As filed with the Securities and Exchange Commission on April 27, 2012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-33632

BROOKFIELD INFRASTRUCTURE PARTNERS L.P.

(Exact name of Registrant as specified in its charter)

Bermuda

(Jurisdiction of incorporation or organization)

73 Front Street

Hamilton, HM 12, Bermuda

+1-441-294-3309

(Address of principal executive offices)

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act:

| Title of class |

Name of each exchange on which registered | |||

| Limited Partnership Units | New York Stock Exchange; Toronto Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

132,352,111 Limited Partnership Units as of December 31, 2011

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ¨ U.S. GAAP |

x International Financial Reporting

Standards as issued |

¨ Other |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

TABLE OF CONTENTS

i

| PAGE | ||||||||||

| Item 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT NON-PRODUCT RELATED MARKET RISK | 161 | ||||||||

| Item 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 161 | ||||||||

| 162 | ||||||||||

| Item 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 162 | ||||||||

| Item 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 162 | ||||||||

| Item 15. | CONTROLS AND PROCEDURES | 162 | ||||||||

| Item 16A. | AUDIT COMMITTEE FINANCIAL EXPERT | 163 | ||||||||

| Item 16B. | CODE OF ETHICS | 163 | ||||||||

| Item 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 163 | ||||||||

| Item 16D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEE | 163 | ||||||||

| Item 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASER | 164 | ||||||||

| Item 16F. | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | 164 | ||||||||

| Item 16G. | CORPORATE GOVERNANCE | 164 | ||||||||

| Item 16H. | MINE SAFETY DISCLOSURES | 164 | ||||||||

| 165 | ||||||||||

| Item 17. | FINANCIAL STATEMENTS | 165 | ||||||||

| Item 18. | FINANCIAL STATEMENTS | 165 | ||||||||

| Item 19. | EXHIBITS | 165 | ||||||||

ii

INTRODUCTION AND USE OF CERTAIN TERMS

Unless otherwise specified, information provided in this annual report on Form 20-F is as of December 31, 2011.

Unless the context requires otherwise, when used in this annual report on Form 20-F, the terms “Brookfield Infrastructure”, “we”, “us” and “our” refer to Brookfield Infrastructure Partners L.P., collectively with its subsidiary entities and the operating entities (as defined below). All dollar amounts contained in this annual report on Form 20-F are expressed in U.S. dollars and references to “dollars”, “$”, “US$” or “USD” are to U.S. dollars, all references to “C$” or “CAD” are to Canadian dollars, and all references to “A$” are to Australian dollars. In addition, all references to “£” or “GBP” are to pound sterling, all references to “NZD” are to New Zealand dollars, all references to “€” or “EUR” are to Euros, and unless the context suggests otherwise, references to:

| • | an “affiliate” of any person are to any other person that, directly or indirectly through one or more intermediaries, controls, is controlled by or is under common control with such person; |

| • | “Brookfield” are to Brookfield Asset Management and any affiliate of Brookfield Asset Management, other than us and, where the context so requires, related entities of Brookfield Asset Management, including Partners Limited and BAM Investment Corp.; |

| • | “Brookfield Asset Management” are to Brookfield Asset Management Inc.; |

| • | “Brookfield Infrastructure” are to Brookfield Infrastructure Partners L.P., collectively with its subsidiary entities and operating entities; |

| • | the “current operations” are to the businesses in which we hold an interest as set out in Item 4.B “Business Overview”; |

| • | the “general partner” are, as the context requires, to the Infrastructure GP LP in its capacity as general partner of the Holding LP, or the Infrastructure General Partner in its capacity as the general partner of the Infrastructure GP LP; |

| • | “Holding Entities” are to the subsidiaries of the Holding LP, from time-to-time, through which we hold all of our interests in the operating entities; |

| • | the “Holding LP” are to Brookfield Infrastructure L.P.; |

| • | the “Infrastructure General Partner” are to Brookfield Infrastructure General Partner Limited, which serves as the general partner of the Infrastructure GP LP; |

| • | the “Infrastructure GP LP” are to Brookfield Infrastructure GP L.P., which serves as the general partner of the Holding LP; |

| • | “Licensing Agreement” are to the licensing agreement described in Item 7.B “Related Party Transactions—Licensing Agreement”; |

| • | our “limited partnership agreement” are to the amended and restated limited partnership agreement of our partnership; |

| • | the “Manager” are to Brookfield Infrastructure Group Corporation, Brookfield Asset Management Barbados Inc., and Brookfield Infrastructure Group L.P. and, unless the context otherwise requires, includes any other affiliate of Brookfield Asset Management that provides services to us pursuant to the Master Services Agreement or any other service agreement or arrangement; |

| • | our “Managing General Partner” are to Brookfield Infrastructure Partners Limited, which serves as our partnership’s general partner; |

1

| • | “Master Services Agreement” are to the master management and administration agreement dated as of December 4, 2007, among the Service Recipients, Brookfield Asset Management and the Manager, as described in Item 6.A “Directors and Senior Management—Our Master Services Agreement”; |

| • | “Merger Transaction” are to our acquisition of the ownership interests in Prime not already held by us, which was completed on December 8, 2010; |

| • | the “Offering” is to the issuance by public offering of 19,370,025 of our units on October 26, 2011; |

| • | “operating entities” are to the entities which directly or indirectly hold our current operations and assets that we may acquire in the future, including any assets held through joint ventures, partnerships and consortium arrangements; |

| • | our “partnership” are to Brookfield Infrastructure Partners L.P.; |

| • | “Prime” are to Prime Infrastructure, known collectively as Babcock & Brown Infrastructure Limited and Babcock & Brown Infrastructure Trust, or BBI, prior to its recapitalization on November 20, 2009; |

| • | “rate base” are to a regulated or notionally stipulated asset base; |

| • | the “Redemption-Exchange Mechanism” are to the mechanism by which Brookfield may request redemption of its limited partnership interests in the Holding LP in whole or in part in exchange for cash, subject to the right of our partnership to acquire such interests (in lieu of such redemption) in exchange for limited partnership units of our partnership, as more fully set forth in Item 10.B “Memorandum and Articles of Association—Description of the Holding LP’s Limited Partnership Agreement—Redemption-Exchange Mechanism”; |

| • | “Redeemable Partnership Unit” is a unit of the Holding LP that has the rights of the Redemption-Exchange Mechanism. See Item 10.B “Memorandum and Articles of Association—Description of the Holding LP’s Limited Partnership Agreement—Units”; |

| • | “Relationship Agreement” are to the relationship agreement dated as of December 4, 2007 by and among our partnership, the Manager, the Holding LP, the Holding Entities and others, as described in Item 7.B “Related Party Transactions—Relationship Agreement”; |

| • | “Service Recipients” are to our partnership, the Holding LP and the Holding Entities; |

| • | “spin-off” are to the issuance of the special dividend by Brookfield Asset Management to its shareholders of 23,344,508 of our units on January 31, 2008; |

| • | our “timber operations” are to our interest in Canadian and U.S. freehold timberlands, as described in Item 4.B “Business Overview—Current Operations—Timber—Overview”; |

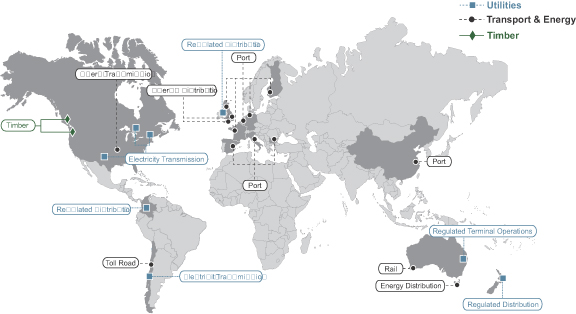

| • | our “transport and energy operations” are to our interests in Australian railroad operation, North American gas transmission operation in the U.S., port operations in the UK, port operations in Europe, Chilean toll road operations, European energy distribution operations in the Channel Islands and Isle of Man, and Australian energy distribution operation, as described in Item 4.B “Business Overview—Current Operations—Transport and Energy Operations—Overview”; |

| • | our “units” are to the limited partnership units in our partnership and references to our “unitholders” are to the holders of our units; |

| • | our “utilities operations” refer to our interests in Australian regulated terminal operation, South American electricity transmission operation in Chile, North American electricity transmission operation in Canada and U.S., Australian energy distribution operation in New Zealand, and European energy distribution operation in the UK, as described in Item 4.B “Business Overview—Current Operations—Utilities—Overview”; and |

| • | “Voting Agreements” are to the voting arrangements described in Item 7.B “Related Party Transactions—Voting Agreements”. |

2

This annual report on Form 20-F contains certain forward-looking statements and information concerning our business and operations. The forward- looking statements and information also relate to, among other things, our objectives, goals, strategies, intentions, plans, beliefs, expectations and estimates and anticipated events or trends. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” or the negative of those terms or other comparable terminology.

Although we believe that our anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based on reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements and information because they involve assumptions, known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information.

The following factors could cause our actual results to differ materially from our forward looking statements and information:

| • | our assets are or may become highly leveraged and we intend to incur indebtedness above the asset level; |

| • | our partnership is a holding entity that relies on its subsidiaries to provide the funds necessary to pay our distributions and meet our financial obligations; |

| • | future sales and issuances of our units, or the perception of such sales or issuances, could depress the trading price of our units; |

| • | future acquisitions may significantly increase the scale and scope of our operations; |

| • | the terms of our senior secured credit facility subject us to financial and operating covenants which restrict our ability to engage in certain types of activities and make distributions in respect of equity; |

| • | foreign currency risk and risk management activities; |

| • | our partnership is not regulated as an investment company under the U.S. Investment Company Act of 1940, as amended, and the rules and regulations promulgated thereunder, or the Investment Company Act; |

| • | we are exempt from certain requirements of Canadian securities laws and we are not subject to the same disclosure requirements as a U.S. domestic issuer; |

| • | effectiveness of our internal controls over financial reporting could have a material effect; |

| • | general economic conditions and risks relating to the global economy; |

| • | commodity risks; |

| • | availability and cost of credit; |

| • | government policy changes; |

| • | exposure to uninsurable losses and force majeure events; |

| • | infrastructure operations may require substantial capital expenditures; |

| • | labour disruptions and economically unfavorable collective bargaining agreements; |

| • | exposure to health and safety related accidents; |

| • | exposure to increased economic regulation; |

3

| • | exposure to environmental risks, including increasing environmental legislation and the broader impacts of climate change; |

| • | high levels of regulation upon many of our operating entities; |

| • | First Nations claims to land, adverse claims or governmental claims may adversely affect our infrastructure operations; |

| • | the competitive market for acquisition opportunities; |

| • | our ability to renew existing contracts and win additional contracts with existing or potential customers; |

| • | timing and price for the completion of unfinished projects; |

| • | some of our current operations are held in the form of joint ventures or partnerships or through consortium arrangements; |

| • | change of control provisions as a result of the Merger Transaction; |

| • | some of our businesses operate in jurisdictions with less developed legal systems and could experience difficulties in obtaining effective legal redress; |

| • | actions taken by national, state, or provincial governments, including nationalization, or the imposition of new taxes, could materially impact the financial performance or value of our assets; |

| • | reliance on computerized business systems; |

| • | utility operation customers may default on their obligations; |

| • | transport and energy operation customers may default on their obligations; |

| • | timber operations may be affected by economic recessions or downturns; |

| • | our operations depend on relevant contractual arrangements; |

| • | reliance on tolling and revenue collection systems; |

| • | weather conditions, industry practice and regulations associated with forestry may limit or prevent harvesting by our timber operations; |

| • | Brookfield’s influence over our partnership; |

| • | the lack of an obligation of Brookfield to source acquisition opportunities for us; |

| • | our dependence on Brookfield and its professionals; |

| • | interests in our Managing General Partner may be transferred to a third party without unitholder consent; |

| • | Brookfield may increase its ownership of our partnership; |

| • | Brookfield does not owe our unitholders any fiduciary duties; |

| • | conflicts of interest between our partnership and our unitholders, on the one hand, and Brookfield, on the other hand; |

| • | our arrangements with Brookfield may contain terms that are less favorable than those which otherwise might have been obtained from unrelated parties; |

4

| • | our Managing General Partner may be unable or unwilling to terminate the Master Services Agreement; |

| • | the limited liability of, and our indemnification of, the Manager; |

| • | our unitholders do not have a right to vote on partnership matters or to take part in the management of our partnership; |

| • | market price of our units may be volatile; |

| • | changes in tax law and practice; and |

| • | other factors described in this annual report on Form 20-F, including, but not limited to, those described under Item 3.D “Risk Factors” and elsewhere in this annual report on Form 20-F. |

In light of these risks, uncertainties and assumptions, the events described by our forward-looking statements and information might not occur. We qualify any and all of our forward-looking statements and information by these cautionary factors. Please keep this cautionary note in mind as you read this annual report on Form 20-F. We disclaim any obligation to update or revise publicly any forward-looking statements or information, whether as a result of new information, future events or otherwise, except as required by applicable law.

CAUTIONARY STATEMENT REGARDING THE USE OF NON-IFRS ACCOUNTING MEASURES

FFO

To measure performance, among other measures, we focus on funds from operations, or FFO.

We define FFO as net income excluding the impact of depreciation and amortization, deferred taxes and other items. FFO is a measure of operating performance, which is not calculated in accordance with, and does not have any standardized meaning prescribed by, International Financial Reporting Standards (IFRS), FFO is therefore unlikely to be comparable to similar measures presented by other issuers. FFO has limitations as an analytical tool. See Item 5 “Operating and Financial Review and Prospects—Reconciliation of Non-IFRS Financial Measures” for more information on this measure, including a reconciliation to the most directly comparable IFRS measure.

AFFO

In addition, we use adjusted funds from operations, or AFFO, as a measure of long-term sustainable cash flow.

We define AFFO as funds from operations (FFO) less maintenance capital expenditures. AFFO is a measure of operating performance, which is not calculated in accordance with, and does not have any standardized meaning prescribed by International Financial Reporting Standards, or IFRS. AFFO is therefore unlikely to be comparable to similar measures presented by other issuers. AFFO has limitations as an analytical tool. See Item 5 “Operating and Financial Review and Prospects—Reconciliation of Non-IFRS Financial Measures” for more information on this measure, including a reconciliation to the most directly comparable IFRS measure.

Adjusted EBITDA

In addition, we focus on adjusted EBITDA, which we define as earnings before interest, taxes, depreciation and amortization. Like FFO, adjusted EBITDA is a measure of operating performance, which is not calculated in accordance with, and does not have any standardized meaning prescribed by IFRS. Adjusted EBITDA is therefore unlikely to be comparable to similar measures presented by other issuers. Adjusted EBITDA has limitations as an analytical tool. See Item 5 “Operating and Financial Review and Prospects” for more information on this measure, including a reconciliation to the most directly comparable IFRS measure.

5

Invested Capital

In addition, in calculating certain performance yields we use invested capital.

We define invested capital as partnership capital adding back the following items: maintenance capital expenditures, non-cash statement of operating results items and other comprehensive income. Invested capital is a measure that is not calculated in accordance with, and does not have any standardized meaning prescribed by IFRS. Invested capital is therefore unlikely to be comparable to similar measures presented by other issuers. Invested capital has limitations as an analytical tool. See Item 5 “Operating and Financial Review and Prospects—Reconciliation of Non-IFRS Financial Measures” for more information on this measure, including a reconciliation to the most directly comparable IFRS measure.

6

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

The following table presents financial data for Brookfield Infrastructure as of and for the periods indicated:

| Statements of Operating Results Key Metrics(1) |

For the Year Ended December 31, |

|||||||||||

| MILLIONS, UNAUDITED |

2011 | 2010 | 2009 | |||||||||

| Revenue |

$ | 1,636 | $ | 634 | $ | 290 | ||||||

| Revenues less direct operating costs & general and administrative costs |

676 | 186 | 74 | |||||||||

| Earnings from investments in associates |

76 | 52 | 14 | |||||||||

| Interest expense—corporate borrowings |

11 | 8 | 8 | |||||||||

| Interest expense—non-recourse borrowings |

324 | 136 | 95 | |||||||||

| Gain on sale of investment (after-tax) |

— | — | 68 | |||||||||

| Fair value gains and other items(2) |

— | 396 | 28 | |||||||||

| Net income attributable to partnership |

187 | 458 | 53 | |||||||||

| Per unit net income |

1.15 | 3.91 | 1.11 | |||||||||

| Funds from operations (FFO)(3)(4) |

392 | 197 | 117 | |||||||||

| Per unit FFO(4)(5) |

2.41 | 1.79 | 2.45 | |||||||||

| Per unit distributions |

1.32 | 1.10 | 1.06 | |||||||||

| (1) | Brookfield Infrastructure prepared its annual consolidated and combined financial statements in accordance with IFRS as issued by the IASB for the years ended December 31, 2011, 2010 and 2009. Brookfield Infrastructure’s consolidated and combined financial statements were prepared in 2010 in accordance with IFRS 1 First-time Adoption of International Financial Reporting Standards. Prior to the adoption of IFRS Brookfield Infrastructure prepared its financial statements in accordance with U.S. generally accepted accounting principles. Brookfield Infrastructure’s transition date was January 1, 2009, or the transition date, and Brookfield Infrastructure has prepared its opening IFRS Statements of Financial Position as of that date. Brookfield Infrastructure has not included financial information for the years ended December 31, 2008 and 2007, as such information is not available on a basis consistent with the consolidated and combined financial information for the years ended December 31, 2011, 2010 and 2009 and cannot be provided on an IFRS basis without unreasonable effort or expense. |

| (2) | See notes 4(a) and 36 for details regarding adjustments to comparative periods. |

| (3) | FFO is defined as net income excluding the impact of depreciation, amortization, deferred taxes and other items. FFO is a measure of operating performance that is not calculated in accordance with, and does not have any standardized meaning prescribed by IFRS. Please see Item 5 “Operating and Financial Review and Prospects—Management’s Discussion and Analysis of Financial Condition and Results of Operations—Reconciliation of Non-IFRS Financial Measures” for a discussion of FFO and its limitations as a measure of our operating performance. |

| (4) | Includes $68 million gain on sale of Transmissoras Brasileiras de Energia, or TBE, in 2009. |

| (5) | During 2011, on average there were 162.5 million units outstanding (2010: 109.9 million, 2009: 47.7 million). |

7

| Statements of Financial Position Key Metrics |

As of December 31, | |||||||||||

| MILLIONS, UNAUDITED |

2011 | 2010 | 2009 | |||||||||

| Cash and cash equivalents |

$ | 153 | $ | 154 | $ | 107 | ||||||

| Total assets |

13,269 | 13,352 | 6,052 | |||||||||

| Partnership capital—attributable to limited partners |

4,182 | 3,348 | 1,887 | |||||||||

| Partnership capital—attributable to general partner |

24 | 23 | 18 | |||||||||

| Non-controlling interest |

1,683 | 1,552 | 1,305 | |||||||||

| Corporate borrowings |

— | 18 | — | |||||||||

| Non-recourse borrowings |

4,885 | 4,575 | 1,926 | |||||||||

Effective December 31, 2010, our partnership entered into voting arrangements with various affiliates of Brookfield whereby our partnership effectively gained control of the Holding LP, as well as Brookfield’s holdings in our timber operations, Australian coal terminal and UK port operations, subject to certain limitations. As this reorganization does not represent a business combination under IFRS 3 Business Combinations, the consolidated financial statements of Brookfield Infrastructure as of and for the years ended December 31, 2011 and 2010 are presented to reflect continuation of control. Therefore, the consolidated and combined statements of financial position, and results of operations are presented as if these arrangements had been in place from the time our partnership acquired control (See note 3 to our consolidated and combined financial statements included in this annual report on Form 20-F for a more detailed description).

The following table reconciles FFO, a non-IFRS financial metric, to the most directly comparable IFRS measure, which is net income:

| For the Year

Ended December 31, |

||||||||||||||||||||||||

| MILLIONS, EXCEPT PER UNIT AMOUNTS, UNAUDITED |

2011 | 2011 (per unit) |

2010 | 2010 (per unit) |

2009 | 2009 (per unit) |

||||||||||||||||||

| Net income attributable to partnership |

$ | 187 | $ | 1.15 | $ | 430 | $ | 3.91 | $ | 53 | $ | 1.11 | ||||||||||||

| Add back or deduct the following: |

||||||||||||||||||||||||

| Depreciation and amortization |

203 | 1.25 | 132 | 1.20 | 26 | 0.55 | ||||||||||||||||||

| Unrealized losses on derivative instruments |

26 | 0.16 | 18 | 0.16 | 15 | 0.31 | ||||||||||||||||||

| Performance fee |

— | — | — | — | (5 | ) | (0.10 | ) | ||||||||||||||||

| Fair value adjustments |

(191 | ) | (1.18 | ) | (10 | ) | (0.09 | ) | 66 | 1.38 | ||||||||||||||

| Revaluation gain |

— | — | (396 | ) | (3.60 | ) | (28 | ) | (0.59 | ) | ||||||||||||||

| Deferred taxes and other items |

167 | 1.03 | 23 | 0.21 | (10 | ) | (0.21 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

FFO(1) |

$ | 392 | $ | 2.41 | $ | 197 | $ | 1.79 | $ | 117 | $ | 2.45 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Includes $68 million gain on a sale of TBE in 2009. |

Brookfield Infrastructure has not included financial information for the years ended December 31, 2008 and 2007, as such information is not available on a basis consistent with the consolidated and combined financial information for the years ended December 31, 2011, 2010 and 2009 and cannot be provided on an IFRS basis without unreasonable effort or expense.

3.B CAPITALIZATION AND INDEBTEDNESS

Not applicable.

3.C REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

8

You should carefully consider the following factors in addition to the other information set forth in this annual report on Form 20-F. If any of the following risks actually occur, our business, financial condition and results of operations and the value of our unitholders’ units would likely suffer.

Risks Relating to Us and Our Partnership

Brookfield Infrastructure and our operating entities are or may become highly leveraged and such indebtedness may result in Brookfield Infrastructure or our operating entities being subject to certain covenants which restrict our ability to engage in certain types of activities or to make distributions to equity.

The Holding LP and many of our operating entities have entered into credit facilities or have incurred other forms of debt, including for the purposes of acquisitions and investments as well as for general corporate purposes. The total quantum of exposure to debt within Brookfield Infrastructure is significant, and we may become more highly leveraged in the future. Some facilities are fully drawn, while some have amounts of principal which are undrawn.

Highly leveraged assets are inherently more sensitive to declines in revenues, increases in expenses and interest rates, and adverse economic, market and industry developments. A leveraged company’s income and net assets also tend to increase or decrease at a greater rate than would otherwise be the case if money had not been borrowed. As a result, the risk of loss associated with a leveraged company, all other things being equal, is generally greater than for companies with comparatively less debt. In addition, the use of indebtedness in connection with an acquisition may give rise to negative tax consequences to certain investors. Leverage may also result in a requirement for short-term liquidity, which may force the sale of assets at times of low demand and/or prices for such assets. This may mean that we are unable to realize fair value for the assets in a sale.

Our credit facilities also contain covenants applicable to the relevant borrower and events of default. Covenants can relate to matters including limitations on financial indebtedness, dividends, investments, minimum net worth, or minimum amounts for interest coverage, adjusted EBITDA or cash flow. If an event of default occurs, or minimum covenant requirements are not satisfied, this can result in a requirement to immediately repay any drawn amounts or the imposition of other restrictions including a prohibition of the payment of distributions to equity.

Our credit facilities or other debt or debt-like instruments may or may not be rated. Should such debt or debt-like instruments be rated, a credit downgrade may have an adverse impact on the cost of such debt.

Our partnership is a holding entity and currently we rely on the Holding LP and, indirectly, the Holding Entities and our operating entities to provide us with the funds necessary to pay distributions and meet our financial obligations.

Our partnership is a holding entity and its sole material asset is its limited partnership interest in the Holding LP, which owns all of the common shares of the Holding Entities, through which we hold all of our interests in the operating entities. Our partnership has no independent means of generating revenue. As a result, we depend on distributions and other payments from the Holding LP and, indirectly, the Holding Entities and our operating entities to provide us with the funds necessary to pay distributions on our units and to meet our financial obligations. The Holding LP, the Holding Entities and our operating entities are legally distinct from us and some of them are or may become restricted in their ability to pay dividends and distributions or otherwise make funds available to us pursuant to local law, regulatory requirements and their contractual agreements, including agreements governing their financing arrangements, such as the Holding LP’s senior secured credit facility and other indebtedness incurred by the operating entities. Any other entities through which we may conduct operations in the future will also be legally distinct from us and may be similarly restricted in their ability to pay dividends and distributions or otherwise make funds available to us under certain conditions. The Holding LP, the Holding Entities and our operating entities will generally be required to service their debt obligations before making distributions to us or their parent entities, as applicable, thereby reducing the amount of our cash flow available to pay distributions, fund working capital and satisfy other needs.

9

Our partnership anticipates that the only distributions that it will receive in respect of our partnership’s limited partnership interests in the Holding LP will consist of amounts that are intended to assist our partnership in making distributions to our unitholders in accordance with our partnership’s distribution policy and to allow our partnership to pay expenses as they become due.

While we plan to review our partnership’s distributions to our unitholders periodically, there is no guarantee that we will be able to increase, or even maintain the level of distributions that are paid. Historically, as a result of this review, we decided to increase distributions in February 2011 and February 2012 respectively. However, such historical increases in distribution payments may not be reflective of any future increases in distribution payments which will be subject to review by the board of directors of our Managing General Partner taking into account prevailing circumstances at the relevant time. Although we intend to make distributions in accordance with our distribution policy, our partnership is not required to pay distributions and neither our partnership nor our Managing General Partner can assure you that our partnership will be able to increase or even maintain the level of distributions that are made in the future.

Future sales or issuances of our units in the public markets, or the perception of such sales or issuances, could depress the trading price of our units.

The sale or issuance of a substantial number of our units or other equity related securities of our partnership in the public markets, or the perception that such sales or issuances could occur, could depress the market price of our units and impair our ability to raise capital through the sale of additional units. We cannot predict the effect that future sales or issuances of our units or other equity-related securities would have on the market price of our units.

The completion of new acquisitions can have the effect of significantly increasing the scale and scope of our operations, including operations in new geographic areas and industry segments, and our Manager may have difficulty managing these additional operations.

A key part of Brookfield Infrastructure’s strategy involves seeking further acquisition opportunities. Acquisitions may increase the scale, scope and diversity of our operations. We depend on the diligence and skill of Brookfield’s professionals to manage us, including integrating all of the acquired business’s operations with our existing operations. These individuals may have difficulty managing the additional operations and may have other responsibilities within Brookfield’s asset management business. If Brookfield does not effectively manage the additional operations, our existing business, financial condition and results of operations may be adversely affected.

Future acquisitions will likely involve some or all of the following risks, which could materially and adversely affect our business, financial condition or results of operations: the difficulty of integrating the acquired operations and personnel into our current operations; potential disruption of our current operations; diversion of resources, including Brookfield’s time and attention; the difficulty of managing the growth of a larger organization; the risk of entering markets in which we have little experience; the risk of becoming involved in labour, commercial or regulatory disputes or litigation related to the new enterprise; and risk of environmental or other liabilities associated with the acquired business; and the risk of a change of control resulting from an acquisition triggering rights of third parties or government agencies under contracts with, or authorizations held by the operating business being acquired. While it is our practice to conduct extensive due diligence investigations into businesses being acquired, it is possible that due diligence may fail to identify a change of control trigger in a material contract or authorization, or that a contractual counterparty or government agency may take a different view on the interpretation of such a provision to that taken by us.

We are subject to foreign currency risk and our risk management activities may adversely affect the performance of our operations.

A significant portion of our current operations are in countries where the U.S. dollar is not the functional currency. These operations pay distributions in currencies other than the U.S. dollar, which we must convert to

10

U.S. dollars prior to making distributions, and certain of our operations have revenues denominated in currencies different from our expense structure, thus exposing us to currency risk. Fluctuations in currency exchange rates could reduce the value of cash flows generated by our operating entities or could make it more expensive for our customers to purchase our services and consequently reduce the demand for our services. In addition, a significant depreciation in the value of such foreign currencies may have a material adverse effect on our business, financial condition and results of operations.

When managing our exposure to such market risks, we may use forward contracts, options, swaps, caps, collars and floors or pursue other strategies or use other forms of derivative instruments. The success of any hedging or other derivative transactions that we enter into generally will depend on our ability to structure contracts that appropriately offset our risk position. As a result, while we may enter into such transactions in order to reduce our exposure to market risks, unanticipated market changes may result in poorer overall investment performance than if the derivative transaction had not been executed. Such transactions may also limit the opportunity for gain if the value of a hedged position increases.

Our partnership is not, and does not intend to become, regulated as an investment company under the Investment Company Act (and similar legislation in other jurisdictions) and if our partnership was deemed an “investment company” under the Investment Company Act, applicable restrictions could make it impractical for us to operate as contemplated.

The Investment Company Act (and similar legislation in other jurisdictions) provide certain protections to investors and impose certain restrictions on companies that are registered as investment companies. Among other things, such rules limit or prohibit transactions with affiliates, impose limitations on the issuance of debt and equity securities and impose certain governance requirements. Our partnership has not been and does not intend to become regulated as an investment company and our partnership intends to conduct its activities so it will not be deemed to be an investment company under the Investment Company Act (and similar legislation in other jurisdictions). In order to ensure that we are not deemed to be an investment company, we may be required to materially restrict or limit the scope of our operations or plans. We will be limited in the types of acquisitions that we may make, and we may need to modify our organizational structure or dispose of assets of which we would not otherwise dispose. Moreover, if anything were to happen which causes our partnership to be deemed an investment company under the Investment Company Act, it would be impractical for us to operate as contemplated. Agreements and arrangements between and among us and Brookfield would be impaired, the type and amount of acquisitions that we would be able to make as a principal would be limited and our business, financial condition and results of operations would be materially adversely affected. Accordingly, we would be required to take extraordinary steps to address the situation, such as the amendment or termination of the Master Services Agreement, the restructuring of our partnership and the Holding Entities, the amendment of our limited partnership agreement or the termination of our partnership, any of which could materially adversely affect the value of our units. In addition, if our partnership were deemed to be an investment company under the Investment Company Act, it would be taxable as a company for U.S. federal income tax purposes, and such treatment could materially adversely affect the value of our units.

Our partnership is an “SEC foreign issuer” under Canadian securities regulations and is exempt from certain requirements of Canadian securities laws and a “foreign private issuer” under U.S. securities laws and as a result is subject to disclosure obligations different from requirements applicable to U.S. domestic registrants listed on the New York Stock Exchange, or the NYSE.

Although our partnership is a reporting issuer in Canada, it is an “SEC foreign issuer” and is exempt from certain Canadian securities laws relating to continuous disclosure obligations and proxy solicitation if our partnership complies with certain reporting requirements applicable in the United States, provided that the relevant documents filed with the U.S. Securities and Exchange Commission, or the SEC, are filed in Canada and sent to our partnership’s security holders in Canada to the extent and in the manner and within the time required by applicable U.S. requirements. Therefore, there may be less publicly available information in Canada about our partnership than would be available if we were a typical Canadian reporting issuer.

11

Although our partnership is subject to the periodic reporting requirement of the U.S. Securities Exchange Act, as amended and the rules and regulations promulgated thereunder, or the Exchange Act, the periodic disclosure required of foreign private issuers under the Exchange Act is different from periodic disclosure required of U.S. domestic registrants. Therefore, there may be less publicly available information about our partnership than is regularly published by or about other public limited partnerships in the United States. Our partnership is exempt from certain other sections of the Exchange Act to which U.S. domestic issuers are subject, including the requirement to provide our unitholders with information statements or proxy statements that comply with the Exchange Act. In addition, insiders and large unitholders of our partnership are not obligated to file reports under Section 16 of the Exchange Act, and certain corporate governance rules imposed by the NYSE are inapplicable to our partnership.

Our failure to maintain effective internal controls could have a material adverse effect on our business in the future and the price of our units.

Any failure to maintain adequate internal controls over financial reporting or to implement required, new or improved controls, or difficulties encountered in their implementation, could cause us to report material weaknesses or other deficiencies in our internal controls over financial reporting and could result in a more than remote possibility of errors or misstatements in our consolidated financial statements that could be material. If we or our independent registered public accounting firm were to conclude that our internal controls over financial reporting were not effective, investors could lose confidence in our reported financial information and the price of our units could decline. Our failure to achieve and maintain effective internal controls could have a material adverse effect on our business in the future, our access to the capital markets and investors’ perception of us. In addition, material weaknesses in our internal controls could require significant expense and management time to remediate.

Risks Relating to Our Operations and the Infrastructure Industry

All of our operating entities are subject to general economic conditions and risks relating to the economy.

Many industries, including the industries in which we operate, are impacted by adverse events in financial markets, which may have a profound effect on global or local economies. Some key impacts of general financial market turmoil include contraction in credit markets resulting in a widening of credit spreads, devaluations and enhanced volatility in global equity, commodity and foreign exchange markets and a general lack of market liquidity. A slowdown in the financial markets or other key measures of the global economy or the local economies of the regions in which we operate, including, but not limited to, new home construction, employment rates, business conditions, inflation, fuel and energy costs, commodity prices, lack of available credit, the state of the financial markets, interest rates and tax rates may adversely affect our growth and profitability.

The demand for services provided by our operating entities are, in part, dependent upon and correlated to general economic conditions and economic growth of the regions applicable to the relevant asset. Poor economic conditions or lower economic growth in a region or regions may, either directly or indirectly, reduce demand for the services provided by an asset.

For example, a credit/liquidity crisis, such as the global crisis experienced in 2008/2009, could materially impact the cost and availability of financing and overall liquidity; the volatility of commodity output prices and currency exchange markets could materially impact revenues, profits and cash flow; volatile energy, commodity input and consumables prices and currency exchange rates could materially impact production costs; poor local or regional economic conditions could materially impact the level of traffic on our toll roads or volume of commodities shipped on our rail network; our timber operations are sensitive to macro-economic conditions in North America and Asia and are thus susceptible to economic recessions or downturns and the level of residential construction, repair and remodeling activity in these markets; our UK regulated distribution business earns connection revenues that would be negatively impacted by an economic recession and a reduction of housing

12

starts in the UK; and the devaluation and volatility of global stock markets could materially impact the valuation of our units. Any one of these factors could have a material adverse effect on our business, financial condition and results of operations. If such increased levels of volatility and market turmoil were to continue, our operations and the trading price of our units may be further adversely impacted.

Some of our operations depend on continued strong demand for commodities, such as natural gas, minerals or timber, for their financial performance. Material reduction in demand for these key commodities can potentially result in reduced value for assets, or in extreme cases, a stranded asset.

Some of our operations are critically linked to the transport or production of key commodities. For example, in the long term, our Australian coal terminal operation relies on demand for coal exports and our North American gas transmission operation relies on demand for natural gas and benefits from higher gas prices. Similarly, our timber operations rely on strong demand for timber products. Accordingly, a downturn in the demand for or price of a key commodity linked to one of our operations may have a material adverse impact on the financial performance or growth prospects of that particular operation.

If a critical upstream or downstream business ceased to operate, this could materially impact our financial performance or the value of one or more of our operating businesses. In extreme cases, our infrastructure could become redundant, resulting in an inability to recover a return on or of capital and potentially triggering covenants and other terms and conditions under associated debt facilities.

General economic and business conditions that impact the debt or equity markets could impact Brookfield Infrastructure’s ability to access credit markets.

General economic and business conditions that impact the debt or equity markets, such as the 2008/2009 global financial crisis, could impact the availability of credit to, and cost of credit for, Brookfield Infrastructure. Brookfield Infrastructure has revolving credit facilities and other short-term borrowings. The amount of interest charged on these will fluctuate based on changes in short-term interest rates. Any economic event that affects interest rates or the ability to refinance borrowings could materially adversely impact Brookfield Infrastructure’s financial condition.

In addition, some of our operations either currently have a credit rating or may have a credit rating in the future. A credit rating downgrade may result in an increase in the cost of debt for the relevant businesses and reduced access to debt markets.

Some assets in our portfolio have a requirement for significant capital expenditure, for example, our Australian railroad operations. For other assets, cash, cash equivalents and short-term investments combined with cash flow generated from operations are believed to be sufficient for it to make the foreseeable required level of capital investment. However, no assurance can be given that additional capital investments will not be required in these businesses. If Brookfield Infrastructure is unable to generate enough cash to finance necessary capital expenditures through operating cash flow, then Brookfield Infrastructure may be required to issue additional equity or incur additional indebtedness. The issue of additional equity would be dilutive to existing unitholders at the time. Any additional indebtedness would increase the leverage and debt payment obligations of Brookfield Infrastructure, and may negatively impact its business, financial condition and results of operations.

All of our operating entities are subject to government policy changes.

Our financial condition and results of operations could also be affected by changes in economic or other government policies or other political or economic developments in each country or region, as well as regulatory changes or administrative practices over which we have no control such as: the regulatory environment related to our business operations and concession agreements; interest rates; currency fluctuations; exchange controls and restrictions; inflation; liquidity of domestic financial and capital markets; policies relating to climate change or

13

policies relating to tax; and other political, social, economic, and environmental and occupational health and safety developments that may occur in or affect the countries in which our operating entities are located or conduct business or the countries in which the customers of our operating entities are located or conduct business or both. In addition, operating costs can be influenced by a wide range of factors, many of which may not be under the control of the owner/operator, including the need to comply with the directives of central and local government authorities. For example, in the case of our utility, transport and energy operations, we cannot predict the impact of future economic conditions, energy conservation measures, alternative fuel requirements, or governmental regulation all of which could reduce the demand for or availability of commodities our transport and energy operations rely upon, most notably coal and natural gas. It is difficult to predict government policies and what form of laws and regulations will be adopted or how they will be construed by the relevant courts, or to the extent which any changes may adversely affect us.

We may be exposed to natural disasters, weather events, uninsurable losses and force majeure events.

Force majeure is the term generally used to refer to an event beyond the control of the party claiming that the event has occurred, including acts of God, fires, floods, earthquakes, wars and labour strikes. The assets of our infrastructure businesses are exposed to unplanned interruptions caused by significant catastrophic events such as cyclones, landslides, explosions, terrorist attacks, war, floods, earthquakes, fires, major plant breakdowns, pipeline or electricity line ruptures, accidents, extreme weather events or other disasters. Operational disruption, as well as supply disruption, could adversely affect the cash flow available from these assets. In addition, the cost of repairing or replacing damaged assets could be considerable and could give rise to third-party claims. In some cases, project agreements can be terminated if the force majeure event is so catastrophic as to render it incapable of remedy within a reasonable time period. Repeated or prolonged interruption may result in a permanent loss of customers, substantial litigation, damage, or penalties for regulatory or contractual non-compliance. Moreover, any loss from such events may not be recoverable in whole or in part under relevant insurance policies. Business interruption insurance is not always available, or available on reasonable economic terms to protect the business from these risks.

Given the nature of the assets operated by our operating entities, we may be more exposed to risks in the insurance market that lead to limitations on coverage and/or increases in premium. For example, our timber operations are not insured against losses from fires, many components of our South American electricity transmission operations and toll roads are not insured or not fully insured against losses from earthquakes and our North American gas transmission operation, our Australasian regulated distribution operations and our European regulated distribution operations self-insure the majority of their line and pipe assets. Therefore, the occurrence of a major or uninsurable event could have a material adverse effect on financial performance. Even if such insurance were available, the cost may be prohibitive. The ability of the operating entities to obtain the required insurance coverage at a competitive price may have an impact on the returns generated by them and accordingly the returns we receive.

For example, the timberlands owned by our timber operations may suffer damage by fire, insect infestation, wind, disease, prolonged drought and other natural and man-made disasters for which there may be no responsive insurance policy. In addition, our regulated energy distribution businesses generate revenue based on the volume transmitted through their systems. Weather that deviates materially from normal conditions could impact these businesses. A number of our businesses may be adversely impacted by extreme weather. Our Australian railroad transports grain on its system, for which it is contracted on a volume basis. A drought could have a material negative impact on revenue from grain transportation.

All of our infrastructure operations may require substantial capital expenditures in the future.

Our utilities and transport and energy operations are capital intensive and require substantial ongoing expenditures for, among other things, additions and improvements, and maintenance and repair of plant and equipment related to our operations. Any failure to make necessary capital expenditures to maintain our

14

operations in the future could impair the ability of our operations to serve existing customers or accommodate increased volumes. In addition, we may not be able to recover such investments based upon the rates our operations are able to charge.

In some of the jurisdictions in which we have utilities or transport and energy operations, certain maintenance capital expenditures may not be covered by the regulatory framework. If our operations in these jurisdictions require significant capital expenditures to maintain our asset base, we may not be able to recover such costs through the regulatory framework. In addition, we may be exposed to disallowance risk in other jurisdictions to the extent that capital expenditures and other costs are not fully recovered through the regulatory framework.

Performance of our operating entities may be harmed by future labour disruptions and economically unfavorable collective bargaining agreements.

Several of our current operations or other business operations have workforces that are unionized or that in the future may become unionized and, as a result, are required to negotiate the wages, benefits and other terms with many of their employees collectively. If an operating entity were unable to negotiate acceptable contracts with any of its unions as existing agreements expire, it could experience a significant disruption of its operations, higher ongoing labour costs and restrictions on its ability to maximize the efficiency of its operations, which could have a material adverse effect on its business, financial condition and results of operations.

In addition, in some jurisdictions where we have operations, labour forces have a legal right to strike which may have an impact on our operations, either directly or indirectly, for example if a critical upstream or downstream counterparty was itself subject to a labour disruption which impacted our ability to operate.

Our operations are exposed to occupational health and safety and accident risks.

Infrastructure projects and operational assets are highly exposed to the risk of accidents that may give rise to personal injury, loss of life, disruption to service and economic loss. Some of the tasks undertaken by employees and contractors are inherently dangerous and have the ability to result in serious injury or death.

Our operating entities are subject to laws and regulations governing health and safety matters, protecting both members of the public and their employees and contractors. Occupational health and safety legislation and regulations differ in each jurisdiction. Any breach of these obligations, or serious accidents involving our employees, contractors or members of the public could expose them to adverse regulatory consequences, including the forfeit or suspension of operating licenses, potential litigation, claims for material financial compensation, reputational damage, fines or other legislative sanction, all of which have the potential to impact the results of our operating entities and our ability to make distributions. Furthermore, where we do not control a business, we have a limited ability to influence health and safety practices and outcomes.

Many of our utilities operations and transport and energy operations are subject to economic regulation and may be exposed to adverse regulatory decisions.

Due to the essential nature of some of the services provided by our assets and the fact that some of these services are provided on a monopoly or near monopoly basis, many of our operations are subject to forms of economic regulation. This regulation can involve different forms of price control and can involve ongoing commitments to economic regulators and other governmental agencies. The terms upon which access to our facilities is provided, including price, can be determined or amended by a regulator periodically. Future terms to apply, including access charges that our operations are entitled to charge, cannot be determined with any certainty, as we do not have discretion as to the amount that can be charged. New legislation, regulatory determinations or changes in regulatory approaches may result in regulation of previously unregulated businesses or material changes to the revenue or profitability of our operations. In addition, a decision by a government or

15

regulator to regulate non-regulated assets may significantly and negatively change the economics of these businesses and the value or financial performance of Brookfield Infrastructure.

Our operating entities are exposed to the risk of environmental damage

Many of Brookfield Infrastructure’s assets are involved in using, handling or transporting substances that are toxic, combustible or otherwise hazardous to the environment. Furthermore some of our assets have operations in or in close proximity to environmentally sensitive areas or densely populated communities. There is a risk of a leak, spillage or other environmental emission will occur at one of these assets, which could cause regulatory infractions, damage to the environment, injury or loss of life. Such an incident if it occurred could result in fines or penalties imposed by regulatory authorities, revocation of licenses or permits required to operate the business or the imposition of more stringent conditions in those licenses or permits, or legal claims for compensation (including punitive damages) by affected stakeholders. All of these have the potential to significantly impact the value or financial performance of Brookfield Infrastructure.

Our operating entities are exposed to the risk of increasing environmental legislation and the broader impacts of climate change.

With an increasing global focus and public sensitivity to environmental sustainability and environmental regulation becoming more stringent, Brookfield Infrastructure’s assets could be subject to increasing environmental responsibility and liability. For example, many jurisdictions in which Brookfield Infrastructure operates are considering implementing, or have implemented, schemes relating to the regulation of carbon emissions. The nature and extent of future regulation in the various jurisdictions in which Brookfield Infrastructure’s operations are situated is uncertain, but is expected to become more complex and stringent.

It is difficult to assess the impact of any such changes on Brookfield Infrastructure. These schemes may result in increased costs to our operations and may have an adverse impact on prospects for growth of some businesses. To the extent such regimes (such as carbon emissions schemes or other carbon emissions regulations) become applicable to the operations of Brookfield Infrastructure (and the costs of such regulations are not able to be fully passed on to consumers), its financial performance may be impacted due to costs applied to carbon emissions and increased compliance costs.

Our operating entities are also subject to laws and regulations relating to the protection of the environment and pollution. Standards are set by these laws and regulations regarding certain aspects of environmental quality and reporting, provide for penalties and other liabilities for the violation of such standards, and establish, in certain circumstances, obligations to remediate and rehabilitate current and former facilities and locations where our operations are, or were, conducted. These laws and regulations may have a detrimental impact on the financial performance of our infrastructure operations and projects through increased compliance costs or otherwise. Any breach of these obligations, or even incidents relating to the environment that do not amount to a breach, could adversely affect the results of our operating entities and their reputations and expose them to claims for financial compensation or adverse regulatory consequences.

Our operations may also be exposed directly or indirectly to the broader impacts of climate change, including extreme weather events, export constraints on commodities, increased resource prices and restrictions on energy and water usage.

Our operating entities may be exposed to higher levels of regulation than in other sectors and breaches of such regulations could expose our operating entities to claims for financial compensation and adverse regulatory consequences.

In many instances, our ownership and operation of infrastructure assets involves an ongoing commitment to a governmental agency. The nature of these commitments exposes the owners of infrastructure assets to a higher

16

level of regulatory control than typically imposed on other businesses. For example, our timber operations are subject to provincial, state and federal government regulations relating to forestry practices and the export of logs. Moreover, several of our utilities and transport and energy operations are subject to government safety and reliability regulations that are specific to their industries. The risk that a governmental agency will repeal, amend, enact or promulgate a new law or regulation or that a governmental authority will issue a new interpretation of the law or regulations, could affect our operating entities substantially.

Sometimes commitments to governmental agencies, for example, under toll road concession arrangements, involve the posting of financial security for performance of obligations. If obligations are breached these financial securities may be called upon by the relevant agency.

There is also the risk that our operating entities do not have, might not obtain, or may lose permits necessary for their operations. Permits or special rulings may be required on taxation, financial and regulatory related issues. Even though most permits and licenses are obtained before the commencement of operations, many of these licenses and permits have to be renewed or maintained over the life of the business. The conditions and costs of these permits, licenses and consents may be changed on any renewal, or, in some cases, may not be renewed due to unforeseen circumstances or a subsequent change in regulations. In any event, the renewal or non-renewal could have a material adverse effect on our business, financial condition and results of operations.

The risk that a government will repeal, amend, enact or promulgate a new law or regulation or that a regulator or other government agency will issue a new interpretation of the law or regulations, may affect our operations or a project substantially. This may also be due to court decisions and actions of government agencies that affect these operations or a project’s performance or the demand for its services. For example, a government policy decision may result in adverse financial outcomes for us through directions to spend money to improve security, safety, reliability or quality of service.

The lands used for our infrastructure assets may be subject to adverse claims or governmental or First Nations rights.

Our operations require large areas of land on which to be constructed and operated. The rights to use the land can be obtained through freehold title, leases and other rights of use. Although we believe that we have valid rights to all material easements, licenses and rights of way for our infrastructure operations, not all of our easements, licenses and rights of way are registered against the lands to which they relate and may not bind subsequent owners. Additionally, different jurisdictions have adopted different systems of land title and in some jurisdictions it may not be possible to ascertain definitively who has the legal right to enter into land tenure arrangements with the asset owner. In some jurisdictions where we have operations, it is possible to claim indigenous rights to land and the existence or declaration of native title may affect the existing or future activities of our utilities, transport and energy or timber operations and impact on their business, financial condition and results of operations.

In addition, a government, court, regulator, or aboriginal group may make a decision or take action that affects an asset or project’s performance or the demand for its services. In particular, a regulator may restrict our access to an asset, or may require us to provide third parties with access, or may affect the pricing structure so as to lower our revenues and earnings. In Australia, native title legislation provides for a series of procedures that may need to be complied with if native title is declared on relevant land. In Canada, courts have recognized that First Nations peoples may possess rights at law in respect of land used or occupied by their ancestors where treaties have not been concluded to deal with these rights. In either case, the claims of a First Nations group may affect the existing or future activities of our operations, impact on our business, financial condition and results of operations, or require that compensation be paid.

17

We operate in a highly competitive market for acquisition opportunities.

Our acquisition strategy is dependent to a significant extent on the ability of Brookfield to identify acquisition opportunities that are suitable for us. We face competition for acquisitions primarily from investment funds, operating companies acting as strategic buyers, construction companies, commercial and investment banks, and commercial finance companies. Many of these competitors are substantially larger and have considerably greater financial, technical and marketing resources than are available to us. Some of these competitors may also have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of acquisitions and to offer terms that we are unable or unwilling to match. Due to the capital intensive nature of infrastructure acquisitions, in order to finance acquisitions we will need to compete for equity capital from institutional investors and other equity providers, including Brookfield, and our ability to consummate acquisitions will be dependent on such capital continuing to be available. Increases in interest rates could also make it more difficult to consummate acquisitions because our competitors may have a lower cost of capital which may enable them to bid higher prices for assets. In addition, because of our affiliation with Brookfield, there is a higher risk that when we participate with Brookfield and others in joint ventures, partnerships and consortiums on acquisitions we may become subject to antitrust or competition laws that we would not be subject to if we were acting alone. These factors may create competitive disadvantages for us with respect to acquisition opportunities.

We cannot provide any assurance that the competitive pressures we face will not have a material adverse effect on our business, financial condition and results of operations or that Brookfield will be able to identify and make acquisitions on our behalf that are consistent with our objectives or that generate attractive returns for our unitholders. We may lose acquisition opportunities in the future if we do not match prices, structures and terms offered by competitors, if we are unable to access sources of equity or obtain indebtedness at attractive rates or if we become subject to antitrust or competition laws. Alternatively, we may experience decreased rates of return and increased risks of loss if we match prices, structures and terms offered by competitors.

Infrastructure assets may be subject to competition risk.

Some assets may be affected by the existence of other competing assets owned and operated by other parties. There can be no assurance that our businesses can renew all their existing contracts or win additional contracts with their existing or potential customers. The ability of our businesses to maintain or improve their revenue is dependent on price, availability and customer service as well as on the availability of access to alternative infrastructure. In the case where the relevant business is unable to retain customers and/or unable to win additional customers to replace those customers it is unable to retain, the revenue from such assets will be reduced.

In addition, wood and paper products are subject to increasing competition from a variety of substitute products, including non-wood and engineered wood products and electronic media. The competitive position of our timber operations and the price realized for our products is also influenced by a number of other factors including: the ability to attract and maintain long-term customer relationships; the quality of our products; the health of the regional converting industry; the costs of timber production; the availability, quality and cost of labour; the cost of fuel; shipping and fee for service costs; changes in global timber supply; technological advances that increase yield in other regions; and the price and availability of substitute wood and non-wood products.

Investments in infrastructure projects prior to or during the construction phase are likely to be subject to increased risk.

A key part of Brookfield Infrastructure’s growth strategy involves identifying and taking advantage of organic growth opportunities within our existing businesses. These opportunities typically involve development and construction of new infrastructure. Investments in new infrastructure projects during the development or

18

construction phase are likely to be subject to additional risk that the project will not receive all required approvals, will not be completed within budget, within the agreed timeframe and to the agreed specifications and, where applicable, will not be successfully integrated into the existing assets. During the construction phase, major risks include: (i) a delay in the projected completion of the project, which can result in an increase in total project construction costs through higher capitalized interest charges and additional labour, material expenses, and a resultant delay in the commencement of cash flow; (ii) the insolvency of the head contractor, a major subcontractor and/or a key equipment supplier, and (iii) construction costs exceeding estimates for various reasons, including inaccurate engineering and planning, labour and building material costs in excess of expectations and unanticipated problems with project start-up. Such unexpected increases may result in increased debt service costs, operations phase debt service costs, operations and maintenance expenses and damage payments for late delivery. This may result in the inability of project owners to meet the higher interest and principal repayments arising from the additional debt required.

Finally, construction projects may be exposed to significant liquidated damages to the extent that commercial operations are delayed beyond prescribed dates or that performance levels do not meet guaranteed levels. For example, large expansion contracts at our Australian railroad contain material liquidated damage clauses if commercial operations are delayed beyond certain dates.

Brookfield has structured some of our current operations as joint ventures, partnerships and consortium arrangements, and we intend to continue to operate in this manner in the future, which will reduce Brookfield’s and our control over our operations and may subject us to additional obligations.

Brookfield has structured some of our current operations as joint ventures, partnerships and consortium arrangements. An integral part of our strategy is to participate with institutional investors in Brookfield sponsored or co-sponsored consortiums for single asset acquisitions and as a partner in or alongside Brookfield sponsored or co-sponsored partnerships that target acquisitions that suit our profile. These arrangements are driven by the magnitude of capital required to complete acquisitions of infrastructure assets and other industry-wide trends that we believe will continue. Such arrangements involve risks not present where a third party is not involved, including the possibility that partners or co-venturers might become bankrupt or otherwise fail to fund their share of required capital contributions. Additionally, partners or co-venturers might at any time have economic or other business interests or goals different from us and Brookfield.

Joint ventures, partnerships and consortium investments generally provide for a reduced level of control over an acquired company because governance rights are shared with others. Accordingly, decisions relating to the underlying operations, including decisions relating to the management and operation and the timing and nature of any exit, are often made by a majority vote of the investors or by separate agreements that are reached with respect to individual decisions. In addition, such operations may be subject to the risk that the company may make business, financial or management decisions with which we do not agree or the management of the company may take risks or otherwise act in a manner that does not serve our interests. Because we may not have the ability to exercise control over such operations, we may not be able to realize some or all of the benefits that we believe will be created from our and Brookfield’s involvement. If any of the foregoing were to occur, our business, financial condition and results of operations could suffer as a result.