InterDigital, Inc.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held June 7, 2023

TO THE SHAREHOLDERS OF INTERDIGITAL, INC.:

We are pleased to invite you to attend our 2023 annual meeting of shareholders, which will be held on Wednesday, June 7, 2023, at 2:00 PM Eastern Time. This year’s annual meeting will be held as a virtual meeting. You will be able to attend and participate in the annual meeting online via a live webcast by visiting www.virtualshareholdermeeting.com/IDCC2023. In addition to voting by submitting your proxy prior to the annual meeting, you also will be able to vote your shares electronically during the annual meeting. Further details regarding the virtual meeting are included in the accompanying proxy statement. At the annual meeting, the holders of our outstanding common stock will act on the following matters:

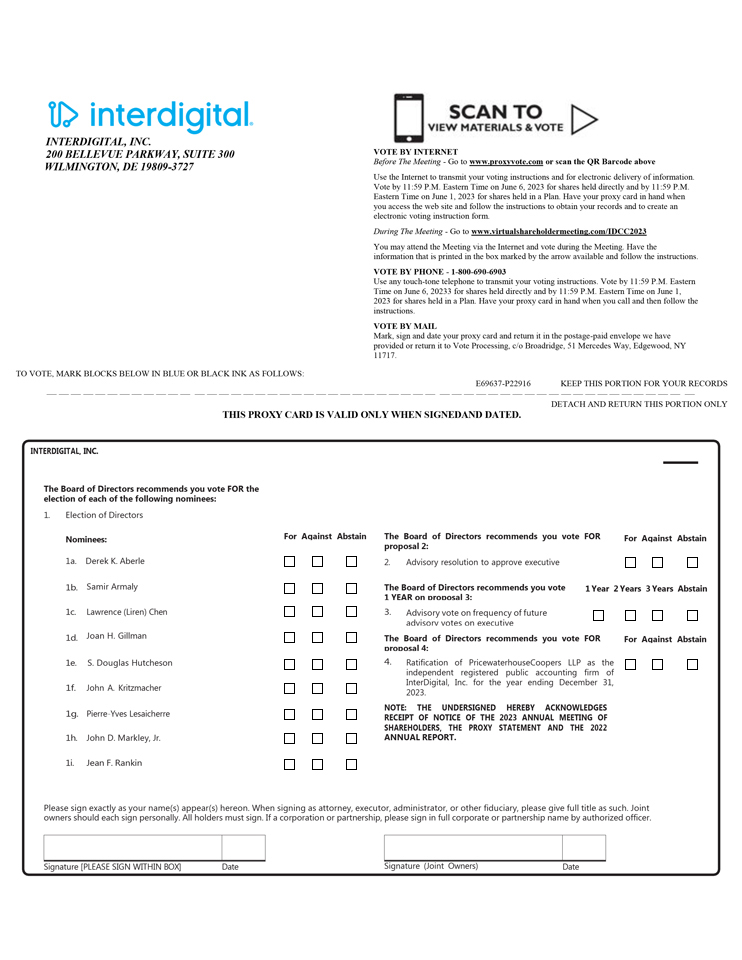

| 1. | Election of the nine director nominees named in the proxy statement, each for a term of one year; |

| 2. | Advisory resolution to approve executive compensation; |

| 3. | Advisory vote on frequency of future advisory votes on executive compensation; |

| 4. | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2023; and |

| 5. | Such other business as may properly come before the annual meeting. |

We are pleased to be using the Securities and Exchange Commission rules that allow companies to furnish proxy materials to their shareholders primarily over the Internet. We believe that this process expedites shareholders’ receipt of the proxy materials, lowers the costs of the annual meeting and helps to conserve natural resources. We also believe that hosting a virtual meeting will enable participation by more of our shareholders in our annual meeting while lowering the cost of conducting the meeting. Shareholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. On or about April 20, 2023, we began mailing our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our 2023 proxy statement and 2022 annual report, and how to vote online. The Notice also includes instructions on how to request a paper copy of the proxy materials, including the notice of annual meeting, 2023 proxy statement, 2022 annual report and proxy card.

All holders of record of shares of our common stock (Nasdaq: IDCC) at the close of business on April 5, 2023 are entitled to vote at the annual meeting and at any postponements or adjournments of the annual meeting. Your vote is important. Regardless of whether you plan to attend the annual meeting, please cast your vote as instructed in the Notice as promptly as possible. Alternatively, if you wish to receive paper copies of your proxy materials, including the proxy card, please follow the instructions in the Notice. Once you receive paper copies of your proxy materials, please complete, sign, date and promptly return the proxy card in the postage-prepaid return envelope provided, or follow the instructions set forth on the proxy card to vote your shares over the Internet or by telephone. Your prompt response is necessary to ensure that your shares are represented at the annual meeting. Voting by Internet, telephone or mail will not affect your right to vote at the annual meeting if you decide to attend the virtual meeting through www.virtualshareholdermeeting.com/IDCC2023. If you are a shareholder who holds stock in a brokerage account (a “street name” holder), you will receive instructions from the holder of record, which you must follow in order for your shares to be voted. Certain of these institutions offer Internet and telephone voting.

IF YOU PLAN TO ATTEND THE ANNUAL MEETING:

The annual meeting will be held as a virtual meeting and begin promptly at 2:00 PM Eastern Time. In order to attend and participate in the annual meeting, you will need to visit www.virtualshareholdermeeting.com/IDCC2023 and follow the instructions that are included in the Notice, on your proxy card or in the voting instructions accompanying your proxy materials. You will also need the 16-digit control number provided therein. Online check-in will begin at 1:30 PM Eastern Time. Please allow sufficient time to complete the online check-in process.

| By Order of the Board of Directors,

|

|

|

| JOSHUA D. SCHMIDT

|

| Chief Legal Officer and Corporate Secretary |

April 20, 2023

Wilmington, Delaware