SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. 2)

|

Filed by the Registrant |

☒ |

| |

|

Filed by a party other than the Registrant |

☐ |

| |

|

Check the appropriate box: |

| ||

|

☒ |

Preliminary Proxy Statement | ||

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

|

☐ |

Definitive Proxy Statement | ||

|

☐ |

Definitive Additional Materials | ||

|

☐ |

Soliciting Material Under Rule 14(a)(12) | ||

|

Armco Metals Holdings, Inc. |

|

(Name of Registrant as Specified in Its Charter) |

|

Not Applicable |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): | ||

|

☐ |

No fee required. | |

|

☒ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

|

|

1. |

Title of each class of securities to which transaction applies: |

|

|

|

Common stock |

|

|

2. |

Aggregate number of securities to which transaction applies: |

|

|

|

12,750,000 shares |

|

|

3. |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

$2.45 per share. Solely for the purpose of calculating the filing fee, the per unit price is equal to the average and low prices of the common stock of Armco Metal Holdings, Inc. on June 17, 2014 on a post-split basis |

|

|

4. |

Proposed maximum aggregate value of the transaction: |

|

|

|

$38,587,500 |

|

|

5. |

Total fee paid: |

|

|

|

$4,970.07 |

|

☒ |

Fee paid previously with preliminary materials. | |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

|

|

1. |

Amount Previously Paid: |

|

|

2. |

Form, Schedule or Registration Statement No.: |

|

|

3. |

Filing Party: |

|

|

4. |

Date Filed: |

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON [●], 2014

We will hold the 2014 Annual Meeting of Stockholders of Armco Metals Holdings, Inc. at the Crowne Plaza Hotel & Resorts, 1221 Chess Drive, Foster City , California 94404 on [●], 2014 at [●] local time. At the annual meeting you will be asked to vote on the following matters:

|

|

● |

the election of five directors, |

|

|

● |

the ratification of the appointment of MaloneBailey , LLP as our independent registered public accounting firm, |

|

● |

the approval of an Amendment to our Articles of Incorporation increasing in the number of authorized shares of our common stock; | |

|

|

● |

the approval of the issuance of securities in connection with the acquisition of 31.37% of Draco Resources, Inc., |

|

|

● |

the approval of the third amendment to our Amended and Restated 2009 Stock Incentive Plan to increase the number of shares of our common stock authorized for issuance under the plan; and |

|

|

● |

any other business as may properly come before the meeting. |

The Board of Directors has fixed the close of business on [●], 2014 as the Record Date for determining the stockholders that are entitled to notice of and to vote at the 2014 Annual Meeting and any adjournments thereof.

All stockholders are invited to attend the annual meeting in person. Your vote is important regardless of the number of shares you own. Please vote your shares by proxy over the Internet by following the instructions provided in the Notice of Internet Availability of Proxy Materials, or, if you request printed copies of the proxy materials by mail, you can also vote by mail, by telephone or by facsimile.

|

|

By Order of the Board of Directors /s/ Kexuan Yao |

|

San Mateo, CA |

Kexuan Yao |

|

[●], 2014 |

Chairman and Chief Executive Officer |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on [●], 2014: This proxy statement, along with our Annual Report on Form 10-K for the year ended December 31, 2013, as amended, are available free of charge on our website www.armcometals.com.

ARMCO METALS HOLDINGS, INC.

PROXY STATEMENT

2014 ANNUAL MEETING

OF STOCKHOLDERS

TABLE OF CONTENTS

|

|

Page No. | |

|

General Information |

2 | |

|

Summary Term Sheet Relating to Proposal 4 |

3 | |

|

Proposal 1 - |

Election of directors |

7 |

|

Proposal 2 - |

Ratification of appointment of MaloneBailey, LLP |

9 |

|

Proposal 3 - |

Approval of an Amendment to our Articles of Incorporation increasing in the number of authorized shares of our common stock |

10 |

|

Proposal 4 - |

Approval of the issuance of securities in connection with the acquisition of 31.37% of Draco Resources, Inc. |

12 |

|

Proposal 5 - |

The approval of the third amendment to our Amended and Restated 2009 Stock Incentive Plan to increase the number of shares of our common stock authorized for issuance under the plan |

41 |

|

Other Matters |

47 | |

|

Dissenter’s Rights |

47 | |

|

Corporate Governance |

47 | |

|

Executive Compensation |

53 | |

|

Principal Stockholders |

56 | |

|

Certain Relationships and Related Transactions |

58 | |

|

Stockholder Proposals to be Presented at the Next Annual Meeting |

59 | |

|

Availability of Annual Report on Form 10-K |

60 | |

|

Stockholders Sharing the Same Last Name and Address |

60 | |

|

Where You Can Find More Information |

60 | |

|

Appendix A |

Amendment to 2009 Plan |

|

Appendix B |

Share Exchange Agreement dated April 15, 2014 by and between Armco Metals Holdings, Inc., Draco Resources, Inc. and the shareholders of Draco Resources, Inc., as amended on May 7, 2014, and as further amended on August 25, 2014 and September 22, 2014. |

|

Appendix C |

Opinion of Scalar Group, Inc. (dba Scalar Analytics) dated July 2, 2014 |

FORWARD-LOOKING STATEMENTS

This proxy statement contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on our current expectations and involve risks and uncertainties which may cause results to differ materially from those set forth in the statements. The forward-looking statements may include statements regarding actions to be taken in the future. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Forward-looking statements should be evaluated together with the many uncertainties that affect our business, particularly those set forth in the section on forward-looking statements, Proposal 4, in the risk factors in Item 1.A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2013 as filed with the Securities and Exchange Commission, as amended (the “2013 10-K”) and our subsequent filings with the Securities and Exchange Commission.

Stockholders Should Read the Entire Proxy Statement

Carefully Prior to Returning Their Proxies

PROXY STATEMENT

FOR

2014 ANNUAL MEETING OF STOCKHOLDERS

General Information

The accompanying proxy is solicited by the Board of Directors of Armco Metals Holdings, Inc. for use at our 2014 Annual Meeting of Stockholders to be held on [●], 2014, or any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of 2014 Annual Meeting of Stockholders. The date of this proxy statement is [●], 2014, the approximate date on which this proxy statement and the enclosed proxy were first sent or made available to our stockholders.

This proxy statement and the accompanying proxy card are being mailed to owners of our common shares in connection with the solicitation of proxies by the Board of Directors for the 2014 Annual Meeting of Stockholders. This proxy procedure is necessary to permit all common stockholders, many of whom live throughout the United States and are unable to attend the 2014 Annual Meeting in person, to vote. We will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes.

Electronic Access. To access our proxy statement and 2013 10-K electronically, please visit our corporate website at www.armcometals.com. The information which appears on our website is not part of this proxy statement.

Voting Securities. Only our stockholders of record as of the close of business on [●], 2014, the Record Date for the 2014 Annual Meeting, will be entitled to vote at the meeting and any adjournment thereof. As of that date, there were [55,318,945] shares of our common stock issued and outstanding, all of which are entitled to vote with respect to all matters to be acted upon at the 2014 Annual Meeting. Each holder of record as of that date is entitled to one vote for each share held. In accordance with our by-laws, the presence of at least 33 1/3% of the voting power, regardless of whether the proxy has authority to vote on all matters, constitutes a quorum which is required in order to hold 2014 Annual Meeting and conduct business. Presence may be in person or by proxy. You will be considered part of the quorum if you voted on the Internet, by telephone, by facsimile or by properly submitting a proxy card or voting instruction form by mail, or if you are present and vote at the 2014 Annual Meeting. Votes for and against, abstentions and “broker non-votes” will each be counted as present for purposes of determining the presence of a quorum.

Broker Non-Votes. A broker non-vote occurs when a broker submits a proxy card with respect to shares held in a fiduciary capacity (typically referred to as being held in “street name”) but declines to vote on a particular matter because the broker has not received voting instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters, but not on non-routine matters. The routine matter to be voted upon at our 2014 Annual Meeting is the ratification of the appointment of our independent registered public accounting firm. The remaining proposals to be voted on at our 2014 Annual Meeting are not considered routine matters.

Voting of Proxies. All valid proxies received prior to the meeting will be exercised. All shares represented by a proxy will be voted, and where a proxy specifies a stockholder’s choice with respect to any matter to be acted upon, the shares will be voted in accordance with that specification. If no choice is indicated on the proxy, the shares will be voted by the individuals named on the proxy card as recommended by the Board of Directors. A stockholder giving a proxy has the power to revoke his or her proxy, at any time prior to the time it is exercised, by delivering to our Corporate Secretary a written instrument revoking the proxy or a duly executed proxy with a later date, or by attending the meeting and voting in person. A stockholder wanting to vote in person at the 2014 Annual Meeting and holding shares of our common stock in street name must obtain a proxy card from his or her broker and bring that proxy card to the 2014 Annual Meeting, together with a copy of a brokerage statement reflecting such share ownership as of the Record Date.

Board of Directors Recommendations. The Board of Directors recommends a vote FOR proposals 1, 2, 3, 4 and 5.

Attendance at the Meeting. You are invited to attend the annual meeting only if you were an Armco Metals stockholder or joint holder as of the close of business on [●], 2014, the Record Date, or if you hold a valid proxy for the 2014 Annual Meeting. In addition, if you are a stockholder of record (owning shares in your own name), your name will be verified against the list of registered stockholders on the Record Date prior to your being admitted to the annual meeting. If you are not a stockholder of record but hold shares through a broker or nominee (in street name), you should provide proof of beneficial ownership on the Record Date, such as a recent account statement or a copy of the voting instruction card provided by your broker or nominee. The meeting will begin at _______ local time. Check-in will begin at ______ local time.

Communication with our Board of Directors. You may contact any of our directors by writing to them c/o Armco Metals Holdings, Inc., One Waters Park Drive, Suite 98, San Mateo, CA 94403. Each communication should specify the applicable director or directors to be contacted as well as the general topic of the communication. We may initially receive and process communications before forwarding them to the applicable director. We generally will not forward to the directors a stockholder communication that is determined to be primarily commercial in nature, that relates to an improper or irrelevant topic, or that requests general information about Armco Metals. Concerns about accounting or auditing matters or communications intended for non-management directors should be sent to the attention of the Chairman of the Audit Committee at the address above. Our directors may at any time review a log of all correspondence received by Armco Metals that is addressed to the independent members of the Board and request copies of any such correspondence.

Who can help answer your questions? If you have additional questions after reading this proxy statement, you may seek answers to your questions by writing, calling or emailing:

Armco Metals Holdings, Inc.

Attention: Caiqing (Christina) Xiong, Corporate Secretary

One Waters Park Drive, Suite 98

San Mateo, California 94403

Telephone: (650) 212-7620

Facsimile: (650) 212-7630

SUMMARY TERM SHEET RELATING TO PROPOSAL 4

This summary term sheet highlights selected information from this proxy statement and may not contain all of the information that is important to you. We urge you to read carefully the entire proxy statement, the annexes, and the other documents to which we refer or incorporate by reference in order to fully understand the acquisition and the related transactions. See “Where You Can Find More Information” on page 41. Each item in this summary refers to the page of this proxy statement on which that subject is discussed in more detail.

Parties to the Draco Acquisition (See page ___).

Armco

Armco Metals Holdings, Inc. is a publicly traded Nevada corporation. We engage in the business of metal ore trading and distribution and scrap metal recycling. Our operations are conducted primarily in China. In our metal ore trading and distribution business, we import, sell and distribute to the metal refinery industry in China, a variety of metal ore that includes iron, chrome, nickel, copper, titanium and manganese ore, as well as non-ferrous metals, and coal. We obtain these raw materials from global suppliers primarily in Brazil, India, Indonesia, Ukraine and the United States and distribute them in China. In addition, we provide sourcing and pricing services for various metals to our network of customers. In our scrap metal recycling business, we recycle scrap metal at our recycling facility and sell the recycled product to steel mills in China for use in the production of recycled steel. Our recycling facility commenced formal operations in the third quarter of 2010, and is located in Banqiao Industrial Zone, part of Lianyungang Economic Development Zone, in the Jiangsu province of China.

Our principal executive offices are located at One Waters Park Drive, Suite 98, San Mateo, CA 94403, and our telephone number is (650) 212-7620.

Draco (see page_______)

Draco Resources, Inc., or “Draco,” a wholly-owned subsidiary of Metawise Group, Inc., a California corporation that we refer to as “Metawise.” was formed as a line of business within Metawise Group, Inc. on January 1, 2010 when Metawise started to investigate the possibility of acquiring the title to iron ore fines in Alabama. Draco’s business model is to supply key raw materials to the Chinese steel industry and it will initially operate as a mineral trading company, acting as a reseller of iron ore fines for Metawise. Metawise has certain rights to sell up to 5 million metric tons of iron ore fines, which we refer to as the “Material,” under an agreement with a third party that owns the Material. On April 2, 2014 Metawise and Draco entered into a Commodities Purchase Agreement related to the Material pursuant to which Draco will act as a reseller of the Material and it will generate revenues based upon the difference between the sales price of the Material to third parties and what it pays Metawise for the Material. On June 23, 2014, Draco, Metawise and certain of the Metawise Nominees entered into a Security Pledge Agreement pursuant to which the Metawise Nominees, who are parties to this agreement, pledged the net profit gains from the Greenfield Agreements and all of their voting rights related thereto to Draco. The pledge, which is limited to any operations of Metawise associated with the Greenfield Agreements, remains in effect so long as the Greenfield Agreements are in effect.

Draco’s principal executive offices are located at 1065 E. Hillside Boulevard, Suite 315, Foster City, CA 94404 and its telephone number is (650) 212-7900.

Shareholder of Draco

Draco’s common stock, which is its only class of equity securities, is currently owned by Metawise. Immediately following the closing of the Draco Acquisition, Metawise will distribute the Acquisition Shares (as defined below) Shares to the following individuals in the percentages set forth opposite their respective names below. We refer to these individuals as the “Metawise Nominees.” After this distribution, Metawise will not own any of the Acquisition Shares.

|

Metawise Nominee |

% of Acquisition Shares to be Distributed by Metawise |

|||

|

Songqiang Chen |

39.6424 | % | ||

|

Jian Fang |

13.7255 | % | ||

|

Changli Yan |

12.5490 | % | ||

|

Hongye Chen |

11.7467 | % | ||

|

Fajie Wang |

11.7647 | % | ||

|

Honglin Zhang |

4.8941 | % | ||

|

Tong Huang |

4.4047 | % | ||

|

Hongbing Lin |

1.2549 | % | ||

| 100.0 | % | |||

The Draco Acquisition (See page ___).

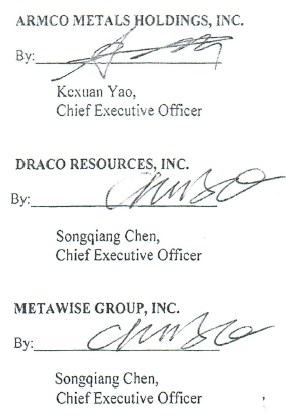

On April 15, 2014 we entered into a Share Exchange Agreement with Draco and the Metawise Nominees identified below. On May 7, 2014 we entered into an amendment to the Share Exchange Agreement to add Metawise as a party to the agreement. Further, on August 25, 2014 we entered into a second amendment to the Share Exchange Agreement to modify certain terms of the original agreement. Finally, on September 22, 2014 we entered into a third amendment to the Share Exchange Agreement to further modify the terms as described below. When used herein, the term “Share Exchange Agreement” also includes the three amendments. The material terms of the Share Exchange Agreement provide:

|

|

● |

at closing we will acquire 31.37% of the outstanding capital stock of Draco from Metawise in exchange for 40,000,000 (the “Acquisition Shares”) of our newly issued common stock. We refer to this as the “Draco Acquisition”; |

|

● |

at closing we will also issue two finders an aggregate of 4,800,000 shares (the “Compensation Shares”) of our newly issued common stock as compensation for their services to us in connection with the Draco Acquisition. This will represent approximately 4.8% of our outstanding common stock on the date of issuance. |

Following the completion of the Draco Acquisition, as giving effect to the distribution of the Acquisition Shares by Metawise to the Metawise Nominees, the Metawise Nominees will own, by virtue of the issuance of the Acquisition Shares, approximately 40% of our then outstanding common stock, giving effect to the issuance of the Compensation Shares, but excluding any additional shares of our common stock issuable upon the exercise of outstanding options or warrants. As a result of the Draco Acquisition, our stockholders’ existing share ownership and voting power will be diluted by the issuance of 44,800,000 newly issued shares of our common stock, which represent approximately 81% of our outstanding common stock as of September [22], 2014.

Accounting Treatment of the Draco Acquisition (See page __).

We will use the equity method to account for investments in Draco which gives Armco the ability to exercise influence over operating and financial policies of the investee. Armco will include the proportionate share of earnings and/or losses of equity method investees in equity income (loss) — net in consolidated statements of income. The carrying value of our equity investment will be reported in equity method investments in our consolidated balance sheets.

Board of Directors and Management of Armco Following the Draco Acquisition (See page __).

Currently, Armco’s Board of Directors consists of five individuals. As described in Proposal 1 appearing elsewhere in this proxy statement, at the 2014 Annual Meeting our stockholders are voting upon the election of five directors, three of whom are current members of the Board that are standing for re-election and the remaining two are new director nominees, including Songqiang Chen and Shiqing Yue. Mr. Chen is Chief Executive Officer of both Metawise and Draco and is Metawise’s principal shareholder. Mr. Yue is an unrelated third party who was nominated by the Nominating and Corporate Governance Committee to serve as an independent director. The election of these two director nominees to our Board is not contingent upon the approval of Proposal 4.

Basis of Stockholder Approval Requirement (See page ___).

Our common stock is listed on the NYSE MKT, and we are subject to the NYSE MKT’s listing standards set forth in the NYSE MKT Company Guide. Although we are not required to obtain shareholder approval under Nevada law in connection with the Draco Acquisition, we are required under Section 712 of the NYSE MKT Company Guide to seek stockholder approval of our proposed issuance of the Shares and the Compensation Shares at the closing of the Draco Acquisition.

Vote Required (See page ___).

Each share of our common stock outstanding on the Record Date for the determination of shareholders entitled to vote at the meeting will be entitled to one vote, in person or by proxy, on each matter submitted for the vote of stockholders. The approval of Proposal 4 requires the affirmative vote of the holders of a majority of the shares of our common stock casting votes in person or by proxy at the 2014 Annual Meeting. The number of such affirmative votes must be at least a majority of the required quorum for the 2014 Annual Meeting, which is 33 1/3% of our issued and outstanding shares of common stock on the Record Date.

When the Draco Acquisition is Expected to be Completed (See page __).

We currently anticipate that the Draco Acquisition will be completed within 10 business days following the 2014 Annual Meeting, assuming Proposal 4 is approved at the meeting.

Recommendation of Our Board of Directors as to Proposal 4

Our Board of Directors unanimously recommends that you vote FOR Proposal 4.

Opinion of Scalar Group, Inc. (See page ___)

Under the terms of the Share Exchange Agreement as executed in April 2014, we were initially seeking to acquire 100% of Draco’s outstanding stock in exchange for shares of our common stock and a warrant to purchase additional shares. Scalar Group, Inc. (dba Scalar Analytics) referred to as Scalar, previously delivered its opinion to our Board of Directors that as of July 2, 2014, and based upon and subject to the factors and assumptions set forth therein, the initial consideration we were to issue in Draco in exchange for 100% of Draco’s outstanding capital stock was fair, from a financial point of view, to the holders of our common stock, on the basis of and subject to the procedures followed, assumptions made, qualifications and limitations on the review undertaken and other matters considered by Scalar in preparing its opinion. Once the parties agreed to a modification in the terms of the Share Exchange Agreement to reduce the percentage of equity interest in Draco we were seeking to acquire to 31.37% of Draco’s outstanding capital stock and to amend the consideration we will issue in the transaction as evidenced by the September 22, 2014 amendment, our Board did not seek an update of the fairness opinion from Scalar.

Scalar’s opinion only addressed the fairness from a financial point of view to our common stockholders, as of July 2, 2014, of the initial acquisition consideration and did not address any other aspect or implication of Draco or the Draco Acquisition, including the modification to the terms of the Draco Acquisition set forth in the September 22, 2014 amendment to the Share Exchange Agreement. The summary of Scalar’s opinion in this proxy statement is qualified in its entirety by reference to the full text of its written opinion, which is included as Appendix C to this proxy statement and sets forth the procedures followed, assumptions made, qualifications and limitations on the review undertaken and other matters considered by Scalar in preparing its opinion. However, Scalar’s opinion and the related analyses set forth in this proxy statement are not intended to be, and do not constitute, a recommendation to our Board of Directors or any stockholder as to how to act or vote with respect to Proposal 4 or related matters.

Interests of the Company’s Executive Officers and Directors in the Draco Acquisition (See page __).

We do not believe that any of our officers or directors have any interests in the Draco Acquisition, other than their interests as our stockholders generally, that are different from your interests as an Armco stockholder. However, we have entered into various transactions with Metawise, Draco and their affiliates which are described later in this proxy statement.

Interests of the Finders (See page ____).

At the closing of the Draco Acquisition, China Direct Investments, Inc. and Shanghai Heqi Investment Center (Limited Partner) will each be issued 2,400,000 shares of our common stock as compensation for acting as finders in the Draco Acquisition, the payment of which is contingent upon the closing of the Draco Acquisition. We have contractual relationships with each of these entities.

Conditions That Must Be Satisfied or Waived for the Draco Acquisition to Occur (See page __).

As more fully described in this proxy statement and in the Share Exchange Agreement, the completion of the Draco Acquisition depends on a number of conditions being satisfied or, where legally permissible, waived. These conditions include, among others,

|

|

● |

the approval of Proposals 3 and 4 at the 2014 Annual Meeting, |

|

|

● |

the absence of any injunction prohibiting the consummation of the Draco Acquisition and absence of any legal requirements enacted by any court or other governmental entity since the date of the Share Exchange Agreement that remain in effect prohibiting consummation of the Draco Acquisition, |

|

|

● |

the continued listing of our common stock on the NYSE MKT, and |

|

|

● |

the lack of any material adverse change in our business and operations. |

Regulatory Approvals (see page __).

We do not believe that any material regulatory approvals, filings, or notices are required in connection with the Draco Acquisition other than the approvals, filings, or notices required under the federal securities laws and the approvals of NYSE MKT for the continued listing of our common stock and the listing of the Acquisition Shares and the Compensation Shares.

PROPOSAL 1

ELECTION OF DIRECTORS

The Board, upon recommendation by the Nominating and Corporate Governance Committee, has nominated Messrs. Kexuan Yao, William Thomson, Kam Ping Chan, Songqiang Chen and Shiqing Yue for election as directors, each to hold office until the 2015 annual meeting of stockholders or until his successor has been duly elected and qualified.

Our current Board is comprised of Messrs. Yao, Thomson and Chen, as well as Weigang Zhao and Weiping Shen. The terms as directors of each of Messrs. Zhao and Shen will expire at the 2014 Annual Meeting and neither of these directors is standing for re-election. In their places, Messrs. Chen and Yue were nominated as directors. Mr. Chen is Chief Executive Officer of both Metawise and Draco. Mr. Yue has no pre-existing relationship with our company, Metawise or Draco and was selected by the Nominating and Corporate Governance Committee to serve as an independent director.

The following is biographical information on the current members of our Board of Directors who are standing for re-election, as well as the director nominees:

Directors Standing for Re-Election

|

Name |

Age |

Positions |

Director Since |

|

Kexuan Yao |

42 |

Chairman, Chief Executive Officer |

2008 |

|

William Thomson |

72 |

Director |

2009 |

|

Kam Ping Chan |

62 |

Director |

2010 |

Kexuan Yao. Mr. Yao has served as the Chairman of the Board of Directors and Chief Executive Officer since June 2008. Mr. Yao has served as the Chairman and General Manager of our Armco Metals International Limited subsidiary (“Armco HK”) since its inception in 2001. From 1996 to 2001, Mr. Yao served as the General Manager of the Tianjian Branch for Zhengzhou Gaoxin District Development Co., Ltd., a Chinese metal distribution business. While at Zhengzhou Gaozin District Development Co., Ltd., his main responsibility was the management of the iron ore import department, which coordinated the delivery of iron ore from around the world into China. Mr. Yao received a bachelor’s degree from Henan University of Agriculture in 1996 and obtained an EMBA degree from the China Europe International Business School (CEIBS) in 2012.

William Thomson. Mr. Thomson has been a member of our Board of Directors since July 2009. Mr. Thomson is a managing partner of Mercana Growth Partners since 2009, a leading merchant banking and crisis management company. Prior to 2009, he was the president of Thomson Associates Inc. for more than 30 years. Mr. Thomson sits on the board of directors of the following publicly-listed companies: Asia Bio Chem Group Co. Ltd. since 2008, Chile Mining Technologies Inc. since 2010, China Armco Metals Inc. since 2009 and the Score Inc. since 2004. During the past 10 years, Mr. Thomson was previously on the board of directors of the following public companies: Atlast Pain & Injury Solutions Inc. from June 2006 to March 2007, Acto Digital Video Systems Inc. from December 2003 to January 2004, China Automotive Systems Inc. from September 2003 to July 2010, Greater China Capital Inc. from February 2010 to February 2012, Imperial Plastech Inc. from November 2002 to January 2005, Industrial Minerals Inc. from March 2007 to June 2009, JITE Technologies Inc. from September 2005 to February 2007, Maxus Technologies Inc. from February 2004 to June 2010, Med Emerg International Inc. from February 1998 to May 2004, Open EC Technologies Inc. from November 2005 to November 2009 and YTW Weslea Growth Capital Corp. From October 2004 to September 2005, Mr. Thomson received his Bachelors’ Degree in Business Commerce from Dalhousie University in 1961, and became a Chartered Accountant affiliated with the Institute of Chartered Accountants in 1963.

Kam Ping Chan Mr. Chan has been a member of our Board of Directors to since September 2010. Since 1994, Mr. Chan has been the Chairman and Executive Director of PNK International, Ltd. and Beston Holdings Group, Ltd. which are engaged in the distribution of metal and metal ore. From 2003 to 2004 Mr. Chan was the Director of International Mineral Limited, an iron ore company, which was acquired by the CITIC PACIFIC in 2004. International Mineral Ltd. was engaged in iron ore exploration and production. From 1989 to 1994, Mr. Chan managed the trading department of Prosperous Enrich, Ltd. which was engaged in importing minerals and ore into the Asian market. From 1985 to 1988 Mr. Chan served as a trader at Cargill Limited in Hong Kong. Mr. Chan graduated from China Fujian Teachers University in 1976 with a Bachelors degree in English.

Director Nominees

|

Name |

Age |

|

Songqiang Chen |

52 |

|

Shiqing Yue |

59 |

Songqiang Chen. Mr. Chen has been Chief Executive Officer of Draco since its formation in August 2013. He has also served as Chairman of Metawise since May 1997 and Chief Executive Officer of its subsidiary Metamining, Inc. since September 2007. Mr. Chen is responsible for the management and development of Metawise Group’s portfolio of mineral comprising iron ore and metallurgical coal reserves. Mr. Chen has extensive business networks in China and other Asian countries in respect to the supply of raw commodities. Mr. Chen immigrated from China in 2002 where he completed 20 years’ experience in general management and procurement roles in provincial government enterprise, including from February 2000 until May 2002 he was Chief Executive Officer of Zhong Yuan Guo Mao, Inc., a Henan, China-based conglomerate, from August 1993 until February 2000 he was Chief Executive Officer of ZhengZhou Fa Zhan, Inc., a Henan, China-based international trading and real estate developer, from May 1990 until June 1993 he was Chief Executive Officer of Zhongguo Guoshang, Inc., a Beijing, China-based international commodities trading firm, and from March 1987 until April 1990 he was Chief Executive Officer of ZhongYuan Kuangchan NaiCai, Inc., a Henan, China-based mining and international trading company. Mr. Chen received a Bachelor of Science from Zhong Zhou University in China.

Shiqing Yue. Mr. Yue is an attorney and has been in private practice since establishing his general practice law office in 2002 in Flushing, New York. He practices law both in the Federal courts and in the courts of the State of New York and his practice involves corporate counseling, reorganization, investment, immigration and civil litigation for clients located both locally and in mainland China, Hong Kong and Taiwan. From 2008 until 2009 he served as a legal consultant for the Shaanxi Fellow Association in America. Mr. Yue received a B.A. from Xian Foreign Language Institute in 1982, a graduate diploma from the China Political Science & Law University, School of Law, in Bejing, China in July 1998 and a J.D. from St. John’s University School of Law, Jamaica, New York in January 2000.

There are no family relationships between any of the directors.

Required Vote

The five candidates receiving the highest number of affirmative votes at the 2014 Annual Meeting will be elected directors. As the election of Messrs. Chen and Yue is not contingent upon the approval of Proposal 4 described later in this report, it is possible that these director nominees will be elected to our Board of Directors even if our stockholders do not approve the acquisition of Draco. Abstentions, broker non-votes and withheld votes will have no effect on the outcome of the vote. In the event any director nominee is unable or unwilling to serve as a director, the individual named as proxy on the proxy card will vote the shares that he represents for election of such other person as the Board of Directors may recommend. The Board has no reason to believe that any director nominee will be unable or unwilling to serve.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" ELECTION

OF THE DIRECTOR NOMINEES.

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT OF MALONEBAILEY LLP

The Audit Committee has appointed MaloneBailey LLP as our independent registered public accounting firm to audit our consolidated financial statements for the fiscal year ending December 31, 2014. Representatives of MaloneBailey LLP will be present at the annual meeting and will have an opportunity to make a statement or to respond to appropriate questions from stockholders. Although stockholder ratification of the appointment of our independent auditor is not required by our by-laws or otherwise, we are submitting the selection of MaloneBailey LLP to our stockholders for ratification to permit stockholders to participate in this important corporate decision. If not ratified, the Audit Committee will reconsider the selection, although the Audit Committee will not be required to select a different independent auditor for our company. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a changes would be in our best interests.

Fees and Services

The following table shows the fees that were billed for the audit and other services provided by MaloneBailey LLP for 2013 and Li & Company, PC, our former auditor, for 2013 and 2012.

|

2013 |

2012 |

|||||||

|

Audit Fees |

$ | 170,000 | $ | 137,500 | ||||

|

Audit-Related Fees |

- | - | ||||||

|

Tax Fees |

7,500 | 7,500 | ||||||

|

All Other Fees |

12,500 | 3,950 | ||||||

|

Total |

$ | 190,000 | $ | 148,950 | ||||

Audit Fees — This category includes the audit of our annual financial statements, review of financial statements included in our Quarterly Reports on Form 10-Q and services that are normally provided by the independent registered public accounting firm in connection with engagements for those fiscal years. This category also includes advice on audit and accounting matters that arose during, or as a result of, the audit or the review of interim financial statements.

Audit-Related Fees — This category consists of assurance and related services by the independent registered public accounting firm that are reasonably related to the performance of the audit or review of our financial statements and are not reported above under “Audit Fees.” The services for the fees disclosed under this category include consultation regarding our correspondence with the Securities and Exchange Commission and other accounting consulting.

Tax Fees — This category consists of professional services rendered by our independent registered public accounting firm for tax compliance and tax advice. The services for the fees disclosed under this category include tax return preparation and technical tax advice.

All Other Fees — This category consists of fees for other miscellaneous items.

Our Board of Directors has adopted a procedure for pre-approval of all fees charged by our independent registered public accounting firm. Under the procedure, the Audit Committee of the Board approves the engagement letter with respect to audit, tax and review services. Other fees are subject to pre-approval by the Audit Committee of the Board. The audit and tax fees paid to the auditors with respect to 2013 were pre-approved by the Audit Committee of the Board of Directors.

Vote Required

The ratification of the appointment of MaloneBailey LLP will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE RATIFICATION

OF THE APPOINTMENT OF MALONEBAILEY LLP.

PROPOSAL 3

APPROVAL OF AN AMENDMENT TO OUR ARTICLES OF INCORPORATION

TO INCREASE AUTHORIZED COMMON STOCK CAPITAL STOCK OF THE COMPANY

At the 2014 Annual Meeting we are asking our stockholders to approve an Amendment to our Articles of Incorporation to increase the number of authorized shares of our common stock. Currently, our authorized capital stock consists of 74,000,000 shares of common stock, par value $0.001 per share, and 1,000,000 shares of preferred stock, par value $0.001 per share. On September [22], 2014, our Board of Directors approved an Amendment to our Articles of Incorporation to increase the number of our authorized shares of common stock from 74,000,000 shares to 200,000,000 shares, and recommended that our stockholders approve this Amendment. At September [22], 2014 we had [55,318,954] shares of our common stock and no shares of preferred stock issued and outstanding. The following table provides information on our shares of common stock which are currently authorized, issued and outstanding, and reserved for issuance as of the date of this proxy statement:

|

September [22], 2014 |

||||||||

|

No. of shares of common stock |

% of authorized |

|||||||

|

Authorized |

74,000,000 | |||||||

|

Issued and outstanding |

55,318,954 | 75 | % | |||||

|

Reserved for issuance underlying outstanding options and warrants |

1,615,387 | 2 | % | |||||

|

Reserved for new grants under the 2009 Stock Incentive Plan |

245,379 |

≤1 |

% | |||||

|

Reserved for possible conversion of the convertible notes |

6,069,621 | 8 | % | |||||

|

Unissued, unreserved shares |

10,750,659 | 15 | % | |||||

Purpose and Effect of the Amendment

The proposed increase in the number of shares of our authorized common stock will provide sufficient shares to issue to in conjunction with the closing of the Draco Acquisition (should Proposal 4 be approved) and the increase in the number of shares of common stock reserved under our 2009 Stock Incentive Plan (should Proposal 5 be approved). The proposed increase in the number of our authorized shares of common stock will also provide us with the ability to issue such stock for a variety of corporate purposes, including debt or equity capital raising transactions, acquisitions or other business development efforts, or other proper corporate purposes. Our Board of Directors reviews and evaluates potential capital raising activities, transactions and other corporate actions on an ongoing basis to determine if such actions would be in the best interests of our company and our stockholders.

Other than in connection with the issuance of shares of our common stock in conjunction with the closing of the Draco Acquisition (should Proposal 4 be approved) and the increase in the number of shares of common stock reserved under our 2009 Stock Incentive Plan (should Proposal 5 be approved), we have no present plan, agreement or understanding involving the issuance of our capital stock except for those shares which are presently reserved as set forth above. However, our Board of Directors believes that the availability of the additional shares for such purposes would be beneficial, because it will enhance our ability to respond promptly to any opportunities without the possible delay and significant expense of calling and holding a special meeting of stockholders to increase authorized capital.

The additional common stock to be authorized by adoption of the proposed Amendment to our Articles of Incorporation would have rights identical to our currently outstanding common stock. The proposed increase in the number of shares of common stock will not change the number of shares of stock outstanding, the par value of our common stock, nor the number of authorized shares of our preferred stock. However, to the extent that the additional authorized shares are issued in the future, including in conjunction with the closing of the Draco Acquisition (should Proposal 4 be approved) and new grants made under the 2009 Stock Incentive Plan (should Proposal 5 be approved), they may decrease the percentage equity ownership of existing stockholders and, depending on the price at which they are issued, may dilute earnings and book value on a per share basis. Our stockholders have no preemptive rights to subscribe for additional shares of common stock when issued, which means that current stockholders do not have a prior right to purchase any newly-issued shares in order to maintain their proportionate ownership of our common stock.

Filing of the Amendment in Nevada

If this Proposal 3 is approved, the increase in our authorized common stock will become effective upon filing of the Amendment to our Articles of Incorporation with the Secretary of State of the State of Nevada. The Amendment will amend and restate the text of Paragraph (a) of Article IV of our Articles of Incorporation to read as follows:

ARTICLE IV

(a) The Corporation shall be authorized to issue the following shares:

|

Class |

Number of Shares |

Par Value |

|

Common |

200,000,000 |

$.001 |

|

Preferred |

1,000,000 |

$.001 |

If the stockholders approve this Proposal 3, at any time prior to the filing of the Amendment with the Secretary of State of the State of Nevada, the Board may abandon the Amendment without further action by the our stockholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE APPROVAL OF THE AMENDMENT INCREASING THE NUMBER OF AUTHORIZED SHARES OF OUR COMMON STOCK.

PROPOSAL 4

APPROVAL OF THE ISSUANCE OF SECURITIES

IN CONNECTION WITH THE ACQUISITION OF 31.37% OF DRACO RESOURCES, INC.

At the 2014 Annual Meeting we are asking our stockholders to approve the issuance of securities in exchange for 31.37% of Draco and as compensation to finders in the transaction as described below, including:

|

|

● |

40,000,000 Acquisition Shares, and |

|

|

● |

4,800,000 Compensation Shares to be issued to China Direct Investments, Inc. and Shanghai Heqi Investment Center (Limited Partner) as finder’s fees. |

Summary of the Share Exchange Agreement

The following description summarizes the material terms of the Share Exchange Agreement. However, it may not contain all of the information that may be important to your consideration of the proposed issuance of the Acquisition Shares and the Compensation Shares. We encourage you to read the Share Exchange Agreement in full, a copy of which is attached as Appendix B.

The description of the Share Exchange Agreement in this proxy statement has been included to provide you with information regarding its terms, and we recommend that you read carefully the Share Exchange Agreement in its entirety. Except for its status as the contractual document that establishes and governs the legal relations among the parties with respect to the Draco Acquisition, we do not intend for its text to be a source of factual, business, or operational information about Armco or Draco. That kind of information can be found elsewhere in this proxy statement. The Share Exchange Agreement contains representations and warranties of the parties as of specific dates and may have been used for the purposes of allocating risk between the parties other than establishing matters as facts. Those representations and warranties are qualified in several important respects, which you should consider as you read them in the Share Exchange Agreement, including contractual standards of materiality that may be different from what may be viewed as material to stockholders. Only the parties themselves may enforce and rely on the terms of the Share Exchange Agreement. As Armco stockholders, you are not third party beneficiaries of the Share Exchange Agreement and therefore may not directly enforce or rely upon its terms and conditions and you should not rely on its representations, warranties, or covenants as characterizations of the actual state of facts or condition of Armco, Draco, Metawise, the Metawise Nominees or any of their respective affiliates. Moreover, information concerning the subject matter of the representations and warranties may have changed since the date of the Share Exchange Agreement and subsequently developed or new information qualifying a representation or warranty may have been included in this proxy statement.

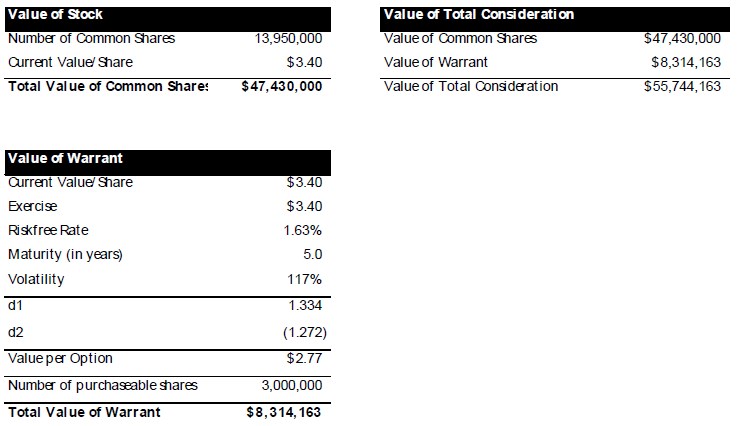

On April 15, 2014 we entered into a Share Exchange Agreement with Draco and the Metawise Nominees pursuant to which we agreed to acquire initially 100% of the outstanding capital stock of Draco in exchange for 12,750,000 shares of our common stock (giving proforma effect to a 1:10 reverse stock split of our common stock) and a five year common stock purchase warrant to purchase 3,000,000 (post-split) shares of our common stock at an exercise price of $3.40 (post-split) per share. On May 7, 2014 we entered into an amendment to the Share Exchange Agreement with Draco and the Metawise Nominees to add Metawise, the current sole shareholder of Draco, as a party. On August 25, 2014 we further amended the terms of the Share Exchange Agreement to provide that we agreed to acquire 40% of the outstanding capital stock of Draco from Metawise in exchange for 51,000,000 Acquisition Shares. This amendment removed the requirement for our company to understand the reverse stock split and also amended the terms related to the payment of the finders fees. Finally, on September 22, 2014 we entered into the third amendment of the Share Exchange Agreement which reduced the percentage of Draco we are seeking to acquire to 31.37% and reduced the number of Acquisition Shares to be issued to 40,000,000.

At the closing of the Draco Acquisition, we will also issue an aggregate of 4,800,000 Compensation Shares to China Direct Investments, Inc. and Shanghai Heqi Investment Center (Limited Partner) as finder’s fees to those entities.

Our Board of Directors approved the Share Exchange Agreement on April 15, 2014, on August 25, 2014 it approved the second amendment which modified the terms of the Draco Acquisition and on September 22, 2014 it approved the third amendment which further modified the terms of the Draco Acquisition. As described elsewhere herein, a condition precedent to the closing of the Draco Acquisition is the continued listing of our common stock on the NYSE MKT. Under the original structure, we were required to obtain prior stockholder consent for the closing of the Draco Acquisition under Section 712 of the NYSE MKT Company Guide as the issuance of shares of our common stock in the acquisition would have been in excess of 20% of our outstanding common stock, as well as under Section 713 as the issuance of the shares would have resulted in a change of control of our company and the Draco Acquisition would have been treated as a reverse merger. Based upon our informal discussions with the Exchange, we were advised that the Exchange would not approve the continued listing of our common stock following the Draco Acquisition based upon the original terms of the transaction and, accordingly, we restructured the transaction pursuant to the second amendment which reduced the percentage of Draco we were seeking to acquire as well as the number of shares we would issue as consideration. Subsequent, and as a result of further informal discussions with the Exchange, we were advised that the Exchange would not continue the listing of our common stock following the Draco Acquisition based upon the revised structure. As a result, we entered into the third amendment which further reduced the percentage of Draco we are seeking to acquire as well as the number of Acquisition Shares we are proposing to issue. While we are still required to obtain stockholder approval for the issuance of the Acquisition Shares and the Compensation Shares in order to comply with Section 712 of the NYSE MKT Company Guide, we do not believe the restructured transaction will be accounted for as a reverse acquisition.

The Share Exchange Agreement contains covenants by the parties, including:

|

|

● |

each party agreed to provide access to the other parties books and records for the purposes of performing customary due diligence, and the closing of the Draco Acquisition is subject to the satisfaction of each party of such due diligence, |

|

|

● |

each party is obligated to pay its own expenses in connection with the preparation of the Share Exchange Agreement and the consummation of the Draco Acquisition, and |

|

|

● |

each party agreed to use its best efforts to consummate the closing of the Draco Acquisition. |

If the conditions to completion of the Share Exchange Agreement are satisfied or waived in accordance with its terms, we will acquire 31.37% of the currently outstanding common stock of Draco from Metawise. Thereafter, we will own a non-controlling minority interest in Draco. The shares of Draco’s capital stock are privately held and not traded in a public market.

Following the completion and as a result of the Draco Acquisition, if consummated, the Acquisition Shares will constitute approximately 40% of our then outstanding common stock, assuming we issue no additional shares between the date of this proxy statement and the closing of the Draco Acquisition, and the Compensation Shares will represent 4.8% of our outstanding shares.

The approval by our stockholders of the issuance of the Acquisition Shares is a condition to the closing of the Draco Acquisition in order to comply with NYSE MKT listing rules, as further described below. In the event that both Proposal 3 and Proposal 4 are not approved at the 2014 Annual Meeting, we will not be able to consummate the Draco Acquisition, and the Share Exchange Agreement will be terminated. A copy of the Share Exchange Agreement is attached as Appendix B to this proxy statement.

Parties to the Share Exchange Agreement

Armco

Armco Metals Holdings, Inc. is a publicly traded Nevada corporation. We engage in the business of metal ore trading and distribution and scrap metal recycling. Our operations are conducted primarily in China. In our metal ore trading and distribution business, we import, sell and distribute to the metal refinery industry in China, a variety of metal ore that includes iron, chrome, nickel, copper, titanium and manganese ore, as well as non-ferrous metals, and coal. We obtain these raw materials from global suppliers primarily in Brazil, India, Indonesia, Ukraine and the United States and distribute them in China. In addition, we provide sourcing and pricing services for various metals to our network of customers. In our scrap metal recycling business, we recycle scrap metal at our recycling facility and sell the recycled product to steel mills in China for use in the production of recycled steel. Our recycling facility commenced formal operations in the third quarter of 2010, and is located in Banqiao Industrial Zone, part of Lianyungang Economic Development Zone, in the Jiangsu province of China.

Our principal executive offices are located at One Waters Park Drive, Suite 98, San Mateo, CA 94403, and our telephone number is (650) 212-7620.

For a description of our history and development, business and organizational structure, see our 2013 10-K. See “Where You Can Find Additional Information” for a description of how to obtain a copy of our 2013 10-K and other SEC filings.

Draco

Draco is a wholly-owned subsidiary of Metawise. Draco was formed as a line of business within Metawise on January 1, 2010 when Metawise started to investigate the possibility of acquiring the title to iron ore fines in Alabama. Draco’s business model is to supply key raw materials to the Chinese steel industry and it will initially operate as a mineral trading company, acting as a reseller of iron ore fines for Metawise. Metawise has certain rights to sell up to 5 million metric tons of iron ore fines, which we refer to as the “Material,” under an agreement with a third party that owns the Material. On April 2, 2014 Metawise and Draco entered into a Commodities Purchase Agreement related to the Material pursuant to which Draco will act as a reseller of the Material and it will generate revenues based upon the difference between the sales price of the Material to third parties and what it pays Metawise for the Material. On June 23, 2014, Draco, Metawise and certain of the Metawise Nominees entered into a Security Pledge Agreement pursuant to which the Metawise Nominees, who are parties to this agreement, pledged the net profit gains from the Greenfield Agreements and all of their voting rights related thereto to Draco. The pledge, which is limited to any operations of Metawise associated with the Greenfield Agreements, remains in effect so long as the Greenfield Agreements are in effect.

Draco’s principal executive offices are located at 1065 E. Hillside Boulevard, Suite 315, Foster City, CA 94404 and its telephone number is (650) 212-7900.

The Board of Directors of Metawise approved the Share Exchange Agreement on April 15, 2014.

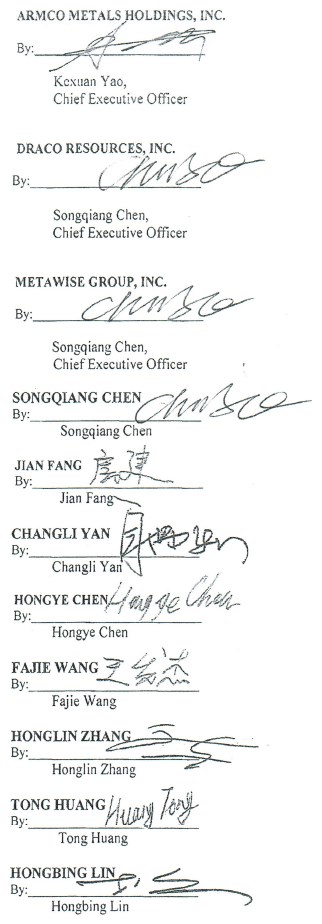

Shareholder of Draco and the Metawise Nominees

Draco’s common stock, which is its only class of equity securities, is currently owned by Metawise. Immediately following the closing of the Draco Acquisition, Metawise will distribute the Acquisition Shares to the following individuals in the percentages set forth opposite their respective names below. We refer to these individuals as the “Metawise Nominees.” After this distribution, Metawise will not own any of the Acquisition Shares.

|

Metawise Nominee |

% of Acquisition Shares to be Distributed by Metawise |

|||

|

Songqiang Chen |

39.6424 |

% | ||

|

Jian Fang |

13.7255 |

% | ||

|

Changli Yan |

12.5490 |

% | ||

|

Hongye Chen |

11.7647 |

% | ||

|

Fajie Wang |

11.7647 |

% | ||

|

Honglin Zhang |

4.8941 |

% | ||

|

Tong Huang |

4.4047 |

% | ||

|

Hongbing Lin |

1.2549 |

% | ||

| 100.0 |

% | |||

Metawise does not presently own any of our securities We have, however, from time to time entered into transactions with Metawise, an affiliate of Metawise, and Draco, including:

● on November 7, 2013 we borrowed $550,000 from Metawise under the terms of a loan agreement. We used the proceeds for working capital. The unsecured loan, which had an initial term of three months, bears interest at 8% per annum, with interest payable upon maturity. The maturity date may be extended for additional three month periods providing that the lender does not provide notice to us two weeks prior to the then maturity date of the inability to extend. At September 22, 2014 we owed Metawise the principal and all accrued interest under this loan;

● on December 23, 2013 we borrowed $500,000 from Kelson Management Inc., an entity controlled by Mr. Song Qiang Chen, under the terms of a loan agreement. We used the proceeds for working capital. The unsecured loan, which had an initial term of one month, bears interest at 8% per annum, with interest payable upon maturity. The maturity date may be extended for additional three month periods providing that the lender does not provide notice to us two weeks prior to the then maturity date of the inability to extend. At September 22, 2014 we owed Kelson Management Inc. $240,000 of the principal and together with accrued interest under this loan,

● on May 22, 2014 we entered into a sales and purchase contract with Draco pursuant to which we agreed to purchase 880 metric tons of mixed metals scraps for a total purchase price of $1,320,000. Under the terms of the agreement, we were obligated to prepay 60% of the purchase price in advance, with the balance due 60 days after the mixed metal scraps arrived in China. The contract was fulfilled during the second quarter of 2014; and

● between June 13, 2014 and July 14, 2014 Draco lent us $55,000 for working capital. The advances are unsecured, interest free and due on demand.

Because the sole shareholder of Draco is a party to the Share Exchange Agreement, there is no additional approval requirement by Metawise in respect of the Draco Acquisition.

Relationships of the Metawise Nominees to Metawise and Armco

Mr. Songqiang Chen is the Chief Executive Officer, a member of the Board of Directors and a principal shareholder of Metawise. Each of the Metawise Nominees is a shareholder of Metawise.

Conditions Precedent to the Closing of the Draco Acquisition

The consummation of the Draco Acquisition is subject to the satisfaction of certain conditions, including:

|

|

● |

the representations and warranties of each of Armco, Draco, Metawise and the Metawise Nominees in the Share Exchange Agreement being true and correct in all material respects as of the date made and as of the closing date of the Draco Acquisition, as though made at that time; |

|

|

● |

each party shall have performed in all agreements and satisfied all conditions obligations required to be performed or satisfied by them under the Share Exchange Agreement at or before the closing date of the Draco Acquisition; |

|

|

● |

no statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed by any court or governmental authority of competent jurisdiction which prohibits the closing of the Draco Acquisition; |

|

|

● |

there shall have been no material adverse effect on the business, operations, properties, prospects or financial condition of either Armco or Draco, taken as a whole, or any change, event, circumstance, development, condition, or effect that has had or would reasonably be expected to have, individually or in the aggregate, a material adverse effect, as defined in the Share Exchange Agreement; and |

|

|

● |

our common stock shall be listed on the NYSE MKT. |

Accounting Treatment of the Draco Acquisition

We will use the equity method to account for investments in Draco which gives Armco the ability to exercise influence over operating and financial policies of the investee. Armco will include the proportionate share of earnings and/or losses of equity method investees in equity income (loss) — net in consolidated statements of income. The carrying value of our equity investment will be reported in equity method investments in our consolidated balance sheets.

Armco Stockholder Approval Requirements for Proposal 4

Our common stock is listed on the NYSE MKT, and we are subject to the NYSE MKT’s listing standards set forth in the NYSE MKT Company Guide. Although we are not required to obtain shareholder approval under Nevada law in connection with the Draco Acquisition, we are required under Section 712 of the NYSE MKT Company Guide to seek stockholder approval of our proposed issuance of the Acquisition Shares at the closing of the Draco Acquisition.

Section 712 requires stockholder approval prior to the issuance of securities to be issued as sole or partial consideration for an acquisition of the stock or assets of another company in where the present or potential issuance of common stock, or securities convertible into common stock, could result in an increase in outstanding common shares of 20% or more. The total shares proposed to be issued as consideration for 31.37% of Draco, including the Acquisition Shares and the Compensation Shares, is 44,800,000 shares, or approximately 81% of our outstanding shares of our outstanding common stock, based on the shares outstanding as of September [2], 2014 or approximately 44.7% of our outstanding shares of common stock that would be outstanding at the closing of the Draco Acquisition. Therefore, we are requesting stockholder approval for the issuance of the Acquisition Shares and the Compensation Shares under the NYSE MKT rules.

Regulatory Approvals

We do not believe that any material regulatory approvals, filings, or notices are required in connection with the Draco Acquisition other than the approvals, filings, or notices required under the federal securities laws and the approvals of NYSE MKT for the continued listing of our common stock and the listing of the Acquisition Shares and the Compensation Shares.

Appraisal Rights

Armco’s stockholders are not entitled to any appraisal rights in connection with the Draco Acquisition.

Armco’s Reasons for the Draco Acquisition

Our Board of Directors:

|

|

● |

has determined that the Share Exchange Agreement and Draco Acquisition are advisable, fair to, and in the best interests of, Armco and its stockholders; |

|

|

● |

has approved the Share Exchange Agreement and the Draco Acquisition; and |

|

|

● |

recommends that the Armco stockholders approve Proposal 4. |

In evaluating the Share Exchange Agreement and the Draco Acquisition, our Board of Directors considered a number of factors that supported its decisions and recommendations, including:

|

|

● |

We expect that Draco may generate gross profit of approximately $20.00 to $30.00 per metric ton on the Material it will purchase from Metawise based on the current spot price of iron ore, CFR China, |

|

|

● |

Draco has already shipped a vessel which contains 48,000 metric tons of iron ore to China. In the future, Draco plans to ship two to three vessels of iron ore to China per month. Using the proceeds from these sales, we expect to be able to further expand our mineral trading business and expect to provide additional working capital for our metal recycling operations, |

|

|

● |

Draco is a U.S.-based company that does not have offices in China. We expect to be able to provide human resources in China which Draco does not currently possess, and |

|

|

● |

We have been in the mineral trading business for many years and have many clients worldwide. |

Our Board of Directors also considered a variety of risks and other potentially negative factors concerning the Draco Acquisition. The material risks and potentially negative factors considered by our Board included:

|

|

● |

the immediate and substantial dilution of the equity interests and voting power of Armco’s current stockholders upon completion of the Draco Acquisition; |

|

● |

because we are acquiring a minority, non-controlling interest in Draco, our financial statements will only represent our portion of its assets, liabilities and net income (loss) from the closing date of the Draco Acquisition forward; | |

|

● |

the risk that our stockholders will not approval Proposal 3 increasing the number of authorized shares of our common stock. If Proposal 3 is not approved, we do not have sufficient authorized but unissued and unreserved shares of our common stock to close the Draco Acquisition even if our stockholders should approval this Proposal 4; |

|

|

● |

the risk that the NYSE MKT will not approve the continued listing of our common stock which would result in our inability to close the Draco Acquisition notwithstanding the possible approval of Proposal 3 and Proposal 4 by our stockholders; |

|

|

● |

the dilution to our stockholders as a result of the issuance of the Acquisition Shares and the Compensation Shares; |

|

|

● |

the risk that Draco may lose access to the Materials associated with the Greenfield Agreements with Metawise; |

|

|

● |

although our management believes the Draco Acquisition will have a positive effect on our business, is it possible that the issuance of a significant number of shares of our common stock will cause a decline in its price, and the increased size of our public float thereafter could adversely affect the price at which it trades; |

|

|

● |

the risk that the Draco Acquisition might not be completed in a timely manner, or at all, due to a failure to satisfy the closing conditions, some of which are outside of our control; |

|

|

● |

the risk of the potential adverse effect of the public announcement of any termination of the Share Exchange Agreement on our business, including our ability to attract new sources of capital, retain key personnel, and maintain its overall competitive position if the Draco Acquisition is not completed; |

|

|

● |

the risk that Draco’s revenue forecasts are not attained at the level or within the timeframe expected; |

|

|

● |

the risk of stockholder lawsuits that may be filed against Armco and/or our Board of Directors in connection with the Share Exchange Agreement; and |

|

|

● |

various other applicable risks associated with the business of Armco, Draco, and the combined company and the Draco Acquisition, including those described above in the section entitled “Risk Factors — Risks Related to Draco and the Draco Acquisition” beginning on page [•]. |

Our Board of Directors concluded, however, that these risks and potentially negative factors were outweighed by the potential benefits of the Draco Acquisition. The foregoing discussion and the discussion under “Background of the Draco Acquisition” are not intended to be exhaustive, but rather include the material factors considered by our Board of Directors in evaluating the proposed acquisition. Our Board of Directors oversaw the performance of financial and legal due diligence by our management and our advisors and conducted a review, evaluation, and negotiation of the terms and conditions of the Draco Acquisition on behalf of Armco. In view of the large number of factors considered by our Board of Directors in connection with the evaluation of the Draco Acquisition and the Share Exchange Agreement and the complexity of these matters, our Board of Directors did not consider it practicable, nor did it attempt, to quantify, rank, or otherwise assign relative weights to the specific factors it considered in reaching its decision, nor did it evaluate whether these factors were of equal importance. Rather, our Board of Directors made its recommendations based on the totality of information presented and the investigation it conducted. In addition, individual directors may have given different weight to the various factors.

In addition to determining that the Draco Acquisition is advisable and in the best interests of Armco and the Armco stockholders, our Board of Directors determined that the transaction was procedurally and substantively fair to the Armco stockholders. Our Board of Directors believes that a number of factors support the determination of procedural and substantive fairness to Armco and Armco’s stockholders, including the following:

|

|

● |

the unanimous recommendation of our Board in favor of the Share Exchange Agreement and the Draco Acquisition in light of the review of Draco’s business prospects by our management and advisors; |

|

|

● |

the fact that Armco has no obligation to effect the Draco Acquisition if a material adverse effect with respect to Draco’s business has occurred since the date of the Share Exchange Agreement; |

|

|

● |

the limited number and nature of the conditions to Draco’s obligation to complete the Draco Acquisition and the limited risk of non-satisfaction of such conditions; and |

|

|

● |

the belief that the terms of the Share Exchange Agreement, including the parties’ representations, warranties, and covenants, and the conditions to their respective obligations, are reasonable under the circumstances. |

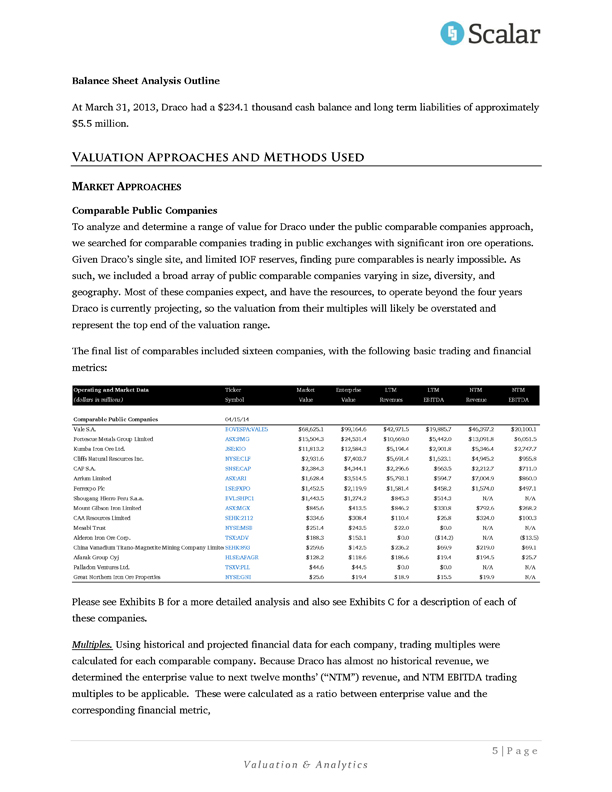

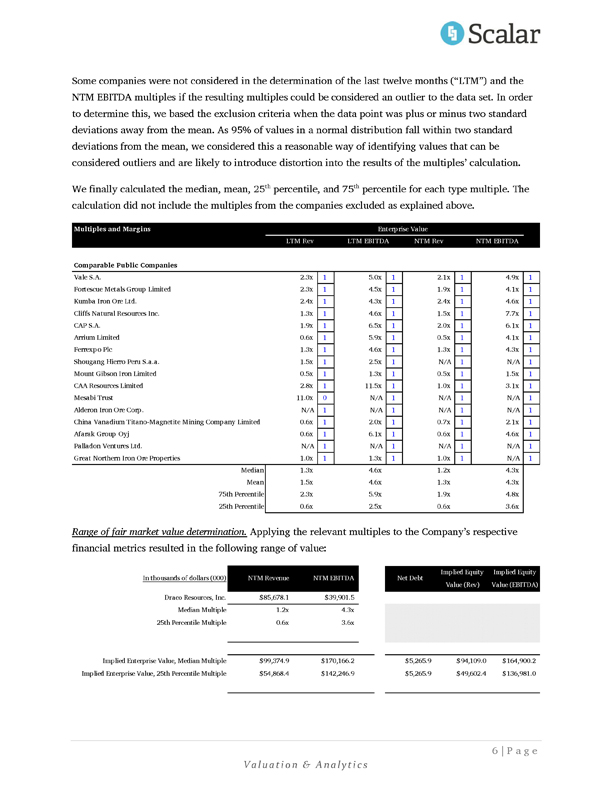

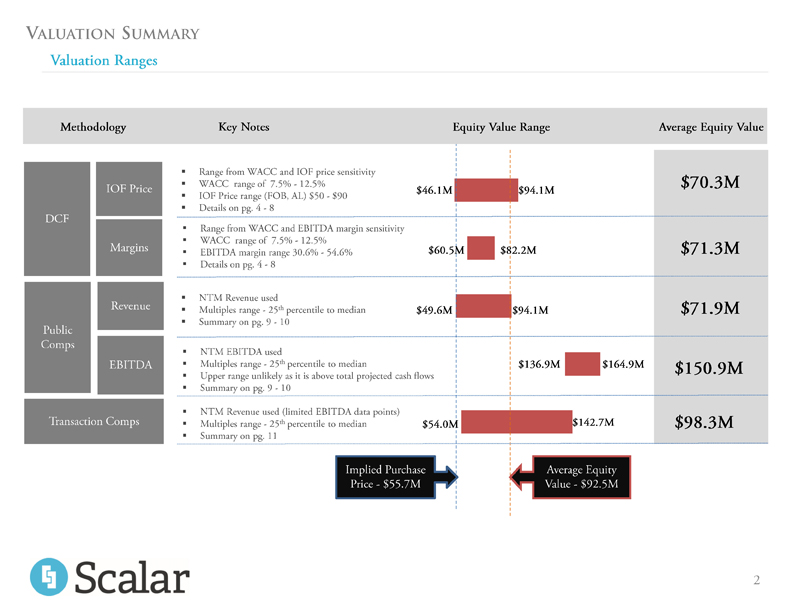

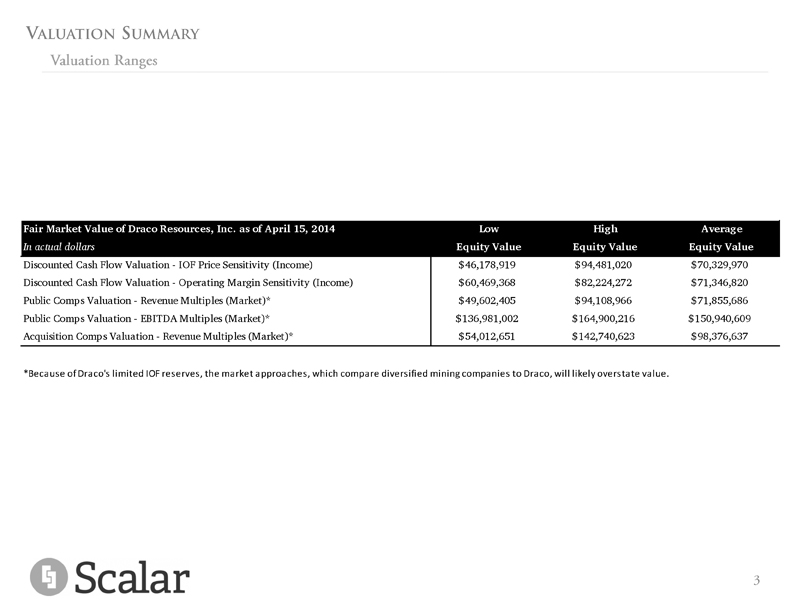

Opinion of Scalar Group, Inc. (dba Scalar Analytics) Financial Advisor to the Armco Board of Directors

Under the terms of the Share Exchange Agreement as initially executed in April 2014, we were seeking to acquire 100% of Draco’s outstanding stock in exchange for shares of our common stock and a warrant to purchase additional shares. On July 2, 2014 Scalar rendered its written opinion to the Board of Directors of Armco that, as of such date and based upon and subject to the factors, assumptions and limitations set forth in its written opinion and described below, the initial acquisition consideration in the Draco Acquisition was fair from a financial point of view to Armco’s stockholders. The full text of the written opinion of Scalar, which sets forth, among other things, the assumptions made, procedures followed, matters considered and limitation on the review undertaken in rendering its opinion, is attached to this proxy statement as Appendix C and incorporated by reference herein. The summary of Scalar opinion set forth in this proxy statement is qualified in its entirety by reference to the full text of the opinion. Stockholders should read this opinion carefully and in its entirety. Scalar’s opinion is directed to the Board of Directors of Armco, addresses only the fairness, from a financial point of view, of the initial acquisition consideration pursuant to the Share Exchange Agreement as of the date of the opinion, and does not address any other aspect of the Draco Acquisition or the relative merits of the proposed transaction compared to any alternative business strategy or transaction in which Armco might engage. The opinion of Scalar does not constitute a recommendation as to how any stockholder should vote with respect to Proposal 4. In addition, this opinion does not in any manner address the prices at which Armco’s common stock will trade following the completion of the transaction. Draco engaged Scalar to render its opinion for the benefit of Armco and paid all fees and costs associated with Scalar’s services.

In arriving at its opinion, Scalar, among other things, obtained the following financial information from Draco in connection with performing this analysis as of April 15, 2014, the date of the original Share Exchange Agreement:

|

● |

historical financial statements for the relevant time period, and |

|

● |

a projected income statement representing Draco management’s and our management’s estimates regarding future operations. |

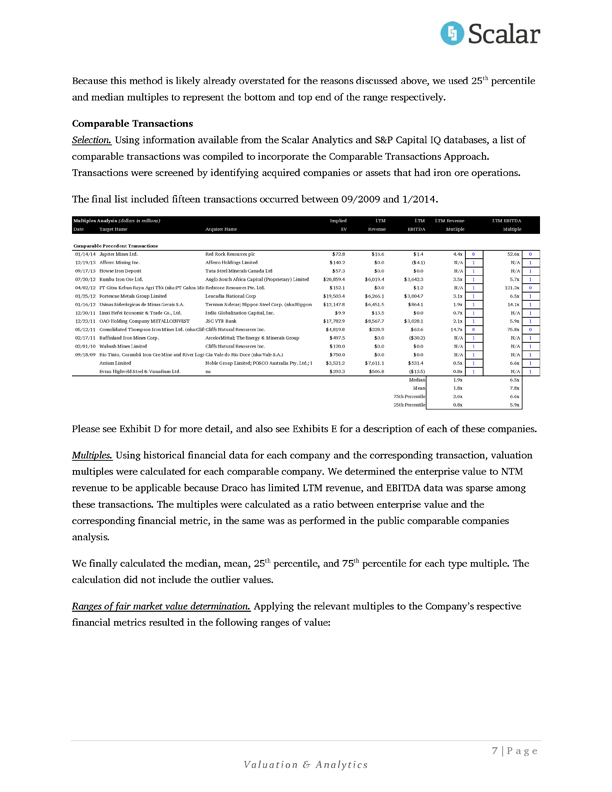

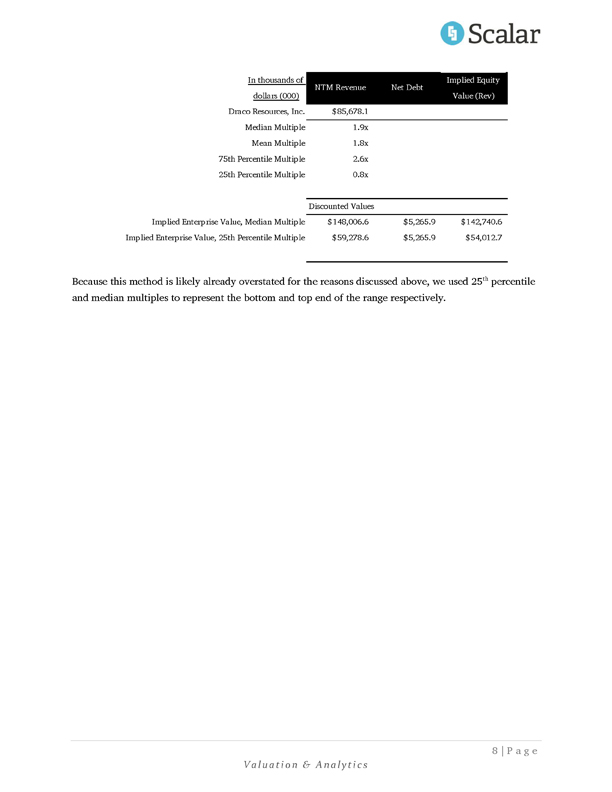

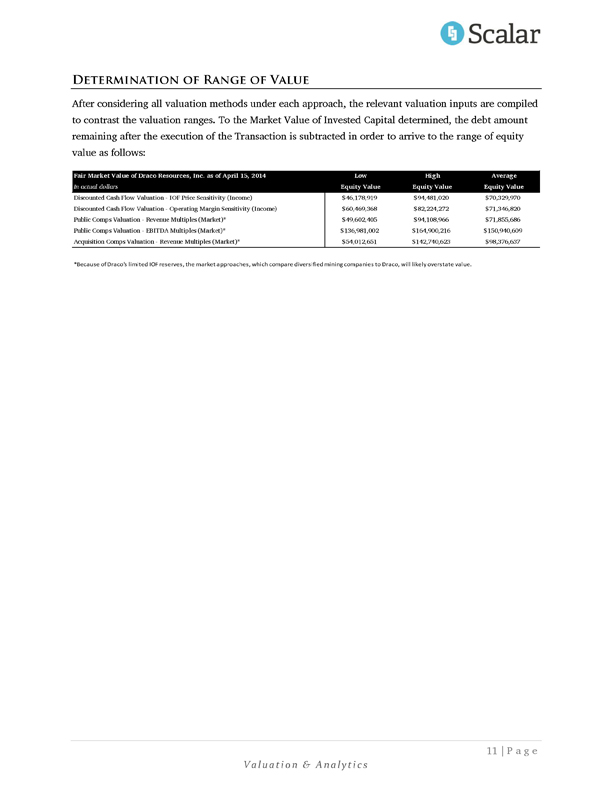

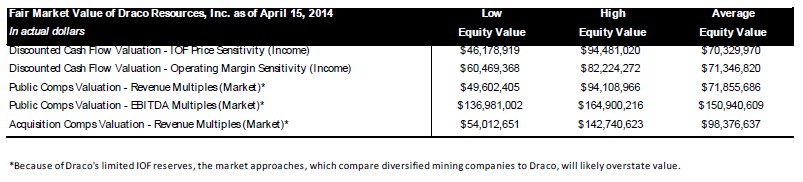

The following is a summary of certain of the financial analyses undertaken and information presented by Scalar in its fairness opinion dated July 2, 2014, which analyses were among those considered by Scalar in connection with delivering its fairness opinion. The fairness opinion was based upon the initial terms of the Share Exchange Agreement pursuant to which we agreed to acquire 100% of Draco. Once the parties agreed to a modification in the terms of the Share Exchange Agreement to reduce the percentage of equity interest in Draco we were acquiring to 31.37% and to amend the consideration we will issue in the transaction as evidenced by the September 22, 2014, our Board did not seek an update of the fairness opinion from Scalar.

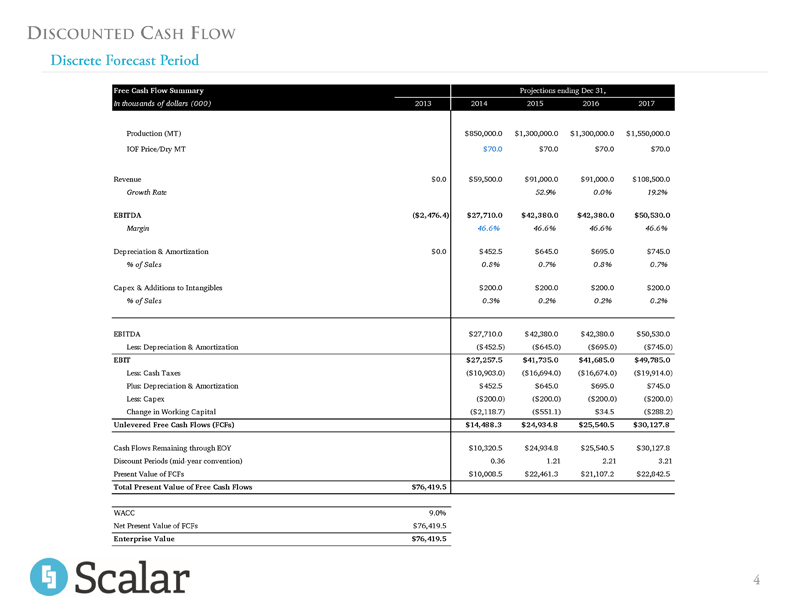

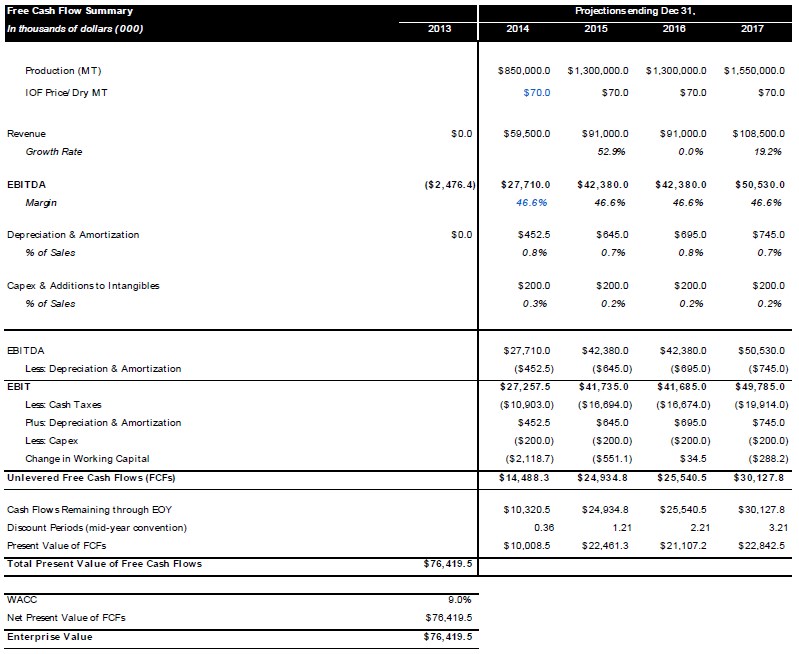

INCOME APPROACH

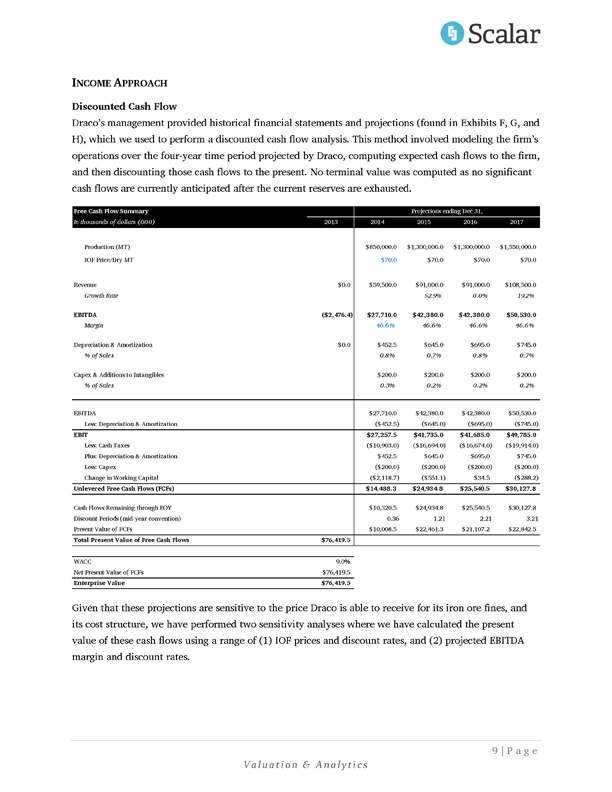

Discounted Cash Flow

Draco’s management provided historical financial statements and projections, which Scalar used to perform a discounted cash flow, or DCF, analysis. This method involved modeling Draco’s operations over the four-year time period projected by Draco, computing expected cash flows to the company, and then discounting those cash flows to the present. No terminal value was computed as no significant cash flows are currently anticipated after the current reserves are exhausted.

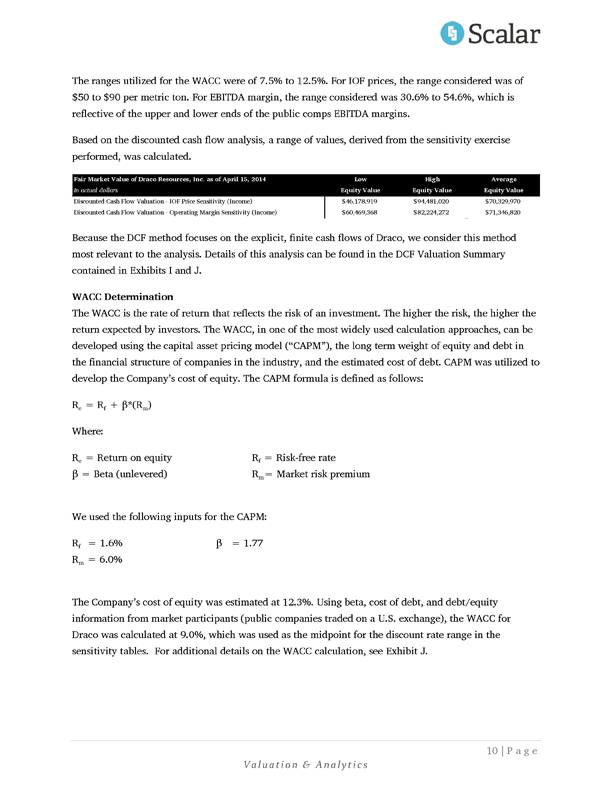

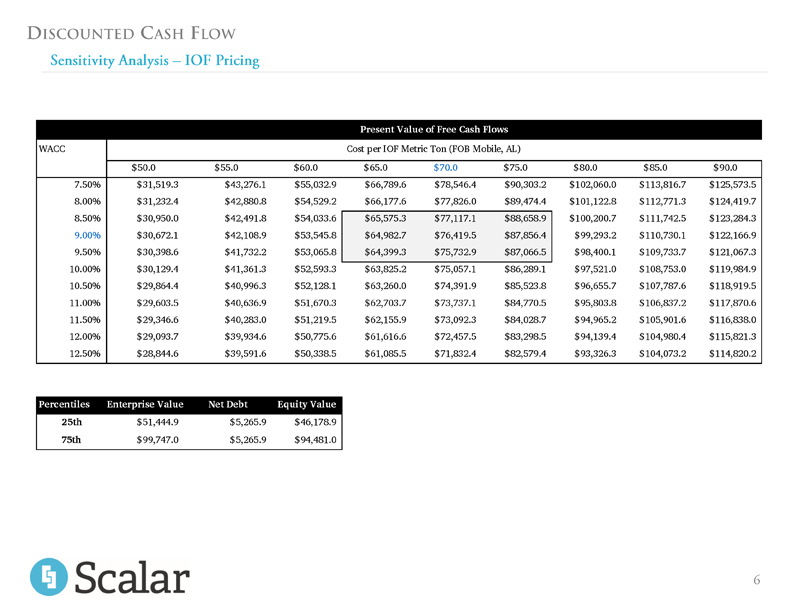

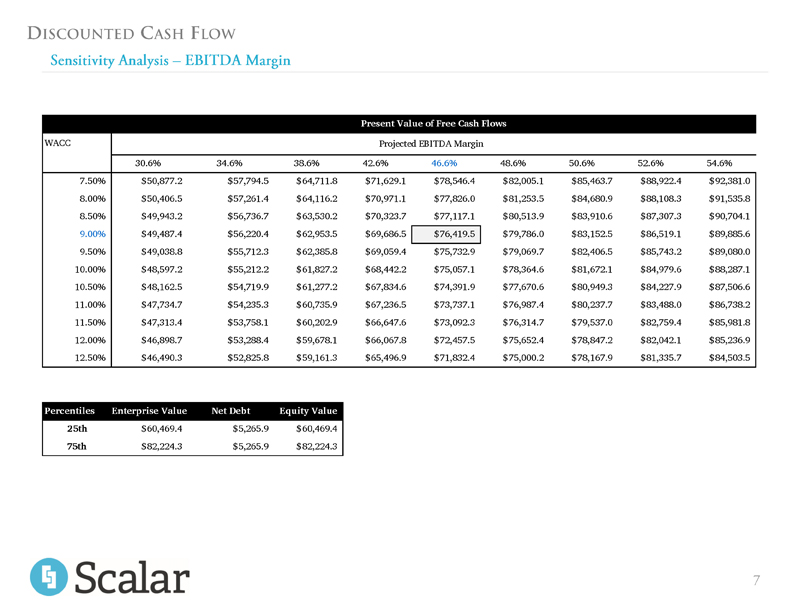

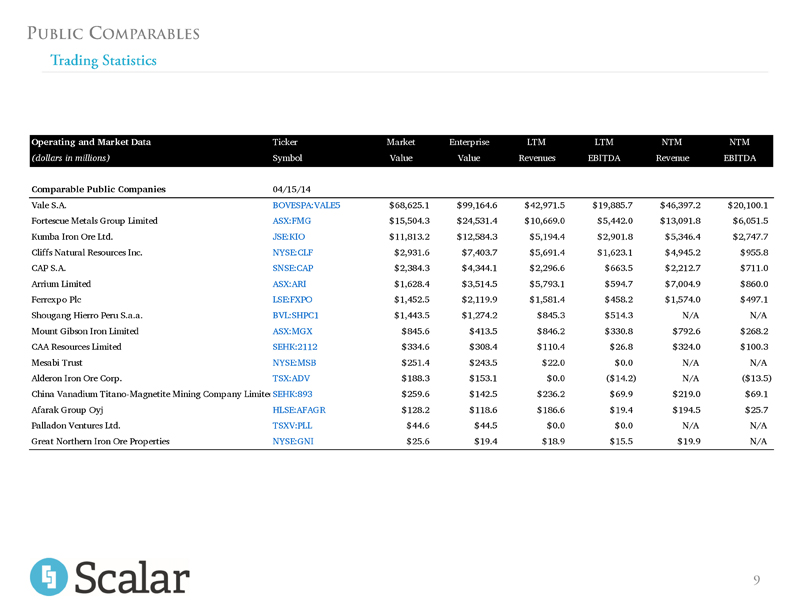

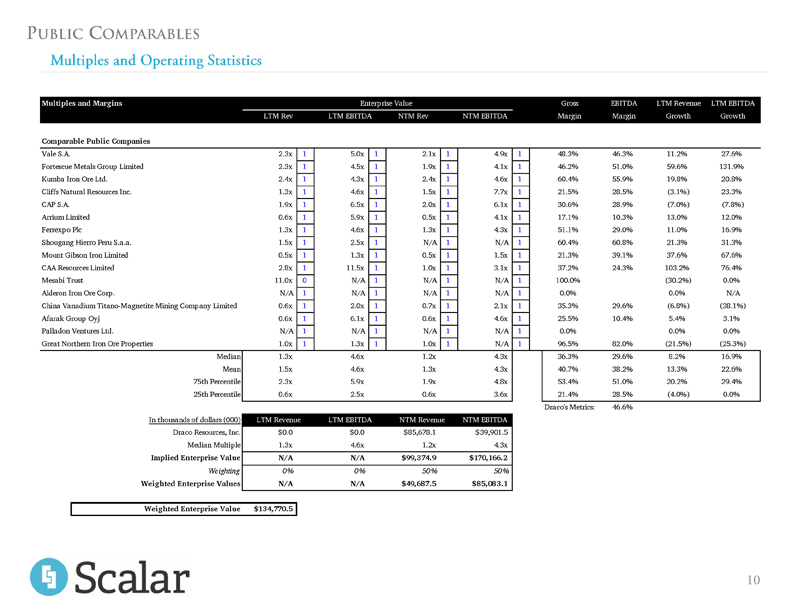

Given that these projections are sensitive to the price Draco is able to receive for its iron ore fines, and its cost structure, Scalar performed two sensitivity analyses where it calculated the present value of these cash flows using a range of (1) iron ore fine prices and discount rates, and (2) projected earnings before income taxes, depreciation and amortization, or EBITDA, margin and discount rates.

The ranges utilized for the weighted average cost of capital, or WACC, were of 7.5% to 12.5%. For iron ore fine prices, the range considered was of $50 to $90 per metric ton. For EBITDA margin, the range considered was 30.6% to 54.6%, which is reflective of the upper and lower ends of the public company comparables EBITDA margins.

Based on the discounted cash flow analysis, a range of values, derived from the sensitivity exercise performed, was calculated.

Because the DCF method focuses on the explicit, finite cash flows of Draco, Scalar consider this method most relevant to the analysis.

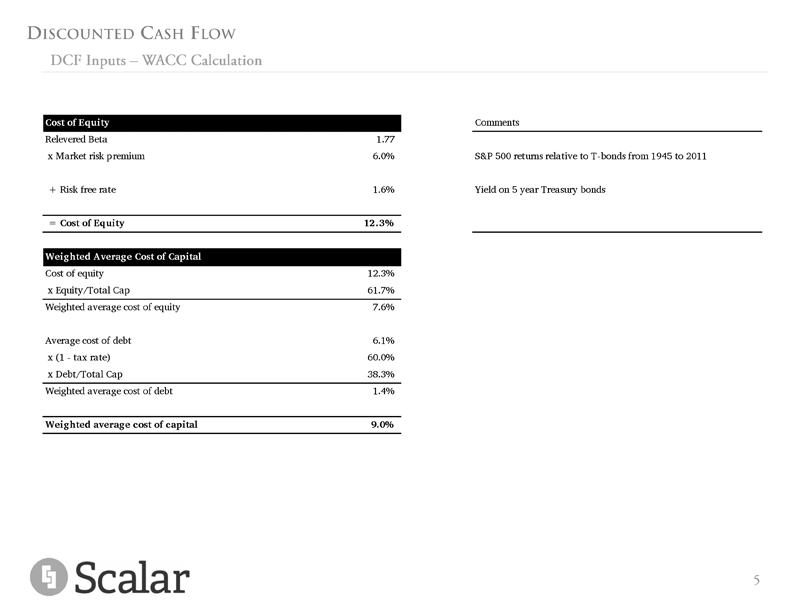

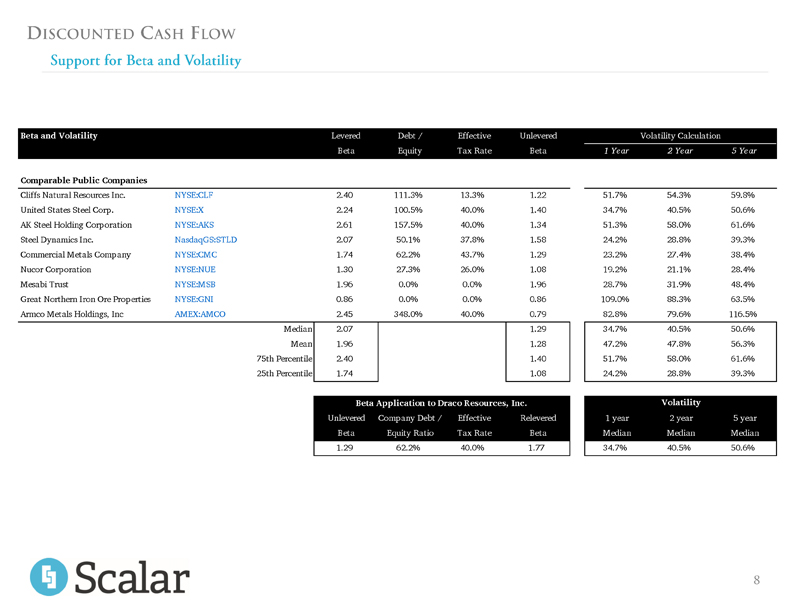

WACC Determination

The WACC is the rate of return that reflects the risk of an investment. The higher the risk, the higher the return expected by investors. The WACC, in one of the most widely used calculation approaches, can be developed using the capital asset pricing model, or CAPM, the long term weight of equity and debt in the financial structure of companies in the industry, and the estimated cost of debt. CAPM was utilized to develop the company’s cost of equity. The CAPM formula is defined as follows:

Re = Rf + ß*(Rm)

Where:

|

Re = Return on equity |

Rf = Risk-free rate |

|

ß = Beta (unlevered) |

Rm= Market risk premium |

Scalar used the following inputs for the CAPM:

|

Rf = 1.6% |

ß = 1.77 |

|

Rm = 6.0% |

|