DocumentExhibit 10.1

Execution Version

| | |

PURCHASE AND SALE AGREEMENT

AND ESCROW INSTRUCTIONS BY AND BETWEEN KBSII 445 SOUTH FIGUEROA, LLC, a Delaware limited liability company

(“Seller”) AND WB UNION PLAZA HOLDINGS LLC , a Delaware limited liability company

(“Buyer”) |

[Union Bank, 445 South Figueroa Street, Los Angeles, CA]

PURCHASE AND SALE AGREEMENT

AND ESCROW INSTRUCTIONS

THIS PURCHASE AND SALE AGREEMENT AND ESCROW INSTRUCTIONS (this “Agreement”) is made and entered into as of July 20, 2022, between KBSII 445 SOUTH FIGUEROA, LLC, a Delaware limited liability company (“Seller”), and WB UNION PLAZA HOLDINGS LLC, a Delaware limited liability company (“Buyer”), with reference to the following:

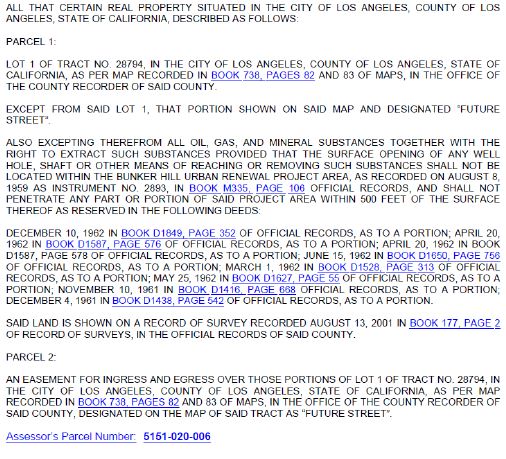

A. Seller is the owner of the improved real property (the “Real Property”) described on Exhibit A attached hereto together with certain personal property located upon or used in connection with such improved real property and certain other assets relating thereto, all as more particularly described in Section 2 hereof.

B. Seller desires to sell to Buyer, and Buyer desires to purchase from Seller, the Real Property, together with certain personal property and related assets on the terms and subject to the conditions contained in this Agreement.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1.BASIC TERMS AND DEFINITIONS; REFERENCES

1.1 Basic Terms and Definitions.

(a)Effective Date. The effective date of this Agreement shall be the date set forth above (“Effective Date”).

(b)Closing Date. The last day that Close of Escrow (as defined in Section 8.1 hereof) may occur shall be October 19, 2022, at 1:00 p.m. (California time) (the “Closing Date”); provided, however, Seller or Buyer shall have the right to extend the Closing Date as provided in Section 7.2(e) below.

(c)Intentionally Omitted.

(d)Intentionally Omitted.

(e)Escrow Holder. The escrow holder shall be Commonwealth Land Title Insurance Company (“Escrow Holder”), whose address is 4100 Newport Place Drive, Suite 120, Newport Beach, California 92660, Escrow Officer: Karen Price; Telephone: (949) 724-3144; Telecopier: (949) 271-5762.

(f)Title Company. The title company shall be Commonwealth Land Title Insurance Company (“Title Company”), whose address is 888 S. Figueroa Street, Suite 2100, Los Angeles, California 90017, Title Coordinator: Amy Musselman; Telephone: (213) 330-3041; Telecopier (213) 330-3085, with a copy to Anthony A. Behrstock; Telephone: (213) 330-2333; Telecopier: (213) 330-3113. Notwithstanding anything herein to the contrary, Seller acknowledges and agrees that Buyer shall have the right to procure “co-insurance” with respect to

the Title Policy to be issued at Closing, such that the Title Company shall insure 50% of the Purchase Price and Riverside Abstract, as agent for Chicago Title Insurance Company (“Co-Insurer”) shall insure 50% of the Purchase Price, and Seller shall deliver to Co-Insurer all documents that Seller has agreed to deliver to the Title Company under the Agreement in order to issue the Title Policy; provided, however, the right to procure such “co-insurance” is subject to the obtainment of such “co-insurance” satisfying the following conditions: (i) no delay in the Closing Date; (ii) no increase in the amount payable by Seller under this Agreement for the Title Policy; and (iii) no requirement that Seller provide any documents that Seller is not obligated to provide under the Agreement.

1.2 References. All references to Exhibits refer to Exhibits attached to this Agreement and all such Exhibits are incorporated herein by reference. The words “herein,” “hereof,” “hereinafter” and words of similar import refer to this Agreement as a whole and not to any particular Section hereof.

2.PURCHASE AND SALE

Subject to the terms and conditions of this Agreement, Seller agrees to sell, assign and transfer to Buyer and Buyer agrees to purchase from Seller, for the purchase price set forth in Section 3 hereof, all of Seller’s right, title and interest in and to the following (collectively, the “Property”):

2.1 The Real Property, together with the buildings located thereon, and all associated parking areas, and all other improvements located thereon (the buildings and such other improvements are referred to herein collectively as the (“Improvements”)); all references hereinafter made to the Real Property shall be deemed to include all rights, privileges, easements and appurtenances benefiting the Real Property and/or the Improvements situated thereon, including, without limitation, all mineral and water rights and all easements, rights-of-way and other appurtenances used or connected with the beneficial use or enjoyment of the Real Property;

2.2 All personal property, equipment, supplies and fixtures (collectively, the “Personal Property”) listed on Exhibit B attached hereto or otherwise left on the Real Property at the Close of Escrow to the extent owned by Seller;

2.3 All of Seller’s interest in any intangible property (expressly excluding the name “KBS” or any derivative thereof, or any name that includes the word “KBS” or any derivative thereof) used or useful in connection with the foregoing, including, without limitation, all contract rights, warranties, guaranties, licenses, permits, entitlements, governmental approvals and certificates of occupancy which benefit the Real Property and/or the Personal Property;

2.4 All of Seller’s interest in all leases affecting the Real Property as of the Close of Escrow (the “Leases”); and

2.5 All of Seller’s interest in the contracts listed on Exhibit C-1 attached hereto and all contracts hereafter entered into by Seller to the extent permitted by the provisions of this Agreement (the “Contracts”), and the contracts described on Schedule 3 subject to the terms of Section 4.5 herein.

Notwithstanding anything to the contrary contained herein, the term “Property” shall expressly exclude any Rents (as such term is defined in Section 10.1 hereof) or any other amounts payable by tenants under the Leases for periods prior to the Close of Escrow, any Rent or other amounts payable by any former tenants of the Property, and any judgments, stipulations, orders, or settlements with any tenants under the Leases or former tenants of the Property (hereinafter collectively referred to as the “Excluded Property”).

3.PURCHASE PRICE AND DEPOSIT

3.1 Purchase Price. The purchase price for the Property shall be One Hundred Fifty-Five Million and No/100 Dollars ($155,000,000.00) (the “Purchase Price”).

3.2 Payment of Purchase Price. The Purchase Price shall be payable as follows:

3.2.1 Concurrently with the execution of this Agreement by Buyer and Seller, and as a condition precedent to the effectiveness hereof, Buyer shall deposit in escrow with Escrow Holder, in cash or current funds, the sum of Seven Million Five Hundred Thousand and No/100 Dollars ($7,500,000.00) (the “Deposit”). Immediately upon Escrow Holder’s receipt of the Deposit (the “Opening of Escrow”), Escrow Holder shall invest the same in a federally insured interest-bearing account acceptable to Seller and Buyer, with all interest accruing thereon credited to the Purchase Price. For purposes of this Agreement, any interest accruing on the Deposit from time to time shall be deemed part of the Deposit. Once made, the Deposit shall be nonrefundable subject to the terms and conditions of this Agreement.

3.2.2 Provided all the conditions in Section 7.1 hereof have been satisfied or waived by Buyer, Buyer shall deposit in cash or current funds with Escrow Holder no later than 1:00 p.m. (California time) on the Closing Date (as defined in Section 1.1(b) hereof) an amount equal to the Purchase Price less the Deposit and all interest accrued thereon plus or minus applicable prorations pursuant to Section 10 hereof.

3.3 Disposition of Deposit Upon Failure to Close. If the Close of Escrow fails to occur due to Buyer’s default under this Agreement (after all of the conditions to Buyer’s obligation to close having been satisfied or waived), then the disposition of the Deposit and all interest accrued thereon shall be governed by Section 13.1 hereof; if the Close of Escrow fails to occur due to Seller’s default under this Agreement (after all of the conditions to Seller’s obligation to close having been satisfied or waived), then the Deposit and all interest accrued thereon shall promptly be refunded to Buyer, subject to Buyer’s election to bring suit for specific performance under Section 13.2 hereunder; and if the Close of Escrow fails to occur due to the failure of any of the conditions set forth in Sections 7.1 or 7.2 hereof other than as a result of Buyer’s or Seller’s default under this Agreement, then the disposition of the Deposit and all interest accrued thereon shall be governed by Section 9.3 hereof.

3.4 Independent Contract Consideration. Additionally, at the same time as the deposit of the Deposit with the Escrow Holder, Buyer shall deliver to Seller in cash the sum of One Hundred and No/100 Dollars ($100.00) (the “Independent Contract Consideration”) which amount has been bargained for and agreed to as consideration for Buyer’s exclusive option to purchase the Real Property and the right to inspect the Real Property as provided herein, and for

Seller’s execution and delivery of this Agreement. The Independent Contract Consideration is in addition to and independent of all other consideration provided in this Agreement, and is nonrefundable in all events.

4.PROPERTY INFORMATION; TENANT ESTOPPEL CERTIFICATES; CONFIDENTIALITY

4.1 Property Information. To the extent not previously made available by Seller prior to the Effective Date, Seller shall make available to Buyer within five (5) business days after the date of this Agreement, to the extent in Seller’s possession, the following, all of which shall be made available for review and copying (at Buyer’s cost and expense) at the offices of KBS Capital Advisors LLC (at the address set forth in Section 15.1 hereof) or at the Real Property (collectively, the “Property Information”):

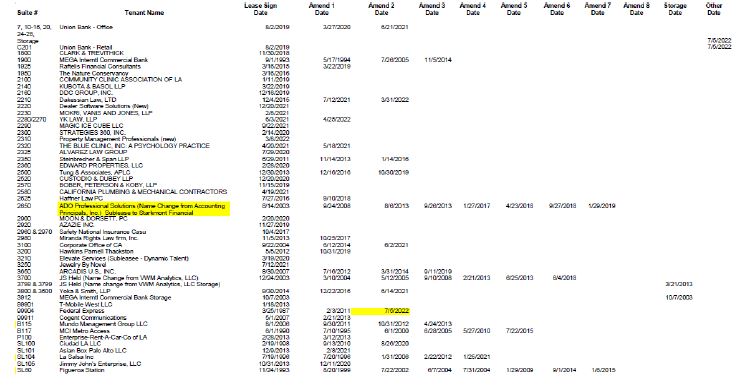

(a)the Leases;

(b)a current rent roll for the Real Property, indicating rents collected, scheduled rents and concessions, delinquencies, and security deposits held (collectively, the “Rent Rolls”);

(c)the most current operating statements for the Real Property, if available (collectively, the “Operating Statements”);

(d)copies of the Contracts;

(e)that certain existing land title survey for the Real Property prepared by Bock & Clark Corporation, Network Project No. 202105932-001 BJK, last revised October 13, 2021 (the “Existing Survey”); and

(f)any environmental, soils and/or engineering reports prepared for Seller or Seller’s predecessors.

Under no circumstances shall Buyer be entitled to review any appraisals relating to the Property or any internal financial audits relating to the Property.

4.2 Title and Survey Review; Title Policy.

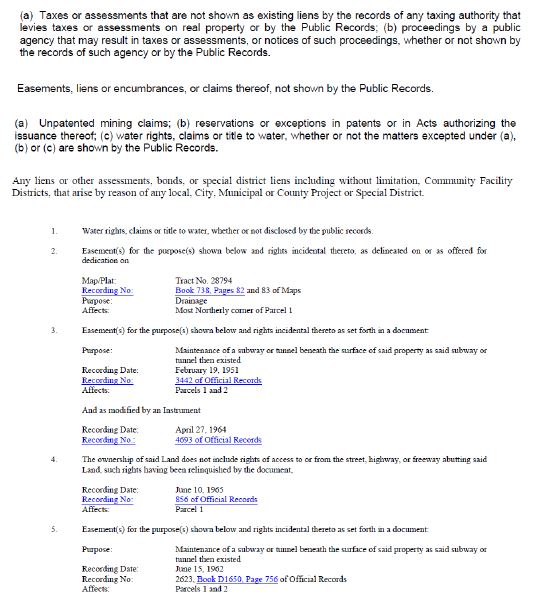

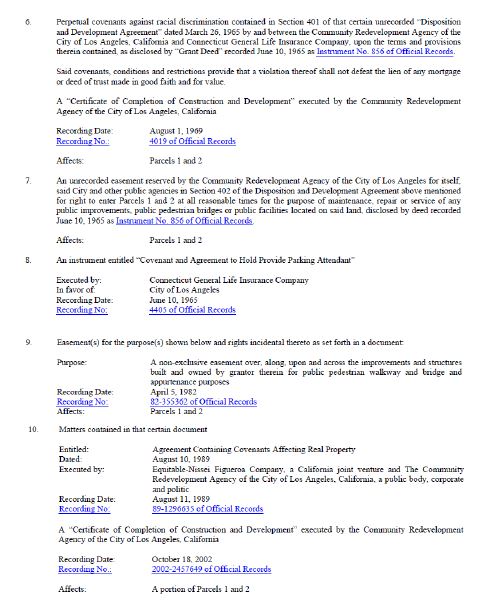

4.2.1 Delivery of Title Report. Buyer acknowledges that the Title Company has delivered to Buyer a preliminary title report or title commitment covering the Real Property (the “Title Report”), together with copies of all documents (collectively, the “Title Documents”) referenced in the Title Report. Buyer, at its option and expense, may (a) obtain a new survey for the Real Property or (b) cause the Existing Survey to be updated or recertified. Buyer understands and acknowledges that if Buyer elects to obtain a new survey or an updated or recertified survey for the Real Property the completion and/or delivery of the surveys or updated or recertified surveys shall not be a condition precedent to the Close of Escrow. Notwithstanding the foregoing, Buyer further acknowledges that Seller makes no representations or warranties, and Seller shall have no responsibility, with respect to the completeness of the Title Documents made available to Buyer by the Title Company.

4.2.2 Intentionally Omitted.

4.2.3 Delivery of Title Policy at Closing. As a condition precedent to the Close of Escrow, the Title Company shall have issued and delivered to Buyer, or shall have irrevocably committed to issue and deliver to Buyer, with respect to the Real Property, a Standard Coverage Owner’s Policy of Title Insurance (2006 Form) (the “Title Policy”) issued by the Title Company as of the date and time of the recording of the Deed (as such term is defined in Section 6.1 hereof) for the Real Property, in the amount of the Purchase Price insuring Buyer as owner of good, marketable and indefeasible fee simple title to the Real Property, subject only to the Permitted Exceptions. Buyer shall have the right to require the Title Policy be issued with ALTA extended coverage, provided that (i) Buyer shall pay all additional premiums and costs associated with extended coverage, (ii) Buyer shall be solely responsible to have prepared and delivered to the Title Company an ALTA survey of the Property acceptable to the Title Company, at Buyer’s expense, it being acknowledged that Buyer may elect to update Seller’s Existing Survey of the Property (the “Survey Update”), and (iii) Seller shall not be required to provide any additional documents in connection with such extended coverage other than the Owner’s Affidavit (as such term is defined in Section 6.1(f) below). For purposes of this Agreement, “Permitted Exceptions” shall mean and include (a) any lien to secure payment of real estate taxes, including special assessments, not delinquent, (b) the lien of supplemental taxes assessed pursuant to Chapter 3.5 commencing with Section 75 of the California Revenue and Taxation Code as a result of the transfer of title to the vestee named in Schedule A or as a result of changes in ownership or new construction occurring on or after the date of policy, (c) (i) all matters which could be revealed or disclosed by Seller’s Existing Survey other than matters first appearing on Buyer’s Survey Update to the extent such matters were created by or with the express written consent of Seller, and (ii) matters affecting the Real Property which are created by or with the written consent of Buyer or which do not materially and deleteriously affect Buyer’s contemplated use of the Real Property, (d) the rights of the tenants under the Leases affecting the Real Property, (e) the exceptions included on Exhibit I, (f) any exception for liens (and/or potential liens) for services, labor or materials heretofore or hereafter furnished to the Property for which Buyer is entitled to a credit at Closing pursuant to this Agreement, for which Buyer is expressly responsible for payment under the terms of this Agreement, and/or which arises from any services, labor or materials contracted for by any tenant at the Property and with respect to which any such tenant is responsible for payment under the terms of its Lease, (g) all applicable laws, ordinances, rules and governmental regulations (including, without limitation, those relating to building, zoning and land use) affecting the development, use, occupancy or enjoyment of the Real Property, and (h) the terms and provisions of that certain easement agreement for chilled water services, a copy of which has been provided to Buyer.

4.3 Inspections.

4.3.1 Inspections in General. Commencing from the Effective Date and continuing until the Closing Date, Buyer, its agents, employees and prospective and actual lenders and partners shall have a limited license (the “License”) to enter upon the Real Property for the purpose of making non-invasive inspections at Buyer’s sole risk, cost and expense. Before any such entry, Buyer shall provide Seller with a certificate of insurance naming Seller as an additional insured and with an insurer and insurance limits and coverage reasonably satisfactory to Seller. In addition, Buyer, its agents, contractors, or subcontractors shall maintain, and shall have provided

evidence reasonably satisfactory to Seller of Workers Compensation Insurance (including a Waiver of Subrogation endorsement in favor of Seller) with coverage amounts required by the applicable statutes of either the state where (a) such entry occurs, or (b) employees of the Buyer, its agents, contractors, or subcontractors, as applicable, are domiciled. All of such entries upon the Real Property shall be at reasonable times during normal business hours and after at least forty-eight (48) hours prior notice (which notice may be given solely by email with a follow-up telephone call to Tim Helgeson at (949) 797-0356) to Seller or Seller’s agent, and Seller or Seller’s agent shall have the right to accompany Buyer during any activities performed by Buyer on the Real Property. Notwithstanding anything stated to the contrary herein, Buyer shall have no right to inspect any of the occupied space in the Real Property (but Buyer may enter same if open to the public), and Buyer shall not contact or speak to any of the tenants under the Leases, unless Buyer provides Seller with no less than forty-eight (48) hours prior written notice (which notice may be given solely by email with a follow-up telephone call to Tim Helgeson at (949) 797-0356) of such intention and Seller or Seller’s representative is present during such inspections and/or discussions with tenants; any discussions with tenants shall immediately cease at the tenant’s request and any discussions with tenants must be limited to their existing tenancy and premises and may not involve any lease renegotiations. Seller agrees to make itself or its representatives reasonably available to be present during Buyer’s inspections and/or discussions with tenants. Inspections by Buyer shall not interfere with the rights of tenants. At Seller’s request, Buyer shall provide Seller (at no cost to Seller) with a copy of the results of any tests and inspections made by Buyer, excluding only market and economic feasibility studies. All inspections shall be made in accordance with all applicable laws (including, without limitation, any federal, state, and local law and guidance issued by the Centers for Disease and Control and Prevention, the State of California, and local health authorities for the limitation of the spread of any infectious diseases (including, without limitation, COVID-19)), as well as any infectious disease related (including, without limitation, COVID-19) property access procedures that may reasonably be adopted by the tenants or Seller. If any inspection or test disturbs the Real Property, Buyer will restore the Real Property to the same condition as existed before the inspection or test. Buyer shall defend, indemnify Seller and hold Seller, Seller’s trustees, officers, tenants, agents, contractors and employees and the Real Property harmless from and against any and all losses, costs, damages, claims, or liabilities, including but not limited to, mechanics’ and materialmens’ liens, any claims and liabilities relating to the handling of hazardous materials by Buyer, its employees, agents, contractors or representatives, any claims and liabilities arising from a purported infection from an infectious disease, including, without limitation, COVID-19, or other loss or liabilities relating to an infectious disease, including, without limitation, COVID-19, and Seller’s attorneys’ fees, arising out of or in connection with Buyer’s, or its agents’, contractors’, employees’, or invitees’ entry upon or inspection of the Real Property. The License may be revoked by Seller upon termination of this Agreement. Buyer hereby accepts the risk that it or its employees, agents or contractors may contract COVID-19 and/or other infectious disease as a result of coming onto the Property and/or entering the building located at the Property. In addition, Buyer shall cause all its employees, agents or contractors to execute and deliver to Seller prior to coming onto the Property such waivers and release of claims as Seller shall reasonably require with respect to the contracting of COVID-19 and/or other infectious diseases while present at the Property; provided, however, that in no event does Buyer provide any representation, warranty or other assurance that any such waiver and/or release is or will be enforceable. The provisions of this Section 4.3.1 shall survive the Close of Escrow or the earlier termination of this Agreement.

4.3.2 Environmental Inspections. The inspections under Section 4.3.1 may include non-invasive Phase I environmental inspections of the Real Property, but no Phase II environmental inspections or other invasive inspections or sampling of soil or materials, including without limitation construction materials, either as part of the Phase I inspections or any other inspections, shall be performed without the prior written consent of Seller, which may be withheld in its sole and absolute discretion, and if consented to by Seller, the proposed scope of work and the party who will perform the work shall be subject to Seller’s review and approval. At Seller’s request, Buyer shall deliver to Seller (at no cost to Seller) copies of any Phase II or other environmental reports to which Seller consents as provided above.

4.4 Tenant Estoppel Certificates. Seller shall endeavor to secure and deliver to Buyer by the Closing Date estoppel certificates (dated no more than 75 days before the Close of Escrow) for all Leases consistent with the information in the Rent Rolls and substantially in the form attached hereto as Exhibit D or such form as may be required under the applicable Leases. Buyer may terminate this Agreement upon two (2) business days written notice (which notice shall be given in accordance with the provisions of Section 15.1) to Seller if, no less than three (3) business days prior to the Closing Date, Seller fails to deliver to Buyer estoppel certificates (dated no more than 75 days before the Close of Escrow) substantially in the form attached hereto as Exhibit D or such form as may be required under any particular Lease (“Tenant Estoppel Certificates”), consistent, in all material respects, with Seller’s representations hereunder and with the Rent Rolls, executed by tenants (and specifically including the tenant Union Bank, N.A. under its office lease (as opposed to its retail lease)) under Leases covering at least seventy-five percent (75%) of the leased rental floor area of the Real Property and meeting the foregoing requirements. Seller will provide Buyer with the executed Tenant Estoppel Certificates promptly upon receipt thereof by Seller. Buyer shall be deemed to have approved an executed Tenant Estoppel Certificate unless it notifies Seller (which notice shall be given in accordance with the provisions of Section 15.1) in writing of its disapproval of the same within three (3) business days following its receipt of the same. At Buyer’s request, Seller hereby agrees to endeavor to obtain updated Tenant Estoppel Certificates; provided, however, notwithstanding the foregoing, under no circumstances shall Buyer’s receipt of such updated Tenant Estoppel Certificates be a condition precedent to Buyer’s obligations to consummate the transaction contemplated under this Agreement. Notwithstanding anything stated to the contrary, the requirement that Tenant Estoppel Certificates be dated no more than 75 days before the Close of Escrow as provided above shall be void and of no force and effect if the Closing Date is extended pursuant to the provisions of Sections 5.4, 7.2(e) or 15.21(c) of this Agreement, and such extension results in a Tenant Estoppel Certificate being dated more than 75 days prior to the Close of Escrow.

4.5 Contracts. Buyer shall assume the obligations arising from and after the Closing Date under the Contracts; provided, however, notwithstanding anything stated to the contrary herein, Buyer shall not be obligated to assume any of Seller’s obligations under, and Seller shall terminate at Close of Escrow, the “PMA” and leasing agreement listed in Exhibit C-1 attached hereto and made a part hereof, except that, notwithstanding Seller’s termination of the PMA and leasing agreement listed in Exhibit C-1 attached hereto, and in consideration of Seller’s terminating the same, Buyer shall be responsible for, and Buyer shall assume pursuant to the terms and provisions of the Assignment of Leases and Contracts and Bill of Sale, as hereinafter defined, all leasing commissions payable (notwithstanding the termination of the PMA and the leasing

agreement) under Article IX of the leasing agreement listed in Exhibit C-1 attached hereto after the Close of Escrow arising out of the lease of space in the Property after the Close of Escrow.

In addition, to the extent the current ongoing work described on Schedule 3 attached hereto is not completed or paid for prior to the Closing Date, Buyer shall assume in writing (pursuant to the Assignment of Leases and Contracts and Bill of Sale) Seller’s obligations (whether arising before or after the Closing Date) under the construction contracts for such work and shall be entitled to a credit towards the Purchase Price equal to the remaining balance under such construction contracts (and Seller hereby agrees to provide evidence reasonably satisfactory to Buyer of the remaining balance under such construction contracts), but only to the extent (a) the same remains unpaid as of the Close of Escrow, and (b) Buyer has not otherwise received a credit towards the Purchase Price for such unpaid work under such construction contracts in the form of outstanding tenant improvement allowances for such tenants as reflected on Schedule 1-2 and pursuant to Section 5.3 hereof. With respect to any such contracts being assumed by Buyer under this Section 4.5, Seller hereby agrees to endeavor to obtain certificates executed by each of the contractors under such construction contracts prior to Closing in the form of that attached hereto as Exhibit J; provided, however, notwithstanding the foregoing, under no circumstances shall Buyer’s receipt of executed certificates under this Section 4.5 be a condition precedent to Buyer’s obligations to consummate the transaction contemplated under this Agreement. Notwithstanding anything to the contrary contained herein, without Buyer’s prior written consent, not to be unreasonably withheld, Seller shall not enter into (a) with respect to any construction contract, any amendments or change orders thereto exceeding the greater of $25,000 or 10% of the contract sum of such construction contract, or (b) new construction contracts. Without altering the provisions herein regarding Seller’s execution of new contracts or amendments of existing contracts affecting the Property (including, without limitation, construction contracts), Seller shall deliver to Buyer a copy of any new contract or contract modification affecting the Property promptly after Seller’s execution thereof.

4.6 Confidentiality. Prior to the Close of Escrow or in the event the Close of Escrow never occurs, the Property Information and all other information, other than matters of public record or matters generally known to the public, furnished to, or obtained through inspection of the Real Property by, Buyer, its affiliates, prospective and actual lenders, prospective and actual assignees, employees, attorneys, accountants and other professionals or agents relating to the Real Property, will be treated by Buyer, its affiliates, prospective and actual lenders, prospective and actual assignees, employees and agents as confidential, and will not be disclosed to anyone (except as reasonably required in connection with Buyer’s, such lenders or assignees’ evaluation of the Real Property) except to Buyer’s consultants who agree to maintain the confidentiality of such information, and will be returned to Seller by Buyer if the Close of Escrow does not occur.

The terms of this Agreement will not be disclosed to anyone prior to or after the Close of Escrow except to Buyer’s and Seller’s consultants and the other parties listed in the first paragraph hereof who agree to maintain the confidentiality of such information and Seller and Buyer agree not to make any public announcements or public disclosures or communicate with any media with respect to the subject matter hereof without the prior written consent of the other party (in their sole and absolute discretion). The confidentiality provisions of this Section 4.6 shall not apply to any disclosures made by Buyer or Seller as required by law, by court order, or in connection with

any subpoena served upon Buyer or Seller; provided Buyer and Seller shall provide each other with written notice before making any such disclosure. Notwithstanding the foregoing and anything to the contrary in this Agreement, nothing contained herein shall impair Seller’s (or any Seller affiliate’s) right to disclose information relating to this Agreement or the Property (a) to any due diligence representatives and/or consultants that are engaged by, work for or are acting on behalf of, any securities dealers and/or broker dealers evaluating Seller or its affiliates, (b) in connection with any filings (including any amendment or supplement to any S-11 filing) with governmental agencies (including the United States Securities and Exchange Commission) by any REIT holding an interest (direct or indirect) in Seller, and (c) to any broker/dealers in the Seller’s or any REIT’s broker/dealer network and any of the REIT’s or Seller’s investors.

5.OPERATIONS AND RISK OF LOSS

5.1 Ongoing Operations. During the pendency of this Agreement, but subject to the limitations set forth below, Seller shall carry on its businesses and activities relating to the Real Property substantially in the same manner as it did before the date of this Agreement. The new and pending lease transactions (the “New and Pending Lease Transactions”) reflected on Schedule 1-1 and Schedule 1-2 attached hereto shall be deemed approved by Buyer for purposes of this Agreement.

5.2 New Contracts. During the pendency of this Agreement, Seller will not enter into any contract that will be an obligation affecting the Real Property subsequent to the Close of Escrow (except contracts entered into in the ordinary course of business that are terminable without cause on 30-days’ notice), without the prior consent of the Buyer, which shall not be unreasonably withheld or delayed.

5.3 Leasing Arrangements. During the pendency of this Agreement, except for the New and Pending Lease Transactions, Seller shall obtain Buyer’s consent, which Buyer approves or disapproves in its discretion before entering into any new lease of space in the Real Property and before entering into a Lease amendment, expansion, or renewal. Buyer shall be deemed to have consented to any new lease or any Lease amendment, expansion, or renewal if it has not notified Seller (which notice shall be given in accordance with the provisions of Section 15.1) specifying with particularity the matters to which Buyer reasonably objects, within seven (7) days after its receipt of Seller’s written request for consent, together with a copy of the Lease amendment, expansion, or renewal or the new lease. At the Close of Escrow, (a) Buyer shall reimburse Seller for commissions, legal fees, the cost of tenant improvements, and all other leasing costs and expenses paid by Seller with respect to all New and Pending Lease Transactions entered into and listed on Schedule 1-1 attached hereto and with respect to all other Lease amendments, expansions or renewals or new leases that were entered into pursuant to this Section 5.3 between the Effective Date and the Close of Escrow in amounts approved by Buyer, (b) Buyer shall be entitled to a credit towards the Purchase Price equal to the leasing commissions, tenant improvement allowances and free rent credits referred to in Schedule 1-2 attached hereto to the extent such transaction has been entered into and the amounts set forth on Schedule 1-2 attached hereto remain unpaid and due and owing as of the Close of Escrow, and (c) Buyer shall assume in writing (pursuant to the Assignment of Leases and Contracts and Bill of Sale) Seller’s obligations (whether arising before or after the Closing Date) under the Leases referred to in Schedule 1-1 and Schedule 1-2 attached hereto (to the extent they have been entered into), and all new leases and

Lease amendments, expansions or renewals entered into in accordance with the terms of this Agreement.

5.4 Damage or Condemnation. Risk of loss resulting from any condemnation or eminent domain proceeding which is commenced or has been threatened against the Real Property before the Close of Escrow, and risk of loss to the Real Property due to fire, flood or any other cause before the Close of Escrow, shall remain with Seller. If before the Close of Escrow the Real Property or any portion thereof shall be materially damaged, or if the Real Property or any material portion thereof shall be subjected to a bona fide threat of condemnation or shall become the subject of any proceedings, judicial, administrative or otherwise, with respect to the taking by eminent domain or condemnation, then Buyer may elect not to acquire the Real Property by delivering written notice of such election to Seller within five (5) business days after Buyer learns of the damage or taking, in which event Buyer shall no longer be obligated to purchase, and Seller shall no longer be obligated to sell, the Real Property. If the Closing Date is within the aforesaid 5-business day period, then the Close of Escrow shall be extended to the next business day following the end of said 5-business day period. If no such election is made, and in any event if the damage is not material, this Agreement shall remain in full force and effect, the purchase contemplated herein, less any interest taken by eminent domain or condemnation, shall be effected with no further adjustment, and upon the Close of Escrow, Seller shall assign, transfer and set over to Buyer all of the right, title and interest of Seller in and to any awards that have been or that may thereafter be made for such taking, and Seller shall assign, transfer and set over to Buyer any insurance proceeds that may thereafter be made for such damage or destruction giving Buyer a credit at the Close of Escrow for any deductible under such policies. For purposes of this Section 5.4, the phrase(s) (i) “Material damage” or “Materially damaged” means damage reasonably exceeding five percent (5%) of the Purchase Price of the Real Property, and (ii) “material portion” means any portion of the Real Property that has a “fair market value” exceeding five percent (5%) of the Purchase Price of the Real Property.

6.SELLER’S AND BUYER’S DELIVERIES

6.1 Seller’s Deliveries into Escrow. No less than one (1) business day prior to the Closing Date (unless a different day is specified below), Seller shall deliver into Escrow (as such term is defined in Section 9 hereof) to the Escrow Holder the following:

(a)Deed. A deed (the “Deed”) in the form attached hereto as Exhibit E, executed and acknowledged by Seller, conveying to Buyer Seller’s title to the Real Property.

(b)Assignment of Leases and Contracts and Bill of Sale. An Assignment of Leases and Contracts and Bill of Sale (“Assignment of Leases and Contracts and Bill of Sale”) in the form of Exhibit F attached hereto, executed by Seller.

(c)State Law Disclosures. Such disclosures and reports as are required by applicable state and local law in connection with the conveyance of the Real Property.

(d)FIRPTA. A Foreign Investment in Real Property Tax Act affidavit executed by Seller substantially in the form of Exhibit G attached hereto.

(e)Seller’s Reaffirmation. A certificate of Seller confirming whether the representations and warranties made by Seller in Section 11.1 hereof continue to be true and correct in all material respects.

(f)Owner’s Affidavit. An owner’s affidavit in the form of Exhibit K attached hereto (“Owner’s Affidavit”), executed by Seller, except that Buyer shall have no right to receive a copy of such Owner’s Affidavit.

(g)Additional Documents. Any additional documents that Escrow Holder or the Title Company may reasonably require for the proper consummation of the transaction contemplated by this Agreement.

(h)California Natural Hazard Disclosure Statement. On the Effective Date, a California Natural Hazard Disclosure Statement in the form attached as Schedule 2 hereto.

6.2 Buyer’s Deliveries into Escrow. No less than one (1) business day prior to the Closing Date (unless a different day is specified below), Buyer shall deliver into Escrow to the Escrow Holder the following:

(a)Purchase Price. The Purchase Price, less the Deposit that is applied to the Purchase Price, plus or minus applicable prorations, deposited by Buyer with the Escrow Holder in immediate, same day federal funds wired for credit into the Escrow Holder’s escrow account and deposited in Escrow Holder’s escrow account no later than 1:00 p.m. (California time) on the Closing Date.

(b)Assignment of Leases and Contracts and Bill of Sale. An Assignment of Leases and Contracts and Bill of Sale executed by Buyer.

(c)State Law Disclosures. Such disclosures and reports as are required by applicable state and local law in connection with the conveyance of the Real Property.

(d)Additional Documents. Any additional documents that Escrow Holder or the Title Company may reasonably require for the proper consummation of the transaction contemplated by this Agreement.

(e)California Natural Hazard Disclosure Statement. On the Effective Date, a California Natural Hazard Disclosure Statement in the form attached as Schedule 2 hereto.

6.3 Closing Statements/Escrow Fees; Tenant Notices. Concurrently with the Close of Escrow, Seller and Buyer shall deposit with the Escrow Holder executed closing statements consistent with this Agreement in the form required by the Escrow Holder and, Seller and Buyer shall execute at the Close of Escrow, and deliver to each tenant immediately after the Close of Escrow, tenant notices regarding the sale of the Real Property in substantially the form of Exhibit H attached hereto, or such other form as may be required by applicable state law.

6.4 Post-Closing Deliveries. Immediately after the Close of Escrow, to the extent in Seller’s possession, Seller shall deliver to the offices of Buyer’s property manager: the original Leases; copies or originals of all contracts, receipts for deposits, and unpaid bills; all keys, if any,

used in the operation of the Real Property; and, if in Seller’s possession, any “as-built” plans and specifications of the Improvements.

7.CONDITIONS TO BUYER’S AND SELLER’S OBLIGATIONS

7.1 Conditions to Buyer’s Obligations. The Close of Escrow and Buyer’s obligation to consummate the transaction contemplated by this Agreement are subject to the satisfaction of the following conditions for Buyer’s benefit (or Buyer’s waiver thereof, it being agreed that Buyer may waive any or all of such conditions) on or prior to the Closing Date or on the dates designated below for the satisfaction of such conditions:

(a)All of Seller’s representations and warranties contained herein shall be true and correct in all material respects as of the date of this Agreement and as of the Closing Date, subject to any qualifications hereafter made to any of Seller’s representations as provided for in Section 11.1 hereof;

(b)As of the Closing Date, Seller shall have performed its respective obligations hereunder and all deliveries to be made at Close of Escrow by Seller shall have been tendered;

(c)There shall exist no actions, suits, arbitrations, claims, attachments, proceedings, assignments for the benefit of creditors, insolvency, bankruptcy, reorganization or other proceedings, pending or threatened against Seller that would materially and adversely affect Seller’s ability to perform its respective obligations under this Agreement;

(d)There shall exist no pending or threatened action, suit or proceeding with respect to Seller before or by any court or administrative agency which seeks to restrain or prohibit, or to obtain damages or a discovery order with respect to, this Agreement or the consummation of the transaction contemplated hereby;

(e)Subject to Section 4.4 above, no less than three (3) business days prior to the Closing Date, Seller shall have delivered or caused to be delivered to Buyer, Tenant Estoppel Certificates complying with the provisions of Section 4.4 above; and

(f)The Title Company shall have irrevocably committed to issue the Title Policy in accordance with the terms and conditions of this Agreement.

If, notwithstanding the nonsatisfaction of any such condition, the Close of Escrow occurs, there shall be no liability on the part of Seller for breaches of representations and warranties of which Buyer had knowledge as of the Close of Escrow.

7.2 Conditions to Seller’s Obligations. The Close of Escrow and Seller’s obligations to consummate the transaction contemplated by this Agreement are subject to the satisfaction of the following conditions for Seller’s benefit (or Seller’s waiver thereof, it being agreed that Seller may waive any or all of such conditions) on or prior to the Closing Date or the dates designated below for the satisfaction of such conditions:

(a)All of Buyer’s representations and warranties contained herein shall be true and correct in all material respects as of the date of this Agreement and as of the Closing Date;

(b)As of the Closing Date, Buyer has performed its obligations hereunder and all deliveries to be made at Close of Escrow by Buyer shall have been tendered including, without limitation, the deposit with Escrow Holder of the amounts set forth in Section 6.2(a) hereof;

(c)There shall exist no actions, suits, arbitrations, claims, attachments, proceedings, assignments for the benefit of creditors, insolvency, bankruptcy, reorganization or other proceedings, pending or threatened against Buyer that would materially and adversely affect Buyer’s ability to perform its obligations under this Agreement;

(d)There shall exist no pending or threatened action, suit or proceeding with respect to Buyer before or by any court or administrative agency which seeks to restrain or prohibit, or to obtain damages or a discovery order with respect to, this Agreement or the consummation of the transaction contemplated hereby; and

(e)Seller shall have received all consents and approvals from all governmental bodies from whom such consents and approvals are necessary in order to consummate the Close of Escrow, but only to the extent Seller’s failure to obtain such consents and/or approvals would prevent Seller from consummating the Close of Escrow (the “Consent and Approval Condition”); provided, however, if the Consent and Approval Condition is not satisfied as of the Closing Date, then either Seller or Buyer (but not both parties) shall be entitled to extend the Closing Date one time to November 16, 2022 for purposes of satisfying the Consent and Approval Condition by providing written notice of the same to the other party prior to Closing. In connection therewith, Seller hereby agrees to use commercially reasonable efforts to satisfy the Consent and Approval Condition, but in no event shall Seller be obligated to incur any costs or expenses in excess of One Hundred Thousand Dollars ($100,000.00) in the aggregate unless Buyer elects, in writing, to reimburse Seller for any such excess costs or expenses for purposes of obtaining any required governmental consents or approvals to satisfy the Consent and Approval Condition. In the event the Closing Date is extended as provided in this Section 7.2(e), upon the satisfaction of the Consent and Approval Condition, Seller shall have the right to accelerate the Closing Date by providing Buyer with no less than five (5) days’ prior written notice of the same.

8.CLOSE OF ESCROW; POSSESSION

8.1 “Close of Escrow” shall mean and refer to Seller’s receipt of the Purchase Price and the other amounts due Seller in accordance with the provisions of Section 9.1(b) below. The Escrow and Buyer’s right to purchase the Real Property will terminate automatically if the Close of Escrow does not occur on or before 1:00 p.m. (California time) on the Closing Date.

8.2 Sole exclusive possession of the Real Property, subject only to the Permitted Exceptions, shall be delivered to Buyer on the Closing Date.

9.ESCROW

9.1 Closing. The escrow (the “Escrow”) for the consummation of this transaction shall be established with Escrow Holder at the address indicated in Section 15.1 hereof by the deposit

of an original signed copy of this Agreement with Escrow Holder contemporaneously with the execution hereof. This Agreement shall constitute both an agreement among Buyer and Seller and escrow instructions for Escrow Holder. If Escrow Holder requires separate or additional escrow instructions which it deems necessary for its protection, Seller and Buyer hereby agree promptly upon request by Escrow Holder to execute and deliver to Escrow Holder such separate or additional escrow instructions (the “Additional Instructions”). In the event of any conflict or inconsistency between this Agreement and the Additional Instructions, this Agreement shall prevail and govern, and the Additional Instructions shall so provide. The Additional Instructions shall not modify or amend the provisions of this Agreement unless otherwise agreed to in writing by Seller and Buyer.

On the Closing Date, provided that the conditions set forth in Sections 7.1 and 7.2 hereof have been satisfied or waived, Escrow Holder shall take the following actions in the order indicated below:

(a)With respect to all closing documents delivered to Escrow Holder hereunder, and to the extent necessary, Escrow Holder is authorized to insert into all blanks requiring the insertion of dates the date of the recordation of the Deed or such other date as Escrow Holder may be instructed in writing by Seller and Buyer;

(b)Deliver to Seller, in cash or current funds, the Purchase Price, plus or minus, as the case may be, the amounts determined in accordance with the provisions of Section 10 hereof, Buyer’s signed counterparts of the Assignment of Leases and Contracts and Bill of Sale and conformed copies of the recorded Deed;

(c)Record the Deed in the official records of the County in which the Real Property is located;

(d)Deliver to Buyer those items referred to in Section 6.1 hereof and a conformed copy of the recorded Deed;

(e)Cause the Title Company to issue the Title Policy for the Real Property in accordance with the provisions of Section 4.2.3 hereof; and

(f)Deliver to Seller and Buyer a final closing statement which has been certified by Escrow Holder to be true and correct.

9.2 Escrow and Title Charges.

(a)Upon the Close of Escrow, escrow, title charges and other closing costs shall be allocated between Seller and Buyer as follows:

(i)Seller shall pay: (1) the premiums for the Title Policy, (2) the cost of recording the Deed, (3) one-half (½) of any escrow fees or similar charges of Escrow Holder, and (4) all sales, gross receipts, compensating, stamp, excise, documentary, transfer, deed or similar taxes or fees (City, County and State) payable in connection with the consummation of the transactions contemplated by this Agreement.

(ii)Buyer shall pay one-half (½) of any escrow fees or similar charges of Escrow Holder. If Buyer desires ALTA extended coverage for any Title Policy, Buyer shall pay the premiums and any additional costs (including any survey costs) for such coverage (additional to the premiums for standard coverage) and the cost of any endorsements to the Title Policy, if required by Buyer.

(iii)Buyer shall pay all costs incurred in connection with Buyer’s updating or recertifying the Existing Surveys or obtaining any surveys for the Real Property.

(iv)Except to the extent otherwise specifically provided herein, all other expenses incurred by Seller and Buyer with respect to the negotiation, documentation and closing of this transaction, including, without limitation, Buyer’s and Seller’s attorneys’ fees, shall be borne and paid by the party incurring same.

(b)If the Close of Escrow does not occur by reason of Buyer’s or Seller’s default under this Agreement, then all escrow and title charges (including cancellation fees) shall be borne by the party in default.

9.3 Procedures Upon Failure of Condition. Except as otherwise expressly provided herein, if any condition set forth in Sections 7.1 or 7.2 hereof is not timely satisfied or waived for a reason other than the default of Buyer or Seller in the performance of its respective obligations under this Agreement:

(a)This Agreement, the Escrow and the respective rights and obligations of Seller and Buyer hereunder shall terminate (other than the indemnity and insurance obligations of Buyer set forth in Sections 4.3.1 and 14 hereof and the confidentiality provisions of Section 4.6 hereof which shall survive such termination) at the written election of the party for whose benefit such condition was imposed, which written election must be made (i) within two (2) business days after (but, as to the condition in Section 7.1(e) above, within one (1) business day after) the date such condition was to be satisfied, or (ii) on the date the Close of Escrow occurs, whichever occurs first;

(b)Escrow Holder, or if Seller is holding the Deposit, Seller shall return the Deposit to Buyer, shall promptly return to Buyer all funds of Buyer in its possession, including the Deposit and all interest accrued thereon, and to Seller and Buyer all documents deposited by them respectively, which are then held by Escrow Holder;

(c)Buyer shall return to Seller the Property Information and Buyer shall deliver to Seller all Work Product (as such term is defined in Section 15.3 hereof); and

(d)Any escrow cancellation and title charges shall be borne equally by Seller and Buyer.

10.PRORATIONS

If the Purchase Price is received by Seller’s depository bank in time to credit to Seller’s account on the Closing Date, the day the Close of Escrow occurs shall belong to Buyer and all prorations hereinafter provided to be made as of the Close of Escrow shall each be made as of the

end of the day before the Closing Date. If the cash portion of the Purchase Price is not so received by Seller’s depository bank on the Closing Date, then the day the Close of Escrow occurs shall belong to Seller and such proration shall be made as of the end of the day that is the Closing Date. In each such proration set forth below, the portion thereof applicable to periods beginning as of Close of Escrow shall be credited to Buyer or charged to Buyer as applicable and the portion thereof applicable to periods ending as of Close of Escrow shall be credited to Seller or charged to Seller as applicable.

10.1 Collected Rent. All rent (including, without limitation, all base rents, additional rents and retroactive rents, and expressly excluding tenant reimbursements for Operating Costs, as hereinafter defined) and all other income (and any applicable state or local tax on rent) (hereinafter collectively referred to as “Rents”) collected under Leases in effect on the Closing Date shall be prorated as of the Close of Escrow. Uncollected Rent shall not be prorated and, to the extent payable for the period prior to the Close of Escrow, shall remain the property of Seller. Buyer shall apply Rent from tenants that are collected after the Close of Escrow first to Rents which are due to Buyer after the Close of Escrow and second to Rents which were due to Seller on or before the Close of Escrow. Any prepaid Rents for the period following the Closing Date shall be paid over by Seller to Buyer. Buyer will make reasonable efforts, without suit, to collect any Rents applicable to the period before the Close of Escrow including, without limitation, sending to tenants bills for the payment of past due Rents during the first twelve (12) month period following the Closing Date. After Closing, Seller shall not pursue collection of any Rents that were past due as of the Closing Date.

10.2 Operating Costs and Additional Rent Reconciliation. Seller, as landlord under the Leases, is currently collecting from tenants under the Leases additional rent to cover taxes, insurance, utilities (to the extent not paid directly by tenants), common area maintenance and other operating costs and expenses (collectively, “Operating Costs”) in connection with the ownership, operation, maintenance and management of the Real Property. To the extent that any additional rent (including, without limitation, estimated payments for Operating Costs) is paid by tenants to the landlord under the Leases based on an estimated payment basis (monthly, quarterly, or otherwise) for which a future reconciliation of actual Operating Costs to estimated payments is required to be performed at the end of a reconciliation period, Buyer and Seller shall make an adjustment at the Close of Escrow for the applicable reconciliation period (or periods, if the Leases do not have a common reconciliation period) based on a comparison of the actual Operating Costs to the estimated payments at the Close of Escrow. If, as of the Close of Escrow, Seller has received additional rent payments in excess of the amount that tenants will be required to pay, based on the actual Operating Costs as of the Close of Escrow, Buyer shall receive a credit in the amount of such excess. If, as of the Close of Escrow, Seller has received additional rent payments that are less than the amount that tenants would be required to pay based on the actual Operating Costs as of the Close of Escrow, Seller shall receive a credit in the amount of such deficiency; provided, however, Seller shall not be entitled to the portion, if any, of such deficiency for which Seller received a credit at the Close of Escrow under clause (b) of Section 10.3 hereof. Operating Costs that are not payable by tenants either directly or reimbursable under the Leases shall be prorated between Seller and Buyer and shall be reasonably estimated by the parties if final bills are not available.

10.3 Taxes and Assessments. Real estate taxes and assessments imposed by any governmental authority (“Taxes”) with respect to the Real Property for the relevant tax year in which the Real Property is being sold and that are not yet due and payable or that have not yet been paid and that are not (and will not be) reimbursable or payable directly by tenants under the Leases (or under leases entered into after the Close of Escrow for vacant space existing at the Close of Escrow) as Operating Costs shall be prorated as of the Close of Escrow based upon the most recent ascertainable assessed values and tax rates and based upon the number of days Buyer and Seller will have owned the Real Property during such relevant tax year. Seller shall receive a credit for any Taxes paid by Seller and applicable to (a) any period after the Close of Escrow, and (b) any period before the Close of Escrow to the extent reimbursable as Operating Costs by (i) existing tenants under the Leases and not yet received from such tenants, or (ii) future tenants that may execute leases covering space in the Real Property that is vacant as of the Close of Escrow. If, as of the Closing Date, Seller is protesting or has notified Buyer, in writing, that it has elected to protest any Taxes for the Real Property, then Buyer agrees that Seller shall have the right (but not the obligation), after the Closing Date, to continue such protest. In such case, any Taxes paid by Buyer after the Closing Date with respect to the Real Property shall be paid under protest and Buyer shall promptly notify Seller of any payments of Taxes made by Buyer with respect to the Real Property. Buyer further agrees to cooperate with Seller and execute any documents requested by Seller in connection with such protest. As to the Real Property, any tax savings received (“Tax Refunds”) for the relevant tax year under any protest, whether filed by Seller or Buyer, shall be prorated between the parties based upon the number of days, if any, Seller and Buyer respectively owned the Real Property during such relevant tax year; if such protest was filed by a Seller, any payment of Tax Refunds to Buyer shall be net of any fees and expenses payable to any third party for processing such protest, including attorneys’ fees. Seller shall have the obligation to refund to any tenants in good standing as of the date of such Tax Refund, any portion of such Tax Refund paid to Seller which may be owing to such tenants, which payment shall be paid to Buyer within fifteen (15) business days of delivery to Seller by Buyer of written confirmation of such tenants’ entitlement to such Tax Refunds. Buyer shall have the obligation to refund to tenants in good standing as of the date of such Tax Refund, any portion of such Tax Refund paid to it which may be owing to such tenants. Seller and Buyer agree to notify the other in writing of any receipt of a Tax Refund within fifteen (15) business days of receipt of such Tax Refund. To the extent either party obtains a Tax Refund, a portion of which is owed to the other party, the receiving party shall deliver the Tax Refund to the other party within fifteen (15) business days of its receipt. If Buyer or Seller fail to pay such amount(s) to the other as and when due, such amount(s) shall bear interest from the date any such amount is due to Seller or Buyer, as applicable, until paid at the lesser of (a) twelve percent (12%) per annum and (b) the maximum amount permitted by law. The obligations set forth herein shall survive the Close of Escrow and Buyer agrees that, as a condition to the transfer of the Property by Buyer, Buyer will cause any transferee to assume the obligations set forth herein.

10.4 Leasing Commissions, Tenant Improvements and Contracts. At Close of Escrow, Buyer shall assume (pursuant to the Assignment of Leases and Contracts and Bill of Sale) the obligation to pay all (a) leasing costs that are due or become due prior to the Closing Date to the extent that the same (i) arise from a new lease or any Lease amendment, extension or expansion hereafter entered into by Seller in accordance with the terms and conditions of this Agreement in amounts approved by Buyer, or (ii) arise out of any New and Pending Lease Transactions (including, without limitation, the commissions and/or tenant improvements referenced in

Section 5.3 hereof in amounts approved by Buyer), and (b) leasing costs that are due after the Closing Date, to the extent disclosed in the Leases, disclosed in any of the Property Information delivered before the date hereof, or disclosed in the Tenant Estoppel Certificates (to the extent such disclosures are consistent with the disclosures in the Leases and said Property Information. Buyer will assume the obligations arising from and after the Closing Date under the Contracts. Buyer and Seller shall each be entitled to the credits, if any, provided for in Section 5.3 herein.

10.5 Tenant Deposits. All tenant security deposits actually received by Seller (and interest thereon if required by law or contract to be earned thereon) and not applied prior to the date hereof to tenant obligations under the Leases shall be transferred or credited to Buyer at the Close of Escrow or placed in escrow if required by law. As of the Close of Escrow, Buyer shall assume Seller’s obligations related to tenant security deposits. Buyer will indemnify defend, and hold Seller harmless from and against all demands and claims made by tenants arising out of the transfer or disposition of any security deposits and will reimburse Seller for all attorneys’ fees incurred or that may be incurred as a result of any such claims or demands as well as for all loss, expenses, verdicts, judgments, settlements, interest, costs and other expenses incurred or that may be incurred by Seller as a result of any such claims or demands by tenants. Seller shall not apply security deposits prior to Closing unless vacant possession is simultaneously obtained.

10.6 Utilities and Utility Deposits. Utilities for the Real Property (excluding utilities for which payment is made directly by tenants), including water, sewer, electric, and gas, based upon the last reading of meters prior to the Close of Escrow, shall be prorated. Seller shall be entitled to a credit for all security deposits held by any of the utility companies providing service to the Real Property. Seller shall endeavor to obtain meter readings on the day before the Closing Date, and if such readings are obtained, there shall be no proration of such items and Seller shall pay at Close of Escrow the bills therefor for the period to the day preceding the Close of Escrow, and Buyer shall pay the bills therefor for the period subsequent thereto. If the utility company will not issue separate bills, Buyer will receive a credit against the Purchase Price for Seller’s portion and will pay the entire bill prior to delinquency after Close of Escrow. If Seller has paid utilities no more than thirty (30) days in advance in the ordinary course of business, then Buyer shall be charged its portion of such payment at Close of Escrow. Buyer shall be responsible for making any security deposits required by utility companies providing service to the Real Property.

10.7 Owner Deposits. Seller shall receive a credit at the Close of Escrow for all bonds, deposits, letters of credit, set aside letters or other similar items, if any, that are outstanding with respect to the Real Property that have been provided by Seller or any of its affiliates to any governmental agency, public utility, or similar entity (collectively, “Owner Deposits”) to the extent assignable to Buyer. To the extent any Owner Deposits are not assignable to Buyer, Buyer shall replace such Owner Deposits and obtain the release of Seller (or its affiliates) from any obligations under such Owner Deposits. To the extent that any funds are released as a result of the termination of any Owner Deposits for which Seller did not get a credit, such funds shall be delivered to Seller immediately upon their receipt.

10.8 Percentage Rents. Percentage rents (“Percentage Rents”) actually collected for the month in which the Close of Escrow occurs shall be prorated as of the Closing Date. Percentage Rents due after the Close of Escrow shall not be prorated; provided, however, after Buyer has completed any reconciliation of actual Percentage Rents payable and estimated

Percentage Rents paid by the subject tenants, and all reconciled amounts have been paid, a reconciliation shall be made between Seller and Buyer with regard to such Percentage Rents. Pursuant to such reconciliation, Seller and Buyer shall be entitled to their proportionate share of all Percentage Rents paid for the subject fiscal Lease year used to calculate each tenant’s Percentage Rents (less any out-of-pocket costs incurred in collecting said amounts, which shall belong to Buyer) based on the number of days of such fiscal year Seller and Buyer owned the Property (and adjusted for any amount of Percentage Rent prorated at Closing or received by Seller or Buyer). As used in this paragraph, the term “Percentage Rents” shall not include and shall have deducted from such Percentage Rent amount any “base” or “minimum” rent component which is payable each month (regardless of actual sales), which “base” or “minimum” rent component shall be prorated or otherwise handled in the manner provided in this Agreement. Buyer will make reasonable efforts, without suit, to collect all Percentage Rents payable after the Close of Escrow and relating to the period prior to the Close of Escrow, and all Percentage Rents which are delinquent as of the Close of Escrow, including, without limitation, sending to tenants bills for the payment of the same. Seller shall not pursue collection of all Percentage Rents payable after the Close of Escrow and relating to the period prior to the Close of Escrow and all Percentage Rents which are delinquent as of the Close of Escrow.

10.9 Final Adjustment After Closing. If final prorations cannot be made at the Close of Escrow for any item being prorated under this Section 10, then, provided Buyer and Seller both identify any such proration (“Post Closing Proration”) in writing before the Close of Escrow, Buyer and Seller agree to allocate such items on a fair and equitable basis as soon as invoices or bills are available and applicable reconciliation with tenants have been completed, with final adjustment to be made as soon as reasonably possible after the Close of Escrow (but in no event later than ninety (90) days after the Close of Escrow, except that adjustments arising from any tax protest under Section 10.3 or from Percentage Rents under Section 10.8 hereof shall not be subject to such 90-day limitation, but shall be made as soon as reasonably possible), to the effect that income and expenses are received and paid by the parties on an accrual basis with respect to their period of ownership. Payments in connection with the final adjustment shall be due no later than ninety (90) days after the Close of Escrow, except that adjustments arising from any tax protest under Section 10.3 or relating to Percentage Rents under Section 10.8 hereof shall not be subject to such 90-day limitation, but shall be made as soon as reasonably possible. Seller shall have reasonable access to, and the right to inspect and audit, Buyer’s books to confirm the final prorations for a period of one (1) year after the Close of Escrow. Notwithstanding anything to the contrary stated in this Section 10, except for any reconciliation arising out of a tax protest under Section 10.3 hereof, or arising out of Percentage Rents under Section 10.8 hereof, and except for any Post Closing Prorations (which must be determined and paid within ninety (90) days after the Close of Escrow), all prorations made under this Section 10 shall be final as of the Close of Escrow and shall not be subject to further adjustment (whether due to an error or for any other reason) after the Close of Escrow.

11.SELLER’S REPRESENTATIONS AND WARRANTIES; AS-IS

11.1 Seller’s Representations and Warranties. In consideration of Buyer’s entering into this Agreement and as an inducement to Buyer to purchase the Real Property from Seller, Seller makes the following representations and warranties to Buyer:

(a)Seller is a limited liability company organized and in good standing under the laws of the State of Delaware. Seller has the legal right, power and authority to enter into this Agreement and to consummate the transactions contemplated hereby, and the execution, delivery and performance of this Agreement have been duly authorized and no other action by Seller is requisite to the valid and binding execution, delivery and performance of this Agreement, except as otherwise expressly set forth herein.

(b)There is no agreement to which Seller is a party or to Seller’s Actual Knowledge binding on Seller which would prevent Seller from consummating the transaction contemplated by this Agreement.

(c)To Seller’s Actual Knowledge, except as disclosed on Schedule 4 attached hereto, Seller has received no written notice from any governmental agency in the last 12 months that the Property or the current use and operation thereof violate any applicable federal, state or municipal law, statute, code, ordinance, rule or regulation (including those relating to environmental matters), except with respect to such violations as have been fully cured prior to the date hereof.

(d)To Seller’s Actual Knowledge, except as disclosed on Schedule 4 attached hereto, Seller has not received written notice from any governmental agency of any currently pending condemnation proceedings relating to the Property.

(e)To Seller’s Actual Knowledge, except as disclosed on Schedule 4 attached hereto, except with respect to slip and fall and similar claims or matters covered by Seller’s commercial liability insurance policy, Seller has not received service of process (or written notice) with respect to any litigation that has been filed and is continuing against Seller that arises out of the ownership of the Property and would materially affect the Property or the use thereof, or Seller’s ability to perform hereunder.

(f)The Rent Roll delivered to Buyer is the rent roll for the Property generated by Seller’s property manager and used by Seller in the ordinary course of business; provided, however, Seller makes no representation or warranty as to the accuracy or completeness of such Rent Roll.

(g)To Seller's Actual Knowledge as of the Effective Date, the Leases listed in Exhibit C-2 attached hereto are all of the leases affecting the Property (including amendments relating thereto).

(h)To Seller's Actual Knowledge, Seller does not have any employees engaged in the operation or maintenance of the Property.

For purposes of this Section 11.1, the phrase “To Seller’s Actual Knowledge” shall mean the actual (and not implied, imputed, or constructive) knowledge of Tim Helgeson (whom the Seller represents is the asset manager for the Real Property), without any inquiry or investigation of any other parties, including, without limitation, the tenants and the property manager of the Real Property.

The representations and warranties made by Seller in this Agreement shall survive the recordation of the Deed until February 28, 2023, and any action for a breach of Seller’s representations or warranties must be made and filed on or before February 28, 2023. If, after the Effective Date, but before the Close of Escrow, Seller becomes aware of any facts or changes in circumstances that would cause any of its representations and warranties in this Agreement to be untrue at Close of Escrow, Seller may notify Buyer in writing of such fact; provided, however, the foregoing shall not affect Seller’s obligation to deliver a Seller’s Reaffirmation as provided in Section 6.1(e) above. In such case, or in the event Buyer obtains information which would cause any of Seller’s representations and warranties to be untrue at Close of Escrow, Buyer, as its sole and exclusive remedy, shall have the right to either (i) terminate this Agreement to the extent that the failure of any such representation or warranty to be true would have a material adverse impact on the Property, in which case the Deposit shall be immediately returned to Buyer and neither party shall have any rights or obligations under this Agreement (except for Sections 4.3.1, 15.3 and 15.5 which survive termination of this Agreement); or (ii) to the extent Buyer is not permitted to terminate this Agreement pursuant to clause (i) above, accept a qualification to Seller’s representations and warranties as of the Close of Escrow and complete the purchase and sale of the Property without any rights to recovery for breach of the unqualified representation and warranty. Other than as set forth in the immediately preceding sentence, if Buyer proceeds with the Close of Escrow, Buyer shall be deemed to have expressly waived any and all remedies for the breach of any representation or warranty discovered by Buyer prior to the Close of Escrow. Notwithstanding the foregoing or anything stated to the contrary in this Agreement, (a) the representations and warranties set forth in Section 11.1(g) herein shall automatically terminate, and shall be of no force or effect, with respect to any Lease for which Buyer receives a Tenant Estoppel, and (b) if any Seller’s representations and warranties were untrue as of the Effective Date and Seller had Actual Knowledge that such representations and warranties were untrue as of the Effective Date, then, provided Buyer terminates this Agreement pursuant to the provisions of this Section 11.1, Seller shall reimburse Buyer for Buyer’s out-of-pocket costs and expenses (including reasonable attorneys’ fees and expenses), as supported by reasonable documentation, incurred in connection with Buyer’s pursuit of the transaction contemplated by this Agreement, not to exceed Three Hundred Fifty Thousand Dollars ($350,000.00) in the aggregate.

11.2 As-Is. As of the Effective Date, Buyer will have:

(a)examined and inspected the Property and will know and be satisfied with the physical condition, quality, quantity and state of repair of the Property in all respects (including, without limitation, the compliance of the Real Property with the Americans With Disabilities Act of 1990 Pub.L. 101-336, 104 Stat. 327 (1990), and any comparable local or state laws (collectively, the “ADA”)) and by proceeding with this transaction shall be deemed to have determined that the same is satisfactory to Buyer;

(b)reviewed the Property Information and all instruments, records and documents which Buyer deems appropriate or advisable to review in connection with this transaction, including, but not by way of limitation, any and all architectural drawings, plans, specifications, surveys, building and occupancy permits, and any licenses, leases, contracts, warranties and guarantees relating to the Real Property or the business conducted thereon, and Buyer, by proceeding with this transaction, shall be deemed to have determined that the same and the information and data contained therein and evidenced thereby are satisfactory to Buyer;

(c)reviewed all applicable laws, ordinances, rules and governmental regulations (including, but not limited to, those relating to building, zoning and land use) affecting the development, use, occupancy or enjoyment of the Real Property, and Buyer, by proceeding with this transaction, shall be deemed to have determined that the same are satisfactory to Buyer; and

(d)at its own cost and expense, made its own independent investigation respecting the Property and all other aspects of this transaction, and shall have relied thereon and on the advice of its consultants in entering into this Agreement, and Buyer, by proceeding with this transaction, shall be deemed to have determined that the same are satisfactory to Buyer.

TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, AND EXCEPT FOR SELLER’S REPRESENTATIONS AND WARRANTIES IN SECTION 11.1 OF THIS AGREEMENT AND ANY WARRANTIES OF TITLE CONTAINED IN THE DEED OR WARRANTIES IN THE CLOSING DOCUMENTS DELIVERED AT THE CLOSE OF ESCROW (“SELLER’S WARRANTIES”), THIS SALE IS MADE AND WILL BE MADE WITHOUT REPRESENTATION, COVENANT, OR WARRANTY OF ANY KIND (WHETHER EXPRESS, IMPLIED, OR, TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, STATUTORY) BY SELLER. AS A MATERIAL PART OF THE CONSIDERATION FOR THIS AGREEMENT, BUYER AGREES TO ACCEPT THE PROPERTY ON AN “AS IS” AND “WHERE IS” BASIS, WITH ALL FAULTS, AND WITHOUT ANY REPRESENTATION OR WARRANTY, ALL OF WHICH SELLER HEREBY DISCLAIMS, EXCEPT FOR SELLER’S WARRANTIES. EXCEPT FOR SELLER’S WARRANTIES, NO WARRANTY OR REPRESENTATION IS MADE BY SELLER AS TO FITNESS FOR ANY PARTICULAR PURPOSE, MERCHANTABILITY, DESIGN, QUALITY, CONDITION, OPERATION OR INCOME, COMPLIANCE WITH DRAWINGS OR SPECIFICATIONS, ABSENCE OF DEFECTS, ABSENCE OF HAZARDOUS OR TOXIC SUBSTANCES, ABSENCE OF FAULTS, FLOODING, OR COMPLIANCE WITH LAWS AND REGULATIONS INCLUDING, WITHOUT LIMITATION, THOSE RELATING TO HEALTH, SAFETY, AND THE ENVIRONMENT (INCLUDING, WITHOUT LIMITATION, THE ADA). BUYER ACKNOWLEDGES THAT BUYER HAS ENTERED INTO THIS AGREEMENT WITH THE INTENTION OF MAKING AND RELYING UPON ITS OWN INVESTIGATION OF THE PHYSICAL, ENVIRONMENTAL, ECONOMIC USE, COMPLIANCE, AND LEGAL CONDITION OF THE PROPERTY AND THAT BUYER IS NOT NOW RELYING, AND WILL NOT LATER RELY, UPON ANY REPRESENTATIONS AND WARRANTIES MADE BY SELLER OR ANYONE ACTING OR CLAIMING TO ACT, BY, THROUGH OR UNDER OR ON SELLER’S BEHALF CONCERNING THE PROPERTY. ADDITIONALLY, EXCEPT FOR SELLER’S WARRANTIES, BUYER AND SELLER HEREBY AGREE THAT (A) EXCEPT FOR SELLER’S WARRANTIES, BUYER IS TAKING THE PROPERTY “AS IS” WITH ALL LATENT AND PATENT DEFECTS AND THAT EXCEPT FOR SELLER’S WARRANTIES, THERE IS NO WARRANTY BY SELLER THAT THE PROPERTY IS FIT FOR A PARTICULAR PURPOSE, (B) EXCEPT FOR SELLER’S WARRANTIES, BUYER IS SOLELY RELYING UPON ITS EXAMINATION OF THE PROPERTY, AND (C) BUYER TAKES THE PROPERTY UNDER THIS AGREEMENT UNDER THE EXPRESS UNDERSTANDING THAT THERE ARE NO EXPRESS OR IMPLIED WARRANTIES (EXCEPT FOR THE LIMITED WARRANTIES OF TITLE SET FORTH IN THE DEED AND SELLER’S WARRANTIES).

WITH RESPECT TO THE FOLLOWING, BUYER FURTHER ACKNOWLEDGES AND AGREES THAT SELLER SHALL NOT HAVE ANY LIABILITY, OBLIGATION OR RESPONSIBILITY OF ANY KIND AND THAT SELLER HAS MADE NO REPRESENTATIONS OR WARRANTIES OF ANY KIND:

1. THE CONTENT OR ACCURACY OF ANY REPORT, STUDY, OPINION OR CONCLUSION OF ANY SOILS, TOXIC, ENVIRONMENTAL OR OTHER ENGINEER OR OTHER PERSON OR ENTITY WHO HAS EXAMINED THE PROPERTY OR ANY ASPECT THEREOF;

2. THE CONTENT OR ACCURACY OF ANY OF THE ITEMS (INCLUDING, WITHOUT LIMITATION, THE PROPERTY INFORMATION) DELIVERED TO BUYER PURSUANT TO BUYER’S REVIEW OF THE CONDITION OF THE PROPERTY; OR

3. THE CONTENT OR ACCURACY OF ANY PROJECTION, FINANCIAL OR MARKETING ANALYSIS OR OTHER INFORMATION GIVEN TO BUYER BY SELLER OR REVIEWED BY BUYER WITH RESPECT TO THE PROPERTY.

BUYER ALSO ACKNOWLEDGES THAT THE REAL PROPERTY MAY OR MAY NOT CONTAIN ASBESTOS AND, IF THE REAL PROPERTY CONTAINS ASBESTOS, THAT BUYER MAY OR MAY NOT BE REQUIRED TO REMEDIATE ANY ASBESTOS CONDITION IN ACCORDANCE WITH APPLICABLE LAW.

BUYER IS A SOPHISTICATED REAL ESTATE INVESTOR AND IS, OR WILL BE AS OF THE CLOSE OF ESCROW, FAMILIAR WITH THE REAL PROPERTY AND ITS SUITABILITY FOR BUYER’S INTENDED USE. THE PROVISIONS OF THIS SECTION 11.2 SHALL SURVIVE INDEFINITELY ANY CLOSING OR TERMINATION OF THIS AGREEMENT AND SHALL NOT BE MERGED INTO THE DOCUMENTS EXECUTED AT CLOSE OF ESCROW.

12.BUYER’S COVENANTS, REPRESENTATIONS AND WARRANTIES; RELEASE; ERISA; INDEMNIFICATION

In consideration of Seller entering into this Agreement and as an inducement to Seller to sell the Real Property to Buyer, Buyer makes the following covenants, representations and warranties:

12.1 Buyer’s Representations and Warranties.