Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2016

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 001-35456

ALLISON TRANSMISSION HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 26-0414014 | |

| (State of Incorporation) | (I.R.S. Employer Identification Number) |

One Allison Way

Indianapolis, IN 46222

(Address of Principal Executive Offices and Zip Code)

(317) 242-5000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting stock held by non-affiliates was approximately $4,186.7 million as of June 30, 2016.

As of February 8, 2017, there were 162,611,552 shares of Common Stock outstanding.

Documents Incorporated by Reference

Portions of the Registrant’s definitive Proxy Statement for its 2017 annual meeting of stockholders will be incorporated by reference in Part III of this Annual Report on Form 10-K.

Table of Contents

1

Table of Contents

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements. The words “believe,” “expect,” “anticipate,” “intend,” “estimate” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. You should not place undue reliance on these forward-looking statements. Although forward-looking statements reflect management’s good faith beliefs, reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements speak only as of the date the statements are made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to: uncertainty in the global regulatory and business environments in which we operate; our participation in markets that are competitive; the highly cyclical industries in which certain of our end users operate; the failure of markets outside North America to increase adoption of fully-automatic transmissions; the concentration of our net sales in our top five customers and the loss of any one of these; future reductions or changes in government subsidies or changes in government subsidies for hybrid vehicles and other external factors impacting demand; U.S. defense spending; general economic and industry conditions; the discovery of defects in our products, resulting in delays in new model launches, recall campaigns and/or increased warranty costs and reduction in future sales or damage to our brand and reputation; our ability to prepare for, respond to and successfully achieve our objectives relating to technological and market developments, competitive threats and changing customer needs; risks associated with our international operations; labor strikes, work stoppages or similar labor disputes, which could significantly disrupt our operations or those of our principal customers; risks related to our substantial indebtedness; and our intention to pay dividends and repurchase shares of our common stock.

Important factors that could cause actual results to differ materially from our expectations are disclosed under Part I, Item 1A, “Risk Factors” in this Annual Report on Form 10-K. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements as well as other cautionary statements that are made from time to time in our other Securities and Exchange Commission filings or public communications. You should evaluate all forward-looking statements made in this Annual Report on Form 10-K in the context of these risks and uncertainties.

Certain Trademarks

This Annual Report on Form 10-K includes trademarks, such as Allison Transmission and ReTran, which are protected under applicable intellectual property laws and are our property and/or the property of our subsidiaries. This report also contains trademarks, service marks, copyrights and trade names of other companies, which are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Solely for convenience, our trademarks and trade names referred to in this report may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

2

Table of Contents

Overview

Allison Transmission Holdings, Inc. and its subsidiaries (“Allison,” the “Company” or “we”) design and manufacture commercial and defense fully-automatic transmissions. The business was founded in 1915 and has been headquartered in Indianapolis, Indiana since inception. Allison was an operating unit of General Motors Corporation (“Old GM”) from 1929 until 2007, when Allison once again became a stand-alone company. In March 2012, Allison began trading on the New York Stock Exchange under the symbol, “ALSN”.

We have approximately 2,600 employees and 13 different transmission product lines. Although approximately 78% of revenues were generated in North America in 2016, we have a global presence by serving customers in Europe, Asia, South America and Africa. We serve customers through an independent network of approximately 1,400 independent distributor and dealer locations worldwide.

Our Business

We are the world’s largest manufacturer of fully-automatic transmissions for medium- and heavy-duty commercial vehicles and medium- and heavy-tactical U.S. defense vehicles. Allison transmissions are used in a wide variety of applications, including on-highway trucks (distribution, refuse, construction, fire and emergency), buses (primarily school, transit and hybrid-transit), motorhomes, off-highway vehicles and equipment (primarily energy, mining and construction) and defense vehicles (wheeled and tracked). We estimate that globally, in 2016, we sold approximately 60% of all fully-automatic transmissions for medium- and heavy-duty on-highway commercial vehicle applications. We believe the Allison brand is one of the most recognized in our industry as a result of the performance, reliability and fuel efficiency of our transmissions and is associated with high quality, durability, vocational value, technological leadership and superior customer service.

We introduced the world’s first fully-automatic transmission for commercial vehicles over 60 years ago. Since that time, we have driven the trend in North America and Western Europe towards increasing automaticity by targeting a diverse range of commercial vehicle vocations. Allison transmissions are optimized for the unique performance requirements of end users, which typically vary by vocation. Our products are highly engineered, requiring advanced manufacturing processes, and employ complex software algorithms for our transmission controls to maximize end user performance. We have developed over 100 different models that are used in more than 2,500 different vehicle configurations and are compatible with more than 500 combinations of engine brands, models and ratings (including diesel, gasoline, natural gas and other alternative fuels). Additionally, we have created thousands of unique Allison-developed calibrations available to be used with our transmission control modules.

Our Industry

Commercial vehicles typically employ one of three transmission types: manual, automated manual transmissions (“AMT”) or fully-automatic. Manual transmissions are the most prevalent transmission type used in Class 8 tractors in North America and in medium- and heavy-duty commercial vehicles, generally, outside North America. Manual transmissions utilize a disconnect clutch causing power to be interrupted during each gear shift resulting in energy loss-related inefficiencies and less work being accomplished for a given amount of fuel consumed. In long-distance trucking, this power interruption is not a significant factor, as the manual transmission provides its highest degree of fuel economy during steady-state cruising. However, steady-state cruising is only one part of the duty cycle. When the duty cycle requires a high degree of “start and stop” activity or speed transients, as is common in many vocations as well as in urban environments, we believe manual transmissions result in reduced performance, lower fuel efficiency, lower average speed for a given amount of fuel consumed and inferior ride quality. Moreover, the clutches must be replaced regularly, resulting in increased maintenance expense and vehicle downtime. Manual transmissions also require a skilled driver to operate the disconnect clutch when launching the vehicle and shifting gears. AMTs are manual transmissions that feature automated operation of the disconnect clutch. Fully-automatic transmissions utilize technology that smoothly shifts gears instead of a disconnect clutch, thereby delivering uninterrupted power to the wheels during gear shifts and requiring minimal driver input. These transmissions deliver superior acceleration, higher productivity, increased fuel efficiency, reduced operating costs, less driveline shock and smoother shifting relative to both manual transmissions and AMTs in vocations with a high degree of “start and stop” activity, as well as in urban environments.

3

Table of Contents

Emerging technologies in commercial-duty transmissions and powertrains include dual clutch transmissions (“DCT”) and electric drive powertrains. DCTs are variants of manual transmissions and AMTs that incorporate a “dual clutch” mechanism to facilitate shifting the manual transmission gearbox. Electric drive powertrains are also emerging in selected end markets, such as transit buses, and are in part driven by efforts to reduce fuel consumption and greenhouse gas emissions. Electric drive powertrains differ from “hybrid” powertrains because they only propel the vehicle with an electric motor; “hybrids” generally utilize both a conventional internal combustion power source and powertrain as well as the means to propel the vehicle electrically. While both emerging technologies are gaining use in niche automotive markets, they are just beginning to evolve and become proven in commercial vehicle markets.

Fuel efficiency, reduction in fuel consumption and greenhouse gas emissions are important considerations for commercial vehicles everywhere and they tend to go together. We believe fuel efficiency, the measure of work performed for a given amount of fuel consumed, is the best method to assess fuel consumption of commercial vehicles as compared to the more commonly-used fuel economy metric of miles-per-gallon (“MPG”). MPG is inadequate for commercial vehicles because it does not encompass two key elements of efficiency that we believe are important to vehicle owners and operators: payload and transport time. For example, if more work can be completed or more payload hauled using the same amount of fuel and/or over a shorter period of time, then we believe the vehicle is more fuel efficient. Since fuel economy only accounts for distance traveled and fuel consumed, ignoring time and work performed, we believe it is therefore an inferior metric to fuel efficiency when it comes to assessing commercial vehicles. Markets, regulations, policies and technology continue to evolve with respect to these topics.

Our Served Markets

We sell our transmissions globally for use in medium- and heavy-duty on-highway commercial vehicles, off-highway vehicles and equipment and defense vehicles. In addition to the sale of transmissions, we also sell branded replacement parts, support equipment and other products necessary to service the installed base of vehicles utilizing our transmissions. The following table provides a summary of our business by end market, for the fiscal year ended December 31, 2016.

| NORTH AMERICA |

OUTSIDE NORTH AMERICA |

DEFENSE | SERVICE | |||||||||||||

| END MARKET | ON- HIGHWAY |

HYBRID TRANSIT BUS |

OFF- HIGHWAY |

ON- HIGHWAY |

OFF- HIGHWAY |

PARTS, SUPPORT EQUIPMENT & OTHER | ||||||||||

|

2016 NET SALES (IN MILLIONS) |

$962 | $61 | $7 | $305 | $12 | $115 | $378 | |||||||||

|

% OF TOTAL |

52% | 3% | 1% | 17% | 1% | 6% | 20% | |||||||||

| MARKET POSITION | • #1 supplier of fully-automatic transmissions |

• A leading supplier of hybrid-propulsion systems |

• A leading independent supplier |

• #1 supplier of fully-automatic transmissions in China

• Established presence in Western Europe |

• A leading independent supplier |

• #1 supplier of transmissions for the U.S. Department of Defense |

• Approximately 1,400 dealers and distributors worldwide | |||||||||

| VOCATIONS OR END USE |

• Distribution

• Emergency

• Refuse

• Construction

• Utility

• School, transit, shuttle and coach buses

• Motorhome

• Metro tractors |

• Hybrid transit bus

• Hybrid shuttle bus |

• Energy

• Mining

• Construction

• Specialty vehicle |

• Distribution

• Emergency

• Refuse

• Construction

• Utility

• Transit, shuttle and coach buses |

• Energy

• Mining

• Construction

• Specialty vehicle |

• Medium- and heavy-tactical wheeled platforms

• Tracked combat platforms |

• Parts

• Support equipment

• Remanufactured transmissions

• Fluids | |||||||||

Refer to NOTE 18, “Concentration of Risk” and NOTE 22, “Geographic Information” in Part II, Item 8, of this Annual Report on Form 10-K for additional information on our significant original equipment manufacturer (“OEM”) customers and net sales by geographical areas.

4

Table of Contents

North America

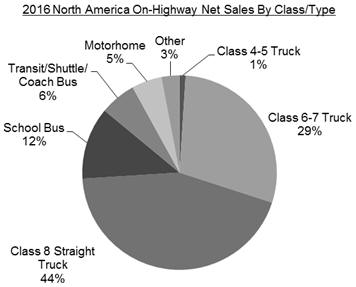

On-Highway. We are the largest manufacturer of fully-automatic transmissions for the on-highway medium- and heavy-duty commercial vehicle market in North America. The following is a summary of our on-highway net sales by vehicle class in North America.

Our core North American on-highway market includes Class 4-5, Class 6-7 and Class 8 straight trucks, conventional transit, shuttle and coach buses, school buses and motorhomes. Class 8 trucks are subdivided into two markets: straight and tractor. Class 8 straight trucks are those with a unified body (e.g., refuse, construction, and dump trucks), while tractors have a vehicle chassis that is separable from the trailer they pull. We have been supplying transmissions for Class 8 straight trucks for decades, and it is a core end market for us. Today, we have very limited exposure to the Class 8 tractor market because lower priced manual transmissions generally meet the needs of these vehicles which are primarily used in long distance hauling. However, we have identified a portion of the Class 8 tractor market that we call metro tractors that are used in urban environments the majority of the time and developed a fully-automatic transmission (the “TC10”) that meets the unique duty cycle requirements of the Class 8 metro tractor market. Combining the startability and continuous, uninterrupted power qualities of a fully-automatic transmission with the cruising aspects of a manual transmission, the TC10 offers an alternative to traditional manual and automated manual transmissions in tractor applications.

We sell substantially all of our transmissions in the North American on-highway market to OEMs. These OEMs, in turn, install our transmissions in vehicles in which our transmission is either the exclusive transmission available or is specifically requested by end users. In 2016, OEM customers representing over 90% of our North American on-highway unit volume participated in long-term supply agreements (“LTSA”) with us. Generally, these supply agreements offer the OEM customer defined levels of mutual commitment with respect to growing Allison’s presence in the OEMs’ products and promotional efforts, pricing and sharing of commodity cost risk. The length of our customer agreements is typically between three and five years. We often compete in this market against independent manufacturers of manual transmissions, AMTs, DCTs, electric drive systems, fully-automatic transmissions manufactured by Ford Motor Company (“Ford”), ZF Friedrichshafen AG (“ZF”) and Voith GmbH, and against vertically integrated OEMs in certain weight classes that use their own internally manufactured transmissions in certain vehicles.

The following table presents a summary of our competitive position by vehicle class in the North America on-highway end market.

| CLASS 4-5 TRUCKS |

CLASS 6-7 TRUCKS |

CLASS 8 STRAIGHT TRUCKS |

SCHOOL BUSES | MOTORHOMES | ||||||

| 2016 SHARE | 3% | 70% | 63% | 92% | 36% | |||||

| PRIMARY COMPETITION |

• Ford |

• Manual Transmissions • AMTs • Ford |

• Manual Transmissions • AMTs |

• Ford |

• Ford |

5

Table of Contents

Hybrid Transit Buses. The interest in conserving fuel and reducing greenhouse gas emissions is driving demand for more fuel efficient commercial vehicles. Our customers in this North American end market are typically city, state and federal governmental entities, which utilize government funds to subsidize a portion of the purchase price for the transit buses containing our hybrid-propulsion system. In this market, we compete primarily with BAE Systems plc and manufacturers of electric drive systems.

Off-Highway. We have provided products used in vehicles and equipment that serve energy, mining and construction applications in North America for over 60 years. Off-highway energy applications include hydraulic fracturing equipment, well-stimulation equipment, pumping equipment, and well-servicing rigs, which often use a fully-automatic transmission to propel the vehicle and drive auxiliary equipment. We maintain a leadership position in this end market, with nearly all producers of well-stimulation and well-servicing equipment utilizing our heavy duty off-highway transmissions. Additionally, we sell kits that can increase the horsepower ratings of our existing off-highway products. Competition includes Caterpillar, Inc. (“Caterpillar”) and Twin Disc, Inc. (“Twin Disc”).

We also provide heavy-duty transmissions used in mining trucks, specialty vehicles and construction vehicles. Mining applications include trucks used to haul various commodities and other products, including rigid dump trucks, underground trucks and long-haul tractor trailer trucks with load capacities between 40 to 110 tons. Our major competitors in this end market are Caterpillar and Komatsu, Ltd. (“Komatsu”), both of which are vertically integrated and manufacture fully-automatic transmissions for their own vehicles. Specialty vehicles using our heavy-duty transmissions include airport rescue and firefighting vehicles and heavy-equipment transporters. Our major competitor in this end market is Twin Disc. Construction applications include articulated dump trucks, with Caterpillar, Volvo Group (“Volvo”) and ZF as competitors.

Outside North America

Outside North America we serve several different markets, including: Europe, Middle East, Africa (“EMEA”), Asia-Pacific, South America and India.

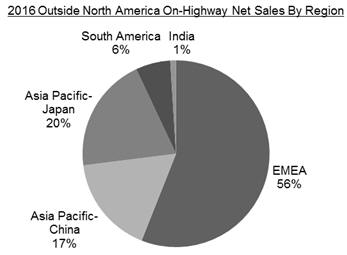

On-Highway. We are the largest manufacturer of fully-automatic transmissions for the commercial vehicle market outside of North America. While the use of fully-automatic transmissions in the medium- and heavy-duty commercial vehicle market has been widely accepted in North America, the markets outside North America continue to be dominated by manual transmissions. In 2016, fully-automatic transmission-equipped medium- and heavy-duty commercial vehicles represented less than 5% of the vehicles in markets outside North America and are concentrated in certain vocational end markets. The following is a summary of our on-highway net sales by region outside of North America.

Europe, Middle East, Africa. EMEA is composed of several different markets, each of which differs significantly from our core North American market by the degree of market maturity, sophistication and acceptance of fully-automatic transmission technology. Within Europe, we serve Western European developed markets, as well as Russian and Eastern European emerging markets, principally in the refuse, emergency, bus, coach, distribution and utility markets. Competition in Western Europe is most notably characterized by a high level of vertical powertrain integration with OEMs often utilizing their own manual transmissions and AMTs in their vehicles. The Middle East and Africa regions are generally characterized by very limited local vehicle production, with imports from the U.S., South America, Turkey, China, India and Europe accounting for the majority of vehicles.

6

Table of Contents

Asia-Pacific. Our key Asia-Pacific markets include China, Japan, Australia, and South Korea; however, we actively participate in several other important Asia-Pacific countries including Taiwan, Indonesia, Malaysia and Thailand, which are primarily importers of commercial vehicles. Within Asia-Pacific, our sales efforts are principally focused on the transit bus and vocational truck markets. Currently, manual transmissions are the predominant transmissions used in commercial vehicles in the Asia-Pacific region.

South America. The South American region is characterized by a high level of OEM integration, with captive manual transmission and AMT manufacturing. Currently, manual transmissions are the predominant transmissions used in commercial vehicles in South America.

India. Currently, manual transmissions are the predominant transmission used in commercial vehicles in India.

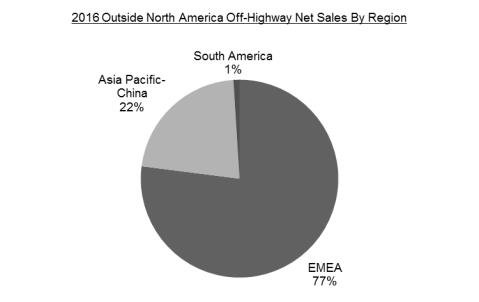

Off-Highway. The following is a summary of our off-highway net sales by region outside of North America.

Europe, Middle East, Africa. Our off-highway markets in EMEA are mining and construction. Our major off-highway competitors are Caterpillar and Komatsu, both of which are vertically integrated manufacturers of off-highway mining vehicles, including the specific fully-automatic transmission used in their mining trucks. A typical construction application is the articulated dump truck, with competition from Caterpillar, Volvo and ZF transmissions.

Asia-Pacific. Off-highway markets in Asia are shared by energy, mining and construction applications. Our primary competitors are Caterpillar, Danyang Winstar Auto Parts Co. and Twin Disc in energy applications, Caterpillar and Komatsu in mining applications and Caterpillar, Volvo and ZF in construction applications.

Defense

We have a long-standing relationship with the U.S. Department of Defense (“DOD”), dating back to 1946, when we began developing our first-generation tank transmission. Today, we sell substantially all of the transmissions for medium- and heavy-tactical wheeled vehicle platforms including the Family of Medium Tactical Vehicles, Armored Security Vehicles, Heavy Expanded Mobility Tactical Trucks, Heavy Equipment Transporters, Palletized Loading Systems, M915 Series Trucks, Medium Tactical Vehicle Replacements and the Logistic Vehicle System Replacement. Additionally, we supplied transmissions for the majority of Mine-Resistant Ambush Protected (“MRAP”) Vehicles and the MRAP All-Terrain Vehicle and for the Joint Light Tactical Vehicle, which is the replacement vehicle for Humvee personnel transport. Transmissions for our wheeled vehicle platforms are typically sold to OEMs.

We are also the supplier on two of the three key tracked vehicle platforms, the Abrams tank and the M113 family of vehicles, which are sold directly to the DOD. Additionally, we sell parts kits to licensees for the production of transmissions for tracked vehicles manufactured outside North America. Overall, we have seen the demand for U.S. defense vehicles decrease as the funding for defense vehicles declines. Additionally, the DOD budgets and supplemental spending have allowed them to recapitalize and reset many vehicle systems, which has reduced the average age of the fleet and the need to procure new vehicles. See Part I, Item 1A, “Risk Factors” of this Annual Report on Form 10-K for a further discussion of risks associated with our contracts with the U.S. DOD.

7

Table of Contents

Globally, we face competition for the supply of our transmissions in tracked defense vehicles primarily from L-3 Communications Corporation, Renk AG and ZF. Additionally, we face limited competition from Caterpillar in certain defense wheeled vehicle platforms.

Service Parts, Support Equipment and Other

The aftermarket provides us with a relatively stable source of revenues as the installed base of vehicles and equipment utilizing our transmissions continues to grow. The need for replacement parts is driven by normal vehicle and equipment maintenance requirements and is not significantly impacted by economic cycles. Uninterrupted operation is generally critical for end users’ profitability. End users focus on getting the vehicle back in service, which in some cases results in the aftermarket purchase decision being less price-sensitive.

The sale of Allison-branded parts and fluids, remanufactured transmissions and support equipment is fundamental to our brand promise. We have assembled a worldwide network of approximately 1,400 independent distributor and dealer locations to sell, service and support our transmissions. As part of our brand strategy, our distributors and dealers are required to sell genuine Allison-branded parts. Within the aftermarket, we offer remanufactured transmissions under our ReTran brand, which provides a cost-effective alternative for transmission repairs and replacements. We also provide support equipment to our OEMs to assist in installing new Allison transmissions into vehicles, and, therefore, sales of support equipment are dependent upon sales of new transmissions.

Over the last few years, traditional aftermarket sales have been tempered by improvements in product quality and durability. While traditional aftermarket sales are expected to grow, support equipment sales fluctuate with the introduction of new transmissions. The competition for service parts and ReTran transmissions comes from a variety of smaller-scale companies sourcing non-genuine “will-fit” parts from unauthorized manufacturers. These “will-fit” parts often do not meet our product specifications, and therefore may be of lesser quality than genuine Allison parts.

8

Table of Contents

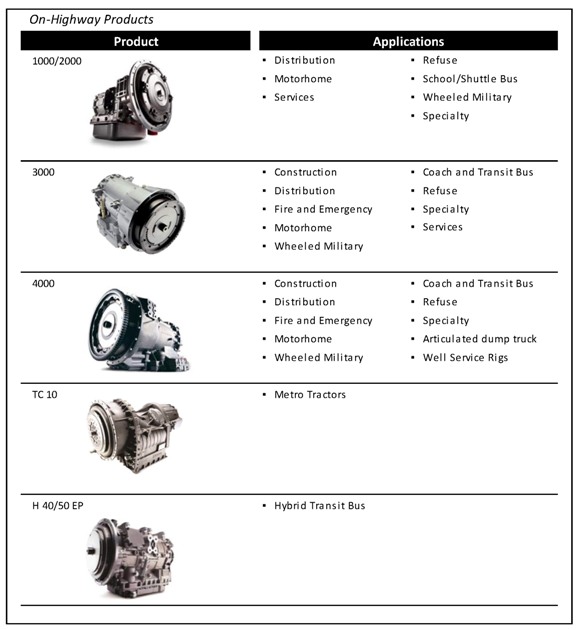

Our Product Offerings

Allison transmissions are sold under the Allison Transmission brand name and remanufactured transmissions are sold under the ReTran brand name. The following is a summary of our 13 transmission product lines.

9

Table of Contents

10

Table of Contents

Product Development and Engineering

We maintain product development and engineering capability dedicated to the design, development, refinement and support of our fully-automatic transmissions and hybrid-propulsion systems. We believe our customers expect our products to provide unparalleled performance and value defined in various ways, including delivering maximum cargo in minimum time, using the least amount of fuel possible while employing the fewest vehicles possible and experiencing maximum vehicle uptime. In response to those needs and the evolving customer focus on fuel efficiency, we provide vehicle specification guidelines, transmission control software and mechanical components to optimize fuel economy while delivering desired vehicle performance. Further, we are developing new technology to improve fuel efficiency and fuel economy by allowing engines to operate more efficiently and at lower speeds to avoid consuming fuel without compromising performance. Building on our engineering capabilities, we pioneered hybrid-propulsion in commercial vehicles and are developing new alternative technologies for use in our global commercial vehicle markets; however, decreased fuel costs, alternative fuels and other technologies have resulted in deteriorating market conditions for hybrid-propulsion vehicles in recent years. For the years ended December 31, 2016, 2015 and 2014, we have invested $88.8 million, $92.5 million and $103.8 million in engineering – research and development expense, respectively.

From time to time, we acquire certain licenses to provide us with technology to complement our portfolio of products and product initiatives, such as our engineering development agreement with Torotrak plc and our development agreement with Fallbrook Technologies, Inc. For the years ended December 31, 2016, 2015 and 2014, we have invested $0.0 million, $0.2 million and $6.1 million, respectively, in engineering – research and development expense related to technology-related licenses.

We maintain test tracks on our Indianapolis, Indiana campus and at our location in Szentgotthard, Hungary for vehicle driving, testing and calibration activities in addition to being a demonstration venue for customers. We also use test track facilities in New Carlisle, Indiana and Apache Junction, Arizona.

Sales and Marketing Organization

Our sales and marketing effort is organized along geographic and customer lines and is comprised of marketing, sales and service professionals, supported by application engineers worldwide. In North America, selling efforts in the on-highway end market are organized by distributor area responsibility, OEM sales and national accounts, for our large end users. Outside North America, we manage our sales, marketing, service and application engineering professionals through regional areas of responsibility. These regional management teams distribute OEM service and application engineering resources globally. We manage our defense products sales, marketing, service and application engineering through professionals based in Indianapolis, Indiana and Detroit, Michigan.

We have developed a marketing strategy to reach OEM customers as well as end users. We target our end users primarily through marketing activities by our sales staff, who directly call on end users and attend local trade shows, targeting specific vocations globally and through our plant tour programs, where end users may test our products on the Indianapolis test track and our enhanced customer experience demonstration track at our Hungary facility.

While our marketing management uses the term “customer” interchangeably for OEMs and end users, the primary objective of our marketing strategy is to create demand for fully-automatic transmissions through:

| • | OEM promotion of our products and incorporation of fully-automatic transmissions in their commercial vehicle product offerings; |

| • | Allison representative and/or Allison distributor contact with identified, major end users; and |

| • | Our network of independent dealers who contact other end users. |

The process is interactive, as Allison representatives, Allison distributors, OEMs and dealers educate customers and respond to the specific applications, requirements and needs of numerous specialty markets.

Similarly, we work with customers, dealers and OEMs to educate, improve and simplify how they specify vehicles and vehicle systems in order to optimize vehicle performance and fuel consumption. Our field organization also works closely with distributors who, in turn, work with dealers to provide end users with education, parts, service and warranty support. The defense marketing group follows a defined plan that identifies country, vehicle and specific OEMs and then approaches the ultimate end user through a variety of channels.

11

Table of Contents

Manufacturing

Our manufacturing strategy provides for distributed capability in manufacturing and assembly of our products for the global commercial vehicle market. Our primary manufacturing facilities, located in Indianapolis, Indiana, consist of approximately 2.3 million square feet of usable manufacturing space in six plants. We also have established customization and parts distribution in the United States, The Netherlands, Brazil, China, Hungary, India and Japan, and plants in Chennai, India and Szentgotthard, Hungary. Our high volume on-highway products are produced in multiple global locations while off-highway, hybrid-propulsion and defense tracked and wheeled products are produced in Indianapolis.

Suppliers and Raw Materials

A significant amount of the part numbers that make up our transmissions are purchased from outside suppliers, and during 2016, we purchased approximately $600.0 million of direct materials and components from outside suppliers. The largest elements of our direct spending are aluminum and steel castings and forgings that are formed by our suppliers into our larger components and assemblies for use in our transmissions. However, our spending on aluminum and steel raw materials directly and indirectly through our purchase of these components constituted approximately 19% of our direct material and component costs in 2016. The balance of our direct and indirect materials and components costs are primarily composed of value-added services and conversion costs. Our supply contracts, along with an intensive supplier selection and performance monitoring process, have enabled us to establish and maintain close relationships with suppliers and have contributed to our overall operating efficiency and industry-leading quality.

Intellectual Property

Patents and other proprietary rights are important to the continued success of our business. We also rely upon trade secrets, know-how, continuing technological innovation and licensing opportunities to develop and maintain our competitive position. We protect our proprietary rights through a variety of methods, including confidentiality agreements and proprietary information agreements with suppliers, employees, consultants and others who may have access to proprietary information. We own over 300 issued patents worldwide, and we have licensing arrangements with respect to more than 600 additional patents and patent applications. We have more than 400 pending patent applications throughout the world that relate to aspects of the technology incorporated in many of our products.

In addition, in conjunction with the sale of Allison (the “Acquisition Transaction”) by Old GM, we acquired an irrevocable, royalty-free, worldwide license of more than 400 U.S. and foreign patents and patent applications, as well as certain unpatented technology and know-how, to manufacture, use and sell fully-automatic transmissions and certain hybrid-propulsion systems for use in vocational and defense vehicles and off-highway products. Such licenses are subject to certain limitations. See Part I, Item 1A, “Risk Factors” of this Annual Report on Form 10-K for a complete discussion of these risks and limitations. In addition, we acquired from Old GM an irrevocable, royalty-free, worldwide license under computer software programs that we use to run our business, including product design. Allison also acquired ownership of trademarks and copyrights relating to our business, subject in some cases to a non-exclusive license back to Old GM for use in connection with its existing six-speed A1000 transmission products, but only up to the termination of production of the A1000 transmission product by General Motors Company (“GM”), the successor to Old GM. GM has assumed Old GM’s obligations under these agreements pursuant to an agreement between us and GM in which GM assumed certain contracts and agreements between us and Old GM (the “Cure Agreement”).

Seasonality

Overall, the demand for our products is relatively consistent over the year. However, in typical market conditions, the North American truck market experiences a higher level of production in the first half of the year due to fewer holidays and the practice of plant shutdowns in July and December. Working capital levels do not fluctuate significantly in the normal course for our business.

Employees

As of December 31, 2016, we had approximately 2,600 employees, with approximately 89% of those employees in the U.S. Approximately 58% of our U.S. employees are represented by the International Union, United Automobile, Aerospace and Agricultural Implement Workers of America (“UAW”) and are subject to a collective bargaining agreement. In November 2012, we entered into a five year agreement with the UAW Local 933 that expires in November 2017. As approximately 46% of our represented employees are currently retirement eligible, we anticipate a shift toward increasing the number of second tier employees over the coming years. There have been no strikes or work stoppages due to Allison-specific issues in over 30 years.

12

Table of Contents

Environmental Compliance

We are subject to a variety of federal, state, local and foreign environmental laws and regulations, including those governing the discharge of pollutants into the air or water, the management and disposal of hazardous substances or wastes, and the cleanup of contaminated sites. Some of our operations require environmental permits and controls to prevent and reduce air and water pollution. These permits are subject to modification, renewal and revocation by issuing authorities. In addition, certain of our products and our customer’s products are subject to certification requirements by a variety of regulatory bodies. We believe we are in substantial compliance with all material environmental laws and regulations applicable to our plants and operations. Historically, our annual costs of achieving and maintaining compliance with environmental, health and safety requirements have not been material to our results.

Increasing global efforts to control emissions of carbon dioxide, methane, ozone, nitrogen oxide and other greenhouse gases and pollutants, as well as the shifting focus of regulatory efforts towards total emissions output, have the potential to impact our facilities, costs, products and customers. The U.S. Environmental Protection Agency (“EPA”) has taken action to control greenhouse gases from certain stationary and mobile sources. In addition, the U.S. Congress is considering proposals to limit greenhouse gas emissions, and several states have taken steps, such as adoption of cap and trade programs or other regulatory systems, to address greenhouse gases. There have also been international efforts seeking legally binding reductions in emissions of greenhouse gases. These developments and further actions that may be taken in the U.S. and in other countries, states or provinces could affect our operations both positively and negatively (e.g., by affecting the demand for or suitability of some of our products).

We also may be subject to liability as a potentially responsible party under the Comprehensive Environmental Response, Compensation and Liability Act and similar state or foreign laws for contaminated properties that we currently own, lease or operate or that we or our predecessors have previously owned, leased or operated, and sites to which we or our predecessors sent hazardous substances. Such liability may be joint and several so that we may be liable for more than our share of contamination, and any such liability may be determined without regard to causation or knowledge of contamination. We or our predecessors have been named potentially responsible parties at contaminated sites from time to time. We do not anticipate our liabilities relating to contaminated sites will be material to our results.

Under the asset purchase agreement with Old GM, Old GM agreed to indemnify us against certain environmental liabilities, including pre-acquisition offsite waste disposal from our facilities, former facilities associated with the business and any properties or facilities relating to the business that Old GM retained. While we are responsible for environmental liabilities that arise due to post-acquisition activities, GM, as successor to Old GM’s obligations, performed remedial activities at our Indianapolis, Indiana manufacturing facilities relating to historical soil and groundwater contamination at the facilities. GM’s activities were referred to as the “Corrective Action” plan, pursuant to the asset purchase agreement, whereby it retained responsibility for completing all obligations covered by a voluntary Corrective Action Agreement that Old GM entered with the EPA. By operation of the asset purchase agreement, once the EPA issues a final decision on GM’s activities under the Corrective Action plan, we assume all responsibility for operating, monitoring and maintaining the ongoing Corrective Action and GM’s indemnification obligations cease.

During the third quarter of 2015, the EPA determined that GM’s remedial activities were complete and that the migration of any contamination was under control, and published a public notice seeking comment on a draft final decision, the issuance of which would result in us assuming responsibility for operating, monitoring and maintaining the ongoing Corrective Action activities through an anticipated agreed order of consent (“AOC”) with the EPA. As a result of the publishing of the draft final decision, we determined that appropriate liabilities for operating, monitoring and maintaining the ongoing remedial activities could be reasonably estimated and recorded approximately $14.0 million for the estimated undiscounted liabilities to be paid out over the next 30 years. The recorded liabilities will be adjusted periodically as remediation efforts progress or as additional technical, regulatory or legal information becomes available. We have funded and expect to continue to fund the expenditures for these activities from operating cash flow.

On January 27, 2016, the EPA issued a final decision, and we assumed all responsibility for the Corrective Action. We entered into an administrative order of consent with the EPA that requires us to provide financial assurance to complete the operation, monitoring and maintenance in the event we fail to do so. On December 23, 2016, we issued a letter of credit to the EPA in the amount of $14.9 million.

Competition

We compete on the basis of product performance, quality, price, distribution capability and service in addition to other factors. We face competition from numerous manufacturers of various types of transmissions for commercial vehicles. We also face competition from manufacturers in our international operations and from international manufacturers entering our domestic market. Furthermore, we face an increasing amount of competition from vertical integration as some of our customers are OEMs that manufacture transmissions for their own products. Despite their transmission manufacturing capabilities, our existing OEM customers have chosen to purchase certain transmissions from us due to the quality, reliability and strong brand of our transmissions and in order to limit fixed costs, minimize production risks and maintain company focus on commercial vehicle design, production and marketing.

13

Table of Contents

Corporate Information

Allison Transmission Holdings, Inc. was incorporated in Delaware on June 22, 2007. Our principal executive offices are located at One Allison Way, Indianapolis, IN 46222 and our telephone number is (317) 242-5000. Our internet address is www.allisontransmission.com. We file annual, quarterly and current reports, proxy statements and other documents with the United States Securities and Exchange Commission (“SEC”), under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These periodic and current reports and all amendments to those reports are available free of charge on the investor relations page of our website at http://ir.allisontransmission.com.We have included our website address throughout this filing as textual references only. The information contained on, or accessible through, our website is not incorporated into this Annual Report on Form 10-K. The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

14

Table of Contents

| ITEM 1A. | Risk Factors |

The following is a cautionary discussion of risks, uncertainties and assumptions that we believe are significant to our business. In addition to the factors discussed elsewhere in this Annual Report on Form 10-K, the following are the important factors that, individually or in the aggregate, we believe could make our actual results differ materially from those described in any forward-looking statements.

Risks Related to Our Business

We participate in markets that are competitive, and our competitors’ actions could have a material adverse effect on our business, results of operations and financial condition.

Our business operates in competitive markets. We compete against other existing or new global manufacturers of transmissions for commercial vehicles on the basis of product performance, quality, price, distribution capability and service in addition to other factors. Actions by our competitors could lead to downward pressure on prices and/or a decline in our market share, either or both of which could adversely affect our results.

In addition, some of our customers or future customers are OEMs that manufacture or could in the future manufacture transmissions for their own products. Despite their transmission manufacturing capabilities, our existing OEM customers have chosen to purchase certain transmissions from us due to customer demand, resulting from the quality of our transmission products and in order to reduce fixed costs, eliminate production risks and maintain company focus. However, we cannot be certain these customers will continue to purchase our products in the future. Increased levels of production insourcing by these customers could result from a number of factors, such as shifts in our customers’ business strategies, acquisition by a customer of another transmission manufacturer, the inability of third-party suppliers to meet specifications and the emergence of low-cost production opportunities in foreign countries. As a result, these OEMs may use transmissions produced internally or by another manufacturer and no longer choose to purchase transmissions from us. A significant reduction in the level of external sourcing of transmission production by our OEM customers could significantly impact our net sales and cash flows and, accordingly, have a material adverse effect on our business, results of operations and financial condition.

Certain of our end users operate in highly cyclical industries, which can result in uncertainty and significantly impact the demand for our products, which could have a material adverse effect on our business, results of operations and financial condition.

Some of the markets in which we operate, including energy, mining, construction, distribution and motorhomes, exhibit a high degree of cyclicality. Decisions to purchase our transmissions are largely a result of the performance of these and other industries we serve. If demand for output in these industries decreases, the demand for our products will likely decrease. Demand in these industries is impacted by numerous factors including prices of commodities, rates of infrastructure spending, housing starts, real estate equity values, interest rates, consumer spending, fuel costs, energy demands, municipal spending and commercial construction, among others. Increases or decreases in these variables globally may significantly impact the demand for our products, which could have a material adverse effect on our business, results of operations and financial condition. If we are unable to accurately predict demand, we may be unable to meet our customers’ needs, resulting in the loss of potential sales, or we may manufacture excess products, resulting in increased inventories and overcapacity in our production facilities, increasing our unit production cost and decreasing our operating margins.

Continued volatility in and disruption to the global economic environment could adversely affect the ability of customers and suppliers to obtain credit and may have a material adverse effect on our business, results of operations and financial condition.

The commercial vehicle industry as a whole has been more adversely affected by volatile economic conditions than many other industries, as the purchase or replacement of commercial vehicles, which are durable items, can be deferred for many reasons, including reduced spending by end users. Future changes in the regulatory and business environments in which we operate may adversely affect our ability to sell our products or source materials needed to manufacture our products. Furthermore, financial instability or bankruptcy at any of our suppliers or customers could disrupt our ability to manufacture our products and impair our ability to collect receivables, any or all of which may have a material adverse effect on our business, results of operations and financial condition. In addition, some of our customers and suppliers may experience serious cash flow problems and, thus, may find it difficult to obtain financing, if financing is available at all. As a result, our customers’ need for and ability to purchase our products or services may decrease, and our suppliers may increase their prices, reduce their output or change their terms of sale. Any inability of customers to pay us for our products and services, or any demands by suppliers for different payment terms, may materially and adversely affect our results of operations and financial condition. Furthermore, our suppliers may not be successful in generating sufficient sales or securing alternate financing arrangements, and therefore may no longer be able to supply goods and services to us. In that event, we would need to find alternate sources for these goods and services, and there is no assurance we would be able to find such alternate sources on favorable terms, if at all. Any such disruption in our supply chain could adversely affect our ability to manufacture and deliver our products on a timely basis, and thereby affect our results of operations.

15

Table of Contents

Our long-term growth prospects and results of operations may be impaired if the rate of adoption of fully-automatic transmissions in commercial vehicles outside North America does not increase.

Our long-term growth strategy depends in part on an increased rate of automaticity outside North America. As part of that strategy, we have established manufacturing facilities in India and Hungary. We have also dedicated significant human resources to serve markets where we anticipate increased adoption of automaticity, including China, India, Brazil and Russia. However, manual transmissions remain the market leader outside North America and there can be no assurance that adoption of automatic transmissions will increase. Factors potentially impacting adoption of automatic transmissions outside of North America include the large existing installed base of manual transmissions, customer preferences for manual transmissions, commercial vehicle OEM vertical integration into manual transmission and AMT manufacturing, increased competition from AMTs, DCTs, electric driving systems, and other alternative transmission technologies and failure to further develop the Allison brand. If the rate of adoption of fully-automatic transmissions does not increase as we have anticipated, our long-term growth prospects and results of operations may be impaired.

Our sales are concentrated among our top five OEM customers and the loss or consolidation of any one of these customers or the discontinuation of particular vehicle models for which we are a significant supplier could reduce our net sales and have a materially adverse effect on our results of operations.

We have in the past and may in the future derive a significant portion of our net sales from a relatively limited number of OEM customers. For the years ended December 31, 2016, 2015 and 2014, our top five customers accounted for approximately 52%, 52% and 45% of our net sales, respectively. Our top three customers, Daimler, PACCAR and Navistar, accounted for approximately 21%, 9% and 9%, respectively, of our net sales during 2016. The loss of, or consolidation of any one of these customers, or a significant decrease in business from, one or more of these customers could harm our business. In addition, the discontinuation of particular vehicle models for which we are a significant supplier could reduce our net sales and have a material adverse effect on our results of operations.

Labor unrest could have a material adverse effect on our business, results of operations and financial condition.

As of December 31, 2016, approximately 58% of our U.S. employees, representing over 50% of our total employees, were represented by the UAW and are subject to a collective bargaining agreement. This agreement expires in November 2017. While we intend to negotiate in good faith with the UAW, we cannot guarantee we will be able to renew a collective bargaining agreement on similar or more favorable terms than those that presently exist. We may incur increased labor costs as a result of any of these renegotiations.

In addition to our unionized work force, many of our direct and indirect customers and vendors have unionized work forces. Strikes, work stoppages or slowdowns experienced by these customers or vendors or their other suppliers could result in slowdowns or closings of assembly plants that use our products or supply materials for use in the production of our products. Organizations responsible for shipping our products may also be impacted by strikes. Any interruption in the delivery of our products could reduce demand for our products and could have a material adverse effect on us.

In general, we consider our labor relations with all of our employees to be good. However, in the future we may be subject to labor unrest. The inability to reach a new agreement could delay or disrupt our operations in the affected regions, including the acquisition of raw materials and components, the manufacture, sales and distribution of products and the provision of services. If strikes, work stoppages or lock-outs at our facilities or at the facilities of our vendors or customers occur or continue for a long period of time, our business, results of operations and financial condition may be materially adversely affected.

16

Table of Contents

We may not be successful in introducing our new products and technologies and responding to customer needs.

We currently have new products and technologies under development. The development of new products and technologies is difficult and the timetable for commercial release is uncertain, and we may not be successful in introducing our new products and responding to customer needs. In addition, it often takes significant time, in some cases multiple fleet buy cycles, before customers gain experience with new products and technologies and those new products and technologies become widely-accepted by the market, if at all. If we do not adequately anticipate the changing needs of our customers by developing and introducing new and effective products and technologies on a timely basis, our competitive position and prospects could be harmed. If our competitors are able to respond to changing market demands and adopt new technologies more quickly than we do, demand for our products could decline, our competitive position could be harmed, and we will not be able to recoup a return on our development investments. Moreover, changing customer demands as well as evolving safety and environmental standards could require us to adapt our products and technologies to address such changes. As a result, in the future we may experience delays in the introduction of some or all of our new products or modifications or enhancements of existing products. Furthermore, there may be production delays due to unanticipated technological setbacks, which may, in turn, delay the release of new products to our end users. If we experience significant delays in production, our net sales and results of operations may be materially adversely affected.

Our success depends on continued research and development efforts, the outcome of which is uncertain.

Our success depends on our ability to improve the efficiency and performance of our transmissions, and we invest significant resources in research and development in order to do so. Nevertheless, the research and development process is time-consuming and costly, and offers uncertain results. We may not be able through our research and development efforts to keep pace with improvements in transmission-related technology of our competitors, and licenses for technologies that would enable us to keep pace with our competitors may not be available on commercially reasonable terms if at all. Finally, our research and development efforts, and generally our ability to introduce improved products in the marketplace, may be constrained by the patents and other intellectual property rights of competitors and others.

A majority of our sales to the defense end market are to U.S. government entities and contractors for the U.S. government, and the loss of a significant number of our contracts, or budgetary declines or future reductions or changes in spending by the U.S. government would have a material adverse effect on our results of operations and financial condition.

The majority of our net sales to the defense end market are derived from contracts (revenue arrangements) with agencies of, and prime system contractors for, the U.S. government. If a significant number of our DOD contracts and subcontracts are simultaneously delayed or cancelled for budgetary, performance or other reasons, it would have a material adverse effect on our results of operations and financial condition. Approximately 6%, or $115 million, of our net sales for the year ended December 31, 2016 were from our Defense end market.

Sales in our defense end market have been, and we expect will continue to be, negatively impacted by declining DOD spending on wheeled and tracked vehicles. In addition to declines in defense budgets, our future financial results may be adversely affected by:

| • | curtailment of the U.S. government’s use of technology or other services and product providers, including curtailment due to government budget reductions, future government shutdowns and related fiscal matters; |

| • | geopolitical developments that affect demand for our products and services; and |

| • | technological developments that impact purchasing decisions or our competitive position. |

17

Table of Contents

Our international operations, in particular our emerging markets, are subject to various risks which could have a material adverse effect on our business, results of operations and financial condition.

Our business is subject to certain risks associated with doing business internationally, particularly in emerging markets. Outside-North America net sales represented approximately 22% of our net sales for 2016. Most of our operations are in the U.S., but we also have manufacturing and customization facilities in India and Hungary with a services agreement with Opel Szentgotthard Automotive Manufacturing Ltd., formerly GM-PTH, and customization capability in Brazil, The Netherlands, China and Japan. Further, we intend to continue to pursue growth opportunities for our business in a variety of business environments outside the U.S., which could exacerbate the risks set forth below. Our international operations are subject to, without limitation, the following risks:

| • | the burden of complying with multiple and possibly conflicting laws and any unexpected changes in regulatory requirements; |

| • | foreign currency exchange controls, import and export restrictions and tariffs, including restrictions promulgated by the Office of Foreign Assets Control of the U.S. Department of the Treasury, and other trade protection regulations and measures; |

| • | political risks, including increased trade protectionism and risks of loss due to civil disturbances, acts of terrorism, acts of war, guerilla activities and insurrection; |

| • | unstable economic, financial and market conditions and increased expenses as a result of inflation or higher interest rates; |

| • | difficulties in enforcement of third-party contractual obligations and intellectual property rights and collecting receivables through foreign legal systems; |

| • | difficulty in staffing and managing international operations and the application of foreign labor regulations; |

| • | differing local product preferences and product requirements; |

| • | fluctuations in currency exchange rates to the extent that our assets or liabilities are denominated in a currency other than the functional currency of the country where we operate; |

| • | potentially adverse tax consequences from changes in tax laws, requirements relating to withholding taxes on remittances and other payments by subsidiaries and restrictions on our ability to repatriate dividends from our subsidiaries; and |

| • | exposure to liabilities under anti-corruption and anti-money laundering laws, including the U.S. Foreign Corrupt Practices Act (“FCPA”) and similar laws and regulations in other jurisdictions. |

Any one of these factors could materially adversely affect our sales of products or services to international customers or harm our reputation, which could have a material adverse effect on our business, results of operations and financial condition.

Our international operations require us to comply with anti-corruption laws and regulations of the U.S. government and various international jurisdictions.

Doing business on a worldwide basis requires us and our subsidiaries to comply with the laws and regulations of the U.S. government and various international jurisdictions, and our failure to comply with these rules and regulations may expose us to liabilities. These laws and regulations may apply to companies, individual directors, officers, employees and agents, and may restrict our operations, trade practices investment decisions and partnering activities. In particular, our international operations are subject to U.S. and foreign anti-corruption laws and regulations, such as the FCPA. The FCPA prohibits U.S. companies and their officers, directors, employees and agents acting on their behalf from corruptly offering, promising, authorizing or providing anything of value to foreign officials for the purposes of influencing official decisions or obtaining or retaining business or otherwise obtaining favorable treatment. The FCPA also requires companies to make and keep books, records and accounts that accurately and fairly reflect transactions and dispositions of assets and to maintain a system of adequate internal accounting controls. As part of our business, we deal with state-owned business enterprises, the employees and representatives of which may be considered foreign officials for purposes of the FCPA. In addition, some of the international locations in which we operate lack a developed legal system and have elevated levels of corruption. As a result of the above activities, we are exposed to the risk of violating anti-corruption laws. Violations of these legal requirements are punishable by criminal fines and imprisonment, civil penalties, disgorgement of profits, injunctions, debarment from government contracts as well as other remedial measures. We have established policies and procedures designed to assist us and our personnel in complying with applicable U.S. and international laws and regulations. However, our employees, subcontractors and agents could take actions that violate these requirements, which could adversely affect our reputation, business, financial condition and results of operations.

18

Table of Contents

Sales of our hybrid-propulsion systems have been, and are expected to continue to be, negatively impacted by external factors, including fuel price trends, regulatory requirements, alternative technologies and governmental entities electing not to subsidize the purchase of such products by end users.

External factors, including diesel and natural gas fuel price trends, emissions and on-board diagnostics regulatory requirements, availability of compatible engine calibrations from engine manufacturers and alternative emerging green technologies, have negatively impacted, and are expected to continue to negatively impact, sales of our hybrid-propulsion systems. In addition, the sales of our hybrid-propulsion systems for use in transit buses have been, and are expected to continue to be, negatively impacted by governmental entities electing not to subsidize the purchase of such products by end users. In 2016, we derived approximately 3% of our net sales from the sale of hybrid-propulsion systems for use in transit buses to city, state and federal governmental end users. Such end users may be eligible to receive certain subsidies as a result of their purchase of vehicles using hybrid-propulsion systems. For example, the Federal Transit Authority and the DOE may provide funds for end users to pursue alternative fuel propulsion systems. While we do not directly receive these subsidies, if any of the subsidizing entities elect to curtail such subsidies to end users for any reason including governmental budget reductions and related fiscal matters, failure of our hybrid technology to qualify for such subsidies or redundancy by alternative technologies created by our competitors, our sales from our hybrid-propulsion systems may be negatively impacted. For the years ended December 31, 2016, 2015 and 2014, we experienced decreases in revenue generated from hybrid-propulsion systems for use in transit buses of 16%, 22% and 11%, respectively.

Any events that impact our brand name, including if the products we manufacture or distribute are found to be defective, could have an adverse effect on our reputation, cause us to incur significant costs and negatively impact our business, results of operations and financial condition.

We face exposure to product liability claims in the event that the use of our products has, or is alleged to have, resulted in injury, death or other adverse effects. We currently maintain product liability insurance coverage, but we cannot be assured that we will be able to obtain such insurance on acceptable terms in the future, if at all, or that any such insurance will provide adequate coverage against potential claims. Product liability claims can be expensive to defend and can divert the attention of management and other personnel for long periods of time, regardless of the ultimate outcome. An unsuccessful product liability defense could have a material adverse effect on our business, results of operation, financial condition or prospects. If one of our products is determined to be defective, we may face substantial warranty costs and may be responsible for significant costs associated with a product recall or a redesign. We have had defect and warranty issues associated with certain of our products in the past, and we cannot give assurance similar product defects will not occur in the future. See NOTE 9 “Product Warranty Liabilities” of Notes to Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K for additional details regarding these warranty issues.

Furthermore, our business depends on the strong brand reputation we have developed. In addition to the risk of defective products, we also face significant risks in our efforts to penetrate new markets, where we have limited brand recognition. We also rely on our reputation with end users of our transmissions to specify our transmissions when purchasing new vehicles from our OEM customers. In the event we are not able to maintain or enhance our brand in these new markets or our reputation is damaged in our existing markets as a result of product defects or recalls, we may face difficulty in maintaining our pricing positions with respect to some of our products or experience reduced demand for our products, which could negatively impact our business, results of operations and financial condition.

Our brand and reputation are dependent on the continued participation and level of service of our numerous independent distributors and dealers.

We work with a network of approximately 1,400 independent distributors and dealers that provide post-sale service and parts and support equipment. Because we depend on the pull-through demand generated by end users for our products, any actions by the independent distributors or dealers, which are not in our control, may harm our reputation and damage the brand loyalty among our customer base. In the event that we are not able to maintain our brand reputation because of the actions of our independent distributors and dealers, we may face difficulty in maintaining our pricing positions with respect to some of our products or have reduced demand for our products, which could negatively impact our business, results of operations and financial condition. In addition, if a significant number of independent dealers were to terminate their contracts, it could adversely impact our business, results of operations and financial condition.

19

Table of Contents

In the event of a catastrophic loss of our key manufacturing facility, our business would be adversely affected.

While we manufacture our products in several facilities and maintain insurance covering our facilities, including business interruption insurance, a catastrophic loss of the use of all or a portion of one of our manufacturing facilities due to accident, labor issues, weather conditions, acts of war, political unrest, terrorist activity, natural disaster or otherwise, whether short- or long-term, would have a material adverse effect on our business, results of operations and financial condition. Our most significant concentration of manufacturing is around our corporate headquarters in Indianapolis, Indiana where we produce approximately 90% of our transmissions. In addition to our Indianapolis manufacturing facilities, we currently operate manufacturing facilities in both Szentgotthard, Hungary and Chennai, India. In the event of a disruption at the Indianapolis facilities, our other facilities may not be adequately equipped to operate at a level sufficient to compensate for the volume of production at the Indianapolis facility due to their size and the fact that they have not yet been tested for such significant increases in production volume.

Increases in cost, disruption of supply or shortage of raw materials or components used in our products could harm our business and profitability.

Our products contain various raw materials, including corrosion-resistant steel, non-ferrous metals such as aluminum and nickel, and precious metals such as platinum and palladium. We use raw materials directly in manufacturing and in transmission components that we purchase from our suppliers. We generally purchase components with significant raw material content on the open market. The prices for these raw materials fluctuate depending on market conditions. Volatility in the prices of raw materials such as steel, aluminum and nickel could increase the cost of manufacturing our products. We may not be able to pass on these costs to our customers, and this could have a material adverse effect on our business, results of operations and financial condition. Even in the event that increased costs can be passed through to customers, our gross margin percentages would decline. Additionally, our suppliers are also subject to fluctuations in the prices of raw materials and may attempt to pass all or a portion of such increases on to us. In the event they are successful in doing so, our margins would decline.

In 2016, approximately 75% of our total spending on components was sourced from approximately 36 suppliers, some of which are the single source for such components. All of the suppliers from which we purchase materials and components used in our business are fully validated suppliers, meaning the suppliers’ manufacturing processes and inputs have been validated under a production part approval process (“PPAP”). Furthermore, there are only a limited number of suppliers for certain of the materials used in our business, such as corrosion-resistant steel. As a result, our business is subject to the risk of additional price fluctuations and periodic delays in the delivery of our materials or components if supplies from a validated supplier are interrupted and a new supplier, if one is available, must be validated or materials and components must be purchased from a supplier without a completed PPAP. Any such price fluctuations or delays, if significant, could harm our profitability or operations. In addition, the loss of a supplier could result in significant material cost increases or reduce our production capacity. We also cannot guarantee we will be able to maintain favorable arrangements and relationships with these suppliers. An increase in the cost or a sustained interruption in the supply or shortage of some of these raw materials or components that may be caused by a deterioration of our relationships with suppliers or by events such as natural disasters, power outages, labor strikes, or the like could negatively impact our business, results of operations and financial condition. Although we have agreements with many of our customers that we will pass such price increases through to them, such contracts may be cancelled by our customers and/or we may not be able to recoup the costs of such price increases. Additionally, if we are unable to continue to purchase our required quantities of raw materials on commercially reasonable terms, or at all, if we are unable to maintain or enter into purchasing contracts for commodities, or if delivery of materials from suppliers is delayed or non-conforming, our operations could be disrupted or our profitability could be adversely impacted.

We could be materially adversely affected by any failure to maintain cost controls.

We rely on our cost structure and operating discipline to achieve strong operating margins. There are many factors that could affect our ability to realize expected cost savings or achieve future cost savings that we are not able to control, including the need for unexpected significant capital expenditures; unexpected changes in commodity or component pricing, including an increase in export or import tariffs, that we are unable to pass on to our suppliers or customers; our inability to maintain efficiencies gained from our workforce optimization initiatives; and our failure to achieve and maintain expected cost savings from our multi-tier wage and benefit structure. Additionally, we have substantial indebtedness of approximately $2,187.6 million as of December 31, 2016. Our inability to maintain our cost controls could adversely impact our operating margins.

20

Table of Contents