Table of contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

________________________

FORM 10-Q

☒ QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED APRIL

30, 2019

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 333-184061

WECONNECT

TECH INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in

Its Charter)

| Nevada |

39-2060052 |

| (State or Other Jurisdiction |

(I.R.S. Employer |

| of Incorporation or Organization) |

Identification No.) |

1st Floor, Block A, Axis Business Campus

No. 13A & 13B, Jalan 225, Section

51A

46100 Petaling Jaya

Selangor, Malaysia

+60 17 380 2755

(Address of Principal Executive Offices and Issuer’s

Telephone Number, including Area Code)

Securities registered pursuant to Section

12(b) of the Act: None

Securities registered

pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001

(Title of class)

Indicate by check mark whether the

registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§

229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files). Yes ☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”,

and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

| |

Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| |

Non-accelerated

filer ☐ |

Smaller reporting

company ☒ |

| |

Emerging growth

company ☐ |

|

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐

No ☒

As of May 29, 2019, the issuer had outstanding

593,610,070 shares of common stock.

TABLE OF CONTENTS

PART I FINANCIAL

INFORMATION

| ITEM 1 | Financial Statements |

WECONNECT TECH INTERNATIONAL, INC.

CONSOLIDATED BALANCE SHEET

(Currency expressed in United States

Dollars (“US$”), except for number of shares)

| | |

April 30, 2019 | | |

July 31,

2018 | |

| | |

| (Unaudited) | | |

| | |

| ASSETS | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,716 | | |

$ | 14,159 | |

| Account receivables | |

| 1,907 | | |

| 179 | |

| Other receivables, deposits and prepayments | |

| 448,583 | | |

| 748,260 | |

| Amount due from related parties | |

| 3,409 | | |

| 38,353 | |

| Inventories | |

| 3,228 | | |

| 3,288 | |

| Total Current Assets | |

$ | 460,843 | | |

$ | 804,239 | |

| | |

| | | |

| | |

| Non-Current Assets | |

| | | |

| | |

| Plant and equipment, net | |

$ | 94,790 | | |

$ | 118,610 | |

| Total Non-Current Assets | |

$ | 94,790 | | |

$ | 118,610 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 555,633 | | |

$ | 922,849 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payables | |

$ | 73,220 | | |

$ | 1,515 | |

| Other payables and accrued liabilities | |

| 211,721 | | |

| 250,624 | |

| Amount due to directors | |

| – | | |

| 51,920 | |

| Amount due to related parties | |

| 909,480 | | |

| 323,424 | |

| Current tax liabilities | |

| 21,210 | | |

| 10,792 | |

| Total Current Liabilities | |

$ | 1,215,631 | | |

$ | 638,275 | |

| | |

| | | |

| | |

| Non-Current Liabilities | |

| | | |

| | |

| Deferred taxation | |

$ | 9,431 | | |

$ | 9,605 | |

| Total Non-Current Liabilities | |

$ | 9,431 | | |

$ | 9,605 | |

| | |

| | | |

| | |

| Total Liabilities | |

$ | 1,225,062 | | |

$ | 647,880 | |

| | |

| | | |

| | |

| Stockholders' Equity | |

| | | |

| | |

| Common stock 593,610,070 shares issued and outstanding at April 30, 2019 and July 31, 2018 | |

$ | 593,610 | | |

$ | 593,610 | |

| Additional paid-in capital | |

| 4,958,781 | | |

| 4,958,781 | |

| Accumulated loss | |

| (5,998,564 | ) | |

| (5,048,961 | ) |

| Accumulated other comprehensive loss | |

| (223,256 | ) | |

| (228,461 | ) |

| Total Stockholders' Equity | |

$ | (669,429 | ) | |

$ | 274,969 | |

| | |

| | | |

| | |

| Total Liabilities and Stockholders' Equity | |

$ | 555,633 | | |

$ | 922,849 | |

(The accompanying notes are integral part

of these financial statements)

WECONNECT TECH INTERNATIONAL,

INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE LOSS

FOR THE THREE AND NINE MONTHS ENDED APRIL

30, 2019

(Currency expressed in United States

Dollars (“US$”), except for number of shares)

| | |

For the Three Months Ended April 30, | | |

For the Nine Months Ended April 30, | |

| | |

2019 (Unaudited) | | |

2018 (Unaudited) | | |

2019 (Unaudited) | | |

2018 (Unaudited) | |

| Revenue | |

$ | 644 | | |

$ | (490 | ) | |

$ | 64,386 | | |

$ | 15,913 | |

| Cost of Revenue | |

| (162 | ) | |

| (12,410 | ) | |

| (10,242 | ) | |

| (70,255 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gross Profit / (Loss) | |

| 482 | | |

| (12,900 | ) | |

| 54,144 | | |

| (54,342 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income | |

| 17 | | |

| 71,491 | | |

| 538 | | |

| 73,539 | |

| General and Administrative Expenses | |

| (222,693 | ) | |

| (326,761 | ) | |

| (995,763 | ) | |

| (1,282,914 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss Before Taxation | |

$ | (222,194 | ) | |

$ | (268,170 | ) | |

$ | (941,081 | ) | |

$ | (1,263,717 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Taxation | |

| – | | |

| – | | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss After Taxation | |

$ | (222,194 | ) | |

$ | (268,170 | ) | |

$ | (941,081 | ) | |

$ | (1,263,717 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Comprehensive Income / (Loss) | |

| | | |

| | | |

| | | |

| | |

| Foreign Currency Translation Adjustment | |

| 8,282 | | |

| 123 | | |

| 9,780 | | |

| (9,832 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total Comprehensive Loss for The Year | |

$ | (213,912 | ) | |

$ | (268,047 | ) | |

$ | (931,301 | ) | |

$ | (1,273,549 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings Per Share | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Number of Common Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

| 593,610,070 | | |

| 88,583,262 | | |

| 593,610,070 | | |

| 88,583,262 | |

(The accompanying notes are integral part

of these financial statements)

WECONNECT TECH INTERNATIONAL, INC.

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE NINE MONTHS ENDED APRIL 30, 2019

(Currency expressed in United States

Dollars (“US$”))

| | |

Nine Months Ended April 30, | |

| | |

2019 (Unaudited) | | |

2018 (Unaudited) | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss | |

$ | (941,081 | ) | |

$ | (1,263,717 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Impairment | |

| 302,134 | | |

| – | |

| Depreciation of plant and equipment | |

| 20,634 | | |

| 22,342 | |

| Gain on disposal of PPE | |

| (504 | ) | |

| (539 | ) |

| Plant and equipment written off | |

| – | | |

| 51,868 | |

| Foreign translation reserve | |

| (2,670 | ) | |

| (66,325 | ) |

| Donated services and rent | |

| – | | |

| 1,500 | |

| Operating loss before working capital changes | |

| (621,487 | ) | |

| (1,254,871 | ) |

| | |

| | | |

| | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Account receivables | |

| (1,735 | ) | |

| (695,936 | ) |

| Other receivables, deposits and prepayments | |

| (15,345 | ) | |

| 3,258 | |

| Amount due to directors | |

| (51,100 | ) | |

| (144,916 | ) |

| Amount due to related parties | |

| 630,658 | | |

| 400,194 | |

| Account payables | |

| 71,834 | | |

| (922,284 | ) |

| Other payables and accrued liabilities | |

| (24,637 | ) | |

| – | |

| Net cash used in operating activities | |

| (11,812 | ) | |

| (2,614,555 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Sales proceed from disposal of plant and equipment | |

| 2,087 | | |

| 1,513 | |

| Purchase of plant and equipment | |

| (496 | ) | |

| (67,707 | ) |

| Net cash generated from / (used in) investing activities | |

| 1,591 | | |

| (66,194 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Issued of share capital | |

| – | | |

| 2,629,433 | |

| Net cash generated from financing activity | |

| – | | |

| 2,629,433 | |

| | |

| | | |

| | |

| Change in cash and cash equivalents | |

| (10,221 | ) | |

| (51,316 | ) |

| Foreign currency translation adjustment | |

| (222 | ) | |

| – | |

| | |

| | | |

| | |

| NET CHANGE IN CASH AND CASH EQUIVALENTS | |

| (10,443 | ) | |

| (51,316 | ) |

| | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD | |

| 14,159 | | |

| 74,091 | |

| | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS, END OF PERIOD | |

$ | 3,716 | | |

$ | 22,775 | |

(The accompanying notes are integral part

of these financial statements)

WECONNECT TECH INTERNATIONAL, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED APRIL

30, 2019

(Amount expressed in United States Dollars

(“US$”), except for number of shares or stated otherwise)

(Unaudited)

| 1. |

Organization and Business Background |

WECONNECT Tech International Inc. was incorporated

under the laws of the State of Nevada on April 25, 2007. For purposes of financial statements presentation, WECONNECT Tech International

Inc. and its subsidiary are herein referred to as “the Company” or “We”.

Our business office is located at 1st Floor,

Block A, Axis Business Campus, No. 13A & 13B, Jalan 225, Section 51A, 46100 Petaling Jaya, Selangor, Malaysia.

On June 8, 2018, we have acquired approximately

99.662% equity interest of MIG Mobile Tech Bhd., a public limited company incorporated in Malaysia. MIG Mobile Tech Bhd. is mainly

engaged in e-commerce, online to offline marketplace and payment eco-system. The non-controlling interest remaining will be 0.338%.

This transaction was accounted for as a transaction among entities under common control and the assets, liabilities, revenues,

and expenses of MIG Mobile Tech Bhd. were carried over to and combined with the Company at historical cost, and as if the transfer

occurred at the beginning of the period. We have conducted our business through MIG Mobile Tech Bhd. since then.

Details of the Company’s subsidiary:

| No | | |

Company Name | |

Place and date of incorporation | |

Particulars of issued capital | |

Principal activities |

| | 1 | | |

MIG Mobile Tech Bhd | |

Malaysia

Oct 1, 2015 | |

50,000,000 of

ordinary shares | |

E-commerce, online to offline

marketplace and payment eco-system |

| 2. |

Summary of Significant Accounting Policies |

Basis of Presentation

The

interim financial information referred to above has been prepared and presented in conformity with accounting principles generally

accepted in the United States applicable to interim financial information and with the instructions to Form 10-Q and Article 8

of Regulation S-X. The interim financial information has been prepared on a basis consistent with prior interim periods and years

and includes all disclosures that are necessary and required by applicable laws and regulations. This report on Form 10-Q should

be read in conjunction with the Company’s financial statements and notes thereto included in the Company’s Form 10-K

for the fiscal year ended July 31, 2018.

In the opinion of management, all adjustments

(consisting of normal and recurring accruals) considered necessary for fair presentation of the Company’s financial position,

results of operations and cash flows have been included. Operating results for the nine months ended April 30, 2019, are not necessarily

indicative of the results that may be expected for future quarters or the year ending July 31, 2019.

Basis of Consolidation

The consolidated financial statements

include the accounts of the Company and its subsidiary. All inter-company accounts and transactions have been eliminated upon

consolidation.

Use of Estimates

The preparation of financial statements

in conformity with generally accepted accounting principles in the United States of America requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities

at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company

regularly evaluates estimates and assumptions related to valuation of donated services and rent, fair value measurements and deferred

income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience

and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making

judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent

from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s

estimates. To the extent there are material differences between the estimates and the actual results, future results of operations

will be affected.

Cash and Cash Equivalents

Cash and cash equivalents are carried at

cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments

with an original maturity of three months or less as of the purchase date of such investments. As of April 30, 2019, and July 31,

2018, the Company had $3,716 and $14,159 in cash and cash equivalents, respectively.

Plant and Equipment

Plant and equipment is stated at cost less

accumulated depreciation and impairment. Depreciation of plant and equipment are calculated on the straight-line method over their

estimated useful lives as follows:

| Classification | |

Principal annual rate / Estimated useful lives |

| Computer hardware and software | |

4 years |

| Furniture and fittings | |

10 years |

| Office equipment | |

5 years |

| Telecommunication | |

2 years |

| Renovation | |

10 years |

| Signboard | |

5 years |

| Security and alarm system | |

4 years |

Expenditures for maintenance and repairs

are expenses as incurred.

Inventories

Inventories consisting of products available

for sell, are stated at the lower of cost or market value. Cost of inventory is determined using the first-in, first-out (FIFO)

method. Inventory reserve is recorded to write down the cost of inventory to the estimated market value due to slow-moving merchandise

and damaged goods, which is dependent upon factors such as historical and forecasted consumer demand, and promotional environment.

The Company takes ownership, risks and rewards of the products purchased. Write downs are recorded in cost of revenues in the Statements

of Operation and Comprehensive Income.

Revenue Recognition

Revenue recognized when it is probable

that the economic benefits associated with the transaction will flow to the enterprise and the amount of the revenue can be measured

reliably. Revenue is measured at the fair value of consideration received or receivable.

| a) |

Sales of goods |

| |

Revenue from sales of goods is recognized when the significant risks and rewards of ownership have been transferred to the buyer. Revenue is measured at the fair value of the consideration received or receivable, net of discounts and taxes application to the revenue. |

| b) |

Rendering of Services |

| |

Revenue from rendering of services is measured by reference to the stage of completions of the transaction at the reporting date. |

| c) |

Interest income |

| |

Interest income is recognized

using the effective interest method and accrued on a timely basis. |

Foreign Currencies Translation

Transactions denominated in currencies

other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of

the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into

the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are

recorded in the statement of operations.

The functional currency of the Company

is the United States Dollars (“US$”) and the accompanying financial statements have been expressed in US$. In addition,

the subsidiary maintains its books and record in a local currency, Malaysian Ringgit (“MYR” or “RM”), which

is functional currency as being the primary currency of the economic environment in which the entity operates.

In general, for consolidation purposes,

assets and liabilities of its subsidiaries whose functional currency is not US$ are translated into US$, in accordance with ASC

Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance sheet date. Revenues and

expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial

statements of foreign subsidiary are recorded as a separate component of other comprehensive income. The Company has not to, the

date of these financial statements, entered into derivative instruments to offset the impact of foreign currency fluctuations.

Translation of amounts from the local currency

of the Company into US$1 has been made at the following exchange rates for the respective years:

| | |

As of and for the period ended

April 30, | |

| | |

2019 | | |

2018 | |

| Period average MYR : US$1 exchange rate | |

| 4.1257 | | |

| 4.0702 | |

| Period end MYR : US$1 exchange rate | |

| 4.1355 | | |

| 3.9195 | |

Fair Value of Financial Instruments

The carrying value of the Company’s

financial instruments: cash and cash equivalents, trade receivable, deposits and other receivables, amount due to related parties

and other payables approximate at their fair values because of the short-term nature of these financial instruments.

The Company also follows the guidance of

the ASC Topic 820-10, “Fair Value Measurements and Disclosures” ("ASC 820-10"), with respect to financial

assets and liabilities that are measured at fair value. ASC 820-10 establishes a three-tier fair value hierarchy that prioritizes

the inputs used in measuring fair value as follows:

| |

Level 1: |

Observable inputs such as quoted prices in active markets; |

| |

Level 2: |

Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and |

| |

Level 3: |

Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions. |

Income Tax

Income taxes are

accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences

attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective

tax bases and operating loss and tax credit carry forwards. Deferred tax assets and liabilities are measured using enacted tax

rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled.

The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes

the enactment date. A valuation allowance is recognized if it is more likely than not that some portion, or all, of a deferred

tax asset will not be realized. There were no significant deferred tax items as of April 30, 2019 and July 31, 2018.

The Company

applied the provisions of ASC 740-10-50, Accounting for Uncertainty in Income Taxes, which provides clarification

related to the process associated with accounting for uncertain tax position recognized in our financial statements. Audit

periods remain open for review until the statute of limitations has passed. The completion of review or the expiration of the

statute of limitations for a given audit period could result in an adjustment to the Company’s liability for income

taxes. Any such adjustment could be material to the Company’s results of operations for

any given quarterly or annual period based, in part, upon the results of operations for the given period. At April 30,

2019 and July 31, 2018, management considered that the Company had no uncertain tax

positions and will continue to evaluate for uncertain positions in the future.

Basic and Diluted Net Income/(Loss)

Per Share

The Company calculates net income/(loss)

per share in accordance with ASC Topic 260, “Earnings per Share.” Basic income/(loss) per share is computed by dividing

the net income/(loss) by the weighted-average number of common shares outstanding during the period. Diluted income per share is

computed similar to basic income/(loss) per share except that the denominator is increased to include the number of additional

common shares that would have been outstanding if the potential common stock equivalents had been issued and if the additional

common shares were dilutive. Diluted earnings per share excludes all dilutive potential shares if their effect is anti-dilutive.

As at April 30, 2019 and 2018, there were no potentially dilutive securities outstanding.

Recent Accounting Pronouncements

Management

has considered all recent accounting pronouncements issued and their potential effect on our financial statements. The Company's

management believes that these recent pronouncements will not have a material effect on the Company's condensed financial statements.

| 3. |

Related Party Transactions |

During

the nine months ended April 30, 2019, MIG Network & Consultancy Sdn. Berhad (the “MIG Network and Consultancy”),

a Malaysian company that Executive Directors of the Company are the major shareholders, has advanced in an aggregate amount of

$909,480, equivalent to RM3,761,155 to the Company for working capital purpose. The advances were unsecured, interest free, and

due on demand. As of April 30, 2019, and July 31, 2018, there were $909,480 and $323,424 advances outstanding, respectively.

| | |

For the

Nine Months

ended | | |

For the

Nine Months

ended | |

| | |

April 30, 2019 | | |

April 30, 2018 | |

| | |

| | |

| |

| Revenue generated from: | |

| | | |

| | |

| North Cloud Sdn Bhd. | |

$ | 26,662 | | |

$ | – | |

| MIG O2O Berhad | |

| 19,391 | | |

| – | |

| MIG Network & Consultancy Sdn. Bhd. | |

| 8,483 | | |

| 13,334 | |

| MIG Mobile Tech Limited | |

| – | | |

| 33 | |

| MIG F&B Chain Sdn. Bhd. | |

| – | | |

| 134 | |

| WPAY International Berhad | |

| 8,962 | | |

| – | |

| | |

$ | 63,498 | | |

$ | 13,501 | |

| | |

| | | |

| | |

| Payroll outsourcing charge back to: | |

| | | |

| | |

| MIG O2O Berhad | |

$ | 36,365 | | |

$ | 75,199 | |

| MIG Network & Consultancy Sdn. Bhd. | |

| 1,572 | | |

| 1,698 | |

| MIG Next Tech Sdn. Bhd. | |

| – | | |

| 364 | |

| North Cloud Sdn. Bhd. | |

| 18,225 | | |

| – | |

| | |

$ | 56,162 | | |

$ | 77,261 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Rental paid to: | |

| | | |

| | |

| MIG Network & Consultancy Sdn. Bhd. | |

$ | 58,503 | | |

$ | 50,321 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Legal fee paid to: | |

| | | |

| | |

| MIG Network & Consultancy Sdn. Bhd. | |

$ | 6,850 | | |

$ | 6,948 | |

| | |

April 30, 2019 | | |

July 31, 2018 | |

| Amount due from related parties: | |

| | | |

| | |

| MIG Network & Consultancy Sdn. Bhd. | |

$ | 3,409 | | |

$ | – | |

| MIG Mobile Tech Limited | |

| – | | |

| 38,353 | |

| | |

$ | 3,409 | | |

$ | 38,353 | |

| | |

| | | |

| | |

| Amount due to related parties: | |

| | | |

| | |

| MIG Network & Consultancy Sdn. Bhd. | |

$ | 909,480 | | |

$ | 323,424 | |

| | |

| | | |

| | |

| Amount due to directors: | |

| | | |

| | |

| Shiong Han Wee | |

$ | – | | |

$ | 6,414 | |

| Kwueh Lin Wong | |

| – | | |

| 45,506 | |

| | |

$ | – | | |

$ | 51,920 | |

| | |

| | | |

| | |

| Accruals for director fee: | |

| | | |

| | |

| Ho Pui Hold | |

$ | 3,000 | | |

$ | – | |

| Wong Mun Wai | |

| 1,500 | | |

| – | |

| | |

$ | 4,500 | | |

$ | – | |

Common Stock

As of April 30, 2019, and July 31, 2018,

there are 593,610,070 shares of common stock issued and outstanding.

Preferred Stock

As of April 30, 2019, and July 31, 2018,

there are no issued and outstanding preferred stocks.

On November 12, 2018, MIG Mobile Tech Berhad,

a subsidiary of the Company, filed a claim against Digiland Private Limited (“Digiland”) for breach of contract and

misrepresentation arising from, among other things, Digiland’s failure to perform under its supplier contract with the Company.

In its suit, MIG Mobile Tech Berhad is seeking a return of funds previously paid to Digiland in the amount of S$800,000 Singapore

Dollars (approximately US $596,000) together with a claim for damages to be assessed by the Singapore Court. Within the same suit,

Digiland has filed a counterclaim against MIG Mobile Tech Berhad for the balance of the payment due to it under contract in the

sum of S$800,000, together with a claim for damages to be assessed by the Singapore Court.

In accordance with applicable accounting

guidance, the Company records accruals for certain of its outstanding legal proceedings, investigations or claims when it is probable

that a liability will be incurred and the amount of loss can be reasonably estimated. The Company evaluates, on a quarterly basis,

developments in legal proceedings, investigations or claims that could affect the amount of any accrual, as well as any developments

that would make a loss contingency both probable and reasonably estimable. The Company discloses the amount of the accrual if the

financial statements would be otherwise misleading, which was not the case for the three months ended April 30, 2019.

Prior to the filing of its claims against

Digiland, the Company recognized the amount of $596,912 in receivable, deposits and prepayments. The amount is being recognized

as deposit because the development of the application-based software has not been materialized to-date. Upon the filing of its

claims, the Company expects to recognize an impairment in the amount of $298,456. The Company is unable to ascertain the result

of the legal proceedings as the proceedings are in the early stages and there is uncertainty arising from the development of the

case.

Excluding fees paid to external legal counsel,

litigation-related expenses and accruals previously recognized, the Company do not expect to recognize additional accruals for

litigation-related expense for the next quarter.

We expect that the aggregate range of reasonably

possible losses, in excess of accruals established, if any, for such legal proceeding is likely to range from S$800,000 and upwards

if Digiland prevails in its counterclaim against us. The estimated aggregate range of reasonably possible losses is based upon

currently available information for those proceedings in which the Company is involved, taking into account the Company’s

best estimate of such losses for those cases for which such estimate can be made. Those matters for which an estimate is not possible

are not included within this estimated range. Therefore, such range represents what the Company believes to be an estimate of possible

loss only for those matters meeting such criteria. It does not represent the Company’s maximum loss exposure.

There is no subsequent events as of April

30, 2019.

| 7. |

Commitment and Contingencies |

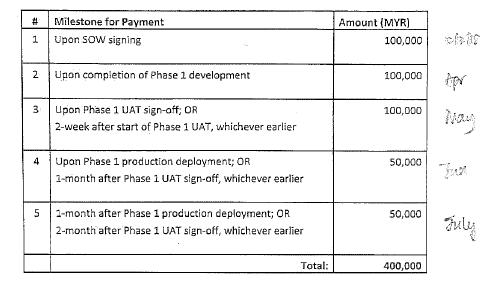

The Company and Artemis Tech Sdn. Bhd.,

or Artemis, are parties to an agreement effective September 14, 2018, pursuant to which Artemis agreed to develop and enhance our

web-based Merchant Management System for MYR 747,500 (approximately US$180,490). The Company paid US$43,428 for the first stage

of development work performed on September 21, 2018. The remaining cost to complete the web-based Merchant Management System in

future is approximately US$137,062. We expect the work to conclude on or about December 31, 2019. The foregoing description of

the Merchant Management System development agreement is qualified in its entirety by reference to such agreement, which is filed

as Exhibit 10.1 to this quarterly report on Form 10-Q and incorporated herein by reference.

The Company and Ang Swie Kheong are parties

to an agreement effective March 12, 2018, pursuant to which Ang Swie Kheong agreed to develop an electronic wallet system for MYR400,000

(approximately US$96,855). The Company had paid a total of US$48,427 for the first stage of application development on April 5,

2018, and July 25, 2018. The remaining cost to complete the electronic wallet system in future is approximately US$48,428. We expect

the work to conclude on or about December 31, 2019. The foregoing description of the E Wallet Agreement development agreement is

qualified in its entirety by reference to such agreement, which is filed as Exhibit 10.2 to this quarterly report on Form 10-Q

and incorporated herein by reference.

The Company entered into an agreement with

Digiland Pte. Ltd. on September 12, 2017, amounting to SGD$1,600.00 (approximately US$1,189,061) for eMobile Apps (User and Merchant)

and Backed Admin Web Portal. The remaining cost to complete the eMobile Apps (User and Merchant) and Backed Admin Web Portal in

future is approximately US$617,559. The Company and Digiland are parties to legal claims against each other, as more fully described

in Note 5 Legal Proceedings of Notes to our Consolidated Financial Statements.

Subsequent to the financial year end, the

Company’s future lease payments of US$5,929 per month for office premise is expected to end on Oct 31, 2019.

When a loss contingency is not both probable

and estimable, the Company does not establish an accrued liability. However, if the loss (or an additional loss in excess of the

accrual) is at least a reasonable possibility and material, then the Company discloses an estimate of the possible loss or range

of loss, if such estimate can be made or discloses that an estimate cannot be made.

The assessments whether a loss is probable

or a reasonable possibility, and whether the loss or a range of loss is estimable, often involve a series of complex judgments

about future events. Management is often unable to estimate a range of reasonably possible loss, particularly where (i) the

damages sought are substantial or indeterminate, (ii) the proceedings are in the early stages, or (iii) the matters involve

novel or unsettled legal theories or a large number of parties. In such cases, there is considerable uncertainty regarding the

timing or ultimate resolution of such matters, therefore, no contingencies were provided as at April 30, 2019.

The comparative figures in fiscal year

ended July 31, 2018 have been restated due to the acquisition of our subsidiary company, MIG Mobile Tech Bhd., on June 8, 2018,

which was accounted for as a Reverse Take Over under common control.

The comparative figures have been reclassified to conform with

the current period presentation.

| ITEM 2 | Management’s Discussion and Analysis of Financial

Condition and Results of Operations |

Forward-looking statements

The following discussion

of our financial condition and results of operations should be read in conjunction with the financial statements and the related

notes thereto included elsewhere in this quarterly report on Form 10-Q. This quarterly report on Form 10-Q contains certain forward-looking

statements and our future operating results could differ materially from those discussed herein. Certain statements contained in

this discussion, including, without limitation, statements containing the words "believes," "anticipates,"

"expects" and the like, constitute "forward-looking statements" within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). However,

as we issue “penny stock,” as such term is defined in Rule 3a51-1 promulgated under the Exchange Act, we are ineligible

to rely on these safe harbor provisions. Such forward-looking statements involve known and unknown risks, uncertainties and other

factors which may cause our actual results, performance or achievements to be materially different from any future results, performance

or achievements expressed or implied by such forward-looking statements. Given these uncertainties, readers are cautioned not to

place undue reliance on such forward-looking statements. We disclaim any obligation to update any such factors or to announce publicly

the results of any revisions of the forward-looking statements contained herein to reflect future events or developments.

Currency and exchange rate

Unless otherwise

noted, all currency figures quoted as “U.S. dollars”, “dollars” or “$” refer to the legal currency

of the United States. Throughout this report, assets and liabilities of the Company’s subsidiaries are translated into U.S.

dollars using the exchange rate on the balance sheet date. Revenue and expenses are translated at average rates prevailing during

the period. The gains and losses resulting from translation of financial statements of foreign subsidiaries are recorded as a separate

component of accumulated other comprehensive income within the statement of stockholders’ equity.

Overview

We are a payment-solution

provider designed to consolidate users’ forms of payment and connect merchants to consumers in a dynamic ecosystem via digital

transactions in the form of mobile payment, visa-powered payment card, and other features such as rewarding in-app system and shopping

aggregator system that are both convenient and rewarding. In a society that is still extremely cash-reliant in its daily transactions,

we offer a cashless transaction solution with our digital payment system that can be used domestically and internationally.

We were founded with

one single technology ambition – to be a one-stop payment solution group backed by an integrated digital eco-system. Centered

around online and offline commerce platforms, the Company boasts three (3) main payment gateways:

| |

iii. |

In-app Reward Program (Coming soon) |

With our participation in online and offline

platforms, we hope to improve the payment landscape in Malaysia, connecting people across emerging markets. We seek to revolutionize

the way business works by providing cutting-edge payment solutions, security, internet & mobile technologies and integrating

with conventional business practices to mitigate the constraints of distance and time for maximum convenience and speed.

Potential Business

Segment

To strengthen our financial

position, on March 18, 2019, we entered into a Share Exchange Agreement with GF Offshore Sdn. Bhd., a private limited company organized

under the laws of Malaysia (“GF”), and certain Investors pursuant to which we agreed to issue Ninety Million (90,000,000)

shares of our common stock, par value $0.001, (the “WECT Shares”) to acquire Three Million Six Hundred Sixty Thousand

(3,660,000) shares of the GF Ordinary Stock (representing up to 60% of the total issued and outstanding shares of GF Ordinary Stock)

held by such Investors. GF is engaged in the business of supplying petroleum oil and gas products.

Under the terms of

the Share Exchange Agreement, GF will be required to meet certain performance milestones during the two-year period after closing.

If GF fails to meet any performance milestone, a portion of the WECT Shares will be subject to claw back. Upon the closing of

the share exchange, we will be required to appoint one independent director and a representative of GF to its board of directors.

In connection with our pending acquisition, Shiong Han Wee, our Chief Executive Officer and Director, was appointed to serve as

a director of GF on April 2, 2019.

We are in active discussions

regarding the definitive terms of such acquisition. Accordingly, the final terms may differ from those described above.

The foregoing description

of the Share Exchange Agreement is qualified in its entirety by reference to such agreement, which is filed as Exhibit 10.1 to

the current report on Form 8-K filed with the Commission on April 15, 2019, and incorporated herein by reference.

History

We were incorporated

under the laws of the State of Nevada on April 25, 2007. Prior to our acquisition of MIG Mobile Tech Berhad (“MMT”),

a corporation organized under the laws of Malaysia, we were an exploration stage company engaged in the acquisition and exploration

of mineral properties. We were also a “shell company” with no meaningful assets or operations other than our efforts

to identify and merge with an operating company. We operated under the name “Contact Minerals Corp. and our securities traded

under the symbol “CNTM.” Effective November 6, 2017, we changed our name to “WECONNECT Tech International, Inc.”

and our symbol to “WECT.” Our business office is located at 1st Floor, Block A, Axis Business Campus, No.

13A & 13B, Jalan 225, Section 51A, 46100 Petaling Jaya, Selangor, Malaysia. Effective June 8, 2018, we consummated the acquisition

of 49,831,007 shares of MMT (the “MMT Shares”), constituting approximately 99.662% of the issued and outstanding securities

of MMT. As a result of our acquisition of the MMT Shares, we ventured into the payment solution business with a focus on users

located in Malaysia.

Effective August 29,

2017, the Company and Kerry McCullagh, the Company’s former Chief Executive Officer, Chief Financial Officer, President,

Secretary and Treasurer (the “Seller”) entered into a stock purchase agreement (the “Stock Purchase Agreement”)

with Shiong Han Wee and Kwueh Lin Wong (collectively, the “Purchasers”). Under the terms of the Stock Purchase Agreement,

the Purchasers agreed to purchase 7,000,000 shares from the Seller (the Seller Shares”) and 78,770,000 shares from the Company

(the “Issued Shares”) for an aggregate purchase price of $350,000. The sale of the Seller Shares and the Issued Shares

consummated September 11, 2017.

Upon the consummation

of the sale, Kerry McCullagh, Alex Langer and William McCullagh, our former executive officers and directors, resigned from all

of their positions with the Company. Their resignations were not due to any dispute or disagreement with the Company on any matter

relating to the Company's operations, policies or practices.

The following individuals

were appointed to serve in the positions set forth next to their names below:

| Name | |

Age | | |

Position |

| Shiong Han Wee | |

| 41 | | |

Director, Chief Executive Officer |

| Kwueh Lin Wong | |

| 41 | | |

Director, Secretary |

Chee Kuen Chim and

Pui Hold Ho were each appointed to serve as a Director of the Company effective September 22, 2017. Mr. Chim resigned from his

positions with the Company effective May 11, 2018, and Mun Wai Wong was appointed to fill the vacancy caused by such resignation

on June 1, 2018.

Effective June 1, 2018,

Kwueh Lin Wong resigned from his position as the Chief Financial Officer of the Company and Chow Wing Loke was appointed to fill

the vacancy caused by Mr. Wong’s resignation.

Effective June 8, 2018,

we consummated the acquisition of 49,831,007 shares of MMT (the “MMT Shares”), constituting approximately 99.662% of

the issued and outstanding securities of MMT. As consideration, we agreed to issue to the MMT shareholders 498,310,070 shares of

our common stock, at a value of US $0.05 per share, for an aggregate value of US$24,915,503.50. As a result of our acquisition

of the MMT Shares, we entered into the payment solution business with a focus on users located in Malaysia.

On

March 18, 2019, we entered into a Share Exchange Agreement with GF Offshorre Sdn. Bhd., a private limited company organized under

the laws of Malaysia (“GF”), and certain Investors pursuant to which we agreed to issue Ninety Million (90,000,000)

shares of our common stock, par value $0.001, (the “WECT Shares”) to acquire Three Million Six Hundred Sixty Thousand

(3,660,000) shares of the GF Ordinary Stock (representing up to 60% of the total issued and outstanding shares of GF Ordinary Stock)

held by such Investors. GF is engaged in the business of supplying petroleum oil and gas products. We are in active discussions

regarding the definitive terms of such acquisition. Accordingly, the final terms may differ from those described above.

Going Concern

The

financial statements have been prepared on a going concern basis which assumes the Company will be able to realize its assets and

discharge its liabilities in the normal course of business for the foreseeable future. Accordingly, our financial statements do

not include adjustments relating to the recoverability and realization of assets and classification of liabilities that might be

necessary should we be unable to continue in operation. As at April 30, 2019, the Company has working capital deficiency of $754,788

and has accumulated losses of $5,998,564 since its inception. Further losses are anticipated in the development of the business,

raising substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements

do not include any adjustment that might result from the outcome of this uncertainty. The consolidated financial statements do

not include any adjustment that might result from the outcome of this uncertainty.

The

ability to continue as a going concern is dependent upon the Company generating profitable operations in the future and/or to obtain

the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come

due. Management expects to finance operating costs over the next twelve months with loans from directors and/or private placements

of common stock, but we cannot guarantee that we will be able to achieve same.

Results of Operations

The following table

provides selected financial data about our company as of April 30, 2019 and 2018.

| | |

For the Three Months Ended April 30, | | |

For the Nine Months Ended April 30, | |

| | |

2019 (Unaudited) | | |

2018 (Unaudited) | | |

2019 (Unaudited) | | |

2018 (Unaudited) | |

| Revenue | |

$ | 644 | | |

$ | (490 | ) | |

$ | 64,386 | | |

$ | 15,913 | |

| Cost of revenue | |

| (162 | ) | |

| (12,410 | ) | |

| (10,242 | ) | |

| (70,255 | ) |

| Other income | |

| 17 | | |

| 71,491 | | |

| 538 | | |

| 73,539 | |

| General and administrative expenses | |

| (222,693 | ) | |

| (326,761 | ) | |

| (995,763 | ) | |

| (1,282,914 | ) |

| Other comprehensive income / (loss) | |

| 8,282 | | |

| 123 | | |

| 9,780 | | |

| (9,832 | ) |

| Total Comprehensive Loss for the Year | |

$ | (213,912 | ) | |

$ | (268,047 | ) | |

$ | (931,301 | ) | |

$ | (1,273,549 | ) |

Three

Months Ended April 30, 2019, Compared to Three Months Ended April 30, 2018

Revenues.

During the three months ended April 30, 2019, and 2018, we earned revenues of $644 and recorded a negative revenue of $(490),

respectively. The slight increase in net revenues is primarily attributable to the increase of merchant’s platform fee.

During the three months

ended April 30, 2019, and 2018, there are no customers accounted for 10% or more of our total net revenues.

General

and Administrative Expenses. General and administrative expenses were $222,693 and $326,761 for the three months

ended April 30, 2019, and 2018, respectively. The decrease in operating expenses was primarily attributable to the decrease of

payroll expenses.

During the three months

ended April 30, 2019 and 2018, no vendors accounted for 10% or more of our total operating costs.

Gross Profit.

We recorded a gross profit of $482 and gross loss of $12,900 for the three months ended April 30, 2019, and 2018, respectively.

The increase in gross profit is mainly attributable to the decrease in cost of revenue due to restructuring of incentives given

to merchants and users in our ecosystem.

Income Tax Expense.

We did not record income tax expenses for the three months ended April 30, 2019, and 2018 respectively.

Comprehensive

Loss. We suffered a comprehensive net loss of $213,912 and $268,047 for the three months ended April 30, 2019, and 2018,

respectively. The decrease in gross loss is primarily attributable to the decrease of general and administrative expenses.

Nine

Months Ended April 30, 2019, Compared to Nine Months Ended April 30, 2018

Revenues.

During the nine months ended April 30, 2019, and 2018, we earned revenues of $64,386 and $15,913, respectively. The increase

in revenues is primarily attributable to IT service fees rendered during the period.

During the nine months

ended April 30, 2019, and 2018, the following customers accounted for 10% or more of our total net revenues:

| | |

Nine months ended April 30, 2019 | | |

Nine months ended April 30, 2018 | |

| | |

Revenues | | |

Percentage of revenues | | |

Revenues | | |

Percentage of revenues | |

| North Cloud Sdn Bhd | |

$ | 26,662 | | |

| 41.4% | | |

$ | – | | |

| – | |

| MIG O2O Berhad | |

| 19,391 | | |

| 30.1% | | |

| – | | |

| – | |

| MIG Network & Consultancy Sdn Bhd | |

| 8,483 | | |

| 13.2% | | |

| 13,334 | | |

| 83.8% | |

| WPAY International Berhad | |

| 8,962 | | |

| 13.9% | | |

| – | | |

| – | |

| | |

| 63,499 | | |

| | | |

| 13,334 | | |

| | |

MIG O2O Berhad, MIG Network & Consultancy

Sdn Bhd and WPAY International Berhad are affiliated with our executive officers and directors, Shiong Han Wee and Kwueh Lin Wong.

North Cloud Sdn Bhd is a shareholder holding less than 5% of our issued and outstanding securities.

General

and Administrative Expenses. Operating expenses were $995,763 and $1,282,914 for the nine months ended April 30,

2019, and 2018, respectively. The decrease in operating expenses was primarily attributable to decrease in marketing and payroll

expenses.

During the nine months

ended April 30, 2019 and 2018, no vendors accounted for 10% or more of our total operating costs.

Gross Profit.

We recorded a gross profit of $54,144 and gross loss of $54,342 for the nine months ended April 30, 2019, and 2018, respectively.

The increase in gross profit is mainly attributable to the decrease in cost of revenue due to restructuring of incentives given

to merchants and users in our ecosystem.

Income Tax Expense.

We did not record income tax expenses for the nine months ended April 30, 2019, and 2018 respectively.

Comprehensive

Loss. We suffered a net loss of $931,301 and $1,273,549 for the nine months ended April 30, 2019, and 2018, respectively.

The decrease in comprehensive loss is primarily attributable to the decrease of general and administrative expenses.

Liquidity

and Capital Resources

Working Capital

| | |

April 30, 2019 | | |

July 31, 2018 | |

| Current Assets | |

$ | 460,843 | | |

$ | 804,239 | |

| Current Liabilities | |

| 1,215,631 | | |

| 638,275 | |

| Working Capital (Deficit)/Surplus | |

$ | (754,788 | ) | |

$ | 165,964 | |

We had current assets

of $460,843 consisting primarily of inventories of $3,228, account receivables of $1,907, other receivables, deposits and prepayments

of $448,583, amount due to related parties of $3,409 and cash and cash equivalents of $3,716 as of April 30, 2019. Our current

liabilities consisted of $909,480 of amount due to related parties, $211,721 of other payables and accruals, $21,210 of current

tax liabilities and $73,220 of account payables.

As of July 31, 2018,

we had current assets of $804,239 and current liabilities of $638,275. Our current assets consisted of $748,260 of other receivables,

deposits and prepayments, $38,353 of amount due from related parties, $14,159 of cash and cash equivalents, $3,288 of inventories

and $179 of trade receivables. Our current liabilities consisted of $323,424 of amount due to related parties, $250,624 of other

payables and accruals, $51,920 of amounts due to directors, $10,792 of current tax liabilities and $1,515 of trade payables.

Cash Flows

| | |

Nine Months

Ended | | |

Nine Months

Ended | |

| | |

April 30, 2019 | | |

April 30, 2018 | |

| Net Cash Used in Operating Activities | |

$ | (11,812 | ) | |

$ | (2,614,555 | ) |

| Net Cash Provided By / (Used In) Investing Activities | |

$ | 1,591 | | |

$ | (66,194 | ) |

| Net Cash Provided by Financing Activities | |

$ | – | | |

$ | 2,629,433 | |

| Effects on changes in foreign exchange rate | |

$ | (222 | ) | |

$ | – | |

| Net decrease in cash and cash equivalents | |

$ | (10,221 | ) | |

$ | (51,316 | ) |

Cash Flow from

Operating Activities

During

the nine months ended April 30, 2019, net cash used in operating activities was $11,812, compared to $2,614,555 for the nine months

ended April 30, 2018. Net cash used in operating activities during the nine months ended April 30, 2019 consisted primarily of

a net loss of $941,081, a decrease in account receivables of $1,735, a decrease in other receivables, deposits and prepayments

of $15,345, a decrease in amount due to directors of $51,100, a decrease in other payables and accrued liabilities of $24,637,

gain on disposal of $504, foreign translation reserve of $2,670, offset by an increase in amount due to related parties of $630,658,

an increase of account payables of $71,834, impairment of $302,134 and depreciation of plant and equipment of 20,634.

Net

cash used in operating activities during the nine months ended April 30, 2018 consisted primarily of a net loss of $1,263,717,

a decrease in account receivables of $695,936, a decrease in amount due to directors of $144,916, a decrease in account payables

of $922,284, foreign translation reserve of $66,325 and gain on disposal of $539, offset by an increase of other receivables,

deposits and prepayments of $3,258, an increase in amount due to related parties of $400,194, depreciation of plant and equipment

of $22,342, plant and equipment written off of $51,868 and donated services and rent of $1,500.

Cash Flow from

Investing Activities

During

the nine months ended April 30, 2019, there was net cash generated from investing activities of $1,591 consisted of sales proceeds

from disposal of property, plant and equipment of $2,087 and offset by $496 from purchase of plant and equipment.

During

the nine months ended April 30, 2018, there was net cash used from investing activities of $66,194 consisted of purchase of plant

and equipment of $67,707, offset by $1,513 of sales proceeds from disposal of property, plant and equipment.

Cash

Flow from Financing Activities

During

the nine months ended April 30, 2019, financing activities did not provide any net cash.

During

the nine months ended April 30, 2018, there was net cash generated from financing activity of $2,629,433 which primarily consisted

of issued of share capital of $2,629,433.

Financing Requirements

During the twelve-month

period following the date of this quarterly report, we anticipate that we will not generate sufficient operating revenue. Accordingly,

we will be required to obtain additional financing in order to pursue our plan of operations during and beyond the next twelve

months. We anticipate that additional funding will be in the form of equity financing from the sale of our common stock or shareholder

loans. However, there is no assurance that we will be able to raise sufficient funding from the sale of our common stock to fund

our business plan should we decide to proceed.

We anticipate continuing

to rely on equity sales of our common shares and advances from our executive officers and directors in order to continue to fund

our business operations. Issuances of additional shares will result in dilution to our existing shareholders. There is no assurance

that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our business

operations.

Off-Balance Sheet Arrangements

We have no significant

off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition,

changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources

that is material to stockholders.

Critical Accounting Policies

The preparation of

financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”)

requires estimates and assumptions that affect the reported amounts of assets and liabilities, revenues and expenses, and related

disclosures of contingent assets and liabilities in the consolidated financial statements and accompanying notes. The SEC has defined

a company’s critical accounting policies as the ones that are most important to the portrayal of the company’s financial

condition and results of operations, and which require the company to make its most difficult and subjective judgments, often as

a result of the need to make estimates of matters that are inherently uncertain. Based on this definition, we have not identified

any additional critical accounting policies and judgments. We also have other key accounting policies, which involve the use of

estimates, judgments and assumptions that are significant to understanding our results, which are described in note 2 to our financial

statements. Although we believe that our estimates, assumptions and judgments are reasonable, they are based upon information presently

available. Actual results may differ significantly from these estimates under different assumptions, judgments or conditions.

Recent accounting pronouncements

The Company has reviewed

all recently issued, but not yet effective, accounting pronouncements and do not believe the future adoption of any such pronouncements

may be expected to cause a material impact on its financial condition or the results of its operations.

| ITEM 3 | Quantitative and Qualitative Disclosures about Market

Risk |

We are a smaller reporting

company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

| ITEM 4 | Controls and Procedures |

Conclusion Regarding the Effectiveness

of Disclosure Controls and Procedures

We conducted an evaluation

of the effectiveness of the design and operation of our disclosure controls and procedures, as such term is defined under Rule

13a-15(e) promulgated under the Securities Exchange Act of 1934, as amended (Exchange Act), under the supervision of and with the

participation of our management, including the Chief Executive Officer and Chief Financial Officer. Based on that evaluation, our

management, including the Chief Executive Officer and Chief Financial Officer, concluded that our disclosure controls and procedures,

subject to limitations as noted below, as of April 30, 2019, and during the period prior to and including the date of this report,

were effective to ensure that all information required to be disclosed by us in the reports that we file or submit under the Exchange

Act is: (i) recorded, processed, summarized and reported, within the time periods specified in the Commission’s rule and

forms; and (ii) accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer,

as appropriate to allow timely decisions regarding required disclosure.

Inherent Limitations

Because of its inherent

limitations, our disclosure controls and procedures may not prevent or detect misstatements. A control system, no matter how well

conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met.

Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control

issues and instances of fraud, if any, have been detected. Also, projections of any evaluation of effectiveness to future periods

are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance

with the policies and procedures may deteriorate.

Changes in Internal Control over Financial

Reporting

Our annual report on

Form 10-K reported that our internal control over financial reporting was effective as of July 31, 2018. Subject to the foregoing

disclosures in this Item 4, there were no changes in our internal control over financial reporting that occurred during our fiscal

quarter ended April 30, 2019, that materially affected, or are reasonably likely to materially affect, our internal control over

financial reporting.

PART II OTHER INFORMATION

On November 12, 2018,

MIG Mobile Tech Berhad, a subsidiary of the Company, filed a claim against Digiland Private Limited (“Digiland”) for

breach of contract and misrepresentation arising from, among other things, Digiland’s failure to perform under its supplier

contract with the Company. In its suit, MIG Mobile Tech Berhad is seeking a return of funds previously paid to Digiland in the

amount of S$800,000 Singapore Dollars (approximately US $596,000) together with a claim for damages to be assessed by the Singapore

Court. Within the same suit, Digiland has filed a counterclaim against MIG Mobile Tech Berhad for the balance of the payment due

to it under contract in the sum of S$800,000, together with a claim for damages to be assessed by the Singapore Court. This matter

is more fully described in Note 5 Legal Proceedings of Notes to our Consolidated Financial Statements.

Other than the item

set forth in Note 5 Legal Proceedings of Notes to our Consolidated Financial Statements, we are not a party to any legal

or administrative proceedings that we believe, individually or in the aggregate, would be likely to have a material adverse effect

on our financial condition or results of operations.

None.

| ITEM 2 | Unregistered Sales of Equity Securities and Use of

Proceeds |

None.

| ITEM 3 | Defaults upon Senior Securities |

None.

| ITEM 4 | Mine Safety Disclosures |

Not applicable.

None.

| Notes: |

| (1) |

Incorporated by reference from our Definitive Information Statement filed with the Securities and Exchange Commission on October 18, 2017. |

| (2) |

Incorporated by reference from our Registration Statement on Form SB-2 filed with the Securities

and Exchange Commission on October 1, 2007. |

| (3) |

Incorporated by reference from our Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on March 14, 2019. |

| (4) |

Incorporated by reference from our Current Report on Form 8-K filed with the Securities and Exchange Commission on September 22, 2017. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

WECONNECT TECH INTERNATIONAL, INC. |

| |

|

| |

|

| |

By: |

/s/

Shiong Han Wee |

| |

|

Shiong Han Wee |

| |

|

Chief Executive Officer |

| |

|

|

| |

|

|

| |

|

| |

|

| Date: June 11, 2019 |

|