UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

(State of Incorporation) |

|

(I.R.S. Employer Identification Number) |

(Address of Principal Executive Offices and Zip Code)

(

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

☒ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the voting and non-voting stock held by non-affiliates was approximately $

As of February 4, 2021, there were

Documents Incorporated by Reference

Portions of the Registrant’s definitive Proxy Statement for its 2021 annual meeting of stockholders will be incorporated by reference in Part III of this Annual Report on Form 10-K.

INDEX

|

|

|

Page |

|

|

|

|

|

Item 1. |

3 |

|

|

|

|

|

|

Item 1A. |

16 |

|

|

|

|

|

|

Item 1B. |

30 |

|

|

|

|

|

|

Item 2. |

31 |

|

|

|

|

|

|

Item 3. |

31 |

|

|

|

|

|

|

Item 4. |

31 |

|

|

|

||

|

|

|

|

|

Item 5. |

32 |

|

|

|

|

|

|

Item 6. |

33 |

|

|

|

|

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

34 |

|

|

|

|

|

Item 7A. |

49 |

|

|

|

|

|

|

Item 8. |

51 |

|

|

|

|

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

97 |

|

|

|

|

|

Item 9A. |

97 |

|

|

|

|

|

|

Item 9B. |

98 |

|

|

|

||

|

|

|

|

|

Item 10. |

99 |

|

|

|

|

|

|

Item 11. |

99 |

|

|

|

|

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

99 |

|

|

|

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

99 |

|

|

|

|

|

Item 14. |

99 |

|

|

|

||

|

|

|

|

|

Item 15. |

100 |

|

|

|

|

|

|

Item 16. |

103 |

|

|

|

|

|

|

|

104 |

|

1

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements. The words “believe,” “expect,” “anticipate,” “intend,” “estimate” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. You should not place undue reliance on these forward-looking statements. Although forward-looking statements reflect management’s good faith beliefs, reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements speak only as of the date the statements are made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to: the duration and spread of the COVID-19 pandemic, including new variants of the virus and the pace and availability of vaccines, mitigating efforts deployed by government agencies and the public at large, and the overall impact from such outbreak on economic conditions, financial market volatility and our business, including but not limited to the operations of our manufacturing and other facilities, our supply chain, our distribution processes and demand for our products and the corresponding impacts to our net sales and cash flow; increases in cost, disruption of supply or shortage of raw materials or components used in our products, including as a result of the COVID-19 pandemic; risks related to our substantial indebtedness; our participation in markets that are competitive; the highly cyclical industries in which certain of our end users operate; uncertainty in the global regulatory and business environments in which we operate; our ability to prepare for, respond to and successfully achieve our objectives relating to technological and market developments, competitive threats and changing customer needs, including with respect to electric hybrid and fully electric commercial vehicles; the concentration of our net sales in our top five customers and the loss of any one of these; the failure of markets outside North America to increase adoption of fully automatic transmissions; the success of our research and development efforts, the outcome of which is uncertain; U.S. and foreign defense spending; risks associated with our international operations, including increased trade protectionism; general economic and industry conditions; the discovery of defects in our products, resulting in delays in new model launches, recall campaigns and/or increased warranty costs and reduction in future sales or damage to our brand and reputation; our ability to identify, consummate and effectively integrate acquisitions; labor strikes, work stoppages or similar labor disputes, which could significantly disrupt our operations or those of our principal customers; and our intention to pay dividends and repurchase shares of our common stock.

Important factors that could cause actual results to differ materially from our expectations are disclosed under Part I, Item 1A, “Risk Factors” in this Annual Report on Form 10-K. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements as well as other cautionary statements that are made from time to time in our other Securities and Exchange Commission filings or public communications. You should evaluate all forward-looking statements made in this Annual Report on Form 10-K in the context of these risks and uncertainties.

Certain Trademarks

This Annual Report on Form 10-K includes trademarks, such as Allison Transmission, ReTran and Walker Die Casting, which are protected under applicable intellectual property laws and are our property and/or the property of our subsidiaries. This report also contains trademarks, service marks, copyrights and trade names of other companies, which are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Solely for convenience, our trademarks and trade names referred to in this report may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

2

PART I.

ITEM 1. Business

Overview

Allison Transmission Holdings, Inc. and its subsidiaries (“Allison,” the “Company,” “we,” “us” or “our”) design and manufacture vehicle propulsion solutions, including commercial-duty on-highway, off-highway and defense fully automatic transmissions and electric hybrid and fully electric systems. The business was founded in 1915 and has been headquartered in Indianapolis, Indiana since inception. Allison was an operating unit of General Motors Corporation from 1929 until 2007, when Allison once again became a stand-alone company. In March 2012, Allison began trading on the New York Stock Exchange under the symbol “ALSN”.

We have approximately 3,300 employees. Although approximately 79% of revenues were generated in North America in 2020, we have a global presence by serving customers in Europe, Asia, South America and Africa. We serve customers through an independent network of approximately 1,400 independent distributor and dealer locations worldwide.

In March 2020, the World Health Organization categorized the novel coronavirus ("COVID-19") as a pandemic, and it continues to impact the United States and other major markets in which we operate across the world, resulting in severe disruptions to global markets and supply chains, significant uncertainty and a weaker global outlook. The effects of the pandemic on the global economy began having a material impact on demand for our products and on our results of operations during the second quarter of 2020 as our suppliers and customers reduced or halted production. Our suppliers and customers resumed production during the third quarter of 2020, resulting in increased demand for our products during the third and fourth quarters of 2020.

To limit the spread of COVID-19, governments continue to take various actions including travel bans and restrictions, quarantines, curfews, stay-at-home orders, social distancing guidelines and business shutdowns and closures. Despite these disruptions, we continued manufacturing operations throughout 2020 allowing us to deliver our products to customers without interruption. However, our global manufacturing facilities cut back on operating levels and shifts during 2020 as a result of government orders, our inability to obtain component parts from suppliers and decreased customer demand and, in certain locations, temporarily suspended operations in the second quarter of 2020.

We continue to take a variety of measures to promote the safety and security of our employees and to maintain operations with as minimal impact as possible to our stakeholders, including increased frequency of cleaning and disinfecting of facilities, social distancing, occupancy limits, mask wearing requirements, remote working when possible, travel restrictions, limitations on visitor access to facilities and on-site COVID-19 testing in our Indianapolis, Indiana headquarters. During the second and third quarter of 2020, we also aligned operations, programs and spending across our entire business with current conditions, including reduced compensation expense through restructuring initiatives of both hourly and salary employees related to voluntary and involuntary separation programs implemented during the second quarter of 2020, furloughed a portion of our workforce, reduced overtime, and assessed the timing and cadence of various capital investments.

Our Business

We are the world’s largest manufacturer of fully automatic transmissions for medium- and heavy-duty commercial vehicles and medium- and heavy-tactical U.S. defense vehicles and a supplier of commercial vehicle electric hybrid and fully electric propulsion systems. Allison solutions are used in a wide variety of applications, including on-highway trucks (distribution, refuse, construction, fire and emergency), buses (primarily school and transit), motorhomes, off-highway vehicles and equipment (primarily energy, mining and construction) and defense vehicles (wheeled and tracked). We believe the Allison brand is one of the most recognized in our industry as a result of the performance, reliability and fuel efficiency of our transmissions and propulsion solutions and is associated with high quality, durability, vocational value, technological leadership and superior customer service.

3

We introduced the world’s first fully automatic transmission for commercial vehicles over 70 years ago. Since that time, we have driven the trend in North America and Western Europe towards increasing automaticity by targeting a diverse range of commercial vehicle vocations. Allison products are optimized for the unique performance requirements of end users, which typically vary by vocation. Our products are highly engineered, requiring advanced manufacturing processes, and employ complex software algorithms for our transmission controls to maximize end user performance. We have developed over 100 different models that are used in more than 2,500 different vehicle configurations and are compatible with more than 500 combinations of engine brands, models and ratings (including diesel, gasoline, natural gas and other alternative fuels). Additionally, we have created thousands of unique Allison-developed calibrations available to be used with our transmission control modules.

Our Industry

Commercial vehicles typically employ one of three transmission types: manual, automated manual or fully automatic. Manual and automated manual transmissions ("AMT") are the most prevalent transmission type used in Class 8 tractors in North America. Manual transmissions are the most prevalent in medium- and heavy-duty commercial vehicles, generally, outside North America. Manual transmissions utilize a disconnect clutch causing power to be interrupted during each gear shift resulting in energy loss-related inefficiencies and less work being accomplished for a given amount of fuel consumed. In long-distance trucking, this power interruption is not a significant factor, as the manual transmission provides its highest degree of fuel economy during steady-state cruising. However, steady-state cruising is only one part of the duty cycle. When the duty cycle requires a high degree of “start and stop” activity or speed transients, as is common in many vocations as well as in urban environments, we believe manual transmissions result in reduced performance, lower fuel efficiency, lower average speed for a given amount of fuel consumed and inferior ride quality. Moreover, the clutches must be replaced regularly, resulting in increased maintenance expense and vehicle downtime. Manual transmissions also require a skilled driver to operate the disconnect clutch when launching the vehicle and shifting gears. AMTs are manual transmissions that feature automated operation of the disconnect clutch. Fully automatic transmissions utilize technology that smoothly shifts gears instead of a disconnect clutch, thereby delivering uninterrupted power to the wheels during gear shifts and requiring minimal driver input. These transmissions deliver superior acceleration, higher productivity, increased fuel efficiency, reduced operating costs, less driveline shock and smoother shifting relative to both manual transmissions and AMTs in vocations with a high degree of “start and stop” activity, as well as in urban environments.

Emerging technologies in commercial-duty propulsion solutions include electric hybrid and fully electric propulsion solutions in certain end markets, such as transit buses, and are in part driven by efforts to reduce fuel consumption and greenhouse gas emissions. Fully electric powertrains differ from electric hybrid powertrains because they only propel the vehicle with an electric motor; while electric hybrids generally utilize both a conventional internal combustion power source and powertrain as well as the means to propel the vehicle electrically. While both emerging technologies are gaining use in niche automotive markets, they are just beginning to evolve and become proven in commercial vehicle markets.

Fuel efficiency, reduction in fuel consumption and reduced emissions are important considerations for commercial vehicles everywhere and they tend to go together. We believe fuel efficiency, the measure of work performed for a given amount of fuel consumed, is the best method to assess fuel consumption of commercial vehicles as compared to the more commonly-used fuel economy metric of miles-per-gallon (“MPG”). MPG is inadequate for commercial vehicles because it does not encompass two key elements of efficiency that we believe are important to vehicle owners and operators: payload and transport time. For example, if more work can be completed or more payload hauled using the same amount of fuel and/or over a shorter period of time, then we believe the vehicle is more fuel efficient. Since fuel economy only accounts for distance traveled and fuel consumed, ignoring time and work performed, we believe it is therefore an inferior metric to fuel efficiency when it comes to assessing commercial vehicles. Markets, regulations, policies and technology continue to evolve with respect to these topics.

4

Our Served Markets

We sell our propulsion solutions globally for use in medium- and heavy-duty on-highway commercial vehicles, off-highway vehicles and equipment and defense vehicles. In addition to the sale of propulsion solutions, we also sell branded replacement parts, support equipment, aluminum die cast components and other products necessary to service the installed base of vehicles utilizing our solutions. The following table provides a summary of our business by end market, for the fiscal year ended December 31, 2020.

|

|

|

|

NORTH AMERICA |

|

|

|

OUTSIDE NORTH AMERICA |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

END MARKET |

|

|

ON- HIGHWAY |

|

|

|

OFF- HIGHWAY |

|

|

|

ON- HIGHWAY |

|

|

|

OFF- HIGHWAY |

|

|

|

DEFENSE |

|

|

|

SERVICE PARTS, SUPPORT EQUIPMENT & OTHER |

|

||||||

|

2020 NET SALES (IN MILLIONS) |

|

|

$ |

1,081 |

|

|

|

$ |

13 |

|

|

|

$ |

280 |

|

|

|

$ |

61 |

|

|

|

$ |

182 |

|

|

|

$ |

464 |

|

|

% OF TOTAL |

|

|

52% |

|

|

|

1% |

|

|

|

13% |

|

|

|

3% |

|

|

|

9% |

|

|

|

22% |

|

||||||

|

VOCATIONS OR END USE |

|

|

• Construction • Distribution • Emergency • Metro Tractors • Motorhome • Refuse • School, transit, shuttle and coach buses • Utility |

|

|

|

• Construction • Energy • Mining • Specialty vehicle |

|

|

|

• Construction • Distribution • Emergency • Refuse • Transit, shuttle and coach buses • Utility |

|

|

|

• Construction • Energy • Mining • Specialty vehicle |

|

|

|

• Medium- and heavy-tactical wheeled platforms • Tracked combat platforms |

|

|

|

• Aluminum die cast components • Extended transmission coverage • Remanufactured transmissions • Royalties • Saleable engineering • Service parts • Support equipment • Transmission fluids |

|

||||||

Refer to NOTE 19, “Concentration of Risk” in Part II, Item 8, of this Annual Report on Form 10-K for additional information on our significant original equipment manufacturer (“OEM”) customers.

5

North America

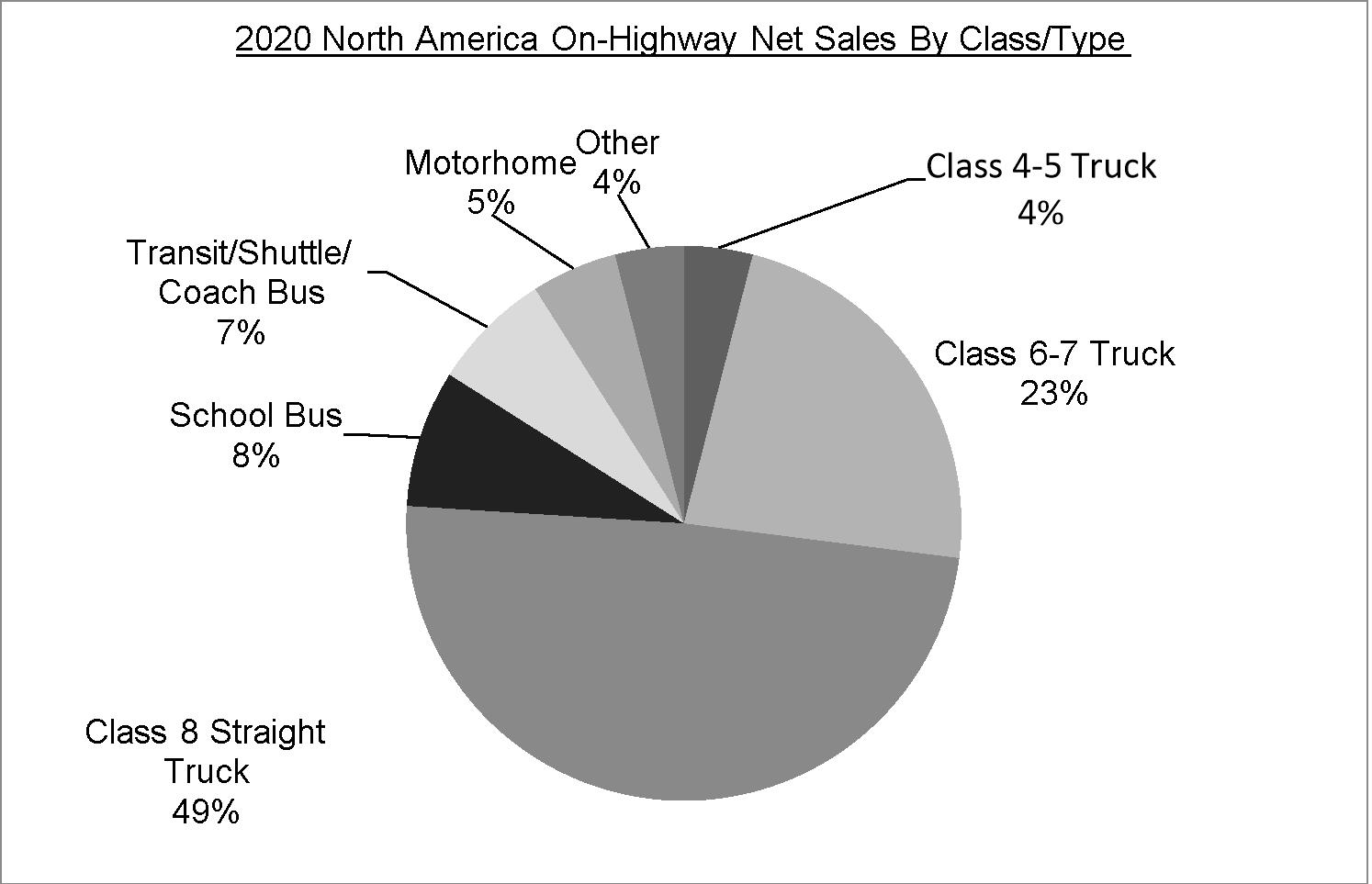

On-Highway. We are the largest manufacturer of fully automatic transmissions for the on-highway medium- and heavy-duty commercial vehicle market in North America. The following is a summary of our on-highway net sales by vehicle class in North America.

Our core North American on-highway market includes Class 4-5, Class 6-7 and Class 8 straight trucks, conventional transit, shuttle and coach buses, school buses and motorhomes. Class 8 trucks are subdivided into two markets: straight and tractor. Class 8 straight trucks are those with a unified body (e.g., refuse, construction, and dump trucks), while tractors have a vehicle chassis that is separable from the trailer they pull. We have been supplying transmissions for Class 8 straight trucks for decades, and it is a core end market for us. Today, we have very limited exposure to the Class 8 line-haul tractor market because lower priced manual transmissions and AMTs generally meet the needs of these vehicles which are primarily used in long distance hauling.

We also provide electric hybrid and fully electric propulsion solutions within the North American on-highway market. The interest in conserving fuel and reducing greenhouse gas emissions is driving demand for more fuel efficient commercial vehicles. Our customers for transit bus applications are typically city, state and federal governmental entities. We compete primarily with BAE Systems plc and manufacturers of fully electric propulsion solutions in this market.

We sell substantially all of our transmissions and propulsion solutions in the North American on-highway market to OEMs. These OEMs, in turn, install our transmissions and propulsion solutions in vehicles in which our product is either the exclusive transmission or propulsion solution available or is specifically requested by end users. In 2020, OEM customers representing over 95% of our North American on-highway unit volume participated in long-term agreements (“LTA”) with us. Generally, these LTAs offer the OEM customer defined levels of mutual commitment with respect to growing Allison’s presence in the OEMs’ products and promotional efforts, pricing and sharing of commodity cost risk. The length of our LTAs is typically between three and five years. We often compete in this market against independent manufacturers of manual transmissions, AMTs, electric hybrid and fully electric propulsion solutions, fully automatic transmissions manufactured by Ford Motor Company (“Ford”), ZF Friedrichshafen AG (“ZF”) and Voith GmbH (“Voith”), and against vertically integrated OEMs in certain weight classes that use their own internally manufactured transmissions in certain vehicles.

6

The following table presents a summary of our competitive position by vehicle class in the North America On-Highway end market.

|

|

|

|

CLASS 4-5 TRUCKS |

|

|

|

CLASS 6-7 TRUCKS |

|

|

|

CLASS 8 STRAIGHT TRUCKS |

|

|

|

SCHOOL BUSES |

|

|

|

MOTORHOMES |

|

|

2020 SHARE |

|

|

14% |

|

|

|

75% |

|

|

|

80% |

|

|

|

84% |

|

|

|

47% |

|

|

PRIMARY COMPETITION |

|

|

• Ford |

|

|

|

• Manual Transmissions • Ford |

|

|

|

• Manual Transmissions • AMTs |

|

|

|

• Ford |

|

|

|

• Ford |

|

Off-Highway. We have provided products used in vehicles and equipment that serve energy, mining and construction applications in North America for over 70 years. Off-highway energy applications include hydraulic fracturing equipment, well-stimulation equipment, pumping equipment, and well-servicing rigs, which often use a fully automatic transmission to propel the vehicle and drive auxiliary equipment. We supply our heavy duty off-highway transmissions to producers of well-stimulation and well-servicing equipment. Competition includes Caterpillar Inc. (“Caterpillar”) and Twin Disc, Inc. (“Twin Disc”).

We also provide heavy-duty transmissions used in mining trucks, specialty vehicles and construction vehicles. Mining applications include trucks used to haul various commodities and other products, including rigid dump trucks, underground trucks and long-haul tractor trailer trucks with load capacities between 40 to 110 tons. Our major competitors in this end market are Caterpillar and Komatsu Ltd. (“Komatsu”), both of which are vertically integrated and manufacture fully automatic transmissions for their own vehicles. Specialty vehicles using our heavy-duty transmissions include airport rescue and firefighting vehicles and heavy-equipment transporters. Our major competitor in this end market is Twin Disc. Construction applications include articulated dump trucks, with Caterpillar, Volvo Group (“Volvo”) and ZF as competitors.

7

Outside North America

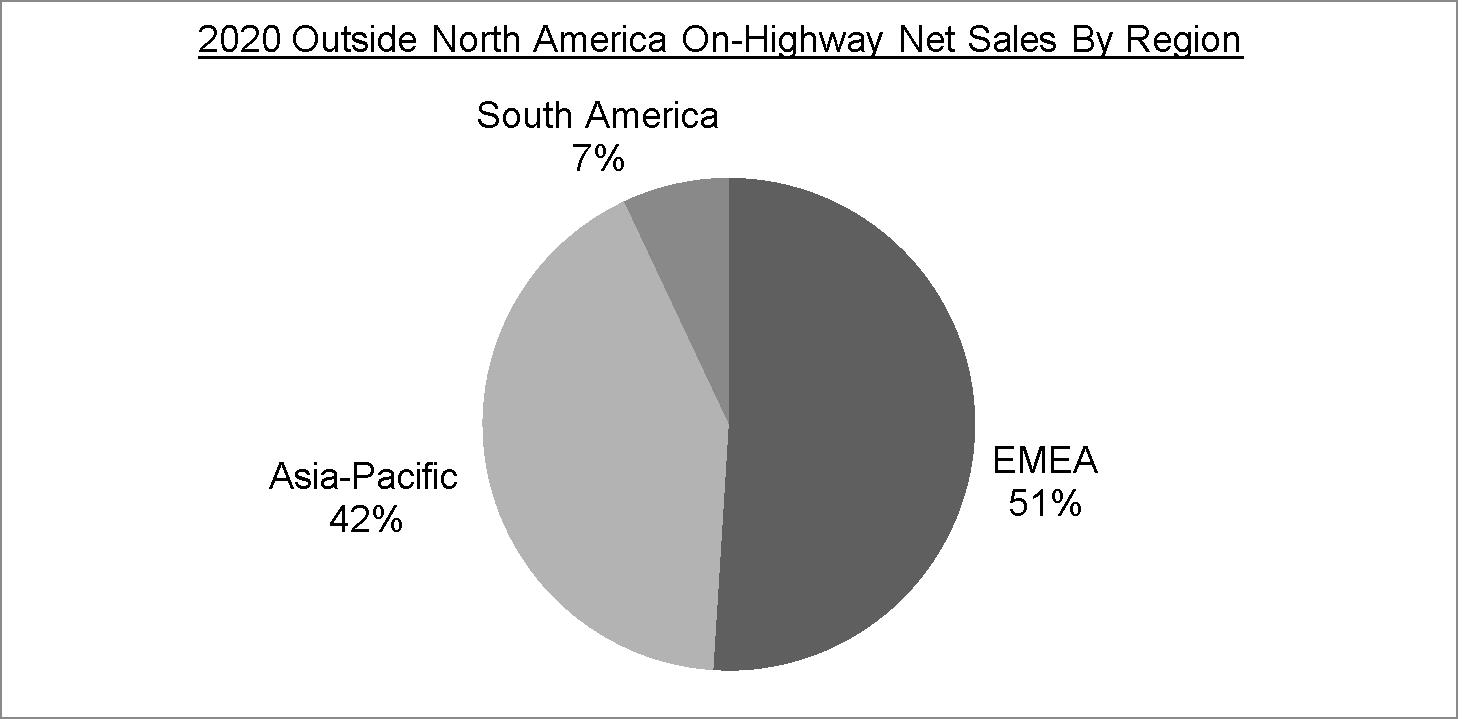

Outside North America we serve several different markets, including: Europe, Middle East, Africa (collectively, “EMEA”), Asia-Pacific and South America.

On-Highway. We are the largest manufacturer of fully automatic transmissions for the commercial vehicle market outside of North America. While the use of fully automatic transmissions in the medium- and heavy-duty commercial vehicle market has been widely accepted in North America, markets outside North America continue to be dominated by manual transmissions. Where adopted, fully automatic transmission-equipped medium- and heavy-duty commercial vehicles are concentrated in certain vocational end markets. We often compete in this market against independent manufacturers of manual transmissions, AMTs, electric hybrid and fully electric propulsion solutions, fully automatic transmissions manufactured by ZF, Voith, and Shaanxi Fast Gear Co., Ltd. and against vertically integrated OEMs. The following is a summary of our on-highway net sales by region outside of North America.

Europe, Middle East, Africa. EMEA is composed of several different markets, each of which differs from our core North American market by the degree of market maturity, sophistication and acceptance of fully automatic transmission and electric propulsion solution technology. Within Europe, we serve Western European developed markets, as well as Russian and Eastern European emerging markets, principally in the refuse, emergency, bus, coach, distribution and utility markets. Competition in Western Europe is most notably characterized by a high level of vertical powertrain integration with OEMs often utilizing their own manual transmissions and AMTs in their vehicles. The Middle East and Africa regions are generally characterized by very limited local vehicle production, with imports from the U.S., South America, Turkey, China, India and Europe accounting for the majority of vehicles.

Asia-Pacific. Our key Asia-Pacific markets include China, Japan, India, and South Korea; however, we actively participate in several other important Asia-Pacific countries including Australia, Taiwan, Indonesia, Malaysia and Thailand, which are primarily importers of commercial vehicles. Within Asia-Pacific, our sales efforts are principally focused on the transit bus and vocational truck markets. Currently, manual transmissions are the predominant transmissions used in commercial vehicles in the Asia-Pacific region. In China, subsidies offered by governmental entities continue to drive the development and adoption of fully electric propulsion solutions for use in the transit bus market.

South America. The South American region is characterized by a high level of OEM integration, with captive manual transmission and AMT manufacturing. Currently, manual transmissions are the predominant transmissions used in commercial vehicles in South America.

8

Off-Highway. The following is a summary of our off-highway net sales by region outside of North America.

Europe, Middle East, Africa. Our off-highway markets in EMEA are mining and construction. Our major off-highway competitors are Caterpillar and Komatsu, both of which are vertically integrated manufacturers of off-highway mining vehicles, including the specific fully automatic transmission used in their mining trucks. A typical construction application is a rigid or articulated dump truck, with competition from Caterpillar, Dana Inc., Volvo and ZF transmissions.

Asia-Pacific. Off-highway markets in Asia are shared by energy, mining and construction applications. Our primary competitors are Caterpillar, Danyang Winstar Auto Parts Co., Ltd., Twin Disc and Xi’an FC Intelligence Transmission Co. Ltd., in energy applications; Caterpillar, Danyang Winstar Auto Parts Co., Ltd. and Komatsu in mining applications; and Caterpillar, Volvo and ZF in construction applications.

Defense

We have a long-standing relationship with the U.S. Department of Defense (“DOD”) dating back to 1946, when we began developing our first-generation tank transmission. Today, we sell substantially all of the transmissions for medium- and heavy-tactical wheeled vehicle platforms including the Joint Light Tactical Vehicle, Light Armored Vehicle, Stryker Armored Vehicle, Mine Resistant Ambush Protected Vehicle, the Family of Medium Tactical Vehicles, Heavy Expanded Mobility Tactical Trucks, Heavy Dump Truck and Heavy Equipment Transporters. Transmissions for our wheeled vehicle platforms are typically sold to OEMs.

We are also the supplier on two of the three key tracked vehicle platforms, the Abrams tank and the M113 family of vehicles, which are sold directly to the DOD. Additionally, we sell parts kits to licensees for the production of transmissions for tracked vehicles manufactured outside North America, and our defense products are in approximately 110 countries around the world. See Part I, Item 1A, “Risk Factors” of this Annual Report on Form 10-K for a discussion of risks associated with our contracts with the DOD.

Globally, we face competition primarily from L3 Technologies, Inc., Renk AG and SAPA S.p.A for supply of tracked vehicle transmissions. Additionally, we face limited competition from ZF in certain defense wheeled vehicles.

Service Parts, Support Equipment and Other

Our service parts, support equipment and other end market is comprised of: Allison-branded service parts and transmission fluids, aluminum die cast components, extended transmission coverage, remanufactured transmissions, royalties, saleable engineering and support equipment. The aftermarket provides us with a relatively stable source of revenues as the installed base of vehicles and equipment utilizing our solutions continues to grow. The need for replacement parts is driven by normal vehicle and equipment maintenance requirements.

9

Uninterrupted operation is generally critical for end users’ profitability. In addition, beginning in 2019 we began selling aluminum die casting components following our acquisition of Walker Die Casting.

The sale of Allison-branded parts and fluids, remanufactured transmissions and support equipment is fundamental to our brand promise. We have assembled a worldwide network of approximately 1,400 independent distributor and dealer locations to sell, service and support our solutions. As part of our brand strategy, our distributors and dealers are required to sell genuine Allison-branded parts. Within the aftermarket, we offer remanufactured transmissions under our ReTran brand, which provides a cost-effective alternative for transmission repairs and replacements. We also provide support equipment to our OEMs to assist in installing new Allison solutions into vehicles, and, therefore, sales of support equipment are dependent upon sales of new solutions. The competition for service parts and ReTran transmissions comes from a variety of smaller-scale companies sourcing non-genuine “will-fit” parts from unauthorized manufacturers. These “will-fit” parts often do not meet our product specifications, and therefore may be of lesser quality than genuine Allison parts.

Our Product Offerings

Allison transmissions and electric propulsion solutions are sold under the Allison Transmission brand name and remanufactured transmissions are sold under the ReTran brand name. The following is a summary of our product lines.

|

|

On-Highway Products |

|

|

|

|

|

|

Product |

|

Applications |

|

|

|

|

1000 Series |

|

Distribution Motorhome Refuse School/Shuttle Bus |

Services Specialty Wheeled Defense |

|

|

|

2000 Series |

|

Distribution Motorhome Refuse School/Shuttle Bus |

Services Specialty Wheeled Defense |

|

|

|

3000 Series |

|

Coach and Transit Bus Construction Distribution Fire and Emergency Metro Tractors |

Motorhome Refuse Services Specialty Wheeled Defense |

|

|

|

4000 Series |

|

Articulated Dump Truck Coach and Transit Bus Construction Distribution Fire and Emergency |

Metro Tractors Motorhome Refuse Specialty Wheeled Defense |

|

|

|

Electric Hybrid Propulsion Solution |

|

Transit and Shuttle Bus |

|

|

|

|

Fully Electric Propulsion Solutions |

|

Transit and Shuttle Bus Trucks |

|

|

|

|

Off-Highway Products |

|

|

|

|

|

|

Product |

|

Applications |

|

|

|

|

5000 Series |

|

Rigid and Articulated Dump Truck Underground Mine Truck Well Service Rigs |

|

|

|

|

6000 Series |

|

Rigid and Articulated Dump Truck Underground Mine Truck Well Service Rigs |

|

|

|

|

8000 Series |

|

Hydraulic Fracturing Equipment Rigid Dump Trucks |

|

|

|

|

9000 Series |

|

Hydraulic Fracturing Equipment Rigid Dump Trucks |

|

|

10

|

|

Defense Products |

|

|

|

|

|

|

Product |

|

Applications |

|

|

|

|

X200 |

|

Tracked Vehicles |

|

|

|

|

3040MX |

|

Tracked Vehicles |

|

|

|

|

X1100 |

|

Tracked Vehicles |

|

|

Product Development and Engineering

We maintain product development and engineering capability dedicated to the design, development, refinement and support of our fully automatic transmissions and electric hybrid and fully electric propulsion systems. We believe our customers expect our products to provide unparalleled performance and value defined in various ways, including delivering maximum cargo in minimum time, using the least amount of fuel possible while employing the fewest vehicles possible and experiencing maximum vehicle uptime. In response to those needs and the evolving customer focus on fuel efficiency, we provide vehicle specification guidelines, propulsion control software and mechanical components to optimize fuel economy while delivering desired vehicle performance.

Further, we are developing new technology to improve fuel efficiency and fuel economy by allowing engines to operate more efficiently and at lower speeds to avoid consuming fuel without compromising performance. Some examples of these development efforts include the announcements of our first 9-speed transmission and the uprated variant of our existing 3000 Series transmission for the on-highway regional haul end-market. We also pioneered electric hybrid-propulsion in commercial vehicles and beginning in 2019, we announced our fully electric propulsion solutions. Building on our existing engineering capabilities and technology acquired in 2019 we continue to enhance our existing electric hybrid-propulsion system with additional electrification features, including our eGen Flex product which has the ability to operate in electric only mode for up to 10 miles. We also continue to develop and enhance new alternative technologies for use in our global commercial vehicle markets, including fully electric centrally-located drive and electrified-axle solutions such as our eGen Power product. Finally, our product development and engineering efforts also extend into our Off-Highway and Defense end-markets through initiatives to develop more efficient and higher-horsepower hydraulic fracturing and mining transmissions, as well as new cross-drive transmissions for tracked applications. From time to time, we also acquire certain licenses to provide us with technology to complement our portfolio of products and product initiatives.

Sales and Marketing Organization

Our sales and marketing effort is organized along geographic and customer lines and is comprised of marketing, sales and service professionals, supported by application engineers worldwide. In North America, selling efforts in the on-highway end market are organized by distributor area responsibility, OEM sales and, for our large end users, national accounts. Outside North America, we manage our sales, marketing, service and application engineering professionals through regional areas of responsibility. These regional management teams distribute OEM service and application engineering resources globally. We manage our defense products sales, marketing, service and application engineering through professionals based in Indianapolis, Indiana and Detroit, Michigan.

We have developed a marketing strategy to reach OEM customers as well as end users. We target our end users primarily through marketing activities by our sales staff, who directly call on end users and attend local trade shows, targeting specific vocations globally and through our plant tour programs, where end users may test our products on our Indianapolis test track and our enhanced customer experience demonstration track at our Hungary facility.

While our marketing management uses the term “customer” interchangeably for OEMs and end users, the primary objective of our marketing strategy is to create demand for fully automatic transmissions and electric propulsion solutions through:

11

|

|

• |

OEM promotion of our products and incorporation of fully automatic transmissions and electric propulsion solutions in their commercial vehicle product offerings; |

|

|

• |

Allison representative and/or Allison distributor contact with identified, major end users; and |

|

|

• |

Our network of independent dealers who contact other end users. |

The process is interactive, as Allison representatives, Allison distributors, OEMs and dealers educate customers and respond to the specific applications, requirements and needs of numerous specialty markets.

Similarly, we work with customers, dealers and OEMs to educate, improve and simplify how they specify vehicles and vehicle systems in order to optimize vehicle performance and fuel consumption. Our field organization also works closely with distributors who, in turn, work with dealers to provide end users with education, parts, service and warranty support. The defense marketing group follows a defined plan that identifies country, vehicle and specific OEMs and then approaches the ultimate end user through a variety of channels.

Manufacturing

Our manufacturing strategy provides for distributed capability in manufacturing and assembly of our products for the global commercial vehicle market. Our primary manufacturing facilities, located in Indianapolis, Indiana, consist of approximately 2.3 million square feet of usable manufacturing space in six plants. We also have established customization and parts distribution in the United States, The Netherlands, Brazil, China, Hungary, India and Japan. Our high volume on-highway products are produced in multiple global locations (United States, Chennai, India and Szentgotthard, Hungary), while off-highway, electric hybrid propulsion and defense tracked products are produced in Indianapolis and fully electric propulsion solutions are produced in Auburn Hills, Michigan. In addition, our aluminum die cast components are produced in Lewisburg, Tennessee.

Suppliers and Raw Materials

A significant amount of the part numbers that make up our transmissions and electric propulsion solutions are purchased from outside suppliers, and during 2020, we purchased approximately $687 million of direct materials and components from outside suppliers. The largest elements of our direct spending are aluminum and steel castings and forgings that are formed by our suppliers into our larger components and assemblies for use in our transmissions and electric propulsion solutions. Our spending on aluminum and steel raw materials directly and indirectly through our purchase of these components constituted approximately 13% of our direct material and component costs in 2020. The balance of our direct and indirect materials and components costs are primarily composed of value-added services and conversion costs. Our supply contracts, along with an intensive supplier selection and performance monitoring process, have enabled us to establish and maintain close relationships with suppliers and have contributed to our overall operating efficiency and quality.

12

Intellectual Property

Patents, trademarks, and other proprietary rights are important to the continued success of our business. We also rely upon trade secrets, know-how, continuing technological innovation and licensing opportunities to develop and maintain our competitive position. We protect our proprietary rights through a variety of methods, including confidentiality agreements and proprietary information agreements with suppliers, employees, consultants and others who may have access to our proprietary information. We own and have licensing arrangements for a number of U.S. and foreign patents related to our products and business. We do not consider our business to be dependent on any single patent, nor will the expiration of any single patent materially affect our business. Our current patents will expire over various periods and we continue to file new patent applications on newly-developed technology.

Seasonality

Overall, the demand for our products is relatively consistent over the year. However, in typical market conditions, the North American truck market experiences a higher level of production in the first half of the year due to fewer holidays and the practice of plant shutdowns in July and December. As a result of the COVID-19 pandemic, demand for our products did not align with demand experienced during typical market conditions, as we experienced a severe decrease in demand in the second quarter of 2020 with demand recovering throughout the second half of 2020. Due to the ongoing uncertainties related to the COVID-19 pandemic, we may experience non-typical market conditions and demand expectation in 2021.

Human Capital

At Allison, we believe in the power of our people, our processes and our products. For more than 100 years, we have built our business on these values: Quality, Customer Focus, Integrity, Innovation, and Teamwork. We use a variety of human capital measures in managing our business, including: workforce demographics; inclusion and diversity; and employee health and safety.

Workforce Demographics. Our people continue to be a critical component in our continued success, the delivery of our values and the execution of our growth initiatives. As of December 31, 2020, we had a highly skilled workforce of approximately 3,300 employees, with approximately 89% of those employees in the U.S. Approximately 47% of our U.S. employees are represented by the International Union, United Automobile, Aerospace and Agricultural Implement Workers of America (“UAW”) and are subject to a collective bargaining agreement. In December 2017, we entered into a six year collective bargaining agreement with UAW Local 933 that expires in November 2023. There have been no strikes or work stoppages due to Allison-specific issues in over 30 years.

Inclusion and Diversity. Allison recognizes the power of different thought, accepts and respects each individual and strives to create an inclusive workplace where everyone can reach their full potential, driving innovation and business results. Our inclusion and diversity efforts in 2020 include establishing an employee-led multicultural resource group, implementing continuous Unconscious Bias Corporate training, participating in career fairs at historically Black colleges and universities, and launching a speaker series to create an open forum on complex and difficult conversations about diversity and inclusion.

Employee Health & Safety. Allison’s overriding priority is to protect the health and safety of each employee. As part of our health and safety programs, employees participate in training focused on this topic and metrics are reviewed regularly, including the number of injury incidents that occur and those incidents that result in lost work days. For 2020, we achieved an overall recordable rate of 1.53, meaning that for every 100 employees, 1.53 employees incurred an injury that resulted in recordable medical treatment and the number of lost work days was 0.28, meaning that for every 100 employees, 0.28 individuals experienced an incident that resulted in days away from work.

13

Government Regulations

We are subject to a variety of federal, state, local and foreign laws and regulations, including those governing the discharge of pollutants into the air or water, the management and disposal of hazardous substances or wastes, and the cleanup of contaminated sites. Some of our operations require environmental permits and controls to prevent and reduce air and water pollution. These permits are subject to modification, renewal and revocation by issuing authorities. In addition, certain of our products and our customer’s products are subject to certification requirements by a variety of regulatory bodies. We believe we are in substantial compliance with all material environmental laws and regulations applicable to our plants and operations. Historically, our annual costs of achieving and maintaining compliance with environmental, health and safety requirements have not been material to our financial results.

Increasing global efforts to control emissions of carbon dioxide, methane, ozone, nitrogen oxide and other greenhouse gases and pollutants, as well as the shifting focus of regulatory efforts towards total emissions output, have the potential to impact our facilities, costs, products and customers. The U.S. Environmental Protection Agency (“EPA”) has taken action to control greenhouse gases from certain stationary and mobile sources. In addition, several states have taken steps, such as adoption of cap and trade programs or other regulatory systems, to address greenhouse gases. There have also been international efforts seeking legally binding reductions in emissions of greenhouse gases. These developments and further actions that may be taken in the U.S. and in other countries, states or provinces could affect our operations both positively and negatively (e.g., by affecting the demand for or suitability of some of our products).

We also may be subject to liability as a potentially responsible party under the Comprehensive Environmental Response, Compensation and Liability Act and similar state or foreign laws for contaminated properties that we currently own, lease or operate or that we or our predecessors have previously owned, leased or operated, and sites to which we or our predecessors sent hazardous substances. Such liability may be joint and several so that we may be liable for more than our share of any contamination, and any such liability may be determined without regard to causation or knowledge of contamination. We or our predecessors have been named potentially responsible parties at contaminated sites from time to time. We do not anticipate our liabilities relating to contaminated sites will be material to our financial results.

Competition

We compete on the basis of product performance, quality, price, distribution capability and service in addition to other factors. We face competition from numerous manufacturers of various types of transmissions and propulsion solutions for commercial vehicles. Furthermore, we face an increasing amount of competition from vertical integration, as some of our customers are OEMs that manufacture transmissions and propulsion solutions for their own products. Despite their transmission and propulsion solutions manufacturing capabilities, we believe that our existing OEM customers have chosen to purchase certain transmissions and propulsion solutions from us due to the quality, reliability and strong brand of our transmissions and propulsion solutions and in order to limit fixed costs, minimize production risks and maintain company focus on commercial vehicle design, production and marketing.

14

Corporate Information

Allison Transmission Holdings, Inc. was incorporated in Delaware on June 22, 2007. Our principal executive offices are located at One Allison Way, Indianapolis, IN 46222 and our telephone number is (317) 242-5000. Our internet address is www.allisontransmission.com. We file annual, quarterly and current reports, proxy statements and other documents with the United States Securities and Exchange Commission (“SEC”), under the Securities Exchange Act of 1934, as amended (“Exchange Act”). These periodic and current reports and all amendments to those reports are available free of charge on the investor relations page of our website at http://ir.allisontransmission.com as soon as reasonably practicable after we electronically file them with, or furnish them to, the SEC. We have included our website address throughout this filing as textual references only. The information contained on, or accessible through, our website is not incorporated into this Annual Report on Form 10-K. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

15

ITEM 1A. Risk Factors

The following is a cautionary discussion of risks, uncertainties and assumptions that we believe are material to our business. In addition to the factors discussed elsewhere in this Annual Report on Form 10-K, the following are the material factors that, individually or in the aggregate, we believe could make our actual results differ materially from those described in any forward-looking statements.

Risks Related to Our Business and Operations

We participate in markets that are competitive, and our competitors’ actions could have a material adverse effect on our business, results of operations and financial condition.

Our business operates in competitive markets. We compete against other existing or new global manufacturers of transmissions and propulsion solutions for commercial vehicles on the basis of product performance, quality, price, distribution capability and service in addition to other factors. In addition, we compete with manufacturers developing alternative technologies, including fully electric propulsion solutions, that may or may not require a transmission. In addition, subsidies offered by governmental entities continue to drive the development and adoption of various alternative technologies. Actions by our competitors could lead to downward pressure on prices and/or a decline in our market share, either or both of which could adversely affect our results.

In addition, some of our customers or future customers are OEMs that manufacture or could in the future manufacture transmissions, propulsion solutions or alternate technologies, including electric propulsion solutions, for their own products. Despite their transmission manufacturing capabilities, our existing OEM customers have chosen to purchase certain transmissions and propulsion solutions from us due to customer demand, resulting from the quality of our products and in order to reduce fixed costs, eliminate production risks and maintain company focus. However, we cannot be certain these customers will continue to purchase our products in the future. Increased levels of production insourcing by these customers could result from a number of factors, such as shifts in our customers’ business strategies, acquisition by a customer of another transmission or propulsion solution manufacturer, the inability of third-party suppliers to meet specifications and the emergence of low-cost production opportunities in foreign countries. As a result, these OEMs may use products produced internally or by another manufacturer and no longer choose to purchase products from us. A significant reduction in the level of external sourcing by our OEM customers could significantly impact our net sales and cash flows and, accordingly, have a material adverse effect on our business, results of operations and financial condition.

Our financial condition and results of operations have been and may continue to be materially adversely affected by the coronavirus pandemic.

The global spread of the novel strain of coronavirus (COVID-19) that has been declared a pandemic by the World Health Organization and the preventative measures taken to contain or mitigate the outbreak have caused, and are continuing to cause, significant volatility and uncertainty and economic disruptions. Governments around the world continue to implement measures to contain or mitigate the spread of the virus, including quarantines, “shelter in place” and “stay at home” orders, travel restrictions, business curtailments and other measures, due to the ongoing pandemic. While we continue to operate our plants consistent with applicable government guidelines, during 2020 our global manufacturing facilities periodically cut back on operating levels and shifts and we experienced, and may experience again, production shutdowns at our manufacturing facilities in Hungary, India, and Tennessee during the second quarter of 2020 as a result of government orders, our inability to obtain component parts from suppliers and decreased customer demand. In addition, many of our suppliers and customers have experienced, and may continue to experience, production slowdowns and/or shutdowns, which may further impact our business, sales and results of operation.

The effects of the COVID-19 pandemic on the global economy had a material impact on demand for our products and our results of operations during 2020. While we began to experience a recovery in demand for our products during the third quarter of 2020 and that recovery in demand continued in the fourth quarter of 2020,

16

demand for our products and our results of operations in the future may once again be adversely impacted by the effects of the pandemic. The extent to which the COVID-19 pandemic may continue to adversely impact our business depends on future developments, which are highly uncertain and unpredictable, including the severity and duration of the outbreak, emerging variants of the virus that may be more contagious than current variants and the effectiveness of actions taken globally to contain or mitigate its effects, including the availability and pace of distribution of vaccines. Any future financial impact cannot be estimated reasonably at this time, but may materially adversely affect our business, supply chain, sales, results of operations, financial condition and cash flows. Even after the COVID-19 pandemic has subsided, we may experience materially adverse impacts to our business due to any resulting economic recession or depression that may continue to impact customer demand and the financial instability or operating viability of our suppliers and customers. Additionally, concerns over the economic impact of COVID-19 have caused extreme volatility in financial and other capital markets which may adversely impact our ability to access capital markets.

Volatility in and disruption to the global economic environment and changes in the regulatory and business environments in which we operate may have a material adverse effect on our business, results of operations and financial condition.

The commercial vehicle industry as a whole has been more adversely affected by volatile economic conditions than many other industries, as the purchase or replacement of commercial vehicles, which are durable items, can be deferred for many reasons, including reduced spending by end users. Future changes in the regulatory and business environments in which we operate, including increased trade protectionism and tariffs, may adversely affect our ability to sell our products or source materials needed to manufacture our products. Furthermore, financial instability or bankruptcy at any of our suppliers or customers could disrupt our ability to manufacture our products and impair our ability to collect receivables, any or all of which may have a material adverse effect on our business, results of operations and financial condition. In addition, some of our customers and suppliers may experience serious cash flow problems and, thus, may find it difficult to obtain financing, if financing is available at all. As a result, our customers’ need for and ability to purchase our products or services may decrease, and our suppliers may increase their prices, reduce their output or change their terms of sale. Any inability of customers to pay us for our products and services, or any demands by suppliers for different payment terms, may materially and adversely affect our results of operations and financial condition. Furthermore, our suppliers may not be successful in generating sufficient sales or securing alternate financing arrangements, and therefore may no longer be able to supply goods and services to us. In that event, we would need to find alternate sources for these goods and services, and there is no assurance we would be able to find such alternate sources on favorable terms, if at all. Any such disruption in our supply chain could adversely affect our ability to manufacture and deliver our products on a timely basis, and thereby affect our results of operations.

Certain of our end users operate in highly cyclical industries, which can result in uncertainty and significantly impact the demand for our products, which could have a material adverse effect on our business, results of operations and financial condition.

Some of the markets in which we operate, including energy, mining, construction, distribution and motorhomes, exhibit a high degree of cyclicality. Decisions to purchase our transmissions are largely a result of the performance of these and other industries we serve. If demand for output in these industries decreases, the demand for our products will likely decrease. Demand in these industries is impacted by numerous factors including prices of commodities, rates of infrastructure spending, housing starts, real estate equity values, interest rates, consumer spending, fuel costs, energy demands, municipal spending and commercial construction, among others. Increases or decreases in these variables globally may significantly impact the demand for our products, which could have a material adverse effect on our business, results of operations and financial condition. If we are unable to accurately predict demand, we may be unable to meet our customers’ needs, resulting in the loss of potential sales, or we may manufacture excess products, resulting in increased inventories and overcapacity in our production facilities, increasing our unit production cost and decreasing our operating margins.

17

Our sales are concentrated among our top five OEM customers and the loss or consolidation of any one of these customers or the discontinuation of particular vehicle models for which we are a significant supplier could reduce our net sales and have a material adverse effect on our results of operations and financial condition.

We have in the past and may in the future derive a significant portion of our net sales from a relatively limited number of OEM customers. For the years ended December 31, 2020, 2019 and 2018, our top five OEM customers accounted for approximately 53%, 54% and 49% of our net sales, respectively. Our top three customers, Daimler AG, PACCAR Inc. and Navistar International Corporation accounted for approximately 20%, 11% and 11%, respectively, of our net sales during 2020. The loss of, or consolidation of, any one of these customers, or a significant decrease in business from, one or more of these customers could harm our business. In addition, the discontinuation of particular vehicle models for which we are a significant supplier could reduce our net sales and have a material adverse effect on our results of operations.

Increases in cost, disruption of supply or shortage of raw materials or components used in our products could harm our business and profitability.

Our products contain various raw materials, including corrosion-resistant steel, non-ferrous metals such as aluminum and nickel, and precious metals such as platinum and palladium. We use raw materials directly in manufacturing and in components that we purchase from our suppliers. We generally purchase components with significant raw material content on the open market. The prices for and availability of these raw materials fluctuate depending on market conditions. Volatility in the prices of raw materials such as steel, aluminum and nickel could increase the cost of manufacturing our products. We may not be able to pass on these costs to our customers, and this could have a material adverse effect on our business, results of operations and financial condition. Even in the event that increased costs can be passed through to customers, our gross margin percentages would decline. Additionally, our suppliers are also subject to fluctuations in the prices of raw materials and may attempt to pass all or a portion of such increases on to us. In the event they are successful in doing so, our margins would decline.

In 2020, approximately 75% of our total spending on components was sourced from approximately 40 suppliers, some of which are the single source for such components. All of the suppliers from which we purchase materials and components used in our business are fully validated suppliers, meaning the suppliers’ manufacturing processes and inputs have been validated under a production part approval process (“PPAP”). Furthermore, there are only a limited number of suppliers for certain of the materials used in our business, such as corrosion-resistant steel. As a result, our business is subject to the risk of additional price fluctuations and periodic delays in the delivery of our materials or components if supplies from a validated supplier are interrupted and a new supplier, if one is available, must be validated or materials and components must be purchased from a supplier without a completed PPAP, which could increase our risk of purchasing non-conforming components. Any such price fluctuations or delays, if significant, could harm our profitability or operations. In addition, the loss of a supplier could result in significant material cost increases or reduce our production capacity. We have experienced, and expect to continue to experience, delays in the availability and receipt of component parts as a result of the COVID-19 pandemic, some of which may materially impact our ability to meet customer demand. We also cannot guarantee we will be able to maintain favorable arrangements and relationships with these suppliers. An increase in the cost or a sustained interruption in the supply or shortage of some of these raw materials or components that may be caused by a deterioration of our relationships with suppliers or by events such as natural disasters, power outages, labor strikes, public health crisis such as pandemics and epidemics or the like could negatively impact our business, results of operations and financial condition. Although we have agreements with many of our customers that we will pass such price increases through to them, such contracts may be canceled by our customers and/or we may not be able to recoup the costs of such price increases. Additionally, if we are unable to continue to purchase our required quantities of raw materials on commercially reasonable terms, or at all, if we are unable to maintain or enter into purchasing contracts for commodities, or if delivery of materials or component parts from suppliers is delayed or non-conforming, our operations could be disrupted, we may not be able to meet customer demand, or our profitability or our financial results may be materially impacted.

18

Our sales to the Defense end market are to government entities and contractors for the U.S. and foreign governments, and the loss of a significant number of our contracts, or budgetary declines or future reductions or changes in spending by the U.S. or foreign governments could have a material adverse effect on our results of operations and financial condition.

Our net sales to the Defense end market are derived from contracts (revenue arrangements) with agencies of, and prime system contractors for, the U.S. government and foreign governments. If a significant number of our Defense contracts and subcontracts are simultaneously delayed or cancelled for budgetary, performance or other reasons, it would have a material adverse effect on our results of operations and financial condition. Approximately 9%, or $182 million, of our net sales for the year ended December 31, 2020 were from our Defense end market.

Our future financial results may be adversely affected by:

|

|

• |

declines in, or uncertainty regarding, U.S. or foreign government defense budgets; |

|

|

• |

curtailment of the U.S. government’s use of technology or other services and product providers, including curtailment due to government budget reductions, future government shutdowns and related fiscal matters; |

|

|

• |

geopolitical developments, including economic sanctions, that affect demand for our products and services; |

|

|

• |

technological developments that impact purchasing decisions or our competitive position; and |

|

|

• |

increased regulatory requirements for defense contractors. |

Our brand and reputation are dependent on the continued participation and level of service of our numerous independent distributors and dealers.

We work with a network of approximately 1,400 independent distributors and dealers that provide post-sale service, service parts and support equipment. Because we depend on the pull-through demand generated by end users for our products, any actions by the independent distributors or dealers, which are not in our control, may harm our reputation and damage the brand loyalty among our customer base. In the event that we are not able to maintain our brand reputation because of the actions of our independent distributors and dealers, we may face difficulty in maintaining our pricing positions with respect to some of our products or have reduced demand for our products, which could negatively impact our business, results of operations and financial condition. In addition, if a significant number of independent dealers were to terminate their contracts, it could adversely impact our business, results of operations and financial condition.

We are subject to cybersecurity risks to operational systems, security systems, or infrastructure owned by Allison or third-party vendors or suppliers.

We are at risk for interruptions, outages, and breaches of: (i) operational systems, including business, financial, accounting, product development, data processing, or manufacturing processes, owned by us or our third-party vendors or suppliers; (ii) facility security systems, owned by us or our third-party vendors or suppliers; and/or (iii) transmission control modules or other in-product technology, owned by us or our third-party vendors or suppliers. Such cyber incidents could materially disrupt operational systems; result in loss of intellectual property, trade secrets or other proprietary or competitively sensitive information; compromise personally identifiable information of employees, customers, suppliers, or others; jeopardize the security of our facilities; and/or affect the performance of transmission control modules or other in-product technology. A cyber incident could be caused by malicious third parties using sophisticated, targeted methods to circumvent firewalls, encryption, and other security defenses, including hacking, fraud, trickery, or other forms of deception. The techniques used by third parties change frequently and may be difficult to detect for long periods of time. A significant cyber incident could impact production capability, harm our reputation and/or subject us to regulatory actions or litigation, any of which could materially affect our business, results of operations and financial condition. While we utilize a number of measures to prevent, detect and mitigate these threats, including employee education, monitoring of networks and systems, and maintenance of backup and protective systems, there is no guarantee such efforts will be successful in preventing a cyber incident. As a result of the COVID-19 pandemic, a significant subset of our global salaried

19

employees are working remotely, which may pose a heightened risk for cyber incidents, including cybersecurity attacks and unauthorized dissemination of proprietary or confidential information, or other disruptions of our operational systems, security systems or infrastructure.

In the event of a catastrophic loss of our key manufacturing facility, our business would be adversely affected.

While we manufacture our products in several facilities and maintain insurance covering our facilities, including business interruption insurance, a catastrophic loss of the use of all or a portion of one of our manufacturing facilities due to accident, labor issues, weather conditions, acts of war, political unrest, terrorist activity, natural disaster, public health crisis, such as pandemics and epidemics or otherwise, whether short- or long-term, would have a material adverse effect on our business, results of operations and financial condition. Our most significant concentration of manufacturing is around our corporate headquarters in Indianapolis, Indiana, where we produce approximately 90% of our transmissions. In addition to our Indianapolis manufacturing facilities, we currently operate manufacturing facilities for our fully electric propulsion solutions in Auburn Hills, Michigan, for our transmissions in both Szentgotthard, Hungary and Chennai, India and for our aluminum die cast components in Lewisburg, Tennessee. In the event of a disruption at the Indianapolis facilities, our other facilities may not be adequately equipped to operate at a level sufficient to compensate for the volume of production at the Indianapolis facility due to their size and the fact that they have not yet been tested for such significant increases in production volume.

Labor unrest could have a material adverse effect on our business, results of operations and financial condition.

As of December 31, 2020, approximately 47% of our U.S. employees, representing approximately 42% of our total employees, were represented by the UAW and are subject to a collective bargaining agreement. Our current collective bargaining agreement with UAW Local 933 is effective through November 2023.

In addition to our unionized work force, many of our direct and indirect customers and vendors have unionized work forces. Strikes, work stoppages or slowdowns experienced by these customers or vendors or their other suppliers could result in slowdowns or closings of assembly plants that use our products or supply materials for use in the production of our products. Organizations responsible for shipping our products may also be impacted by strikes. Any interruption in the delivery of our products could reduce demand for our products and could have a material adverse effect on us.

In general, we consider our labor relations with all of our employees to be good. However, in the future we may be subject to labor unrest. If strikes, work stoppages or lock-outs at our facilities or at the facilities of our vendors or customers occur or continue for a long period of time, our business, results of operations and financial condition may be materially adversely affected.

Strategic Risks

Our success depends on research and development efforts, and we may not be successful in developing or introducing new products and technologies and responding to customer needs.

Our success depends on our ability to develop or introduce new products and technologies and improve the efficiency and performance of our current products, and we invest significant resources in research and development in order to do so. We currently have enhancements to our existing products and technologies and new products and technologies under development, including electric hybrid and fully electric propulsion solutions, for planned introduction into certain end markets. The development of new products and technologies is difficult, time-consuming and costly and the timetable for commercial release is uncertain. Not all of our new product launches have been successful, and we may not be successful in the future in introducing other new products and responding to customer needs. In addition, it often takes significant time, in some cases multiple fleet buy cycles,

20

before customers gain experience with new products and technologies and those new products and technologies become widely-accepted by the market, if at all. Given the early stages of development of some of these new products and technologies, there can be no guarantee of future market acceptance and investment returns with respect to these products. In addition, the increased adoption of electric propulsion solutions could result in lower demand for our fully automatic transmissions and, over time, the demand for related service parts and support equipment, which would impact our margins. If we do not adequately anticipate the changing needs of our customers by keeping pace with improvements and changes in transmission-related or vehicle propulsion technology and developing and introducing new and effective products and technologies on a timely basis, or if the products and technologies we develop do not become market-leading, our competitive position and prospects could be harmed. If our competitors are able to respond to changing market demands and adopt new technologies more quickly than we do, demand for our products could decline, our competitive position could be harmed, our future research and development activities may be constrained due to intellectual property rights of others, licenses for technologies that would enable us to keep pace with our competitors may not be available on commercially reasonable terms if at all and we may not be able to recoup a return on our development investments. Moreover, changing customer demands as well as evolving regulatory, safety and environmental standards could require us to adapt our products and technologies to address such changes. As a result, in the future we may experience delays in the introduction of some or all of our new products or modifications or enhancements of existing products. Furthermore, there may be production delays due to unanticipated technological setbacks, which may, in turn, delay the release of new products to our end users. If we experience significant delays or increased costs in the production, launch or acceptance of our products and technologies, our net sales and results of operations may be materially adversely affected.

Our long-term growth prospects and results of operations may be impaired if the rate of adoption of fully automatic transmissions in commercial vehicles outside North America does not increase.