UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-Q

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended September 30, 2013

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _________________ to _________________

Commission File No.: 333-146182

Biozone Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

20-5978559

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

550 Sylvan Avenue

Suite 101

Englewood Cliffs, NJ 07632

(Address of principal executive offices)

Issuer’s telephone number: (201) 608-5101

Check whether the registrant filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filter ¨

|

|

Accelerated filter ¨

|

|

Non-accelerated filter ¨

|

(Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of November 15, 2013, there were 75,663,316 shares of our common stock outstanding.

Quarterly Report on Form 10-Q for the

Nine months ended September 30, 2013

Table of Contents

| |

Page

|

|

PART I. FINANCIAL INFORMATION

|

|

|

Item 1. Financial Statements

|

|

|

Consolidated Balance Sheets as of September 30, 2013 (unaudited) and December 31, 2012

|

3

|

|

Consolidated Statements of Operations for the Three and Nine Months Ended September 30, 2013 and 2012 (unaudited):

|

4

|

|

Consolidated Statements of Cash Flows for the Nine Months Ended September 30, 2013 and 2012 (unaudited):

|

5

|

|

Notes to Unaudited Consolidated Financial Statements:

|

6

|

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

21

|

|

Item 3. Quantitative and Qualitative Disclosures About Market Risk

|

25

|

|

Item 4 Controls and Procedures

|

25

|

| |

|

PART II. OTHER INFORMATION

|

|

|

Item 1. Legal Proceedings

|

26

|

|

Item 1A. Other Information

|

26

|

|

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

|

27

|

|

Item 3. Defaults Upon Senior Securities

|

27

|

Item 4. Mine Safety Disclosures

|

27

|

Item 5. Other Information

|

|

|

|

27

|

| BIOZONE PHARMACEUTICALS, INC. |

|

| CONSOLIDATED BALANCE SHEETS |

|

| |

|

| |

|

September 30, 2013

|

|

|

December 31, 2012

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

529,895 |

|

|

$ |

62,296 |

|

|

Account receivable net of allowance for doubtful accounts

|

|

|

50,281 |

|

|

|

784,733 |

|

|

$61,973 and $46,119, respectively

|

|

|

|

|

|

|

|

|

|

Finance receivables, net

|

|

|

311,714 |

|

|

|

- |

|

|

Inventories

|

|

|

1,726,450 |

|

|

|

1,507,009 |

|

|

Prepaid expenses and other current assets

|

|

|

207,661 |

|

|

|

120,210 |

|

|

Total current assets

|

|

|

2,826,001 |

|

|

|

2,474,248 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

3,133,216 |

|

|

|

3,333,919 |

|

|

Due from purchaser of Glyderm assets

|

|

|

400,000 |

|

|

|

- |

|

|

Deferred financing costs, net

|

|

|

10,169 |

|

|

|

10,573 |

|

|

Goodwill

|

|

|

1,026,984 |

|

|

|

1,026,984 |

|

|

Intangibles, net

|

|

|

148,477 |

|

|

|

190,894 |

|

|

Assets of discontinued operations

|

|

|

51,843 |

|

|

|

203,149 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

4,770,689 |

|

|

|

4,765,519 |

|

| |

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$ |

7,596,690 |

|

|

$ |

7,239,767 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' DEFICIENCY

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Account payable

|

|

|

209,060 |

|

|

|

589,468 |

|

|

Accrued expenses and other current liabilities

|

|

|

3,953,411 |

|

|

|

3,106,332 |

|

|

Accrued interest

|

|

|

539,256 |

|

|

|

286,382 |

|

|

Notes payable - shareholder

|

|

|

- |

|

|

|

1,099,715 |

|

|

Convertible notes payable

|

|

|

2,255,380 |

|

|

|

1,472,152 |

|

|

Deferred income tax

|

|

|

102,022 |

|

|

|

102,022 |

|

|

Derivative instruments

|

|

|

8,029,003 |

|

|

|

919,394 |

|

|

Current portion of long term debt

|

|

|

165,623 |

|

|

|

181,752 |

|

|

Liabilities of discontinued operations

|

|

|

33,430 |

|

|

|

168,296 |

|

|

Total current liabilities

|

|

|

15,287,185 |

|

|

|

7,925,513 |

|

| |

|

|

|

|

|

|

|

|

|

Long Term Debt

|

|

|

2,764,081 |

|

|

|

2,894,579 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders' deficiency

|

|

|

|

|

|

|

|

|

|

Common stock, $.001 par value, 100,000,000 shares authorized,

|

|

|

70,111 |

|

|

|

63,143 |

|

|

70,111,100 and 63,142,969 shares issued and outstanding at September 30, 2013,

|

|

|

|

|

|

|

and December 31, 2012, respectively

|

|

|

|

|

|

|

|

|

|

Additional paid-in capital

|

|

|

11,133,642 |

|

|

|

10,484,611 |

|

|

Accumulated deficit

|

|

|

(21,658,329 |

) |

|

|

(14,128,079 |

) |

| |

|

|

|

|

|

|

|

|

|

Total shareholders' deficiency

|

|

|

(10,454,576 |

) |

|

|

(3,580,325 |

) |

| |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' deficiency

|

|

$ |

7,596,690 |

|

|

$ |

7,239,767 |

|

|

BIOZONE PHARMACEUTICALS, INC.

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

(Unaudited)

|

| |

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2013

|

|

|

2012

|

|

|

2013

|

|

|

2012

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$ |

2,086,986 |

|

|

$ |

4,734,148 |

|

|

$ |

5,764,116 |

|

|

$ |

12,860,988 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

|

|

(977,165 |

) |

|

|

(2,827,922 |

) |

|

|

(3,742,495 |

) |

|

|

(7,703,507 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

1,109,821 |

|

|

|

1,906,226 |

|

|

|

2,021,621 |

|

|

|

5,157,481 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and adminstrative expenses

|

|

|

1,373,459 |

|

|

|

1,352,748 |

|

|

|

3,884,886 |

|

|

|

4,236,747 |

|

|

Selling expenses

|

|

|

86,772 |

|

|

|

59,029 |

|

|

|

386,986 |

|

|

|

407,284 |

|

|

Research and development expenses

|

|

|

55,390 |

|

|

|

155,941 |

|

|

|

81,066 |

|

|

|

584,059 |

|

|

Total Operating Expenses

|

|

|

1,515,621 |

|

|

|

1,567,718 |

|

|

|

4,352,938 |

|

|

|

5,228,090 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) from operations

|

|

|

(405,800 |

) |

|

|

338,508 |

|

|

|

(2,331,317 |

) |

|

|

(70,609 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(991,601 |

) |

|

|

(482,960 |

) |

|

|

(1,948,686 |

) |

|

|

(4,970,657 |

) |

|

Change in fair market value of derivative liability

|

|

|

(4,660,841 |

) |

|

|

21,912 |

|

|

|

(4,148,748 |

) |

|

|

477,830 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes

|

|

|

(6,058,242 |

) |

|

|

(122,540 |

) |

|

|

(8,428,751 |

) |

|

|

(4,563,436 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations

|

|

|

(6,058,242 |

) |

|

|

(122,540 |

) |

|

|

(8,428,751 |

) |

|

|

(4,563,436 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from discontinued operations, net of taxes

|

|

|

64,058 |

|

|

|

23,810 |

|

|

|

212,848 |

|

|

|

104,232 |

|

|

Gain on sale of assets

|

|

|

685,653 |

|

|

|

- |

|

|

|

685,653 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(5,308,531 |

) |

|

$ |

(98,730 |

) |

|

$ |

(7,530,250 |

) |

|

$ |

(4,459,204 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share from continuing operations

|

|

$ |

(0.09 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.07 |

) |

|

Net income per common share from discontinued operations

|

|

$ |

0.01 |

|

|

$ |

0.00 |

|

|

$ |

0.01 |

|

|

$ |

0.00 |

|

|

Net loss per common share

|

|

$ |

(0.08 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.07 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted weighted average common shares outstanding

|

|

|

70,098,825 |

|

|

|

69,418,903 |

|

|

|

67,119,343 |

|

|

|

61,631,047 |

|

|

BIOZONE PHARMACEUTICAL, INC.

|

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

(Unaudited)

|

|

| |

|

|

|

|

|

|

| |

|

Nine Months Ended September 30,

|

|

| |

|

2013

|

|

|

2012

|

|

| |

|

|

|

|

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

Net loss from continuing operations

|

|

|

(8,428,751 |

) |

|

|

(4,563,436 |

) |

|

Income from discontinued operations

|

|

|

898,501 |

|

|

|

104,232 |

|

|

Net loss

|

|

$ |

(7,530,250 |

) |

|

$ |

(4,459,204 |

) |

|

Adjustments to reconcile net loss to net cash

|

|

|

|

|

|

|

|

|

|

used in operating activities:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Bad debt expense

|

|

|

16,667 |

|

|

|

99,803 |

|

|

Depreciation & Amortization

|

|

|

400,409 |

|

|

|

360,554 |

|

|

Amortization of financing costs

|

|

|

404 |

|

|

|

21,723 |

|

|

Gain (loss) on change in fair value of derivative liability

|

|

|

4,148,748 |

|

|

|

(477,830 |

) |

|

Stock and warrant based compensation

|

|

|

177,876 |

|

|

|

120,000 |

|

|

Non-cash interest expense

|

|

|

1,775,086 |

|

|

|

4,742,188 |

|

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Account receivable-trade

|

|

|

717,785 |

|

|

|

(545,776 |

) |

|

Finance receivable

|

|

|

(311,714 |

) |

|

|

- |

|

|

Inventories

|

|

|

(219,441 |

) |

|

|

(300,133 |

) |

|

Prepaid expenses and other current assets

|

|

|

(87,451 |

) |

|

|

(351,690 |

) |

|

Accounts payable

|

|

|

(380,408 |

) |

|

|

(558,990 |

) |

|

Accrued expenses and other current liabilities

|

|

|

847,079 |

|

|

|

(283,980 |

) |

|

Other assets

|

|

|

(447,215 |

) |

|

|

- |

|

|

Discontinued operations

|

|

|

16,440 |

|

|

|

(3,364 |

) |

|

Net cash used in operating activities

|

|

|

(875,985 |

) |

|

|

(1,636,699 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(86,366 |

) |

|

|

(320,116 |

) |

|

Net cash used in investing activities

|

|

|

(86,366 |

) |

|

|

(320,116 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

|

|

Proceeds from convertible debt

|

|

|

2,100,000 |

|

|

|

3,750,000 |

|

|

Proceeds from sale of common stock

|

|

|

950,000 |

|

|

|

650,000 |

|

|

Payment of deferred financing costs

|

|

|

- |

|

|

|

(36,304 |

) |

|

Repayment of debt

|

|

|

(217,550 |

) |

|

|

(190,593 |

) |

|

Payment to shareholder

|

|

|

(1,052,500 |

) |

|

|

|

|

|

Repayment of borrowings from noteholders

|

|

|

(350,000 |

) |

|

|

(2,550,000 |

) |

|

Net cash provided by financing activities

|

|

|

1,429,950 |

|

|

|

1,623,103 |

|

| |

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents

|

|

|

467,599 |

|

|

|

(333,712 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, beginning of period

|

|

|

62,296 |

|

|

|

416,333 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, end of period

|

|

$ |

529,895 |

|

|

$ |

82,621 |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow information:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Interest paid

|

|

$ |

173,600 |

|

|

$ |

312,232 |

|

|

Debt discount from warrant liability

|

|

$ |

2,000,000 |

|

|

$ |

2,755,274 |

|

|

Cashless exercise of warrants for common stock

|

|

$ |

- |

|

|

$ |

6,503,201 |

|

BioZone Pharmaceuticals, Inc.

Notes to the Consolidated Financial Statements

September 30, 2013

(unaudited)

Note 1 - Basis of Presentation

The accompanying unaudited consolidated financial statements presented herein have been prepared in accordance with the instructions to Form 10-Q and do not include all the information and note disclosures required by accounting principles generally accepted in the United States. The consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012 filed with the Securities and Exchange Commission (the “SEC”) on April 1, 2013. In the opinion of management, this interim information includes all material adjustments, which are of a normal and recurring nature, necessary for fair presentation.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Estimates that are particularly susceptible to change include assumptions used in determining the fair value of securities owned and non-readily marketable securities.

The results of operations for the three and nine months ended September 30, 2013 are not necessarily indicative of the results to be expected for the entire year or for any other period.

NOTE 2 - Business Description

BioZone Pharmaceuticals, Inc. (formerly, International Surf Resorts, Inc.; the “Company”, “we”, “our”) was incorporated under the laws of the State of Nevada on December 4, 2006. On March 1, 2011, we changed our name from International Surf Resorts, Inc. to BioZone Pharmaceuticals, Inc.

The BioZone Lab group (the operating subsidiaries of the Company) has operated since inception as a developer, manufacturer, and marketer of over-the-counter drugs and preparations, cosmetics, and nutritional supplements on behalf of health care product marketing companies and national retailers. We have been developing our proprietary drug delivery technology (the “BioZone Technology”) as an enhancement for approved, generic prescription drugs that are limited due to poor stability or bioavailability or variable absorption.

NOTE 3 – Going Concern

These consolidated financial statements are presented on the basis that we will continue as a going concern. The going concern concept contemplates the realization of assets and satisfaction of liabilities in the normal course of business. The Company has incurred operating losses for the current period ended September 30, 2013 as well as its last two fiscal years, has a working capital deficiency of $12,461,184 and an accumulated deficit of $21,658,329 as of September 30, 2013. These conditions, among others, raise substantial doubt about the Company’s ability to continue as a going concern. Subsequent to September 30, 2013, the Company entered into an agreement to sell its operating assets. It expects to close the sale by December 31, 2013. Upon closing, the Company will have a material stock ownership of MusclePharm Corporation (“MSLP”), cash, expects to have no liabilities and only one employee of the Company. The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

NOTE 4. - Summary of Significant Accounting Policies

Revenue Recognition. We follow the guidance of the SEC’s Staff Accounting Bulletin (“SAB”) 104 for revenue recognition and Accounting Standards Codification (“ASC”) Topic 605, “Revenue Recognition”. The Company operates as a contract manufacturer and produces finished goods according to customer specifications. The agreements with customers do not contain any rights of return other than for goods that fail to meet the specifications provided by the customer. The Company has not experienced any significant returns from customers and accordingly, in management’s opinion, no reserve for returns is provided. We record revenue when persuasive evidence of an arrangement exists, services have been rendered or product delivery has occurred, the selling price to the customer is fixed or determinable and collectability of the revenue is reasonably assured.

Principles of Consolidation. The consolidated financial statements include the accounts of the Company and its subsidiaries, all of which are wholly owned, and 580 Garcia Ave, LLC (“580 Garcia”) a Variable Interest Entity.

Convertible Instruments. We evaluate and account for conversion options embedded in convertible instruments in accordance with ASC 815 “Derivatives and Hedging Activities”. Applicable Generally Accepted Accounting Principles (“GAAP”) requires companies to bifurcate conversion options from their host instruments and account for them as free standing derivative financial instruments according to certain criteria. The criteria include circumstances in which (a) the economic characteristics and risks of the embedded derivative instrument are not clearly and closely related to the economic characteristics and risks of the host contract, (b) the hybrid instrument that embodies both the embedded derivative instrument and the host contract is not re-measured at fair value under other GAAP with changes in fair value reported in earnings as they occur and (c) a separate instrument with the same terms as the embedded derivative instrument would be considered a derivative instrument.

We account for convertible instruments (when we have determined that the embedded conversion options should not be bifurcated from their host instruments) as follows: We record when necessary, discounts to convertible notes for the intrinsic value of conversion options embedded in debt instruments based upon the differences between the fair value of the underlying common stock at the commitment date of the note transaction and the effective conversion price embedded in the note. Debt discounts under these arrangements are amortized over the term of the related debt to their stated date of redemption.

Common Stock Purchase Warrants. We classify as equity any contracts that require physical settlement or net-share settlement or provide us a choice of net-cash settlement or settlement in our own shares (physical settlement or net-share settlement) provided that such contracts are indexed to our own stock as defined in ASC 815-40 ("Contracts in Entity's Own Equity"). We classify as assets or liabilities any contracts that require net-cash settlement (including a requirement to net cash settle the contract if an event occurs and if that event is outside our control) or give the counterparty a choice of net-cash settlement or settlement in shares (physical settlement or net-share settlement). We assess classification of our common stock purchase warrants and other free standing derivatives at each reporting date to determine whether a change in classification between assets and liabilities is required.

Our derivative instruments consisting of warrants to purchase our common stock were valued using the Black-Scholes option pricing model, using the following assumptions at June 30, 2013:

|

Estimated dividends

|

None

|

|

Expected volatility

|

184%

|

|

Risk-free interest rate

|

0.83%

|

|

Expected term

|

2 to 5 years

|

Goodwill. Goodwill represents the excess of the consideration transferred over the fair value of net assets of business purchased. Goodwill is not being amortized but is evaluated for impairment on at least an annual basis.

NOTE 5.- Discontinued Operations.

On September 3, 2013, the Company entered into an Asset Purchase Agreement, (the “APA”), by and among the Company, BioZone Laboratories, Inc., the Company’s wholly owned subsidiary (“BZL”) (and Lautus Pharmaceuticals LLC, a New Jersey limited liability company (“Lautus” or the “Buyer”). (The Company and BZL are referred to herein as the “Sellers”).

Pursuant to the APA, the Buyer purchased from the Sellers certain assets relating to the Glyderm® brand of skin care products currently manufactured and sold by BZL. Specifically, the Sellers sold all of their interests in (A) the Glyderm® trademark, the Glyderm® patents, the Glyderm® product formulations, the domain names, www.glydermonline.com and www.glydermskincare.com, and the Glyderm® internet website; and (B) the Sellers’ entire inventory of Glyderm® products held for resale (the “Purchased Assets”).

The purchase price for the Purchased Assets is an aggregate amount equal to: (A) one million dollars ($1,000,000), payable as follows: (i) six hundred thousand dollars ($600,000) payable at the closing of the APA (the “Closing Date”), (ii) two hundred thousand dollars ($200,000) payable six (6) months after the Closing Date, and (iii) two hundred thousand dollars ($200,000) payable twelve (12) months after the Closing Date; plus (B) the purchase price for the inventory, calculated based on the amount of units of Glyderm® products purchased on the Closing Date at the price per unit that BZL charges its non-retail customers for similar products. The Buyer will pay the purchase price for the inventory as the Glyderm® products contained in the inventory are sold by the Buyer to third parties.

Simultaneous with the closing of the APA, BZL and the Buyer entered into a Supply Agreement providing for the manufacture of Glyderm® products by BZL on behalf of the Buyer. The term of the Supply Agreement is five years and is subject to termination upon various events set forth in the Supply Agreement, including termination at the Buyer’s option upon ninety days prior written notice. The Supply Agreement contains a schedule of the price per unit that the Buyer has agreed to pay BZL for the manufacture of Glyderm® products. The Buyer is not obligated to purchase any minimum amount of Glyderm® products from BZL during the term of the Supply Agreement. BZL’s assets are subject to the proposed MSLP sale.

In addition, BZL and the Buyer entered into a Services Agreement on the Closing Date pursuant to which BZL will provide to Buyer certain ongoing operational support on behalf of Buyer for a period of twelve months from the Closing Date.

The analysis of the total gain on disposal, carrying values of the assets and liabilities disposed, and also the net cash inflow from the disposal were as follows:

|

Gain on divestment of Glyderm Brand

|

|

Purchase price

|

|

|

1,000,000 |

|

|

Carrying value of net assets

|

|

|

314,347 |

|

|

Net gain on divestment

|

|

|

685,653 |

|

| |

|

|

|

|

|

Carrying value of net assets

|

|

Receivables

|

|

|

181,716 |

|

|

Inventory

|

|

|

125,899 |

|

|

Website

|

|

|

2,662 |

|

|

Deferred financing costs

|

|

|

2,368 |

|

|

Other assets

|

|

|

1,702 |

|

| |

|

|

314,347 |

|

The results of the disposal of the Glyderm brand, and the cash flows from discontinued operations are disclosed under discontinued operations in the nine months ended September 30, 2013 and 2012, and the comparative results have been restated accordingly.

The results of the discontinued operations are as follows:

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2013

|

|

|

2012

|

|

|

2013

|

|

|

2012

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales

|

|

$ |

95,112 |

|

|

$ |

159,610 |

|

|

$ |

402,861 |

|

|

$ |

454,956 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

|

|

(24,380 |

) |

|

|

(43,344 |

) |

|

|

(100,148 |

) |

|

|

(114,112 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

70,732 |

|

|

|

116,266 |

|

|

|

302,713 |

|

|

|

340,844 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and adminstrative expenses

|

|

|

4,000 |

|

|

|

20,400 |

|

|

|

45,807 |

|

|

|

48,274 |

|

|

Selling expenses

|

|

|

2,674 |

|

|

|

72,056 |

|

|

|

44,058 |

|

|

|

188,338 |

|

|

Total Operating Expenses

|

|

|

6,674 |

|

|

|

92,456 |

|

|

|

89,865 |

|

|

|

236,612 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from discontinued operations

|

|

|

64,058 |

|

|

|

23,810 |

|

|

|

212,848 |

|

|

|

104,232 |

|

NOTE 6 - Property and Equipment.

A summary of property and equipment and the estimated useful lives used in the computation of depreciation and amortization is as follows:

|

Fixed Asset

|

|

Useful Life

|

|

September 30, 2013

|

|

|

December 31, 2012

|

|

| |

|

|

|

|

|

|

|

|

|

Vehicles

|

|

5 years

|

|

|

300,370 |

|

|

|

300,370 |

|

|

Furniture and Fixtures

|

|

10 years

|

|

|

66,711 |

|

|

|

64,539 |

|

|

Computers

|

|

5 years

|

|

|

251,487 |

|

|

|

234,123 |

|

|

MFG equipment

|

|

10 years

|

|

|

4,182,352 |

|

|

|

4,062,593 |

|

|

Lab Equipment

|

|

10 years

|

|

|

985,015 |

|

|

|

973,772 |

|

|

Bldg/Leasehold

|

|

19 years (remainder of lease)

|

|

|

1,676,418 |

|

|

|

1,676,418 |

|

|

Building

|

|

40 years

|

|

|

571,141 |

|

|

|

571,141 |

|

|

Land

|

|

Not depreciated

|

|

|

380,000 |

|

|

|

380,000 |

|

| |

|

|

|

|

8,413,494 |

|

|

|

8,262,956 |

|

|

Accumulated depreciation

|

|

|

|

|

(5,280,278 |

) |

|

|

(4,929,037 |

) |

|

Net

|

|

|

|

|

3,133,216 |

|

|

|

3,333,919 |

|

NOTE 7 – Finance Receivables.

Finance receivables, net, consisted of the following:

| |

|

September 30, 2013

|

|

|

December 31, 2012

|

|

| |

|

|

|

|

|

|

|

Accounts receivable purchased

|

|

|

3,510,406 |

|

|

|

- |

|

|

Cash remitted

|

|

|

(1,247,134 |

) |

|

|

- |

|

|

Cash remitted to vendors

|

|

|

(1,848,959 |

) |

|

|

- |

|

|

Fees

|

|

|

(102,599 |

) |

|

|

- |

|

|

Finance receivables, net

|

|

|

311,714 |

|

|

|

- |

|

On March 22, 2013, BZL entered into a Factoring and Security Agreement (the “Factoring Agreement”) with Midland American Capital Corporation (“Midland”) pursuant to which Midland will provide up to $1,500,000 of financing, on a discretionary basis, against the Company’s accounts receivable.

Under the Factoring Agreement, Midland has agreed to purchase certain accounts receivables of the Company and the Company has agreed to pay Midland an initial fee of 2.5% of the face amount of an account (subject to certain adjustments) plus 0.833% of the face amount of an account (subject to certain adjustments) for each 10 day period following the first 30 days of financing. If the receivable is not paid within 75 days of the purchase of the account, Midland can chargeback the receivable to the Company, unless the debtor became insolvent, subject to certain exceptions. In addition, Midland may chargeback the receivable to the Company in the case of an event of default or upon termination of the Factoring Agreement. The Factoring Agreement provides for certain customary covenants of the Company and the Company is subject to penalties in the event of a misdirected fee, a missing notation of Midland on an invoice and late charges on any monies owed to Midland. The term of the Factoring Agreement is one year and is subject to termination by either party upon sixty days prior written notice subject to certain exceptions. MSLP has agreed to assume the Factoring Agreement and acquire the accounts receivable. We agreed to guarantee that collections of the accounts receivable were at least equal to the assumed liability under the Factoring Agreement.

In connection with the execution of the Factoring Agreement, the Company entered into a Purchase Money Rider (the “Purchase Money Rider”) with Midland pursuant to which Midland will provide to the Company, on a discretionary basis, financing to procure raw materials for the manufacture of the Company’s goods. The financing under the Purchase Money Rider may be made via direct payment to the Company’s suppliers or issuance of letters of credit. The Company will be required to pay Midland an initial purchase fee of 2.95% of the amount financed plus a purchase money fee of 0.933% of the amount financed for each 10 day period following the first 30 days of financing.

As collateral security for all of the Company’s obligations under the Factoring Agreement and Purchase Money Rider, BZL granted Midland a security interest in all of its assets. To further secure the Company’s obligations under the Factoring Agreement and Purchase Money Rider, the Company and Baker Cummins Corp., a subsidiary of the Company, executed a Guarantee and Security Agreement pursuant to which each of them agreed to guaranty the Company’s obligations owed by Midland secured by a security interest in all of their assets.

In addition, in connection with the execution of the Factoring Agreement and Purchase Money Rider, Elliot Maza, the Chief Executive Officer, Chief Financial Officer and Secretary of the Company and Brian Keller, the President and Chief Scientific Officer of the Company executed a Validity Guaranty pursuant to which each of these persons has agreed to indemnify Midland from any loss incurred in the event of breach of certain representations and warranties made to Midland or any misstatement, fraud or criminal act on the part of any officer or agent of the Company. Furthermore, certain note holders holding notes in the aggregate principal amount of $2,300,000 entered into inter-creditor agreements, whereby such note-holders agreed to subordinate to Midland their security interest in certain assets of the Company.

NOTE 8 - Equity Method Investments.

Our investment in BetaZone Laboratories LLC (“Betazone”), our significant unconsolidated subsidiary, is accounted for using the equity method of accounting. Summarized financial information for our investment in Betazone assuming 100% ownership interest is as follows:

| |

|

September 30, 2013

|

|

|

December 31, 2012

|

|

|

Balance sheet

|

|

|

|

|

|

|

|

Current assets

|

|

|

66,264

|

|

|

|

3,825

|

|

|

Current liabilities

|

|

|

383,379

|

|

|

|

301,864

|

|

| |

|

|

|

|

|

Statement of operations

|

|

|

Nine Months ended September 30, 2013

|

|

|

|

Year ended December 31, 2012

|

|

|

Revenues

|

|

|

47,893

|

|

|

|

40,002

|

|

|

Net loss

|

|

|

(19,075

|

)

|

|

|

(272,935

|

)

|

In 2011, when the Company’s share of losses equaled the carrying value of its investment, the equity method of accounting was suspended, and no additional losses were charged to operations. The Company’s unrecorded share of losses for the nine months ended September 30, 2013 totaled $8,584.

As of August 14, 2013, Betazone was liquidated.

NOTE 9 - Convertible Notes Payable

The “February 2012 Notes”

On February 24, 2012, we entered into a Securities Purchase Agreement with OPKO Health Inc. pursuant to which we borrowed $1,700,000 evidenced by a 10% convertible note due two years from the date of issuance and issued warrants to purchase 8,500,000 shares of the our common stock, at an exercise price of $0.40 per share.

On February 28, 2012 and February 29, 2012, we entered in a Securities Purchase Agreement with two additional buyers pursuant to which we borrowed an additional $600,000 evidenced by notes and issued warrants to purchase an additional 3,000,000 shares of our common stock, at an exercise price of $0.40 per share. The notes and warrants contained the same terms as the notes and warrants issued to OPKO as described above.

In connection with the sale of the notes and the warrants, the Company and the collateral agent for the buyers entered into a Pledge and Security Agreement pursuant to which all of our obligations under the notes are secured by a first priority perfected security interest in all of our tangible and intangible assets, including all of our ownership interest in our subsidiaries.

The entire principal amount and any accrued and unpaid interest on the notes is due and payable in cash on the maturity date set forth in the notes. The notes bear interest at the rate of 10% per annum. The notes are convertible into shares of our common stock at an initial conversion price of $0.20 per share, subject to adjustment. We may prepay any outstanding amount due under the notes, in whole or in part, prior to the maturity date. The notes are subject to certain “Events of Defaults” which could cause all amounts due and owing thereunder to become immediately due and payable. Among other things, our failure to pay any accrued but unpaid interest when due, the failure to perform any obligation under the governing transaction documents or if any representation or warranty made by the Company in connection with the governing transaction documents proves to have been incorrect in any material respect constitutes an Event of Default under the governing transaction documents.

The Company is prohibited from effecting a conversion of the notes or exercise of the warrants, to the extent that as a result of such conversion or exercise the holder would beneficially own more than 4.99% (subject to waiver) in the aggregate of the issued and outstanding shares of the Company’s common stock, calculated immediately after giving effect to the issuance of shares of common stock upon conversion of such note or exercise of such warrant, as the case may be.

All of the warrants granted with the above notes have been exercised.

We determined that the initial fair value of the warrants was $5,221,172 based on the Black-Scholes option pricing model, which we treated as a liability with a corresponding decrease in the carrying value of the notes. Under authoritative guidance, the carrying value of the notes may not be reduced below zero. Accordingly, we recorded interest expense of $2,921,172 at the time of the issuance of the notes, which is the excess of the value of the warrants over the allocated fair value of the notes. The discount related to the notes will be amortized over the term of the notes as interest expense, calculated using an effective interest method.

We determined that according to ASC 470120-30, a beneficial conversion feature existed based on the intrinsic value of the conversion feature. Due to the fact that the carrying amount of the convertible notes has been reduced to zero, based on the discount allocated from the value of the warrants referred to above, that no beneficial conversion feature is to be recorded. ASC 470-20-30-8 states that if the intrinsic value of the beneficial conversion feature is greater than the proceeds allocated to the convertible instrument, the amount of the discount assigned to the beneficial conversion feature shall be limited to the amount of the proceeds allocated to the convertible instrument.

The “March 2012 Purchase Order Note”

On March 13, 2012, we borrowed $1,000,000 and issued an accredited investor a 10% senior secured convertible promissory note (the “Purchase Order Note”).

The Company has not recorded a beneficial conversion feature on the March 2012 Purchase Order Notes due to the effective conversion price being greater than the fair value of the Company’s stock at the issuance date.

As of September 30, 2013, the Company had repaid $900,000 of the Purchase Order Note. On October 8, 2013, the holder converted the remaining amount due under the Note into 1,180,192 shares and the note was cancelled.

The “April 2012 Working Capital Note”

On April 18, 2012, we borrowed $250,000 and issued an accredited investor a 10% senior convertible promissory note (the “Working Capital Note”).

On June 28, 2012, the holder of the Working Capital Note exchanged such Note for the June 2012 Convertible Notes described below.

The “June 2012 Working Capital Notes”

On June 13, 2012, we borrowed $200,000 and issued accredited investors a 10% promissory notes (the “June 2012 Working Capital Notes”). .

On June 28, 2012, the holders of the June 2012 Working Capital Notes exchanged such notes for the June 2012 Convertible Notes described below.

The “June 2012 Convertible Notes”

On June 28, 2012, we issued $455,274 of 10% convertible promissory notes (the “June 2012 Convertible Notes”) and warrants (the “June 2012 Warrants”) to purchase 2,250,000 shares of our common stock to the holders of the Working Capital Notes and June 2012 Working Capital Notes with an aggregate amount of principal and accrued interest due as of such date equal to the aggregate principal amount of the June 2012 Convertible Notes. The Working Capital Notes and June 2012 Working Capital Notes were cancelled.

The June 2012 Convertible Notes mature June 28, 2014. We may prepay any outstanding amounts owing under the June 2012 Convertible Notes, in whole or in part, at any time prior to the maturity date. The entire remaining principal amount and all accrued but unpaid or unconverted interest is due and payable on the earlier of the Maturity Date or the occurrence of an Event of Default (each as defined in the June 2012 Convertible Notes). The June 2012 Convertible Notes are convertible into shares of our common stock at an initial conversion price of $0.20 per share.

The Company is prohibited from effecting a conversion of the June 2012 Convertible Notes or exercise of the June 2012 Warrants, to the extent that as a result of such conversion or exercise, the holder would beneficially own more than 4.99% (subject to waiver) in the aggregate of the issued and outstanding shares of the Company’s common stock, calculated immediately after giving effect to the issuance of shares of common stock upon conversion of the June 2012 Convertible Note or exercise of the June 2012 Warrants, as the case may be.

The June 2012 Warrants are exercisable immediately, expire ten years after the date of issuance and have an initial exercise price of $0.40 per share. The June 2012 Warrants are exercisable in cash or through a “cashless exercise”. We determined that the initial fair value of the June 2012 Warrants was $1,036,042 based on the Black-Scholes option pricing model, which we treated as a liability with a corresponding decrease in the carrying value of the June 2012 Convertible Notes. Under authoritative guidance, the carrying value of the June 2012 Convertible Notes may not be reduced below zero. Accordingly, we recorded interest expense of $580,768, which is the excess of the value of the June 2012 Warrants over the allocated fair value of the June 2012 Convertible Notes, at the date of the issuance. The discount related to the June 2012 Convertible Notes will be amortized over the term of the Notes as interest expense, calculated using an effective interest method.

We determined that according to ASC 470120-30, a beneficial conversion feature existed based on the intrinsic value of the conversion feature. Due to the fact that the carrying amount of the convertible notes has been reduced to zero, based on the discount allocated from the value of the warrants referred to above, that no beneficial conversion feature is to be recorded. ASC 470-20-30-8 states that if the intrinsic value of the beneficial conversion feature is greater than the proceeds allocated to the convertible instrument, the amount of the discount assigned to the beneficial conversion feature shall be limited to the amount of the proceeds allocated to the convertible instrument.

The “June 2013 Convertible Note”

On June 20, 2013, we borrowed $50,000 and issued a convertible promissory note (the “June 2013 Convertible Note”) which matures one year from its issue date. We may prepay any outstanding amounts owing under the June 2013 Convertible Note, in whole or in part, at any time prior to the maturity date. The entire remaining principal amount and all accrued but unpaid or unconverted interest is due and payable on the earlier of the Maturity Date or the occurrence of an Event of Default (each as defined in the June 2013 Convertible Note). The June 2013 Convertible Note is convertible into shares of our common stock at a conversion price equal to the lower of $0.55 per share or 60% of the lowest trade price in the 25 trading days previous to the conversion. The Company repaid the Note in its entirety in September 2013.

In September 2013, the Company sold an additional promissory note for an aggregate purchase price of $50,000 for the same terms as above.

The “August 2013 Convertible Note”

On August 26, 2013, the Company entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with an investor (the “Buyer”) pursuant to which the Company (i) borrowed $2,000,000 and issued a 10% secured convertible promissory note (the “August 2013 Note”) due one year from the date of issuance (the “Maturity Date”) and issued (ii) warrants (the “August 2013 Warrants”) to purchase 10,000,000 shares of the Company’s common stock.

The August 2013 Note is convertible into shares of the Company’s common stock at an initial conversion price of $0.20 per share, subject to adjustment. The Company may prepay any outstanding amount due under the August 2013 Note, in whole or in part, prior to the Maturity Date. The August 2013 Note is subject to certain “Events of Defaults” which could cause all amounts due and owing thereunder to become immediately due and payable. Among other things, the Company's failure to pay any accrued but unpaid interest when due, the failure to perform any obligation under the Transaction Documents (as defined below) or a determination that any representation or warranty made by the Company in connection with the Transaction Documents shall prove to have been incorrect in any material respect shall constitute an Event of Default under the Transaction Documents.

The August 2013 Warrants are immediately exercisable and expire ten years after the date of issuance. The August 2013 Warrants have an initial exercise price of $0.40 per share. The August 2013 Warrants are exercisable in cash or by way of a cashless exercise while a registration statement covering the shares of Common Stock issuable upon exercise of the Warrants or an exemption from registration is not available. We determined that the initial fair value of the August 2013 Warrants was $2,488,983 based on the Black-Scholes option pricing model, which we treated as a liability with a corresponding decrease in the carrying value of the August 2013 Note. Under authoritative guidance, the carrying value of the August 2013 Note may not be reduced below zero. Accordingly, we recorded interest expense of $488,983, which is the excess of the value of the August 2013 Warrants over the allocated fair value of the August 2013 Note, at the date of the issuance. The discount related to the August 2013 Note will be amortized over the term of the Notes as interest expense, calculated using an effective interest method.

The Company is prohibited from effecting a conversion of the August 2013 Note or exercise of the August 2013 Warrants to the extent that as a result of such conversion or exercise, the Buyer would beneficially own more than 4.99% (subject to waiver) in the aggregate of the issued and outstanding shares of the Company’s common stock, calculated immediately after giving effect to the issuance of shares of common stock upon conversion of the August 2013 Note or exercise of the Warrants, as the case may be.

In connection with the sale of the August 2013 Note and the August 2013 Warrants, the Company, the Buyer and the collateral agent for other secured creditors of the Company (including our Chairman, Roberto Prego-Novo) agreed to enter into an Amended and Restated Pledge and Security Agreement (the “Security Agreement” and, collectively with the Securities Purchase Agreement, the Note and the Warrant, the “Transaction Documents”) pursuant to which all of the Company’s obligations under the August 2013 Note are secured by a perfected security interest in all of the tangible and intangible assets of the Company, including all of its ownership interest in its subsidiaries, pari pasu, with the previous secured creditors, all of which is subordinated to the accounts receivable lender to the Company. Further, pursuant to the Security Agreement, the Note holder, the collateral agent and the prior secured creditors agreed to further subordinate the granted security interest to a security interest previously granted to another investor in the Company.

The Company has granted the Note holder “piggy-back” registration rights with respect to the shares of common stock underlying the August 2013 Note and the shares of common stock underlying the August 2013 Warrants for a period of twelve (12) months from the date of closing.

The following table sets forth a summary of all the outstanding convertible promissory notes at September 30, 2013:

|

Convertible promissory notes issued

|

|

|

8,605,274 |

|

|

Notes repaid

|

|

|

(3,200,000 |

) |

|

Less amounts converted to common stock

|

|

|

(500,000 |

) |

| |

|

|

4,905,274 |

|

|

Less debt discount

|

|

|

2,649,894 |

|

|

Balance September 30, 2013

|

|

|

2,255,380 |

|

NOTE 10 - Notes Payable – Shareholder.

This amount is due to our former Executive Vice President for advances made to the Company, bears interest at a weighted average rate of approximately 10% and is due on demand. On September 10, 2013, as part of the settlement agreement, the Company paid the shareholder $1,052,500 as consideration for all the shareholder notes payable (see Note 15).

NOTE 11 - Long Term Debt.

Long-term debt consists of the following:

| |

|

9/30/2013

|

|

|

12/31/2012

|

|

|

Notes payable of Biozone Labs

|

|

|

|

|

|

|

|

Capitalized lease obligations bearing interest at rates ranging from 8.6% to 16.3%,

|

|

$ |

124,954 |

|

|

$ |

192,323 |

|

|

payable in monthly installments of $168 to $1,589, inclusive of interest

|

|

|

|

|

|

|

|

|

|

City of Pittsburg Redevelopment Agency, 3% interest, payable in monthly installments

|

|

|

195,358 |

|

|

|

221,190 |

|

|

of $3,640 inclusive of interest

|

|

|

|

|

|

|

|

|

|

Other

|

|

|

75,000 |

|

|

|

80,000 |

|

|

Notes payable of 580 Garcia Properties

|

|

|

|

|

|

|

|

|

|

Mortgage payable of 580 Garcia collateralized by the land and building

|

|

|

2,534,392 |

|

|

|

2,582,818 |

|

|

payable in monthly installments of $20,794, inclusive of interest at 7.24% per annum

|

|

|

|

|

|

|

|

|

| |

|

$ |

2,929,704 |

|

|

$ |

3,076,331 |

|

|

Less: current portion

|

|

|

165,623 |

|

|

|

181,752 |

|

| |

|

|

2,764,081 |

|

|

|

2,894,579 |

|

NOTE 12 - Warrants

The “March 2011 Warrants”

In March 2011, the Company issued the March 2011 Warrants to purchase securities of the Company.

On February 28, 2012, each holder of March 2011 Warrants entered into a Cancellation Agreement, which provides, among other things, for the cancellation of the March 2011 Warrants. In exchange, the Company issued to the former holders of the March 2011 Warrants a total of 1,000,000 replacement warrants (the “Replacement Warrants”). The Replacement Warrants may be exercised immediately and expire four years after the date of issue. Each Warrant has an initial exercise price of $0.60 per share, subject to adjustment for certain corporate reorganization transactions.

As of September 30, 2013, a total of 1,000,000 Replacement Warrants remain outstanding, with an exercise price of $0.60 per share.

The “September 2011 Warrant”

In connection with the sale of the September 2011 Note, we issued the September 2011 Warrant to purchase certain securities of the Company.

On November 30, 2011, the holder of the September 2011 Note converted the entire principal amount and accrued interest due with respect to the note into 1,018,356 shares of our common stock and the September 2011 Warrant was cancelled. In exchange, we issued to the holder a Replacement Warrant to purchase 500,000 shares of our common stock at an exercise price of $1.00 per share.

On June 28, 2012, the holder of the Replacement Warrant exercised his right to acquire 500,000 shares of our common stock through the cashless exercise feature and we issued to the holder 375,000 shares of our common stock.

The “January 2012 Warrants”

On January 11, 2012 and January 25, 2012, we sold an aggregate of 1,300,000 units (the “Units”) to accredited investors. Each Unit was sold for a purchase price of $0.50 per Unit and consisted of: (i) one share of the Company’s common stock and (ii) a four-year warrant to purchase one-half of a share of common stock at $1.00 per share, subject to adjustment upon the occurrence of certain events (the “January 2012 Warrants”). The January 2012 Warrants contain cashless exercise rights. Based on authoritative guidance, we have accounted for the January 2012 Warrants as liabilities.

As of September 30, 2013, a total of 650,000 January 2012 Warrants remain outstanding, with an exercise price of $0.50 per share.

The “February 2012 Warrants”

In connection with the sale of the February 2012 Notes, we issued the February 2012 Warrants entitling the holders to purchase up to 11,500,000 shares of our common stock (Note 7).

The February 2012 Warrants expire ten years from date of issuance and have an exercise price of $0.40 per share. The February 2012 Warrants contain a cashless exercise feature. Based on authoritative guidance, we have accounted for the February 2012 Warrants as liabilities. The liability for the warrants, measured at fair value, based on a Black-Scholes option pricing model, has been offset by a reduction in the carrying value of the related February 2012 Notes.

On April 25, 2012, certain holders February 2012 Warrants exercised their right to acquire 3,000,000 shares of our common stock through the cashless exercise feature and we issued to the holders a total of 2,636,804 shares of our common stock.

On July 3, 2012, the remaining holder of February 2012 Warrants exercised its right to acquire 8,500,000 shares of our common stock through the cashless exercise feature and we issued to the holder 7,650,000 shares of our common stock.

The Advisory and Consulting Warrants

As part of an Advisory and Consulting Agreement between the Company and Tekesta Capital Partners, in April 2012, we issued 200,000 warrants to purchase the Company’s common stock exercisable at $0.60 per share. Based on authoritative guidance, we have accounted for these warrants as liabilities.

On August 2, 2012, holders of all the outstanding warrants issued under the Advisory and Consulting Agreement exercised their warrants on a cashless basis and received a total of 170,000 shares of the Company’s common stock.

“The June 2012 Warrants”

In connection with the issuance of the June 2012 Notes, we issued the June 2012 Warrants entitling the holders to purchase up to a total of 2,250,000 shares of our common stock (Note 7). The June 2012 Warrants had an exercise price of $0.40 per share. The June 2012 Warrants contained a cashless exercise feature. Based on authoritative guidance, we have accounted for the June 2012 Warrants as liabilities. The liability for the June 2012 Warrants, measured at fair value, based on a Black-Scholes option pricing model, has been offset by a reduction in the carrying value of the related June 2012 Notes.

On June 28, 2012, the holders of the June 2012 Warrants cashlessly exercised the Warrants and we issued to the holders a total of 2,025,000 shares of our common stock.

“The April 2013 Offering Warrants”

In connection with the issuance of shares in the April 2013 Offering (Note 14), we issued the April 2013 Offering Warrants entitling the holders to purchase up to a total of 1,900,000 shares of our common stock.

The April 2013 Offering Warrants expire five years from the date of issuance and have an exercise price of $0.50 per share, subject to adjustment upon the occurrence of certain events such as stock splits and dividends. The Warrants may be exercised on a cashless basis if at any time there is no effective registration statement covering the resale of the shares of Common Stock underlying the Warrants. The Warrants contain limitations on the holder’s ability to exercise the Warrant in the event such exercise causes the holder to beneficially own in excess of 4.99% of the Company’s issued and outstanding Common Stock, subject to a discretionary increase in such limitation by the holder to 9.99% upon 61 days’ notice.

Based on authoritative guidance, we have accounted for the April 2013 Offering Warrants as liabilities. The liability for the April 2013 Offering Warrants measured at fair value, based on a Black-Scholes option pricing model, has been offset by a reduction in the carrying value of the shares issued in the April 2013 Offering.

The Company paid placement agent fees of $26,500 in cash to a broker-dealer in connection with the sale of the Units. Additionally, the Company issued to the broker-dealer, in connection with the sale of the Units, a warrant to purchase up to 64,000 shares of common stock with substantially the same terms as the Warrants issued to the Investors, as defined in Note 14.

As of September 30, 2013, 1,964,000 warrants remain outstanding. On October 18, 2013, an investor holding 100,000 warrants cashlessly exercised the warrants and received 29,069 shares.

“The August 2013 Warrants”

In connection with the issuance of the August 2013 Notes, we issued the August 2013 Warrants entitling the holders to purchase up to a total of 10,000,000 shares of our common stock (Note 7).

The August 2013, Warrants expire ten years from the date of issuance and have an exercise price of $0.40 per share. The August 2013 Warrants contain a cashless exercise feature. These warrants provide the holder with piggyback registration rights, which obligate us to register the shares underlying the warrants upon the request of the holder in the event that we decide to register any of our common stock either for our own account or the account of a security holder (subject to certain exceptions). Based on authoritative guidance, we have accounted for the August 2013 Warrants as liabilities. The liability for the August 2013 Warrants, measured at fair value, based on a Black-Scholes option pricing model, has been offset by a reduction in the carrying value of the related June 2012 Notes.

As of September 30, 2013 10,000,000 warrants remained outstanding.

NOTE 13 - Concentrations.

Two customers accounted for approximately 24% and 20% of our sales during the nine months ended September 30, 2013 as compared to 27% and 25% of the our sales for the nine months ended September 30, 2012. Two customers accounted for approximately 34% and 19% of our sales for the three months ended September 30, 2013 as compared to 40% and 22% of our sales for the three months ended September 30, 2012.

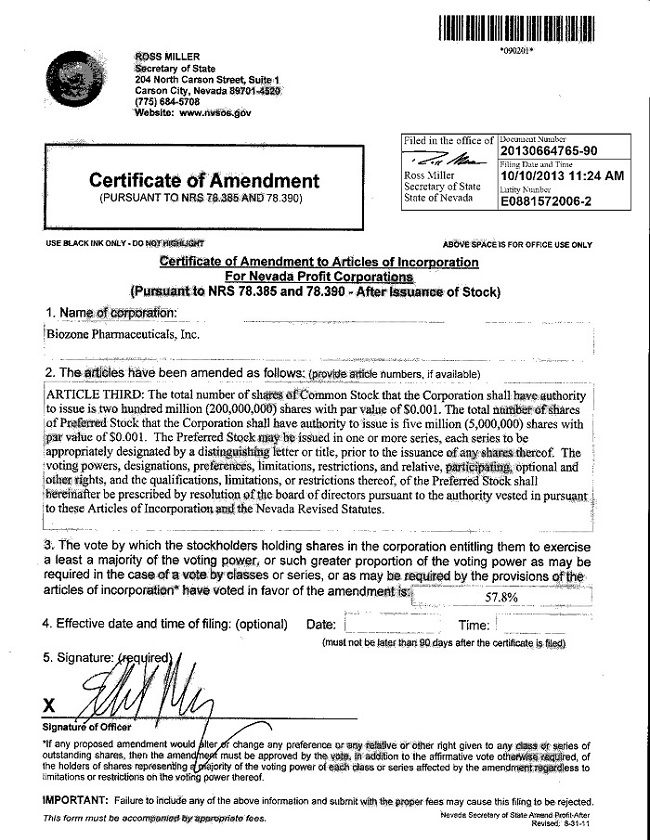

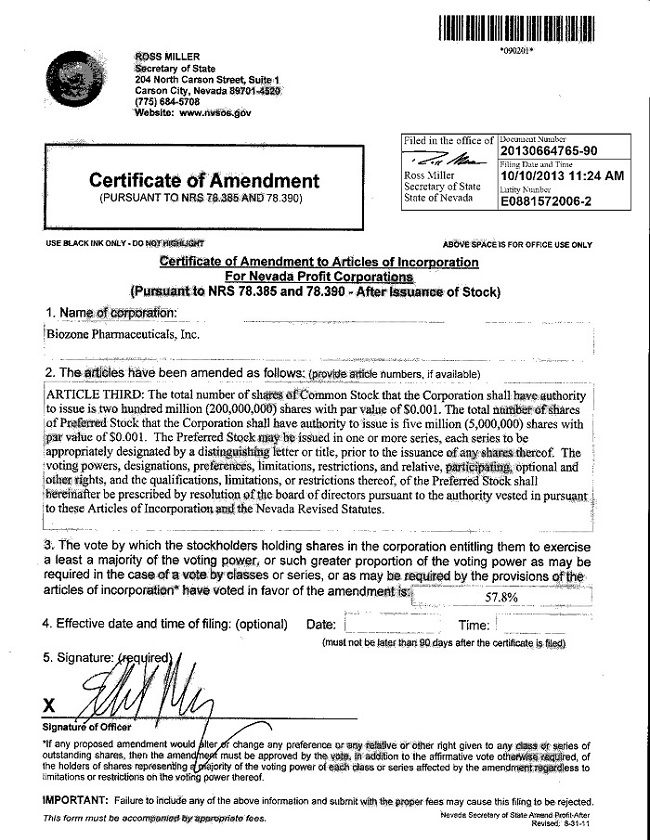

NOTE 14. Capital Deficiency

On April 12, 2013, the Company sold to certain accredited investors (the “Investors”) an aggregate of 2,000,000 units (the “Units”) with gross proceeds to the Company of $500,000. On April 18, 2013, the Company sold an additional 1,200,000 Units to certain additional Investors with gross proceeds to the Company of $300,000. On April 25, 2013, the Company sold an additional 600,000 units to an additional Investor with gross proceeds to the Company of $150,000 (together, the “April 2013 Offering”).

Each Unit was sold for a purchase price of $0.25 per Unit and consisted of: (i) one share of the Company’s common stock and (ii) a five-year warrant (the “April Warrants”) to purchase fifty (50%) percent of the number of shares of common stock purchased at an exercise price of $0.50 per share, subject to adjustment upon the occurrence of certain events such as stock splits, combinations and dividends. In addition on April 19, 2013, the Company issued 2,518,356 shares of its common stock to other investors as part of a ratchet anti-dilution agreement with those investors.

The Company paid placement agent fees of $26,500 in cash to a broker-dealer in connection with the sale of the Units. Additionally, the Company issued to the broker-dealer, in connection with the sale of the Units, a warrant to purchase up to 64,000 shares of common stock with substantially the same terms as the April Warrants issued to the Investors.

On July l, 2013, the Company issued 500,000 shares of common stock for services rendered to the Company.

On July 2, 2013, the Company issued 150,000 shares of common stock for services rendered to the Company.

NOTE 15 - Contingencies

Employment Agreements

On June 30, 2011, the Company entered into three year executive employment agreements with three stockholders, Brian Keller, Christian Oertle and Daniel Fisher, to serve as our President, Chief Operating Officer and Executive Vice President, respectively. The agreements with Messrs. Keller and Fisher provide for annual salaries of $200,000 each and the agreement with Mr. Oertle provides for an annual salary of $150,000. Pursuant to the terms of the agreements, each of these stockholders is eligible to participate in the Company’s long term incentive compensation programs and is entitled to an annual bonus if the Company meets or exceeds criteria adopted by the Compensation Committee of the Board, subject to certain claw back rights. The agreements provide for payments of six months’ severance in the event of early termination (other than for cause).

On January 30, 2012, Mr. Fisher was removed from his position as Executive Vice President. Pursuant to his employment agreement, Mr. Fisher was entitled to accrued salary through the date of termination. In addition, Mr. Fisher claimed pay for accrued vacation. We have paid Mr. Fisher $56,000 in unpaid salary and vacation pay and $23,000 in penalties of which $5,769 remains outstanding and was due on April 15, 2013. Mr. Fisher has demanded delivery to him of 6,650,000 shares of the Company’s common stock. See Litigation below concerning a settlement with Mr. Fisher.

Leases

The Company leases its facilities under operating leases that expire at various dates. Total rent expense under these leases is recognized ratably over the initial period of each lease. Total rent and related expenses under operating leases were $317,712 and $450,877 for the nine months ended September 30, 2013 and 2012, respectively, and $98,491 and $133,595 for the three months ended September 30, 2013 and 2012, respectively. Operating lease obligations after 2013 relate primarily to office facilities.

Litigation

Except as set forth below, we are not involved in any pending legal proceeding or litigation that could have a material impact upon our business or results of operations. To the best of our knowledge, no governmental authority is contemplating any proceeding to which we are a party or to which any of our properties is subject, which would reasonably be likely to have a material adverse effect on our business or results of operations.

Daniel Fisher v. BioZone Pharmaceuticals, Inc., Elliot Maza, Brauser Honig Frost Group, Michael Brauser, Barry Honig, and The Frost Group LLC

United States District Court, Northern District of California, No. 12-03716

On July 16, 2012, Daniel Fisher (“Fisher”), a former officer and director of the Company, commenced an action in the United States District Court for the Northern District of California against the Company and certain officers and investors thereof. Fisher asserts claims for breach of contract, conversion, wrongful termination, and unjust enrichment, and violation of the federal whistleblower statute arising from his former role as an officer and director of the Company and certain contractual agreements that he entered into with the Company. Fisher seeks $23 million in damages against all defendants.

This suit was settled on September 10, 2013, see below.

BioZone Pharmaceuticals, Inc. v. Daniel Fisher and 580 Garcia Properties, LLC

Supreme Court of the State of New York, County of New York, No. 652489/2012

On September 10, 2013, the Company settled the Fisher litigation by entering into a Settlement Agreement and Mutual Release (the “Settlement Agreement”) among Fisher, the Company, BZL, The Frost Group LLC, BrauserHonig Frost Group, Phillip Frost, Michael Brauser, Barry Honig, Elliot Maza, Brian Keller and Roberto Prego-Novo (collectively, the “Parties” and, individually, as a “Party”) dated as of September 5, 2013.

Pursuant to the Settlement Agreement, Fisher dismissed all of his claims contained in the action entitled, Daniel Fisher v. BioZone Pharmaceuticals, Inc., et al., No. 12-CV-03450 (WHA) (LB) United States District Court, Northern District of California, No. 12-03716, in consideration of the Company’s payment to him of the sum of $1,050,000 and the dismissal of the Company’s claims contained in the action entitled, BioZone Pharmaceuticals, Inc. v. Daniel Fisher and 580 Garcia Properties, LLC, Supreme Court of the State of New York, County of New York, No. 652489/2012.

Also, pursuant to the Settlement Agreement, Fisher sold his entire holdings of 6,650,000 shares of the Company’s common stock to various private accredited investors. The purchase of Fisher’s shares, which was a condition to the effectiveness of the Settlement Agreement, was completed on September 10, 2013.