cami_s3a1-112712.htm

Registration No. 333-184354

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CHINA ARMCO METALS, INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

26-0491904

(I.R.S. Employer Identification Number)

One Waters Park Drive

Suite 98, San Mateo, CA

(650) 212-7620

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Kexuan Yao

Chief Executive Officer

China Armco Metals, Inc.

One Waters Park Drive

Suite 98, San Mateo, CA

(650) 212-7620

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

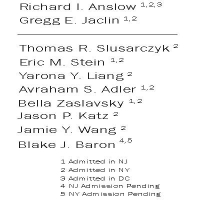

Richard I. Anslow, Esq.

Anslow & Jaclin, LLP

195 Route 9 South, Suite 204

Manalapan, NJ 07726

(732) 409-1212

From time to time after the effective date of this Registration Statement.

(Approximate date of commencement of proposed sale to the public)

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

(Do not check if a

smaller reporting company)

|

Smaller reporting company þ

|

CALCULATION OF REGISTRATION FEE CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities

To Be Registered

|

|

Amount

To Be Registered (1)

|

|

Proposed Maximum Offering Price Per Share (1)

|

|

Proposed Maximum Aggregate Offering Price (1) (2) (3)

|

|

Amount of

Registration Fee

|

|

Common Stock (3)

Preferred Stock (3)

Warrants (3) (4)

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

$1,621,356 |

|

|

$221.15

|

|

|

(1)

|

Not applicable pursuant to Form S-3 General Instruction II(D).

|

|

(2)

|

These figures are estimates made solely for the purpose of calculating the registration fee pursuant to Rule 457(o).

|

|

(3)

|

In addition to the securities issued directly under this registration statement, we are registering an indeterminate number of shares of common stock and preferred stock as may be issued upon conversion or exchange of the securities issued directly under this registration statement. No separate consideration will be received for any shares of common stock or preferred so issued upon conversion or exchange.

|

|

(4)

|

Includes warrants to purchase common stock, warrants to purchase preferred stock.

|

We hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until we shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 27, 2012

PRELIMINARY PROSPECTUS

CHINA ARMCO METALS, INC.

COMMON STOCK

PREFERRED STOCK

WARRANTS

This prospectus relates to common stock, preferred stock (including convertible preferred stock), and warrants for equity securities which we may sell from time to time in one or more offerings up to $1,621,356 of common stock, preferred stocks, and warrants. We may sell these securities to or through underwriters, directly to investors or through agents. We will specify the terms of the securities, and the names of any underwriters or agents, in supplements to this prospectus. You should read this prospectus and each supplement carefully before you invest. This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement.

Our common stock is listed on the NYSE MKT LLC, or NYSE MKT, under the symbol "CNAM." As of November 26, 2012, the aggregate market value of our outstanding common stock held by non-affiliates is approximately $ 4,864,069, based on 18,223,727 shares of outstanding common stock, of which 12,471,972 shares are held by non-affiliates, and a per share price of $0.39, based on the closing sale price of our common stock on November 26, 2012.

Investing in our securities involves significant risks. Before buying our securities you should refer to the risk factors included in our periodic reports, in prospectus supplements relating to specific offerings of securities and in other documents that we file with the Securities and Exchange Commission. See "Risk Factors" beginning on page 2 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus is .

TABLE OF CONTENTS

| |

|

|

ABOUT THIS PROSPECTUS

|

1

|

|

PROSPECTUS SUMMARY

|

1

|

|

RISK FACTORS

|

3

|

|

FORWARD LOOKING STATEMENTS

|

3

|

|

USE OF PROCEEDS

|

12

|

|

DILUTION

|

13

|

|

DESCRIPTION OF THE COMMON STOCK AND PREFERRED STOCK WE MAY OFFER

|

13

|

|

DESCRIPTION OF THE WARRANTS WE MAY OFFER

|

14

|

|

PLAN OF DISTRIBUTION

|

15

|

|

VALIDITY OF SECURITIES

|

17

|

|

EXPERTS

|

17

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

18

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

18

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or SEC, using the "shelf" registration process. Under this shelf registration process, we may sell common stock, preferred stock (including convertible preferred stock), and warrants for equity securities from time to time in one or more offerings up to $1,621,356 of common stock, preferred stock, and warrants. This prospectus provides you with a general description of the securities we may offer. Each time we sell any securities under this prospectus, we will provide a prospectus supplement containing specific information about the terms of that offering. The prospectus supplement may also add or update information contained in this prospectus, but the prospectus supplement may not contradict information in this prospectus. To the extent there is a new update to the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in this prospectus or any prospectus supplement—the statement in the later-dated document modifies or supersedes the earlier statement.

You should read both this prospectus and any prospectus supplement together with additional information described below under the headings "Where You Can Find More Information" and "Incorporation of Certain Information By Reference."

Unless otherwise expressly stated or the context indicates otherwise, references in this prospectus to the "Company", "we", "us" and "our" include China Armco Metals, Inc. and its consolidated subsidiaries; references in this prospectus to “MT” means metric tons, references in this prospectus to “PRC” or “China” means People’s Republic of China.

PROSPECTUS SUMMARY

You should read the following summary together with the more detailed information regarding our Company and the securities being registered appearing elsewhere in this prospectus.

China Armco Metals, Inc.

We are a U.S. company that is engaged in metal ore trading and distribution and scrap metal recycling. Our operations are conducted primarily in China.

In our metal ore trading and distribution business, we import, sell and distribute to the metal refinery industry in the PRC a variety of metal ore which includes iron, chrome, nickel, copper and manganese ore, as well as non-ferrous metals, and coal. We obtain these raw materials from global suppliers primarily in Brazil, India, Indonesia, Ukraine and the United States and distribute them in the PRC. In addition, we provide sourcing and pricing services for various metals to our network of customers.

In our scrap metal recycling business, we recycle scrap metal at our recycling facility (the "Facility") and sell the recycled product to steel mills for use in the production of recycled steel. Our scrap metal recycling business is conducted through the Facility, which commenced formal operations in the third quarter of 2010.

An investment in us is subject to a number of risks and significant uncertainty. Please see the risk factors under the heading "Risk Factors," beginning on page 2 of this prospectus for a discussion of these and other risks relating to our business and investment in our securities.

Corporate Information

We were formerly known as Cox Distributing, Inc., which was founded as an unincorporated business in January 1984 and became a “C” corporation in the State of Nevada on April 6, 2007. Cox Distributing, Inc. was founded by Stephen E. Cox, our former president and chief executive officer, and engaged in the distribution of organic fertilizer products used to improve soil and growing conditions for the potato farmers of eastern Idaho. Prior to June 27, 2008, Mr. Cox was our only employee.

On June 27, 2008, we entered into a share purchase agreement with Armco Metals International Limited (formerly “Armco & Metawise (H.K) Limited”) (“Armco HK”) and Feng Gao, the sole shareholder of Armco HK. In connection with the acquisition, we purchased from Ms. Gao 100% of the issued and outstanding shares of Armco HK’s capital stock for $6,890,000 by delivery of our purchase money promissory note. In addition, we issued to Ms. Gao a stock option entitling Ms. Gao to purchase a total of 5,300,000 shares of our common stock exercisable at $1.30 per share which expired on September 30, 2008 and 2,000,000 shares exercisable at $5.00 per share which expired on June 30, 2010. On August 12, 2008, Ms. Gao exercised her option to purchase and we issued 5,300,000 shares of our common stock in exchange for our $6,890,000 note held by Ms. Gao. Prior to the acquisition, there were 10,000,000 shares of our common stock issued and outstanding. In connection with the acquisition, 7,694,000 shares of common stock held by Mr. Cox were cancelled, leaving 2,306,000 shares of common stock issued and outstanding. The 5,300,000 shares issued to Ms. Gao represented approximately 69.7% of our issued and outstanding common stock giving effect to the cancellation of 7,694,000 shares of our common stock owned by Mr. Cox. No additional common stock was issued to Mr. Cox in connection with the acquisition. After the cancellation of 7,694,000 shares of common stock, Mr. Cox held 6,200 shares. These shares were exchanged on December 30, 2008 for all of the assets and liabilities of our fertilizer business, after which time we no longer operated the fertilizer business and Mr. Cox was no longer a shareholder.

As a result of the ownership interests of the former shareholders of Armco HK, for financial statement reporting purposes, the merger between us and Armco HK was treated as a reverse acquisition with Armco HK deemed the accounting acquirer and our company deemed the accounting acquiree under the purchase method of accounting in accordance with paragraph 805-40-05-2 of the FASB Accounting Standards Codification. The reverse merger is deemed a capital transaction and the net assets of Armco HK (the accounting acquirer) were carried forward to us (the legal acquirer and the reporting entity) at their carrying value before the combination. The acquisition process utilized our capital structure and the assets and liabilities of Armco HK which were recorded at historical cost. As a result of our reverse acquisition of Armco HK, we have assumed the business and operations of Armco HK with our principle activities engaged in the import, export and distribution of ferrous and non-ferrous ore and metals. On June 27, 2008, we amended our Articles of Incorporation, and changed our name to China Armco Metals, Inc. to better identify the Company with the business conducted, through its wholly owned subsidiaries in China, import, export and distribution of ferrous and non-ferrous ores and metals, and processing and distribution of scrap steel.

Armco HK was incorporated on July 13, 2001 under the laws of the Hong Kong Special Administrative Region (“HK SAR”) of the People’s Republic of China (“PRC”). On March 22, 2011, Armco HK amended its Memorandum and Articles of Association, and changed its name from Armco & Metawise (H.K) Limited to its current name.

On January 9, 2007, Armco HK formed Armco (Lianyungang) Renewable Metals, Inc. (“Renewable Metals”, formerly known as "Armet”), a wholly-owned foreign enterprise (“WOFE”) subsidiary in the City of Lianyungang, Jiangsu Province, PRC. Renewable Metals engages in the processing and distribution of scrap metal. On December 28, 2007, Armco HK entered into a Share Transfer Armco Agreement with Renewable Metals, whereby Armco HK transferred to Renewable Metals all of its equity interest in Henan Armco and Metawise Trading Co., Ltd. (“Henan Armco”), a company incorporated on June 6, 2002 in the City of Zhengzhou, Henan Province, PRC and under common control of Armco HK. Henan Armco engages in the import, export and distribution of ferrous and non-ferrous ores and metals. On December 1, 2008, Armco HK transferred its 100% equity interest in Renewable Metals to Armco Metals.

On June 4, 2009, the Company formed Armco (Lianyungang) Holdings, Inc. (“Lianyungang Armco”), a WOFE subsidiary in the City of Lianyungang, Jiangsu Province, PRC. Lianyungang Armco intends to engage in marketing and distribution of the recycled scrap steel.

On July 16, 2010, we formed a new subsidiary named Armco Metals (Shanghai) Holdings, Ltd. (“Armco Shanghai”). Armco Shanghai serves as our China operations headquarters and oversees the activities of the company regarding financing and international trading.

Our principal executive offices are located at One Waters Park Drive, Suite 98, San Mateo, California, and our telephone number is (650) 212-7620. Our website is www.armcometals.com. The information on our website does not constitute a part of this prospectus.

RISK FACTORS

Investing in our securities involves high risks and uncertainties that may result in a loss of all or part of your investment. You should carefully review the risk factors contained under the heading "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2012, which risk factors are incorporated by reference in this prospectus, the information contained under the heading "Special Note Regarding Forward-Looking Statements" and other information incorporated by reference in this prospectus before making an investment decision. If any of such risks occur, our business, financial condition or results of operations could be materially harmed, the market price of our securities could decline, and you could lose all or part of your investment.

In addition, each applicable prospectus supplement will contain a discussion of risks applicable to the particular type of securities that we are offering under that prospectus supplement. Prior to making a decision about investing in our securities, you should carefully consider the risk factors in this prospectus in addition to the specific risk factors discussed under the caption "Risk Factors" in the applicable prospectus supplement, together with all other information contained in the applicable prospectus supplement or appearing in, or incorporated by reference in, this prospectus.

FORWARD LOOKING STATEMENTS

This prospectus, any prospectus supplement and the documents we incorporate by reference in this prospectus include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, which we refer to as the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act. We may identify these statements by the use of words such as believe, expect, anticipate, intend, potential, strategy, plan, and similar expressions. These forward-looking statements involve known and unknown risks and uncertainties. Our actual results may differ materially from those set forth in these forward-looking statements as a result of a number of different factors, including those described under the caption "Risk Factors" and elsewhere in this prospectus.

Risks Related To Our Business

WE OPERATE IN A BUSINESS THAT IS CYCLICAL AND WHERE DEMAND CAN BE VOLATILE, WHICH COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION OR RESULTS OF OPERATIONS.

We operate in a business that is cyclical and where demand can be volatile, which could have a material adverse effect on our results of operations and financial condition. The timing and magnitude of the cycles in the business in which we operate are difficult to predict. Purchase prices for the raw materials we purchase (metal ore and scrap metal), and selling prices for our products (metal ore, scrap and recycled metal) are volatile and beyond our control. While we attempt to respond to changing raw material costs through adjustments to the sales price of our products, our ability to do so is limited by competitive and other market factors. Differences in economic conditions between the foreign markets, where we acquire our metal ore and a significant portion of our scrap metal, and the markets in the PRC, where we sell our products, could have a material adverse effect on our business, financial condition and results of operations. A significant reduction in selling prices for our products may have a material adverse effect on our business, financial condition and results of operations, and adversely impact our ability to recover purchase costs from end customers. A decline in market prices for our products between the date of the sales order and shipment of the product may impact the customer’s ability to obtain letters of credit to cover the full sales amount. A decline in selling prices for our products coupled with customers failing to meet their contractual obligations may also result in a net realizable value adjustment to the average cost of inventory to reflect the lower of cost or fair market value. Additionally, changing prices could potentially impact the volume of raw materials available to us, the volume of ore and processed metal sold by us and inventory levels. The cyclical nature of our businesses tends to reflect and be amplified by changes in general economic conditions, both domestically and internationally. For example, the automobile and construction industries typically experience cutbacks in production, resulting in decreased demand for steel, copper and aluminum. This can lead to significant decreases in demand and pricing for our metal ore and recycled metal.

OUR BUSINESS DEPENDS ON ADEQUATE SUPPLY AND AVAILABILITY OF METAL ORE AND SCRAP METAL.

Our business requires metal ore and scrap metal that are sourced from third-party suppliers. We are affected by industry supply conditions, which generally involve risks beyond our control, including costs of these materials, transportation costs and market demand. As a result, we may not be able to obtain an adequate supply of quality metal ore or scrap metal in a timely or cost-effective manner. If an adequate supply of scrap metal is not available to us, we would be unable to recycle metals at desired volumes, which would have a material adverse effect on our business, financial condition and results of operations.

OUR BUSINESS DEPENDS ON ADEQUATE SUPPLY AND AVAILABILITY OF ELECTRICITY, WHICH HAS RECENTLY BEEN CURTAILED BY THE CHINESE AUTHORITIES.

We rely on electricity to operate equipment at the Facility. Our steel mill and other customers are also dependent on electricity to convert our recycled scrap metal into steel and other products. Accordingly, the successful operation of our business and the Facility requires a reliable supply of electricity. The PRC’s electricity industry has historically experienced shortages and price volatility as a result of a variety of factors, including surging demand as a result of rapid growth in the PRC and disruptions in the supply of coal used to produce electricity. In addition, the Chinese authorities mandated a significant reduction of energy usage and instituted “rolling brownouts” during the third and fourth quarters of 2010 in an effort to meet targets for energy consumption and emissions set by the 11th Five Year Plan (2006-2010). This policy adversely impacted our revenues in the end of third quarter and the entire fourth quarter of 2010 by reducing our ability to operate the Facility. The energy restrictions also negatively affected steel companies’ production thereby reducing the demand and prices for the metal ore we distributed and the processed scrap metal produced at the Facility. As a result, we experienced a decrease in revenues, which adversely impact our business, financial condition and results of operations for the third and fourth quarters of 2010.

While the “rolling brownouts” restrictions has been eliminated with the implementation of the PRC’s 12th Five Year Plan (2011-2015) on January 1, 2011, there can be no assurances that additional energy use restrictions will not be imposed in the future. Any continuation of these restrictions will have a material adverse effect on our business, financial condition and results of operations. We are also unable to predict whether other energy or environmental policies will be adopted by the Chinese government that could adversely impact our operations in future periods.

UNEXPECTED EQUIPMENT FAILURES MAY LEAD TO PRODUCTION CURTAILMENTS OR SHUTDOWNS.

If we suffer interruptions in our production capabilities, such interruptions will adversely affect our production costs, steel available for sales and revenues for the affected period, and may have a material adverse effect on our business, financial condition and results of operations. In addition to equipment failures, the Facility is also subject to the risk of catastrophic loss due to unanticipated events such as acts of god (including earthquakes and floods), fires, explosions, terrorism, public health pandemics and labor disputes. Our recycling processes are highly dependent upon critical pieces of equipment, such as shredders and cutting machines, as well as electrical equipment. This equipment may, on occasion, be out of service as a result of unanticipated failures. We may in the future experience material shutdowns of the Facility or periods of reduced production as a result of such equipment failures. Our shredding machine is highly complex and requires experienced and knowledgeable personnel to efficiently operate and maintain. Because we are in the early stages of operating this machine, we have experienced delays and inefficiencies due to our lack of operational experience with the machine.

THE FACILITY IS IN AN EARLY STAGE OF OPERATION AND IS NOT CURRENTLY OPERATING AT FULL PRODUCTION CAPABILITY

We commenced operations at the Facility and we are currently operating at significantly less than full production capacity. Our ability to achieve full production capacity is dependent upon, among other items, our ability to attract sufficient customers to purchase the scrap metal that we recycle and our ability to obtain raw materials at favorable prices to support our production. There can be no assurance that we will achieve full production capability at the Facility in the future.

THE SCRAP METAL RECYCLING MARKETS IN WHICH WE OPERATE ARE HIGHLY COMPETITIVE. COMPETITIVE PRESSURES FROM EXISTING AND NEW COMPANIES COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The markets for scrap metal are highly competitive, both in the purchase of raw scrap and the sale of processed scrap. We compete to purchase raw scrap with numerous independent recyclers, large public scrap processors and smaller scrap companies. Successful procurement of materials is determined primarily by the price and promptness of payment for the raw scrap and the proximity of the Facility to the source of the unprocessed scrap. We occasionally face competition for purchases of unprocessed scrap from producers of steel products, such as integrated steel mills and mini-mills, which have vertically integrated their operations by entering the scrap metal recycling business. Many of these producers have substantially greater financial, marketing and other resources. Our operating costs could increase as a result of competition with these other companies for raw scrap.

We compete in a global market with regard to the sale of processed scrap. Competition for sales of processed scrap is based primarily on the price, quantity and quality of the scrap metals, as well as the level of service provided in terms of consistency of quality, reliability and timing of delivery. To the extent that one or more of our competitors becomes more successful with respect to any key factor, our ability to attract and retain consumers could be materially and adversely affected. Our scrap metal processing operations also face competition from substitutes for prepared ferrous scrap, such as pre-reduced iron pellets, hot briquetted iron, pig iron, iron carbide and other forms of processed iron. The availability of substitutes for ferrous scrap could result in a decreased demand for processed ferrous scrap, which could result in lower prices for such products.

UNANTICIPATED DISRUPTIONS IN OUR SCRAP METAL RECYCLING OPERATIONS OR SLOWDOWNS BY OUR SHIPPING COMPANIES COULD ADVERSELY AFFECT OUR ABILITY TO DELIVER OUR PRODUCTS, WHICH COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATION, AND OUR RELATIONSHIP WITH OUR CONSUMERS.

Our ability to process and fulfill orders and manage inventory depends on the efficient and uninterrupted operation of the Facility. In addition, our products are usually transported to consumers by third-party truck, rail carriers and vessel services. As a result, we rely on the timely and uninterrupted performance of these third party shipping companies. Due to factors beyond our control, including changes in fuel prices, political events, governmental regulation of transportation, changes in market rates, carrier availability and disruptions in transportation infrastructure, we may be forced to increase our charges for transportation services. Consequently, we may not be able to transport our products in a timely and cost-effective manner. Any interruption in our operations or interruption or delay in transportation services could cause orders to be canceled, lost or delivered late, goods to be returned or receipt of goods to be refused. As a result, any disruption could negatively impact our relationships with our customers and have a material adverse effect on our business, financial condition and results of operations.

DURING UNCERTAIN ECONOMIC CONDITIONS, CUSTOMERS MAY BE UNABLE TO FULFILL THEIR CONTRACTUAL OBLIGATIONS.

We enter into sales contracts preceded by negotiations that include fixing price, quantities, shipping terms and other contractual elements. Upon finalization of these terms and satisfactory completion of other contractual contingencies by us, our customers typically open a letter of credit to satisfy their obligation under the contract prior to shipment by us. In many instances, and particularly during uncertain economic conditions, we are at risk on consummating the transaction until our customers successfully obtain the letter of credit. As a result, the customer may not be able to fulfill its obligation under the contract in times of illiquid market conditions. Moreover, as described elsewhere in this Form 10-K, suppliers and customers in the PRC often breach contracts and there may be inadequate recourse for us to enforce such agreements.

IF WE WERE TO LOSE ORDER VOLUMES FROM ANY OF OUR MAJOR CUSTOMERS, OUR SALES WOULD DECLINE SIGNIFICANTLY AND OUR CASH FLOWS WOULD BE REDUCED, WHICH COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

In 2011, our largest customers purchased products from us on a spot or short term contract basis and in the future may choose not to continue to purchase our products. A loss of order volumes from any major customer, or a significant reduction in their purchase orders could have a material adverse effect on our business, financial condition and results of operations. In addition, if we experience such a loss of order volumes or significant reduction in purchase orders, we would likely be required to increase borrowings under our credit facilities to meet our cash flow needs.,

WE WILL NEED ADDITIONAL FINANCING TO FUND WORKING CAPITAL AND THE POTENTIAL EXPANSION OF THE FACILITY. ADDITIONAL CAPITAL RAISING EFFORTS IN FUTURE PERIODS IS LIKELY TO BE DILUTIVE TO OUR THEN CURRENT SHAREHOLDERS OR RESULT IN INCREASED INTEREST EXPENSE IN FUTURE PERIODS.

We will need to raise additional capital to increase the volume of our purchases of metal ore that we trade and distribute. Moreover, if we decide to expand the capacity of the Facility, we will also need additional capital to fund that expansion. Our future capital requirements depend on a number of factors. These factors include, but are not limited to, the scope of our expansion efforts and the amount of available metal ore, our ability to manage growth and expansion and our ability to control expenses. In the event we seek to raise additional capital through the issuance of debt or its equivalents, this will result in increased interest expense. If we raise additional capital through the issuance of equity or convertible debt securities, the percentage ownership of our company held by existing shareholders will be reduced and those shareholders may experience significant dilution. As we will generally not be required to obtain the consent of our shareholders if we elect to expand the Facility or to purchase more raw materials required in our operations, shareholders are dependent upon the sole discretion and judgment of our management in determining the number of, and characteristics of, stock issued to raise funds for these purposes and others. In addition, new securities may contain certain rights, preferences or privileges that are senior to those of our common stock. We cannot assure you that we will be able to raise the working capital as needed in the future on terms acceptable to us, if at all. Any inability to raise capital as needed would have a material adverse effect on our business, financial condition and results of operations.

CERTAIN AGREEMENTS TO WHICH WE ARE A PARTY AND WHICH ARE MATERIAL TO OUR OPERATIONS LACK VARIOUS LEGAL PROTECTIONS WHICH ARE CUSTOMARILY CONTAINED IN SIMILAR CONTRACTS PREPARED IN THE UNITED STATES.

Our subsidiaries include companies organized under the laws of the PRC and which conduct all of their business and operations in the PRC and Hong Kong. We are a party to certain contracts related to our operations in the PRC and Hong Kong. While these contracts contain the basic business terms of the agreements between the parties, these contracts do not contain certain clauses which are customarily contained in similar contracts prepared in the United States. These clauses include representations and warranties of the parties, confidentiality and non-compete clauses, provisions outlining events of defaults and termination provisions. In addition, remedies and dispute resolution mechanisms in our contracts are typically vague, rendering enforcement of these contracts difficult. Because our contracts in the PRC omit these customary clauses, notwithstanding the differences in Chinese and U.S. laws, we may not have the same legal protections as we would if the contracts contained these additional clauses. We anticipate that our Chinese and Hong Kong subsidiaries will likely enter into contracts in the future which will likewise omit these customary legal protections. While we have not been subject to any material adverse consequences as a result of the omission of these customary clauses, and we generally consider the contracts to which we are a party to contain all the material terms of our business arrangements with the other party, future events may occur which lead to a dispute which could have been avoided if the contracts included customary clauses in conformity with U.S. standards. Contractual disputes which may arise from this lack of legal protection could divert management's time from the operation of our business, require us to expend funds attempting to settle a possible dispute, limit the time our management would otherwise devote to the operation of our business, and have a material adverse effect on our business, financial condition and results of operations.

WE DEPEND ON OUR KEY MANAGEMENT PERSONNEL AND THE LOSS OF THEIR SERVICES COULD ADVERSELY AFFECT OUR BUSINESS.

Our future performance depends substantially on the services of our senior management and other key personnel, as well as our ability to retain and motivate them. The loss of the services of any of our executive officers, including a Chairman and CEO, or other key employees could have a material adverse effect on our business, results of operations and financial condition. Although we entered into a three-year employment agreement with Kexuan Yao, our Chairmen of the Board, President, and Chief Executive Officer and pursuant to such employment agreement we will purchase on the life of Kexuan Yao up to $50 million of key man life insurance with the Company as the beneficiary of the death benefit, we cannot guarantee that these measures will sufficiently secure Kexuan Yao’s services with us or remedy the loss of the services of Kexuan Yao if that occurs.

Our business depends on attracting and retaining key personnel. Our future success also will depend on our ability to attract, train, retain and motivate highly skilled technical, managerial, sales, and customer support personnel. Competition for these personnel is intense, and we may be unable to successfully attract, integrate, or retain sufficiently qualified personnel.

IF OUR CUSTOMERS DO NOT COMPLY WITH THEIR EXISTING COMMERCIAL CONTRACTS AND COMMITMENTS, IT COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Most consumers of the metals products we sell have been adversely impacted by the global recession and related economic downturn. Many of our customers have experienced reductions in their operations. Prices for many of the metals products we sell have declined, in some instances substantially. These factors have contributed to attempts by some of our customers to seek renegotiation or cancellation of their existing purchase commitments. In addition, some of our customers have breached previously agreed upon contracts to buy our products by refusing delivery of the products. Where appropriate, we will in the future pursue litigation to recover our damages resulting from customer contract defaults, although the success of any such litigation and our ultimate ability to recover for contractual breaches is uncertain. If a large number of our customers were to default on their existing contractual obligations to purchase our products, it would have a material adverse effect on our business, financial condition and results of operations.

Risks Related To Doing Business in the PRC

A SUBSTANTIAL PORTION OF OUR ASSETS AND OPERATIONS ARE LOCATED IN THE PRC AND ARE SUBJECT TO CHANGES RESULTING FROM THE POLITICAL AND ECONOMIC POLICIES OF THE PRC GOVERNMENT.

Our business operations could be restricted by the political environment in the PRC. The PRC has operated as a socialist state since 1949 and is controlled by the Communist Party of China. In recent years, however, the government has introduced reforms aimed at creating a "socialist market economy" and policies have been implemented to allow business enterprises greater autonomy in their operations. Changes in the political leadership of the PRC may have a significant effect on laws and policies related to the current economic reform programs, the other policies affecting business and the general political, economic and social environment in the PRC, including the introduction of measures to control inflation, changes in the rate or method of taxation, the imposition of additional restrictions on currency conversion and remittances abroad, and foreign investment. The PRC's economy has experienced significant growth in the past decade, although growth has recently been slowing. Moreover, economic reforms and growth in the PRC have been more successful in certain provinces than in others, and the continuation or increases of such disparities could affect the political or social stability of the PRC.

Because these economic reform measures may be inconsistent or ineffective, there are no assurances that:

the Chinese government will continue its pursuit of economic reform policies; economic policies, even if pursued, will be successful; policies will not be significantly altered from time to time; or operations in the PRC will not become subject to the risk of nationalization.

Although we believe that the economic reform and the macroeconomic measures adopted by the Chinese government have had a positive effect on the economic development of the PRC, the future direction of these economic reforms is uncertain and the uncertainty may have a material adverse effect on our business, results of operations and financial condition.

We cannot assure you that we will be able to capitalize on these economic reforms, assuming the reforms continue. Because our business model is dependent upon the continued economic reform and growth in the PRC, any change in Chinese government policy could have a material adverse effect on our business, financial condition and results of operations. Even if the Chinese government continues its policies of economic reform, there are no assurances that economic growth in the PRC will continue or that we will be able to take advantage of these opportunities in a fashion that will provide financial benefit to us.

THE CHINESE GOVERNMENT EXERTS SUBSTANTIAL INFLUENCE OVER THE MANNER IN WHICH OUR CHINESE SUBSIDIARIES MUST CONDUCT THEIR BUSINESS ACTIVITIES.

The PRC has permitted provincial and local economic autonomy and private economic activities. The government of the PRC has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in the PRC or particular regions of the PRC, and could require us to operate our business differently, including by requiring us to divest ourselves of any interest we then hold in our Chinese subsidiaries.

FLUCTUATION IN THE VALUE OF THE RENMINBI (RMB) MAY HAVE A MATERIAL ADVERSE EFFECT ON YOUR INVESTMENT.

The change in value of the RMB, the main currency in the PRC, against the U.S. dollar and other currencies is affected by, among other things, changes in the PRC’s political and economic conditions. Under the current PRC policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This policy has resulted in the appreciation of the RMB against the U.S. dollar. While the international reaction to the RMB revaluation has generally been positive, there remains significant international pressure on the Chinese government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the RMB against the U.S. dollar. Because a significant portion of our costs and expenses is denominated in RMB, any potential future revaluation could further increase our costs and have a material adverse effect on our business, financial condition and results of operations.

RESTRICTIONS ON CURRENCY EXCHANGE LIMIT OUR ABILITY TO RECEIVE AND USE OUR REVENUES EFFECTIVELY. WE MAY NOT HAVE READY ACCESS TO CASH ON DEPOSIT IN BANKS IN THE PRC.

Because a substantial portion of our revenues are in the form of RMB, any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside the PRC or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies, after providing valid commercial documents, at those banks authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, is subject to government approval in the PRC, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that we could have ready access to the cash should we wish to transfer it to bank accounts outside the PRC nor can we be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB, especially with respect to foreign exchange transactions. As a result, we may suffer delays in our ability to meet our obligations outside the PRC and may be required to seek additional amounts of borrowings to fund our operations outside the PRC.

WE MAY BE UNABLE TO ENFORCE OUR RIGHTS DUE TO POLICIES REGARDING THE REGULATION OF FOREIGN INVESTMENTS IN THE PRC.

The PRC's legal system is a civil law system based on written statutes in which decided legal cases have little value as precedent, unlike the common law system prevalent in the United States. The PRC does not have a well-developed, consolidated body of laws governing foreign investment enterprises. As a result, the administration of laws and regulations by government agencies may be subject to considerable discretion and variation, and may be subject to influence by external forces unrelated to the legal merits of a particular matter. The PRC's regulations and policies with respect to foreign investments are evolving. Definitive regulations and policies with respect to such matters as the permissible percentage of foreign investment and permissible rates of equity returns have not yet been published. Statements regarding these evolving policies have been conflicting and any such policies, as administered, are likely to be subject to broad interpretation and discretion and to be modified, perhaps on a case-by-case basis. The uncertainties regarding such regulations and policies present risks which may affect our current operations and future plans in the PRC and elsewhere. If we are unable to enforce any legal rights we may have under our contracts or otherwise, our ability to compete with other companies in the steel industry and the other industries in which we compete could be severely limited. As a consequence, we would experience a loss of revenue in future periods which could have a material adverse effect on our business, financial condition and results of operations.

BECAUSE THERE IS LIMITED BUSINESS AND LITIGATION INSURANCE COVERAGE AVAILABLE IN THE PRC, ANY BUSINESS DISRUPTION OR LITIGATION WE EXPERIENCE MIGHT RESULT IN OUR INCURRING SUBSTANTIAL COSTS AND DIVERTING SIGNIFICANT RESOURCES TO HANDLE SUCH DISRUPTION OR LITIGATION.

While business disruption insurance may be available to a limited extent in the PRC, we have determined that the risks of disruption and the difficulties and costs associated with acquiring such insurance render it commercially impractical for us to have such insurance. As a result, we do not have any business liability or business disruption coverage for our operations in the PRC. Accordingly, any business disruption or litigation might result in our incurring substantial costs and the diversion of resources.

CHINESE REGULATIONS RELATING TO OFFSHORE INVESTMENT ACTIVITIES BY CHINESE RESIDENTS AND EMPLOYEE STOCK OPTIONS GRANTED BY OVERSEAS-LISTED COMPANIES MAY INCREASE OUR ADMINISTRATIVE BURDEN. IF OUR SHAREHOLDERS WHO ARE CHINESE RESIDENTS, OR OUR PRC EMPLOYEES WHO ARE GRANTED OR EXERCISE STOCK OPTIONS, FAIL TO MAKE ANY REQUIRED REGISTRATIONS OR FILINGS, WE MAY BE UNABLE TO DISTRIBUTE PROFITS AND MAY BECOME SUBJECT TO LIABILITY UNDER CHINESE LAWS.

The State Administration of Foreign Exchange ("SAFE") has promulgated regulations that require Chinese residents and PRC corporate entities to register with local branches of SAFE in connection with their direct or indirect offshore investment activities. Under the SAFE regulations, Chinese residents who make, or have previously made, direct or indirect investments in offshore companies will be required to register those investments. In addition, any Chinese resident who is a direct or indirect shareholder of an offshore company is required to file or update the registration with the local branch of SAFE with respect to that offshore company regarding certain material changes to the capital of the offshore company. If any Chinese shareholder fails to make the required SAFE registration or file or update the registration, the Chinese subsidiaries of that offshore parent company may be prohibited from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to their offshore parent company. In addition, the offshore parent company may also be prohibited from injecting additional capital into its Chinese subsidiaries. Moreover, failure to comply with the various SAFE registration requirements described above could result in liability under Chinese laws for evasion of applicable foreign exchange restrictions.

We cannot provide any assurances that all of our shareholders who are Chinese residents will make or obtain any applicable registrations or approvals required by these SAFE regulations. The failure or inability of our Chinese resident shareholders to comply with the registration procedures set forth therein may subject us to fines and legal sanctions, restrict our cross-border investment activities, or limit our Chinese subsidiaries' ability to distribute dividends or obtain foreign-exchange-denominated loans used by our company.

On March 28, 2007, SAFE promulgated the Application Procedure of Foreign Exchange Administration for Domestic Individuals Participating in Employee Stock Holding Plan or Stock Option Plan of Overseas Listed Company (the "Stock Option Rule"), to regulate foreign exchange procedures for Chinese individuals participating in employee stock holding and stock option plans of overseas companies. Under the Stock Option Rule, a Chinese domestic individual must comply with various foreign exchange procedures through a domestic agent institution when participating in any employee stock holding plan or stock option plan of an overseas listed company. Certain domestic agent institutions, such as the Chinese subsidiaries of an overseas listed company, a labor union of such company that is a legal person or a qualified financial institution, among others things, shall file with SAFE and be responsible for completing relevant foreign exchange procedures on behalf of Chinese domestic individuals. These procedures include but are not limited to applying to obtain SAFE approval for exchanging foreign currency in connection with owning stock or stock option exercises. Concurrent with the filing of such applications with SAFE, the Chinese subsidiary, as a domestic agent, must obtain approval from SAFE to open a special foreign exchange account at a Chinese domestic bank to hold the funds in connection with the stock purchase or option exercise, any returns based on stock sales, any stock dividends issued and any other income or expenditures approved by SAFE. Chinese subsidiaries are also required to obtain approval from SAFE to open an overseas special foreign exchange account at an overseas trust bank to hold overseas funds used in connection with any stock purchase.

Under the Stock Option Rule, all proceeds obtained by Chinese domestic individuals from sales of stock shall be fully remitted back to the PRC after relevant overseas expenses are deducted. The foreign exchange proceeds from these sales can be converted into RMB or transferred to the individual's foreign exchange savings account after the proceeds have been remitted back to the special foreign exchange account opened at the Chinese domestic bank. If the stock option is exercised in a cashless exercise, the Chinese domestic individuals are required to remit the proceeds to the special foreign exchange account. We and our Chinese employees who have been granted stock options are subject to this Stock Option Rule. If we or our Chinese employees holding options fail to comply with these regulations, we or our employees may be subject to fines and legal sanctions.

FUTURE INFLATION IN THE PRC MAY INHIBIT ECONOMIC ACTIVITY IN THE PRC.

In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. While inflation has been more moderate since 1995, high inflation in the future could cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in the PRC. Any actions by the Chinese government to regulate growth and contain inflation could have the effect of limiting our ability to operate our business in future periods.

Risks Related To Our Stock Performance

OUR STOCK PRICE IS HIGHLY VOLATILE.

The market price of our common stock is volatile, and this volatility may continue. Numerous factors, many of which are beyond our control, may cause the market price of our common stock to fluctuate significantly. In addition to market and industry factors, the price and trading volume for our common stock may be highly volatile for factors that are specific to our company. These factors include but are not limited to our low public float, that we have a controlling shareholder, our recent financial performance and the heightened regulatory scrutiny that certain companies with significant operations in China are experiencing in the United States. These and other factors could cause the market price for our shares to change substantially.

Securities class action litigation is often instituted against companies following periods of volatility in their stock price. This type of litigation could result in substantial costs to us and divert our management's attention and resources.

Moreover, the trading market for our common stock will be influenced by research or reports that industry or securities analysts publish about us or our business. If one or more analysts who cover us downgrade our common stock, the market price for our common stock would likely decline. If one or more of these analysts cease coverage of us or fail to regularly publish reports on us, we could lose visibility in the financial markets, which, in turn, could cause the market price for our common stock or trading volume to decline.

Furthermore, securities markets may from time to time experience significant price and volume fluctuations for reasons unrelated to operating performance of particular companies. These market fluctuations may adversely affect the price of our common stock and other interests in our company at a time when you want to sell your interest in us.

WE MAY HAVE DIFFICULTY ESTABLISHING ADEQUATE MANAGEMENT, LEGAL AND FINANCIAL CONTROLS IN THE PRC.

Our personnel employed in China are generally unfamiliar Western styles of management and financial reporting concepts and practices, which include sufficient corporate governance, internal controls and computer, financial and other control systems. In addition, we may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC, as we compete for global talent with larger and more well funded enterprises. As a result of these factors, we may experience difficulties in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards and applicable law in connection with our operations and our potential future acquisitions, if any. Therefore, we are likely to experience difficulties in implementing and maintaining adequate internal controls. Any such deficiencies, weaknesses or lack of compliance could have a material adverse effect on our business, financial condition and results of operations.

FAILURE TO COMPLY WITH THE UNITED STATES FOREIGN CORRUPT PRACTICES ACT COULD SUBJECT US TO PENALTIES AND OTHER ADVERSE CONSEQUENCES.

We are subject to the United States Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. We have implemented these policies through our Code of Conduct. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in the PRC. While we make every effort to comply with FCPA and our Company Code of Conduct, we can make no assurance that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that will likely have a material adverse effect on our business, financial condition and results of operations.

Risks Related to our Securities

PROVISIONS OF OUR ARTICLES OF INCORPORATION AND BYLAWS MAY DELAY OR PREVENT A TAKEOVER WHICH MAY NOT BE IN THE BEST INTERESTS OF OUR STOCKHOLDERS.

Provisions of our Articles of Incorporation and Bylaws may be deemed to have anti-takeover effects, which include when and by whom special meetings of our stockholders may be called, and may delay, defer or prevent a takeover attempt. In addition, certain provisions of the Nevada Revised Statutes also may be deemed to have certain anti-takeover effects which include that control of shares acquired in excess of certain specified thresholds will not possess any voting rights unless these voting rights are approved by a majority of a corporation's disinterested stockholders. Further, our Articles of Incorporation authorizes the issuance of up to 1,000,000 shares of preferred stock with such rights and preferences as may be determined from time to time by our Board of Directors in their sole discretion. Our Board of Directors may, without stockholder approval, issue series of preferred stock with dividends, liquidation, conversion, voting or other rights that could adversely affect the voting power or other rights of the holders of our common stock.

OUR CONTROLLING SECURITY HOLDERS MAY TAKE ACTIONS THAT CONFLICT WITH YOUR INTERESTS.

Our officers and directors beneficially own approximately 45.4% in the aggregate of our common stock. In this case, all of our officers and directors together will then likely be able to exercise control over all matters requiring stockholder approval, including the election of directors, amendment of our Articles of Incorporation and approval of significant corporate transactions, and they will have significant control over our management and policies. The directors elected by these security holders will be able to significantly influence decisions affecting our capital structure. This control may have the effect of delaying or preventing changes in control or changes in management, or limiting the ability of our other security holders to approve transactions that they may deem to be in their best interest.

Except as required by law, we undertake no obligation to update or revise any forward looking statement as a result of new information, future events or otherwise. All forward-looking statements included in this registration statement are made as of the date hereof.

Unless otherwise indicated in the applicable prospectus supplement, we anticipate that the net proceeds from the sale of the securities that we may offer under this prospectus and any accompanying prospectus supplement will be used for general corporate purposes. We will set forth in a prospectus supplement relating to a specific offering any intended use for the net proceeds received from the sale of securities in that offering. We will have significant discretion in the use of any net proceeds. Investors will be relying on the judgment of our management regarding the application of the proceeds of any sale of securities. We may invest the net proceeds temporarily until we use them for their stated purpose.

We may offer shares of common stock, shares of preferred stock, or warrants to purchase common stock, preferred stock, or any combination of the foregoing, either individually or as units consisting of one or more securities. We may offer up to an aggregate of $1,621,356 of securities under this prospectus. If securities are offered as units, we will describe the terms of the units in a prospectus supplement.

DILUTION

We will set forth in a prospectus supplement the following information, as required, regarding any dilution of the equity interests of investors purchasing securities in an offering under this prospectus:

• the net tangible book value per share of our equity securities before and after the offering;

• the amount of the change in such net tangible book value per share attributable to the cash payments made by purchasers in the offering; and

• the amount of the immediate dilution from the public offering price which will be absorbed by such purchasers.

DESCRIPTION OF THE COMMON STOCK AND PREFERRED STOCK WE MAY OFFER

The following is a description of the common stock and preferred stock we may offer under this prospectus. While the terms we have summarized below will apply generally to any future common stock or preferred stock that we may offer, we will describe the particular terms of these securities in more detail in the applicable prospectus supplement.

Common Stock

We are authorized to issue 74,000,000 shares of common stock. The holders of common stock are entitled to one vote per share on all matters submitted to a vote of the stockholders. Cumulative voting of shares of common stock is prohibited, which means that the holders of a majority of shares voting for the election of directors can elect all members of our board of directors. Except as otherwise required by applicable law, a majority vote is sufficient for any act of stockholders. The holders of common stock are entitled to receive ratably such dividends, if any, as may be declared from time to time by our board of directors out of funds legally available for the payment of dividends. In the event of our liquidation, dissolution, or winding up, the holders of common stock are entitled to share ratably in all assets remaining after payment of liabilities and amounts owed to holders of preferred stock. The holders of common stock have no preemptive or conversion rights or other subscription rights, and there are no redemption or sinking fund provisions applicable to the common stock.

The rights, preferences and privileges of holders of our common stock are subject to, and may be injured by, the rights of the holders of shares of any series of preferred stock that we may designate and issue in the future. The issuance of preferred stock could decrease the amount of earnings and assets available for distribution to holders of common stock or adversely affect the rights and powers of the holders of common stock, including their voting rights.

Preferred Stock

We are authorized to issue up to 1,000,000 shares of preferred stock having rights senior to our common stock. Our board of directors is authorized to establish the powers, rights, preferences, privileges and designations of one or more series of preferred stock without further stockholder approval, including:

| |

•

|

|

redemption rights and terms of redemption; and

|

| |

•

|

|

liquidation preferences.

|

The rights, preferences, privileges and restrictions of the preferred stock of each series will be fixed by a certificate of designation relating to each series. The prospectus supplement relating to each series will specify the terms of the preferred stock, including:

| |

•

|

|

the maximum number of shares in the series and the distinctive designation;

|

| |

•

|

|

the terms on which dividends will be paid, if any;

|

| |

•

|

|

the terms on which the shares may be redeemed, if at all;

|

| |

•

|

|

the liquidation preference, if any;

|

| |

•

|

|

the terms of any retirement or sinking fund for the purchase or redemption of the shares of the series;

|

| |

•

|

|

the terms and conditions, if any, on which the shares of the series will be convertible into, or exchangeable for, shares of any other class or classes of capital stock;

|

| |

•

|

|

the voting rights, if any, on the shares of the series; and

|

| |

•

|

|

any or all other preferences and relative, participating, operational or other special rights or qualifications, limitations or restrictions of the shares.

|

We will describe the specific terms of a particular series of preferred stock in the prospectus supplement relating to that series. The description of preferred stock above and the description of the terms of a particular series of preferred stock in the prospectus supplement are not complete. You should refer to the applicable certificate of designation for complete information. The prospectus supplement will contain a description of U.S. federal income tax consequences relating to the particular series of preferred stock.

DESCRIPTION OF WARRANTS TO PURCHASE

The following summarizes the terms of common stock warrants and preferred stock warrants we may issue. This description is subject to the detailed provisions of a stock warrant agreement that we will enter into between us and a stock warrant agent we select at the time of issue.

General

We may issue stock warrants evidenced by stock warrant certificates under a stock warrant agreement independently or together with any securities we offer by any prospectus supplement. If we offer stock warrants, the prospectus supplement will describe the terms of the stock warrants, including:

| |

•

|

|

the offering price, if any;

|

| |

•

|

|

if applicable, the designation and terms of the preferred stock purchasable upon exercise of the preferred stock warrants;

|

| |

•

|

|

the number of shares of common or preferred stock purchasable upon exercise of one stock warrant and the initial price at which the shares may be purchased upon exercise;

|

| |

•

|

|

the dates on which the right to exercise the stock warrants begins and expires;

|

| |

•

|

|

U.S. federal income tax consequences;

|

| |

•

|

|

call provisions, if any;

|

| |

•

|

|

the currencies in which the offering price and exercise price are payable; and

|

| |

•

|

|

if applicable, the antidilution provisions of the stock warrants.

|

The shares of common stock or preferred stock we issue upon exercise of the stock warrants will, when issued in accordance with the stock warrant agreement, be validly issued, fully paid and nonassessable.

Exercise of Stock Warrants

You may exercise stock warrants by surrendering to the stock warrant agent the stock warrant certificate, which indicates your election to exercise all or a portion of the stock warrants evidenced by the certificate. Surrendered stock warrant certificates must be accompanied by payment of the exercise price in the form of cash or a check. The stock warrant agent will deliver certificates evidencing duly exercised stock warrants to the transfer agent. Upon receipt of the certificates, the transfer agent will deliver a certificate representing the number of shares of common stock or preferred stock purchased. If you exercise fewer than all the stock warrants evidenced by any certificate, the stock warrant agent will deliver a new stock warrant certificate representing the unexercised stock warrants.

No Rights as Stockholders

Holders of stock warrants are not entitled to vote, to consent, to receive dividends or to receive notice as stockholders with respect to any meeting of stockholders, or to exercise any rights whatsoever as stockholders of the Company.

PLAN OF DISTRIBUTION

We may sell the securities covered by this prospectus from time to time in one or more offerings. Registration of the securities covered by this prospectus does not mean, however, that those securities will necessarily be offered or sold.

We may sell the securities separately or together:

| |

•

|

|

through one or more underwriters or dealers in a public offering and sale by them;

|

| |

•

|

|

directly to investors; or

|

We may sell the securities from time to time:

| |

•

|

|

in one or more transactions at a fixed price or prices, which may be changed from time to time;

|

| |

•

|

|

at market prices prevailing at the times of sale;

|

| |

•

|

|

at prices related to such prevailing market prices; or

|

We will describe the method of distribution of the securities and the terms of the offering in the prospectus supplement.

Any discounts or concessions allowed or re-allowed or paid to dealers may be changed from time to time.

If underwriters are used in the sale of any securities, the securities will be acquired by the underwriters for their own account and may be resold from time to time in one or more transactions described above. The securities may be either offered to the public through underwriting syndicates represented by managing underwriters, or directly by underwriters. Generally, the underwriters’ obligations to purchase the securities will be subject to conditions precedent. We may use underwriters with whom we have a material relationship. We will describe in the prospectus supplement, naming the underwriter, the nature of any such relationship.

We may sell the securities offered through this prospectus directly. In this case, no underwriters or agents would be involved. Such securities may also be sold through agents designated from time to time. The prospectus supplement will name any agent involved in the offer or sale of the offered securities and will describe any commissions payable to the agent. Unless otherwise indicated in the prospectus supplement, any agent will agree to use its reasonable best efforts to solicit purchases for the period of its appointment.

We may sell the securities directly to institutional investors or others who may be deemed to be underwriters within the meaning of the Securities Act with respect to any sale of those securities. The terms of any such sales will be described in the prospectus supplement.

We may authorize underwriters, dealers or agents to solicit offers by certain purchasers to purchase the securities from us at the public offering price set forth in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date in the future. The contracts will be subject only to those conditions set forth in the prospectus supplement, and the prospectus supplement will set forth any commissions we pay for solicitation of these contracts.

We may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If the applicable prospectus supplement indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings of stock, and may use securities received from us in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter and will be identified in the applicable prospectus supplement or in a post-effective amendment.

Underwriters, dealers and agents may be entitled to indemnification by us against certain civil liabilities, including liabilities under the Securities Act, or to contribution with respect to payments made by the underwriters, dealers or agents, under agreements between us and the underwriters, dealers and agents.

We may grant underwriters who participate in the distribution of securities an option to purchase additional securities to cover over-allotments, if any, in connection with the distribution.

Underwriters, dealers or agents may receive compensation in the form of discounts, concessions or commissions from us or our purchasers, as their agents in connection with the sale of securities. These underwriters, dealers or agents may be considered to be underwriters under the Securities Act. As a result, discounts, commissions or profits on resale received by the underwriters, dealers or agents may be treated as underwriting discounts and commissions. The prospectus supplement will identify any such underwriter, dealer or agent and describe any compensation received by them from us. Any initial public offering price and any discounts or concessions allowed or re-allowed or paid to dealers may be changed from time to time.

Unless otherwise specified in the related prospectus supplement, all securities we offer, other than common stock, will be new issues of securities with no established trading market. Any underwriters may make a market in these securities, but will not be obligated to do so and may discontinue any market making at any time without notice. Any common stock sold pursuant to a prospectus supplement will be listed for trading on the NYSE MKT or other principal market for our common stock. We may apply to list any series of debt securities, preferred stock or warrants on an exchange, but we are not obligated to do so. Therefore, there may not be liquidity or a trading market for any series of securities.

Any underwriter may engage in over-allotment transactions, stabilizing transactions, short-covering transactions and penalty bids in accordance with Regulation M under the Exchange Act. Over-allotment involves sales in excess of the offering size, which create a short position. Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum. Short covering transactions involve purchases of the securities in the open market after the distribution is completed to cover short positions. Penalty bids permit the underwriters to reclaim a selling concession from a dealer when the securities originally sold by the dealer are purchased in a covering transaction to cover short positions. Those activities may cause the price of the securities to be higher than it would otherwise be. If commenced, the underwriters may discontinue any of the activities at any time. We make no representation or prediction as to the direction or magnitude of any effect that such transactions may have on the price of the securities. For a description of these activities, see the information under the heading “Underwriting” or “Plan of Distribution” in the applicable prospectus supplement.

Underwriters, broker-dealers or agents who may become involved in the sale of the common stock may engage in transactions with and perform other services for us in the ordinary course of their business for which they receive compensation.

VALIDITY OF SECURITIES

The validity of the common stock, preferred stock, and warrants to purchase equity securities offered pursuant to this prospectus will be passed upon by Anslow & Jaclin, LLP, special counsel to China Armco Metals, Inc..

EXPERTS

Our consolidated balance sheets as of December 31, 2011 and 2010, and the related consolidated statements of income and comprehensive income, stockholders' equity and cash flows for the years then ended incorporated by reference into this prospectus have been audited by Li & Company, PC, independent registered public accounting firm, as indicated in their report with respect thereto, and have been so included in reliance upon the report of such firm given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file periodic reports, proxy statements and other information with the SEC as required by the Exchange Act. You may read and copy any materials we file with the SEC at the SEC's Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information about the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can review our electronically filed reports, proxy and information statements, and other information regarding us on the SEC's Internet site at http://www.sec.gov. The information contained on the SEC's website is expressly not incorporated by reference into this prospectus.

Our SEC filings are also available on our website, http:// www.armcometals.com. The information on this website is expressly not incorporated by reference into, and does not constitute a part of, this prospectus.

This prospectus contains summaries of provisions contained in some of the documents discussed in this prospectus, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to in this prospectus have been filed or will be filed or incorporated by reference as exhibits to the registration statement of which this prospectus is a part. If any contract, agreement or other document is filed or incorporated by reference as an exhibit to the registration statement, you should read the exhibit for a more complete understanding of the document or matter involved.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE