qualify as a class of publicly-offered securities, 25% or more of our shares being owned by ERISA investors. If a shareholder acquires shares in excess of the ownership limits or in violation of the restrictions on transfer, we:

| • | May consider the transfer to be void ab initio. |

| • | May not reflect the transaction on our books. |

| • | May institute legal action to enjoin the transaction. |

| • | May redeem such excess shares. |

| • | Automatically transfer any excess shares to a charitable trust for the benefit of a charitable beneficiary. |

14

Table of Contents

If such excess shares are transferred to a trust for the benefit of a charitable beneficiary, the charitable trustee shall sell the excess shares and the shareholder will be paid the net proceeds from the sale equal to the lesser of: (1) the price paid by the shareholder or the “market price” of our shares if no value was paid or (2) the price per share received by the charitable trustee.

If shares are acquired in violation of the ownership limits or the restrictions on transfer described above:

| • | Transferee may lose its power to dispose of the shares; and |

| • | Transferee may incur a loss from the sale of such shares if the fair market price decreases. |

These limitations may have the effect of preventing a change of control or takeover of us by a third party, even if the change in control or takeover would be in the best interest of our shareholders.

Complying with REIT requirements may restrict our ability to operate in a way to maximize profits.

To qualify as a REIT, we must continually satisfy tests concerning, among other things, the sources of our income, the nature and diversification of our assets, the amounts we distribute to our shareholders, and the ownership of our common shares. For example, we may be required to pay dividends to our shareholders at disadvantageous times, including when we do not have readily available funds. Thus, compliance with the REIT requirements may hinder our ability to operate solely on the basis of maximizing profits.

Complying with REIT requirements may force us to forego or liquidate otherwise attractive investments which could negatively impact shareholder value.

To qualify as a REIT, at the end of each calendar quarter, at least 75% of our assets must consist of cash, cash items, government securities and qualified real estate assets. The remainder of our investments in securities (other than government securities and qualified real estate assets), in general, cannot include more than 10% of the voting securities of any one issuer or more than 10% of the value of the outstanding securities of any one issuer. In addition, no more than 5% of the value of our assets (other than government securities and qualified real estate assets) can consist of the securities of any one issuer, and no more than 25% of the value of our assets may be represented by securities of one or more taxable REIT subsidiaries. Therefore, we may be required to liquidate otherwise attractive investments or may be forced to forego attractive investments to satisfy these requirements. Such action or inaction could be adverse to our shareholder interests.

Gains from asset sales may be subject to a 100% prohibited transaction tax, which tax could reduce the trust’s available assets and reduce shareholder value.

We may have to sell assets from time to time to satisfy our REIT distribution requirements and other REIT requirements or for other purposes. The IRS may posit one or more asset sales may be “prohibited transactions.” If we are deemed to have engaged in a “prohibited transaction,” our gain from such sale would be subject to a 100% tax. The Internal Revenue Code sets forth a safe harbor for REITs that wish to sell property without risking the imposition of the 100% tax, but we cannot assure you we will be able to qualify for the safe harbor. We will use reasonable efforts to avoid the 100% tax by (1) conducting activities that may otherwise be considered a prohibited transaction through a taxable REIT subsidiary, (2) conducting our operations in such a manner so no sale or other disposition of an asset we own, directly or through any subsidiary other than a taxable REIT subsidiary, will be treated as a prohibited transaction or (3) structuring certain sales of our assets to comply with a safe harbor available under the Internal Revenue Code. We do not intend to hold assets in a manner to cause their dispositions to be treated as “prohibited transactions,” but we cannot assure you the IRS will not challenge our position, especially if we make frequent sales or sales of assets in which we have short holding periods. Payment of a 100% tax would adversely affect our results of operations.

15

Table of Contents

Ordinary dividends payable by REITs generally are taxed at the higher ordinary income rate which could reduce the net cash received by shareholders as a result of an investment in the trust and may be detrimental to our ability to raise additional funds through the sale of our common shares.

The maximum U.S. federal income tax rate for “qualified dividends” payable by U.S. corporations to individual U.S. shareholders currently is 20%. In general, ordinary dividends payable by REITs to its shareholders, however, are generally not eligible for the reduced rates and generally are taxed at ordinary income rates (the maximum individual income tax rate currently is 39.6%). This result could reduce the net cash received by shareholders as a result of an investment in the trust and could be detrimental to our ability to raise additional funds through the sale of our common shares.

Changes in legislative or other actions affecting REITs may adversely affect our status as a REIT.

The rules dealing with U.S. federal income taxation are constantly under review by the legislative process, the IRS and the U.S. Treasury Department. Changes to tax laws (which changes may apply retroactively) could adversely affect us or our shareholders. Furthermore, new legislation, regulations, administrative interpretations or court decisions could change the federal income tax laws with respect to our qualification as a REIT or the federal income tax consequences of our qualification. We cannot predict whether, when, in what forms, or with what effective dates, the laws applicable to us or our shareholders may be changed.

Our Board of Trustees may revoke our REIT election without shareholder approval, and we would no longer be required to make distributions of our net income.

Our Board of Trustees can revoke or otherwise terminate our REIT election without the approval of our shareholders if our Board determines it is not in our best interest to continue to qualify as a REIT. In such case, we would become subject to U.S. federal income tax on our taxable income, and we no longer would be required to distribute most of our net income to our shareholders, which may reduce the total return to our shareholders and affect the value of the shares.

Risks Related to Tax-Exempt Investors

Common shares may not be a suitable investment for tax-exempt investors.

There are special considerations that apply to investing in common shares on behalf of a trust, pension, profit sharing or 401(k) plans, health or welfare plans, trusts, individual retirement accounts (IRAs), or Keogh plans. If you are investing the assets of any of the above in common shares, you should satisfy yourself:

| • | Your investment is consistent with your fiduciary obligations under applicable law, including common law, ERISA and the Internal Revenue Code; |

| • | Your investment is made in accordance with the documents and instruments that govern the trust, plan or IRA, including any investment policy; |

| • | Your investment satisfies the prudence and diversification requirements of Sections 404(a)(1)(B) and 404(a)(1)(C) of ERISA and other applicable provisions of ERISA and the Internal Revenue Code; |

| • | Your investment will not impair the liquidity of the trust, plan or IRA; |

| • | Your investment will not produce “unrelated business taxable income” for the trust, plan or IRA; |

| • | You will be able to value the assets of the trust, plan or IRA annually in accordance with ERISA requirements and applicable provisions of the trust, plan or IRA; and |

| • | Your investment will not constitute a prohibited transaction under Section 406 of ERISA or Section 4975 of the Internal Revenue Code. |

We have not evaluated, and will not evaluate, whether an investment in us is suitable for any particular trust, plan, or IRAs.

16

Table of Contents

Under certain circumstances, tax-exempt shareholders may be subject to unrelated business taxable income, which could adversely affect such shareholders.

Neither ordinary nor capital gain distributions with respect to our common shares nor gain from the sale of our common shares, in general, should constitute unrelated business taxable income to tax-exempt shareholders. The following, however, are some exceptions to this rule:

| • | Under certain circumstances, part of the income and gain recognized by certain qualified employee pension trusts with respect to our common shares may be treated as unrelated business taxable income if our common shares are held predominately by qualified employee pension trusts (which we do not expect to be the case); |

| • | Part of the income and gain recognized by a tax-exempt shareholder with respect to common shares would constitute unrelated business taxable income if the tax-exempt shareholder incurs debt to acquire the common shares; and |

| • | Part or all of the income or gain recognized with respect to our common shares held by social clubs, voluntary employee benefit associations, supplemental unemployment benefit trusts and qualified group legal services plans that are exempt from federal income taxation under Sections 501(c)(7), (9), (17), or (20) of the Internal Revenue Code may be treated as unrelated business taxable income. |

Therefore, tax-exempt shareholders are not assured all dividends received from the trust will be tax-exempt.

Risks Related to Our Relationship with the Advisor and Its Affiliates

We depend on our Advisor for the successful operations of the REIT, and if required, we may not be able to find a suitable replacement advisor.

Our ability to achieve our investment objectives is dependent upon the successful performance of our Advisor in locating attractive acquisitions, advising on dispositions of real estate properties and other real estate related assets, advising on any financing arrangements and other administrative tasks to operate our business. If the Advisor suffers or is distracted by adverse financial, operational problems in connection with its operations unrelated to us or for any reason, it may be unable to allocate a sufficient amount of time and resources to our operations. If this occurs, our ability to achieve our investment objectives or pay dividends to our shareholders may be adversely affected. Any adversity experienced by the Advisor or problems in our relationship with the Advisor could also adversely impact the operation of our properties and, consequently, our cash flow and ability to pay dividends to shareholders.

Either we or the Advisor can terminate the Advisory Agreement upon 60 days written notice to the other party for any reason, or we can terminate the Advisory Agreement immediately for cause or material breach of the Advisory Agreement. In addition, the Board of Trustees may determine not to renew the Advisory Agreement in any year. If this occurs, we would need to find another advisor to provide us with day-to-day management services or engage employees to provide these services directly to us, which would likely be difficult to do and may be costly. There can be no assurances we would be able to find a suitable replacement advisor or suitable employees or enter into agreements for such services on acceptable terms.

The termination or replacement of the Advisor could trigger a default or repayment event under financings.

Lenders providing financing for our acquired properties may include provisions in the mortgage loan documentation that state the termination or replacement of the Advisor is an event of default or an event triggering acceleration of the repayment of the loan in full. Even though we will attempt to have such provisions excluded from the loan documents, the lenders may still require them to be included. In addition, the termination or replacement of the Advisor could trigger an event of default under any credit agreement governing a line of credit we may obtain in the future. If an event of default or repayment event occurs with respect to any of our properties, our ability to achieve our investment objectives could be materially adversely affected.

17

Table of Contents

The Advisor may not be able to retain its key employees, which could adversely affect our ability to carry out our investment strategies.

We depend on the retention by the Advisor of its key officers, employees and governors. However, none of these individuals have an employment agreement with the Advisor. The loss of any or all of the services by the Advisor’s key officers, employees and governors and the Advisor’s inability to find, or any delay in finding, replacements with equivalent skills and experience, could adversely impact our ability to successfully carry out our investment strategies and achieve our investment objectives.

Our future success also depends on the Advisor’s and its affiliates’ ability to identify, hire, train and retain highly qualified real estate, managerial, financial, marketing and technical personnel to provide the services to us pursuant to the Advisory Agreement and any other written services agreement, including any property management agreements. Competition for such personnel is intense, and the Advisor or its affiliates may not be able to attract, assimilate or retain such personnel in the future. The inability to attract and retain the necessary personnel could have a material adverse effect on our business and results of operations.

Payment of fees and expenses to the Advisor reduces the cash available for dividends.