INVESTOR

PRESENTATION

NYSE: CIM

3rd Quarter 2017

Information is unaudited, estimated and subject to change.

DISCLAIMER This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the UnitedStates Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates andprojections and, consequently, readers should not rely on these forward-looking statements as predictions of future

events. Words such as “goal” “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,”

“may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify

such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that

could cause actual results to differ materially from expected results, including, among other things, those described in

our most recent Annual Report on Form 10-K , and any subsequent Quarterly Reports on Form 10-Q, under the caption

“Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of credit markets

and general economic conditions; changes in interest rates and the market value of our assets; the rates of default or

decreased recovery on the mortgages underlying our target assets; the occurrence, extent and timing of credit losses

within our portfolio; the credit risk in our underlying assets; declines in home prices; our ability to establish, adjust and

maintain appropriate hedges for the risks in our portfolio; the availability and cost of our target assets; our ability to

borrow to finance our assets and the associated costs; changes in the competitive landscape within our industry; our

ability to manage various operational risks and costs associated with our business; interruptions in or impairments to our

communications and information technology systems; our ability to acquire residential mortgage loans and successfully

securitize the residential mortgage loans we acquire; our ability to oversee our third party sub-servicers; the impact of

any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process; our

exposure to legal and regulatory claims; legislative and regulatory actions affecting our business; the impact of new or

modified government mortgage refinance or principal reduction programs; our ability to maintain our REIT qualification;

and limitations imposed on our business due to our REIT status and our exempt status under the Investment Company

Act of 1940.

Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the

date made. Chimera does not undertake or accept any obligation to release publicly any updates or revisions to any

forward-looking statement to reflect any change in its expectations or any change in events, conditions or

circumstances on which any such statement is based. Additional information concerning these and other risk factors is

contained in Chimera’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written

and oral forward-looking statements concerning Chimera or matters attributable to Chimera or any person acting on its

behalf are expressly qualified in their entirety by the cautionary statements above.

This presentation may include industry and market data obtained through research, surveys, and studies conducted by

third parties and industry publications. We have not independently verified any such market and industry data from

third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or

investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This

presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of

the terms of an offer that the parties or their respective affiliates would accept.

Readers are advised that the financial information in this presentation is based on company data available at the time of

this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors.

Information is unaudited, estimated and subject to change. 2

CHIMERA IS A RESIDENTIAL MORTGAGE REIT

Chimera develops and manages a portfolio of leveraged mortgage investments to

produce an attractive quarterly dividend for shareholders

▪ Established in 2007

▪ Internally managed since August 2015

▪ Total Capital $3.6 Billion

▪ Total Portfolio $20.8 Billion

▪ Common Stock Price $18.92 / Dividend Yield 10.57%

▪ 8.00% Fixed Series A Preferred Stock Price $26.25

▪ 8.00% Variable Series B Preferred Stock Price $26.45

▪ Overall leverage ratio 4.6:1 / Recourse leverage ratio 1.8:1

All data as of September 30, 2017

Information is unaudited, estimated and subject to change. 3

TOTAL RETURN

Chimera has outperformed it's peers since internalization of management in August 2015

All data as of September 30, 2017

*Assuming reinvestment of dividends

Source: Bloomberg

CIM US Equity REM US Equity SPY US Equity

Cumulative Total Return*

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

-10%

-20%

-30%

8/5

/20

15

9/1

6/2

015

10/

27/

201

5

12/

8/2

015

1/2

1/2

016

3/3

/20

16

4/1

4/2

016

5/2

5/2

016

7/7

/20

16

8/1

7/2

016

9/2

8/2

016

11/

8/2

016

12/

20/

201

6

2/2

/20

17

3/1

6/2

017

4/2

7/2

017

6/8

/20

17

7/2

0/2

017

8/3

0/2

017

81%

36%

25%

9/30/201

7

Information is unaudited, estimated and subject to change. 4

HISTORICAL TOTAL RETURN

Chimera has consistently produced industry and market leading returns

All data as of September 30, 2017

*Assuming reinvestment of dividends

Source: Bloomberg

1 year 3 year 5 year

Cumulative Total Return *

200%

150%

100%

50%

0%

CIM US Equity REM US Equity SPY US Equity

32%

21% 19%

85%

37% 36%

180%

41%

93%

Information is unaudited, estimated and subject to change. 5

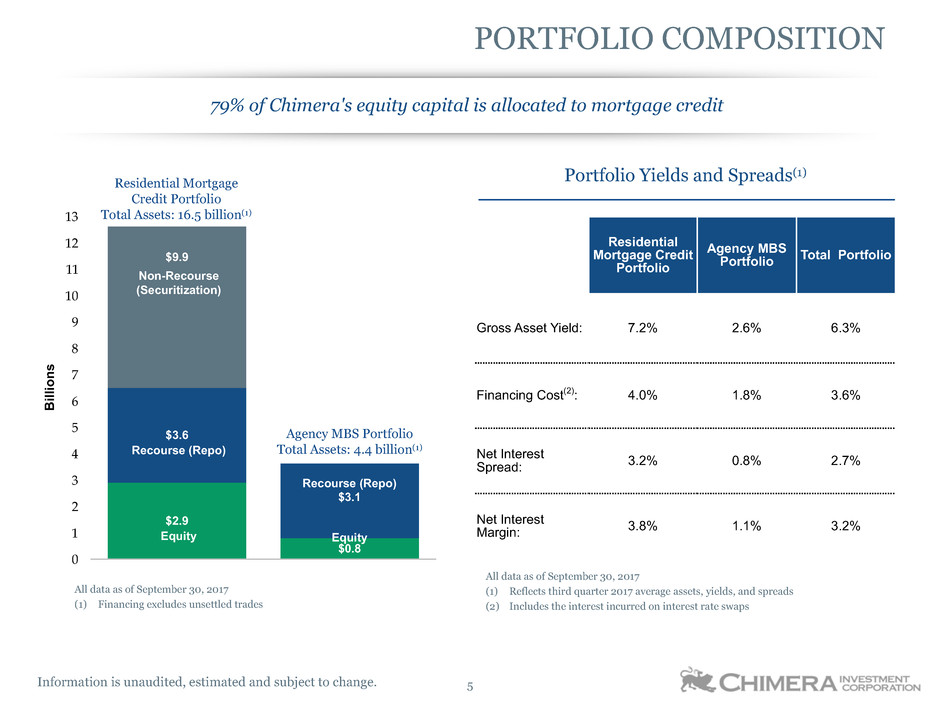

PORTFOLIO COMPOSITION

Residential

Mortgage Credit

Portfolio

Agency MBS

Portfolio Total Portfolio

Gross Asset Yield: 7.2% 2.6% 6.3%

Financing Cost(2): 4.0% 1.8% 3.6%

Net Interest

Spread: 3.2% 0.8% 2.7%

Net Interest

Margin: 3.8% 1.1% 3.2%

Portfolio Yields and Spreads(1)

13

12

11

10

9

8

7

6

5

4

3

2

1

0

B

ill

io

ns

$2.9

$0.8

$3.6

$3.1

$9.9

Non-Recourse

(Securitization)

Recourse (Repo)

Recourse (Repo)

Equity Equity

Agency MBS Portfolio

Total Assets: 4.4 billion(1)

Residential Mortgage

Credit Portfolio

Total Assets: 16.5 billion(1)

79% of Chimera's equity capital is allocated to mortgage credit

All data as of September 30, 2017

(1) Reflects third quarter 2017 average assets, yields, and spreads

(2) Includes the interest incurred on interest rate swaps

All data as of September 30, 2017

(1) Financing excludes unsettled trades

Information is unaudited, estimated and subject to change. 6

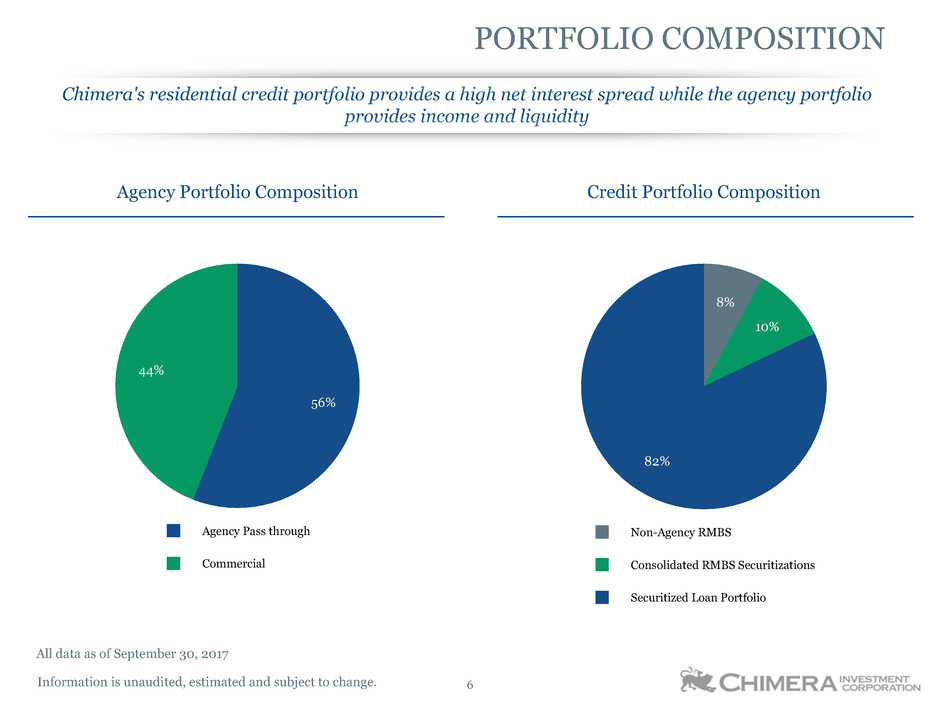

Agency Pass through

Commercial

56%

44%

Agency Portfolio Composition Credit Portfolio Composition

PORTFOLIO COMPOSITION

Chimera's residential credit portfolio provides a high net interest spread while the agency portfolio

provides income and liquidity

All data as of September 30, 2017

Non-Agency RMBS

Consolidated RMBS Securitizations

Securitized Loan Portfolio

8%

10%

82%

Information is unaudited, estimated and subject to change. 7

2016-2017 Chimera

Acquires $10.5 Billion

Seasoned Loan

Portfolio

• Performing loans with 10 years

of payment history

• 10 securitizations with all

senior securities placed

• $ 2.0 billion bonds retained

for investment portfolio

2014 Chimera Acquires

$4.8 Billion Seasoned

Loan Portfolio

• Originated by American General

• 7 Securitizations with embedded

call options

• 5 deals called and re-securitized

• 2 original deals are currently

callable

2009–2011 Chimera

Creates and Retains

$3.2 Billion High Yield

Subordinate Bonds

• $1.7 billion current remaining

face value of subordinate bonds

• Durable value over wide band of

prepayment rates

• Difficult to re-create in size and

price

UNIQUE MORTGAGE CREDIT PORTFOLIO

Key transactions distinguish Chimera from other Mortgage REITs

Re-Remic Subordinate Bond Portfolio

Springleaf Seasoned Loan Portfolio

Risk Retention Seasoned

Loan Portfolio

All data as of September 30, 2017

Information is unaudited, estimated and subject to change. 8

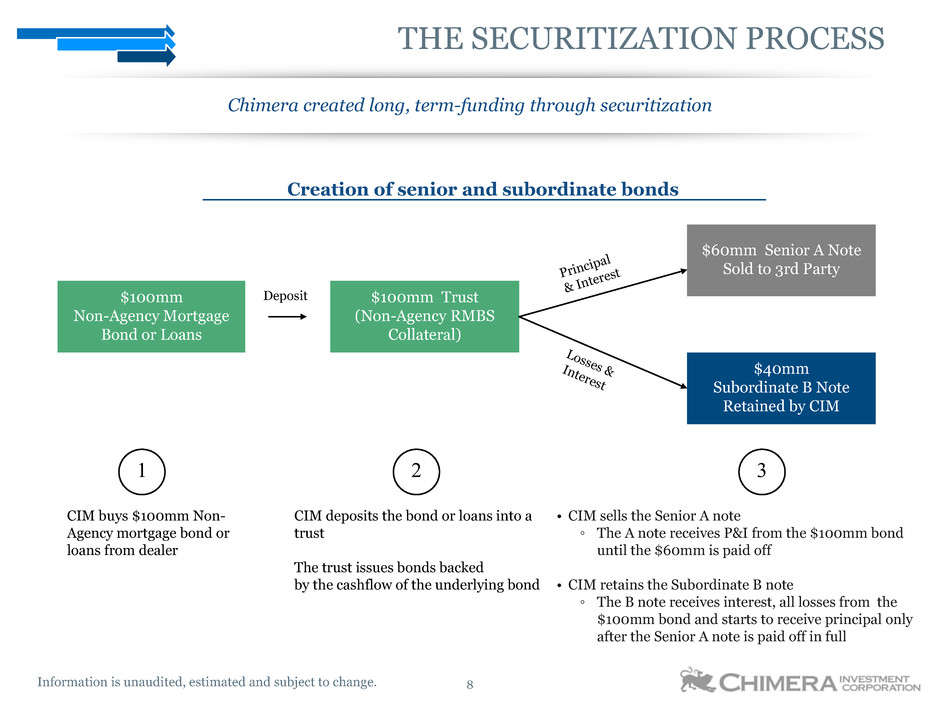

THE SECURITIZATION PROCESS

Chimera created long, term-funding through securitization

Creation of senior and subordinate bonds

$100mm

Non-Agency Mortgage

Bond or Loans

$100mm Trust

(Non-Agency RMBS

Collateral)

Deposit

$60mm Senior A Note

Sold to 3rd Party

$40mm

Subordinate B Note

Retained by CIM

CIM buys $100mm Non-

Agency mortgage bond or

loans from dealer

CIM deposits the bond or loans into a

trust

The trust issues bonds backed

by the cashflow of the underlying bond

• CIM sells the Senior A note

◦ The A note receives P&I from the $100mm bond

until the $60mm is paid off

• CIM retains the Subordinate B note

◦ The B note receives interest, all losses from the

$100mm bond and starts to receive principal only

after the Senior A note is paid off in full

Principa

l

& Interes

t

Losses

&Interes

t

1 2 3

Information is unaudited, estimated and subject to change. 9

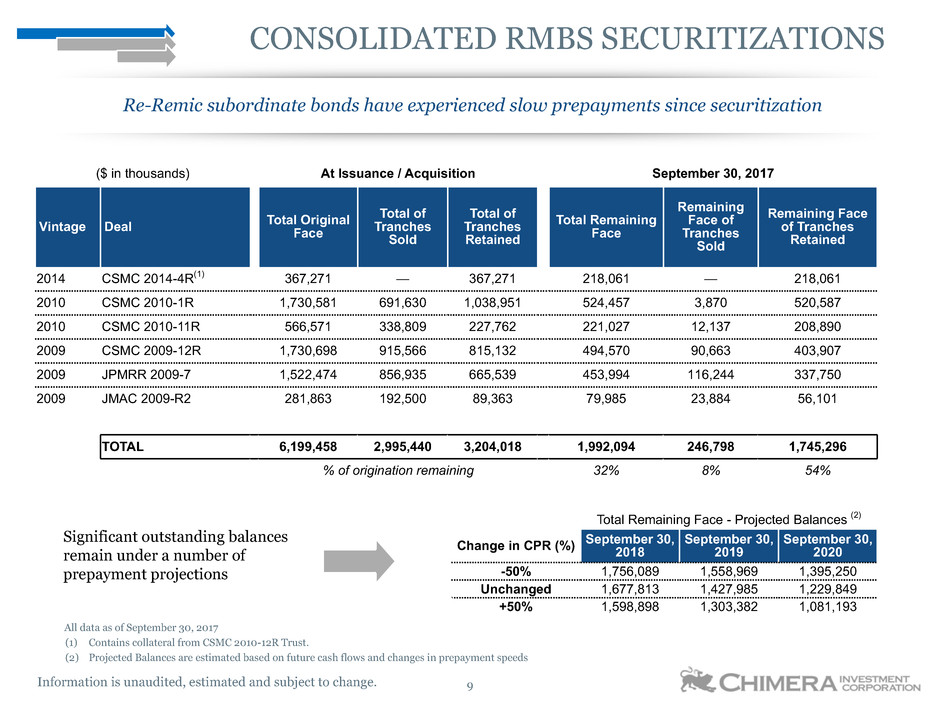

($ in thousands) At Issuance / Acquisition September 30, 2017

Vintage Deal Total OriginalFace

Total of

Tranches

Sold

Total of

Tranches

Retained

Total Remaining

Face

Remaining

Face of

Tranches

Sold

Remaining Face

of Tranches

Retained

2014 CSMC 2014-4R(1) 367,271 — 367,271 218,061 — 218,061

2010 CSMC 2010-1R 1,730,581 691,630 1,038,951 524,457 3,870 520,587

2010 CSMC 2010-11R 566,571 338,809 227,762 221,027 12,137 208,890

2009 CSMC 2009-12R 1,730,698 915,566 815,132 494,570 90,663 403,907

2009 JPMRR 2009-7 1,522,474 856,935 665,539 453,994 116,244 337,750

2009 JMAC 2009-R2 281,863 192,500 89,363 79,985 23,884 56,101

TOTAL 6,199,458 2,995,440 3,204,018 1,992,094 246,798 1,745,296

% of origination remaining 32% 8% 54%

CONSOLIDATED RMBS SECURITIZATIONS

▪ Re-Remic subordinate bonds have had slow prepayments considering the low interest rate environment

▪ Chimera expects the subordinate bond portfolio to have meaningful impact on earnings for the foreseeable future

All data as of September 30, 2017

(1) Contains collateral from CSMC 2010-12R Trust.

(2) Projected Balances are estimated based on future cash flows and changes in prepayment speeds

Significant outstanding balances

remain under a number of

prepayment projections

Total Remaining Face - Projected Balances (2)

Change in CPR (%) September 30,2018

September 30,

2019

September 30,

2020

-50% 1,756,089 1,558,969 1,395,250

Unchanged 1,677,813 1,427,985 1,229,849

+50% 1,598,898 1,303,382 1,081,193

Re-Remic subordinate bonds have experienced slow prepayments since securitization

Information is unaudited, estimated and subject to change. 10

ACQUISITION OF SEASONED LOAN PORTFOLIO

Since 2014 Chimera has acquired $15.3 billion of seasoned performing loans through bulk transactions

2014

Springleaf

Acquisition

▪ $4.8 billion seasoned

loans

▪ 7 securitizations

▪ Loans originated for

American General

portfolio

2015 - 2016

Springleaf

Optimization

▪ Chimera refinances 5 of

the 7 Springleaf deals into

CIM securitizations

▪ All new Chimera

securitizations have call

rights

2016

Bank Portfolio

Acquisition

▪ $5.2 billion seasoned

loans

▪ 4 original securitizations

2017

Bank Portfolio

Acquisition

▪ $5.3 billion seasoned

loans

▪ 6 original securitizations

Springleaf

Acquisition

Bank

Portfolio

Acquisition

All data as of September 30, 2017

Information is unaudited, estimated and subject to change. 11

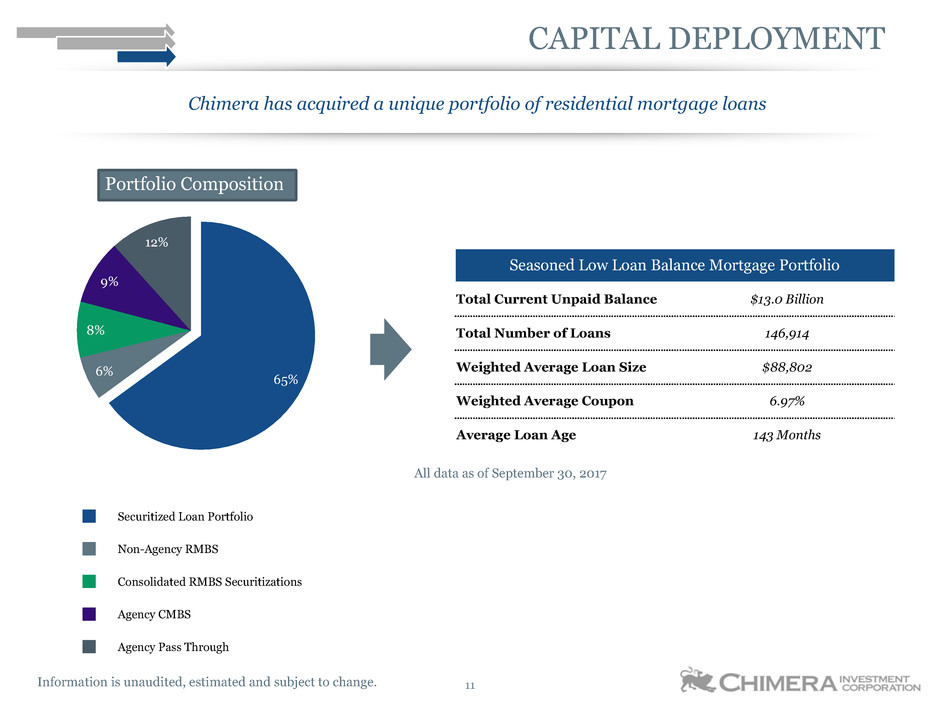

CAPITAL DEPLOYMENT

Chimera has acquired a unique portfolio of residential mortgage loans

All data as of September 30, 2017

Seasoned Low Loan Balance Mortgage Portfolio

Total Current Unpaid Balance $13.0 Billion

Total Number of Loans 146,914

Weighted Average Loan Size $88,802

Weighted Average Coupon 6.97%

Average Loan Age 143 Months

Securitized Loan Portfolio

Non-Agency RMBS

Consolidated RMBS Securitizations

Agency CMBS

Agency Pass Through

65%6%

8%

9%

12%

Portfolio Composition

Information is unaudited, estimated and subject to change. 12

2016 SECURITIZATION ACTIVITY

Chimera securitized $5.8 billion in 2016 growing the investment portfolio to $16.3 billion

Loan Securitizations

CIM 2016-1

$1,499,341,000

April 2016

CIM 2016-2

$1,762,177,000

May 2016

CIM 2016-3

$1,746,084,000

May 2016

CIM 2016-4

$601,733,000

October 2016

CIM 2016-5

$66,171,000

October 2016

CIM 2016-FRE 1

$185,881,000

October 2016

▪ Chimera has one of the largest seasoned, performing, small balance residential

loan portfolios in the Mortgage REIT Industry

▪ Chimera securitized $185 million loans with Freddie Mac in a pilot program

▪ Chimera expects high single digit yields on the portfolio without leverage

All data as of September 30, 2017

Information is unaudited, estimated and subject to change. 13

2017 SECURITIZATION ACTIVITY

Chimera has securitized $5.3 billion in 2017 growing the investment portfolio to $20.8 billion

Loan Securitizations

CIM 2017-1

$526,267,000

January 2017

CIM 2017-2

$331,440,000

February 2017

CIM 2017-3

$2,434,640,000

March 2017

CIM 2017-4

$830,510,000

March 2017

▪ Chimera closed six securitizations in the first nine months of seasoned,

performing, low-loan balance residential mortgage loans

▪ Chimera sold $4.1 billion of these securities, retaining an interest of $1.1 billion

All data as of September 30, 2017

CIM 2017-5

$377,034,000

May 2017

CIM 2017-6

$782,725,000

August 2017

Information is unaudited, estimated and subject to change. 14

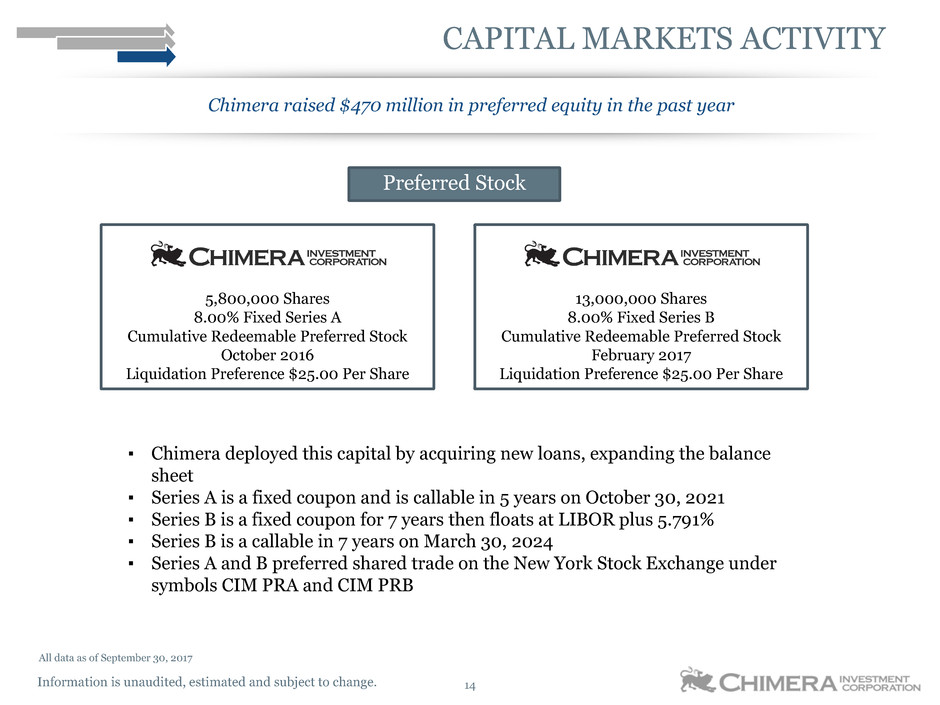

CAPITAL MARKETS ACTIVITY

Chimera raised $470 million in preferred equity in the past year

All data as of September 30, 2017

Preferred Stock

5,800,000 Shares

8.00% Fixed Series A

Cumulative Redeemable Preferred Stock

October 2016

Liquidation Preference $25.00 Per Share

▪ Chimera deployed this capital by acquiring new loans, expanding the balance

sheet

▪ Series A is a fixed coupon and is callable in 5 years on October 30, 2021

▪ Series B is a fixed coupon for 7 years then floats at LIBOR plus 5.791%

▪ Series B is a callable in 7 years on March 30, 2024

▪ Series A and B preferred shared trade on the New York Stock Exchange under

symbols CIM PRA and CIM PRB

13,000,000 Shares

8.00% Fixed Series B

Cumulative Redeemable Preferred Stock

February 2017

Liquidation Preference $25.00 Per Share

Information is unaudited, estimated and subject to change. 15

RECENT EVENTS

4th quarter subsequent events

▪ $356 million secured term financing

▪ 2-year term

▪ Non-mark-to-market

▪ Financed legacy CUSIPS

▪ $512 million rated securitization CIM 2017-7

▪ Deal rated by Fitch & DBRS

▪ Rated transaction broadens CIM investor base for senior tranches of securitization

▪ Senior most tranches rated AAA

▪ 5.08% WAC, 137 month WALA

▪ $144,000 Average Loan Balance

▪ Refinanced securitized debt related to $1.3 billion of loan collateral

▪ Called Springleaf 2013-2A

▪ Called Springleaf 2013-3A

▪ Called CSMC 2014-CIM1

▪ Called CIM 2016-5

Information is unaudited, estimated and subject to change. 16

SUMMARY

Chimera has a unique portfolio of high yielding assets, created

through securitization, which would be difficult to recreate in size and

scale

Upward trending macro economic conditions for the housing market

are positive for the credit of Chimera's mortgage portfolio

New risk retention rules present an attractive opportunity for

companies like Chimera to sponsor mortgage securitizations

Opportunity for

Permanent Capital

Positive Macro

Economic

Environment

Franchise

Mortgage Assets

Chimera has assembled a portfolio of unique mortgage assets with a goal to provide high

and durable income to shareholders

Information is unaudited, estimated and subject to change.

Appendix

Information is unaudited, estimated and subject to change. 18

Agency Securities – As of September 30, 2017 Repo Days to Maturity – As of September 30, 2017

Security

Type Coupon

(1) Current

Face

Weighted

Average

Market Price

Weighted

Average CPR

Agency

Pass-

through

3.50% $878,766 103.3 10.3

4.00% 1,261,567 105.5 10.8

4.50% 176,505 107.7 15.7

Commercial 3.6% 1,774,802 102.1 —

Agency IO 0.7% N/M(2) 3.6 9.8

Total $4,091,640

Maturity PrincipalBalance

Weighted

Average Rate

Weighted

Average Days

Within 30 days $2,433,157 1.40%

30 to 59 days 473,727 1.38%

60 to 89 days 189,350 1.37%

90 to 360 days — —%

Total $3,096,234 1.39% 21 Days

The majority of Chimera's Agency Portfolio consists of highly liquid pass-through securities

AGENCY MBS PORTFOLIO AND FUNDING

All data as of September 30, 2017

(1) Coupon is a weighted average for Commercial and Agency IO

(2) Notional Agency IO was $3.2 billion as of September 30, 2017

Information is unaudited, estimated and subject to change. 19

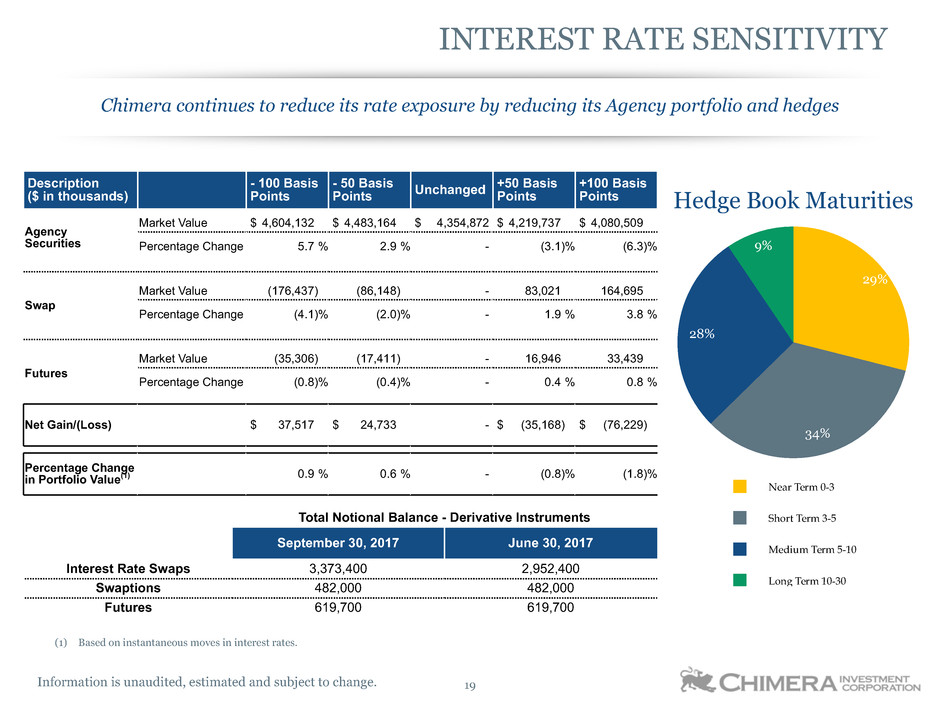

Description

($ in thousands)

- 100 Basis

Points

- 50 Basis

Points Unchanged

+50 Basis

Points

+100 Basis

Points

Agency

Securities

Market Value $ 4,604,132 $ 4,483,164 $ 4,354,872 $ 4,219,737 $ 4,080,509

Percentage Change 5.7 % 2.9 % - (3.1)% (6.3)%

Swap

Market Value (176,437) (86,148) - 83,021 164,695

Percentage Change (4.1)% (2.0)% - 1.9 % 3.8 %

Futures

Market Value (35,306) (17,411) - 16,946 33,439

Percentage Change (0.8)% (0.4)% - 0.4 % 0.8 %

Net Gain/(Loss) $ 37,517 $ 24,733 - $ (35,168) $ (76,229)

Percentage Change

in Portfolio Value(1) 0.9 % 0.6 % - (0.8)% (1.8)% Near Term 0-3

Short Term 3-5

Medium Term 5-10

Long Term 10-30

Hedge Book Maturities

29%

34%

28%

9%

INTEREST RATE SENSITIVITY

Chimera continues to reduce its rate exposure by reducing its Agency portfolio and hedges

Total Notional Balance - Derivative Instruments

September 30, 2017 June 30, 2017

Interest Rate Swaps 3,373,400 2,952,400

Swaptions 482,000 482,000

Futures 619,700 619,700

(1) Based on instantaneous moves in interest rates.

chimerareit.com