• | After-tax Distributable Earnings Per Adjusted Share of $0.48 and $1.28 for the quarter and nine months ended September 30, 2020 are both 4% higher compared to the comparable periods in 2019. |

• | Distributable operating earnings was up 13% and 9% for the quarter and nine months ended September 30, 2020, respectively, compared to the comparable periods in 2019. |

• | Assets Under Management and Fee Paying Assets Under Management were $234 billion and $177 billion, up 12% and 16%, respectively, over the last 12 months. Uncalled commitments were $67 billion, up 19% year-over-year, of which $20 billion will contribute to Fee Paying Assets Under Management as that capital is either invested or enters its investment period. |

• | Book Value was $18 billion or $20.26 per adjusted share as of September 30, 2020. |

• | KKR’s regular dividend of $0.135 per common share was declared for the quarter ended September 30, 2020. |

• | During the quarter, we raised $1.8 billion in net proceeds through Mandatory Convertible Preferred Stock and Senior Notes offerings to be used to finance the acquisition of Global Atlantic, which is expected to close in early 2021. (2) |

(1) | Represents only that portion of the business held by KKR & Co. Inc. and does not include the economic interests that are held by KKR Holdings L.P. Our non-GAAP financial results are presented prior to giving effect to the allocation of ownership interests between KKR & Co. Inc. and KKR Holdings L.P. and as such represents the business in total. |

(2) | Global Atlantic refers to Global Atlantic Financial Group. The acquisition is subject to regulatory approvals and certain other customary closing conditions. |

Share Repurchase Activity -- October 27, 2015 through October 23, 2020 (2) | ||||

(Amounts in millions, except per share amounts) | Inception to Date | |||

Open Market Share Repurchases | 52.3 | |||

Reduction of Shares for Retired Equity Awards (3) | 19.1 | |||

Total Repurchased Shares and Retired Equity Awards | 71.4 | |||

Total Capital Used | $ | 1,356 | ||

Average Price Paid Per Share (4) | $ | 18.99 | ||

Remaining Availability under Current Share Repurchase Plan | $ | 462 | ||

(1) | References to the repurchase and reduction of shares relate to shares of KKR common stock. |

(2) | KKR & Co. Inc.'s initial repurchase authorization was announced on October 27, 2015. |

(3) | Refers to the retirement of equity awards issued pursuant to the Amended and Restated KKR & Co. Inc. 2010 Equity Incentive Plan and the KKR & Co. Inc. 2019 Equity Incentive Plan (collectively the "Equity Incentive Plans"). |

(4) | Average price paid per share reflects total capital used to repurchase shares and to retire equity awards from inception to October 23, 2020 divided by the total number of repurchased shares and retired equity awards. |

GAAP CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) | ||||||||||||||||

(Amounts in thousands, except share and per share amounts) | ||||||||||||||||

Quarter Ended | Nine Months Ended | |||||||||||||||

September 30, 2020 | September 30, 2019 | September 30, 2020 | September 30, 2019 | |||||||||||||

Revenues | ||||||||||||||||

Fees and Other | $ | 563,340 | $ | 416,217 | $ | 1,337,385 | $ | 1,308,206 | ||||||||

Capital Allocation-Based Income (Loss) | 1,331,898 | 374,268 | 888,342 | 1,849,623 | ||||||||||||

Total Revenues | 1,895,238 | 790,485 | 2,225,727 | 3,157,829 | ||||||||||||

Expenses | ||||||||||||||||

Compensation and Benefits | 882,339 | 427,527 | 1,211,526 | 1,581,056 | ||||||||||||

Occupancy and Related Charges | 17,321 | 14,894 | 51,222 | 46,777 | ||||||||||||

General, Administrative and Other | 194,039 | 177,112 | 491,327 | 529,278 | ||||||||||||

Total Expenses | 1,093,699 | 619,533 | 1,754,075 | 2,157,111 | ||||||||||||

Investment Income (Loss) | ||||||||||||||||

Net Gains (Losses) from Investment Activities | 2,284,602 | (4,590 | ) | (179,033 | ) | 2,237,273 | ||||||||||

Dividend Income | 116,379 | 147,989 | 295,047 | 187,744 | ||||||||||||

Interest Income | 354,865 | 344,140 | 1,040,052 | 1,068,378 | ||||||||||||

Interest Expense | (223,709 | ) | (268,747 | ) | (725,245 | ) | (782,601 | ) | ||||||||

Total Investment Income (Loss) | 2,532,137 | 218,792 | 430,821 | 2,710,794 | ||||||||||||

Income Tax Expense (Benefit) | 359,375 | 53,132 | 204,960 | 386,124 | ||||||||||||

Net Income (Loss) Attributable to Noncontrolling Interests | 1,909,458 | 87,058 | 206,225 | 1,843,781 | ||||||||||||

Series A and B Preferred Stock Dividends | 8,341 | 8,341 | 25,023 | 25,023 | ||||||||||||

Net Income (Loss) Attributable to KKR & Co. Inc. Common Stockholders (1) | $ | 1,056,502 | $ | 241,213 | $ | 466,265 | $ | 1,456,584 | ||||||||

Net Income (Loss) Attributable to KKR & Co. Inc. Per Share of Common Stock (1) | ||||||||||||||||

Basic | $ | 1.86 | $ | 0.44 | $ | 0.82 | $ | 2.69 | ||||||||

Diluted (2) | $ | 1.79 | $ | 0.43 | $ | 0.80 | $ | 2.63 | ||||||||

Weighted Average Shares of Common Stock Outstanding (1) | ||||||||||||||||

Basic | 562,425,576 | 546,336,936 | 560,124,947 | 541,631,675 | ||||||||||||

Diluted (2) | 589,116,387 | 559,532,065 | 569,910,981 | 554,786,356 | ||||||||||||

GAAP CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (UNAUDITED) | ||||||||

(Amounts in thousands, except per share amounts) | ||||||||

As of | ||||||||

September 30, 2020 | December 31, 2019 | |||||||

Assets | ||||||||

Cash and Cash Equivalents | $ | 4,363,105 | $ | 2,346,713 | ||||

Investments | 60,990,162 | 54,936,268 | ||||||

Other Assets | 5,302,066 | 3,616,338 | ||||||

Total Assets | $ | 70,655,333 | $ | 60,899,319 | ||||

Liabilities and Equity | ||||||||

Debt Obligations | $ | 31,451,641 | $ | 27,013,284 | ||||

Other Liabilities | 5,160,062 | 3,383,661 | ||||||

Total Liabilities | 36,611,703 | 30,396,945 | ||||||

Stockholders' Equity | ||||||||

KKR & Co. Inc. Stockholders' Equity - Series A and B Preferred Stock | 482,554 | 482,554 | ||||||

KKR & Co. Inc. Stockholders' Equity - Series C Mandatory Convertible Preferred Stock | 1,115,792 | — | ||||||

KKR & Co. Inc. Stockholders' Equity - Series I and II Preferred Stock, Common Stock (1) | 10,599,310 | 10,324,936 | ||||||

Noncontrolling Interests | 21,845,974 | 19,694,884 | ||||||

Total Equity | 34,043,630 | 30,502,374 | ||||||

Total Liabilities and Equity | $ | 70,655,333 | $ | 60,899,319 | ||||

KKR & Co. Inc. Stockholders' Equity Per Outstanding Share of Common Stock (1) | $ | 18.72 | $ | 18.44 | ||||

(1) | As used in this press release, references to common stock for prior periods mean Class A common stock of KKR & Co. Inc. and references to Series I Preferred Stock and Series II Preferred Stock for prior periods mean Class B common stock and Class C common stock of KKR & Co. Inc., respectively. |

(2) | Consistent with prior quarters, KKR Holdings L.P. units have been excluded from the calculation of diluted earnings per share of common stock since the exchange of these units would not dilute KKR’s respective ownership interests in the KKR Group Partnership L.P. |

DISTRIBUTABLE REVENUES, DISTRIBUTABLE EXPENSES AND AFTER-TAX DISTRIBUTABLE EARNINGS (UNAUDITED) | ||||||||||||||||||||

(Amounts in thousands, except share and per share amounts) | ||||||||||||||||||||

DISTRIBUTABLE REVENUES | ||||||||||||||||||||

Quarter Ended | Nine Months Ended | |||||||||||||||||||

September 30, 2020 | June 30, 2020 | September 30, 2019 | September 30, 2020 | September 30, 2019 | ||||||||||||||||

Distributable Revenues | ||||||||||||||||||||

Fees and Other, Net | ||||||||||||||||||||

Management Fees | $ | 359,831 | $ | 332,861 | $ | 314,793 | $ | 1,024,450 | $ | 910,105 | ||||||||||

Transaction Fees | 300,645 | 161,339 | 164,892 | 560,404 | 655,421 | |||||||||||||||

Monitoring Fees | 28,824 | 26,902 | 27,546 | 86,875 | 79,621 | |||||||||||||||

Fee Credits | (115,442 | ) | (75,111 | ) | (61,308 | ) | (226,167 | ) | (274,278 | ) | ||||||||||

Total Fees and Other, Net | 573,858 | 445,991 | 445,923 | 1,445,562 | 1,370,869 | |||||||||||||||

Realized Performance Income (Loss) | ||||||||||||||||||||

Carried Interest | 217,978 | 345,665 | 296,344 | 924,974 | 838,608 | |||||||||||||||

Incentive Fees | 16,223 | 9,733 | 11,184 | 36,913 | 52,485 | |||||||||||||||

Total Realized Performance Income (Loss) | 234,201 | 355,398 | 307,528 | 961,887 | 891,093 | |||||||||||||||

Realized Investment Income (Loss) | ||||||||||||||||||||

Net Realized Gains (Losses) | 172,224 | 36,536 | 26,529 | 215,430 | 146,334 | |||||||||||||||

Interest Income and Dividends | 88,191 | 53,789 | 183,705 | 280,474 | 312,969 | |||||||||||||||

Total Realized Investment Income (Loss) | 260,415 | 90,325 | 210,234 | 495,904 | 459,303 | |||||||||||||||

Total Distributable Revenues | $ | 1,068,474 | $ | 891,714 | $ | 963,685 | $ | 2,903,353 | $ | 2,721,265 | ||||||||||

DISTRIBUTABLE EXPENSES | ||||||||||||||||||||

Quarter Ended | Nine Months Ended | |||||||||||||||||||

September 30, 2020 | June 30, 2020 | September 30, 2019 | September 30, 2020 | September 30, 2019 | ||||||||||||||||

Distributable Expenses | ||||||||||||||||||||

Compensation and Benefits (1) | $ | 427,396 | $ | 356,614 | $ | 385,237 | $ | 1,161,240 | $ | 1,088,552 | ||||||||||

Occupancy and Related Charges | 13,639 | 13,964 | 14,141 | 41,717 | 44,586 | |||||||||||||||

Other Operating Expenses | 76,163 | 72,051 | 77,532 | 227,842 | 235,285 | |||||||||||||||

Total Distributable Expenses | $ | 517,198 | $ | 442,629 | $ | 476,910 | $ | 1,430,799 | $ | 1,368,423 | ||||||||||

AFTER-TAX DISTRIBUTABLE EARNINGS | ||||||||||||||||||||

Quarter Ended | Nine Months Ended | |||||||||||||||||||

September 30, 2020 | June 30, 2020 | September 30, 2019 | September 30, 2020 | September 30, 2019 | ||||||||||||||||

After-tax Distributable Earnings | ||||||||||||||||||||

(+) Total Distributable Revenues | $ | 1,068,474 | $ | 891,714 | $ | 963,685 | $ | 2,903,353 | $ | 2,721,265 | ||||||||||

(-) Total Distributable Expenses | 517,198 | 442,629 | 476,910 | 1,430,799 | 1,368,423 | |||||||||||||||

(=) Total Distributable Operating Earnings | 551,276 | 449,085 | 486,775 | 1,472,554 | 1,352,842 | |||||||||||||||

(-) Interest Expense | 54,458 | 50,784 | 48,326 | 152,676 | 139,315 | |||||||||||||||

(-) Series A and B Preferred Dividends | 8,341 | 8,341 | 8,341 | 25,023 | 25,023 | |||||||||||||||

(-) Income (Loss) Attributable to Noncontrolling Interests | 2,709 | 1,002 | 881 | 4,800 | 3,104 | |||||||||||||||

(-) Income Taxes Paid | 75,413 | 63,315 | 40,429 | 198,763 | 155,237 | |||||||||||||||

After-tax Distributable Earnings | $ | 410,355 | $ | 325,643 | $ | 388,798 | $ | 1,091,292 | $ | 1,030,163 | ||||||||||

After-tax Distributable Earnings Per Adjusted Share | $ | 0.48 | $ | 0.39 | $ | 0.46 | $ | 1.28 | $ | 1.23 | ||||||||||

Weighted Average Adjusted Shares (2) | 861,854,785 | 845,065,077 | 842,585,116 | 851,501,835 | 839,255,710 | |||||||||||||||

Assets Under Management | $ | 233,808,800 | $ | 221,756,700 | $ | 208,427,000 | $ | 233,808,800 | $ | 208,427,000 | ||||||||||

Fee Paying Assets Under Management | $ | 177,290,200 | $ | 160,329,800 | $ | 152,997,400 | $ | 177,290,200 | $ | 152,997,400 | ||||||||||

Capital Invested and Syndicated Capital | $ | 10,019,100 | $ | 6,877,800 | $ | 5,043,800 | $ | 22,059,000 | $ | 18,222,900 | ||||||||||

Uncalled Commitments | $ | 67,077,600 | $ | 66,818,800 | $ | 56,605,200 | $ | 67,077,600 | $ | 56,605,200 | ||||||||||

Fee Related Earnings | $ | 318,900 | $ | 244,582 | $ | 250,414 | $ | 799,635 | $ | 759,874 | ||||||||||

(1) | Includes equity-based compensation of $42.5 million, $39.9 million, and $54.4 million for the quarters ended September 30, 2020, June 30, 2020, and September 30, 2019, respectively, and $133.4 million and $157.9 million for the nine months ended September 30, 2020 and 2019, respectively. |

(2) | Includes shares of KKR & Co. Inc. common stock assuming conversion of all of the Series C Mandatory Convertible Preferred Stock. See Exhibit A for KKR's Weighted Average GAAP Shares of Common Stock Outstanding to Weighted Average Adjusted Shares. |

SCHEDULE OF SELECTED SUPPLEMENTAL FINANCIAL INFORMATION (UNAUDITED) | ||||||||||||||||||||

(Amounts in thousands) | ||||||||||||||||||||

PRIVATE MARKETS BUSINESS LINE REVENUES & OPERATING METRICS | ||||||||||||||||||||

Quarter Ended | Nine Months Ended | |||||||||||||||||||

September 30, 2020 | June 30, 2020 | September 30, 2019 | September 30, 2020 | September 30, 2019 | ||||||||||||||||

Fees and Other, Net | ||||||||||||||||||||

Management Fees | $ | 241,788 | $ | 223,221 | $ | 202,632 | $ | 682,269 | $ | 578,494 | ||||||||||

Transaction Fees | 133,943 | 85,478 | 63,580 | 236,289 | 298,893 | |||||||||||||||

Monitoring Fees | 28,824 | 26,902 | 27,546 | 86,875 | 79,621 | |||||||||||||||

Fee Credits | (107,275 | ) | (69,273 | ) | (44,625 | ) | (192,027 | ) | (224,546 | ) | ||||||||||

Total Fees and Other, Net | $ | 297,280 | $ | 266,328 | $ | 249,133 | $ | 813,406 | $ | 732,462 | ||||||||||

Realized Performance Income (Loss) | ||||||||||||||||||||

Carried Interest | $ | 217,978 | $ | 345,665 | $ | 281,494 | $ | 889,334 | $ | 813,858 | ||||||||||

Incentive Fees | 701 | 885 | — | 2,723 | 1,485 | |||||||||||||||

Total Realized Performance Income (Loss) | $ | 218,679 | $ | 346,550 | $ | 281,494 | $ | 892,057 | $ | 815,343 | ||||||||||

Assets Under Management | $ | 135,758,500 | $ | 124,828,200 | $ | 114,368,500 | $ | 135,758,500 | $ | 114,368,500 | ||||||||||

Fee Paying Assets Under Management | $ | 90,351,000 | $ | 77,356,100 | $ | 73,824,100 | $ | 90,351,000 | $ | 73,824,100 | ||||||||||

Capital Invested | $ | 6,232,000 | $ | 5,506,000 | $ | 2,372,100 | $ | 13,172,000 | $ | 9,624,400 | ||||||||||

Uncalled Commitments | $ | 56,202,000 | $ | 55,427,200 | $ | 46,579,800 | $ | 56,202,000 | $ | 46,579,800 | ||||||||||

PUBLIC MARKETS BUSINESS LINE REVENUES & OPERATING METRICS | ||||||||||||||||||||

Quarter Ended | Nine Months Ended | |||||||||||||||||||

September 30, 2020 | June 30, 2020 | September 30, 2019 | September 30, 2020 | September 30, 2019 | ||||||||||||||||

Fees and Other, Net | ||||||||||||||||||||

Management Fees | $ | 118,043 | $ | 109,640 | $ | 112,161 | $ | 342,181 | $ | 331,611 | ||||||||||

Transaction Fees | 8,436 | 6,423 | 17,313 | 36,228 | 53,241 | |||||||||||||||

Fee Credits | (8,167 | ) | (5,838 | ) | (16,683 | ) | (34,140 | ) | (49,732 | ) | ||||||||||

Total Fees and Other, Net | $ | 118,312 | $ | 110,225 | $ | 112,791 | $ | 344,269 | $ | 335,120 | ||||||||||

Realized Performance Income (Loss) | ||||||||||||||||||||

Carried Interest | $ | — | $ | — | $ | 14,850 | $ | 35,640 | $ | 24,750 | ||||||||||

Incentive Fees | 15,522 | 8,848 | 11,184 | 34,190 | 51,000 | |||||||||||||||

Total Realized Performance Income (Loss) | $ | 15,522 | $ | 8,848 | $ | 26,034 | $ | 69,830 | $ | 75,750 | ||||||||||

Assets Under Management | $ | 98,050,300 | $ | 96,928,500 | $ | 94,058,500 | $ | 98,050,300 | $ | 94,058,500 | ||||||||||

Fee Paying Assets Under Management | $ | 86,939,200 | $ | 82,973,700 | $ | 79,173,300 | $ | 86,939,200 | $ | 79,173,300 | ||||||||||

Capital Invested | $ | 1,708,300 | $ | 1,158,900 | $ | 2,021,200 | $ | 6,509,300 | $ | 6,041,400 | ||||||||||

Uncalled Commitments | $ | 10,875,600 | $ | 11,391,600 | $ | 10,025,400 | $ | 10,875,600 | $ | 10,025,400 | ||||||||||

CAPITAL MARKETS BUSINESS LINE REVENUES & OPERATING METRICS | ||||||||||||||||||||

Quarter Ended | Nine Months Ended | |||||||||||||||||||

September 30, 2020 | June 30, 2020 | September 30, 2019 | September 30, 2020 | September 30, 2019 | ||||||||||||||||

Transaction Fees | $ | 158,266 | $ | 69,438 | $ | 83,999 | $ | 287,887 | $ | 303,287 | ||||||||||

Syndicated Capital | $ | 2,078,800 | $ | 212,900 | $ | 650,500 | $ | 2,377,700 | $ | 2,557,100 | ||||||||||

PRINCIPAL ACTIVITIES BUSINESS LINE REVENUES | ||||||||||||||||||||

Quarter Ended | Nine Months Ended | |||||||||||||||||||

September 30, 2020 | June 30, 2020 | September 30, 2019 | September 30, 2020 | September 30, 2019 | ||||||||||||||||

Realized Investment Income (Loss) | ||||||||||||||||||||

Net Realized Gains (Losses) | $ | 172,224 | $ | 36,536 | $ | 26,529 | $ | 215,430 | $ | 146,334 | ||||||||||

Interest Income and Dividends | 88,191 | 53,789 | 183,705 | 280,474 | 312,969 | |||||||||||||||

Total Realized Investment Income (Loss) | $ | 260,415 | $ | 90,325 | $ | 210,234 | $ | 495,904 | $ | 459,303 | ||||||||||

BOOK ASSETS, BOOK LIABILITIES AND BOOK VALUE (UNAUDITED) | |||||||||

(Amounts in thousands, except share and per share amounts) | |||||||||

BOOK ASSETS | |||||||||

As of | |||||||||

September 30, 2020 | December 31, 2019 | ||||||||

Book Assets | |||||||||

Cash and Short-term Investments | $ | 4,994,772 | $ | 2,783,905 | |||||

Investments | 14,042,391 | (1) | 13,026,387 | ||||||

Net Unrealized Carried Interest | 1,884,642 | (2) | 1,982,251 | (2) | |||||

Tax Assets | 139,605 | 111,719 | |||||||

Other Assets | 4,187,603 | 3,716,189 | |||||||

Total Book Assets | $ | 25,249,013 | $ | 21,620,451 | |||||

BOOK LIABILITIES | |||||||||

As of | |||||||||

September 30, 2020 | December 31, 2019 | ||||||||

Book Liabilities | |||||||||

Debt Obligations - KKR (ex-KFN) | $ | 4,642,479 | $ | 3,097,460 | |||||

Debt Obligations - KFN | 948,517 | 948,517 | |||||||

Tax Liabilities | 254,211 | 169,997 | |||||||

Other Liabilities | 1,083,694 | 514,236 | |||||||

Total Book Liabilities | $ | 6,928,901 | $ | 4,730,210 | |||||

BOOK VALUE | |||||||||

As of | |||||||||

September 30, 2020 | December 31, 2019 | ||||||||

Book Value | |||||||||

(+) Total Book Assets | $ | 25,249,013 | $ | 21,620,451 | |||||

(-) Total Book Liabilities | 6,928,901 | 4,730,210 | |||||||

(-) Noncontrolling Interests | 31,089 | 26,291 | |||||||

(-) Series A and B Preferred Stock | 500,000 | 500,000 | |||||||

Book Value | $ | 17,789,023 | $ | 16,363,950 | |||||

Book Value Per Adjusted Share | $ | 20.26 | $ | 19.24 | |||||

Adjusted Shares | 877,876,658 | 850,388,924 | |||||||

(1) | See schedule of investments that follows on the next page. |

(2) | The following table provides net unrealized carried interest by business line: |

As of | |||||||||

September 30, 2020 | December 31, 2019 | ||||||||

Private Markets Business Line | $ | 1,865,042 | $ | 1,832,581 | |||||

Public Markets Business Line | 19,600 | 149,670 | |||||||

Total | $ | 1,884,642 | $ | 1,982,251 | |||||

SCHEDULE OF INVESTMENTS (UNAUDITED) (1) |

(Amounts in thousands, except percentage amounts) |

As of September 30, 2020 | ||||

Investments | Fair Value | |||

Private Equity Funds / SMAs | $ | 5,939,123 | ||

Private Equity Co-Investments and Other Equity | 4,024,203 | |||

Private Equity Total | 9,963,326 | |||

Energy | 687,477 | |||

Real Estate | 1,149,910 | |||

Infrastructure | 566,391 | |||

Real Assets Total | 2,403,778 | |||

Alternative Credit | 559,823 | |||

CLOs | 695,471 | |||

Other Credit | 155,423 | |||

Credit Total | 1,410,717 | |||

Other | 264,570 | |||

Total Investments | $ | 14,042,391 | ||

As of September 30, 2020 | |||||||

Significant Investments: (3) | Fair Value | Fair Value as a % of Total Investments | |||||

Fiserv, Inc. | $ | 1,468,909 | 10.5 | % | |||

USI, Inc. | 884,610 | 6.3 | % | ||||

BridgeBio Pharma Inc. | 514,082 | 3.7 | % | ||||

PetVet Care Centers, LLC | 486,376 | 3.5 | % | ||||

Heartland Dental, LLC | 473,590 | 3.4 | % | ||||

Total Significant Investments | 3,827,567 | 27.4 | % | ||||

Other Investments | 10,214,824 | 72.6 | % | ||||

Total Investments | $ | 14,042,391 | 100.0 | % | |||

(1) | Investments is a term used solely for purposes of financial presentation of a portion of KKR’s balance sheet and includes majority ownership of subsidiaries that operate KKR’s asset management and other businesses, including the general partner interests of KKR’s investment funds. |

(2) | Private Equity includes KKR private equity funds, co-investments alongside such KKR sponsored private equity funds, core private equity funds and other opportunistic investments. Equity investments in other asset classes, such as energy, real estate, and alternative credit appear in these other asset classes. |

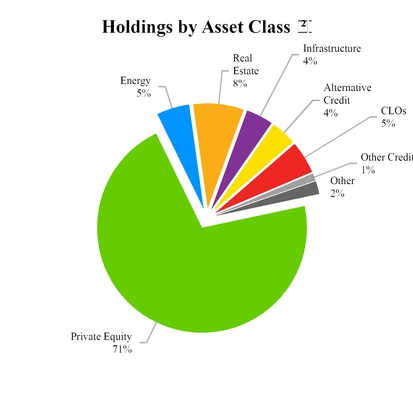

(3) | Significant Investments include the top five investments based on their fair values as of September 30, 2020. Significant Investments exclude (i) investments expected to be syndicated, (ii) investments expected to be transferred in connection with a new fundraising, and (iii) investments in funds and other entities that are owned by one or more third parties and established for the purpose of making investments. Accordingly, this list of Significant Investments should not be relied upon as a substitute for the "Holdings by Asset Class" pie chart above for information about the asset class exposure of KKR's balance sheet. The fair value figures include the co-investment and the limited partner and/or general partner interests held by KKR in the underlying investment, if applicable. |

ASSETS UNDER MANAGEMENT (UNAUDITED) | ||||||||||||

(Amounts in thousands) | ||||||||||||

Private Markets Business Line | Public Markets Business Line | Total | ||||||||||

Quarter Ended September 30, 2020 | ||||||||||||

June 30, 2020 | $ | 124,828,200 | $ | 96,928,500 | $ | 221,756,700 | ||||||

New Capital Raised | 5,754,000 | 2,916,700 | 8,670,700 | |||||||||

Distributions and Other | (2,447,100 | ) | (5,655,700 | ) | (1) | (8,102,800 | ) | |||||

Change in Value | 7,623,400 | 3,860,800 | 11,484,200 | |||||||||

September 30, 2020 | $ | 135,758,500 | $ | 98,050,300 | $ | 233,808,800 | ||||||

Nine Months Ended September 30, 2020 | ||||||||||||

December 31, 2019 | $ | 119,274,700 | $ | 99,080,400 | $ | 218,355,100 | ||||||

New Capital Raised | 20,193,000 | 11,999,400 | 32,192,400 | |||||||||

Distributions and Other | (10,253,900 | ) | (11,822,800 | ) | (2) | (22,076,700 | ) | |||||

Change in Value | 6,544,700 | (1,206,700 | ) | 5,338,000 | ||||||||

September 30, 2020 | $ | 135,758,500 | $ | 98,050,300 | $ | 233,808,800 | ||||||

Trailing Twelve Months Ended September 30, 2020 | ||||||||||||

September 30, 2019 | $ | 114,368,500 | $ | 94,058,500 | $ | 208,427,000 | ||||||

New Capital Raised | 24,069,600 | 15,801,300 | 39,870,900 | |||||||||

Impact of Other Transactions | — | 2,172,900 | (3) | 2,172,900 | ||||||||

Distributions and Other | (13,096,100 | ) | (13,549,400 | ) | (4) | (26,645,500 | ) | |||||

Change in Value | 10,416,500 | (433,000 | ) | 9,983,500 | ||||||||

September 30, 2020 | $ | 135,758,500 | $ | 98,050,300 | $ | 233,808,800 | ||||||

(1) | Includes $4,270.3 million of redemptions by fund investors. |

(2) | Includes $8,816.9 million of redemptions by fund investors. |

(3) | Includes KKR's incremental pro rata portion of AUM of $2,172.9 million managed by Marshall Wace LLP due to an additional 5% interest acquired by KKR on November 22, 2019. |

(4) | Includes $10,254.8 million of redemptions by fund investors. |

FEE PAYING ASSETS UNDER MANAGEMENT (UNAUDITED) | ||||||||||||

(Amounts in thousands) | ||||||||||||

Private Markets Business Line | Public Markets Business Line | Total | ||||||||||

Quarter Ended September 30, 2020 | ||||||||||||

June 30, 2020 | $ | 77,356,100 | $ | 82,973,700 | $ | 160,329,800 | ||||||

New Capital Raised | 15,370,800 | 3,194,200 | 18,565,000 | |||||||||

Distributions and Other | (771,900 | ) | (2,489,700 | ) | (1) | (3,261,600 | ) | |||||

Net Changes in Fee Base of Certain Funds (2) | (2,177,800 | ) | — | (2,177,800 | ) | |||||||

Change in Value | 573,800 | 3,261,000 | 3,834,800 | |||||||||

September 30, 2020 | $ | 90,351,000 | $ | 86,939,200 | $ | 177,290,200 | ||||||

Nine Months Ended September 30, 2020 | ||||||||||||

December 31, 2019 | $ | 76,918,100 | $ | 84,291,700 | $ | 161,209,800 | ||||||

New Capital Raised | 18,773,900 | 11,384,900 | 30,158,800 | |||||||||

Distributions and Other | (4,747,500 | ) | (9,071,900 | ) | (3) | (13,819,400 | ) | |||||

Net Changes in Fee Base of Certain Funds (2) | (2,177,800 | ) | — | (2,177,800 | ) | |||||||

Change in Value | 1,584,300 | 334,500 | 1,918,800 | |||||||||

September 30, 2020 | $ | 90,351,000 | $ | 86,939,200 | $ | 177,290,200 | ||||||

Trailing Twelve Months Ended September 30, 2020 | ||||||||||||

September 30, 2019 | $ | 73,824,100 | $ | 79,173,300 | $ | 152,997,400 | ||||||

New Capital Raised | 22,807,800 | 15,217,100 | 38,024,900 | |||||||||

Impact of Other Transactions | — | 2,172,900 | (4) | 2,172,900 | ||||||||

Distributions and Other | (5,584,800 | ) | (10,619,600 | ) | (5) | (16,204,400 | ) | |||||

Net Changes in Fee Base of Certain Funds (2) | (2,418,300 | ) | — | (2,418,300 | ) | |||||||

Change in Value | 1,722,200 | 995,500 | 2,717,700 | |||||||||

September 30, 2020 | $ | 90,351,000 | $ | 86,939,200 | $ | 177,290,200 | ||||||

(1) | Includes $1,828.8 million of redemptions by fund investors. |

(2) | Represents the impact of certain funds entering their post-investment period. |

(3) | Includes $5,616.3 million of redemptions by fund investors. |

(4) | Includes KKR's incremental pro rata portion of FPAUM of $2,172.9 million managed by Marshall Wace LLP due to an additional 5% interest acquired by KKR on November 22, 2019. |

(5) | Includes $6,974.0 million of redemptions by fund investors. |

INVESTMENT VEHICLE SUMMARY (UNAUDITED) | ||||||||||||||||||||||

As of September 30, 2020 | ||||||||||||||||||||||

(Amounts in millions, except percentages) | ||||||||||||||||||||||

Investment Period | Amount | |||||||||||||||||||||

Start Date | End Date | Commitment | Uncalled Commitments | Percentage Committed by General Partner | Invested | Realized | Remaining Cost | Remaining Fair Value | ||||||||||||||

Private Markets Business Line | ||||||||||||||||||||||

Private Equity and Growth Funds | ||||||||||||||||||||||

Americas Fund XII | 1/2017 | 1/2023 | $ | 13,500.0 | $ | 6,433.0 | 5.8% | $ | 7,174.4 | $ | 192.3 | $ | 7,072.3 | $ | 11,226.3 | |||||||

North America Fund XI | 9/2012 | 1/2017 | 8,718.4 | 546.1 | 2.9% | 9,609.9 | 11,986.8 | 4,866.9 | 8,848.3 | |||||||||||||

2006 Fund (1) | 9/2006 | 9/2012 | 17,642.2 | 247.4 | 2.1% | 17,309.3 | 31,683.5 | 2,926.1 | 4,730.6 | |||||||||||||

Millennium Fund (1) | 12/2002 | 12/2008 | 6,000.0 | — | 2.5% | 6,000.0 | 14,123.1 | — | 6.1 | |||||||||||||

European Fund V | 3/2019 | 7/2025 | 6,401.0 | 4,362.6 | 1.8% | 2,038.4 | — | 2,038.4 | 2,401.8 | |||||||||||||

European Fund IV | 12/2014 | 3/2019 | 3,516.6 | 266.2 | 5.7% | 3,372.9 | 3,024.0 | 2,172.1 | 3,404.4 | |||||||||||||

European Fund III (1) | 3/2008 | 3/2014 | 5,513.1 | 153.3 | 5.2% | 5,359.8 | 10,524.4 | 336.7 | 284.5 | |||||||||||||

European Fund II (1) | 11/2005 | 10/2008 | 5,750.8 | — | 2.1% | 5,750.8 | 8,507.4 | — | 34.3 | |||||||||||||

Asian Fund IV | 7/2020 | 7/2026 | 13,096.3 | 13,096.3 | 7.6% | — | — | — | — | |||||||||||||

Asian Fund III | 4/2017 | 7/2020 | 9,000.0 | 3,719.3 | 5.6% | 5,640.1 | 1,238.1 | 5,266.8 | 6,977.3 | |||||||||||||

Asian Fund II | 4/2013 | 4/2017 | 5,825.0 | 36.5 | 1.3% | 6,802.5 | 4,779.1 | 4,107.5 | 5,159.6 | |||||||||||||

Asian Fund (1) | 7/2007 | 4/2013 | 3,983.3 | — | 2.5% | 3,974.3 | 8,723.3 | 17.1 | 29.8 | |||||||||||||

China Growth Fund (1) | 11/2010 | 11/2016 | 1,010.0 | — | 1.0% | 1,010.0 | 831.9 | 531.1 | 428.2 | |||||||||||||

Next Generation Technology Growth Fund II | 12/2019 | 12/2025 | 2,088.3 | 1,463.6 | 7.2% | 624.7 | — | 624.7 | 697.9 | |||||||||||||

Next Generation Technology Growth Fund | 3/2016 | 12/2019 | 658.9 | 6.8 | 22.5% | 658.3 | 290.7 | 545.8 | 986.4 | |||||||||||||

Health Care Strategic Growth Fund | 12/2016 | 12/2021 | 1,331.0 | 917.9 | 11.3% | 503.9 | 95.9 | 410.7 | 771.0 | |||||||||||||

Global Impact Fund | 2/2019 | 2/2025 | 1,242.2 | 804.7 | 8.1% | 437.5 | — | 437.5 | 482.1 | |||||||||||||

Total Private Equity and Growth Funds | 105,277.1 | 32,053.7 | 76,266.8 | 96,000.5 | 31,353.7 | 46,468.6 | ||||||||||||||||

Co-Investment Vehicles and Other | Various | Various | 10,494.0 | 3,232.7 | Various | 7,535.3 | 5,299.5 | 4,957.7 | 6,463.0 | |||||||||||||

Total Private Equity | 115,771.1 | 35,286.4 | 83,802.1 | 101,300.0 | 36,311.4 | 52,931.6 | ||||||||||||||||

Core Investment Vehicles | Various | Various | 9,900.3 | 3,512.2 | 35.6% | 6,388.1 | — | 6,388.1 | 8,852.3 | |||||||||||||

Real Assets | ||||||||||||||||||||||

Energy Income and Growth Fund II | 6/2018 | 6/2021 | 994.2 | 587.6 | 20.1% | 416.3 | 9.6 | 407.1 | 396.5 | |||||||||||||

Energy Income and Growth Fund | 9/2013 | 6/2018 | 1,974.2 | 54.8 | 12.9% | 1,967.9 | 785.9 | 1,288.3 | 995.0 | |||||||||||||

Natural Resources Fund (1) | Various | Various | 887.4 | 0.9 | Various | 886.5 | 123.2 | 194.2 | 71.2 | |||||||||||||

Global Energy Opportunities | Various | Various | 914.1 | 170.3 | Various | 518.4 | 138.1 | 347.6 | 216.6 | |||||||||||||

Global Infrastructure Investors III | 6/2018 | 6/2024 | 7,191.2 | 4,503.9 | 3.8% | 2,856.8 | 169.5 | 2,799.2 | 2,891.7 | |||||||||||||

Global Infrastructure Investors II | 10/2014 | 6/2018 | 3,040.6 | 161.1 | 4.1% | 3,119.4 | 2,667.7 | 2,067.1 | 2,425.0 | |||||||||||||

Global Infrastructure Investors | 9/2011 | 10/2014 | 1,040.2 | 25.1 | 4.8% | 1,046.7 | 2,096.7 | 129.3 | 110.4 | |||||||||||||

Asia Pacific Infrastructure Investors | 1/2020 | 1/2026 | 2,805.6 | 2,805.6 | 8.9% | — | — | — | — | |||||||||||||

Real Estate Partners Americas II | 5/2017 | 12/2020 | 1,921.2 | 787.7 | 7.8% | 1,311.4 | 421.7 | 1,106.8 | 1,265.2 | |||||||||||||

Real Estate Partners Americas | 5/2013 | 5/2017 | 1,229.1 | 148.2 | 16.3% | 1,010.7 | 1,354.5 | 199.9 | 98.1 | |||||||||||||

Real Estate Partners Europe | 9/2015 | 12/2019 | 713.1 | 198.5 | 9.6% | 586.3 | 154.0 | 506.4 | 621.5 | |||||||||||||

Real Estate Credit Opportunity Partners II | 4/2019 | 6/2022 | 950.0 | 626.0 | 5.3% | 324.0 | 5.9 | 324.0 | 318.4 | |||||||||||||

Real Estate Credit Opportunity Partners | 2/2017 | 4/2019 | 1,130.0 | 122.2 | 4.4% | 1,007.8 | 210.9 | 1,007.8 | 937.1 | |||||||||||||

Property Partners Americas | 12/2019 | (2) | 2,012.5 | 1,686.7 | 24.8% | 325.8 | — | 325.8 | 356.4 | |||||||||||||

Co-Investment Vehicles and Other | Various | Various | 6,791.9 | 4,029.4 | Various | 2,762.5 | 900.2 | 2,758.8 | 3,233.4 | |||||||||||||

Total Real Assets | 33,595.3 | 15,908.0 | 18,140.5 | 9,037.9 | 13,462.3 | 13,936.5 | ||||||||||||||||

Unallocated Commitments (3) | 1,068.7 | 1,068.7 | Various | — | — | — | — | |||||||||||||||

Private Markets Total | 160,335.4 | 55,775.3 | 108,330.7 | 110,337.9 | 56,161.8 | 75,720.4 | ||||||||||||||||

Public Markets Business Line (4) | ||||||||||||||||||||||

Alternative Credit | ||||||||||||||||||||||

Dislocation Opportunities Fund | 5/2020 | 11/2021 | 2,797.3 | 2,441.3 | 14.3% | 356.0 | 7.2 | 355.9 | 431.1 | |||||||||||||

Special Situations Fund II | 2/2015 | 3/2019 | 3,524.7 | 528.4 | 9.0% | 2,996.3 | 769.8 | 2,508.3 | 2,127.0 | |||||||||||||

Special Situations Fund | 1/2013 | 1/2016 | 2,274.3 | 1.3 | 11.6% | 2,273.0 | 1,552.4 | 1,313.3 | 509.1 | |||||||||||||

Mezzanine Partners | 7/2010 | 3/2015 | 1,022.8 | 102.7 | 4.4% | 920.1 | 1,092.1 | 255.4 | 153.3 | |||||||||||||

Private Credit Opportunities Partners II | 12/2015 | 12/2020 | 2,245.1 | 668.7 | 2.2% | 1,576.4 | 138.3 | 1,529.6 | 1,574.6 | |||||||||||||

Lending Partners III | 4/2017 | 11/2021 | 1,497.8 | 836.4 | 1.7% | 661.4 | 167.8 | 661.4 | 669.6 | |||||||||||||

Lending Partners II | 6/2014 | 6/2017 | 1,335.9 | 156.8 | 3.7% | 1,179.1 | 1,100.7 | 529.9 | 219.3 | |||||||||||||

Lending Partners | 12/2011 | 12/2014 | 460.2 | 53.0 | 15.2% | 407.2 | 450.7 | 118.5 | 17.3 | |||||||||||||

Lending Partners Europe II | 6/2019 | 9/2023 | 836.6 | 836.6 | 6.7% | — | — | — | — | |||||||||||||

Lending Partners Europe | 3/2015 | 3/2019 | 847.6 | 212.3 | 5.0% | 635.3 | 229.8 | 535.8 | 372.6 | |||||||||||||

Total Alternative Credit | 16,842.3 | 5,837.5 | 11,004.8 | 5,508.8 | 7,808.1 | 6,073.9 | ||||||||||||||||

Other Alternative Credit Vehicles | Various | Various | 10,769.4 | 4,765.7 | Various | 6,003.7 | 3,616.3 | 4,097.7 | 3,887.9 | |||||||||||||

Unallocated Commitments (3) | 124.3 | 124.3 | Various | — | — | — | — | |||||||||||||||

Public Markets Total | 27,736.0 | 10,727.5 | 17,008.5 | 9,125.1 | 11,905.8 | 9,961.8 | ||||||||||||||||

Total Eligible To Receive Carried Interest | $ | 188,071.4 | $ | 66,502.8 | $ | 125,339.2 | $ | 119,463.0 | $ | 68,067.6 | $ | 85,682.2 | ||||||||||

(1) | The "Invested" and "Realized" columns do not include the amounts of any realized investments that restored the unused capital commitments of the fund investors, if any. |

(2) | Open ended fund. |

(3) | Represents unallocated commitments from our strategic investor partnerships. |

(4) | The "Commitment" and "Uncalled Commitments" columns include income that is eligible to be reinvested if permitted under the terms of the investment vehicle agreements. |

INVESTMENT VEHICLE SUMMARY (UNAUDITED) (CONTINUED) | ||||||||||||

As of September 30, 2020 | ||||||||||||

(Amounts in millions) | ||||||||||||

Uncalled Commitments | Remaining Fair Value | Total | ||||||||||

Carried Interest Eligible | $ | 66,502.8 | $ | 85,682.2 | $ | 152,185.0 | ||||||

Incentive Fee Eligible | ||||||||||||

Hedge Fund Partnerships (1) | — | 19,914.5 | 19,914.5 | |||||||||

Business Development Companies (BDCs) | — | 14,749.0 | 14,749.0 | |||||||||

KKR Real Estate Finance Trust Inc. | — | 1,128.7 | 1,128.7 | |||||||||

Other | — | 5,405.4 | 5,405.4 | |||||||||

Total Carried Interest and Incentive Fee Eligible | 66,502.8 | 126,879.8 | 193,382.6 | |||||||||

Collateralized Loan Obligations (CLOs) | — | 17,185.9 | 17,185.9 | |||||||||

Leveraged Credit / Hedge Fund Partnerships (1) / Other | 574.8 | 22,665.5 | 23,240.3 | |||||||||

Total Assets Under Management | $ | 67,077.6 | $ | 166,731.2 | $ | 233,808.8 | ||||||

(1) | Represents KKR's pro rata portion of AUM of hedge fund managers in which KKR holds a minority ownership interest. Total AUM for Hedge Fund Partnerships is $23,469.9 million, of which $19,914.5 million is incentive fee eligible. |

KKR’S PORTION OF TOTAL UNCALLED COMMITMENTS TO ITS INVESTMENT FUNDS | ||||||||||

(Amounts in thousands) | ||||||||||

As of | ||||||||||

September 30, 2020 | December 31, 2019 | |||||||||

Private Markets Business Line | $ | 5,140,600 | $ | 4,551,500 | ||||||

Public Markets Business Line | 603,400 | 689,700 | ||||||||

Total | $ | 5,744,000 | $ | 5,241,200 | ||||||

EXHIBIT A | ||||||||||

GAAP COMMON STOCK AND ADJUSTED SHARES (UNAUDITED) | ||||||||||

The following table provides a reconciliation of KKR's Weighted Average GAAP Shares of Common Stock Outstanding to Weighted Average Adjusted Shares: | ||||||||||

Quarter Ended | ||||||||||

September 30, 2020 | June 30, 2020 | September 30, 2019 | ||||||||

Weighted Average GAAP Shares of Common Stock Outstanding - Basic | 562,425,576 | 558,774,162 | 546,336,936 | |||||||

Adjustments: | ||||||||||

Weighted Average KKR Holdings Units (1) | 282,692,900 | 286,290,915 | 296,248,180 | |||||||

Weighted Average Common Stock - Series C Mandatory Convertible Preferred Stock(2) | 16,736,309 | — | — | |||||||

Weighted Average Adjusted Shares (3) | 861,854,785 | 845,065,077 | 842,585,116 | |||||||

Nine Months Ended | ||||||||||

September 30, 2020 | September 30, 2019 | |||||||||

Weighted Average GAAP Shares of Common Stock Outstanding - Basic | 560,124,947 | 541,631,675 | ||||||||

Adjustments: | ||||||||||

Weighted Average KKR Holdings Units (1) | 285,757,397 | 297,624,035 | ||||||||

Weighted Average Common Stock - Series C Mandatory Convertible Preferred Stock(2) | 5,619,491 | — | ||||||||

Weighted Average Adjusted Shares (3) | 851,501,835 | 839,255,710 | ||||||||

The following table provides a reconciliation of KKR's GAAP Shares of Common Stock Outstanding to Adjusted Shares: | ||||||||||

As of | ||||||||||

September 30, 2020 | December 31, 2019 | |||||||||

GAAP Shares of Common Stock Outstanding | 566,334,746 | 560,007,579 | ||||||||

Adjustments: | ||||||||||

KKR Holdings Units (1) | 278,781,478 | 290,381,345 | ||||||||

Common Stock - Series C Mandatory Convertible Preferred Stock (2) | 32,760,434 | — | ||||||||

Adjusted Shares (3) | 877,876,658 | 850,388,924 | ||||||||

Unvested Shares of Common Stock | 15,683,349 | 22,712,604 | ||||||||

(1) | Shares that may be issued by KKR & Co. Inc. upon exchange of units in KKR Holdings L.P. for KKR common stock. |

(2) | Assumes that all shares of Series C Mandatory Convertible Preferred Stock have been converted to shares of KKR & Co. Inc. common stock on September 30, 2020. |

(3) | Amounts exclude unvested shares granted under the Equity Incentive Plans. |

EXHIBIT A (CONTINUED) | ||||||||||||

RECONCILIATION OF NET INCOME (LOSS) ATTRIBUTABLE TO KKR & CO. INC. PER SHARE OF COMMON STOCK - BASIC (GAAP BASIS) | ||||||||||||

TO AFTER-TAX DISTRIBUTABLE EARNINGS PER ADJUSTED SHARE AND ADJUSTED EBITDA (UNAUDITED) | ||||||||||||

(Amounts in thousands, except share and per share amounts) | ||||||||||||

Quarter Ended | ||||||||||||

September 30, 2020 | June 30, 2020 | September 30, 2019 | ||||||||||

Net Income (Loss) Attributable to KKR & Co. Inc. Per Share of Common Stock - Basic | $ | 1.86 | $ | 1.25 | $ | 0.44 | ||||||

Weighted Average Shares of Common Stock Outstanding - Basic | 562,425,576 | 558,774,162 | 546,336,936 | |||||||||

Net Income (Loss) Available to KKR & Co. Inc. Common Stockholders | $ | 1,047,685 | $ | 698,628 | $ | 241,213 | ||||||

(+) Accumulated Series C Mandatory Convertible Preferred Dividend | 8,817 | — | — | |||||||||

Net Income (Loss) Attributable to KKR & Co. Inc. Common Stockholders | $ | 1,056,502 | $ | 698,628 | $ | 241,213 | ||||||

(+) Net Income (Loss) Attributable to Noncontrolling Interests held by KKR Holdings L.P. | 691,730 | 462,410 | 175,231 | |||||||||

(+) Equity-based and Other Compensation - KKR Holdings L.P. | 21,802 | 21,098 | 22,539 | |||||||||

(+) Amortization of Intangibles and Other, net | 11,211 | 58,469 | 49,659 | |||||||||

(+) Strategic Corporate Transaction-Related Charges (1) | 10,697 | — | — | |||||||||

(+) Non-recurring Items (2) | — | 88,322 | 22,839 | |||||||||

(-) Net Unrealized Carried Interest | 995,376 | 478,027 | 13,695 | |||||||||

(-) Net Unrealized Gains (Losses) | 1,088,901 | 867,581 | 130,972 | |||||||||

(+) Unrealized Performance Income Compensation | 418,728 | 199,375 | 9,281 | |||||||||

(+) Income Tax Expense (Benefit) | 359,375 | 206,264 | 53,132 | |||||||||

(-) Income Taxes Paid | 75,413 | 63,315 | 40,429 | |||||||||

After-tax Distributable Earnings | $ | 410,355 | $ | 325,643 | $ | 388,798 | ||||||

Weighted Average Adjusted Shares | 861,854,785 | 845,065,077 | 842,585,116 | |||||||||

After-tax Distributable Earnings Per Adjusted Share | $ | 0.48 | $ | 0.39 | $ | 0.46 | ||||||

After-tax Distributable Earnings | $ | 410,355 | $ | 325,643 | $ | 388,798 | ||||||

(+) Equity-based Compensation (Equity Incentive Plans) | 42,488 | 39,933 | 54,395 | |||||||||

(+) Income (Loss) Attributable to Noncontrolling Interests | 2,709 | 1,002 | 881 | |||||||||

(+) Income Taxes Paid | 75,413 | 63,315 | 40,429 | |||||||||

(+) Series A and B Preferred Dividends | 8,341 | 8,341 | 8,341 | |||||||||

(+) Core Interest Expense (3) | 41,409 | 37,511 | 34,491 | |||||||||

(+) Depreciation and Amortization | 4,568 | 4,817 | 4,250 | |||||||||

Adjusted EBITDA (4) | $ | 585,283 | $ | 480,562 | $ | 531,585 | ||||||

(1) | Represents transaction costs related to the acquisition of Global Atlantic. |

(2) | Represents a $88.3 million non-recurring impairment charge taken on one of our equity method investments during the three months ended June 30, 2020 and a non-recurring $22.8 million make-whole premium associated with KKR’s refinancing of its 2020 Senior Notes for the three months ended September 30, 2019. |

(3) | Core interest expense may be used by certain debt investors as an alternative measurement of interest expense incurred by KKR and excludes interest expense related to debt obligations from investment financing arrangements related to certain of KKR’s investment funds, investment vehicles and principal investments and also excludes interest expense incurred by KFN. The financing arrangements excluded from core interest expense are not direct obligations of the general partners of KKR’s private equity funds or its management companies, and in the case of debt obligations of KFN, are non-recourse to KKR beyond the assets of KFN. KKR believes this measure is useful to debt investors as it provides an indication of the amount of interest expense borne by KKR excluding interest expense that is allocated to KKR’s investment funds, other noncontrolling interest holders and KFN. Additionally, we believe this measure is useful for analyzing KKR’s ability to service its debt obligations other than the debt obligations of KFN. |

(4) | Adjusted EBITDA may be useful to debt investors in evaluating KKR's ability to service its debt and provides insight into the amount of KKR’s distributable earnings before the impact of interest expense, taxes, depreciation and amortization, equity-based compensation, preferred dividends and noncontrolling interests. |

EXHIBIT A (CONTINUED) | ||||||||||

RECONCILIATION OF NET INCOME (LOSS) ATTRIBUTABLE TO KKR & CO. INC. PER SHARE OF COMMON STOCK - BASIC (GAAP BASIS) | ||||||||||

TO AFTER-TAX DISTRIBUTABLE EARNINGS PER ADJUSTED SHARE AND ADJUSTED EBITDA (UNAUDITED) | ||||||||||

(Amounts in thousands, except share and per share amounts) | ||||||||||

Nine Months Ended | ||||||||||

September 30, 2020 | September 30, 2019 | |||||||||

Net Income (Loss) Attributable to KKR & Co. Inc. Per Share of Common Stock - Basic | $ | 0.82 | $ | 2.69 | ||||||

Weighted Average Shares of Common Stock Outstanding - Basic | 560,124,947 | 541,631,675 | ||||||||

Net Income (Loss) Available to KKR & Co. Inc. Common Stockholders | $ | 457,448 | $ | 1,456,584 | ||||||

(+) Accumulated Series C Mandatory Convertible Preferred Dividend | 8,817 | — | ||||||||

Net Income (Loss) Attributable to KKR & Co. Inc. Common Stockholders | $ | 466,265 | $ | 1,456,584 | ||||||

(+) Net Income (Loss) Attributable to Noncontrolling Interests held by KKR Holdings L.P. | 301,946 | 1,017,827 | ||||||||

(+) Equity-based and Other Compensation - KKR Holdings L.P. | 63,596 | 68,460 | ||||||||

(+) Amortization of Intangibles and Other, net | 7,454 | 131,192 | ||||||||

(+) Strategic Corporate Transaction-Related Charges (1) | 10,697 | — | ||||||||

(+) Non-recurring Items (2) | 88,322 | 22,839 | ||||||||

(-) Net Unrealized Carried Interest | (186,537 | ) | 924,626 | |||||||

(-) Net Unrealized Gains (Losses) | (18,049 | ) | 1,352,181 | |||||||

(+) Unrealized Performance Income Compensation | (57,771 | ) | 379,181 | |||||||

(+) Income Tax Expense (Benefit) | 204,960 | 386,124 | ||||||||

(-) Income Taxes Paid | 198,763 | 155,237 | ||||||||

After-tax Distributable Earnings | $ | 1,091,292 | $ | 1,030,163 | ||||||

Weighted Average Adjusted Shares | 851,501,835 | 839,255,710 | ||||||||

After-tax Distributable Earnings Per Adjusted Share | $ | 1.28 | $ | 1.23 | ||||||

After-tax Distributable Earnings | $ | 1,091,292 | $ | 1,030,163 | ||||||

(+) Equity-based Compensation (Equity Incentive Plans) | 133,424 | 157,891 | ||||||||

(+) Income (Loss) Attributable to Noncontrolling Interests | 4,800 | 3,104 | ||||||||

(+) Income Taxes Paid | 198,763 | 155,237 | ||||||||

(+) Series A and B Preferred Dividends | 25,023 | 25,023 | ||||||||

(+) Core Interest Expense (3) | 112,784 | 97,724 | ||||||||

(+) Depreciation and Amortization | 14,189 | 12,954 | ||||||||

Adjusted EBITDA (4) | $ | 1,580,275 | $ | 1,482,096 | ||||||

(1) | Represents transaction costs related to the acquisition of Global Atlantic. |

(2) | Represents a $88.3 million non-recurring impairment charge taken on one of our equity method investments during the nine months ended September 30, 2020 and a non-recurring $22.8 million make-whole premium associated with KKR’s refinancing of its 2020 Senior Notes for the nine months ended September 30, 2019. |

(3) | Core interest expense may be used by certain debt investors as an alternative measurement of interest expense incurred by KKR and excludes interest expense related to debt obligations from investment financing arrangements related to certain of KKR’s investment funds, investment vehicles and principal investments and also excludes interest expense incurred by KFN. The financing arrangements excluded from core interest expense are not direct obligations of the general partners of KKR’s private equity funds or its management companies, and in the case of debt obligations of KFN, are non-recourse to KKR beyond the assets of KFN. KKR believes this measure is useful to debt investors as it provides an indication of the amount of interest expense borne by KKR excluding interest expense that is allocated to KKR’s investment funds, other noncontrolling interest holders and KFN. Additionally, we believe this measure is useful for analyzing KKR’s ability to service its debt obligations other than the debt obligations of KFN. |

(4) | Adjusted EBITDA may be useful to debt investors in evaluating KKR's ability to service its debt and provides insight into the amount of KKR’s distributable earnings before the impact of interest expense, taxes, depreciation and amortization, equity-based compensation, preferred dividends and noncontrolling interests. |

EXHIBIT A (CONTINUED) | ||||||||||||

RECONCILIATION OF TOTAL GAAP REVENUES TO TOTAL DISTRIBUTABLE REVENUES (UNAUDITED) | ||||||||||||

(Amounts in thousands) | ||||||||||||

Quarter Ended | ||||||||||||

September 30, 2020 | June 30, 2020 | September 30, 2019 | ||||||||||

Total GAAP Revenues | $ | 1,895,238 | $ | 1,331,994 | $ | 790,485 | ||||||

(+) Management Fees - Consolidated Funds and Other | 121,365 | 122,740 | 108,922 | |||||||||

(-) Fee Credits - Consolidated Funds | 25,955 | 14,240 | 3,838 | |||||||||

(-) Capital Allocation-Based Income (Loss) (GAAP) | 1,331,898 | 938,521 | 374,268 | |||||||||

(+) Realized Carried Interest | 217,978 | 345,665 | 296,344 | |||||||||

(+) Realized Investment Income (Loss) | 260,415 | 90,325 | 210,234 | |||||||||

(-) Revenue Earned by Other Consolidated Entities | 6,687 | 1,052 | 29,838 | |||||||||

(-) Capstone Fees | 17,429 | 17,195 | — | |||||||||

(-) Expense Reimbursements | 44,553 | 28,002 | 34,356 | |||||||||

Total Distributable Revenues | $ | 1,068,474 | $ | 891,714 | $ | 963,685 | ||||||

Nine Months Ended | ||||||||||||

September 30, 2020 | September 30, 2019 | |||||||||||

Total GAAP Revenues | $ | 2,225,727 | $ | 3,157,829 | ||||||||

(+) Management Fees - Consolidated Funds and Other | 362,887 | 348,467 | ||||||||||

(-) Fee Credits - Consolidated Funds | 40,422 | 21,469 | ||||||||||

(-) Capital Allocation-Based Income (GAAP) | 888,342 | 1,849,623 | ||||||||||

(+) Realized Carried Interest | 924,974 | 838,608 | ||||||||||

(+) Realized Investment Income (Loss) | 495,904 | 459,303 | ||||||||||

(-) Revenue Earned by Other Consolidated Entities | 21,054 | 90,693 | ||||||||||

(-) Capstone Fees | 55,542 | — | ||||||||||

(-) Expense Reimbursements | 100,779 | 121,157 | ||||||||||

Total Distributable Revenues | $ | 2,903,353 | $ | 2,721,265 | ||||||||

RECONCILIATION OF TOTAL GAAP EXPENSES TO TOTAL DISTRIBUTABLE EXPENSES (UNAUDITED) | ||||||||||||

(Amounts in thousands) | ||||||||||||

Quarter Ended | ||||||||||||

September 30, 2020 | June 30, 2020 | September 30, 2019 | ||||||||||

Total GAAP Expenses | $ | 1,093,699 | $ | 757,068 | $ | 619,533 | ||||||

(-) Equity-based and Other Compensation - KKR Holdings L.P. | 21,802 | 21,098 | 22,539 | |||||||||

(-) Unrealized Performance Income Compensation | 418,728 | 199,375 | 9,281 | |||||||||

(-) Amortization of Intangibles | 399 | 379 | 383 | |||||||||

(-) Strategic Corporate Transaction-Related Charges | 10,697 | — | — | |||||||||

(-) Reimbursable Expenses | 50,382 | 38,020 | 38,515 | |||||||||

(-) Expenses relating to Other Consolidated Entities | 43,268 | 35,457 | 38,233 | |||||||||

(-) Capstone Expenses | 14,433 | 14,048 | — | |||||||||

(+) Other | (16,792 | ) | (6,062 | ) | (33,672 | ) | ||||||

Total Distributable Expenses | $ | 517,198 | $ | 442,629 | $ | 476,910 | ||||||

Nine Months Ended | ||||||||||||

September 30, 2020 | September 30, 2019 | |||||||||||

Total GAAP Expenses | $ | 1,754,075 | $ | 2,157,111 | ||||||||

(-) Equity-based and Other Compensation - KKR Holdings L.P. | 63,596 | 69,085 | ||||||||||

(-) Unrealized Performance Income Compensation | (57,771 | ) | 379,181 | |||||||||

(-) Amortization of Intangibles | 1,158 | 1,301 | ||||||||||

(-) Strategic Corporate Transaction-Related Charges | 10,697 | — | ||||||||||

(-) Reimbursable Expenses | 123,364 | 140,241 | ||||||||||

(-) Expenses relating to Other Consolidated Entities | 98,726 | 139,248 | ||||||||||

(-) Capstone Expenses | 46,278 | — | ||||||||||

(+) Other | (37,228 | ) | (59,632 | ) | ||||||||

Total Distributable Expenses | $ | 1,430,799 | $ | 1,368,423 | ||||||||

EXHIBIT A (CONTINUED) | ||||||||

RECONCILIATION OF CERTAIN GAAP TO NON-GAAP BALANCE SHEET MEASURES (UNAUDITED) | ||||||||

(Amounts in thousands) | ||||||||

As of | ||||||||

September 30, 2020 | December 31, 2019 | |||||||

Total GAAP Assets | $ | 70,655,333 | $ | 60,899,319 | ||||

(-) Impact of Consolidation of Funds and Other Entities | 43,250,461 | 37,453,629 | ||||||

(-) Carry Pool Reclassification | 1,393,381 | 1,448,879 | ||||||

(-) Other Reclassifications | 762,478 | 376,360 | ||||||

Total Book Assets | $ | 25,249,013 | $ | 21,620,451 | ||||

As of | ||||||||

September 30, 2020 | December 31, 2019 | |||||||

Total GAAP Liabilities | $ | 36,611,703 | $ | 30,396,945 | ||||

(-) Impact of Consolidation of Funds and Other Entities | 27,526,943 | 23,841,496 | ||||||

(-) Carry Pool Reclassification | 1,393,381 | 1,448,879 | ||||||

(-) Other Reclassifications | 762,478 | 376,360 | ||||||

Total Book Liabilities | $ | 6,928,901 | $ | 4,730,210 | ||||

As of | ||||||||

September 30, 2020 | December 31, 2019 | |||||||

KKR & Co. Inc. Stockholders' Equity - Series I and II Preferred Stock, Common Stock | $ | 10,599,310 | $ | 10,324,936 | ||||

(+) Impact of Consolidation of Funds and Other Entities | 398,649 | 327,826 | ||||||

(-) Other Reclassifications | 17,446 | 17,446 | ||||||

(+) Noncontrolling Interests Held by KKR Holdings L.P. | 5,692,718 | 5,728,634 | ||||||

(+) Series C Mandatory Convertible Preferred Stock | 1,115,792 | — | ||||||

Book Value | $ | 17,789,023 | $ | 16,363,950 | ||||