UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2012

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

COMMISSION FILE NUMBER 000-53556

YATERRA VENTURES CORP.

(Exact name of registrant as specified in its charter)

|

NEVADA

|

73-3249571

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

240 Martin Street, #3

|

||

|

Blaine, WA

|

98230

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(416) 792 - 5555

Issuer's telephone number

Securities registered under Section 12(b) of the Exchange Act: N/A.

Securities registered under Section 12(g) of the Exchange Act: Common Stock, $0.001 Par Value Per Share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark whether the registrant has submitted electronically and posted on it’s corporate Web site, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o |

Accelerated filer

|

o |

|

Non-accelerated filer

|

o |

Smaller reporting company

|

x |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $482,658 as of February 29, 2013 based on a price of $0.0029, being the last price at which the registrant sold shares of its common stock prior to that date.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

As of November 20, 2013, the Registrant had 1,588,288,119 shares of common stock outstanding.

|

YATERRA VENTURES CORP.

|

|

ANNUAL REPORT ON FORM 10-K

|

|

FOR THE YEAR ENDED AUGUST 31, 2012

|

|

TABLE OF CONTENTS

|

2

PART I

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report constitute "forward-looking statements.” These statements, identified by words such as “plan,” "anticipate,” "believe,” "estimate,” "should,” "expect" and similar expressions include our expectations and objectives regarding our future financial position, operating results and business strategy. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in the forward-looking statements.

Forward looking statements are based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable at the date the such statement are made.

We advise you to carefully review the reports and documents we file from time to time with the United States Securities and Exchange Commission (the “SEC”), particularly our periodic reports filed with the SEC pursuant to the Securities Exchange Act of 1934 (the "Exchange Act").

As used in this Annual Report, the terms “we”, “us”, “our”, and the “Company” refer to Yaterra Ventures Corp., unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

|

ITEM 1.

|

BUSINESS.

|

General

We were incorporated on November 20, 2006 in Nevada.

Until May 2012 we were an exploration stage company engaged in the acquisition and exploration of oil, gas and minerals. In connection with the share exchange that occurred in May 2012, we expanded our operations to include oil and gas exploration. We primarily concentrate on the acquisition of hydrocarbon leases, interests and properties in the Permian Basin and the Bend Arch-Fort Worth Basin. Currently, we hold a 100% interest in two mineral properties that we call the “Blue Jack Property” and the “Minnie Claim”. The Blue Jack Property is comprised of 10 mineral claims covering approximately 206 acres located in Humboldt County, Nevada. The Minnie Claim covers an area of 20 acres, located in the Leecher Creek Mining Division, Washington State. We plan to focus our resources on the (i) Blue Jack Property in order to assess whether it possesses mineral deposits of gold, silver, copper and rare earth minerals capable of commercial extraction and (ii) acquiring oil and gas properties. To date, we have not acquired any oil or gas leases due to lack of capital.

In September 2011, we allowed our option to acquire up to a 60% interest in the Frances Property located in the Vancouver Mining Division, British Columbia to lapse. We made this determination in order to focus our financial resources on implementing an exploration program on the Blue Jack Property.

In November 2011, we completed a preliminary rock sampling program on the Blue Jack Property. The results of this initial program indicated that the Blue Jack Property contained anomalous values of rare earth minerals. Based on these results, we plan to commence Phase I of the Blue Jack exploration program in Spring 2012. See “Properties – Blue Jack Property – Exploration Program.”

3

On May 21, 2012, we completed the acquisition of Pure Spectrum Oil, Inc. (“Pure Spectrum”), a company incorporated under the laws of the State of Nevada, in the United States of America, pursuant to which we acquired all of the issued and outstanding common shares of Pure Spectrum from its shareholders in exchange for the issuance of a total of 4,000,000 shares of our common stock and the assumption of amounts payable in the amount of $1,035,068. As a result of the acquisition of the Pure Spectrum shares, we are also now engaged in the business of oil and gas exploration.

For accounting purposes, the acquisition of Pure Spectrum is being accounted for at historical carrying values in a manner similar to acquisition under common control method since our Chief Executive Officer and controlling shareholder is also the Chief Executive Officer and controlling shareholder of Pure Spectrum. Transfers or exchanges of equity instruments between entities under common control are recorded at the carrying amount of the transferring entity at the date of transfer with no goodwill or other intangible assets recognized. We did not recognize a gain or loss on the acquisition of Pure Spectrum because this acquisition is accounted for as an acquisition under common control. Our consolidated financial statements and reported results of operations reflect the Pure Spectrum carryover values, and our reported results of operations and stockholders’ equity have been retroactively restated for all periods presented to reflect the operations of Pure Spectrum and the Company as if the acquisition had occurred on May 21, 2012, the date the Company and Pure Spectrum commenced common control. All intercompany accounts and balances have been eliminated in consolidation.

In the third Fiscal Quarter of 2013, we expanded our operations into digital media. We plan to release our expanded business plan in the first fiscal quarter of 2014, in conjunction with our launch. However, to date our core business will remain Oil, Gas and Mineral Exploration.

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we enter into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs.

Company Summary

Introduction and Business

We are an oil and gas exploration and exploitation corporation focused on acquisition and production in and around the Permian Basin and the Bend Arch-Fort Worth Basin (collectively the “Basins”). Containing one of the world’s thickest deposits of rocks from the Permian geologic period, the Permian Basin spans approximately Two Hundred Fifty (250) miles wide and Three Hundred (300) miles long. It is largely contained in the western part of Texas .

The Bend Arch-Fort Worth Basin is a geological system covering Fifty-Four Thousand (54,000) square miles, primarily comprised within north-central Texas and southwestern Oklahoma (see image on the left). The United States Geological Survey estimated an average of Twenty-Six Trillion Seven Hundred Billion (26,700,000,000,000) cubic feet of undiscovered natural gas and a mean of One Billion One Hundred Million (1,100,000,000) barrels of undiscovered natural gas liquids in the Bend Arch-Fort Worth Basin. According to the United States Geological Survey. National Assessment of Oil and Gas Fact Sheet. 2003. Web. 14 June 2011, the market for oil hydrocarbons and petroleum in the United States has grown exponentially, creating an unprecedented demand for refined oil and gas. We plan to launch an operating infrastructure for the profitable production of oil and gas through a sustainable business model for the acquisition and retention of valuable leases, wells and other related properties.

We plan to seek funding to procure long-term leases and the equipment necessary for gainful drilling. We intend to enter into operating agreements for the production of oil and gas through the existing orphan well program with the Railroad Commission of Texas on acquired properties, sell existing interests and rights to leases and properties, and acquire new interests and properties to generate a base cash-flow. However, they can be no assurance that we will be able to obtain financing for these leases.

4

We expect to focus our search for petrochemicals on distressed and orphaned oil and gas properties near areas of proven production. The Railroad Commission of Texas identifies such wells as “non-compliant” properties. These wells have been inactive for a minimum of twelve (12) months with the responsible operator's Organizational Report (“Form P-5”) delinquent for more than Twelve (12) months. In order to obtain the right, title and related interest in these wells, we must have an active Form P-5 and provide a good faith claim to operate the wells upon request. To date, we do not have an active Form P-5 and there can be no assurance that we will obtain an active P-5.

It should be noted that the Form P-5 process is as follows according to Railroad Commission of Texas Statewide Rule 1, revised February 1986 Who Is To File Form P-5: any entity, i.e., person, firm, partnership, joint stock association, corporation, or any other organization, domestic or foreign, operating wholly or partially within this state, acting as principal or agent for another, for the purpose of performing operations within the jurisdiction of the Commission, as shown in Statewide Rule 1. When To File Form P-5: Initial Filing - the initial Form P-5 must be filed prior to beginning the first operation that is within Commission jurisdiction or when an organization name is being changed. This initial filing will cover all subsequent operations.”

Purchasing orphaned and distressed wells is common practice in the oil and gas industry. There is direct competition from both smaller and larger oil producers distributing to the One Hundred Forty-Eight (148) refineries in the United States.

Yaterra and the Oil and Gas Industry

According to Alex Epstein’s Four Dirty Secrets about Clean Energy. 2011 and Steve Hargreaves. Oil Demand to Hit Highest Level Ever. 2011, the demand for oil and natural gas has increased in recent years and is expected to increase in the future. Consistent with this trend consumption of oil in the United States is projected to rise from Eighteen Million Five Hundred Fifty Thousand (18,550,000) barrels of oil per day in 2012 to Eighteen Million Six Hundred Sixty Nine Thousand (18,690,000) barrels of oil per day in 2014 as stated by the United States. Energy Information Administration. Short-Term Energy Outlook. The average price of imported crude oil for refineries in the United States is expected to decrease from the 2013 average of Ninety-Nine Dollars and Forty-Seven Cents ($99.47) per barrel to Ninety-Six Dollars and Ninety-Nine Cents ($96.99) per barrel in 2014.

In addition, the United States Energy Information Administration. Short-Term Energy Outlook projects natural gas production to increase from 70 bcf/d in 2013 to 70.4 Bcf/d in 2014, which is an increase from 69.2 Bcf/d in 2012.

Significant Challenges

Our lack of operating capital and stretched cash-flow impose both short and long-term challenges. Acquiring an orphaned well requires an active Form P-5 Organization Report, which details an applicant’s operations. This form must be filed with the Texas Railroad Commission (“TRRC”) by any entity or person operating under the commission of the TRRC within the State of Texas. According to the Railroad Commission’s website, we must be a “Bonded Operator” and have a good faith claim to operate acquired wells. Furthermore, the Railroad Commission of Texas. Instructions: Individual & Blanket Performance Bonds Letters of Credit or Cash Deposits. Austin, TX. published July 2011, requires that a Blanket Performance Bond be submitted to cover all wells and operations. The minimum amount for a Blanket Performance Bond is Twenty-Five Thousand Dollars ($25,000.00) which covers acquisition and operation of up to Ten (10) wells. The equipment, maintenance and general overhead necessary to produce oil at an efficient rate requires significant additional working capital.

We also anticipate possible legal and regulatory challenges. Expenditures of time and resources may be required in accordance with various state and federal compliance laws, including licensing and operating requirements. Crude oil and natural gas reserve engineering is a subjective process that is inherently risky. Various uncertainties exist when estimating quantities of proved crude oil and natural gas reserves. Accordingly, estimating underground accumulations of crude oil and natural gas cannot be precisely measured. The accuracy of any reserve estimate is the function of the quality of available data and engineering and geological interpretation. Numerous market uncertainties may impact our performance, including future hydrocarbon production, changes in the price of oil, availability of indispensible equipment and services, and competitors with greater financial resources.

We are also subject to several categories of risk associated with development stage activities.

5

Operations and Services

Operational Goals

We are seeking to become a Bonded Operator, which will enable us to acquire the rights to orphaned wells and distressed properties through the Railroad Commission of Texas (“TRRC” or the “Commission”). Management believes that this method of acquiring assets will strategically position the Company to obtain the properties and leases at discounted rates, thus reserving cash for subsequent overhead and operational expenditures. Our short-term goal is to identify the orphaned and distressed properties retaining the highest expected rate of production, including the quality of the oil extracted and the progress of the previous owner’s well development.

Once sufficient funds for adequate working capital are received and the Blanket Performance Bond is filed with the TRRC allowing for the operation and acquisition of the orphaned wells and distressed properties, we expect to shift considerable resources to drilling and acquiring necessary equipment. We anticipate that with adequate capital the newly acquired wells will be fully operational and productive within months; however no assurance can be given as to the timing of such operations. We further expect to harmonize our plan for growth with production by retaining long-term operational staff and permanent corporate directors and officers.

Acquiring Orphaned Properties

Once we are funded and considered a Bonded Operator under Commission rules, we can acquire up to Ten (10) orphaned and distressed oil and gas properties. Based on projected costs and levels of oil and gas production, Management expects expansion to begin in Texas. To acquire more than Ten (10) wells, we must increase the amount of its Blanket Performance Bond to Fifty Thousand Dollars ($50,000.00) as expressly stated in the Railroad Commission of Texas. Instructions: Individual & Blanket Performance Bonds Letters of Credit or Cash Deposits, July 2011

Becoming a Bonded Operator with the Commission enables us to acquire the rights and interests of the orphaned properties. Properties will be selected based on perceived risk, whereby Management will identify low to moderate risk oil and natural gas reserves by reviewing and reprocessing previously recorded seismic data, third-party geological data, and third-party engineering economic analysis. The TRRC releases a complete list of distressed wells available for acquisition monthly, and we expect to thoroughly review the available properties and make cognizant and calculated selections based upon our years of experience in the oil and natural gas industry.

Location

We plan to concentrate our initial expansion in the Bend Arch-Fort Worth Basin. We predict that both the Permian Basin and the Bend Arch-Fort Worth Basin contain worthwhile acquisition prospects. With adequate initial capital, of which there can be no assurance that we will receive, we plan to expand into several counties in Texas.

Regulatory Matters

The Railroad Commission of Texas (“TRRC”) has primary regulatory jurisdiction over the oil and natural gas industry, pipeline transporters, natural gas and hazardous liquid pipeline industry, natural gas utilities, the petroleum industry and coal and uranium surface mining operations.

Acquiring an orphaned well requires an active Organization Report, or Form P-5. This form details an applicant’s operations and must be filed with the TRRC by any entity or person operating under the commission of the TRRC within the State of Texas. Furthermore, we must be a “bonded operator” and have a good faith claim to operate the acquired wells in order to acquire an orphaned well. At this present time, we have yet to acquire orphan wells.

6

An operator that acquires an orphan well is responsible for regulatory compliance. The TRRC requires that any wells acquired must be properly plugged pursuant to Statewide Rule 14. The acquiring operator assumes responsibility for the physical operation and control of the wells and the duty to comply with all the Commission’s rules and filings requirements.

Compliance with Regulation

There are several governmental regulations that materially restrict mineral exploration. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. If we enter the production phase, the cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

|

(i)

|

Water discharge will have to meet drinking water standards;

|

|

|

(ii)

|

Dust generation will have to be minimal or otherwise re-mediated;

|

|

|

(iii)

|

Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation;

|

|

|

(iv)

|

An assessment of all material to be left on the surface will need to be environmentally benign;

|

|

|

(v)

|

Ground water will have to be monitored for any potential contaminants;

|

|

|

(vi)

|

The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and

|

|

|

(vii)

|

There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species.

|

Competition

We are an exploration stage company. We compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than we do. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

Research and Development Expenditures

We have not incurred any research expenditures since our incorporation.

Patents and Trademarks

We do not own, either legally or beneficially, any patents or trademarks.

Employees

We have no employees other than our Chief Executive Officer, Cedric Atkinson and our interim Chief Financial Officer, Gregory K. Clements. We conduct our business largely through consultants.

7

|

ITEM 2.

|

PROPERTIES.

|

We rent office space located at 240 Martin Street, #3, Blaine, Washington, 98230. The office space consists of 80 square feet that we rent at a monthly price of $316.

We currently do not own any physical property or any real property. We own a 100% interest in our lead mineral project called the Blue Jack Property. We also hold a 100% interest in another mineral property called the Minnie Claim.

The Blue Jack Property

Our lead mineral property is the Blue Jack Property. We acquired the Blue Jack Property in September 2008 for $16,000. The Blue Jack Property is comprised of 10 mineral claims, located in Humboldt County, Nevada. Each claim covers 20.67 acres for an aggregate 206.66 acres.

Description of Property

The Blue Jack Property is recorded with the Bureau of Land Management in the State of Nevada under the following name and record numbers:

|

Name of Mineral

Claims

|

Nevada NMC Number

|

Expiry

Date

|

||

|

PT 10

|

984039 |

September 1, 2013

|

||

|

PT 11

|

984040 |

September 1, 2013

|

||

|

PT 12

|

984041 |

September 1, 2013

|

||

|

PT 13

|

984042 |

September 1, 2013

|

||

|

PT 14

|

984043 |

September 1, 2013

|

||

|

PT 15

|

984044 |

September 1, 2013

|

||

|

PT 16

|

984045 |

September 1, 2013

|

||

|

PT 17

|

984046 |

September 1, 2013

|

||

|

PT 18

|

984047 |

September 1, 2013

|

||

|

PT 19

|

984048 |

September 1, 2013

|

Federal regulations require a yearly maintenance fee to keep the claims in good standing. In accordance with Federal regulations, the Blue Jack Property is in good standing to September 1, 2013. A yearly maintenance fee of $140 per claim is required to be paid to the Bureau of Land Management prior to the expiry date to keep the claims in good standing for an additional year. If we fail to pay the required amount of the maintenance fee we may lose all interest that we have in the Blue Jack Property. As of this date, we have not made the current payment due to the Bureau of Land Management. We are currently reevaluating the project’s viability. If we do decide to proceed with these claims, we due stand a chance to lose all interest in these claims if we fail to pay the maintenance fee before the claims are purchased by a 3rd party.

8

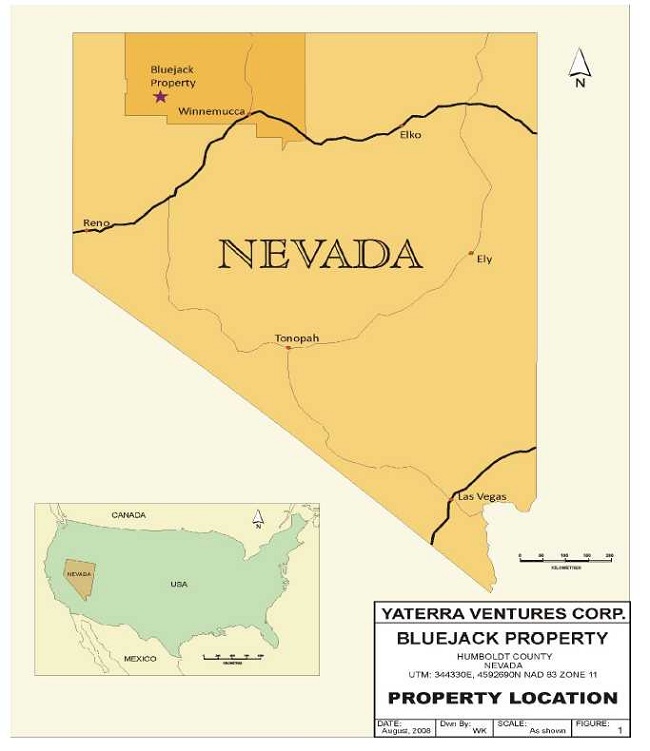

Figure 1

Location of the Blue Jack Property

Location and Access

The Blue Jack Property is located in Humboldt County in northwestern Nevada. The property is located 102 miles northwest of Winnemucca, Nevada. Winnemucca is located 166 miles northeast of Reno, Nevada.

The property is easily accessible from Winnemucca by paved highway for 76 miles, then by a gravel road for 24 miles and then by a desert trail for 3 miles.

9

Climate and Physiography

Average temperatures in the area range from 18°F in December to 95°F in July. The region is extremely dry, receiving only 7.9 inches of precipitation annually. An average of 1.1 inches of precipitation falls during the month of May. July is the driest month with a total average of 0.3 inches of precipitation.

The Blue Jack Property is located at the northern margin of the Black Rock Valley Desert along the eastern flanks of the transition between the Black Rock Range to the south and Pine Forest Range to the north. The valley floor is located at an elevation of approximately 4200 feet. Elevations on the property are moderate, ranging from 4600 to 5300 feet, and quickly rise to above 8650 feet in the mountains to the east of the property. The main showing and historic workings are located in the centre of the property at an elevation of 4875 feet.

The area consists of sagebrush and desert grass covered flats and hills typical of the Nevada desert. The region is well populated with desert jack rabbits and antelope.

History

The Blue Jack Property is located within the Varyville mining district of Humboldt County. This area is centered around Bartlett Peak between the Black Rock Range to the south and the Pine Forest Range to the north. The district and subsequent town site were named after a lode discovery in the 1870’s. The Varyville district has been referred to in various publications over the years as the Columbia, the Leonard Creek and the Bartlett district.

Other properties throughout the district have extensive workings, but no recorded production of ore.

Records indicate that geologists conducted a sampling of a trench located on the Blue Jack Property in order to determine whether uranium mineralization existed on the property. Previous reports also indicated that the Resource Investigation Division of the US Atomic Energy Commission (“AEC”) located and investigated radioactive localities in the 1950’s. AEC geologists compiled detailed data on select uranium deposits, one of which was a showing on the Blue Jack Property.

Regional Geology

The region in which the Blue Jack Property is found consists mainly of Tertiary volcanic rocks. The region also contains some metamorphosed fine clastic sedimentary formations mainly from the Triassic and Jurassic Periods. Sediments in the region are also overlain by basalts, tuffs and gravels. Older rocks have been intruded by several different bodies of granodiorites, quartz-monzonites and diorites from the Cretaceous and Tertiary Periods.

In the Pine Forest Range, several intrusive rocks are exposed, which indicates that the deposits in the region have a deep-seated source. The host rock for most of the deposits in the region is a metasedimentary and metavolcanic complex in fault contact with the core plutonic complex underlying the range. The deposits are virtually all structurally controlled. Faulting provided a conduit for the hydrothermal fluids to migrate, resulting in mineralization along the trend.

Property Geology

The Blue Jack Property is defined by diorites and granodiorites in fault contact with highly foliated and fractured shaley silicified limestones and metasediments. A strong shear zone defines the faulted contact, which strikes at 320 degrees and dips steeply to the northeast. The ground to the south of the property is overlain by Quaternary alluvium and boulders of basaltic and andesitic composition. Based on regional geological mapping, these are likely from the Triassic Period as well.

10

On the Blue Jack Property, there is mineralization exposed in a historic trench, being approximately 248 feet long by 33 feet wide, located along a strike with the fault contact. The fault is marked by intensely fractured limestones and metasediments in the foot wall and fractured granodiorites in the hanging wall to the west. Fault gouge is significantly abundant in many areas along the trench.

Faulting appears to be the controlling factor in mineralization. Copper mineralization appears to be consistent throughout the exposed fractured rocks. Jasper veining and chalcedony are present in the northern exposures of the trench, indicating a possibility that gold mineralization may exist on the property.

Exploration Program

Our exploration program for the Blue Jack Property is expected to include the following:

|

Phase

|

Recommended Exploration Program

|

Estimated

Cost

|

Status

|

||||

|

Phase Ia

|

Detailed geological mapping and radiometric surveys and rock and soil sampling along grid.

|

$ | 25,700 |

To be reevaluated in the 4th quarter of 2013. A decision will be made subject to market conditions, demand and obtaining additional financing.

|

|||

|

Phase Ib

|

Geophysical survey (IP and magnetometer).

|

$ | 43,050 |

To be reevaluated in the 4th quarter of 2013. A decision will be made subject to market conditions, demand and obtaining additional financing.

|

|||

|

Phase IIa

|

Conducting trenching along the fault zones.

|

$ | 40,500 |

To be determined based on the Results of Phase 1a and 1b.

|

|||

|

Phase IIb

|

Reverse circular drill testing of the property.

|

$ | 206,000 |

To be determined based on the Results of Phase 1a and 1b.

|

|||

|

Total Estimated Cost

|

$ | 315,250 | |||||

In November 2011, we completed a preliminary rock sampling program on the Blue Jack Property. For this program, we obtained four rock samples in order to determine the appropriate target for Phase I of our exploration program. Results of the program showed a presence of rare earth minerals that we believe justifies some follow up work. The samples were fire assayed by ALS Minerals located in Reno Nevada. Based on the above, we have elected to proceed with Phase Ia of our exploration program, subject to obtaining additional financing.

The Minnie Claim

We acquired a 100% interest in the Minnie Claim in March 28, 2007 for $6,000 in cash. We have suspended our exploration program on the Minnie Claim in order to focus our resources on the Blue Jack Property.

Description of Property

The Minnie Claim is recorded with the Bureau of Land Management in the State of Washington under number 3115896. The Minnie Claim is in good standing until September 1, 2013. In order to maintain the Minnie Claim in good standing we will need to pay $140 to the Bureau of Land Management on September 1, 2013. As of this date, we have not made the current payment due to the Bureau of Land Management. We are currently reevaluating the projects viability. If we do decide to proceed with these claims, we due stand a chance to lose all interest in these claims if we fail to pay the maintenance fee before the claims are purchased by a third party.

11

Figure 2

Location of the Minnie Claim

12

Location and Access

The Minnie Mining Claim is located between the towns of Twisp and Carlton in Okanogan County, Washington. The center of the property is approximately 2.8 miles northeast of Carlton, within what is referred to as Leecher Canyon.

The property is accessible by a paved highway within 2.7 miles of the claim. A well maintained gravel road provides access to the Minnie Claim.

History of Exploration

Mining history in the Cascades dates back to 1853 when placer gold was discovered in the Yakima Valley. This led to a brief gold rush in the area, and gold occurrences were reported throughout the Cascades. Placer gold was discovered in Okanogan River in 1860, which possibly led to the discovery of gold at nearby Gold Ridge and Leecher Canyon.

The area covered by the Minnie Claim has a recorded history of work dating back to 1949, when it was owned by Franklin Blocksom. Historical records indicate the property contains gold, silver, and zinc in a leached and honeycombed quartz vein located in metamorphic rocks. The vein is up to 3 feet wide, and was developed and explored by several open cuts including a 160 foot adit with a 55 foot winze, a 25 foot drift and a 30 foot stope.

Geology

Regional Geology

The Minnie Claim is located within the North Cascade Range, and consists of an active volcanic arc superimposed upon a Tertiary-age bedrock. Recent uplift has created high topographic relief. The North Cascades are composed of faulted and folded Mesozoic and Paleozoic crystalline and metamorphic rocks and tertiary intrusive, volcanic and sedimentary rocks.

Regionally, the center of gold mining is found in the Republic Graben, located in the Republic District of Washington. As of 1989, records indicate that the district produced over 2.5 million ounces of gold and 14 million ounces of silver, mainly in epithermal systems related to the final stages of Eocene calc-alkaline volcanism. In the Okanogan County, gold mineralization occurs in a skarn on Buckhorn property which also contains bismuth and cobalt mineralization. Porphyry copper-molybdenum deposits have been drilled at Oroville and Keller. The Mount Tolman deposit at Keller is the third or fourth largest molybdenum reserve in the United States.

Property Geology

The Minnie Claim is underlain by Pre-Tertiary metamorphic rocks. Mineralization of the claim consists of gold, silver, and zinc minerals within epithermal quartz veins up to a meter in width.

Records indicate the leached and honeycomb quartz veins contain pyrite, chalcopyrite, sheelite and marcasite. The open structure of the quartz veins are entirely filled with sulfide mineralization.

Three rock samples were collected earlier in the year, indicating a potential for economic mineralization may exist on the property with elevated gold, silver, copper and zinc values.

13

Current State of Exploration Activities

We have suspended our exploration program on the Minnie Claim in order to focus our resources on the Blue Jack Property.

Prior to our suspension of the exploration program on the Minnie Claim, our consulting geologist had commenced Phase I of our exploration program. He collected nine rock samples from the Minnie Claim. The samples consisted of outcrop grabs across strike as well as float samples of mineralized veins near historical workings. These samples were sent to an independent laboratory for testing. In January 2009, we received the fire assay results on the rock samples and they indicated the occurrence of gold mineralization on the Minnie Claim. The fire assay results on the rock samples are summarized as follows:

|

Sample No.

|

Au Results

(oz/t)

|

Ag Results

(oz/t)

|

Cu Results

(%)

|

Zn Results

(%)

|

||||||

|

ML001

|

n/a

(13 ppb)

|

n/a

(<0.5 ppm)

|

0.08

(792 ppm)

|

0.38

(3810 ppm)

|

||||||

|

ML002

|

n/a

(10 ppb)

|

n/a

(<0.5 ppm)

|

0.01

(134 ppm)

|

0.40

(3950 ppm)

|

||||||

|

ML003

|

0.112

(3850 ppb)

|

1.823

(62.5 ppm)

|

0.02

(173 ppm)

|

0.04

(441 ppm)

|

||||||

|

ML004

|

0.037

(1265 ppb)

|

3.208

(110 ppm)

|

0.28

(2800 ppm)

|

0.44

(4350 ppm)

|

||||||

|

ML005

|

0.057

(1965 ppb)

|

0.645

(22.1 ppm)

|

0.06

(605 ppm)

|

0.05

(512 ppm)

|

||||||

|

ML006

|

0.098

(3360 ppb)

|

15.779

(541 ppm)

|

0.65

(6480 ppm)

|

3.70 | ||||||

|

ML007

|

0.063

(2170 ppb)

|

9.188

(315 ppm)

|

0.65

(6480 ppm)

|

0.77

(7720 ppm)

|

||||||

|

ML008

|

0.010

(359 ppb)

|

0.505

(17.3 ppm)

|

0.11

(1080 ppm)

|

0.07

(716 ppm)

|

||||||

|

ML009

|

0.028

(972 ppb)

|

1.350

(46.3 ppm)

|

0.15

(1450 ppm)

|

0.03

(347 ppm)

|

||||||

Note: Conversions to ounces per ton (oz/ton) on the tables above employ a factor of 34285.7 ppb equaling 1 troy ounce per short ton and 34.2857 ppm equaling 1 troy ounce per short ton.

|

ITEM 3.

|

LEGAL PROCEEDINGS.

|

We are not a party to any other legal proceedings and, to our knowledge, no other legal proceedings are pending, threatened or contemplated.

|

ITEM 4.

|

MINE SAFETY DISCLOSURE

|

Not applicable

14

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

MARKET INFORMATION

The principal market for our common stock is the OTC Bulletin Board. Our shares commenced quotation on the OTC Bulletin Board on May 19, 2009 under the symbol “YTRV.” The following is the high and low bid information for our common stock during each fiscal quarter of our last two fiscal years.

|

HIGH

|

LOW

|

|||||||

|

QUARTER

|

($)

|

($)

|

||||||

|

1st Quarter 2011

|

0.99 | 0.3 | ||||||

|

2nd Quarter 2011

|

1 | 0.3 | ||||||

|

3rd Quarter 2011

|

0.45 | 0.3 | ||||||

|

4th Quarter 2011

|

0.3 | 0.3 | ||||||

|

1st Quarter 2012

|

0.51 | 0.3 | ||||||

|

2nd Quarter 2012

|

0.51 | 0.51 | ||||||

|

3rd Quarter 2012

|

0.51 | 0.3 | ||||||

|

4th Quarter 2012

|

0.5 | 0.012 | ||||||

|

1st Quarter 2013

|

0.0265 | 0.0017 | ||||||

|

2nd Quarter 2013

|

0.0099 | 0.001 | ||||||

|

3rd Quarter 2013

|

0.0039 | 0.0002 | ||||||

|

4th Quarter 2013 to date

|

0.0003 | 0.0001 | ||||||

REGISTERED HOLDERS OF OUR COMMON STOCK

As of November 20, 2013, there were 16 registered holders of our common stock. We believe that a number of stockholders hold stock on deposit with their brokers or investment bankers registered in the name of stock depositories.

DIVIDENDS

We have not declared any dividends on our common stock since our inception. There are no dividend restrictions that limit our ability to pay dividends on our common stock in our Articles of Incorporation or Bylaws. Chapter 78 of the Nevada Revised Statutes (the “NRS”), does provide certain limitations on our ability to declare dividends. Section 78.288 of Chapter 78 of the NRS prohibits us from declaring dividends where, after giving effect to the distribution of the dividend:

|

(a)

|

we would not be able to pay our debts as they become due in the usual course of business; or

|

|

(b)

|

except as may be allowed by our Articles of Incorporation, our total assets would be less than the sum of our total liabilities plus the amount that would be needed, if we were to be dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution of stockholders who may have preferential rights and whose preferential rights are superior to those receiving the distribution.

|

15

We have neither declared nor paid any cash dividends on our capital stock and do not anticipate paying cash dividends in the foreseeable future. Our current policy is to retain any earnings in order to finance the expansion of our operations. Our board of directors will determine future declaration and payment of dividends, if any, in light of the then-current conditions they deem relevant and in accordance with the NRS.

RECENT SALES OF UNREGISTERED SECURITIES

On May 21, 2012, we issued, in advance, 10,000,000 common shares to our CEO. The shares vest 2,000,000 per annum over a 5 year term. These securities were issued pursuant to Section 4(a)(2) of the Securities Act of 1933. Our CEO represented hisr intention to acquire the securities for investment only and not with a view towards distribution, and he had been given adequate information about us to make an informed investment decision and he was an accredited investor. We did not engage in any general solicitation or advertising.

On May 21, 2012, we issued 4,000,000 common shares to Five Individuals for the acquisition of Pure Spectrum Oil, Inc. These securities were issued pursuant to Section 4(a)(2) of the Securities Act of 1933. The holders represented their intention to acquire the securities for investment only and not with a view towards distribution, and that they were accredited investors. The holders were given adequate information about us to make an informed investment decision. We did not engage in any general solicitation or advertising.

On June 6, 2012, we issued 1,900,000 common shares for consulting services valued at $950,000. These securities were issued pursuant to Section 4(a)(2) of the Securities Act of 1933. The holders represented their intention to acquire the securities for investment only and not with a view towards distribution and that they were accredited investors. The holders were given adequate information about us to make an informed investment decision. We did not engage in any general solicitation or advertising.

Between June and August, 2012, we issued 17,426,097 common shares for the settlement of $30,000 in debt. These securities were issued pursuant to Section 4(a)(2) of the Securities Act of 1933. The holders represented their intention to acquire the securities for investment only and not with a view towards distribution and that they were accredited investors. The holders were given adequate information about us to make an informed investment decision. We did not engage in any general solicitation or advertising.

During June 2012, we issued 750,000 shares upon the conversion of $37,500 convertible note payables. The 750,000 exchange was consummated and conversion shares were issued in reliance upon Section 3(a)(9) of the Securities Act of 1933.

During the year ended August 31, 2012, we issued a convertible notes in the aggregate principal amount of $135,000. The notes bear interest at 8% -36% per annum, are unsecured and are repayable one year after the issue date. The September note is convertible into shares of our common stock at a conversion price equal to 75% of the lowest trading price of our common stock during the 10 consecutive trading days prior to the conversion date. These securities were issued pursuant to Section 4(a)(2) of the Securities Act of 1933. The holders represented their intention to acquire the securities for investment only and not with a view towards distribution and that they were accredited investors. The holders were given adequate information about us to make an informed investment decision. We did not engage in any general solicitation or advertising.

On each of September 4, 2012 and March 29, 2013, we issued convertible notes in the principal amount of $25,000 and $20,000, respectively. The notes bear interest at 8% per annum, are unsecured and are repayable one year after the issue date. The September note is convertible into shares of our common stock at a conversion price equal to 50% of the lowest trading price of our common stock during the 10 consecutive trading days prior to the conversion date. The March note is convertible into shares of our common stock at a conversion price equal to 58% of the 3 day average of the lowest trading price of our common stock during the 10 consecutive trading days prior to the conversion date These securities were issued pursuant to Section 4(a)(2) of the Securities Act of 1933. The holders represented their intention to acquire the securities for investment only and not with a view towards distribution and that they were accredited investors. The holders were given adequate information about us to make an informed investment decision. We did not engage in any general solicitation or advertising. and that they were accredited investors.

On October 1, 2012, we issued an aggregate of 65,000,000 shares to three individuals as compensation for services. These securities were issued pursuant to Section 4(a)(2) of the Securities Act of 1933. The holders represented their intention to acquire the securities for investment only and not with a view towards distribution and that they were accredited investors. The holders were given adequate information about us to make an informed investment decision. We did not engage in any general solicitation or advertising.

On October 1, 2012 we issued 5,000,000 shares to one consulting company as compensation for services. These securities were issued pursuant to Section 4(a)(2) of the Securities Act of 1933. The holder represented its intention to acquire the securities for investment only and not with a view towards distribution and that they were accredited investors. The holders were given adequate information about us to make an informed investment decision. We did not engage in any general solicitation or advertising.

16

On October 7, 2012 we issued a 10% convertible note in the principal amount of $63,040 in exchange for seventeen (17) 10% promissory notes with principal balances of an aggregate of $47,628 and an aggregate of $15,412 in accrued interest. The issued note is convertible into common stock at a conversion price of 45% of the average of the lowest 3 trading prices for the common stock during the 30 trading day period ending one trading day prior to the date the conversion notice. The note exchange was effected in reliance upon Section 3(a)(9) of the Securities Act of 1933.

During the quarter ended November 30, 2012, an aggregate of 23,068,269 shares were issued upon an aggregate of $47,136 in debt conversions from two note holders. These exchanges were consummated and conversion shares were issued in reliance upon Section 3(a)(9) of the Securities Act of 1933.

On January 22, 2013, we issued a 21% convertible note in the principal amount of $25,000 in exchange for a 21% convertible note dated 06/20/202 with outstanding principal and accrued interest of $25,000. The issued note is convertible at any time after the issue date into shares of Common Stock at a conversion price of $0.00055. The note exchange was effected in reliance upon Section 3(a)(9) of the Securities Act of 1933.

On January 22, 2013, we issued a 21% convertible note in the principal amount of $34,018 in exchange for a 21% convertible note dated 06/20/202 with outstanding principal and accrued interest of $34,018.08. The issued note is convertible at any time after the issue date into shares of Common Stock at a conversion price of $0.00055. The note exchange was effected in reliance upon Section 3(a)(9) of the Securities Act of 1933.

On February 14, 2013, we issued a 21% convertible note in the principal amount of $34,105 in exchange for a 21% convertible note dated 06/20/202 with outstanding principal and accrued interest of $34,104.83. The issued note is convertible at any time after the issue date into shares of Common Stock at a conversion price of $0.00055. The note exchange was effected in reliance upon Section 3(a)(9) of the Securities Act of 1933.

On each of February 22, 2013, March 19, 2013, April 2, 2013, May 6, 2013, we issued convertible notes in the principal amount of $35,000, $50,000, $19,250 and $25,000, respectively due on October 22, 2013, March 18, 2014, April 1, 2014 and May 5, 2014. The notes bear interest at 12% per annum, are unsecured. The February note is convertible into shares of our common stock at a conversion price equal to 55% of the lowest trading price of our common stock during the 5 consecutive trading days prior to the conversion date. The March and May notes are convertible into shares of our common stock at a conversion price equal to 50% of the average of the 5 lowest trading price of our common stock during the 20 consecutive trading days prior to the conversion date. The April note is convertible into shares of our common stock at a conversion price equal to 55% of the lowest trading price of our common stock during the 5 consecutive trading days prior to the conversion date. These securities were issued pursuant to Section 4(a)(2) of the Securities Act of 1933. The holders represented their intention to acquire the securities for investment only and not with a view towards distribution, and that they were accredited investors. The holders were given adequate information about us to make an informed investment decision. We did not engage in any general solicitation or advertising.

On February 26, 2013, we issued a 12% convertible note in the principal amount of $76,416 in exchange for a convertible note with outstanding principal and accrued interest of $76,416. The issued note is convertible at any time after the issue date into shares of Common Stock at 50% of the lowest trading price in 20 days prior to the date of conversion, as reported by Quotestream. The note exchange was effected in reliance upon Section 3(a)(9) of the Securities Act of 1933.

During the quarter ended February 28, 2013, an aggregate of 124,459,466 shares were issued upon an aggregate of $116,458 in debt conversions from four note holders.The exchanges were consummated and conversion shares were issued in reliance upon Section 3(a)(9) of the Securities Act of 1933.

On each of March 1, 2013, March 1, 2013, March 22, 2013 and May 6, 2013, we issued convertible notes in the principal amount of $55,000, $1,045, $8,000 and $25,000, respectively. The notes bear interest at 21% per annum, are unsecured and are repayable one year after the issue date. The March and April notes are convertible into shares of our common stock at a conversion price equal to 50% of the lowest trading price of our common stock during the 90 consecutive trading days prior to the conversion date. The May note is convertible into shares of our common stock at a conversion price equal to 50% of the average of the 3 lowest trading price of our common stock during the 10 consecutive trading days prior to the conversion date. These securities were issued pursuant to Section 4(a)(2) of the Securities Act of 1933. The holders represented their intention to acquire the securities for investment only and not with a view towards distribution, and that they were accredited investors. The holders were given adequate information about us to make an informed investment decision. We did not engage in any general solicitation or advertising.

17

On March 4, 2013, the Company issued to its President 1,500,000 shares of Series Preferred A Stock and 500,000 shares of Series Preferred A Stock and 20,000,000 shares of common stock to a member of management as compensation for services. These securities were issued pursuant to Section 4(a)(2) of the Securities Act of 1933. The holders represented their intention to acquire the securities for investment only and not with a view towards distribution. The holders were given adequate information about us to make an informed investment decision, and that they were accredited investors. We did not engage in any general solicitation or advertising.

On March 19, 2013, we issued a 12% convertible note in the principal amount of $100,098 due December 19, 2013 in exchange for three (3) 10% promissory notes in the aggregate principal amount of $23,000 together with accrued interest of $6,718.05 and six (6) 10% convertible notes in the aggregate principal amount of $63,000, respectively and accrued interest of $7,381. The issued note is convertible principal and unpaid interest into shares of common stock at conversion price of 50% of lowest 5 days prior to conversion, but no less than $0.00004. The note exchange was effected in reliance upon Section 3(a)(9) of the Securities Act of 1933.

On April 16, 2013, we issued a 10% convertible note in the principal amount of $29,275 that is payable on demand in exchange for nine (9) 10% promissory notes with aggregate principal amounts of $29,275. The issued note is convertible into shares of our common stock at a conversion price equal to 45% of the average of the lowest 3 trading prices for the common stock during the 30 trading day period ending one trading day prior to the date the conversion notice. The note exchange was effected in reliance upon Section 3(a)(9) of the Securities Act of 1933.

On May 6, 2013, we issued a 10% convertible note in the principal amount of $50,000 in exchange for a $50,000 note (principal plus accrued interest). The issued note can be converted at any time after the issue date into a shares of Common Shares at 70% of the average five(5) days lowest trading price within the 20 days prior to the date of conversion, as reported by Quotestream. This note exchange was effected in reliance upon Section 3(a)(9) of the Securities Act of 1933.

During the quarter ended May 31, 2013, an aggregate of 711,987,619 shares were issued upon an aggregate of $221,275 in debt conversions from four note holders. The conversion shares were issued in reliance upon Section 3(a)(9) of the Securities Act of 1933.

During the quarter ended August 31, 2013, an aggregate of 603,066,667 shares were issued upon an aggregate of $32,820 in debt conversions from four note holders. The conversion shares were issued in reliance upon Section 3(a)(9) of the Securities Act of 1933.

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

Revenues

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we enter into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs.

18

Expenses

The major components of our expenses for the year ended August 31, 2012 and 2011 are outlined in the table below:

|

Percentage

|

||||||||||||

|

Years Ended August 31,

|

Increase

|

|||||||||||

|

2012

|

2011

|

(Decrease)

|

||||||||||

|

Operating Expenses:

|

||||||||||||

|

Selling, general and administrative

|

$ | 14,483 | $ | 27,344 | (47 | %) | ||||||

|

Mineral property costs

|

7,474 | 11,333 | (34 | %) | ||||||||

|

Professional fees and compensation

|

85,035 | 63,663 | 34 | % | ||||||||

|

Management compensation

|

173,529 | 48,000 | 262 | % | ||||||||

|

Stock-based compensation

|

965,706 | - | N/A | |||||||||

|

Depreciation and amortization expense

|

- | 98 | (100 | %) | ||||||||

|

Impairment of mineral property

|

- | 25,369 | (100 | %) | ||||||||

|

Total operating expenses

|

1,246,227 | 175,807 | 609 | % | ||||||||

|

Other Expenses:

|

||||||||||||

|

Loss on change in fair value of derivative liabilities

|

(430,591 | ) | - | N/A | ||||||||

|

Interest expense

|

(1,262,311 | ) | (25,381 | ) | 4,873 | % | ||||||

|

Loss on extinguishment of debt

|

(1,783,048 | ) | - | N/A | ||||||||

|

Total other expenses

|

(3,475,950 | ) | (25,381 | ) | 13,595 | % | ||||||

|

Net loss

|

$ | (4,722,177 | ) | $ | (201,188 | ) | 2,247 | % | ||||

Our operating expenses increased from $175,807 during the year ended August 31, 2011, to $1,246,227, during the year ended August 31, 2012. The increase was due primarily to increased management compensation and we issued stock to outside professionals and consultants for work performed that created an additional expense for the year ended August 31, 2012 of $965,706 for these services.

Our other expenses increased from $25,381 during the year ended August 31, 2011, to $3,475,950, during the year ended August 31, 2012. The increase was primarily due to increases in the accounting treatment of new debt acquired to raise operating capital and the acquisition of Pure Spectrum. We recorded expenses for the loss on extinguishment of debt of $1,783,048. We also recorded a loss on the change in fair value of our derivative liabilities of $430,591 and we recorded $1,262,311 in interest expense for the year ended August 31, 2012.

Management compensation consists of salaries and stock compensation incurred to our executive directors and officers. During the year ended August 31, 2011 we recorded $48,000 in salary and during the year ended August 31, 2012 we recorded $131,955 in salary, $15,706 in stock-based compensation and we accrued an additional $41,574 in stock-based compensation per our CEO’s stock grant. This increase was primarily due to a change in management during the year ended August 31, 2012.

If we are able to obtain sufficient financing to proceed with our plan of operation, of which there is no assurance, we expect that our expenses will increase significantly as we engage in mining and exploration activities.

19

|

Years Ended August 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

Net cash used in operating activities

|

$ | (138,979 | ) | $ | (92,462 | ) | ||

|

Net cash used in investing activities

|

- | (1,007 | ) | |||||

|

Net cash provided by financing activities

|

138,979 | 93,418 | ||||||

|

Net decrease in cash during the period

|

$ | - | $ | (51 | ) | |||

Working Capital

|

Percentage

|

||||||||||||

|

At August 31,

2012

|

At August 31,

2011

|

Increase / (Decrease)

|

||||||||||

|

Current Assets

|

$ | 37,500 | $ | 360 | 10316.67 | % | ||||||

|

Current Liabilities

|

3,372,585 | 485,367 | 594.85 | % | ||||||||

|

Working Capital Deficit

|

$ | (3,335,085 | ) | $ | (485,007 | ) | 587.64 | % | ||||

As of August 31, 2012, we had no cash on hand and a working capital deficit of $3,335,085. The increase in our working capital deficit is primarily a result of: (i) an increase in accounts payable due to a lack of capital to meet our ongoing expenditures; and (ii) the fact that as we secure financing to continue our operations, we have secured loans to fund the acquisition of Pure Spectrum, and we received $135,500 in convertible loans. The loans bear interest at 8% to 12%, are unsecured and due on demand. We have incurred a cumulative net loss of $5,398,184 for the period from the date of our inception on November 20, 2006 to August 31, 2012 and have not attained profitable operations to date.

Since our inception, we have used our common stock to raise money for our operations and to fund our property acquisitions. We have not obtained profitable operations and are dependent upon obtaining additional financing to pursue our plan of operation.

Future Financings

We currently do not have sufficient financial resources to implement Phase Ia of our exploration program on the Blue Jack Property. Therefore, we will need to obtain additional financing in order to implement our exploration program on the Blue Jack Property as well as for the acquisition of any additional properties. Our plan of operation calls for us to spend significantly more than our current capital resources or the amount of financing that we have been able to obtain to date. As such, there is a substantial doubt that we will be able to raise significant financing to complete our stated plan of operation. Any substantial financing that we are able to obtain is expected to be in the form of equity financing, which will result in dilution to existing shareholders.

OFF-BALANCE SHEET ARRANGEMENTS

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

20

CRITICAL ACCOUNTING POLICIES

Our significant accounting policies are disclosed in Note 2 of our audited financial statements for the year ended August 31, 2012 included in this Annual Report on Form 10-K. We have identified certain accounting policies, described below, that are most important to the portrayal of our current financial condition and results of operations.

Use of Estimates

The preparation of financial statements, in conformity with generally accepted accounting principles, requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying disclosures. Actual results may differ from the estimates.

Significant accounts that require estimates as a basis for determining the stated amounts include mineral property acquisition costs and impairment, accrued liabilities and the valuation allowance of deferred tax assets.

Exploration Stage Enterprise

Our financial statements are prepared using the accrual method of accounting. Until such properties are acquired and developed, we will continue to prepare our financial statements and related disclosures in accordance with entities in the exploration stage.

Mineral Property Interests

We are an exploration stage mining company and have not yet realized any revenue from our operations. We are primarily engaged in the acquisition, exploration and development of mining properties. Exploration costs are expensed as incurred regardless of the stage of development or existence of reserves. Costs of acquisition are capitalized subject to impairment testing when facts and circumstances indicate impairment may exist.

We regularly perform evaluations of any investment in mineral properties to assess the recoverability and/or the residual value of our investments in these assets. All long-lived assets are reviewed for impairment whenever events or circumstances change which indicate the carrying amount of an asset may not be recoverable.

Our management periodically reviews the carrying value of our investments in mineral leases and claims with internal and external mining related professionals. A decision to abandon, reduce or expand a specific project is based upon many factors including general and specific assessments of mineral deposits, anticipated future mineral prices, anticipated future costs of exploring, developing and operating a production mine, the expiration term and ongoing expenses of maintaining mineral properties and the general likelihood that we will continue exploration on such project. We do not set a pre-determined holding period for properties with unproven deposits; however, properties which have not demonstrated suitable metal concentrations at the conclusion of each phase of an exploration program are re-evaluated to determine if future exploration is warranted, whether there has been any impairment in value and that their carrying values are appropriate.

If an area of interest is abandoned or it is determined that its carrying value cannot be supported by future production or sale, the related costs are charged against operations in the year of abandonment or determination of value. The amounts recorded as mineral leases and claims represent costs to date and do not necessarily reflect present or future values.

Our exploration activities and proposed mine development are subject to various laws and regulations governing the protection of the environment. These laws are continually changing, generally becoming more restrictive. We have made, and expect to make in the future, expenditures to comply with such laws and regulations.

21

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

|

Yaterra Ventures Corp.

INDEX TO FINANCIAL STATEMENTS

Consolidated financial statements for the years ended August 31, 2012 and 2011, including:

|

1.

|

Report of Independent Registered Public Accounting Firm;

|

|

2.

|

Consolidated Balance Sheets as of August 31, 2012 and 2011;

|

|

3.

|

Consolidated Statements of Expenses for the years ended August 31, 2012 and 2011 and for the period from November 20, 2006 (Inception) to August 31, 2012;

|

|

4.

|

Consolidated Statements of Cash Flows for the years ended August 31, 2012 and 2011 and for the period from November 20, 2006 (Inception) to August 31, 2012;

|

|

5.

|

Consolidated Statement of Stockholders’ Equity (Deficit) from November 20, 2006 (Inception) to August 31, 2012; and

|

|

6.

|

Notes to the Consolidated Financial Statements.

|

22

Report of Independent Registered Public Accounting Firm

To the Board of Directors of

Yaterra Ventures Corp.

(An Exploration Stage Company)

Toronto, Ontario Canada

We have audited the accompanying consolidated balance sheets of Yaterra Ventures Corp. (an exploration stage company) and its subsidiary (collectively, the “Company”) as of August 31, 2012 and 2011, and the related consolidated statements of expenses, stockholders’ equity (deficit), and cash flows for each of the years then ended and for the period from November 20, 2006 (inception) through August 31, 2012. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Yaterra Ventures Corp. (an exploration stage company) and its subsidiary as of August 31, 2012 and 2011, and the results of their operations and their cash flows for each of the years then ended and for period from November 20, 2006 (inception) through August 31, 2012 in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered losses from operations and has a working capital deficit and an accumulated deficit as of August 31, 2012, which raise substantial doubt about its ability to continue as a going concern. Management’s plans regarding those matters also are described in Note 1. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| /s/ MaloneBailey, LLP |

| www.malonebailey.com

Houston, Texas

November 20, 2013

|

23

|

YATERRA VENTURES CORP.

|

|||||

|

(An Exploration Stage Company)

|

|||||

|

CONSOLIDATED BALANCE SHEETS

|

|

August 31,

|

||||||||

|

2012

|

2011

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets:

|

||||||||

|

Deposits

|

$ | 25,000 | $ | - | ||||

|

Prepaid expense and other current assets

|

12,500 | 360 | ||||||

|

Total Current Assets

|

37,500 | 360 | ||||||

|

Total Assets

|

$ | 37,500 | $ | 360 | ||||

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable and accrued liabilities

|

$ | 224,610 | $ | 208,274 | ||||

|

Amounts payable to related parties

|

125,250 | - | ||||||

|

Accrued interest

|

172,002 | 36,257 | ||||||

|

Accrued interest on related party notes

|

3,797 | 70 | ||||||

|

Debt

|

161,589 | 233,680 | ||||||

|

Related party debt

|

23,544 | 7,086 | ||||||

|

Related party convertible debt, net of unamortized discounts of $18,750 and $0

|

6,250 | - | ||||||

|

Convertible debt, net of unamortized discounts of $64,739 and $0

|

1,096,026 | - | ||||||

|

Derivative liabilities

|

1,559,517 | - | ||||||

|

Total Current Liabilities

|

3,372,585 | 485,367 | ||||||

|

Stockholders’ Deficit:

|

||||||||

|

Preferred stock, $0.001 par value, 100,000,000 shares authorized, none issued and outstanding

|

- | - | ||||||

|

Common stock, $0.001 par value, 100,000,000 shares authorized, 35,706,097 and 1,630,000 shares issued and outstanding

|

35,706 | 1,630 | ||||||

|

Additional paid-in capital

|

2,027,393 | 189,370 | ||||||

|

Deficit accumulated during the exploration stage

|

(5,398,184 | ) | (676,007 | ) | ||||

|

Total Stockholders’ Deficit

|

(3,335,085 | ) | (485,007 | ) | ||||

|

Total Liabilities and Stockholders’ Deficit

|

$ | 37,500 | $ | 360 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

F-1

|

YATERRA VENTURES CORP.

|

||||||||

|

(An Exploration Stage Company)

|

||||||||

|

CONSOLIDATED STATEMENTS OF EXPENSES

|

|

November 20, 2006

|

||||||||||||

|

(Inception)

|

||||||||||||

|

Years Ended August 31,

|

Through

|

|||||||||||

|

2012

|

2011

|

August 31, 2012

|

||||||||||

|

Operating Expenses:

|

||||||||||||

|

Selling, general and administrative

|

$ | 14,483 | $ | 27,344 | $ | 112,641 | ||||||

|

Mineral property costs

|

7,474 | 11,333 | 60,414 | |||||||||

|

Professional fees and compensation

|

1,224,270 | 111,663 | 1,679,918 | |||||||||

|

Depreciation and amortization expense

|

- | 98 | 1,086 | |||||||||

|

Impairment of mineral property

|

- | 25,369 | 25,369 | |||||||||

|

Total operating expenses

|

1,246,227 | 175,807 | 1,879,4278 | |||||||||

|

Other Expenses:

|

||||||||||||

|

Loss on change in fair value of derivative liabilities

|

(430,591 | ) | - | (430,591 | ) | |||||||

|

Interest expense

|

(1,262,311 | ) | (25,381 | ) | (1,305,117 | ) | ||||||

|

Loss on extinguishment of debt

|

(1,783,048 | ) | - | (1,783,048 | ) | |||||||

|

Total other expenses

|

(3,475,950 | ) | (25,381 | ) | (3,518,756 | ) | ||||||

|

Net loss

|

$ | (4,722,177 | ) | $ | (201,188 | ) | $ | (5,398,184 | ) | |||

|

Net Loss Per Share - Basic and Diluted

|

$ | (0.59 | ) | $ | (0.12 | ) | ||||||

|

Weighted Average Number of Common Shares Outstanding - Basic and Diluted

|

7,981,849 | 1,630,000 | ||||||||||

|

The accompanying notes are an integral part of these consolidated financial statements.

|

||||||||||||

F-2

|

YATERRA VENTURES CORP.

|

||||||||

|

(An Exploration Stage Company)

|

||||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

November 20, 2006

|

||||||||||||

|

(Inception)

|

||||||||||||

|

Years Ended August 31,

|

Through

|

|||||||||||

|

2012

|

2011

|

August 31, 2012

|

||||||||||

|

Cash Flows from Operating Activities

|

||||||||||||

|

Net loss

|

$ | (4,722,177 | ) | $ | (201,188 | ) | $ | (5,398,184 | ) | |||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||||||

|

Amortization of debt discounts

|

1,103,164 | - | 1,103,164 | |||||||||

|

Depreciation

|

- | 98 | 1,086 | |||||||||

|

Loss on change in fair value of derivatives

|

430,591 | - | 430,591 | |||||||||

|

Loss on extinguishment of debt

|

1,783,048 | - | 1,783,048 | |||||||||

|

Accrued preferred stock compensation

|

41,574 | - | 41,574 | |||||||||

|

Stock-based compensation

|

965,706 | - | 965,706 | |||||||||

|

Impairment of mineral property

|

- | 25,369 | 25,369 | |||||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Prepaid expenses and other current assets

|

(12,140 | ) | (360 | ) | (12,402 | ) | ||||||

|

Accounts payable and accrued liabilities

|

142,278 | 83,549 | 352,941 | |||||||||

|

Accounts payable and accrued liabilities to related parties

|

128,977 | 70 | 159,547 | |||||||||

|

Net cash used in operating activities

|

(138,979 | ) | (92,462 | ) | (547,560 | ) | ||||||

|

Cash Flows from Investing Activities

|

||||||||||||

|

Mineral property acquisition costs

|

- | (1,007 | ) | (22,000 | ) | |||||||

|