Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-Q

(Mark One)

|

| |

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2017 OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number: 001-35107

APOLLO GLOBAL MANAGEMENT, LLC

(Exact name of Registrant as specified in its charter)

|

| | |

Delaware | | 20-8880053 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

9 West 57th Street, 43rd Floor

New York, New York 10019

(Address of principal executive offices) (Zip Code)

(212) 515-3200

(Registrant’s telephone number, including area code)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer | | x | | Accelerated filer | | ¨ |

Non-accelerated filer | | o (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

| | | | Emerging growth company | | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | |

| ¨ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of November 2, 2017 there were 193,540,853 Class A shares and 1 Class B share outstanding.

|

| | |

| TABLE OF CONTENTS | |

| | Page |

PART I | | |

| | |

ITEM 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

ITEM 1A. | | |

| | |

ITEM 2. | | |

| | |

ITEM 3. | | |

| | |

ITEM 4. | | |

| | |

PART II | | |

| | |

ITEM 1. | | |

| | |

ITEM 1A. | | |

| | |

ITEM 2. | | |

| | |

ITEM 3. | | |

| | |

ITEM 4. | | |

| | |

ITEM 5. | | |

| | |

ITEM 6. | | |

| |

| |

Forward-Looking Statements

This quarterly report may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements include, but are not limited to, discussions related to Apollo’s expectations regarding the performance of its business, liquidity and capital resources and the other non-historical statements in the discussion and analysis. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. When used in this quarterly report, the words “believe,” “anticipate,” “estimate,” “expect,” “intend” and similar expressions are intended to identify forward-looking statements. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. These statements are subject to certain risks, uncertainties and assumptions, including risks relating to our dependence on certain key personnel, our ability to raise new private equity, credit or real assets funds, market conditions generally, our ability to manage our growth, fund performance, changes in our regulatory environment and tax status, the variability of our revenues, net income and cash flow, our use of leverage to finance our businesses and investments by our funds and litigation risks, among others. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in the Company’s

Annual Report on Form 10-K filed with the United States Securities and Exchange Commission (the “SEC”) on February 13, 2017 (the “2016 Annual Report”); as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report and in our other filings. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

Terms Used in This Report

In this quarterly report, references to “Apollo,” “we,” “us,” “our” and the “Company” refer collectively to Apollo Global Management, LLC, a Delaware limited liability company, and its subsidiaries, including the Apollo Operating Group and all of its subsidiaries, or as the context may otherwise require;

“AMH” refers to Apollo Management Holdings, L.P., a Delaware limited partnership, that is an indirect subsidiary of Apollo Global Management, LLC;

“Apollo funds”, “our funds” and references to the “funds” we manage, refer to the funds (including the parallel funds and alternative investment vehicles of such funds), partnerships, accounts, including strategic investment accounts or “SIAs,” alternative asset companies and other entities for which subsidiaries of the Apollo Operating Group provide investment management or advisory services;

“Apollo Operating Group” refers to (i) the limited partnerships through which our Managing Partners currently operate our businesses and (ii) one or more limited partnerships formed for the purpose of, among other activities, holding certain of our gains or losses on our principal investments in the funds, which we refer to as our “principal investments”;

“Assets Under Management”, or “AUM”, refers to the assets of the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment-related services, including, without limitation, capital that such funds, partnerships and accounts have the right to call from investors pursuant to capital commitments. Our AUM equals the sum of:

| |

(i) | the fair value of the investments of the private equity funds, partnerships and accounts we manage or advise plus the capital that such funds, partnerships and accounts are entitled to call from investors pursuant to capital commitments; |

| |

(ii) | the net asset value, or “NAV,” of the credit funds, partnerships and accounts for which we provide investment management or advisory services, other than certain collateralized loan obligations (“CLOs”) and collateralized debt obligations (“CDOs”), which have a fee-generating basis other than the mark-to-market value of the underlying assets, plus used or available leverage and/or capital commitments; |

| |

(iii) | the gross asset value or net asset value of the real assets funds, partnerships and accounts we manage, and the structured portfolio company investments of the funds, partnerships and accounts we manage or advise, which includes the leverage used by such structured portfolio company investments; |

| |

(iv) | the incremental value associated with the reinsurance investments of the portfolio company assets we manage or advise; and |

| |

(v) | the fair value of any other assets that we manage or advise for the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment-related services, plus unused credit facilities, including capital commitments to such funds, partnerships and accounts for investments that may require pre-qualification or other conditions before investment plus any other capital commitments to such funds, partnerships and accounts available for investment that are not otherwise included in the clauses above. |

Our AUM measure includes Assets Under Management for which we charge either nominal or zero fees. Our AUM measure also includes assets for which we do not have investment discretion, including certain assets for which we earn only investment-related service fees, rather than management or advisory fees. Our definition of AUM is not based on any definition of Assets Under Management contained in our operating agreement or in any of our Apollo fund management agreements. We consider multiple factors for determining what should be included in our definition of AUM. Such factors include but are not limited to (1) our ability to influence the investment decisions for existing and available assets; (2) our ability to generate income from the underlying assets in our funds; and (3) the AUM measures that we use internally or believe are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, our calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Our calculation also differs from the manner in which our affiliates registered with the SEC report “Regulatory Assets Under Management” on Form ADV and Form PF in various ways;

“Fee-Generating AUM” consists of assets of the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment-related services and on which we earn management fees, monitoring fees or other investment-related fees pursuant to management or other fee agreements on a basis that varies among the Apollo funds, partnerships and accounts. Management fees are normally based on “net asset value,” “gross assets,” “adjusted par asset value,” “adjusted cost of all unrealized portfolio investments,” “capital commitments,” “adjusted assets,” “stockholders’ equity,” “invested capital” or “capital contributions,” each as defined in the applicable management agreement. Monitoring fees, also referred to as advisory fees, with respect to the structured portfolio company investments of the funds, partnerships and accounts we manage or advise, are generally based on the total value of such structured portfolio company investments, which normally includes leverage, less any portion of such total value that is already considered in Fee-Generating AUM;

“Non-Fee-Generating AUM” refers to AUM that does not produce management fees or monitoring fees. This measure generally includes the following:

| |

(i) | fair value above invested capital for those funds that earn management fees based on invested capital; |

| |

(ii) | net asset values related to general partner and co-investment interests; |

| |

(iii) | unused credit facilities; |

| |

(iv) | available commitments on those funds that generate management fees on invested capital; |

| |

(v) | structured portfolio company investments that do not generate monitoring fees; and |

| |

(vi) | the difference between gross asset and net asset value for those funds that earn management fees based on net asset value. |

“Carry-Eligible AUM” refers to the AUM that may eventually produce carried interest income. All funds for which we are entitled to receive a carried interest income allocation are included in Carry-Eligible AUM, which consists of the following:

| |

(i) | “Carry-Generating AUM”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is currently above its hurdle rate or preferred return, and profit of such funds, partnerships and accounts is being allocated to the general partner in accordance with the applicable limited partnership agreements or other governing agreements; |

| |

(ii) | “AUM Not Currently Generating Carry”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is currently below its hurdle rate or preferred return; and |

| |

(iii) | “Uninvested Carry-Eligible AUM”, which refers to capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is available for investment or reinvestment subject to the provisions of applicable limited partnership agreements or other governing agreements, which capital is not currently part of the NAV or fair value of investments that may eventually produce carried interest income allocable to the general partner. |

“AUM with Future Management Fee Potential” refers to the committed uninvested capital portion of total AUM not

currently earning management fees. The amount depends on the specific terms and conditions of each fund;

We use AUM as a performance measure of our funds’ investment activities, as well as to monitor fund size in relation to professional resource and infrastructure needs. Non-Fee-Generating AUM includes assets on which we could earn carried interest income;

“Advisory” refers to certain assets advised by Apollo Asset Management Europe PC LLP, a wholly-owned subsidiary of Apollo Asset Management Europe LLP (collectively, “AAME”). The AAME entities are subsidiaries of Apollo. Until AAME receives full authorization by the UK Financial Conduct Authority (“FCA”), references to AAME in this report mean AAME and Apollo Management International LLP, an existing FCA authorized and regulated subsidiary of Apollo in the United Kingdom;

“capital deployed” or “deployment” is the aggregate amount of capital that has been invested during a given period (which may, in certain cases, include leverage) by (i) our drawdown funds, (ii) SIAs that have a defined maturity date and (iii) funds and SIAs in our real assets debt strategy;

“carried interest”, “carried interest income” and “incentive income” refer to interests granted to Apollo by an Apollo fund that entitle Apollo to receive allocations, distributions or fees which are based on the performance of such fund or its underlying investments;

“Contributing Partners” refer to those of our partners and their related parties (other than our Managing Partners) who indirectly beneficially own (through Holdings) Apollo Operating Group units;

“drawdown” refers to commitment-based funds and certain SIAs in which investors make a commitment to provide capital at the formation of such funds and SIAs and deliver capital when called as investment opportunities become available. It includes assets of Athene Holding Ltd. (“Athene Holding”) and its subsidiaries (collectively “Athene”) managed by Athene Asset Management, L.P. (“Athene Asset Management” or “AAM”) that are invested in commitment-based funds;

“gross IRR” of a private equity fund represents the cumulative investment-related cash flows (i) for a given investment for the fund or funds which made such investment, and (ii) for a given fund, in the relevant fund itself (and not any one investor in the fund), in each case, on the basis of the actual timing of investment inflows and outflows (for unrealized investments assuming disposition on September 30, 2017 or other date specified) aggregated on a gross basis quarterly, and the return is annualized and compounded before management fees, carried interest and certain other fund expenses (including interest incurred by the fund itself) and measures the returns on the fund’s investments as a whole without regard to whether all of the returns would, if distributed, be payable to the fund’s investors. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor;

“gross IRR” of a credit fund represents the annualized return of a fund based on the actual timing of all cumulative fund cash flows before management fees, carried interest income allocated to the general partner and certain other fund expenses. Calculations may include certain investors that do not pay fees. The terminal value is the net asset value as of the reporting date. Non-U.S. dollar denominated (“USD”) fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor;

“gross IRR” of a real assets fund represents the cumulative investment-related cash flows in the fund itself (and not any one investor in the fund), on the basis of the actual timing of cash inflows and outflows (for unrealized investments assuming disposition on September 30, 2017 or other date specified) starting on the date that each investment closes, and the return is annualized and compounded before management fees, carried interest, and certain other fund expenses (including interest incurred by the fund itself) and measures the returns on the fund’s investments as a whole without regard to whether all of the returns would, if distributed, be payable to the fund’s investors. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor;

“gross return” of a credit or real assets fund is the monthly or quarterly time-weighted return that is equal to the percentage change in the value of a fund’s portfolio, adjusted for all contributions and withdrawals (cash flows) before the effects of management fees, incentive fees allocated to the general partner, or other fees and expenses. Returns of Athene sub-advised portfolios and CLOs represent the gross returns on invested assets, which exclude cash. Returns over multiple periods are calculated by geometrically linking each period’s return over time;

“Holdings” means AP Professional Holdings, L.P., a Cayman Islands exempted limited partnership through which our Managing Partners and Contributing Partners indirectly beneficially own their interests in the Apollo Operating Group units;

“inflows” represents (i) at the individual segment level, subscriptions, commitments, and other increases in available capital, such as acquisitions or leverage, net of inter-segment transfers, and (ii) on an aggregate basis, the sum of inflows across the private equity, credit and real assets segments;

“liquid/performing” includes CLOs and other performing credit vehicles, hedge fund style credit funds, structured credit funds and SIAs, as well as sub-advised managed accounts owned by or related to Athene. Certain commitment-based SIAs are included as the underlying assets are liquid;

“Managing Partners” refer to Messrs. Leon Black, Joshua Harris and Marc Rowan collectively and, when used in reference to holdings of interests in Apollo or Holdings, includes certain related parties of such individuals;

“net IRR” of a private equity fund means the gross IRR applicable to a fund, including returns for related parties which may not pay fees or carried interest, net of management fees, certain fund expenses (including interest incurred or earned by the fund itself) and realized carried interest all offset to the extent of interest income, and measures returns at the fund level on amounts that, if distributed, would be paid to investors of the fund. To the extent that a fund exceeds all requirements detailed within the applicable fund agreement, the estimated unrealized value is adjusted such that a percentage of up to 20.0% of the unrealized gain is allocated to the general partner of such fund, thereby reducing the balance attributable to fund investors. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor;

“net IRR” of a credit fund represents the annualized return of a fund after management fees, carried interest income allocated to the general partner and certain other fund expenses, calculated on investors that pay such fees. The terminal value is the net asset value as of the reporting date. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor;

“net IRR” of a real assets fund represents the cumulative cash flows in the fund (and not any one investor in the fund), on the basis of the actual timing of cash inflows received from and outflows paid to investors of the fund (assuming the ending net asset value as of September 30, 2017 or other date specified is paid to investors), excluding certain non-fee and non-carry bearing parties, and the return is annualized and compounded after management fees, carried interest, and certain other expenses (including interest incurred by the fund itself) and measures the returns to investors of the fund as a whole. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor;

“net return” of a credit or real assets fund represents the gross return after management fees, incentive fees allocated to the general partner, or other fees and expenses. Returns of Athene sub-advised portfolios and CLOs represent the gross or net returns on invested assets, which exclude cash. Returns over multiple periods are calculated by geometrically linking each period’s return over time;

“our manager” means AGM Management, LLC, a Delaware limited liability company that is controlled by our Managing Partners;

“permanent capital vehicles” refers to (a) assets that are owned by or related to Athene (“ATH”) or AGER Bermuda Holding Ltd. (“AGER”), (b) assets that are owned by or related to MidCap FinCo Designated Activity Company (“MidCap”) and managed by Apollo, (c) assets of publicly traded vehicles managed by Apollo such as Apollo Investment Corporation (“AINV”), Apollo Commercial Real Estate Finance, Inc. (“ARI”), Apollo Tactical Income Fund Inc. (“AIF”), and Apollo Senior Floating Rate Fund Inc. (“AFT”), in each case that do not have redemption provisions or a requirement to return capital to investors upon exiting the investments made with such capital, except as required by applicable law and (d) a non-traded business development company from which Apollo earns certain investment-related service fees. The investment management agreements of AINV, AIF and AFT have one year terms, are reviewed annually and remain in effect only if approved by the boards of directors of such companies or by the affirmative vote of the holders of a majority of the outstanding voting shares of such companies, including in either case, approval by a majority of the directors who are not “interested persons” as defined in the Investment Company Act of 1940. In

addition, the investment management agreements of AINV, AIF and AFT may be terminated in certain circumstances upon 60 days’ written notice. The investment management agreement of ARI has a one year term and is reviewed annually by ARI’s board of directors and may be terminated under certain circumstances by an affirmative vote of at least two-thirds of ARI’s independent directors. The investment management or advisory arrangements between MidCap and Apollo and Athene and Apollo, may also be terminated under certain circumstances. The agreement pursuant to which Apollo earns certain investment-related service fees from a non-traded business development company may be terminated under certain limited circumstances;

“private equity fund appreciation (depreciation)” refers to gain (loss) and income for the traditional private equity funds (as defined below), Apollo Natural Resources Partners, L.P. (“ANRP I”), Apollo Natural Resources Partners II, L.P. (“ANRP II”), Apollo Special Situations Fund, L.P. and AION Capital Partners Limited (“AION”) for the periods presented on a total return basis before giving effect to fees and expenses. The performance percentage is determined by dividing (a) the change in the fair value of investments over the period presented, minus the change in invested capital over the period presented, plus the realized value for the period presented, by (b) the beginning unrealized value for the period presented plus the change in invested capital for the period presented. Returns over multiple periods are calculated by geometrically linking each period’s return over time;

“private equity investments” refer to (i) direct or indirect investments in existing and future private equity funds managed or sponsored by Apollo, (ii) direct or indirect co-investments with existing and future private equity funds managed or sponsored by Apollo, (iii) direct or indirect investments in securities which are not immediately capable of resale in a public market that Apollo identifies but does not pursue through its private equity funds, and (iv) investments of the type described in (i) through (iii) above made by Apollo funds;

“Realized Value” refers to all cash investment proceeds received by the relevant Apollo fund, including interest and dividends, but does not give effect to management fees, expenses, incentive compensation or carried interest to be paid by such Apollo fund;

“Remaining Cost” represents the initial investment of the fund in a portfolio investment, reduced for any return of capital distributed to date on such portfolio investment;

“Strategic Investor” refers to the California Public Employees’ Retirement System, or “CalPERS”;

“Total Invested Capital” refers to the aggregate cash invested by the relevant Apollo fund and includes capitalized costs relating to investment activities, if any, but does not give effect to cash pending investment or available for reserves;

“Total Value” represents the sum of the total Realized Value and Unrealized Value of investments;

“traditional private equity funds” refers to Apollo Investment Fund I, L.P. (“Fund I”), AIF II, L.P. (“Fund II”), a mirrored investment account established to mirror Fund I and Fund II for investments in debt securities (“MIA”), Apollo Investment Fund III, L.P. (together with its parallel funds, “Fund III”), Apollo Investment Fund IV, L.P. (together with its parallel fund, “Fund IV”), Apollo Investment Fund V, L.P. (together with its parallel funds and alternative investment vehicles, “Fund V”), Apollo Investment Fund VI, L.P. (together with its parallel funds and alternative investment vehicles, “Fund VI”), Apollo Investment Fund VII, L.P. (together with its parallel funds and alternative investment vehicles, “Fund VII”), Apollo Investment Fund VIII, L.P. (together with its parallel funds and alternative investment vehicles, “Fund VIII”) and Apollo Investment Fund IX, L.P. (together with its parallel funds and alternative investment vehicles, “Fund IX”);

“Unrealized Value” refers to the fair value consistent with valuations determined in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”), for investments not yet realized and may include pay in kind, accrued interest and dividends receivable, if any. In addition, amounts include committed and funded amounts for certain investments; and

“Vintage Year” refers to the year in which a fund’s final capital raise occurred, or, for certain funds, the year in which a fund’s investment period commences as per its governing agreements.

PART I—FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

APOLLO GLOBAL MANAGEMENT, LLC

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (UNAUDITED)

AS OF SEPTEMBER 30, 2017 AND DECEMBER 31, 2016

(dollars in thousands, except share data) |

| | | | | | | |

| As of

September 30, 2017 | | As of

December 31, 2016 |

Assets: | | | |

Cash and cash equivalents | $ | 930,848 |

| | $ | 806,329 |

|

Cash and cash equivalents held at consolidated funds | 10,195 |

| | 7,335 |

|

Restricted cash | 4,165 |

| | 4,680 |

|

U.S. Treasury securities, at fair value | 198,900 |

| | — |

|

Investments | 1,708,064 |

| | 1,494,744 |

|

Assets of consolidated variable interest entities: | | | |

Cash and cash equivalents | 44,226 |

| | 41,318 |

|

Investments, at fair value | 1,170,550 |

| | 913,827 |

|

Other assets | 63,723 |

| | 46,666 |

|

Carried interest receivable | 1,577,984 |

| | 1,257,105 |

|

Due from related parties | 287,352 |

| | 254,853 |

|

Deferred tax assets | 591,754 |

| | 572,263 |

|

Other assets | 164,588 |

| | 118,860 |

|

Goodwill | 88,852 |

| | 88,852 |

|

Intangible assets, net | 19,153 |

| | 22,721 |

|

Total Assets | $ | 6,860,354 |

| | $ | 5,629,553 |

|

Liabilities and Shareholders’ Equity | | | |

Liabilities: | | | |

Accounts payable and accrued expenses | $ | 79,062 |

| | $ | 57,465 |

|

Accrued compensation and benefits | 144,664 |

| | 52,754 |

|

Deferred revenue | 155,081 |

| | 174,893 |

|

Due to related parties | 643,401 |

| | 638,126 |

|

Profit sharing payable | 710,873 |

| | 550,148 |

|

Debt | 1,361,044 |

| | 1,352,447 |

|

Liabilities of consolidated variable interest entities: | | | |

Debt, at fair value | 972,632 |

| | 786,545 |

|

Other liabilities | 85,403 |

| | 68,034 |

|

Other liabilities | 116,211 |

| | 81,613 |

|

Total Liabilities | 4,268,371 |

| | 3,762,025 |

|

Commitments and Contingencies (see note 14) |

|

| |

|

|

Shareholders’ Equity: | | | |

Apollo Global Management, LLC shareholders’ equity: | | | |

Preferred shares (11,000,000 and 0 shares issued and outstanding as of September 30, 2017 and December 31, 2016, respectively) | 264,398 |

| | — |

|

Class A shares, no par value, unlimited shares authorized, 193,540,853 and 185,460,294 shares issued and outstanding at September 30, 2017 and December 31, 2016, respectively | — |

| | — |

|

Class B shares, no par value, unlimited shares authorized, 1 share issued and outstanding at September 30, 2017 and December 31, 2016 | — |

| | — |

|

Additional paid in capital | 1,627,767 |

| | 1,830,025 |

|

Accumulated deficit | (560,613 | ) | | (986,186 | ) |

Accumulated other comprehensive loss | (2,061 | ) | | (8,723 | ) |

Total Apollo Global Management, LLC shareholders’ equity | 1,329,491 |

| | 835,116 |

|

Non-Controlling Interests in consolidated entities | 149,736 |

| | 90,063 |

|

Non-Controlling Interests in Apollo Operating Group | 1,112,756 |

| | 942,349 |

|

Total Shareholders’ Equity | 2,591,983 |

| | 1,867,528 |

|

Total Liabilities and Shareholders’ Equity | $ | 6,860,354 |

| | $ | 5,629,553 |

|

See accompanying notes to condensed consolidated financial statements.

APOLLO GLOBAL MANAGEMENT, LLC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2017 AND 2016

(dollars in thousands, except share data)

|

| | | | | | | | | | | | | | | |

| For the Three Months Ended

September 30, | | For the Nine Months Ended

September 30, |

| 2017 | | 2016 | | 2017 | | 2016 |

Revenues: | | | | | | | |

Management fees from related parties | $ | 301,443 |

| | $ | 274,313 |

| | $ | 852,291 |

| | $ | 775,171 |

|

Advisory and transaction fees from related parties, net | 16,209 |

| | 29,801 |

| | 54,905 |

| | 102,699 |

|

Carried interest income from related parties | 346,580 |

| | 199,617 |

| | 833,459 |

| | 407,134 |

|

Total Revenues | 664,232 |

| | 503,731 |

| | 1,740,655 |

| | 1,285,004 |

|

Expenses: | | | | | | | |

Compensation and benefits: | | | | | | | |

Salary, bonus and benefits | 108,853 |

| | 92,591 |

| | 316,011 |

| | 290,013 |

|

Equity-based compensation | 24,485 |

| | 26,163 |

| | 70,332 |

| | 74,203 |

|

Profit sharing expense | 137,296 |

| | 90,152 |

| | 339,679 |

| | 179,767 |

|

Total Compensation and Benefits | 270,634 |

| | 208,906 |

| | 726,022 |

| | 543,983 |

|

Interest expense | 13,303 |

| | 12,832 |

| | 39,497 |

| | 30,505 |

|

General, administrative and other | 68,149 |

| | 58,566 |

| | 189,918 |

| | 187,285 |

|

Placement fees | 5,397 |

| | 1,953 |

| | 12,560 |

| | 5,781 |

|

Total Expenses | 357,483 |

| | 282,257 |

| | 967,997 |

| | 767,554 |

|

Other Income: | | | | | | | |

Net gains from investment activities | 68,932 |

| | 17,746 |

| | 102,936 |

| | 50,287 |

|

Net gains from investment activities of consolidated variable interest entities | 845 |

| | 800 |

| | 11,085 |

| | 2,817 |

|

Income from equity method investments | 47,488 |

| | 23,213 |

| | 102,877 |

| | 64,356 |

|

Interest income | 1,504 |

| | 1,192 |

| | 2,929 |

| | 3,073 |

|

Other income (loss), net | 25,387 |

| | (40 | ) | | 44,776 |

| | 485 |

|

Total Other Income | 144,156 |

| | 42,911 |

| | 264,603 |

| | 121,018 |

|

Income before income tax provision | 450,905 |

| | 264,385 |

| | 1,037,261 |

| | 638,468 |

|

Income tax provision | (16,542 | ) | | (29,667 | ) | | (54,926 | ) | | (62,508 | ) |

Net Income | 434,363 |

| | 234,718 |

| | 982,335 |

| | 575,960 |

|

Net income attributable to Non-Controlling Interests | (231,411 | ) | | (140,099 | ) | | (542,507 | ) | | (340,077 | ) |

Net Income Attributable to Apollo Global Management, LLC | 202,952 |

| | 94,619 |

| | 439,828 |

| | 235,883 |

|

Net income attributable to Preferred Shareholders | (4,383 | ) | | — |

| | (9,155 | ) | | — |

|

Net Income Attributable to Apollo Global Management, LLC Class A Shareholders | $ | 198,569 |

| | $ | 94,619 |

| | $ | 430,673 |

| | $ | 235,883 |

|

Distributions Declared per Class A Share | $ | 0.52 |

| | $ | 0.37 |

| | $ | 1.46 |

| | $ | 0.90 |

|

Net Income Per Class A Share: | | | | | | | |

Net Income Available to Class A Share – Basic | $ | 1.00 |

| | $ | 0.50 |

| | $ | 2.19 |

| | $ | 1.24 |

|

Net Income Available to Class A Share – Diluted | $ | 1.00 |

| | $ | 0.50 |

| | $ | 2.19 |

| | $ | 1.24 |

|

Weighted Average Number of Class A Shares Outstanding – Basic | 192,882,082 |

| | 184,438,515 |

| | 190,014,240 |

| | 183,602,982 |

|

Weighted Average Number of Class A Shares Outstanding – Diluted | 192,882,082 |

| | 184,438,515 |

| | 190,014,240 |

| | 183,602,982 |

|

See accompanying notes to condensed consolidated financial statements.

APOLLO GLOBAL MANAGEMENT, LLC

CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2017 AND 2016

(dollars in thousands, except share data)

|

| | | | | | | | | | | | | | | |

| For the Three Months Ended

September 30, | | For the Nine Months Ended

September 30, |

| 2017 | | 2016 | | 2017 | | 2016 |

Net Income | $ | 434,363 |

| | $ | 234,718 |

| | $ | 982,335 |

| | $ | 575,960 |

|

Other Comprehensive Income, net of tax: | | | | | | | |

Currency translation adjustments, net of tax | 5,643 |

| | 1,144 |

| | 14,583 |

| | 3,103 |

|

Net gain from change in fair value of cash flow hedge instruments, net of tax | 27 |

| | 26 |

| | 78 |

| | 79 |

|

Net income on available-for-sale securities | 290 |

| | 900 |

| | 189 |

| | 450 |

|

Total Other Comprehensive Income, net of tax | 5,960 |

| | 2,070 |

| | 14,850 |

| | 3,632 |

|

Comprehensive Income | 440,323 |

| | 236,788 |

| | 997,185 |

| | 579,592 |

|

Comprehensive Income attributable to Non-Controlling Interests | (236,410 | ) | | (140,644 | ) | | (550,695 | ) | | (341,539 | ) |

Comprehensive Income Attributable to Apollo Global Management, LLC | $ | 203,913 |

| | $ | 96,144 |

| | $ | 446,490 |

| | $ | 238,053 |

|

See accompanying notes to condensed consolidated financial statements.

APOLLO GLOBAL MANAGEMENT, LLC

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES

IN SHAREHOLDERS’ EQUITY (UNAUDITED)

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2017 AND 2016

(dollars in thousands, except share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Apollo Global Management, LLC Shareholders | | | | | | | | |

| Class A Shares | | Class B Shares | | Preferred Shares | | Additional Paid in Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Loss | | Total Apollo Global Management, LLC Shareholders’ Equity | | Non-Controlling Interests in Consolidated Entities | | Non-Controlling Interests in Apollo Operating Group | | Total Shareholders’ Equity |

Balance at January 1, 2016 | 181,078,937 |

| | 1 |

| | $ | — |

| | $ | 2,005,509 |

| | $ | (1,348,384 | ) | | $ | (7,620 | ) | | $ | 649,505 |

| | $ | 86,561 |

| | $ | 652,915 |

| | $ | 1,388,981 |

|

Dilution impact of issuance of Class A shares | — |

| | — |

| | — |

| | 340 |

| | — |

| | — |

| | 340 |

| | — |

| | — |

| | 340 |

|

Capital increase related to equity-based compensation | — |

| | — |

| | — |

| | 53,910 |

| | — |

| | — |

| | 53,910 |

| | — |

| | — |

| | 53,910 |

|

Capital contributions | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 12,933 |

| | — |

| | 12,933 |

|

Distributions | — |

| | — |

| | — |

| | (172,095 | ) | | — |

| | — |

| | (172,095 | ) | | (10,555 | ) | | (194,371 | ) | | (377,021 | ) |

Payments related to issuances of Class A shares for equity-based awards | 4,245,086 |

| | — |

| | — |

| | 41 |

| | (35,297 | ) | | — |

| | (35,256 | ) | | — |

| | — |

| | (35,256 | ) |

Repurchase of Class A Shares | (954,447 | ) | | — |

| | — |

| | (12,902 | ) | | — |

| | — |

| | (12,902 | ) | | — |

| | — |

| | (12,902 | ) |

Exchange of AOG Units for Class A shares | 374,223 |

| | — |

| | — |

| | 1,539 |

| | — |

| | — |

| | 1,539 |

| | — |

| | (1,251 | ) | | 288 |

|

Net income | — |

| | — |

| | — |

| | — |

| | 235,883 |

| | — |

| | 235,883 |

| | 3,891 |

| | 336,186 |

| | 575,960 |

|

Currency translation adjustments, net of tax | — |

| | — |

| | — |

| | — |

| | — |

| | 1,683 |

| | 1,683 |

| | 1,670 |

| | (250 | ) | | 3,103 |

|

Net gain from change in fair value of cash flow hedge instruments | — |

| | — |

| | — |

| | — |

| | — |

| | 37 |

| | 37 |

| | — |

| | 42 |

| | 79 |

|

Net loss on available-for-sale securities | — |

| | — |

| | — |

| | — |

| | — |

| | 450 |

| | 450 |

| | — |

| | — |

| | 450 |

|

Balance at September 30, 2016 | 184,743,799 |

| | 1 |

| | $ | — |

| | $ | 1,876,342 |

| | $ | (1,147,798 | ) | | $ | (5,450 | ) | | $ | 723,094 |

| | $ | 94,500 |

| | $ | 793,271 |

| | $ | 1,610,865 |

|

Balance at January 1, 2017 | 185,460,294 |

| | 1 |

| | $ | — |

| | $ | 1,830,025 |

| | $ | (986,186 | ) | | $ | (8,723 | ) | | $ | 835,116 |

| | $ | 90,063 |

| | $ | 942,349 |

| | $ | 1,867,528 |

|

Adoption of new accounting guidance | — |

| | — |

| | — |

| | — |

| | 22,901 |

| | — |

| | 22,901 |

| | — |

| | — |

| | 22,901 |

|

Dilution impact of issuance of Class A shares | — |

| | — |

| | — |

| | (295 | ) | | — |

| | — |

| | (295 | ) | | — |

| | — |

| | (295 | ) |

Equity issued in connection with Preferred shares offering | — |

| | — |

| | 264,398 |

| | — |

| | — |

| | — |

| | 264,398 |

| | — |

| | — |

| | 264,398 |

|

Capital increase related to equity-based compensation | — |

| | — |

| | — |

| | 52,442 |

| | — |

| | — |

| | 52,442 |

| | — |

| | — |

| | 52,442 |

|

Capital contributions | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 43,758 |

| | — |

| | 43,758 |

|

Distributions | — |

| | — |

| | (9,155 | ) | | (288,726 | ) | | — |

| | — |

| | (297,881 | ) | | (4,570 | ) | | (329,172 | ) | | (631,623 | ) |

Payments related to issuances of Class A shares for equity-based awards | 2,096,389 |

| | — |

| | — |

| | — |

| | (28,001 | ) | | — |

| | (28,001 | ) | | — |

| | — |

| | (28,001 | ) |

Repurchase of Class A shares | (233,248 | ) | | — |

| | — |

| | (6,903 | ) | | — |

| | — |

| | (6,903 | ) | | — |

| | — |

| | (6,903 | ) |

Exchange of AOG Units for Class A shares | 6,217,418 |

| | — |

| | — |

| | 41,224 |

| | — |

| | — |

| | 41,224 |

| | — |

| | (30,631 | ) | | 10,593 |

|

Net income | — |

| | — |

| | 9,155 |

| | — |

| | 430,673 |

| | — |

| | 439,828 |

| | 8,967 |

| | 533,540 |

| | 982,335 |

|

Currency translation adjustments, net of tax | — |

| | — |

| | — |

| | — |

| | — |

| | 6,436 |

| | 6,436 |

| | 11,518 |

| | (3,371 | ) | | 14,583 |

|

Net gain from change in fair value of cash flow hedge instruments | — |

| | — |

| | — |

| | — |

| | — |

| | 37 |

| | 37 |

| | — |

| | 41 |

| | 78 |

|

Net income on available-for-sale securities | — |

| | — |

| | — |

| | — |

| | — |

| | 189 |

| | 189 |

| | — |

| | — |

| | 189 |

|

Balance at September 30, 2017 | 193,540,853 |

| | 1 |

| | $ | 264,398 |

| | $ | 1,627,767 |

| | $ | (560,613 | ) | | $ | (2,061 | ) | | $ | 1,329,491 |

| | $ | 149,736 |

| | $ | 1,112,756 |

| | $ | 2,591,983 |

|

See accompanying notes to condensed consolidated financial statements.

APOLLO GLOBAL MANAGEMENT, LLC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2017 AND 2016

(dollars in thousands, except share data)

|

| | | | | | | |

| For the Nine Months Ended

September 30, |

| 2017 | | 2016 |

Cash Flows from Operating Activities: | | | |

Net income | $ | 982,335 |

| | $ | 575,960 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Equity-based compensation | 70,332 |

| | 74,203 |

|

Depreciation and amortization | 15,241 |

| | 14,139 |

|

Unrealized gains from investment activities | (107,803 | ) | | (50,084 | ) |

Income from equity method investments | (102,877 | ) | | (64,356 | ) |

Change in fair value of contingent obligations | 4,619 |

| | 11,736 |

|

Deferred taxes, net | 49,817 |

| | 52,184 |

|

Other non-cash amounts included in net income, net | 1,310 |

| | (10,766 | ) |

Cash flows due to changes in operating assets and liabilities: | | | |

Carried interest receivable | (325,786 | ) | | (348,815 | ) |

Due from related parties | (47,536 | ) | | (49,863 | ) |

Accounts payable and accrued expenses | 21,597 |

| | 24,306 |

|

Accrued compensation and benefits | 91,910 |

| | 65,602 |

|

Deferred revenue | (17,285 | ) | | 29,168 |

|

Due to related parties | (12,776 | ) | | 68,726 |

|

Profit sharing payable | 179,703 |

| | 168,741 |

|

Other assets and other liabilities, net | (14,409 | ) | | (8,082 | ) |

Cash distributions of earnings from equity method investments | 41,335 |

| | 17,079 |

|

Satisfaction of contingent obligation | (23,597 | ) | | (10,096 | ) |

Apollo Fund and VIE related: | | | |

Net realized and unrealized (gains) losses from investing activities and debt | (10,111 | ) | | 621 |

|

Change in cash held at consolidated variable interest entities | 2,157 |

| | 4,139 |

|

Purchases of investments | (517,652 | ) | | (396,810 | ) |

Proceeds from sale of investments | 385,035 |

| | 422,922 |

|

Changes in other assets and other liabilities, net | 1,925 |

| | (17,483 | ) |

Net Cash Provided by Operating Activities | $ | 667,484 |

| | $ | 573,171 |

|

Cash Flows from Investing Activities: | | | |

Purchases of fixed assets | $ | (5,929 | ) | | $ | (4,921 | ) |

Purchase of investments | (14,774 | ) | | (44,530 | ) |

Purchase of U.S. Treasury securities | (198,868 | ) | | — |

|

Cash contributions to equity method investments | (116,233 | ) | | (188,572 | ) |

Cash distributions from equity method investments | 80,360 |

| | 68,685 |

|

Issuance of related party loans | (5,834 | ) | | (3,906 | ) |

Repayment of related party loans | 17,700 |

| | — |

|

Other investing activities | (626 | ) | | 919 |

|

Net Cash Used in Investing Activities | $ | (244,204 | ) | | $ | (172,325 | ) |

Cash Flows from Financing Activities: | | | |

Issuance of Preferred shares (net of issuance costs) | $ | 264,398 |

| | $ | — |

|

Distributions to Preferred Shareholders | (9,155 | ) | | — |

|

Principal repayments of debt | (30 | ) | | (200,000 | ) |

Issuance of debt | — |

| | 532,706 |

|

Satisfaction of tax receivable agreement | (17,895 | ) | | — |

|

Purchase of Class A shares | (18,463 | ) | | (13,003 | ) |

Payments related to issuances of Class A shares for RSUs | (28,001 | ) | | (35,297 | ) |

Distributions paid | (288,726 | ) | | (172,095 | ) |

Distributions paid to Non-Controlling Interests in Apollo Operating Group | (329,172 | ) | | (194,371 | ) |

Other financing activities | (2,949 | ) | | (11,926 | ) |

Apollo Fund and VIE related: | | | |

Issuance of debt | 534,595 |

| | — |

|

Principal repayment of debt | (442,640 | ) | | — |

|

Distributions paid to Non-Controlling Interests in consolidated entities | (347 | ) | | (4,133 | ) |

Contributions from Non-Controlling Interests in consolidated entities | 42,484 |

| | 12,897 |

|

Net Cash Used in Financing Activities | $ | (295,901 | ) | | $ | (85,222 | ) |

Net Increase in Cash and Cash Equivalents | 127,379 |

| | 315,624 |

|

Cash and Cash Equivalents, Beginning of Period | 813,664 |

| | 617,322 |

|

Cash and Cash Equivalents, End of Period | $ | 941,043 |

| | $ | 932,946 |

|

Supplemental Disclosure of Cash Flow Information: | | | |

Interest paid | $ | 32,207 |

| | $ | 20,045 |

|

Interest paid by consolidated variable interest entities | 9,026 |

| | 13,911 |

|

Income taxes paid | 8,070 |

| | 5,806 |

|

Supplemental Disclosure of Non-Cash Investing Activities: | | | |

Non-cash contributions to equity method investments | $ | — |

| | $ | 1,231 |

|

Non-cash distributions from equity method investments | (26,167 | ) | | (4,496 | ) |

Non-cash purchases of other investments, at fair value | 25,091 |

| | — |

|

Supplemental Disclosure of Non-Cash Financing Activities: | | | |

Capital increases related to equity-based compensation | $ | 52,442 |

| | $ | 53,910 |

|

Other non-cash financing activities | (296 | ) | | 364 |

|

Adjustments related to exchange of Apollo Operating Group units: | | | |

Deferred tax assets | $ | 46,539 |

| | $ | 1,807 |

|

Due to affiliates | (35,946 | ) | | (1,519 | ) |

Additional paid in capital | (10,593 | ) | | (288 | ) |

Non-Controlling Interest in Apollo Operating Group | 30,631 |

| | 1,251 |

|

See accompanying notes to condensed consolidated financial statements.

APOLLO GLOBAL MANAGEMENT, LLC

NOTES TO CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

(dollars in thousands, except share data, except where noted)

1. ORGANIZATION

Apollo Global Management, LLC (“AGM”, together with its consolidated subsidiaries, the “Company” or “Apollo”) is a global alternative investment manager whose predecessor was founded in 1990. Its primary business is to raise, invest and manage private equity, credit and real assets funds as well as strategic investment accounts, on behalf of pension, endowment and sovereign wealth funds, as well as other institutional and individual investors. For these investment management services, Apollo receives management fees generally related to the amount of assets managed, transaction and advisory fees and carried interest income related to the performance of the respective funds that it manages. Apollo has three primary business segments:

| |

• | Private equity—primarily invests in control equity and related debt instruments, convertible securities and distressed debt investments; |

| |

• | Credit—primarily invests in non-control corporate and structured debt instruments including performing, stressed and distressed investments across the capital structure; and |

| |

• | Real assets—primarily invests in real estate equity for the acquisition and recapitalization of real estate assets, portfolios, platforms and operating companies, and real estate debt including first mortgage and mezzanine loans, preferred equity and commercial mortgage backed securities. |

Organization of the Company

The Company was formed as a Delaware limited liability company on July 3, 2007 and completed a reorganization of its predecessor businesses on July 13, 2007 (the “2007 Reorganization”). The Company is managed and operated by its manager, AGM Management, LLC, which in turn is indirectly wholly-owned and controlled by Leon Black, Joshua Harris and Marc Rowan, its Managing Partners.

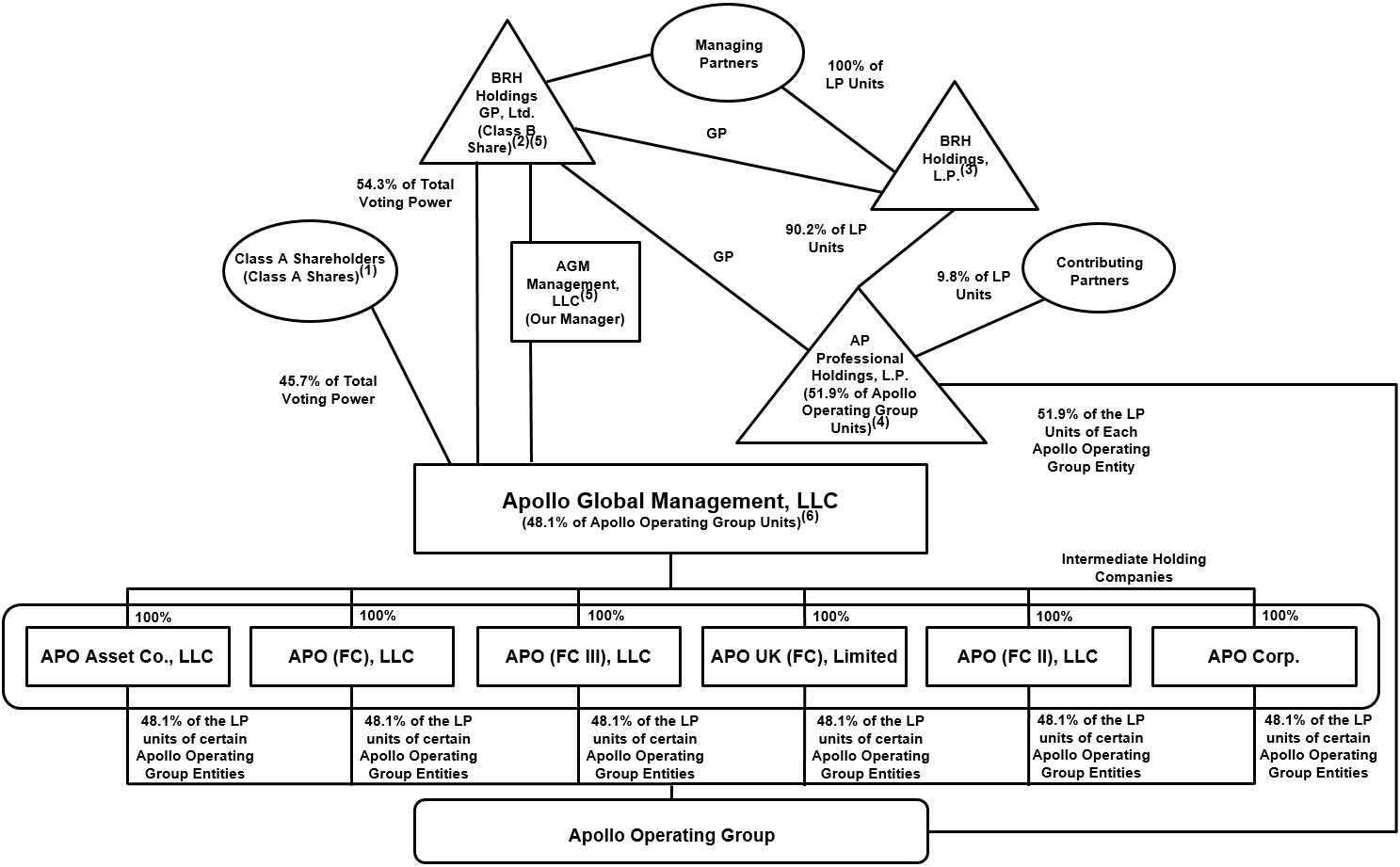

As of September 30, 2017, the Company owned, through six intermediate holding companies that include APO Corp., a Delaware corporation that is a domestic corporation for U.S. federal income tax purposes, APO Asset Co., LLC, a Delaware limited liability company that is a disregarded entity for U.S. federal income tax purposes, APO (FC), LLC, an Anguilla limited liability company that is treated as a corporation for U.S. federal income tax purposes, APO (FC II), LLC, an Anguilla limited liability company that is treated as a corporation for U.S. federal income tax purposes, APO UK (FC), Limited, a United Kingdom incorporated company that is treated as a corporation for U.S. federal income tax purposes, and APO (FC III), LLC, a Cayman Islands limited liability company (collectively, the “Intermediate Holding Companies”), 48.1% of the economic interests of, and operated and controlled all of the businesses and affairs of, the Apollo Operating Group through its wholly-owned subsidiaries.

AP Professional Holdings, L.P., a Cayman Islands exempted limited partnership (“Holdings”), is the entity through which the Managing Partners and certain of the Company’s other partners (the “Contributing Partners”) indirectly beneficially own interests in each of the partnerships that comprise the Apollo Operating Group (“AOG Units”). As of September 30, 2017, Holdings owned the remaining 51.9% of the economic interests in the Apollo Operating Group. The Company consolidates the financial results of the Apollo Operating Group and its consolidated subsidiaries. Holdings’ ownership interest in the Apollo Operating Group is reflected as a Non-Controlling Interest in the accompanying condensed consolidated financial statements.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements are prepared in accordance with U.S. GAAP for interim financial information and instructions to the Quarterly Report on Form 10-Q. The condensed consolidated financial statements and these notes are unaudited and exclude some of the disclosures required in annual financial statements. Management believes it has made all necessary adjustments (consisting only of normal recurring items) so that the condensed consolidated financial statements are presented fairly and that estimates made in preparing its condensed consolidated financial statements are reasonable and prudent. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. These condensed consolidated financial statements should be read in conjunction with the annual financial statements included in the 2016 Annual Report.

The condensed consolidated financial statements include the accounts of the Company, its wholly-owned or majority-owned subsidiaries, the consolidated entities which are considered to be variable interest entities (“VIEs”) and for which the

APOLLO GLOBAL MANAGEMENT, LLC

NOTES TO CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

(dollars in thousands, except share data, except where noted)

Company is considered the primary beneficiary, and certain entities which are not considered VIEs but which the Company controls through a majority voting interest.

Intercompany accounts and transactions, if any, have been eliminated upon consolidation.

Certain reclassifications, when applicable, have been made to the prior period’s condensed consolidated financial statements and notes to conform to the current period’s presentation and are disclosed accordingly.

Consolidation

The types of entities with which Apollo is involved generally include subsidiaries (e.g., general partners and management companies related to the funds the Company manages), entities that have all the attributes of an investment company (e.g., funds) and securitization vehicles (e.g., CLOs). Each of these entities is assessed for consolidation on a case by case basis depending on the specific facts and circumstances surrounding that entity.

Pursuant to the consolidation guidance, the Company first evaluates whether it holds a variable interest in an entity. Fees that are customary and commensurate with the level of services provided, and where the Company does not hold other economic interests in the entity that would absorb more than an insignificant amount of the expected losses or returns of the entity, would not be considered a variable interest. Apollo factors in all economic interests including proportionate interests through related parties, to determine if such interests are considered a variable interest. As Apollo’s interests in many of these entities are solely through market rate fees and/or insignificant indirect interests through related parties, Apollo is not considered to have a variable interest in many of these entities and no further consolidation analysis is performed. For entities where the Company has determined that it does hold a variable interest, the Company performs an assessment to determine whether each of those entities qualify as a VIE.

The determination as to whether an entity qualifies as a VIE depends on the facts and circumstances surrounding each entity and therefore certain of Apollo’s funds may qualify as VIEs under the variable interest model whereas others may qualify as voting interest entities (“VOEs”) under the voting interest model. The granting of substantive kick-out rights is a key consideration in determining whether a limited partnership or similar entity is a VIE and whether or not that entity should be consolidated.

Under the variable interest model, Apollo consolidates those entities where it is determined that the Company is the primary beneficiary of the entity. The Company is determined to be the primary beneficiary when it has a controlling financial interest in the VIE, which is defined as possessing both (i) the power to direct the activities of the VIE that most significantly impact the VIE’s economic performance and (ii) the obligation to absorb losses of the VIE or the right to receive benefits from the VIE that could potentially be significant to the VIE. Apollo determines whether it is the primary beneficiary of a VIE at the time it becomes initially involved with the VIE and reconsiders that conclusion continuously. Investments and redemptions (either by Apollo, related parties of Apollo or third parties) or amendments to the governing documents of the respective entity may affect an entity’s status as a VIE or the determination of the primary beneficiary.

Assets and liabilities of the consolidated VIEs are primarily shown in separate sections within the condensed consolidated statements of financial condition. Changes in the fair value of the consolidated VIEs’ assets and liabilities and related interest, dividend and other income and expenses are presented within net gains from investment activities of consolidated variable interest entities in the condensed consolidated statements of operations. The portion attributable to Non-Controlling Interests is reported within net income attributable to Non-Controlling Interests in the condensed consolidated statements of operations. For additional disclosures regarding VIEs, see note 4.

Under the voting interest model, Apollo consolidates those entities it controls through a majority voting interest. Apollo does not consolidate those VOEs in which substantive kick-out rights have been granted to the unrelated investors to either dissolve the fund or remove the general partner.

Fair Value of Financial Instruments

The fair value of a financial instrument is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions.

Except for the Company’s debt obligations (as described in note 9), Apollo’s financial instruments are recorded at fair value or at amounts whose carrying values approximate fair value. See “Investments, at Fair Value” below. While Apollo’s valuations of portfolio investments are based on assumptions that Apollo believes are reasonable under the circumstances, the actual realized gains or losses will depend on, among other factors, future operating results, the value of the assets and market conditions at the

APOLLO GLOBAL MANAGEMENT, LLC

NOTES TO CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

(dollars in thousands, except share data, except where noted)

time of disposition, any related transaction costs and the timing and manner of sale, all of which may ultimately differ significantly from the assumptions on which the valuations were based. Financial instruments’ carrying values generally approximate fair value because of the short-term nature of those instruments or variable interest rates related to the borrowings.

Fair Value Hierarchy

U.S. GAAP establishes a hierarchical disclosure framework which prioritizes and ranks the level of market price observability used in measuring financial instruments at fair value. Market price observability is affected by a number of factors, including the type of financial instrument, the characteristics specific to the financial instrument and the state of the marketplace, including the existence and transparency of transactions between market participants. Financial instruments with readily available quoted prices in active markets generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

Financial instruments measured and reported at fair value are classified and disclosed based on the observability of inputs used in the determination of fair values, as follows:

Level I - Quoted prices are available in active markets for identical financial instruments as of the reporting date. The types of financial instruments included in Level I include listed equities and debt. The Company does not adjust the quoted price for these financial instruments, even in situations where the Company holds a large position and the sale of such position would likely deviate from the quoted price.

Level II - Pricing inputs are other than quoted prices in active markets, which are either directly or indirectly observable as of the reporting date, and fair value is determined through the use of models or other valuation methodologies. Financial instruments that are generally included in this category include corporate bonds and loans, less liquid and restricted equity securities and certain over-the-counter derivatives where the fair value is based on observable inputs. These financial instruments exhibit higher levels of liquid market observability as compared to Level III financial instruments.

Level III - Pricing inputs are unobservable for the financial instrument and includes situations where there is little observable market activity for the financial instrument. The inputs into the determination of fair value may require significant management judgment or estimation. Financial instruments that are included in this category generally include general and limited partner interests in corporate private equity and real assets funds, opportunistic credit funds, distressed debt and non-investment grade residual interests in securitizations and CDOs and CLOs where the fair value is based on observable inputs as well as unobservable inputs.

When a security is valued based on broker quotes, the Company subjects those quotes to various criteria in making the determination as to whether a particular financial instrument would qualify for classification as Level II or Level III. These criteria include, but are not limited to, the number and quality of the broker quotes, the standard deviations of the observed broker quotes, and the percentage deviation from independent pricing services.

In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, a financial instrument’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the financial instrument when the fair value is based on unobservable inputs.

Transfers between levels of the fair value hierarchy are recognized as of the end of the reporting period.

Private Equity Investments

The value of liquid investments in Apollo’s private equity funds, where the primary market is an exchange (whether foreign or domestic) is determined using period end market prices. Such prices are generally based on the close price on the date of determination.

Valuation approaches used to estimate the fair value of investments in Apollo’s private equity funds that are less liquid include the market approach and the income approach. The market approach provides an indication of fair value based on a comparison of the subject company to comparable publicly traded companies and transactions in the industry. The market approach is driven more by current market conditions, including actual trading levels of similar companies and, to the extent available, actual

APOLLO GLOBAL MANAGEMENT, LLC

NOTES TO CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

(dollars in thousands, except share data, except where noted)

transaction data of similar companies. Judgment is required by management when assessing which companies are similar to the subject company being valued. Consideration may also be given to such factors as the Company’s historical and projected financial data, valuations given to comparable companies, the size and scope of the Company’s operations, the Company’s strengths, weaknesses, expectations relating to the market’s receptivity to an offering of the Company’s securities, applicable restrictions on transfer, industry and market information and assumptions, general economic and market conditions and other factors deemed relevant. The income approach provides an indication of fair value based on the present value of cash flows that a business or security is expected to generate in the future. The most widely used methodology in the income approach is a discounted cash flow method. Inherent in the discounted cash flow method are assumptions of expected results, the determination of a terminal value and a calculated discount rate.

Credit Investments

The majority of investments in Apollo’s credit funds are valued based on quoted market prices and valuation models. Quoted market prices are valued based on the average of the “bid” and the “ask” quotes provided by multiple brokers wherever possible without any adjustments. Apollo will designate certain brokers to use to value specific securities. In order to determine the designated brokers, Apollo considers the following: (i) brokers with which Apollo has previously transacted, (ii) the underwriter of the security and (iii) active brokers indicating executable quotes. In addition, when valuing a security based on broker quotes wherever possible Apollo tests the standard deviation amongst the quotes received and the variance between the concluded fair value and the value provided by a pricing service. When broker quotes are not available Apollo considers the use of pricing service quotes or other sources to mark a position. When relying on a pricing service as a primary source, Apollo (i) analyzes how the price has moved over the measurement period, (ii) reviews the number of brokers included in the pricing service’s population and (iii) validates the valuation levels with Apollo’s pricing team and traders.

Debt and equity securities that are not publicly traded or whose market prices are not readily available are valued at fair value utilizing a model based approach to determine fair value. Valuation approaches used to estimate the fair value of illiquid credit investments also may include the market approach and the income approach, as previously described above. The valuation approaches used consider, as applicable, market risks, credit risks, counterparty risks and foreign currency risks.

Real Assets Investments

The estimated fair value of commercial mortgage-backed securities (“CMBS”) in Apollo’s real assets funds is determined by reference to market prices provided by certain dealers who make a market in these financial instruments. Broker quotes are only indicative of fair value and may not necessarily represent what the funds would receive in an actual trade for the applicable instrument. Additionally, the loans held-for-investment are stated at the principal amount outstanding, net of deferred loan fees and costs for certain investments. The loans in Apollo’s real assets funds are evaluated for possible impairment on a quarterly basis. For Apollo’s real assets funds, valuations of non-marketable underlying investments are determined using methods that include, but are not limited to (i) discounted cash flow estimates or comparable analysis prepared internally, (ii) third party appraisals or valuations by qualified real estate appraisers and (iii) contractual sales value of investments/properties subject to bona fide purchase contracts. Methods (i) and (ii) also incorporate consideration of the use of the income, cost, or sales comparison approaches of estimating property values.

Certain of the private equity, credit, and real assets funds may also enter into foreign currency exchange contracts, total return swap contracts, credit default swap contracts, and other derivative contracts, which may include options, caps, collars and floors. Foreign currency exchange contracts are marked-to-market by recognizing the difference between the contract exchange rate and the current market rate as unrealized appreciation or depreciation. If securities are held at the end of this period, the changes in value are recorded in income as unrealized. Realized gains or losses are recognized when contracts are settled. Total return swap and credit default swap contracts are recorded at fair value as an asset or liability with changes in fair value recorded as unrealized appreciation or depreciation. Realized gains or losses are recognized at the termination of the contract based on the difference between the close-out price of the total return or credit default swap contract and the original contract price. Forward contracts are valued based on market rates obtained from counterparties or prices obtained from recognized financial data service providers.

Valuation Process

On a quarterly basis, Apollo utilizes valuation committees consisting of members from senior management, to review and approve the valuation results related to the investments of the funds it manages. For certain publicly traded vehicles managed by the Company, a review is performed by an independent board of directors. The Company also retains independent valuation firms to provide third-party valuation consulting services to Apollo, which consist of certain limited procedures that management

APOLLO GLOBAL MANAGEMENT, LLC

NOTES TO CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

(dollars in thousands, except share data, except where noted)

identifies and requests them to perform. The limited procedures provided by the independent valuation firms assist management with validating their valuation results or determining fair value. The Company performs various back-testing procedures to validate their valuation approaches, including comparisons between expected and observed outcomes, forecast evaluations and variance analyses. However, because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material.

Financial Instruments held by Consolidated VIEs

The Company measures both the financial assets and financial liabilities of the consolidated CLOs in its condensed consolidated financial statements using the fair value of the financial assets of the consolidated CLOs, which are more observable than the fair value of the financial liabilities of the consolidated CLOs. As a result, the financial assets of the consolidated CLOs are measured at fair value and the financial liabilities are measured in consolidation as: (i) the sum of the fair value of the financial assets and the carrying value of any non-financial assets that are incidental to the operations of the CLOs less (ii) the sum of the fair value of any beneficial interests retained by the Company (other than those that represent compensation for services) and the Company’s carrying value of any beneficial interests that represent compensation for services. The resulting amount is allocated to the individual financial liabilities (other than the beneficial interest retained by the Company) using a reasonable and consistent methodology. Under the measurement alternative, net income (loss) attributable to Apollo Global Management, LLC reflects the Company’s own economic interests in the consolidated CLOs including (i) changes in the fair value of the beneficial interests retained by the Company and (ii) beneficial interests that represent compensation for collateral management services.

The consolidated VIEs hold investments that could be traded over-the-counter. Investments in securities that are traded on a securities exchange or comparable over-the-counter quotation systems are valued based on the last reported sale price at that date. If no sales of such investments are reported on such date, and in the case of over-the-counter securities or other investments for which the last sale date is not available, valuations are based on independent market quotations obtained from market participants, recognized pricing services or other sources deemed relevant, and the prices are based on the average of the “bid” and “ask” prices, or at ascertainable prices at the close of business on such day. Market quotations are generally based on valuation pricing models or market transactions of similar securities adjusted for security-specific factors such as relative capital structure priority and interest and yield risks, among other factors. When market quotations are not available, a model based approach is used to determine fair value.

As previously noted, the Company measures the debt obligations of the consolidated CLOs on the basis of the fair value of the financial assets of the consolidated CLOs.

Fair Value Option

Apollo has elected the fair value option for the Company’s investment in Athene Holding, the assets and liabilities of certain of its consolidated VIEs (including CLOs), the Company’s U.S. Treasury securities with original maturities greater than three months when purchased, and certain of the Company’s other investments. Such election is irrevocable and is applied to financial instruments on an individual basis at initial recognition. Apollo has applied the fair value option for certain corporate loans, other investments and debt obligations held by the consolidated VIEs that otherwise would not have been carried at fair value. See notes 3, 4, and 5 for further disclosure on the investments in Athene Holding and financial instruments of the consolidated VIEs and other investments for which the fair value option has been elected.

Cash and Cash Equivalents

Apollo considers all highly liquid short-term investments with original maturities of three months or less when purchased to be cash equivalents. Cash and cash equivalents include money market funds and U.S. treasury securities with original maturities of three months or less when purchased. Interest income from cash and cash equivalents is recorded in interest income in the condensed consolidated statements of operations. The carrying values of the money market funds and U.S. treasury securities of $428.1 million as of September 30, 2017, which approximate their fair values due to their short-term nature and are categorized as Level I within the fair value hierarchy. Substantially all of the Company’s cash on deposit is in interest bearing accounts with major financial institutions and exceed insured limits.

U.S. Treasury securities, at fair value

U.S. Treasury securities, at fair value includes U.S. Treasury bills with original maturities greater than three months when purchased. These securities are recorded at fair value. Interest income on such securities is separately presented from the overall change in fair value and is recognized in interest income in the condensed consolidated statements of operations. Any

APOLLO GLOBAL MANAGEMENT, LLC

NOTES TO CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

(dollars in thousands, except share data, except where noted)

remaining change in fair value of such securities, that is not recognized as interest income, is recognized in net gains from investment activities in the condensed consolidated statements of operations.