UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File No. 000-53177

Ridgewood Energy W Fund, LLC

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

26-0225130

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

14 Philips Parkway, Montvale, NJ 07645

|

|

(Address of principal executive offices) (Zip code)

|

|

|

|

(800) 942-5550

|

|

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Shares of LLC Membership Interest

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if the disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐ |

Accelerated filer

|

☐ |

|

Non-accelerated filer

|

☐ |

Smaller reporting company

|

☒ |

|

(Do not check if a smaller reporting company)

|

|

Emerging growth company

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

There is no market for the shares of LLC Membership Interest in the Fund. As of March 9, 2018 there were 332.2918 shares of LLC Membership Interest outstanding.

RIDGEWOOD ENERGY W FUND, LLC

2017 ANNUAL REPORT ON FORM 10-K

|

|

|

|

PAGE

|

|

|

|

|

|

|

PART I

|

|

|

|

|

|

ITEM 1

|

|

2 |

|

|

ITEM 1A

|

|

10 |

|

|

ITEM 1B

|

|

10 |

|

|

ITEM 2

|

|

11 |

|

|

ITEM 3

|

|

12 |

|

|

ITEM 4

|

|

12 |

|

PART II

|

|

|

|

|

|

ITEM 5

|

|

13 |

|

|

ITEM 6

|

|

13 |

|

|

ITEM 7

|

|

13 |

|

|

ITEM 7A

|

|

19 |

|

|

ITEM 8

|

|

19 |

|

|

ITEM 9

|

|

19 |

|

|

ITEM 9A

|

|

19 |

|

|

ITEM 9B

|

|

20 |

|

PART III

|

|

|

|

|

|

ITEM 10

|

|

20 |

|

|

ITEM 11

|

|

21 |

|

|

ITEM 12

|

|

21 |

|

|

ITEM 13

|

|

22 |

|

|

ITEM 14

|

|

22 |

|

PART IV

|

|

|

|

|

|

ITEM 15

|

|

23 |

| |

|

|

|

| |

|

|

24 |

FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report on Form 10-K (“Annual Report”) and the documents Ridgewood Energy W Fund, LLC (the “Fund”) has incorporated by reference into this Annual Report, other than purely historical information, including estimates, projections and statements relating to the Fund’s business plans, strategies, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that are based on current expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from the forward-looking statements. You are therefore cautioned against relying on any such forward-looking statements. Forward-looking statements can generally be identified by words such as “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “plan,” “target,” “pursue,” “may,” “will,” “will likely result,” and similar expressions and references to future periods. Examples of events that could cause actual results to differ materially from historical results or those anticipated include weather conditions, such as hurricanes, changes in market and other conditions affecting the pricing, production and demand of oil and natural gas, the cost and availability of equipment, and changes in domestic and foreign governmental regulations, as well as other risks and uncertainties discussed in this Annual Report in Item 1. “Business” and Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. Examples of forward-looking statements made herein include statements regarding projects, investments, insurance, capital expenditures and liquidity. Forward-looking statements made in this document speak only as of the date on which they are made. The Fund undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

PART I

Overview

The Fund is a Delaware limited liability company (“LLC”) formed on May 17, 2007 to primarily acquire interests in oil and natural gas properties located in the United States offshore waters of Texas, Louisiana and Alabama in the Gulf of Mexico.

The Fund initiated its private placement offering on June 15, 2007, selling whole and fractional shares of membership interests (“Shares”), consisting of Limited Liability Shares of Membership Interests (“Limited Liability Shares”) and Investor GP Shares of Membership Interests (“Investor GP Shares”), primarily at $200 thousand per whole Share. The Limited Liability Shares and the Investor GP Shares constitute a single class of securities as defined in Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In 2011, pursuant to the limited liability company agreement (the “LLC Agreement”), Ridgewood Energy Corporation, as manager of the Fund, converted all then outstanding Investor GP Shares to Limited Liability Shares. There is no public market for the Shares and one is not likely to develop. In addition, the Shares are subject to material restrictions on transfer and resale and cannot be transferred or resold except in accordance with the Fund’s LLC Agreement and applicable federal and state securities laws. The private placement offering was terminated on December 17, 2007. The Fund raised $66.0 million and, after payment of $10.8 million in offering fees, commissions and investment fees, the Fund had $55.2 million for investments and operating expenses.

Manager

Ridgewood Energy Corporation (the “Manager” or “Ridgewood Energy”) was founded in 1982. The Manager has direct and exclusive control over the management of the Fund’s operations. The Manager performs, or arranges for the performance of, the management, advisory and administrative services required for Fund operations. Such services include, without limitation, the administration of shareholder accounts, shareholder relations, the preparation, review and dissemination of tax and other financial information and the management of the Fund’s investments in projects. In addition, the Manager provides office space, equipment and facilities and other services necessary for Fund operations. The Manager also engages and manages contractual relations with unaffiliated custodians, depositories, accountants, attorneys, corporate fiduciaries, insurers, banks and others as required. Historically, when the Fund sought project investments, the Manager located potential projects, conducted due diligence, and negotiated the investment transactions with respect to those projects. Additional information regarding the Manager is available through its website at www.ridgewoodenergy.com. No information on such website shall be deemed to be included or incorporated by reference into this Annual Report.

As compensation for its services, the Manager is entitled to an annual management fee, payable monthly, equal to 2.5% of the total capital contributions made by the Fund’s shareholders, net of cumulative dry-hole and related well costs incurred by the Fund. The Manager is entitled to receive the management fee from the Fund regardless of the Fund’s profitability in that year. Management fees during the years ended December 31, 2017 and 2016 were $0.9 million and $1.0 million, respectively. Additionally, the Manager is entitled to receive a 15% interest in cash distributions from operations made by the Fund. The Fund did not pay distributions during the years ended December 31, 2017 and 2016.

In addition to the management fee, the Fund is required to pay all other expenses it may incur, including insurance premiums, expenses of preparing periodic reports for shareholders and the Securities Exchange Commission (“SEC”), taxes, third-party legal, accounting and consulting fees, litigation expenses and other expenses.

Business Strategy

The Fund’s primary investment objective is to generate cash flow for distribution to its shareholders by generating returns across a portfolio of oil and natural gas projects. The frequency and amount of such distributions are within the Manager’s discretion, subject to available cash flow from operations. The Fund, along with other exploration and production companies, has invested in the drilling and development of both shallow and deepwater oil and natural gas projects in the U.S. offshore waters of Texas, Louisiana and Alabama in the Gulf of Mexico. The Fund’s ownership in its projects is recorded with the Bureau of Ocean Energy Management, an agency of the United States Department of Interior (“BOEM”), as a working interest, which is an undivided fractional interest in a lease block that provides the owner with the right to drill, produce and conduct operating activities and share in any resulting oil and natural gas production.

The Fund’s capital has been fully invested in projects. As a result, the Fund will not invest in any new projects and will limit its investment activities, if any, to those projects in which it currently has a working interest, as discussed below under the heading “Properties” in this Item 1. “Business” of this Annual Report.

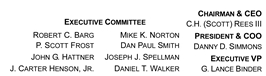

Investment Committee

Ridgewood Energy maintains an investment committee consisting of five employees of the Manager (the “Investment Committee”). The members of the Investment Committee provide operational, financial, scientific and technical oil and gas expertise to the Fund. Two members of the Investment Committee are based out of the Manager’s Montvale, New Jersey office and three members are based out of the Manager’s Houston, Texas office. The Investment Committee’s current activities with respect to the Fund are principally related to the development and operation of properties in which it already has a working interest.

Participation and Joint Operating Agreements

On behalf of the Fund, and with respect to the Fund’s projects, the Manager negotiated participation and joint operating agreements with the operators of each project. Under each joint operating agreement, proposals and decisions with respect to a project and related activities are generally made based on percentage ownership approvals and, although an operator’s percentage ownership may constitute a majority ownership, operators generally seek consensus relating to project decisions.

Project Information

The Fund’s existing projects are located in the waters of the Gulf of Mexico on the Outer Continental Shelf (“OCS”). The Outer Continental Shelf Lands Act (“OCSLA”), which was enacted in 1953, governs certain activities with respect to working interests and the exploration of oil and natural gas in the OCS. See further discussion under the heading “Regulation” in this Item 1. “Business” of this Annual Report.

Leases in the OCS are generally issued for a primary lease term of 5, 7 or 10 years, depending on the water depth of the lease block. Once a lessee drills a well and begins production, the lease term is extended for the duration of commercial production.

The lessee of a particular block, for the term of the lease, has the right to drill and develop exploratory wells and conduct other activities throughout the block. If the initial well on the block is successful, a lessee, or third-party operator for a project, may conduct additional geological studies and may determine to drill additional exploratory or development wells. If a development well is to be drilled in the block, each lessee owning working interests in the block must be offered the opportunity to participate in, and cover the costs of, the development well up to that particular lessee’s working interest ownership percentage.

Royalty Payments

Generally, and depending on the lease, working interest owners of an offshore oil and natural gas lease under the OCSLA pay a royalty of 12.5%, 16.67% or 18.75% to the U.S. Government through the Office of Natural Resources Revenue (“ONRR”). Other than the ONRR royalties, the Fund does not have material royalty burdens with the exception of the overriding royalty interests (“ORRI”) payable to the lender under and as required by the Fund’s credit agreement applicable to the Beta Project. See Note 3 of “Notes to Financial Statements” – “Credit Agreement – Beta Project Financing” contained in Item 8. “Financial Statements and Supplementary Data” within this Annual Report for more information regarding the credit agreement.

Deep Gas Royalty Relief

On January 26, 2004, the BOEM promulgated a rule providing incentives for companies to increase deep natural gas production in the Gulf of Mexico (the “Royalty Relief Rule”). The Fund currently has one project, the Cobalt Project, which is eligible for royalty relief under the Royalty Relief Rule. The Royalty Relief Rule does not extend to deep waters of the Gulf of Mexico off the OCS nor does it apply if the price of natural gas exceeds $11.80 (estimated) per Million British Thermal Units (“mmbtu”), adjusted annually for inflation.

Deepwater Royalty Relief

In addition to the Royalty Relief Rule, the Deep Water Royalty Relief Act of 1995 (the “Deepwater Royalty Relief Act”) was enacted to promote exploration and production of oil and natural gas in the deepwater of the Gulf of Mexico and relieves eligible leases from paying royalties to the U.S. Government on certain defined amounts of deepwater production. The Deepwater Royalty Relief Act expired in the year 2000 but was extended for qualified leases by the BOEM to promote continued interest in deepwater. The Fund currently has two projects, the Beta and Liberty projects, which are eligible for royalty relief under the Deepwater Royalty Relief Act. The Deepwater Royalty Relief Act does not apply to oil if the prices of oil exceed certain thresholds (currently estimated to be between $37.93 per barrel and $49.25 per barrel), adjusted annually for inflation. The Deepwater Royalty Relief Act does not apply to natural gas if the prices of natural gas exceed certain thresholds (currently estimated to be between $4.74 per mmbtu and $8.21 per mmbtu) adjusted annually for inflation.

Properties

Productive Wells

The following table sets forth the number of productive oil and natural gas wells in which the Fund owned an interest as of December 31, 2017. Productive wells are producing wells and wells mechanically capable of production. Gross wells are the total number of wells in which the Fund owns a working interest. Net wells are the sum of the Fund’s fractional working interests owned in the gross wells. All of the wells, each of which produces both oil and natural gas, are located in the offshore waters of the Gulf of Mexico and are operated by third-party operators.

|

|

|

Total Productive Wells

|

|

|

|

|

Gross

|

|

|

Net

|

|

|

Oil and natural gas

|

|

|

6

|

|

|

|

0.29

|

|

Acreage Data

The following table sets forth the Fund’s interests in developed and undeveloped oil and natural gas acreage as of December 31, 2017. Gross acres are the total number of acres in which the Fund owns a working interest. Net acres are the sum of the fractional working interests owned in gross acres. Ownership interests generally take the form of working interests in oil and natural gas leases that have varying terms. All of the Fund’s oil and natural gas acreage is located in the offshore waters of the Gulf of Mexico.

|

Developed Acres

|

|

|

Undeveloped Acres

|

|

|

Gross

|

|

|

Net

|

|

|

Gross

|

|

|

Net

|

|

| |

28,033

|

|

|

|

1,459

|

|

|

|

6,124

|

|

|

|

184

|

|

Information regarding the Fund’s current projects, all of which are located in the offshore waters of the Gulf of Mexico, is provided in the following table. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report under the heading “Liquidity Needs” for information regarding the funding of the Fund’s capital commitments.

|

|

|

|

|

|

Total Spent

|

|

|

Total

|

|

|

|

|

|

Working

|

|

|

through

|

|

|

Fund

|

|

|

|

Project

|

|

Interest

|

|

|

December 31, 2017

|

|

|

Budget

|

|

Status

|

|

|

|

|

|

|

(in thousands)

|

|

|

|

Producing Properties

|

|

|

|

|

|

|

|

|

|

|

|

Beta Project

|

|

3.0%

|

|

|

$

|

25,582

|

|

|

$

|

28,800

|

|

The Beta Project is expected to include the development of five wells. Wells #1 and #2 commenced production during third quarter 2016 and fourth quarter 2016, respectively. Wells #3 and #4 commenced production during second quarter 2017 and third quarter 2017, respectively. Well #5 began drilling in third quarter 2017 and is expected to commence production in first quarter 2018. The Fund expects to spend $1.8 million for additional development costs and $1.4 million for asset retirement obligations.

|

|

Cobalt Project

|

|

5.0%

|

|

|

$

|

2,368

|

|

|

$

|

2,436

|

|

The Cobalt Project, a single-well project, commenced production in 2009. The Fund expects to spend $0.1 million for asset retirement obligations.

|

|

Liberty Project

|

|

12.0%

|

|

|

$

|

13,387

|

|

|

$

|

14,974

|

|

The Liberty Project, a single-well project, commenced production in 2010. After being shut-in during early-2016 due to third-party facilities' repair and maintenance activities, the well resumed production in early-May 2016. The well was shut-in again in late-June 2017 due to gas dehydration unit work, resuming production in late-September 2017. The operator is currently flowing the well's current zone together with the behind-pipe zone at no cost to the Fund. The Fund expects to spend $1.6 million for asset retirement obligations.

|

Marketing/Customers

The Manager, on behalf of the Fund, markets the Fund’s oil and natural gas to third parties consistent with industry practice. Beta Sales and Transport, LLC (“Beta S&T”), a wholly-owned subsidiary of the Manager, acts as an aggregator to and as an accommodation for the Fund and other funds managed by the Manager to facilitate the transportation and sale of oil and natural gas produced from the Beta Project. During 2016, the Fund entered into a master agreement with Beta S&T pursuant to which Beta S&T is obligated to purchase from the Fund all of its interests in oil and natural gas produced from the Beta Project and sell such volumes to unrelated third-party purchasers. The number of customers purchasing the Fund’s oil and natural gas may vary from time to time. Currently, and during 2017, the Fund had three major customers in the public market. Because a ready market exists for oil and natural gas, the Fund does not believe that the loss of any individual customer would have a material adverse effect on its financial position or results of operations. The Fund’s current producing projects are near existing transportation infrastructure and pipelines.

The Fund’s oil and natural gas generally is sold to its customers at prevailing market prices, which fluctuate with demand as a result of related industry variables. The markets for, and prices of, oil and natural gas have been volatile, and they are likely to continue to be volatile in the future. This volatility is caused by numerous factors and market conditions that the Fund cannot control or influence; therefore, it is impossible to predict the future price of oil and natural gas with any certainty. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report under the headings “Commodity Price Changes”, “Results of Operations – Overview” and “Results of Operations – Oil and Gas Revenue” for information regarding the impact of prices on the Fund’s oil and gas revenue. In the past, the Fund has entered, and in the future, may enter into transactions or derivative contracts that fix the future prices or establish a price floor for portions of its oil or natural gas production.

Seasonality

Generally, the Fund’s business operations are not subject to seasonal fluctuations in the demand for oil and natural gas that would result in more of the Fund’s oil and natural gas being sold, or likely to be sold, during one or more particular months or seasons. Once a project is producing, the operator of the project extracts oil and natural gas reserves throughout the year. Once extracted, oil and natural gas can be sold at any time during the year.

However, notwithstanding the ability of the Fund’s projects to produce year-round, the Fund’s properties are located in the Gulf of Mexico; therefore, its operations and cash flows may be significantly impacted by hurricanes and other inclement weather. Such events may also have a detrimental impact on third-party pipelines and processing facilities, upon which the Fund relies to transport and process the oil and natural gas it produces. The National Hurricane Center defines hurricane season in the Gulf of Mexico as June through November. The Fund did not experience any significant damage, shut-ins, or production stoppages due to hurricane activity in 2017.

Operators

The projects in which the Fund has invested are operated and controlled by unaffiliated third-party entities acting as operators. The operators are responsible for drilling, administration and production activities for leases jointly owned by working interest owners and act on behalf of all working interest owners under the terms of the applicable joint operating agreement. In certain circumstances, operators will enter into agreements with independent third-party subcontractors and suppliers to provide the various services required for operating leases. Currently, the Fund's properties are operated by LLOG Exploration Offshore, L.L.C., Walter Oil & Gas Corporation and W&T Offshore, Inc.

Because the Fund does not operate any of the projects in which it has acquired a working interest, shareholders have to rely on the Manager to continue to manage the projects prudently, efficiently and fairly.

Insurance

The Manager has obtained what it believes to be adequate insurance for the funds that it manages to cover the risks associated with the funds’ passive investments, including those of the Fund. Although the Fund is not an operator, the Manager has, nonetheless, obtained hazard, property, general liability and other insurance in commercially reasonable amounts to cover its projects, as well as general liability, directors’ and officers’ liability and similar coverage for its business operations. However, there is no assurance that such insurance will be adequate to protect the Fund from material losses related to its projects. In addition, the Manager’s practice is to obtain insurance as a package that is intended to cover most, if not all, of the funds under its management. The Manager re-evaluates its insurance coverage on an annual basis. While the Manager believes it has obtained adequate insurance in accordance with customary industry practices, the possibility exists, depending on the extent of the insurable incident, that insurance coverage may not be sufficient to cover all losses. In addition, depending on the extent, nature and payment of any claims during a particular policy period to the Fund or its affiliates, yearly insurance coverage may be exhausted and become insufficient to cover a claim by the Fund in a given year.

Salvage Fund

The Fund deposits cash in a separate interest-bearing account, or salvage fund, to provide for its proportionate share of the cost of dismantling and removal of production platforms and facilities and plugging and abandoning the wells at the end of their useful lives in accordance with applicable federal and state laws and regulations. As of December 31, 2017, the Fund has $2.3 million invested in a salvage fund. On a monthly basis, the Fund expects to contribute to the salvage fund a portion of the operating income from the Beta Project, to fund its asset retirement obligations. Such contributions to the salvage fund will reduce the amount of cash distributions that could otherwise be made to investors by the Fund. Any portion of the salvage fund that remains after the Fund has paid for all of its asset retirement obligations will be distributed to the shareholders and the Manager. There are no restrictions on withdrawals from the salvage fund.

Competition

Competition exists in the acquisition of oil and natural gas leases and in all sectors of the oil and natural gas exploration and production industry. The Fund, through the Manager, has competed with other companies for the acquisition of leases, as well as percentage ownership interests in oil and natural gas working interests in the secondary market. The Fund does not anticipate the acquisition of any additional ownership interests in oil and natural gas working interests as its capital has been fully allocated to current and past projects.

Employees

The Fund has no employees. The Manager operates and manages the Fund.

Offices

The administrative office of both the Fund and the Manager is located at 14 Philips Parkway, Montvale, NJ 07645, and their phone number is 800-942-5550. The Manager leases additional office space at 1254 Enclave Parkway, Houston, TX 77077 and 125 Worth Avenue, Suite 318, Palm Beach, Florida, 33480. In addition, the Manager maintains leases for other offices that are used for administrative purposes for the Fund and other funds managed by the Manager.

Regulation

Oil and natural gas exploration, development, production and transportation activities are subject to extensive federal and state laws and regulations. Regulations governing exploration and development activities require, among other things, the Fund’s operators to obtain permits to drill projects and to meet bonding, insurance and environmental requirements in order to drill, own or operate projects. In addition, the location of projects, the method of drilling and casing projects, the restoration of properties upon which projects are drilled, and the plugging and abandoning of projects are also subject to regulations. The Fund owns projects that are located in the offshore waters of the Gulf of Mexico on the OCS. The Fund’s operations and activities are therefore governed by the OCSLA and certain other laws and regulations.

Outer Continental Shelf Lands Act

Under the OCSLA, the United States federal government has jurisdiction over oil and natural gas development on the OCS. As a result, the United States Secretary of the Interior is empowered to sell exploration, development and production leases of a defined submerged area of the OCS, or a block, through a competitive bidding process. Such activity is conducted by the BOEM. Federal offshore leases are managed both by the BOEM and the Bureau of Safety and Environmental Enforcement (“BSEE”) pursuant to regulations promulgated under the OCSLA. The OCSLA authorizes regulations relating to safety and environmental protection applicable to lessees and permittees operating on the OCS. Specific design and operational standards may apply to OCS vessels, rigs, platforms, vehicles and structures. BSEE regulates the design and operation of well control and other equipment at offshore production sites, implementation of safety and environmental management systems, and mandatory third-party compliance audits, among other requirements. BSEE adopted strict requirements for subsea drilling production equipment and had proposed new requirements to implement equipment reliability improvements, building upon enhanced industry standards for blowout preventers and blowout prevention technologies, and reforms in well design, well control, casing, cementing, real-time well monitoring and subsea containment. In April 2016, BSEE adopted a final rule establishing updated standards for blowout prevention systems and other well controls pertaining to offshore activities (the “Well Control Rule”). The Well Control Rule became effective July 28, 2016, however compliance with certain provisions is deferred until 2018 or thereafter as specified. The Well Control Rule imposes new requirements relating to, among, other things, well design, well control, casing, cementing, real-time well monitoring and subsea containment. The Well Control Rule applies directly to operators as opposed to non-operators. BSEE has also published a policy statement on safety culture with nine characteristics of a robust safety culture. In April 2017, the “Presidential Order Implementing an America-First Offshore Energy Strategy” was issued, which, among other things, directed the BSEE to review the Well Control Rule. Given the fact that compliance with the Well Control Rule is the responsibility of the operators and the exploration and development of each well is different, the future costs associated with compliance that will be incurred by non-operators, such as the Fund, cannot be determined or estimated. Violations of environmentally related lease conditions or regulations issued pursuant to the OCSLA can result in substantial civil and criminal penalties as well as potential court injunctions curtailing operations and the cancellation of leases. Such enforcement liabilities, delay or restriction of activities can result from either governmental or citizen prosecution.

BOEM Notice to Lessees on Supplemental Bonding

On July 14, 2016, the BOEM issued a Notice to Lessees (“NTL”) that discontinued and materially replaced existing policies and procedures regarding financial security (i.e. supplemental bonding) for decommissioning obligations of lessees of federal oil and gas leases and owners of pipeline rights-of-way, rights-of use and easements on the OCS (“Lessees”). Generally, the new NTL (i) ended the practice of excusing Lessees from providing such additional security where co-lessees had sufficient financial strength to meet such decommissioning obligations, (ii) established new criteria for determining financial strength and additional security requirements of such Lessees, (iii) provided acceptable forms of such additional security and (iv) replaced the waiver system with one of self-insurance. The new rule became effective as of September 12, 2016; however on January 6, 2017, the BOEM announced that it was suspending the implementation timeline for six months in certain circumstances. On June 22, 2017, the BOEM announced that the implementation timeline extension will remain in effect pending the completion of its review of the new NTL. The Fund, as well as other industry participants, are working with the BOEM, its operators and working interest partners to determine and agree upon the correct level of decommissioning obligations to which they may be liable and the manner in which such obligations will be secured. The impact of the NTL, if enforced without change or amendment, may require the Fund to fully secure all of its potential abandonment liabilities to the BOEM’s satisfaction using one or more of the enumerated methods for doing so. Potentially this could increase costs to the Fund if the Fund is required to obtain additional supplemental bonding, fund escrow accounts or obtain letters of credit.

Sales and Transportation of Oil and Natural Gas

The Fund, directly or indirectly through affiliated entities, sells its proportionate share of oil and natural gas to the market and receives market prices from such sales. These sales are not currently subject to regulation by any federal or state agency. However, in order for the Fund to make such sales, it is dependent upon unaffiliated pipeline companies whose rates, terms and conditions of transport are subject to regulation by the Federal Energy Regulatory Commission. Generally, depending on certain factors, pipelines can charge rates that are either market-based or cost-of-service-based. In some circumstances, rates can be agreed upon pursuant to settlement. Thus, the rates that pipelines charge the Fund, although regulated, are beyond the Fund’s control. Nevertheless, such rates would apply uniformly to all transporters on that pipeline and, as a result, management does not anticipate that the impact to the Fund of any changes in such rates, terms or conditions would be materially different than the impact to other oil or natural gas producers and marketers.

Environmental Matters and Regulation

The Fund’s operations are subject to pervasive environmental laws and regulations governing the discharge of materials into the air and water, the handling and managing of waste materials, and the protection of aquatic species and habitats. While most of the activities to which these federal, state and local environmental laws and regulations apply are conducted by the operators on the Fund’s behalf, the Fund shares the liability along with its other working interest owners for any environmental damage. The environmental laws and regulations to which its operations are subject may require the Fund, or the operator, to acquire permits to commence drilling operations, restrict or prohibit the release of certain materials or substances into the environment, impose the installation of certain environmental control devices, require certain remedial measures to prevent pollution and other discharges such as the plugging of abandoned projects and, finally, impose in some instances severe penalties, fines and liabilities for the environmental damage that may be caused by the Fund’s projects.

Some of the environmental laws that apply to oil and natural gas exploration and production are described below:

Oil Pollution Act. The Oil Pollution Act of 1990, as amended (the “OPA”), amends Section 311 of the Federal Water Pollution Control Act of 1972, as amended (the “Clean Water Act”) and was enacted in response to the numerous tanker spills, including the Exxon Valdez spill, that occurred in the 1980s. Among other things, the OPA clarifies the federal response authority to, and increases penalties for, such spills. OPA imposes strict, joint and several liabilities on “responsible parties” for damages, including natural resource damages, resulting from oil spills into or upon navigable waters, adjoining shorelines or in the exclusive economic zone of the United States. A “responsible party” includes the owner or operator of an onshore facility and the lessee or permit holder of the area in which an offshore facility is located. The OPA, and regulations promulgated thereunder, establishes a liability limit for onshore facilities and deepwater ports of $633.85 million, while the liability limit for a responsible party for offshore facilities, including any offshore pipeline, is equal to all removal costs plus up to $133.65 million in other damages for each incident. These liability limits may not apply if a spill is caused by a party’s gross negligence or willful misconduct, if the spill resulted from violation of a federal safety, construction or operating regulation, or if a party fails to report a spill or to cooperate fully in a clean-up. Regulations under the OPA require owners and operators of rigs in United States waters to maintain certain levels of financial responsibility. A failure to comply with the OPA’s requirements may subject a responsible party to civil, criminal, or administrative enforcement actions. The Fund is not aware of any action or event that would subject us to liability under the OPA. Compliance with the OPA’s financial assurance and other operating requirements has not had, and the Fund believes will not in the future have, a material impact on the Fund’s operations or financial condition.

Clean Water Act. Generally, the Clean Water Act imposes liability for the unauthorized discharge of pollutants, including petroleum products, into the surface and coastal U.S. waters, except in strict conformance with discharge permits issued by the federal, or state, if applicable, agency. Regulations governing water discharges also impose other requirements, such as the obligation to prepare spill response plans. The Fund’s operators are responsible for compliance with the Clean Water Act, although the Fund may be liable for any failure of the operator to do so.

Clean Air Act. The Federal Clean Air Act of 1970, as amended (the “Clean Air Act”), restricts the emission of certain air pollutants. Prior to constructing new facilities, permits may be required before work can commence and existing facilities may be required to incur additional capital costs to add equipment to ensure and maintain compliance. As a result, the Fund’s operations may be required to incur additional costs to comply with the Clean Air Act.

Other Environmental Laws. In addition to the above, the Fund’s operations may be subject to the Resource Conservation and Recovery Act of 1976, as amended, which regulates the generation, transportation, treatment, storage, disposal and cleanup of certain hazardous wastes, as well as the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended, which imposes joint and several liability without regard to fault or legality of conduct on classes of persons who are considered responsible for the release of a hazardous substance into the environment.

The above represents a brief outline of significant environmental laws that may apply to the Fund’s operations. The Fund believes that its operators are in compliance with each of these environmental laws and the regulations promulgated thereunder. The Fund does not believe that its environmental, health and safety risks are materially different from those of comparable companies in the United States in the offshore oil and gas industry. However, there are no assurances that the environmental regulations described above will not result in curtailment of production; material increases in the costs of production, development or exploration; enforcement actions or other penalties as a result of any non-compliance with any such regulations; or otherwise have a material adverse effect on the Fund’s operating results and cash flows.

Dodd-Frank Act. The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), among other provisions, establishes federal oversight and regulation of the over-the-counter derivatives market and entities that participate in that market and, in addition, requires certain additional SEC reporting requirements.

On February 3, 2017, the “Presidential Executive Order on Core Principles for Regulating the United States Financial System” (the “Order”) was issued to review the Dodd-Frank Act. A series of reports were issued by the U.S. Department of the Treasury in 2017 pursuant to the Order generally recommending the harmonization, balancing and streamlining of rules and regulations relating to, among other things, the over-the-counter derivative market. The Fund cannot predict at this time what regulations or portions of the law, if any, will be changed as a result of the Order.

Currently, under the LLC Agreement, the Fund has the authority to utilize derivative instruments to manage the price risk attributable to its oil and gas production. The Dodd-Frank Act mandates that many derivatives be executed in regulated markets and submitted for clearing to regulated clearinghouses. Derivatives will be subject to minimum daily margin requirements set by the relevant clearinghouse and, potentially, by the SEC or the U.S. Commodity Futures Trading Commission (“CFTC”), and derivatives dealers may demand the unilateral ability to increase margin requirements beyond any regulatory or clearinghouse minimums. In addition, as required by the Dodd-Frank Act, the CFTC has set “speculative position limits” (which are limits imposed on the maximum net long or net short speculative positions that a person may hold or control with respect to futures or options contracts traded on the U.S. commodities exchange) with respect to most energy contracts. These requirements under the Dodd-Frank Act could significantly increase the cost of any derivatives transactions of the Fund (including through requirements to post collateral, which could adversely affect the Fund’s liquidity), materially alter the terms of derivatives transactions and make it more difficult for the Fund to enter into customized transactions, cause the Fund to liquidate certain positions it may hold, reduce the ability of the Fund to protect against price volatility and other risks by making certain hedging strategies impossible or so costly that they are not economical to implement, and increase the Fund’s exposure to less creditworthy counterparties. If as a result of the legislation and regulations, the Fund alters any hedging program that may be in effect from time to time, the Fund’s operations may become more volatile and its cash flows may be less predictable, which could adversely affect the Fund’s performance. The Fund is not currently, and has not been during 2017, or at any time since 2012, a party to any derivative instruments or hedging programs.

The Dodd-Frank Act also required the SEC to issue rules requiring resource extraction issuers to disclose annually information relating to certain payments made by the issuer to the U.S. federal government or a foreign government for the purpose of the commercial development of oil, natural gas or minerals. Rules issued by the SEC in 2012 were subsequently vacated in federal court in 2013. On June 27, 2016, the SEC adopted amended resource extraction disclosure rules pursuant to Section 1504 of the Dodd-Frank Act. However, on February 14, 2017, a bill was passed by the United States Congress eliminating the SEC resource extraction disclosure rules. The SEC had one year to issue replacement rules to implement Section 1504 of the Dodd-Frank Act. The Fund cannot predict whether the SEC will issue replacement rules or, if it does, whether such rules will remain in effect.

Not required.

|

|

UNRESOLVED STAFF COMMENTS

|

None.

The information regarding the Fund’s properties that is contained in Item 1. “Business” of this Annual Report under the headings “Project Information” and “Properties,” is incorporated herein by reference.

Drilling Activity

The following table sets forth the Fund’s drilling activity during the years ended December 31, 2017 and 2016. Gross wells are the total number of wells in which the Fund has an interest. Net wells are the sum of the Fund’s fractional working interests owned in the gross wells. All of the wells, which produce both oil and natural gas, are located in the offshore waters of the Gulf of Mexico. See Item 1. “Business” of this Annual Report under the heading “Properties” for more information about the well in-progress as of December 31, 2017.

|

|

|

2017

|

|

|

2016

|

|

|

|

|

Gross

|

|

|

Net

|

|

|

Gross

|

|

|

Net

|

|

|

Exploratory wells:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

-

|

|

|

|

-

|

|

|

|

1

|

|

|

|

0.03

|

|

|

In-progress

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Exploratory well total

|

|

|

-

|

|

|

|

-

|

|

|

|

1

|

|

|

|

0.03

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Development wells:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive

|

|

|

2

|

|

|

|

0.06

|

|

|

|

1

|

|

|

|

0.03

|

|

|

In-progress

|

|

|

1

|

|

|

|

0.03

|

|

|

|

1

|

|

|

|

0.03

|

|

|

Development well total

|

|

|

3

|

|

|

|

0.09

|

|

|

|

2

|

|

|

|

0.06

|

|

Unaudited Oil and Gas Reserve Quantities

The preparation of the Fund’s oil and gas reserve estimates are completed in accordance with the Fund’s internal control procedures over reserve estimation. Such control procedures include: 1) verification of input data that is provided to an independent petroleum engineering firm; 2) engagement of well-qualified and independent reservoir engineers for preparation of reserve reports annually in accordance with SEC reserve estimation guidelines; and 3) a review of the reserve estimates by the Manager.

The Manager’s primary technical person in charge of overseeing the Fund’s reserve estimates has a B.S. degree in Petroleum Engineering and is a member of the Society of Petroleum Engineers, the Association of American Drilling Engineers and the American Petroleum Institute. With over thirty years of industry experience, he is currently responsible for reserve reporting, engineering and economic evaluation of exploration and development opportunities, and the oversight of drilling and production operations.

The Fund’s reserve estimates as of December 31, 2017 and 2016 were prepared by Netherland, Sewell & Associates, Inc. (“NSAI”), an independent petroleum engineering firm. The information regarding the qualifications of the petroleum engineer is included within the report from NSAI, which is filed as Exhibit 99.1 to this Annual Report, and is incorporated herein by reference.

Proved Reserves. Proved oil and gas reserves are estimated quantities of oil and natural gas, which geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions. Proved developed oil and gas reserves are proved reserves expected to be recovered through existing wells with existing equipment and operating methods. Proved undeveloped oil and gas reserves are proved reserves expected to be recovered through new wells on undrilled acreage, or through existing wells where a relatively major expenditure is required for recompletion. The information regarding the Fund’s proved reserves, which is contained in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report under the heading “Critical Accounting Estimates – Proved Reserves”, is incorporated herein by reference. The information regarding the Fund’s unaudited net quantities of proved developed and undeveloped reserves, which is contained in Table III in the “Supplementary Financial Information – Information about Oil and Gas Producing Activities – Unaudited” included in Item 8. “Financial Statements and Supplementary Data” of this Annual Report, is incorporated herein by reference.

Proved Undeveloped Reserves. As of December 31, 2017, the Fund had proved undeveloped reserves related to the Beta Project totaling 0.1 million barrels of oil, 7 thousand barrels of natural gas liquid (“NGL”) and 45 thousand mcf of natural gas. As of December 31, 2016, the Fund had proved undeveloped reserves related to the Beta Project totaling 27 thousand barrels of oil and 16 thousand mcf of natural gas. The Beta Project was determined to be a discovery in 2012 and commenced production in third quarter 2016.

During the year ended December 31, 2017, the Fund incurred costs to advance the development of its proved undeveloped reserves of approximately $3.8 million, related to the Beta Project. Information regarding estimated future development costs relating to the Beta Project, which is contained in Item 1. “Business” of this Annual Report under the heading “Properties”, is incorporated herein by reference. Estimated future development costs include capital spending on major development projects, some of which will take several years to complete. Proved undeveloped reserves related to major development projects will be reclassified to proved developed reserves when production commences.

Production and Prices

The information regarding the Fund’s production of oil and natural gas, and certain price and cost information during the years ended December 31, 2017 and 2016 that is contained in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report under the headings “Results of Operations – Overview” and “Results of Operations – Operating Expenses” is incorporated herein by reference.

Delivery Commitments

As of December 31, 2017, the Fund had no delivery obligations or delivery commitments under any existing contracts.

None.

None.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

There is currently no established public trading market for the Shares. As of January 31, 2018, there were 848 shareholders of record of the Fund.

Distributions are made in accordance with the provisions of the LLC Agreement. At various times throughout the year, the Manager determines whether there is sufficient available cash, as defined in the LLC Agreement, for distribution to shareholders. Due to the significant capital required to develop the Beta Project, distributions have been impacted, and may be impacted in the future by amounts reserved to provide for its ongoing development costs, debt service costs and funding of its estimated asset retirement obligations. There is no requirement to distribute available cash and, as such, available cash is distributed to the extent and at such times as the Manager believes is advisable. The Fund did not pay distributions during the years ended December 31, 2017 and 2016.

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

Not required.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview of the Fund’s Business

The Fund was organized primarily to acquire interests in oil and gas properties located in the United States offshore waters of Texas, Louisiana and Alabama in the Gulf of Mexico. The Fund’s primary investment objective is to generate cash flow for distribution to its shareholders by generating returns across a portfolio of oil and natural gas projects. Distributions to shareholders are made in accordance with the Fund’s LLC Agreement. The frequency and amount of such distributions are within the Manager’s discretion, subject to available cash flow from operations. The Fund’s remaining capital has been fully allocated to its projects. As a result, the Fund will not invest in any new projects.

The Manager performs, or arranges for the performance of, the management, advisory and administrative services required for Fund operations. The Fund does not currently, nor is there any plan to, operate any project in which the Fund participates. The Manager enters into operating agreements with third-party operators for the management of all development and producing operations, as appropriate. See Item 1. “Business” of this Annual Report under the headings “Project Information” and “Properties” for more information regarding the projects of the Fund.

Commodity Price Changes

Changes in commodity prices may significantly affect liquidity and expected operating results. Declines in oil and gas prices not only reduce revenues and profits, but could also reduce the quantities of reserves that are commercially recoverable. Significant declines in prices could result in non-cash charges to earnings due to impairment.

Oil and natural gas commodity prices have been subject to significant fluctuations during the past several years. The Fund anticipates price cyclicality in its planning and believes it is well positioned to withstand price volatility. Despite operating in a volatile commodity price environment, the Fund continued to advance the development of the Beta Project, which commenced production during the second half of 2016. The Fund has suspended distributions and continues to conserve cash to provide for the continued development of the Beta Project. See “Results of Operations” under this Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for more information on the average oil and natural gas prices received by the Fund during the years ended December 31, 2017 and 2016. If oil and natural gas prices decline, even if only for a short period of time, the Fund’s results of operations and liquidity will be adversely impacted.

Market pricing for oil and natural gas is volatile, and is likely to continue to be volatile in the future. This volatility is caused by numerous factors and market conditions that the Fund cannot control or influence. Therefore, it is impossible to predict the future price of oil and natural gas with any certainty. Factors affecting market pricing for oil and natural gas include:

|

· |

economic conditions, including demand for petroleum-based products;

|

|

· |

actions by OPEC, the Organization of Petroleum Exporting Countries;

|

|

· |

political instability in the Middle East and other major oil and gas producing regions;

|

|

· |

governmental regulations, both domestic and foreign;

|

|

· |

domestic and foreign tax policy;

|

|

· |

the pace adopted by foreign governments for the exploration, development, and production of their national reserves;

|

|

· |

the supply and price of foreign oil and gas;

|

|

· |

the cost of exploring for, producing and delivering oil and gas;

|

|

· |

the discovery rate of new oil and gas reserves;

|

|

· |

the rate of decline of existing and new oil and gas reserves;

|

|

· |

available pipeline and other oil and gas transportation capacity;

|

|

· |

the ability of oil and gas companies to raise capital;

|

|

· |

the overall supply and demand for oil and gas; and

|

|

· |

the price and availability of alternate fuel sources.

|

Critical Accounting Estimates

The discussion and analysis of the Fund’s financial condition and results of operations are based upon the Fund’s financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). In preparing these financial statements, the Fund is required to make certain estimates, judgments and assumptions. These estimates, judgments and assumptions affect the reported amounts of the Fund’s assets and liabilities, including the disclosure of contingent assets and liabilities, at the date of the financial statements and the reported amounts of its revenues and expenses during the periods presented. The Fund evaluates these estimates and assumptions on an ongoing basis. The Fund bases its estimates and assumptions on historical experience and on various other factors that the Fund believes to be reasonable at the time the estimates and assumptions are made. However, future events and actual results may differ from these estimates and assumptions and such differences may have a material impact on the results of operations, financial position or cash flows. See Note 1 of “Notes to Financial Statements” – “Organization and Summary of Significant Accounting Policies” contained in Item 8. “Financial Statements and Supplementary Data” within this Annual Report for a discussion of the Fund’s significant accounting policies. The following is a discussion of the accounting policies and estimates the Fund believes are most significant.

Accounting for Acquisition, Exploration and Development Costs

Acquisition, exploration and development costs are accounted for using the successful efforts method. Costs of acquiring unproved and proved oil and natural gas leasehold acreage, including lease bonuses, brokers’ fees and other related costs, are capitalized. Costs of drilling and equipping productive wells and related production facilities are capitalized. Annual lease rentals and exploration expenses are expensed as incurred.

Proved Reserves

Estimates of proved reserves are key components of the Fund’s most significant financial estimates involving its rate for recording depletion and amortization. Annually, the Fund engages an independent petroleum engineering firm to perform a comprehensive study of the Fund’s proved properties to determine the quantities of reserves and the period over which such reserves will be recoverable. The Fund’s estimates of proved reserves are based on the quantities of oil and natural gas that geological and engineering data demonstrate, with reasonable certainty, to be recoverable in future years from known reservoirs under existing economic and operating conditions. However, there are numerous uncertainties inherent in estimating quantities of proved reserves and in projecting future revenues, rates of production and timing of development expenditures, including many factors beyond the Fund’s control. The estimation process is very complex and relies on assumptions and subjective interpretations of available geologic, geophysical, engineering and production data and the accuracy of reserve estimates is a function of the quality and quantity of available data, engineering and geological interpretation and judgment. In addition, as a result of volatility and changing market conditions, commodity prices and future development costs will change from period to period, causing estimates of proved reserves and future net revenues to change.

Asset Retirement Obligations

Asset retirement obligations include costs to plug and abandon the Fund’s wells and to dismantle and relocate or dispose of the Fund’s production platforms and related structures and restoration costs of land and seabed. The Fund develops estimates of these costs based upon the type of production structure, water depth, reservoir depth and characteristics, ongoing discussions with the wells’ operators and, at times, with information provided by third-party abandonment consultants specializing in the oil and gas industry. Because these costs typically extend many years into the future, estimating these future costs is difficult and requires significant judgment that is subject to future revisions based upon numerous factors such as the timing of settlements, the credit-adjusted risk-free rates used and inflation rates, including changing technology and the political and regulatory environment. Estimates are reviewed on a bi-annual basis, or more frequently if an event occurs that would dictate a change in assumptions or estimates.

Impairment of Long-Lived Assets

The Fund reviews the carrying value of its oil and gas properties annually and when management determines that events and circumstances indicate that the recorded carrying value of properties may not be recoverable. Impairments are determined by comparing estimated future net undiscounted cash flows to the carrying value at the time of the review. If the carrying value exceeds the estimated future net undiscounted cash flows, the carrying value of the asset is written down to fair value, which is determined using estimated future net discounted cash flows from the asset. The fair value determinations require considerable judgment and are sensitive to change. Different pricing assumptions, reserve estimates or discount rates could result in a different calculated impairment. Given the volatility of oil and natural gas prices, it is reasonably possible that the Fund’s estimate of future net discounted cash flows from proved oil and natural gas reserves could change in the near term.

Results of Operations

The following table summarizes the Fund’s results of operations during the years ended December 31, 2017 and 2016, and should be read in conjunction with the Fund’s financial statements and the notes thereto included within Item 8. “Financial Statements and Supplementary Data” in this Annual Report.

|

|

|

Year ended December 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

|

|

(in thousands)

|

|

|

Revenue

|

|

|

|

|

|

|

|

Oil and gas revenue

|

|

$

|

8,051

|

|

|

$

|

2,725

|

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

Depletion and amortization

|

|

|

5,666

|

|

|

|

1,629

|

|

|

Management fees to affiliate

|

|

|

899

|

|

|

|

960

|

|

|

Operating expenses

|

|

|

1,413

|

|

|

|

905

|

|

|

General and administrative expenses

|

|

|

189

|

|

|

|

150

|

|

|

Total expenses

|

|

|

8,167

|

|

|

|

3,644

|

|

|

Loss from operations

|

|

|

(116

|

)

|

|

|

(919

|

)

|

|

Interest expense, net

|

|

|

(942

|

)

|

|

|

(366

|

)

|

|

Net loss

|

|

$

|

(1,058

|

)

|

|

$

|

(1,285

|

)

|

Overview. The following table provides information related to the Fund’s oil and gas production and oil and gas revenue during the years ended December 31, 2017 and 2016. NGL sales are included within gas sales.

|

|

|

Year ended December 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

Number of wells producing

|

|

|

6

|

|

|

|

4

|

|

|

Total number of production days

|

|

|

1,603

|

|

|

|

737

|

|

|

Oil sales (in thousands of barrels)

|

|

|

151

|

|

|

|

59

|

|

|

Average oil price per barrel

|

|

$

|

48

|

|

|

$

|

41

|

|

|

Gas sales (in thousands of mcfs)

|

|

|

274

|

|

|

|

136

|

|

|

Average gas price per mcf

|

|

$

|

3.03

|

|

|

$

|

2.20

|

|

The increases in the above table were primarily related to the commencement of production of the Beta Project, coupled with the Liberty Project, which was shut-in during early-2016. See Item 1. “Business” of this Annual Report under the heading “Properties” for more information.

Oil and Gas Revenue. Generally, the Fund sells oil, gas and NGLs under two types of agreements, which are common in the oil and gas industry. In the first type of agreement, or a netback agreement, the Fund receives a price, net of transportation expense incurred by the purchaser, and the Fund records revenue at the net price received. In the second type of agreement, the Fund pays transportation expense directly, and transportation expense is included within operating expenses in the statements of operations.

Oil and gas revenue during the year ended December 31, 2017 was $8.1 million, an increase of $5.3 million from the year ended December 31, 2016. The increase was attributable to increased sales volume totaling $4.1 million coupled with increased oil and gas prices totaling $1.2 million.

See “Overview” above for factors that impact the oil and gas revenue volume and rate variances.

Depletion and Amortization. Depletion and amortization during the year ended December 31, 2017 was $5.7 million, an increase of $4.0 million from the year ended December 31, 2016. The increase was attributable to an increase in production volumes totaling $2.3 million coupled with an increase in the average depletion rate totaling $1.7 million. The increase in the average depletion rate was primarily attributable to the onset of production of the Beta Project. Depletion and amortization rates were also impacted by changes in reserve estimates provided annually by the Fund’s independent petroleum engineers.

See “Overview” above for certain factors that impact the depletion and amortization volume and rate variances.

Management Fees to Affiliate. An annual management fee, totaling 2.5% of total capital contributions, net of cumulative dry-hole and related well costs incurred by the Fund, is paid monthly to the Manager. Such fee may be temporarily waived by the Manager to accommodate the Fund’s short-term capital commitments.

Operating Expenses. Operating expenses represent costs specifically identifiable or allocable to the Fund’s wells, as detailed in the following table.

|

|

|

Year ended December 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

|

|

(in thousands)

|

|

|

Lease operating expense

|

|

$

|

974

|

|

|

$

|

550

|

|

|

Insurance expense

|

|

|

209

|

|

|

|

170

|

|

|

Accretion expense

|

|

|

116

|

|

|

|

144

|

|

|

Transportation and processing expense

|

|

|

54

|

|

|

|

4

|

|

|

Workover expense and other

|

|

|

60

|

|

|

|

37

|

|

|

|

|

$

|

1,413

|

|

|

$

|

905

|

|

Lease operating expense and transportation and processing expense relates to the Fund’s producing properties. Insurance expense represents premiums related to the Fund’s properties, which vary depending upon the number of wells producing or drilling. Accretion expense relates to the asset retirement obligations established for the Fund’s proved properties. Workover expense represents costs to restore or stimulate production of existing reserves.

The average production cost, which includes lease operating expense, transportation and processing expense and insurance expense, was $6.28 per barrel of oil equivalent (“BOE”) during the year ended December 31, 2017 compared to $8.85 per BOE during the year ended December 31, 2016. The decrease was primarily attributable to the Beta Project, which had lower cost per BOE in 2017. The Beta Project, which commenced production in third quarter 2016, has lower cost per BOE as compared to other projects due to the processing of production through its standalone facility. The production costs per BOE may decline over time as throughput increases from the project or other projects expected to tie-in to the facility.

General and Administrative Expenses. General and administrative expenses represent costs specifically identifiable or allocable to the Fund, such as accounting and professional fees and insurance expenses.

Interest Expense, Net. Interest expense, net is comprised of interest expense and amortization of debt discounts and deferred financing costs related to the Fund’s long-term borrowings (see “Liquidity Needs” below for additional information), and interest income earned on cash and cash equivalents and salvage fund.

Capital Resources and Liquidity

Operating Cash Flows

Cash flows provided by operating activities during the year ended December 31, 2017 were $4.2 million, primarily related to revenue received of $7.5 million, partially offset by operating expenses of $2.2 million, management fees of $0.9 million and general and administrative expenses of $0.2 million.

Cash flows provided by operating activities during the year ended December 31, 2016 were $0.1 million, primarily related to revenue received of $2.0 million, partially offset by management fees of $1.0 million, operating expenses of $0.8 million and general and administrative expenses of $0.1 million.

Investing Cash Flows

Cash flows used in investing activities during the year ended December 31, 2017 were $4.0 million, related to capital expenditures for oil and gas properties of $3.9 million and investments in salvage fund of $0.1 million.

Cash flows used in investing activities during the year ended December 31, 2016 were $3.3 million, primarily related to capital expenditures for oil and gas properties.

Financing Cash Flows

Cash flows used in financing activities during the year ended December 31, 2017 were $0.9 million, related to the repayment of long-term borrowings.

Cash flows provided by financing activities during the year ended December 31, 2016 were $3.8 million, related to proceeds from long-term borrowings.

Estimated Capital Expenditures

The Fund has entered into multiple agreements for the acquisition, drilling and development of its oil and gas properties. The estimated capital expenditures associated with these agreements vary depending on the stage of development on a property-by-property basis. See Item 1. “Business” of this Annual Report under the heading “Properties” and “Liquidity Needs” below for additional information.

Capital expenditures for oil and gas properties have been funded with the capital raised by the Fund in its private placement offering, and in certain circumstances, through debt financing. The Fund’s remaining capital has been fully allocated to its projects. As a result, the Fund will not invest in any new projects and will limit its investment activities, if any, to those projects in which it currently has a working interest.

Liquidity Needs

The Fund’s primary short-term liquidity needs are to fund its operations, capital expenditures for its oil and gas properties and borrowing repayments. Such needs are funded utilizing operating income and existing cash on-hand.

As of December 31, 2017, the Fund’s estimated capital commitments related to its oil and gas properties were $4.9 million (which include asset retirement obligations for the Fund’s projects of $3.1 million), of which $2.5 million is expected to be spent during the year ending December 31, 2018, related to the settlement of asset retirement obligations for certain of the Fund’s projects and the continued development of the Beta Project. As a result of continued development of the Beta Project, the Fund has experienced negative cash flows for the year ended December 31, 2017. Additionally, current liabilities exceed current assets as of December 31, 2017. Future results of operations and cash flows are dependent on the continued successful development and the related production of oil and gas revenues from the Beta Project. Based upon its current cash position and its current reserve estimates, the Fund expects cash flow from operations to be sufficient to cover its commitments, borrowing repayments and ongoing operations. Reserve estimates are projections based on engineering data that cannot be measured with precision, require substantial judgment, and are subject to frequent revision. However, if cash flow from operations is not sufficient to meet the Fund’s commitments, the Manager will temporarily waive all or a portion of the management fee as well as provide short-term financing to accommodate the Fund’s short-term commitments if needed.

The Manager is entitled to receive an annual management fee from the Fund regardless of the Fund’s profitability in that year. However, pursuant to the terms of the LLC Agreement, the Manager is also permitted to waive the management fee at its own discretion.

Distributions, if any, are funded from available cash from operations, as defined in the LLC Agreement, and the frequency and amount are within the Manager’s discretion. Due to the significant capital required to develop the Beta Project, distributions have been impacted, and may be impacted in the future, by amounts reserved to provide for its ongoing development costs, debt service costs and funding its estimated asset retirement obligations.

Credit Agreement

In November 2012, the Fund entered into a credit agreement (as amended on September 30, 2016 and September 15, 2017, the “Credit Agreement”) with Rahr Energy Investments LLC, as administrative agent and lender (and any other banks or financial institutions that may in the future become a party thereto, collectively “Lenders”), that provided for an aggregate loan commitment to the Fund of approximately $9.4 million to provide capital toward the funding of the Fund’s share of development costs on the Beta Project. As of December 31, 2017 and 2016, the Fund had borrowings of $8.5 million and $9.4 million, respectively, under the Credit Agreement. As of December 31, 2016, in accordance with the terms of the Credit Agreement, there were no additional borrowings available to the Fund.