UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|||

|

☒ |

|

Smaller reporting company |

|

||

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. YES ☐ NO

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on New York Stock Exchange on March 16, 2022 is approximately $

The number of shares of Registrant’s Common Stock outstanding as of March 16, 2022 was

DOCUMENTS INCORPORATED BY REFERENCE

None

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

3 |

|

Item 1A. |

34 |

|

Item 1B. |

95 |

|

Item 2. |

95 |

|

Item 3. |

95 |

|

Item 4. |

95 |

|

|

|

|

PART II |

|

|

Item 5. |

96 |

|

Item 6. |

96 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

97 |

Item 7A. |

111 |

|

Item 8. |

111 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

146 |

Item 9A. |

146 |

|

Item 9B. |

146 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

146 |

|

|

|

PART III |

|

|

Item 10. |

147 |

|

Item 11. |

152 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

164 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

166 |

Item 14. |

170 |

|

|

|

|

PART IV |

|

|

Item 15. |

171 |

|

Item 16. |

174 |

i

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (this "Annual Report") contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended, (the "Exchange Act"), that involve risks and uncertainties, including statements based on our current expectations, assumptions, estimates and projections about future events, our business, financial condition, results of operations and prospects, our industry and the regulatory environment in which we operate. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of those terms, or other comparable terms intended to identify statements about the future. The forward-looking statements included herein are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. These risks and uncertainties, all of which are difficult or impossible to predict accurately and many of which are beyond our control, include, but are not limited to those made below under “Summary of Risk Factors” and in Item 1A. Risk Factors in this Annual Report.

You should carefully consider these risks, as well as the additional risks described in other documents we file with the Securities and Exchange Commission (“SEC”). We also operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in, or implied by, any forward-looking statements.

The forward-looking statements included herein are based on current expectations of our management based on available information and are believed to be reasonable. In light of the significant risks and uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that such results will be achieved, and readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date hereof. Except as required by law, we undertake no obligation to revise the forward-looking statements contained herein to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. You should read this Annual Report and the documents we file with the SEC, with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by the cautionary statements referenced above.

Summary of Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or that may adversely affect our business, financial condition and results of operations. You should carefully consider the risks discussed in this Annual Report under the section titled “Risk Factors,” which are summarized below.

1

2

PART I

Item 1. Business.

Overview

We are a commercial-stage medical technology company focused on saving teeth from tooth decay, the most prevalent chronic disease globally. We have developed the GentleWave System, an innovative technology platform designed to treat tooth decay by cleaning and disinfecting the microscopic spaces within teeth without the need to remove tooth structure. Our initial focus is on leveraging the GentleWave System, the first and only system for root canal therapy ("RCT") cleared by the U.S. Food and Drug Administration (“FDA”), that employs a sterilized, single-use procedure instrument, to transform RCT by addressing the limitations of conventional methods. The system utilizes our proprietary mechanism of action, which combines procedure fluid optimization, broad-spectrum acoustic energy and advanced fluid dynamics, to debride and disinfect deep regions of the complex root canal system in a less invasive procedure that preserves tooth structure. The clinical benefits of our GentleWave System when compared to conventional methods of RCT include improved clinical outcomes, such as superior cleaning that is independent of root canal complexity and tooth anatomy, high and rapid rates of healing and minimal to no post-operative pain. In addition to the clinical benefits, the GentleWave System can improve the workflow and economics of dental practices. We are focused on establishing the GentleWave Procedure as the standard of care for RCT. As of December 31, 2021, we had an installed base of approximately 820 GentleWave Systems that had performed more than 750,000 GentleWave patient procedures since commercialization.

Tooth decay refers to the breakdown or damage of one or more layers of dental tissue and is referred to as cavities in the earlier stages and root canal infections in the later stages. In the United States, 92% of adults between the ages of 20 and 64 have had dental cavities in their permanent teeth. The United States spends approximately $148 billion annually on professional dental services, of which we estimate that approximately 55%, or $81 billion, of spending is directly associated with treating tooth decay.

Our initial commercial efforts are focused on utilizing our GentleWave System to transform RCT in the United States and Canada. We estimate that approximately 17 million root canal procedures are performed annually in our target markets, accounting for approximately $17 billion in healthcare-related expenditures. We estimate there are approximately 5,000 endodontists and 50,000 general dentists in our target markets that perform more than 75% of all root canal procedures, which represents a potential annual addressable market of approximately $1.9 billion. We also believe there is a significant opportunity for our GentleWave System to address RCT outside the United States and Canada, with approximately 50 million root canal procedures performed annually on a global basis including the United States and Canada. In addition, we are exploring opportunities to leverage our technology platform beyond RCT to treat cavities in earlier-stage tooth decay, for which we estimate there are approximately 175 million procedures performed in the United States each year.

RCT is a treatment for late-stage tooth decay that aims to save the patient’s tooth instead of removing it. Conventional methods of RCT depend primarily on instruments to manually scrape and remove tooth structure and open canals inside the tooth in order to remove and irrigate infected tissue. We believe that conventional methods of RCT do not adequately clean and disinfect the entire root canal system, primarily due to the complexity and uniqueness of each root canal and the inability of current endodontic technologies to effectively reach the microscopic spaces within the tooth. Conventional methods of RCT also generally require extensive use of instrumentation within the root canal system, which can result in the removal of substantial tooth structure, weaken the tooth and impact its long-term survival. This lack of sufficient cleaning and removal of substantial tooth structure can result in poor clinical outcomes, such as high treatment failure rates and significant post-operative pain. In addition, other limitations of conventional methods of performing RCT include: a frequent need for multiple visits to complete the procedure, a lack of standardized procedure protocols and a complex procedure that can be difficult to perform.

Our GentleWave System represents an innovative technology platform and approach to RCT. The GentleWave System is a Class II device and has received 510(k) clearance from the FDA. The key components of our GentleWave System are a sophisticated and mobile console and a pre-packaged, sterilized, single-use PI. The GentleWave System utilizes a proprietary mechanism of action that is designed to combine procedure fluid optimization, broad-spectrum acoustic energy and advanced fluid dynamics to efficiently and effectively reach

3

microscopic spaces within teeth and dissolve and remove tissue and bacteria with minimal or no removal of tooth structure. We have invested significant resources in establishing a broad intellectual property portfolio that protects the GentleWave Procedure and its unique mechanism of action, as well as future capabilities under development. As of December 31, 2021, we held 122 issued patents and there were 98 pending patent applications that include device, design, system and method claims.

We believe our GentleWave System transforms the patient and dental practitioner experience and addresses many of the limitations of conventional RCT by providing the following key benefits:

Clinical Outcome Benefits

Practice and Dental Practitioner Benefits

We are committed to continuing to generate evidence to support the clinical benefits of the GentleWave System. These benefits have been demonstrated in-vivo and in-vitro across two prospective, multi-center clinical studies, over 30 peer-reviewed journal publications and in real-world, clinical practice. For example, results from our PURE study demonstrated a treatment success rate of 97% at the six- and 12-month follow-ups for patients treated using the GentleWave System.

In the United States and Canada, our direct sales force markets and sells the GentleWave System to dental practitioners performing a high volume of root canals as part of their practice. These practitioners are typically reimbursed, in part, for the cost of our products by third party payors or are otherwise paid directly by patients in connection with procedures performed. Our commercial strategy and sales model involves a focus on driving adoption of our GentleWave System by increasing our installed base of consoles and maximizing recurring PI revenue through increased utilization. We intend to expand the size of our sales and clinician support teams to support our efforts of driving adoption and utilization of the GentleWave System. We also plan to pursue marketing authorizations and similar certifications to enable marketing and engage in other market access initiatives over time in attractive international regions in which we see significant potential opportunity.

We generated revenue of $33.2 million and a net loss of $48.5 million for the year ended December 31, 2021 compared to revenue of $23.4 million and a net loss of 46.7 million for the year ended December 31, 2020. As of December 31, 2021, our accumulated deficit was $312.0 million. The COVID-19 pandemic and the measures imposed by numerous state and local jurisdictions impacted our financial results primarily during 2020.

4

Our Success Factors

We believe the continued growth of our company will be driven by the following success factors:

5

Our Growth Strategies

Our mission is to improve quality of life by saving teeth and stopping the progression of tooth decay. Our goal is to establish the GentleWave Procedure as the standard of care for tooth decay, with an initial focus on transforming RCT. The key elements of our growth strategy are:

6

7

Market Overview

Our Addressable Market Opportunity in Tooth Decay

Tooth decay is the most prevalent chronic disease globally. In the United States, 92% of adults between the ages of 20 and 64 having had dental cavities in their permanent teeth. The incidence of tooth decay has grown significantly over the past several decades, primarily driven by an aging population and unhealthy diets that are high in sugar and other carbohydrates. The United States spends approximately $148 billion annually on professional dental services, of which we estimate that approximately 55%, or $81 billion, of spending is directly associated with treating tooth decay. If left untreated, tooth decay may progress and also result in a number of uncomfortable symptoms, including tooth discoloration, severe toothache or tooth sensitivity, and eventually lead to tooth loss. Additionally, studies have shown that poor oral health may impact overall health and is associated with diseases such as cardiovascular disease, pneumonia and pregnancy and birth complications.

We are focused on utilizing our GentleWave System to transform RCT. Our commercial efforts are primarily focused on driving awareness and adoption of our system in our initial target markets of the United States and Canada, where we estimate that approximately 17 million root canal procedures are performed annually, accounting for approximately $17 billion in healthcare-related expenditures. We estimate that there are approximately 5,000 endodontists and 176,000 general dentists in this market. Within the general dentist population, we estimate that a subset of approximately 50,000 general dentists perform approximately 90% of their root canal procedures instead of referring to a specialist. Collectively, we estimate that endodontists and this subset of non-referring general dentists perform more than 75% of all root canal procedures in the United States and Canada. Given the average selling price of our products and our estimates on replacement cycle, and the number of root canals performed annually, we estimate that our total annual addressable market in the United States and Canada is approximately $1.9 billion. We also believe there is a significant opportunity for our GentleWave System in RCT outside the United States and Canada, with more than 50 million root canal procedures performed annually on a global basis including the United States and Canada.

In addition, we are exploring opportunities to leverage our technology platform beyond RCT to treat cavities in earlier-stage tooth decay, for which we estimate there are approximately 175 million procedures performed in the United States each year. We believe that by utilizing our GentleWave System to treat cavities, the number of general dentists that we target can expand to include all 176,000 general dentists in the United States and Canada.

Overview of Tooth Anatomy

Teeth are hard, mineral-rich structures embedded in the jaw. Adults typically have 32 teeth that are separated into three categories – anteriors, premolars and molars – based on each tooth’s shape, location and function.

Every tooth has the same general structure and is divided into two major regions: the crown and the root. The crown is the functional part of the tooth that is visible above the gums, while the root extends below the gums and anchors the tooth to the jawbone. Teeth typically have between one and three roots depending on the category of tooth. At the center of each root are narrow, hollow spaces called root canals, which contain blood vessels, nerves and tissues. Each root has a minimum of one canal, but may contain multiple canals that may be interconnected. At the apex of the root is a small opening, called the apical foramen, which serves as an entry point for blood vessels and nerves.

Teeth are comprised of four layers of dental tissue, with each layer varying in composition, density and function. The outermost layer of tissue that covers the crown, called the enamel, acts as a barrier that protects the tooth from exogenous factors, including extreme temperatures, bacteria and acid that are encountered daily. Enamel is the hardest and most mineral-rich tissue in the human body but does not contain any living cells. Beneath the enamel is dentin, a bone-like layer of living tissue that extends almost the entire length of the tooth and forms the structural framework of the tooth. Dentin is comprised of hollow, microscopic channels, called dentin tubules, which lead directly to the innermost parts of the tooth, or pulp, and play a key role in transmitting pain signals and transporting nutrients within the tooth. The pulp is a living layer of soft tissue that fills the inside of the tooth and is comprised of blood vessels, connective tissue and nerves that provides nutrition to the tooth and acts as its nerve center. The pulp is in the pulp chamber – a space inside the crown below the dentin layer – and the root canals of the tooth. Collectively, the pulp chamber and all root canals, including the complex anatomies, within a tooth are referred to as the root canal system.

8

The root canal system is complex and unique for each person, tooth, and root, making it difficult to effectively treat or clean. Progressing from the orifice to the apex, root canals exhibit unpredictable three-dimensional curvature. At any point, a single root canal may bifurcate into multiple canals, or multiple root canals may converge into a single canal. Each root canal may also include branches such as accessory canals, or smaller canals that branch off from the main canal, and isthmuses, or narrow connections between separate root canals, for example c-shaped canals can be the most challenging anatomical variations to effectively treat and clean. Root canals generally narrow and grow increasingly complicated near the apex of the tooth. The formation and configuration of the root canal is influenced by a variety of factors, including type of tooth and patient demographic. The complexity of the root canal system contributes to the difficulty of effectively and efficiently cleaning all the spaces where diseased tissue and bacteria may exist.

Tooth Decay Overview

Tooth decay refers to the loss of mineral (demineralization) and breakdown of one or more layers of tooth tissue. It is generally caused by dental plaque or biofilm, a sticky, colorless film of bacteria that forms on teeth. Biofilm generally develops when foods containing carbohydrates, such as sugars and starches, are left on the teeth. Bacteria that live in the mouth thrive on these foods, producing acids as a result. Tooth decay starts with the interaction between the tooth, the biofilm at the tooth surface and dietary sugars which produce acids. Over time, if these acids are not removed, a cavity, or hole, may form in the tooth.

Tooth decay generally occurs in five distinct stages that are delineated by how deep the decay has penetrated within the various layers of tooth tissue. These stages are described below:

Tooth decay is generally diagnosed by a general dentist during a routine dental examination. General dentists utilize a variety of methods to diagnose tooth decay, including examining and probing the mouth and teeth with dental instruments and using imaging modalities such as x-rays. The presence of symptoms associated with tooth decay is also taken into consideration during the examination. Based on the extent of decay, the dentist may perform a restorative procedure or refer the patient to be treated by a specialist, such as an endodontist, who specializes in diagnosing and treating tooth pain and performing RCT, or oral surgeon.

9

Treatment Options for Tooth Decay

While tooth decay may be prevented with good oral hygiene, once the infection breaches the enamel layer, intervention from a dental clinician is generally required. The main goal of treating tooth decay is to remove the debris, bacteria, and damaged tissues, while preserving as much of the tooth’s natural structure as possible. Tooth decay treatment is largely determined by the stage of the decay.

Earlier Stage Tooth Decay

A decay that has breached the enamel or dentin layers, but not yet the pulp, is typically treated by general dentists, and involves scraping of tooth structure using drills and burs to remove the infected tissues.

Later Stage Tooth Decay

Once the infection reaches the pulp, it will typically require more aggressive intervention. Two common procedures used to treat this stage of tooth decay include RCT or a tooth extraction that may lead to a dental implant procedure.

Root Canal Therapy. RCT is a treatment for late-stage tooth decay that aims to save the patient’s tooth instead of removing it. Preserving the tooth can provide several benefits to the patient, including maintaining functionality and preserving the natural appearance of the tooth and smile. During RCT, a clinician attempts to remove the infected pulp tissue from the root of the tooth. The clinician will then fill the root canals to prevent reinfection and place a dental crown on the tooth to protect and restore it. In conventional RCT, multiple visits may be required to complete a root canal procedure.

Tooth Extraction and Dental Implant Procedure. In cases of severe tooth decay or where other treatment options have failed, the diseased tooth may need to be extracted, or removed, from its socket in the bone. Tooth extraction can be associated with negative outcomes such as severe pain, inflammation, nerve injury, bone loss and infection. Tooth extraction is generally followed by the placement of a dental implant, which is intended to mimic the look and feel of a natural tooth. Placement of a dental implant is time intensive and requires multiple visits to complete, with the entire process often lasting upwards of a year. Due to the high cost of dental implants, some patients may choose not to fill the empty space where the tooth was previously located or may opt for an alternative such as a bridge or dentures, all of which are often associated with poor aesthetic and functional outcomes.

Overview of Conventional Methods of Root Canal Therapy

Root canal procedures generally begin with preparing the tooth, which includes x-ray imaging, administration of a local anesthetic to numb the area and isolation of the tooth using a protective sheet to prevent salivary and bacterial contamination. Once the tooth is prepared, conventional methods of RCT are generally divided into three steps: access, shaping and irrigation, and obturation.

Access

Dental drills and burs are used to create an opening in the tooth, often referred to as an access cavity, which involves removing a portion of the enamel and dentin to provide access to the pulp chamber. Conventional access cavities provide visualization of the root canal system, create an unobstructed, straight-line path for instruments to reach the apex of each root and must be large enough to successfully identify and treat the root canals.

Shaping and Irrigation

Shaping and irrigation is a critical step of RCT that can significantly impact the long-term success of the procedure. During this step, clinicians use a mechanical technique, referred to as instrumentation, and a chemical technique, referred to as irrigation, in an attempt to remove bacteria, infection and damaged tissues.

Instrumentation involves the use of instruments called endodontic files to mechanically scrape the root canal walls and remove tooth structure to reduce the amount of bacteria inside the root canal. Endodontic files are used to enlarge the canal space to facilitate irrigation and to shape the canals to enable easier obturation later in the

10

procedure. A series of endodontic files are typically used during RCT that increase in size throughout the procedure, which can lead to significant removal of tooth structure and may impact the long-term survival of the tooth.

Clinicians use irrigation to further disinfect the root canals by utilizing a variety of chemicals, techniques and devices to dissolve both organic and inorganic materials. A root canal is generally irrigated with multiple chemicals in between the use of files and reduces friction between the instruments and dentin. Irrigation is also used to remove materials dislodged during instrumentation as well as the smear layer, a paste-like mixture of dentin, pulp and bacteria that is created during instrumentation and adheres to the root canal walls. The most common irrigation technique utilizes syringes and needles that are inserted directly into the root canals. Several other devices, such as sonic, ultrasonic and laser-assisted irrigation devices, may also be used to improve irrigation by increasing the movement of the irrigant within the root canal. Sonic and ultrasonic activation use a vibrating metal or plastic tip to move fluids within the canal. This technology requires the tip to be inserted into each root canal, and can generate air bubbles inside the fluid that weaken or dampen the extent of cavitation. For laser activation, the root canal is filled with fluid and the tip of a laser is inserted inside the tooth. The tip pulses laser energy into the fluid, which creates acoustic waves and energy. This energy can have limited range and air bubbles that create the energy can weaken or dampen the extent of captivation. In addition, sonic, ultrasonic and laser technologies can generate heat buildup and aerosols, generally lack fluid refreshment during the procedure and require the separate injection and aspiration of procedure fluids throughout the procedure. Further, these methods are limited in their ability to reach deep regions of the root canal system and rely on extensive instrumentation to provide access to those regions.

Obturation

Once shaping and irrigation is complete, the root canals are typically filled and sealed using an inert, biocompatible material called gutta percha as well as sealers in a process referred to as obturation. The goal of obturation is to create a strong seal for each root canal to prevent bacteria from seeping back into the tooth as well as entomb any residual bacteria that may not have been removed during the procedure. Improper sealing may result in renewed infection and inflammation and require additional intervention. Following obturation, the tooth is restored and a dental crown is placed over the treated area.

Limitations of Conventional Methods of Root Canal Therapy

While RCT enables treatment of late stage tooth decay without extracting the tooth, conventional methods of performing RCT, particularly shaping and irrigation, have a number of limitations, including:

11

Our Solution

We have developed a proprietary technology platform with an innovative approach to the treatment of tooth decay. Our GentleWave System is a Class II device and is FDA-cleared for preparing, cleaning and irrigating teeth indicated for RCT and is the first and only FDA-cleared system for RCT that employs a sterilized, single-use procedure instrument to automate the cleaning and disinfection of microscopic spaces within root canals without the need to remove tooth structure.

In addition to our GentleWave console and single-use procedure instruments, we also offer ancillary single-use products, such as SoundSeal and our Sonendo-branded liquid solution of EDTA. SoundSeal is a material used during the GentleWave Procedure to build and create a sealing platform on the top of the crown, which facilitates an airtight seal between the PI and the tooth. Our company-branded EDTA is a liquid used during the GentleWave Procedure to help debride and disinfect the root canal system, and is introduced and circulated throughout the root canal system via the GentleWave System. We also offer our widely used TDO practice management software, which is designed to improve practice workflow and seamlessly integrate with the GentleWave System.

12

Benefits of the GentleWave System

We believe our GentleWave System transforms the patient and clinician experience and addresses many of the limitations of conventional RCT by providing the following key benefits:

Clinical Outcome Benefits

Practice & Clinician Benefits

13

Components of the GentleWave System and Mechanism of Action

The key components of our GentleWave System are a sophisticated and mobile console and a sterilized single-use PI. We also offer ancillary single-use products such as SoundSeal and our company-branded EDTA. The console is a one-time capital equipment purchase, while PIs and ancillary single-use products are recurring consumable purchases based on the number of procedures performed and clinician need.

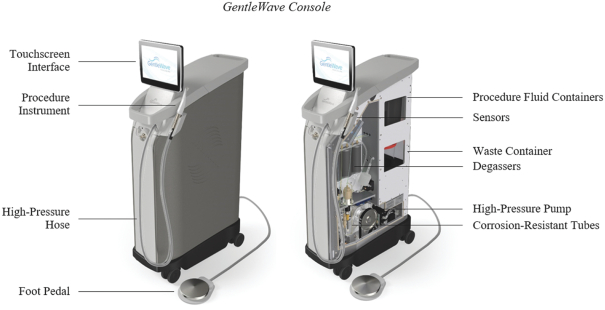

GentleWave Console

The console is designed to prepare and deliver procedure fluids into the PI via a high-pressure hose. The console includes fluid containers, electronics, software, corrosion-resistant tubes, a high-pressure pump, sensors, valves and a waste canister. The console is controlled by advanced software and operated via an intuitive touchscreen interface that simplifies procedure setup and treatment delivery. The console also collects the waste fluids delivered from the PI via a low-pressure evacuation tube. The console features an integrated RFID reader, which reads the RFID tag inside the PI and verifies that the correct PI is being used while also preventing re-use. The console is enabled with wireless connectivity capabilities that allow for automatic software updates, remote monitoring of the system to ensure reliability and real-time tracking of system utilization.

14

The image below depicts the console and its components:

GentleWave Procedure Instrument

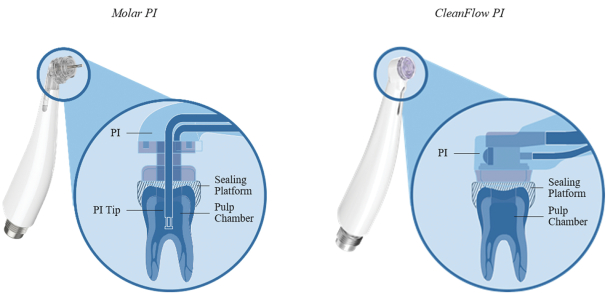

The PI is a pre-packaged, sterilized, single-use instrument connected to the console via a high-pressure hose that delivers optimized fluids from the console to the distal end of the PI. The distal end of the PI interacts with the tooth and is composed of four key components: an orifice, or nozzle, a flow-deflector, a sealing component and an evacuation tube. Currently, there is a PI for molar teeth (a "Molar PI") and one for anteriors and premolars (an "APM PI"). The differences in design are driven by the anatomical differences in teeth. While our APM PI cleans the tooth without entering it, our current Molar PI requires the tip of the instrument to be placed inside the pulp chamber during treatment.

We have developed a next generation PI called CleanFlow PI, which has received 510(k) clearance by the FDA and has been approved by Health Canada. The CleanFlow PI utilizes the same mechanism of action as our existing PIs, but has been improved so that no components of the PI enter the tooth, regardless of tooth type. We believe the CleanFlow PI transforms the way root canal procedures are performed by cleaning the inside of the tooth from outside the tooth through the endodontic access opening, and will further simplify the GentleWave Procedure, expand our indications for use, improve user experience and enable clinicians to preserve even more tooth structure.

15

The image below depicts our Molar PI and CleanFlow PI and their respective mechanisms of action:

GentleWave System Mechanism of Action

The GentleWave System mechanism of action is designed to clean and disinfect the entire root canal system simultaneously and remotely, or without requiring insertion of our PI into each root canal. The key components of the GentleWave System utilize a proprietary mechanism of action that combines procedure fluid optimization, broad-spectrum acoustic energy and advanced fluid dynamics to efficiently dissolve tissue and bacteria using minimal or no instrumentation.

The console enables a multi-stage process of optimizing procedure fluids, which include distilled water, sodium hypochlorite and EDTA, before they are delivered to the PI. Initially, the console extracts fluids from built-in containers and passes them through degassers, or components designed to reduce the fluid’s dissolved air content. In the absence of the console’s proprietary degassing process, air bubbles in the procedure fluids may act as barriers that inhibit the delivery of fluids and broad-spectrum acoustic energy throughout the root canal system. After degassing, the concentration of each procedure fluid is measured and adjusted precisely in preparation for delivery to the root canal system, thereby standardizing the concentration of procedure fluids, including sodium hypochlorite, across every procedure. The console detects and notifies the user if an incorrect or chemically degraded solution is being used, and also continuously refreshes procedure fluids during treatment.

The PI enables a process by which broad-spectrum acoustic energy and advanced fluid dynamics are created within the root canal system. Once optimized and pressurized, procedure fluids are delivered from the console to the distal end of the PI via a high-pressure hose. In the distal end of the PI, a proprietary orifice converts the procedure fluids into a high-speed fluid jet. The fluid jet flows through the tip of the PI until it reaches openings that allow it to interact with accumulated stationary fluid inside the pulp chamber. This interaction creates a strong shear force, which causes continuous hydrodynamic cavitation in the form of a cavitation cloud containing thousands of cavitation bubbles. The continuous formation and implosion of cavitation bubbles generates shock waves and broad-spectrum acoustic energy that propagate throughout the root canal system. The hydrodynamic cavitation that is created generates a broad range of frequencies that enables the optimal delivery of acoustic energy into structures of various dimensions inside the root canal system. The tip of the PI is designed to deflect the fluid jet in a manner that generates a flow over the orifices of the root canal, which induces a vortical flow and negative pressure inside the root canals. The vortical flow is optimized to rapidly dissolve and remove tissue, bacteria and debris from the root canal system, while the negative pressure minimizes the possibility of extrusion of the procedure fluids beyond the apex of the root.

16

The GentleWave Procedure

We designed the GentleWave Procedure to be simple to learn, requiring only general dental skills to perform, and easy to integrate into a practice’s existing workflow. Certain steps of the GentleWave Procedure, including access and obturation and tooth restoration, are generally the same as conventional RCT. However, the GentleWave Procedure transforms cleaning and disinfection, the most important aspect of RCT, by replacing the cumbersome, ineffective and invasive step of shaping and irrigation with the following simpler, more effective and less-invasive steps:

• |

Ensuring an unobstructed path within the root canal: Once the tooth is accessed using traditional access methods, the clinician may use endodontic files to ensure there is an open fluid path to the apex and to facilitate obturation later in the procedure. Based on our commercial experience, we are seeing clinicians move towards using only one file, and in some cases no files, for this step of the procedure, instead of using many files to scrape and remove tooth structure and enlarge canals. |

|

|

• |

Standardizing and automating cleaning and disinfection: Once a fluid pathway is established, a material, such as our SoundSeal product, is used to create a platform on top of the crown, which facilitates an airtight seal between the PI and the tooth. Once the PI is positioned on the tooth and a sealed environment is confirmed, the clinician uses the intuitive touchscreen interface on the GentleWave Console to select from a predefined set of treatment protocols. The foot pedal attached to the GentleWave Console is depressed to activate the GentleWave System, creating a closed loop fluid management system that seamlessly transitions between stages of the procedure, requiring minimal intervention from the clinician during treatment. |

Peer-Reviewed Research and Clinical Studies

We are committed to continuing to generate evidence to support the clinical benefits of the GentleWave System. These benefits have been observed in-vivo and in-vitro across two prospective, multi-center clinical studies, over 30 peer-reviewed journal publications and by real-world, clinical practice, with over 750,000 patients treated using the GentleWave System as of December 31, 2021. Our robust base of research and clinical data supports our belief that the GentleWave System has delivered strong clinical outcomes, including high and rapid healing rates with minimal to no post-operative pain, and provided superior cleaning of the entire root canal system in a less invasive procedure. In addition, the GentleWave System has been observed to drive procedure efficiency, enabling a greater proportion of root canal procedures to be completed in a single visit and reducing the need for endodontic files. Other than the SUPREME study referred to below, we do not believe any studies were powered for statistical significance, which we believe is common in the field of endodontic and dental research.

Strong Clinical Outcomes

We have conducted two prospective, multi-center clinical studies to date, in which we have observed strong clinical outcomes and benefits for patients treated with the GentleWave System. For these studies, the primary effectiveness endpoint was treatment success, defined as teeth that were considered to be healed or healing. Healing was assessed using a composite endpoint that included both clinical and radiographic components. Post-operative pain was also assessed as a secondary endpoint using a visual analog scale, where each patient ranked their level of pain from zero to ten, with ten being the highest level of pain.

Healing Rates after Endodontic Treatment Using the GentleWave System

In 2013, we conducted a prospective, multi-center, non-significant risk clinical study to assess the long-term performance of the GentleWave System (the "PURE study"), which evaluated healing rates for molars 12 months after root canal treatment. The study also included data evaluating healing rates at six months after treatment. Six-month results were published in the Journal of Clinical and Experimental Dentistry in 2016 and 12-month results were published in the Journal of Endodontics in 2016.

The study cohort was composed of 89 patients in need of endodontic therapy who were consented and received treatment via a GentleWave System from one of six private endodontic clinics in Southern California. The six

17

endodontists that participated as investigators were trained to use the GentleWave System and performed a standardized treatment procedure at each respective clinical site. Additionally, 92.1% of the enrolled patients were treated in a single visit. Pre-operative, intra-operative and post-operative data were collected from the patients and assessed by two trained, blinded and independent evaluators. Seventy-seven patients, or 86.5%, returned for the six-month follow-up and 75 patients, or 84.2%, returned for the 12-month follow-up.

At the six-month follow-up, the cumulative success rate was 97.4%, with 77.9% classified as healed and 19.5% as healing. At the 12-month follow-up, the cumulative success rate was 97.3%, with 92.0% classified as healed and 5.3% as healing. The observed high, rapid and sustained healing rates in this study imply efficient cleaning of tissue debris, bacteria and biofilm from the root canal system in a single-visit procedure using the GentleWave System.

In addition to the high rate of healing, patients reported minimal to no post-operative pain. At two days after treatment, zero patients experienced severe post-operative pain and 3.8% experienced moderate post-operative pain. Zero patients reported any incidence of pain after 14 days following treatment.

Healing Rates of Periapical Lesions after Endodontic Treatment Using the GentleWave System

A study was published in the Journal of Endodontics in 2018 that included data from the PURE study and another prospective, multi-center study conducted in 2015 comparing healing after treatment with the GentleWave System as compared to a traditional root canal therapy literature control (the "SUPREME study"). The published study evaluated healing rates for molars with significant periapical lesions 12 months after root canal treatment using the GentleWave System.

The study cohort was composed of 45 patients from the PURE and SUPREME studies with periapical lesions in need of endodontic therapy who were consented and received treatment via a GentleWave System from one of four private endodontic clinics in Southern California. The four endodontists that participated as investigators were trained to use the GentleWave System and performed a standardized treatment procedure at each respective clinical site. Additionally, 88.9% of the enrolled patients were treated in a single-visit procedure. Data were collected from the patients and assessed by two trained, blinded and independent evaluators. Forty-four patients, or 97.8%, returned for the 12-month follow-up.

At the 12-month follow-up, the cumulative success rate was 97.7%, with 81.8% classified as healed and 15.9% as healing. Further, all teeth that were treated successfully were considered completely functional and had resolution for measured indices of mobility, soft tissue lesions, sinus tract and furcation involvement. The exhibited healing rate in this study implies that the GentleWave System treats root canal infections, causing inflammation in or around the root canal system to abate, ultimately allowing periapical lesions to heal.

In addition to the high rates of healing, patients reported minimal to no post-operative pain. At two days after treatment, zero patients experienced moderate or severe post-operative pain, and 15.6% reported mild pain. No patients reported post-operative pain at the six- and 12-month follow-up visits.

Superior Cleaning in a Less Invasive Procedure

Numerous in-vitro studies have been conducted that validate the novel mechanism of action of our GentleWave System. In these studies the GentleWave System successfully cleaned the root canal system, including complex anatomies, in a procedure that is less invasive than conventional methods.

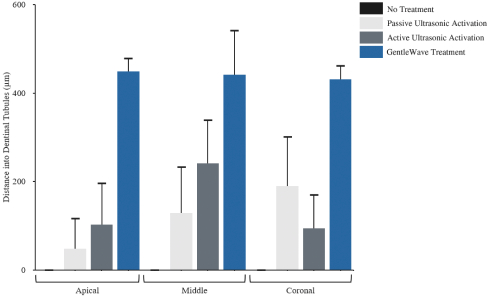

Cleaning of Complex and Small Root Canal Anatomies Superior to Conventional Methods

A study supported by us and published in the Dentistry Journal in 2016 compared the penetration depth of treatment fluids using the GentleWave System with devices commonly used in conventional methods. Specifically, the conventional methods in the study used passive ultrasonic activation with a PiezonMaster 700 (EMS) with an ESI-tip and active ultrasonic activation using a PiezonMaster 700 with an ESI-tip with maximum irrigation rate. The in-vitro study included 40 extracted human molars. The GentleWave System achieved statistical significance in

18

cleaning deeper into the dentinal tubules in the apical, middle and coronal regions, with treatment fluids cleaning dentinal tubules in the apical region between 4 and 8.5 times deeper than the other devices.

Debridement of GentleWave Compared to Conventional Methods

A study published in the Journal of Endodontics in 2015 compared the debridement efficacy of the GentleWave System with a conventional method for cleaning root canals. This study was funded by us and our employees were involved in the design of the study. Study data was acquired and analyzed independently of us. The conventional method in the study used a 30G Max-i-Probe side-vented irrigation needle and NiTi rotary instruments (endodontic files). The in-vitro study included 45 freshly extracted molars. The GentleWave System showed a statistically significant greater cleaning capacity and reduction in residual debris compared to teeth that were cleaned conventionally. Conventional instrumentation and irrigation cleaned debris from 67.8% and 87.3% of the apical and middle regions of the root canal, respectively. The GentleWave System cleaned substantially more debris, removing 97.2% and 98.1% of the debris from the apical and middle regions, respectively. The GentleWave System also

19

demonstrated more complete cleaning in complex anatomies. In teeth with isthmi, 98.3% of isthmi areas were free of tissue debris after the GentleWave Procedure, compared to 64.3% of isthmi areas after conventional methods.

Removal of Biofilm and Bacteria Superior to Conventional Methods

A study funded by us and published in Materials in 2019 compared disinfection and biofilm removal efficacy using the GentleWave System with minimal instrumentation with a device commonly used in conventional methods with conventional instrumentation. The device used in conventional methods used passive ultrasonic activation with a PiezonMaster 700 with an ESI-tip together with conventional rotary instrumentation (endodontic files). The in-vitro study included 47 freshly extracted human molars. The GentleWave System showed an ability to remove biofilm and bacteria in complex anatomies, demonstrated by statistically significant greater biofilm removal in the apical and isthmus regions of the root canal compared with conventional methods. Independent evaluators assessed and scored treated teeth on a scale from zero to three, with zero representing no bacteria and three representing large colonies of bacteria with greater than 50% of the wall covered in biofilm. In the middle and isthmus regions of the root canal, teeth treated with the GentleWave System all received scores of zero while teeth treated conventionally received scores of two and three. In the apical region of the root canal, teeth treated with the GentleWave System received scores ranging from zero to one while teeth treated conventionally received scores ranging from two to three.

Ability to Preserve More of the Original Tooth Structure without Instrumentation

A study funded by us and published in the Journal of Endodontics in 2018 examined root canal wall anatomy in uninstrumented premolar teeth cleaned using the GentleWave System. The in vitro study included 24 freshly extracted human premolars. The GentleWave System fully cleaned the root canal system of organic material without any instrumentation while leaving the original tooth structure intact. No organic tissue remnants or dentin debris were detected following treatment.

Enhanced Procedure Efficiency

The GentleWave System has been shown to improve procedure efficiency by enabling clinicians to perform RCT in a single visit while reducing the need for instrumentation. In 2020, we conducted a survey of 35 clinicians that focused on quantifying the practice benefits provided by our GentleWave System. The survey compared the percentage of single-visit RCT cases and endodontic file costs before and after adoption of the GentleWave System. The results of the survey showed an increase in the number of single-visit RCT cases from 57% to 90% of total root canal procedures following GentleWave System adoption. This increase in the proportion of single-visit RCT cases

20

enabled by the GentleWave System was observed across cases of varying complexity. These survey results are supported by data from our peer-reviewed, prospective clinical studies as well as commercial experience. Our survey also demonstrated a reduction in the need for instrumentation, with users reporting an average reduction in endodontic file costs of 41% after adopting the GentleWave System. The results of this survey may not be representative of the entire dental population and are based on informal feedback we received in performing the survey.

Sales and Marketing

Our commercial strategy and sales model involves a focus on facilitating adoption of our GentleWave System by increasing our installed base of consoles and maximizing procedural instrument revenue through increased utilization. As of December 31, 2021, our sales and marketing team consisted of approximately 77 employees working collaboratively across a range of clinician facing roles to support an installed base of approximately 820 GentleWave Systems. We have structured our sales and clinician support team with specialized roles, including 24 capital sales representatives, 17 consumable sales representatives, five clinical training specialists, nine field service engineers and ten marketing team members. During 2021, we expanded the size of our sales and clinician support teams and add a team focused on consumable sales to support our efforts for adoption and utilization of the GentleWave System.

Sales

In the United States and Canada, our direct sales force markets and sells the GentleWave System to clinicians performing a high volume of root canals as part of their practice. We estimate that there are approximately 5,000 endodontists and 176,000 general dentists in the United States and Canada. Endodontists perform approximately four million root canal procedures annually. Within the general dentist population, we estimate that a subset of approximately 50,000 general dentists perform approximately 90% of their root canal procedures, representing approximately nine million root canal procedures annually. Our sales force leverages third-party data on root canal procedure volumes by practitioner, thereby enabling us to efficiently and effectively identify target accounts. We believe that our current targeting strategy identifies a well-defined base of clinicians that is accessible by our direct sales organization.

Our capital sales representatives are responsible for generating demand for consoles both from new clinicians and broadening adoption among clinicians that already use our products. Our sales and marketing teams identify key opportunities that enable capital sales representatives to drive expansion of console placements across markets. Following the sale of a console, capital sales representatives participate in the onboarding process with the clinical training specialist.

Our clinical training specialists are dedicated to clinician, training and continuing education, often within larger group practices, and universities. Our clinical training specialists lead comprehensive onsite training programs, which generally allow clinicians to perform procedures independently following a few days of training. They play an important role in supporting our sales organization to enable increased confidence and utilization.

During 2021, we developed a team of consumable sales representatives that are focused on building relationships with clinician and dental practitioners, driving higher utilization and increasing PI revenue within the practice. Our consumable sales representatives will train and onboard new accounts and provide continuing education and practice support for existing accounts. Our consumable sales representatives partner with clinicians to enhance practice efficiency and clinical workflow and increase patient volumes.

Our field service engineers, augmented by a third-party service partner, work closely with our sales team to ensure high uptime for the GentleWave Systems and a positive user experience by performing preventive maintenance and responding to on-site device needs. Field service engineers operate efficiently to ensure our console installed base remains well-maintained and capable of high utilization levels. The GentleWave System has continuous monitoring capabilities that we can use to remotely diagnose and proactively identify needed maintenance to maximize the efficiency of our targeted site visits.

21

The GentleWave System is currently authorized for sale within the United States and Canada. We plan to pursue regulatory clearances, certifications and other market access initiatives over time in attractive international regions in which we see significant potential opportunity. For these select international regions, we intend to explore the commercial opportunity either through distributors or direct sales.

Marketing

Our marketing team is focused on expanding awareness of the GentleWave System and its benefits among prospective patients and the broader dental practitioner community. Our professional marketing and educational initiatives include publications and podium presentations at industry conferences and scientific forums, organizing peer-to-peer dialogue and events to educate clinicians on the benefits of the GentleWave System and leveraging our strong network of supportive key opinion leaders. Moving forward, we will work to draw more attention to the GentleWave Procedure in select markets where we have established a large installed base by communicating the benefits of our system through targeted direct-to-patient marketing activities including social, digital and search optimization.

We partner with clinicians through various practice support programs, which focus on increasing awareness and strengthening referral relationships with general dentists. For example, through our GPS Program, we provide guidance to our partner practices on comprehensive staff training, expansive Sonendo-sponsored marketing initiatives and engaging self-marketing strategies. We also provide content for digital marketing and social media postings to educate patients on the GentleWave Procedure and increase new business for practices. We believe our marketing programs help differentiate the GentleWave System and are valuable in helping clinicians further grow their practices.

Research and Development

We are committed to developing innovations that transform dentistry, with a focus on saving teeth. We have established a dedicated research and development team comprised of 58 individuals as of December 31, 2021, with strong research and development capabilities in the treatment of tooth decay using fluid optimization, broad-spectrum acoustic energy and advanced fluid dynamics as well as integrating hardware and software to create an exceptional user and patient experience. A core part of our research and development strategy is engagement with our network of clinicians, which enables us to leverage real-world feedback to deliver meaningful innovation to clinicians. We believe our strategy will allow us to continue to develop new functionalities and upgrades to our GentleWave System, enable us to innovate, enhance our competitive position and expand our addressable market.

As we continue to transform RCT, our research and development efforts are focused on innovating our technologies to improve the usability of the GentleWave System, enhance the efficiency and predictability of the GentleWave Procedure and enable our system to perform other elements of root canal procedures, such as obturation of the root canal system. We expect to launch CleanFlow PI, our next-generation, single-use PI, which will enable us to clean the inside of the tooth from the outside, expand our indications for use and further improve the usability of our GentleWave System. We are also exploring development of next-generation technologies that expand the application of our GentleWave System beyond RCT for use in treating cavities in earlier-stage tooth decay.

Manufacturing and Supply Chain

We currently manufacture, assemble, test and ship our GentleWave System, which includes our console and single-use PI, at our approximately 55,000 square foot facility in Laguna Hills, California. This facility provides approximately 10,000 square feet of space for our production operations, including receiving, manufacturing, quality control, inventory and shipping.

We use a combination of internally manufactured and externally-sourced components to produce our GentleWave System. Externally-sourced components include off-the-shelf materials, sub-assemblies and custom parts that are provided by approved suppliers. For certain of these components, there are relatively few alternative sources of supply. For example, our GentleWave console includes a number of components, including high pressure lines, high pressure pumps, fluid temperature control systems, degassing components and user interface control systems, most of which we source externally from third party suppliers. We rely on Teledyne SSI to supply our high pressure

22

pump, Marlow Industries, Inc. for our fluid temperature control systems and Idex Health & Science LLC for our degassing components. While there may be other suppliers that could make or provide any one of our externally-sourced components, we seek to manage single-source supplier risk by regularly assessing the quality and capacity of our suppliers and actively managing lead times and inventory levels of sourced components. In addition, particularly as we expand our business and sales, we are continuously reviewing sources and approving alternative suppliers to dual or multi-source certain of our components. We generally seek to maintain sufficient supply levels to help mitigate any supply interruptions and enable us to find and qualify another source of supply. Finished single-use PIs are sterilized at one of two qualified suppliers. The manufacture of our ancillary single-use products, including our branded EDTA solution and SoundSeal Material, is outsourced to a contract manufacturer.

Our suppliers are evaluated, qualified and approved as part of our supplier quality program, which includes verification and monitoring procedures to ensure that our suppliers comply with FDA and ISO standards, as well as our own specifications and requirements. We inspect and verify externally sourced components under strict processes supported by internal policies and procedures.

We are undertaking continuous margin improvement programs, including implementing lean manufacturing methods and collaborating with our suppliers to reduce material costs, and have executed several product design improvements to reduce product cost. We are also currently working to optimize several parts of our manufacturing process as well as consolidate the manufacture of several of the components for our console and single-use PI to fewer third-party suppliers.

Competition

Our proprietary technology platform represents an innovative approach to the treatment of tooth decay. As a result, our treatment method competes directly against conventional methods of treating root canals. We compete with manufacturers and suppliers of devices, instruments and other supplies used in connection with such conventional treatments. The market for these devices and instruments is highly fragmented with primary supply chains concentrated across a few larger manufacturers and distributors, such as Dentsply Sirona, Envista and Henry Schein. Many of our competitors have longer, more established operating histories, and significantly greater name recognition and financial, technical, marketing, sales, distribution and other resources.

We believe the primary competitive factors for companies that market new or alternative treatments and solutions in dental applications include acceptance by leading clinicians, patient outcomes and adverse event rates, patient experience and treatment time, ease-of-use and reliability, patient recovery time and level of discomfort, economic benefits and cost savings, intellectual property protection and the development of successful sales and marketing channels. One of the major hurdles to widespread adoption of our solutions will be overcoming established treatment patterns, which will require education of patients, clinicians and their referral sources.

In addition, we may compete with additional competitors and products outside the United States and Canada when we pursue plans to market our products internationally. Among other competitive advantages, such companies may have more established sales and marketing programs and networks, established relationships with clinicians and greater name recognition in such markets.

We believe our ability to compete effectively will be dependent on our ability to build the commercial infrastructure necessary to demonstrate the value of the GentleWave Procedure, maintain and improve product quality and feature functionality, build the infrastructure to support the operating needs of the business and achieve cost reductions.

Intellectual Property

We actively seek to protect the intellectual property and proprietary technology that we believe is important to our business. We rely on a combination of trademark, copyright, patent, trade secret and other intellectual property laws, employment, confidentiality and invention assignment agreements, and protective contractual provisions with our employees, contractors, consultants, suppliers, partners and other third parties, to protect our intellectual property rights.

As of December 31, 2021, we owned 29 U.S. patents, which are expected to expire between April 19, 2027 and April 18, 2038, and there were 33 pending U.S. patent applications. As of December 31, 2021, we had 93 total

23

issued foreign patents in Australia, Canada, China, Europe, Great Britain, France, Germany, Italy, Switzerland, Austria, Belgium, Denmark, Spain, Hungary, Ireland, Netherlands, Sweden, Hong Kong, Israel, India, Japan, Mexico, Singapore, and South Africa, and there were 59 total pending foreign patent applications in Canada, China, Brazil, Eurasia, Europe, Hong Kong, Israel, India, Japan, and South Korea, and 6 pending Patent Cooperation Treaty applications. The term of any individual patent depends on the relevant laws and regulations in the country in which it is granted. In most countries, including the United States, the patent term for a utility patent is generally 20 years from the earliest claimed filing date of a nonprovisional patent application in the applicable country.

As of December 31, 2021, we owned 15 U.S. patents, 11 pending U.S. patent applications, 60 foreign patents in Australia, Canada, China, Europe, France, Germany, Great Britain, Hong Kong, India, Israel, Italy, Japan, Singapore, Spain, and Switzerland, 20 pending foreign patent applications in Australia, Brazil, Canada, China, Europe, Israel, Japan, South Korea, and India, and 1 pending Patent Cooperation Treaty application that relate to our GentleWave console and procedure instruments. These patents and patent applications belong to patent families relating to the following technology areas:

As of December 31, 2021, we owned 116 registered trademarks and 48 pending trademark applications worldwide, including trademark registrations for “Sonendo” and “GentleWave” in the United States and other countries.

Our pending patent and trademark applications may not result in issued patents or registered trademarks, and we cannot assure you that any current or subsequently issued patents or registered trademarks will protect our intellectual property rights, provide us with any competitive advantage or withstand or retain its original scope after a validity or enforceability challenge from a third party. Notwithstanding the scope of the patent protection available to us, a competitor could develop competitive products that are not covered by our intellectual property, and we may be unable to stop such competitor from commercializing such products. While there is no active litigation involving any of our patents or other intellectual property rights and we have not received any notices of patent or other intellectual property infringement, we may be required to enforce or defend our intellectual property rights against third parties in the future. Because patent applications can take many years to issue, there may be applications unknown to us, which applications may later result in issued patents that our existing or future products or technologies may be alleged to infringe. There has been substantial litigation regarding patent and other intellectual property rights in the medical device industry. In the future, we may need to engage in litigation to enforce patents issued or licensed to us, protect our trade secrets or know-how, defend against claims of infringement of the rights of others or determine the scope and validity of the proprietary rights of others. Litigation could be costly and could divert our attention from other functions and responsibilities. Furthermore, even if our patents are found to be valid and infringed, a court may refuse to grant injunctive relief against the infringer and instead grant us monetary damages and/or ongoing royalties. Such monetary compensation may be insufficient to adequately offset the damage to our business caused by the infringer’s competition in the market. Adverse determinations in litigation could subject us to significant liabilities to third parties, could require us to seek licenses from third parties and pay significant royalties to such third parties and could prevent us from manufacturing, selling or using our product or techniques, any of which could severely harm our business.

24

Our knowledge and experience, creative product development, marketing staff and trade secret information, with respect to manufacturing processes and product design, are important in maintaining our proprietary product lines. As a condition of employment, we require all employees and key contractors to execute an agreement obligating them to maintain the confidentiality of our proprietary information and assign to us inventions and other intellectual property created during their employment. See “Risk Factors—Risks Related to Our Intellectual Property” for additional information regarding these and other risks related to our intellectual property portfolio and their potential effect on us.

Government Regulation

Our products and our operations are subject to extensive regulation by the FDA, and other federal and state authorities in the United States, as well as comparable authorities in foreign jurisdictions. For example, our GentleWave device is subject to regulation as a medical device in the United States under the Federal Food, Drug, and Cosmetic Act ( the "FDCA"), as implemented and enforced by the FDA.

United States Regulation

The FDA regulates the development, design, non-clinical and clinical research, manufacturing, safety, efficacy, labeling, packaging, storage, installation, servicing, recordkeeping, premarket clearance or approval, adverse event reporting, advertising, promotion, marketing and distribution, and import and export of medical devices to ensure that medical devices distributed domestically are safe and effective for their intended uses and otherwise meet the requirements of the FDCA.

FDA Premarket Clearance and Approval Requirements

Unless an exemption applies, each medical device commercially distributed in the United States requires either FDA clearance of a premarket notification submitted under Section 510(k) of the FDCA, or approval of a premarket approval application ("PMA"). Under the FDCA, medical devices are classified into one of three classes—Class I, Class II or Class III—depending on the degree of risk associated with each medical device and the extent of manufacturer and regulatory control needed to ensure its safety and effectiveness. Class I includes devices with the lowest risk to the patient and are those for which safety and effectiveness can be assured by adherence to the FDA’s General Controls for medical devices, which include compliance with the applicable portions of the Quality System Regulation ("QSR"), facility registration and product listing, reporting of adverse medical events, and truthful and non-misleading labeling, advertising for certain devices, and promotional materials. Class II devices are subject to the FDA’s General Controls, and special controls as deemed necessary by the FDA to ensure the safety and effectiveness of the device. These special controls can include performance standards, post-market surveillance, patient registries, and FDA guidance documents.

While most Class I devices are exempt from the 510(k) premarket notification requirement, manufacturers of most Class II devices are required to submit to the FDA a premarket notification under Section 510(k) of the FDCA requesting permission to commercially distribute the device. The FDA’s permission to commercially distribute a device subject to a 510(k) premarket notification is generally known as 510(k) clearance. Devices deemed by the FDA to pose the greatest risks, such as life sustaining, life supporting or some implantable devices, or devices that have a new intended use, or use advanced technology that is not substantially equivalent to that of a legally marketed device, are placed in Class III, requiring approval of a PMA. Some pre-amendment devices are unclassified, but are subject to the FDA’s premarket notification and clearance process in order to be commercially distributed. Our currently marketed GentleWave System, which includes our GentleWave console and PIs, is a Class II device and has received 510(k) clearance from the FDA.

510(k) Clearance Marketing Pathway

Our current products are subject to requirements for pre-market notification and clearance under section 510(k) of the FDCA. To obtain 510(k) clearance, we must submit to the FDA a premarket notification submission demonstrating that the proposed device is “substantially equivalent” to a predicate device. A predicate device is a legally marketed device that is not subject to premarket approval (i.e., a device that was legally marketed prior to May 28, 1976 (pre-amendments device), a device that has been reclassified from Class III to Class II or I, a device

25

that was found substantially equivalent through the 510(k) process, or a 501(k)-exempt device). The FDA’s 510(k) clearance process usually takes from three to twelve months, but may take longer. The FDA may require additional information, including clinical data, to make a determination regarding substantial equivalence. In addition, FDA collects user fees for certain medical device submissions and annual fees and for medical device establishments.

If the FDA agrees that the device is substantially equivalent to a predicate device currently on the market, it will grant 510(k) clearance to commercially market the device. If the FDA determines that the device is “not substantially equivalent” to a previously cleared device, the device is automatically designated as a Class III device. The device sponsor must then fulfill more rigorous PMA requirements, or can request a risk-based classification determination for the device in accordance with the “de novo” process, which is a route to market for novel medical devices that are low to moderate risk and are not substantially equivalent to a predicate device.

After a device receives 510(k) clearance, any modification that could significantly affect its safety or effectiveness, or that would constitute a major change or modification in its intended use, will require a new 510(k) clearance or, depending on the modification, PMA approval. The FDA requires each manufacturer to determine whether the proposed change requires submission of a 510(k) or a PMA in the first instance, but the FDA can review any such decision and disagree with a manufacturer’s determination. If the FDA disagrees with a manufacturer’s determination, the FDA can require the manufacturer to cease marketing and/or request the recall of the modified device until such marketing authorization has been granted. Also, in these circumstances, the manufacturer may be subject to significant regulatory fines or penalties.

Over the last several years, the FDA has proposed reforms to its 510(k) clearance process, and such proposals could include increased requirements for clinical data and a longer review period, or could make it more difficult for manufacturers to utilize the 510(k) clearance process for their products. For example, in November 2018, FDA officials announced steps that the FDA intended to take to modernize the 510(k) pathway. Among other things, the FDA announced that it planned to develop proposals to drive manufacturers utilizing the 510(k) pathway toward the use of newer predicates. These proposals included plans to potentially sunset certain older devices that were used as predicates under the 510(k) clearance pathway, and to potentially publish a list of devices that have been cleared on the basis of demonstrated substantial equivalence to predicate devices that are more than 10 years old. These proposals have not yet been finalized or adopted, although the FDA may work with Congress to implement such proposals through legislation.

More recently, in September 2019, the FDA issued revised final guidance describing an optional “safety and performance based” premarket review pathway for manufacturers of “certain, well-understood device types” to demonstrate substantial equivalence under the 510(k) clearance pathway by showing that such device meets objective safety and performance criteria established by the FDA, thereby obviating the need for manufacturers to compare the safety and performance of their medical devices to specific predicate devices in the clearance process. The FDA has developed and maintains a list device types appropriate for the “safety and performance based” pathway and continues to develop product-specific guidance documents that identify the performance criteria for each such device type, as well as the testing methods recommended in the guidance documents, where feasible.

PMA Approval Pathway