Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file: number 001-34028

AMERICAN WATER WORKS COMPANY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 51-0063696 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1025 Laurel Oak Road, Voorhees, NJ | 08043 | |

| (Address of principal executive offices) | (Zip Code) | |

(856) 346-8200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common stock, par value $0.01 per share | New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12(b)-2 of the Exchange Act.:

| Large accelerated filer | þ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Small reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Common Stock, $0.01 par value—$5,166,650,955 as of June 30, 2011.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

Common Stock, $0.01 par value per share—175,717,124 shares, as of February 21, 2012.

DOCUMENTS INCORPORATED BY REFERENCE

(1) Portions of the Company’s Proxy Statement for the Company’s 2012 Annual Meeting of Stockholders are incorporated by reference into Part III of this report.

Table of Contents

Table of Contents

We have made statements under the captions “Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and in other sections of this Annual Report on Form 10-K (“Form 10-K”), or incorporated certain statements by reference into this Form 10-K, that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and the Private Securities Litigation Reform Act of 1995. In some cases, these forward-looking statements can be identified by words with prospective meanings such as “intend,” “plan,” “estimate,” “believe,” “anticipate,” “expect,” “predict,” “project,” “forecast,” “outlook,” “future,” “potential,” “continue,” “may,” “can,” “should” and “could” and similar expressions. Forward-looking statements may relate to, among other things, our future financial performance, including our operations and maintenance (“O&M”) efficiency ratio, our growth and portfolio optimization strategies, our projected capital expenditures and related funding requirements, our ability to repay debt, our ability to finance current operations and growth initiatives, the impact of legal proceedings and potential fines and penalties, business process and technology improvement initiatives, trends in our industry, regulatory or legal developments or rate adjustments, including rate case filings, filings for infrastructure surcharges and filings to address regulatory lag.

Forward-looking statements are predictions based on our current expectations and assumptions regarding future events. They are not guarantees of any outcomes, financial results or levels of performance and you are cautioned not to place undue reliance upon them. These forward-looking statements are subject to a number of risks and uncertainties, and new risks and uncertainties of which we are not currently aware or which we do not currently perceive may arise in the future from time to time. Should any of these risks or uncertainties materialize, or should any of our expectations or assumptions prove incorrect, then our results may vary materially from those discussed in the forward-looking statements herein. Factors that could cause actual results to differ from those discussed in forward-looking statements include, but are not limited to, the factors discussed under the caption “Risk Factors” and the following factors:

| • | the decisions of governmental and regulatory bodies, including decisions to raise or lower rates; |

| • | the timeliness of regulatory commissions’ actions concerning rates; |

| • | changes in customer demand for, and patterns of use of, water, such as may result from conservation efforts; |

| • | changes in laws, governmental regulations and policies, including environmental, health and water quality and public utility regulations and policies; |

| • | weather conditions, patterns or events, including drought or abnormally high rainfall; |

| • | our ability to affect significant changes to our business processes and corresponding technology; |

| • | our ability to appropriately maintain current infrastructure and manage expansion of our business; |

| • | our ability to obtain permits and other approvals for projects; |

| • | changes in our capital requirements; |

| • | our ability to control operating expenses and to achieve efficiencies in our operations; |

| • | our ability to obtain adequate and cost-effective supplies of chemicals, electricity, fuel, water and other raw materials that are needed for our operations; |

| • | our ability to successfully acquire and integrate water and wastewater systems that are complementary to our operations and the growth of our business or dispose of assets or lines of business that are not complementary to our operations and the growth of our business; |

| • | cost overruns relating to improvements or the expansion of our operations; |

| • | changes in general economic, business and financial market conditions; |

| • | access to sufficient capital on satisfactory terms; |

| • | fluctuations in interest rates; |

1

Table of Contents

| • | restrictive covenants in or changes to the credit ratings on our current or future debt that could increase our financing costs or affect our ability to borrow, make payments on debt or pay dividends; |

| • | fluctuations in the value of benefit plan assets and liabilities that could increase our cost and funding requirements; |

| • | our ability to utilize our U.S. and state net operating loss carryforwards; |

| • | migration of customers into or out of our service territories; |

| • | difficulty in obtaining insurance at acceptable rates and on acceptable terms and conditions; |

| • | the incurrence of impairment charges; |

| • | labor actions, including work stoppages; |

| • | ability to retain and attract qualified employees; and |

| • | civil disturbance, or terrorist threats or acts or public apprehension about future disturbances or terrorist threats or acts. |

Any forward-looking statements we make, speak only as of the date of this Form 10-K. Except as required by law, we do not have any obligation, and we specifically disclaim any undertaking or intention, to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or otherwise.

2

Table of Contents

PART I

| ITEM 1. | BUSINESS |

Our Company

American Water Works Company, Inc., (the “Company”), a Delaware corporation, is the most geographically diversified, as well as the largest publicly-traded, United States water and wastewater utility company, as measured by both operating revenue and population served. As a holding company, we conduct substantially all of our business operations through our subsidiaries. Our approximately 7,000 employees provide an estimated 15 million people with drinking water, wastewater and other water-related services in over 30 states and two Canadian provinces.

In 2011, our on-going operations generated $2,666.2 million in total operating revenue and $803.1 million in operating income. In 2010, our on-going operations generated $2,555.0 million in total operating revenue and $728.1 million in operating income.

We have two operating segments that are also the Company’s two reportable segments: the Regulated Businesses and the Market-Based Operations. For further details on our segments, see Note 21 of the Consolidated Financial Statements.

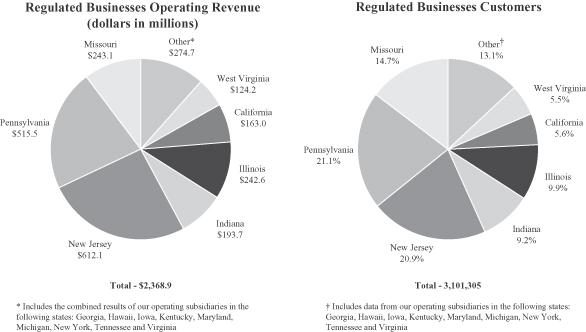

For 2011, our Regulated Businesses segment generated $2,368.9 million in operating revenue, which accounted for 88.8% of our total consolidated operating revenue. For the same period, our Market-Based Operations segment generated $327.8 million in operating revenue, which accounted for 12.3% of total consolidated operating revenue.

For additional financial information, please see the financial statements and related notes thereto appearing elsewhere in this Form 10-K.

Our History as a Public Company

The Company was founded in 1886 as the American Water Works & Guarantee Company for the purposes of building and purchasing water systems in McKeesport, Pennsylvania. In 1935, the Company was reorganized under its current name, and in 1947 the common stock of the Company became publicly traded on the New York Stock Exchange (“NYSE”). In 2003, we were acquired by RWE Aktiengesellschaft, which we refer to as RWE, a stock corporation incorporated in the Federal Republic of Germany. On April 28, 2008, RWE Aqua Holdings GmbH, a German limited liability company and a direct wholly-owned subsidiary of RWE, which then was the sole owner of the Company’s common stock, completed a partial divestiture of its investment through an initial public offering (“IPO”). Subsequently, RWE continued to divest of its investment in our common stock through public offerings and on November 24, 2009, RWE completed the divestiture. As a result of the IPO, we again became listed on the NYSE under the symbol “AWK” and resumed our position as the largest publicly traded water utility company in the United States.

During 2011, we either sold or announced the sale of assets or stock of certain of our regulated and market based subsidiaries as outlined in “Our Regulated Businesses” and “Our Market-Based Operation” discussions below. As such, these subsidiaries have been presented as discontinued operations for all periods presented, and are not included in the discussions below unless otherwise noted. See Note 3 to Consolidated Financial Statements for further details on our discontinued operations.

Regulated Businesses Overview

Our primary business involves the ownership of subsidiaries that provide water and wastewater utility services to residential, commercial, industrial and other customers, including sale for resale and public authority customers. Our subsidiaries that provide these services are generally subject to economic regulation by certain

3

Table of Contents

state commissions or other entities engaged in economic regulation, hereafter referred to as “PUCs”, in the states in which they operate. The federal government and the states also regulate environmental, health and safety, and water quality matters. We report the results of our primary business in the Regulated Businesses segment.

As noted above, for 2011, operating revenue for our Regulated Businesses segment was $2,368.9 million, accounting for 88.8% of total consolidated operating revenue for the same period. Regulated Businesses segment operating revenues were $2,285.7 million for 2010 and $2,076.6 million for 2009, accounting for 89.5% and 90.7%, respectively, of total operating revenues for the same periods.

The following charts set forth operating revenue for 2011 and customers as of December 31, 2011, for the states in which our Regulated Businesses provide services:

| ||

Market-Based Operations Overview

We also provide services that are not subject to economic regulation by state PUCs through our Market-Based Operations. Our Market-Based Operations include three lines of business:

| • | Contract Operations Group, which enters into contracts to operate and maintain water and wastewater facilities mainly for the United States military, municipalities, and the food and beverage industry; |

| • | Homeowner Services Group, which provides services to domestic homeowners and smaller commercial establishments to protect against the cost of repairing broken or leaking water pipes and clogged or blocked sewer pipes inside and outside their accommodations; and |

| • | Terratec Environmental Ltd., which we refer to as Terratec, which primarily provides biosolids management, transport and disposal services to municipal and industrial customers. |

4

Table of Contents

For 2011, operating revenue for our Market-Based Operations was $327.8 million, accounting for 12.3% of total operating revenue for the same period. The Market-Based Operations’ operating revenue was $294.7 million for 2010 and $238.2 million for 2009, accounting for 11.5% and 10.4%, respectively, of total operating revenues for the same periods.

Our Industry

Overview

The United States water and wastewater industry has two main sectors (i) utility ownership, which involves supplying water and wastewater services to consumers; and (ii) general services, which involves providing water and wastewater related services to water and wastewater utilities and other customers on a contract basis.

The utility sector includes investor-owned as well as municipal systems that are owned and operated by local governments or governmental subdivisions. The Environmental Protection Agency (“EPA”) estimates that government-owned systems make up the vast majority of the United States water and wastewater utility segment, accounting for approximately 84% of all United States community water systems and approximately 98% of all United States community wastewater systems. Investor-owned water and wastewater systems account for the remainder of the United States water and wastewater community water systems. Growth of service providers in the investor-owned regulated utility sector is achieved through organic growth within a franchise area, the provision of bulk water service to other community water systems and/or acquisitions, including small water and wastewater systems, typically serving fewer than 10,000 customers that are in close geographic proximity to already established regulated operations, which we herein refer to as “tuck-ins.”

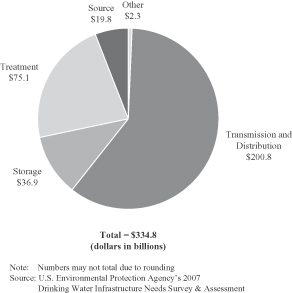

The utility sector is characterized by high barriers to entry, given the capital intensive nature of the industry. The aging water and wastewater infrastructure in the United States is in constant need of modernization and facilities replacement. Increased regulations to improve water quality and the management of water and wastewater residuals’ discharges, which began with passage of the Clean Water Act in 1972 and the Safe Drinking Water Act in 1974, have been among the primary drivers of the need for modernization. The EPA estimated that approximately $335 billion of capital spending would be necessary between 2007 and 2026 to replace aging infrastructure and to comply with standards to ensure quality water systems across the United States. Also, in 2007 the EPA estimated that approximately $390 billion of capital spending would be necessary over the next 20 years to replace aging infrastructure and ensure quality wastewater systems across the United States. In addition, the 2011 American Society of Civil Engineers’ report, Failure to Act: The Economic Impact of Current Investment Trends in Water and Wastewater Treatment Infrastructure estimates that as investment needs continue to escalate and current funding trends continue to fall short of the needs, it will likely result in unreliable water service and wastewater treatment. According to the report, this can result in water disruptions, impediments to emergency response, and damage to other types of infrastructure, as well as water shortages (from failing infrastructure and drought) that may result in unsanitary conditions and increase the likelihood of public health issues.

5

Table of Contents

The following chart sets forth estimated capital expenditure needs from 2007 through 2026 for United States water systems:

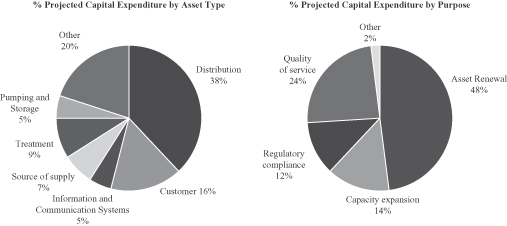

Over the next several years, we estimate that Company-funded capital investment for our operations will range between $800 million and $1 billion per year. Our capital investment includes both infrastructure renewal programs, where we replace existing infrastructure, as needed, and construction of facilities to meet environmental requirements and new customer growth. The charts below set forth our estimated percentage of projected capital expenditures by asset type and purpose of investment, respectively:

Investor-owned water and wastewater utilities generally require regulatory approval processes in order to do business, which may involve obtaining relevant operating approvals, including certificates of public convenience and necessity (or similar authorizations) from state PUCs. Investor-owned water and wastewater systems are generally subject to economic regulation by the state PUCs in the states in which they operate. The federal government and the states also regulate environmental, health and safety and water quality matters for both investor-owned and government-owned water and wastewater utilities.

6

Table of Contents

The general services sector includes engineering and consulting companies and numerous other fee-for-service businesses. These include building and operating water and wastewater utility systems, system repair services, lab services, sale of water infrastructure and distribution products (such as pipes) and other specialized services. The general services segment is characterized by aggressive competition and market-driven growth and profit margins.

According to the EPA, the utility segment of the United States water and wastewater industry is highly fragmented, with approximately 52,000 community water systems and approximately 16,000 community wastewater facilities. Fifty-six percent of the approximately 52,000 community water systems are very small, serving a population of 500 or less.

This large number of relatively small, fragmented water systems as well as fragmented wastewater facilities may result in inefficiencies in the marketplace, since such utilities may not have the operating expertise, financial and technological capability or economies of scale to provide services or raise capital as efficiently as larger utilities. Larger utilities that have greater access to capital are generally more capable of making mandated and other necessary infrastructure upgrades to both water and wastewater systems. In addition, water and wastewater utilities with large customer bases, spread across broad geographic regions, may more easily absorb the impact of significant variations in precipitation and temperatures, such as droughts, excessive rain and cool temperatures in specific areas. Larger utilities generally are able to spread overhead expenses over a larger customer base, thereby reducing the costs to serve each customer. Since many administrative and support activities can be efficiently centralized to gain economies of scale, companies that participate in industry consolidation have the potential to improve operating efficiencies, lower costs per unit and improve service at the same time.

Water and Wastewater Rates

Investor-owned water and wastewater utilities generate operating revenue from customers based on rates that are generally established by state PUCs through a rate-setting process that may include public hearings, evidentiary hearings and the submission by the utility of evidence and testimony in support of the requested level of rates. In evaluating a rate case, state PUCs typically focus on six areas: (i) the amount and prudence of investment in facilities considered “used and useful” in providing public service; (ii) the operating and maintenance costs and taxes associated with providing the service (typically by making reference to a representative 12-month period of time, known as a test year); (iii) the appropriate rate of return; (iv) revenue at existing rates; (v) the tariff or rate design that allocates operating revenue requirements across the customer base; and (vi) the quality of service the utility provides, including issues raised by customers.

7

Table of Contents

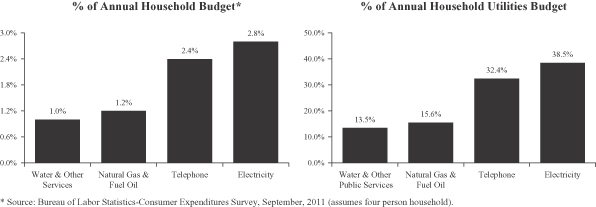

Water and wastewater rates in the United States are among the lowest rates in developed countries; and for most U.S. consumers, water and wastewater bills make up a relatively small percentage of household expenditures compared to other utility services. The following chart sets forth the relative cost of water and other public services, including trash and garbage collection and sewer maintenance, in the United States as a percentage of total household utility expenditures:

Our Regulated Businesses

Our core Regulated Businesses, which consist of locally managed utility subsidiaries that generally are economically regulated by the states in which they operate, accounted for $2,368.9 million or 88.8% of our consolidated operating revenue in 2011. Our Regulated Businesses provide a high degree of financial stability because (i) high barriers to entry provide certain protections from competitive pressures; (ii) economic regulation promotes predictability in financial planning and long-term performance through the rate-setting process; and (iii) our customer base.

As a result of our portfolio optimization initiative, we announced certain acquisitions to and dispositions from our Regulated Businesses. In May, 2011, we completed the acquisition of 11 regulated water systems and 48 wastewater systems in Missouri for a purchase price of $3.3 million, Additionally in June 2011, we completed the sale of the assets of our Texas regulated subsidiary for proceeds of $6.2 million. The Missouri acquisition added approximately 1,700 water customers and nearly 2,000 wastewater customers. The Texas assets served approximately 4,200 water and 1,100 wastewater customers in the greater Houston metropolitan area.

In January 2011, we announced that we had entered into an agreement with EPCOR Water (USA) Inc. (“EPCOR USA”) to sell all the stock of our regulated water and wastewater operating companies located in Arizona and New Mexico. The sale of these operating companies was completed on January 31, 2012.

On July 8, 2011 we entered into an agreement to purchase seven regulated water systems in New York for approximately $71 million, adding approximately 50,000 customers to our New York regulated operations. In a separate agreement, we will sell eight regulated water systems and one wastewater system in Ohio for approximately $89 million, plus assumed liabilities of approximately $31 million for an estimated enterprise value of approximately $120 million. Ohio American Water currently serves approximately 58,000 customers. The completion of both transactions is subject to customary closing conditions including regulatory approval by the PUCs in both New York and Ohio. In February 2012, the Ohio PUC approved the sale of our Ohio subsidiary, however both approvals are required to close the transactions. The closing on these transactions is expected to occur in the first half of 2012.

As noted above, as a result of these sales or pending sales, these regulated subsidiaries are presented as discontinued operations. Therefore, the amounts, statistics and tables presented in this section refer only to on-going operations, unless otherwise noted.

8

Table of Contents

The following table sets forth operating revenue for 2011 and number of customers from continuing operations as well as an estimate of population served as of December 31, 2011 in the states where our Regulated Businesses operate:

| Operating Revenues (in millions) |

% of Total | Number of Customers |

% of Total | Estimated Population Served (in millions) |

% of Total | |||||||||||||||||||

| New Jersey |

$ | 612.1 | 25.8 | % | 647,083 | 20.9 | % | 2.5 | 21.9 | % | ||||||||||||||

| Pennsylvania |

515.5 | 21.8 | % | 655,291 | 21.1 | % | 2.2 | 19.3 | % | |||||||||||||||

| Illinois(a) |

242.6 | 10.2 | % | 307,076 | 9.9 | % | 1.2 | 10.5 | % | |||||||||||||||

| Missouri |

243.1 | 10.3 | % | 454,094 | 14.7 | % | 1.5 | 13.2 | % | |||||||||||||||

| Indiana |

193.7 | 8.2 | % | 285,120 | 9.2 | % | 1.2 | 10.5 | % | |||||||||||||||

| California |

163.0 | 6.9 | % | 173,529 | 5.6 | % | 0.6 | 5.3 | % | |||||||||||||||

| West Virginia(b) |

124.2 | 5.2 | % | 171,898 | 5.5 | % | 0.6 | 5.3 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Subtotal (Top Seven States) |

2,094.2 | 88.4 | % | 2,694,091 | 86.9 | % | 9.8 | 86.0 | % | |||||||||||||||

| Other(c) |

274.7 | 11.6 | % | 407,214 | 13.1 | % | 1.6 | 14.0 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Regulated Businesses |

$ | 2,368.9 | 100.0 | % | 3,101,305 | 100.0 | % | 11.4 | 100.0 | % | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | Includes Illinois-American Water Company, which we refer to as ILAWC and American Lake Water Company, also a regulated subsidiary in Illinois. |

| (b) | West Virginia-American Water Company, which we refer to as WVAWC, and its subsidiary Bluefield Valley Water Works Company. |

| (c) | Includes data from our operating subsidiaries in the following states: Georgia, Hawaii, Iowa, Kentucky, Maryland, Michigan, New York, Tennessee, and Virginia. |

Approximately 88.4% of operating revenue from our Regulated Businesses in 2011 was generated from approximately 2.7 million customers in our seven largest states, as measured by operating revenues. In fiscal year 2011, no single customer accounted for more than 10% of our annual operating revenue.

Overview of Networks, Facilities and Water Supply

Our Regulated Businesses operate in approximately 1,100 communities in 16 states in the United States. Our primary operating assets include approximately 80 surface water treatment plants, 500 groundwater treatment plants, 1,000 groundwater wells, 100 wastewater treatment facilities, 1,100 treated water storage facilities, 1,200 pumping stations and 90 dams and 46,000 miles of mains and collection pipes. We own substantially all of the assets used by our Regulated Businesses. We generally own the land and physical assets used to store, extract and treat source water. Typically, we do not own the water itself, which is held in public trust and is allocated to us through contracts and allocation rights granted by federal and state agencies or through the ownership of water rights pursuant to local law. Maintaining the reliability of our networks is a key activity of our Regulated Businesses. We have ongoing infrastructure renewal programs in all states in which our Regulated Businesses operate. These programs consist of both rehabilitation of existing mains and replacement of mains that have reached the end of their useful service lives.

Our ability to meet the existing and future water demands of our customers depends on an adequate supply of water. Drought, governmental restrictions, overuse of sources of water, the protection of threatened species or habitats or other factors may limit the availability of ground and surface water. We employ a variety of measures to ensure that we have adequate sources of water supply, both in the short-term and over the long-term. The geographic diversity of our service areas tends to mitigate some of the economic effect of weather extremes for the Company as a whole. In any given summer, some areas are likely to experience drier than average weather while other areas will experience wetter than average weather.

9

Table of Contents

Our Regulated Businesses are dependent upon a defined source of water supply. Our Regulated Businesses obtain their water supply from surface water sources such as reservoirs, lakes, rivers and streams. In addition, we also obtain water from ground water sources, such as wells and purchase water from other water suppliers.

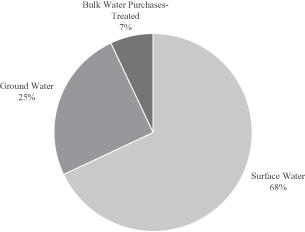

The following chart sets forth the sources of water supply for our Regulated Businesses for 2011 by volume:

In our long-term planning, we evaluate quality, quantity, growth needs and alternate sources of water supply as well as transmission and distribution capacity. Sources of supply are seasonal in nature and weather conditions can have a pronounced effect on supply. In order to ensure that we have adequate sources of water supply, we use comprehensive planning processes and maintain contingency plans to minimize the potential impact on service through a wide range of weather fluctuations. In connection with supply planning for most surface or groundwater sources, we employ sophisticated models to determine safe yields under different rainfall and drought conditions. Surface and groundwater levels are routinely monitored so that supply capacity deficits may be predicted and mitigated, as needed, through demand management and additional supply development.

The percentage of finished water supply by source type for our top seven states by Regulated Businesses revenues for 2011 is as follows:

| Ground Water | Surface water | Purchased water | ||||||||||

| New Jersey |

21 | % | 73 | % | 6 | % | ||||||

| Pennsylvania |

7 | % | 92 | % | 1 | % | ||||||

| Illinois |

32 | % | 57 | % | 11 | % | ||||||

| Missouri(a) |

12 | % | 87 | % | 1 | % | ||||||

| Indiana |

57 | % | 42 | % | 1 | % | ||||||

| California(b) |

67 | % | — | 33 | % | |||||||

| West Virginia |

— | 100 | % | — | ||||||||

| (a) | There are limitations in our Joplin service area where the projected source of water supply capacity is unable to meet projected peak demands under certain drought conditions. To manage this issue on the demand side, the water use of a large industrial customer can be restricted under an interruptible tariff. Additional wells have been and will be developed to address short-term supply deficiencies. Missouri-American Water Company is working with a consortium of agencies to determine a long-term supply solution for the Joplin, Missouri region. |

| (b) | In Monterey, in order to augment our sources of water supply, we have implemented conservation rates and other programs to address demand and are utilizing aquifer storage and recovery facilities to store winter water for summer use. Additionally, in other areas, we are making arrangements to extend or expand our purchase of water from neighboring water providers. |

10

Table of Contents

The level of treatment we apply to the water varies significantly depending upon the quality of the water source and customer stipulations. Surface water sources, such as rivers, typically require significant treatment, while some groundwater sources, such as aquifers, require chemical treatment only. In addition, a small amount of treated water is purchased from neighboring water purveyors. Treated water is transported through an extensive transmission and distribution network, which includes underground pipes, above ground storage facilities and numerous pumping facilities with the ultimate distribution of the treated water to the customers’ premises.

We also have installed production meters to measure the water that we deliver to our distribution network. We employ a variety of methods of customer meter reading to monitor consumption; ranging from meters with mechanical registers where consumption is manually recorded by meter readers to meters with electronic registers capable of transmitting consumption data to proximity devices (touch read) or via radio frequency to mobile or fixed network data collectors. The majority of new meters are able to support future advances in electronic meter reading.

Wastewater services involve the collection of wastewater from customers’ premises through sewer lines. The wastewater is then transported through a sewer network to a treatment facility, where it is treated to meet required effluent standards. The treated wastewater is finally returned to the environment as effluent, and the solid waste byproduct of the treatment process is disposed of in accordance with applicable standards and regulations.

Customers

We have a large and geographically diverse customer base in our Regulated Businesses. For the purposes of our Regulated Businesses, an active customer is defined as a connection to our water and/or wastewater networks. A customer with both water and wastewater would count as two customers. Also, as in the case of apartment complexes, businesses and many homes, multiple individuals may be served by a single connection.

Residential customers make up the majority of our customer base in all of the states in which we operate. In 2011, residential customers accounted for 91.1% of the customers and 59.0% of the operating revenue of our Regulated Businesses. We also serve commercial customers, such as shops and businesses; industrial customers, such as large-scale manufacturing and production operations; and public authorities, such as government buildings and other public sector facilities, including schools. We also supply water to public fire hydrants for firefighting purposes, to private fire customers for use in fire suppression systems in office buildings and other facilities as well as providing bulk water supplies to other water utilities for distribution to their own customers.

The following table sets forth the number of water and wastewater customers (by customer class) for our Regulated Businesses as of December 31, 2011, 2010, and 2009:

| December 31, | ||||||||||||||||||||||||

| 2011 | 2010 | 2009 | ||||||||||||||||||||||

| Water | Wastewater | Water | Wastewater | Water | Wastewater | |||||||||||||||||||

| Residential |

2,730,524 | 95,092 | 2,728,205 | 93,156 | 2,721,085 | 92,183 | ||||||||||||||||||

| Commercial |

216,415 | 5,462 | 216,967 | 5,355 | 216,964 | 5,292 | ||||||||||||||||||

| Industrial |

3,885 | 13 | 4,033 | 13 | 4,241 | 13 | ||||||||||||||||||

| Private fire |

33,887 | 10 | 33,610 | 11 | 33,062 | 3 | ||||||||||||||||||

| Public authority & other |

15,818 | 199 | 15,436 | 197 | 15,430 | 196 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

3,000,529 | 100,776 | 2,998,251 | 98,732 | 2,990,782 | 97,687 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

11

Table of Contents

The following table sets forth water services operating revenue by customer class and wastewater services operating revenue, excluding other revenues, for our Regulated Businesses for 2011, 2010, and 2009:

| Year Ended December 31, | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| (in millions) | ||||||||||||

| Water service |

||||||||||||

| Residential |

$ | 1,339.4 | $ | 1,300.2 | $ | 1,185.9 | ||||||

| Commercial |

474.2 | 457.0 | 417.0 | |||||||||

| Industrial |

116.0 | 110.2 | 97.5 | |||||||||

| Public and other |

323.0 | 314.1 | 281.3 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total water services |

$ | 2,252.6 | $ | 2,181.5 | $ | 1,981.7 | ||||||

| Wastewater services |

76.3 | 69.0 | 64.3 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 2,328.9 | $ | 2,250.5 | $ | 2,046.0 | ||||||

|

|

|

|

|

|

|

|||||||

Substantially all of our regulated water customers are metered, which allows us to measure and bill for our customers’ water consumption, typically on a monthly basis. Our wastewater customers are billed either on a fixed charge basis or based on their water consumption.

Customer usage of water is affected by weather conditions, particularly during the summer. Our water systems generally experience higher demand in the summer due to the warmer temperatures and increased usage by customers for lawn irrigation and other outdoor uses. Summer weather that is cooler and wetter than average generally serves to suppress customer water demand and can reduce water operating revenue and operating income. Summer weather that is hotter and drier than average generally increases operating revenues and operating income. However, when weather conditions are extremely dry and even if our water supplies are sufficient to serve our customers, our systems may be affected by drought-related warnings and/or water usage restrictions imposed by governmental agencies, thereby reducing customer demand and operating revenue. These restrictions may be imposed at a regional or state level and may affect our service areas, regardless of our readiness to meet unrestricted customer demands. Other factors affecting our customers’ usage of water include conservation initiatives, including the use of more efficient household fixtures and appliances among residential consumers; declining household sizes in the United States; and deterioration in the economy and credit markets which could have an adverse impact on our industrial and commercial customers’ operational and financial performance.

Customer growth in our Regulated Businesses is driven by (i) organic population growth in our authorized service areas; (ii) adding new customers to our regulated customer base by acquiring water and/or wastewater utility systems; and (iii) the sale of water to other community water systems. Generally, we add customers through tuck-ins of small water and/or wastewater systems, typically serving fewer than 10,000 customers, in close geographic proximity to areas where we currently operate our Regulated Businesses. We will continue to acquire water and wastewater utilities through tuck-ins. The proximity of tuck-in opportunities to our regulated footprint allows us to integrate and manage the acquired systems and operations using our existing management and to achieve efficiencies. Historically, pursuing tuck-ins has been a fundamental part of our growth strategy. We intend to continue to expand our regulated footprint geographically by acquiring water and wastewater systems in our existing markets and, if appropriate, certain markets in the United States where we do not currently operate our Regulated Businesses. We will also selectively seek larger acquisitions that allow us to acquire multiple water and wastewater utility systems in our existing and new markets. Before entering new regulated markets, we will evaluate the regulatory environment to ensure that we will have the opportunity to achieve an appropriate rate of return on our investment while maintaining our high standards for quality, reliability and compliance with environmental, health and safety and water quality standards.

12

Table of Contents

Supplies

Our water and wastewater operations require an uninterrupted supply of chemicals, energy and fuel, as well as maintenance material and other critical inputs. Many of these inputs are subject to short-term price volatility. Short-term price volatility is partially mitigated through existing procurement contracts, current supplier continuity plans, and the regulatory rate setting process.

Because of our geographic diversity, we maintain relationships with many chemical, equipment and service suppliers in the marketplace, and we do not rely on any single entity for a material amount of our supplies. We also employ a strategic sourcing process intended to ensure reliability in supply and long-term cost effectiveness. As a result of this process and our strong relationships with suppliers, we are able to mitigate interruptions in the delivery of the products and services that are critical to our operations.

We typically have a combination of standby power generation or dual electric service feeds at key facilities, multiple water production facilities, emergency interconnections with adjacent water systems and finished water storage that keep our operations running in the event of a temporary loss of our primary energy supplies.

Regulation

Economic Regulation

Our Regulated Businesses are generally subject to extensive economic regulation by their respective PUCs. The term “economic regulation” is intended to indicate that these state PUCs regulate the economic aspects of service to the public but do not generally establish water quality standards, which are typically set by the United States Environmental Protection Agency (“EPA”) and/or state environmental authorities. State PUCs have broad authority to regulate many of the economic and service aspects of the utilities. For example, state PUCs often issue certificates of public convenience and necessity (or similar authorizations) that may be required for a company to provide service in specific areas. They also approve the rates and conditions under which service is provided and have extensive authority to establish rules and regulations under which the utilities operate. Specific authority might differ from state to state, but in most states PUCs approve rates, accounting treatments, long-term financing programs, significant capital expenditures and plant additions, transactions and relationships between the regulated subsidiary and affiliated entities, reorganizations, mergers and acquisitions. In many instances, approvals are required prior to the transaction. Regulatory policies not only vary from state to state, but can change over time as well. These policies will affect the timing as well as the extent of recovery of expenses and the realized return on invested capital. Our results of operations are significantly affected by rates authorized by the PUCs in the states in which we operate, and we are subject to risks and uncertainties associated with rate case delays or inadequate rate recovery.

Economic regulation of utilities involves many competing, and occasionally conflicting, public interests and policy goals. The primary responsibility of PUCs is to promote the overall public interest by balancing the interests of customers and the utility. Although the specific approach to economic regulation varies, certain general principles are consistent across the states in which our regulated subsidiaries operate. For example, based on certain legal and regulatory principles, utilities are entitled to recover, through rates charged to customers, prudent and reasonable operating costs as well as an opportunity to earn an appropriate return on and recovery of prudent, used and useful capital investment necessary to provide service to customers. PUCs will also generally accord a utility the right to serve specific areas and will also provide investor-owned utilities with limited protection from competition because the requirement of an investor-owned utility to operate pursuant to a certificate of public convenience and necessity (or similar authorizations) typically prevents other investor-owned utilities from competing with it in the authorized area. In return, the utility undertakes the obligation to provide reliable service without unreasonable discrimination to all customers within the authorized area.

Our operating revenue is typically determined by reference to a volumetric charge based on consumption and a base fee component set by a tariff approved by the PUC. The process to obtain approval for a change in

13

Table of Contents

rates generally involves filing a petition or “rate case” by the utility with the PUC on a periodic basis as determined by the need to recover capital expenditures, reduced revenue, increased operating costs or the utility determines that its current authorized return is not sufficient, given current market conditions, to provide a reasonable return on investment. A PUC may also initiate a rate proceeding or investigation if it believes a utility may be earning in excess of its authorized rate of return or other issues exist which justify a review. PUCs may also impose other conditions on the content and timing of filings designed to affect rates. Rate cases often involve a lengthy administrative process which can be costly. The utility, the state PUC staff, consumer advocates, and other customers, who may participate in the process, generally submit testimony and supporting financial data from a twelve month period of time, known as the “test year.” State statutes and PUC rules and precedent usually determine whether the test year should be based on a historical period, a historical period adjusted for certain “known and measurable” changes or forecasted data. The majority of our states require the test year to be based on a historical period adjusted for certain known and measurable changes. The evidence is presented in public hearings held in connection with the rate case, which are economic and service quality fact-finding in nature, and are typically conducted in a trial-like setting before the PUC or an administrative law judge. During the process, the utility is required to provide PUC staff and intervenors with all relevant information they may request concerning the utility’s operations, costs and investments. The decision of the PUC should be based on the evidence presented at the hearing.

Some state PUCs are more restrictive than others with regard to the types of expenses and investments that may be recovered in rates as well as with regard to the transparency of their rate-making processes and how they reach their final rate determinations. However, in evaluating a rate case, state PUCs typically focus on a number of areas, including, the amount and prudence of investment in facilities; operating and maintenance expenses and taxes; the appropriate cost of capital and equity return; revenues at current and expected levels; allocation of the revenue requirements among customer classes; service quality and issues raised by customers.

Failure of the PUCs to recognize reasonable and prudent operating and capital costs can result in the inability of the utility to earn the allowed return and can have a significant impact on the operations and earnings of our Regulated Businesses. Rate cases and other rate-related proceedings can take several months to over a year to complete. Therefore, there is frequently a delay, or regulatory lag, between the time one of our regulated subsidiaries makes a capital investment or incurs an operating cost increase and when those costs are reflected in rates. For instance, an unexpected increase in chemical costs or new capital investment that is not reflected in the most recently completed rate case will generally not begin to be recovered by the regulated subsidiary until the effective date of the subsequent rate case. Our rate case management program is guided by the goals of obtaining efficient recovery of costs of capital and utility operating and maintenance costs, including costs incurred for compliance with environmental regulations. The management team at each of our regulated subsidiaries anticipates the time required for the regulatory process and files rate cases with the goal of obtaining rates that reflect as closely as possible the cost of providing service at the time the rates become effective. Even if rates are sufficient, we face the risk that we will not achieve the rates of return on and of invested capital that are permitted by the PUC.

Our regulated subsidiaries work with legislatures and PUCs to mitigate the adverse impact of regulatory lag through the adoption of positive regulatory policies. These policies include, for example, infrastructure replacement surcharges that allow rates to change rates outside the context of a general rate proceeding to reflect, on a more timely basis, investments to replace aging infrastructure necessary to sustain high quality, reliable service. Currently, Pennsylvania, Illinois, Missouri, Indiana, New York and California allow the use of infrastructure surcharges. In November 2011, the New Jersey Board of Public Utilities (“BPU”) voted unanimously to publish draft rules that, if adopted, would implement a distribution system improvement charge for specified water infrastructure investments. The draft rules were published for public comment in December 2011. Allowing time for resolution of public comments and final approval, April 2012 is the earliest estimate for the rule to become final.

Forward-looking test year mechanisms allow us to earn, on a more current basis, our current or projected usage and costs and a rate of return on our current or projected invested capital. Some states have permitted use

14

Table of Contents

of a fully forecasted test year instead of historical data to set rates. Examples of these states include: Illinois, Kentucky, New York, Tennessee and California. In all states in which we operate on a regulated basis, PUCs have allowed utilities to update historical data for certain “known and measurable” changes that occur for some limited period of time subsequent to the historical test year. This allows utilities to take account of more current costs or capital investments in the rate-setting process. The extent to which historical data can be updated will generally vary from state to state.

Surcharge mechanisms are also available in a number of states to reflect, outside of general rate proceeding, changes in major operating expenses which may be beyond the utility’s control. For example, New Jersey, California, Virginia and Illinois have allowed surcharges for purchased water costs. California has allowed surcharges for power and certain other costs, and New York has allowed annual reconciliations for revenues and expenses such as power, fuel, chemicals and property taxes.

Certain states have approved consolidated rates or single-tariff pricing policies. Consolidated rates or single-tariff pricing is the use of a unified rate structure for multiple water systems that are owned and operated by a single utility, but may or may not be contiguous or physically interconnected. The single-tariff pricing structure may be used fully or partially in a state, based on costs that are determined on a state-wide or intra-state regional basis, thereby moderating the impact of periodic fluctuations in local costs while lowering administrative costs for us and our customers. For states that do not employ singe-tariffs, we may have multiple general rate cases filed at any given point in time. States that have adopted a full or partial single-tariff pricing policy included: Pennsylvania, New Jersey, West Virginia, Kentucky, Ohio, Indiana, Illinois and Iowa. Therefore, of our seven largest states, five have some form of single-tariff pricing.

Another mechanism to address issues of regulatory lag is the potential ability, in certain circumstances, to recover in rates a return on utility plant before it is in service, instead of capitalizing an allowance for funds used during construction. Examples of states that have allowed such recovery include Pennsylvania, Ohio, Kentucky, Virginia, Illinois and California. In addition, some states, such as Indiana, allow the utility to seek pre-approval of certain capital projects and associated costs. In this pre-approval process, the PUC assesses the prudency of such projects.

In some states, the PUC has implemented mechanisms to enhance utility revenue stability in light of conservation initiatives, decreasing per capita consumption or other factors. Sometimes referred to as “decoupling,” these mechanisms, to some extent, separate recoverable revenues from volumes of water sold. For example, the state of California has decoupled revenues from water sold to help achieve the state initiative to reduce water usage by 20% by 2020. This progressive regulation enables utilities to encourage conservation, as revenues are not tied to sales. Also, as a result of this mechanism, utilities are less susceptible to consumption changes as a result of conservation, declining per capita usage or other factors affecting consumption. Likewise, New York has implemented a surcharge or credit based on the difference between actual net revenues for the preceding year and the net revenue target as estimated in the most recent rate case.

The Company pursues these positive regulatory policies as part of our rate and revenue management program to enhance our ability to provide high quality, sustainable, cost effective service to customers, to facilitate efficient recovery of our costs and investments, and to ensure positive short-term liquidity and long-term profitability. The ability of the Company to seek regulatory treatment as described above does not guarantee that the state PUCs will accept the Company’s proposal in the context of a particular rate case, and these policies will reduce, but not eliminate, regulatory lag associated with traditional rate making processes. However, the Company strives to use these and other regulatory policies to address issues of regulatory lag wherever appropriate. It is also our strategy to expand their use in areas where they may not currently apply.

Environmental, Health and Safety and Water Quality Regulation

Our water and wastewater operations are subject to extensive United States federal, state and local laws and regulations, and in the case of our Canadian operations, Canadian laws and regulations governing the protection

15

Table of Contents

of the environment, health and safety, the quality of the water we deliver to our customers, water allocation rights and the manner in which we collect, treat, discharge and dispose of wastewater. We are also subject to certain regulations regarding fire protection services in the areas we serve. These regulations include the Safe Drinking Water Act, the Clean Water Act and other federal, state, local and Canadian laws and regulations governing the provision of water and wastewater services, particularly with respect to the quality of water we distribute. We also are subject to various federal, state, local and Canadian laws and regulations governing the storage of hazardous materials, the management and disposal of hazardous and solid wastes, discharges to air and water, the cleanup of contaminated sites, dam safety and other matters relating to the protection of the environment and health and safety. State PUCs also set conditions and standards for the water and wastewater services we deliver.

Environmental, health and safety and water quality regulations are complex and change frequently. The overall trend has been that they have become more stringent over time. As newer or stricter standards are introduced, our capital and operating costs could increase. We incur substantial costs associated with compliance with environmental, health and safety and water quality regulation to which our Regulated Businesses are subject. In the past, we have generally been able to recover costs associated with compliance related to environmental, health and safety standards, but this recovery is affected by regulatory lag and the corresponding uncertainties surrounding rate recovery.

We maintain a comprehensive environmental policy including responsible business practices, compliance with environmental laws and regulations, effective use of natural resources, and stewardship of biodiversity. We believe that our operations are materially in compliance with, and in many cases surpass, minimum standards required by applicable environmental laws and regulations. Water samples from across our water systems are analyzed on a regular basis for material compliance with regulatory requirements. Across the Company, we conduct over one million water quality tests each year at our laboratory facilities and plant operations, including continuous on-line instrumentations such as monitoring turbidity levels, disinfectant residuals and adjustments to chemical treatment based on changes in incoming water. For 2011, we achieved a score of greater than 99% for drinking water compliance and according to the EPA statistics, American Water’s performance has been far better than the industry average over the last several years. In fact, in 2011, American Water was 28 times better than the industry average for compliance with drinking water quality standards (Maximum Contaminant Levels) and 118 times better for compliance with drinking water monitoring and reporting requirements.

We participate in the Partnership for Safe Water, the United States EPA’s voluntary program to meet more stringent goals for reducing microbial contaminants. With 67 of our 86 surface water plants receiving the program’s “Director” award, we account for approximately one-third of the plants receiving such awards nationwide. In addition, 62 American Water plants have received the “Five-Year Phase III” award, while 40 have been awarded the “Ten-Year Phase III” award.

Safe Drinking Water Act

The Federal Safe Drinking Water Act and regulations promulgated thereunder establish national quality standards for drinking water. The EPA has issued rules governing the levels of numerous naturally occurring and man-made chemical and microbial contaminants and radionuclides allowable in drinking water and continues to propose new rules. These rules also prescribe testing requirements for detecting contaminants, the treatment systems which may be used for removing contaminants and other requirements. Federal and state water quality requirements have become increasingly stringent, including increased water testing requirements, to reflect public health concerns.

To effect the removal or inactivation of microbial organisms, the EPA has promulgated various rules to improve the disinfection and filtration of drinking water and to reduce consumers’ exposure to disinfectants and byproducts of the disinfection process. In January 2006, the EPA promulgated the Long-term 2 Enhanced Surface Water Treatment Rule and the Stage 2 Disinfectants and Disinfection Byproduct Rule. In October 2006,

16

Table of Contents

the EPA finalized the Ground Water Rule, applicable to water systems providing water from underground sources. In 2006, the EPA also proposed revisions to the monitoring and reporting requirements of the existing Lead and Copper Rule. In 2012, we anticipate that the EPA will finalize revisions to the Total Coliform Rule that were part of the mandate of a Federal Advisory Committee appointed to negotiate the changes. Most of the anticipated changes to the rule will not be effective until 2013 or later. The EPA is actively considering regulations for a number of contaminants, including hexavalent chromium, fluoride, nitrosamines, perchlorate, some pharmaceuticals and certain volatile organic compounds, but we do not anticipate that any of these regulations will be completed in 2012.

Although it is difficult to project the ultimate costs of complying with the above or other pending or future requirements, we do not expect current requirements under the Safe Drinking Water Act to have a material impact on our operations or financial condition. In addition, capital expenditures and operating costs to comply with environmental mandates traditionally have been recognized by PUCs as appropriate for inclusion in establishing rates. As a result, we expect to fully recover the operating and capital costs resulting from these pending or future requirements.

Clean Water Act

The Federal Clean Water Act regulates discharges from drinking water and wastewater treatment facilities into lakes, rivers, streams and groundwater. In addition to requirements applicable to our wastewater collection systems, our operations require discharge permits under the National Pollutant Discharge Elimination System, (“NPDES”), permit program established under the Clean Water Act. Pursuant to the NPDES program, the EPA or implementing states set maximum discharge limits for wastewater effluents and overflows from wastewater collection systems. We believe that we maintain the necessary permits and approvals for the discharges from our water and wastewater facilities. From time to time, discharge violations occur at our facilities, some of which

result in fines. We do not expect any such violations or fines to have a material impact on our results of operations or financial condition.

Other Environmental, Health and Safety and Water Quality Matters

Our operations also involve the use, storage and disposal of hazardous substances and wastes. For example, our water and wastewater treatment facilities store and use chlorine and other chemicals which generate wastes that require proper handling and disposal under applicable environmental requirements. We also could incur remedial costs in connection with any contamination relating to our operations or facilities or our off-site disposal of wastes. Although we are not aware of any material cleanup or decontamination obligations, the discovery of contamination or the imposition of such obligations in the future could result in additional costs. Our facilities and operations also are subject to requirements under the United States Occupational Safety and Health Act and are subject to inspections thereunder. For further information, see “Business—Research and Development.”

Certain of our subsidiaries are involved in pending legal proceedings relating to environmental matters. These proceedings are described further in the section entitled “Item 3—Legal Proceedings.”

Competition

In our Regulated Businesses, we generally do not face direct competition in providing services in our existing markets because (i) we operate within those markets pursuant to certificates of public convenience and necessity (or similar authorizations) issued by state PUCs; and (ii) the high cost of constructing a new water and wastewater system in an existing market creates a barrier to market entry. Our Regulated Businesses do face competition from governmental agencies, other investor-owned utilities, large industrial customers with the ability to provide their own water supply/treatment process and strategic buyers that are entering new markets and/or making strategic acquisitions. Our largest investor-owned competitors, when pursuing acquisitions, based

17

Table of Contents

on a comparison of operating revenues and population served, are Aqua America Inc., United Water (owned by Suez Environnement), American States Water Co. and California Water Services Group.

Condemnation

The potential exists that portions of our subsidiaries’ utility assets could be acquired by municipalities or other local government entities through one or more of the following methods:

| • | eminent domain (also known as condemnation); |

| • | the right of purchase given or reserved by a municipality or political subdivision when the original certificate of public convenience and necessity was granted; and |

| • | the right of purchase given or reserved under the law of the state in which the utility subsidiary was incorporated or from which it received its certificate. |

The acquisition consideration related to such a transaction initiated by a local government may be determined consistent with applicable eminent domain law, or may be negotiated or fixed by appraisers as prescribed by the law of the state or in the particular franchise or charter. We believe our operating subsidiaries would be entitled to fair market value for any assets required to be sold, and we are of the opinion that fair market value would be in excess of the book value for such assets.

We are periodically subject to condemnation proceedings in the ordinary course of business, the last of which occurred in September 2008. We actively monitor condemnation activities that may affect us as soon as we become aware of them. We do not believe that condemnation poses a material threat to our ability to operate our Regulated Businesses.

Our Market-Based Operations

In addition to our Regulated Businesses, we operate the following Market-Based Operations, which generated $327.8 million of operating revenue in 2011 representing 12.3% of total operating revenue for the same period. Of the lines of business outlined below, no single group within our Market-Based Operations generates in excess of 10% of our aggregate revenue.

Contract Operations Group

Our Contract Operations Group enters into public/private partnerships, including O&M and Design, Build and Operate (“DBO”) contracts for the provision of services to water and wastewater facilities for the United States military, municipalities, the food and beverage industry and other customers. We typically make no capital investment under these contracts with municipalities and other customers; instead we perform our services for a fee. During the contract term, we may make limited capital investments under our contracts with the United States military and certain industrial customers. Our Contract Operations Group generated revenue of $230.5 million in 2011, representing 70.3% of revenue for our Market-Based Operations.

On December 31, 2011, we completed the sale of our Applied Water Management, Inc. group (“AWM”) in two separate transactions for combined proceeds of approximately $3.0 million. AWM provided customized water and wastewater management solutions through contract operations with real estate developers, industrial clients, and small-to-midsized communities. Its annual revenue and net loss in 2011 were $21.6 million and $0.6 million, respectively. As noted above, this subsidiary is included in discontinued operations for all periods presented. Therefore, all amounts and statistics disclosed for the Contract Operations Group refers only to on-going operations of the Contract Operations Group.

We are currently party to more than 100 contracts, varying in size and scope, across the United States and Canada, with contracts ranging in term from two to 50 years. Included in the these contracts are nine 50-year

18

Table of Contents

contracts with the Department of Defense for the operation and maintenance of the water and wastewater systems and one 3-year sub-contract with a municipality, acting as primary contractor with the Department of Defense, for similar services on an interim basis until construction of new connections to an existing municipal facility are completed. All of our contracts with the U.S. government may be terminated, in whole or in part, prior to the end of the 50-year term for convenience of the U.S. government or as a result of default or non-performance by the subsidiary performing the contract. In either event, pursuant to the standard terms of the U.S. government contract termination provisions, we would be entitled to recover allowable costs that we may have incurred under the contract, plus the contract profit margin on incurred costs. The contract price for each of these contracts is subject to redetermination two years after commencement of operations and every three years thereafter. Price redetermination is a contract mechanism to periodically adjust the service fee in the next period to reflect changes in contract obligations and anticipated market conditions.

Homeowner Services Group

Our Homeowner Services Group, through our Service Line Protection Program, provides services to domestic homeowners and smaller commercial establishments to protect against the cost of repairing broken or leaking water pipes and clogged or blocked sewer pipes inside and outside their accommodations.

Our LineSaver™ program involves partnering with municipalities to offer our protection programs to homeowners serviced by the municipalities. Our Homeowner Services Group has approximately 900,000 customer contracts in 17 states.

Terratec Environmental Ltd

Our Market-Based Operations also includes our biosolids management group, Terratec, which is located in Canada and provides environmentally sustainable management and disposal of biosolids and wastewater by-products.

Competition

We face competition in our Market-Based Operations from a number of service providers, including Veolia Environnement, American States, OMI and Southwest Water, particularly in the area of O&M contracting. Securing new O&M contracts is highly competitive, as these contracts are awarded based on a combination of customer relationships, service levels, competitive pricing, references and technical expertise. We also face competition in maintaining existing O&M contracts to which we are a party, as the municipal and industrial fixed term contracts frequently come up for renegotiation and are subject to an open bidding process.

Research and Development

We established a formal research and development program in 1981 with the goal of improving water quality and operational effectiveness in all areas of our business. Our research and development personnel are located in New Jersey. In addition, our quality control and testing laboratory in Belleville, Illinois supports research through sophisticated testing and analysis. Since its inception, our research and development program has evolved to become a leading water-related research program, achieving advancements in the science of drinking water, including sophisticated water testing procedures and desalination technologies.

Since the formation of the EPA in 1970, we have collaborated with the agency to achieve effective environmental, health and safety and water quality regulation. This relationship has developed to include sharing of our research and national water quality monitoring data in addition to our treatment and distribution system optimization research. Our engagement with the EPA has helped us to achieve a leadership position for our company within the water and wastewater industry and has provided us with early insight into emerging regulatory issues and initiatives, thereby allowing us to anticipate and to accommodate our future compliance requirements.

19

Table of Contents

In 2011, we spent $2.6 million on research and development compared to $2.8 million spent in 2010 and 2009. Approximately one-quarter of our research budget is comprised of competitively awarded outside research grants. Such grants reduce the cost of research and allow collaboration with leading national and international researchers.

We believe that continued research and development activities are critical in providing quality and reliable service at reasonable rates, in maintaining our leadership position in the industry and will provide us with a competitive advantage as we seek additional business with new and existing customers.

Support Services

Our American Water Works Service Company subsidiary provides shared services and corporate governance that achieve economies of scale through central administration. These services are provided predominantly to our Regulated Businesses under the terms of contracts with these companies that have been approved by state PUCs, where necessary. These services, which are provided at cost, may include accounting, administration, business development, corporate secretarial, education and training, engineering, financial, health and safety, human resources, information systems, legal, operations, procurement, rates, security, risk management, water quality and research and development. These arrangements afford our operating companies professional and technical talent on an economical and timely basis. We also operate two national customer service centers, which are located in Alton, Illinois and Pensacola, Florida.

Our security department provides oversight and governance of physical and information security throughout our operations and is responsible for designing, implementing, monitoring and supporting active and effective physical and information security controls. We have complied with EPA regulations concerning vulnerability assessments and have made filings to the EPA as required. Vulnerability assessments are conducted regularly to evaluate the effectiveness of existing security controls and serve as the basis for further capital investment in security for the facility. Information security controls are deployed or integrated to prevent unauthorized access to company information systems, assure the continuity of business processes dependent upon automation, ensure the integrity of our data and support regulatory and legislative compliance requirements. While we do not make public comments on the details of our security programs, we are in contact with federal, state and local law enforcement agencies to coordinate and improve the security of our water delivery systems and to safeguard our water supply.

Employee Matters

Currently, approximately 49% of our workforce is represented by unions. We have 83 collective bargaining agreements in place with 19 different unions representing our unionized employees. In September 2010, we declared “impasse” in negotiations of our national benefits agreement with most of the labor unions representing employees in our Regulated Businesses. The prior agreement expired on July 31, 2010; however negotiations did not produce a new agreement. We implemented our last, best and final offer on January 1, 2011 in order to maintain health care coverage for our employees in accordance with terms of the offer. The unions have challenged our right to implement our last, best, and final offer. In this regard, following the filing by the Utility Workers Union of America of an unfair labor practice charge, the National Labor Relations Board (“NLRB”) issued a complaint against us in January 2012, claiming that we implemented the last, best and final offer without providing sufficient notice of the existence of a dispute with the Federal Mediation and Conciliation Service, a state mediation agency, and several state departments of labor. We have asserted that we did, in fact, provide sufficient notice. A hearing date on the matter has not been set. In addition, six local unions filed grievances or demands for arbitration under their respective local collective bargaining agreements regarding our implementation of the last, best and final offer. In response, we filed a declaratory judgment action against the local unions in United States District Court for the District of New Jersey seeking, among other things, an injunction preventing the unions from filing grievances or demanding arbitration under the local collective bargaining agreements with respect to the implementation of our last, best and final offer. Three of the unions were removed from the litigation after they agreed to a dismissal with prejudice. Two of the unions were

20

Table of Contents

removed from the New Jersey District Court action, and the Company is pursuing similar declaratory judgment actions against the unions in United States District Courts in Pennsylvania and West Virginia. We will continue to defend our position in any challenge presented by the unions. Management does not expect any work disruption by union members at this time. In addition to matters relating to the expired national benefit agreement, five local union contracts covering approximately 700 employees expired without a new agreement being reached prior to December 31, 2011. One contract relating to employees in St. Louis, Missouri was negotiated to impasse and our last, best and final offer was implemented on July 11, 2011. There have been no work stoppages with respect to these contracts. Nevertheless, management has developed contingency plans that will be implemented as necessary if a work stoppage or strike does occur. Over one-quarter of our local union contracts will expire during 2012.

Available Information