Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

|

| |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-35882

BLACKHAWK NETWORK HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

| | |

Delaware | | 43-2099257 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

|

| | |

6220 Stoneridge Mall Road Pleasanton, CA | | 94588 |

(Address of Principal Executive Offices) | | (Zip Code) |

(925) 226-9990

(Registrant’s Telephone Number, Including Area Code)

|

| | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 per share | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer | | ý | | Accelerated filer | | ¨ |

| | | | | |

Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of June 17, 2016 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of voting stock held by non-affiliates of the registrant was $1.6 billion.

As of February 6, 2017, there were 55,763,000 shares of the Registrant’s Common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for the 2017 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K are incorporated by reference in Part III, Items 10-14 of this Annual Report on Form 10-K.

Blackhawk Network Holdings, Inc.

FORM 10-K

Table of Contents

|

| | |

| | Page |

PART I. | |

| | |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

PART II. | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

PART III. | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

PART IV. | |

Item 15. | | |

Item 16. | | |

| |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA

This Annual Report on Form 10-K, which we refer to as this Annual Report, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We intend that these forward-looking statements be subject to the safe harbors created by those provisions .These statements contained in this Annual Report include, but not limited to, statements regarding our expectations, beliefs, intentions, strategies, future operations, future financial position, future revenue, projected expenses and plans and objectives of management. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “suggest,” “may,” “might,” “plan,” “project,” “will,” “would,” “should,” “could,” “can,” “predict,” “potential,” “continue,” “objective,” or the negative of these terms, or other variations on such terms of comparable terminology intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. The forward-looking statements contained in this Annual Report involve a number of risks, uncertainties, and assumptions, many of which are outside of our control. Factors that could cause actual results to differ materially from projected results include, but are not limited to, those discussed in “Risk Factors” included elsewhere in this Annual Report. Readers are expressly advised to review and consider those Risk Factors. Although we believe that the assumptions underlying the forward-looking statements contained in this Annual Report are reasonable, any of the assumptions could be inaccurate, and therefore there can be no assurance that the results anticipated by such statements will occur. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. Furthermore, past performance in operations or trading price of our common is not necessarily indicative of future performance. We disclaim any intention or obligation to update, supplement, or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

As used herein, “Blackhawk,” the “Company,” “we,” “our,” “us,” and similar terms refer to Blackhawk Network Holdings, Inc., unless the context indicates otherwise. The names “Blackhawk,” “Blackhawk Engagement Solutions,” “Cardpool,” “GiftCardMall,” “InteliSpend,” “Retailo,” “Parago,” “CardLab,” “Incentec,” “GiftCards.com,” “Achievers,” “NimbleCommerce,” “Extrameasures,” “Spafinder,” “Grass Roots” and other product or service names are trademarks or registered trademarks of entities owned by us.

PART I.

ITEM 1. BUSINESS

Overview

Blackhawk is a leading prepaid payment network utilizing proprietary technology to offer to consumers and businesses a broad selection of prepaid cards in physical and electronic forms, as well as complementary prepaid products, payment services and incentives solutions. We currently offer our products and/or solutions directly or through commercial relationships in the United States and 25 other countries and can deliver solutions in over 100 countries.

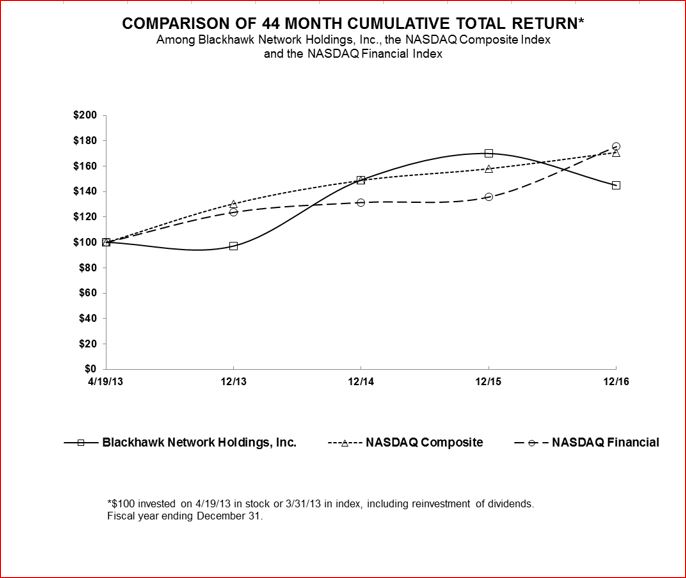

We were founded in 2001 as a division of Safeway Inc. (“Safeway”, which merged with Albertsons Holdings LLC in January 2015 and is referred to hereinafter as “Albertsons/Safeway”). We were incorporated in Delaware in 2006 and completed our initial public offering in April 2013. In April 2014, Safeway distributed the remaining shares it then held to its shareholders (the “Spin-Off”). In May 2015, we converted all outstanding shares of our Class B common stock into shares of Class A common stock on a one-for-one basis and renamed Class A common stock as common stock which continues to trade on the NASDAQ exchange under the symbol “HAWK”.

We believe our extensive network provides significant benefits to our key constituents: consumers who purchase, receive or use the products and services we offer; content providers who offer branded gift cards and other prepaid products that are redeemable for goods and services; distribution partners who sell those products; and business clients that distribute our products as customer incentives or rewards, or offer one or more of our incentive platforms to their employees or sales forces. For consumers, we provide convenience and value by offering a broad variety of quality brands and content through physical and digital retail distribution locations or through loyalty, incentive and reward programs offered by our business clients. For our content providers, we drive incremental sales by providing access to millions of consumers and creating new customer relationships. For our retail distribution partners, we provide an important product category that can drive incremental in-store and online traffic and customer loyalty. For our business clients, we provide a wide array of services, software and prepaid products to enhance their customer loyalty, sales channel incentive and employee engagement programs. Our technology platforms allow us to efficiently and seamlessly connect our network participants and offer new products and services as payment technologies evolve. We believe the breadth of our distribution network and product content, combined with our consumer reach and technology platforms, create powerful network effects that enhance value for our constituents.

We are one of the largest third-party distributors of gift cards in the world based on the value of funds loaded on the cards we distribute. Our retail network connects to more than 900 content providers and over 244,000 active retail distribution locations, providing access to tens of millions of consumer visits per week. In addition, we sell physical and electronic gift cards or eGifts to consumers through leading online distributors, such as Amazon.com and Staples.com, and our websites GiftCards.com, GiftCardMall.com, GiftCardLab.com and Cardpool.com. Our retail channels accounted for over $14.5 billion in transaction dollar volume during fiscal 2016.

We have also established a leading position in the incentives and rewards marketplace over the past four years through our acquisitions of InteliSpend Prepaid Solutions, LLC and its subsidiaries (collectively, “InteliSpend”) in 2013, Incentec Solutions, Inc. (“Incentec”), CardLab, Inc. and its subsidiaries (collectively, “CardLab”), Parago, Inc. and its subsidiaries (collectively, “Parago”) in 2014, Achievers Corp. and its subsidiaries (collectively, “Achievers”) in 2015, and IMShopping, Inc. and its subsidiary (collectively, “NimbleCommerce”), Omni Prepaid LLC and its subsidiaries (collectively, “GiftCards”), 888extramoney.com LLC (“Extrameasures”) and The Grass Roots Group Holdings Limited and its subsidiaries (collectively, “Grass Roots”) in 2016. We provide a broad variety of customized employee, consumer and sales channel incentives, loyalty and engagement solutions to over 20,000 business clients worldwide.

Distribution

U.S. Retail Distribution

Our U.S. retail distribution network consists of our physical distribution partners such as grocery, specialty, convenience and other retail stores, our websites GiftCardMall.com, GiftCardLab.com, GiftCards.com, NimbleCommerce.com and third-party online and digital merchants.

The following are selected examples of our U.S. direct distribution partners across various retail channels:

|

| |

Grocery | Ahold, Albertsons/Safeway, Giant Eagle, Kroger, Publix, Whole Foods |

| |

Specialty/Other | Bed Bath & Beyond, Best Buy, The Home Depot, Lowe’s, Michaels, Office Depot, Staples, Kohl’s |

| |

Convenience | Kroger Convenience Stores, QuikTrip, Wawa |

| |

Digital | Amazon.com, eBay.com, Staples.com, PayPal.com, Samsung Pay, Verizon, Chase Pay, MileagePlus (United Airlines) |

| |

We typically enter into contracts with our retail distribution partners ranging from three years to five years in length. The agreements generally include varying degrees of exclusivity for our distribution of prepaid products in their stores. They also provide, among other things, that we will pay our distribution partner a negotiated commission based on a percentage of the content provider commission or purchase fee we receive upon the sale of our various products and services. We believe our extensive gift card content, some of which is exclusive, coupled with frequent marketing promotions and the relatively high productivity for the space utilized, is an incentive for our retail distribution partners to continue to renew our distribution agreements with them.

As of December 31, 2016, we had over 46,000 locations in the U.S. across approximately 140 retail distribution partners. Our largest U.S. retail distribution partner during each of the last three fiscal years was Kroger, where consumers activated prepaid products or purchased telecom handsets that generated 11.8%, 12.1% and 14.4% of our total worldwide operating revenues for the fiscal years 2016, 2015 and 2014, respectively. Giant Eagle and Albertsons/Safeway each generated 5.0% and 6.6% of our 2016 total worldwide operating revenues, respectively, 5.3% and 9.2% of our 2015 total worldwide operating revenues, respectively, and 7.1% and 10.8% of our 2014 total worldwide operating revenues, respectively.

We also sell prepaid products online through our websites GiftCards.com, GiftCardMall.com and GiftCardLab.com, through third-party online retailers including Amazon.com, Staples.com and eBay.com, and through websites operated by certain of our retail distribution partners such as Albertsons-Safeway, Giant Eagle, Kroger and Meijer. In addition, we provide solutions including application program interfaces (“APIs”), to allow our “digital” distribution partners that have consumer-facing applications to incorporate gift cards and related prepaid capabilities and functions into their services. These partners include financial institutions, social networks, smartphone providers, retailers and other payment services companies, including Samsung Pay and Google Wallet.

Revenue from U.S. Retail sales totaled 59.3%, 64.7% and 71.1% of our total operating revenues for 2016, 2015 and 2014, respectively.

Incentive, Loyalty and Engagement Products Distribution

We provide incentives, loyalty and engagement solutions for consumers, customers, sales personnel, channels and employees. Our consumer incentives business provides end-to-end rebate processing and prepaid product fulfillment services directly to a wide range of manufacturers, retailers and service providers. We provide a hosted platform solution to businesses that allow them to manage integrated sales promotions and incentive programs for sales personnel and sales channels, using points, prepaid products and other rewards. We also offer directly to enterprise clients a hosted software-as-a-service solution to create a more engaged workforce through social recognition, wellness incentives and achievement awards. We provide physical prepaid card and eGift fulfillment services for organizations that have consumer loyalty programs such as financial institutions and airlines. Our fulfillment services are also integrated to our incentives and reward solutions and provided to our direct business clients as well as to other providers of incentives programs. In addition, we sell customized network branded prepaid cards and merchant gift cards to business customers through our OmniCard.com website and other business partners. We provide these services, collectively, to over 20,000 business clients and generated revenues totaling 15.2%, 11.8% and 5.4% of total worldwide operating revenues for 2016, 2015 and 2014, respectively.

International Distribution

Outside the United States, we have followed a similar retail strategy of distributing through leading grocery chains, but with a greater emphasis on convenience store chains which receive higher volume of consumer traffic as compared to the U.S.. In certain countries, we distribute through sub-distributors that contract with in-country retailers for sale of our products and in certain other countries, we operate through joint ventures with local businesses to distribute global and local content. As of December 31, 2016, our products were sold in over 198,000 locations across approximately 415 retail distribution partners.

Besides consumer sales through our international retail distribution partners, our regional teams sell prepaid products and incentives solutions directly to business clients and to other providers of incentives and rewards solutions. Our acquisition of Grass Roots in October 2016 significantly increased such sales, particularly in the United Kingdom. During 2017, we plan to launch our direct-to-consumer and direct-to-business websites in additional countries outside the U.S. and we will also begin to offer our employee engagement platform to business customers outside the U.S. and Canada. Revenue from international sales totaled 25.5%, 23.5% and 23.5% of our total operating revenues for 2016, 2015 and 2014, respectively (see Note 12—Segment Reporting and Enterprise-Wide Disclosures for information on long-lived assets internationally).

Products and Services

Prepaid products that we offer at retail are “activated” when a consumer loads funds (with cash or with a debit or credit card payment) at a retail store location or online. We also provide reloads for reloadable prepaid products, including prepaid telecom accounts and general-purpose reloadable (“GPR”) cards.

We typically negotiate multi-year contracts with our content providers. For many of our content providers, we have various types of exclusivity provisions related to certain of the retail channels through which we distribute their products. As of December 31, 2016, we had agreements with over 900 content providers.

Our incentives businesses provides software, consulting services, program management, reward processing and reward fulfillment to our business clients. The majority of rewards are fulfilled using a prepaid open loop card.

Apple Inc. is our largest content provider and represented 12.7%, 13.7% and 13.6% of our total operating revenues for 2016, 2015 and 2014, respectively. No other content provider represented more than 10% of our total operating revenues during these periods.

For information on revenues and segment profit for our three reportable segments, see Note 12—Segment Reporting and Enterprise-Wide Disclosures in the notes to our consolidated financial statements.

Retail Products

Gift Card Products

Closed Loop (Private-Branded) Gift Cards. Closed loop (private-branded) gift cards are generally described as merchant or brand-specific prepaid cards, used for transactions exclusively at a particular merchant’s branded locations and websites (including franchise locations) or for a specific business’s services wherever they are provided. We distribute closed loop gift cards in categories including digital media and e-commerce, dining, electronics, entertainment, fashion, transportation, home improvement and travel. We are continuing to expand relationships with partners that offer products or services for consumer self-use as much as for gifting, and for which our grocery and other retail distribution channels provide a convenient location to load funds onto these prepaid products. Examples include Airbnb, Uber, metropolitan transit cards and lottery. In 2015, we acquired Didix Gifting & Promotions B.V. and its subsidiaries (collectively, “Didix”), a provider of “aggregated category” gift and promotional-themed cards that can be redeemed at a variety of participating merchants grouped by category such as restaurants. In 2016, we acquired Spafinder Wellness, Inc. and its subsidiaries (collectively, “Spafinder”), a provider of prepaid cards that can be used at over 25,000 spas and salons in the U.S., Canada and the United Kingdom, and Samba Days Experience Group Ltd. and certain of its subsidiaries (collectively, “Samba”), a provider of aggregated content cards in Canada and the United Kingdom. Gift cards that we distribute for sale directly to consumers in physical or online locations carry no consumer fees, and funds associated with the cards generally do not expire. Closed loop products contributed 62% of total operating revenues in 2016.

|

| |

Product Category

| Selected Brands

|

Digital Media & e-commerce | Amazon.com, Facebook, Google Play, iTunes, Microsoft |

Dining | Applebee’s, Outback Steakhouse, Starbucks, Subway |

Electronics | Best Buy, GameStop |

Entertainment and Leisure | AMC Theatres, Regal Entertainment Group, Spafinder |

Fashion | Forever 21, JCPenney, Kohl’s, Macy’s, TJ Maxx |

Transportation | DART, BP, Shell, Uber |

Home Improvement and Office | Home Depot, Lowe’s, Office Depot, Staples |

Travel | Airbnb, Southwest Airlines |

Other Retail | Barnes & Noble, Bed Bath & Beyond, Target, Toys“R”Us |

Open Loop (Network-Branded) Gift Cards. Open loop (Network-Branded) gift cards are prepaid gift cards associated with an electronic payment network (such as Visa, MasterCard, American Express, or Discover), and are honored at multiple, unaffiliated locations (wherever cards from these networks are generally accepted). They are not merchant-specific. We distribute non-reloadable open loop gift cards carrying the American Express, MasterCard and Visa brands in our retail channels. During 2016, we introduced “category cards” which are open loop gift cards that can only be redeemed at specific categories of merchants such as dining or fashion. We also introduced a Visa-branded card that can be used wherever Visa-branded cards are honored but that also provide a merchant loyalty incentive in the form of “cash back” that is loaded onto the card after the card is redeemed at a participating merchant location. With the acquisition of GiftCards, we began offering a fully customizable Visa electronic gift card delivered by email or to a mobile device. We serve as the program manager for our proprietary Visa gift cards that we distribute. Funds loaded on these cards by consumers at our retail distribution locations generally do not expire and can be redeemed at most merchant locations that accept the credit cards of the same network brand. Open loop products contributed 14% of total operating revenues for 2016.

Prepaid Telecom Products

We distribute a full range of prepaid wireless or cellular cards used to load airtime onto the prepaid handsets. We also purchase certain handsets from manufacturers and sell them for a small markup to our retail distribution partner locations. Our prepaid wireless cards are denominated either in minutes purchased, which generally do not expire, or, increasingly, as flat rate voice and/or data plans. We offer prepaid telecom cards from major carriers including AT&T, Sprint’s Boost Network and Virgin Mobile brands, T-Mobile, TracFone and Verizon. Prepaid telecom cards and handsets contributed 3% of total operating revenues for 2016.

Prepaid Financial Services Products (Open Loop Reloadable)

We distribute GPR cards provided by Green Dot, NetSpend and other industry leaders in this product category. GPR cards have features similar to a typical bank checking account, including fee-free direct deposit, in-store and online purchasing capability wherever a credit card is accepted, bill payment and ATM cash access. We offer a proprietary reload network named REloadit, which allows consumers to reload funds onto their previously purchased third-party GPR cards. In 2016, we sold our proprietary GPR product line branded PayPower to NetSpend in the U.S. and a financial services company in Canada and have discontinued sales of this branded product in 2017. The prepaid financial services products contributed less than 1% of total operating revenues for 2016.

Loyalty, Engagement and Incentive Products

Our incentives businesses provide (i) solutions to allow businesses to manage consumer incentive programs, including in-store, online or mail-in rebate processing, (ii) a hosted software platform for managing sales person and sales channel incentive programs, (iii) bulk prepaid card ordering systems and websites to allow business and incentive program clients to use prepaid cards as part of their own incentive and reward programs, and (iv) direct-to-participant fulfillment services for prepaid cards, checks and merchandise. Our prepaid products for the incentives businesses include open loop incentive cards, open loop reloadable incentive cards that allow multiple incentives and rewards to be loaded onto a recipient’s card, restricted authorization network incentive cards that permit redemption at only selected merchants as well as closed loop gift cards. Funds on open loop incentive cards that are offered by businesses as incentives, rewards, or promotions generally have expiration dates ranging from 90 days to one year from the date of card activation.

We offer a hosted software-as-a-service platform for enterprise customers to implement employee engagement programs. The functions and content of the programs can be configured for each customer’s requirements and are designed similarly to a social media application. Our solutions include mobile applications as well as web-based tools for both employers and

employee-participants to give monetary-based and non-monetary recognition for various achievements, behavior or milestones. Points earned through our employee engagement businesses can be redeemed by recipients for prepaid cards or merchandise.

Revenues from our incentives businesses accounted for 15% of total operating revenues for 2016.

Cardpool Exchange Services

Cardpool, our gift card exchange business, offers consumers an online marketplace and various retail locations to sell unused gift cards that they do not want and an online sales website to purchase gift cards at a discount that others have sold to Cardpool. Cardpool contributed 4% of total operating revenues in 2016.

Digital Services for Online and Mobile Applications

We have developed a technology platform to integrate prepaid products with other parties’ online, digital and mobile applications. In addition, we have developed application program interfaces, or APIs, that allow our digital distribution partners to offer gift cards and eGifts for purchase or for redemption in their online and mobile applications. Revenue contribution from the digital services business is incorporated into the operating revenues for the related businesses.

Other Services

We receive marketing funds from our content providers to promote their prepaid cards throughout our retail distribution network. In some instances, we may receive a portion of other fees such as account maintenance, interchange or referral fees for certain open loop cards. We also receive other fees related to certain closed loop programs. These revenues have been included in the applicable products detailed above. We also receive recurring monthly management fees from partners for certain program services.

We provide card production and processing services to some of our prepaid gift and telecom content providers. These services accounted for 1% of total operating revenues in 2016.

Description of Revenue Types

In a typical retail closed loop card transaction, the consumer purchases a gift card from our retail distribution partner who collects the transaction dollar volume. The retail distribution partner then forwards to us the collected amount, less the retail distribution partner’s share of the commission. We then remit the transaction dollar volume of each card, less the total amount of the commission and fees, to the applicable content provider. The cardholders access the value they loaded on a closed loop card by using the card to pay for goods or services at the content provider’s physical store point-of-sale system or online at the content provider’s website.

For a retail open loop card transaction, the consumer purchases a Visa, MasterCard or American Express branded gift card from our retail distribution partner who collects the transaction dollar volume and a purchase fee. For bank-issued cards, the retail distribution partner then forwards to us the transaction dollar volume and purchase fee, less the retail distribution partner’s share of the purchase fee. We then remit the transaction dollar volume of each card to the issuing bank, retaining the balance of the consumer purchase fee. The cardholders can access the value they loaded on an open loop card by using the card to pay for goods or services at any merchant that accepts the network-branded card. For such transactions, the issuing bank transfers funds through the network association to the merchant’s bank following the consumer’s purchase. The process is virtually the same with respect to American Express gift cards. In addition to the portion of the consumer purchase fee, we earn program management fees from issuing banks that are based on unspent card balances, as well as interchange fees, account service fees, merchant commissions from participating merchants on cash-back products and, in some countries, card expiration fees resulting from the balances on expired cards.

For our incentives businesses, we typically earn client purchase fees for the sale of incentive cards; fees for processing and fulfillment; program management fees from issuing banks that are based on expected balances remaining on cards after expiration or non-use, interchange and other fees from issuing banks; merchant commissions on the redemption of certain open loop incentive cards using our proprietary restricted authorization network; monthly or periodic fees for client use of our management software; and miscellaneous program management and integration fees. Our employee engagement business also earns revenue from redemption of employee rewards for merchandise or prepaid products.

The following table describes how fees are earned for each of the following products:

|

| |

Products and Services | How We Earn Fees |

| |

Closed Loop Gift Cards | Content providers pay us commission and fees based on transaction dollar volume. We share commissions with our retail distribution partners.

For aggregated category giftcards that are issued by Blackhawk, we earn commissions from the retail participants and also recognize revenues for unredeemed balances. |

| |

Open Loop Gift Cards | Consumers pay a purchase fee upon card activation depending on transaction dollar volume. We share this fee with our retail distribution partners and content providers.

Our issuing banks pay us additional program management fees and other fees for our Visa gift cards, based, in part, on unspent balances.

We also earn a portion of merchant interchange fees when customers use our proprietary Visa gift card for purchases. Merchants pay us a commission on “cash-back” cards when redeemed with them. |

| |

Prepaid Telecom Products | The telecom carriers pay us a commission based on transaction dollar volume. We share these commissions with our retail distribution partners.

We purchase handsets from manufacturers and sell them with a markup to our retail distribution partners. Our retail distribution partners retain the full proceeds from the sale of handsets to consumers. |

| |

Prepaid Financial Services Products |

We earn a flat fee for each third-party GPR card sold by our retail distribution partners. We share this fee with our retail distribution partners. We also earn account maintenance and interchange fees from these third-party GPR content providers. When consumers reload GPR cards on our REloadit network, we collect a fee, which we share with our retail distribution partners. For third-party GPR cards, this fee is also shared with the third-party GPR content provider. |

| |

Loyalty, Incentive and Reward Products | We earn fees when we sell incentive cards to our business clients.

We earn fees for processing and fulfillment of consumer rebates.

Our issuing banks pay us additional program management fees and other fees for our open loop incentive cards.

We earn a portion of merchant interchange fees when consumers use our open loop incentive cards for purchases. We earn additional commissions when consumer make purchases using our restricted authorization network cards. We earn revenues when employees redeem points for merchandise or prepaid cards.

We earn subscription or periodic fees for use by customers of Blackhawk’s Achievers software. |

| |

Cardpool Exchange Services | We earn a markup on the sale of pre-owned closed loop gift cards, which we purchase from consumers at a discount to the amount of funds remaining on a card. |

| |

Other Fee Categories | Content providers pay us marketing funds to support programs that we coordinate with our retail distribution partners for the in-store or online promotion of their gift cards. We earn revenue for card production and packaging services for content providers. We earn fees related to certain closed loop card programs. We earn a split and/or fees on merchant promotions purchased through the NimbleCommerce.com website. We earn management fees, transaction fees and technology fees from our business clients. |

Technology

We own and operate the critical components of our technology platforms including our transaction acquiring switch, prepaid card processing system, settlement systems, order management/fulfillment system and digital platforms. These integrated systems are designed to allow us to authorize, process and settle transactions, fulfill products to distribution partners or consumers, address security and regulatory compliance, rapidly onboard new retail distribution partners and content providers and provide customer service across our network’s broad points of contact and electronic mediums. We own and operate various technology platforms related to our Incentives business.

Our product and service offerings are enabled by our technology platform in the following ways:

Gift Cards. We have made a significant investment in direct connections to our retail distribution partners to ensure high reliability of the gift card activation transaction at the point of sale. We process activation transactions primarily through direct connections to the card processing systems of our content providers or their service providers. In addition, for our proprietary Visa gift cards, we process all post-activation transactions, including redemptions, directly on our proprietary cloud-based processing platform. We have value-added features enabled through our processing platform that we believe can help differentiate our proprietary prepaid cards in the market.

Digital Services. Our digital platform is built on a scalable and configurable web platform. It deploys a service-oriented architecture in which web services enable other digital providers to utilize the prepaid services we offer.

Cardpool Exchange Services. Cardpool operates on a proprietary platform built on an open source web framework that manages pricing, spreads, orders and inventory for our gift card exchange marketplace and provides a web-based interface for customers and an API-based interface for partners.

Incentives. Blackhawk incentives platforms include software used by business clients for purchase and management of incentives and rewards, a consumer rebate processing platform that digitizes all rebate claims submitted and applies automated program rules for validation of claims, Achievers’ hosted “Aspire” software platform that provides a social media-like interface for employee engagement, and reward fulfillment platforms that allow us to immediately fulfill approved rewards with checks, prepaid cards, or merchandise. We also provide reports and analytical tools for our business clients to evaluate the effectiveness of their programs. Most open loop incentive cards we issue are also processed on our proprietary cloud-based processing platform.

Over the past three years, our capital expenditures related to the development of these technology platforms, other card management platforms and related hardware totaled over $140 million, including over $51 million in 2016. Over the past several years, we have also acquired multiple platforms as a result of acquisitions, some of which we intend to consolidate into a single platform during 2017.

We believe our technology capabilities, enhanced by the platforms we acquired to provide scalable loyalty, incentive and reward solutions, provide us with significant competitive advantages and cannot be easily replicated. Our systems are designed to be secure, highly reliable and scalable. Our technology capital expenditures included expenditures for hardware, licensed software and internally developed software for processing and switching technologies, mobile applications and enhancements to our enterprise resource planning and other infrastructure systems.

Sales and Marketing

Our sales and marketing teams manage our relationships with content providers, retail distribution partners and incentive business clients. They also develop retail marketing programs and communication strategies to reach consumers. We provide or fund product display fixtures and provide or coordinate merchandising visits intended to maintain in-stock conditions on the displays. We also manage or participate in the design of effective in-store marketing programs funded jointly by our content partners and distribution partners. In addition, we use online marketing in connection with GiftCards.com, GiftCardMall.com, GiftCardLab.com, OmniCard.com and Cardpool.com. For our incentive business clients, we provide research papers, consumer and employee analyses and other tools and services to develop their incentive and reward programs.

Operations and Customer Service

Our operations services include production and fulfillment of prepaid products for which we contract with third-party card printing, warehouse and fulfillment logistics providers. Contracts with these providers are typically for terms of three to four

years. In the United States, Canada and the United Kingdom, we have integrated our order management systems with our third-party service providers’ warehouse management systems to optimize fulfillment to stores. For select retail distribution partners that elect to participate, we also operate an inventory tracking and replenishment system and deliver automated re-orders directly to individual stores to optimize in-stock positions. In the U.S., we provide in-store merchandising services for certain retail distribution partners.

Our services also include a customer service function that utilizes both in-house and third-party call centers to support our proprietary open loop products, fulfillment and card activation for our retail distribution channel, online gift card sales and our business incentive and reward channel. Our in-house call centers are located in Reno, Nevada, in San Salvador, El Salvador and in Miramichi, Canada. We employ second level customer and partner support personnel at our corporate headquarters in Pleasanton, California, and our various regional offices. We utilize Interactive Voice Response systems, web-based support and email support in our customer service efforts. We also operate Network and Security Operations Centers to monitor systems and partner connections worldwide.

Bank Partners

We derive a material amount of our revenue from our program-managed proprietary open loop products, which include our proprietary Visa gift and open loop incentive cards. For the year ended December 31, 2016, these programs represented 17.6% of our total operating revenues. The issuing banks for these programs, as well as issuing banks for other network-branded card programs that we program manage, provide Federal Deposit Insurance Corporation (“FDIC”) insured depository accounts tied to prepaid open loop cards, access to ATM networks, membership in the card associations and other banking functions. The issuing banks hold cardholder funds, charge applicable fees on certain products and collect interchange fees charged to merchants when cardholders make purchase transactions using prepaid open loop cards. Our issuing banks remit some or all of those fees to us plus additional fees for our program management services.

In the United States, we currently serve as program manager for three issuing banks for our proprietary open loop products: MetaBank, Sunrise Bank, N.A. and The Bancorp Bank. MetaBank has been an issuing bank for our proprietary Visa gift cards since 2007, was an issuing bank for the incentive and reward products for InteliSpend, Parago and Extrameasures prior to our acquisitions of these companies, and will continue as an issuing bank for incentive and rewards products for our incentives businesses. For the fiscal years ended December 31, 2016, January 2, 2016 and January 3, 2015, the MetaBank program represented 13.2%, 15.2% and 11.6%, respectively, of our total operating revenues. Sunrise Bank, N.A. has been an issuing bank for our proprietary Visa gift card program since November 2011. The Bancorp Bank has been an issuing bank for our Visa-branded GPR cards since May 2012, and was an issuing bank for CardLab and GiftCards.com prior to our acquisitions of those companies.

Outside the United States, we contract with several issuing banks for open loop products that we program manage. For the year ended December 31, 2016, these programs represented approximately 1.4% of our total operating revenues.

Please see “Risk Factors—Risks Related to Our Business and Industry—We rely on relationships with card issuing banks for services related to products for which we act as program manager, and our business, results of operations and financial condition could be materially and adversely affected if we fail to maintain these relationships or if we maintain them under new terms that are less favorable to us” and “Risk Factors—A data security breach could expose us to costly government enforcement actions, liability and protracted and costly litigation, and could adversely affect our reputation and operating revenues” for additional information.

Competition

Due to the breadth of our product offerings and distribution channels, we face a number of competitors across different business sectors domestically and internationally in our Retail Products business, including some competitors whose products we distribute in select locations. Many of our existing competitors with respect to our closed loop and open loop business are larger than we are and have greater resources, larger and more diversified customer bases and greater name recognition than we do. Our competitors include Visa, Western Union, MoneyGram, Green Dot, NetSpend, Euronet and InComm. New companies, or alliances among existing companies, may be formed that rapidly achieve a significant market position. Our Incentives business competes with others who provide rebate and incentive processing services such as Young America, ACB and other providers of traditional travel and merchandise incentives and awards such as Maritz, Aimia and OC Tanner as well as companies focused on employee incentives such as Globoforce. Our incentives and rewards business also competes with other prepaid products companies for fulfillment of awards including Citibank Prepaid Solutions, InComm, and multiple other prepaid card providers for the incentives business. We also face competition from companies who are developing new prepaid access technologies and from businesses outside of the prepaid industry, including traditional providers of financial services such as banks and money services providers like First Data Corporation, and card issuers that offer credit cards, private label retail cards and gift cards. Retailers and other content partners who have a widely used prepaid card like Apple iTunes and Amazon may offer their own programs as an alternative for incentives and rewards or payments. Some of these competitors offer digital solutions that do not require plastic cards for redemption by the consumer and allow for the sale of prepaid cards through new or existing online and mobile channels.

Overall, our ability to continue to compete effectively will be based on a number of factors, including customer service, quality and range of products and services offered, reliability and security of our technology platforms, price, reputation, customer convenience and other considerations. For additional information about competition, please see “Risk Factors—Risks Related to Our Business and Industry—We face intense competitive pressure, which may materially and adversely affect our revenues and profitability. Continued consolidation within our industry could increase the bargaining power of our current and future clients and vendors and further increase our client concentration or reduce competition among our third-party vendors;” “—We rely on our content providers for our product and service offerings, and the loss of one or more of our top content providers or a decline in the contracted commission when such a content provider renews its agreement with us or a decline in demand for their products, or our failure to maintain existing exclusivity arrangements with certain content providers or to attract new content providers to our network, could have a material adverse effect on our business, results of operations and financial condition;” and “—If our retail distribution partners fail to actively and effectively promote our products and services, or if they implement operational decisions that are inconsistent with our interests, our future growth and results of operations may suffer.”

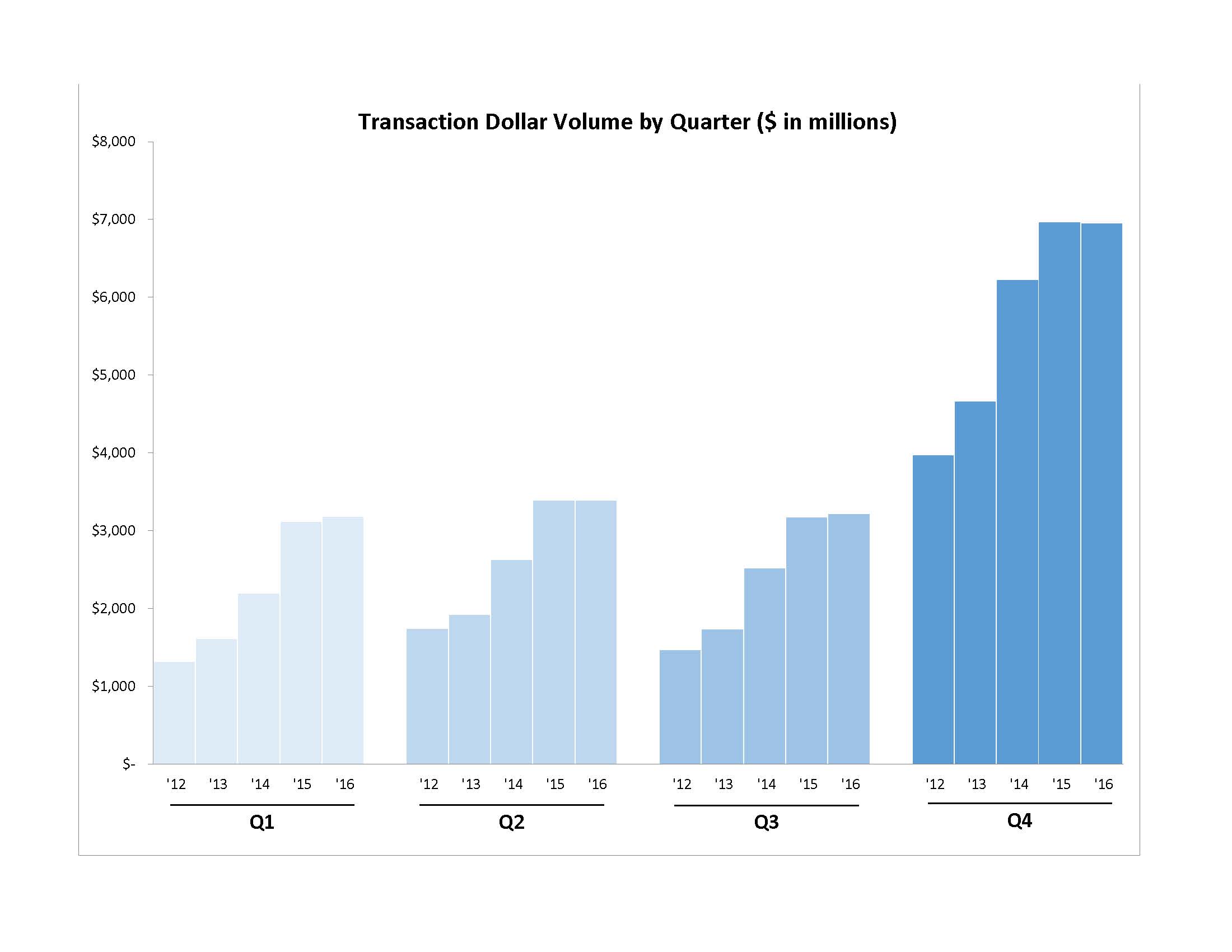

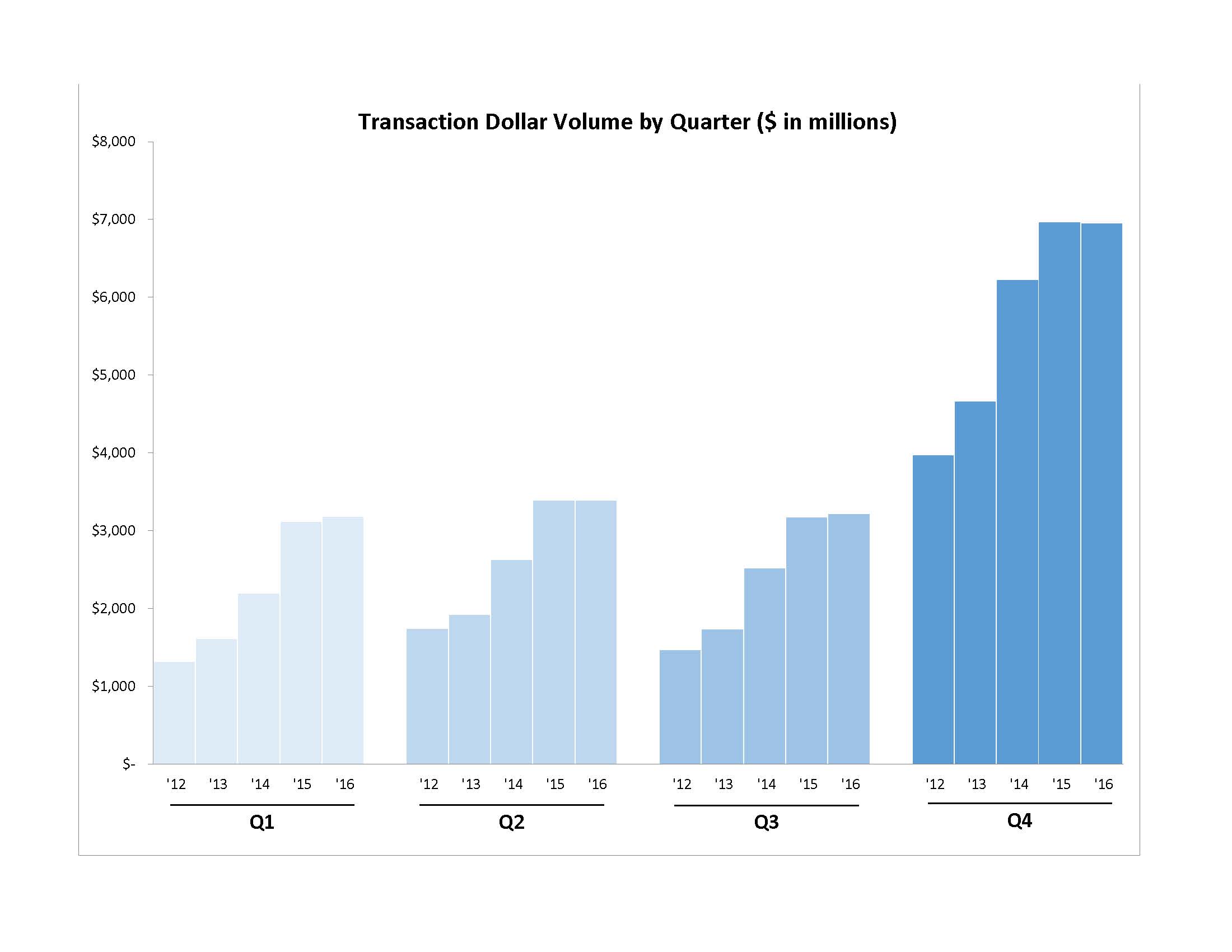

Seasonal Variations

Our retail distribution business is significantly affected by seasonal consumer spending habits, which are most pronounced in December of each year as a result of the holiday selling season. A significant portion of gift card sales occurs in late December of each year during the holiday gifting season. As a result, we earn a significant portion of our revenues, net income and cash flows during the fourth quarter of each year. We also experience an increase in revenues, net income and cash flows during the second quarter of each year, which we primarily attribute to the Mother’s Day, Father’s Day and graduation gifting season. Depending on when the Easter holiday occurs, the associated increase could occur in either the first or second quarter. For additional information about the effects of seasonality on our business, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Quarterly Results of Operations and Seasonality.”

Intellectual Property

The technologies used in the payments industry are protected by a wide array of intellectual property rights. Our intellectual property is important to our continued success. Like other companies in our industry, we rely on patent, trademark and copyright laws and trade secret protection in the United States and other countries, as well as employee and third-party nondisclosure agreements and other methods to protect our intellectual property and other proprietary rights. We also license technology from third parties which provide various levels of protection against technology infringement by third parties.

We pursue the registration of our intellectual property rights, such as domain names, trademarks, service marks and patents, in the United States and in various other countries. We own dozens of registered trademarks, including the Blackhawk Network, REloadit, InteliSpend, Parago, Achievers, GiftCards and Everywhere gift card trademarks. We also have many pending trademark applications. Through agreements with our retail distribution partners and customers, we authorize and monitor the use of our trademarks in connection with their activities with us.

As of December 31, 2016, we own, or are the exclusive licensee of, over 70 patents in various countries providing coverage for systems and methods relating to prepaid product loads and reloads, ewallet services, eGift card transactions, swipe/scan reload, packaging, card design, processing, online services, card exchange, and fraud prevention in eGift card transactions. These patents expire at various dates, ranging from 2020 to 2033. We own over an additional 150 patent applications in various countries for various card assemblies and packaging, security features, activation and processing methods, and online prepaid services and have licensed exclusive rights that arise from ten patent applications. We do not know whether any of our pending patent applications will result in the issuance of patents or whether the examination process will require us to narrow our claims. We believe a robust patent portfolio to protect our intellectual property rights and proprietary systems will become increasingly important as the prepaid industry continues to expand.

Regulation

We operate in an ever-evolving and complex legal and regulatory environment. We, the products and services that we offer and market, and those for which we provide processing services, are subject to a variety of federal, state and foreign laws and regulations, including, but not limited to:

| |

• | federal anti-money laundering laws and regulations, including the USA PATRIOT Act (the “Patriot Act”), the Bank Secrecy Act (the “BSA”), anti-terrorist financing laws and regulations and anti-bribery and corrupt practices laws and regulations in the U.S., and similar international laws and regulations; |

| |

• | state unclaimed property laws and regulations and state money transmitter or similar licensing laws and regulations; |

| |

• | federal and state consumer protection laws, including the Credit Card Accountability Responsibility and Disclosure Act of 2009 (the “CARD Act”), and the Durbin Amendment to Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), and laws and regulations relating to privacy and data security; and |

| |

• | foreign jurisdiction payment services industry laws and regulations. |

Anti-Money Laundering Regulation. We are subject to a comprehensive federal anti-money laundering (“AML”) regulatory regime that is constantly evolving. The AML laws and regulations to which we are subject include the BSA, as amended by the Patriot Act. The BSA requires U.S. financial institutions to assist U.S. government agencies to detect and prevent money laundering by: (a) developing, implementing and maintaining an AML program; (b) implementing a customer identification program; (c) not engaging in business with foreign shell banks; (d) establishing customer due diligence procedures and, where appropriate, enhanced customer due diligence procedures for certain customers and foreign correspondent and private banking accounts; and (e) sharing certain information with other financial institutions and the U.S. government. Pursuant to the BSA, we have instituted a BSA/AML compliance program. Please see “Risk Factors—Risks Related to Our Business and Industry—We are increasingly facing more stringent anti-money laundering laws and regulations, compliance with which may increase our costs of operation, decrease our operating revenues and disrupt our business” for additional information.

Our subsidiary, Blackhawk Network California, Inc. (“Blackhawk Network California”), is registered as a money services business with the Financial Crimes Enforcement Network (“FinCEN”) of the Treasury Department and is subject to certain reporting, recordkeeping and AML requirements under the BSA and its implementing regulations. In addition, the Prepaid Access Rule promulgated by FinCEN, under its authority to implement the BSA, imposes certain obligations, such as registration and collection of consumer information, on “providers of prepaid access” for certain prepaid access programs, including certain prepaid products issued by banks. FinCEN has taken the position that where the issuing bank has principal oversight and control of such prepaid access programs, no other participant in the distribution chain, including us as the program manager of such prepaid access programs, is required to register as a provider of prepaid access under the Prepaid Access Rule. On November 4, 2013, FinCEN affirmed that it did not expect Blackhawk to register as a provider of prepaid access under the Prepaid Access Rule for the bank-issued products for which we serve as a program manager.

In order to qualify for certain exclusions under the Prepaid Access Rule, some of our content providers modified operational elements of their products, such as limiting the amount that can be loaded onto a card in any one day. In addition, pursuant to the Prepaid Access Rule, we and some of our retail distribution partners have adopted policies and procedures to prevent the sale of more than $10,000 in prepaid access (including closed loop and open loop prepaid access products) to any one person during any one day.

Anti-Terrorism and Anti-Bribery Regulation. We are also subject to an array of federal anti-terrorism and anti-bribery legislation. For example, the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”) administers a series of laws and regulations that impose economic and trade sanctions against targeted foreign countries and regimes, terrorists, international narcotics traffickers, those engaged in activities related to the proliferation of weapons of mass destruction, and other entities and persons that pose threats to the national security, foreign policy or economy of the United States. As part of its enforcement efforts, OFAC publishes a list of individuals and companies owned or controlled by, or acting for or on behalf of, targeted countries, as well as those, such as terrorists and narcotics traffickers designated under programs that are not country-specific, with whom U.S. persons are generally prohibited from dealing.

The Foreign Corrupt Practices Act (“FCPA”) prohibits the payment of bribes to foreign government officials and political figures and includes anti-bribery provisions enforced by the Department of Justice and accounting provisions enforced by the Securities and Exchange Commission (the “SEC”). The FCPA has a broad reach, covering all U.S. companies and citizens doing business abroad, among others, and defining a foreign official to include not only those holding public office but also local citizens affiliated with foreign government-run or -owned organizations. The FCPA also requires maintenance of appropriate books and records and maintenance of adequate internal controls to prevent and detect possible FCPA violations. Please see “Risk Factors—Risks Related to Our Business and Industry—Abuse of our prepaid products for purposes of financing sanctioned countries, terrorist funding, bribery or corruption could cause reputational or other harm that could have a material adverse effect on our business, results of operations and financial condition” for additional information.

State Unclaimed Property Regulation. For some of our prepaid products, we or our issuing banks are required to remit unredeemed funds to certain (but not all) states pursuant to unclaimed property laws and regulations. However, unclaimed property laws and regulations are subject to change. Please see “Risk Factors—Risks Related to Our Business and Industry—Costs of compliance or penalties for failure to comply with or changes in state unclaimed property laws and regulations and changes in state tax codes could have a material adverse effect on our business, financial condition and results of operations” for additional information.

Money Transmitter License Regulation. Most states regulate the business of sellers of traveler’s checks, money orders, drafts and other monetary instruments, which we refer to collectively as money transmitters. While many states expressly exempt banks and their agents from regulation as money transmitters, others purport to regulate the money transmittal businesses of bank agents or do not extend exemptions to non-branch bank agents. We have historically taken the position that state money transmitter statutes do not apply to our core prepaid card distribution business. Nonetheless, in connection with our open loop business, we rely on the money transmitter licenses of Blackhawk Network California in connection with our bank-issued products in some of those states; and for our core retail distribution business, Blackhawk Network, Inc., is licensed in connection with gift card distribution in two states, Maryland and West Virginia.

Blackhawk Network California is a licensed money transmitter in 48 U.S. jurisdictions and Puerto Rico. The remaining U.S. jurisdictions do not currently regulate money transmitters or have determined that we do not need to be licensed in connection with our current businesses. In those states where we are licensed, we are subject to direct supervision and regulation by the relevant state licensing authorities charged with enforcement of the money transmitter statutes and must comply with various restrictions and requirements, such as those related to the maintenance of certain levels of net worth, surety bonding, selection and oversight of our authorized delegates, permissible investments in an amount equal to our outstanding payment obligations with respect to some of the products subject to licensure, recordkeeping and reporting, and disclosures to consumers. We are also subject to periodic examinations by the relevant licensing authorities, which may include reviews of our compliance practices, policies and procedures, financial position and related records, various agreements that we have with our issuing banks, retail distribution partners and other third parties, privacy and data security policies and procedures, and other matters related to our business. As a regulated entity, Blackhawk Network California incurs significant costs associated with regulatory compliance. We anticipate that compliance costs and requirements will increase in the future for our regulated subsidiaries and that additional subsidiaries may become subject to these or new regulations. Please see “Risk Factors—Risks Related to Our Business and Industry—If we fail to maintain our existing money transmitter licenses or permits, or fail to obtain new licenses or permits in a timely manner, our business, results of operations and financial condition could be materially and adversely affected” for additional information.

Consumer Protection Regulation. We are subject to various federal, state and foreign consumer protection laws and regulations, including those related to unfair and deceptive trade practices as well as privacy and data security, which are discussed under “Risk Factors—Risks Related to Our Business and Industry—Failure to comply with, or further expansion of, consumer protection regulations could have a material adverse effect on our business, results of operations and financial condition,” “—Data protection and regulations related to privacy, data protection and information security could increase our costs, as well as negatively impact our growth,” and “—A data security breach could expose us to costly government enforcement actions, liability and protracted and costly litigation, and could adversely affect our reputation and operating revenues.”

Federal Regulation. Congress and federal regulatory agencies have enacted and implemented laws and regulations that affect the prepaid industry, such the CARD Act and FinCEN’s Prepaid Access Rule. Products of certain non-bank financial services companies, including money transmitters and prepaid access providers, are now regulated at the federal level by the Consumer Financial Protection Bureau (the “CFPB”), which began operations in July 2011, bringing additional uncertainty to the regulatory system and its impact on our business. Please see “Risk Factors—Risks Related to Our Business and Industry—We are increasingly facing more stringent anti-money laundering laws and regulations, compliance with which may increase our costs of operation, decrease our operating revenues and disrupt our business,” “—Abuse of our prepaid products for purposes of financing sanctioned countries, terrorist funding, bribery or corruption could cause reputational or other harm that could have a material adverse effect on our business, results of operations and financial condition,” “—Failure to comply with, or further expansion of, consumer protection regulations could have a material adverse effect on our business, results of operations and financial condition,” and “—Failure by us to comply with federal banking regulation may subject us to fines and penalties and our relationships with our issuing banks may be harmed” for additional information.

Privacy Regulation. In the ordinary course of our business, we collect and store personally identifiable information about customers of our various websites, users of our incentive platforms, and holders of our proprietary Visa gift and open loop incentive cards. This information may include names, addresses, email addresses, social security numbers, driver’s license numbers and account numbers. We also maintain a database of cardholder data for our proprietary Visa gift card relating to specific transactions, including account numbers, in order to process transactions and prevent fraud. These activities subject us to certain privacy and information security laws, regulations and rules in the United States (including, for example, the privacy provisions of the Gramm-Leach-Bliley Act and its implementing regulations and various other federal and state privacy and information security statutes and regulations) and the Payment Card Industry Data Security Standard (“PCI DSS”) issued by the Payment Card Industry Security Standards Council, as well as foreign regulation imposed by the European Union and certain Asia-Pacific countries.

These laws, as well as our agreements with our issuing banks, contain restrictions relating to the collection, processing, storage, disposal, use and disclosure of personal information and require that we have in place policies regarding information privacy and security. We have in effect a privacy policy, as well as business processes, relating to personal information provided to us in connection with requests for information or services, and we continue to work with our issuing banks and other third parties to update our policies and processes and adapt our business practices in order to comply with applicable privacy laws and regulations. Certain state laws and regulations also require us to notify affected individuals of certain kinds of security breaches of their personal information. These laws and regulations may also require us to notify state law enforcement, regulators or consumer reporting agencies in the event of a data breach. Please see “Risk Factors—Risks Related to Our Business and Industry—Failure to comply with, or further expansion of, consumer protection regulations could have a material adverse effect on our business, results of operations and financial condition,” “—Data protection and regulations related to privacy, data protection and information security could increase our costs, as well as negatively impact our growth,” and “—A data security breach could expose us to costly government enforcement actions, liability and protracted and costly litigation, and could adversely affect our reputation and operating revenues” for additional information.

Card Association and Network Organization Rules. In addition to the laws and regulations discussed above, we and our issuing banks are also subject to card association and debit network rules and standards. These rules and standards apply to a variety of activities, including how consumers and merchants may use their cards and data security. Each applicable card association and network organization audits us from time to time to ensure our compliance with these rules and standards. Noncompliance with these rules or standards due to our acts or omissions or the acts or omissions of businesses that work with us could result in fines and penalties or the termination of the card association registrations held by us or any of our issuing banks. Please see “Risk Factors—Risks Related to Our Business and Industry—Changes in card association rules or standards set by Visa, MasterCard and Discover, or changes in card association and debit network fees or products or interchange rates, could materially and adversely affect our business, financial condition and results of operations” for additional information.

Foreign Regulation. We are subject to regulation by foreign governments and must maintain permits and licenses in certain foreign jurisdictions in order to conduct our business. Our Blackhawk Network (UK) Limited subsidiary is regulated as an electronic money institution in the United Kingdom and issues an open loop product. We have “passported” the money license to Germany, Belgium and the Netherlands under EU regulations. Foreign regulations also present obstacles to, or increased costs associated with, our expansion into international markets. For example, in certain jurisdictions we face costs associated with repatriating funds to the United States, administrative costs associated with payment settlement and other compliance costs related to doing business in foreign jurisdictions. We are also subject to foreign privacy and other regulations. These foreign regulations often differ in kind, scope and complexity from U.S. regulations. Please see “Risk Factors—Risks Related to Our Business and Industry—We are subject to added business, political, regulatory, operational, financial and economic risks associated with our international operations” and “—Data protection and regulations related to privacy, data protection and information security could increase our costs, as well as negatively impact our growth” for additional information.

For additional information about the regulatory environment in which we operate, please see “Risk Factors—Risks Related to Our Business and Industry—We operate in a highly and increasingly regulated environment, and failure by us or our partners and clients to comply with applicable laws and regulations could have a material adverse effect on our business, results of operations and financial condition” and “—Changes in laws and regulations to which we are subject, or to which we may become subject in the future, may materially increase our costs of operation, decrease our operating revenues and disrupt our business.”

Employees

As of December 31, 2016, we had 3,191 employees. We are not subject to any collective bargaining agreement and have never been subject to a work stoppage. We believe that we have maintained good relationships with our employees.

Corporate and Available Information

Our principal executive offices are located at 6220 Stoneridge Mall Road, Pleasanton, California 94588, and our telephone number at that location is (925) 226-9990. Our website is www.blackhawknetwork.com. The information available on or that can be accessed through our website is not incorporated by reference into and is not a part of this Annual Report and should not be considered to be part of this Annual Report.

We file reports with the SEC, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any other filings required by the SEC. We make available on our Investor Relations website, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information on our website is not incorporated by reference into this Annual Report or in any other report or document we file with the SEC.

The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

ITEM 1A. RISK FACTORS

Our business faces significant risks, some of which are set forth below to enable readers to assess, and be appropriately apprised of, many of the risks and uncertainties applicable to the forward-looking statements made in this Annual Report on Form 10-K. You should carefully consider these risk factors as each of these risks could adversely affect our business, operating results, cash flows and financial condition. If any of the events or circumstances described in the following risks actually occurs, our business may suffer, the trading price of our common stock and our 2022 Notes could decline and our financial condition and results of operations could be harmed. Given these risks and uncertainties, you are cautioned not to place undue reliance on forward-looking statements. These risks should be read in conjunction with the other information set forth in this Annual Report on Form 10-K. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us, or that we currently believe to be immaterial, may also adversely affect our business.

We may not be able to grow at historic rates in the future, if at all.

Our revenues grew from $1.8 billion in 2015 to $1.9 billion in 2016, representing a growth rate of 5%, which was substantially lower than the average growth rate of 23% in the immediately preceding three years. There can be no assurance that we will be able to continue our historic growth rates in future periods. Our ability to maintain and grow our business depends on a number of factors, many of which are outside our control. These include:

| |

• | changes in consumer and corporate preferences and demand for the products and services that we offer; |

| |

• | our ability to retain and attract new retail and corporate customers; |

| |

• | our ability to maintain and expand our distribution network and business partners; |

| |

• | our ability to maintain and expand the supply and variety of products and services that we distribute and offer; |

| |

• | our ability to increase the productivity of our distribution partners’ stores; |

| |

• | our ability to anticipate and adapt to technological changes in the industry, as well as to develop new technologies to deliver our product and service offerings; |

| |

• | our ability to maintain our relationships with banks that issue open loop prepaid cards (card issuing banks) and other industry participants; |

| |

• | pricing pressure in the face of increasing competition and other market forces; |

| |

• | regulatory changes or uncertainties that increase compliance costs, decrease the attractiveness of the products and services we offer or make it more difficult or less attractive for us, our distribution partners or our content providers, including card issuing banks, to participate in our industry; and |

| |

• | consumer acceptance of our product and services offerings in international markets, and our ability to grow our international operations and manage related regulatory compliance and foreign currency fluctuations. |

Even if we are successful in increasing our operating revenues through our various initiatives and strategies, we may experience a decline in growth rates and/or an increase in expenses, which could have a material adverse effect on our business, results of operations and financial condition.

Our future growth and profitability depend upon our continued expansion within the markets in which we currently operate and the further expansion of these markets. As part of our strategy to achieve this expansion, we look for acquisition opportunities, investments and alliance relationships with other businesses that will allow us to increase our market penetration, technological capabilities, product offerings and distribution capabilities. We may not be able to successfully identify suitable acquisition, investment and alliance candidates in the future, and if we do, they may not provide us with the value and benefits we anticipate.

Our operating revenues may decline if we lose one or more of our top retail distribution partners, fail to maintain existing relationships with our retail distribution partners or fail to attract new retail distribution partners to our network, or if the financial performance of our retail distribution partners’ businesses declines.

The success of our business depends in large part upon our relationships with retail distribution partners. During 2016, 2015 and 2014, products sold through our top five largest retail distribution partners accounted for approximately 28.5%, 32.2% and 36.4% of our operating revenues, respectively. Many of our retail distribution partner agreements are subject to renewal every three to five years. Upon expiration of their agreements with us, our distribution partners may enter into relationships with our competitors instead of renewing their agreements with us, renew all or a portion of their agreements with us on less favorable terms or establish direct relationships with our content providers. In addition, a distribution partner may file for bankruptcy or otherwise sell off or wind-down its business. There is no assurance that we will be able to continue our relationships with these distribution partners on the same terms, or at all, in future periods. Among other things, many of our distribution partner agreements contain varying degrees of exclusivity for us as the provider of prepaid products in their stores, and it is important to our competitive positioning to maintain those exclusive relationships. Our operating results could be materially and adversely affected if any of our significant distribution partners terminates, fails to renew or fails to renew on similar or more favorable terms, its agreement with us; and any publicity regarding such loss could harm our reputation, making it more difficult to attract and retain other distribution partners. In addition, exclusive relationships between potential distribution partners and our competitors as well as other commercial arrangements may make it difficult for us to attract new distribution partners to our network.

The success of our business also depends on the continued success of our distribution partners’ businesses. Accordingly, our operating results may fluctuate with the performance of our partners’ businesses, including their ability to maintain and increase consumer traffic in their stores.

If our retail distribution partners fail to actively and effectively promote our products and services, or if they implement operational decisions that are inconsistent with our interests, our future growth and results of operations may suffer.

Approximately 74.4% of our 2016 operating revenues were derived from sales of our products and services through our retail distribution partners. Our success depends heavily on the prepaid products selected for display by our distribution partners and how our distribution partners actually display and promote the prepaid products, which we can influence and facilitate, but do not control. For example, the in-store placement and size of our prepaid card displays, as well as the marketing and merchandising efforts of our distribution partners for our products and services, all have an impact on the number and transaction dollar volume of products and services sold. Although we advise our distribution partners concerning optimal display of the card content, our contracts allow distribution partners to exercise significant discretion over the placement and promotion of our products in their stores. In addition, our distribution partners who only have basic displays of our products

may not be willing or able to implement enhanced displays and marketing efforts, which could significantly harm our ability to grow our business. If our distribution partners give more favorable placement or promotion to the products and services of our competitors, or otherwise fail to effectively market our products and services, or implement changes in their systems that disrupt the integration with our processing systems, our results of operations may suffer.