UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For

the fiscal year ended

OR

For the transition period from to

Commission

file number:

(Exact name of registrant as specified in its charter)

| (State of other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s Telephone Number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: None

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate

by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Indicate

by check mark whether the Registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934

(“Exchange Act”) during the preceding 12 months (or for such shorter period that the Registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |||

Smaller

reporting company Emerging

Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the Registrant is a shell company, as defined in Rule 12b-2 of the Exchange Act. Yes ☐

As

of June 30, 2021, the aggregate market value of the voting and non-voting shares of common stock of the registrant issued and outstanding

on such date, excluding shares held by affiliates of the registrant as a group, was $

Number of shares of Common Stock outstanding as of March 31, 2022:

TABLE OF CONTENTS

| 2 |

PART I

ITEM 1. BUSINESS

Change in Fiscal Year End

On February 12, 2021, the Company’s Board of Directors (the “Board”) approved a change in our fiscal year end from the last day of June to a calendar fiscal year ending on the last day of December of each year, effective January 1, 2021. In this report, references to “fiscal year” refer to years ending December 31, 2021 and June 30, 2020. References in this report to the “transition period” refer to the six-month period ended December 31, 2020.

Our Business

The Company was incorporated for the purpose of engaging in mineral exploration and development activities. The Company’s sole focus is the Bunker Hill mine (the “Mine”), as described below.

On August 28, 2017, the Company announced that it signed a definitive agreement with Placer Mining Corporation (“Placer Mining”), the current owner of the Mine, for the lease and option to purchase the Mine in Idaho (the “Lease and Option Agreement”).

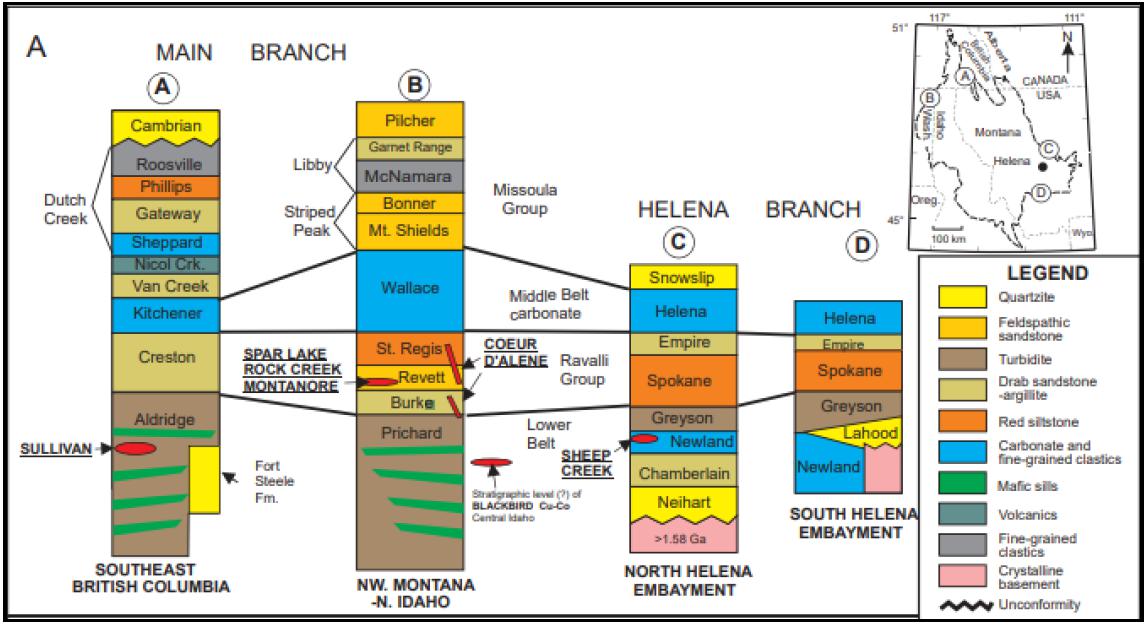

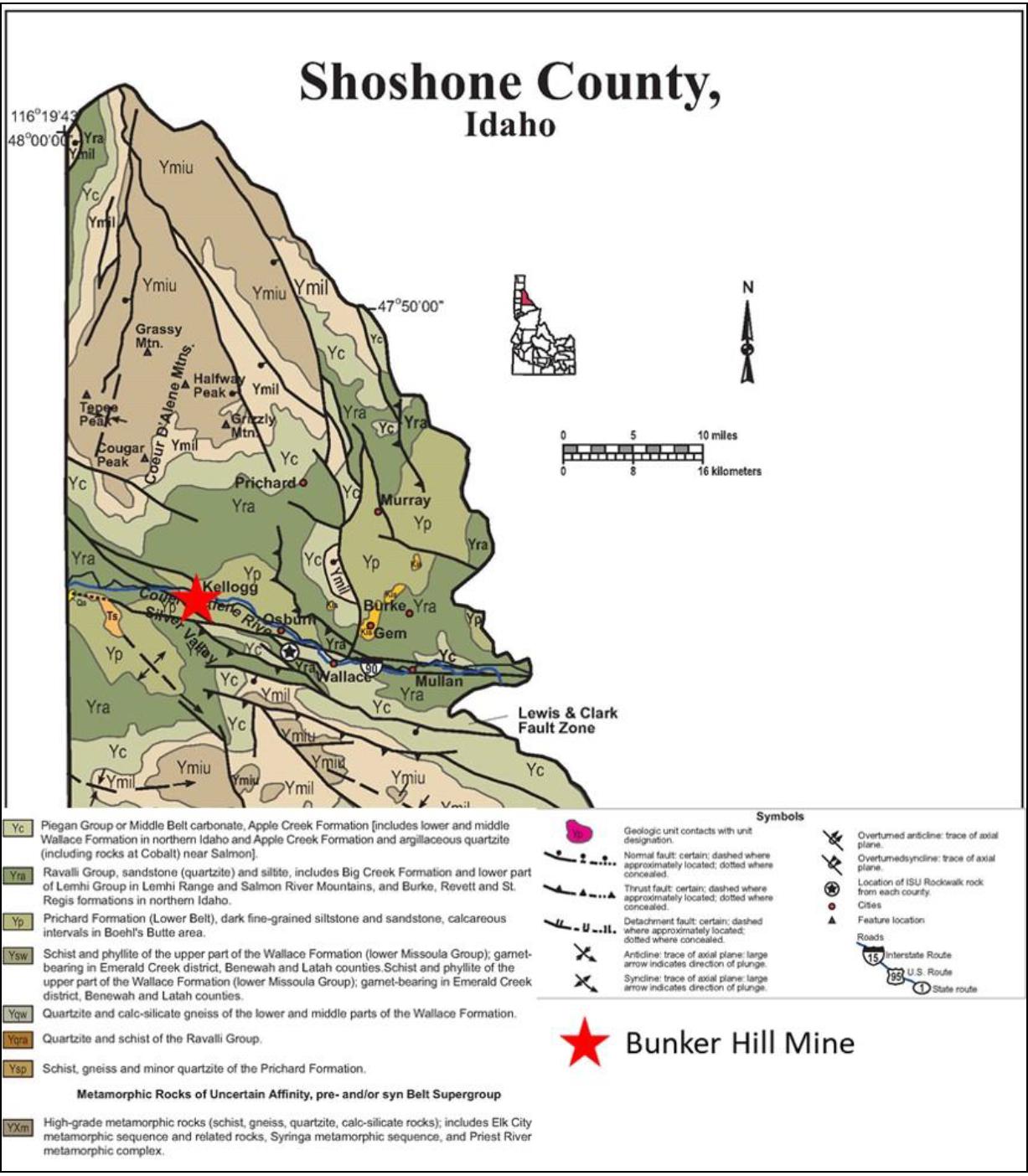

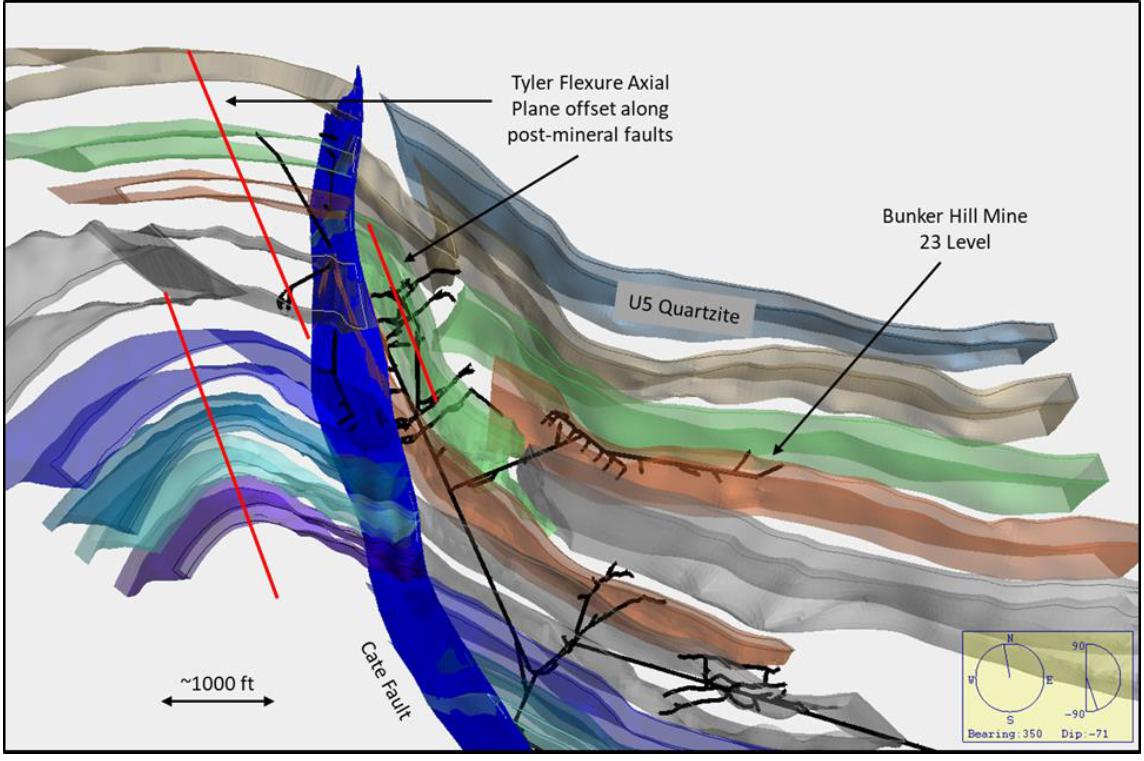

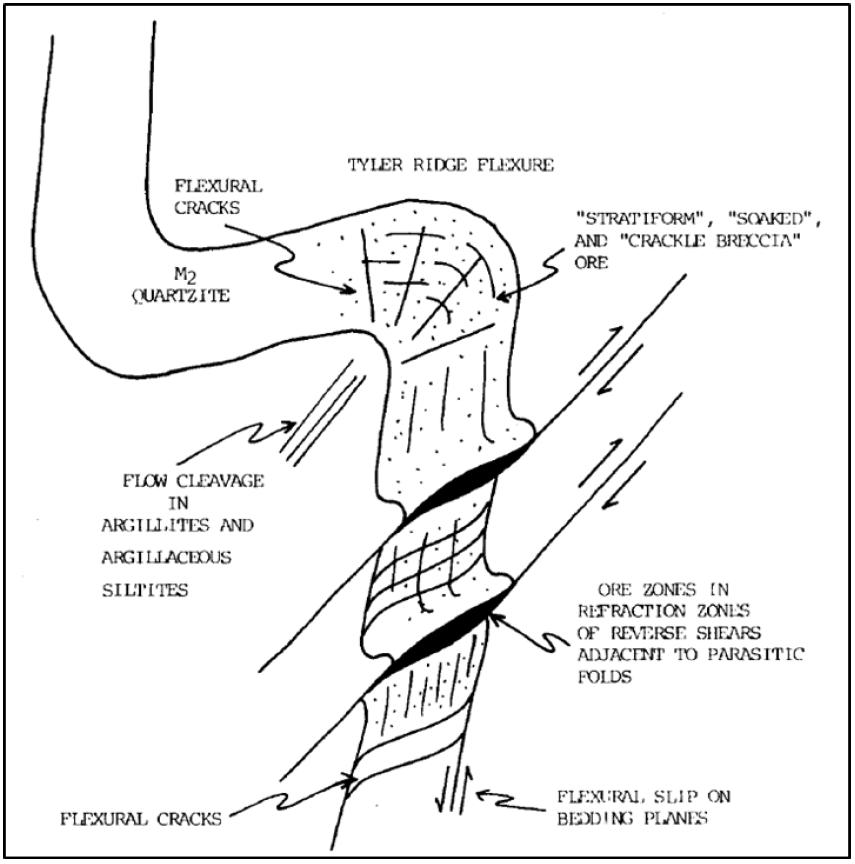

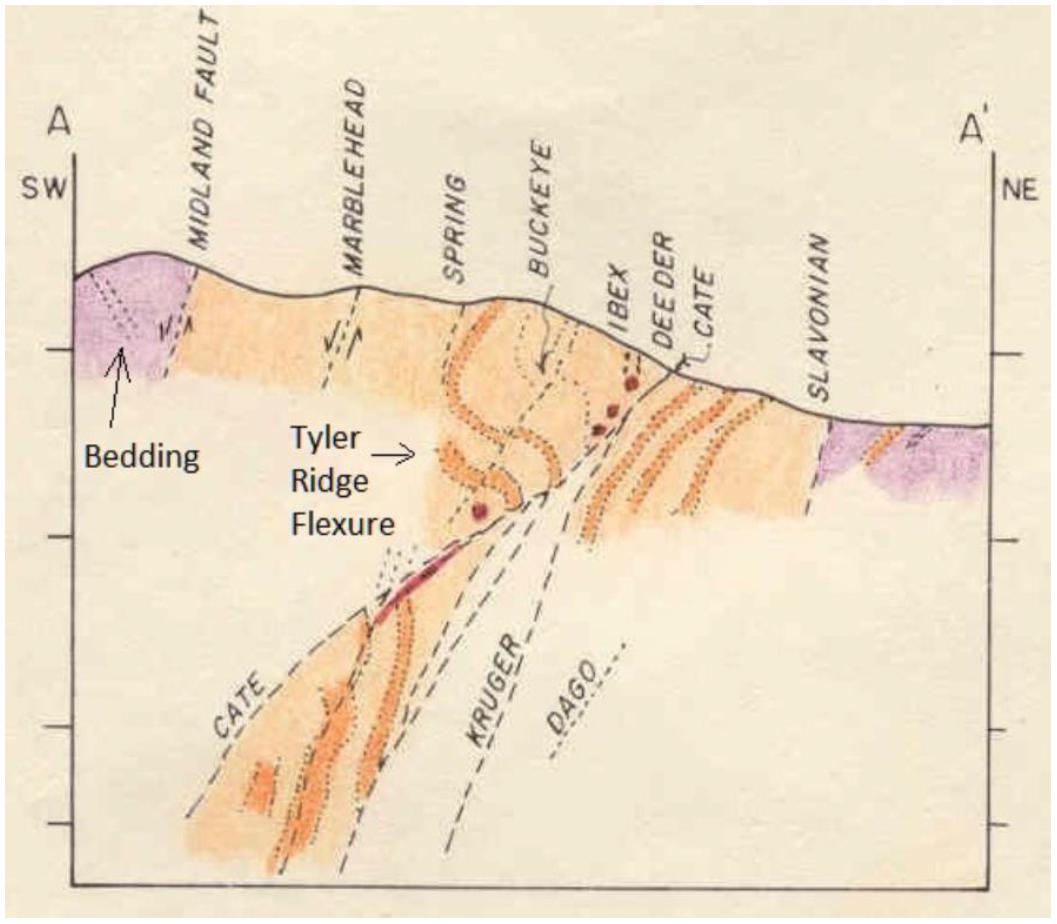

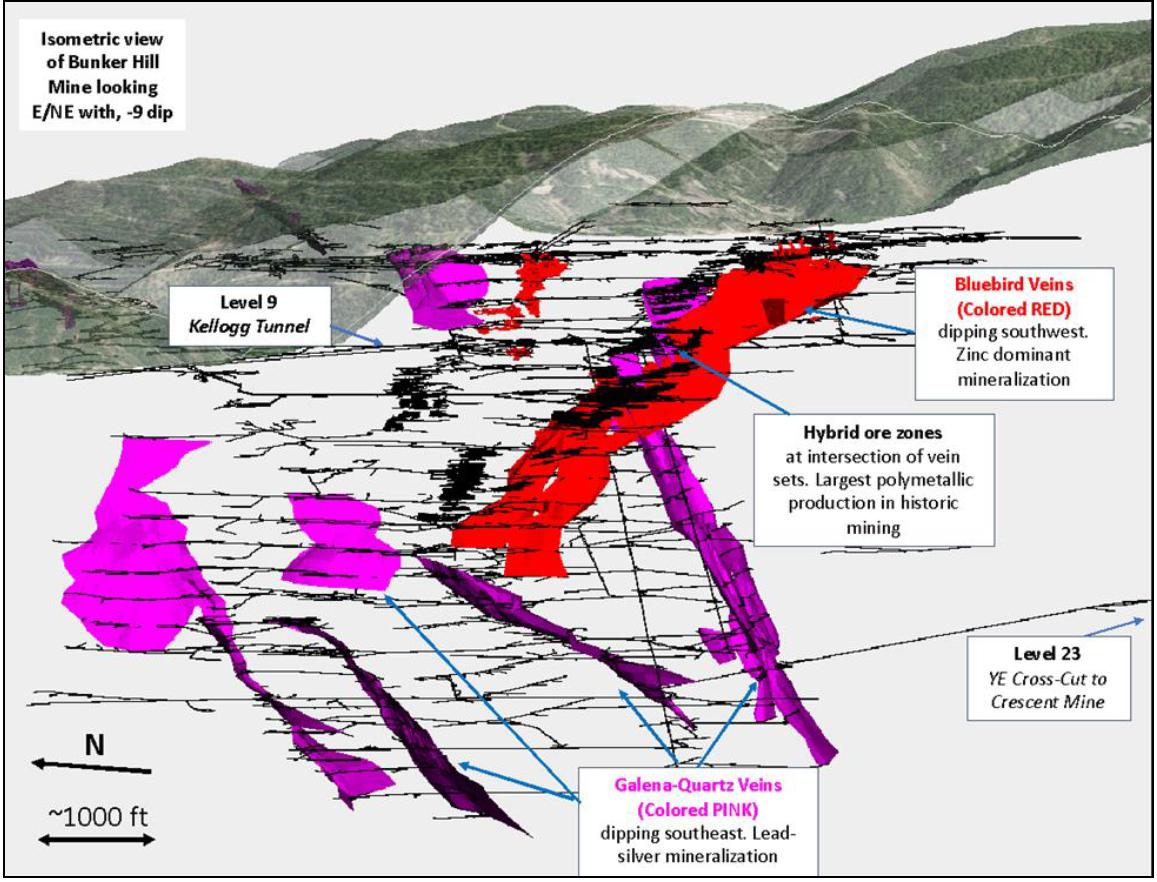

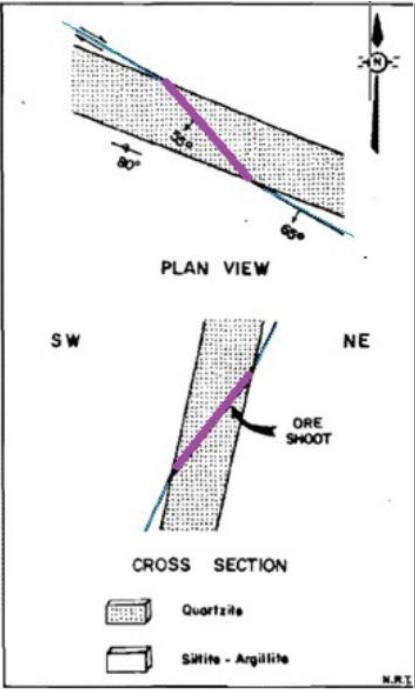

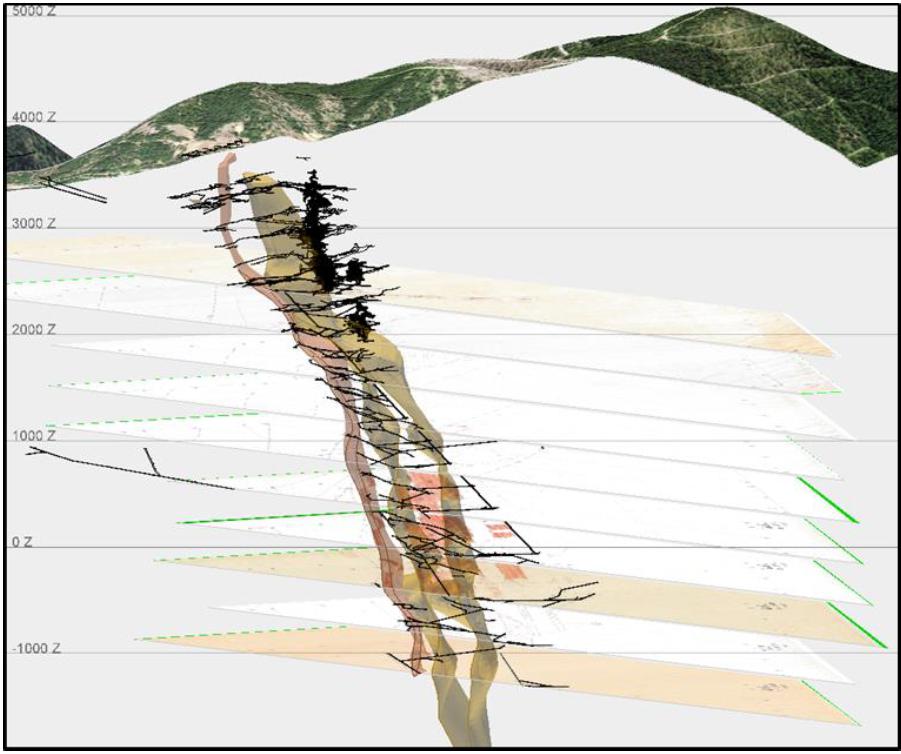

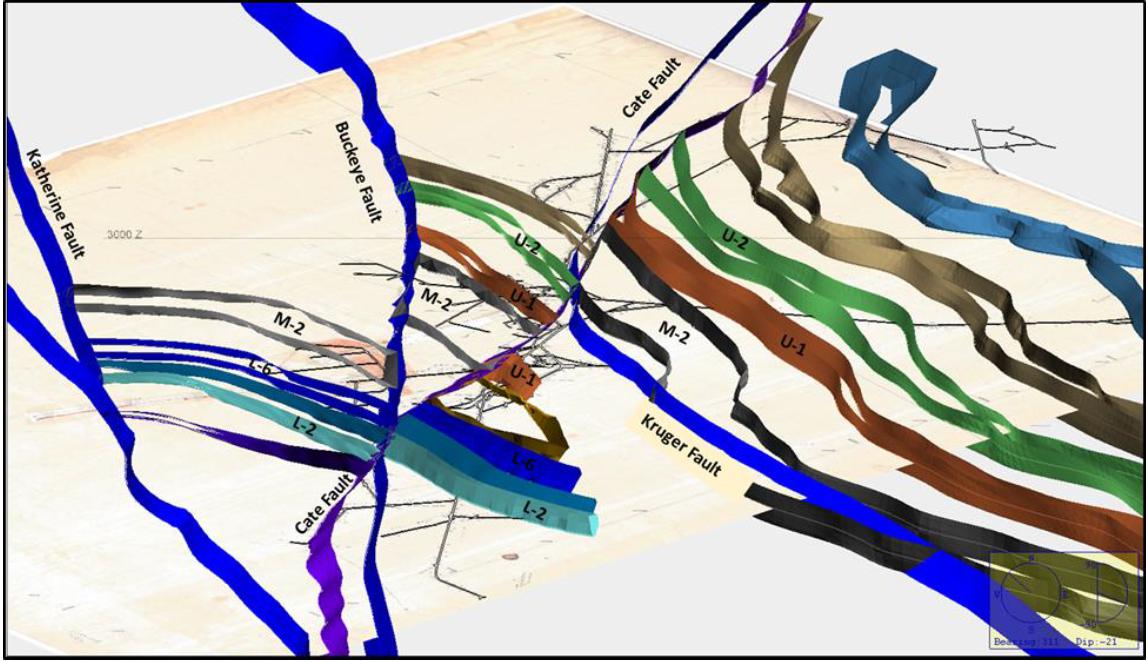

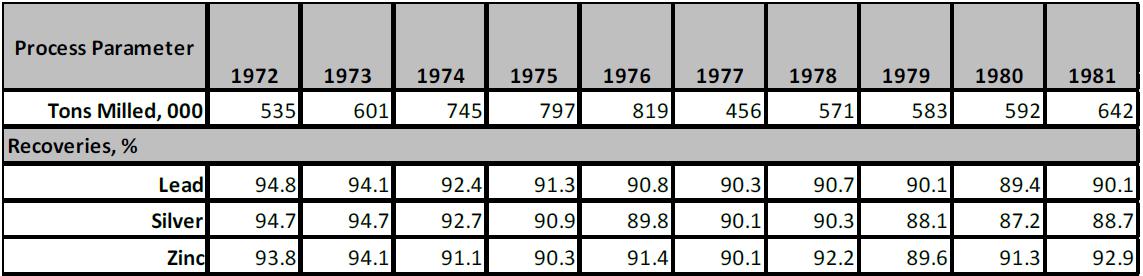

The Mine remains the largest single producing mine by tonnage in the Coeur d’Alene lead, zinc and silver mining district in Northern Idaho. Historically and according to the Bunker Hill Mines Annual Report 1980, the Mine produced over 35,000,000 tonnes of ore grading on average 8.76% lead, 3.67% zinc, and 155 g/t silver. The Mine is the Company’s only focus, with a view to raising capital to rehabilitate the mine and put it back into production.

On November 1, 2019, the Lease and Option Agreement was amended (the “Amended Agreement”). Under the terms of the Amended Agreement, the Company has an option to purchase the marketable assets of the Mine for a purchase price of $11,000,000 at any time prior to the expiration of the Amended Agreement, payable $6,200,000 in cash, and $4,800,000 in unregistered Common Shares of the Company (calculated using the market price at the time of exercise of the purchase option). Upon signing the Amended Agreement, the Company paid a one-time, non-refundable cash payment of $300,000 to Placer Mining. This payment will be applied to the cash portion of the purchase price upon execution of the purchase option. In the event the Company elects not to exercise the purchase option, the payment shall be treated as an additional care and maintenance payment. An additional term of the Amended Agreement provides for the elimination of all royalty payments that were to be paid to Placer Mining.

Under the terms of the Amended Agreement, during the term of the lease, the Company must make care and maintenance payments in the amount of $60,000 monthly plus other expenses, i.e. taxes, utilities and mine rescue payments.

On July 27, 2020, the Company announced that it secured, for a $150,000 cash payment, a further extension to the Lease and Option, Amended and Extension Agreements to purchase the Mine from Placer Mining (the “Second Extension”). The Second Extension is for a further 18 months and is in addition to the 6-month extension. This Second Extension expires on August 1, 2022. This Second Extension provides the Company with more time to invest the proceeds of the ongoing financing in ways that compile and digitize fully over 95 years of historical and geological data, verify the historical reserves, and explore the high-grade silver targets within the Mine complex.

| 3 |

On November 20, 2020 the Company successfully renegotiated the Amended Agreement. Under the new terms, the purchase price has been decreased from $11,000,000 to $7,700,000, with $5,700,000 payable in cash (with an aggregate of $300,000 to be credited toward the purchase price of the Mine as having been previously paid by the Company and an aggregate of $5,400,000 payable in cash outstanding) and $2,000,000 in Common Shares of the Company. The reference price for the payment in Common Shares will be based on the share price of the last equity raise before the option is exercised. The Company will continue to make a monthly care and maintenance payment of $60,000 to the Lessor in return for on-going technical support to the Company. Under this amendment to the Amended Agreement, the Company’s contingent obligation to settle $1,787,300 of accrued payments due to the Lessor has been waived. Further, under the amendment to the Amended Agreement, the Company is to make an advance payment of $2,000,000 to Placer Mining, which shall be credited toward the purchase price of the Mine when the Company elects to exercise its purchase right. In the event that the Company irrevocably elects not to exercise its purchase right, the advance payment of $2,000,000 will be repaid to the Company within twelve months from the date of such election. The Company made this advance payment, which had the effect of decreasing the remaining amount payable to purchase the Mine to an aggregate of $3,400,000 payable in cash and $2,000,000 in Common Shares of the Company.

As a part of the purchase price, the Amended Agreement also requires payments pursuant to an agreement with the U.S. Environmental Protection Agency (“EPA”) whereby for so long as the Company leases, owns and/or occupies the Mine, the Company will make payments to the EPA on behalf of Placer Mining in satisfaction of the EPA’s claim for cost recovery. These payments, if all are made, will total $20,000,000. The agreement calls for payments starting with $1,000,000 30 days after a fully ratified agreement was signed (which payment was made) followed by $2,000,000 on November 1, 2018 and $3,000,000 on each of the next 5 anniversaries with a final $2,000,000 payment on November 1, 2024. In addition to these payments, the Company is to make semi-annual payments of $480,000 on June 1 and December 1 of each year, to cover the EPA’s estimated costs of maintaining and treating water at the water treatment facility with a true-up to be paid by the Company once the actual costs are determined. The November 1, 2018, December 1, 2018, June 1, 2019, November 1, 2019, November 1, 2020, and November 1, 2021 payments were not made, and the Company engaged in discussions with the EPA in an effort to reschedule these payments in ways that enable the sustainable operation of the Mine as a viable long-term business.

| 4 |

On December 20, 2021, the Company announced the execution of a non-binding term sheet outlining a $50,000,000 non-dilutive project finance package, the execution of a settlement agreement amendment with the EPA, and the execution of an agreement to purchase of the Bunker Hill Mine.

The non-binding term sheet with Sprott Private Resource Streaming and Royalty Corp. (“SRSR”) and other investors outlined a $50,000,000 project financing package that the Company expects to fulfill the majority of its funding requirements to restart the Bunker Hill Mine. The financing package consisted of a $8,000,000 royalty convertible debenture (the “Royalty Convertible Debenture”), a $5,000,000 (increased to $6,000,000) convertible debenture (the “Convertible Debenture”), and a multi-metals stream of up to $37,000,000 (the “Stream”, together with the Royalty Convertible Debenture and the Convertible Debenture, the “Project Financing Package”). The closing for Royalty Convertible Debenture, the Convertible Debenture and the Stream are conditional on a number of matters, including the finalization of definitive documentation, regulatory and stock exchange approvals, and closing of the purchase of Bunker Hill Mine.

The Company consummated the $8,000,000 the Royalty Convertible Debenture in January 2022. The Royalty Convertible Debenture will initially bear interest at an annual rate of 9.0% payable in cash or Common Shares at the Company’s option, until such time that SRSR elects to convert a royalty, with such conversion option expiring at the earlier of advancement of the Stream or 18 months. In the event of conversion, the Royalty Convertible Debenture will cease to exist and the Company will grant a royalty for 1.85% of life-of-mine gross revenue from mining claims considered to be historically worked, contiguous to current accessible underground development, and covered by the Company’s 2021 ground geophysical survey (the “SRSR Royalty”). A 1.35% rate will apply to claims outside of these areas. The Royalty Convertible Debenture will initially be secured by a share pledge of the Company’s operating subsidiary, Silver Valley, until such time that a full security package is put in place. In the event of non-conversion, the principal of the Royalty Convertible Debenture will be repayable in cash.

The Company also consummated the $6,000,000 Convertible Debenture in January 2022, which was increased from a previously-announced $5,000,000. The Convertible Debenture will initially bear interest at an annual rate of 7.5%, payable in cash or shares at the Company’s option, and a maturity of 18 months from the closing of the Royalty Convertible Debenture. Until the closing of the Stream, the Convertible Debenture is convertible into Common Shares at a price of C$0.30 per Common Share, subject to stock exchange approval. Alternatively, SRSR may elect to retire the Convertible Debenture with the cash proceeds from the Stream. The Company may elect to repay the Convertible Debenture early; if SRSR elects not to exercise its conversion option at such time, a minimum of 12 months of interest would apply.

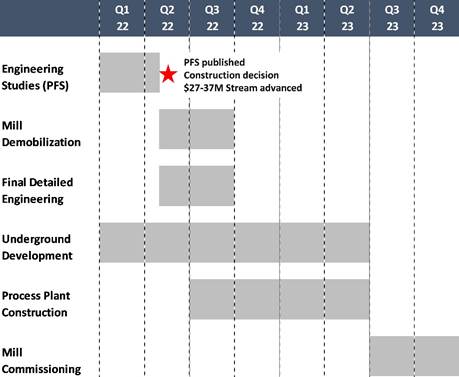

Subject to SRSR internal approvals, further technical and other diligence, and satisfactory definitive documentation, the Company expects to close the Stream concurrent with a formal construction decision being made by the end of Q2 2022. A minimum of $27,000,000 and a maximum of $37,000,000 (the “Stream Amount”) will be made available under the Stream, at the Company’s option, once the conditions of availability of the Stream have been satisfied. Assuming the maximum funding of $37,000,000 is drawn, the Stream would apply to 10% of payable metals sold until a minimum quantity of metal is delivered consisting of, individually, 55 million pounds of zinc, 35 million pounds of lead, and 1 million ounces of silver. Thereafter, the Stream would apply to 2% of payable metals sold. If the Company elects to draw less than $37,000,000 under the Stream, the percentage and quantities of payable metals streamed will adjust pro-rata. The delivery price of streamed metals will be 20% of the applicable spot price.

The Company may buy back 50% of the Stream Amount at a 1.40x multiple of the Stream Amount between the second and third anniversary of the date of funding, and at a 1.65x multiple of the Stream Amount between the third and fourth anniversary of the date of funding. The Company will be permitted to incur additional indebtedness of $15,000,000 and a cost over-run facility of $13,000,000 from other financing counterparties.

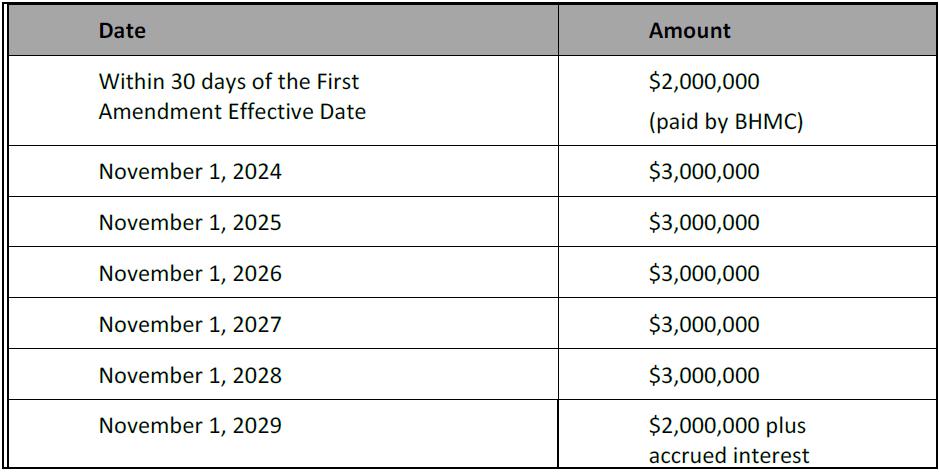

Effective December 19, 2021, the Company entered into an amended Settlement Agreement between the Company, Idaho Department of Environmental Quality, US Department of Justice and the EPA (the “Amended Settlement”). Upon entering the Amended Settlement, the Company is now fully compliant with its payment obligations to these parties. The Amended Settlement modifies the payment schedule and payment terms for recovery of historical environmental response costs at Bunker Hill Mine by the EPA. A total of $19,000,000 remains to be paid by the Company. The new payment schedule includes a $2,000,000 payment to the EPA within 30 days of the execution of this Amended Settlement. The remaining $17,000,000 will be paid on the following dates:

| Date | Amount | |||

| November 1, 2024 | $ | 3,000,000 | ||

| November 1, 2025 | $ | 3,000,000 | ||

| November 1, 2026 | $ | 3,000,000 | ||

| November 1, 2027 | $ | 3,000,000 | ||

| November 1, 2028 | $ | 3,000,000 | ||

| November 1, 2029 | $2,000,000 plus accrued interest | |||

| 5 |

The Amended Settlement includes additional payment for outstanding water treatment costs that have been incurred over the period from 2018 through 2020. This $2,900,000 payment will be made within 90 days of execution of this Amended Settlement.

In addition to the changes in payment terms and schedule, the Company has committed to securing financial assurance in the form of performance bonds or letters of credit deemed acceptable to the EPA. The financial assurance will total $17,000,000, corresponding to the Company’s obligations to be paid in the 2024-2029 period as outlined above, that can be drawn on by the EPA in the event of non-performance by the Company (the “Financial Assurance”). The amount of the bonds will decrease over time as individual payments are made. If the Company does not post the Financial Assurance within 90 days of execution of the Amended Settlement, it must issue an irrevocable letter of credit for $9,000,000. The EPA may draw on this letter of credit after an additional 90 days if the Company is unable to either put the Financial Assurance in place or make payment for the full $17,000,000 of remaining historical cost recovery sums. In the event neither occurs, the terms of the initial Settlement Agreement will be reinstated. On March 22, 2022, the Company reported that in consultation with the EPA, it has committed to meet the $2,900,000 payment and Financial Assurance obligations by 180 days from the effective date of the Amended Settlement Agreement.

On January 10, 2022, the Company announced that following the approval of the transaction by Placer Mining Corp. shareholders and satisfaction of other closing conditions, the purchase of the Bunker Hill Mine closed on January 7, 2022. The terms of the purchase were modified to $5,400,000 in cash, from $3,400,000 of cash and $2,000,000 of Common Shares. Concurrently, the Royalty Convertible Debenture in the amount of $8,000,000 also closed as definitive documentation and all closing conditions were met.

On January 31, 2022, the Company announced that following the satisfaction of all closing conditions, including completion of definitive documentation and a full security package, the Convertible Debenture closed on January 28, 2022. The parties agreed to amend the funding to $6,000,000, an increase of $1,000,000 from the previously envisaged amount of $5,000,000, reflecting increased demand from Sprott and other investors. The terms of the Convertible Debenture are unchanged from the Company’s news release of December 20, 2021 as described above.

On March 9, 2022, the Company announced a private placement of up to C$15,000,000 of special warrants of the Company (the “Special Warrants”). The Company intends to use the net proceeds of the offering to fund the restart and development of the Mine, outstanding obligations to the EPA, and for general corporate purposes.

In support of plans to rapidly restart the Mine, the Company worked systematically through 2020 and 2021 to delineate mineral resources and conduct various technical studies. If successful in closing the Stream, together with securing additional financing requirements, which may include additional indebtedness of $15,000,000 and a cost over-run facility of $13,000,000, management believes that it is well positioned to execute this strategy.

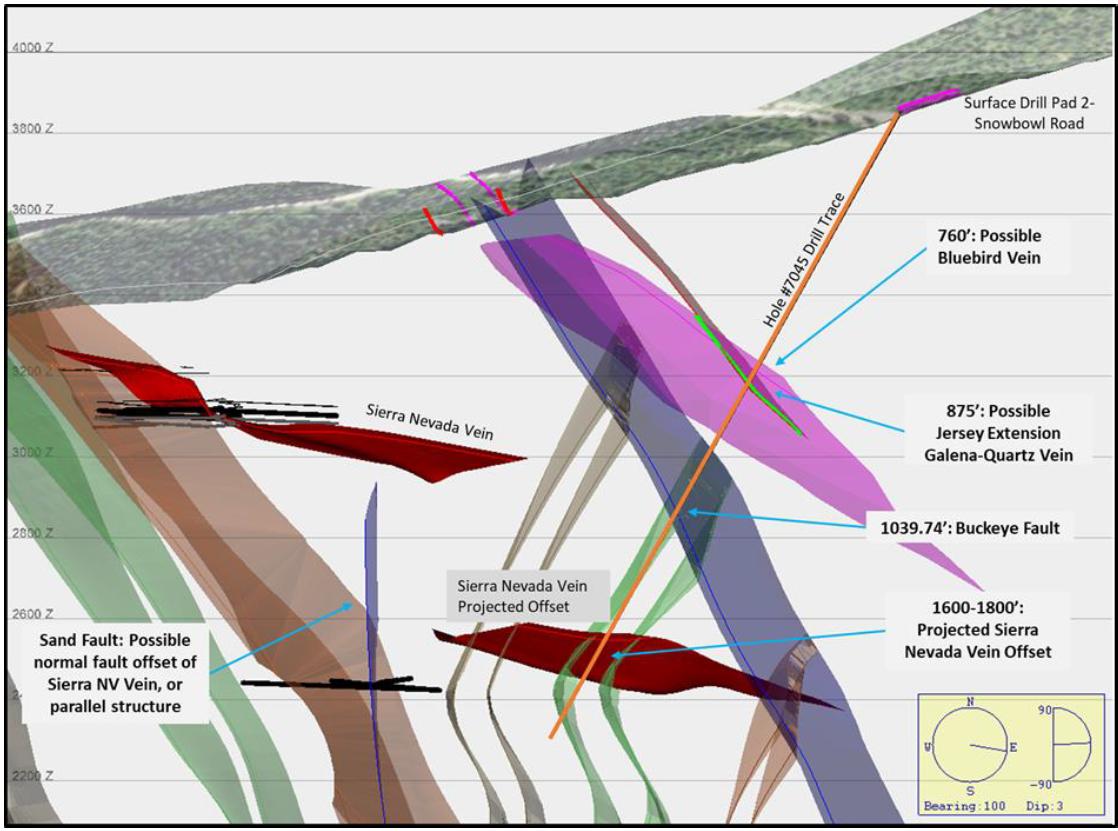

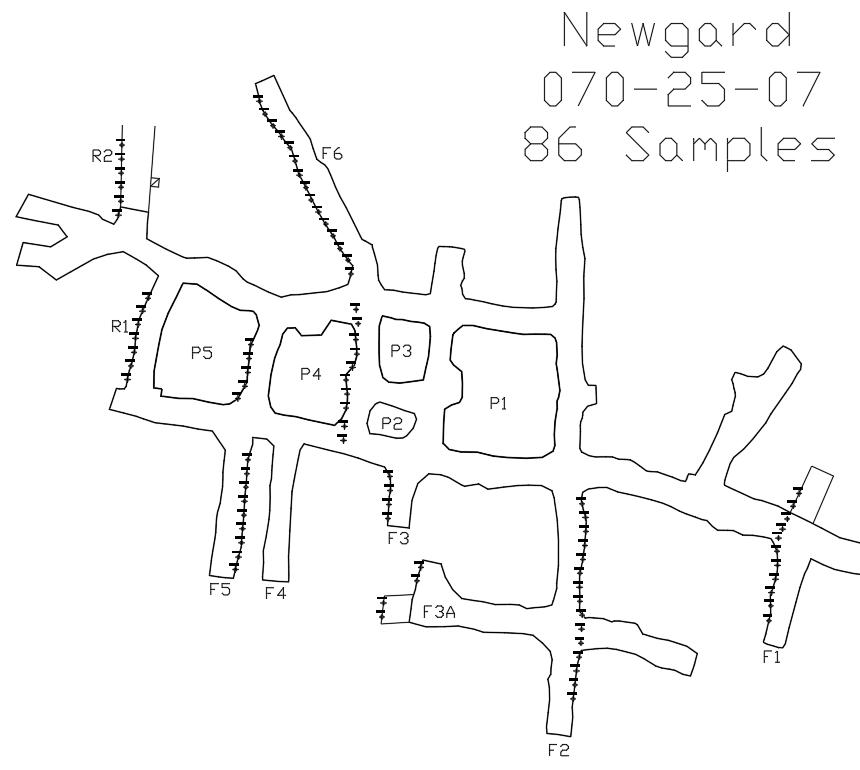

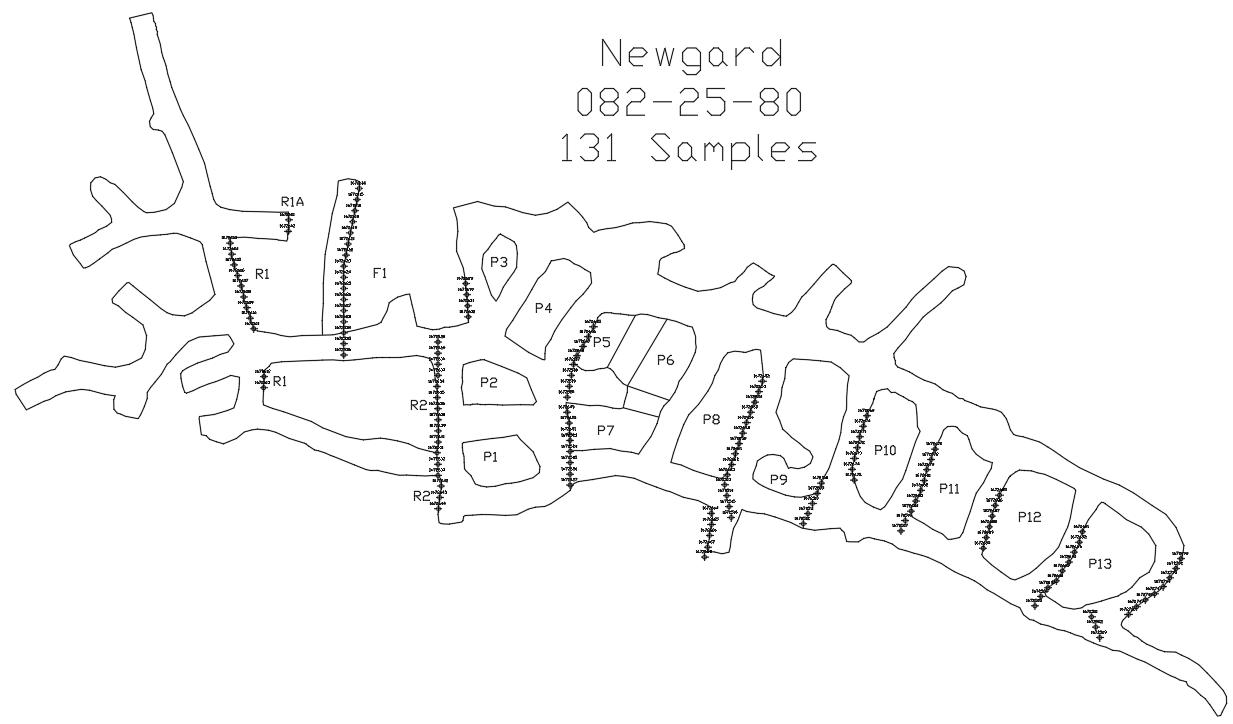

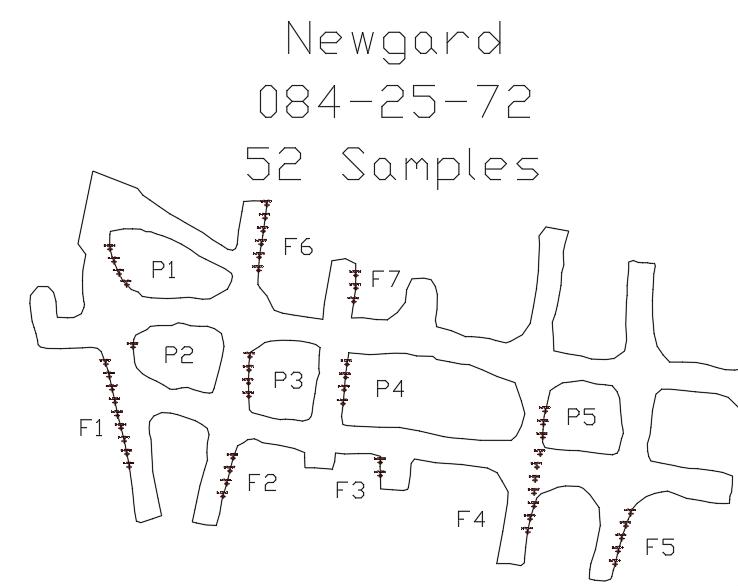

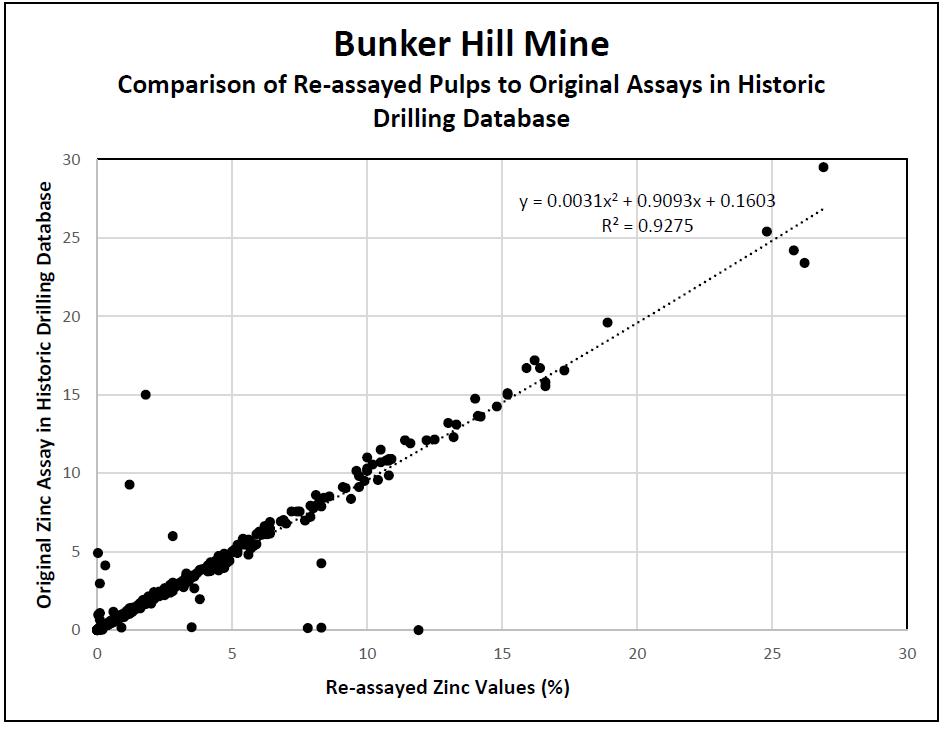

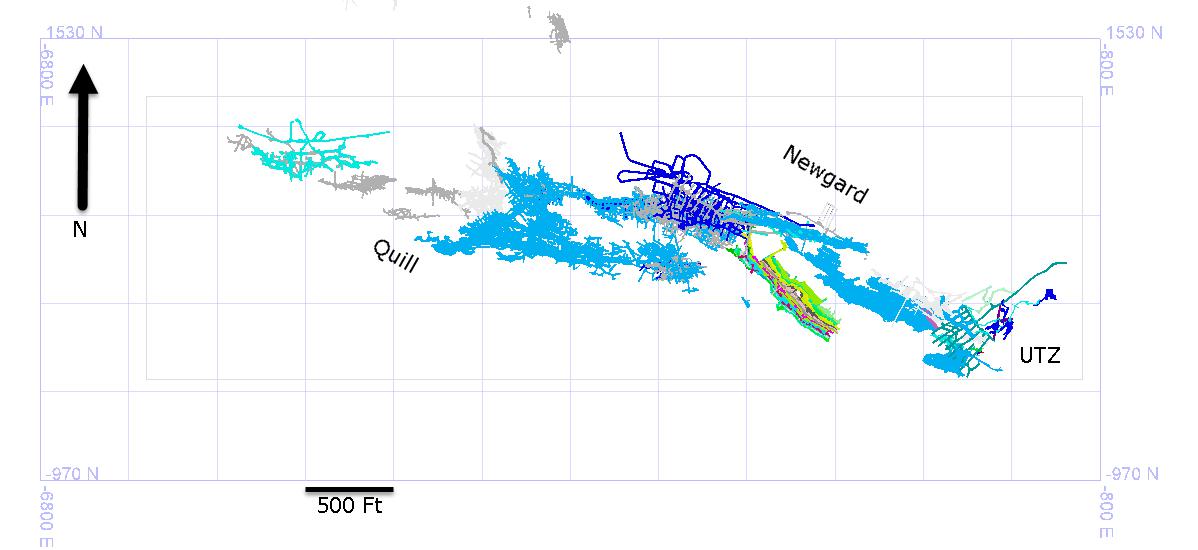

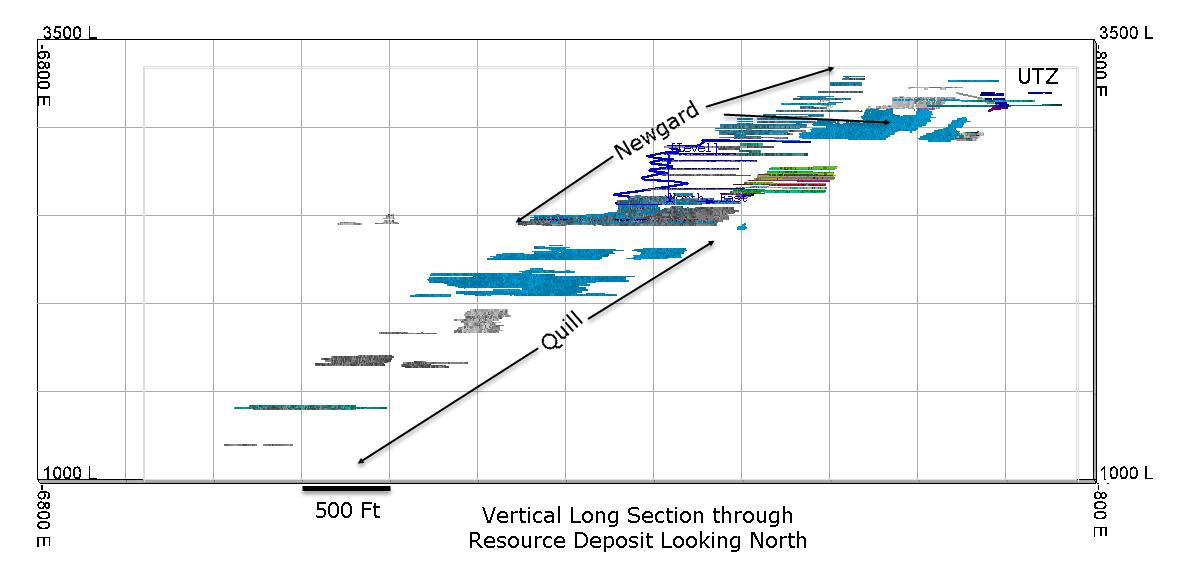

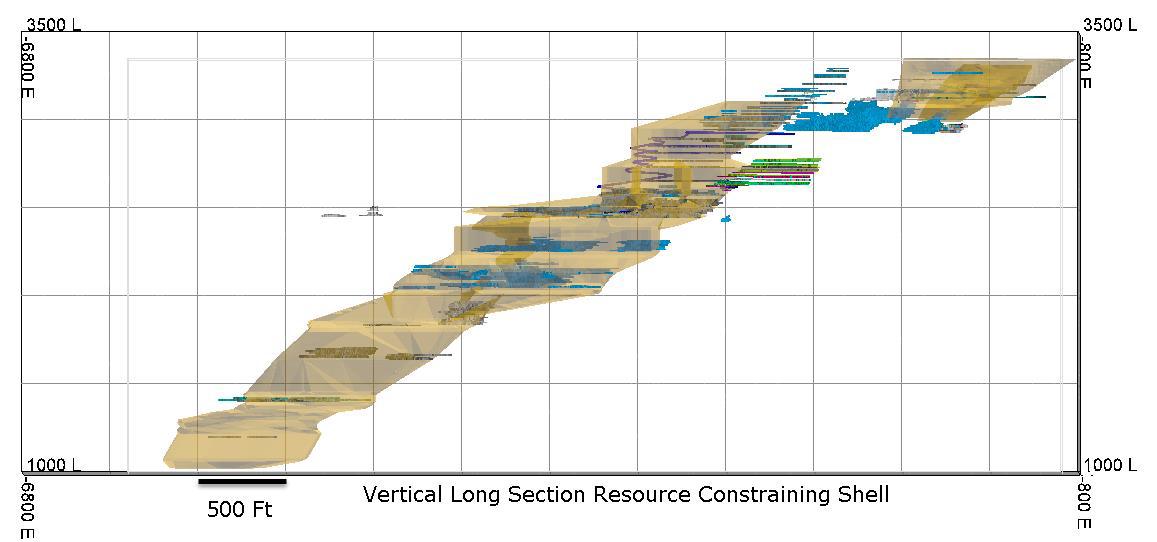

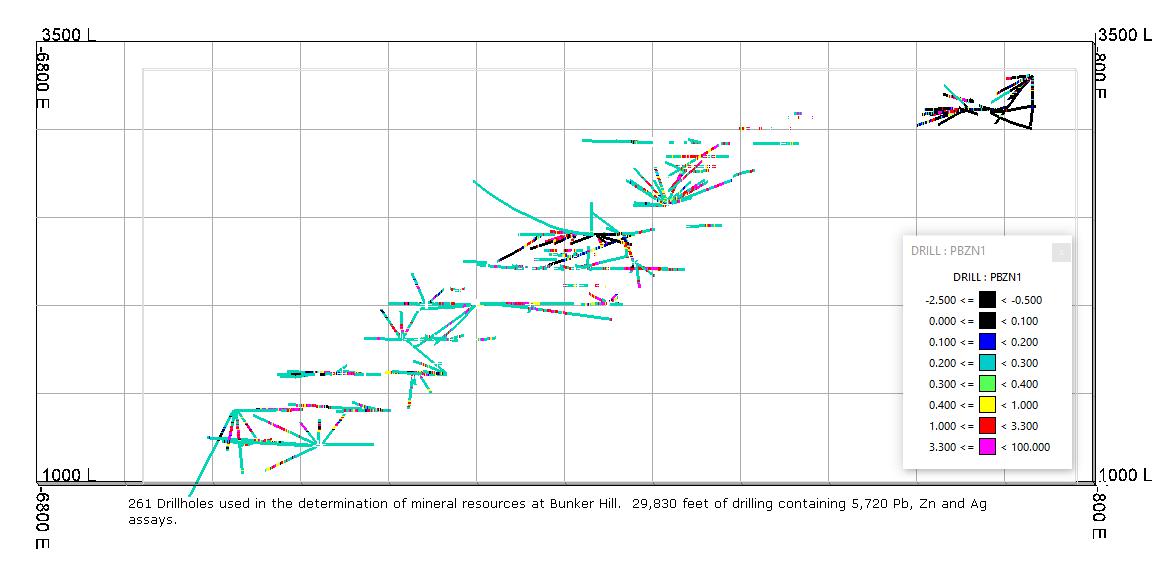

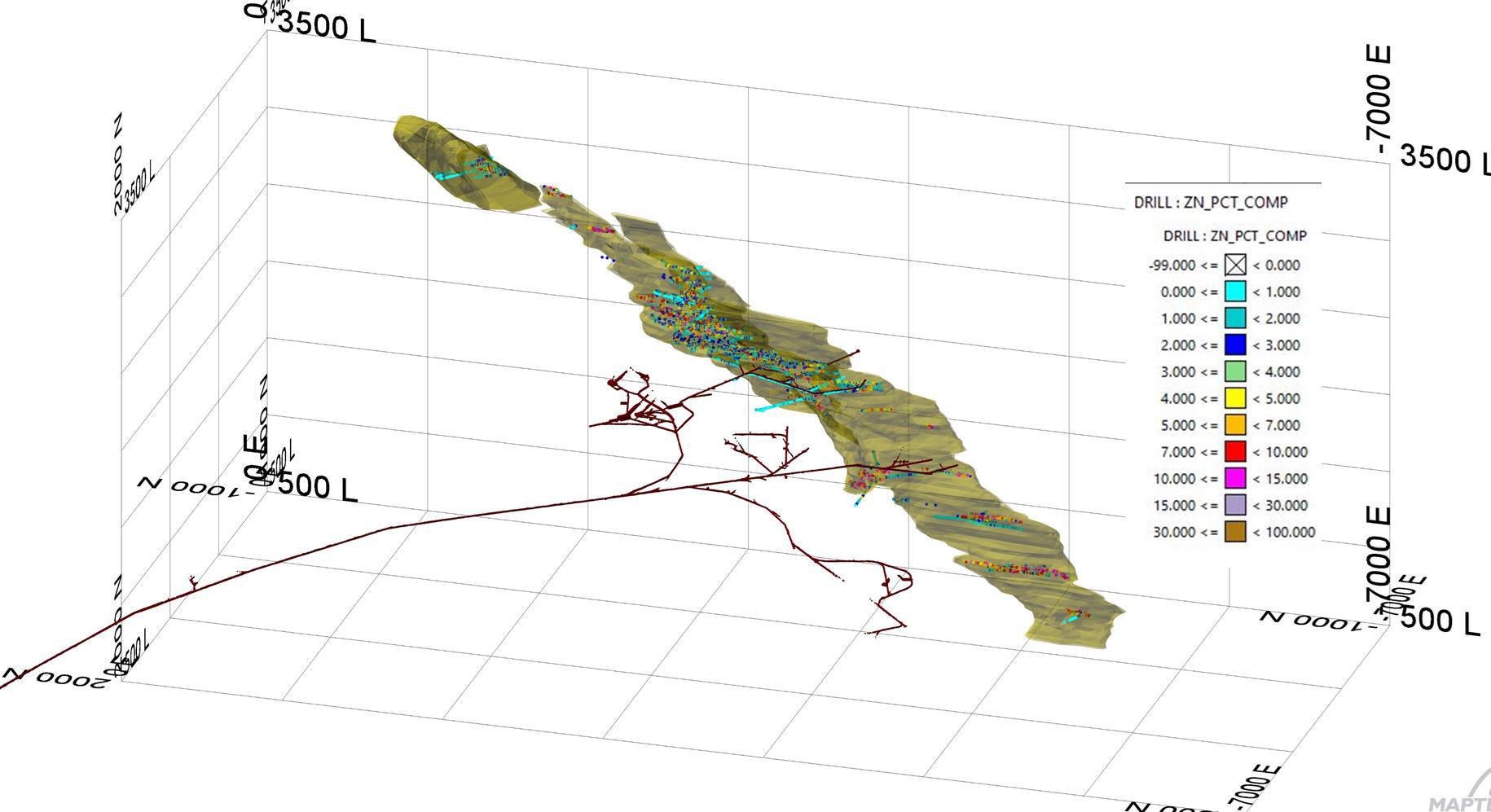

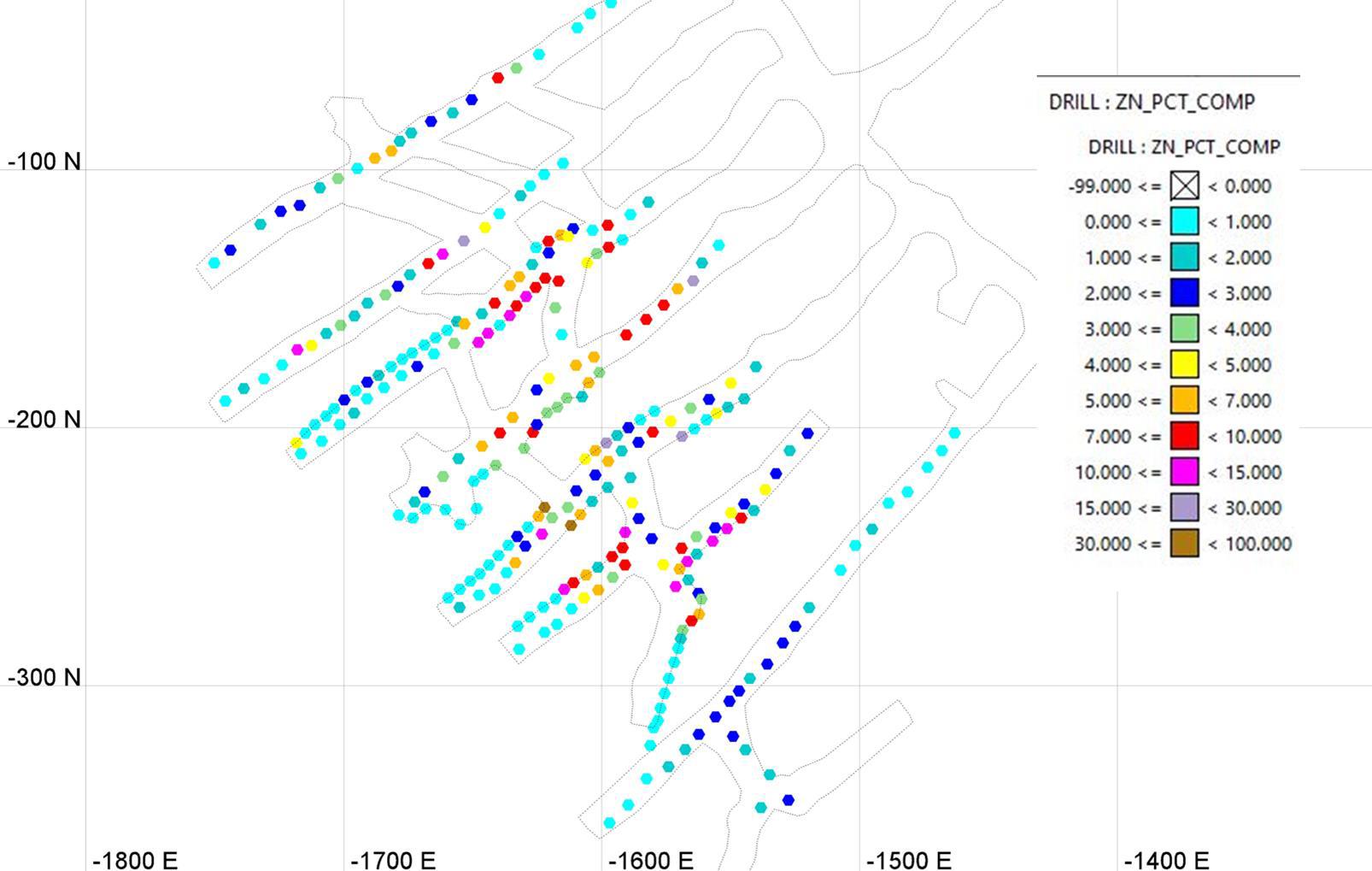

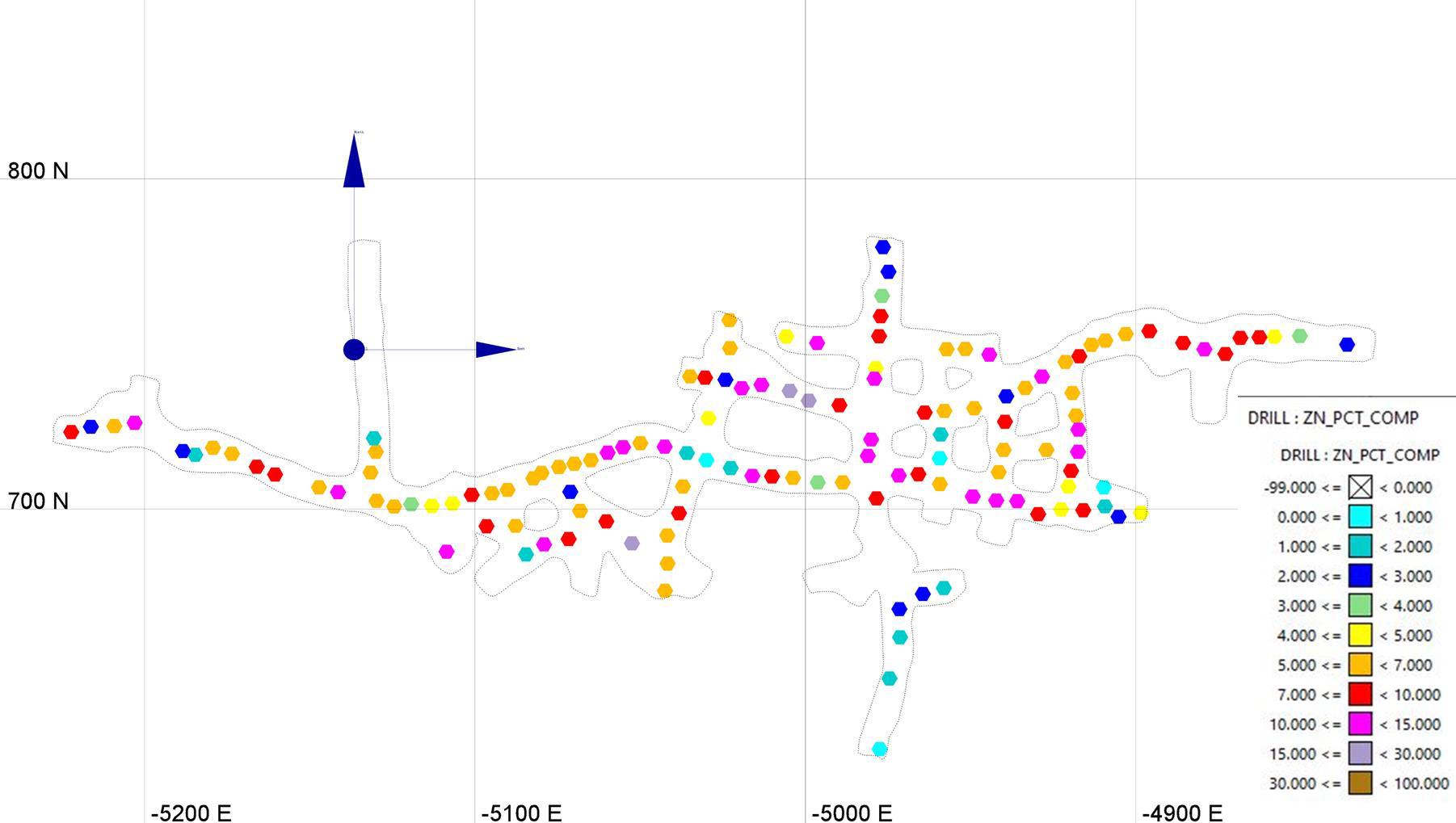

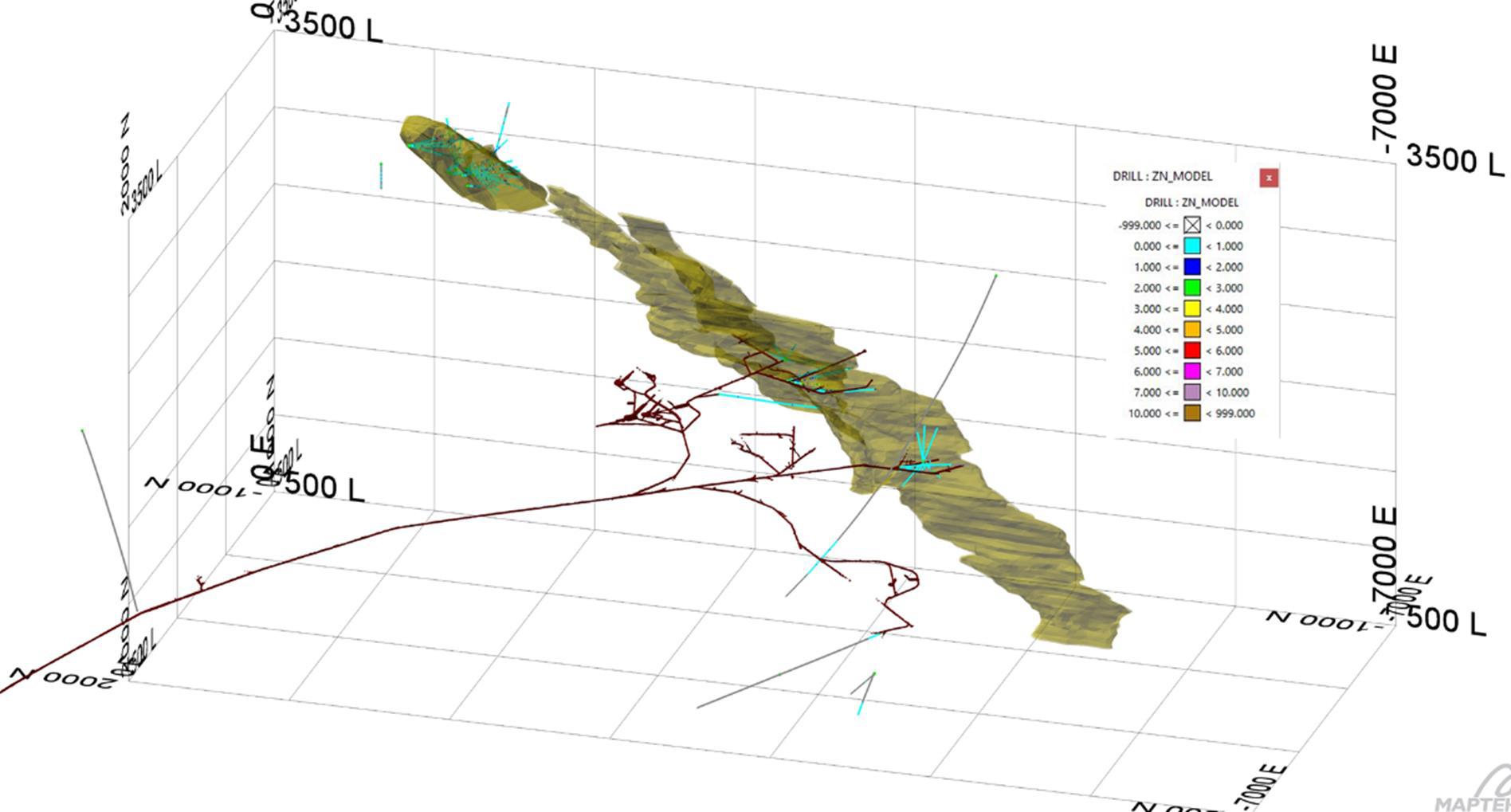

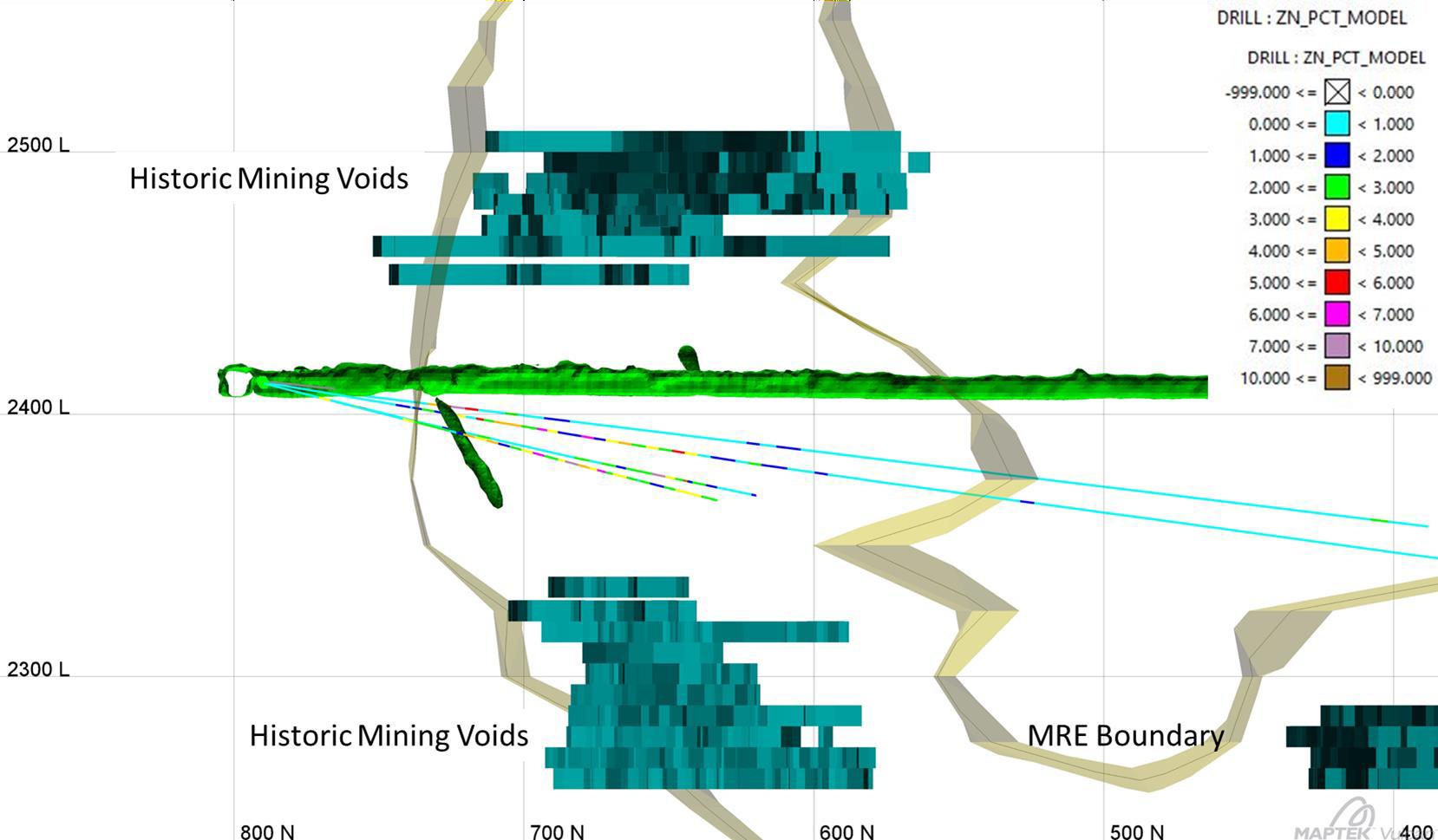

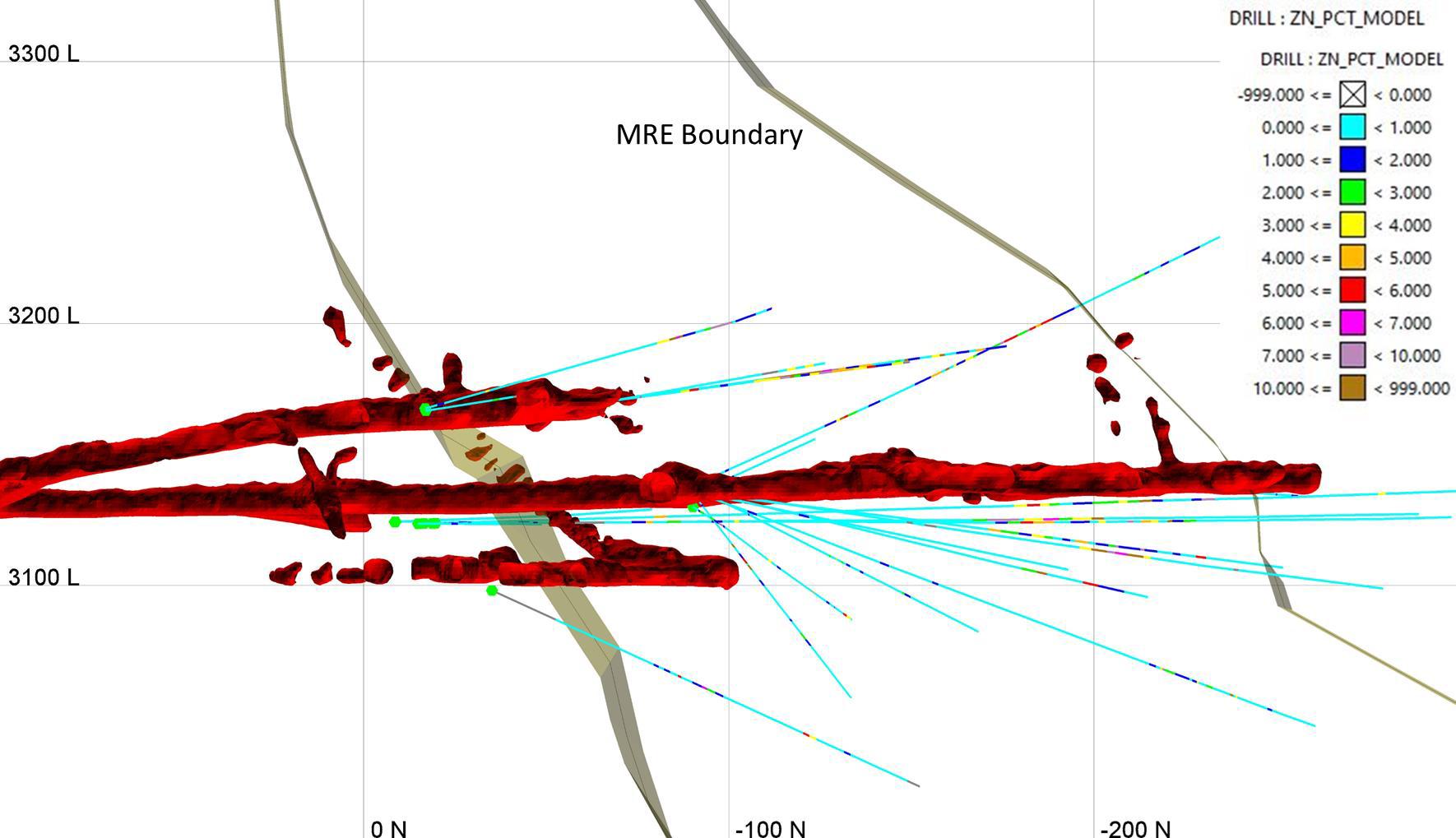

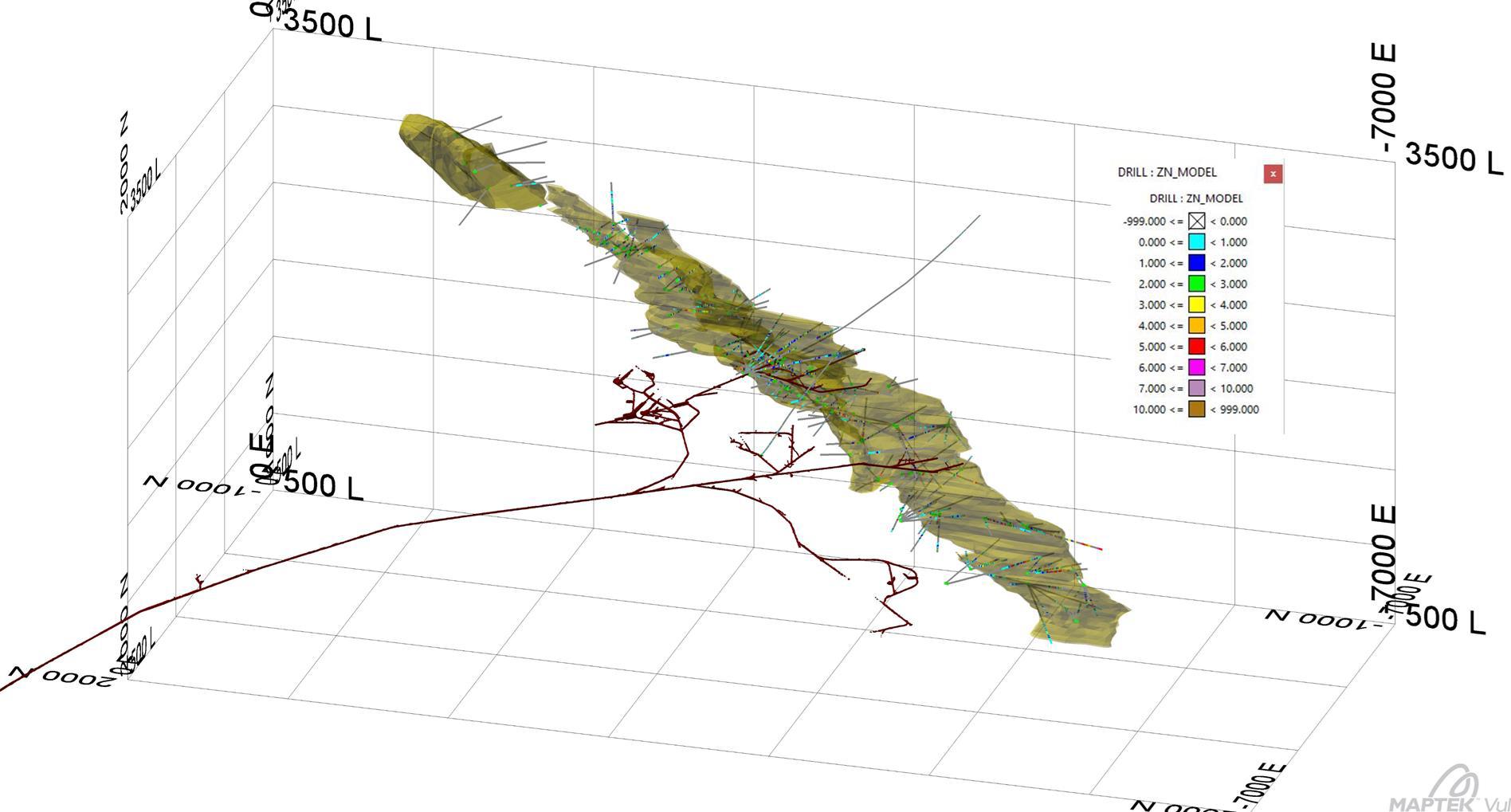

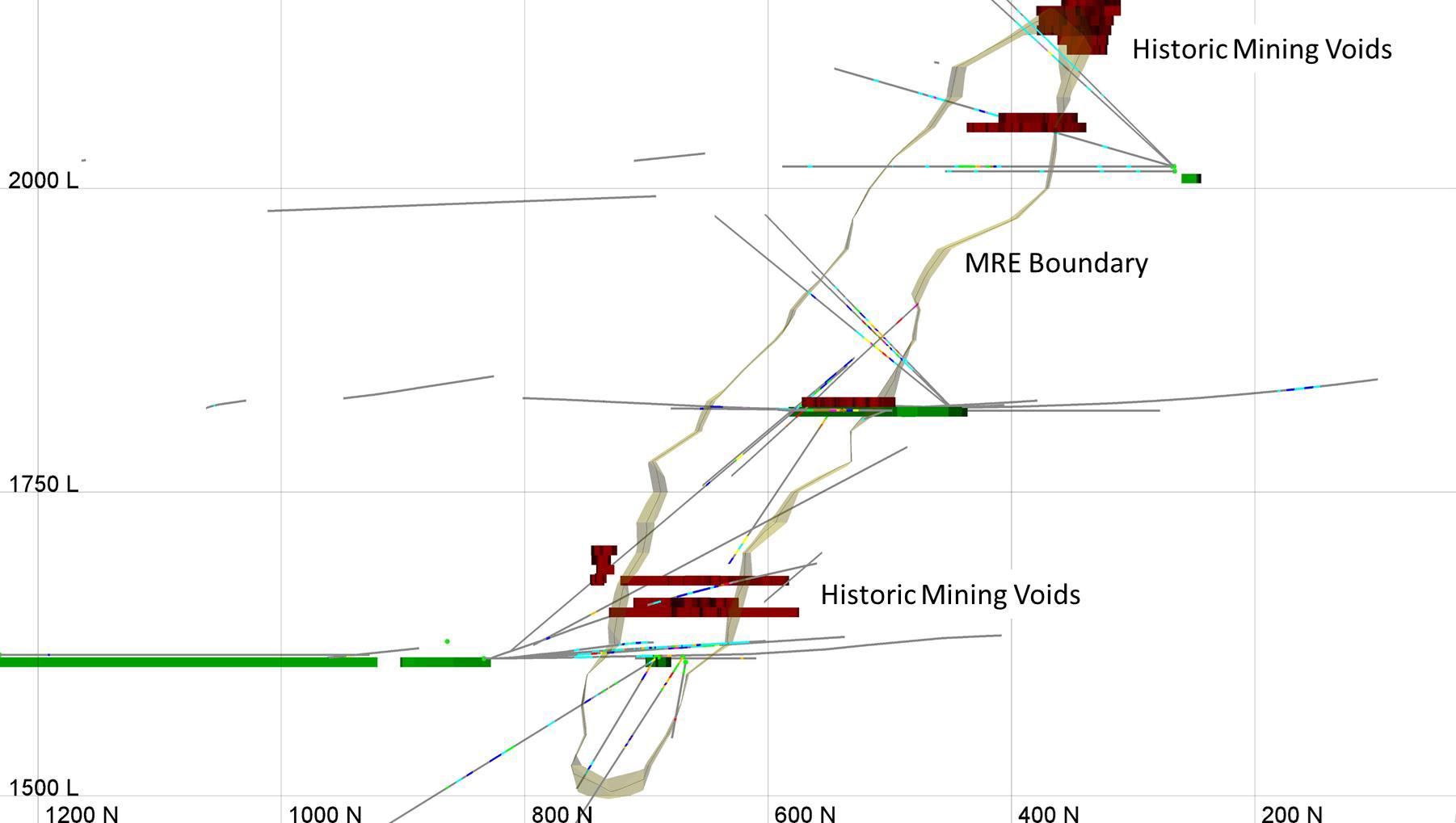

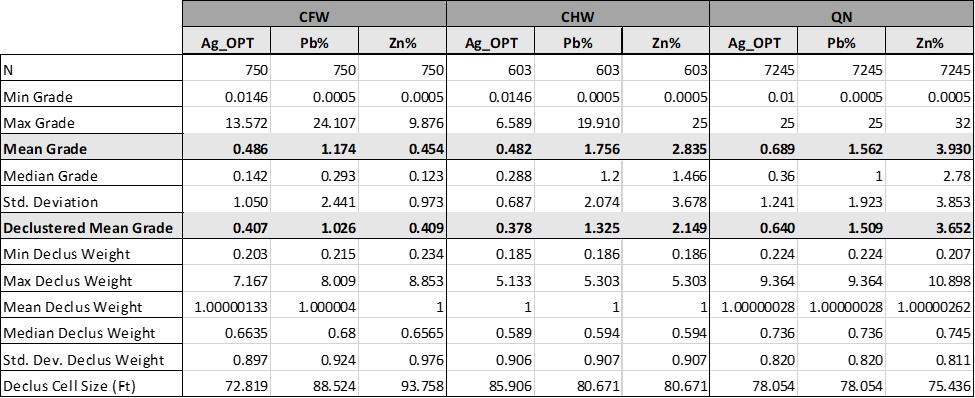

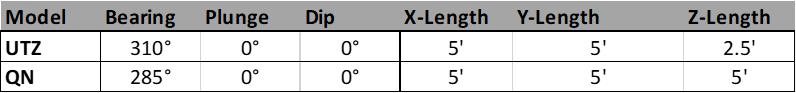

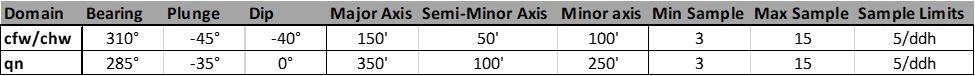

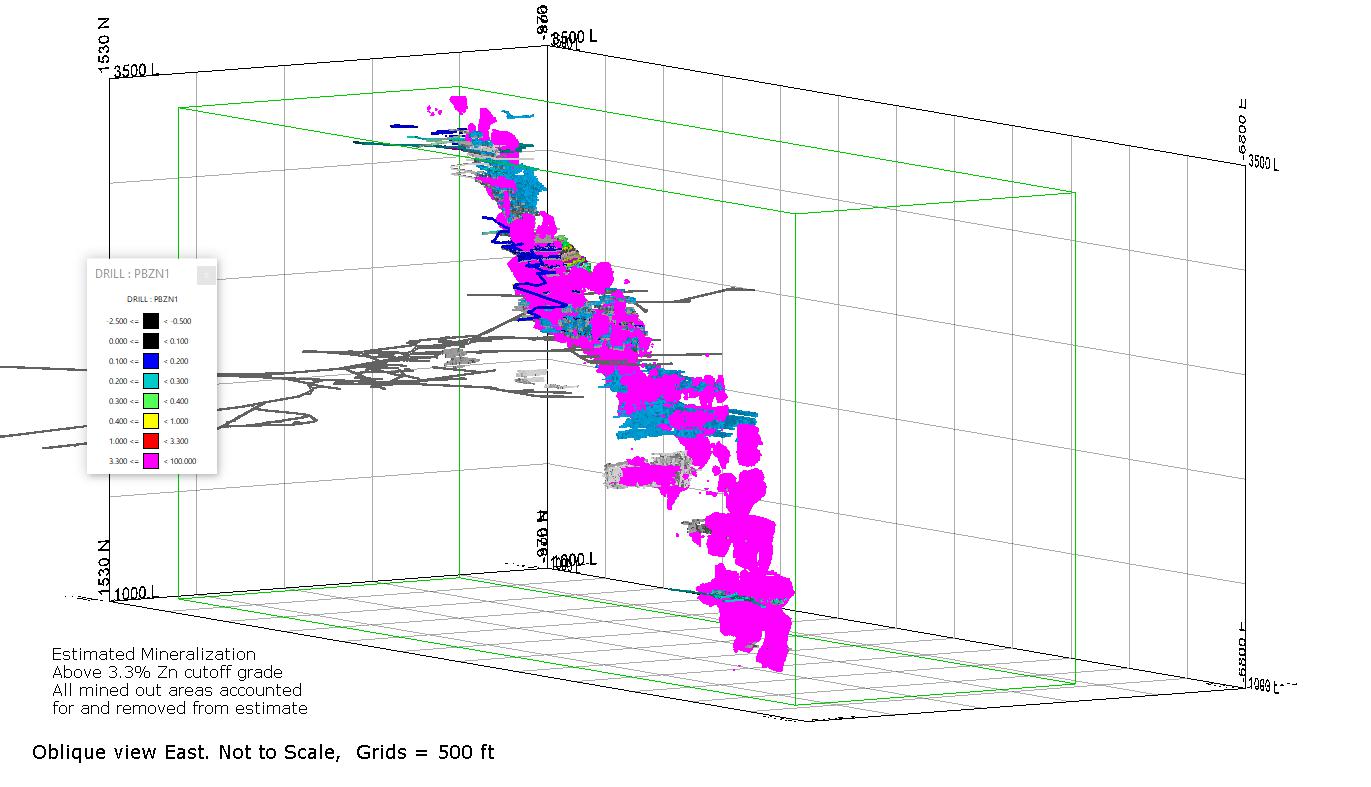

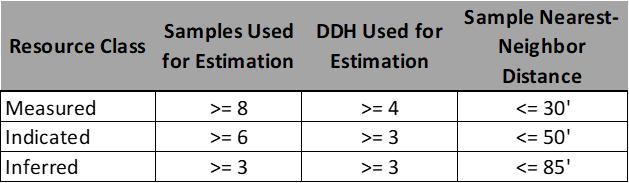

Between April and July 2020, the Company worked to validate in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) standards up to 9 million tons of primarily zinc ore contained within the UTZ, Quill and Newgard Ore Bodies. This involved over 9,000 feet of drilling from Underground and extensive sampling from the many open stopes above the water-level. These zones could provide the majority of the early feed if the Company were to achieve a restart of the Mine.

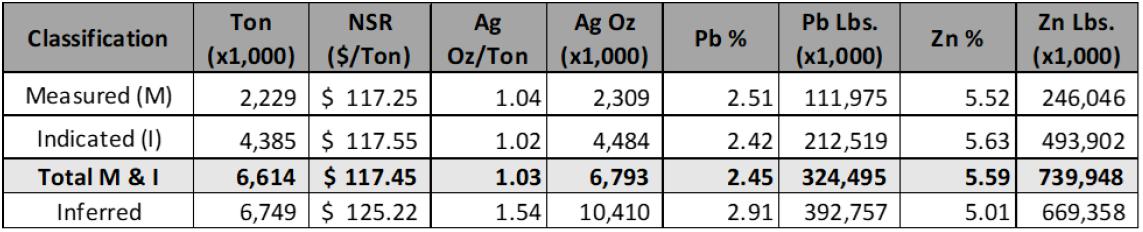

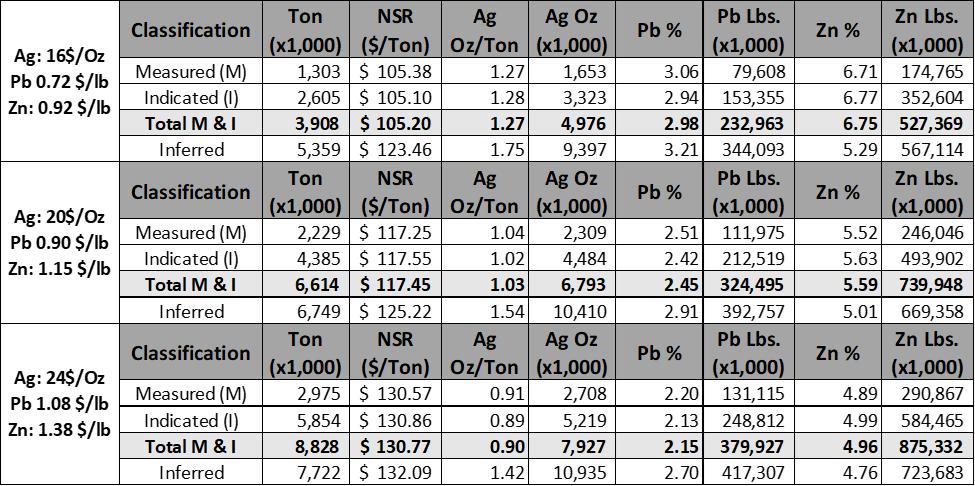

On September 28, 2020, the Company announced its maiden mineral resources estimate consisting of a total of 8.9 million tons in the Inferred category, containing 11 million ounces of silver, 880 million pounds of zinc, and 410 million pounds of lead, which represented the result of the Company’s extensive drilling and sampling efforts conducted between April and July 2020.

On November 12, 2020, the Company announced the launch of a Preliminary Economic Assessment (“PEA”) to assess the potential for a rapid restart of the Mine for minimal capital by focusing on the de-watered upper areas of the Mine, utilizing existing infrastructure, and based on truck haulage and toll milling methods.

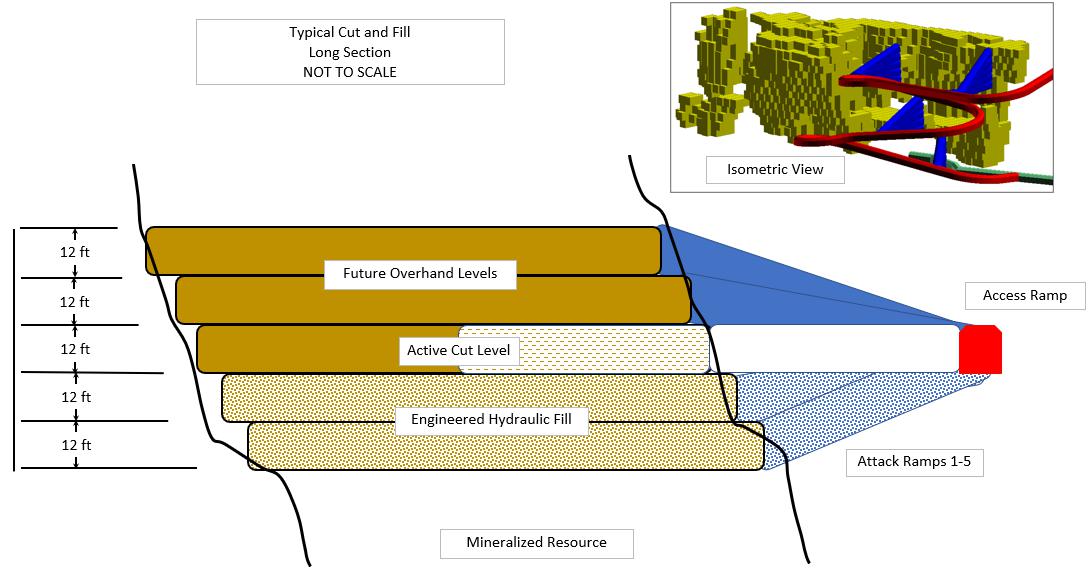

On January 26, 2021, the Company reported continued progress towards completing the previously announced PEA, and further detail regarding the potential parameters of the restart, including: i) low up-front capital costs through utilization of existing infrastructure, potentially enabling a rapid production restart; ii) a staged approach to mining, potentially supporting a long-life operation; iii) underground processing and tailings deposition with potential for high recovery rates; iv) development of a sustainable operation with minimal environmental footprint; and v) potential increase in the existing resource base.

| 6 |

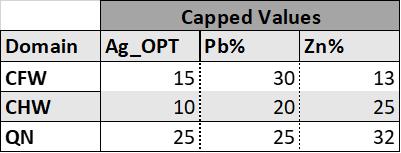

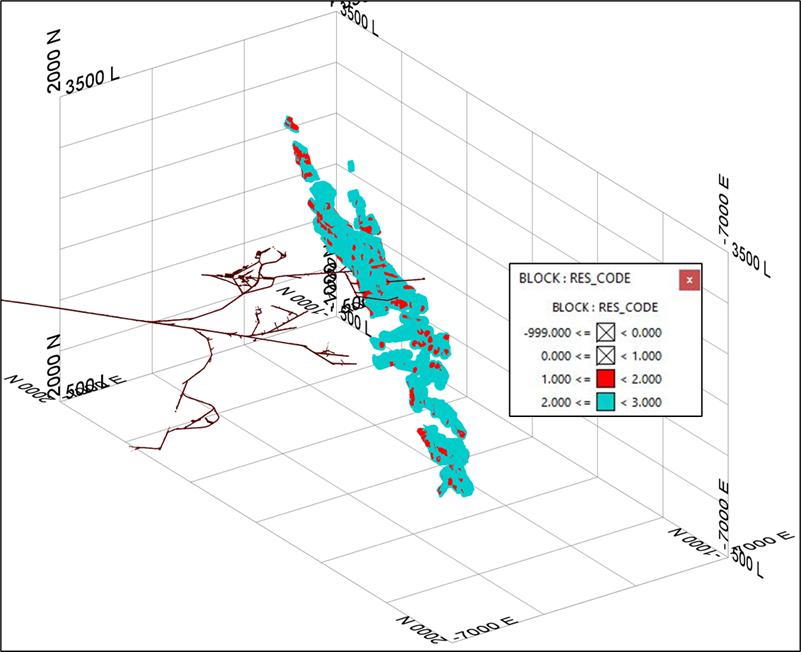

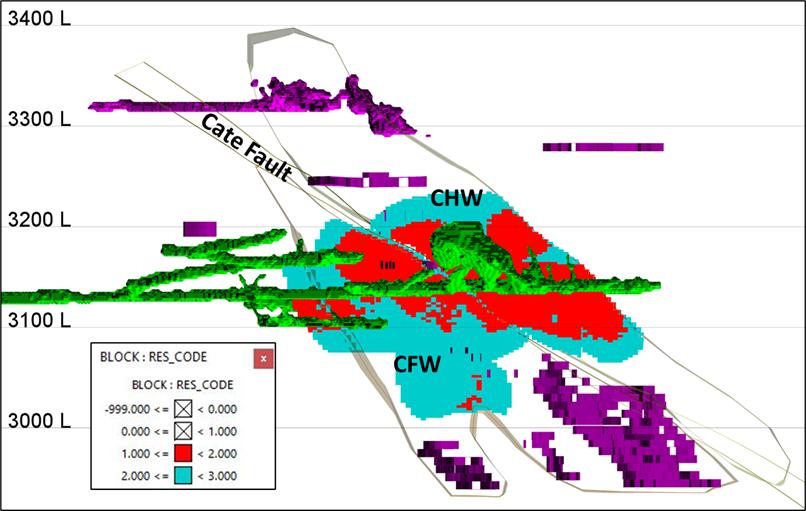

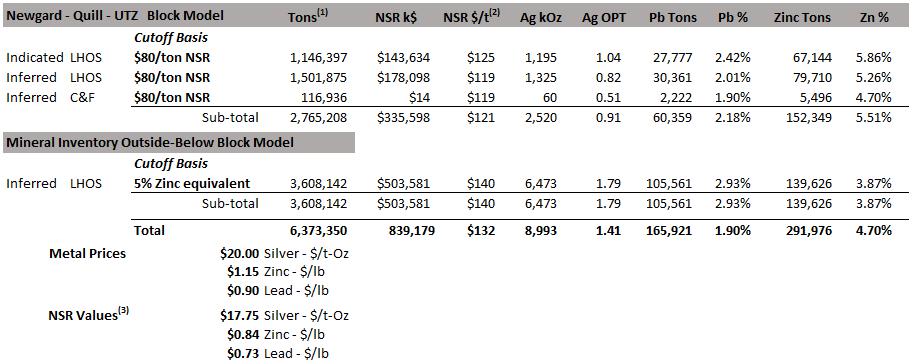

On March 19, 2021, the Company announced a mineral resource estimate consisting of a total of: 4.4 million tons in the Indicated category, containing 3.0 million ounces of silver, 487 million pounds of zinc, and 176 million pounds of lead; 5.6 million tons in the Inferred category, containing 8.3 million ounces of silver, 548 million pounds of zinc, and 312 million pounds of lead.

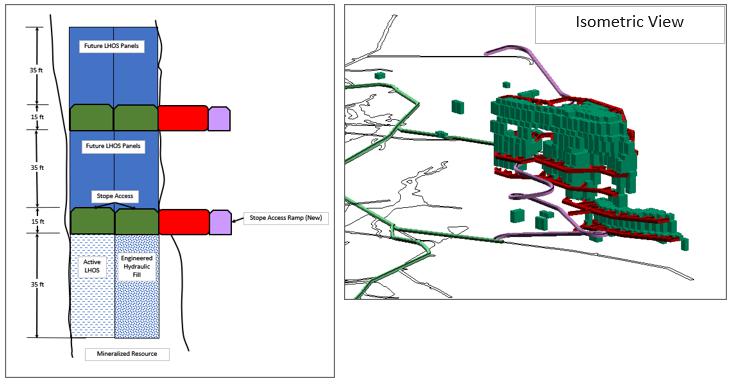

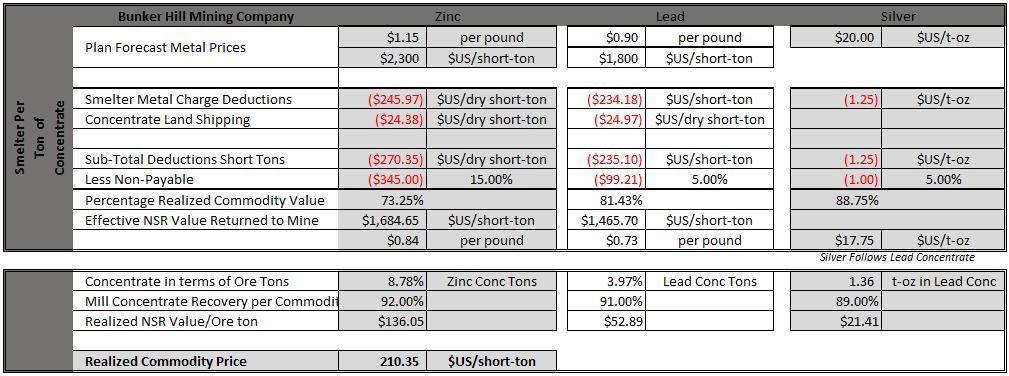

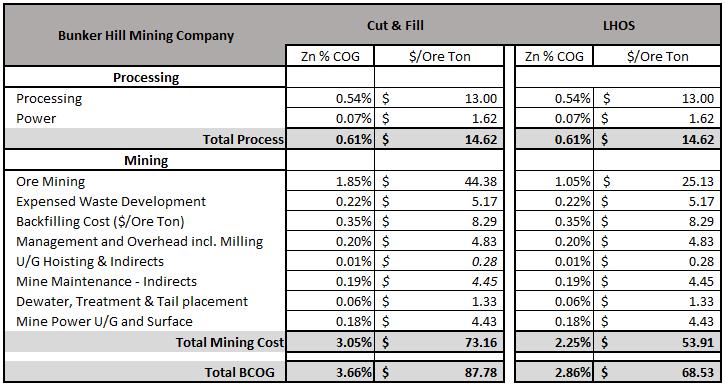

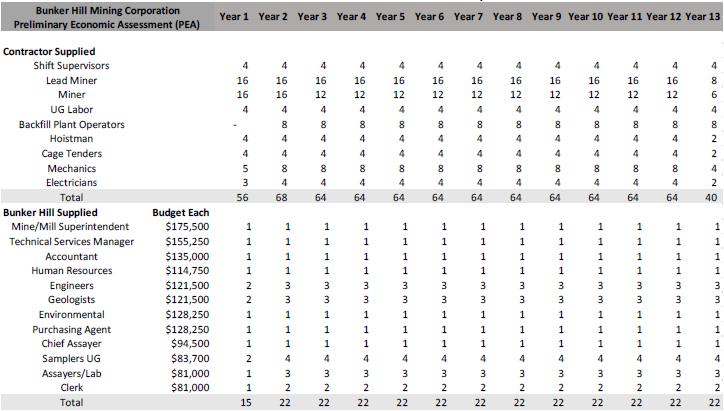

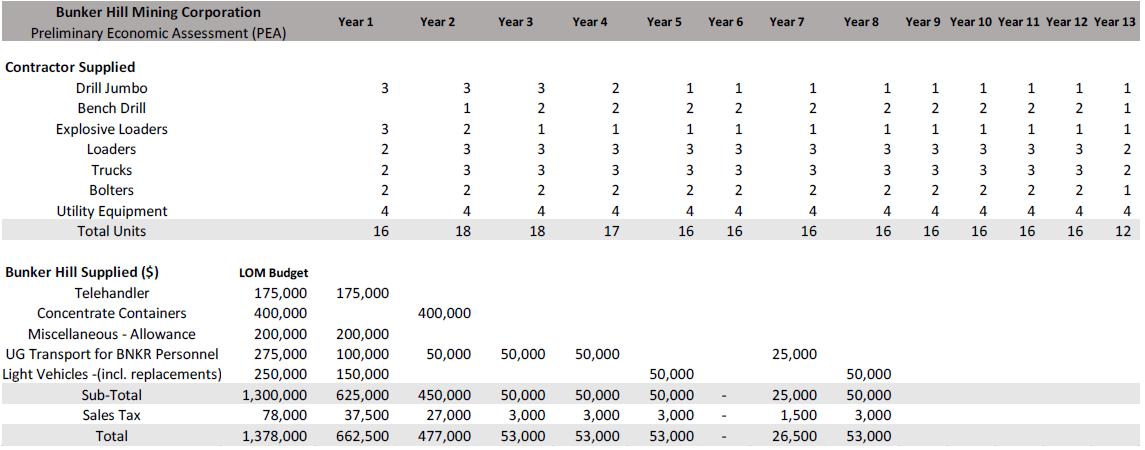

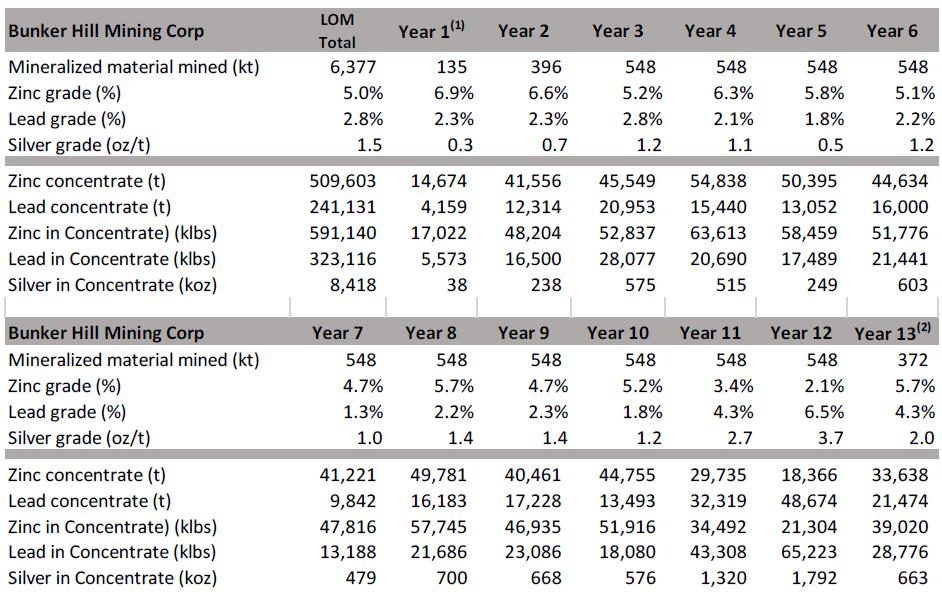

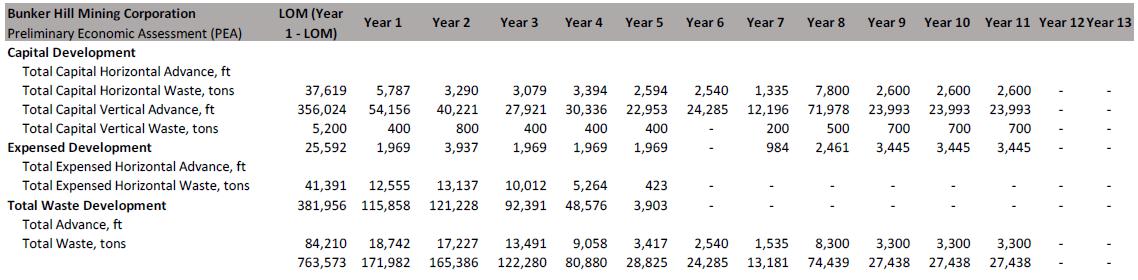

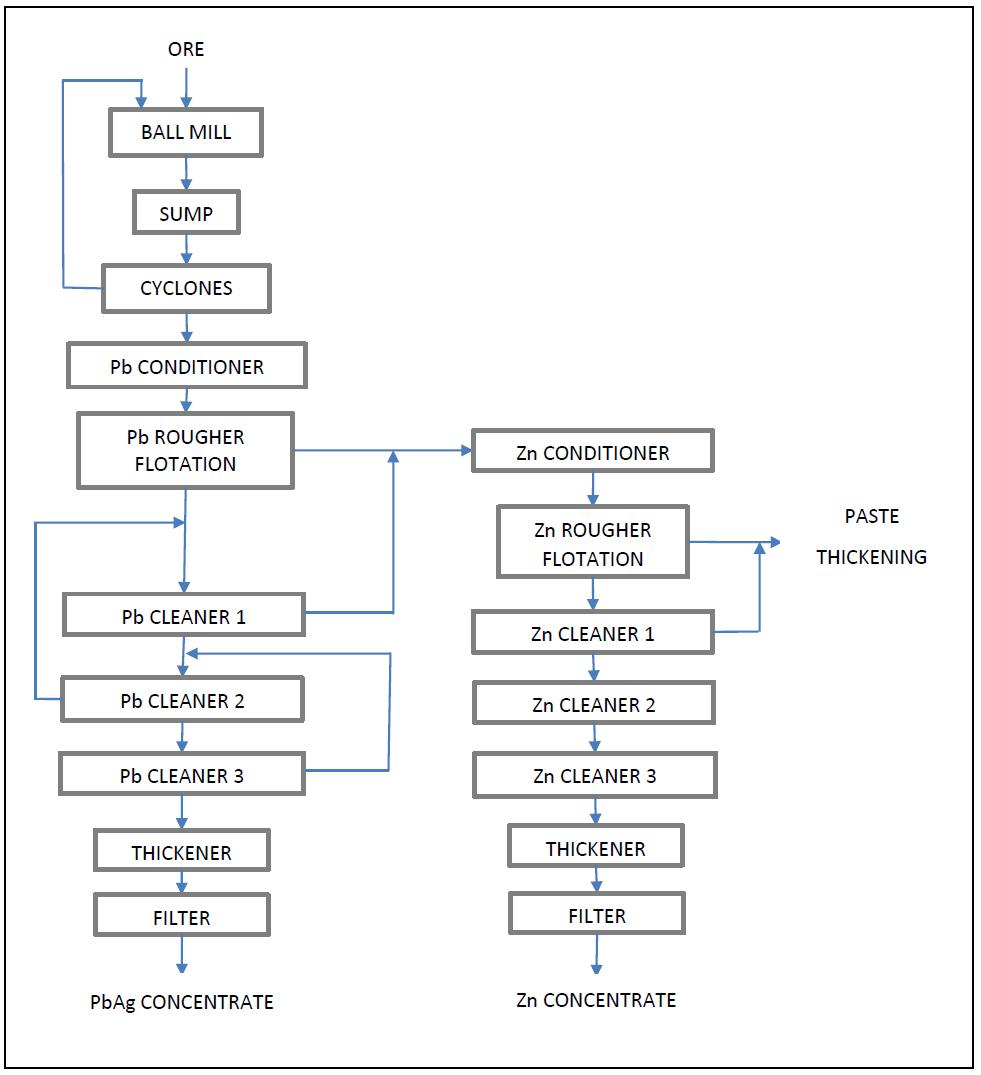

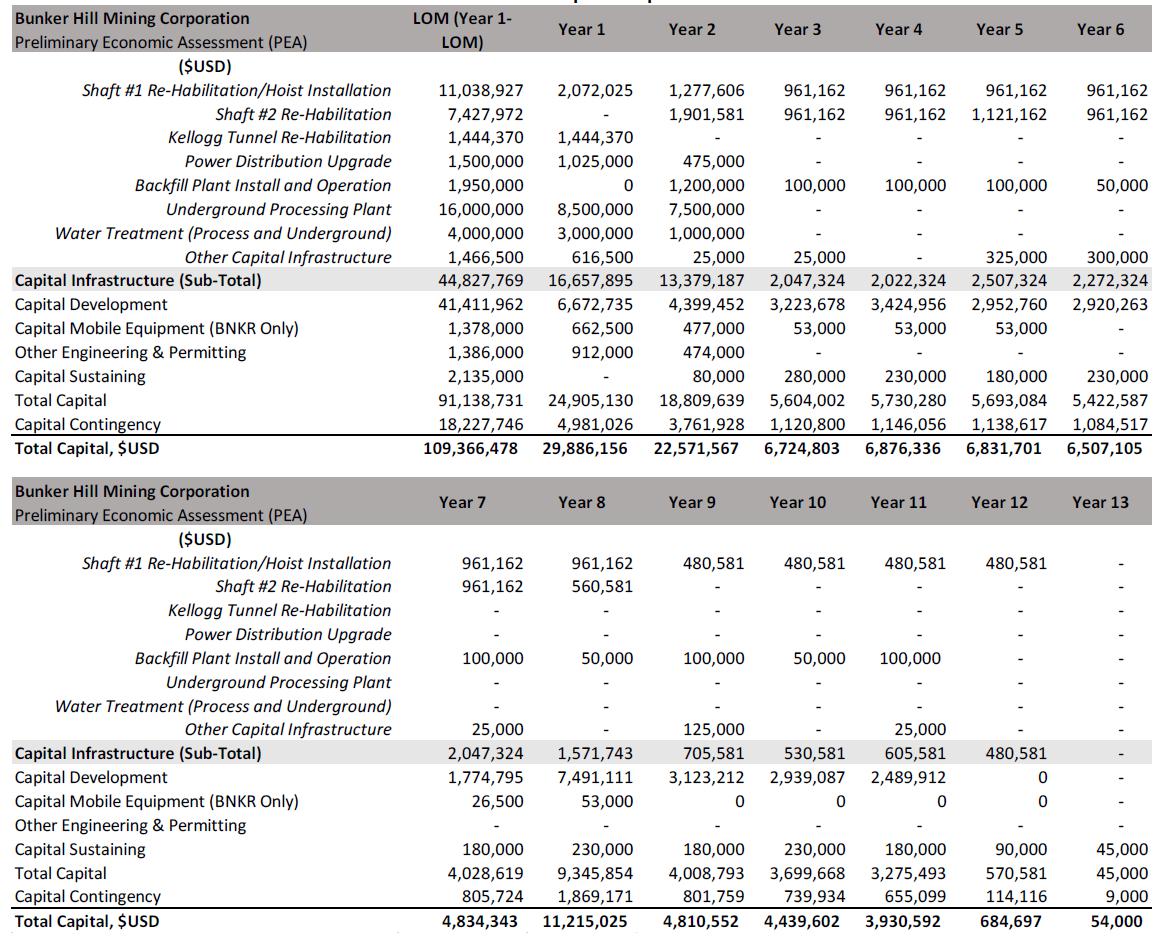

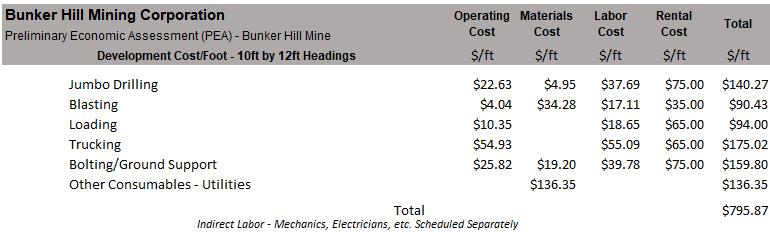

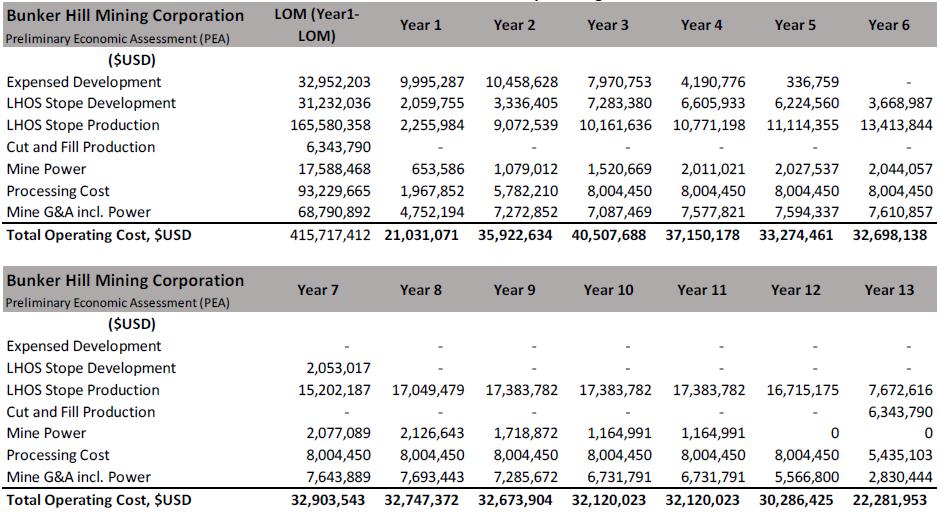

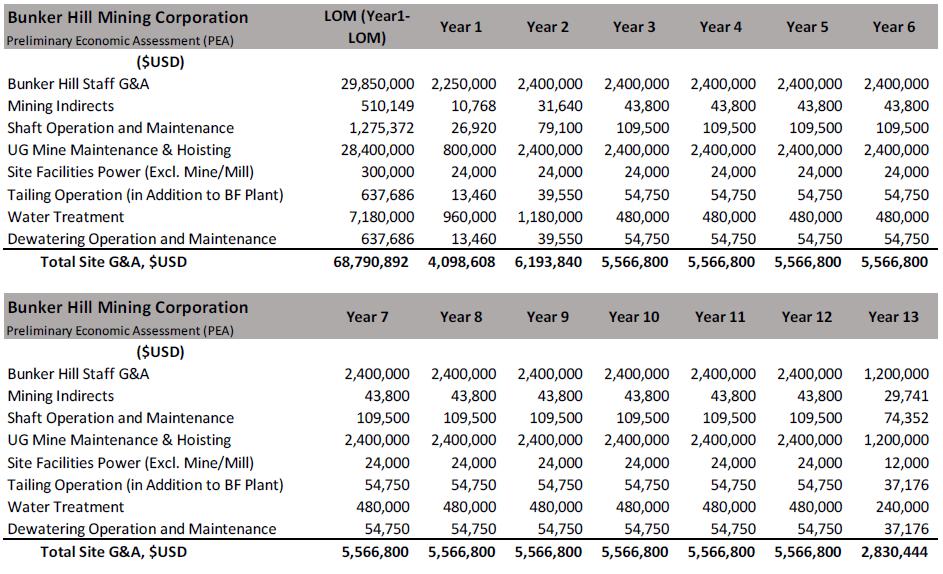

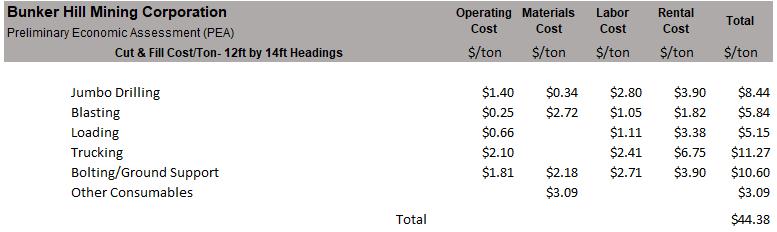

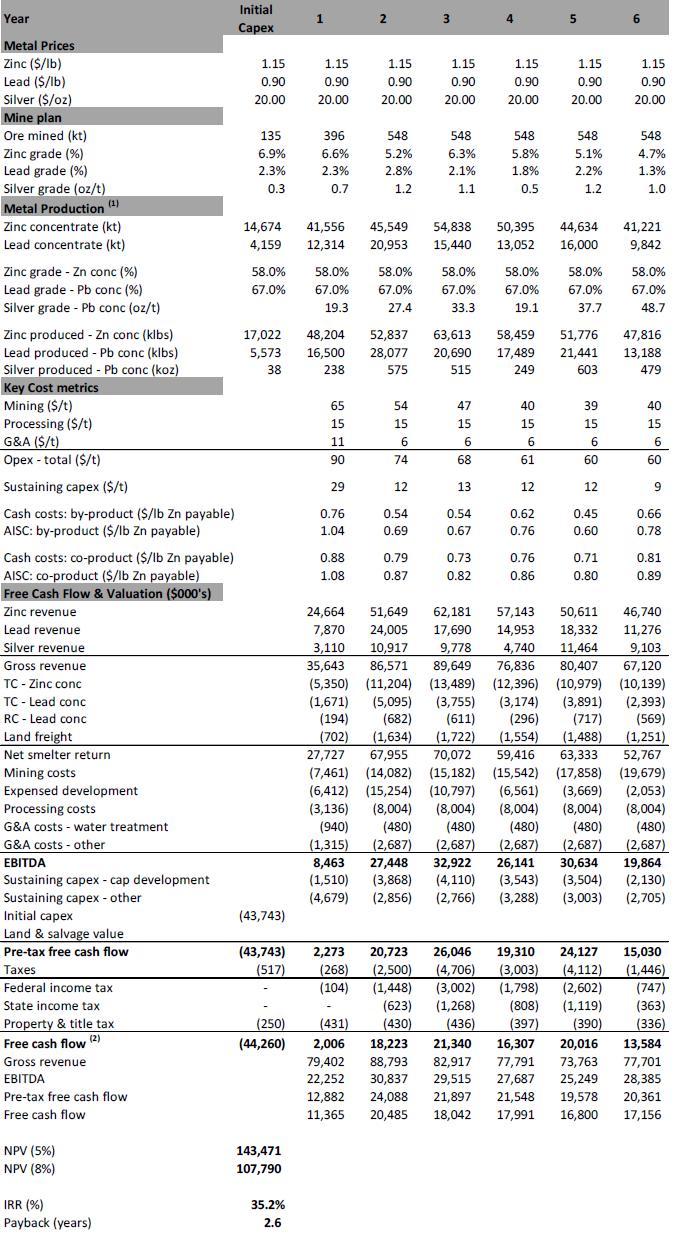

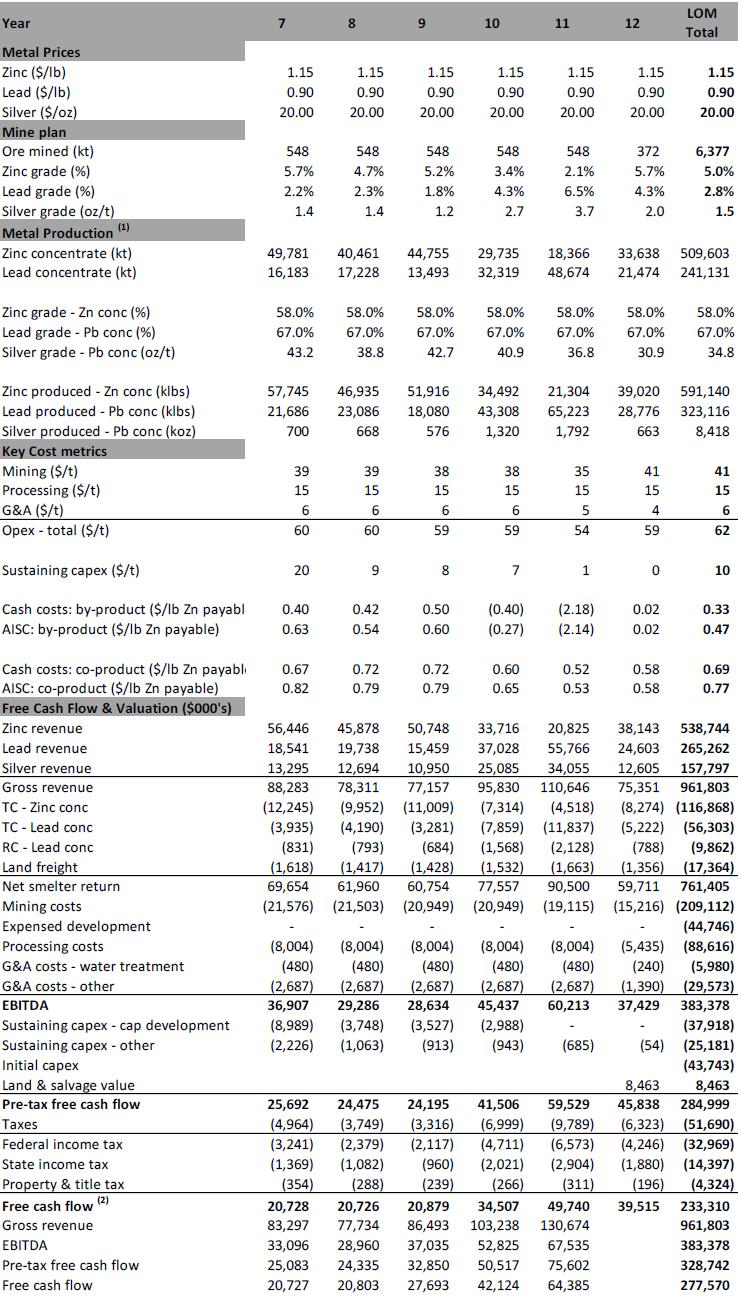

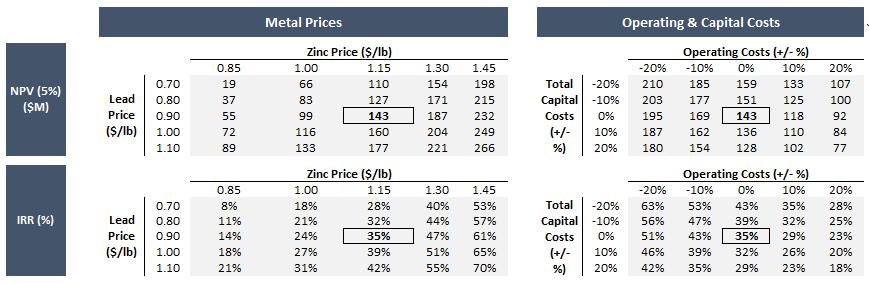

On April 20, 2021, the Company announced the results of its PEA for the Mine. The PEA contemplates a $42,000,000 initial capital cost (including 20% contingency) to rapidly restart the Mine, generating approximately $20,000,000 of annual average free cash flow over a 10-year mine life, and producing over 550 million pounds of zinc, 290 million pounds of lead, and 7 million ounces of silver at all-in sustaining costs of $0.65 per payable pound of zinc (net of by-products). The PEA contemplates a low environmental footprint, long-term water management solution, and significant positive economic impact for the Shoshone County, Idaho community. The PEA is based on the Mineral Resource Estimate described above and published on May 3, 2021, following the drilling program conducted in 2020 and early 2021 to validate the historical reserves. The PEA includes a mining inventory of 5.5Mt, which represents a portion of the 4.4Mt Indicated mineral resource and 5.6Mt Inferred mineral resource that comprise the Mineral Resource Estimate. The PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the project described in the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

On May 3, 2021, the Company filed a technical report with further detail regarding the mineral resource estimate announced on March 19, 2021, entitled “Technical Report for the Bunker Hill Mine, Coeur d’Alene Mining District, Shoshone County, Idaho, USA” with an effective date of March 22, 2021. This technical report was prepared in accordance with the requirements of subpart 1300 of Regulation S-K (the “SEC Mining Modernization Rules”) and Canadian National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”).

On June 4, 2021, the Company filed a technical report entitled “Technical Report And Preliminary Economic Assessment For Underground Milling And Concentration Of Lead, Silver And Zinc At The Bunker Hill Mine, Bunker Hill Mine, Coeur d’Alene Mining District, Shoshone County, Idaho, USA” in support of the PEA that it announced on April 20, 2021 (as described above). This technical report was prepared in accordance with the requirements of the SEC Mining Modernization Rules and NI 43-101

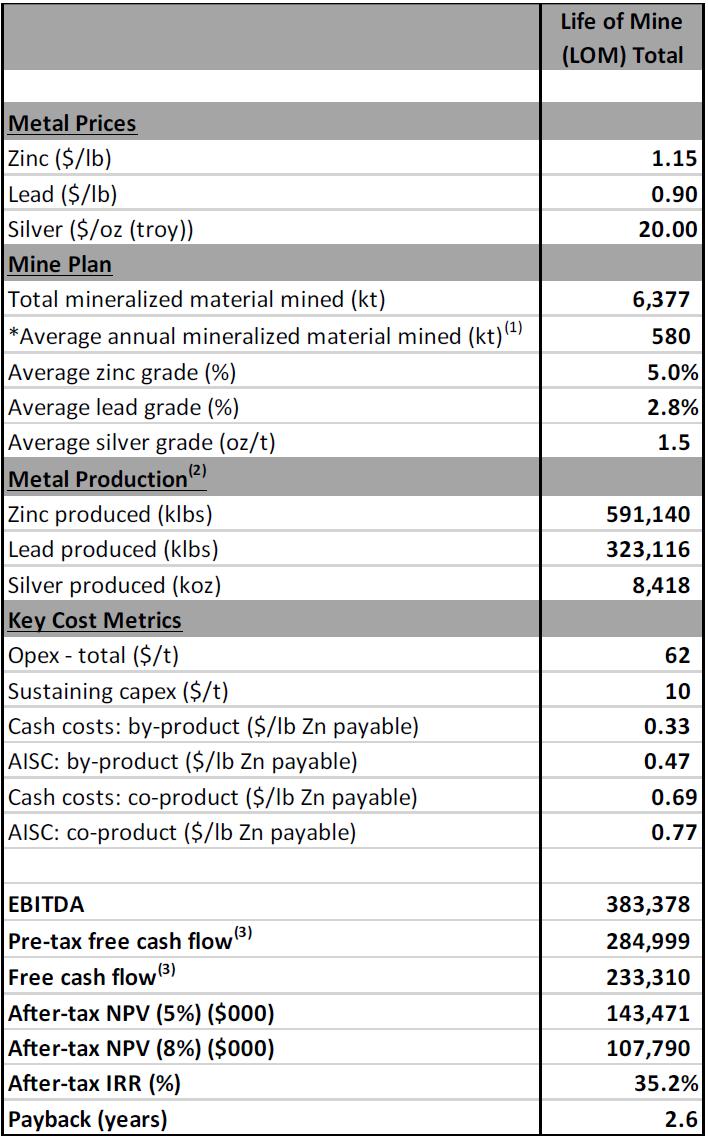

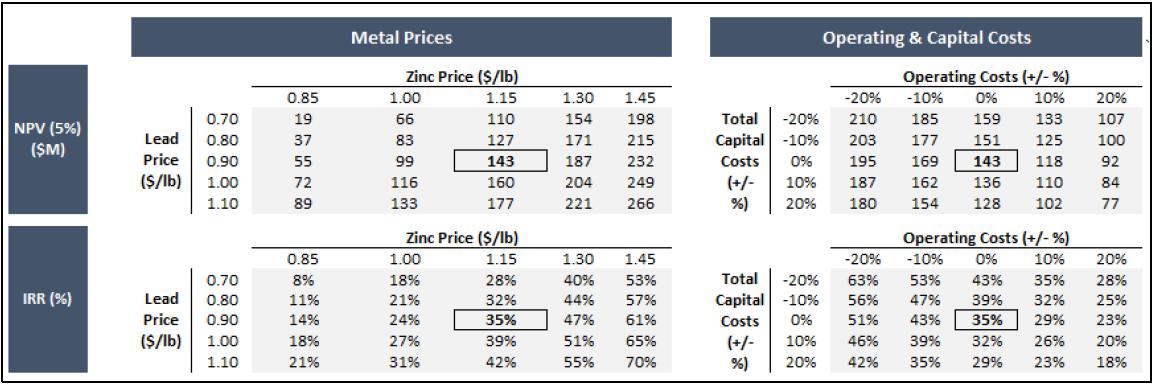

On September 20, 2021, the Company announced the results of an updated PEA for the Mine. The updated PEA contemplates a $44,000,000 initial capital cost (including 20% contingency) to rapidly restart the Mine, generating approximately $25,000,000 of annual average free cash flow over an 11-year mine life, and producing over 590 million pounds of zinc, 320 million pounds of lead, and 8 million ounces of silver at all-in sustaining costs of $0.47 per payable pound of zinc (net of by-products). As with the PEA published on June 4, 2021, the updated PEA is based on the Mineral Resource Estimate described above and published on May 3, 2021, following the drilling program conducted in 2020 and early 2021 to validate the historical reserves. The PEA includes a mining inventory of 6.4Mt, which represents a portion of the 4.4Mt Indicated mineral resource and 5.6Mt Inferred mineral resource that comprise the Mineral Resource Estimate.

On November 3, 2021, the Company filed a technical report entitled “Technical Report And Preliminary Economic Assessment For Underground Milling And Concentration Of Lead, Silver And Zinc At The Bunker Hill Mine, Bunker Hill Mine, Coeur d’Alene Mining District, Shoshone County, Idaho, USA” in support of the updated PEA that it announced on September 20, 2021 (as described above).

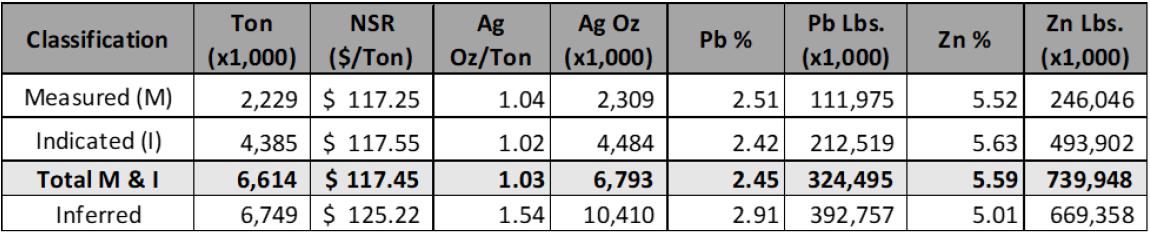

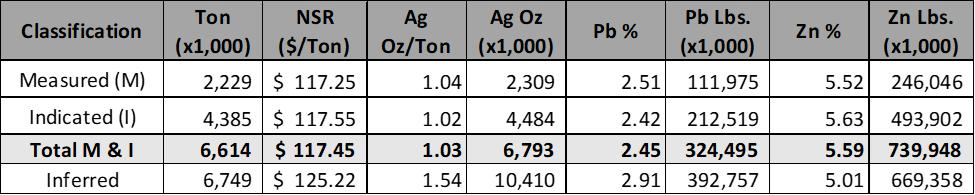

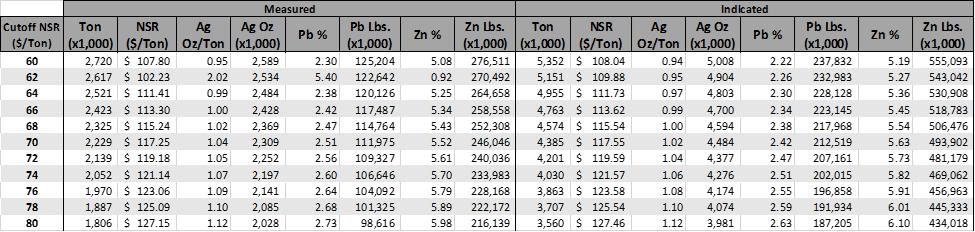

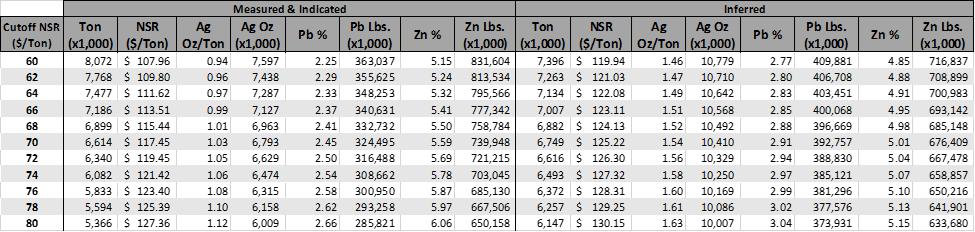

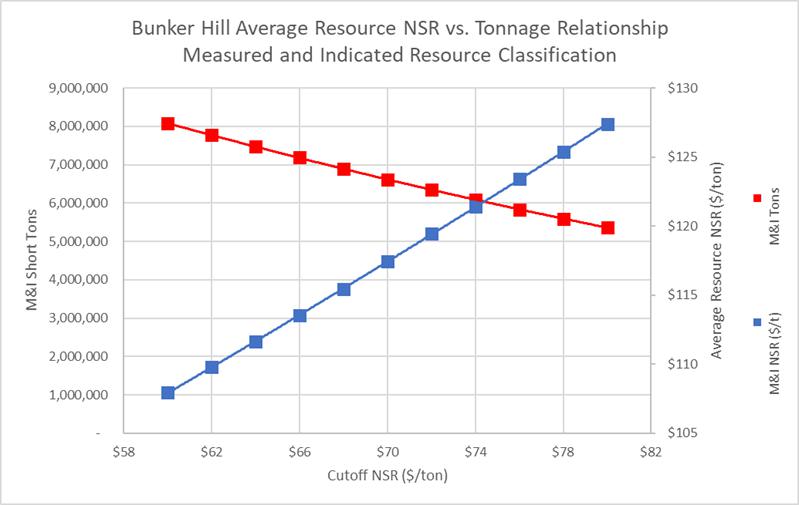

On November 30, 2021, the Company announced the completion of an updated mineral resource estimate (the “Mineral Resource Estimate” or “MRE”) for the Bunker Hill Mine consisting of a total of: 6.6 million tons in the Measured and Indicated category, containing 6.8 million ounces of silver, 740 million pounds of zinc, and 324 million pounds of lead; 6.7 million tons in the Inferred category, containing 10.4 million ounces of silver, 669 million pounds of zinc, and 392 million pounds of lead.

On December 29, 2021, the Company filed a technical report entitled “Technical Report And Preliminary Economic Assessment For Underground Milling And Concentration Of Lead, Silver And Zinc At The Bunker Hill Mine, Bunker Hill Mine, Coeur d’Alene Mining District, Shoshone County, Idaho, USA” (the “Technical Report” or “Bunker Hill Technical Report”) in support of the updated MRE that it announced on November 30, 2021 (as described above). This technical report was prepared in accordance with the requirements of the SEC Mining Modernization Rules and NI-43-101 and is filed as an exhibit to the Registration Statement of which this prospectus is a part.

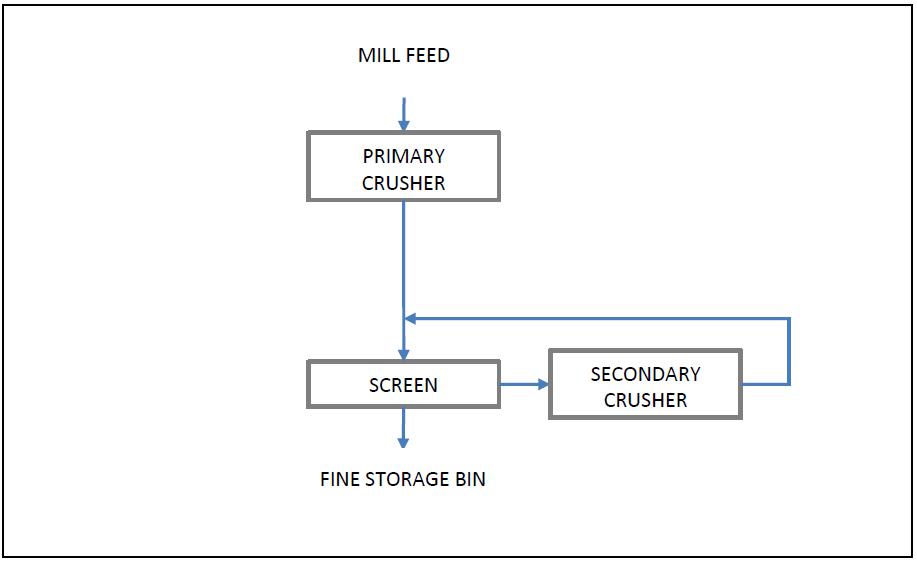

On January 31, 2022, the Company announced the signing of a non-binding Memorandum of Understanding (“MOU”) with Teck Resources Limited (“Teck”) for the purchase of a comprehensive package of equipment and parts inventory from its Pend Oreille site (the “Pend Oreille Process Plant”) in eastern Washington State, approximately 145 miles from the Bunker Hill Mine by road. The package comprises substantially all processing equipment of value located at the site, including complete crushing, grinding and flotation circuits suitable for a planned ~1,500 ton-per-day operation at Bunker Hill, and total inventory of nearly 10,000 components and parts for mill, assay lab, conveyer, field instruments, and electrical spares. The MOU outlines a purchase price under two scenarios, at Teck’s option: an all-cash $2,750,000 purchase price, or a $3,000,000 purchase price comprised of cash and Bunker Hill shares. Each option includes a $500,000 non-refundable deposit, which has been paid by the Company subsequent to the end of the year. On March 7, 2022, the Company announced the signing of an Asset Purchase agreement for the purchase of the Pend Oreille Process Plant. Closing of the transaction remains subject to certain conditions, including payment of the remaining purchase price by May 15, 2022.

| 7 |

On March 3, 2022, the Company announced the purchase of a 225-acre surface land parcel for approximately $200,000. The Company intends this to serve as a strategic asset for the rapid restart of the Mine, optimizing construction efficiency and costs while providing improved access to prospective areas identified by our recent geophysics survey.

Water Management Optimization

In September 2020, the Company began its water management program with the goal of improving the understanding of the Mine’s water system and enacting immediate improvement in the water quality of effluent leaving the Mine for treatment at the Central Treatment Plant (“CTP”). Informed by historical research provided by the EPA, the Company initiated a study of the water system of the Mine to: i) identify of the areas where sulphuric acid (Acid Mine Drainage, or “AMD”) is generated in the greatest and most concentrated quantities, and ii) understand the general flow paths of AMD on its way through and out of the mine as it travels to the CTP.

Leveraging its improved understanding through this study, on February 11, 2021 the Company announced the successful commissioning of a water pre-treatment plant located within the Mine, designed to significantly improve the quality of Mine water discharge, which in turn would support a rapid restart of the Mine. Specifically, the water pre-treatment plant achieves this goal by reducing significantly the amount of treatment required at the CTP, and the associated costs, before the Mine water is discharged into the south fork of the Coeur D’Alene River, removing over 70% of the metals from water before it leaves the Mine, with the potential for further improvements.

In an effort to improve transparency to all stakeholders with regard to the results of this system, the Company launched a water quality tracking platform on its website on March 15, 2021, which uploads real-time data every five minutes and provides an interactive database to allow detailed historical analysis.

Business Operations

The Mine is a lead-silver-zinc Mine. When back in production, the Company intends to mill mineralized material on-site or at a local third-party mill to produce both lead-silver and zinc concentrates which will then be shipped to third party smelters for processing.

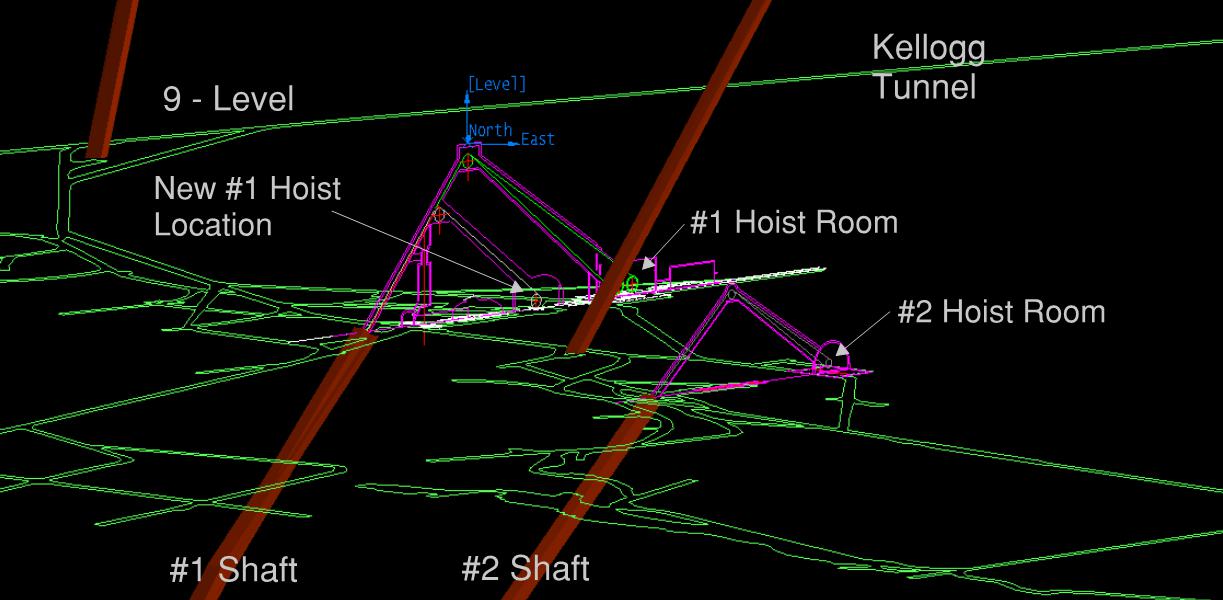

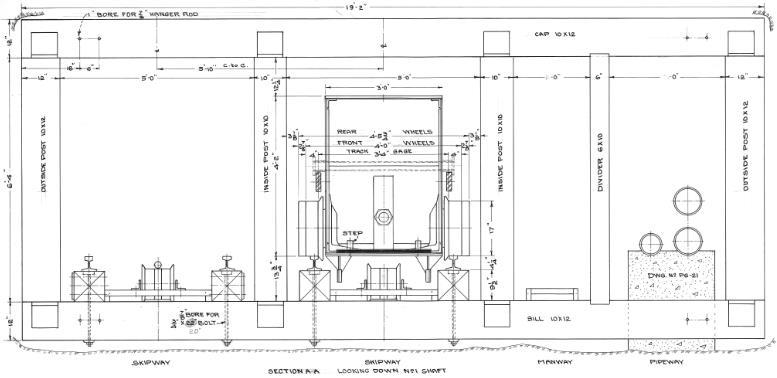

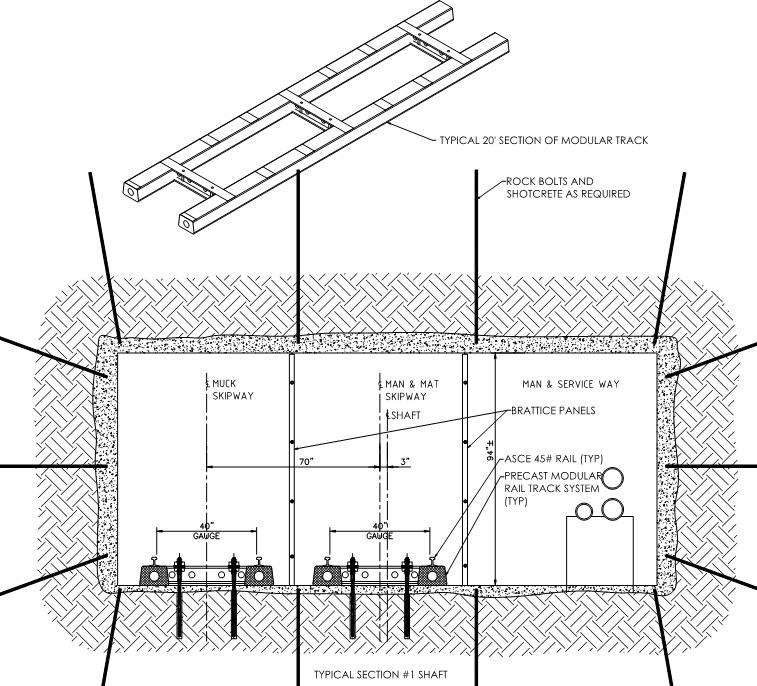

Infrastructure

The Mine includes all mining rights and claims, surface rights, fee parcels, mineral interests, easements, existing infrastructure at Milo Gulch, and the majority of machinery and buildings at the Kellogg Tunnel portal level, as well as all equipment and infrastructure anywhere underground at the Bunker Hill Mine Complex. It also includes all current and historic data relating to the Bunker Hill Mine Complex, such as drill logs, reports, maps, and similar information located at the Mine site or any other location.

Government Regulation and Approval

The current exploration activities and any future mining operations are subject to extensive laws and regulations governing the protection of the environment, waste disposal, worker safety, mine construction, and protection of endangered and protected species. The Company has made, and expects to make in the future, significant expenditures to comply with such laws and regulations. Future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have an adverse impact on the Company’s financial condition or results of operations.

| 8 |

It is anticipated that it may be necessary to obtain the following environmental permits or approved plans prior to commencement of mine operations:

| ● | Reclamation and Closure Plan | |

| ● | Water Discharge Permit | |

| ● | Air Quality Operating Permit | |

| ● | Industrial Artificial (tailings) pond permit | |

| ● | Obtaining Water Rights for Operations |

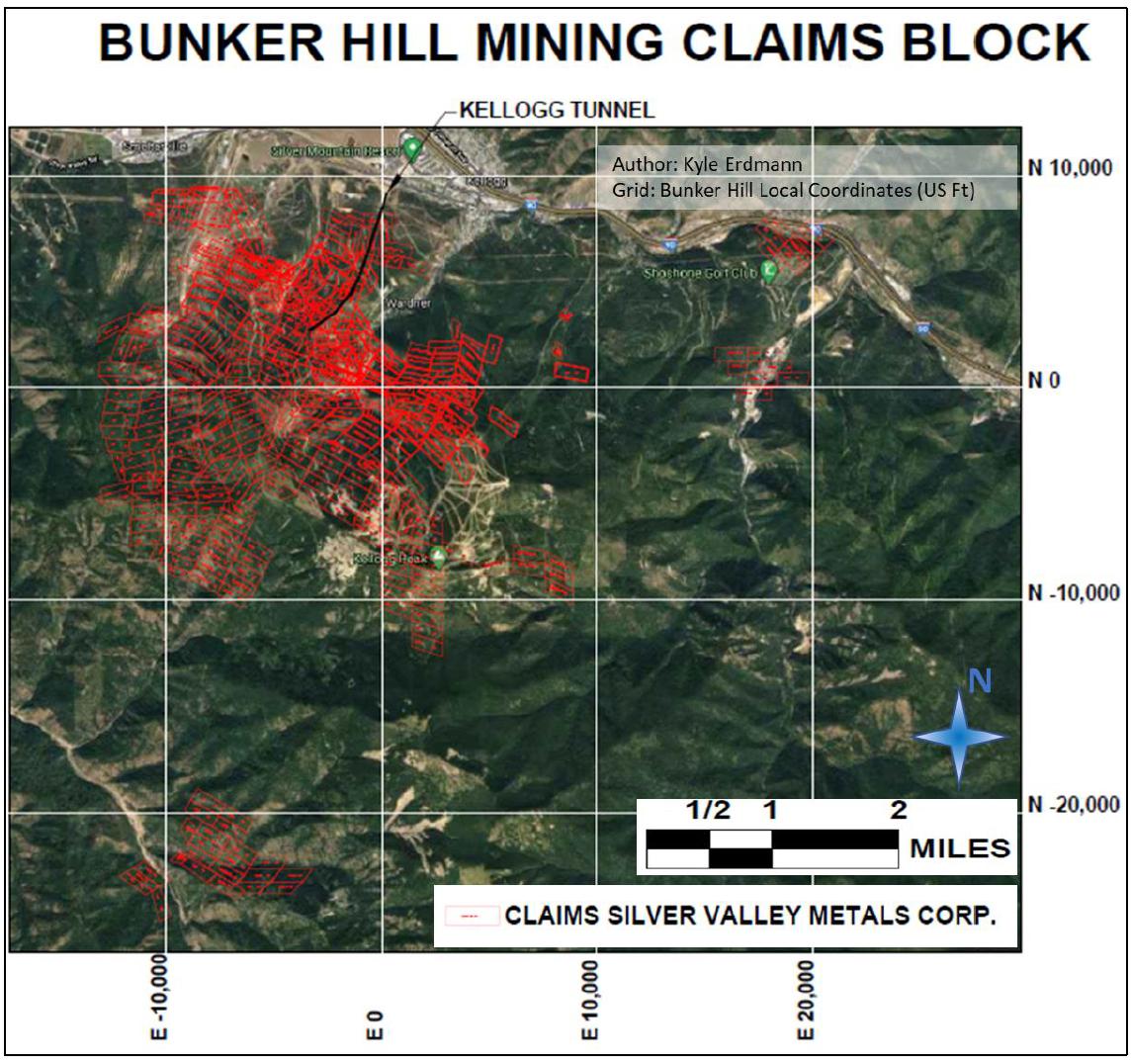

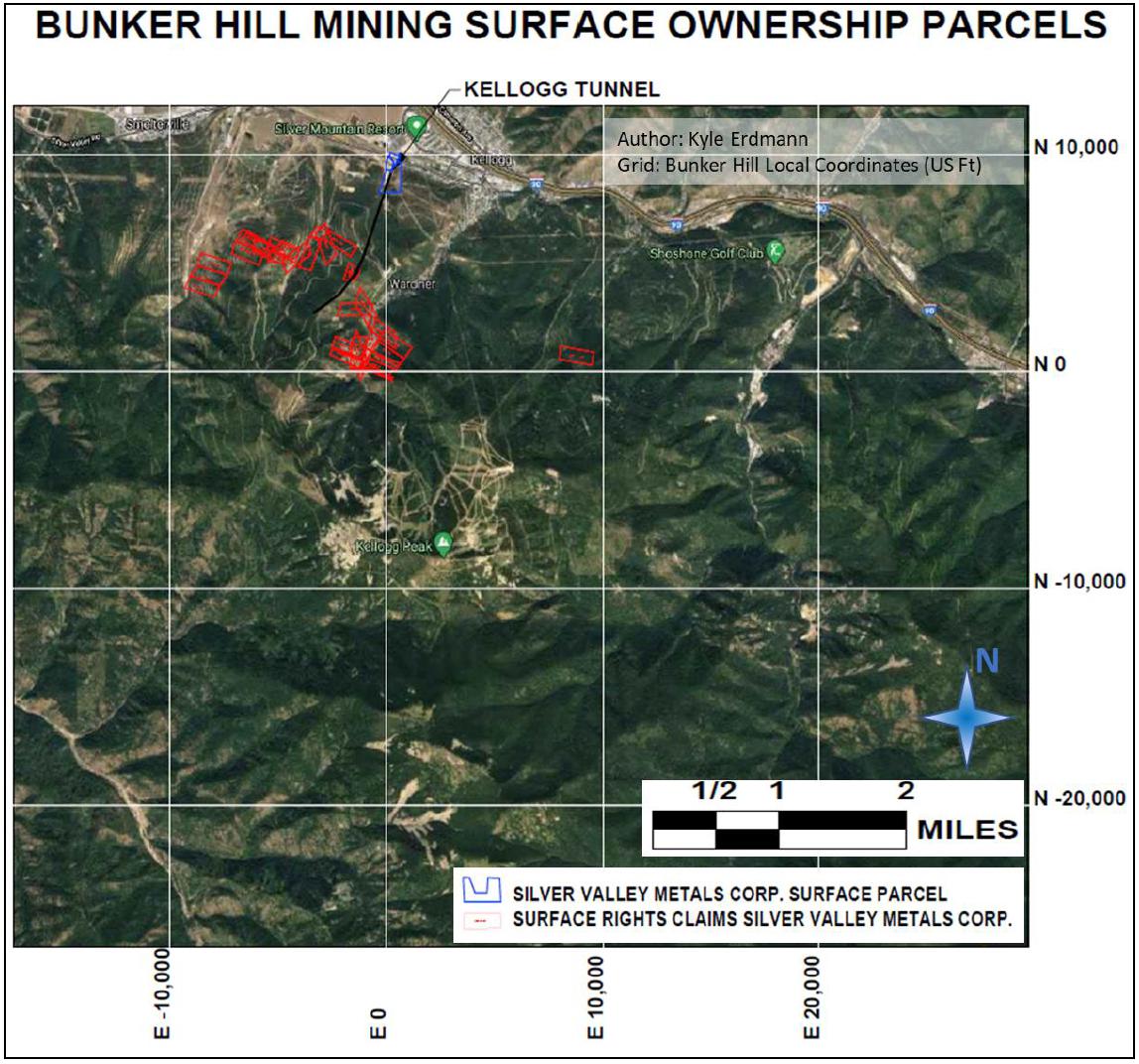

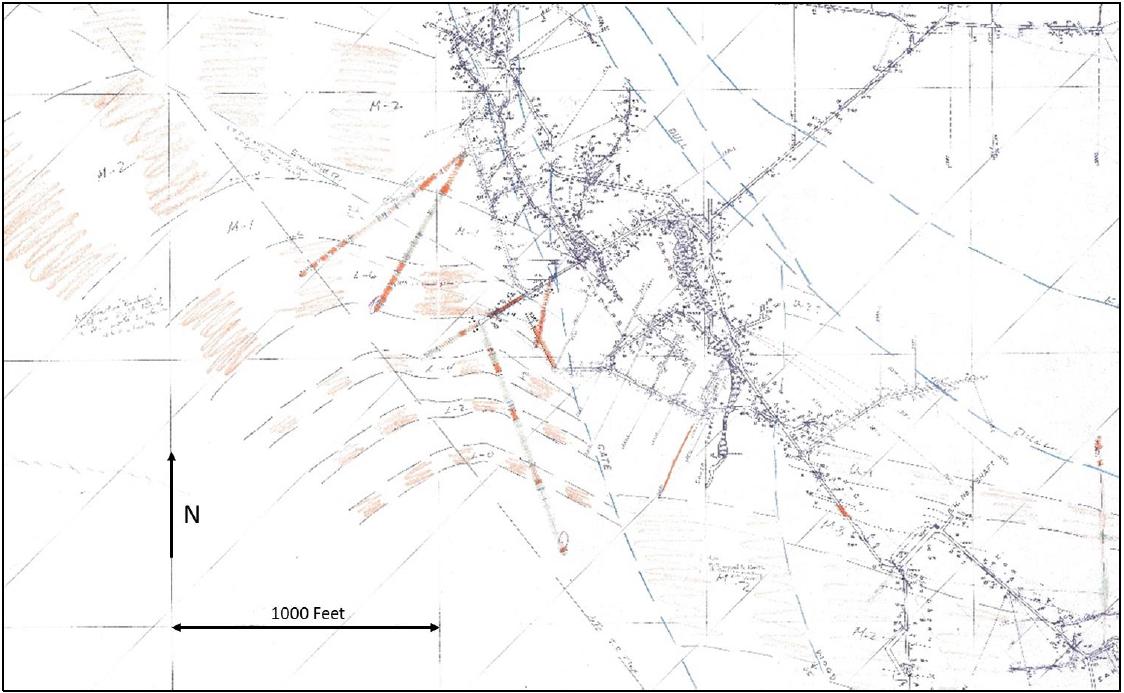

Property Description

The Company has mineral rights to approximately 440 patented mining claims covering over 5700 acres. Of these claims, 35 include surface ownership of approximately 259 acres. It also has certain parcels of fee property which includes mineral and surface rights but not patented mining claims. Mining claims and fee properties are located in Townships 47, 48 North, Range 2 East, Townships 47, 48 North, Range 3 East, Boise Meridian, Shoshone County, Idaho.

Surface rights were originally owned by various previous owners of the claims until the acquisition of the properties by Bunker Limited Partners (“BLP”). BLP sold off surface rights to various parties over the years while maintaining access to conduct mining operations and exploration activities as well as easements to a cross over and access other of its properties containing mineral rights. Said rights were reserved to its assigns and successors in continuous perpetuity. Idaho Law also allows mineral right holders access to mine and explore for minerals on properties to which they hold minerals rights.

Title to all patented mining claims included in the transaction was transferred from Bunker Hill Mining Co. (U.S.) Inc. by Warranty Deed in 1992. The sale of the property was approved of by the U.S. Trustee and U.S. Bankruptcy Court.

Over 90% of surface ownership of patented mining claims not owned by Placer Mining is owned by different landowners. These include: Stimpson Lumber Co.; Riley Creek Lumber Co.; Powder LLC.; Golf LLC.; C & E Tree Farms; and Northern Lands LLC.

Patented mining claims in the State of Idaho do not require permits for underground mining activities to commence on private lands. Other permits associated with underground mining may be required, such as water discharge and site disturbance permits. The water discharge is being handled by the EPA at the existing CTP. The Company expects to take on the water treatment responsibility in the future and obtain an appropriate discharge permit.

Competition

The Company competes with other mining and exploration companies in connection with the acquisition of mining claims and leases on zinc and other base and precious metals prospects as well as in connection with the recruitment and retention of qualified employees. Many of these companies are much larger than the Company, have greater financial resources and have been in the mining business for much longer than it has. As such, these competitors may be in a better position through size, finances and experience to acquire suitable exploration and development properties. The Company may not be able to compete against these companies in acquiring new properties and/or qualified people to work on its current project, or any other properties that may be acquired in the future.

Given the size of the world market for base precious metals such as silver, lead and zinc, relative to the number of individual producers and consumers, it is believed that no single company has sufficient market influence to significantly affect the price or supply of these metals in the world market.

Employees

The Company has four employees. The balance of the Company’s operations is contracted for as consultants.

Reports to Security Holders

The Company files reports with the SEC under section 15d of the Securities Exchange Act of 1934 (the “Exchange Act”). The reports will be filed electronically. All copies of any materials filed with the SEC may be read at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that will contain copies of the reports that are filed electronically. The address for the SEC Internet site is http://www.sec.gov.

ITEM 1A. RISK FACTORS

As a Smaller Reporting Company, this item is not required under SEC rules. However, the Company believes that it is important to have an understanding of the risks associated with an investment in the Company. In addition, these risk factors are incorporated by reference in press releases and other Company publications for purposes of the Private Securities Reform Act of 1995.

| 9 |

General Risk Factors

The Company’s ability to operate as a going concern is in doubt.

The audit opinion and notes that accompany the Company’s Financial Statements disclose a going concern qualification to its ability to continue in business. The accompanying Financial Statements have been prepared under the assumption that the Company will continue as a going concern. The Company is an exploration and development stage company and has incurred losses since its inception. The Company has incurred losses resulting in an accumulated deficit of $72,491,150 as of December 31, 2021 and further losses are anticipated in the development of its business.

The Company currently has no historical recurring source of revenue and its ability to continue as a going concern is dependent on its ability to raise capital to fund its future exploration and working capital requirements or its ability to profitably execute its business plan. The Company’s plans for the long-term return to and continuation as a going concern include financing its future operations through sales of its Common Shares and/or debt and the eventual profitable exploitation of the Mine. Additionally, the volatility in capital markets and general economic conditions in the U.S. and elsewhere can pose significant challenges to raising the required funds. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The Company’s consolidated financial statements do not give effect to any adjustments required to realize its assets and discharge its liabilities in other than the normal course of business and at amounts different from those reflected in the accompanying Financial Statements.

The Company will require significant additional capital to fund its business plan.

The Company will be required to expend significant funds to determine whether proven and probable mineral reserves exist at its properties, to continue exploration and, if warranted, to develop its existing properties, and to identify and acquire additional properties to diversify its property portfolio. The Company anticipates that it will be required to make substantial capital expenditures for the continued exploration and, if warranted, development of the Mine. The Company has spent and will be required to continue to expend significant amounts of capital for drilling, geological, and geochemical analysis, assaying, and feasibility studies with regard to the results of its exploration at the Mine. The Company may not benefit from some of these investments if it is unable to identify commercially exploitable mineral reserves.

Neither the Company nor any of the directors of the Company nor any other party can provide any guarantee or assurance, that the Company will be able to raise sufficient capital to satisfy the Company’s short-term obligations. The Company does not have sufficient funds to satisfy its short-term financial obligations, as at December 31, 2021, the Company has $486,063 in cash and total current liabilities of $22,795,277 and total liabilities of $38,314,164.

If the Company cannot raise additional capital, the Company will be in breach of its debt obligations, including under the Royalty Convertible Debenture and the Convertible Debenture. Further, pursuant to the terms of the Company’s agreement with the EPA, the Company is required to make certain payments to the EPA on behalf of Placer Mining in the amount of $20,000,000 for cost recovery. If the Company is unable to raise sufficient capital, the Company may be unable to pay the cost of recovery resulting in a breach of its obligations and the failure to pay may be considered a default under the terms of the Amended Settlement with the EPA and the Amended Agreement with Placer Mining.

Neither the Company nor any of the directors of the Company nor any other party can provide any guarantee or assurance that the full $50,000,000 project financing package will be finalized or close, as the Project Financing Package remains subject to SRSR internal approvals, further technical and other due diligence and satisfactory documentation. Approximately $14,000,000 of the project financing closed in January 2022, subsequent to the close of the year. If the full Project Financing Package does not close there is no guarantee that capital can be raised on terms favorable to the Company, or at all. Any additional equity funding will dilute existing shareholders.

In support of plans to rapidly restart the Mine, the Company worked systematically through 2020 and 2021 to delineate mineral resources and conduct various technical studies. Executing this strategy may require securing additional financing, which may include additional indebtedness of $15,000,000 and a cost over-run facility of $13,000,000.

The Company’s ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including the status of the national and worldwide economy and the price of metals. Capital markets worldwide were adversely affected by substantial losses by financial institutions, caused by investments in asset-backed securities and remnants from those losses continue to impact the ability for the Company to raise capital. The Company may not be successful in obtaining the required financing or, if it can obtain such financing, such financing may not be on terms that are favorable to us.

The Company’s inability to access sufficient capital for its operations could have a material adverse effect on its financial condition, results of operations, or prospects. Sales of substantial amounts of securities may have a highly dilutive effect on the Company’s ownership or share structure. Sales of a large number of shares of the Company’s Common Shares in the public markets, or the potential for such sales, could decrease the trading price of the Common Shares and could impair the Company’s ability to raise capital through future sales of Common Shares. The Company has not yet commenced commercial production at any of its properties and, therefore, has not generated positive cash flows to date and has no reasonable prospects of doing so unless successful commercial production can be achieved at the Mine. The Company expects to continue to incur negative investing and operating cash flows until such time as it enters into successful commercial production. This will require the Company to deploy its working capital to fund such negative cash flow and to seek additional sources of financing. There is no assurance that any such financing sources will be available or sufficient to meet the Company’s requirements, or if available, available upon terms acceptable to the Company. There is no assurance that the Company will be able to continue to raise equity capital or to secure additional debt financing, or that the Company will not continue to incur losses.

| 10 |

The Company has a limited operating history on which to base an evaluation of its business and prospects.

Since its inception, the Company has had no revenue from operations. The Company has no history of producing products from the Bunker Hill property. The Mine is a historic, past producing mine with very little recent exploration work. Advancing the Mine into the development stage will require significant capital and time, and successful commercial production from the Mine will be subject to completing feasibility studies, permitting and re-commissioning of the Mine, constructing processing plants, and other related works and infrastructure. As a result, the Company is subject to all of the risks associated with developing and establishing new mining operations and business enterprises, including:

| ● | completion of feasibility studies to verify reserves and commercial viability, including the ability to find sufficient ore reserves to support a commercial mining operation; | |

| ● | the timing and cost, which can be considerable, of further exploration, preparing feasibility studies, permitting and construction of infrastructure, mining and processing facilities; | |

| ● | the availability and costs of drill equipment, exploration personnel, skilled labor, and mining and processing equipment, if required; | |

| ● | the availability and cost of appropriate smelting and/or refining arrangements, if required; | |

| ● | compliance with stringent environmental and other governmental approval and permit requirements; | |

| ● | the availability of funds to finance exploration, development, and construction activities, as warranted; | |

| ● | potential opposition from non-governmental organizations, local groups or local inhabitants that may delay or prevent development activities; | |

| ● | potential increases in exploration, construction, and operating costs due to changes in the cost of fuel, power, materials, and supplies; and | |

| ● | potential shortages of mineral processing, construction, and other facilities related supplies. |

The costs, timing, and complexities of exploration, development, and construction activities may be increased by the location of its properties and demand by other mineral exploration and mining companies. It is common in exploration programs to experience unexpected problems and delays during drill programs and, if commenced, development, construction, and mine start-up. In addition, the Company’s management and workforce will need to be expanded, and sufficient housing and other support systems for its workforce will have to be established. This could result in delays in the commencement of mineral production and increased costs of production. Accordingly, the Company’s activities may not result in profitable mining operations and it may not succeed in establishing mining operations or profitably producing metals at any of its current or future properties, including the Mine.

The Company has a history of losses and expects to continue to incur losses in the future.

The Company has incurred losses since inception, has had negative cash flow from operating activities, and expects to continue to incur losses in the future. The Company has incurred the following losses from operations during each of the following periods:

| ● | $18,752,504 for the year ended December 31, 2021; and | |

| ● | $9,454,396 for the transition period ended December 31, 2020 | |

| ● | $10,793,823 for the year ended June 30, 2020 |

The Company expects to continue to incur losses unless and until such time as the Mine enters into commercial production and generates sufficient revenues to fund continuing operations. The Company recognizes that if it is unable to generate significant revenues from mining operations and dispositions of its properties, the Company will not be able to earn profits or continue operations. At this early stage of its operation, the Company also expects to face the risks, uncertainties, expenses, and difficulties frequently encountered by smaller reporting companies. The Company cannot be sure that it will be successful in addressing these risks and uncertainties and its failure to do so could have a materially adverse effect on its financial condition.

Epidemics, pandemics or other public health crises, including COVID-19, could adversely affect the Company’s business.

The Company’s operations could be significantly adversely affected by the effects of a widespread outbreak of epidemics, pandemics or other health crises, including the recent outbreak of respiratory illness caused by the novel coronavirus (“COVID-19”), which was declared a pandemic by the World Health Organization on March 12, 2020. The Company cannot accurately predict the impact COVID-19 will have on its operations and the ability of others to meet their obligations with the Company, including uncertainties relating to the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak, and the length of travel and quarantine restrictions imposed by governments of affected countries. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, resulting in an economic downturn that could further affect the Company’s operations and ability to finance its operations.

| 11 |

The Russia/Ukraine crisis, including the impact of sanctions or retributions thereto, could adversely affect the Company’s business.

The Company’s operations could be adversely affected by the effects of the escalating Russia/Ukraine crisis and the effects of sanctions imposed against Russia or that country’s retributions against those sanctions, embargos or further-reaching impacts upon energy prices, food prices and market disruptions. The Company cannot accurately predict the impact the crisis will have on its operations and the ability of contractors to meet their obligations with the Company, including uncertainties relating the severity of its effects, the duration of the conflict, and the length and magnitude of energy bans, embargos and restrictions imposed by governments. In addition, the crisis could adversely affect the economies and financial markets of the United States in general, resulting in an economic downturn that could further affect the Company’s operations and ability to finance its operations. Additionally, the Company cannot predict changes in precious metals pricing or changes in commodities pricing which may alternately affect the Company either positively or negatively.

Risks Related to Mining and Exploration

The Mine is in the exploration stage. There is no assurance that the Company can establish the existence of any mineral reserve on the Mine or any other properties the Company may acquire in commercially exploitable quantities. Unless and until the Company does so, the Company cannot earn any revenues from these properties and if the Company does not do so, the Company will lose all of the funds that it expends on exploration. If the Company does not discover any mineral reserve in a commercially exploitable quantity, the exploration component of its business could fail.

The Company has not established that any of its mineral properties contain any mineral reserve according to recognized reserve guidelines, nor can there be any assurance that the Company will be able to do so.

The Company has not established that any of its mineral properties contain any mineral reserve according to recognized reserve guidelines, nor can there be any assurance that the Company will be able to do so. In general, the probability of any individual prospect having a “reserve” that meets the requirements of the SEC is small, and the Mine may not contain any “reserves” and any funds that the Company spends on exploration could be lost. Even if the Company does eventually discover a mineral reserve on the Mine, there can be no assurance that it can be developed into a producing mine and that the Company can extract those minerals. Both mineral exploration and development involve a high degree of risk, and few mineral properties that are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade, and other attributes of the mineral deposit, the proximity of the mineral deposit to infrastructure such as processing facilities, roads, rail, power, and a point for shipping, government regulation, and market prices. Most of these factors will be beyond its control, and any of them could increase costs and make extraction of any identified mineral deposit unprofitable.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses.

Exploration for and the production of minerals is highly speculative and involves much greater risk than many other businesses. Most exploration programs do not result in the discovery of mineralization, and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. The Company’s operations are, and any future development or mining operations the Company may conduct will be, subject to all of the operating hazards and risks normally incidental to exploring for and development of mineral properties, including, but not limited to:

| ● | economically insufficient mineralized material; | |

| ● | fluctuation in production costs that make mining uneconomical; | |

| ● | labor disputes; | |

| ● | unanticipated variations in grade and other geologic problems; | |

| ● | environmental hazards; | |

| ● | water conditions; | |

| ● | difficult surface or underground conditions; | |

| ● | industrial accidents; | |

| ● | metallurgic and other processing problems; | |

| ● | mechanical and equipment performance problems; | |

| ● | failure of dams, stockpiles, wastewater transportation systems, or impoundments; | |

| ● | unusual or unexpected rock formations; and | |

| ● | personal injury, fire, flooding, cave-ins and landslides. |

Any of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates, costs and expenditures, potential revenues, and production dates. If the Company determines that capitalized costs associated with any of its mineral interests are not likely to be recovered, the Company would incur a write-down of its investment in these interests. All of these factors may result in losses in relation to amounts spent that are not recoverable, or that result in additional expenses.

Commodity price volatility could have dramatic effects on the results of operations and the Company’s ability to execute its business plan.

The price of commodities varies on a daily basis. The Company’s future revenues, if any, will likely be derived from the extraction and sale of base and precious metals. The price of those commodities has fluctuated widely, particularly in recent years, and is affected by numerous factors beyond its control including economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global and regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and therefore the economic viability of the Company’s business, could negatively affect its ability to secure financing or its results of operations.

| 12 |

The Company’s production, development plans and cost estimates in the PEA may vary and/or not be achieved.

The PEA is preliminary in nature and will include Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Consequently, there is no certainty that the PEA will be realized. The decision to implement the Mine restart scenario to be included in the PEA will not be based on a feasibility study of mineral reserves demonstrating economic and technical viability, and therefore there is increased risk that the PEA results will not be realized. If the Company is unable to achieve the results in the PEA, it may have a material negative impact on the Company and its capital investment to implement the restart scenario may be lost.

Costs charged to the Company by the Idaho Department of Environmental Quality (“IDEQ”) for treatment of waste water fluctuate a great deal and are not within the Company’s control.

The Company is billed annually for water treatment activities performed by the IDEQ for the EPA. The water treatment costs that Bunker Hill is billed for are partially related to the EPA’s direct cost of treating the water emanating from the Bunker Hill Mine, which are comprised of lime and flocculant usage, electricity consumption, maintenance and repair, labor and some overhead. Rate of discharge of effluent from the Bunker Hill Mine is largely dependent on the level of precipitation within a given year and how close in the calendar year the Company is to the spring run-off. Increases in water infiltrations and gravity flows within the mine generally increase after winter and result in a peak discharge rate in May. Increases in gravity flow and consequently the rate of water discharged by the mine have a highly robust correlation with metal concentrations and consequently metals loads of effluent.

Hydraulic loads (quantities of water per unit of time) and metal loads (quantities of metals per unit of volume of effluent per unit of time) are the two main determinants of cost of water treatment by the EPA in the relationship with the Bunker Hill Mine because greater metal loads consume more lime and more flocculent and more electricity to remove the increased levels of metals and make the water clean. The scale of the treatment plant is determined by how much total water can be processed (hydraulic load) at any one point in time. This determines how much labor is required to operate the plant and generally determine the amount of overhead required to run the EPA business.

The EPA has completed significant upgrades to the water treatment capabilities of the CTP and is now capable of producing treated water than can meet a much higher discharge standard (which Bunker Hill will be forced to meet beyond May 2023). While it was understood that improved performance capability would increase the cost of operating the plant, it was unclear to EPA, and consequently to Bunker Hill, how much the costs would increase by.

These elements described above, and others, impact the direct costs of water treatment. A significant portion of the total amount invoiced by EPA each year is indirect cost that is determined as a percentage of the direct cost. Each year the indirect costs percentage changes within each region of the EPA. Bunker Hill has no ability to impact the percentage of indirect cost that is set by the EPA regional office. Bunker Hill also has no advanced notice of what the percentage of indirect cost will be until it receives its invoice in June of the year following the billing period. The Company remains unable to estimate EPA billings to a high degree of accuracy.

Estimates of mineralized material and resources are subject to evaluation uncertainties that could result in project failure.

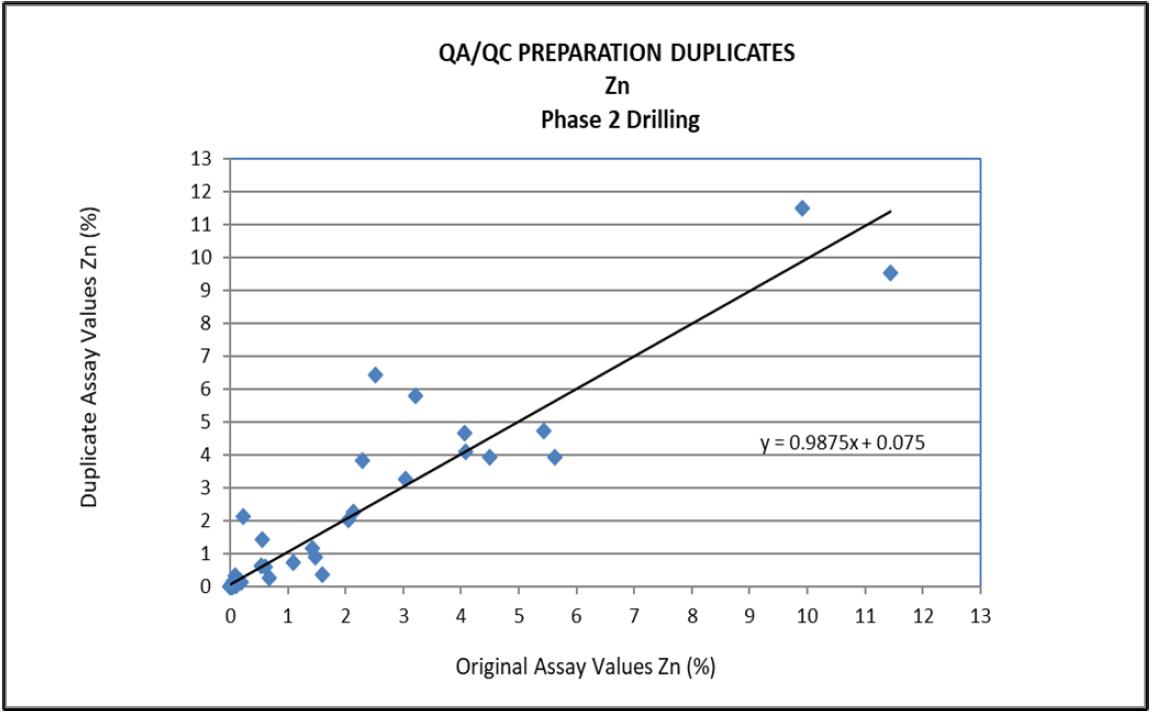

Its exploration and future mining operations, if any, are and would be faced with risks associated with being able to accurately predict the quantity and quality of mineralized material and resources/reserves within the earth using statistical sampling techniques. Estimates of any mineralized material or resource/reserve on the Mine would be made using samples obtained from appropriately placed trenches, test pits, underground workings, and intelligently designed drilling. There is an inherent variability of assays between check and duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. Additionally, there also may be unknown geologic details that have not been identified or correctly appreciated at the current level of accumulated knowledge about the Mine. This could result in uncertainties that cannot be reasonably eliminated from the process of estimating mineralized material and resources/reserves. If these estimates were to prove to be unreliable, the Company could implement an exploitation plan that may not lead to commercially viable operations in the future.

Any material changes in mineral resource/reserve estimates and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital.

As the Company has not commenced actual production, mineralization resource estimates may require adjustments or downward revisions. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by future feasibility studies and drill results. Minerals recovered in small scale tests may not be duplicated in large scale tests under on-site conditions or in production scale.

The Company’s exploration activities may not be commercially successful, which could lead the Company to abandon its plans to develop the Mine and its investments in exploration.

The Company’s long-term success depends on its ability to identify mineral deposits on the Mine and other properties the Company may acquire, if any, that the Company can then develop into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks, and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment, or labor. The success of commodity exploration is determined in part by the following factors:

| ● | the identification of potential mineralization based on surficial analysis; | |

| ● | availability of government-granted exploration permits; | |

| ● | the quality of its management and its geological and technical expertise; and | |

| ● | the capital available for exploration and development work. |

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors that include, without limitation, the particular attributes of the deposit, such as size, grade, and proximity to infrastructure; commodity prices, which can fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals, and environmental protection. The Company may invest significant capital and resources in exploration activities and may abandon such investments if the Company is unable to identify commercially exploitable mineral reserves. The decision to abandon a project may have an adverse effect on the market value of the Company’s securities and the ability to raise future financing.

| 13 |

The Company is subject to significant governmental regulations that affect its operations and costs of conducting its business and may not be able to obtain all required permits and licenses to place its properties into production.

The Company’s current and future operations, including exploration and, if warranted, development of the Mine, do and will require permits from governmental authorities and will be governed by laws and regulations, including:

| ● | laws and regulations governing mineral concession acquisition, prospecting, development, mining, and production; | |

| ● | laws and regulations related to exports, taxes, and fees; | |

| ● | labor standards and regulations related to occupational health and mine safety; and | |

| ● | environmental standards and regulations related to waste disposal, toxic substances, land use reclamation, and environmental protection. |

Companies engaged in exploration activities often experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations, and permits. Failure to comply with applicable laws, regulations, and permits may result in enforcement actions, including the forfeiture of mineral claims or other mineral tenures, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or costly remedial actions. The Company cannot predict if all permits that it may require for continued exploration, development, or construction of mining facilities and conduct of mining operations will be obtainable on reasonable terms, if at all. Costs related to applying for and obtaining permits and licenses may be prohibitive and could delay its planned exploration and development activities. The Company may be required to compensate those suffering loss or damage by reason of the mineral exploration or its mining activities, if any, and may have civil or criminal fines or penalties imposed for violations of, or its failure to comply with, such laws, regulations, and permits.

Existing and possible future laws, regulations, and permits governing operations and activities of exploration companies, or more stringent implementation of such laws, regulations and permits, could have a material adverse impact on the Company’s business and cause increases in capital expenditures or require abandonment or delays in exploration. The Mine is located in Northern Idaho and has numerous clearly defined regulations with respect to permitting mines, which could potentially impact the total time to market for the project.

The Company’s activities are subject to environmental laws and regulations that may increase its costs of doing business and restrict its operations.

Both mineral exploration and extraction require permits from various federal, state, and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that the Company will be able to obtain or maintain any of the permits required for the exploration of the mineral properties or for the construction and operation of the Mine at economically viable costs. If the Company cannot accomplish these objectives, its business could fail. The Company believes that it is in compliance with all material laws and regulations that currently apply to its activities but there can be no assurance that the Company can continue to remain in compliance. Current laws and regulations could be amended, and the Company might not be able to comply with them, as amended. Further, there can be no assurance that the Company will be able to obtain or maintain all permits necessary for its future operations, or that it will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, the Company may be delayed or prohibited from proceeding with planned exploration or development of the mineral properties.

The Company’s activities are subject to extensive laws and regulations governing environment protection. The Company is also subject to various reclamation related conditions. Although the Company closely follows and believes it is operating in compliance with all applicable environmental regulations, there can be no assurance that all future requirements will be obtainable on reasonable terms. Failure to comply may result in enforcement actions causing operations to cease or be curtailed and may include corrective measures requiring capital expenditures. Intense lobbying over environmental concerns by non-governmental organizations has caused some governments to cancel or restrict development of mining projects. Current publicized concern over climate change may lead to carbon taxes, requirements for carbon offset purchases or new regulation. The costs or likelihood of such potential issues to the Company cannot be estimated at this time.

The legal framework governing this area is constantly developing, therefore the Company is unable to fully ascertain any future liability that may arise from the implementation of any new laws or regulations, although such laws and regulations are typically strict and may impose severe penalties (financial or otherwise). The proposed activities of the Company, as with any exploration company, may have an environmental impact which may result in unbudgeted delays, damage, loss and other costs and obligations including, without limitation, rehabilitation and/or compensation. There is also a risk that the Company’s operations and financial position may be adversely affected by the actions of environmental groups or any other group or person opposed in general to the Company’s activities and, in particular, the proposed exploration and mining by the Company within the state of Idaho and the United States.

Environmental hazards unknown to the Company, which have been caused by previous or existing owners or operators of the Mine, may exist on the properties in which the Company holds an interest. Many of its properties in which the Company has ownership rights are located within the Coeur d’Alene Mining District, which is currently the site of a Federal Superfund cleanup project. It is possible that environmental cleanup or other environmental restoration procedures could remain to be completed or mandated by law, causing unpredictable and unexpected liabilities to arise.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on the Company’s business.

A number of governments or governmental bodies have introduced or are contemplating legislative and/or regulatory changes in response to concerns about the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on the Company, on its future venture partners, if any, and on its suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting, and other costs necessary to comply with such regulations. Any adopted future climate change regulations could also negatively impact the Company’s ability to compete with companies situated in areas not subject to such limitations. Given the emotional and political significance and uncertainty surrounding the impact of climate change and how it should be dealt with, the Company cannot predict how legislation and regulation will ultimately affect its financial condition, operating performance, and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by the Company or other companies in its industry could harm the Company’s reputation. The potential physical impacts of climate change on its operations are highly uncertain, could be particular to the geographic circumstances in areas in which the Company operates and may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels, and changing temperatures. These impacts may adversely impact the cost, production, and financial performance of the Company’s operations.

| 14 |

There are several governmental regulations that materially restrict mineral exploration. The Company will be subject to the federal regulations (environmental) and the laws of the State of Idaho as the Company carries out its exploration program. The Company may be required to obtain additional work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While the Company’s planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase its costs of doing business and prevent it from carrying out its exploration program.

Land reclamation requirements for the Company’s properties may be burdensome and expensive.

Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance.

Reclamation may include requirements to:

| ● | control dispersion of potentially deleterious effluents; | |

| ● | treat ground and surface water to drinking water standards; and | |

| ● | reasonably re-establish pre-disturbance landforms and vegetation. |

In order to carry out reclamation obligations imposed on the Company in connection with its potential development activities, the Company must allocate financial resources that might otherwise be spent on further exploration and development programs. The Company plans to set up a provision for its reclamation obligations on its properties, as appropriate, but this provision may not be adequate. If the Company is required to carry out unanticipated reclamation work, its financial position could be adversely affected.

Social and environmental activism may have an adverse effect on the reputation and financial condition of the Company or its relationship with the communities in which it operates.

There is an increasing level of public concern relating to the effects of mining on the nature landscape, in communities and on the environment. Certain non-governmental organizations, public interest groups and reporting organizations (“NGOs”) who oppose resource development can be vocal critics of the mining industry. In addition, there have been many instances in which local community groups have opposed resource extraction activities, which have resulted in disruption and delays to the relevant operation. While the Company seeks to operate in a socially responsible manner and believes it has good relationships with local communities in the regions in which it operates, NGOs or local community organizations could direct adverse publicity against and/or disrupt the operations of the Company in respect to one or more of its properties, regardless of its successful compliance with social and environmental best practices, due to political factors, activities of unrelated third parties on lands in which the Company has an interest or the Company’s operations specifically. Any such actions and the resulting media coverage could have an adverse effect on the reputation and financial condition of the Company or its relationships with the communities in which it operates, which could have a material adverse effect on the Company’s business, financial condition, results of operations, cash flows or prospects.

The mineral exploration and mining industry is highly competitive.

The mining industry is intensely competitive in all of its phases. As a result of this competition, some of which is with large established mining companies with substantial capabilities and with greater financial and technical resources than the Company’s, the Company may be unable to acquire additional properties, if any, or financing on terms it considers acceptable. The Company also competes with other mining companies in the recruitment and retention of qualified managerial and technical employees. If the Company is unable to successfully compete for qualified employees, its exploration and development programs may be slowed down or suspended. The Company competes with other companies that produce its planned commercial products for capital. If the Company is unable to raise sufficient capital, its exploration and development programs may be jeopardized or it may not be able to acquire, develop, or operate additional mining projects.

The silver industry is highly competitive, and the Company is required to compete with other corporations and business entities, many of which have greater resources than it does. Such corporations and other business entities could outbid the Company for potential projects or produce minerals at lower costs, which would have a negative effect on the Company’s operations.

Metal prices are highly volatile. If a profitable market for its metals does not exist, the Company may have to cease operations.

Mineral prices have been highly volatile and are affected by numerous international economic and political factors over which the Company has no control. The Company’s long-term success is highly dependent upon the price of silver, as the economic feasibility of any ore body discovered on its current property, or on other properties the Company may acquire in the future, would, in large part, be determined by the prevailing market price of the minerals. If a profitable market does not exist, the Company may have to cease operations.

A shortage of equipment and supplies could adversely affect the Company’s ability to operate its business.

The Company is dependent on various supplies and equipment to carry out its mining exploration and, if warranted, development operations. Any shortage of such supplies, equipment, and parts could have a material adverse effect on the Company’s ability to carry out its operations and could therefore limit, or increase the cost of, production.

| 15 |

Joint ventures and other partnerships, including offtake arrangements, may expose the Company to risks.

The Company may enter into joint ventures, partnership arrangements, or offtake agreements, with other parties in relation to the exploration, development, and production of the properties in which the Company has an interest. Any failure of such other companies to meet their obligations to the Company or to third parties, or any disputes with respect to the parties’ respective rights and obligations, could have a material adverse effect on the Company, the development and production at its properties, including the Mine, and on future joint ventures, if any, or their properties, and therefore could have a material adverse effect on its results of operations, financial performance, cash flows and the price of its Common Shares.

The Company may experience difficulty attracting and retaining qualified management to meet the needs of its anticipated growth, and the failure to manage its growth effectively could have a material adverse effect on its business and financial condition.

The success of the Company is currently largely dependent on the performance of its directors and officers. The loss of the services of any of these persons could have a materially adverse effect on the Company’s business and prospects. There is no assurance the Company can maintain the services of its directors, officers or other qualified personnel required to operate its business. As the Company’s business activity grows, the Company will require additional key financial, administrative and mining personnel as well as additional operations staff. There can be no assurance that these efforts will be successful in attracting, training and retaining qualified personnel as competition for persons with these skill sets increase. If the Company is not successful in attracting, training and retaining qualified personnel, the efficiency of its operations could be impaired, which could have an adverse impact on the Company’s operations and financial condition. In addition, the COVID-19 pandemic may cause the Company to have inadequate access to an available skilled workforce and qualified personnel, which could have an adverse impact on the Company’s financial performance and financial condition.

The Company is dependent on a relatively small number of key employees, including its Chief Executive Officer (the “CEO”) and Chief Financial Officer (the “CFO”). The loss of any officer could have an adverse effect on the Company. The Company has no life insurance on any individual, and the Company may be unable to hire a suitable replacement for them on favorable terms, should that become necessary.

The Company may be subject to potential conflicts of interest with its directors and/or officers.