Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22107

SEI Structured Credit Fund, LP

(Exact name of Registrant as specified in charter)

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

Timothy Barto

c/o SEI Investments Management Corporation

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: (610) 676-2533

Date of fiscal year end: December 31, 2011

Date of reporting period: December 31, 2011

Table of Contents

| Item 1. | Reports to Stockholders. |

Table of Contents

SEI STRUCTURED CREDIT FUND, L.P.

Financial Statements

For the year ended December 31, 2011

With Report of Independent Registered Public Accounting Firm

Table of Contents

SEI Structured Credit Fund, L.P.

Financial Statements

For the year ended December 31, 2011

| 1 | ||||

| 2 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 24 | ||||

| 27 | ||||

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Fund’s Form N-Q is available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling (888) 786-9977; and (ii) on the Commission’s website at http://www.sec.gov, no later than August 31st of each year.

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Partners and Board of Directors of

SEI Structured Credit Fund, L.P.

We have audited the accompanying statement of assets and liabilities of SEI Structured Credit Fund, L.P. (the “Fund”), including the schedule of investments, as of December 31, 2011, and the related statements of operations and cash flows for the year then ended and the statements of changes in limited partners’ capital for each of the two years in the period then ended. These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2011, by correspondence with the custodian and management of the underlying investment fund. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of SEI Structured Credit Fund, L.P. at December 31, 2011, the results of its operations and its cash flows for the year then ended and the changes in its limited partners’ capital for each of the two years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Philadelphia, Pennsylvania

February 29, 2012

1

Table of Contents

SEI Structured Credit Fund, L.P.

December 31, 2011

| Description |

Par Value | Fair Value | ||||||

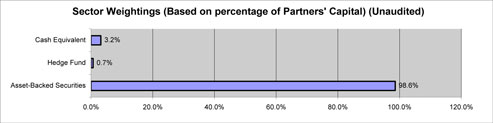

| ASSET-BACKED SECURITIES (C) — 98.6% |

||||||||

| CAYMAN ISLANDS — 98.6% |

||||||||

| Aberdeen Loan Funding, Ser 2008-1A, Cl B 2.079%, 11/01/18 (A)(B) |

$ | 4,500,000 | $ | 3,471,750 | ||||

| ACAS Business Loan Trust, Ser 2007-1A, Cl C 1.311%, 08/16/19 (A)(B) |

3,032,004 | 2,516,564 | ||||||

| ACAS Business Loan Trust, Ser 2007-2A, Cl B 1.461%, 11/18/19 (A)(B) |

6,509,847 | 5,533,370 | ||||||

| ACAS CLO, Ser 2007-1A, Cl A1J 0.719%, 04/20/21 (A)(B) |

12,067,000 | 9,979,409 | ||||||

| AMMC CDO, Ser 2011-9A –%, 01/15/22 (B) |

5,000,000 | 4,000,000 | ||||||

| ARES CLO, Ser 2006-5RA, Cl D 2.406%, 02/24/18 (A)(B) |

5,456,574 | 3,710,471 | ||||||

| Avenue CLO Fund, Ser 2006-4A, Cl B 1.235%, 11/07/18 (A)(B) |

4,500,000 | 2,970,000 | ||||||

| Avenue CLO Fund, Ser 2007-5A, Cl D2 8.690%, 04/25/19 (B) |

1,372,428 | 960,699 | ||||||

| Baker Street Funding, Ser 2006-1A, Cl D 2.103%, 10/15/19 (A)(B) |

2,500,000 | 1,512,500 | ||||||

| Brentwood CLO, Ser 2006-1A, Cl B 1.249%, 02/01/22 (A)(B) |

3,750,000 | 2,175,000 | ||||||

| Callidus Debt Partners Fund, Ser 2001-1A, Cl B2 3.320%, 12/20/13 (A)(B) |

1,440,701 | 1,393,878 | ||||||

| Carlyle High Yield Partners, Ser 2005-7A, Cl D1 2.279%, 09/30/19 (A)(B) |

1,191,037 | 726,532 | ||||||

| Churchill Financial Cayman, Ser 2007-1A, Cl D1 2.991%, 07/10/19 (A)(B) |

5,000,000 | 3,000,000 | ||||||

| CIT CLO, Ser 2007-1A, Cl D 2.563%, 06/20/21 (A)(B) |

3,000,000 | 2,053,500 | ||||||

| Claris III Jr. 0.729%, 08/04/21 |

6,501,061 | 4,745,774 | ||||||

| COLTS Trust, Ser 2005-2A, Cl C 1.413%, 12/20/18 (A)(B) |

9,000,000 | 8,174,250 | ||||||

| Commercial Industrial Finance, Ser 2006-1A, Cl B2L 4.409%, 10/20/20 (A)(B) |

2,483,217 | 1,440,266 | ||||||

| Commercial Industrial Finance, Ser 2006-1BA, Cl B1L 2.170%, 12/22/20 (A)(B) |

3,914,000 | 2,387,540 | ||||||

| Commercial Industrial Finance, Ser 2006-1BA, Cl B2L 4.570%, 12/22/20 (A) |

1,000,000 | 590,000 | ||||||

| Commercial Industrial Finance, Ser 2006-2A, Cl B1L 2.127%, 03/01/21 (A)(B) |

2,805,000 | 1,654,950 | ||||||

| Commercial Industrial Finance, Ser 2006-2A, Cl B2L 4.527%, 03/01/21 (A)(B) |

2,364,092 | 1,371,174 | ||||||

| Commercial Industrial Finance, Ser 2007-1A, Cl A3L 1.194%, 05/10/21 (A)(B) |

2,800,000 | 1,949,920 | ||||||

| Commercial Industrial Finance, Ser 2007-1A, Cl B2L 4.344%, 05/10/21 (A) |

3,011,795 | 1,686,605 | ||||||

2

Table of Contents

SEI Structured Credit Fund, L.P.

Schedule of Investments

December 31, 2011

| Description |

Par Value | Fair Value | ||||||

| Commercial Industrial Finance, Ser 2007-2A, Cl B 1.153%, 04/15/21 (A)(B) |

$ | 5,000,000 | $ | 3,300,000 | ||||

| Commercial Industrial Finance, Ser 2007-3A, Cl B 1.670%, 07/26/21 (A)(B) |

12,000,000 | 9,057,600 | ||||||

| Denali Capital CLO IV, Ser 2004-4A, Cl C 2.871%, 08/23/16 (A)(B) |

2,000,000 | 1,680,000 | ||||||

| Dryden XXII Senior Loan Fund, Ser 2011-22A, Cl D 6.039%, 01/15/22 (A)(B) |

3,000,000 | 2,280,000 | ||||||

| Eaton Vance CDO IV, Ser 2007-9A, Cl D 1.909%, 04/20/19 (A)(B) |

4,500,000 | 2,610,000 | ||||||

| Emerson Place CLO, Ser 2006-1A, Cl D 1.953%, 01/15/19 (A)(B) |

11,000,000 | 5,885,000 | ||||||

| Emporia Preferred Funding, Ser 2007-3A, Cl C 1.316%, 04/23/21 (A)(B) |

18,438,000 | 12,528,621 | ||||||

| FM Leveraged Capital Fund, Ser 2006-2A, Cl B 0.927%, 11/15/20 (A)(B) |

2,340,000 | 1,917,630 | ||||||

| FM Leveraged Capital Fund, Ser 2006-2A, Cl D 2.057%, 11/15/20 (A)(B) |

15,996,000 | 10,397,400 | ||||||

| Foxe Basin CLO 2003, Ser 2003-1A, Cl C 3.796%, 12/15/15 (A)(B) |

5,319,952 | 4,468,760 | ||||||

| Franklin CLO IV Pref. 09/20/15 |

2,000,000 | 80,000 | ||||||

| Fraser Sullivan CLO, Ser 2011-5A, Cl EF 02/23/21 (B) |

5,000,000 | 3,900,000 | ||||||

| Freidbergmilstein Private Capital Fund 01/15/19 (A) |

1,000,000 | 15,000 | ||||||

| Friedbergmilstein Private Capital Fund, Ser 2004-1A, Cl D1 2.903%, 01/15/19 (A)(B) |

9,910,169 | 8,126,338 | ||||||

| Gale Force CLO, Ser 2005-1A, Cl D1 2.307%, 11/15/17 (A)(B) |

5,500,000 | 3,616,250 | ||||||

| Gannett Peak CLO, Ser 2006-1A 1.942%, 10/27/20 (A)(B) |

2,500,000 | 1,550,000 | ||||||

| Genesis CLO, Ser 2007-2A 9.391%, 01/10/16 (A)(B) |

7,992,000 | 6,233,760 | ||||||

| Genesis CLO, Ser 2007-2A, Cl E 6.391%, 01/10/16 (A)(B) |

4,000,000 | 3,134,000 | ||||||

| Gleneagles CLO, Ser 2005-1A, Cl B 0.979%, 11/01/17 (A)(B) |

9,000,000 | 6,525,000 | ||||||

| Gleneagles CLO, Ser 2005-1A, Cl C 1.329%, 11/01/17 (A)(B) |

22,000,000 | 14,520,000 | ||||||

| Global Leveraged Capital Credit Opportunity Fund, Ser 2006-1A, Cl B 1.009%, 12/20/18 (A)(B) |

23,500,000 | 18,435,750 | ||||||

| Grayson CLO, Ser 2006-1A, Cl B 1.129%, 11/01/21 (A)(B) |

9,189,000 | 5,421,510 | ||||||

| Grayson CLO, Ser 2006-1A, Cl C 1.979%, 11/01/21 (A)(B) |

8,000,000 | 4,000,000 | ||||||

| Greyrock CDO, Ser 2005-1A, Cl B1L 2.257%, 11/15/17 (A)(B) |

3,000,000 | 1,980,000 | ||||||

| GSC Capital Loan Funding CLO, Ser 2005-1A, Cl D 1.371%, 02/18/20 (A)(B) |

5,000,000 | 3,437,500 | ||||||

| GSC Partners CDO Fund, Ser 2006-7A, Cl B 1.056%, 05/25/20 (A)(B) |

2,000,000 | 1,540,000 | ||||||

| GSC Partners CDO Fund, Ser 2006-7A, Cl C 1.506%, 05/25/20 (A)(B) |

13,000,000 | 9,230,000 | ||||||

| GSC Partners CDO Fund, Ser 2007-8A, Cl B 1.153%, 04/17/21 (A)(B) |

5,000,000 | 3,214,450 | ||||||

| Hewett’s Island CDO, Ser 2006-5A, Cl D 1.977%, 12/05/18 (A)(B) |

5,500,000 | 3,135,000 | ||||||

| Jasper CLO, Ser 2005-1A, Cl B 1.009%, 08/01/17 (A)(B) |

946,000 | 700,040 | ||||||

| Jasper CLO, Ser 2005-1A, Cl C 1.329%, 08/01/17 (A)(B) |

500,000 | 300,000 | ||||||

3

Table of Contents

SEI Structured Credit Fund, L.P.

Schedule of Investments

December 31, 2011

| Description |

Par Value | Fair Value | ||||||

| Knightsbridge CLO, Ser 2007-1A, Cl E 9.391%, 01/11/22 (A)(B) |

$ | 2,000,000 | $ | 1,560,000 | ||||

| Latitude CLO, Ser 2005-1A, Cl B1 1.446%, 12/15/17 (A)(B) |

6,000,000 | 3,796,200 | ||||||

| Latitude CLO, Ser 2006-2A, Cl C 2.146%, 12/15/18 (A)(B) |

4,000,000 | 2,160,000 | ||||||

| LCM, Ser 2010-8A, Cl LP 01/14/21 (B) |

2,000,000 | 1,700,000 | ||||||

| Liberty CLO, Ser 2005-1A, Cl B 1.329%, 11/01/17 (A)(B) |

1,230,000 | 738,000 | ||||||

| Lightpoint CLO, Ser 2007-7A, Cl D 4.457%, 05/15/21 (A)(B) |

2,260,000 | 1,395,234 | ||||||

| MC Funding, Ser 2006-1A, Cl C 1.513%, 12/20/20 (A)(B) |

15,000,000 | 11,017,500 | ||||||

| MC Funding, Ser 2006-1A, Cl E 4.313%, 12/20/20 (A)(B) |

12,760,000 | 9,036,887 | ||||||

| Newstar Trust, Ser 2007-1A, Cl A1 0.763%, 09/30/22 (A)(B) |

7,960,029 | 7,164,026 | ||||||

| Ocean Trails CLO, Ser 2007-2A, Cl A2 0.758%, 06/27/22 (A)(B) |

500,000 | 376,250 | ||||||

| Olympic CLO, Ser 2004-1A, Cl B1L 3.357%, 05/15/16 (A)(B) |

3,000,000 | 2,541,000 | ||||||

| Red River CLO, Ser 2006-1A, Cl B 0.879%, 07/27/18 (A) |

15,000,000 | 10,875,000 | ||||||

| Red River CLO, Ser 2006-1A, Cl C 1.149%, 07/27/18 (A) |

10,000,000 | 6,500,000 | ||||||

| Red River CLO, Ser 2006-1A, Cl D 2.079%, 07/27/18 (A) |

14,519,000 | 7,695,070 | ||||||

| Rockwall CDO, Ser 2006-1A, Cl A1LA 0.729%, 08/01/21 (A)(B) |

14,560,962 | 12,049,196 | ||||||

| Rockwall CDO, Ser 2006-1A, Cl A1LB 0.929%, 08/01/21 (A)(B) |

10,111,000 | 6,471,040 | ||||||

| Rockwall CDO, Ser 2006-1A, Cl A2L 1.079%, 08/01/21 (A)(B) |

9,388,055 | 5,538,952 | ||||||

| Rockwall CDO, Ser 2007-1A, Cl A1LA 0.679%, 08/01/24 (A)(B) |

31,252,231 | 24,376,740 | ||||||

| Rockwall CDO, Ser 2007-1A, Cl A1LB 0.979%, 08/01/24 (A)(B) |

12,000,000 | 8,040,000 | ||||||

| San Gabriel CLO, Ser 2007-1A, Cl B1L 2.790%, 09/10/21 (A)(B) |

3,000,000 | 2,085,000 | ||||||

| Sargas CLO I, Ser 2006-1A, Cl B 1.212%, 08/27/20 (A)(B) |

1,000,000 | 680,000 | ||||||

| Southfork CLO, Ser 2005-1A, Cl C 2.529%, 02/01/17 (A)(B) |

14,750,000 | 9,440,000 | ||||||

| Southport CLO, Ser 2004-1A, Cl D 6.403%, 10/15/16 (A)(B) |

989,691 | 781,856 | ||||||

| Telos CLO, Ser 2006-1A, Cl D 2.091%, 10/11/21 (A)(B) |

18,000,000 | 11,385,000 | ||||||

| Telos CLO, Ser 2007-2A, Cl D 2.603%, 04/15/22 (A)(B) |

12,000,000 | 7,380,000 | ||||||

| Waterfront CLO, Ser 2007-1A, Cl D 5.153%, 08/02/20 (A)(B) |

4,750,000 | 3,040,000 | ||||||

| Westchester CLO, Ser 2007-1A, Cl C 1.279%, 08/01/22 (A)(B) |

5,125,000 | 2,460,000 | ||||||

| Westwood CDO, Ser 2007-2A, Cl D 2.218%, 04/25/22 (A)(B) |

4,440,000 | 2,708,400 | ||||||

| Whitehorse, Ser 2006-1A, Cl B1L 2.279%, 05/01/18 (A)(B) |

1,000,000 | 695,400 | ||||||

4

Table of Contents

SEI Structured Credit Fund, L.P.

Schedule of Investments

December 31, 2011

| Description |

Par Value/Cost/Shares | Fair Value | ||||||

| Zohar CDO, Ser 2007-3A, Cl A2 1.109%, 04/15/19 (A)(B) |

$ | 10,000,000 | $ | 5,800,000 | ||||

|

|

|

|||||||

| Total Asset-Backed Securities |

390,710,512 | |||||||

|

|

|

|||||||

| HEDGE FUND — 0.7% |

||||||||

| CAYMAN ISLANDS — 0.7% |

1,500,000 | 2,961,790 | ||||||

|

|

|

|||||||

| Total Hedge Fund |

2,961,790 | |||||||

|

|

|

|||||||

| MONEY MARKET FUND — 3.2% |

||||||||

| UNITED STATES — 3.2% |

||||||||

| SEI Daily Income Trust Prime Obligation Fund, Cl A |

12,696,413 | 12,696,413 | ||||||

|

|

|

|||||||

| Total Money Market Fund |

12,696,413 | |||||||

|

|

|

|||||||

| Total Investments in Securities — 102.5% |

$ | 406,368,715 | ||||||

|

|

|

|||||||

The following restricted securities were held by the Portfolio as of December 31, 2011:

| Acquisition Date |

Cost | Fair Value | % of Partners’ Capital |

First Available Redemption Date |

Liquidity Frequency |

|||||||||||||||||||

| Ares Enhanced Credit Opportunities, L.P. |

5/1/2008 | $ | 1,500,000 | $ | 2,961,790 | 0.75 | % | 6/30/2011 | Quarterly | |||||||||||||||

Percentages based on Partners’ Capital of $396,344,780.

| CDO | — | Collateralized Debt Obligation | ||

| Cl | — | Class | ||

| CLO | — | Collateralized Loan Obligation | ||

| L.P. | — | Limited Partnership | ||

| Ser | — | Series |

| (A) | Variable rate security. The rate reported is the rate in effect as of December 31, 2011. |

| (B) | Securities sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended. At December 31, 2011, the market value of the Rule 144A positions amounted to $358,523,063 or 88.2% of total investments in securities. |

| (C) | Securities considered illiquid. The total value of such securities as of December 31, 2011 was $393,672,302 and represented 99.3% of Partners’ Capital. |

| (D) | Security considered restricted. The total market value of such securities as of December 31, 2011 was $2,961,790 and represented 0.7% of Partners’ Capital. |

| (E) | Rate shown is the 7-day effective yield as of December 31, 2011. |

| (F) | Investment in affiliated security. |

| (G) | The selected class of Hedge Fund is still in its initial lock – up period. The frequency of redemptions may be extended until the Hedge Fund exits this period. |

5

Table of Contents

SEI Structured Credit Fund, L.P.

Schedule of Investments

December 31, 2011

The following is a summary of the inputs used as of December 31, 2011 in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Asset-Backed Securities |

$ | — | $ | — | $ | 390,710,512 | $ | 390,710,512 | ||||||||

| Hedge Fund |

— | — | 2,961,790 | 2,961,790 | ||||||||||||

| Money Market Fund |

12,696,413 | — | — | 12,696,413 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 12,696,413 | $ | — | $ | 393,672,302 | $ | 406,368,715 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The following is a reconciliation of the investments in which significant unobservable inputs (Level 3) were used in determining value:

| Asset-Backed Securities |

Hedge Funds | |||||||

| Beginning balance as of January 1, 2011 |

$ | 307,509,437 | $ | 10,398,213 | ||||

| Accrued discounts/premiums |

7,363,982 | — | ||||||

| Realized gain/(loss) |

38,382,990 | 315,315 | ||||||

| Change in unrealized appreciation/(depreciation) |

(29,418,314 | ) | 63,577 | |||||

| Proceeds from sales |

(183,143,119 | ) | (7,815,315 | ) | ||||

| Purchases |

250,015,536 | — | ||||||

| Net transfer in and/or out of Level 3 |

— | — | ||||||

|

|

|

|

|

|||||

| Ending balance as of December 31, 2011 |

$ | 390,710,512 | $ | 2,961,790 | ||||

|

|

|

|

|

|||||

| Changes in unrealized gains/(losses) included in earnings related to securities still held at reporting date |

$ | (3,946,436 | ) | $ | 63,577 | |||

|

|

|

|

|

|||||

For the year ended December 31, 2011, there were no transfers between Level 1 and Level 2 assets and liabilities. For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements. Amounts designated as “—” are $0 or have been rounded to $0.

See accompanying note.

6

Table of Contents

SEI Structured Credit Fund, L.P.

Statement of Assets and Liabilities

December 31, 2011

| Assets |

||||

| Investments in securities, at value (cost $372,261,320) |

$ | 393,672,302 | ||

| Investment in affiliate, at value (cost $12,696,413, see note 2) |

12,696,413 | |||

| Interest receivable from investments |

1,702,471 | |||

| Receivable for securities sold |

4,027,567 | |||

|

|

|

|||

| Total assets |

412,098,753 | |||

|

|

|

|||

| Liabilities |

||||

| Capital withdrawals payable |

12,631,158 | |||

| Payable for investment securities purchased |

3,000,000 | |||

| Administration fees payable |

34,081 | |||

| Other accrued expenses |

88,734 | |||

|

|

|

|||

| Total liabilities |

15,753,973 | |||

|

|

|

|||

| Limited Partners’ capital |

$ | 396,344,780 | ||

|

|

|

|||

| Limited Partners’ capital |

||||

| Represented by: |

||||

| Paid-in-capital |

$ | 374,933,798 | ||

| Net unrealized appreciation on investments |

21,410,982 | |||

|

|

|

|||

| Limited Partners’ capital |

$ | 396,344,780 | ||

|

|

|

|||

See accompanying notes.

7

Table of Contents

SEI Structured Credit Fund, L.P.

For the year ended December 31, 2011

| Investment income |

||||

| Interest income |

$ | 26,009,892 | ||

| Interest income from affiliated investment |

4,912 | |||

|

|

|

|||

| 26,014,804 | ||||

| Expenses |

||||

| Administration fee |

356,024 | |||

| Professional fees |

56,250 | |||

| Directors’ fees |

30,000 | |||

| Miscellaneous expenses |

179,409 | |||

|

|

|

|||

| Total expenses |

621,683 | |||

|

|

|

|||

| Net investment income |

25,393,121 | |||

|

|

|

|||

| Realized and unrealized gains (losses) on investments |

||||

| Net realized gain on investments |

25,779,543 | |||

| Net change in unrealized appreciation (depreciation) on investments |

(22,878,195 | ) | ||

|

|

|

|||

| Net realized and unrealized gains on investments |

2,901,348 | |||

|

|

|

|||

| Net increase in partners’ capital resulting from operations |

$ | 28,294,469 | ||

|

|

|

|||

See accompanying notes.

8

Table of Contents

SEI Structured Credit Fund, L.P.

Statements of Changes in Limited Partners’ Capital

| For the

year ended December 31, 2011 |

For the

year ended December 31, 2010 |

|||||||

| From investment activities |

||||||||

| Net investment income |

$ | 25,393,121 | $ | 24,077,502 | ||||

| Net realized gain on investments |

25,779,543 | 87,699,851 | ||||||

| Net change in unrealized appreciation (depreciation) on investments |

(22,878,195 | ) | 1,449,686 | |||||

|

|

|

|

|

|||||

| Net increase in partners’ capital resulting from operations |

28,294,469 | 113,227,039 | ||||||

| Distributions |

||||||||

| Return of capital |

— | (94,992,481 | ) | |||||

|

|

|

|

|

|||||

| Partners’ capital transactions |

||||||||

| Capital contributions |

82,717,174 | 20,007,501 | ||||||

| Capital withdrawals |

(27,336,751 | ) | (44,846,174 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) in partners’ capital derived from capital transactions |

55,380,423 | (24,838,673 | ) | |||||

| Net increase (decrease) in partners’ capital |

83,674,892 | (6,604,115 | ) | |||||

| Partners’ capital beginning of year |

312,669,888 | 319,274,003 | ||||||

|

|

|

|

|

|||||

| Partners’ capital end of year |

$ | 396,344,780 | $ | 312,669,888 | ||||

|

|

|

|

|

|||||

See accompanying notes.

9

Table of Contents

SEI Structured Credit Fund, L.P.

For the year ended December 31, 2011

| Cash flows from operating activities |

||||

| Net increase in partners’ capital resulting from operations |

$ | 28,294,469 | ||

| Adjustments to reconcile net increase in partners’ capital resulting from operations to net cash used in operating activities: |

||||

| Purchases of long-term investments |

(313,723,370 | ) | ||

| Proceeds from sales of long-term investments |

267,056,093 | |||

| Amortization on discount (see Note 2) |

(17,410,534 | ) | ||

| Net purchase of short-term investments |

(4,604,906 | ) | ||

| Net realized gain on investments |

(25,779,543 | ) | ||

| Net change in unrealized appreciation (depreciation) on investments |

22,878,195 | |||

| Decrease in capital withdrawal receivable from underlying funds |

1,003,558 | |||

| Increase in securities sold receivable |

(4,027,567 | ) | ||

| Increase in interest receivable |

(748,965 | ) | ||

| Increase in securities purchased payable |

3,000,000 | |||

| Decrease in administration fees payable |

(20,678 | ) | ||

| Decrease in other accrued expenses |

(4,079 | ) | ||

|

|

|

|||

| Net cash used in operating activities |

(44,087,327 | ) | ||

| Cash flows from financing activities |

||||

| Capital contributions |

82,717,174 | |||

| Capital withdrawals |

(38,629,847 | ) | ||

|

|

|

|||

| Net cash provided by financing activities |

44,087,327 | |||

|

|

|

|||

| Net change in cash and cash equivalents |

— | |||

|

|

|

|||

| Cash and cash equivalents |

||||

| Beginning of year |

— | |||

|

|

|

|||

| End of year |

$ | — | ||

|

|

|

|||

See accompanying notes.

10

Table of Contents

SEI Structured Credit Fund, L.P.

December 31, 2011

1. Organization

SEI Structured Credit Fund, LP (the “Fund”) is a Delaware limited partnership established on June 26, 2007 and commenced operations on August 1, 2007. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as a closed-end, non-diversified, management investment company. The Fund offers limited partnership interests (“Interests”) solely through private placement transactions to investors (“Limited Partners”) that have signed an investment management agreement with SEI Investments Management Corporation (“SIMC” or the “Adviser”), the investment adviser to the Fund. As of December 31, 2011, the SEI Structured Credit Segregated Portfolio owned approximately 68.1% of the Fund, while the only other remaining Limited Partner owned approximately 31.9% of the Fund.

The Fund’s objective is to seek to generate high total returns. There can be no assurance that the Fund will achieve its objective. The Fund pursues its investment objective by investing in a portfolio comprised of collateralized debt obligations (“CDOs”) and other structured credit investments. CDOs involve special purpose investment vehicles formed to acquire and manage a pool of loans, bonds and/or other fixed income assets of various types. CDOs fund their investments by issuing several classes of securities, the repayment of which is linked to the performance of the underlying assets, which serve as collateral for certain securities issued by the CDO. In addition to CDOs, the Fund’s investments may include fixed income securities, loan participations, credit-linked notes, medium-term notes, registered and unregistered investment companies or pooled investment vehicles, and derivative instruments, such as credit default swaps and total return swaps (collectively with CDOs, “Structured Credit Investments”).

SEI Investment Strategies, LLC (the “General Partner”), a Delaware limited liability company, serves as the General Partner to the Fund and has no investment in the Fund as of December 31, 2011. The General Partner has delegated the management and control of the business and affairs of the Fund to the Board of Directors (the “Board”). A majority of the Board is and will be persons who are not “interested persons” (as defined in the 1940 Act) with respect to the Fund.

2. Significant Accounting Policies

The following is a summary of significant accounting and reporting policies followed by the Fund in preparing the financial statements:

11

Table of Contents

SEI Structured Credit Fund, L.P.

Notes to Financial Statements (continued)

December 31, 2011

2. Significant Accounting Policies (continued)

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Management believes that the estimates utilized in preparing the Fund’s financial statements are reasonable and prudent; however, actual results could differ from these estimates and it is reasonably possible that differences could be material.

Valuation of Investments

CDOs and other Structured Credit Investments are priced based upon valuations provided by independent, third party pricing agents using their proprietary valuation methodology. The third-party pricing agents may value Structured Credit Investments at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. Such methodologies generally consider such factors as security prices, yields, maturities, call features, ratings and developments relating to specific securities in arriving at valuations.

If a price for a CDO or other Structured Credit Investment cannot be obtained from an independent, third-party pricing agent, the Fund shall seek to obtain a bid price from at least one dealer, who is independent of the Fund. In such cases, the independent dealer providing the price on the CDO or Structured Credit Investment may also be a market maker, and in many cases the only market maker, with respect to that security. As of December 31, 2011, all asset-backed securities are valued by an independent dealer who is also a market maker.

A dealer’s valuation reflects its judgment of the price of an asset, assuming an arm’s length transaction at the valuation date between knowledgeable, willing market participants and sufficient time in advance of the valuation date to market the instrument. It generally assumes a round lot institutional transaction, without consideration for whether the client is long or short the instrument, and without adjustment for the size of the client’s position. The valuation pertains to an assumed transaction, does not necessarily reflect actual quoted or other prices, and does not indicate that an active market exists for the financial instrument.

12

Table of Contents

SEI Structured Credit Fund, L.P.

Notes to Financial Statements (continued)

December 31, 2011

2. Significant Accounting Policies (continued)

Valuation of Investments (continued)

A dealer’s valuation may be formulated using inputs such as a combination of observable market transactions of the exact security or a similar security and internal models. Bids-Wanted-In Competition, or BWICs, are widely distributed auctions of securities whose results are the primary input used by dealers to establish valuations for structured credit securities. Dealers supplement BWIC results with private transactions and model-driven valuations. Model-driven valuations require assumptions regarding default, recovery, and prepayment rates that are consistent with current market conditions.

In situations where market inputs are not available or do not provide a sufficient basis under current market conditions for pricing the instrument, the valuation may reflect the dealer’s view of the assumptions that market participants would use in pricing the instrument. Since market participants may have materially different views as to future supply, demand, credit quality and other factors relevant to pricing financial instruments, as well as bid and ask prices, valuations may differ materially among dealers. The actual level at which these instruments trade (if trades occur) could be materially different from the dealer’s valuation.

Debt obligations with remaining maturities of sixty days or less may be valued at their amortized cost, which approximates fair value. Investments in open-ended investment companies are valued based on reported NAV of the investment company.

Securities for which market prices are not “readily available” or may be unreliable are valued in accordance with Fair Value Procedures established by the Board. The Fund’s Fair Value Procedures are implemented through a Fair Value Committee (the “Committee”) designated by the Board. When a security is valued in accordance with the Fair Value Procedures, the Committee will determine the value after taking into consideration relevant information reasonably available to the Committee.

Examples of factors the Committee may consider are: the last trade price, the performance of the market or of the issuer’s industry, the liquidity of the security, the size of the holding in the Fund, or any other appropriate information. The determination of a security’s fair value price often involves the consideration of a number of subjective factors, and is therefore subject to the unavoidable risk that the value assigned to a security may be higher or lower than the security’s value would be if a reliable market quotation for the security was readily available. At December 31, 2011, there were no securities that were fair valued by the Committee.

13

Table of Contents

SEI Structured Credit Fund, L.P.

Notes to Financial Statements (continued)

December 31, 2011

2. Significant Accounting Policies (continued)

Valuation of Investments (concluded)

Certain Structured Credit Investments may be structured as private investment partnerships. Traditionally, a trading market for holdings of this type does not exist. The fair value of the Fund’s Interest in such a private investment fund will represent the amount that the Fund could reasonably expect to receive from the private investment fund if the Fund’s Interest were sold at the time of valuation, determined based on information reasonably available at the time the valuation is made and that the Fund believes to be reliable. Unless determined otherwise in accordance with the Fund’s Fair Value Procedures, the fair value of the Fund’s Interest in a private investment fund will usually be the value attributed to such interest, as of that time of valuation, as reported to the Fund by the private investment fund’s manager, administrator, or other designed agent. As a practical matter, the Adviser and the Board have little or no means of independently verifying the valuations provided by such private investment funds. In the unlikely event that a private investment fund does not report a value to the Fund on a timely basis and such fund is not priced by independent pricing agents of the Fund, the Fund’ Committee would determine the fair value of the private investment fund based on the most recent value reported by the private investment fund, as well as any other relevant information available at the time the Fund values its portfolio. As of December 31, 2011, there were no securities fair valued in accordance with the Fund’s Fair Value Procedures.

The Board will periodically review the Fund’s valuation policies and will update them as necessary to reflect changes in the types of securities in which the Fund invests.

Fair Value of Financial Instruments

In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price).

14

Table of Contents

SEI Structured Credit Fund, L.P.

Notes to Financial Statements (continued)

December 31, 2011

2. Significant Accounting Policies (continued)

Fair Value of Financial Instruments (continued)

Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date;

Level 2 – Observable market based inputs or unobservable inputs that are corroborated by market data, which includes financial instruments that are valued using models or other valuation methodologies. These models are primarily industry standard models that consider various assumptions, including time value, yield curve, volatility factors, prepayment speeds, default rates, loss severity, current market and contractual prices for the underlying financial instruments, as well as other relevant economic measures. Substantially all of these assumptions are observable in the marketplace, can be derived from observable data or are supported by observable levels at which transactions are executed in the marketplace;

Level 3 – Unobservable inputs that are not corroborated by market data (supported by little or no market activity), which is comprised of financial instruments whose fair value is estimated based on internally developed models or methodologies utilizing significant inputs that are generally less readily observable.

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

For the year ended December 31, 2011, there have been no significant changes to the Fund’s fair valuation methodologies.

15

Table of Contents

SEI Structured Credit Fund, L.P.

Notes to Financial Statements (continued)

December 31, 2011

2. Significant Accounting Policies (continued)

Income Recognition and Security Transactions

Security transactions are recorded on the trade date for financial reporting purposes. Costs used in determining net realized capital gains and losses on the sale of securities are on the basis of specific identification. Dividend income is recognized on the ex-dividend date, and interest income is recognized using the accrual basis of accounting except for certain heavily subordinated collateralized loan obligations (“CLOs”) for which the Fund cannot reasonably estimate performance. Amortization and accretion is calculated using the scientific interest method, which approximates the effective interest method over the estimated life of the security. Amortization of premiums and discounts are included in interest income.

Collateralized Debt Obligations

The Fund invests in CDOs which include CLOs and other similarly structured securities. CLOs are a type of asset-backed security. A CLO is a trust typically collateralized by a pool of loans, which may include, among others, domestic and foreign senior secured loans, senior unsecured loans, and subordinate corporate loans, including loans that may be rated below investment grade or equivalent unrated loans. CDOs may charge management fees and administrative expenses. For CDOs, the cashflows from the trust are split into two or more portions, called tranches, varying in risk and yield. The riskiest portion is the “equity” tranche which bears the bulk of defaults from the bonds or loans in the trust and serves to protect the other, more senior tranches from default in all but the most severe circumstances. Since it is partially protected from defaults, a senior tranche from a CDO trust typically has a higher rating and lower yield than their underlying securities, and can be rated investment grade. Despite the protection from the equity tranche, CDO tranches can experience substantial losses due to actual defaults, increased sensitivity to defaults due to collateral default and disappearance of protecting tranches, market anticipation of defaults, as well as aversion to CDO securities as a class.

The risks of an investment in a CDO depend largely on the type of the collateral securities and the class of the CDO in which the Fund invests. Normally, CLOs and other CDOs are privately offered and sold, and thus, are not registered under the securities laws. As a result, investments in CDOs may be characterized by the Fund as illiquid securities; however, an active dealer market may exist for CDOs, allowing a CDO to qualify for Rule 144A transactions.

16

Table of Contents

SEI Structured Credit Fund, L.P.

Notes to Financial Statements (continued)

December 31, 2011

2. Significant Accounting Policies (continued)

Collateralized Debt Obligations (continued)

In addition to the normal risks associated with fixed income securities (e.g., interest rate risk and default risk), CDOs carry additional risks including, but not limited to: (i) the possibility that distributions from collateral securities will not be adequate to make interest or other payments; (ii) the quality of the collateral may decline in value or default; (iii) the Fund may invest in CDOs that are subordinate to other classes; and (iv) the complex structure of the security may not be fully understood at the time of investment and may produce disputes with the issuer or unexpected investment results.

Federal Taxes

The Fund intends to be treated as a partnership for federal, state, and local income tax purposes. The Limited Partners are responsible for the tax liability or benefit relating to its distributive share of taxable income or loss. Accordingly, no provision for federal, state, or local income taxes is reflected in the accompanying financial statements.

For the period ended December 31, 2011, in accordance with the accounting guidance provided in the AICPA Audit and Accounting Guide, “Audits of Investment Companies,” the Fund reclassified $25,393,121 and $25,779,543 from accumulated net investment income and accumulated net realized gain, respectively, to net Limited Partners’ capital. The reclassification was to reflect, as an adjustment to net Limited Partners’ capital, the amount of taxable income that has been allocated to the Limited Partners and has no effect on net assets.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is “more-likely-than-not” (i.e., greater than 50-percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. The Fund did not record any tax provisions in the current period. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., the last 3 tax year ends, as applicable), on-going analysis of and changes to tax laws, regulations and interpretations thereof.

17

Table of Contents

SEI Structured Credit Fund, L.P.

Notes to Financial Statements (continued)

December 31, 2011

2. Significant Accounting Policies (concluded)

Restricted Securities

As of December 31, 2011, the Fund owned private placement investments that were purchased through private offerings or acquired through initial public offerings and cannot be sold without prior registration under the Securities Act of 1933 or pursuant to an exemption therefrom. In addition, the Fund has generally agreed to further restrictions on the disposition of certain holdings as set forth in various agreements entered into in connection with the purchase of these investments. These investments are valued at fair value as determined in accordance with the procedures approved by the Board. For the acquisition dates, cost and fair value of these investments, along with their liquidity terms at December 31, 2011, see the Schedule of Investments.

Cash and Cash Equivalents

The Fund treats all highly liquid financial instruments that mature within three months of acquisition as cash equivalents. Cash equivalents are valued at cost plus accrued interest, which approximates fair value. At December 31, 2011, the Fund did not hold any cash and held $12,696,413 in an affiliated money market fund which is classified as part of the Fund’s investment portfolio in the Schedule of Investments.

3. Adviser, Administrator and Other Transactions

The Adviser does not charge a management fee to the Fund. Limited Partners are responsible for paying the fees of the Adviser directly under their individual investment management agreement with the Adviser. Each agreement sets forth the fees to be paid to the Adviser, which are ordinarily expressed as a percentage of the Limited Partner’s assets managed by the Adviser. This fee, which is negotiated between the Limited Partner and the Adviser, may include a performance-based fee and/or a fixed-dollar fee for certain specified services.

The Adviser has voluntarily agreed that certain expenses of the Fund, including custody fees and administrative fees, calculated monthly, shall not in the aggregate exceed 0.50% per annum of the Fund’s monthly average net asset value, and the Adviser or its affiliates will waive Fund fees or reimburse Fund expenses to the extent necessary so that such 0.50% limit is not exceeded. The following expenses of the Fund are specifically excluded from the expense limit: organizational expenses; extraordinary, non-recurring and certain other unusual expenses; taxes and fees; and expenses incurred indirectly by the Fund through its investments in Structured Credit Investments. The Adviser may discontinue all or part of this waiver at any time.

18

Table of Contents

SEI Structured Credit Fund, L.P.

Notes to Financial Statements (continued)

December 31, 2011

3. Adviser, Administrator and Other Transactions (continued)

SEI Global Services, Inc. (the “Administrator”), serves as the Fund’s administrator. The Administrator is a wholly-owned subsidiary of SEI Investments Company. The Administrator provides certain administrative, accounting, and transfer agency services to the Fund. The services performed by the Administrator may be completed by one or more of its affiliated companies. The Fund pays the Administrator a fee equal to 0.10% (on an annualized basis) of the Fund’s Net Asset Value which is accrued monthly based on month-end net assets and is paid monthly, and reimburses the Administrator for certain out-of-pocket expenses.

SEI Investments Distribution Co. (the “Placement Agent”) serves as the Fund’s placement agent pursuant to an agreement with the Fund. The Placement Agent is a wholly owned subsidiary of SEI Investments Company. The Placement Agent is not compensated by the Fund for its services rendered under the agreement.

4. Allocation of Profits and Losses

The Fund maintains a separate capital account for each of its Limited Partners. As of the last day of each month, the Fund shall allocate net profits or losses for that month to the capital accounts of all Limited Partners, in proportion to their respective opening capital account balances for such month (after taking into account any capital contributions deemed to be made as of the first day of such month).

5. Partners’ Capital

The Fund, in the discretion of the Board, may sell interests to new Limited Partners and may allow existing Limited Partners to purchase additional Interests in the Fund on such days as are determined by the Board in its sole discretion. It is the Fund’s intention to allow limited purchases of Interests only during designated subscription periods as may be established by the Board or its designees (currently, the Adviser) and communicated to Limited Partners. The Board or its designee will determine the amount of Interests offered to Limited Partners during a subscription period at its discretion. During the established subscription periods, Interests may be purchased on a business day, or at such other times as the Board may determine, at the offering price (which is net asset value). The Fund may discontinue its offering at any time.

The Fund is a closed-end investment company, and therefore no Limited Partner will have the right to require the Fund to redeem its Interests. The Fund from time to time may offer to repurchase outstanding Interests pursuant to written tenders by Limited

19

Table of Contents

SEI Structured Credit Fund, L.P.

Notes to Financial Statements (continued)

December 31, 2011

5. Partners’ Capital (continued)

Partners. Repurchase offers will be made at such times and on such terms as may be determined by the Board in its sole discretion. In determining whether the Fund should repurchase Interests from Limited Partners pursuant to written tenders, the Board will consider the recommendations of the Adviser.

The Adviser expects that it will recommend to the Board that the Fund offer to repurchase Interests four times each year, as of the last business day of March, June, September, and December. However, Limited Partners will not be permitted to tender for repurchase Interests that were acquired less than two years prior to the effective date of the proposed repurchase.

Even after the initial two year period, it is possible that there will be extended periods during which illiquidity in the underlying investments held by the Fund or other factors will cause the Board to elect not to conduct repurchase offers. Such periods may coincide with periods of negative performance. In addition, even in the event of a repurchase offer, it is possible that there will be an oversubscription to the repurchase offer, in which case an Investor may not be able to redeem the full amount that the Investor wishes to redeem.

During the year ended December 31, 2011, the Fund offered to repurchase Interests resulting in capital withdrawals of $27,336,751.

6. Investment Transactions

The cost of security purchases and proceeds from the sale and maturity of securities, other than temporary cash investments, during the year ended December 31, 2011 were $313,723,370 and $267,056,093, respectively.

As of December 31, 2011, the estimated cost of investments for tax purposes is $375,533,659 Net unrealized appreciation on investments for tax purposes was $30,835,056 consisting of $41,714,612 of gross unrealized appreciation and $10,879,556 of gross unrealized depreciation.

7. Concentrations of Risk

In the normal course of business, the Fund may trade various financial instruments and may enter into various investment activities with off-balance sheet risk. The Fund’s satisfaction of the obligations may exceed the amount recognized in the statement of assets and liabilities.

20

Table of Contents

SEI Structured Credit Fund, L.P.

Notes to Financial Statements (continued)

December 31, 2011

7. Concentrations of Risk (continued)

(a) Market risk

Market risk encompasses the potential for both losses and gains and includes price risk, interest rate risk, prepayment risk and collateral performance risk. The Fund’s market risk management strategy is driven by the Fund’s investment objective. The Adviser oversees each of the risks in accordance with policies and procedures.

(i) Price risk

Price risk is the risk the value of the instrument will fluctuate as a result of changes in market prices, whether caused by factors specific to an individual investment, its issuer or any factor affecting financial instruments traded in the market. As all of the Fund’s financial instruments are carried at fair value with fair value changes recognized in the Statement of Operations, all changes in market conditions directly affect net assets.

(ii) Interest rate risk

The fair value of the Fund’s investments will change in response to interest rate changes and other factors. During periods of falling interest rates, the values of fixed income securities generally rise. Conversely, during periods of rising interest rates, the values of such securities generally decline. Changes by recognized rating agencies in the ratings of any fixed income security and in the ability of an issuer to make payments of interest and principal may also affect the value of these investments.

(iii) Prepayment risk

Prepayment risk is the risk associated with the early unscheduled return of principal on a fixed-income security. Some fixed-income securities, such as CDOs, have embedded call options which may be exercised by the issuer, or in the case of a CDO, the borrower. The yield-to-maturity of such securities cannot be known for certain at the time of purchase since the cash flows are not known. When principal is returned early, future interest payments will not be paid on that part of the principal. If the security was purchased at a premium (a price greater than 100) the security’s yield will be less than what was estimated at the time of purchase.

(iv) Collateral performance risk

Collateral performance risk is the risk that defaults or underperformance of the CDO’s underlying collateral negatively impacts scheduled payments to a tranche based on relative seniority in the overall capital structure of each deal.

21

Table of Contents

SEI Structured Credit Fund, L.P.

Notes to Financial Statements (continued)

December 31, 2011

7. Concentrations of Risk (continued)

(b) Counterparty credit risk

Counterparty credit risk is the risk a counterparty to a financial instrument could fail on a commitment that it has entered into with the Fund. The Fund minimizes counterparty credit risk by undertaking transactions with large well-capitalized counterparties or brokers and by monitoring the creditworthiness of these counterparties.

8. Indemnifications

The Fund enters into contracts that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is unknown. However, since inception the Fund has not had claims or losses pursuant to these contracts and expects the risk of loss to be remote.

9. Financial Highlights

The following represents the ratios to average net assets and other supplemental information for the following periods:

| For the year ended December 31, | 2011 | 2010 | 2009 | 2008 | 2007* | |||||||||||||||

| Total return (1) |

8.36 | % | 42.92 | % | 189.59 | % | (62.03 | )% | 5.82 | %(3) | ||||||||||

| Limited Partners’ capital, end of period (000’s) |

$ | 396,345 | $ | 312,670 | $ | 319,274 | $ | 72,893 | $ | 25,034 | ||||||||||

| Ratio to average partners’ capital† |

||||||||||||||||||||

| Net investment income ratio†† |

||||||||||||||||||||

| Net investment income, net of waivers |

7.23 | % | 8.09 | % | 8.11 | % | 18.28 | % | 9.13 | %(2) | ||||||||||

| Expense ratio†† |

||||||||||||||||||||

| Operating expenses, before waivers |

0.18 | % | 0.21 | % | 0.31 | % | 0.51 | % | 1.54 | %(2)(4) | ||||||||||

| Operating expenses, net of waivers |

0.18 | % | 0.21 | % | 0.30 | % | 0.49 | % | 0.37 | %(2)(4) | ||||||||||

| Portfolio turnover rate |

76.57 | % | 94.63 | % | 141.21 | % | 13.88 | % | 21.85 | %(3) | ||||||||||

| * | For the period August 1, 2007 (commencement of operations) through December 31, 2007. |

| † | Ratios to average partners’ capital are calculated based on the outstanding Limited Partners’ capital during the period and for all the Limited Partners taken as a whole. |

22

Table of Contents

SEI Structured Credit Fund, L.P.

Notes to Financial Statements (concluded)

December 31, 2011

9. Financial Highlights (continued)

| †† | Ratios do not include the Fund’s allocated share of income/expense from hedge funds. |

| (1) | Total return is calculated for all the Limited Partners taken as a whole. A Limited Partner’s return may vary from these returns based on the timing of capital transactions. |

| (2) | Annualized. |

| (3) | Not annualized. |

| (4) | Expense ratios include offering costs and tax liability costs, which are not annualized. Had the offering costs and tax liability costs been annualized, the ratio for “Operating expenses, before waivers” and “Operating expenses, net of waivers” would have been 1.67% and 0.50%, respectively. |

10. Recent Accounting Pronouncements

In May 2011, the Financial Accounting Standards Board issued Accounting Standards Update 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs” (“ASU 2011-04”). ASU 2011-04 includes common requirements for measurement of and disclosure about fair value between U.S. GAAP and International Financial Reporting Standards (“IFRS”). ASU 2011-04 will require reporting entities to disclose quantitative information about the unobservable inputs used in the fair value measurements categorized within Level 3 of the fair value hierarchy. In addition, ASU 2011-04 will require reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements. The new and revised disclosures are effective for interim and annual reporting periods beginning after December 15, 2011. At this time, management is evaluating the implications of ASU 2011-04 and its impact on the financial statements has not been determined.

11. Subsequent Events

The Fund has evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no disclosures and/or adjustments were required to the financial statements.

23

Table of Contents

SEI Structured Credit Fund, L.P.

Approval of the Advisory Agreements with the Adviser (Unaudited)

SEI Structured Credit Fund, L.P. (the “Fund”) has entered into an investment advisory agreement with SEI Investments Management Corporation (“SIMC” or the “Adviser”) dated July 20, 2007 (the “Advisory Agreement”). Pursuant to the Advisory Agreement, SIMC is responsible for the day-to-day investment management of the Fund’s assets.

The Investment Company Act of 1940, as amended (the “1940 Act”), requires that the initial approval of, as well as the continuation of, the Fund’s Advisory Agreement must be specifically approved by: (i) the vote of the Board of Directors of the Fund (the “Board”) or by a vote of the shareholders of the Fund; and (ii) the vote of a majority of the directors who are not parties to the Advisory Agreement or “interested persons” (as defined under the 1940 Act) of any party to the Advisory Agreement (the “Independent Directors”), cast in person at a meeting called for the purpose of voting on such approval. In connection with their consideration of such approvals, the Board must request and evaluate, and SIMC is required to furnish, such information as may be reasonably necessary to evaluate the terms of the Advisory Agreement. In addition, the Securities and Exchange Commission (“SEC”) takes the position that, as part of their fiduciary duties with respect to a fund’s fees, fund boards are required to evaluate the material factors applicable to a decision to approve an advisory agreement.

The discussion immediately below summarizes the materials and information presented to the Board in connection with the Board’s Annual Review of the Advisory Agreement and the conclusions made by the Directors when determining to continue the Advisory Agreement for an additional one-year period.

Consistent with the responsibilities referenced above, the Board called and held a meeting on March 22, 2011 to consider whether to renew the Advisory Agreement. In preparation for the meeting, the Board provided SIMC with a written request for information and received and reviewed extensive written materials in response to that request, including information as to the performance of the Fund versus benchmarks, the levels of fees for various categories of services provided by SIMC and its affiliates and the overall expense ratio of the Fund, comparisons of such fees and expenses with such fees and expenses incurred by other funds, the costs to SIMC and its affiliates of providing such services, including a profitability analysis, SIMC’s compliance program, and various other matters. The information provided in connection with the Board meeting was in addition to the detailed information about the Fund that the Board reviews during the course of each year, including information that relates to the operations and performance of the Fund.

24

Table of Contents

SEI Structured Credit Fund, L.P.

Approval of the Advisory Agreements with the Adviser (Unaudited)

(continued)

The Directors also received a memorandum from Fund counsel regarding the responsibilities of directors in connection with their consideration of an investment advisory agreement. In addition, prior to voting, the Independent Directors received advice from Fund counsel regarding the contents of the Adviser’s written materials.

As noted above, the Board requested and received written materials from SIMC. Specifically, this requested information and written response included: (a) the quality of SIMC’s investment management and other services; (b) SIMC’s investment management personnel; (c) SIMC’s operations and financial condition; (d) SIMC’s investment strategies; (e) the level of the advisory fees that SIMC charges the Fund compared with the advisory fees charged to comparable funds; (f) the overall fees and operating expenses of the Fund compared with similar funds; (g) the level of SIMC’s profitability from its Fund-related operations; (h) SIMC’s compliance systems; (i) SIMC’s policies on and compliance procedures for personal securities transactions; (j) SIMC’s reputation, expertise and resources in domestic and/or international financial markets; and (k) the Fund’s performance compared with benchmark indices.

The Independent Directors met in executive session, outside the presence of Fund management, and the full Board met in executive session to consider and evaluate a variety of factors relating to the approval of the continuation of the Advisory Agreement. The Independent Directors also participated in question and answer sessions with representatives of the Adviser. At the conclusion of the Board’s deliberations, the Board including the Independent Directors unanimously approved the continuation of the Advisory Agreement for an additional one-year period. The approval was based on the Board’s (including the Independent Directors’) consideration and evaluation of a variety of specific factors discussed at the March 22, 2011 Board meeting and other Board meetings held throughout the year, including:

- the nature, extent and quality of the services provided to the Fund under the Advisory Agreement, including the resources of SIMC and its affiliates dedicated to the Fund;

- the Fund’s investment performance and how it compared to that of appropriate benchmarks;

- the expenses of the Fund under the Advisory Agreement and how those expenses compared to those of other comparable funds;

- the profitability of SIMC and its affiliates with respect to the Fund, including both direct and indirect benefits accruing to SIMC and its affiliates; and

25

Table of Contents

SEI Structured Credit Fund, L.P.

Approval of the Advisory Agreements with the Adviser (Unaudited)

(concluded)

- the extent to which economies of scale would be realized as the Fund grows and whether fee levels in the Advisory Agreement reflect those economies of scale for the benefit of Fund investors.

Nature, Extent and Quality of Services. The Board concluded that, within the context of its full deliberations, the nature, extent and quality of services provided by SIMC to the Fund and the resources of SIMC and its affiliates dedicated to the Fund supported renewal of the Advisory Agreement.

Fund Performance. The Board concluded that, within the context of its full deliberations, the performance of the Fund supported renewal of the Advisory Agreement.

Fund Expenses. The Board concluded that, within the context of its full deliberations, the expenses of the Fund are reasonable and supported renewal of the Advisory Agreement.

Profitability. The Board concluded that, within the context of its full deliberations, the profitability of SIMC is reasonable and supported renewal of the Advisory Agreement.

Economies of Scale. The Board concluded that, within the context of its full deliberations, the Fund obtains reasonable benefit from economies of scale.

Based on its evaluation of the information and the conclusions with respect thereto at its meeting on March 22, 2011, the Board, including all of the Independent Directors, unanimously approved the Advisory Agreement and concluded that the compensation under the Advisory Agreement is fair and reasonable in light of such services and expenses and such other matters as the Independent Directors and the Board considered to be relevant in the exercise of their reasonable judgment. In the course of their deliberations, the Board, including the Independent Directors, did not identify any one particular factor or specific piece of information that determined whether to approve the Advisory Agreement .

26

Table of Contents

SEI Structured Credit Fund, L.P.

Additional Information

Directors and Officers of the Partnership (Unaudited)

December 31, 2011

Set forth below are the Names, Age, Addresses, Position with the Partnership, Length of Time Served, the Principal Occupations During the Past Five Years, Number of Portfolios in Fund Complex Overseen by the Director, and Other Directorships Outside the Fund Complex of each of the persons currently serving as Directors and Officers of the Partnership.

| Name, Age and Address of Independent Directors |

Length Time Served |

Principal Occupation(s) During Past 5 Years |

Number of Portfolios in Fund Complex Overseen by Director** |

Other Directorships Held by Director | ||||

| Nina Lesavoy (54) 3 E. 63rd St. New York, NY 10065 |

Since 2007 | Founder & Managing Director, Avec Capital since April 2008, Partner, Cue Capital 2002-2008. |

85 | Trustee of SEI Alpha Strategy Portfolios, L.P., SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional International Trust, SEI Liquid Asset Trust, SEI Institutional Investments Trust, SEI Tax Exempt Trust, and SEI Institutional Managed Trust, and Adviser Managed Trust. | ||||

27

Table of Contents

SEI Structured Credit Fund, L.P.

Additional Information

Directors and Officers of the Partnership (Unaudited) (continued)

December 31, 2011

| Name, Age and Address of Independent Directors |

Length Time Served |

Principal Occupation(s) During Past 5 Years |

Number of Portfolios in Fund Complex Overseen by Director** |

Other Directorships Held by Director | ||||

| George J. Sullivan (69) 7 Essex Green Drive, Suite 52B Peabody, MA 01960 |

Since 2007 | Self Employed Consultant, Newfound Consultants Inc., April 1997 – December 2011. Member of independent review committee for SEI’s Canadian- registered mutual funds. | 85 | Trustee of State Street Navigator Securities Lending Trust, The Advisors’ Inner Circle Fund, The Advisors’ Inner Circle Fund II (f/k/a The Arbor Fund), Bishop Street Funds, SEI Alpha Strategy Portfolios, L.P., SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional Investments Trust, SEI Institutional International Trust, SEI Liquid Asset Trust, SEI Tax Exempt Trust, and SEI Institutional Managed Trust, and Adviser Managed Trust. | ||||

28

Table of Contents

SEI Structured Credit Fund, L.P.

Additional Information

Directors and Officers of the Partnership (Unaudited) (continued)

December 31, 2011

| Name, Age and Address of Independent Directors |

Length of Time Served |

Principal Occupation(s) During Past 5 Years |

Number of Portfolios in Fund Complex Overseen by Director** |

Other Directorships Held by Director | ||||

| James M. Williams (64) 1200 Getty Drive, Suite 400, Los Angeles, CA 90049-1681 |

Since 2007 |

Vice President and Chief Investment Officer, J. Paul Getty Trust, Non Profit Foundation for Visual Arts, since December 2002 | 85 | Trustee of Ariel Mutual Funds, SEI Alpha Strategy Portfolios, L.P., SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional Investments Trust, SEI Institutional International Trust, SEI Liquid Asset Trust, SEI Tax Exempt Trust, and SEI Institutional Managed Trust, and Adviser Managed Trust. | ||||

29

Table of Contents

SEI Structured Credit Fund, L.P.

Additional Information

Directors and Officers of the Partnership (Unaudited) (continued)

December 31, 2011

| Name, Age and Address of Independent Directors |

Length of Time Served |

Principal Occupation(s) During Past 5 Years |

Number of Portfolios in Fund Complex Overseen by Director** |

Other Directorships Held by Director | ||||

| Robert A. Nesher* (65) One Freedom Valley Drive Oaks, PA 19456 |

Since 2007 |

President of the Fund, Chairman of the Board, SEI Funds — The Advisors’ Inner Circle Fund and the Advisors’ Inner Circle Fund II. Currently performs various services on behalf of SEI Investments for which Mr. Nesher is compensated. | 85 | Trustee of The Advisors’ Inner Circle Fund, The Advisors’ Inner Circle Fund II (f/k/a The Arbor Fund) and Bishop Street Funds; Director of SEI Global Master Fund, plc, SEI Global Assets Fund, plc, SEI Global Investments Fund, plc, SEI Islamic Investments Fund, plc, SEI Investments Global, Limited, SEI Investments – Global Fund Services Limited, SEI Investments (Europe) Limited, SEI Global Nominee Ltd, SEI Alpha Strategy Portfolios, L.P., SEI Asset Allocation Trust, SEI Daily Income Trust, SEI Institutional Investments Trust, SEI Institutional International Trust, SEI Liquid Asset Trust, SEI Tax Exempt Trust, SEI Institutional Managed Trust and Adviser Managed Trust. | ||||

30

Table of Contents

SEI Structured Credit Fund, L.P.

Additional Information

Directors and Officers of the Partnership (Unaudited) (continued)

December 31, 2011

| Name and Age of Officers |

Position(s) Held with the Master Fund and Length of Time Served |

Principal Occupation(s) During Past 5 Years | ||

| Peter Rodriguez (50) |

Treasurer, since March 2011 | Director, Fund Accounting, SEI Investments Global Fund Services (March 2011, September 2002 to March 2005 and 1997-2002); Director, Mutual Fund Trading, SEI Private Trust Company (May 2009 to February 2011); Director, Asset Data Services, Global Wealth Services (June 2006 to April 2009); Director, Portfolio Accounting, SEI Investments Global Fund Services (March 2005 to June 2006) | ||

| Timothy D. Barto (43) |

Vice President, since 2007 and Assistant Secretary, since 2008 |

General Counsel Vice President and Secretary of the Adviser since 2004. Vice President and Assistant Secretary of SEI since 2001, and of the Administrator since November 1999. | ||

| James Ndiaye (42) |

Vice President since 2007 Secretary, December 2009 |

Vice President and Assistant Secretary of Adviser since 2005. | ||

31

Table of Contents

SEI Structured Credit Fund, L.P.

Additional Information

Directors and Officers of the Partnership (Unaudited) (concluded)

December 31, 2011

| Name and Age of Officers |

Position(s) Held with the Master Fund and Length of Time Served |

Principal Occupation(s) During Past 5 Years | ||

| Aaron Buser (40) |

Vice President and Assistant Secretary, since June 2008 | Vice President and Assistant Secretary of Adviser since 2007. Associate at Stark & Stark 2004- 2007. | ||

| Russell Emery (48) |

Chief Compliance Officer, since 2007 | Chief Compliance Officer of SEI Fund Complex, SEI Opportunity Fund, L.P., (until September 2009) Bishop Street Funds, The Advisors’ Inner Circle Fund and the Advisors’ Inner Circle Fund II, since March 2006; Director of Investment Product Management and Development, SIMC February 2003– March 2006. | ||

| * | Mr. Nesher is a trustee who may be deemed to be an “interested” person of the Fund as that term is defined in the 1940 Act by virtue of his affiliation with the Fund’s Distributor. |

| ** | The “Fund Complex” consists of registered investment companies that are part of the following investment trusts and limited partnerships: SEI Institutional Investments Trust, SEI Institutional Management Trust, SEI Institutional International Trust, SEI Liquid Asset Trust, SEI Daily Income Trust, SEI Tax Exempt Trust, SEI Asset Allocation Trust, SEI Structured Credit, L.P. SEI Alpha Strategy Portfolios, L.P. and Adviser Managed Trust. |

32

Table of Contents

| Item 2. | Code of Ethics. |

The Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, comptroller or principal accounting officer. A copy of its code of ethics is filed with this Form N-CSR under Item 12(a)(1).

| Item 3. | Audit Committee Financial Expert. |

| (a)(1) | The Registrant’s board of directors has determined that the Registrant has at least one audit committee financial expert serving on the audit committee. |

| (a)(2) | The audit committee financial expert is George Sullivan. Mr. Sullivan is independent as defined in Form N-CSR Item 3(a)(2). |

| Item 4. | Principal Accountant Fees and Services. |

Fees billed by Ernst & Young, LLP Related to the Registrant.

Ernst & Young, LLP billed the Registrant aggregate fees for services rendered to the Registrant for the last two fiscal years as follows:

| 2011 |

2010 | |||||||||||||

| All fees and services to the Fund that were pre- approved |

All fees and affiliates that |

All other fees to service did not require pre- |

All fees and the Fund that |

All fees and services to service affiliates that were pre- approved |

All other fees and services to service affiliates that did not require pre- approval | |||||||||

| (a) | Audit Fees | $65,000 | N/A | N/A | $53,000 | N/A | N/A | |||||||

| (b) | Audit-Related Fees | $0 | N/A | N/A | $0 | N/A | N/A | |||||||

| (c) | Tax Fees | $0 | N/A | N/A | $0 | N/A | N/A | |||||||

| (d) | All Other Fees | $0 | N/A | N/A | $0 | N/A | N/A | |||||||

Notes:

| (1) | Audit fees include amounts related to the audit of the Registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. |

Table of Contents

| (2) | Other fees and services not requiring pre-approval include amounts billed in fiscal year 2011 and 2010 related to services provided in connection with internal control reports issued pursuant to SAS No. 70. |

(e)(1) The Fund’s Audit Committee has adopted and the Board of Directors has ratified an Audit and Non-Audit Services Pre-Approval Policy (the “Policy”), which sets forth the procedures and the conditions pursuant to which services proposed to be performed by the independent auditor of the Fund may be pre-approved.

The Policy provides that all requests or applications for proposed services to be provided by the independent auditor must be submitted to the Registrant’s Chief Financial Officer (“CFO”) and must include a detailed description of the services proposed to be rendered. The CFO will determine whether such services:

| (1) | require specific pre-approval; |

| (2) | are included within the list of services that have received the general pre-approval of the Audit Committee pursuant to the Policy; or |

| (3) | have been previously pre-approved in connection with the independent auditor’s annual engagement letter for the applicable year or otherwise. In any instance where services require pre-approval, the Audit Committee will consider whether such services are consistent with SEC’s rules and whether the provision of such services would impair the auditor’s independence. |

Requests or applications to provide services that require specific pre-approval by the Audit Committee will be submitted to the Audit Committee by the CFO. The Audit Committee will be informed by the CFO on a quarterly basis of all services rendered by the independent auditor. The Audit Committee has delegated specific pre-approval authority to either the Audit Committee Chair or financial expert, provided that the estimated fee for any such proposed pre-approved service does not exceed $100,000 and any pre-approval decisions are reported to the Audit Committee at its next regularly scheduled meeting.

Services that have received the general pre-approval of the Audit Committee are identified and described in the Policy. In addition, the Policy sets forth a maximum fee per engagement with respect to each identified service that has received general pre-approval.

All services to be provided by the independent auditor shall be provided pursuant to a signed written engagement letter with the Registrant, the investment advisor or applicable control affiliate (except that matters as to which an engagement letter would be impractical because of timing issues or because the matter is small may not be the subject of an engagement letter) that sets forth both the services to be provided by the independent auditor and the total fees to be paid to the independent auditor for those services.