UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22092

Oppenheimer Global Value Fund

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Arthur S. Gabinet

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: April 30

Date of reporting period: 10/30/2015

Item 1. Reports to Stockholders.

| 3 | ||||||

| 6 | ||||||

| 9 | ||||||

| 11 | ||||||

| 14 | ||||||

| 16 | ||||||

| 17 | ||||||

| Financial Highlights | 18 | |||||

| Notes to Financial Statements | 23 | |||||

| 39 | ||||||

| 42 | ||||||

| Trustees and Officers | 43 | |||||

|

|

44

|

|

Class A Shares

AVERAGE ANNUAL TOTAL RETURNS AT 10/30/15*

| Class A Shares of the Fund | ||||||||

| Without Sales Charge |

With Sales Charge | MSCI All Country World Index |

||||||

| 6-Month |

-2.17% | -7.79% | -4.77% | |||||

|

|

||||||||

| 1-Year |

3.44 | -2.51 | -0.03 | |||||

|

|

||||||||

| 5-Year |

9.94 | 8.65 | 7.68 | |||||

|

|

||||||||

| Since Inception (10/1/07) |

5.19 | 4.42 | 2.03 | |||||

|

|

||||||||

Performance data quoted represents past performance, which does not guarantee future results.

The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 5.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. Returns for periods of less than one year are cumulative and not annualized. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677).

*October 30, 2015, was the last business day of the Fund’s semiannual period. See Note 2 of the accompanying Notes to Financial Statements. Index returns are calculated through October 31, 2015.

2 OPPENHEIMER GLOBAL VALUE FUND

In a volatile market environment, the Fund’s Class A shares (without sales charge) returned -2.17% during the reporting period, outperforming the MSCI All Country World Index (the “Index”), which returned -4.77%. The Fund’s outperformance versus the Index was driven by its holdings in the financials, materials and energy sectors.

3 OPPENHEIMER GLOBAL VALUE FUND

4 OPPENHEIMER GLOBAL VALUE FUND

5 OPPENHEIMER GLOBAL VALUE FUND

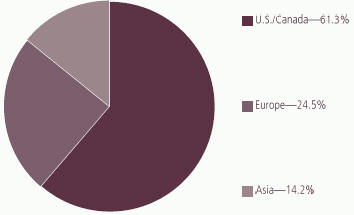

REGIONAL ALLOCATION

Portfolio holdings and allocations are subject to change. Percentages are as of October 30, 2015, and are based on the total market value of investments.

*October 30, 2015, was the last business day of the Fund’s semiannual period. See Note 2 of the accompanying Notes to Financial Statements.

6 OPPENHEIMER GLOBAL VALUE FUND

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 10/30/15

| Inception Date | 6-Month | 1-Year | 5-Year | Since Inception | ||||||||||||||

| Class A (GLVAX) |

10/1/07 | -2.17% | 3.44% | 9.94% | 5.19% | |||||||||||||

| Class C (GLVCX) |

10/1/07 | -2.52% | 2.67% | 9.10% | 4.39% | |||||||||||||

| Class I (GLVIX) |

8/28/12 | -1.93% | 3.93% | N/A | 14.10% | |||||||||||||

| Class R (GLVNX) |

10/1/07 | -2.27% | 3.21% | 9.66% | 4.92% | |||||||||||||

| Class Y (GLVYX) |

10/1/07 | -2.03% | 3.72% | 10.27% | 5.52% | |||||||||||||

|

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 10/30/15

| ||||||||||||||||||

| Inception Date | 6-Month | 1-Year | 5-Year | Since Inception | ||||||||||||||

| Class A (GLVAX) |

10/1/07 | -7.79% | -2.51% | 8.65% | 4.42% | |||||||||||||

| Class C (GLVCX) |

10/1/07 | -3.50% | 1.67% | 9.10% | 4.39% | |||||||||||||

| Class I (GLVIX) |

8/28/12 | -1.93% | 3.93% | N/A | 14.10% | |||||||||||||

| Class R (GLVNX) |

10/1/07 | -2.27% | 3.21% | 9.66% | 4.92% | |||||||||||||

| Class Y (GLVYX) |

10/1/07 | -2.03% | 3.72% | 10.27% | 5.52% | |||||||||||||

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 5.75%; and for Class C shares, the contingent deferred sales charge (“CDSC”) of 1% for the 1-year period. Prior to 7/1/14, Class R shares were named Class N shares. Beginning 7/1/14, new purchases of Class R shares will no longer be subject to a CDSC upon redemption (any CDSC will remain in effect for purchases prior to 7/1/14). There is no sales charge for Class I and Class Y shares. Returns for periods of less than one year are cumulative and not annualized.

The Fund’s performance is compared to the performance of the MSCI All Country World Index. The MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Index is unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the Index. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc. or its affiliates.

7 OPPENHEIMER GLOBAL VALUE FUND

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800.CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

8 OPPENHEIMER GLOBAL VALUE FUND

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and/or contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended October 30, 2015.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended October 30, 2015” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9 OPPENHEIMER GLOBAL VALUE FUND

| Actual | Beginning Account Value May 1, 2015 |

Ending Account Value |

Expenses 6 Months Ended |

|||||||||

|

|

||||||||||||

| Class A |

$ | 1,000.00 | $ | 978.30 | $ | 6.45 | ||||||

|

|

||||||||||||

| Class C |

1,000.00 | 974.80 | 10.22 | |||||||||

|

|

||||||||||||

| Class I |

1,000.00 | 980.70 | 4.27 | |||||||||

|

|

||||||||||||

| Class R |

1,000.00 | 977.30 | 7.74 | |||||||||

|

|

||||||||||||

| Class Y |

1,000.00 | 979.70 | 5.21 | |||||||||

| Hypothetical | ||||||||||||

| (5% return before expenses) | ||||||||||||

|

|

||||||||||||

| Class A |

1,000.00 | 1,018.50 | 6.58 | |||||||||

|

|

||||||||||||

| Class C |

1,000.00 | 1,014.70 | 10.43 | |||||||||

|

|

||||||||||||

| Class I |

1,000.00 | 1,020.70 | 4.35 | |||||||||

|

|

||||||||||||

| Class R |

1,000.00 | 1,017.20 | 7.90 | |||||||||

|

|

||||||||||||

| Class Y |

1,000.00 | 1,019.75 | 5.32 | |||||||||

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended October 30, 2015 are as follows:

| Class | Expense Ratios | |||

|

|

||||

| Class A |

1.30% | |||

|

|

||||

| Class C |

2.06 | |||

|

|

||||

| Class I |

0.86 | |||

|

|

||||

| Class R |

1.56 | |||

|

|

||||

| Class Y |

1.05 | |||

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

10 OPPENHEIMER GLOBAL VALUE FUND

STATEMENT OF INVESTMENTS October 30, 2015* Unaudited

11 OPPENHEIMER GLOBAL VALUE FUND

STATEMENT OF INVESTMENTS Unaudited / Continued

Footnotes to Statement of Investments

* October 30, 2015 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

1. Non-income producing security.

12 OPPENHEIMER GLOBAL VALUE FUND

Footnotes to Statement of Investments (Continued)

2. Represents securities sold under Rule 144A, which are exempt from registration under the Securities Act of 1933, as amended. These securities have been determined to be liquid under guidelines established by the Board of Trustees. These securities amount to $10,678,708 or 2.11% of the Fund’s net assets at period end.

3. Rate shown is the 7-day yield at period end.

4. Is or was an affiliate, as defined in the Investment Company Act of 1940, as amended, at or during the reporting period, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the reporting period in which the issuer was an affiliate are as follows:

| Shares April 30, 2015 |

Gross Additions |

Gross Reductions |

Shares October 30, 2015 |

|||||||||||||

|

|

||||||||||||||||

| Oppenheimer Institutional Money |

||||||||||||||||

| Market Fund, Cl. E |

— | 130,888,037 | 120,517,436 | 10,370,601 | ||||||||||||

| Value | Income | |||||||

|

|

||||||||

| Oppenheimer Institutional Money Market Fund, Cl. E |

$ | 10,370,601 | $ | 4,958 | ||||

Distribution of investments representing geographic holdings, as a percentage of total investments at value, is as follows:

| Geographic Holdings | Value | Percent | ||||||||||||||

|

| ||||||||||||||||

| United States |

$ | 311,982,415 | 61.3 % | |||||||||||||

| China |

44,463,270 | 8.7 | ||||||||||||||

| United Kingdom |

33,178,391 | 6.5 | ||||||||||||||

| Japan |

21,914,115 | 4.3 | ||||||||||||||

| Germany |

21,247,703 | 4.2 | ||||||||||||||

| France |

19,162,748 | 3.8 | ||||||||||||||

| Switzerland |

17,684,452 | 3.5 | ||||||||||||||

| Sweden |

12,393,884 | 2.4 | ||||||||||||||

| Denmark |

7,916,671 | 1.6 | ||||||||||||||

| Netherlands |

7,263,166 | 1.4 | ||||||||||||||

| Finland |

6,166,127 | 1.2 | ||||||||||||||

| India |

5,658,931 | 1.1 | ||||||||||||||

|

|

| |||||||||||||||

| Total |

$ | 509,031,873 | 100.0 % | |||||||||||||

|

|

| |||||||||||||||

See accompanying Notes to Financial Statements.

13 OPPENHEIMER GLOBAL VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES October 30, 20151 Unaudited

|

|

||||

| Assets |

||||

| Investments, at value—see accompanying statement of investments: |

||||

| Unaffiliated companies (cost $439,700,977) |

$ | 498,661,272 | ||

| Affiliated companies (cost $10,370,601) |

10,370,601 | |||

|

|

|

|||

| 509,031,873 | ||||

|

|

||||

| Receivables and other assets: |

||||

| Dividends |

527,076 | |||

| Shares of beneficial interest sold |

393,421 | |||

| Investments sold |

369,705 | |||

| Other |

13,057 | |||

|

|

|

|||

| Total assets |

510,335,132 | |||

|

|

||||

| Liabilities |

||||

| Bank overdraft |

470 | |||

|

|

||||

| Payables and other liabilities: |

||||

| Investments purchased |

3,518,521 | |||

| Shares of beneficial interest redeemed |

702,624 | |||

| Distribution and service plan fees |

63,923 | |||

| Trustees’ compensation |

6,344 | |||

| Shareholder communications |

1,511 | |||

| Other |

18,563 | |||

|

|

|

|||

| Total liabilities |

4,311,956 | |||

|

|

||||

| Net Assets |

$ | 506,023,176 | ||

|

|

|

|||

|

|

||||

| Composition of Net Assets |

||||

| Par value of shares of beneficial interest |

$ | 12,078 | ||

|

|

||||

| Additional paid-in capital |

459,048,588 | |||

|

|

||||

| Accumulated net investment loss |

(1,407,156) | |||

|

|

||||

| Accumulated net realized loss on investments and foreign currency transactions |

(10,574,681) | |||

|

|

||||

| Net unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies |

58,944,347 | |||

|

|

|

|||

| Net Assets |

$ | 506,023,176 | ||

|

|

|

|||

1. October 30, 2015 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

14 OPPENHEIMER GLOBAL VALUE FUND

|

|

||||

| Net Asset Value Per Share |

||||

|

Class A Shares: |

||||

|

Net asset value and redemption price per share (based on net assets of $212,608,738 and 5,064,065 shares of beneficial interest outstanding) |

$ | 41.98 | ||

|

Maximum offering price per share (net asset value plus sales charge of 5.75% of offering price) |

$ | 44.54 | ||

|

|

||||

|

Class C Shares: |

||||

|

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $80,976,440 and 2,017,444 shares of beneficial interest outstanding) |

$ | 40.14 | ||

|

|

||||

|

Class I Shares: |

||||

|

Net asset value, redemption price and offering price per share (based on net assets of $78,672,271 and 1,843,041 shares of beneficial interest outstanding) |

$ | 42.69 | ||

|

|

||||

|

Class R Shares: |

||||

|

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $8,033,410 and 194,486 shares of beneficial interest outstanding) |

$ | 41.31 | ||

|

|

||||

| Class Y Shares: |

||||

| Net asset value, redemption price and offering price per share (based on net assets of $125,732,317 and 2,958,844 shares of beneficial interest outstanding) |

$ | 42.49 | ||

See accompanying Notes to Financial Statements.

15 OPPENHEIMER GLOBAL VALUE FUND

OPERATIONS For the Six Months Ended October 30, 20151 Unaudited

|

|

||||||

| Investment Income |

||||||

| Dividends: |

||||||

| Unaffiliated companies (net of foreign withholding taxes of $123,223) |

$ | 2,820,912 | ||||

| Affiliated companies |

4,958 | |||||

|

|

|

|

||||

| Total investment income |

2,825,870 | |||||

|

|

||||||

| Expenses |

||||||

| Management fees |

1,909,385 | |||||

|

|

||||||

| Distribution and service plan fees: |

||||||

| Class A |

272,597 | |||||

| Class C |

425,127 | |||||

| Class R |

20,072 | |||||

|

|

||||||

| Transfer and shareholder servicing agent fees: |

||||||

| Class A |

244,449 | |||||

| Class C |

93,593 | |||||

| Class I |

5,652 | |||||

| Class R |

8,878 | |||||

| Class Y |

136,722 | |||||

|

|

||||||

| Shareholder communications: |

||||||

| Class A |

6,126 | |||||

| Class C |

2,346 | |||||

| Class I |

39 | |||||

| Class R |

211 | |||||

| Class Y |

1,984 | |||||

|

|

||||||

| Custodian fees and expenses |

14,195 | |||||

|

|

||||||

| Trustees’ compensation |

3,694 | |||||

|

|

||||||

| Borrowing fees |

2,131 | |||||

|

|

||||||

| Other |

40,476 | |||||

|

|

|

|

||||

| Total expenses |

3,187,677 | |||||

| Less reduction to custodian expenses |

(60) | |||||

| Less waivers and reimbursements of expenses |

(3,226) | |||||

|

|

|

|

||||

| Net expenses |

3,184,391 | |||||

|

|

||||||

| Net Investment Loss |

(358,521) | |||||

|

|

||||||

| Realized and Unrealized Gain (Loss) |

||||||

| Net realized loss on: |

||||||

| Investments from unaffiliated companies |

(4,134,174) | |||||

| Foreign currency transactions |

(823,469) | |||||

|

|

|

|

||||

| Net realized loss |

(4,957,643) | |||||

|

|

||||||

| Net change in unrealized appreciation/depreciation on: |

||||||

| Investments |

(3,118,523) | |||||

| Translation of assets and liabilities denominated in foreign currencies |

1,832,679 | |||||

|

|

|

|

||||

| Net change in unrealized appreciation/depreciation |

(1,285,844) | |||||

|

|

||||||

| Net Decrease in Net Assets Resulting from Operations |

$ | (6,602,008) | ||||

|

|

|

|

||||

1. October 30, 2015 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

See accompanying Notes to Financial Statements.

16 OPPENHEIMER GLOBAL VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| Six Months Ended October 30, 20151 (Unaudited) |

Year Ended April 30, 2015 |

|||||||

|

|

||||||||

| Operations |

||||||||

| Net investment loss |

$ | (358,521) | $ | (281,015) | ||||

|

|

||||||||

| Net realized loss |

(4,957,643) | (5,674,707) | ||||||

|

|

||||||||

| Net change in unrealized appreciation/depreciation |

(1,285,844) | 22,951,999 | ||||||

|

|

|

|||||||

| Net increase (decrease) in net assets resulting from operations |

(6,602,008) | 16,996,277 | ||||||

|

|

||||||||

| Dividends and/or Distributions to Shareholders |

||||||||

| Distributions from net realized gain: |

||||||||

| Class A |

— | (4,487,045) | ||||||

| Class C |

— | (1,634,041) | ||||||

| Class I |

— | (260,759) | ||||||

| Class R2 |

— | (127,350) | ||||||

| Class Y |

— | (2,408,895) | ||||||

|

|

|

|||||||

| — | (8,918,090) | |||||||

|

|

||||||||

| Beneficial Interest Transactions |

||||||||

| Net increase (decrease) in net assets resulting from beneficial interest transactions: |

||||||||

| Class A |

(13,160,267) | (73,763,587) | ||||||

| Class C |

(6,214,664) | (5,636,807) | ||||||

| Class I |

56,463,753 | 3,859,342 | ||||||

| Class R2 |

110,498 | 2,547,817 | ||||||

| Class Y |

(4,668,165) | 16,497,902 | ||||||

|

|

|

|||||||

| 32,531,155 | (56,495,333) | |||||||

|

|

||||||||

| Net Assets |

||||||||

| Total increase (decrease) |

25,929,147 | (48,417,146) | ||||||

|

|

||||||||

| Beginning of period |

480,094,029 | 528,511,175 | ||||||

|

|

|

|||||||

| End of period (including accumulated net investment loss of $1,407,156 and $1,048,635, respectively) |

$ | 506,023,176 | $ | 480,094,029 | ||||

|

|

|

|||||||

1. October 30, 2015 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

2. Effective July 1, 2014, Class N shares were renamed Class R. See Note 1 of the accompanying Notes.

See accompanying Notes to Financial Statements.

17 OPPENHEIMER GLOBAL VALUE FUND

| Class A | Six Months October 30, 20151 |

Year Ended April 30, 2015 |

Year Ended April 30, 2014 |

Year Ended April 30, |

Year Ended April 30, |

Year Ended April 29, |

||||||||||||||||||

|

|

||||||||||||||||||||||||

| Per Share Operating Data |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 42.91 | $ | 42.01 | $ | 35.48 | $ | 29.20 | $ | 31.60 | $ | 26.18 | ||||||||||||

|

|

||||||||||||||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment income (loss)2 |

(0.02) | 0.02 | (0.17) | 0.12 | (0.09) | (0.16) | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.91) | 1.63 | 6.75 | 6.16 | (2.18) | 5.58 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total from investment operations |

(0.93) | 1.65 | 6.58 | 6.28 | (2.27) | 5.42 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Dividends and/or distributions to shareholders: |

||||||||||||||||||||||||

| Dividends from net investment income |

0.00 | 0.00 | (0.05) | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

| Distributions from net realized gain |

0.00 | (0.75) | 0.00 | 0.00 | (0.13) | 0.00 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total dividends and/or distributions to shareholders |

0.00 | (0.75) | (0.05) | 0.00 | (0.13) | 0.00 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Net asset value, end of period |

$ | 41.98 | $ | 42.91 | $ | 42.01 | $ | 35.48 | $ | 29.20 | $ | 31.60 | ||||||||||||

|

|

|

|||||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Total Return, at Net Asset Value3 |

(2.17)% | 3.94% | 18.59% | 21.51% | (7.16)% | 20.70% | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 212,609 | $ | 231,060 | $ | 301,854 | $ | 94,978 | $ | 56,178 | $ | 32,944 | ||||||||||||

|

|

||||||||||||||||||||||||

| Average net assets (in thousands) |

$ | 219,716 | $ | 266,375 | $ | 206,885 | $ | 63,128 | $ | 33,226 | $ | 8,939 | ||||||||||||

|

|

||||||||||||||||||||||||

| Ratios to average net assets:4 |

||||||||||||||||||||||||

| Net investment income (loss) |

(0.11)% | 0.04% | (0.41)% | 0.40% | (0.33)% | (0.57)% | ||||||||||||||||||

| Expenses excluding interest and fees from borrowings |

1.30% | 1.31% | 1.30% | 1.34% | 1.41% | 1.73% | ||||||||||||||||||

| Interest and fees from borrowings |

0.00%5 | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total expenses6 |

1.30% | 1.31% | 1.30% | 1.34% | 1.41% | 1.73% | ||||||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses |

1.30% | 1.31% | 1.30% | 1.34% | 1.34% | 1.40% | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Portfolio turnover rate |

43% | 102% | 59% | 87% | 62% | 37% | ||||||||||||||||||

1. October 30, 2015 and April 29, 2011 represent the last business days of the Fund’s respective reporting periods.

See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| Six Months Ended October 30, 2015 |

1.30 | % | ||||||

| Year Ended April 30, 2015 |

1.31 | % | ||||||

| Year Ended April 30, 2014 |

1.30 | % | ||||||

| Year Ended April 30, 2013 |

1.34 | % | ||||||

| Year Ended April 30, 2012 |

1.41 | % | ||||||

| Year Ended April 29, 2011 |

1.73 | % |

See accompanying Notes to Financial Statements.

18 OPPENHEIMER GLOBAL VALUE FUND

| Class C | Six Months October 30, 20151 |

Year Ended April 30, 2015 |

Year Ended April 30, 2014 |

Year Ended April 30, 2013 |

Year Ended April 30, 2012 |

Year Ended April 29, 2011 1 |

||||||||||||||||||

|

|

||||||||||||||||||||||||

| Per Share Operating Data |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 41.18 | $ | 40.65 | $ | 34.56 | $ | 28.67 | $ | 31.26 | $ | 26.11 | ||||||||||||

|

|

||||||||||||||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment loss2 |

(0.17) | (0.30) | (0.50) | (0.13) | (0.33) | (0.37) | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.87) | 1.58 | 6.59 | 6.02 | (2.13) | 5.52 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total from investment operations |

(1.04) | 1.28 | 6.09 | 5.89 | (2.46) | 5.15 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Dividends and/or distributions to shareholders: |

||||||||||||||||||||||||

| Dividends from net investment income |

0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

| Distributions from net realized gain |

0.00 | (0.75) | 0.00 | 0.00 | (0.13) | 0.00 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total dividends and/or distributions to shareholders |

0.00 | (0.75) | 0.00 | 0.00 | (0.13) | 0.00 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Net asset value, end of period |

$ | 40.14 | $ | 41.18 | $ | 40.65 | $ | 34.56 | $ | 28.67 | $ | 31.26 | ||||||||||||

|

|

|

|||||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Total Return, at Net Asset Value3 |

(2.52)% | 3.16% | 17.65% | 20.55% | (7.84)% | 19.73% | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 80,977 | $ | 89,540 | $ | 94,011 | $ | 18,062 | $ | 9,116 | $ | 3,824 | ||||||||||||

|

|

||||||||||||||||||||||||

| Average net assets (in thousands) |

$ | 84,119 | $ | 92,759 | $ | 51,545 | $ | 11,396 | $ | 5,630 | $ | 745 | ||||||||||||

|

|

||||||||||||||||||||||||

| Ratios to average net assets:4 |

||||||||||||||||||||||||

| Net investment loss |

(0.87)% | (0.75)% | (1.23)% | (0.43)% | (1.19)% | (1.26)% | ||||||||||||||||||

| Expenses excluding interest and fees from borrowings |

2.06% | 2.07% | 2.06% | 2.16% | 2.26% | 2.63% | ||||||||||||||||||

| Interest and fees from borrowings |

0.00%5 | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total expenses6 |

2.06% | 2.07% | 2.06% | 2.16% | 2.26% | 2.63% | ||||||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses |

2.06% | 2.07% | 2.06% | 2.14% | 2.15% | 2.15% | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Portfolio turnover rate |

43% | 102% | 59% | 87% | 62% | 37% | ||||||||||||||||||

1. October 30, 2015 and April 29, 2011 represent the last business days of the Fund’s respective reporting periods.

See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| Six Months Ended October 30, 2015 |

2.06 | % | ||||||

| Year Ended April 30, 2015 |

2.07 | % | ||||||

| Year Ended April 30, 2014 |

2.06 | % | ||||||

| Year Ended April 30, 2013 |

2.16 | % | ||||||

| Year Ended April 30, 2012 |

2.26 | % | ||||||

| Year Ended April 29, 2011 |

2.63 | % |

See accompanying Notes to Financial Statements.

19 OPPENHEIMER GLOBAL VALUE FUND

| FINANCIAL HIGHLIGHTS Continued | ||||

| Class I | Six Months Ended October 30, 20151 (Unaudited) |

Year Ended April 30, 2015 |

Year Ended April 30, 2014 |

Period Ended April 30, |

||||||||||||

|

|

||||||||||||||||

| Per Share Operating Data |

||||||||||||||||

| Net asset value, beginning of period |

$ | 43.53 | $ | 42.42 | $ | 35.76 | $ | 28.68 | ||||||||

|

|

||||||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||

| Net investment income3 |

0.06 | 0.18 | 0.04 | 0.07 | ||||||||||||

| Net realized and unrealized gain (loss) |

(0.90) | 1.68 | 6.78 | 7.01 | ||||||||||||

|

|

|

|||||||||||||||

| Total from investment operations |

(0.84) | 1.86 | 6.82 | 7.08 | ||||||||||||

|

|

||||||||||||||||

| Dividends and/or distributions to shareholders: |

||||||||||||||||

| Dividends from net investment income |

0.00 | 0.00 | (0.16) | 0.00 | ||||||||||||

| Distributions from net realized gain |

0.00 | (0.75) | 0.00 | 0.00 | ||||||||||||

|

|

|

|||||||||||||||

| Total dividends and/or distributions to shareholders |

0.00 | (0.75) | (0.16) | 0.00 | ||||||||||||

|

|

||||||||||||||||

| Net asset value, end of period |

$ | 42.69 | $ | 43.53 | $ | 42.42 | $ | 35.76 | ||||||||

|

|

|

|||||||||||||||

|

|

||||||||||||||||

| Total Return, at Net Asset Value4 |

(1.93)% | 4.40% | 19.09% | 24.69% | ||||||||||||

|

|

||||||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 78,672 | $ | 18,703 | $ | 14,350 | $ | 6,364 | ||||||||

|

|

||||||||||||||||

| Average net assets (in thousands) |

$ | 37,381 | $ | 15,286 | $ | 10,473 | $ | 2,381 | ||||||||

|

|

||||||||||||||||

| Ratios to average net assets:5 |

||||||||||||||||

| Net investment income |

0.31% | 0.43% | 0.10% | 0.31% | ||||||||||||

| Expenses excluding interest and fees from borrowings |

0.86% | 0.87% | 0.86% | 0.89% | ||||||||||||

| Interest and fees from borrowings |

0.00%6 | 0.00% | 0.00% | 0.00% | ||||||||||||

|

|

|

|||||||||||||||

| Total expenses7 |

0.86% | 0.87% | 0.86% | 0.89% | ||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses |

0.86% | 0.87% | 0.86% | 0.89% | ||||||||||||

|

|

||||||||||||||||

| Portfolio turnover rate |

43% | 102% | 59% | 87% | ||||||||||||

1. October 30, 2015 represents the last business day of the Fund’s reporting period. See Note 2 of the accompanying Notes.

2. For the period from August 28, 2012 (inception of offering) to April 30, 2013.

3. Per share amounts calculated based on the average shares outstanding during the period.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

5. Annualized for periods less than one full year.

6. Less than 0.005%.

7. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| Six Months Ended October 30, 2015 |

0.86 | % | ||||||

| Year Ended April 30, 2015 |

0.87 | % | ||||||

| Year Ended April 30, 2014 |

0.86 | % | ||||||

| Period Ended April 30, 2013 | 0.89 | % |

See accompanying Notes to Financial Statements.

20 OPPENHEIMER GLOBAL VALUE FUND

| Class R | Six Months

October 30, |

Year Ended April 30, 2015 |

Year Ended April 30, 2014 |

Year Ended April 30, 2013 |

Year Ended April 30, 2012 |

Year Ended April 29, 2011 1 |

||||||||||||||||||

|

|

||||||||||||||||||||||||

| Per Share Operating Data |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 42.27 | $ | 41.50 | $ | 35.11 | $ | 28.98 | $ | 31.43 | $ | 26.11 | ||||||||||||

|

|

||||||||||||||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment income (loss)2 |

(0.08) | (0.12) | (0.29) | 0.03 | (0.17) | (0.22) | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.88) | 1.64 | 6.68 | 6.10 | (2.15) | 5.54 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total from investment operations |

(0.96) | 1.52 | 6.39 | 6.13 | (2.32) | 5.32 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Dividends and/or distributions to shareholders: |

||||||||||||||||||||||||

| Dividends from net investment income |

0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

| Distributions from net realized gain |

0.00 | (0.75) | 0.00 | 0.00 | (0.13) | 0.00 | ||||||||||||||||||

| Total dividends and/or distributions to shareholders |

0.00 | (0.75) | 0.00 | 0.00 | (0.13) | 0.00 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Net asset value, end of period |

$ | 41.31 | $ | 42.27 | $ | 41.50 | $ | 35.11 | $ | 28.98 | $ | 31.43 | ||||||||||||

|

|

|

|||||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Total Return, at Net Asset Value3 |

(2.27)% | 3.70% | 18.20% | 21.15% | (7.35)% | 20.38% | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 8,033 | $ | 8,113 | $ | 5,445 | $ | 1,555 | $ | 1,278 | $ | 610 | ||||||||||||

|

|

||||||||||||||||||||||||

| Average net assets (in thousands) |

$ | 7,981 | $ | 6,980 | $ | 3,548 | $ | 1,188 | $ | 763 | $ | 150 | ||||||||||||

|

|

|

|||||||||||||||||||||||

| Ratios to average net assets:4 |

||||||||||||||||||||||||

| Net investment income (loss) |

(0.37)% | (0.30)% | (0.69)% | 0.11% | (0.62)% | (0.78)% | ||||||||||||||||||

| Expenses excluding interest and fees from borrowings |

1.56% | 1.53% | 1.57% | 1.64% | 1.67% | 3.21% | ||||||||||||||||||

| Interest and fees from borrowings | 0.00%5 | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total expenses6 |

1.56% | 1.53% | 1.57% | 1.64% | 1.67% | 3.21% | ||||||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses |

1.56% | 1.53% | 1.56% | 1.64% | 1.60% | 1.65% | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Portfolio turnover rate |

43% | 102% | 59% | 87% | 62% | 37% | ||||||||||||||||||

1. October 30, 2015 and April 29, 2011 represent the last business days of the Fund’s respective reporting periods.

See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| Six Months Ended October 30, 2015 |

1.56 | % | ||||||

| Year Ended April 30, 2015 |

1.53 | % | ||||||

| Year Ended April 30, 2014 |

1.57 | % | ||||||

| Year Ended April 30, 2013 |

1.64 | % | ||||||

| Year Ended April 30, 2012 |

1.67 | % | ||||||

| Year Ended April 29, 2011 |

3.21 | % |

See accompanying Notes to Financial Statements.

21 OPPENHEIMER GLOBAL VALUE FUND

| FINANCIAL HIGHLIGHTS Continued | ||||

| Class Y | Six Months October 30, |

Year Ended April 30, 2015 |

Year Ended April 30, 2014 |

Year Ended April 30, 2013 |

Year Ended April 30, 2012 |

Year Ended April 29, 2011 1 |

||||||||||||||||||

|

|

||||||||||||||||||||||||

| Per Share Operating Data |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 43.38 | $ | 42.35 | $ | 35.73 | $ | 29.32 | $ | 31.62 | $ | 26.11 | ||||||||||||

|

|

||||||||||||||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment income (loss)2 |

0.03 | 0.08 | (0.09) | 0.23 | (0.03) | (0.08) | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

(0.92) | 1.70 | 6.84 | 6.18 | (2.14) | 5.59 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total from investment operations |

(0.89) | 1.78 | 6.75 | 6.41 | (2.17) | 5.51 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Dividends and/or distributions to shareholders: |

||||||||||||||||||||||||

| Dividends from net investment income |

0.00 | 0.00 | (0.13) | 0.00 | 0.00 | 0.00 | ||||||||||||||||||

| Distributions from net realized gain |

0.00 | (0.75) | 0.00 | 0.00 | (0.13) | 0.00 | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total dividends and/or distributions to shareholders |

0.00 | (0.75) | (0.13) | 0.00 | (0.13) | 0.00 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Net asset value, end of period |

$ | 42.49 | $ | 43.38 | $ | 42.35 | $ | 35.73 | $ | 29.32 | $ | 31.62 | ||||||||||||

|

|

|

|||||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Total Return, at Net Asset Value3 |

(2.03)% | 4.22% | 18.88% | 21.86% | (6.83)% | 21.11% | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Ratios/Supplemental Data |

||||||||||||||||||||||||

| Net assets, end of period (in thousands) |

$ | 125,732 | $ | 132,678 | $ | 112,851 | $ | 22,158 | $ | 12,464 | $ | 4,248 | ||||||||||||

|

|

||||||||||||||||||||||||

| Average net assets (in thousands) |

$ | 122,881 | $ | 135,104 | $ | 59,159 | $ | 15,188 | $ | 7,141 | $ | 637 | ||||||||||||

|

|

||||||||||||||||||||||||

| Ratios to average net assets:4 |

||||||||||||||||||||||||

| Net investment income (loss) |

0.14% | 0.20% | (0.22)% | 0.74% | (0.11)% | (0.28)% | ||||||||||||||||||

| Expenses excluding interest and fees from borrowings |

1.05% | 1.07% | 1.04% | 1.03% | 1.14% | 1.58% | ||||||||||||||||||

| Interest and fees from borrowings |

0.00%5 | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | ||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Total expenses6 |

1.05% | 1.07% | 1.04% | 1.03% | 1.14% | 1.58% | ||||||||||||||||||

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses |

1.05% | 1.05% | 1.04% | 1.02% | 1.05% | 1.05% | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| Portfolio turnover rate |

43% | 102% | 59% | 87% | 62% | 37% | ||||||||||||||||||

1. October 30, 2015 and April 29, 2011 represent the last business days of the Fund’s respective reporting periods.

See Note 2 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

4. Annualized for periods less than one full year.

5. Less than 0.005%.

6. Total expenses including indirect expenses from affiliated fund fees and expenses were as follows:

| Six Months Ended October 30, 2015 |

1.05 | % | ||||||

| Year Ended April 30, 2015 |

1.07 | % | ||||||

| Year Ended April 30, 2014 |

1.04 | % | ||||||

| Year Ended April 30, 2013 |

1.03 | % | ||||||

| Year Ended April 30, 2012 |

1.14 | % | ||||||

| Year Ended April 29, 2011 |

1.58 | % |

See accompanying Notes to Financial Statements.

22 OPPENHEIMER GLOBAL VALUE FUND

NOTES TO FINANCIAL STATEMENTS October 30, 2015 Unaudited

1. Organization

Oppenheimer Global Value Fund (the “Fund”) is registered under the Investment Company Act of 1940 (“1940 Act”), as amended, as a diversified open-end management investment company. The Fund’s investment objective is to seek capital appreciation. The Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OppenheimerFunds, Inc. (“OFI” or the “Sub-Adviser”). The Manager has entered into a sub-advisory agreement with OFI.

The Fund offers Class A, Class C, Class I, Class R and Class Y shares. As of July 1, 2014, Class N shares were renamed Class R shares. Class N shares subject to a contingent deferred sales charge (“CDSC”) on July 1, 2014, continue to be subject to a CDSC after the shares were renamed. Purchases of Class R shares occurring on or after July 1, 2014, are not subject to a CDSC upon redemption. Class A shares are sold at their offering price, which is normally net asset value plus a front-end sales charge. Class C and Class R shares are sold without a front-end sales charge but may be subject to a contingent deferred sales charge (“CDSC”). Class R shares are sold only through retirement plans. Retirement plans that offer Class R shares may impose charges on those accounts. Class I and Class Y shares are sold to certain institutional investors or intermediaries without either a front-end sales charge or a CDSC, however, the intermediaries may impose charges on their accountholders who beneficially own Class I and Class Y shares. All classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class. Class A, C and R shares have separate distribution and/or service plans under which they pay fees. Class I and Class Y shares do not pay such fees.

The following is a summary of significant accounting policies followed in the Fund’s preparation of financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

|

|

||||

| 2. Significant Accounting Policies | ||||

Security Valuation. All investments in securities are recorded at their estimated fair value, as described in Note 3.

Reporting Period End Date. The last day of the Fund’s reporting period is the last day the New York Stock Exchange was open for trading during the period. The Fund’s financial statements have been presented through that date to maintain consistency with the Fund’s net asset value calculations used for shareholder transactions.

Foreign Currency Translation. The Fund’s accounting records are maintained in U.S. dollars. The values of securities denominated in foreign currencies and amounts related to the purchase and sale of foreign securities and foreign investment income are translated into U.S. dollars as of the close of the New York Stock Exchange (the “Exchange”), normally 4:00 P.M. Eastern time, on each day the Exchange is open for trading. Foreign exchange rates may be valued primarily using a reliable bank, dealer or service authorized by the Board of Trustees.

23 OPPENHEIMER GLOBAL VALUE FUND

| NOTES TO FINANCIAL STATEMENTS Unaudited / Continued |

||||

2. Significant Accounting Policies (Continued)

Reported net realized gains and losses from foreign currency transactions arise from sales of portfolio securities, sales and maturities of short-term securities, sales of foreign currencies, exchange rate fluctuations between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized appreciation and depreciation on the translation of assets and liabilities denominated in foreign currencies arise from changes in the values of assets and liabilities, including investments in securities at fiscal period end, resulting from changes in exchange rates.

The effect of changes in foreign currency exchange rates on investments is separately identified from the fluctuations arising from changes in market values of securities held and reported with all other foreign currency gains and losses in the Fund’s Statement of Operations.

Allocation of Income, Expenses, Gains and Losses. Income, expenses (other than those attributable to a specific class), gains and losses are allocated on a daily basis to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles, are recorded on the ex-dividend date. Income and capital gain distributions, if any, are declared and paid annually or at other times as deemed necessary by the Manager.

The tax character of distributions is determined as of the Fund’s fiscal year end. Therefore, a portion of the Fund’s distributions made to shareholders prior to the Fund’s fiscal year end may ultimately be categorized as a tax return of capital.

Investment Income. Dividend income is recorded on the ex-dividend date or upon ex-dividend notification in the case of certain foreign dividends where the ex-dividend date may have passed. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income is recognized on an accrual basis. Discount and premium, which are included in interest income on the Statement of Operations, are amortized or accreted daily.

Custodian Fees. “Custodian fees and expenses” in the Statement of Operations may include interest expense incurred by the Fund on any cash overdrafts of its custodian account during the period. Such cash overdrafts may result from the effects of failed trades in portfolio securities and from cash outflows resulting from unanticipated shareholder redemption activity. The Fund pays interest to its custodian on such cash overdrafts, to the extent they are not offset by positive cash balances maintained by the Fund, at a rate equal to the Federal Funds Rate plus 0.50%. The “Reduction to custodian expenses” line item, if applicable,

24 OPPENHEIMER GLOBAL VALUE FUND

2. Significant Accounting Policies (Continued)

represents earnings on cash balances maintained by the Fund during the period. Such interest expense and other custodian fees may be paid with these earnings.

Security Transactions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Indemnifications. The Fund’s organizational documents provide current and former Trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Federal Taxes. The Fund intends to comply with provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its investment company taxable income to shareholders. Therefore, no federal income or excise tax provision is required. The Fund files income tax returns in U.S. federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remains open for the three preceding fiscal reporting period ends.

During the fiscal year ended April 30, 2015, the Fund did not utilize any capital loss carryforward to offset capital gains realized in that fiscal year. Details of the fiscal year ended April 30, 2015 capital loss carryforwards are included in the table below. Capital loss carryforwards with no expiration, if any, must be utilized prior to those with expiration dates. Capital losses with no expiration will be carried forward to future years if not offset by gains.

| Expiring | ||||

| No expiration |

$ | 1,255,457 | ||

At period end, it is estimated that the capital loss carryforwards would be $6,213,100, which will not expire. The estimated capital loss carryforward represents the carryforward as of the end of the last fiscal year, increased or decreased by capital losses or gains realized in the first six months of the current fiscal year. During the reporting period, it is estimated that the Fund will not utilize any capital loss carryforward to offset realized capital gains.

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of dividends and distributions made during the fiscal year from net investment income or net realized gains are determined in accordance with federal income tax requirements, which may differ from the character of net investment income or net realized gains presented in those financial statements in accordance with GAAP. Also, due to timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or net realized gain was recorded by the Fund.

The aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation of securities and other investments for federal income tax

25 OPPENHEIMER GLOBAL VALUE FUND

| NOTES TO FINANCIAL STATEMENTS Unaudited / Continued |

||||

|

|

||||

2. Significant Accounting Policies (Continued)

purposes at period end are noted in the following table. The primary difference between book and tax appreciation or depreciation of securities and other investments, if applicable, is attributable to the tax deferral of losses or tax realization of financial statement unrealized gain or loss.

| Federal tax cost of securities |

$ | 453,660,264 | ||

|

|

|

|||

| Gross unrealized appreciation |

$ | 75,929,599 | ||

| Gross unrealized depreciation |

(20,557,990) | |||

|

|

|

|||

| Net unrealized appreciation |

$ | 55,371,609 | ||

|

|

|

Use of Estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

|

|

||||

| 3. Securities Valuation | ||||

The Fund calculates the net asset value of its shares as of the close of the New York Stock Exchange (the “Exchange”), normally 4:00 P.M. Eastern time, on each day the Exchange is open for trading, except in the case of a scheduled early closing of the Exchange, in which case the Fund will calculate net asset value of the shares as of the scheduled early closing time of the Exchange.

The Fund’s Board has adopted procedures for the valuation of the Fund’s securities and has delegated the day-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for determining a “fair valuation” for any security for which market quotations are not “readily available.” The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

Valuation Methods and Inputs

Securities are valued using unadjusted quoted market prices, when available, as supplied primarily by third party pricing services or dealers.

The following methodologies are used to determine the market value or the fair value of the types of securities described below:

Securities traded on a registered U.S. securities exchange (including exchange-traded derivatives other than futures and futures options) are valued based on the last sale price of the security reported on the principal exchange on which it is traded, prior to the time when the Fund’s assets are valued. In the absence of a sale, the security is valued at the mean between the bid and asked price on the principal exchange or, if not available from the principal exchange, obtained from two dealers. If bid and asked prices are not available from either the exchange or two dealers, the security is valued by using one of the following

26 OPPENHEIMER GLOBAL VALUE FUND

|

|

||||

3. Securities Valuation (Continued)

methodologies (listed in order of priority): (1) using a bid from the principal exchange, (2) the mean between the bid and asked price as provided by a single dealer, or (3) a bid from a single dealer. A security of a foreign issuer traded on a foreign exchange, but not listed on a registered U.S. securities exchange, is valued based on the last sale price on the principal exchange on which the security is traded, as identified by the third party pricing service used by the Manager, prior to the time when the Fund’s assets are valued. If the last sale price is unavailable, the security is valued at the most recent official closing price on the principal exchange on which it is traded. If the last sales price or official closing price for a foreign security is not available, the security is valued at the mean between the bid and asked price per the exchange or, if not available from the exchange, obtained from two dealers. If bid and asked prices are not available from either the exchange or two dealers, the security is valued by using one of the following methodologies (listed in order of priority): (1) using a bid from the exchange, (2) the mean between the bid and asked price as provided by a single dealer, or (3) a bid from a single dealer.

Shares of a registered investment company that are not traded on an exchange are valued at that investment company’s net asset value per share.

Corporate and government debt securities (of U.S. or foreign issuers) and municipal debt securities, event-linked bonds, loans, mortgage-backed securities, collateralized mortgage obligations, and asset-backed securities are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers who may use matrix pricing methods to determine the evaluated prices.

Short-term money market type debt securities with a remaining maturity of sixty days or less are valued at cost adjusted by the amortization of discount or premium to maturity (amortized cost), which approximates market value. Short-term debt securities with a remaining maturity in excess of sixty days are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers.

Forward foreign currency exchange contracts are valued utilizing current and forward currency rates obtained from third party pricing services. When the settlement date of a contract is an interim date for which a quotation is not available, interpolated values are derived using the nearest dated forward currency rate.

A description of the standard inputs that may generally be considered by the third party pricing vendors in determining their evaluated prices is provided below.

| Security Type | Standard inputs generally considered by third-party pricing vendors | |

|

| ||

| Corporate debt, government debt, municipal, mortgage-backed and asset-backed securities |

Reported trade data, broker-dealer price quotations, benchmark yields, issuer spreads on comparable securities, the credit quality, yield, maturity, and other appropriate factors. | |

|

| ||

| Loans | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. | |

|

| ||

| Event-linked bonds | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. | |

27 OPPENHEIMER GLOBAL VALUE FUND

| NOTES TO FINANCIAL STATEMENTS Unaudited / Continued |

||||

|

|

||||

3. Securities Valuation (Continued)

If a market value or price cannot be determined for a security using the methodologies described above, or if, in the “good faith” opinion of the Manager, the market value or price obtained does not constitute a “readily available market quotation,” or a significant event has occurred that would materially affect the value of the security, the security is fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Valuation Committee and the Fund’s Board or (ii) as determined in good faith by the Manager’s Valuation Committee. The Valuation Committee considers all relevant facts that are reasonably available, through either public information or information available to the Manager, when determining the fair value of a security. Fair value determinations by the Manager are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined. Those fair valuation standardized methodologies include, but are not limited to, valuing securities at the last sale price or initially at cost and subsequently adjusting the value based on: changes in company specific fundamentals, changes in an appropriate securities index, or changes in the value of similar securities which may be further adjusted for any discounts related to security-specific resale restrictions. When possible, such methodologies use observable market inputs such as unadjusted quoted prices of similar securities, observable interest rates, currency rates and yield curves. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities nor can it be assured that the Fund can obtain the fair value assigned to a security if it were to sell the security.

To assess the continuing appropriateness of security valuations, the Manager, or its third party service provider who is subject to oversight by the Manager, regularly compares prior day prices, prices on comparable securities, and sale prices to the current day prices and challenges those prices exceeding certain tolerance levels with the third party pricing service or broker source. For those securities valued by fair valuations, whether through a standardized fair valuation methodology or a fair valuation determination, the Valuation Committee reviews and affirms the reasonableness of the valuations based on such methodologies and fair valuation determinations on a regular basis after considering all relevant information that is reasonably available.

Classifications

Each investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs are used in determining the value of each of the Fund’s investments as of the reporting period end. These data inputs are categorized in the following hierarchy under applicable financial accounting standards:

1) Level 1-unadjusted quoted prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange)

2) Level 2-inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market corroborated inputs such as interest rates, prepayment speeds, credit risks, etc.)

28 OPPENHEIMER GLOBAL VALUE FUND

|

|

||||

| 3. Securities Valuation (Continued) | ||||

3) Level 3-significant unobservable inputs (including the Manager’s own judgments about assumptions that market participants would use in pricing the asset or liability).

The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The table below categorizes amounts that are included in the Fund’s Statement of Assets and Liabilities at period end based on valuation input level:

| Level 3— | ||||||||||||||||

| Level 1— | Level 2— | Significant | ||||||||||||||

| Unadjusted | Other Significant | Unobservable | ||||||||||||||

| Quoted Prices | Observable Inputs | Inputs | Value | |||||||||||||

|

|

||||||||||||||||

| Assets Table |

||||||||||||||||

| Investments, at Value: |

||||||||||||||||

| Common Stocks |

||||||||||||||||

| Consumer Discretionary |

$ | 121,365,068 | $ | 27,337,669 | $ | — | $ | 148,702,737 | ||||||||

| Consumer Staples |

— | 12,200,263 | — | 12,200,263 | ||||||||||||

| Financials |

76,610,512 | 12,393,884 | — | 89,004,396 | ||||||||||||

| Health Care |

16,915,228 | 14,592,854 | — | 31,508,082 | ||||||||||||

| Industrials |

12,787,332 | 26,836,293 | — | 39,623,625 | ||||||||||||

| Information Technology |

101,200,018 | 16,844,835 | — | 118,044,853 | ||||||||||||

| Materials |

14,795,039 | 4,683,358 | — | 19,478,397 | ||||||||||||

| Telecommunication Services |

— | 18,254,666 | — | 18,254,666 | ||||||||||||

| Utilities |

14,501,117 | — | — | 14,501,117 | ||||||||||||

| Preferred Stock |

— | 7,343,136 | — | 7,343,136 | ||||||||||||

| Investment Company |

10,370,601 | — | — | 10,370,601 | ||||||||||||

|

|

|

|||||||||||||||

| Total Assets |

$ | 368,544,915 | $ | 140,486,958 | $ | — | $ | 509,031,873 | ||||||||

|

|

|

|||||||||||||||

Forward currency exchange contracts and futures contracts, if any, are reported at their unrealized appreciation/depreciation at measurement date, which represents the change in the contract’s value from trade date. All additional assets and liabilities included in the above table are reported at their market value at measurement date.

|

|

||||

| 4. Investments and Risks | ||||

Risks of Foreign Investing. The Fund may invest in foreign securities which are subject to special risks. Securities traded in foreign markets may be less liquid and more volatile than those traded in U.S. markets. Foreign issuers are usually not subject to the same accounting and disclosure requirements that U.S. companies are subject to, which may make it difficult for the Fund to evaluate a foreign company’s operations or financial condition. A change in the value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of investments denominated in that foreign currency and in the value of any income or distributions the Fund may receive on those investments. The value of foreign investments may be affected by exchange control regulations, foreign taxes, higher transaction and other costs, delays in the settlement of transactions, changes in economic or monetary policy in the United States or abroad, expropriation or nationalization of a company’s assets, or other political and economic factors. In addition, due to the inter-relationship of global economies and financial markets, changes in political and economic factors in one country or region

29 OPPENHEIMER GLOBAL VALUE FUND

| NOTES TO FINANCIAL STATEMENTS Unaudited / Continued |

||||

|

|

||||

| 4. Investments and Risks (Continued) | ||||

could adversely affect conditions in another country or region. Investments in foreign securities may also expose the Fund to time-zone arbitrage risk. Foreign securities may trade on weekends or other days when the Fund does not price its shares. At times, the Fund may emphasize investments in a particular country or region and may be subject to greater risks from adverse events that occur in that country or region. Foreign securities and foreign currencies held in foreign banks and securities depositories may be subject to limited or no regulatory oversight.

Investments in Affiliated Funds. The Fund is permitted to invest in other mutual funds advised by the Manager (“Affiliated Funds”). Affiliated Funds are open-end management investment companies registered under the 1940 Act, as amended. The Manager is the investment adviser of, and the Sub-Adviser provides investment and related advisory services to, the Affiliated Funds. When applicable, the Fund’s investments in Affiliated Funds are included in the Statement of Investments. Shares of Affiliated Funds are valued at their net asset value per share. As a shareholder, the Fund is subject to its proportional share of the Affiliated Funds’ expenses, including their management fee. The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in the Affiliated Funds.

Each of the Affiliated Funds in which the Fund invests has its own investment risks, and those risks can affect the value of the Fund’s investments and therefore the value of the Fund’s shares. To the extent that the Fund invests more of its assets in one Affiliated Fund than in another, the Fund will have greater exposure to the risks of that Affiliated Fund.

Investment in Oppenheimer Institutional Money Market Fund. The Fund is permitted to invest daily available cash balances in a money market Affiliated Fund. The Fund may invest the available cash in Class E shares of Oppenheimer Institutional Money Market Fund (“IMMF”) to seek current income while preserving liquidity or for defensive purposes. IMMF is regulated as a money market fund under the Investment Company Act of 1940, as amended.

Equity Security Risk. Stocks and other equity securities fluctuate in price. The value of the Fund’s portfolio may be affected by changes in the equity markets generally. Equity markets may experience significant short-term volatility and may fall sharply at times. Different markets may behave differently from each other and U.S. equity markets may move in the opposite direction from one or more foreign stock markets. Adverse events in any part of the equity or fixed-income markets may have unexpected negative effects on other market segments.

The prices of individual equity securities generally do not all move in the same direction at the same time and a variety of factors can affect the price of a particular company’s securities. These factors may include, but are not limited to, poor earnings reports, a loss of customers, litigation against the company, general unfavorable performance of the company’s sector or industry, or changes in government regulations affecting the company or its industry.

30 OPPENHEIMER GLOBAL VALUE FUND

|

|

||||

5. Market Risk Factors

The Fund’s investments in securities and/or financial derivatives may expose the fund to various market risk factors:

Commodity Risk. Commodity risk relates to the change in value of commodities or commodity indexes as they relate to increases or decreases in the commodities market. Commodities are physical assets that have tangible properties. Examples of these types of assets are crude oil, heating oil, metals, livestock, and agricultural products.

Credit Risk. Credit risk relates to the ability of the issuer of debt to meet interest and principal payments, or both, as they come due. In general, lower-grade, higher-yield debt securities are subject to credit risk to a greater extent than lower-yield, higher-quality securities.

Equity Risk. Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market.

Foreign Exchange Rate Risk. Foreign exchange rate risk relates to the change in the U.S. dollar value of a security held that is denominated in a foreign currency. The U.S. dollar value of a foreign currency denominated security will decrease as the dollar appreciates against the currency, while the U.S. dollar value will increase as the dollar depreciates against the currency.