Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-33843

Synacor, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 16-1542712 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

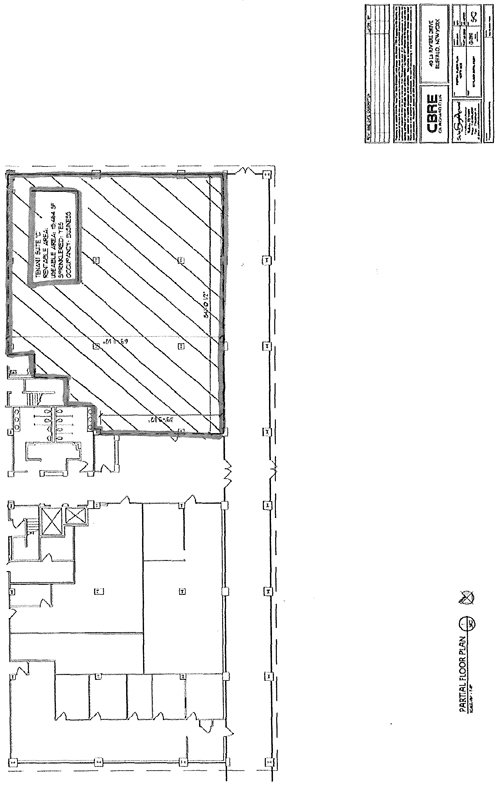

| 40 La Riviere Drive, Suite 300 Buffalo, New York |

14202 | |

| (Address of principal executive offices) | (Zip Code) | |

(716) 853-1362

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| (Title of each class) |

(Name of each exchange on which registered) | |

| Common Stock, $0.01 par value | The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None.

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of shares of common stock held by non-affiliates as of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, computed by reference to the closing sale price of $1.61 per share on The Nasdaq Global Market on June 30, 2015, was approximately $36,999,903. For purposes of this disclosure, shares of common stock held by persons who held more than 10% of the outstanding shares of common stock at such time and shares held by executive officers and directors of the registrant have been excluded because such persons may be deemed to be affiliates. This determination of executive officer or affiliate status is not necessarily a conclusive determination for other purposes.

As of March 3, 2016, there were 30,023,414, shares of the registrant’s common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the definitive Proxy Statement to be used in connection with the registrant’s 2016 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K to the extent stated. That Proxy Statement will be filed within 120 days of registrant’s fiscal year ended December 31, 2015.

Table of Contents

| PART I | ||||

| Item 1. | 3 | |||

| Item 1A. | 11 | |||

| Item 1B. | 32 | |||

| Item 2. | 33 | |||

| Item 3. | 33 | |||

| Item 4. | 33 | |||

| PART II | ||||

| Item 5. | 34 | |||

| Item 6. | 36 | |||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

40 | ||

| Item 7A. | 56 | |||

| Item 8. | 57 | |||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

57 | ||

| Item 9A. | 57 | |||

| Item 9B. | 57 | |||

| PART III | ||||

| Item 10. | 58 | |||

| Item 11. | 58 | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

58 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

58 | ||

| Item 14. | 58 | |||

| PART IV | ||||

| Item 15. | 59 | |||

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes forward-looking statements that reflect our current views with respect to future events or our future financial performance, are based on information currently available to us, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements, including statements containing the words “believes,” “can,” “expects,” “anticipates,” “estimates,” “intends,” “objective,” “plans,” “possibly,” “potential,” “predicts,” “targets,” “likely,” “may,” “might,” “would,” “should,” “could,” and similar expressions or phrases (including the negatives of such expressions or phrases). We intend all such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements in the sections of this Annual Report on Form 10-K titled “Trends Affecting Our Business” and “Key Initiatives” as well as statements about:

| • | our expected future financial performance; |

| • | our expectations regarding our operating expenses; |

| • | our strategies and business plan; |

| • | our ability to maintain or broaden relationships with existing customers and develop relationships with new customers; |

| • | our success in anticipating market needs or developing new or enhanced services and products to meet those needs; |

| • | our expectations regarding market acceptance of our services and products; |

| • | our ability to recruit and retain qualified technical and other key personnel; |

| • | our competitive position in our industry, as well as innovations by our competitors; |

| • | our success in managing growth; |

| • | our expansion in international markets; |

| • | our ability to successfully integrate assets and personnel from our acquisitions; |

| • | our success in identifying and managing potential acquisitions; |

| • | our capacity to protect our confidential information and intellectual property rights; |

| • | our need to obtain additional funding and our ability to obtain funding in the future on acceptable terms; and |

| • | anticipated trends and challenges in our business and the markets in which we operate. |

Any forward-looking statements contained in this Annual Report on Form 10-K are based upon our historical performance and our current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. All forward-looking statements involve risks, assumptions and uncertainties. Given these risks, assumptions and uncertainties, you should not place undue reliance on any forward-looking statements. The occurrence of the events described, and the achievement of the expected results, depend on many factors, some or all of which are not predictable or within our control.

Actual results may differ materially from expected results. See “Risk Factors” and elsewhere in this Annual Report on Form 10-K for a more complete discussion of these risks, assumptions and uncertainties and for other risks, assumptions and uncertainties. These risks, assumptions and uncertainties are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements.

1

Table of Contents

Other unknown or unpredictable factors also could harm our results. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Annual Report on Form 10-K might not occur, and we therefore qualify all of our forward-looking statements by these cautionary statements. Any forward-looking statement made by us in this Annual Report on Form 10-K speaks only as of the date on which it is made. Except as required by law, we undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Unless expressly indicated or the context requires otherwise, the terms “Synacor,” “Company,” “we,” “us,” and “our” in this document refer to Synacor, Inc., a Delaware corporation, and, where appropriate, our wholly-owned subsidiaries.

2

Table of Contents

PART I

| ITEM 1. | BUSINESS |

Our Business

We enable our customers to better engage with their consumers. Our customers include video, internet and communications providers, device manufacturers and enterprises. We are their trusted technology development, multiplatform services and revenue partner.

We enable our customers to provide their consumers engaging, multiscreen experiences with products that require scale, actionable data and sophisticated implementation. Through our Managed Portals and Advertising solutions, we enable our customers to earn incremental revenue by monetizing media among their consumers. At the same time, because consumers have high expectations for their online experience as a result of advances in video, mobile and social, we provide, through our Recurring and Fee-Based Revenue solutions, a suite of products and services that helps our customers successfully meet those high expectations by enabling them to deliver to their consumers access to the same digital content across all devices, including PCs, tablets, smartphones and connected TVs.

Products and Services

Our Managed Portals and Advertising solutions provide our customers with substantial revenue opportunities generated by their consumers’ engagement across devices. This business generated 71% of our revenue for 2015.

Our Managed Portals are intended to be daily destinations for consumers and are delivered across devices and under our customers’ own brand names. To help our customers increase their consumers’ engagement, we deliver relevant content, such as top news, entertainment, and long- and short-form video and apps, on our Managed Portals. We have licensing and distribution agreements with a wide range of programmers and content and service providers. In addition, consumers have the ability through our portals to manage their email and messaging, pay bills, receive special promotions and perform other account management needs.

We monetize the online traffic generated by consumers through search advertising, digital advertising (including video), and syndicated content on our Managed Portals. As we monetize our customers’ online traffic on our Managed Portals, we share a portion of this revenue with our customers, resulting in a mutually beneficial partnership.

Our Recurring and Fee-Based Revenue solutions generated 29% of our revenue for 2015 and are comprised of our End-to-End Advanced Video Services, Email/Collaboration Services, and paid content and premium services:

| • | End-to-End Advanced Video Services include our Cloud ID Authentication Platform and Search & Discovery Metadata Platform. Our End-to-End Advanced Video Services offering is a highly-reliable, economically efficient, managed service that enables our customers to provide their consumers with TV Everywhere and multiscreen Over The Top (OTT) services. |

Cloud ID Authentication

Consumers can watch TV on a myriad of devices, but many find the login process frustrating. Synacor Cloud ID addresses this issue by offering home-based auto-authentication and social login, which improve the consumer experience by reducing login failures.

Search & Discovery Metadata Platform

Once a consumer is authenticated, our Search & Discovery Metadata Platform helps them find their desired content successfully and easily. We curate videos every day and have compiled more than

3

Table of Contents

800,000 long- and short-form videos from hundreds of sources. We believe that we fill an important role for our customers as use of streaming video increases and consumers’ video content consumption preferences shift away from traditional viewing habits.

| • | Our Email/Collaboration Services include white-label hosting, security and migration. With the acquisition of certain assets related to the Zimbra Email/Collaboration products and services business (the “Zimbra assets” or “Zimbra”) in 2015, our software and managed service offering now supports a network of over 1,000 value-added resellers, or VARs, over 500 Business Service Providers, or BSPs, and over 3,500 enterprise, government and nonprofit customers, and it powers approximately 500 million mailboxes. |

Recent Developments

On February 26, 2016, we completed the acquisition of certain assets from Technorati, Inc., or Technorati, an advertising technology company. Combining Technorati’s publisher network, proprietary SmartWrapper solution and other advertising technology with our existing network of Managed Portals and Advertising solutions and our monetization engine creates a large-scale media solutions platform that enables our customers to increase engagement with their consumers and further monetize that engagement. We expect the acquisition of Technorati to drive additional advertising demand, to accelerate our content and advertising syndication strategy by giving us access to over 1,000 new publishers; and to add new tools for publishers to our platform.

Our Strategy

Our strategy is, with operational and financial discipline, to:

| • | increase value for existing customers by optimizing consumer experience and monetization; |

| • | innovate on Synacor-as-a-platform for advanced services; |

| • | win new customers in current and related verticals; and |

| • | extend our product portfolio into emerging growth areas. |

Increasing value for existing customers by optimizing user experience and monetization

With respect to our Managed Portals and Advertising solutions, 80% of our customers’ consumers have upgraded to our latest-generation portal, driving an 11% increase in year-over-year engagement. Our portal, with its engaging user experience and responsive design for desktop and mobile web, and our mobile apps, have video threaded throughout and is designed to optimize consumer engagement and monetization. We are also decreasing the implementation time for customers to launch our latest-generation portal.

Innovating on Synacor-as-a-platform for advanced services

Our Cloud ID Authentication platform is reported as having some of the highest consumer login success rates in the industry.

We believe we fill an important role as the number of streaming video consumers increases because we believe that our customers are looking for a single vendor with whom to work, not a balkanized group of vendors. We created a professional services team to work with partners to support the delivery of our End-to-End Advanced Video Services. Our acquisition of the assets of NimbleTV in 2015 also resulted in innovation in our End-to-End Advanced Video Services. Our acquisitions of the Zimbra assets in 2015 and certain assets from Technorati in 2016 resulted in innovations in our email/collaboration and digital advertising capabilities, respectively.

4

Table of Contents

Winning new customers in current and related verticals

We have an established presence among broadband and pay-TV providers in the U.S. and Canada. Some of these providers use our complete suite of solutions, and others use only certain components. We view this as a growth opportunity within our existing customer base.

We also are expanding the definition of the “Portal” to include widgets, syndicated content, or thematic mobile apps, which gives us opportunities to syndicate our products to new verticals and publishers.

Extending our product portfolio into emerging growth areas

We plan to capitalize on opportunities such as international expansion and delivery of business services. Through our acquisition of the Zimbra assets we have expanded our international customer base, and we believe this represents an opportunity to find new customers for our Managed Portals and Advertising solutions.

Technology and Operations

Technology Architecture

To route traffic through our network in the most efficient manner, we use load-balancing products. These products spread work among multiple servers and link controllers that monitor the availability and performance of multiple connections. Our technology is reliable, fault tolerant and scalable through the addition of more servers as usage grows.

Data Center Facilities

We currently operate and maintain six data centers in regionally diverse locations and have a network operations center that is staffed 24 hours a day, seven days a week. Our primary data centers are located in shared facilities in Atlanta, Georgia; Dallas, Texas; Lewis Center, Ohio; Denver, Colorado; Toronto, Canada and Amsterdam, The Netherlands. All systems are fully monitored for reporting continuity and fault isolation. The data centers are each in a physically secure facility using monitoring, environmental alarms, closed circuit television and redundant power sources. Our network operations center also is located in a secure facility.

Customers

Our Managed Portals and Advertising customers principally consist of high-speed internet service providers, such as Cequel Communications, LLC, or Suddenlink Communications, Mediacom Communications Corporation and CenturyLink, Inc., or CenturyLink, as well as consumer electronics manufacturers, such as Toshiba America Information Systems, Inc., or Toshiba. Contracts with these customers typically have an initial term of two to three years from the deployment of our Managed Portals and frequently provide for one or more automatic renewal terms of one to two years each. Our Managed Portals and Advertising customer contracts typically contain service level agreements that call for specific system “up times” and 24 hours per day, seven days per week support. As of December 31, 2015, we had agreements with over 50 Managed Portals and Advertising customers.

Our Recurring and Fee-Based customers consist of high-speed internet service providers along with enterprises, government and nonprofit organizations, either directly or through resellers. Contracts with these customers typically have an initial term of one to three years and frequently provide for one or more automatic renewal terms of one to two years each. Our Recurring and Fee-Based customer contracts also typically contain service level agreements that call for specific system “up times” and 24 hours per day, seven days per week support. As of December 31, 2015, we had agreements, both directly and indirectly through resellers, with over 120 high-speed internet service providers and over 3,500 enterprise, government and nonprofit customers.

5

Table of Contents

Revenue attributable to CenturyLink, Toshiba and Verizon together accounted for approximately 49% of our revenue, or $53.5 million for the year ended December 31, 2015. For 2015, revenue attributable to one of these customers accounted for 20% or more of our revenue, and to each of the other two customers accounted for more than 10% of our revenue.

Content and Service Providers

We license the content available in our Managed Portals, including free and paid content offerings and premium services, from numerous third-party content and service partners. These partners provide a variety of content, including news and information, entertainment, sports, music, video, games, shopping, travel, autos, careers and finance. Our relationships with content providers give consumers access to over one hundred thousand short-form video and articles each month. To obtain this content, we enter into a variety of licensing arrangements with the content providers. These arrangements are typically one to three years in duration with payment terms that may be based on traffic, advertising revenue share, number of subscribers, flat fee payments over time, or some combination thereof. In addition to using licensed content to populate our Managed Portals, we also provide premium services and paid content that subscribers may purchase for additional fees. As of December 31, 2015, we had arrangements with over 50 content providers, such as The Associated Press, CNN, Tribune Content Agency, Gracenote, and Bankrate.

Sales and Marketing

Managed Portals and Advertising Solutions

Our sales and marketing efforts focus on five primary areas: customer acquisitions, client services, account management, marketing and advertising sales. Our customer acquisition team consists of direct sales personnel who call upon prospective customers, typically large and mid-sized high-speed internet service providers and consumer electronics manufacturers. A significant amount of time and effort is devoted to researching and analyzing the requirements and objectives of each prospective customer. Each bid is specifically customized for the prospective customer, and often requires many months of interaction and negotiation before an agreement is reached.

Once an agreement is reached, our client services team, working closely with the customer acquisition team, assumes responsibility for managing the customer relationship during the time of the initial deployment and integration period, which is usually three to six months. During this period, the customer’s technology is assessed and, if required, modifications are proposed to make it compatible with our technology. The client services team is responsible for the quality of the client deployment, customer relationship management during the time of deployment, and integration and project management associated with upgrades and enhancements.

After deployment, our account management team takes over management of the customer relationship, analyzing the ways in which a customer could further benefit from increased use of our products and services. The account management team is responsible for ongoing customer relationship management, upgrades and enhancements to the available products and services, as well as tracking the financial elements and performance of the customer relationship.

Our marketing team works closely with our account management team to deliver marketing programs that support our customers’ sales efforts as well as their consumers’ interaction with these products and services. We assist our customers in developing marketing materials and advertising that can be accessed by consumers through different media outlets, including the internet, print, television and radio. We also assist our customers in training their customer service representatives to introduce and sell premium services and our paid content offerings to new and existing customers.

Our advertising sales team sells advertising inventory directly to advertisers, frequently through the advertising agencies representing those advertisers. These advertisers may be small companies with the advertising locally or regionally focused on the Managed Portals of one customer, or large companies with

6

Table of Contents

nationwide advertising on the Managed Portals of many customers. We have a team of direct advertising sales employees and independent advertising sales representatives focused on this effort and will continue to develop this team and attempt to grow the amount of advertising revenue generated with our customers. As of December 31, 2015, we had arrangements with over 50 advertising partners such as DoubleClick, NCC Media, Criteo, Razorfish and Comcast Spotlight.

Email/Collaboration

We market our Email/Collaboration product through both direct and indirect sales channels. Our regional sales and marketing teams host several events each year with partners and run various campaigns to generate sales leads. Once a lead has been identified, our internal sales representatives work closely with our regional partners on better identifying the opportunity and gathering customer requirements.

We sell to internet service providers primarily through a direct sales force consisting of regional account executives. Sales cycles can be six months or longer. We sell to prospective government, nonprofit and enterprise customers through a two-tier indirect model via over 1,000 VARs and over 500 BSPs. Our VARs sell on-premise licenses to end customers while our BSPs sell a cloud service to the end customer. Sales cycles can range from thirty days to six months, depending on size and scope.

Government Regulation

We generally are not regulated other than under international, federal, state and local laws applicable to the internet or e-commerce or to businesses in general. Some regulatory authorities have enacted or proposed specific laws and regulations governing the internet and online entertainment. These laws and regulations cover issues such as taxation, pricing, content, distribution, quality and delivery of services and products, electronic contracts, intellectual property rights, user privacy and information security.

Federal laws regarding the internet that could have an impact on our business include the following: the Digital Millennium Copyright Act of 1998, which is intended to reduce the liability of online service providers of third-party content, including content that may infringe copyrights or rights of others; the Children’s Online Privacy Protection Act, which imposes additional restrictions on the ability of online services to collect user information from minors; and the Protection of Children from Sexual Predators Act, which requires online service providers to report evidence of violations of federal child pornography laws under certain circumstances.

Laws and regulations regarding user privacy and information security impact our business because we collect and use personal information through our technology. We use this information to deliver more relevant content and services and provide consumers with a personalized online experience. We share this information on an aggregate basis with our customers and content providers and, subject to confidentiality agreements, to prospective customers and content providers. Laws such as the CAN-SPAM Act of 2003 or other user privacy or security laws could restrict our and our customers’ ability to market products to their consumers, create uncertainty in internet usage and reduce the demand for our services and products or require us to redesign our Managed Portals.

Intellectual Property

We believe that the protection of our intellectual property is critical to our success. We rely on copyright, service mark and patent enforcement, contractual restrictions and trade secret laws to protect our proprietary rights. We have entered into confidentiality and invention assignment agreements with our employees and contractors, and nondisclosure agreements with certain parties with whom we conduct business in order to limit access to, and disclosure of, our proprietary information. In 2015, we acquired intellectual property, including patents and trademarks, through our acquisitions of assets from NimbleTV and Zimbra. Additionally, we have applied for patents to protect certain of our intellectual property. Our registered service mark in the United States is Synacor®.

7

Table of Contents

We endeavor to protect our internally-developed systems and maintain our trademarks and service marks. We generally control access to and use of our proprietary software and other confidential information through the use of internal and external controls, including contractual protections with employees, contractors, customers and partners, and our software is protected by United States and international copyright laws.

In addition to legal protections, we believe that factors such as the technological and creative skills of our personnel, new product developments, frequent product enhancements and reliable product support and services are essential to establishing and maintaining a technology leadership position.

Competition

The market for internet-based services and products in which we operate is highly competitive and involves rapidly-changing technologies and customer and consumer requirements, as well as evolving industry standards and frequent product introductions. While we believe that our technology offers considerable value and flexibility to our customers by helping them to extend their consumer relationships to a wide variety of internet-based services, we face competition at four levels:

| • | When one of our prospective or existing customers considers another supplier, including one of our partners, for elements of the services or products which we provide. |

| • | When consumers choose to rely on other vendors for similar products and services. |

| • | When content and service providers prefer to establish direct relationships with one or more of our customers. |

| • | When one of our customers decides to make the significant headcount and technology investment to develop products and services in-house similar to those that we provide. |

Our technology competes primarily with high-speed internet service providers that have internal information technology staff capable of developing similar solutions in-house.

Managed Portals and Advertising Solutions

In addition, with respect to our Managed Portals and Advertising solutions, we compete with companies such as Facebook, Inc.; Yahoo! Inc. or Yahoo!; Google; AOL, a division of Verizon, or AOL; Hulu; Netflix; Amazon; and MSN, a division of Microsoft Corporation, or Microsoft, which have destination websites of their own or are capable of delivering content, service offerings and search or advertising models similar to ours.

We also compete with providers of paid content and services over the internet, especially companies with the capability of bundling paid content and premium services in much the same manner that we do. These companies include ESPN3, F-Secure Corporation, Exent Technologies Ltd., Zynga Inc., MLB Advanced Media, Symantec Corporation, McAfee, Inc., Activision Blizzard, Inc. and Electronic Arts Inc. In some cases we have performed software integrations with these companies on behalf of our customers or, as in the case of F-Secure Corporation, we have partnered with them in order to offer their services more broadly to all our customers.

We believe the principal competitive factors in our markets include a company’s ability to:

| • | reinforce the brands of our cable, satellite, telecom and consumer electronics customers; |

| • | produce products that are flexible and easy to use; |

| • | offer competitive fees for Managed Portal development and operation; |

| • | generate additional revenue for our customers; |

| • | enable our customers to be involved in designing the “look and feel” of their online presence; |

| • | offer services and products that meet the changing needs of our customers and their consumers, including emerging technologies and standards; |

8

Table of Contents

| • | provide high-quality product support to assist the customer’s service representatives; and |

| • | aggregate content to deliver more compelling bundled packages of paid content. |

We believe that we distinguish ourselves from potential competitors in three principal ways. First, we provide a white-label solution that, unlike the co-branded approach of most of our competitors, creates a consumer experience that reinforces our customers’ and partners’ brands. Second, we give customers control over the sign-on process and billing function for a wide range of internet services and content by integrating with their internal systems (where applicable) thereby allowing our customers to “own the consumer.” Finally, our solutions are flexible and neutral, meaning that we allow deliverables that are customized to our customers’ specific needs, as well as advanced video solutions that are either end-to-end or a la carte.

Email/Collaboration

With respect to our Email/Collaboration solutions, we compete primarily with Google and Microsoft in the enterprise and government markets, and with Open-Xchange and OpenWave in the internet service provider markets.

We believe the principal competitive factors in the email/collaboration market include a company’s ability to:

| • | provide customers the ability to perform security and compliance audits of our source code; |

| • | deliver anti-spam, anti-virus and encryption technologies; |

| • | provide products and services at lowest possible total cost of ownership (TCO); |

| • | provide local partners the ability to store data within the legal jurisdiction of the country where their consumers do business; |

| • | provide an enterprise-ready solution suitable for large-scale deployments including such enterprise features such as delegated administration, detailed logging, and performance and availability transparency; |

| • | offer access to real-time performance and availability statistics; |

| • | afford customers and partners the ability to rebrand their cloud collaboration experience; and |

| • | make available to partners both integrations and extensions to the collaboration cloud environment specific to consumers’ needs. |

We believe that we distinguish ourselves from potential competitors in several ways. First, we offer our Email/Collaboration products and services a la carte, enabling consumers to buy only the services they need, providing for a much lower TCO. Second, our Zimbra Email/Collaboration solution is a complete feature-rich, enterprise-ready solution scalable up to 40 million mailboxes. Finally, our products are customizable and extendable and designed to meet very high standards of security.

Employees

As of December 31, 2015, we had 284 employees in the United States and 103 based internationally. None of our employees are represented by a labor union, and we consider current employee relations to be good.

Corporate Information

Synacor’s predecessor company was originally formed as a New York corporation, and in November 2002, Synacor re-incorporated under the laws of the State of Delaware. Our headquarters are located at 40 La Riviere Drive, Buffalo, New York 14202, and our telephone number is (716) 853-1362.

9

Table of Contents

We have determined that we have a single reporting segment. A summary of our financial information by geographic location is found in Note 7, Information About Segment and Geographic Areas, in the Notes to Consolidated Financial Statements. Our international operations and sales subject us to a variety of risks; see Item 1A, “Risk Factors,” for further discussion.

Available Information

Our internet website address is http://www.synacor.com. We provide free access to various reports that we file with or furnish to the Securities and Exchange Commission, or SEC, through our website, as soon as reasonably practicable after they have been filed or furnished. These reports include, but are not limited to, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports. Our SEC reports can be accessed through the investor relations section of our website, or through http://www.sec.gov. Information on our website does not constitute part of this Annual Report on Form 10-K or any other report we file or furnish with the SEC. Stockholders may request copies of these documents from:

Synacor, Inc.

Investor Relations Department

40 La Riviere Dr.

Suite 300

Buffalo, New York 14202

10

Table of Contents

| ITEM 1A. | RISK FACTORS |

Our business and financial results are subject to numerous risks and uncertainties, including those described below, which could adversely and materially affect our business, financial condition or results of operations. You should carefully consider these risks and uncertainties, including the following risk factors and all other information contained in this Annual Report on Form 10-K, together with any other documents we file with the SEC.

Risks Related to Our Business

Our search advertising partner, Google, accounts for a significant portion of our revenue, and any loss of, or diminution in, our business relationship with Google would materially and adversely affect our financial performance.

We rely on traffic on our Managed Portals to generate search and digital advertising revenue, a substantial portion of which is derived from text-based links to advertisers’ websites as a result of internet searches. We have a revenue-sharing relationship with Google under which we include a Google-branded search tool on our Managed Portals. When a consumer makes a search request using this tool, we deliver it to Google, and Google returns search results to us that include advertiser-sponsored links. If the consumer clicks on a sponsored link, Google receives payment from the sponsor of that link and shares a portion of that payment with us. We then typically share a portion of that payment with the applicable customer. Our Google-related search advertising revenue attributable to our customers, which consists of the portion of the payment from the sponsor that Google shares with us, accounted for approximately 51%, 42%, and 28% of our revenue in 2013, 2014, and 2015 or $57.5 million, $45.4 million, and $31.2 million respectively. Our agreement with Google was renewed in March 2014 for a three year term and expires in February 2017 unless we and Google mutually elect to renew it. Additionally, Google may terminate our agreement if we experience a change in control, if we enter into an agreement providing for a change in control, if we do not maintain certain search and digital advertising revenue levels or if we fail to conform to Google’s search policies and advertising policies. Google may from time to time change its existing, or establish new, methodologies and metrics for valuing the quality of internet traffic. Any changes in these methodologies, metrics and advertising technology platforms could decrease the advertising rates that we receive and/or the amount of revenue that we generate from digital advertisements. If advertisers were to discontinue their advertising via internet searches, if Google’s revenue from search-based advertising were to decrease, if Google’s share of the search revenue were to be increased or if our agreement with Google were to be terminated for any reason or renewed on less favorable terms, our business, financial condition and results of operations would be materially and adversely affected. Moreover, consumers’ increased use of search tools other than the Google-branded search tool we provide would have similar effects.

A loss of any significant Managed Portals and Advertising customer could negatively affect our financial performance.

We derive a substantial portion of our revenue from a small number of Managed Portal customers. Revenue attributable to these customers includes the Recurring and Fee-Based revenue earned directly from them, as well as the search and digital advertising revenue earned through our relationships with our advertising partners, such as Google, based on traffic generated from our Managed Portals. Revenue attributable to Charter Communications, Inc., or Charter Communications, CenturyLink, Toshiba and Verizon Services Group, Inc., or Verizon, together accounted for approximately 68% and 67% of our revenue, or $75.6 million and $71.1 million for the years ended December 31, 2013 and 2014 respectively. For each period, revenue attributable to one of these customers accounted for 20% or more of our revenue, and to each of the other three customers accounted for more than 10% of our revenue. Revenue attributable to CenturyLink, Toshiba and Verizon together accounted for approximately 49% of our revenue, or $53.5 million for the year ended December 31, 2015. For 2015, revenue attributable to one of these customers accounted for 20% or more of our revenue, and to each of the other two customers accounted for more than 10% of our revenue.

11

Table of Contents

Our contracts with our Managed Portals and Advertising customers generally have an initial term of approximately two to three years from the launch of their Managed Portals and frequently provide for one or more automatic renewal terms of one to two years each. If any one of these key contracts is not renewed or is otherwise terminated, or if revenue from these significant customers declines because of competitive or other reasons, our revenue would decline and our ability to achieve or sustain profitability would be impaired. In addition to the loss of Recurring and Fee-Based revenue, we would also lose significant revenue from the related search and digital advertising services that we provide. In addition to the decline of revenue, we may have to impair our long-lived assets, to the extent that such assets are used exclusively to support these customers, which would adversely impact our results of operations and financial position. For example, our agreement with Charter Communications, as amended, enables Charter Communications to terminate certain services under the agreement upon 150 days’ written notice at any time after December 31, 2015 and enabled Charter Communications to terminate certain other services under the agreement (the “Former Services”) upon 45 days’ written notice at any time after September 30, 2015. In September 2015, Charter Communications elected to terminate its agreement with us solely with respect to the Former Services and, per our agreement, paid us an early termination fee. Accordingly, revenue attributable to Charter Communications has declined and we expect it to continue to decline in future periods.

We have a history of significant pre-tax net losses and may not be profitable in future periods, which would limit our ability to use our net operating loss carryforwards.

We have incurred significant losses in each year of operation other than 2009, 2011, and 2012, including a pre-tax net loss of $3.6 million in 2010, a pre-tax net loss of $1.5 million in 2013, a pre-tax net loss of $8.1 million in 2014 and a pre-tax net loss of $3.1 million in 2015. Our pre-tax net income in 2009, 2011, and 2012 was $0.3 million, $3.9 million, and $5.6 million, respectively. We have taken cost saving measures, including a reduction in workforce carried out in September 2014. However, our expenses may increase in future periods as we implement initiatives designed to grow our business including, among other things, acquisitions of complementary businesses (such as our acquisition of the Zimbra assets and our acquisition of certain assets from Technorati), the development and marketing of new services and products, licensing of content, expansion of our infrastructure and international expansion. If our revenue does not sufficiently increase to offset these expected increases in operating expenses, we may incur significant losses and may not be profitable. Although our revenue in 2015 increased as compared to 2014, our revenue in 2015 declined as compared to 2013. We may not be able to return to or maintain profitability in the future. Any failure to achieve or maintain profitability may materially and adversely affect our business, financial condition, results of operations and impact our ability to utilize our net operating loss carryforwards. As a result of our pre-tax cumulative losses, we have established a full valuation allowance against our deferred income tax asset, which includes our net operating loss carryforwards.

Many individuals are using devices other than personal computers and software applications other than internet browsers to access the internet. If users of these devices and software applications do not widely adopt the applications and other solutions we develop for them, our business could be adversely affected.

The number of people who access the internet through devices other than PCs, including tablets, smartphones and connected TVs, has increased dramatically in the past few years and is projected to continue to increase. Similarly, individuals are increasingly accessing the internet through apps other than internet browsers, such as those available for download through Apple Inc.’s App Store and the Android Market. Our Managed Portals include our responsive desktop and mobile web products and also our mobile native iOS and Android apps. If consumers do not use our mobile products at all or use these products less frequently than previously, our financial results could be negatively affected. Additionally, as new devices and new apps are continually being released, it is difficult to predict the problems we may encounter in developing new versions of our apps and other solutions for use on these alternative devices and apps, and we may need to devote significant resources to the creation, support and maintenance of such apps and solutions. If users of these devices and apps do not widely adopt the apps and other solutions we develop, our business, financial condition and results of operations could be adversely affected.

12

Table of Contents

Consumer tastes continually change and are unpredictable, and sales of our Managed Portals and Advertising solutions may decline if we fail to enhance our service and content offerings to achieve continued consumer acceptance.

Our business depends on aggregating and providing services and content that our customers will place on our Managed Portals, including television programming, news, entertainment, sports and other content that their consumers find engaging, and premium services and paid content that their consumers will buy. Accordingly, we must continue to invest significant resources in licensing efforts, research and development and marketing to enhance our service and content offerings, and we must make decisions about these matters well in advance of product releases to implement them in a timely manner. Our success depends, in part, on unpredictable and volatile factors beyond our control, including consumer preferences, competing content providers and websites and the availability of other news, entertainment, sports and other services and content. While we work with our customers to have their consumers’ homepages set to our Managed Portals, a consumer may easily change that setting, which would likely decrease the use of our Managed Portals. Similarly, consumers who change their device’s operating system or internet browser may no longer have our Managed Portals set as their default homepage, and unless they change it back to our Managed Portals, their usage of our Managed Portals would likely decline and our results of operations could be negatively impacted. Consumers who acquire new consumer electronics devices will no longer have our Managed Portals initially set as their default homepage, and unless they change the default to our Managed Portals, their usage of our Managed Portals would likely decline and our results of operations could be negatively impacted.

If our services are not responsive to the requirements of our customers or the preferences of their consumers, or the services are not brought to market in a timely and effective manner, our business, financial condition and results of operations would be harmed. Even if our services and content are successfully introduced and initially adopted, a subsequent shift in the preferences of our customers or their consumers could cause a decline in the popularity of our services and content that could materially reduce our revenue and harm our business, financial condition and results of operations.

Our revenue growth will be adversely affected if we are unable to expand the breadth of our services and products or to introduce new services and products on a timely basis.

To retain our existing customers, attract new customers and increase revenue, we must continue to develop and introduce new services and products on a timely basis and continue to develop additional features to our existing product base. If our existing and prospective customers do not perceive that we will deliver our services and products on schedule, or if they do not perceive our services and products to be of sufficient value and quality, we may lose the confidence of our existing customers and fail to increase sales to these existing customers, and we may not be able to attract new customers, each of which would adversely affect our operating results.

Our sales cycles and the contracting process with new customers are long and unpredictable and may require us to incur expenses before executing a customer agreement, which makes it difficult to project when, if at all, we will obtain new customers and when we will generate additional revenue and cash flows from those customers.

We market our services and products directly to high-speed internet service and communications providers, consumer electronics manufacturers, and directly and indirectly to enterprises, and governmental and nonprofit organizations. New customer relationships typically take time to obtain and finalize because of the burdensome cost of migrating from an existing solution to our platform. Due to operating procedures in many organizations, a significant time period may pass between selection of our services and products by key decision-makers and the signing of a contract. The length of time between the initial customer sales call and the realization of significant sales is difficult to predict and can range from several months to several years. As a result, it is difficult to predict when we will obtain new customers and when we will begin to generate revenue and cash flows from these potential new customers.

13

Table of Contents

As part of our sales cycle for our Managed Portals and Advertising customers, we may incur significant expenses in the form of compensation and related expenses and equipment acquisition before executing a definitive agreement with a prospective customer so that we may be ready to launch shortly following execution of a definitive agreement. If conditions in the marketplace generally or with a specific prospective customer change negatively, it is possible that no definitive agreement will be executed, and we will be unable to recover any expenses incurred before a definitive agreement is executed, which would in turn have an adverse effect on our business, financial condition and results of operations.

Many of our customers are high-speed internet service providers, and consolidation within the cable and telecommunications industries could adversely affect our business, financial condition and results of operations.

Our revenue from high-speed internet service and communications providers, including our search and digital advertising revenue generated by online consumer traffic on our Managed Portals and our revenue from our Email/Collaboration offerings, accounted for approximately 83% in 2013, approximately 85% in 2014 and approximately 82% in 2015. The cable and telecommunications industries have experienced consolidation over the past several years, and we expect that this trend will continue. As a result of consolidation, some of our customers may be acquired by companies with which we do not have existing relationships and which may have relationships with one of our competitors or may have the in-house capacity to perform the services we provide. As a result, such acquisitions could cause us to lose customers and the associated revenue. Under our agreements with some of our customers, including Verizon and CenturyLink, they have the right to terminate the agreement if we are acquired by one of their competitors.

Consolidation may also require us to renegotiate our agreements with our customers as a result of enhanced customer leverage. We may not be able to offset the effects of any such renegotiations, and we may not be able to attract new customers to counter any revenue declines resulting from the loss of customers or their subscribers.

We rely, to a significant degree, on indirect sales channels for the distribution of our Email/Collaboration products, and disruption within these channels could adversely affect our business, financial condition, operating results and cash flows.

We use a variety of indirect distribution methods for our offerings, including channel partners, such as cloud service providers, distributors, and value added resellers. A number of these partners in turn distribute our offerings via their own networks of channel partners with whom we have no direct relationship. These relationships allow us to offer our technologies to a much larger customer base than we would otherwise be able through our direct sales and marketing efforts.

We rely, to a significant degree, on each of our channel partners to select, screen and maintain relationships with its distribution network and to distribute our offerings in a manner that is consistent with applicable law and regulatory requirements and our quality standards. If our channel partners or a partner in its distribution network violate applicable law or regulatory requirements or misrepresent the functionality of our offerings, our reputation could be damaged and we could be subject to potential liability. Furthermore, our channel partners may offer their own products and services that are competitive with our offerings or may not distribute and market our offerings effectively. Our existing channel partner relationships do not, and any future channel partner relationships may not, afford us any exclusive marketing or distribution rights. In addition, if a channel partner is acquired by a competitor or its business units are reorganized or divested, our revenue derived from that partner may be adversely impacted.

Recruiting and retaining qualified channel partners and training them in the use of our technologies require significant time and resources. If we fail to devote sufficient resources to support and expand our network of channel partners, our business may be adversely affected. In addition, because we rely on channel partners for the indirect distribution of our technologies, we may have little or no contact with the ultimate end-users of our

14

Table of Contents

technologies, thereby making it more difficult for us to establish brand awareness, ensure proper delivery and installation of our software, support ongoing customer requirements, estimate end-user demand, respond to evolving customer needs and obtain renewals from end-users.

Most of our sales to government entities have been made indirectly through our channel partners. Government entities may have statutory, contractual, or other legal rights to terminate contracts with our channel partners for convenience or due to a default, and any such termination may adversely impact our future operating results. Governments routinely investigate and audit government contractors’ administrative processes, and any unfavorable audit could result in the government refusing to continue buying our offerings, a reduction of revenue or fines or civil or criminal liability if the audit uncovers improper or illegal activities.

If our indirect distribution channel is disrupted, we may be required to devote more resources to distribute our offerings directly and support our customers, which may not be as effective and could lead to higher costs, reduced revenue and growth that is slower than expected.

As technology continues to evolve, the use of our products by our current and prospective consumer electronics manufacturer customers may decrease and our business could be adversely affected.

The consumer electronics industry is subject to rapid change, and our contracts for Managed Portals and Advertising solutions with our consumer electronics manufacturer customers are not exclusive. As consumer electronics manufacturers continue to develop new technologies and introduce new models and devices, there can be no assurance that we will be able to develop solutions that will persuade consumer electronics manufacturers that are our customers at such time to utilize our technology for those new devices. If our current and prospective consumer electronics manufacturer customers elect not to integrate our solutions into their new products, our business, financial condition and results of operations could be adversely affected.

Moreover, updates to internet browser technology may adversely affect our business. For example, for our consumer electronics manufacturer customers that have the Windows 8 operating system pre-installed on some of their devices, the Windows 8 operating system places our Managed Portal on a second tab when the internet browser is launched, leading to decreased search and digital advertising revenue. Further, upgrades to the Windows 10 operating system default to Microsoft’s latest Edge browser and displace users’ previous browser settings including default homepages, which can also lead to decreased search and digital advertising revenue. Unless consumers change their browser settings back to our Managed Portals, their usage of our Managed Portals would likely decline and our results of operations could be negatively impacted.

We invest in features and functionality designed to increase consumer engagement with our Managed Portals; however, these investments may not lead to increased revenue.

Our future growth and profitability will depend in large part on the effectiveness and efficiency of our efforts to provide a compelling consumer experience that increases consumer engagement with our Managed Portals. We have made and will continue to make substantial investments in features and functionality for our technology that are designed to drive consumer engagement. Not all of these activities directly generate revenue, and we cannot assure you that we will reap sufficient rewards from these investments to make them worthwhile. If the expenses that we incur in connection with these activities do not result in increased consumer engagement that in turn results in revenue increases that exceed these expenses, our business, financial condition and results of operations will be adversely affected.

Our services and products may become less competitive or even obsolete if we fail to respond to technological developments.

Our future success will depend, in part, on our ability to modify or enhance our services and products to meet customer and consumer needs, to add functionality and to address technological advancements that would

15

Table of Contents

improve their performance. For example, if our smartphone and tablet products fail to capture the increased search activity on such devices or if our services and products do not adapt to the increasing video usage on the internet or to take into account evolving developments in social networking, then they could begin to appear obsolete. Similarly, if we fail to develop new ways to deliver content and services through apps other than traditional internet browsers, consumers could seek alternative means of accessing content and services.

To remain competitive, we will need to develop new services and products and adapt our existing ones to address these and other evolving technologies and standards. However, we may be unsuccessful in identifying new opportunities or in developing or marketing new services and products in a timely or cost-effective manner. In addition, our product innovations may not achieve the market penetration or price levels necessary for profitability. If we are unable to develop enhancements to, and new features for, our existing services and products or if we are unable to develop new services and products that keep pace with rapid technological developments or changing industry standards, our services and products may become obsolete, less marketable and less competitive, and our business will be harmed.

We depend on third parties for content that is critical to our business, and our business could suffer if we do not continue to obtain high-quality content at a reasonable cost.

We license the content that we aggregate on our Managed Portals from numerous third-party content providers, and our future success is highly dependent upon our ability to maintain and enter into new relationships with these and other content providers. In the future, some of our content providers may not give us access to high-quality content, may fail to adapt to changes in consumer tastes or may increase the royalties, fees or percentages that they charge us for their content, any of which could have a material negative effect on our operating results. Our rights to the content that we offer to our customers and their consumers are not exclusive, and the content providers could license their content to our competitors. Our content providers could even grant our competitors exclusive licenses. In addition, our customers are not prohibited from entering into content deals directly with our content providers. Any failure to enter into or maintain satisfactory arrangements with content providers would adversely affect our ability to provide a variety of attractive services and products to our customers. Our reputation and operating results could suffer as a result, and it may be more difficult for us to develop new relationships with potential customers.

Our Zimbra Email/Collaboration solution was developed as an open-source software product. As such, it may be relatively easy for competitors, some of which may have greater resources than we have, to compete with us.

One of the characteristics of open source software is that anyone may modify and redistribute the existing open source software and use it to compete with us. Such competition can develop without the degree of overhead and lead time required by traditional proprietary software companies. In addition, some of these competitors may make their open source software available for free download and use on an ad hoc basis or may position their open source software as a loss leader. We cannot guarantee that we will be able to compete successfully against current and future competitors or that competitive pressure and/or the availability of open source software will not result in price reductions, reduced operating margins and loss of market share, any one of which could adversely affect our business, financial condition, operating results and cash flows.

Our revenue and operating results may fluctuate, which makes our results difficult to predict and could cause our results to fall short of expectations.

As a result of the rapidly changing nature of the markets in which we compete, our quarterly and annual revenue and operating results are likely to fluctuate from period to period. These fluctuations may be caused by a

16

Table of Contents

number of factors, many of which are beyond our control, including but not limited to the various factors set forth in this “Risk Factors” section, as well as:

| • | any failure to maintain strong relationships and favorable revenue-sharing arrangements with our Managed Portals and Advertising partners, in particular Google, including a reduction in the quantity or pricing of sponsored links that consumers click on or a reduction in the pricing of digital advertisements by advertisers; |

| • | the timing of our investment in, or the timing of our monetization of, our products and services, such as our end-to-end video solutions portfolio or our Zimbra Email/Collaboration product; |

| • | any failure of significant customers to renew their agreements with us; |

| • | our ability to attract new customers; |

| • | our ability to increase sales of premium services and paid content to our existing customers’ consumers; |

| • | any development by our significant customers of the in-house capacity to replace the solutions we provide; |

| • | the release of new product and service offerings by our competitors or our customers; |

| • | variations in the demand for our services and products and the implementation cycles of our services and products by our customers; |

| • | changes to internet browser technology that may render our Managed Portals less competitive; |

| • | changes in our pricing policies or those of our competitors; |

| • | changes in the prices our customers charge their consumers for email, premium services and paid content; |

| • | service outages, other technical difficulties or security breaches; |

| • | limitations relating to the capacity of our networks, systems and processes; |

| • | our failure to accurately estimate or control costs, including costs related to the implementation of our solutions for new customers; |

| • | maintaining appropriate staffing levels and capabilities relative to projected growth; |

| • | the timing of costs related to the development or acquisition of technologies, services or businesses to support our existing customers and potential growth opportunities; and |

| • | general economic, industry and market conditions and those conditions specific to internet usage and online businesses. |

For these reasons and because the market for our services and products is relatively new and rapidly changing, it is difficult to predict our future financial results.

Expansion into international markets, which is an important part of our strategy, but where we have limited experience, will subject us to risks associated with international operations.

We plan to expand our product offerings internationally, particularly in Asia, Canada, Latin America and Europe. Although our exposure to international markets has increased as a result of our acquisition of the Zimbra assets in September 2015, we have limited experience in marketing and operating our services and products in international markets, and we may not be able to successfully develop or grow our business in these markets. Our success in these markets will be directly linked to the success of our relationships with potential customers, resellers, content partners and other third parties.

17

Table of Contents

As the international markets in which we operate continue to grow, we expect that competition in these markets will intensify. Local companies may have a substantial competitive advantage because of their greater understanding of, and focus on, the local markets. Some of our domestic competitors who have substantially greater resources than we do may be able to more quickly and comprehensively develop and grow in international markets. International expansion may also require significant financial investment including, among other things, the expense of developing localized products, the costs of acquiring foreign companies and the integration of such companies with our operations, expenditure of resources in developing customer and content relationships and the increased costs of supporting remote operations.

Other risks of doing business in international markets include the increased risks and burdens of complying with different legal and regulatory standards, difficulties in managing and staffing foreign operations, recruiting and retaining talented direct sales personnel, limitations on the repatriation of funds and fluctuations of foreign exchange rates, varying levels of internet technology adoption and infrastructure and our ability to enforce contracts and our intellectual property rights in foreign jurisdictions. In addition, our success in international expansion could be limited by barriers to international expansion such as tariffs, adverse tax consequences and technology export controls. If we cannot manage these risks effectively, the costs of doing business in some international markets may be prohibitive or our costs may increase disproportionately to our revenue. Some of our business partners also have international operations and are subject to the risks described above. Even if we are able to successfully manage the risks of international operations, our business may be adversely affected if our business partners are not able to successfully manage these risks.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

We are subject to the United States Foreign Corrupt Practices Act, which generally prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices may occur with respect to our expansion into international markets. Our employees or other agents may engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences, including adverse publicity and damage to our reputation that may have a material adverse effect on our business, financial condition and results of operations.

Our agreements with some of our customers and content providers require fixed payments, which could adversely affect our financial performance.

Certain of our agreements with Managed Portals and Advertising customers and content providers require us to make fixed payments to them. The aggregate amount of such fixed payments for the years ending December 31, 2016, 2017 and 2018 are approximately $4.1 million, $2.0 million, and $0.6 million, respectively. We are required to make these fixed payments regardless of the achievement of any revenue objectives or subscriber or usage levels. If we do not achieve our financial objectives, these contractual commitments would constitute a greater percentage of our revenue than originally anticipated and would adversely affect our profitability.

Our agreements with some of our customers and content providers contain penalties for non-performance, which could adversely affect our financial performance.

We have entered into service level agreements with many of our customers. These agreements generally call for specific system “up times” and 24 hours per day, seven days per week support and include penalties for non-performance. We may be unable to fulfill these commitments due to circumstances beyond our control, which could subject us to substantial penalties under those agreements, harm our reputation and result in a reduction of revenue or the loss of customers, which would in turn have an adverse effect on our business, financial condition and results of operations. To date, we have never incurred any material penalties.

18

Table of Contents

System failures or capacity constraints could harm our business and financial performance.

The provision of our services and products depends on the continuing operation of our information technology and communications systems. Any damage to or failure of our systems could result in interruptions in our service. Such interruptions could harm our business, financial condition and results of operations, and our reputation could be damaged if people believe our systems are unreliable. Our systems are vulnerable to damage or interruption from snow storms, terrorist attacks, floods, fires, power loss, telecommunications failures, security breaches, computer malware, computer hacking attacks, computer viruses, computer denial of service attacks or other attempts to, or events that, harm our systems. Our data centers are also subject to break-ins, sabotage and intentional acts of vandalism and to potential disruptions if the operators of the facilities have financial difficulties. Although we maintain insurance to cover a variety of risks, the scope and amount of our insurance coverage may not be sufficient to cover our losses resulting from system failures or other disruptions to our online operations. For example, the limit on our business interruption insurance is approximately $29.7 million. Any system failure or disruption and any resulting losses that are not recoverable under our insurance policies may materially harm our business, financial condition and results of operations. To date, we have never experienced any material losses.

Our data centers are not on full second-site redundancy, however we have the capability to do so; only certain customers require us to. We regularly back-up our systems and store the system back-ups in Atlanta, Georgia; Dallas, Texas; Lewis Center, Ohio; Denver, Colorado; Toronto, Canada; and Amsterdam, the Netherlands. If we were forced to relocate to an alternate site and to rely on our system back-ups to restore the systems, we would experience significant delays in restoring the functionality of our platform and could experience loss of data, which could materially harm our business and our operating results.

Security breaches, computer viruses and computer hacking attacks could harm our business, financial condition and results of operations.

Security breaches, computer malware and computer hacking attacks are prevalent in the technology industry. Any security breach caused by hacking, which involves efforts to gain unauthorized access to information or systems, or to cause intentional malfunctions or loss or corruption of data, software, hardware or other computer equipment, and the inadvertent transmission of computer viruses could harm our business, financial condition and results of operations. We have previously experienced hacking attacks on our systems, and may in the future experience hacking attacks. Though it is difficult to determine what harm may directly result from any specific interruption or breach, any failure to maintain performance, reliability, security and availability of our technology infrastructure to the satisfaction of our customers and their consumers may harm our reputation and our ability to retain existing customers and attract new customers.

We may not maintain acceptable website performance for our Managed Portals and Advertising customers, which may negatively impact our relationships with our customers and harm our business, financial condition and results of operations.

A key element to our continued growth is the ability of our customers’ consumers in all geographies to access our Managed Portals and other offerings within acceptable load times. We refer to this as website performance. We may in the future experience platform disruptions, outages and other performance problems due to a variety of factors, including infrastructure changes, human or software errors, capacity constraints due to an overwhelming number of users accessing our technology simultaneously, and denial of service or fraud or security attacks.

In some instances, we may not be able to identify the cause or causes of these website performance problems within an acceptable period of time. It may become increasingly difficult to maintain and improve website performance, especially during peak usage times, and as our solutions become more complex and our user traffic increases. If our Managed Portals and Advertising solutions are unavailable when consumers attempt to access them or do not load as quickly as they expect, consumers may seek other alternatives to obtain the

19

Table of Contents

information for which they are looking, and may not use our products and services as often in the future, or at all. This would negatively impact our relationships with our customers. We expect to continue to make significant investments to maintain and improve website performance. To the extent that we do not effectively address capacity constraints, upgrade our systems as needed and continually develop our technology and network architecture to accommodate actual and anticipated changes in technology, our business and operating results may be harmed.

We rely on our management team and need additional personnel to expand our business, and the loss of key officers or an inability to attract and retain qualified personnel could harm our business, financial condition and results of operations.

We depend on the continued contributions of our senior management and other key personnel, especially Himesh Bhise, our President and Chief Executive Officer, and William J. Stuart, our Chief Financial Officer. The loss of the services of any of our executive officers or other key employees could harm our business and our prospects. All of our executive officers and key employees are at-will employees, which means they may terminate their employment relationship with us at any time.