Exhibit 99.1

Energy XXI Gulf Coast Announces First Quarter 2017 Results

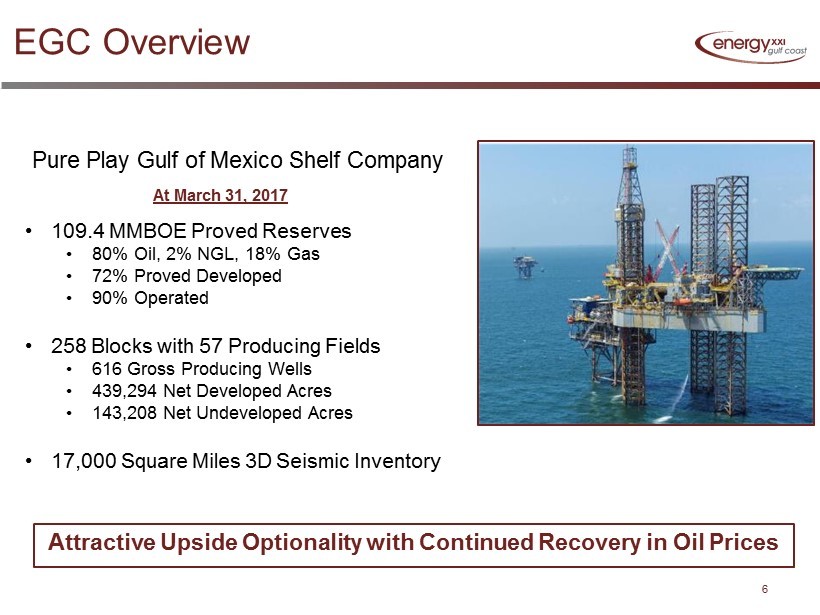

HOUSTON – May 22, 2017 – Energy XXI Gulf Coast, Inc. (“EGC” or the “Company”) (NASDAQ: EXXI) today reported operational and financial results for the first quarter of 2017.

First Quarter 2017 Highlights and Recent Key Items:

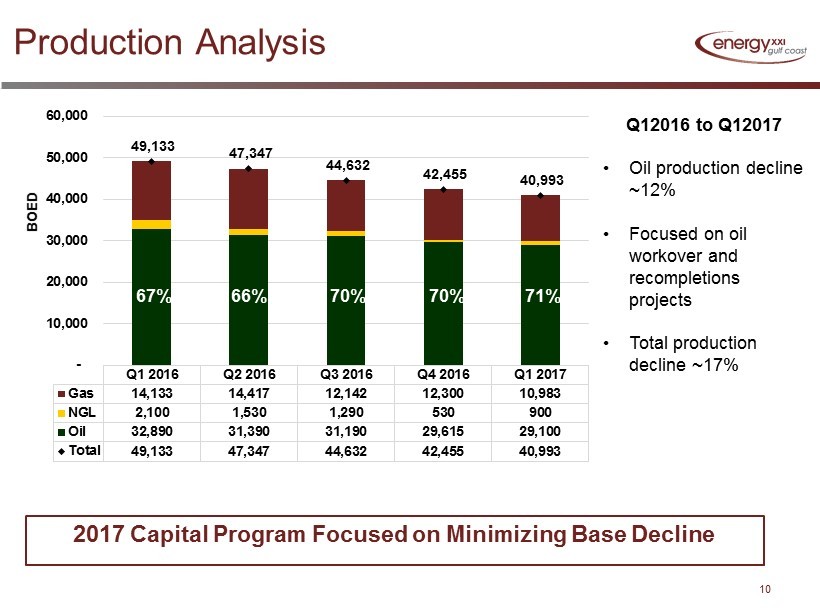

| · | Produced an average of approximately 41,000 barrels of oil equivalent (“BOE”) per day in the first quarter of 2017, of which 71% was oil |

| · | Reported strong cash and cash equivalents of $160.5 million at March 31, 2017 |

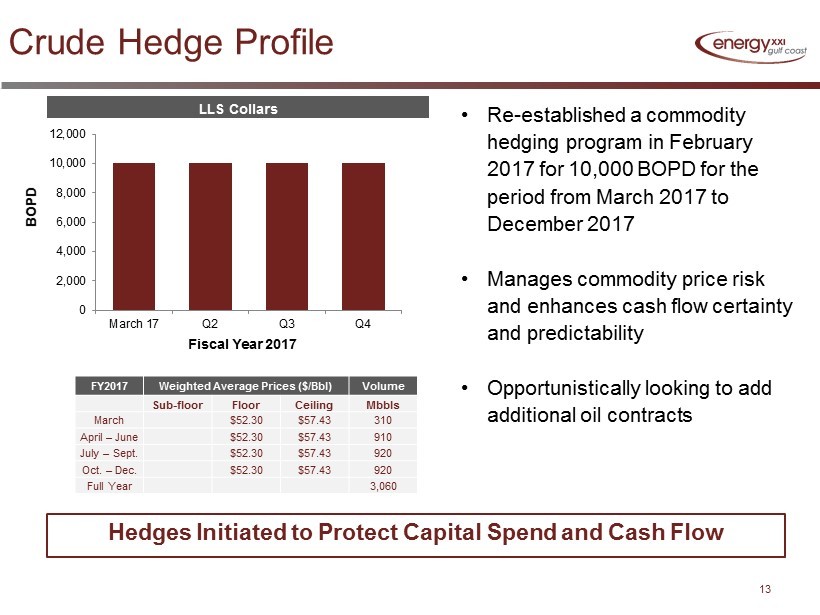

| · | Reestablished a commodity hedging program in February 2017 by entering into costless collars for 10,000 barrels of oil per day from March 2017 to December 2017 |

| · | Commenced trading on the NASDAQ Global Select Market on February 28, 2017 |

| · | Contracted a rig to begin development drilling program, spudding first well in early June |

| · | Retained Morgan Stanley to assist with the evaluation of strategic alternatives |

For the first quarter of 2017, EGC reported a net loss of $65.3 million, or ($1.97) per diluted share while Adjusted EBITDA totaled $42.6 million. The first quarter loss includes a non-cash ceiling test impairment charge of $44.1 million primarily related to the decrease in SEC proved reserves and the present value of those SEC proved reserves discounted at 10% (“PV-10 Value”) relative to the estimated reserves prepared by EGC’s internal reservoir engineers as of year-end 2016. EGC recently received the final results of its independently engineered reserves report prepared by Netherland Sewell and Associates as of March 31, 2017.

Adjusted EBITDA is a Non-GAAP financial measure and is described and reconciled to net loss in the attached table under “Reconciliation of Non-GAAP Measures.”

Douglas E. Brooks, EGC’s Chief Executive Officer and President commented, “Our first quarter results demonstrate our continued focus on the base business which generated $42.6 million of Adjusted EBITDA. After over a year of minimal capital spending on drilling projects, we will soon spud our first development well in 2017 and remain confident in our strong, oil-weighted asset base. While we continue to develop our long-term strategic plan, our near-term commitment to HSE excellence, minimizing base production decline and reducing operating and overhead expenses remains unchanged. Through the effective execution of this commitment, EGC will look to add value in a recovering price environment.”

Revenue, Production and Pricing

Total revenues for the first quarter of 2017 were $157.9 million, which includes a $3.7 million gain on derivative financial instruments.

During the first quarter of 2017, EGC produced and sold approximately 41,000 net BOE per day which was comprised of 29,100 barrels of oil (“BBL”) at an average realized price of $51.04 per BBL (before the effect of derivatives), 900 barrels of natural gas liquids (NGL’s) at an average realized price of $27.52 per BBL, and 65.9 million cubic feet of gas (“MMCF”) at an average realized price of $3.10 per thousand cubic feet (“MCF”). EGC operates approximately 90% of its reserves, substantially all of which are located in the U.S. Gulf of Mexico.

First Quarter 2017 Costs and Expenses

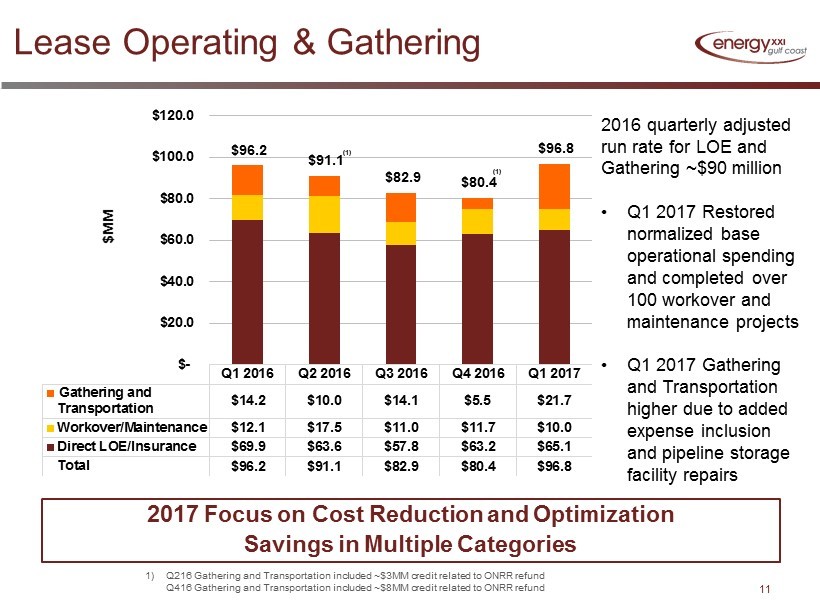

Total lease operating expenses (“LOE”) were $75.2 million, or $20.39 per BOE, which consisted of $58.9 million in direct lease operating expense, $10 million in workover and maintenance and $6.3 million in insurance expense. The Company continues to evaluate additional cost saving opportunities that will not impact health, safety or operational integrity. EGC successfully completed over 100 expense workover and maintenance projects during the quarter.

Gathering and Transportation expense was $21.7 million, or $5.89 per BOE for the first quarter of 2017 and included increased commodity marketing deductions, inclusion of gathering and transportation expenses that were historically included in lease operating expenses of $5.1 million and expenses incurred on pipeline storage facility repairs of approximately $2.4 million.

General and administrative (“G&A”) expense was $23.8 million, or $6.47 per BOE. While the Company has taken significant steps to reduce overall G&A costs over the past 12 months, with decreases in personnel costs, the first quarter of 2017 included additional costs related to severance and restructuring costs totaling approximately $6.2 million. General and administrative expense includes $0.9 million of non-cash expense primarily related to stock based compensation.

2

Depreciation, depletion and amortization (“DD&A”) expense was $42.0 million, or $11.39 per BOE. As discussed previously, there was a ceiling test impairment charge of $44.1 million during the quarter.

Accretion of asset retirement obligation was $12.4 million. In conjunction with the adoption of fresh start accounting, the discount rate used for ARO decreased to 6.5%.

EGC recorded no income tax expense or benefit during the quarter due to its inability to currently record any additional net deferred tax assets.

Commodity Hedging

EGC did not have any commodity hedges in place prior to February 2017 when it entered into oil contracts (costless collars) benchmarked to Argus-LLS, to hedge 10,000 barrels of oil per day of production for the period from March 2017 to December 2017 with an average floor price of $52.30 and an average ceiling price of $57.43 per barrel. The Company does not have any hedges in place on natural gas production. No additional hedges have been put in place since February but EGC expects to consider additional derivative arrangements in the future.

Capital Expenditure Program

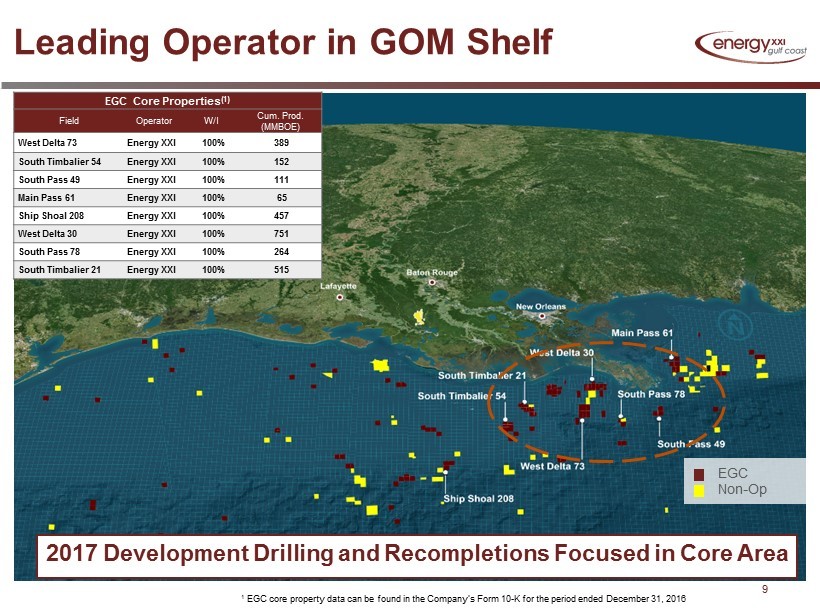

During the three months ended March 31, 2017, the Company incurred capital costs, excluding acquisitions but including abandonment activities, totaling $19.4 million. The Company did not drill any new wells during that period, but did incur capital expenditures for the successful execution of several well recompletions and facility improvements in the Company’s core properties. EGC spent approximately $9.3 million related to abandonment activities.

The Company recently contracted a rig to drill its first 2017 development well beginning in early June. EGC continues to expect its capital expenditure program for 2017 to be in the range of $140 to $170 million, including $50 to $70 million for abandonment activities. The 2017 capital program is expected to be fully funded with available cash and internal cash flow.

Balance Sheet and Liquidity

The Company’s estimate of its asset retirement obligations was revised downward by $135.4 million during the three months ended March 31, 2017, primarily due to changes in estimated timing of settlements for its plugging and abandonment liabilities. Asset retirement obligations totaled $623 million at the end of the first quarter 2017.

3

As of March 31, 2017, EGC had $74 million drawn on its three-year secured credit facility, the same amount drawn as of year-end 2016. At year-end 2016, the remaining $228 million under the $302 million facility was utilized to maintain outstanding letters of credit, primarily in favor of ExxonMobil to secure certain abandonment obligations. On March 10, 2017, the letters of credit issued in favor of ExxonMobil were reduced to $200 million. Under the terms of the credit facility, the commitments under the facility were permanently reduced by $12.5 million to $289.5 million.

At March 31, 2017, liquidity totaled $173 million which is comprised of cash and cash equivalents totaling $160.5 million and $12.5 million available for borrowing under its three-year credit facility.

Conference Call

As previously announced, the Company will hold a conference call to discuss its first quarter financial and operating results this morning, Monday, May 22, 2017, at 10:00 a.m. Central Time (11:00 a.m. Eastern Time). Interested parties may participate by dialing (877) 794-3620. International parties may dial (631) 813-4724. The confirmation code is 22507001. This call will also be webcast on EGC’s website at www.energyxxi.com. A replay of the call will be archived and available on the web site shortly after the live call.

Fresh Start Accounting

Upon emergence from the Company’s Chapter 11 restructuring, EGC elected to adopt fresh start accounting as of December 31, 2016. As a result of the application of fresh start accounting and the effects of the implementation of the plan of reorganization, the financial statements on or after December 31, 2016 are not comparable with the financial statements prior to that date. References to “Successor” refer to the reorganized EGC subsequent to the adoption of fresh start accounting. References to “Predecessor” refer to Energy XXI Ltd. prior to the adoption of fresh start accounting.

Non-GAAP Measures

The Company refers to “PV-10” as the present value of estimated future net revenues of estimated proved reserves using a discount rate of 10%. This amount includes projected revenues less estimated production costs, abandonment costs and development costs but does not include effects, if any, of income taxes, which is included in standardized measure of discounted future net cash flows, which is the most directly comparable U.S. GAAP financial measure. PV-10 is not a financial measure prescribed under accounting principles generally accepted in the U.S. (“U.S. GAAP”). Management believes that the non-U.S. GAAP financial measure of PV-10 is relevant and useful for evaluating the relative monetary significance of oil and natural gas properties. PV-10 is used internally when assessing the potential return on investment related to oil and natural gas properties and in evaluating acquisition opportunities. EGC believes the use of this pre-tax measure is valuable because there are unique factors that can impact an individual company when estimating the amount of future income taxes to be paid. Management believes that the presentation of PV-10 provides useful information to investors because it is widely used by professional analysts and sophisticated investors in evaluating oil and natural gas companies. PV-10 is not a measure of financial or operating performance under U.S. GAAP, nor is it intended to represent the current market value of our estimated oil and natural gas reserves. PV-10 should not be considered in isolation or as a substitute for the standardized measure of discounted future net cash flows as defined under U.S. GAAP.

4

Adjusted EBITDA is a supplemental non-GAAP financial. Adjusted EBITDA is not a measure of net income or cash flows as determined by United States generally accepted accounting principles, or US GAAP. EGC believes that Adjusted EBITDA is useful because it allows it to more effectively evaluate its operating performance and compare the results of its operations from period to period without regard to its financing methods or capital structure. EGC excludes items such as property and inventory impairments, asset retirement obligation accretion, unrealized derivative gains and losses, non-cash share-based compensation expense, non-cash deferred rent expense and restructuring and severance expense. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, net income or cash flows from operating activities as determined in accordance with US GAAP or as an indicator of its operating performance or liquidity. EGC’s computations of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, including those relating to the intent, beliefs, plans, or expectations of EGC are based upon current expectations and are subject to a number of risks, uncertainties, and assumptions. It is not possible to predict or identify all such factors and the following list should not be considered a complete statement of all potential risks and uncertainties relating to emergence from Chapter 11, the recent change in EGC’s senior management team, or EGC’s oil and gas reserves, including, but not limited to: (i) the PV-10 and reserve volumes reported in the final NSAI reserve report, (ii) the level of potential upside actually realized by EGC from its non-proved resource base, (iii) the effects of the departure of EGC’s senior leaders on the Company’s employees, suppliers, regulators and business counterparties, (iv) the impact of restrictions in the exit financing on EGC’s ability to make capital investments and pursue strategic growth opportunities and (v) other risks and uncertainties. These risks and uncertainties could cause actual results, including project plans and related expenditures and resource recoveries, to differ materially from those described in the forward-looking statements. For a more detailed discussion of risk factors, please see Part I, Item 1A, “Risk Factors” of the Transition Report on Form 10-K for the transition period ended December 31, 2016 filed by EGC for more information. EGC assumes no obligation and expressly disclaims any duty to update the information contained herein except as required by law.

About the Company

Energy XXI Gulf Coast, Inc. is an independent oil and natural gas development and production company whose assets are primarily located in the U.S. Gulf of Mexico waters offshore Louisiana and Texas. The Company’s near-term strategy emphasizes exploitation of key assets, enhanced by its focus on financial discipline and operational excellence. To learn more, visit EGC’s website at www.EnergyXXI.com.

Investor Relations Contact

Al Petrie

Investor Relations Coordinator

713-351-0617

apetrie@energyxxi.com

5

ENERGY XXI GULF COAST, INC.

CONSOLIDATED BALANCE SHEETS

(In Thousands, except share information)

| Successor | ||||||||

| March 31, | December 31, | |||||||

| 2017 | 2016 | |||||||

| ASSETS | (Unaudited) | |||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 160,479 | $ | 165,368 | ||||

| Accounts receivable | ||||||||

| Oil and natural gas sales | 67,952 | 68,143 | ||||||

| Joint interest billings, net | 5,687 | 5,600 | ||||||

| Other | 2,321 | 17,944 | ||||||

| Prepaid expenses and other current assets | 21,449 | 25,957 | ||||||

| Restricted cash | 7,114 | 32,337 | ||||||

| Derivative financial instruments | 3,409 | - | ||||||

| Total Current Assets | 268,411 | 315,349 | ||||||

| Property and Equipment | ||||||||

| Oil and natural gas properties, net - full cost method of accounting, including $283.9 million and $376.1 million of unevaluated properties not being amortized at March 31, 2017 and December 31, 2016, respectively | 893,360 | 1,097,479 | ||||||

| Other property and equipment, net | 16,277 | 18,807 | ||||||

| Total Property and Equipment, net of accumulated depreciation, depletion, amortization and impairment | 909,637 | 1,116,286 | ||||||

| Other Assets | ||||||||

| Restricted cash | 25,606 | 25,583 | ||||||

| Other assets | 25,681 | 28,244 | ||||||

| Total Other Assets | 51,287 | 53,827 | ||||||

| Total Assets | $ | 1,229,335 | $ | 1,485,462 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | 70,706 | $ | 101,117 | ||||

| Accrued liabilities | 33,827 | 63,660 | ||||||

| Asset retirement obligations | 73,073 | 56,601 | ||||||

| Current maturities of long-term debt | 3,616 | 4,268 | ||||||

| Total Current Liabilities | 181,222 | 225,646 | ||||||

| Long-term debt, less current maturities | 73,996 | 74,229 | ||||||

| Asset retirement obligations | 549,938 | 696,763 | ||||||

| Other liabilities | 14,299 | 14,481 | ||||||

| Total Liabilities | 819,455 | 1,011,119 | ||||||

| Stockholders’ Equity | ||||||||

| Preferred stock, $0.01 par value, 10,000,000 shares authorized and no shares outstanding at March 31, 2017 and December 31, 2016 | - | - | ||||||

| Common stock, $0.01 par value, 100,000,000 shares authorized and 33,211,594 shares | ||||||||

| issued and outstanding at March 31, 2017 and December 31, 2016 | 332 | 332 | ||||||

| Additional paid-in capital | 881,138 | 880,286 | ||||||

| Accumulated deficit | (471,590 | ) | (406,275 | ) | ||||

| Total Stockholders’ Equity | 409,880 | 474,343 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 1,229,335 | $ | 1,485,462 | ||||

6

ENERGY XXI GULF COAST, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In Thousands, except per share information)

(Unaudited)

| Successor | Predecessor | |||||||

| Three Months | Three Months | |||||||

| Ended | Ended | |||||||

| March 31, | March 31, | |||||||

| 2017 | 2016 | |||||||

| Revenues | ||||||||

| Oil sales | $ | 133,621 | $ | 92,192 | ||||

| Natural gas liquids sales | 2,227 | 2,889 | ||||||

| Natural gas sales | 18,368 | 14,430 | ||||||

| Gain on derivative financial instruments | 3,698 | 6,774 | ||||||

| Total Revenues | 157,914 | 116,285 | ||||||

| Costs and Expenses | ||||||||

| Lease operating | 75,157 | 82,044 | ||||||

| Production taxes | 239 | 221 | ||||||

| Gathering and transportation | 21,716 | 14,155 | ||||||

| Depreciation, depletion and amortization | 42,006 | 53,847 | ||||||

| Accretion of asset retirement obligations | 12,397 | 15,057 | ||||||

| Impairment of oil and natural gas properties | 44,054 | 340,469 | ||||||

| General and administrative expense | 23,848 | 28,358 | ||||||

| Total Costs and Expenses | 219,417 | 534,151 | ||||||

| Operating Loss | (61,503 | ) | (417,866 | ) | ||||

| Other (Expense) Income | ||||||||

| Other income, net | 22 | 388 | ||||||

| Gain on early extinguishment of debt | - | 777,022 | ||||||

| Interest expense | (3,834 | ) | (198,768 | ) | ||||

| Total Other (Expense) Income , net | (3,812 | ) | 578,642 | |||||

| (Loss) Income Before Income Taxes | (65,315 | ) | 160,776 | |||||

| Income Tax Expense (Benefit) | - | - | ||||||

| Net (Loss) Income | (65,315 | ) | 160,776 | |||||

| Preferred Stock Dividends | - | 2,378 | ||||||

| Net (Loss) Income Attributable to Common Stockholders | $ | (65,315 | ) | $ | 158,398 | |||

| (Loss) Income per Share | ||||||||

| Basic | $ | (1.97 | ) | $ | 1.65 | |||

| Diluted | $ | (1.97 | ) | $ | 1.55 | |||

| Weighted Average Number of Common Shares Outstanding | ||||||||

| Basic | 33,228 | 95,916 | ||||||

| Diluted | 33,228 | 104,001 | ||||||

7

ENERGY XXI GULF COAST, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands)

(Unaudited)

| Successor | Predecessor | |||||||

| Three Months | Three Months | |||||||

| Ended | Ended | |||||||

| March 31, | March 31, | |||||||

| 2017 | 2016 | |||||||

| Cash Flows From Operating Activities | ||||||||

| Net (loss) Income | $ | (65,315 | ) | $ | 160,776 | |||

| Adjustments to reconcile net (loss) income to net cash provided by | ||||||||

| (used in) operating activities: | ||||||||

| Depreciation, depletion and amortization | 42,006 | 53,847 | ||||||

| Impairment of oil and natural gas properties | 44,054 | 340,469 | ||||||

| Gain on early extinguishment of debt | - | (777,022 | ) | |||||

| Change in fair value of derivative financial instruments | (3,409 | ) | 61,325 | |||||

| Accretion of asset retirement obligations | 12,397 | 15,057 | ||||||

| Amortization and write off of debt issuance costs and other | - | 126,475 | ||||||

| Deferred rent | 2,015 | 2,362 | ||||||

| Stock-based compensation | 852 | 186 | ||||||

| Changes in operating assets and liabilities | ||||||||

| Accounts receivable | 15,727 | (37,276 | ) | |||||

| Prepaid expenses and other assets | 6,969 | (1,918 | ) | |||||

| Restricted cash | 25,201 | - | ||||||

| Settlement of asset retirement obligations | (9,316 | ) | (21,313 | ) | ||||

| Accounts payable, accrued liabilities and other | (59,683 | ) | (31,946 | ) | ||||

| Net Cash Provided by (Used in) Operating Activities | 11,498 | (108,978 | ) | |||||

| Cash Flows from Investing Activities | ||||||||

| Capital expenditures | (19,105 | ) | (18,047 | ) | ||||

| Insurance payments received | 2,051 | - | ||||||

| Transfer to restricted cash | - | (9,537 | ) | |||||

| Proceeds from the sale of other property and equipment | 1,269 | - | ||||||

| Other | - | (21 | ) | |||||

| Net Cash Used in Investing Activities | (15,785 | ) | (27,605 | ) | ||||

| Cash Flows from Financing Activities | ||||||||

| Proceeds from the issuance of common and preferred stock, net of offering costs | - | 22 | ||||||

| Payments on long-term debt | (602 | ) | (2,880 | ) | ||||

| Fees related to debt extinguishment | - | (1,446 | ) | |||||

| Debt issuance costs | - | (1,531 | ) | |||||

| Other | - | (25 | ) | |||||

| Net Cash Used in Financing Activities | (602 | ) | (5,860 | ) | ||||

| Net Decrease in Cash and Cash Equivalents | (4,889 | ) | (142,443 | ) | ||||

| Cash and Cash Equivalents, beginning of period | 165,368 | 325,890 | ||||||

| Cash and Cash Equivalents, end of period | $ | 160,479 | $ | 183,447 | ||||

8

ENERGY XXI GULF COAST, INC.

RECONCILIATION OF NON-GAAP MEASURES

(In Thousands, except per share information)

(Unaudited)

As required under Regulation G of the Securities Exchange Act of 1934, provided below is a reconciliation of net loss to Adjusted EBITDA, a non-GAAP financial measure.

| Three Months | ||||

| Ended | ||||

| March 31, | ||||

| 2017 | ||||

| Net Loss | $ | (65,315 | ) | |

| Interest expense | 3,834 | |||

| Depreciation, depletion and amortization | 42,006 | |||

| Impairment of oil and natural gas properties | 44,054 | |||

| Accretion of asset retirement obligations | 12,397 | |||

| Change in fair value of derivative financial instruments | (3,409 | ) | ||

| Non-cash stock-based compensation | 852 | |||

| Deferred rent(1) | 2,015 | |||

| Severance and restructuring costs | 6,200 | |||

| Adjusted EBITDA | $ | 42,634 | ||

| (1) | The deferred rent of approximately $2 million is the non-cash portion of rent which reflects the extent to which our GAAP straight-line rent expense recognized exceeds our cash rent payments |

9

Operational Information

| Successor | Predecessor | |||||||||||||||||||||||

| Three Months | ||||||||||||||||||||||||

| Ended | On | Quarter Ended | ||||||||||||||||||||||

March 31, | December

31, | December

31, | September 30, | June 30, | March 31, | |||||||||||||||||||

| Operating Highlights | 2017 | 2016 | 2016 | 2016 | 2016 | 2016 | ||||||||||||||||||

| (In thousands, except per unit amounts) | ||||||||||||||||||||||||

| Operating revenues | ||||||||||||||||||||||||

| Oil sales | $ | 133,621 | $ | - | $ | 132,308 | $ | 122,732 | $ | 130,083 | $ | 92,192 | ||||||||||||

| Natural gas liquids sales | 2,227 | - | 1,389 | 2,144 | 2,996 | 2,889 | ||||||||||||||||||

| Natural gas sales | 18,368 | - | 19,368 | 17,735 | 14,725 | 14,430 | ||||||||||||||||||

| Gain on derivative financial instruments | 3,698 | - | - | - | - | 6,774 | ||||||||||||||||||

| Total revenues | 157,914 | - | 153,065 | 142,611 | 147,804 | 116,285 | ||||||||||||||||||

| Percentage of oil revenues prior to gain | ||||||||||||||||||||||||

| on derivative financial instruments | 87 | % | - | 86 | % | 86 | % | 88 | % | 84 | % | |||||||||||||

| Operating expenses | ||||||||||||||||||||||||

| Lease operating expense | ||||||||||||||||||||||||

| Insurance expense | 6,250 | - | 6,287 | 6,309 | 8,269 | 8,312 | ||||||||||||||||||

| Workover and maintenance | 10,005 | - | 11,705 | 11,010 | 17,471 | 12,105 | ||||||||||||||||||

| Direct lease operating expense | 58,902 | - | 56,908 | 51,477 | 55,309 | 61,627 | ||||||||||||||||||

| Total lease operating expense | 75,157 | - | 74,900 | 68,796 | 81,049 | 82,044 | ||||||||||||||||||

| Production taxes | 239 | - | 268 | 214 | 155 | 221 | ||||||||||||||||||

| Gathering and transportation | 21,716 | - | 5,478 | 14,073 | 10,014 | 14,155 | ||||||||||||||||||

| Depreciation, depletion and amortization | 42,006 | - | 29,053 | 31,573 | 40,078 | 53,847 | ||||||||||||||||||

| Accretion of asset retirement obligations | 12,397 | - | 19,536 | 19,437 | 18,905 | 15,057 | ||||||||||||||||||

| Impairment of oil and natural gas properties | 44,054 | 406,275 | - | 86,820 | 142,640 | 340,469 | ||||||||||||||||||

| General and administrative | 23,848 | - | 12,122 | 15,435 | 23,174 | 28,358 | ||||||||||||||||||

| Total operating expenses | 219,417 | 406,275 | 141,357 | 236,348 | 316,015 | 534,151 | ||||||||||||||||||

| Operating (loss) income | $ | (61,503 | ) | $ | (406,275 | ) | $ | 11,708 | $ | (93,737 | ) | $ | (168,211 | ) | $ | (417,866 | ) | |||||||

| Sales volumes per day | ||||||||||||||||||||||||

| Oil (MBbls) | 29.1 | - | 29.6 | 30.0 | 31.4 | 32.9 | ||||||||||||||||||

| Natural gas liquids (MBbls) | 0.9 | - | 0.5 | 1.3 | 1.5 | 2.1 | ||||||||||||||||||

| Natural gas (Mmcf) | 65.9 | - | 73.8 | 72.8 | 86.5 | 84.8 | ||||||||||||||||||

| Total (MBOE) | 41.0 | - | 42.5 | 43.4 | 47.3 | 49.1 | ||||||||||||||||||

| Percent of sales volumes from oil | 71 | % | - | 70 | % | 69 | % | 66 | % | 67 | % | |||||||||||||

| Average sales price | ||||||||||||||||||||||||

| Oil per Bbl | $ | 51.04 | $ | - | $ | 48.54 | $ | 44.52 | $ | 45.55 | $ | 30.80 | ||||||||||||

| Natural gas liquid per Bbl | 27.52 | 28.50 | 18.12 | 21.55 | 15.12 | |||||||||||||||||||

| Natural gas per Mcf | 3.10 | - | 2.85 | 2.65 | 1.87 | 1.87 | ||||||||||||||||||

| Gain on derivative financial

instruments per BOE | 1.00 | - | - | - | - | 1.52 | ||||||||||||||||||

| Total revenues per BOE | 42.83 | - | 39.19 | 35.73 | 34.32 | 26.01 | ||||||||||||||||||

| Operating expenses per BOE | ||||||||||||||||||||||||

| Lease operating expense | ||||||||||||||||||||||||

| Insurance expense | 1.70 | - | 1.61 | 1.58 | 1.92 | 1.86 | ||||||||||||||||||

| Workover and maintenance | 2.71 | - | 3.00 | 2.76 | 4.06 | 2.71 | ||||||||||||||||||

| Direct lease operating expense | 15.98 | - | 14.57 | 12.90 | 12.84 | 13.79 | ||||||||||||||||||

| Total lease operating expense per BOE | 20.39 | - | 19.18 | 17.24 | 18.82 | 18.36 | ||||||||||||||||||

| Production taxes | 0.06 | - | 0.07 | 0.05 | 0.04 | 0.05 | ||||||||||||||||||

| Gathering and transportation | 5.89 | - | 1.40 | 3.53 | 2.33 | 3.17 | ||||||||||||||||||

| Depreciation, depletion and amortization | 11.39 | - | 7.44 | 7.91 | 9.31 | 12.05 | ||||||||||||||||||

| Accretion of asset retirement obligations | 3.36 | - | 5.00 | 4.87 | 4.39 | 3.37 | ||||||||||||||||||

| Impairment of oil and natural gas properties | 11.95 | - | - | 21.75 | 33.12 | 76.17 | ||||||||||||||||||

| General and administrative | 6.47 | - | 3.10 | 3.87 | 5.38 | 6.34 | ||||||||||||||||||

| Total operating expenses per BOE | 59.51 | - | 36.19 | 59.22 | 73.39 | 119.51 | ||||||||||||||||||

| Operating (loss) income per BOE | $ | (16.68 | ) | $ | - | $ | 3.00 | $ | (23.49 | ) | $ | (39.07 | ) | $ | (93.50 | ) | ||||||||

10