cnam20121022_s8.htm

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHINA ARMCO METALS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada |

26-0491904 |

|

(State or other jurisdiction of |

(I.R.S Employer |

|

incorporation or organization) |

Identification Number) |

|

|

|

|

One Waters Park Drive, Suite 98, San Mateo, CA |

94403 |

|

(Address of Principal Executive Offices) |

(Zip Code) |

CHINA ARMCO METALS, INC.'S

AMENDED AND RESTATED 2009 STOCK INCENTIVE PLAN

(Full title of the plan)

Mr. Kexuan Yao

Chief Executive Officer

China Armco Metals, Inc.

One Waters Park Drive

Suite 98

San Mateo, CA 94403

(Name, address and telephone number of agent for service)

Copy to:

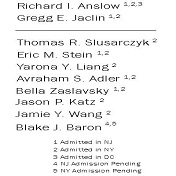

Richard I. Anslow, Esq.

Anslow & Jaclin, LLP

195 Route 9 South, Suite 204

Manalapan, NJ 07726

(732) 409-1212

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ☐ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☐ |

|

Smaller reporting company ☒ |

|

(Do not check if a smaller reporting company) |

|

|

|

CALCULATION OF REGISTRATION FEE |

|

|

|

Title of

of securities to

be registered |

|

Amount to be

registered (1) |

|

|

Proposed maximum

offering price

per share (2) |

|

|

Proposed maximum

aggregate offering

price (2) |

|

|

Amount of

registration

fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock $0.001 par value (4) |

|

|

4,000,000 |

|

|

$ |

0.33 |

|

|

$ |

1,320,000 |

|

|

$180.05 |

|

|

(1) This Registration Statement covers an additional 4,000,000 shares of common stock of China Armco Metals, Inc. reserved for issuance under the China Armco Metals, Inc.'s Amended and Restated 2009 Stock Incentive Plan. This Registration Statement also covers additional shares of common stock of China Armco Metals, Inc. that may be issuable by reason of stock splits, stock dividends, or other adjustment provisions of the Amended and Restated 2009 Stock Incentive Plan, in accordance with Rule 416 under the Securities Act of 1933, as amended.

(2) Estimated solely for the purpose of calculating the registration fee computed pursuant to Rule 457(c) and (h), upon the basis of the average of the high and low prices of the common stock as reported on the NYSE MKT on October 16, 2012.

EXPLANATORY NOTE

China Armco Metals, Inc. (the “Company”) has prepared this Registration Statement in accordance with the requirements of Form S-8 under the Securities Act of 1933, as amended (the “Securities Act”), to register an additional 4,000,000 shares of common stock reserved for issuance under the Company's Amended and Restated 2009 Stock Incentive Plan (the “Plan”). Unless the context requires otherwise, references herein to the Plan are intended to relate to the Plan as so defined, and to the equity compensation and incentive arrangements which the Plans amend and restate. The additional shares to be registered on this Registration Statement are of the same class as securities covered by Registration Statement No. 333-162774 on Form S-8 filed on October 3, 2009, the contents of which are incorporated herein by reference in accordance with General Instruction E to Form S-8.

This Registration Statement also includes a reoffer prospectus prepared in accordance with General Instruction C of Form S-8 and the requirements of Part I of Form S-3 which may be utilized for reofferings and resales by the selling stockholders on a continuous or delayed basis in the future of up to 804,011 shares of common stock that constitute “control securities.” The reoffer prospectus is a combined prospectus pursuant to Rule 429(a) of the Securities Act that relates to 3,195,989 shares registered under this Registration Statement and which may subsequently be issued to the selling stockholders under the Plan and also relates to 804,011 shares that were previously issued to the selling stockholders under the Plan.

The reoffer prospectus does not contain all of the information included in the registration statement, certain items of which are contained in schedules and exhibits to the registration statement, as permitted by the rules and regulations of the Securities and Exchange Commission (the “Commission”). Statements contained in this reoffer prospectus as to the contents of any agreement, instrument or other document referred to are not necessarily complete. With respect to each such agreement, instrument or other document filed as an exhibit to the registration statement, we refer you to the exhibit for a more complete description of the matter involved, and each such statement shall be deemed qualified in its entirety by this reference.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS*

Item 1. Plan Information.*

Item 2. Registrant Information and Employee Plan Annual Information.**

| |

* |

The documents containing the information specified in Part I of Form S-8 will be sent or given to employees as specified in Rule 428(b)(1) of the Securities Act. Such documents need not be filed with the Securities and Exchange Commission (the “Commission”) either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities Act. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act. |

| |

** |

Upon written or oral request, any document incorporated by reference in Item 3 of Part II of this Registration Statement (which documents are incorporated by reference in this Section 10(a) prospectus), and any document required to be delivered to a participant in the Plan pursuant to Rule 428(b) or additional information about the China Armco Metals, Inc.'s Amended and Restated 2009 Stock Incentive Plan are available, without charge, by contacting the Company at:

China Armco Metals, Inc.

One Waters Park Drive, Suite 98

San Mateo, California

Attention: (Caiqing) Christina Xiong

(650) 212-7620 |

REOFFER PROSPECTUS

CHINA ARMCO METALS, INC.

804,011 Shares of Common Stock

This reoffer prospectus relates to 804,011 shares of common stock of China Armco Metals, Inc. (“China Armco” or the “Company”), $0.001 par value, which may be offered for sale from time to time by certain stockholders or their successors in interest (the “Selling Stockholders”). The Company will not receive any proceeds from the sale of shares of common stock pursuant to this reoffer prospectus. The Selling Stockholders have acquired, or will acquire in the future, the common stock pursuant to grants of restricted shares, incentive stock options or nonqualified stock options under the Company's Amended and Restated 2009 Stock Incentive Plan (the “Plan”), and these stockholders may resell all, a portion, or none of these shares of common stock from time to time.

This reoffer prospectus has been prepared for the purpose of registering the shares under the Securities Act of 1933, as amended (the “Securities Act”) to allow for future sales by the Selling Stockholders, on a continuous or delayed basis, to the public without restriction. Each stockholder who sells shares of our common stock pursuant to this reoffer prospectus may be deemed to be an “underwriter” within the meaning of the Securities Act. Any commissions received by a broker or dealer in connection with resales of shares may be deemed to be underwriting commissions or discounts under the Securities Act.

You should carefully read this reoffer prospectus and any accompanying prospectus supplement before you make your investment decision. The shares of common stock offered hereby may be sold from time to time directly by, or on behalf of, each Selling Stockholder in one or more transactions on the NYSE MKT or on any stock exchange on which our common stock may be listed at the time of sale, in privately negotiated transactions, or through a combination of such methods, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at fixed prices (which may be changed) or at negotiated prices. We are paying the expenses incurred in registering the Selling Stockholders' shares, but all selling and other expenses incurred by each of the Selling Stockholders will be borne by that stockholder.

An investment in our securities is highly speculative, involves a high degree of risk and should be considered only by persons who can afford the loss of their entire investment. Please see “Risk Factors” beginning on page 4 of this prospectus.

Our common stock is listed on the NYSE MKT under the trading symbol “CNAM.” The last reported sale price of our common stock on the NYSE MKT on October 22, was $0.32 per share.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this reoffer prospectus is October 23, 2012.

TABLE OF CONTENTS

|

CHINA ARMCO METALS, INC. |

6 |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

7 |

|

RISK FACTORS |

8 |

|

USE OF PROCEEDS |

8 |

|

DOCUMENTS INCORPORATED BY REFERENCE |

12 |

___________________________________

This prospectus incorporates important business and financial information about China Armco Metals, Inc. that is not included in or delivered with this prospectus. You may request a copy of all documents that are incorporated by reference in this prospectus by writing or telephoning the Company at the following address: China Armco Metals, Inc., Attention: (Caiqing) Christina Xiong, Corporate Secretary, One Waters Park Drive, Suite 98, San Mateo, California; telephone (650) 212-7620. Copies of all documents requested will be provided without charge (not including the exhibits to those documents, unless the exhibits are specifically incorporated by reference into those documents or this prospectus).

PROSPECTUS SUMMARY

This summary highlights selected information from this prospectus and may not contain all the information that is important to you. To understand the circumstances and terms of the offering and for complete information about China Armco Metals, Inc. you should read this entire document and the information incorporated by reference, including the financial statements and the notes to the financial statements.

CHINA ARMCO METALS, INC.

We are a U.S. company that is engaged in metal ore trading and distribution and scrap metal recycling. Our operations are conducted primarily in China.

In our metal ore trading and distribution business, we import, sell and distribute to the metal refinery industry in the PRC a variety of metal ore which includes iron, chrome, nickel, copper and manganese ore, as well as non-ferrous metals, and coal. We obtain these raw materials from global suppliers primarily in Brazil, India, Indonesia, Ukraine and the United States and distribute them in the PRC. In addition, we provide sourcing and pricing services for various metals to our network of customers.

In our scrap metal recycling business, we recycle scrap metal at our recycling facility (the "Facility") and sell the recycled product to steel mills for use in the production of recycled steel. Our scrap metal recycling business is conducted through the Facility, which commenced formal operations in the third quarter of 2010.

Corporate Information

We were formerly known as Cox Distributing, Inc., which was founded as an unincorporated business in January 1984 and became a “C” corporation in the State of Nevada on April 6, 2007. Cox Distributing, Inc. was founded by Stephen E. Cox, our former president and chief executive officer, and engaged in the distribution of organic fertilizer products used to improve soil and growing conditions for the potato farmers of eastern Idaho. Prior to June 27, 2008, Mr. Cox was our only employee.

On June 27, 2008, we entered into a share purchase agreement with Armco Metals International Limited (formerly “Armco & Metawise (H.K) Limited”) (“Armco HK”) and Feng Gao, the sole shareholder of Armco HK. In connection with the acquisition, we purchased from Ms. Gao 100% of the issued and outstanding shares of Armco HK's capital stock for $6,890,000 by delivery of our purchase money promissory note. In addition, we issued to Ms. Gao a stock option entitling Ms. Gao to purchase a total of 5,300,000 shares of our common stock exercisable at $1.30 per share which expired on September 30, 2008 and 2,000,000 shares exercisable at $5.00 per share which expired on June 30, 2010. On August 12, 2008, Ms. Gao exercised her option to purchase and we issued 5,300,000 shares of our common stock in exchange for our $6,890,000 note held by Ms. Gao. Prior to the acquisition, there were 10,000,000 shares of our common stock issued and outstanding. In connection with the acquisition, 7,694,000 shares of common stock held by Mr. Cox were cancelled, leaving 2,306,000 shares of common stock issued and outstanding. The 5,300,000 shares issued to Ms. Gao represented approximately 69.7% of our issued and outstanding common stock giving effect to the cancellation of 7,694,000 shares of our common stock owned by Mr. Cox. No additional common stock was issued to Mr. Cox in connection with the acquisition. After the cancellation of 7,694,000 shares of common stock, Mr. Cox held 6,200 shares. These shares were exchanged on December 30, 2008 for all of the assets and liabilities of our fertilizer business, after which time we no longer operated the fertilizer business and Mr. Cox was no longer a shareholder.

As a result of the ownership interests of the former shareholders of Armco HK, for financial statement reporting purposes, the merger between us and Armco HK was treated as a reverse acquisition with Armco HK deemed the accounting acquirer and our company deemed the accounting acquiree under the purchase method of accounting in accordance with paragraph 805-40-05-2 of the FASB Accounting Standards Codification. The reverse merger is deemed a capital transaction and the net assets of Armco HK (the accounting acquirer) were carried forward to us (the legal acquirer and the reporting entity) at their carrying value before the combination. The acquisition process utilized our capital structure and the assets and liabilities of Armco HK which were recorded at historical cost. As a result of our reverse acquisition of Armco HK, we have assumed the business and operations of Armco HK with our principle activities engaged in the import, export and distribution of ferrous and non-ferrous ore and metals. On June 27, 2008, we amended our Articles of Incorporation, and changed our name to China Armco Metals, Inc. to better identify the Company with the business conducted, through its wholly owned subsidiaries in China, import, export and distribution of ferrous and non-ferrous ores and metals, and processing and distribution of scrap steel.

Armco HK was incorporated on July 13, 2001 under the laws of the Hong Kong Special Administrative Region (“HK SAR”) of the People's Republic of China (“PRC”). On March 22, 2011, Armco HK amended its Memorandum and Articles of Association, and changed its name from Armco & Metawise (H.K) Limited to its current name.

On January 9, 2007, Armco HK formed Armco (Lianyungang) Renewable Metals, Inc. (“Renewable Metals”, formerly known as "Armet”), a wholly-owned foreign enterprise (“WOFE”) subsidiary in the City of Lianyungang, Jiangsu Province, PRC. Renewable Metals engages in the processing and distribution of scrap metal. On December 28, 2007, Armco HK entered into a Share Transfer Armco Agreement with Renewable Metals, whereby Armco HK transferred to Renewable Metals all of its equity interest in Henan Armco and Metawise Trading Co., Ltd. (“Henan Armco”), a company incorporated on June 6, 2002 in the City of Zhengzhou, Henan Province, PRC and under common control of Armco HK. Henan Armco engages in the import, export and distribution of ferrous and non-ferrous ores and metals. On December 1, 2008, Armco HK transferred its 100% equity interest in Renewable Metals to Armco Metals.

On June 4, 2009, the Company formed Armco (Lianyungang) Holdings, Inc. (“Lianyungang Armco”), a WOFE subsidiary in the City of Lianyungang, Jiangsu Province, PRC. Lianyungang Armco intends to engage in marketing and distribution of the recycled scrap steel.

On July 16, 2010, we formed a new subsidiary named Armco Metals (Shanghai) Holdings, Ltd. (“Armco Shanghai”). Armco Shanghai serves as our China operations headquarters and oversees the activities of the company regarding financing and international trading.

Our principal executive offices are located at One Waters Park Drive, Suite 98, San Mateo, California, and our telephone number is (650) 212-7620. Our website is www.armcometals.com. The information on our website does not constitute a part of this prospectus.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This reoffer prospectus and the documents incorporated by reference herein contain forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including, without limitation, statements as to expectations, beliefs and strategies regarding the future. Such forward-looking statements may be included in, but not limited to, press releases, oral statements made with the approval of an authorized executive officer or in various filings made by the Company with the Commission. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In addition to the factors set forth in this prospectus, including the sections titled “Risk Factors,” “Business” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” from our 2011 Annual Report on Form 10-K and the other documents incorporated by reference in this prospectus, the following factors, among others, could cause actual results or outcomes to differ materially from the forward-looking statements:

|

● |

We operate in cyclical industries and we experience volatile demand for our products. |

|

● |

Our ability to operate our scrap metal recycling facility efficiently and profitably. |

|

● |

Our ability to obtain sufficient capital to fund a potential expansion of our scrap metal recycling facility. |

|

● |

Our ability to establish adequate management, legal and financial controls in the United States and the PRC. |

|

● |

The availability to us of supplies of metal ore and scrap metal upon favorable terms. |

|

● |

The availability of electricity to operate our scrap metal recycling facility. |

|

● |

Fluctuations in raw material prices may affect our operating results as we may not be able to pass on cost increases to customers. |

|

● |

The lack of various legal protections in certain agreements to which we are a party which are customarily contained in similar contracts prepared in the United States and which are material to our operations. |

|

● |

Our dependence on our key management personnel. |

|

● |

Our potential inability to meet the filing and internal control reporting requirements imposed by the SEC. |

|

● |

The effect of changes resulting from the political and economic policies of the Chinese government on our assets and operations located in the PRC. |

|

● |

The limitation on our ability to receive and use our revenues effectively as a result of restrictions on currency exchange in the PRC. |

|

● |

The impact on future inflation in China on economic activity in China. |

|

● |

Our ability to enforce our rights due to policies regarding the regulation of foreign investments in the PRC. |

|

● |

The restrictions imposed under regulations relating to offshore investment activities by Chinese residents and the increased administrative burden we face and the creation of regulatory uncertainties that may limit or adversely affect our ability to complete any business combinations with our PRC-based subsidiaries. |

|

● |

Our ability to comply with the United States Foreign Corrupt Practices Act which could subject us to penalties and other adverse consequences. |

|

● |

The provisions of our articles of incorporation and bylaws which may delay or prevent a takeover which may not be in the best interests of our shareholders. |

|

● |

Our controlling stockholders may take actions that conflict with your interests. |

Any forward-looking statements should be considered in light of these and other risk factors. Words such as “anticipates,” “believes,” “forecast,” “potential,” “contemplates,” “expects,” “intends,” “plans,” “seeks,” “estimates,” “could,” “would,” “will,” “may,” “can,” and similar expressions identify forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties that could cause actual results to differ materially from the results contemplated by the forward-looking statements. Many of the important factors that will determine these results and values are beyond our ability to control or predict. You are cautioned not to put undue reliance on any forward-looking statements. Except as otherwise required by law, China Armco assumes no obligation to update or revise any forward-looking statements.

RISK FACTORS

Investing in our common stock involves risks that could affect us and our business, as well as the industry in which we operate. Please see the risk factors in our Annual Report on Form 10-K, for the year ended December 31, 2011, which is incorporated by reference into this reoffer prospectus as well as additional periodic reports we file with the Commission. Although we have tried to discuss key factors, please be aware that other risks may prove to be important in the future. New risks may emerge at any time and we cannot predict such risks or estimate the extent to which they may affect our financial performance. Before purchasing our common stock, you should carefully consider the risks discussed in the documents incorporated by reference herein and the other information in this reoffer prospectus, the registration statement accompanying this reoffer prospectus and any applicable prospectus supplement. Each of the risks discussed could result in a decrease in the value of our common stock and your investment in our common stock

USE OF PROCEEDS

All proceeds from the sale of the common stock offered hereby will be for the accounts of the Selling Stockholders. We will not receive any of the proceeds from the sale from time to time of the common stock offered hereby. All expenses of registration incurred in connection with this offering are being borne by us, but all selling and other expenses incurred by any Selling Stockholder will be borne by such Selling Stockholder.

SELLING STOCKHOLDERS

The Selling Stockholders have acquired and will in the future, acquire the common stock pursuant to grants of restricted shares and options under the Company's Plan. The table below sets forth the following information regarding the beneficial ownership of common stock held by the Selling Stockholders as of October 18, 2012: (i) the name and position of each Selling Stockholder who may sell common stock pursuant to this prospectus; (ii) the number of shares of common stock owned by each Selling Stockholder as of the date above; (iii) the number of shares of common stock offered under this prospectus, which includes shares of common stock that may be acquired upon the exercise of options or warrants previously issued to the Selling Stockholders under the Plan and shares of restricted stock granted to the Selling Stockholder pursuant to the Plans that are no longer subject to restrictions or that may be subject to restrictions that have not yet lapsed; and (iv) the amount and percentage of common stock to be owned by each such Selling Stockholder if such Selling Stockholder were to sell all of the shares of common stock which may be offered pursuant to this prospectus.

Unless otherwise specified, the address of each of the selling stockholders listed below is c/o China Armco Metals, Inc., One Waters Park Drive, Suite 98, San Mateo, California.

|

Selling Stockholder |

|

Position |

|

Total Shares

Beneficially

Owned Prior

to Offering (1) |

|

|

Maximum

Shares

Offered

Pursuant

to this

Prospectus (2) |

|

|

Shares

Beneficially

Owned

Following

Resale (3) |

|

|

Percentage

of

Outstanding

Shares of

Common Stock

after the

Offering (4) |

|

|

Kexuan Yao |

|

Chief Executive Officer and Chairman of the Board |

|

|

6,249,951 |

|

|

|

804,011 |

|

|

|

5,445,940 |

|

|

|

33.94% |

|

|

|

(1) |

The number and percentage of shares beneficially owned is determined in accordance with Rule 13d-3 of the Exchange Act, and the information is not necessarily indicative of beneficial ownership for any other purpose. All such information is based on information provided to us by the Selling Stockholders. Under such rule, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares which the individual has the right to acquire within 60 days of the date of this prospectus through the exercise of any stock option or other right. Unless otherwise indicated below, each person has sole voting and investment power with respect to the shares shown as beneficially owned. Percentage of beneficial ownership is based on 18,348,727 shares of common stock outstanding on October 18, 2012. |

|

|

(2) |

For purposes of this table, the number of shares of common stock offered includes the number of shares of restricted stock and stock options granted to the security holder under the Plan, regardless of whether the restrictions on such shares of restricted stock have lapsed or all such stock options have fully vested. The number of shares of common stock offered does not include shares of common stock which may be acquired upon the exercise of options or shares of restricted stock that may be granted under the Plan in the future to the selling stockholders, which information is not currently known. |

|

|

(3) |

Assumes that each Selling Stockholder sells all shares registered under this registration statement. However, to our knowledge, there are no agreements, arrangements or understandings with respect to the sale of any of our common stock, and each selling stockholder may decide not to sell its shares that are registered under this registration statement. |

|

|

|

|

|

|

(4) |

Based upon 18,348,727 shares of common stock issued and outstanding as of October 18, 2012. |

|

|

|

|

|

|

(5) |

Includes 6,189,997 shares of common stock directly owned by himself, and 59,954 shares of common stock owned by his spouse, and 66,667 shares of unvested restricted common stock awarded pursuant to our 2009 Stock Incentive Plan, which will be vested 66,667 shares on December 15, 2012. |

PLAN OF DISTRIBUTION

It is anticipated that the shares will be sold from time-to-time by the Selling Stockholders or by their pledgees, donees, transferees or other successors in interest. Such sales may be made on the NYSE MKT or on any stock exchange on which our common stock may be listed at the time of sale, at prices and at terms then prevailing or at prices related to the then current market price, or in negotiated transactions.

The shares may be sold by one or more of the following: (i) a block trade in which the broker or dealer so engaged will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; (ii) purchases by a broker or dealer for its account pursuant to this prospectus; or (iii) ordinary brokerage transactions and transactions in which the broker solicits purchases. The Selling Stockholder may also sell shares directly to purchasers. Any broker or dealer may receive compensation in the form of commissions, discounts or concessions from the Selling Stockholders and/or purchasers of the shares or both. Such compensation as to a particular broker or dealer may be in excess of customary commissions.

In connection with their sales, a Selling Stockholder and any participating broker or dealer may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions they receive and the proceeds of any sale of shares may be deemed to be underwriting discounts and commissions under the Securities Act.

We are bearing all costs relating to the registration of the shares of common stock. Any commissions or other fees payable to broker-dealers in connection with any sale of the shares will be borne by the Selling Stockholder or other party selling such shares. In order to comply with certain states' securities laws, if applicable, the shares may be sold in such jurisdictions only through registered or licensed brokers or dealers. Sales of the shares must also be made by the Selling Stockholders in compliance with all other applicable state securities laws and regulations.

In addition to any shares sold hereunder, Selling Stockholders may sell shares of common stock in compliance with Rule 144. There is no assurance that the Selling Stockholders will sell all or a portion of the common stock offered hereby.

The Selling Stockholders may agree to indemnify any broker-dealer or agent that participates in transactions involving sales of the shares against certain liabilities in connection with the offering of the shares arising under the Securities Act.

LEGAL MATTERS

Legal matters in connection with this offering, including, without limitation, the validity of the common stock offered hereby, are being passed upon for us by Anslow & Jaclin, LLP.

EXPERTS

The consolidated financial statements of the Company incorporated into this prospectus by reference to the Company's Annual Report on Form 10-K for the year ended December 31, 2011, as filed with the Commission on March 30, 2012 have been audited by Li & Company, PC, independent registered public accounting firm, as stated in their reports, which are incorporated herein by reference, and have been so incorporated in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

ABOUT THIS PROSPECTUS

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. The information contained in this prospectus and in the documents incorporated by reference is accurate only as of their respective dates, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations, prospects and risks may have changed since those dates.

AVAILABLE INFORMATION

China Armco files annual, quarterly and special reports, proxy statements and other information with the Commission. Stockholders may inspect and copy these materials at the Public Reference Room maintained by the Commission at Room 1580, 100 F Street, N.E., Washington, D.C. 20549. Please call the Commission at 1-800-SEC-0330 for more information on the operation of the Public Reference Room. The Commission maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the Commission. The address of that site is http://www.sec.gov. China Armco maintains an Internet site at http:// www.armcometals.com/.

DOCUMENTS INCORPORATED BY REFERENCE

This prospectus is part of a registration statement on Form S-8 that China Armco filed with the Commission in accordance with the requirements of Part I of Form S-3 and General Instruction C of the Instructions to Form S-8. The Commission allows this filing to “incorporate by reference” information that the Company previously filed with the Commission. This means the Company can disclose important information to you by referring you to other documents that it filed with the Commission. The information that is incorporated by reference is considered part of this prospectus, and information that the Company files later will automatically update and may supersede this information. For further information about the Company and the securities being offered, you should refer to the registration statement and the following documents that are incorporated by reference:

(a) The Company's annual report on Form 10-K for the fiscal year ended December 31, 2011, filed with the Commission on March 30, 2012.

(b) The Company's quarterly reports on Form 10-Q for the quarters ended June 30, 2012, filed with the Commission on August 14, 2012 and March 31 2012, filed with the Commission on May 15, 2012.

(c) The Company's reports on Form 8-K filed with the Commission on April 19, 2012, April 24, 2012, May 10, 2012, and July 18, 2012.

(d) The description of the Company's common stock set forth in the Company's registration statement on Form S-3 (Commission File No. 333-184354), as amended, originally filed on October 10, 2012.

In addition, all documents filed by the Company subsequent to those listed above with the Commission pursuant to sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, will be deemed to be incorporated by reference into the registration statement and to be a part thereof from the date of filing of such documents. Any statement contained in a document incorporated by reference into the registration statement will be deemed to be modified or superseded for purposes of the registration statement to the extent that a statement contained therein or in any other subsequently filed document which also is or is deemed to be incorporated by reference therein modifies or supersedes such statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of the registration statement.

The Company will provide without charge to each person to whom a copy of this prospectus is delivered, on the written or oral request of such person, a copy of any and all of the information that has been incorporated by reference into the registration statement (other than exhibits to such information unless such exhibits are specifically incorporated by reference into the information that the registration statement incorporates). Written or oral requests for such information should be directed to: China Armco Metals, Inc., Attention: (Caiqing) Christina Xiong, Corporate Secretary, One Waters Park Drive, Suite 98, San Mateo, California; telephone (650) 212-7620.

The Company has not authorized any person to give any information or to make any representations in connection with sale of the shares by the Selling Stockholders other than those contained in this prospectus. You should not rely on any information or representations in connection with such sales other than the information or representations in this prospectus. You should not assume that there has been no change in the Company's affairs since the date of this prospectus or that the information in this prospectus is correct as of any time after its date. This prospectus is not an offer to sell or a solicitation of an offer to buy shares in any state or under any circumstances in which such an offer or solicitation is unlawful.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by the Company with the Commission are incorporated by reference into this registration statement:

(a) The Company's annual report on Form 10-K for the fiscal year ended December 31, 2011, filed with the Commission on March 30, 2012.

(b) The Company's quarterly reports on Form 10-Q for the quarters ended June 30, 2012, filed with the Commission on August 14, 2012 and March 31 2012, filed with the Commission on May 15, 2012.

(c) The Company's reports on Form 8-K filed with the Commission on April 19, 2012, April 24, 2012, May 10, 2012, and July 18, 2012.

(d) The description of the Company's common stock set forth in the Company's registration statement on Form S-3 (Commission File No. 333-184354), as amended, originally filed on October 10, 2012.

In addition, all documents filed by the Company subsequent to those listed above with the Commission pursuant to sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, will be deemed to be incorporated by reference into this registration statement and to be a part hereof from the date of filing of such documents. Any statement contained in a document incorporated by reference into this registration statement will be deemed to be modified or superseded for purposes of this registration statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this registration statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

None.

Item 6. Indemnification of Directors and Officers.

Nevada Revised Statutes

Pursuant to the provisions of Section 78.7502 of the Nevada Revised Statutes (the “NRS”), every Nevada corporation has authority to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, except an action by or in the right of the corporation, by reason of the fact that such person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys' fees, judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with the action, suit or proceeding if such person acted in good faith and in a manner which such person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause or belief his conduct was unlawful.

Pursuant to the provisions of Section 78.7502, every Nevada corporation also has the authority to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that such person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses including amounts paid in settlement and attorneys' fees actually and reasonably incurred by such person in connection with the defense or settlement of the action or suit if such person acted in good faith and in a manner which such person reasonably believed to be in or not opposed to the best interests of the corporation. No indemnification shall be made, however, for any claim, issue or matter as to which a person has been adjudged by a court of competent jurisdiction to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court determines that in view of all the circumstances, the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

Our Article of Incorporation

Article XI of our Article of Incorporation provides that the corporation shall indemnify all directors, officers, employees, and agents to the fullest extent permitted by Nevada law as provided within NRS 78.751 or any other law then in effect or as it may hereafter be amended.

Our Bylaws

Section 8.01 of our Bylaws specifies that the corporation shall indemnify any officer or director who was or is a party or is threatened to be made a party to any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative (other than an action by or in the right of the corporation), by reason of the fact that he is or was a director or officer of the corporation (and, in the discretion of the board of directors, may so indemnify a person by reason of the fact that he is or was an employee or agent of the corporation or is or was serving at the request of the corporation as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust, or other enterprise), against expenses (including attorneys' fees), judgments, fines, and amounts paid in settlement actually and reasonably incurred by him in connection with any such action, suit, or proceeding, if he acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. The termination of any action, suit, or proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation, or, with respect to any criminal action or proceeding, he had reasonable cause to believe that his conduct was unlawful.

Section 8.02 of our Bylaws further specifies that the corporation shall indemnify any director or officer who was or is a party or is threatened to be made a party to any threatened, pending, or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that he is or was a director or officer of the corporation (and, in the discretion of the board of directors, may so indemnify a person by reason of the fact that he is or was an employee or agent of the corporation or is or was serving as an employee or agent of another corporation, partnership, joint enture, trust, or other enterprise), against expenses (including attorneys' fees) actually and reasonably incurred by him in connection with the defense or settlement of such action or suit, if he acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification shall be made in respect of any claim, issue, or matter as to which such person shall have been adjudged by a court of competent jurisdiction, after exhaustion of all appeals therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court in which such action r suit was brought or other court of competent jurisdiction shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

Securities and Exchange Commission Position on Certain Indemnification

Insofar as indemnification by us for liabilities arising under the Securities Exchange Act of 1934 may be permitted to our directors, officers and controlling persons pursuant to provisions of the Articles of Incorporation and Bylaws, or otherwise, we have been advised that in the opinion of the SEC, such indemnification is against public policy and is, therefore, unenforceable. In the event that a claim for indemnification by such director, officer or controlling person of us in the successful defense of any action, suit or proceeding is asserted by such director, officer or controlling person in connection with the securities being offered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

The Exhibit Index immediately preceding the exhibits is incorporated herein by reference.

Item 9. Undertakings.

(a) The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made and to the extent required by the Securities Act and the rules and regulations promulgated thereunder, a post-effective amendment to this registration statement:

(i) To include any prospectus required by section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of this registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of a prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in this registration statement or any material change to such information in this registration statement;

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to section 13 or section 15(d) of the Exchange Act, that are incorporated by reference in this registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant's annual report pursuant to section 13(a) or section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan's annual report pursuant to section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceedings) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of San Mateo, California, on October 23, 2012.

|

|

CHINA ARMCO METALS, INC. |

|

|

|

|

|

By: |

/s/ Kexuan Yao |

|

|

|

Kexuan Yao |

|

|

|

Chief Executive Officer |

Pursuant to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities and on the date(s) indicated:

Pursuant to the requirements of the Securities Act of 1933, this report has been signed by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

Signature |

|

Title |

|

Date |

|

|

|

|

|

|

|

/s/ Kexuan Yoo |

|

Chief Executive Officer, Chairman |

|

October 23, 2012 |

|

Kexuan Yoo |

|

|

|

|

|

|

|

|

|

|

|

/s/ Fengtao Wen |

|

Chief Financial Officer |

|

October 23, 2012 |

|

Fengtao Wen |

|

|

|

|

|

|

|

|

|

|

|

/s/ Weigang Zhao |

|

Vice General Manager of Renewable Metals, Director |

|

October 23, 2012 |

|

Weigang Zhao |

|

|

|

|

|

|

|

|

|

|

|

/s/ Weiping Shen |

|

Director |

|

October 23, 2012 |

|

Weiping Shen |

|

|

|

|

|

|

|

|

|

|

|

/s/ William Thomson |

|

Director |

|

October 23, 2012 |

|

William Thomson |

|

|

|

|

|

|

|

|

|

|

|

/s/ Kamping Chan |

|

Director |

|

October 23, 2012 |

|

Kamping Chan |

|

|

|

|

INDEX TO EXHIBITS

Item 16. Exhibits.

|

Exhibit Index |

|

Description of Document |

Filed Herewith |

Previously Filed |

Incorporated by Reference To: |

|

|

|

|

|

|

|

|

|

2.1 |

|

Share Purchase Agreement between Cox Distributing, Inc. and Armco & Metawise (HK), Ltd., dated June 27, 2008. |

|

|

Exhibit 10.4 to the Registrant's Current Report on Form 8-K filed on July 1, 2008. |

|

|

|

|

|

|

|

|

|

|

3.1 |

|

Articles of Incorporation of the Registrant as filed with the Secretary of State of Nevada. |

|

|

Exhibits 3.1 to the Registrant's Registration Statement on Form SB-2 filed on August 27, 2007. |

|

|

|

|

|

|

|

|

|

|

3.2 |

|

Bylaws of the registrant. |

|

|

Exhibit 3.2 to the Registrant's Registration Statement on Form SB-2 filed on August 27, 2007. |

|

|

|

|

|

|

|

|

|

|

3.3 |

|

Amendments to Bylaws |

|

|

Exhibit 3.3 to the Registrant's Current Report on Form 8-K filed on April 1, 2010.. |

|

|

|

|

|

|

|

|

|

|

4.1 |

|

Form of Warrant |

|

|

Exhibit 4.1 to the Registrant's Current Report on Form 8-K filed on July 31, 2008. |

|

|

|

|

|

|

|

|

|

|

4.2 |

|

Form of $7.50 Warrant (April 2010 Offering) |

|

|

Exhibit 4.2 to the Registrant's Current Report on Form 8-K filed on April 20, 2010. |

|

|

|

|

|

|

|

|

|

|

4.3 |

|

Form of Amendment to Subscription Agreement and Common Stock Purchase Warrant |

|

|

Exhibit 4.2 to the Registrant's Quarterly Report on Form 10-Q for the period ended March 31, 2010. |

|

|

|

|

|

|

|

|

|

|

5.1 |

|

Opinion of Anslow & Jaclin, LLP |

X |

|

|

|

|

|

|

|

|

|

|

|

|

10.1 |

|

Stock Option Agreement between Cox Distributing, Inc. and Feng Gao dated June 27, 2008 |

|

|

Exhibit 10.5 to the Registrant's Current Report on Form 8-K filed on July 1, 2008. |

|

|

|

|

|

|

|

|

|

|

10.2 |

|

Call Option Agreement between Kexuan Yao and Feng Gao, dated June 27, 2008 |

|

|

Exhibit 10.6 to the Registrant's Current Report on Form 8-K filed on July 1, 2008. |

|

|

|

|

|

|

|

|

|

|

10.3 |

|

Exclusive Consulting Agreement between Armco & Metawise (HK) Ltd. and Henan Armco & Metawise Trading Co., Ltd. dated June 27, 2008. |

|

|

Exhibit 10.7 to the Registrant's Current Report on Form 8-K filed on July 1, 2008. |

|

|

|

|

|

|

|

|

|

|

10.4 |

|

Exclusive Consulting Agreement between Armco & Metawise (HK) Ltd. and Armet (Lianyungang) Scraps Co., Ltd. dated June 27, 2008. |

|

|

Exhibit 10.8 to the Registrant's Current Report on Form 8-K filed on July 1, 2008. |

|

|

10.5 |

|

Consulting Agreement between Stephen E. Cox (“Client”), and Capital Once Resource Co., Ltd. dated June 27, 2008 |

|

|

Exhibit 10.9 to the Registrant's Current Report on Form 8-K filed on July 1, 2008. |

|

|

|

|

|

|

|

|

|

|

10.6 |

|

Services Agreement between Stephen D. Cox Supply and Cox Distributing, Inc. dated June 27, 2008. |

|

|

Exhibit 10.10 to the Registrant's Current Report on Form 8-K filed on July 1, 2008. |

|

|

10.7 |

|

Form of Subscription Agreement |

|

|

Exhibit 10.1 to the Registrant's Current Report on Form 8-K filed on July 31, 2008. |

|

|

|

|

|

|

|

|

|

|

10.8 |

|

Form of Regulation S Subscription Agreement |

|

|

Exhibit 10.2 to the Registrant's Current Report on Form 8-K filed on July 31, 2008. |

|

|

|

|

|

|

|

|

|

|

10.9 |

|

Cancellation Agreement with Feng Gao |

|

|

Exhibit 10.9 to the Registrant's Registration Statement on Form S-1 filed on September 11, 2008. |

|

|

|

|

|

|

|

|

|

|

10.10 |

|

Employment Agreement with Mr. Kexuan Yao dated December 18, 2008 |

|

|

Exhibit 10.1 to the Registrant's Current Report on Form 8-K filed on January 13, 2009 |

|

|

|

|

|

|

|

|

|

|

10.11 |

|

Amendment to Call Option between Mr. Kexuan Yao and Ms. Feng Gao dated December 18, 2008 |

|

|

Exhibit 10.2 to the Registrant's Current Report on Form 8-K filed on January 13, 2009 |

|

|

|

|

|

|

|

|

|

|

10.12 |

|

China Armco Metals, Inc. 2009 Stock Incentive Plan |

|

|

Exhibit 10.1 to the Registrant's Current Report on Form 8-K filed on October 28, 2009 |

|

|

|

|

|

|

|

|

|

|

10.13 |

|

Form of China Armco Metals, Inc. Restricted Stock Agreement |

|

|

Exhibit 10.2 to the Registrant's Current Report on Form 8-K filed on October 28, 2009 |

|

|

|

|

|

|

|

|

|

|

10.14 |

|

Loan Agreement between Armet (Lianyungang) Renewable Resources Co., Ltd. and Bank of China Dated September 4, 2009 |

|

|

Exhibit 10.14 to the Registrant's Annual Report on Form 10-K for the year ended December 31, 2009 |

|

|

|

|

|

|

|

|

|

|

10.15 |

|

Banking Facilities Agreement between Armco & Metawise (H.K.) Limited and DBS Bank (Hong Kong) Limited dated April 22, 2009 |

|

|

Exhibit 10.15 to the Registrant's Annual Report on Form 10-K for the year ended December 31, 2009 |

|

|

|

|

|

|

|

|

|

|

10.16 |

|

Uncommitted Trade Finance Facilities Agreement between Armco & Metawise (H.K.) Limited and RZB Austria Finance (Hong Kong) dated March 25, 2009 |

|

|

Exhibit 10.16 to the Registrant's Annual Report on Form 10-K for the year ended December 31, 2009 |

|

|

|

|

|

|

|

|

|

|

10.17 |

|

Line of Credit Review Approval Notice between Henan Armco & Metawise Trading Co., Ltd. and Guangdong Development Bank Zhengzhou Branch dated October 21, 2009 |

|

|

Exhibit 10.17 to the Registrant's Annual Report on Form 10-K for the year ended December 31, 2009 |

|

|

10.18 |

|

General Agreement Relating to Commercial Credits between Armco & Metawise (HK) Limited and ING Bank N.V., Hong Kong Branch dated December 3, 2009 |

|

|

Exhibit 10.18 to the Registrant's Annual Report on Form 10-K for the year ended December 31, 2009 |

|

|

|

|

|

|

|

|

|

|

10.19 |

|

Armet (Lianyungang) Renewable Resources Co., Ltd. Scrap Metal Sales Contract between dated February 21, 2010 |

|

|

Exhibit 10.19 to the Registrant's Annual Report on Form 10-K for the year ended December 31, 2009 |

|

|

|

|

|

|

|

|

|

|

10.20 |

|

Form of Securities Purchase Agreement of April 2010 Offering |

|

|

Exhibit 10.20 to the Registrant's Current Report on Form 8-K filed on April 20, 2010. |

|

|

|

|

|

|

|

|

|

|

10.21 |

|

Form of Registration Rights Agreement of April 2010 Offering |

|

|

Exhibit 10.21 to the Registrant's Current Report on Form 8-K filed on April 20, 2010. |

|

|

|

|

|

|

|

|

|

|

10.22 |

|

Scrap Metal Sales Contract between Armet (Lianyungang) Renewable Resources Co. and Jiangsu Lihuai Iron & Steel Co., Ltd. dated February 21, 2010 |

|

|

Exhibit 10.19 to the Registrant's Quarterly Report on Form 10-Q for the period ended March 31, 2010. |

|

|

|

|

|

|

|

|

|

|

14.1 |

|

Code of Ethics |

|

|

Exhibit 14.1 to the Registrant's Annual Report on Form 10-K for the year ended December 31, 2009 |

|

|

|

|

|

|

|

|

|

|

21.1 |

|

List of subsidiaries of the Registrant |

|

|

Exhibit 21.1 to the Registrant's Annual Report on Form 10-K for the year ended December 31, 2009 |

|

|

|

|

|

|

|

|

|

|

23.1 |

|

Consent of Li & Company, PC |

X |

|

|

|

|

23.2 |

|

Consent of Anslow & Jaclin, LLP (contained in Exhibit 5.1) |

X |

|

|

II-7