hubs-10q_20170331.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED March 31, 2017

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 001-36680

HubSpot, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

20-2632791 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

25 First Street, 2nd Floor

Cambridge, Massachusetts, 02141

(Address of principal executive offices)

(888) 482-7768

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☐ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☐ |

|

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. YES ☐ NO ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

There were 36,555,873 shares of the registrant’s Common Stock issued and outstanding as of April 27, 2017.

HUBSPOT, INC.

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of the federal securities laws, and these statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this Quarterly Report on Form 10-Q include, but are not limited to, statements about:

|

|

• |

our future financial performance, including our expectations regarding our revenue, cost of revenue, gross margin and operating expenses; |

|

|

• |

maintaining and expanding our customer base and increasing our average subscription revenue per customer; |

|

|

• |

the impact of competition in our industry and innovation by our competitors; |

|

|

• |

our anticipated growth and expectations regarding our ability to manage our future growth; |

|

|

• |

our predictions about industry and market trends; |

|

|

• |

our ability to anticipate and address the evolution of technology and the technological needs of our customers, to roll-out upgrades to our existing software platform and to develop new and enhanced applications to meet the needs of our customers; |

|

|

• |

our ability to maintain our brand and inbound marketing thought leadership position; |

|

|

• |

the impact of our corporate culture and our ability to attract, hire and retain necessary qualified employees to expand our operations; |

|

|

• |

the anticipated effect on our business of litigation to which we are or may become a party; |

|

|

• |

our ability to successfully acquire and integrate companies and assets; and |

|

|

• |

our ability to stay abreast of new or modified laws and regulations that currently apply or become applicable to our business both in the United States and internationally. |

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Quarterly Report on Form 10-Q.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Quarterly Report on Form 10-Q primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in “Risk Factors” and elsewhere in this Quarterly Report on Form 10-Q. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Quarterly Report on Form 10-Q. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

The forward-looking statements made in this Quarterly Report on Form 10-Q relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Quarterly Report on Form 10-Q to reflect events or circumstances after the date of this Quarterly Report on Form 10-Q or to reflect new information or the occurrence of unanticipated events, except as required by law.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

3

PART I — Financial Information

|

ITEM 1. |

Financial Statements |

HubSpot, Inc.

Unaudited Consolidated Balance Sheets

(in thousands)

|

|

|

March 31, |

|

|

December 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

69,786 |

|

|

$ |

59,702 |

|

|

Short-term investments |

|

|

53,001 |

|

|

|

54,648 |

|

|

Accounts receivable — net of allowance for doubtful accounts of $748 at March 31, 2017 and $617 at December 31, 2016 |

|

|

34,935 |

|

|

|

38,984 |

|

|

Deferred commission expense |

|

|

9,550 |

|

|

|

9,025 |

|

|

Restricted cash |

|

|

- |

|

|

|

162 |

|

|

Prepaid hosting costs |

|

|

2,234 |

|

|

|

5,299 |

|

|

Prepaid expenses and other current assets |

|

|

10,263 |

|

|

|

8,433 |

|

|

Total current assets |

|

|

179,769 |

|

|

|

176,253 |

|

|

Long-term investments |

|

|

37,846 |

|

|

|

35,718 |

|

|

Property and equipment, net |

|

|

34,697 |

|

|

|

30,201 |

|

|

Capitalized software development costs, net |

|

|

7,072 |

|

|

|

6,523 |

|

|

Restricted cash |

|

|

4,940 |

|

|

|

321 |

|

|

Other assets |

|

|

1,184 |

|

|

|

966 |

|

|

Goodwill |

|

|

9,773 |

|

|

|

9,773 |

|

|

Total assets |

|

$ |

275,281 |

|

|

$ |

259,755 |

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

3,257 |

|

|

$ |

4,350 |

|

|

Accrued compensation costs |

|

|

8,717 |

|

|

|

11,415 |

|

|

Other accrued expenses |

|

|

18,187 |

|

|

|

15,237 |

|

|

Capital lease obligations |

|

|

790 |

|

|

|

796 |

|

|

Deferred rent |

|

|

249 |

|

|

|

159 |

|

|

Deferred revenue |

|

|

104,432 |

|

|

|

95,426 |

|

|

Total current liabilities |

|

|

135,632 |

|

|

|

127,383 |

|

|

Capital lease obligations, net of current portion |

|

|

288 |

|

|

|

275 |

|

|

Deferred rent, net of current portion |

|

|

11,643 |

|

|

|

10,079 |

|

|

Deferred revenue, net of current portion |

|

|

1,139 |

|

|

|

1,171 |

|

|

Asset retirement obligations |

|

|

611 |

|

|

|

591 |

|

|

Other long-term liabilities |

|

|

1,625 |

|

|

|

1,556 |

|

|

Total liabilities |

|

|

150,938 |

|

|

|

141,055 |

|

|

Commitments and contingencies (Note 6) |

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Common stock |

|

|

36 |

|

|

|

36 |

|

|

Additional paid-in capital |

|

|

379,459 |

|

|

|

365,444 |

|

|

Accumulated other comprehensive loss |

|

|

(708 |

) |

|

|

(864 |

) |

|

Accumulated deficit |

|

|

(254,444 |

) |

|

|

(245,916 |

) |

|

Total stockholders’ equity |

|

|

124,343 |

|

|

|

118,700 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

275,281 |

|

|

$ |

259,755 |

|

The accompanying notes are an integral part of the consolidated financial statements.

4

HubSpot, Inc.

Unaudited Consolidated Statements of Operations

(in thousands, except per share data)

|

|

|

For the Three Months Ended March 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

Subscription |

|

$ |

77,503 |

|

|

$ |

54,936 |

|

|

Professional services and other |

|

|

4,749 |

|

|

|

4,024 |

|

|

Total revenue |

|

|

82,252 |

|

|

|

58,960 |

|

|

Cost of revenues: |

|

|

|

|

|

|

|

|

|

Subscription |

|

|

11,409 |

|

|

|

8,910 |

|

|

Professional services and other |

|

|

5,663 |

|

|

|

5,061 |

|

|

Total cost of revenues |

|

|

17,072 |

|

|

|

13,971 |

|

|

Gross profit |

|

|

65,180 |

|

|

|

44,989 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

13,370 |

|

|

|

9,804 |

|

|

Sales and marketing |

|

|

46,672 |

|

|

|

35,198 |

|

|

General and administrative |

|

|

13,138 |

|

|

|

9,848 |

|

|

Total operating expenses |

|

|

73,180 |

|

|

|

54,850 |

|

|

Loss from operations |

|

|

(8,000 |

) |

|

|

(9,861 |

) |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

303 |

|

|

|

179 |

|

|

Interest expense |

|

|

(52 |

) |

|

|

(87 |

) |

|

Other expense |

|

|

(128 |

) |

|

|

(333 |

) |

|

Total other income (expense) |

|

|

123 |

|

|

|

(241 |

) |

|

Loss before income tax provision |

|

|

(7,877 |

) |

|

|

(10,102 |

) |

|

Income tax provision |

|

|

(198 |

) |

|

|

(52 |

) |

|

Net loss |

|

$ |

(8,075 |

) |

|

$ |

(10,154 |

) |

|

Net loss per share, basic and diluted |

|

$ |

(0.22 |

) |

|

$ |

(0.29 |

) |

|

Weighted average common shares used in computing basic

and diluted net loss per share: |

|

|

36,205 |

|

|

|

34,692 |

|

The accompanying notes are an integral part of the consolidated financial statements.

5

HubSpot, Inc.

Unaudited Consolidated Statements of Comprehensive Loss

(in thousands)

|

|

|

For the Three Months Ended March 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

Net loss |

|

$ |

(8,075 |

) |

|

$ |

(10,154 |

) |

|

Other comprehensive loss: |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

121 |

|

|

|

166 |

|

|

Changes in unrealized gain on investments, net of

income taxes of $18 for the three months ended March 31, 2017 and $0 for the

three months ended March 31, 2016 |

|

|

35 |

|

|

|

334 |

|

|

Comprehensive loss |

|

$ |

(7,919 |

) |

|

$ |

(9,654 |

) |

The accompanying notes are an integral part of the consolidated financial statements.

6

HubSpot, Inc.

Unaudited Consolidated Statements of Cash Flows

(in thousands)

|

|

|

For the Three Months Ended March 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

Operating Activities: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(8,075 |

) |

|

$ |

(10,154 |

) |

|

Adjustments to reconcile net loss to net cash and cash equivalents provided

by operating activities |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

3,329 |

|

|

|

2,201 |

|

|

Stock-based compensation |

|

|

9,303 |

|

|

|

6,231 |

|

|

Provision for deferred income taxes |

|

|

(27 |

) |

|

|

3 |

|

|

Amortization of bond premium discount |

|

|

77 |

|

|

|

221 |

|

|

Noncash rent expense |

|

|

1,667 |

|

|

|

1,112 |

|

|

Unrealized currency translation |

|

|

(46 |

) |

|

|

(252 |

) |

|

Changes in assets and liabilities, net of acquisition |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

4,176 |

|

|

|

347 |

|

|

Prepaid expenses and other assets |

|

|

1,061 |

|

|

|

(2,403 |

) |

|

Deferred commission expense |

|

|

(464 |

) |

|

|

(299 |

) |

|

Accounts payable |

|

|

(1,250 |

) |

|

|

(804 |

) |

|

Accrued expenses |

|

|

922 |

|

|

|

(1,154 |

) |

|

Deferred rent |

|

|

(34 |

) |

|

|

(23 |

) |

|

Deferred revenue |

|

|

8,453 |

|

|

|

8,152 |

|

|

Net cash and cash equivalents provided by operating activities |

|

|

19,092 |

|

|

|

3,178 |

|

|

Investing Activities: |

|

|

|

|

|

|

|

|

|

Purchases of investments |

|

|

(16,367 |

) |

|

|

(8,969 |

) |

|

Maturities of investments |

|

|

15,860 |

|

|

|

8,875 |

|

|

Purchases of property and equipment |

|

|

(5,835 |

) |

|

|

(6,641 |

) |

|

Capitalization of software development costs |

|

|

(1,610 |

) |

|

|

(1,434 |

) |

|

Restricted cash |

|

|

(4,431 |

) |

|

|

— |

|

|

Net cash and cash equivalents used in investing activities |

|

|

(12,383 |

) |

|

|

(8,169 |

) |

|

Financing Activities: |

|

|

|

|

|

|

|

|

|

Employee taxes paid related to the net share settlement of stock-based awards |

|

|

(1,153 |

) |

|

|

(958 |

) |

|

Proceeds related to the issuance of common stock under stock plans |

|

|

4,340 |

|

|

|

2,992 |

|

|

Repayments of capital lease obligations |

|

|

(240 |

) |

|

|

(142 |

) |

|

Net cash and cash equivalents provided by financing activities |

|

|

2,947 |

|

|

|

1,892 |

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

|

428 |

|

|

|

538 |

|

|

Net increase (decrease) in cash and cash equivalents |

|

|

10,084 |

|

|

|

(2,561 |

) |

|

Cash and cash equivalents, beginning of period |

|

|

59,702 |

|

|

|

55,580 |

|

|

Cash and cash equivalents, end of period |

|

$ |

69,786 |

|

|

$ |

53,019 |

|

|

Supplemental cash flow disclosure: |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

192 |

|

|

$ |

87 |

|

|

Cash paid for income taxes |

|

$ |

37 |

|

|

$ |

73 |

|

|

Non-cash investing and financing activities: |

|

|

|

|

|

|

|

|

|

Property and equipment acquired under capital lease |

|

$ |

247 |

|

|

$ |

257 |

|

|

Capital expenditures incurred but not yet paid |

|

$ |

1,525 |

|

|

$ |

2,974 |

|

The accompanying notes are an integral part of the consolidated financial statements.

7

HubSpot, Inc.

Notes to Unaudited Consolidated Financial Statements

1. Organization and Operations

HubSpot, Inc. (the “Company”) was formed as a limited liability company in Delaware on April 4, 2005. The Company converted to a Delaware corporation on June 7, 2007. The Company provides a cloud-based inbound marketing and sales platform which features integrated applications to help businesses attract visitors to their websites, convert visitors into leads, close leads into customers and delight customers so they become promoters of those businesses. These integrated applications include social media, search engine optimization, blogging, website content management, marketing automation, email, CRM, analytics, and reporting.

The Company is headquartered in Cambridge, Massachusetts, and has wholly-owned subsidiaries in Dublin, Ireland, which commenced operations in January 2013, in Sydney, Australia, which commenced operations in August 2014, in Singapore, which commenced operations in October 2015, and in Tokyo, Japan, which commenced operations in July 2016. Additionally, the Company has announced that it will open an office in Berlin, Germany during the second half of 2017.

The accompanying unaudited consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) applicable to interim periods, under the rules and regulations of the United States Securities and Exchange Commission (“SEC”). In the opinion of management, the Company has prepared the accompanying unaudited consolidated financial statements on a basis substantially consistent with the audited consolidated financial statements of the Company as of and for the year ended December 31, 2016, and these consolidated financial statements include all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of the results of the interim periods presented. All intercompany balances and transactions have been eliminated in consolidation.

The results of operations for the interim periods presented are not necessarily indicative of the results to be expected for any subsequent quarter or for the entire year ending December 31, 2017. The year-end balance sheet data was derived from audited financial statements, but this Form 10-Q does not include all disclosures required under GAAP. Certain information and note disclosures normally included in annual financial statements prepared in accordance with GAAP have been omitted under the rules and regulations of the SEC.

These interim financial statements should be read in conjunction with the audited consolidated financial statements and related notes contained in the Company’s Annual Report on Form 10-K filed with the SEC on February16, 2017. There have been no changes in the Company’s significant accounting policies from those that were disclosed in the Company’s Annual Report on Form 10-K that have had a material impact on our consolidated financial statements and related notes, except the adoption of updated guidance related to certain aspects of share-based payments to employee described within the Recent Accounting Pronouncements below.

Recent Accounting Pronouncements

Recent accounting standards not included below are not expected to have a material impact on our consolidated financial position and results of operations.

The Company adopted updated guidance related to certain aspects of share-based payments to employees. The guidance requires the recognition of the income tax effects of awards in the income statement when the awards vest or are settled, thus eliminating additional paid-in capital pools. As a result of the adoption, we recorded an increase to deferred tax assets with a corresponding increase to the valuation allowance of $30.4 million to recognize net operating loss carryforwards attributable to excess tax benefits on stock compensation that had not been previously recognized as additional paid-in capital. In addition, the Company changed its policy election to account for forfeitures as they occur rather than on an estimated basis. The change in the policy election related to forfeitures resulted in the Company reclassifying $453 thousand from additional paid-in capital to accumulative deficit for the net cumulative-effect adjustment in stock compensation expense related to prior periods.

In January 2017, the Financial Accounting Standards Board (“FASB”) issued guidance simplifying the accounting for goodwill impairment by removing Step 2 of the goodwill impairment test. Under current guidance, Step 2 of the goodwill impairment test requires entities to calculate the implied fair value of goodwill in the same manner as the amount of goodwill recognized in a business combination by assigning the fair value of a reporting unit to all of the assets and liabilities of the reporting unit. The carrying value in excess of the implied fair value is recognized as goodwill impairment. Under the new standard, goodwill impairment is recognized based on Step 1 of the current guidance, which calculates the carrying value in excess of the reporting unit’s fair value. The new standard is effective beginning in January 2020, with early adoption permitted. We do not believe the adoption of this guidance will have a material impact on our consolidated financial statements.

8

In November 2016, the FASB issued guidance related to the presentation of restricted cash within the statement of cash flows. The guidance requires entities to show the changes in cash, cash equivalents, and restricted cash in the statement of cash flows. Entities will no longer present transfers between cash and cash equivalents and restricted cash in the statement of cash flows. As of March 31, 2017, we had $4.9 million in restricted cash. The new standard is effective beginning in the first quarter of 2018, with early adoption permitted. We do not believe the adoption of this guidance will have a material impact on our consolidated financial statements.

In February 2016, the FASB issued guidance that requires lessees to recognize most leases on their balance sheets but record expenses on their income statements in a manner similar to current accounting. For lessors, the guidance modifies the classification criteria and the accounting for sales-type and direct financing leases. The guidance is effective in 2019 with early adoption permitted. The Company is currently evaluating the impact of this guidance on the consolidated financial statements.

In May 2014, the FASB issued updated guidance and disclosure requirements for recognizing revenue. The new revenue recognition standard provides a five-step analysis of transactions to determine when and how revenue is recognized. The core principle is that a company should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The standard also provides guidance on the recognition of costs related to obtaining customer contracts. In July 2015, the FASB approved the deferral of the new standard's effective date by one year. The new standard now is effective for annual reporting periods beginning January 1, 2018. The FASB will permit companies to adopt the new standard early, but not before the original effective date of January 1, 2017. The Company will adopt the standard on January 1, 2018, and currently anticipates adopting the standard using the modified retrospective method, which would result in a cumulative effect adjustment as of the date of adoption. The Company has established a cross-functional coordinated team that is continuing to assess potential impacts of the standard on the timing of revenue recognition and accounting for deferred commission balances and whether the adoption will have a material impact on the consolidated financial statements and footnote disclosures.

2. Net Loss per Share

Basic net loss per share is computed by dividing net loss by the weighted average number of common shares outstanding for the period. Diluted net loss per share is computed by giving effect to all potential dilutive common stock equivalents outstanding for the period. For purposes of this calculation, options to purchase common stock, restricted stock units (“RSUs”), and Employee Stock Purchase Plan (“ESPP”) are considered to be potential common stock equivalents.

A reconciliation of the denominator used in the calculation of basic and diluted net loss per share is as follows:

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

Net loss |

|

$ |

(8,075 |

) |

|

$ |

(10,154 |

) |

|

Weighted-average common shares outstanding — basic |

|

|

36,205 |

|

|

|

34,692 |

|

|

Dilutive effect of share equivalents resulting from stock

options, RSUs, and ESPP |

|

|

— |

|

|

|

— |

|

|

Weighted-average common shares,

outstanding — diluted |

|

|

36,205 |

|

|

|

34,692 |

|

|

Net loss per share, basic and diluted |

|

$ |

(0.22 |

) |

|

$ |

(0.29 |

) |

9

Additionally, since the Company incurred net losses for each of the periods presented, diluted net loss per share is the same as basic net loss per share. The Company’s outstanding stock options, RSUs, and ESPP were not included in the calculation of diluted net loss per share as the effect would be anti-dilutive. The following table contains all potentially dilutive common stock equivalents.

|

|

|

As of March 31, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

(in thousands) |

|

|

Options to purchase common shares |

|

|

2,561 |

|

|

|

3,200 |

|

|

RSUs |

|

|

2,013 |

|

|

|

1,785 |

|

|

ESPP |

|

|

3 |

|

|

|

— |

|

3. Fair Value of Financial Instruments

The Company measures certain financial assets at fair value. Fair value is determined based upon the exit price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants, as determined by either the principal market or the most advantageous market. Inputs used in the valuation techniques to derive fair values are classified based on a three-level hierarchy, as follows:

|

|

• |

Level 1 — Quoted prices in active markets for identical assets or liabilities. |

|

|

• |

Level 2 — Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which all significant inputs are observable or can be derived principally from or corroborated by observable market data for substantially the full term of the assets or liabilities. |

|

|

• |

Level 3 — Unobservable inputs to the valuation methodology that are significant to the measurement of fair value of assets or liabilities. |

The following table details the fair value measurements within the fair value hierarchy of the Company’s financial assets and liabilities at March 31, 2017 and December 31, 2016.

|

|

|

March 31, 2017 |

|

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

|

|

|

(in thousands) |

|

|

Cash equivalents and investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds |

|

$ |

32,128 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

32,128 |

|

|

Commercial paper |

|

|

— |

|

|

|

11,962 |

|

|

|

— |

|

|

|

11,962 |

|

|

Corporate bonds |

|

|

— |

|

|

|

67,901 |

|

|

|

— |

|

|

|

67,901 |

|

|

U.S. government agency obligations |

|

|

— |

|

|

|

10,984 |

|

|

|

— |

|

|

|

10,984 |

|

|

Restricted cash: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates of deposit |

|

|

— |

|

|

|

4,940 |

|

|

|

— |

|

|

|

4,940 |

|

|

Total |

|

$ |

32,128 |

|

|

$ |

95,787 |

|

|

$ |

— |

|

|

$ |

127,915 |

|

|

|

|

December 31, 2016 |

|

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

|

|

|

(in thousands) |

|

|

Cash equivalents and investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds |

|

$ |

32,260 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

32,260 |

|

|

Commercial paper |

|

|

— |

|

|

|

12,439 |

|

|

|

— |

|

|

|

12,439 |

|

|

Corporate bonds |

|

|

— |

|

|

|

66,947 |

|

|

|

— |

|

|

|

66,947 |

|

|

U.S. government agency obligations |

|

|

— |

|

|

|

10,980 |

|

|

|

— |

|

|

|

10,980 |

|

|

Total |

|

$ |

32,260 |

|

|

$ |

90,366 |

|

|

$ |

— |

|

|

$ |

122,626 |

|

The Company considers all highly liquid investments purchased with a remaining maturity of three months or less to be cash equivalents. The fair value of the Company’s investments in certain money market funds is their face value and such instruments are classified as Level 1 and are included in cash and cash equivalents on the consolidated balance sheets. At March 31, 2017 and December 31, 2016, our Level 2 securities were priced by pricing vendors. These pricing vendors utilize the most recent observable market information in pricing these securities or, if specific prices are not available for these securities, use other observable inputs like market transactions involving identical or comparable securities.

10

For certain other financial instruments, including accounts receivable, accounts payable, capital leases and other current liabilities, the carrying amounts approximate their fair value due to the relatively short maturity of these balances.

Restricted cash is comprised of certificates of deposit related to landlord guarantees for our leased facilities. These restricted cash balances have been excluded from our cash and cash equivalents balance on our consolidated balance sheets.

The following tables summarize the composition of our short- and long-term investments at March 31, 2017 and December 31, 2016.

|

|

|

March 31, 2017 |

|

|

|

|

Amortized

Cost |

|

|

Unrealized

Gains |

|

|

Unrealized

Losses |

|

|

Aggregate

Fair Value |

|

|

|

|

(in thousands) |

|

|

Commercial paper |

|

$ |

11,967 |

|

|

$ |

— |

|

|

$ |

(5 |

) |

|

$ |

11,962 |

|

|

Corporate bonds |

|

|

68,034 |

|

|

|

3 |

|

|

|

(136 |

) |

|

|

67,901 |

|

|

U.S. government agency obligations |

|

|

10,999 |

|

|

|

1 |

|

|

|

(16 |

) |

|

|

10,984 |

|

|

Total |

|

$ |

91,000 |

|

|

$ |

4 |

|

|

$ |

(157 |

) |

|

$ |

90,847 |

|

|

|

|

December 31, 2016 |

|

|

|

|

Amortized

Cost |

|

|

Unrealized

Gains |

|

|

Unrealized

Losses |

|

|

Aggregate

Fair Value |

|

|

|

|

(in thousands) |

|

|

Commercial paper |

|

$ |

12,446 |

|

|

$ |

— |

|

|

$ |

(7 |

) |

|

$ |

12,439 |

|

|

Corporate bonds |

|

|

67,126 |

|

|

|

— |

|

|

|

(179 |

) |

|

|

66,947 |

|

|

U.S. government agency obligations |

|

|

10,998 |

|

|

|

— |

|

|

|

(18 |

) |

|

|

10,980 |

|

|

Total |

|

$ |

90,570 |

|

|

$ |

— |

|

|

$ |

(204 |

) |

|

$ |

90,366 |

|

For all of our securities for which the amortized cost basis was greater than the fair value at March 31, 2017, the Company has concluded that there is no plan to sell the security nor is it more likely than not that the Company would be required to sell the security before its anticipated recovery. In making the determination as to whether the unrealized loss is other-than-temporary, the Company considered the length of time and extent the investment has been in an unrealized loss position, the financial condition and near-term prospects of the issuers, the issuers’ credit rating and the time to maturity.

Contractual Maturities

The contractual maturities of short-term and long-term investments held at March 31, 2017 and December 31, 2016 are as follows:

|

|

|

March 31, 2017 |

|

|

December 31, 2016 |

|

|

|

|

Amortized

Cost Basis |

|

|

Aggregate

Fair Value |

|

|

Amortized

Cost Basis |

|

|

Aggregate

Fair Value |

|

|

|

|

(in thousands) |

|

|

(in thousands) |

|

|

Due within one year |

|

$ |

53,059 |

|

|

$ |

53,001 |

|

|

$ |

54,694 |

|

|

$ |

54,648 |

|

|

Due after 1 year through 2 years |

|

|

37,941 |

|

|

|

37,846 |

|

|

|

35,876 |

|

|

|

35,718 |

|

|

Total |

|

$ |

91,000 |

|

|

$ |

90,847 |

|

|

$ |

90,570 |

|

|

$ |

90,366 |

|

11

4. Property and Equipment, Net

Property and equipment, net consists of the following:

|

|

|

March 31, 2017 |

|

|

December 31, 2016 |

|

|

|

|

(in thousands) |

|

|

Computer equipment and purchased software |

|

$ |

3,364 |

|

|

$ |

3,237 |

|

|

Employee computer equipment |

|

|

1,780 |

|

|

|

1,534 |

|

|

Furniture and fixtures |

|

|

8,237 |

|

|

|

8,174 |

|

|

Office equipment |

|

|

2,357 |

|

|

|

2,326 |

|

|

Leasehold improvements |

|

|

23,902 |

|

|

|

23,693 |

|

|

Equipment under capital lease |

|

|

2,658 |

|

|

|

2,412 |

|

|

Internal-use software |

|

|

1,732 |

|

|

|

1,301 |

|

|

Construction in progress |

|

|

5,390 |

|

|

|

322 |

|

|

Total property and equipment |

|

|

49,420 |

|

|

|

42,999 |

|

|

Less accumulated depreciation and amortization |

|

|

(14,723 |

) |

|

|

(12,798 |

) |

|

Property and equipment, net |

|

$ |

34,697 |

|

|

$ |

30,201 |

|

Depreciation and amortization expense on property and equipment was $1.9 million for the three months ended March 31, 2017 and $981 thousand for the three months ended March 31, 2016.

5. Capitalized Software Development Costs

Capitalized software development costs, exclusive of those recorded within property and equipment, consisted of the following:

|

|

|

March 31, 2017 |

|

|

December 31, 2016 |

|

|

|

|

(in thousands) |

|

|

Gross capitalized software development costs |

|

$ |

27,054 |

|

|

$ |

25,152 |

|

|

Accumulated amortization |

|

|

(19,982 |

) |

|

|

(18,629 |

) |

|

Capitalized software development costs, net |

|

$ |

7,072 |

|

|

$ |

6,523 |

|

Capitalized software development costs are amortized on a straight-line basis over their estimated useful life of two to three years.

The following table summarizes software development costs capitalized, stock-based compensation included in capitalized software development costs, and amortization of capitalized software development costs.

|

|

|

Three Months Ended March 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

|

|

(in thousands) |

|

|

Software development costs capitalized |

|

$ |

1,902 |

|

|

$ |

1,627 |

|

|

Stock-based compensation included in capitalized software

development costs |

|

$ |

338 |

|

|

$ |

193 |

|

|

Amortization of software development costs |

|

$ |

1,369 |

|

|

$ |

1,196 |

|

6. Commitments and Contingencies

Contractual Obligations

There were no material changes in our commitments under contractual obligations, as disclosed in the Company’s audited consolidated financial statements for the year ended December 31, 2016 and related notes thereto contained in the Company’s Annual Report on Form 10-K, except those disclosed below.

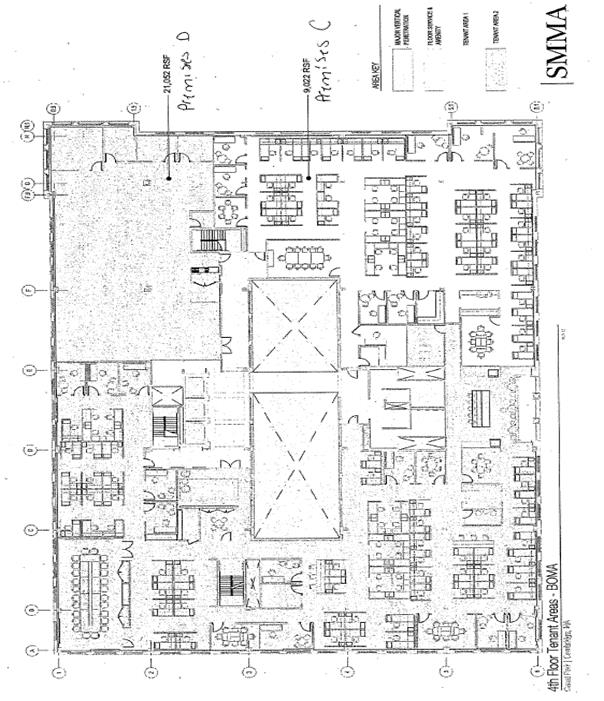

In February 2017, the Company signed an amendment related to a leased facility in Cambridge, Massachusetts. The amended lease increased the Company’s future commitments by approximately $6.0 million, which will be payable over approximately nine years.

12

Legal Contingencies

From time to time, we may become a party to litigation and subject to claims incident to the ordinary course of business, including intellectual property claims, labor and employment claims, and threatened claims, breach of contract claims, tax, and other matters. We currently have no material pending litigation.

7. Changes in Accumulated Other Comprehensive Loss

The following table summarizes the changes in accumulated other comprehensive loss, which is reported as a component of stockholders’ equity, for the three months ended March 31, 2017.

|

|

|

Cumulative Translation Adjustment |

|

|

Unrealized Loss on

Investments |

|

|

Total |

|

|

|

|

(in thousands) |

|

|

Beginning balance at January 1, 2017 |

|

$ |

(589 |

) |

|

$ |

(275 |

) |

|

$ |

(864 |

) |

|

Other comprehensive loss before reclassifications |

|

|

121 |

|

|

|

35 |

|

|

|

156 |

|

|

Amounts reclassified from accumulated other

comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Ending balance at March 31, 2017 |

|

$ |

(468 |

) |

|

$ |

(240 |

) |

|

$ |

(708 |

) |

8. Stock-Based Compensation Expense

The following two tables show stock-based compensation expense by award type and where the stock-based compensation expense is recorded in the Company’s consolidated statements of operations:

|

|

|

Three Months Ended March 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

|

|

(in thousands) |

|

|

Options |

|

$ |

1,247 |

|

|

$ |

1,478 |

|

|

RSUs |

|

|

7,790 |

|

|

|

4,533 |

|

|

Employee stock purchase plan |

|

|

266 |

|

|

|

220 |

|

|

Total stock-based compensation expense |

|

$ |

9,303 |

|

|

$ |

6,231 |

|

Effect of stock-based compensation expense on income by line item:

|

|

|

Three Months Ended March 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

|

|

(in thousands) |

|

|

Cost of revenue, subscription |

|

$ |

115 |

|

|

$ |

94 |

|

|

Cost of revenue, service |

|

|

449 |

|

|

|

324 |

|

|

Research and development |

|

|

2,442 |

|

|

|

1,758 |

|

|

Sales and marketing |

|

|

3,770 |

|

|

|

2,427 |

|

|

General and administrative |

|

|

2,527 |

|

|

|

1,628 |

|

|

Total stock-based compensation expense |

|

$ |

9,303 |

|

|

$ |

6,231 |

|

Capitalized software development costs excluded from stock-based compensation expense is $338 thousand for the three months ended March 31, 2017 and $193 thousand for the three months ended March 31, 2016.

13

9. Segment Information and Geographic Data

The Company operates as one operating segment. Operating segments are defined as components of an enterprise for which separate financial information is regularly evaluated by the chief operating decision makers (“CODMs”), which are the Company’s chief executive officer and chief operating officer, in deciding how to allocate resources and assess performance. The Company’s CODMs evaluate the Company’s financial information and resources and assess the performance of these resources on a consolidated basis. Since the Company operates in one operating segment, all required financial segment information can be found in the consolidated financial statements. Revenue and long-lived assets by geographic region, based on the physical location of the operations recording the sale or the asset, are as follows:

Revenues by geographical region:

|

|

|

Three Months Ended March 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

Americas |

|

$ |

64,352 |

|

|

$ |

48,777 |

|

|

Europe |

|

|

13,844 |

|

|

|

8,499 |

|

|

Asia Pacific |

|

|

4,056 |

|

|

|

1,684 |

|

|

Total |

|

$ |

82,252 |

|

|

$ |

58,960 |

|

|

Percentage of revenues generated outside of the Americas |

|

|

22 |

% |

|

|

17 |

% |

In the three months ended March 31, 2017, revenue derived from customers outside the United States (international) was approximately 30% of total revenue. In the three months ended March 31, 2016, revenue derived from customers outside the United States (international) was approximately 26% of total revenue.

Total long-lived assets by geographical region:

|

|

|

As of March 31, 2017 |

|

|

As of December 31, 2016 |

|

|

Americas |

|

$ |

27,441 |

|

|

$ |

23,205 |

|

|

Europe |

|

|

4,824 |

|

|

|

4,716 |

|

|

Asia Pacific |

|

|

2,432 |

|

|

|

2,280 |

|

|

Total long-lived assets |

|

$ |

34,697 |

|

|

$ |

30,201 |

|

|

Percentage of long-lived assets held outside of the

Americas |

|

|

21 |

% |

|

|

23 |

% |

14

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and related notes appearing elsewhere in this Quarterly Report on Form 10-Q and our Annual Report on Form 10-K for the year ended December 31, 2016 filed with the SEC on February 16, 2017. As discussed in the section titled “Special Note Regarding Forward-Looking Statements,” the following discussion and analysis contains forward-looking statements that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified below, and those discussed in the section titled “Risk Factors” included under Part II, Item 1A below.

Overview

We provide a cloud-based marketing and sales software platform that enables businesses to deliver an inbound experience. An inbound marketing and sales experience attracts, engages and delights customers by being more relevant, more helpful, more personalized and less interruptive than traditional marketing and sales tactics. Our software platform features integrated applications to help businesses attract visitors to their websites, convert visitors into leads, close leads into customers and delight customers so that they become promoters of those businesses. These integrated applications include social media, search engine optimization, blogging, website content management, marketing automation, email, sales productivity, CRM, analytics and reporting.

While our platform can scale to the enterprise, we focus on selling to mid-market businesses because we believe we have significant competitive advantages attracting and serving them. We efficiently reach these businesses at scale through our proven inbound go-to-market approach and our marketing agency partners. Our platform is particularly suited to serving the needs of mid-market business-to-business companies. These mid-market businesses seek an integrated, easy to implement and easy to use solution to reach customers and compete with organizations that have larger marketing and sales budgets. As of March 31, 2017, we had 31,262 total customers including 24,775 marketing customers of varying sizes in more than 90 countries, representing almost every industry.

We derive most of our revenue from subscriptions to our cloud-based software platform and related professional services, which consist of customer on-boarding and training services. Subscription revenue accounted for 94% of our total revenue in the three months ended March 31, 2017 and 93% of our total revenue in the three months ended March 31, 2016. We sell three product plans at different base prices on a subscription basis, each of which includes our core platform and integrated applications to meet the needs of the various customers we serve. Customers pay additional fees if the number of contacts stored and tracked in the customer’s database exceeds specified thresholds. We generate additional revenue based on the purchase of additional subscriptions, purchases of our add-on products and the number of account users, subdomains and website visits. Substantially all of our customers’ subscriptions are one year or less in duration.

Subscriptions are non-cancelable and are billed in advance on various schedules. Because the mix of billing terms for orders can vary from period to period, the annualized value of the orders we enter into with our customers will not be completely reflected in deferred revenue at any single point in time. Accordingly, we do not believe that change in deferred revenue is an accurate indicator of future revenue for a given period of time.

Most of our customers purchase on-boarding and training services which are designed to help customers enhance their ability to attract, engage and delight their customers using our platform. Professional services and other revenue accounted for 6% of our total revenue in the three months ended March 31, 2017 and 7% of our total revenue in the three months ended March 31, 2016. We expect professional services and other margins to range from a moderate loss to breakeven for the foreseeable future.

We have focused on rapidly growing our business and plan to continue to make investments to help us address some of the challenges facing us to support this growth, such as demand for our platform by existing and new customers, significant competition from other providers of marketing software and related applications and rapid technological change in our industry. We believe that the growth of our business is dependent on many factors, including our ability to expand our customer base, increase adoption of our platform within existing customers, develop new products and applications to extend the functionality of our platform and provide a high level of customer service. We expect to increase our investment in sales and marketing as we continue to expand our sales teams, increase our marketing activities and grow our international operations. We also expect to increase our investment in research and development as we continue to introduce new products and applications to extend the functionality of our platform. We also intend to invest in maintaining a high level of customer service and support which we consider critical for our continued success. We plan to continue investing in our data center infrastructure and services capabilities in order to support continued future customer growth. We also expect to continue to incur additional general and administrative expenses as a result of both our growth and the infrastructure required to be a public company. We expect to use our cash flow from operations and the proceeds from our prior stock offerings to fund these growth strategies and do not expect to be profitable in the near term.

15

We believe that these investments will result in an increase in our subscription revenue base. This will result in revenue increasing faster than the increase in sales and marketing, research and development and general and administrative expenses, exclusive of stock-based compensation, as we reach economies of scale. With this increased operating leverage, we expect our operating margins to increase in the long term. However, we will incur losses in the short term. If we are unable to achieve our revenue growth objectives, including a high rate of renewals of our customer agreements, we may not be able to achieve profitability.

Key Business Metrics

The following key business metrics are presented in this Quarterly Report on Form 10-Q or in our press release announcing our financial results which is furnished on Form 8-K. We use these key business metrics to evaluate our business, measure our performance, identify trends affecting our business and results of operations, formulate financial projections and make strategic decisions. During the first quarter of 2017, our paid sales product business became a more significant part of our product offerings. To reflect this development, for periods beginning with the first quarter of 2017, our key business metrics will include our paid sales product customers and revenue as described below. These key business metrics may be calculated in a manner different than similar key business metrics used by other companies.

Total Customers. We believe that our ability to increase our customer base is an indicator of our market penetration and growth of our business as we continue to expand our sales force and invest in marketing efforts. We define our total customers at the end of a particular period as the number of business entities or individuals with one or more paid subscriptions to our sales or marketing platforms, either paid directly or through an agency partner. We do not include in total customers business entities or individuals with one or more paid subscriptions solely for our legacy HubSpot Sales ($10) product. A single customer may have separate paid subscriptions for separate websites, sales licenses or seats, or our marketing and sales platforms, but we count these as one customer if certain customer-provided information such as company name, URL, or email address indicate that these subscriptions are managed by the same business entity or individual. As of March 31, 2017 we had 31,262 total customers.

Marketing Customers. Our marketing customers are a sub-set of our total customers. We define marketing customers at the end of a particular period as our total customers, excluding business entities or individuals that have only paid for a subscription to our sales platform. As of March 31, 2017 we had 24,775 total marketing customers.

Total Average Subscription Revenue per Customer. We believe that our ability to increase the total average subscription revenue per customer is an indicator of our ability to grow the long-term value of our existing customer relationships. We define total average subscription revenue per customer during a particular period as subscription revenue, excluding revenue from our legacy HubSpot Sales ($10) product, from our total customers during the period divided by the average total customers during the same period. In the three months ended March 31, 2017, total average subscription revenue per customer was $10,357.

Marketing Average Subscription Revenue per Customer. We define marketing average subscription revenue per customer during a particular period as subscription revenue from our marketing customers during the period, divided by our average marketing customers during the same period. In the three months ended March 31, 2017, marketing average subscription revenue per customer was $12,598.

Total Subscription Dollar Retention Rate. We believe that our ability to retain and expand a customer relationship is an indicator of the stability of our revenue base and the long-term value of our customers. We assess our performance in this area using a metric we refer to as our Total Subscription Dollar Retention Rate. We compare the aggregate Total Contractual Monthly Subscription Revenue of our total customer base as of the beginning of each month, which we refer to as Total Retention Base Revenue, to the aggregate Total Contractual Monthly Subscription Revenue of the same group of customers at the end of that month, which we refer to as Total Retained Subscription Revenue. We define Total Contractual Monthly Subscription Revenue as the total amount of subscription fees contractually committed to be paid for a full month under all of our total customer agreements, excluding any commissions owed to our partners. We do not include in Total Contractual Monthly Subscription Revenue any subscription fees contractually committed to be paid by business entities or individuals with subscriptions for our legacy HubSpot Sales ($10) product. Our Total Subscription Dollar Retention Rate for a given period is calculated by first dividing Total Retained Subscription Revenue by Total Retention Base Revenue for each month in the period, calculating the weighted average of these rates using the Total Retention Base Revenue for each month in the period, and then annualizing the resulting rates.

Marketing Subscription Dollar Retention Rate. Our marketing subscription dollar retention rate for a given period is calculated by first dividing Total Retained Marketing Subscription Revenue by Total Retention Base Marketing Revenue for each month in the period, calculating the weighted average of these rates using the Total Retention Base Marketing Revenue for each month in the period, and then annualizing the resulting rates. We compare the aggregate Total Contractual Monthly Marketing Subscription Revenue of our marketing customers as of the beginning of each month, which we refer to as Total Retention Base Marketing

16

Revenue, to the aggregate Total Contractual Monthly Marketing Subscription Revenue of the same group of marketing customers at the end of that month, which we refer to as Total Retained Marketing Subscription Revenue. We define Total Contractual Monthly Marketing Subscription Revenue as the total amount of subscription fees contractually committed to be paid for a full month under all of our marketing customer agreements, excluding any commissions owed to our partners.

Results of Operations for the Three Months Ended March 31, 2017 and 2016

The following tables set forth our results of operations for the periods presented and as a percentage of our total revenue for those periods. The data has been derived from the unaudited consolidated financial statements contained in this Quarterly Report on Form 10-Q which include, in our opinion, all adjustments, consisting only of normal recurring adjustments, that we consider necessary for a fair statement of the financial position and results of operations for the interim periods presented. The period-to-period comparison of financial results is not necessarily indicative of financial results to be achieved in future periods.

|

|

|

For the Three Months Ended March 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

Subscription |

|

$ |

77,503 |

|

|

$ |

54,936 |

|

|

Professional services and other |

|

|

4,749 |

|

|

|

4,024 |

|

|

Total revenue |

|

|

82,252 |

|

|

|

58,960 |

|

|

Cost of revenues: |

|

|

|

|

|

|

|

|

|

Subscription |

|

|

11,409 |

|

|

|

8,910 |

|

|

Professional services and other |

|

|

5,663 |

|

|

|

5,061 |

|

|

Total cost of revenues |

|

|

17,072 |

|

|

|

13,971 |

|

|

Gross profit |

|

|

65,180 |

|

|

|

44,989 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

13,370 |

|

|

|

9,804 |

|

|

Sales and marketing |

|

|

46,672 |

|

|

|

35,198 |

|

|

General and administrative |

|

|

13,138 |

|

|

|

9,848 |

|

|

Total operating expenses |

|

|

73,180 |

|

|

|

54,850 |

|

|

Loss from operations |

|

|

(8,000 |

) |

|

|

(9,861 |

) |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

303 |

|

|

|

179 |

|

|

Interest expense |

|

|

(52 |

) |

|

|

(87 |

) |

|

Other income (expense) |

|

|

(128 |

) |

|

|

(333 |

) |

|

Total other income (expense) |

|

|

123 |

|

|

|

(241 |

) |

|

Loss before income tax provision |

|

|

(7,877 |

) |

|

|

(10,102 |

) |

|

Income tax provision |

|

|

(198 |

) |

|

|

(52 |

) |

|

Net loss |

|

$ |

(8,075 |

) |

|

$ |

(10,154 |

) |

17

|

|

|

Three Months

Ended March 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

Subscription |

|

|

94 |

% |

|

|

93 |

% |

|

Professional services and other |

|

6 |

|

|

7 |

|

|

Total revenue |

|

100 |

|

|

100 |

|

|

Cost of revenues: |

|

|

|

|

|

|

|

|

|

Subscription |

|

14 |

|

|

15 |

|

|

Professional services and other |

|

7 |

|

|

9 |

|

|

Total cost of revenue |

|

21 |

|

|

24 |

|

|

Gross profit |

|

79 |

|

|

76 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

16 |

|

|

17 |

|

|

Sales and marketing |

|

57 |

|

|

60 |

|

|

General and administrative |

|

16 |

|

|

17 |

|

|

Total operating expenses |

|

89 |

|

|

93 |

|

|

Loss from operations |

|

|

(10 |

) |

|

|

(17 |

) |

|

Total other income (expense) |

|

|

— |

|

|

|

— |

|

|

Loss before income tax provision |

|

|

(10 |

) |

|

|

(17 |

) |

|

Income tax provision |

|

|

— |

|

|

|

— |

|

|

Net loss |

|

|

(10 |

)% |

|

|

(17 |

)% |

Percentages are based on actual values. Totals may not sum due to rounding.

Three Months Ended March 31, 2017 Compared to the Three Months Ended March 31, 2016

Revenue

|

|

|

Three Months

Ended March 31, |

|

|

|

|

|

|

|

|

|

|

(dollars in thousands) |

|

2017 |

|

|

2016 |

|

|

$ Change |

|

|

% Change |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription |

|

$ |

77,503 |

|

|

$ |

54,936 |

|

|

$ |

22,567 |

|

|

|

41 |

% |

|

Professional services and other |

|

|

4,749 |

|

|

|

4,024 |

|

|

|

725 |

|

|

|

18 |

% |

|

Total revenue |

|

$ |

82,252 |

|

|

$ |

58,960 |

|

|

$ |

23,292 |

|

|

|

40 |

% |

Subscription revenue increased during the three months ended March 31, 2017 compared to the same period in 2016 primarily due to the increase in total marketing customers, which grew from 19,322 as of March 31, 2016 to 24,775 as of March 31, 2017, and an increase in average subscription revenue per marketing customer, which grew from $11,494 for the three months ended March 31, 2016 to $12,598 for the three months ended March 31, 2017. The growth in total customers was primarily driven by our increased sales representative capacity to meet market demand. The increase in average subscription revenue per customer was driven primarily by existing customers increasing their use of our products, existing customers purchasing additional subscriptions and add-on products, and new customers purchasing our higher price product plans.

The 18% increase in professional services and other revenue resulted primarily from the delivery of on-boarding and training services for subscriptions sold.

Cost of Revenue, Gross Profit and Gross Margin Percentage

|

|

|

Three Months

Ended March 31, |

|

|

|

|

|

|

|

|

|

|

(dollars in thousands) |

|

2017 |

|

|

2016 |

|

|

$ Change |

|

|

% Change |

|

|

Total cost of revenue |

|

$ |

17,072 |

|

|

$ |

13,971 |

|

|

$ |

3,101 |

|

|

|

22 |

% |

|

Gross profit |

|

$ |

65,180 |

|

|

$ |

44,989 |

|

|

$ |

20,191 |

|

|

|

45 |

% |

|

Gross margin percentage |

|

|

79 |

% |

|

|

76 |

% |

|

|

|

|

|

|

|

|

18

Total cost of revenue for the three months ended March 31, 2017 increased compared to the same period in 2016 primarily due to an increase in subscription and hosting costs, employee-related costs, amortization of developed technology, and allocated overhead expenses. The increase in gross margin was primarily driven by improved leverage of our hosting costs relative to growth in subscription revenue.

|

|

|

Three Months

Ended March 31, |

|

|

|

|

|

|

|

|

|

|

(dollars in thousands) |

|

2017 |

|

|

2016 |

|

|

$ Change |

|

|

% Change |

|

|

Subscription cost of revenue |

|

$ |

11,409 |

|

|

$ |

8,910 |

|

|

$ |

2,499 |

|

|

|

28 |

% |

|

Percentage of subscription revenue |

|

|

15 |

% |

|

|

16 |

% |

|

|

|

|

|

|

|

|

The increase in subscription cost of revenue for the three months ended March 31, 2017 compared to the same period in 2016 was primarily due to the following:

|

|

|

|

|

Change |

|

|

|

|

|

|

Three Months |

|

|

|

|

|

|

(in thousands) |

|

|

Subscription and hosting costs |

|

|

|

$ |

1,134 |

|

|

Employee-related costs |

|

|

|

|

964 |

|

|

Capitalized software amortization |

|

|

|

|

255 |

|

|

Allocated overhead expenses |

|

|

|

|

146 |

|

|

|

|

|

|

$ |

2,499 |

|

Subscription and hosting costs increased due to growth in our marketing customer base from 19,322 at March 31, 2016 to 24,775 at March 31, 2017. Employee-related costs increased as a result of increased headcount as we continue to grow our customer support organization to support our customer growth and improve service levels and offerings. Amortization of capitalized software development costs increased due to the increased number of developers working on our software platform as we continue to develop new products and increased functionality. Allocated overhead expenses increased due to expansion of our leased space and infrastructure as we continue to grow our business and expand headcount.

|

|

|

Three Months

Ended March 31, |

|

|

|

|

|

|

|

|

|

|