Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

OR

|

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-34028

AMERICAN WATER WORKS COMPANY, INC.

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 51-0063696 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1 Water Street, Camden, NJ | 08102-1658 |

(Address of principal executive offices) | (Zip Code) |

(856) 955-4001

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common stock, par value $0.01 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Common Stock, $0.01 par value—$13,802,100,000 as of June 29, 2018 (solely for purposes of calculating this aggregate market value, American Water has defined its affiliates to include (i) those persons who were, as of June 29, 2018, its executive officers, directors or known beneficial owners of more than 10% of its common stock, and (ii) such other persons who were deemed, as of June 29, 2018, to be controlled by, or under common control with, American Water or any of the persons described in clause (i) above).

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date: Common Stock, $0.01 par value per share—180,751,697 shares as of February 14, 2019.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the American Water Works Company, Inc. definitive proxy statement for the 2019 Annual Meeting of Shareholders to be filed with the Securities and Exchange Commission within 120 days after December 31, 2018 are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

|

| | |

| | Page |

| |

| | |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| | |

Item 15. | | |

Item 16. | | |

| |

| |

FORWARD-LOOKING STATEMENTS

We have made statements in Item 1—Business, Item 1A—Risk Factors, and Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations, and in other sections of this Form 10-K, or incorporated certain statements by reference into this Form 10-K, that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. In some cases, these forward-looking statements can be identified by words with prospective meanings such as “intend,” “plan,” “estimate,” “believe,” “anticipate,” “expect,” “predict,” “project,” “propose,” “assume,” “forecast,” “likely,” “uncertain,” “outlook,” “future,” “pending,” “goal,” “objective,” “potential,” “continue,” “seek to,” “may,” “can,” “should,” “will” and “could” or the negative of such terms or other variations or similar expressions. Forward-looking statements may relate to, among other things: our future financial performance, including our operation and maintenance (“O&M”) efficiency ratio; our liquidity and future cash flows; our growth and portfolio optimization strategies; our projected capital expenditures and related funding requirements; our ability to repay debt; our projected strategy to finance current operations and growth initiatives; the impact of legal proceedings and potential fines and penalties; business process, technology improvement and other strategic initiatives; trends in our industry; regulatory, legislative, tax policy or legal developments; rate adjustments, including through general rate case filings, filings for infrastructure surcharges and filings to address regulatory lag; and impacts that the Tax Cuts and Jobs Act (the “TCJA”) may have on us and on our business, results of operations, cash flows and liquidity.

Forward-looking statements are predictions based on our current expectations and assumptions regarding future events. They are not guarantees or assurances of any outcomes, financial results or levels of activity, performance or achievements, and you are cautioned not to place undue reliance upon them. These forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Our actual results may vary materially from those discussed in the forward-looking statements included herein as a result of the factors discussed under Item 1A—Risk Factors, and the following important factors:

| |

• | the decisions of governmental and regulatory bodies, including decisions to raise or lower customer rates; |

| |

• | the timeliness and outcome of regulatory commissions’ actions concerning rates, capital structure, authorized return on equity, capital investment, system acquisitions, taxes, permitting and other decisions; |

| |

• | changes in customer demand for, and patterns of use of, water, such as may result from conservation efforts; |

| |

• | limitations on the availability of our water supplies or sources of water, or restrictions on our use thereof, resulting from allocation rights, governmental or regulatory requirements and restrictions, drought, overuse or other factors; |

| |

• | changes in laws, governmental regulations and policies, including with respect to environmental, health and safety, water quality and emerging contaminants, public utility and tax regulations and policies, and impacts resulting from U.S., state and local elections; |

| |

• | weather conditions and events, climate variability patterns, and natural disasters, including drought or abnormally high rainfall, prolonged and abnormal ice or freezing conditions, strong winds, coastal and intercoastal flooding, earthquakes, landslides, hurricanes, tornadoes, wildfires, electrical storms and solar flares; |

| |

• | the outcome of litigation and similar governmental and regulatory proceedings, investigations or actions; |

| |

• | our ability to appropriately maintain current infrastructure, including our operational and technology systems, and manage the expansion of our business; |

| |

• | exposure or infiltration of our critical infrastructure and our technology systems, including the disclosure of sensitive, personal or confidential information contained therein, through physical or cyber attacks or other means; |

| |

• | our ability to obtain permits and other approvals for projects; |

| |

• | changes in our capital requirements; |

| |

• | our ability to control operating expenses and to achieve efficiencies in our operations; |

| |

• | the intentional or unintentional actions of a third party, including contamination of our water supplies or water provided to our customers; |

| |

• | our ability to obtain adequate and cost-effective supplies of chemicals, electricity, fuel, water and other raw materials that are needed for our operations; |

| |

• | our ability to successfully meet growth projections for our regulated and market-based businesses, either individually or in the aggregate, and capitalize on growth opportunities, including our ability to, among other things: |

| |

• | acquire, close and successfully integrate regulated operations and market-based businesses; |

| |

• | enter into contracts and other agreements with, or otherwise obtain, new customers in our market-based businesses; and |

| |

• | realize anticipated benefits and synergies from new acquisitions; |

| |

• | risks and uncertainties associated with contracting with the U.S. government, including ongoing compliance with applicable government procurement and security regulations; |

| |

• | cost overruns relating to improvements in or the expansion of our operations; |

| |

• | our ability to maintain safe work sites; |

| |

• | our exposure to liabilities related to environmental laws and similar matters resulting from, among other things, water and wastewater service provided to customers, including, for example, our water transfer business focused on customers in the shale natural gas exploration and production market; |

| |

• | changes in general economic, political, business and financial market conditions; |

| |

• | access to sufficient capital on satisfactory terms and when and as needed to support operations and capital expenditures; |

| |

• | fluctuations in interest rates; |

| |

• | restrictive covenants in or changes to the credit ratings on us or our current or future debt that could increase our financing costs or funding requirements or affect our ability to borrow, make payments on debt or pay dividends; |

| |

• | fluctuations in the value of benefit plan assets and liabilities that could increase our cost and funding requirements; |

| |

• | changes in federal or state general, income and other tax laws, including any further rules, regulations, interpretations and guidance by the U.S. Department of the Treasury and state or local taxing authorities (collectively, the “Related Interpretations”) related to the enactment of the TCJA, the availability of tax credits and tax abatement programs, and our ability to utilize our U.S. federal and state income tax net operating loss (“NOL”) carryforwards; |

| |

• | migration of customers into or out of our service territories; |

| |

• | the use by municipalities of the power of eminent domain or other authority to condemn our systems, or the assertion by private landowners of similar rights against us; |

| |

• | our difficulty or inability to obtain insurance, our inability to obtain insurance at acceptable rates and on acceptable terms and conditions, or our inability to obtain reimbursement under existing insurance programs for any losses sustained; |

| |

• | the incurrence of impairment charges related to our goodwill or other assets; |

| |

• | labor actions, including work stoppages and strikes; |

| |

• | our ability to retain and attract qualified employees; |

| |

• | civil disturbances or terrorist threats or acts, or public apprehension about future disturbances or terrorist threats or acts; and |

| |

• | the impact of new, and changes to existing, accounting standards. |

These forward-looking statements are qualified by, and should be read together with, the risks and uncertainties set forth above and the risk factors included in Item 1A—Risk Factors and other statements contained in this Form 10-K, and you should refer to such risks, uncertainties and risk factors in evaluating such forward-looking statements. Any forward-looking statements we make speak only as of the date this Form 10-K was filed with the U.S. Securities and Exchange Commission (“SEC”). Except as required by the federal securities laws, we do not have any obligation, and we specifically disclaim any undertaking or intention, to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or otherwise. New factors emerge from time to time, and it is not possible for us to predict all such factors. Furthermore, it may not be possible to assess the impact of any such factor on our businesses, either viewed independently or together, or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing factors should not be construed as exhaustive.

PART I

Our Company

With a history dating back to 1886, American Water is the largest and most geographically diverse, publicly-traded water and wastewater utility company in the United States, as measured by both operating revenues and population served. A holding company originally incorporated in Delaware in 1936, we employ approximately 7,100 professionals who provide drinking water, wastewater and other related services to more than 14 million people in 46 states and Ontario, Canada. We conduct the majority of our business through regulated utilities that provide water and wastewater services, collectively presented as our “Regulated Businesses.” We also operate market-based businesses that provide a broad range of related and complementary water, wastewater and other services. Individually, these businesses do not meet the criteria of a reportable segment in accordance with generally accepted accounting principles in the United States (“GAAP”), and are collectively presented as our Market-Based Businesses, which is consistent with how management assesses the results of these businesses.

Throughout this Form 10-K, unless the context otherwise requires, references to “we,” “us,” “our,” the “Company,” and “American Water” mean American Water Works Company, Inc. and its subsidiaries, taken together as a whole. References to “parent company” mean American Water Works Company, Inc., without its subsidiaries.

Regulated Businesses

Our primary business involves the ownership of utilities that provide water and wastewater services to residential, commercial, industrial, public authority, fire service and sale for resale customers. Our utilities operate in approximately 1,600 communities in 16 states in the United States, with approximately 3.4 million active customers to our water and wastewater networks. Services provided by our utilities are generally subject to economic regulation by certain state utility commissions or other entities engaged in utility regulation, collectively referred to as Public Utility Commissions (“PUCs” or “Regulators”). Certain federal, state and local governments also regulate environmental, health and safety, and water quality matters. We report the results of the services provided by our utilities in our Regulated Businesses segment. Operating revenues for our Regulated Businesses were $2,984 million for 2018, $2,958 million for 2017 and $2,871 million for 2016, accounting for 87%, 88% and 87%, respectively, of the Company’s total operating revenues for the same periods.

The following table provides a geographic summary of our Regulated Businesses’ operating revenues and the number of customers we serve, by type of service, for and as of the year ended December 31, 2018:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Revenues (in millions) | | Number of Customers (in thousands) |

| Water (a) | | Wastewater | | Total | | % of Total | | Water | | Wastewater | | Total | | % of Total |

New Jersey | $ | 682 |

| | $ | 41 |

| | $ | 723 |

| | 24.2 | % | | 648 |

| | 49 |

| | 697 |

| | 20.6 | % |

Pennsylvania | 627 |

| | 62 |

| | 689 |

| | 23.1 | % | | 660 |

| | 65 |

| | 725 |

| | 21.4 | % |

Missouri | 309 |

| | 10 |

| | 319 |

| | 10.7 | % | | 469 |

| | 14 |

| | 483 |

| | 14.3 | % |

Illinois | 277 |

| | 20 |

| | 297 |

| | 10.0 | % | | 286 |

| | 35 |

| | 321 |

| | 9.5 | % |

California | 218 |

| | 3 |

| | 221 |

| | 7.4 | % | | 176 |

| | 3 |

| | 179 |

| | 5.3 | % |

Indiana | 219 |

| | — |

| | 219 |

| | 7.3 | % | | 305 |

| | 2 |

| | 307 |

| | 9.1 | % |

West Virginia | 143 |

| | 1 |

| | 144 |

| | 4.8 | % | | 166 |

| | 1 |

| | 167 |

| | 4.9 | % |

Total—Top Seven States (b) | 2,475 |

| | 137 |

| | 2,612 |

| | 87.5 | % | | 2,710 |

| | 169 |

| | 2,879 |

| | 85.1 | % |

Other states (c) | 348 |

| | 24 |

| | 372 |

| | 12.5 | % | | 472 |

| | 31 |

| | 503 |

| | 14.9 | % |

Total Regulated Businesses | $ | 2,823 |

| | $ | 161 |

| | $ | 2,984 |

| | 100.0 | % | | 3,182 |

| | 200 |

| | 3,382 |

| | 100.0 | % |

| |

(a) | Includes other operating revenues consisting primarily of miscellaneous utility charges, fees and rents. |

| |

(b) | Our “Top Seven States” are determined based upon operating revenues. |

| |

(c) | Includes our utilities in the following states: Georgia, Hawaii, Iowa, Kentucky, Maryland, Michigan, New York, Tennessee and Virginia. |

See Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 20—Segment Information in the Notes to Consolidated Financial Statements for additional information.

Customers

Our Regulated Businesses have a large and geographically diverse customer base. A customer is defined as a person, business, municipality or any other entity that purchases our water or wastewater services as of the last business day of a reporting period. One single customer may purchase our services for use by multiple individuals or businesses, as is the case in many homes, apartment complexes, businesses and governmental entities.

The vast majority of our regulated water customers are metered, which allows us to measure and bill for our customers’ water usage, typically on a monthly basis. We employ a variety of methods of customer meter reading to monitor consumption. These methods range from meters with mechanical registers where consumption is manually recorded by meter readers, to meters with electronic registers capable of transmitting consumption data to proximity devices or via radio frequency to mobile or fixed network data collectors. Our wastewater customers are billed either a flat rate or based upon their water consumption.

Residential customers make up a substantial portion of our customer base in all of the states in which we operate. We also serve (i) commercial customers, such as food and beverage providers, commercial property developers and proprietors, and energy suppliers, (ii) fire service customers, where we supply water through our distribution systems to public fire hydrants for firefighting purposes and to private fire customers for use in fire suppression systems in office buildings and other facilities, (iii) industrial customers, such as large-scale manufacturers, mining and production operations, (iv) public authorities, such as government buildings and other public sector facilities, including schools and universities, and (v) other utilities and community water and wastewater systems in the form of bulk contracts for the supply of water or the treatment of wastewater, for their own customers.

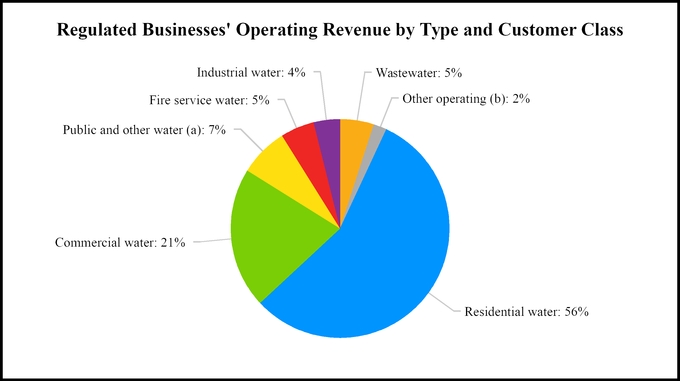

The following chart depicts the allocation of our Regulated Businesses’ operating revenue by type, including a breakout of the total water services revenues by class of customer, for the year ended December 31, 2018:

| |

(a) | Includes water revenues from public authorities and other utilities and community water systems under bulk contracts. |

| |

(b) | Includes other operating revenues consisting primarily of miscellaneous utility charges, fees and rents. |

The following table provides the number of water and wastewater customers we served by class as of December 31:

|

| | | | | | | | | | | | | | | | | |

| 2018 | | 2017 | | 2016 |

(In thousands) | Water | | Wastewater | | Water | | Wastewater | | Water | | Wastewater |

Residential | 2,892 |

| | 188 |

| | 2,872 |

| | 182 |

| | 2,846 |

| | 171 |

|

Commercial | 222 |

| | 11 |

| | 221 |

| | 11 |

| | 220 |

| | 10 |

|

Fire service | 48 |

| | — |

| | 47 |

| | — |

| | 45 |

| | — |

|

Industrial | 4 |

| | — |

| | 4 |

| | — |

| | 4 |

| | — |

|

Public and other (a) | 16 |

| | 1 |

| | 16 |

| | — |

| | 16 |

| | — |

|

Total | 3,182 |

| | 200 |

| | 3,160 |

| | 193 |

| | 3,131 |

| | 181 |

|

| |

(a) | Includes public authorities and other utilities and community water and wastewater systems under bulk contracts. Bulk contracts, which are accounted for as a single customer in the table above, generally result in service to multiple customers. |

Customer growth in our Regulated Businesses is primarily from (i) adding new customers to our customer base through acquisitions of water and/or wastewater utility systems, (ii) organic population growth in our authorized service areas, and (iii) sale of water to other water utilities and community water systems.

Capital Investment

The aging water and wastewater infrastructure in the United States is in need of replacement and modernization. The American Society of Civil Engineers published its Report Card for America’s Infrastructure in 2017 and gave the drinking water industry a grade of “D,” and the wastewater infrastructure a grade of “D+,” primarily because much of the country’s infrastructure is nearing the end of its useful life. The report also stated that, on an annual basis, approximately 2 trillion gallons of treated water are lost in the United States through more than 240,000 main breaks, at an estimated cost of $2.6 billion. This represents approximately 20% of all treated water in the country. In addition, approximately 900 billion gallons of untreated sewage is discharged into the country’s rivers and streams every year. As documented in the American Water Works Association’s Buried No Longer: Confronting America’s Water Infrastructure Challenge, restoring the country’s existing water systems as they reach the end of their useful lives, and expanding them to serve a growing population, will cost at least $1 trillion between 2011 and 2035, just to maintain the current levels of water service. In addition, increased regulation related to water quality and the management of water and wastewater residual discharges, which began with the passage of the Clean Water Act in 1972 and the Safe Drinking Water Act in 1974, is also a primary driver for the need to modernize the country’s water and wastewater infrastructure.

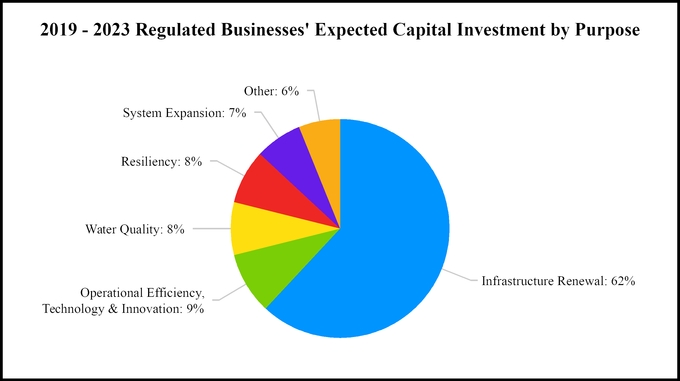

To address the growing infrastructure needs in the areas we serve, we plan to invest $7.3 billion over the next five years, including $1.6 billion in 2019, for capital improvements to our Regulated Businesses’ water and wastewater infrastructure, largely for pipe replacement and upgrading aging water and wastewater treatment facilities. We have proactively improved our pipe renewal rate from a 250-year replacement cycle to a 120-year replacement cycle, which we anticipate will enable us to replace nearly 2,000 miles of mains and collection pipes between 2019 and 2023. In addition, during this same five-year period, our capital investment in treatment plants, storage tanks and other key, above-ground facilities has increased over 10%, further addressing infrastructure renewal, resiliency, water quality, operational efficiency, technology and innovation, and emerging regulatory compliance needs. Additionally, we are investing significantly in resiliency projects to address the impacts of climate and weather variability by hardening our assets.

Economic Regulation and Rate Making

Our Regulated Businesses operate under a regulatory compact whereby, in exchange for exclusive rights to provide water and wastewater services in defined service territories, we have an obligation to serve customers within those territories requesting service, within reasonable limits. In return for agreeing to invest capital into our water and wastewater systems, we are given the opportunity to recover our costs of doing business and earn a reasonable rate of return on our investments.

The operations of our Regulated Businesses are generally subject to economic regulation by PUCs in the state in which they operate, with the primary responsibility of the PUCs to promote the overall public interest by balancing the interest of customers and utility investors. Specific authority might differ from state to state, but in most states, PUCs review and approve rates charged to customers, accounting treatments, long-term financing programs and cost of capital, O&M expenses, capital expenditures, taxes, affiliated transactions and relationships, reorganizations and mergers and acquisitions, along with imposing certain penalties or granting certain incentives. Regulatory policies vary from state to state and could potentially change over time. These policies will affect the timing, as well as the extent, of recovery of expenses and the realized return on invested capital.

The process to obtain approval for a change in rates generally occurs by way of a rate case filed by the utility with the PUC on a periodic basis. The timing of rate case filings is typically determined by either periodic requirements in the regulatory jurisdiction or by the utility’s need to increase its revenue requirement to recover capital investment costs, changes in operating revenues, operating costs or other market conditions. Our rate case management program is guided by the principles of (i) obtaining timely recovery of capital investment costs, (ii) recognizing declining sales resulting from reduced consumption, and (iii) obtaining appropriate recovery of utility O&M costs, including costs incurred for compliance with environmental regulations. The program attempts to minimize “regulatory lag,” which is the time between the occurrence of an event that triggers a change in the utility’s revenue requirement and its recognition in rates. For example, regulatory lag describes the time between when a capital investment is placed into service for the benefit of the customer and when the Company can begin earning a return of and on that capital investment, through the ratemaking process. It also applies to the lag in the recognition in rate recovery of changes in expenses and revenues.

Our Regulated Businesses support regulatory practices at the PUCs and state legislatures that mitigate the adverse impact of regulatory lag. The following table provides examples of approved regulatory practices:

|

| | | | |

Regulatory Practices | | Description | | States Allowed |

Infrastructure replacement surcharges | | Allows rates to change periodically, outside a general rate case proceeding, to reflect recovery of capital investments made to replace infrastructure necessary to sustain safe, reliable services for our customers. These mechanisms typically involve periodic filings and reviews to ensure transparency. | | IA, IL, IN, MO, NJ, NY, PA, TN, VA, WV |

Future test year | | A test period used for setting rates, which begins with the date new rates are effective. This allows current or projected revenues, expenses and capital investments to be collected on a timelier basis. | | CA, HI, IA, IL, IN, KY, NY, PA, TN, VA |

Hybrid test year | | Allows an update to historical data for “known and measurable” changes that occur subsequent to the historical test year. | | MD, MO, NJ, WV |

Utility plant recovery mechanisms | | Allows recovery of the full return on utility plant costs during the construction period, instead of capitalizing an allowance for funds used during construction. In addition, some states allow the utility to seek pre-approval of certain capital projects and associated costs. In this pre-approval process, the PUC may assess the prudency of such projects. | | CA, IL, KY, NY, PA, TN, VA |

Expense mechanisms | | Allows changes in certain operating expenses, which may fluctuate based on conditions beyond the utility’s control, to be recovered outside of a general rate case proceeding or deferred until the next general rate case proceeding. | | CA, IL, MD, MO, NJ, NY, PA, TN, VA |

Revenue stability mechanisms | | Separates a utility’s cost recovery from the amount of water it sells to recover its fixed costs and ongoing infrastructure investment needs. Such a mechanism adjusts rates periodically to ensure that a utility’s revenue will be sufficient to cover its costs, regardless of sales volume, including recognition of declining sales resulting from reduced consumption, while providing an incentive for customers to use water more efficiently. | | CA, IL, NY |

Consolidated tariffs | | Use of a unified rate structure for water systems owned and operated by a single utility, which may or may not be physically interconnected. The consolidated tariff pricing structure may be used fully or partially in a state, and is generally used to prioritize capital investments and moderate the impact of periodic fluctuations in local costs, while lowering administrative costs for customers. Pennsylvania also permits a blending of water and wastewater revenue requirements. | | CA, IA, IL, IN, KY, MD, MO, NJ, NY, PA, VA, WV |

We pursue or seek enhancement to these regulatory practices to facilitate efficient recovery of our costs and capital investments in order to continue to provide safe, clean, reliable and affordable services to our customers. The ability to seek regulatory treatment as described above does not guarantee that the PUCs will accept our proposal in the context of a particular rate case, and these regulatory practices may reduce, but not eliminate, regulatory lag associated with traditional rate making processes. It is also our strategy to expand their use in areas where they may not currently apply.

Acquisitions and Strategic Growth

The U.S. water and wastewater industries include investor-owned systems as well as municipal systems that are owned and operated by local governments or governmental subdivisions. Both industries are highly fragmented. According to the U.S. Environmental Protection Agency (“EPA”), approximately 84% of the water market is served by municipal systems and approximately 98% of the country’s wastewater systems are government owned. The EPA also estimates that there are approximately 50,000 community water systems and approximately 15,000 community wastewater systems in the United States, with approximately 80% of the community water systems serving a population of 3,000 or less. This large number of relatively small, fragmented water and wastewater systems may result in inefficiencies in the marketplace, since such utilities may not have the operating expertise, financial and technological capability or economies of scale to provide services or raise capital as efficiently as larger utilities. Larger utilities that have greater access to capital are generally more capable of making mandated and other necessary infrastructure upgrades to their water and wastewater systems. In addition, water and wastewater utilities with large customer bases, spread across broad geographic regions, may more easily absorb the impact of significant variations in precipitation and temperatures, such as droughts, excessive rain and cool or warm temperatures in specific areas. Larger utilities generally are able to spread support services over a larger customer base, thereby reducing the costs to serve each customer. Since many administrative and support activities can be efficiently centralized to gain economies of scale, companies that participate in industry consolidation have the potential to improve operating efficiencies, lower costs per unit and improve service at the same time. Larger utilities also typically have the expertise to operate systems more efficiently and can attract and retain employees needed to operate the utility over time.

A fundamental aspect of our growth strategy is to pursue acquisitions of small and medium water and/or wastewater systems of between 3,000 and 30,000 customers, in geographic proximity to areas where we operate our Regulated Businesses. The proximity of acquisition opportunities to our regulated footprint allows us to integrate and manage the acquired systems and operations primarily using our existing management, although we typically retain the majority of employees, and to achieve operational efficiencies and prioritize capital investment needs. Our current customer mix of 94% water and 6% wastewater also presents strategic opportunities for wastewater growth and systems consolidation, allowing us to add wastewater customers where we already serve water customers. We intend to continue to expand our regulated footprint geographically by acquiring water and wastewater systems in our existing markets and, if appropriate, pursuing acquisition opportunities in certain domestic markets where we do not currently operate our Regulated Businesses. Before entering new regulated markets, we will evaluate the business and regulatory climates to ensure that we will have the opportunity to achieve an appropriate rate of return on our investment while maintaining our high standards for providing safe, reliable and affordable services to our customers, as well as a line of sight to grow our base customers to attain efficiencies after entering the new domestic market.

Increasingly stringent environmental, health and safety, and water quality regulations, the amount of infrastructure in need of significant capital investment, financial challenges and industry legislation are several elements that may drive more municipalities to consider selling their water and wastewater assets.

We are an experienced utility with proven access to capital and financial, technical, and managerial resources with public service commission oversight. We are a solution provider and believe that many communities could benefit from receiving safe and reliable water and wastewater service.

Industry Legislation

In 2017, New Jersey enacted the Water Quality Accountability Act (the “WQAA”), which sets new operational standards for all water utilities in New Jersey, including municipal and investor-owned utilities with more than 500 service connections. This law imposes new requirements in areas such as cybersecurity, asset management, water quality reporting, remediation of notices of violation, and hydrant and valve maintenance. The WQAA requires the most senior water manager, or either the executive director for municipal utility authorities or the mayor or chief executive officer for municipally owned public water systems, to certify that the system meets the requirements under the WQAA. On October 19, 2018, our New Jersey American Water subsidiary certified that it was in compliance with all aspects of the Act.

In 2018, similar legislation was passed in Indiana, which sets new operational standards and requirements for water and wastewater treatment plants in areas such as capital asset management, cost-benefit analysis and cybersecurity.

Also, in 2018, President Trump signed America’s Water Infrastructure Act of 2018. The legislation includes policies intended to improve water and wastewater system management and authorization for states to assess options for consolidation for systems that do not comply with the federal Safe Drinking Water Act and its rules and regulations. The legislation increases funding to water system funding programs, including the State Revolving Loan Fund program and the Water Infrastructure Finance and Innovation Act.

Our regulated subsidiaries in California, Illinois, Indiana, Iowa, Maryland, Missouri, New Jersey and Pennsylvania have access to fair market value legislation for private sector investment in public sector systems. We support full optionality for municipalities, including state legislation that enables the consolidation of the largely fragmented water and wastewater industries through third-party fair market valuations of purchased property. Fair market value assessment of water and wastewater systems is an alternative to the traditional depreciated original cost method of valuation, providing municipalities with a purchase price that is reflective of the assets’ value, while the utility has increased assurance of recovering the purchase price over the life of the assets, subject to state regulatory commission approval.

Consolidated tariffs use a unified rate structure for systems owned and operated by a single utility, which may or may not be physically interconnected. Consolidated tariff pricing moderates the impact of periodic fluctuations in local costs and promotes a more universal water infrastructure investment in the state. As a result, consolidated tariffs can make it easier to incorporate new systems into an existing utility and can ensure economies of scale for even the smallest of systems and prioritize capital needs across the state. Overall, this brings cost-effective, higher quality services to a larger number of citizens. Eleven of our regulated subsidiaries currently have some form of consolidated tariff pricing, including Illinois, Indiana, Iowa, Kentucky, Maryland, Missouri, New Jersey, New York, Pennsylvania, Virginia, and West Virginia.

In 2018, legislation was passed in our Missouri and California subsidiaries changing the public vote requirement for the sale of water or wastewater systems. In Missouri, the public vote requirement for the sale of a municipal water or wastewater system changed to a simple majority for more than 500 small towns. Historically, only larger communities required a simple majority, while smaller communities needed a two-thirds majority. This legislation increases the options for small towns, should they decide to address their water and sewer challenges through an asset sale. In California, the vote required to allow cities to sell sewer systems changed to a simple majority as compared to a two-thirds majority.

Competition

In our Regulated Businesses, we generally do not face direct competition in our existing markets because (i) we operate in those markets pursuant to franchises, charters, certificates of public convenience and necessity or similar authorizations (collectively, “CPCNs”) issued by state PUCs, and (ii) the high cost of constructing a new water and wastewater system in an existing market creates a high barrier to market entry. However, our Regulated Businesses do face competition from governmental agencies, other investor-owned utilities, large industrial customers with the ability to provide their own water supply/treatment process and strategic buyers that are entering new markets and/or making strategic acquisitions. When pursuing acquisitions, our largest investor-owned competitors, based on a comparison of operating revenues and population served, are Aqua America, Inc., Suez North America, American States Water Company and California Water Service Group. From time to time, we also face competition from infrastructure funds, multi-utility companies and others, such as Algonquin Power and Utilities Corp., Eversource Energy and Corix.

Condemnation and Eminent Domain

All or portions of our Regulated Businesses’ utility assets could be acquired by state, municipal or other government entities through one or more of the following methods: (i) eminent domain (also known as condemnation); (ii) the right of purchase given or reserved by a municipality or political subdivision when the original CPCN was granted; and (iii) the right of purchase given or reserved under the law of the state in which the utility subsidiary was incorporated or from which it received its CPCN. The acquisition consideration related to such a proceeding initiated by a local government may be determined consistent with applicable eminent domain law, or may be negotiated or fixed by appraisers as prescribed by the law of the state or in the particular CPCN.

As such, we are periodically subject to condemnation proceedings in the ordinary course of business. For example, a citizens group in Monterey, California successfully added “Measure J” to the November 6, 2018 election ballot asking voters to decide whether the Monterey Peninsula Water Management District (the “MPWMD”) should conduct a feasibility study concerning the potential purchase of our California subsidiary’s Monterey water service assets, and, if feasible, to proceed with a purchase of those assets without an additional public vote. This service territory represents approximately 40,000 customers. On November 27, 2018, Measure J was certified to have passed. The MPWMD has until August 27, 2019 to complete a feasibility study and submit to its board a written plan for acquiring the system assets. If the MPWMD were to determine that such an acquisition is feasible, then the MPWMD would commence a multi-year eminent domain proceeding against our California subsidiary to first establish the MPWMD’s right to take the system assets and, if such right is established, determine the amount of just compensation to be paid for the system assets.

Also, five municipalities in the Chicago, Illinois area (approximately 30,300 customers in total) formed a water agency and filed an eminent domain lawsuit against our Illinois subsidiary in January 2013, seeking to condemn the water pipeline that serves those five municipalities. Before filing its eminent domain lawsuit, the water agency made an offer of $38 million for the pipeline. A jury trial will take place to establish the value of the pipeline. Although the date of this trial has not currently been scheduled, it is likely to commence in the fourth quarter of 2019.

Furthermore, the law in certain jurisdictions in which our Regulated Businesses operate provides for eminent domain rights allowing private property owners to file a lawsuit to seek just compensation against a public utility, if a public utility’s infrastructure has been determined to be a substantial cause of damage to that property. In these actions, the plaintiff would not have to prove that the public utility acted negligently. In California, most recently, lawsuits have been filed in connection with large-scale natural events such as wildfires. Some have included allegations that infrastructure of certain utilities triggered the natural event that resulted in damage to the property. In some cases, the PUC has allowed certain costs or losses incurred by the utility to be recovered from customers in rates, but in other cases such recovery in rates has been disallowed. Also, the utility may have obtained insurance that could respond to some or all of such losses, although the utility would be at risk for any losses not ultimately subject to rate or insurance recovery or losses that exceed the limits of such insurance.

Water Supply and Wastewater Services

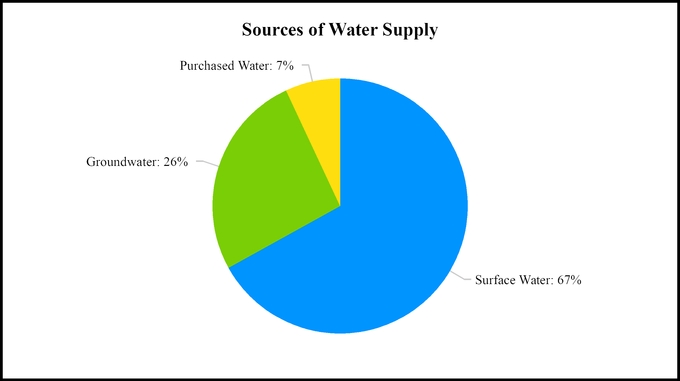

Our Regulated Businesses generally own the physical assets used to store, pump, treat and deliver water to our customers and collect, treat, transport and recycle wastewater. Typically, we do not own the water itself, which is held in public trust and is allocated to us through contracts, permits and allocation rights granted by federal and state or multi-state agencies or through the ownership of water rights pursuant to local law. We are dependent on defined sources of water supply and obtain our water supply from surface water sources such as reservoirs, lakes, rivers and streams; from groundwater sources, such as wells and aquifers; and water purchased from third-party water suppliers. The level of water treatment we apply varies significantly depending upon the quality of the water source and customer stipulations. Surface water sources typically generally require significant treatment, while groundwater sources often require chemical treatment only.

The following chart depicts our sources of water supply as of December 31, 2018:

The following table provides percentages of water supply by source type for our top seven states for 2018 were as follows:

|

| | | | | |

| Surface Water | | Ground Water | | Purchased Water |

New Jersey | 71% | | 24% | | 5% |

Pennsylvania | 91% | | 7% | | 2% |

Missouri | 79% | | 20% | | 1% |

Illinois | 53% | | 36% | | 11% |

California | — | | 64% | | 36% |

Indiana | 44% | | 56% | | — |

West Virginia | 99% | | — | | 1% |

Our ability to meet the existing and future water demands of our customers depends on an adequate water supply. Drought, governmental restrictions, overuse of sources of water, the protection of threatened species or habitats, contamination or other factors may limit the availability of ground and surface water. We employ a variety of measures in an effort to obtain adequate sources of water supply, both in the short-term and over the long-term. The geographic diversity of our service areas may mitigate some of the economic effects on the water supply associated with weather extremes we might encounter in any particular service territory. For example, in any given summer, some areas may experience drier than average weather, which may reduce the amount of source water available, while other areas we serve may experience wetter than average weather.

In our long-term planning, we evaluate quality, quantity, growth needs and alternate sources of water supply as well as transmission and distribution capacity. Water supply is seasonal in nature and weather conditions can have a pronounced effect on supply. In order to ensure that we have adequate water supply, we use long-term planning processes and maintain contingency plans to minimize the potential impact on service caused by climate variability and a wide range of weather fluctuations. In connection with supply planning for most surface or groundwater sources, we employ models to determine safe yields under different rainfall and drought conditions. Surface and ground water levels are routinely monitored so that supply capacity deficits may, to the extent possible, be predicted and mitigated through demand management and additional supply development. An example of our use of long-term planning to ensure that we have adequate water supply is our involvement in the Monterey Peninsula Water Supply Project (the “Water Supply Project”) in California. The Water Supply Project includes the construction of a desalination plant, owned by our California subsidiary, and the construction of wells that would supply water to the desalination plant. In addition, the Water Supply Project also includes our California subsidiary’s purchase of water from a groundwater replenishment project between the Monterey Regional Water Pollution Control Agency (now known as Monterey One Water) and the MPWMD. The Water Supply Project is intended, among other things, to fulfill obligations of our California subsidiary to eliminate unauthorized diversions from the Carmel River as required under orders of the California State Water Resources Control Board (the “SWRCB”). For more information, see Item 3—Legal Proceedings—Alternative Water Supply in Lieu of Carmel River Diversions.

Wastewater services involve the collection of wastewater from customers’ premises through sewer lines. The wastewater is then transported through a sewer network to a treatment facility, where it is treated to meet required regulatory standards for wastewater before being returned to the environment. The solid waste by-product of the treatment process is disposed of or recycled in accordance with applicable standards and regulations.

Seasonality

Customer demand for our water service is affected by weather and tends to vary with temperature, rainfall levels and the frequency of rainfall. Customer demand is generally greater during the warmer months, primarily due to increased water usage for irrigation systems and other outdoor water use. As such, we typically expect our operating revenues to be the highest in the third quarter of each year. Weather that is hotter and drier than average generally increases operating revenues, whereas, weather that is cooler and/or wetter than average generally serves to suppress customer water demand and can reduce water operating revenues. Three of our jurisdictions, California, Illinois and New York, have adopted revenue stability mechanisms which permit us to collect state PUC-authorized revenue for a given period which is not tied to the volume of water sold during that period, thereby lessening the impact of weather variability. See “Economic Regulation and Rate Making” for additional information regarding revenue stability mechanisms.

Market-Based Businesses

Through our Market-Based Businesses, we provide a broad range of related and complementary water and wastewater services primarily to residential and smaller commercial customers, the U.S. government on military installations and shale natural gas exploration and production companies, as well as municipalities, utilities and industrial customers. These businesses are not subject to economic regulation by state PUCs and the services provided generally do not require significant capital investment. Operating revenues for our Market-Based Businesses were $476 million for 2018, $422 million for 2017 and $451 million for 2016, accounting for 14%, 13% and 14%, respectively, of the Company’s total operating revenues for the same periods.

Our primary Market-Based Businesses include the following operating segments:

| |

• | Homeowner Services Group, which provides various warranty protection programs to residential and smaller commercial customers; |

| |

• | Military Services Group, which enters into long-term contracts with the U.S. government to provide water and wastewater services on various military installations; and |

| |

• | Keystone Clearwater Solutions, LLC (“Keystone”), which provides customized water transfer services for shale natural gas exploration and production companies. |

We also enter into contracts with municipal, commercial and industrial customers to operate and manage water and wastewater facilities and provide other related services through our Contract Services Group. During 2018, we closed on the sale of the majority of our Contract Services Group’s O&M contracts to subsidiaries of Veolia Environnement S.A. See Note 4—Acquisitions and Divestitures in the Notes to Consolidated Financial Statements for additional information. We will retain four of our Contract Services Group’s O&M contracts due to their proximity to our existing service areas, and expect the majority of the remaining contracts to be sold to other parties, or expire within the next twelve months.

Homeowner Services Group

Our Homeowner Services Group, which includes our June 4, 2018 acquisition of Pivotal Home Solutions (“Pivotal”), provides warranty protection programs to residential and smaller commercial customers to protect against repair costs for interior and exterior water and sewer lines, interior gas and electric lines, heating and cooling systems, water heaters and other home appliances, as well as power surge protection and other related services. We also develop partnerships with municipalities, utilities and other organizations to offer our protection programs to customers serviced by, or affiliated with, those municipalities, utilities and organizations. The term of these partnership agreements is typically three to five years, with mutual optional renewals. As of December 31, 2018, our Homeowner Services Group had approximately 3 million customer contracts in 43 states, and 26 partnership agreements with utilities, municipalities and other organizations.

Military Services Group

Our Military Services Group operates on 14 military installations under 50-year contracts with the U.S. government as part of its Utility Privatization Program. The scope of these contracts generally includes the operation and maintenance of the installation’s water and wastewater systems and a capital program focused on asset replacement and, in certain instances, systems expansion. The replacement of assets assumed when a contract is awarded to the Company is funded from the contract fee. At times, new assets are required to support the installation’s mission and the construction of these assets are funded by the U.S. government as separate modifications or amendments to the contract. The capital program historically has not used the Company’s equity or debt borrowings; rather, we have used limited working capital for short-term needs under these contracts. In April 2018, the U.S. Army instituted a requirement that a bidder must offer financing in its proposal for a new capital project. The Company is currently exploring strategies to address the U.S. Army’s revised requirements for new projects on which it may seek to bid, including partnering with third parties for off-balance sheet financing.

The contract price for nine of our contracts with the U.S. government is subject to redetermination two years after commencement of operations, and every three years thereafter. Price redetermination is a contract mechanism to periodically adjust the service fee in the next period, to reflect changes in contract obligations and anticipated market conditions. The remaining five contracts with the U.S. government are subject to annual price adjustments under a mechanism similar to price redetermination called “Economic Price Adjustment.” All of these contracts may be terminated, in whole or in part, prior to the end of the 50-year term for convenience of the U.S. government, or as a result of default or non-performance by the subsidiary performing the contract. In either event, pursuant to termination provisions applicable to these contracts, we would be entitled to recover allowable costs that we may have incurred under the contract, plus the contract profit margin on incurred costs. Our backlog of revenue associated with our contracts with the U.S. government is approximately $4.3 billion, with an average remaining contract term of 42 years.

Keystone

In July 2015, we acquired a 95% interest in Water Solutions Holdings, LLC, including its wholly owned subsidiary, Keystone. During 2018, pursuant to the exercise of put options by the minority owners, we acquired the remaining 5% interest in Keystone, bringing our ownership interest to 100%. Keystone is a water service and management solutions company that serves shale natural gas exploration and production customers in the Appalachian Basin. During 2018, Keystone exited its construction and water trucking business lines, narrowing the scope of its business going forward to customized water transfer services. Keystone operates under master service agreements that are generally shorter term in nature. When the initial term of these agreements expire, they typically renew automatically on an annual basis, and are generally cancelable by either party with 30 days prior notice. As of December 31, 2018, Keystone serves approximately 47 customers.

Competition

We face competition in our Market-Based Businesses from a number of service providers, including HomeServe USA in our Homeowner Services Group, and American States Water Company, Suez North America, and Veolia Environnement S.A. in our Military Services Group. Keystone currently faces competition from water service providers that typically provide services to particular segments of the water management cycle, such as Select Energy Services, Inc., TETRA Technologies, Inc. and Baker Corp.

Environmental, Health and Safety, and Water Quality Regulation

Our water and wastewater operations, including the services provided by both our Regulated Businesses and Market-Based Businesses, are subject to extensive federal, state and local laws and regulations, and in the case of our Canadian operations, Canadian laws and regulations, governing the protection of the environment, health and safety, the provision of water and wastewater services, particularly with respect to the quality of water we deliver to our customers, and the manner in which we collect, treat, discharge, recycle and dispose of wastewater. In the United States, these regulations are developed under legislation including the Safe Drinking Water Act, the Reduction of Lead in Drinking Water Act and the Clean Water Act. States also have the authority to develop their standards and requirements in these areas. We are subject to various federal, state, local and Canadian laws and regulations governing the storage of hazardous materials, the management and disposal of hazardous and solid wastes, discharges to air and water, the cleanup of contaminated sites, dam safety and other matters relating to the protection of the environment and health and safety. PUCs also set conditions and standards for the water and wastewater services we deliver.

Environmental, health and safety, and water quality regulations are complex and change frequently. For example, while the EPA has issued a non-enforceable Health Advisory for the combined level of two perfluorinated compounds, the New Jersey Department of Environmental Protection has adopted a more stringent maximum contaminant level for a third compound, perfluorononanoic acid, or PFNA, and perfluorooctanoic acid, or PFOA, and will be seeking to adopt similar standards for other perfluoroalkyl and polyfluoroalkyl substances, or PFAS. The overall trend has been that drinking water standards have become increasingly more stringent over time. As newer or stricter standards are introduced, our capital and operating costs could increase. We incur substantial costs associated with compliance with the environmental, health and safety, and water quality standards to which our operations are subject and we invest in technology solutions for enhanced detection and monitoring. In the past, our Regulated Businesses have generally been able to recover the costs associated with compliance; however, this recovery is affected by regulatory lag and the corresponding uncertainties surrounding rate recovery. We estimate that we will make capital expenditures of $133 million and $120 million during 2019 and 2020, respectively, for environmental control facilities, which we define for this purpose as any project (or portion thereof) that involves the preservation of air, water or land. We also maintain an environmental program that includes responsible business practices, compliance with environmental laws and regulations, and effective use of natural resources. We believe that our operations are materially in compliance with, and in many cases surpass, minimum standards required by applicable environmental laws and regulations.

Our operations also involve the use, storage and disposal of hazardous substances and wastes. For example, our water and wastewater treatment facilities store and use chlorine and other chemicals that generate wastes that require proper handling and disposal under applicable environmental requirements. We also could incur remedial costs in connection with any contamination relating to our operations or facilities or our off-site disposal of wastes. The Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (“CERCLA”), authorizes the EPA, and comparable state laws authorize state environmental authorities, to issue orders and bring enforcement actions to compel responsible parties to investigate and take remedial actions at any site that is determined to present an actual or potential threat to human health or the environment because of an actual or threatened release of one or more hazardous substances. Parties that generated or transported hazardous substances to such sites, as well as current and former owners and operators of such sites, may be deemed liable, without regard to fault, under CERCLA or comparable state laws. Although we are not aware of any material cleanup or decontamination obligations, the discovery of contamination or the imposition of such obligations in the future could result in additional costs. Our facilities and operations are also subject to requirements under the U.S. Occupational Safety and Health Act and inspections thereunder. Certain of our subsidiaries are involved in pending legal proceedings relating to environmental matters. See Item 3—Legal Proceedings for additional information.

Safe Drinking Water Act

The Safe Drinking Water Act and related regulations establish national quality standards for drinking water. The EPA has issued rules governing the levels of numerous, naturally occurring and man-made chemical and microbial contaminants and radionuclides allowable in drinking water, and continues to propose new rules. These rules also prescribe testing requirements for detecting regulated contaminants, the treatment systems that may be used for removing those contaminants, and other requirements. To date, the EPA has set standards for approximately 90 contaminants and indicators for drinking water, and there is a process in place to make a regulatory determination on at least five additional compounds every five years.

To help formulate the basis for future regulations, the EPA has the authority to require monitoring for additional, unregulated contaminants under the Unregulated Contaminant Monitoring Rule (the “Monitoring Rule”). Our facilities have participated in the data gathering effort for the Monitoring Rule in previous rounds, which occurs every five years, and are also a participant in the ongoing fourth round, which is scheduled for completion by the end of 2020. There are millions of other chemical compounds that are not regulated, many of which are lacking a testing methodology, occurrence data, health effects information and/or treatment technology. The process of developing new drinking water standards is long and complex, but we actively participate with the EPA and other water industry groups by sharing research and water quality operational knowledge. See Item 1—Business—Research and Development—Emerging Containments for additional information.

To effect the removal or inactivation of microbial organisms, the EPA has established various rules to improve the disinfection and filtration of drinking water and to reduce consumers’ exposure to disinfectants and by-products of the disinfection process. In 2006, the EPA issued the Long-Term 2 Enhanced Surface Water Treatment Rule and the Stage 2 Disinfectants and Disinfection Byproduct Rule and finalized the Ground Water Rule, which is applicable to systems providing water from underground sources. In 2016, the revised Total Coliform Rule implemented a “find and fix” process where exceeding bacterial trigger levels requires an assessment to correct any sanitary defects. We are within the EPA’s time frame for compliance with these standards, which includes sample collection, data analysis, engineering planning and system implementation. Recent monitoring under the Long-Term 2 Rule has resulted in the need for more than 30 of our surface water systems to provide additional protection against cryptosporidium. In most cases, this will involve installing UV disinfection at an estimated cost ranging from $150 million to $250 million. Further, the EPA is actively considering regulations for a number of contaminants, including strontium, hexavalent chromium, fluoride, nitrosamines, perchlorate, some pharmaceuticals and certain volatile organic compounds. We do not anticipate that any such regulations, if enacted, will require implementation in 2019.

Across the Company, we conduct over one million water quality tests each year at our laboratory facilities and plant operations, including continuous online instrumentations such as monitoring turbidity levels, disinfectant residuals and adjustments to chemical treatment based on changes in incoming water. We participate in the Partnership for Safe Water, the EPA’s voluntary program to meet more stringent goals for reducing microbial contaminants. With 69 of our 81 surface water treatment plants receiving the EPA program’s prestigious “Director” award, which recognizes utilities that (i) have completed a comprehensive self-assessment report, (ii) created an action plan for continuous improvement, and (iii) produced high-quality drinking water, we account for approximately one-third of the plants receiving such awards nationwide. In addition, 67 of our surface water treatment plants have received the “Five-Year Phase III” award, 62 plants have received the “Ten-Year Phase III” award, 58 plants have received the “Fifteen-Year Phase III” award, and 3 plants have received the “Twenty-Year Phase III” award; these awards recognize plants that have met the Director award status for five, 10, 15 and 20 years, respectively. Further, nine of our surface water plants have received the “Presidents” award, which recognizes treatment plants that achieve the Partnership’s rigorous individual filter effluent turbidity standards.

Although it is difficult to project the ultimate costs of complying with the above or other pending or future requirements, we expect current requirements under the Safe Drinking Water Act and other similar laws to be recoverable through the regulatory process and therefore compliance costs are not expected to have a material impact on our operations or financial condition. In addition, capital expenditures and operating costs to comply with environmental mandates have been traditionally recognized by PUCs as appropriate for inclusion in establishing rates. As a result, we expect to recover the operating and capital costs resulting from these pending or future requirements.

Lead and Copper Rule and Reduction of Lead in Drinking Water Act

Across the country, there is a renewed focus on the potential risk of lead in drinking water. In 1991, the EPA published the Lead and Copper Rule (“LCR”) to control lead and copper in drinking water and, since that time, has issued minor revisions in 2000, 2004 and 2007, enhancing monitoring, reporting and public education requirements. In 2011, Congress enacted the Reduction of Lead in Drinking Water Act regarding the use and introduction into commerce of lead pipes, plumbing fittings for fixtures, solder and flux. While these advances have made an impact in reducing lead exposure in drinking water, legacy lead plumbing materials, primarily in building plumbing, still remain in many communities. The EPA is currently working to develop long-term revisions to the LCR, with a revised draft likely in 2019. It is currently estimated that approximately 5% of our service lines contain lead (“LSLs”). We have reviewed our inventories of company owned service lines, our related practices and are working with stakeholders to develop feasible solutions to remove legacy lead from service lines in older neighborhoods. Our goal is to replace our LSLs in most areas over an approximate 10-year time frame, at an estimated cost ranging from $600 million to $1.2 billion. In cases where we are replacing an American Water owned LSL, our standard approach will be to replace the company-owned portion of the service line, and work with the customer to replace the customer-owned portion of the service line at the same time. Replacing the full service line is considered a best practice as advised by the Lead Service Line Replacement Collaborative and the American Water Works Association. The Lead Service Line Replacement Collaborative is a diverse group of public health, water utility, environmental, labor, consumer, and housing organizations from across the country working together to encourage communities to accelerate the full replacement of LSLs through collaborative efforts at the local level. The prioritization of this work will depend on several factors, including our planned water main and service line renewal projects, adjacent projects by municipalities or other utilities, LCR compliance monitoring results and cooperation with our customers with respect to the customer-owned portion of the service line. There is also a special focus placed on low-income neighborhoods.

Clean Water Act

The Clean Water Act regulates discharges from drinking water and wastewater treatment facilities into lakes, rivers, streams and groundwater. In addition to requirements applicable to our wastewater collection systems, our operations require discharge permits under the National Pollutant Discharge Elimination System (“NPDES”) permit program established under the Clean Water Act, which must be renewed every five years. Pursuant to the NPDES permit program, the EPA and implementing states set maximum discharge limits for wastewater effluents and overflows from wastewater collection systems. Discharges that exceed the limits specified under NPDES permits can lead to the imposition of fines and penalties, and persistent non-compliance could lead to significant fines and penalties and other compliance costs. In addition, the difficulty of obtaining and complying with NPDES permits, and renewing expiring permits, may impose time and cost burdens on our operations. From time to time, discharge violations occur at our facilities, some of which result in fines. We do not expect any such violations or fines to have a material impact on our results of operations or financial condition.

Environmental, Social Responsibility and Governance

Integrating environmental, social responsibility and governance (“ESG”) policies and practices into our daily operations emphasizes our belief that the only way to do business is to do it responsibly, and that the “how” is just as important as the “what” for long-term financial sustainability. Being committed to ESG principles means striving to:

| |

• | keep employees safe and injury-free, and develop each person to his or her full potential; |

| |

• | be a leader in environmental sustainability, caring for the planet, and leading the nation in outstanding water safety and quality; |

| |

• | deliver personalized customer service with empathy and care; |

| |

• | make communities better because we are there; and |

| |

• | be transparent, accessible and well-governed for our shareholders and investors. |

This focus is derived from our vision statement, “clean water for life,” and our core values: (i) safety; (ii) trust; (iii) environmental leadership; (iv) teamwork; and (v) high performance, the principles by which we work and live. Our vision and values drive our company strategy, which is centered on five central themes:

| |

• | Safety—The safety of our employees and our customers is the number one focus for American Water. |

| |

• | Customers—Our customers are at the center of everything we do, helping us to shape our strategic priorities. We challenge ourselves so that if our regulated utility customers had a choice of providers, we would want them to choose us. |

| |

• | People—Maintaining an environment which is open, transparent, diverse and inclusive, and where our people feel valued, included and accountable, is critical to our ability to serve our customers every day. |

| |

• | Operational Excellence—Our operational excellence strategy helps us to find better and more efficient ways to do business, and to provide safe, clean and affordable water services for our customers. |

| |

• | Growth—We believe that when companies grow, they can invest more in creating stable jobs, training, benefits, infrastructure and our communities. Our growth benefits all of our stakeholders, including our shareholders. |

In 2017, we issued our fourth biennial Corporate Responsibility Report, covering our performance in 2015 to 2016. Our first report was issued in 2011, making us the first large water services company to measure its performance against the Global Reporting Index. In addition, our sustainability practices have supported our inclusion in the Euronext Vigeo® U.S. 50 index, FTSE4Good index series, 2018 Constituent MSCI ESG Leaders Indexes, NAACP Equity Inclusion and Empowerment Index and the most recent 2019 Bloomberg Gender-Equality Index. Highlights of our commitment to our ESG policies and practices are summarized below:

Environmental and Sustainability Practices

| |

• | Lowered our greenhouse gas emissions through December 31, 2017 by approximately 31% since our base year of 2007 with a goal of reducing 40% by 2025. |

| |

• | Design, construct, operate and maintain our systems for efficiency and best practices. |

| |

• | Deconstructed the San Clemente Dam in California to restore the “run of the river” and we are building the Water Supply Project using marine life friendly slant wells. |

| |

• | Expect to spend between $8.0 billion and $8.6 billion on capital investments from 2019 to 2023 to address aging infrastructure, reduce or eliminate leaks, improve cyber and physical security, and increase resiliency of critical assets from the impacts of climate variability. |

| |

• | Scientists dedicated to research and partnering with water research foundations, on water quality and technology-water source monitoring. |

| |

• | Collaboration and partnerships with federal and state agencies to support effective environmental, health and safety and water quality standards and regulations. |

Social Responsibility

| |

• | During 2018, nearly 80,000 hours of safety training were completed by our employees. |

| |

• | During 2018, over 86% of our job requisitions had a diverse candidate pool, with more than 50% of transfers or promotions filled by minority, female, veteran or disabled individuals. |

| |

• | Achieved a customer satisfaction rating in the top quartile among our industry peer group. |

| |

• | More than 5,000 hours of Company-sponsored community service performed during 2018 by our employees. |

| |

• | Company-sponsored workplace giving campaigns with the United Way and Water For People. |

| |

• | Through annual contributions from the American Water Charitable Foundation, we focused on supporting our employees in their own charitable endeavors, providing support for disaster relief efforts, and providing funding for initiatives related to clean water, conservation, education and community sustainability. |

Governance

| |

• | The Board of Directors and each of its committees are led by an independent, non-executive chairperson. |

| |

• | Board of Directors met 13 times in 2018. |

| |

• | Established the Safety, Environmental, Technology and Operations committee of the Board of Directors. |

| |

• | We have achieved gender parity among the members of the Board of Directors. |

| |

• | Our average director tenure is approximately seven years. |

| |

• | Demonstrated & Representative Expertise |

| |

• | Our Board of Directors has demonstrated expertise, including experience in utilities, cybersecurity, financial services, serving as a public company CEO, operational and manufacturing, and global entity management. |

Research and Development

Our Research and Development Program

We maintain an industry-leading Research and Development (“R&D”) program that is designed to enhance our services, help ensure compliance, and improve quality and operational effectiveness. Our R&D personnel are located in New Jersey and Illinois, the latter housing our quality control and testing laboratory, which supports our R&D activities through testing and analysis.