UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

|

þ

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under Rule 14a-12

|

China Armco Metals, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box):

|

þ

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

1.

|

Title of each class of securities to which transaction applies:

|

|

2.

|

Aggregate number of securities to which transaction applies:

|

|

3.

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

4.

|

Proposed maximum aggregate value of transaction:

|

|

5.

|

Total fee paid:

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-1 1(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

1.

|

Amount Previously Paid:

|

|

2.

|

Form, Schedule or Registration Statement No.:

|

|

3.

|

Filing Party:

|

|

4.

|

Date Filed:

|

1

May 6, 2013

Dear Stockholder:

You are cordially invited to attend the 2013 annual meeting of our stockholders on July 2, 2013, at 2 p.m. Pacific Standard Time, at Crowne Plaza Hotel, 1221 Chess Drive, Foster City, CA 94404. Matters on which action will be taken at the meeting are explained in detail in the attached Notice and Proxy Statement.

Our Annual Report for the year ended December 31, 2012 on Form 10-K is available through our website at www.armcometals.com under the heading “Investor Relations” and the subheading “Company Financial Reports” and is also included herein. Additionally, a form of proxy card and information on how to vote by mail, through the Internet, by fax or by phone is included herein.

We sincerely hope that you will be able to attend the meeting in person and we look forward to seeing you. Whether or not you expect to be present at the meeting, please promptly vote as your vote is important. Instructions regarding the various methods of voting are contained on the proxy card, including voting by mail, through the Internet, by fax or by phone. If you attend the annual meeting, you may revoke your proxy and vote your own shares.

|

Sincerely,

|

|||

|

China Armco Metals, Inc.

|

|||

|

/s/ Kexuan Yao

|

|||

|

Kexuan Yao

|

|||

|

Chairman of the Board of Directors,

|

|||

|

President and Chief Executive Officer

|

|||

2

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 2, 2013

To the stockholders of China Armco Metals, Inc.,

You are cordially invited to attend the 2013 annual meeting of stockholders of China Armco Metals, Inc. to be held at Crowne Plaza Hotel, 1221 Chess Drive, Foster City, CA 94404 on July 2, 2013 at 2 p.m. Pacific Standard Time. At the annual meeting you will be asked to vote on the following matters:

|

·

|

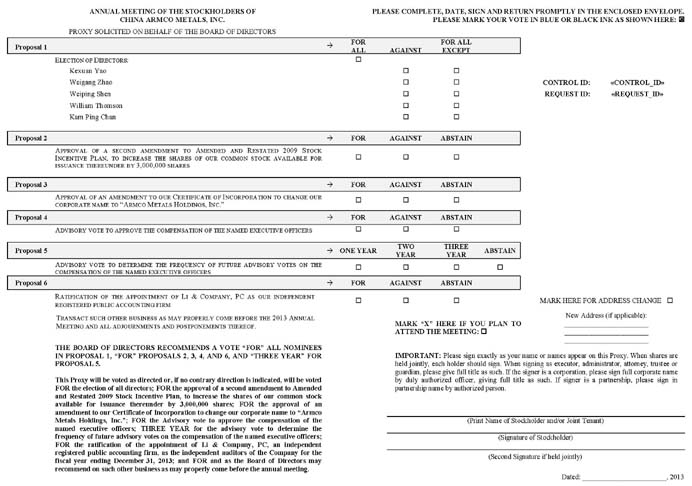

Proposal 1: To elect a Board of Directors consisting of five members;

|

|

·

|

Proposal 2: To approve a second amendment to the Amended and Restated 2009 Stock Incentive Plan, to increase the shares of our common stock available for issuance thereunder by 3,000,000 shares; and

|

|

·

|

Proposal 3: To approve an amendment to our Certificate of Incorporation to change our corporate name to Armco Metals Holdings, Inc.;

|

|

·

|

Proposal 4: To hold an advisory vote to approve the compensation of the named executive officers;

|

|

·

|

Proposal 5: To hold an advisory vote to determine the frequency of future advisory votes on the compensation of the named executive officers;

|

|

·

|

Proposal 6: To ratify the appointment of Li an Company, PC as our independent registered public accounting firm;

|

|

·

|

To consider and act upon any other business as may properly come before the annual meeting or any adjournments thereof.

|

The Board of Directors recommends that you vote at the annual meeting “FOR” Proposals 1, 2, 3, 4, and 6 and “Three Years” on Proposal 5. These items of business are more fully described in the proxy statement that is attached to this Notice. The Board of Directors has fixed the close of business on May 21, 2013 as the “Record Date” for determining the stockholders that are entitled to notice of and to vote at the annual meeting and any adjournments thereof. A list of stockholders entitled to vote at the meeting will be available for examination for a period of ten days before the meeting in person at our corporate offices in San Mateo, California and Shanghai, China, and also at the meeting. Stockholders may examine the list for purposes related to the meeting.

It is important that your shares are represented and voted at the meeting. You can vote your shares by completing, signing, dating, and returning your completed proxy card or vote by mail, over the Internet, by fax or by phone by following the instructions included in the proxy statement. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the proxy statement.

You may attend the annual meeting and vote in person even if you have previously voted by proxy in one of the ways listed above. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

|

By Order of the Board of Directors

|

|||

|

/s/ Kexuan Yao

|

|||

|

Shanghai, China

|

Chairman of the Board of Directors

President and Chief Executive Officer

|

||

|

May 6, 2013

|

3

TABLE OF CONTENTS

|

Page

|

||||

|

General

|

5

|

|||

|

Questions and Answers

|

5

|

|||

|

Who Can Help Answer Your Questions?

|

8

|

|||

|

Corporate Governance

|

9

|

|||

|

Board Committees

|

11

|

|||

|

Director Compensation

|

12

|

|||

|

Audit Committee Report

|

13

|

|||

|

Executive Officers and Key Employees

|

15

|

|||

|

Executive Compensation

|

16

|

|||

|

Principal Stockholders

|

22

|

|||

|

Certain Relationships and Related Transactions

|

23

|

|||

|

Proposal 1 - Election of Directors

|

25

|

|||

|

Proposal 2 - Ratification of the Appointment of Li and Company, PC

|

26

|

|||

|

Proposal 3 – Approval of a second amendment to Amended and Restated 2009 Stock Incentive Plan

|

33

|

|||

|

Proposal 4 – Advisory vote to approve the compensation of the named executive officers;

|

34

|

|||

|

Proposal 5 – Advisory vote to determine the frequency of future advisory votes on the compensation of the named executive officers;

|

35

|

|||

|

Proposal 6 – Ratification of the Appointment of Li and Company, PC

|

36

|

|||

|

Other Matters

|

36

|

|||

|

Annual Report on Form 10-K

|

36

|

|||

|

Householding of Proxy Materials

|

36

|

|||

|

Proposals of Stockholders

|

37

|

|||

|

Where You Can Find More Information

|

37

|

|||

4

Stockholders Should Read the Entire Proxy Statement Carefully Prior to Returning Their Proxies

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

GENERAL

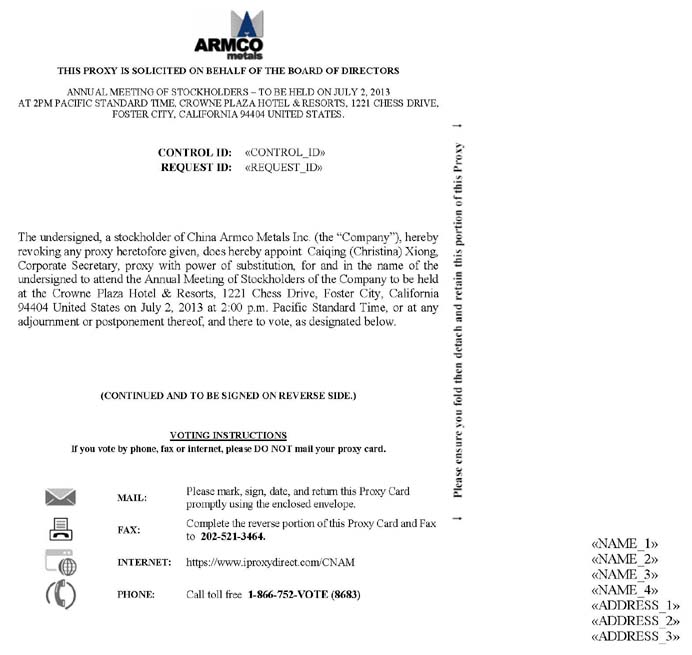

The enclosed proxy is solicited on behalf of the Board of Directors of China Armco Metals, Inc. for use at our annual meeting of stockholders to be held the Crowne Plaza Hotel, 1221 Chess Drive, Foster City, CA 94404 on July 2, 2013 at 2 p.m. Pacific Standard Time. Voting materials, including this proxy statement, the proxy card and our 2012 Annual Report on Form 10-K for the year ended December 31, 2012, are being delivered to all or our stockholders on or about May 23, 2013.

QUESTIONS AND ANSWERS

Following are some commonly asked questions raised by our stockholders and answers to each of those questions.

What may I vote on at the annual meeting?

At the annual meeting, stockholders will consider and vote upon the following matters:

|

·

|

to elect a Board of Directors consisting of five members;

|

|

·

|

to approve a second amendment to the Amended and Restated 2009 Stock Incentive Plan to increase the shares of our common stock available for issuance thereunder by 3,000,000 shares;

|

|

·

|

to approve an amendment to our Certificate of Incorporation to change our corporate name to Armco Metals Holdings, Inc.;

|

|

·

|

to hold advisory vote to approve the compensation of the named executive officers;

|

|

·

|

to hold advisory vote to determine the frequency of future advisory votes on the compensation of the named executive officers;

|

|

·

|

to ratify the appointment of Li and Company, PC as our independent registered public accounting firm; and

|

|

·

|

such other matters as may properly come before the annual meeting or any adjournments thereof.

|

How does the Board of Directors recommend that I vote on the proposals?

The Board of Directors recommends a vote “FOR” each of the nominees to the Board of Directors, “FOR” the approval of the amendment to the Amended and Restated 2009 Stock Incentive Plan, “FOR” the approval of the change of our corporate name from China Armco Metals, Inc. to Armco Metals Holdings, Inc., “FOR” the advisory vote to approve the compensation of the named executive officers; “Three Years” for the advisory vote to determine the frequency of future advisory votes on the compensation of the named executive officers; and “FOR” the proposal ratifying the appointment of Li and Company, PC.

How do I vote?

You can vote either in person at the annual meeting or by proxy, by mail, by fax, by phone or over the Internet whether or not you attend the annual meeting. To obtain directions to attend the annual meeting, please call (650) 212-7620. If your shares are registered directly in your name with our transfer agent, Action Stock Transfer Corp., you are considered the stockholder of record with respect to those shares and we are sending a Notice directly to you. As the stockholder of record, you have the right to vote in person at the annual meeting. If you choose to do so, you can bring the proxy card that is part of this proxy statement or vote at the annual meeting using the ballot provided at the meeting. Even if you plan to attend the annual meeting in person, we recommend that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the annual meeting in person.

Most of our stockholders hold their shares in street name through a stockbroker, bank or other nominee rather than directly in their own name. In that case, you are considered the beneficial owner of shares held in street name and the Notice is being forwarded to you. As the beneficial owner, you are also invited to attend the annual meeting. Because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the annual meeting unless you obtain a “legal proxy” from the stockbroker, trustee or nominee that holds your shares, giving you the right to vote the shares at the meeting. You will need to contact your stockbroker, trustee or nominee to obtain a legal proxy, and you will need to bring it to the annual meeting in order to vote in person.

5

You can vote by proxy in four ways:

|

·

|

by mail – If you received your proxy materials by mail, you can vote by mail by using the enclosed proxy card;

|

|

·

|

by Internet – You can vote by Internet by following the instructions on the Notice to access the proxy materials or on your proxy card if you received your materials by mail;

|

|

·

|

By fax – 202-521-3464; and

|

|

·

|

By phone - 1-866-752-VOTE (8683).

|

If you vote by proxy, your shares will be voted at the annual meeting in the manner you indicate.

The Internet, phone and fax voting system for stockholders of record will close at 12:00am, Pacific Standard Time, on July 2, 2013. Please refer to the proxy card for details on all methods of voting.

What happens if additional matters are presented at the annual meeting?

Other than the election of directors, the amendment to the Amended and Restated 2009 Stock Incentive Plan, the amendment to our Certificate of Incorporation, the advisory vote to approve the compensation of the named executive officers, the advisory vote to determine the frequency of future advisory votes on the compensation of the named executive officers, and the ratification of the appointment of our auditor, we are not aware of any other business to be acted upon at the annual meeting. If you grant a proxy, the person named as proxy holder, Caiqing (Christina) Xiong, our corporate secretary, will have the discretion to vote your shares on any additional matters properly presented for a vote at the annual meeting.

What happens if I do not give specific voting instructions?

If you hold shares in your name and you sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our Board of Directors on all matters and as the proxy holder may determine in her discretion with respect to any other matters properly presented for a vote before the annual meeting. If you hold your shares through a stockbroker, bank or other nominee and you do not provide instructions on how to vote, your stockbroker or other nominee may exercise their discretionary voting power with respect to certain proposals that are considered as “routine” matters. For example, Proposal 6 - ratification of the appointment of Li and Company, PC as our independent registered public accounting firm is commonly considered as a routine matter, and thus your stockbroker, bank or other nominee may exercise their discretionary voting power with respect to Proposal 6. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform us that it does not have the authority to vote on these matters with respect to your shares. This is generally referred to as a “broker non-vote.” When the vote is tabulated for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present, but will not otherwise be counted. In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to Proposal 1 - the election of a director to our Board of Directors, Proposal 2 - the second amendment to the Amended and Restated 2009 Stock Incentive Plan, Proposal 3 - the amendment to our Certificate of Incorporation, Proposal 4 - the advisory vote to approve the compensation of the named executive officers, Proposal 5 - the advisory vote to determine the frequency of future advisory votes on the compensation of the named executive officers. We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the notice.

What is the quorum requirement for the annual meeting?

On May 21, 2013, the Record Date for determining which stockholders are entitled to vote, there were 23,484,288 shares of our common stock outstanding which is our only class of voting securities. Each share of common stock entitles the holder to one vote on matters submitted to a vote of our stockholders. A majority of our outstanding common shares as of the Record Date must be present at the annual meeting (in person or represented by proxy) in order to hold the meeting and conduct business. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum, even if you wish to abstain from voting on some or all matters introduced at the annual meeting, if you are present and vote in person at the meeting or have properly submitted a proxy card or voted by fax, by phone or by using the Internet.

How can I change my vote after I return my proxy card?

You may revoke your proxy and change your vote at any time before the final vote at the annual meeting. You may do this by signing a new proxy card with a later date, by voting on a later date by using the Internet (only your latest Internet proxy submitted prior to the annual meeting will be counted), or by attending the annual meeting and voting in person. However, your attendance at the annual meeting will not automatically revoke your proxy unless you vote at the annual meeting or specifically request in writing that your prior proxy be revoked.

6

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within our company or to third parties, except:

|

·

|

as necessary to meet applicable legal requirements;

|

|

·

|

to allow for the tabulation of votes and certification of the vote; and

|

|

·

|

to facilitate a successful proxy solicitation.

|

Any written comments that a stockholder might include on the proxy card will be forwarded to our management.

Where can I find the voting results of the annual meeting?

The preliminary voting results will be announced at the annual meeting. The final voting results will be tallied by our Inspector of Elections and reported in a Current Report on Form 8-K which we will file with the SEC within four business days of the date of the annual meeting.

How can I obtain a separate set of voting materials?

To reduce the expense of delivering duplicate voting materials to our stockholders who may have more than one China Armco Metals, Inc. stock account, we are delivering only one Notice to certain stockholders who share an address, unless otherwise requested. If you share an address with another stockholder and have received only one Notice, you may write or call us to request to receive a separate Notice. Similarly, if you share an address with another stockholder and have received multiple copies of the Notice, you may write or call us at the address and phone number below to request delivery of a single copy of this Notice. For future annual meetings, you may request separate Notices, or request that we send only one Notice to you if you are receiving multiple copies, by writing or calling us at:

China Armco Metals, Inc.

Attention: Caiqing (Christina) Xiong, Corporate Secretary

One Waters Park Drive, Suite 98

San Mateo, California 94403

Tel: 650.212.7620

Fax: 650.212.7630

Who pays for the cost of this proxy solicitation?We will pay the costs of the solicitation of proxies. We may also reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding the voting materials to their customers who are beneficial owners and obtaining their voting instructions. In addition to soliciting proxies by mail, our board members, officers and employees may solicit proxies on our behalf, without additional compensation, personally, electronically or by telephone.

How can I obtain a copy of China Armco Metals, Inc.’s 2012 Annual Report on Form 10-K?

You may obtain a copy of our Annual Report on Form 10-K for the year ended December 31, 2012 by sending a written request to the address listed above under “How can I obtain a separate set of voting materials”. We will furnish the Form 10-K without exhibits at no charge. If you prefer a copy of the Form 10-K including exhibits, you will be charged a fee (which will be limited to our reasonable expenses in furnishing such exhibits). Our 2012 Annual Report on Form 10-K is available by accessing our Investor Relations page of our website at www.armcometals.com and our Form 10-K with exhibits is available on the website of the SEC at www.sec.gov.

7

What is the voting requirement to approve the proposals?

In the election of directors, the five persons receiving the highest number of (or plurality) “FOR” votes at the annual meeting will be elected. There will be no cumulative voting in the election of directors. The proposal to approve the second amendment to the Amended and Restated 2009 Stock Incentive Plan will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal. The proposal to approve an amendment to our Certificate of Incorporation to change our corporate name to Armco Metals Holdings, Inc. will be approved if there is a quorum and the votes cast “FOR” the proposal reaches the majority of the outstanding voting power. The proposal to ratify the appointment of Li and Company, PC as our independent registered public accounting firm will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal.

The advisory vote to approve the compensation of named executive officers will be approved if there is a quorum and the votes cast “FOR” the proposal exceeds those cast against the proposal. The advisory vote to determine the frequency of future advisory votes on the compensation of named executive officers requires the affirmative vote of the holders of the majority of the votes cast by the holders of the Company’s common stock at the annual meeting. Stockholders may either vote “ONE YEAR,” “TWO YEARS,” “THREE YEARS,” or “ABSTAIN.” If none of the alternatives receives the majority of votes cast, the Company will consider the alternative that receives the highest number of votes cast by stockholders to be the frequency selected by the stockholders. The approval of the advisory vote to approve the compensation of named executive officers and the approval of the advisory vote to determine the frequency of future advisory votes on the compensation of named executive officers are non-binding advisory votes.

Abstentions and broker non-votes will be treated as shares that are present, or represented and entitled to vote for purposes of determining the presence of a quorum at the annual meeting. Abstentions will not be counted in determining the number of votes cast in connection with any matter presented at the annual meeting. Broker non-votes will not be counted as a vote cast on any matter presented at the annual meeting.

Do I Have Dissenters’ (Appraisal) Rights?

Appraisal rights are not available to our shareholders with any of the proposals described above to be brought before the annual meeting of shareholders.

How can I communicate with the non-employee directors on China Armco Metals, Inc. Board of Directors?

The Board of Directors encourages stockholders who are interested in communicating directly with the non-employee directors as a group to do so by writing to the non-employee directors in care of our corporate secretary. Stockholders can send communications by mail to:

Caiqing (Christina) Xiong, Corporate Secretary

China Armco Metals, Inc.

One Waters Park Drive, Suite 98

San Mateo, California 94403

Correspondence received that is addressed to the non-employee directors will be reviewed by our corporate secretary or his designee, who will regularly forward to the non-employee directors a summary of all such correspondence and copies of all correspondence that, in the opinion of our corporate secretary, deals with the functions of the Board of Directors or committees thereof or that our corporate secretary otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by us that is addressed to the non-employee members of the Board of Directors and request copies of any such correspondence.

WHO CAN HELP ANSWER YOUR QUESTIONS?

You may seek answers to your questions by writing, calling or emailing us at:

Caiqing (Christina) Xiong, Corporate Secretary

China Armco Metals, Inc.

One Waters Park Drive, Suite 98

San Mateo, California 94403

Tel: 650.212.7620

Fax: 650.212.7630

Info@ArmcoMetals.com

8

CORPORATE GOVERNANCE

Board of Directors

The Board of Directors oversees our business affairs and monitors the performance of management. In accordance with our corporate governance principles, the Board of Directors does not involve itself in day-to-day operations. The directors keep themselves informed through discussions with the Chief Executive Officer, other key executives and by reading the reports and other materials that we send them and by participating in Board of Directors and committee meetings. Our directors hold office until their successors have been elected and duly qualified unless the director resigns or by reason of death or other cause is unable to serve in the capacity of director. Biographical information about our directors is provided in “Election of Directors – Proposal No. 6” on page 36.

Director Independence

We are required to have a majority of independent directors within the meaning of applicable NYSE MKT (formerly “NYSE Amex”) Company Guide rules. The Board of Directors has determined three of the five directors are independent, which excludes Kexuan Yao, our Chairman and Chief Executive Officer and Weigang Zhao, vice general manager of Armco (Lianyungang) Renewable Resources Metals,Co., Ltd Inc.. (“Renewable Metals”).

Board Leadership Structure

Our Board does not have a policy on whether the role of Chairman and Chief Executive Officer (CEO) should be separate or combined, but believes that the most effective leadership structure for us at this time is to have these roles combined. Given our size, we believe having a single leader for both our company and the Board of Directors eliminates duplication of effort and efficiency while providing clear leadership for our company. We do not have a lead independent director; however, three of five our current directors are independent and each of our standing committees (Audit, Nominating and Corporate Governance and Compensation) is comprised solely of independent directors. We believe this structure provides adequate oversight of our operations by our independent directors in conjunction with our Chairman/CEO.

Board of Directors Meetings and Attendance

During the fiscal year 2012, the Board of Directors held four meetings. With the exception of Kam Ping Chan and Weiping Shen, each missing one meeting, all directors attended each meeting. In addition, the Board of Directors approved certain actions by unanimous written consent on one occasion. It is our policy that directors should make every effort to attend the annual meeting of stockholders, and Kexuan Yao, Weiping Shen and William Thomson serving at the time attended the annual meeting of stockholders in 2012.

Code of Business Conduct and Ethics

We adopted a Code of Business Conduct and Ethics that applies to all of our directors, officers and employees, including our principal executive officer and principal financial and accounting officer. A copy of the Code of Business Conduct and Ethics is available on the Investor Relations page of our website at www.armcometals.com. We will post on our website any amendment to our Code of Business Conduct and Ethics or waivers of our Code of Business Conduct and Ethics for directors and executive officers.

Complaints Regarding Accounting Matters

The Audit Committee has established procedures for:

|

·

|

the receipt, retention and treatment of complaints regarding accounting, internal accounting controls, or auditing matters; and

|

|

·

|

the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters.

|

9

Communications with Directors

The Board of Directors has approved procedures for stockholders to send communications to individual directors or the non-employee directors as a group. Written correspondence should be addressed to the director or directors in care of Caiqing (Christina) Xiong, Corporate Secretary of China Armco Metals, Inc., One Waters Park Drive, Suite 98, San Mateo, California 94403. Correspondence received that is addressed to the non-employee directors will be reviewed by our corporate secretary or his designee, who will regularly forward to the non-employee directors a summary of all such correspondence and copies of all correspondence that, in the opinion of our corporate secretary, deals with the functions of the Board of Directors or committees thereof or that the corporate secretary otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by China Armco Metals, Inc. that is addressed to the non-employee members of the Board of Directors and request copies of any such correspondence. You may also contact individual directors by calling our principal executive offices at (650) 212-7620.

Legal Proceedings

There are no legal proceedings to which any director, director nominee, officer or affiliate of our company, any owner of record or beneficially of more than 5% of common stock, or any associate of any such director, officer, affiliate of our company or security holder that is a party adverse to our company or any of our subsidiaries or has a material interest adverse to us.

Compliance With Section 16(a) of the Exchange Act

Based solely upon a review of Forms 3 and 4 and amendments thereto under Rule 16a-3(d) of the Securities Exchange Act of 1934 filed during the fiscal year ended December 31, 2012, we are not aware that any officer, director or 10% or greater beneficial owner failed to file on a timely basis, as disclosed in the aforementioned Forms, reports required by Section 16(a) of the Securities Exchange Act of 1934 with respect to the fiscal year ended December 31, 2012, other than as set forth below:

|

Name

|

Number of

Late Reports

|

Transactions

Not Timely Reported

|

Known Failures

to File a

Required Form

|

|||||||||

|

Fengtao Wen

|

2

|

2

|

2

|

|||||||||

|

Weigang Zhao

|

1

|

1

|

1

|

|||||||||

|

Kexuan Yao

|

2

|

2

|

2

|

|||||||||

|

Weiping Shen

|

1

|

1

|

1

|

|||||||||

10

BOARD COMMITTEES

The Board of Directors has standing Audit, Compensation and Nominating and Corporate Governance Committees. Each of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee has a written charter. The charters, as they may be amended from time to time, are available on our website at www.armcometals.com. Information concerning the current membership and function of each committee is as follows:

Board of Directors and Committee Membership

|

Director

|

Audit

Committee

Member

|

Compensation

Committee

Member

|

Nominating and

Governance

Committee Member

|

|||

|

Kexuan Yao

|

||||||

|

Weigang Zhao

|

||||||

|

William Thomson

|

X(1)

|

X(1)

|

X

|

|||

|

Kam Ping Chan

|

X

|

X

|

X

|

|||

|

Weiping Shen

|

X

|

X

|

X(1)

|

(1) Denotes Chairman.

Audit Committee. The Audit Committee is responsible to the Board of Directors for the areas of audit and compliance and oversees our financial reporting process, including monitoring the integrity of the financial statements and the independence and performance of the registered public accounting firm and supervises our compliance with legal and regulatory requirements. The current members of the Audit Committee are Weiping Shen, William Thomson and Kam Ping Chan. The Board of Directors has determined that Mr. Thomson, Chairman of the Audit Committee, is an “audit committee financial expert” as defined under SEC rules. The Board of Directors has affirmatively determined that none of the members of the Audit Committee have a material relationship with us that would interfere with the exercise of independent judgment and each of the members of the Audit Committee are “independent” as defined in the applicable NYSE MKT rules. The Audit Committee held three meetings during the 2012 fiscal year, with each member attending each meeting with the exception of our director Kam Ping Chan, who missed one Audit Committee meeting. The responsibilities of the Audit Committee, as approved by the Board of Directors, are set forth in the Audit Committee Charter, a copy of which is included as Exhibit 99.1 of our Form 8-K filed with the SEC on October 28, 2009.

Compensation Committee. The Compensation Committee is responsible for reviewing and recommending our compensation and employee benefit policies to the Board of Directors for its approval and implementation. The current members of the Compensation Committee are Weiping Shen, William Thomson and Kam Ping Chan, each of whom are “independent” directors within the meaning of the applicable NYSE MKT rules. The chairman of the Compensation Committee is Mr. Thomson.

The Compensation Committee reviews and recommends to the Board of Directors for approval the compensation for our Chief Executive Officer, including salaries, bonuses and grants of awards under our equity incentive plans. The Compensation Committee and the Board of Directors review and act upon proposals by non-interested management to determine the compensation to other executive officers. The Compensation Committee, among other things, reviews and recommends to the Board of Directors employees to whom awards will be made under our equity incentive plans, determines the number of options to be awarded, and the time, manner of exercise and other terms of the awards.

In September 2011, the Compensation Committee engaged Frederic. W. Cook & Co., Inc., an independent compensation consultant, to advise us on the compensation provided to Mr. Kexuan Yao, and determine what actions, if any, were appropriate regarding future executive compensation arrangements. In developing their assessment, the consultant considered pay practices of companies in similar industries and of similar size. As a result of its analysis, Frederic. W. Cook & Co., Inc. recommended that the target compensation to Mr. should generally be positioned at the median of comparably sized companies in similar industries. The consultant further recommended components and terms of each components of Mr. Yao’s future compensation. Based on the analysis and recommendations, the Compensation Committee adopted and approved the New CEO as described below under “Executive Employment Agreements and Narrative Regarding Executive Compensation”.

The Compensation Committee holds two meetings during the 2012 fiscal year. The responsibilities of the Compensation Committee, as approved by the Board of Directors, are set forth in the Compensation Committee Charter, a copy of which is included as Exhibit 99.2 of our Form 8-K filed with the SEC on October 28, 2009.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee was formed: (1) to assist the Board of Directors by identifying individuals qualified to become board members and to recommend for selection by the Board of Directors the director nominees to stand for election for the next annual meeting of our stockholders; (2) to recommend to the Board of Directors director nominees for each committee of the Board of Directors; (3) to oversee the evaluation of the Board of Directors and management and (4) to develop and recommend to the Board of Directors a set of corporate governance guidelines and enhancements to the Code of Business Conduct and Ethics. The responsibilities of the Nominating and Corporate Governance Committee, as approved by the Board of Directors, are set forth in the Nominating and Corporate Governance Committee Charter, a copy of which is included as Exhibit 99.3 of our Form 8-K filed with the SEC on October 28, 2009. The current members of the Nominating and Corporate Governance Committee are Weiping Shen, William Thomson and Kam Ping Chan, each of whom are “independent” directors within the meaning of the applicable NYSE MKT rules. The chairman of the Nominating and Corporate Governance Committee is Mr. Shen.

NYSE MKT rules require director nominees to be either selected, or recommended for the Board of Directors’ selection, either by a majority of our independent directors or our Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for selecting those individuals to recommend to the entire Board of Directors for election to the board. The committee will consider candidates for directors proposed by security holders. The Nominating and Corporate Governance Committee’s policy is to accept written submissions that include the name, address and telephone number of the proposed nominee, along with a brief statement of the candidate’s qualifications to serve as a director. If the proposed nominee is not the security holder submitting the name of the candidate, a letter from the candidate agreeing to the submission of his or her name for consideration should be provided at the time of submission. If the committee believes it to be appropriate, committee members may meet with the proposed nominee before making a final determination whether to recommend the individual as a nominee to the entire Board of Directors to stand for election to the board.

11

The Nominating and Corporate Governance Committee identifies director nominees through a combination of referrals, including by management, existing board members and security holders and direct solicitations, where warranted. Once a candidate has been identified, the Nominating and Corporate Governance Committee reviews the individual’s experience and background and may discuss the proposed nominee with the source of the recommendation.

Among the factors that the committee considers when evaluating proposed nominees are their knowledge and experience in business matters and in the metals and recycling industry, finance, capital markets and mergers and acquisitions. The committee may request references and additional information from the candidate prior to reaching a conclusion. The committee is under no obligation to formally respond to recommendations, although as a matter of practice, every effort is made to do so.

The Nominating and Corporate Governance Committee received no security holder recommendations for nomination to the Board of Directors in connection with the annual meeting of stockholders. Upon the resignation of Mr. Pang on May 4, 2012, the Nominating and Governance Committee recommended and our Board of Director approved that Mr. Weiping Shen to stand for election as a director. The current five members of the Board of Directors of the Company were each elected as a director at the 2012 annual meeting of stockholders. The Nominating and Corporate Governance Committee hold two meetings during the 2012 fiscal year.

DIRECTOR COMPENSATION

The Board of Directors' general policy on director compensation is that compensation for non-employee directors should consist of a combination of cash and equity based compensation. The following table summarizes the compensation paid by us to our directors during the fiscal year of 2012.

Director Compensation Table for the 2012 Fiscal Year

|

Director

|

Fees earned

or paid

in cash ($)

|

Stock

Awards ($)

(2)

|

Total ($)

|

|||||||

|

Kexuan Yao (1)

|

-

|

-

|

0

|

|||||||

|

Weigang Zhao (1)

|

-

|

-

|

0

|

|||||||

|

William Thomson

|

40,000

|

-

|

40,000

|

|||||||

|

Kamping Chan

|

20,000

|

1,782

|

(3)

|

21,782

|

||||||

|

Weiping Shen (4)

|

-

|

34,500

|

34,500

|

|||||||

|

(1)

|

In accordance with our Board of Directors' general policy directors who are full time employees (Messrs. Yao and Zhao) are not paid for his service as a director in addition to their regular employee compensation.

|

|

(2)

|

The amounts in this column represent the fair value of the award as of the grant date as computed in accordance with FASB ASC Topic 718.

|

|

(3)

|

The amount in this column represents the fair value of 6,250 shares of the Company’s common stock, granted on December 19, 2011, at $0.2851 per share, for his services provided in 2012. Each 50% of such award vested on June 30, 2012 and December 31, 2012.

|

|

(4)

|

Mr. Weiping Shen was appointed to serve as a member of our Board of Directors on May 4, 2012, effectively immediately. The amounts in this column represent the fair value of 50,000 shares of the Company’s common stock, granted on May 4, 2012, at $0.69 per shares, for his services provided from May 4, 2012 to May 3, 2013. Each 50% of such shares shall vest on September 30, 2012 and May 3, 2013.

|

12

Pursuant to our agreement with William Thomson, Mr. Thomson, as compensation for serving as our director, shall receive an annual salary of $40,000 during the fiscal year of 2012, payable on a quarterly basis.

Pursuant to our agreement with Kamping Chan, Mr. Chan, as compensation for serving as our director, shall receive a salary of $20,000 from October 1, 2011 to December 31, 2012, each $5,000 payable on a quarterly basis commencing on March 31, 2012. Mr. Chan shall also receive 6,250 shares of the Company’s common stock, and each 50% of such shares shall vest on June 30, 2012 and December 31, 2012.

Pursuant to our agreement with Weiping Shen, Mr. Shen, as compensation for serving as our director, shall receive a salary of 50,000 shares of the Company’s common stock from May 4, 2012 to May 3, 2013, and each 50% of such shares shall vest on September 30, 2012 and May 3, 2013.

AUDIT COMMITTEE REPORT

Report of the Audit Committee of the Board of Directors

The Audit Committee provides assistance to the Board of Directors in fulfilling its oversight responsibilities relating to our corporate accounting and reporting practices toward assurance of the quality and integrity of our consolidated financial statements. The purpose of the Audit Committee is to serve as an independent and objective party to monitor our financial reporting process and internal control system; oversee, review and appraise the audit activities of our independent registered public accounting firm and internal auditing function, maintain complete, objective and open communication between the Board of Directors, the independent accountants, financial management and the internal audit function.

Our independent registered public accounting firm reports directly to the Audit Committee and the Audit Committee is solely responsible to appoint or replace our independent registered public accounting firm and to assure its independence and to provide oversight and supervision thereof. The Audit Committee determines compensation of the independent registered public accounting firm and has established a policy for approval of non-audit related engagements awarded to the independent registered public accounting firm. Such engagements must not impair the independence of the registered public accounting firm with respect to our company as prescribed by the Sarbanes-Oxley Act of 2002; thus payment amounts are limited and non-audit related engagements must be approved in advance by the Audit Committee. The Audit Committee determines the extent of funding that we must provide to the Audit Committee to carry out its duties and has determined that such amounts were sufficient in 2012.

With respect to the fiscal year ended December 31, 2012, in addition to its other work, the Audit Committee:

|

·

|

Reviewed and discussed with management our audited consolidated financial statements as of December 31, 2012 and for the year then ended;

|

|

·

|

Discussed with Li and Company, PC the matters required to be discussed by Statement on Auditing Standards No. 61, “Communication with Audit Committees,” as amended, with respect to its review of the findings of the independent registered public accounting firm during its examination of our financial statements; and

|

|

·

|

Received from Li and Company, PC written affirmation of its independence as required by the Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees.” In addition, the Audit Committee discussed with Li and Company, PC its independence and determined that the provision of non-audit services was compatible with maintaining auditor independence.

|

The Audit Committee recommended, based on the review and discussion summarized above, that the Board of Directors include the 2012 audited consolidated financial statements in the 2012 Form 10-K for the fiscal year ended December 31, 2012 for filing with the SEC.

|

Audit Committee of the Board of Directors of China Armco Metals, Inc.

|

|||

|

William Thomson, Chairman

|

|||

|

Weiping Shen

|

|||

|

Kam Ping Chan

|

|||

13

Information About Auditors

The Audit Committee of the Board of Directors appointed Li and Company, PC as the independent registered public accounting firm to conduct the audit of our consolidated financial statements for the 2012 fiscal year and to report on our consolidated balance sheets, statements of income and other related statements, which appointment was ratified by the stockholders at the 2012 annual meeting of stockholders. Li and Company, PC has served as our independent registered public accounting firm since May 2008. The Audit Committee Charter includes the procedures for pre-approval of all fees charged by our independent registered public accounting firm. Under the procedure, the Audit Committee of the Board of Directors approves the engagement letter with respect to audit, tax and review services. Other fees are subject to pre-approval by the Audit Committee. The audit and audit-related fees paid to the auditors with respect to the 2012 fiscal year were pre-approved by the Audit Committee of the Board of Directors.

Fees and Services

The following table shows the fees that were billed for the audit and other services provided by Li and Company, PC for the years ended December 31, 2012 and 2011.

|

2012

|

2011

|

|||||||

|

Audit Fees

|

||||||||

|

$

|

137,500

|

$

|

130,000

|

|||||

|

Audit-Related Fees

|

||||||||

|

-

|

-

|

|||||||

|

Tax Fees

|

||||||||

|

7,500

|

7,500

|

|||||||

|

All Other Fees

|

||||||||

|

3,950

|

1,600

|

|||||||

|

Total:

|

||||||||

|

$

|

148,950

|

$

|

139,100

|

|||||

Audit Fees – This category includes the audit of our annual financial statements, review of financial statements included in our quarterly reports and services that are normally provided by the independent registered public accounting firm in connection with engagements for those years and services that are normally provided by our independent registered public accounting firm in connection with statutory audits and SEC regulatory filings or engagements.

Audit-Related Fees – This category consists of assurance and related services by the independent registered public accounting firm that are reasonably related to the performance of the audit or review of our financial statements and are not reported above under “Audit Fees”.

Tax Fees – This category consists of professional services rendered by our independent registered public accounting firm for tax compliance and tax advice. The services for the fees disclosed under this category include tax return preparationand technical tax advice.

All Other Fees – This category consists of fees for attending annual stockholder meeting.

14

Pre-Approval Policies and Procedure for Audit and Permitted Non-Audit Services

The Audit Committee has developed policies and procedures regarding the approval of all non-audit services that are to be rendered by our independent registered public accounting firm, as permitted under applicable laws and the corresponding fees for such services. In situations where the full Audit Committee is unavailable to pre-approve any permitted non-audit services to be rendered by our independent registered public accounting firm: (i) our Chief Executive Officer will evaluate the proposed engagement to confirm that the engagement is not prohibited by any applicable rules of the SEC or NYSE MKT, (ii) following such confirmation by the Chief Executive Officer , the Chairperson of the Audit Committee will determine whether we should engage our independent registered public accounting firm for such permitted non-audit services and, if so, negotiate the terms of the engagement with our independent registered public accounting firm and (iii) the Chairperson of the Audit Committee will report to the full Audit Committee at its next regularly scheduled meeting about any engagements of our independent registered public accounting firm for permitted non-audit services that have been approved by the Chairperson. Alternatively, after confirmation by the Chief Executive Officer, the full committee may pre-approve engagements of our independent registered public accounting firm at Audit Committee meetings.

All audit services and non-audit services and all fees associated with such services performed by our independent registered public accounting firm in the 2012 and 2011 fiscal year were approved by our Audit Committee. Consistent with these policies and procedures, all future audit services and non-audit services and all fees associated with such services performed by our independent registered public accounting firm will be approved by the Chairperson of the Audit Committee and ratified by the Audit Committee or approved by the full Audit Committee.

EXECUTIVE OFFICERS AND KEY EMPLOYEES

Executive Officers and Key Employees

The following table sets forth information about our executive officers and key employees as of the date of this report:

|

Name

|

Age

|

Positions and Offices Held

|

||

|

Kexuan Yao

|

41

|

Chairman, President and Chief Executive Officer

|

||

|

Fengtao Wen

|

39

|

Chief Financial Officer

|

||

|

Weigang Zhao

|

34

|

Vice General Manager of Renewable Metals and Director

|

Kexuan Yao, age 41, Mr. Yao has served as the Chairman of the Board of Directors and Chief Executive Officer since June 2008. Mr. Yao has served as the Chairman and General Manager of our subsidiary Armco Metals International Limited (formerly “Armco & Metawise (H.K) Limited”) (“Armco HK”) since its inception in 2001. From 1996 to 2001, Mr. Yao served as the General Manager of the Tianjian Branch for Zhengzhou Gaoxin District Development Co., Ltd., a Chinese metal distribution business. While at Zhengzhou Gaozin District Development Co., Ltd., his main responsibility was the management of the iron ore import department, which coordinated the delivery of iron ore from around the world into China. Mr. Yao received a bachelor’s degree from Henan University of Agriculture in 1996 and expects to obtain an EMBA degree from the China Europe International Business School (CEIBS) within this year. Our Board of Directors believes Mr. Yao’s experience in the metal ore business and his experience and success in operating Armco Metals International Limited are important attributes that enhance the quality of the Board of Directors.

Fengtao Wen, age 39, Mr. Wen has served as our Chief Financial Officer since June 2008. Mr. Wen has served as the accounting manager of our subsidiary Armco Metals International Limited and its subsidiary Henan Armco & Metawise Trading Co., Ltd. (“Henan Armco”) since 2005 and is responsible for supervision of financial controls and management of these entities. From 1996 to 2005, Mr. Wen worked in the accounting department of Zhengzhou Smithing Co., Ltd. Mr. Wen graduated from the Economics Department of Zhengzhou University in 1996.

Weigang Zhao, age 34, Mr. Zhao has been a member of our Board of Directors since June 2008. Mr. Zhao is a key employee and has served as the Vice General Manager of Armco Metals International Limited’s subsidiary Armco (Lianyungang) Renewable Metals, Inc. (“Renewable Metals”, formerly known as “Armet Lianyuang”) since 2007. From 2005 through 2006 Mr. Zhao served as a manager in the supply department at Henan Anyang Steel Co., Ltd. From 2003 through 2004 Mr. Zhao served as the marketing manager at Sinotrans Henan Co., Ltd. Mr. Zhao graduated with a bachelor’s degree in Economics from Henan College of Finance and Economics in 2002. Our Board of Directors believes Mr. Zhao’s experience in the steel industry is a key qualification for his inclusion on the Board of Directors.

15

EXECUTIVE COMPENSATION

The following discussion provides compensation information pursuant to the scaled disclosure rules applicable to “smaller reporting companies” under SEC rules and may contain statements regarding future individual and Company performance targets and goals. These targets and goals are disclosed in the limited context of the Company’s compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. We specifically caution stockholders not to apply these statements to other contexts.

The Board of Directors administers the compensation program for the executive officers. The Compensation Committee is responsible for reviewing and recommending our compensation and employee benefit policies to the Board for its approval and implementation. The Compensation Committee reviews and recommends to the Board of Directors for approval the compensation for our Chief Executive Officer, including salaries, bonuses and grants of awards under our equity incentive plans. The Compensation Committee and the Board of Directors review and act upon proposals by non-interested management to determine the compensation to other executive officers. The Compensation Committee, among other things, reviews and recommends to the Board of Directors employees to whom awards will be made under our equity incentive plans, determines the number of options to be awarded, and the time, manner of exercise and other terms of the awards.

The intent of the compensation program is to align the executive’s interests with that of our stockholders, while providing incentives and competitive compensation for implementing and accomplishing our short-term and long-term strategic and operational goals and objectives. The compensation of the named executive officers consists of base salary, discretionary bonus, and equity in the Company.

Chief Executive Officer’s Compensation

On December 18, 2008, we entered into an employment agreement with Mr. Yao, our Chief Executive Officer and Chairman of the Board of Directors, for a term of thirty-six (36) months commencing January 1, 2009 (the “CEO Agreement”). The CEO Agreement expired on December 31, 2011.

On October 26, 2009, we awarded 200,000 shares of our restricted common stock (the “CEO Restricted Stock Award”) pursuant to our 2009 Stock Incentive Plan to Mr. Yao. The shares awarded to Mr. Yao vested 66,667 shares on December 15, 2010, 66,667 shares on December 15, 2011 and 66,666 shares on December 15, 2012.

On February 8, 2011, we awarded 200,000 shares of our restricted common stock (the “CEO Restricted Stock Award”) pursuant to our 2009 Stock Incentive Plan to Mr. Yao. The shares awarded to Mr. Yao vest 125,00 shares on a quarterly basis.

The CEO Agreement and the CEO Restricted Stock Award were approved by our Board of Directors when there were no independent directors on the board. Accordingly, Mr. Yao and other members of management who were also board members in 2008, each had significant influence over the terms and conditions of the CEO Agreement.

Advice of Compensation Consultant

In September 2011, the Compensation Committee engaged Frederic. W. Cook & Co., Inc., an independent compensation consultant, to advise us on the compensation provided to our Chief Executive Officer, Mr. Kexuan Yao, and determine what actions, if any, were appropriate regarding future executive compensation arrangements.

16

In developing their assessment, the consultant considered pay practices of companies in similar industries and of similar size. The consultant also gave consideration to the fact that Mr. Yao has provided personal guarantee for certain of our credit facilities. As a result of its analysis, Frederic. W. Cook & Co., Inc. recommended that the target compensation to Mr. Yao should generally be positioned at the median of comparably sized companies in similar industries. The consultant further recommended components and terms of each components of Mr. Yao’s future compensation. Based on the analysis and recommendations, the Compensation Committee adopted and approved the New CEO Agreement as described below under “Executive Employment Agreements and Narrative Regarding Executive Compensation”.

In 2012, Mr. Yao elected to forego the annual cash bonus in amount equal to 50% of his base Salary for 2012 due under Section 4(b) of the New CEO Agreement.

In 2012, the Board of Directors awarded Mr. Yao 50,000 shares of the Company’s common stock as bonus for his service in the first half of 2012, multiplied by $0.33, which was the closing stock price per share on July 30, 2012, the date of grant, and 68,187 shares of the Company’s common stock as bonus for his service in the second half of 2012, multiplied by $0.35, which was the closing stock price per share on November 12, 2012. Both grants fully vested on the date of grant. The Board of Directors utilized the Evaluation System (as defined below “Other Executive Officers’ Compensations”) in reviewing and determining the awarded stock bonus.

In 2012, given to the limited cash reserve of the Company, the Board of Director approved a grant of an aggregate of 582,223 shares of the Company’s common stock in lieu of the cash compensation of approximately $195,071 (based on the closing stock price on the grant date) foregone at the election by Mr. Yao.

Other Executive Officers’ Compensations

The compensation of our Chief Financial Officer and Vice General Manager of Renewable Metals is determined by the Board of Directors, by reviewing and acting upon proposals by non-interested management. The proposals are formed based upon the scope of the named executive officer’s duties and responsibilities to our Company and a number of performance-based factors including, the individual performance in each evaluation period, and the company’s financial (such as revenue growth, profitability, increase return on investment) and non-financial performance (such as improvement of timely delivery, quality control, cost control, safety of operation, increase of customer base and satisfaction (such performance-based factors collectively as the “Evaluation System”). The Board of Directors also considers pay practice to executives in comparable companies in the location where such executives are based.

Our Board of Directors did not consult with any experts or other third parties in fixing the amount of compensation for our Chief Financial Officer and Vice General Manager of Renewable Metals.

In 2012, the Board of Directors awarded each of our Chief Financial Officer, Mr. Fengtao Wen and Vice General Manager of Renewable Metals, Mr. Weigang Zhao, 50,000 shares of the Company’s common stock as bonus for their services in the first half of 2012, multiplied by $0.33, which was the closing stock price per share on July 30, 2012, the date of grant.

In 2012, given to the limited cash reserve of the Company, the Board of Director approved a grant of an aggregate of 178,421 shares of the Company’s common stock in lieu of the cash compensation of approximately $60,994 (based on the closing stock price on the grant date) foregone at the election by our Chief Financial Officer, Mr. Fengtao Wen, and a grant of an aggregate of 122,907 shares of the Company’s common stock in lieu of the cash compensation of approximately $42,904 (based on the closing stock price on the grant date) foregone at the election by Vice General Manager of Renewable Metals, Mr. Weigang Zhao.

We do not have employment agreements with our Chief Financial Officer and Vice General Manager of Renewable Metals. The non-interested management proposed to increase the base salary for 2013 of such named executive officers by 10% compared to 2012 provided that the named executive officers meet a set of performance goals required for each of them. The Board of Directors have not discussed or approved such proposal.

Summary Compensation Table

The following table summarizes all compensation recorded by us in the last two fiscal years for:

|

·

|

our principal executive officer, our principal financial officer or other individuals serving in a similar capacities; and

|

|

·

|

our two most highly compensated executive officers other than our principal executive officer and principal financial officer, who were serving as executive officers as of December 31, 2012.

|

17

For definitional purposes these individuals are sometimes referred to as the “named executive officers”. The value attributable to any stock or option awards is computed in accordance with ASC Topic 718. The amounts reflected in columns (e) represent the dollar amount recognized for financial statement reporting purposes with respect to 2012 and 2011 for the grant date fair value of securities granted in each respective year in accordance with ASC Topic 718. Pursuant to SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. These amounts reflect our accounting expense for these awards, and do not correspond to the actual value that may be realized upon exercise or vesting.

|

Name and

principal

position (a)

|

Year

(b)

|

Salary ($)

(c)

|

Bonus ($)

(d)

|

Stock

Awards($)

(e) (2)

|

Option

Awards

($)

(f)

|

All Other

Compensation

(i)(1)

|

Total

($)

(j)

|

|||||||||||||||||||

|

Kexuan Yao,

|

||||||||||||||||||||||||||

|

Chief Executive Officer

|

2012

|

$250,000

|

(6)

|

$289,858

|

(6)

|

$539,858

|

||||||||||||||||||||

|

and Director

|

2011

|

$

|

99,945

|

-

|

$

|

38,170

|

(3)

|

-

|

$

|

-

|

$

|

138,115

|

||||||||||||||

|

Fengtao Wen,

|

||||||||||||||||||||||||||

|

Chief

|

2012

|

$

|

30,764

|

$

|

77,494

|

(7)

|

$

|

108,258

|

||||||||||||||||||

|

Financial Officer

|

2011

|

$

|

26,880

|

-

|

$

|

10,335

|

(4)

|

-

|

$

|

-

|

$

|

37,215

|

||||||||||||||

|

Weigang Zhao,

|

||||||||||||||||||||||||||

|

Vice General

|

||||||||||||||||||||||||||

|

Manager of Renewable Metals

|

2012

|

$

|

10,450

|

$

|

59,404

|

(8)

|

$

|

69,854

|

||||||||||||||||||

|

and Director

|

2011

|

$

|

8,364

|

-

|

$

|

2,291

|

(5)

|

-

|

$

|

-

|

$

|

10,655

|

||||||||||||||

|

(1)

|

All perquisites awarded to the above individuals were less than $10,000 for each of the 2012 and 2011 fiscal years.

|

|

(2)

|

The amounts in this column represent the fair value of the award as of the grant date as computed in accordance with FASB ASC Topic 718.

|

|

(3)

|

Representing 141,371 shares of the Company’s common stock for his 2011 services in lieu of cash multiplied by $0.27, which was the closing stock price per share on December 15, 2011, the date of grant. Such shares fully vested on the date of grant.

|

|

(4)

|

Representing 38,276 shares of the Company’s common stock for his 2011 services in lieu of cash multiplied by $0.27, which was the closing stock price per share on December 15, 2011, the date of grant. Such shares fully vested on the date of grant.

|

|

(5)

|

Representing 8,485 shares of the Company’s common stock for his 2011 services in lieu of cash multiplied by $0.27, which was the closing stock price per share on December 15, 2011, the date of grant. Such shares fully vested on the date of grant.

|

|

(6)

|

Representing aggregated shares granted to him in 2012 as follows:

· 435,363 shares of the Company’s common stock for his first half of 2012 services in lieu of cash multiplied by $0.33, which was the closing stock price per share on July 30, 2012, the date of grant. Such shares fully vested on the date of grant;

·215,027 shares of the Company’s common stock, of which 146,860 shares for his fourth quarter of 2012 services in lieu of cash multiplied by $0.35, which was the closing stock price per share on November 12, 2012, the date of grant, and 68,187shares as stock bonus for his service in the second half of 2012,, multiplied by $0.35, which was the closing stock price per share on November 12, 2012. Such shares fully vested on the date of grant; and

· 125,000 shares of the Company’s common stock for each quarter of 2012 services multiplied by $0.49, which was the closing stock price per share on February 8, 2012, the date of grant per employment agreement. Each of such 125,000 shares vested on April 1, 2012, July 1, 2012, October 1, 2012 and January 1, 2013, respectively (and such the grants were authorized by our board prior to each such issuance in 2012).

|

18

|

(7)

|

Representing aggregated shares granted to him in 2012 as follows:

· 10,000 shares of the Company’s common stock for his 2011 services in lieu of cash multiplied by $0.57, which was the closing stock price per share on February 6, 2012, the date of grant. Such shares fully vested on the date of grant. Such shares were accounted as 2012 compensation.

· 51,167 shares of the Company’s common stock for his first half of 2012 services in lieu of cash multiplied by $0.33, which was the closing stock price per share on July 30, 2012, the date of grant. Such shares fully vested on the date of grant;

·50,000 shares of the Company’s common stock for bonus for his first half of 2012 service, multiplied by $0.33, which was the closing stock price per share on July 30, 2012, the date of grant. Such shares fully vested on the date of grant; and

· 117,254 shares of the Company’s common stock for his second half of 2012 services in lieu of cash multiplied by $0.35, which was the closing stock price per share on November 12, 2012, the date of grant. Such shares fully vested on the date of grant.

|

|

(8)

|

Representing aggregated shares granted to him in 2012 as follows:

· 5,653 shares of the Company’s common stock for his first half of 2012 services in lieu of cash multiplied by $0.33, which was the closing stock price per share on July 30, 2012, the date of grant. Such shares fully vested on the date of grant.

·50,000 shares of the Company’s common stock for bonus for his first half of 2012 service, multiplied by $0.33, which was the closing stock price per share on July 30, 2012, the date of grant. Such shares fully vested on the date of grant.

· 117,254 shares of the Company’s common stock for his second half of 2012 services in lieu of cash multiplied by $0.35, which was the closing stock price per share on November 12, 2012, the date of grant. Such shares fully vested on the date of grant.

|

Outstanding Equity Awards at Year End

|

OPTION AWARDS

|

STOCK AWARDS

|

||||||||||||||||||||

|

Name

|

Number of Securities Underlying Unexercised options (#)(b)

|

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#)(c)

|

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#)(d)

|

Option

Exercise

Price ($)(e)

|

Option

Expiration

Date (f)

|

Number of Shares or Units of Stock that have not Vested (#)(g) (1)

|

Value of Shares or Units of Stock that have not Vested ($)(h)(2)

|

Equity Incentive

Plan Awards:

Number of

Unearned

Shares, Units or

Other Rights

that have not

Vested (#)(i)(3)

|

Equity Incentive Plan Awards: Market or

Payout Value of

Unearned Shares, Units

or Other Rights that

have not

Vested ($)(j) (2)

|

||||||||||||

|

Kexuan Yao

|

-

|

-

|

-

|

-

|

-

|

1,125,000

|

$

|

551,250

|

1,125,000

|

$

|

551,250

|

||||||||||

|

Fengtao Wen

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||

|

Weigang Zhao

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||

|

(1)

|

This column reflects the number of shares of our restricted common stock awarded to the respective named executive officer that had not yet vested as of December 31, 2012.

|

|

(2)

|

Determined based on the closing market price of our common stock on December 31, 2012, the last trading day in fiscal year ended December 31, 2011, of $0.49 per share.

|

|

(3)

|

Number of shares reflects each 125,000 shares of restricted common stock which shall vest on January 1, 2013, April 1, 2013, July 1, 2013, October 1, 2013, January 1, 2014, April 1, 2014, July 1, 2014, October 1, 2014 and January 1, 2015 if Mr. Yao remains as our employee at the time of vesting.

|

19

Executive Employment Agreements and Narrative Regarding Executive Compensation

Kexuan Yao

On December 18, 2008, we entered into an employment agreement with Mr. Yao, our Chief Executive Officer and Chairman of the Board of Directors, for a term of thirty-six (36) months commencing January 1, 2009 (the “CEO Agreement”). The CEO Agreement expired on December 31, 2011.

On October 26, 2009, we awarded 200,000 shares of our restricted common stock (the “CEO Restricted Stock Award”) pursuant to our 2009 Stock Incentive Plan to Mr. Yao. The shares awarded to Mr. Yao vest 66,667 shares on December 15, 2010, 66,667 shares on December 15, 2011 and 66,666 shares on December 15, 2012. For accounting purposes, we will recognize as compensation expense the approximately $656,000 associated with this restricted stock award over the three (3) year vesting period.

On February 8, 2011, we awarded 200,000 shares of our restricted common stock (the “CEO Restricted Stock Award”) pursuant to our 2009 Stock Incentive Plan to Mr. Yao. The shares awarded to Mr. Yao vest 125,00 shares on a quarterly basis. For accounting purposes, we will recognize as compensation expense the approximately $748,500 associated with this restricted stock award over the three (3) year vesting period.

The CEO Agreement and the CEO Restricted Stock Award were approved by our Board of Directors when there were no independent directors on the board. Accordingly, Mr. Yao and other members of management who were also board members in 2008, each had significant influence over the terms and conditions of the CEO Agreement.

On February 8, 2012, Company and Kexuan Yao entered into a second Employment Agreement (the “New CEO Agreement”), to employ Mr. Yao as the Company’s Chairmen of the Board of the Directors, President, and Chief Executive Officer. The initial term of employment under the agreement is from January 1, 2012 (the “Effective Date”) until December 31, 2014, unless sooner terminated in accordance with the terms of the Employment Agreement. Pursuant to the Employment Agreement, Mr. Yao is entitled to, among others, the following compensation and benefits:

● A base salary at an annual rate of (i) $250,000 for the period beginning on the Effective Date through December 31, 2012; (ii) $270,000 for the period beginning on January 1, 2013 through December 31, 2013; and (iii) $300,000 for the period beginning on January 1, 2014 through December 31, 2014.

● A cash bonus equal to 50% of Mr. Yao’s base salary for each year during the contract term.

● During the employment term, the compensation committee shall have the discretion to grant Mr. Yao annual bonuses pursuant to a specified time or fixed schedule specified under the compensation plan at the date of the deferral of such compensation. Mr. Yao is also eligible to receive any other bonus under any other bonus plan, stock option or equity-based plan, or other policy or program of the Company, as may be approved by the compensation committee and in accordance with any stockholder approval incentive plan in effect at the time of such decision.

● Mr. Yao to receive 1,500,000 shares of the Company’s common stock (the “Restricted Shares”), subject to the terms and conditions of the Amended and Restated China Armco Metals, Inc. 2009 Stock Incentive Plan. The Restricted Shares will vest according to the following schedule: 125,000 shares of Restricted Shares to vest on the first day of each quarter over a three year period commencing on April 1, 2012 and terminating on January 1, 2015, provided, however, if the Executive is terminated pursuant to Section 5 of the CEO New Agreement, the Executive shall forfeit all the unvested Restricted Shares as of such termination.

● Eligibility to participate in the Company’s benefit plans that are generally provided for executive employees.

20