UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the quarterly period ended

OR

Commission File Number

(Exact name of registrant as specified in its charter)

|

||

(State or other jurisdiction of incorporation) |

|

(IRS Employer Identification No.) |

|

|

|

|

||

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading symbol |

|

Name of each exchange on which registered |

|

|

|

The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer, ” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

☒ |

|

Smaller reporting company |

|

|

Emerging growth company |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of May 3, 2024, the registrant had

Evoke pharma, inc.

Form 10-Q

TABLE OF CONTENTS

i

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Evoke Pharma, Inc.

Condensed Balance Sheets

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

||

|

|

(unaudited) |

|

|

|

|

||

Assets |

|

|

|

|

|

|

||

Current Assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Accounts receivable, net of allowance for credit losses of $ |

|

|

|

|

|

|

||

Prepaid expenses |

|

|

|

|

|

|

||

Inventories |

|

|

|

|

|

|

||

Other current assets |

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

||

Deferred offering costs |

|

|

— |

|

|

|

|

|

Total assets |

|

$ |

|

|

$ |

|

||

Liabilities and stockholders' equity (deficit) |

|

|

|

|

|

|

||

Current Liabilities: |

|

|

|

|

|

|

||

Accounts payable and accrued expenses |

|

$ |

|

|

$ |

|

||

Accrued compensation |

|

|

|

|

|

|

||

Note payable |

|

|

|

|

|

|

||

Accrued interest payable |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

Stockholders' equity (deficit): |

|

|

|

|

|

|

||

Preferred stock, $ |

|

|

|

|

|

|

||

Common stock, $ |

|

|

|

|

|

|

||

Additional paid-in capital |

|

|

|

|

|

|

||

Accumulated deficit |

|

|

( |

) |

|

|

( |

) |

Total stockholders' equity (deficit) |

|

|

|

|

|

( |

) |

|

Total liabilities and stockholders' equity (deficit) |

|

$ |

|

|

$ |

|

||

See accompanying notes to these unaudited condensed financial statements.

1

Evoke Pharma, Inc.

Condensed Statements of Operations

(Unaudited)

|

|

Three Months Ended March 31, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Net product sales |

|

$ |

|

|

$ |

|

||

Operating expenses: |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

Research and development |

|

|

|

|

|

|

||

Selling, general and administrative |

|

|

|

|

|

|

||

Total operating expenses |

|

|

|

|

|

|

||

Loss from operations |

|

|

( |

) |

|

|

( |

) |

Other income (expense): |

|

|

|

|

|

|

||

Interest income |

|

|

|

|

|

|

||

Interest expense |

|

|

( |

) |

|

|

( |

) |

Total other expense |

|

|

( |

) |

|

|

( |

) |

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

Net loss per share of common stock, basic and diluted |

|

$ |

( |

) |

|

$ |

( |

) |

Weighted-average shares used to compute basic and diluted net loss per share |

|

|

|

|

|

|

||

See accompanying notes to these unaudited condensed financial statements.

2

Evoke Pharma, Inc.

Condensed Statements of Stockholders’ Equity (Deficit)

(Unaudited)

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

Total |

|

|||||

|

|

Common Stock |

|

|

Paid-In |

|

|

Accumulated |

|

|

Stockholders' |

|

||||||||

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Equity (Deficit) |

|

|||||

Balance as of January 1, 2024 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Issuance of common stock, Pre-Funded Warrants, Series |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

||||

Amendment and issuance of common stock and |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

||||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance as of March 31, 2024 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

Total |

|

|||||

|

|

Common Stock |

|

|

Paid-In |

|

|

Accumulated |

|

|

Stockholders' |

|

||||||||

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Equity |

|

|||||

Balance as of January 1, 2023 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance as of March 31, 2023 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||

See accompanying notes to these unaudited condensed financial statements.

3

Evoke Pharma, Inc.

Condensed Statements of Cash Flows

(Unaudited)

|

|

Three Months Ended March 31, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Operating activities |

|

|

|

|

|

|

||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

||

Stock-based compensation expense |

|

|

|

|

|

|

||

Interest expense |

|

|

|

|

|

|

||

Non-cash lease expense |

|

|

— |

|

|

|

|

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

||

Accounts receivable, net |

|

|

( |

) |

|

|

( |

) |

Prepaid expenses and other current assets |

|

|

|

|

|

|

||

Inventories |

|

|

( |

) |

|

|

( |

) |

Accounts payable and accrued expenses |

|

|

|

|

|

|

||

Accrued compensation |

|

|

( |

) |

|

|

( |

) |

Operating lease liabilities |

|

|

— |

|

|

|

( |

) |

Net cash used in operating activities |

|

|

( |

) |

|

|

( |

) |

Financing activities |

|

|

|

|

|

|

||

Proceeds from February 2024 Offering, net of issuance costs |

|

|

|

|

|

— |

|

|

Payment of February 2024 Offering costs |

|

|

( |

) |

|

|

— |

|

Proceeds from amendment and exercise of Series B Warrants, net of issuance costs |

|

|

|

|

|

— |

|

|

Net cash provided by financing activities |

|

|

|

|

|

— |

|

|

Net increase (decrease) in cash and cash equivalents |

|

|

|

|

|

( |

) |

|

Cash and cash equivalents at beginning of period |

|

|

|

|

|

|

||

Cash and cash equivalents at end of period |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Supplemental disclosure of non-cash financing activities |

|

|

|

|

|

|

||

Offering costs included in accounts payable |

|

$ |

|

|

$ |

— |

|

|

See accompanying notes to these unaudited condensed financial statements.

4

Evoke Pharma, Inc.

Notes to Condensed Financial Statements

(Unaudited)

1. Organization and Basis of Presentation

Evoke Pharma, Inc. (the “Company”) was incorporated under the laws of the state of Delaware in

Since its inception, the Company has devoted its efforts to developing its sole product, Gimoti® (metoclopramide) nasal spray, the first and only nasally-administered product indicated for the relief of symptoms in adults with acute and recurrent diabetic gastroparesis. On June 19, 2020, the Company received approval from the U.S. Food and Drug Administration (“FDA”) for its 505(b)(2) New Drug Application (“NDA”) for Gimoti. The Company launched U.S. commercial sales of Gimoti in October 2020 through its commercial partner Eversana Life Science Services, LLC (“Eversana”).

The Company’s activities are subject to the significant risks and uncertainties associated with any specialty pharmaceutical company that has launched its first commercial product, including market acceptance of the product and the potential need to obtain additional funding for its operations.

Going Concern

The financial statements have been prepared assuming the Company will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred recurring losses and negative cash flows from operations since inception and expects to continue to incur net losses for the foreseeable future until such time, if ever, that it can generate significant revenues from the sale of Gimoti. As of March 31, 2024, the Company had approximately $

The Company’s net losses may fluctuate significantly from quarter-to-quarter and year-to-year. The Company anticipates that it will be required to raise additional funds through debt, equity or other forms of financing, such as potential collaboration arrangements, to fund future operations and continue as a going concern.

There can be no assurance that additional financing will be available when needed or on acceptable terms. If the Company is not able to secure adequate additional funding, the Company may be forced to make reductions in spending, extend payment terms with suppliers, and/or suspend or curtail commercialization activities. Any of these actions could materially harm the Company’s business, results of operations, financial condition and future prospects. There can be no assurance that the Company will be able to successfully commercialize Gimoti. Because the Company’s business is entirely dependent on the success of Gimoti, if the Company is unable to secure additional financing, successfully commercialize Gimoti or identify and execute on strategic alternatives for Gimoti or the Company, the Company will be required to curtail all of its activities and may be required to liquidate, dissolve or otherwise wind down its operations.

Notice of Delisting

On May 24, 2023, the Company received a written notice from Nasdaq indicating that, based on the Company's stockholders’ equity of $

On March 18, 2024, the Company announced that the Panel granted the Company’s request to continue its listing on the Nasdaq Capital Market, subject to the Company filing a Form 10-Q on or before May 15, 2024, demonstrating that, as of March 31, 2024, the Company is in compliance with the Minimum Stockholders’ Equity Requirement. The Panel noted the Company’s steps to maintain

5

compliance with the Minimum Stockholders’ Equity Requirement on a long-term basis, including the equity financing completed in February 2024, which provided the Company net proceeds of $

As of March 31, 2024, the Company remained in compliance with the Minimum Stockholders’ Equity Requirement.

On February 21, 2024, the Company received a letter from Nasdaq indicating that, for the last thirty consecutive business days, the bid price for the Company's common stock had closed below the minimum $

In accordance with Nasdaq listing rules, the Company was provided an initial period of 180 calendar days, or until August 19, 2024, to regain compliance. The letter states that Nasdaq will provide written notification that the Company has achieved compliance with its rules if at any time before August 19, 2024, the bid price of the Company's common stock closes at $

2. Summary of Significant Accounting Policies

The accompanying unaudited condensed financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and with the instructions of the Securities and Exchange Commission (“SEC”) on Form 10-Q and Rule 8-03 of Regulation S-X. Accordingly, they do not include all of the information and disclosures required by GAAP for complete financial statements. In the opinion of management, the condensed financial statements include all adjustments necessary, which are of a normal and recurring nature, for the fair presentation of the Company’s financial position and of the results of operations and cash flows for the periods presented. These financial statements should be read in conjunction with the audited financial statements and notes thereto for the year ended December 31, 2023 included in the Company’s Annual Report on Form 10-K/A filed with the SEC on May 14, 2024. The results of operations for the interim period shown in this report are not necessarily indicative of the results that may be expected for any other interim period or for the full year. The balance sheet at December 31, 2023, has been derived from the audited financial statements at that date.

Cash and Cash Equivalents

Fair Value of Financial Instruments

The carrying amounts of all financial instruments, including accounts receivable and accounts payable and accrued expenses, are considered to be representative of their respective fair values because of the short-term nature of those instruments. The carrying value of the note payable approximates fair value based upon interest rates the Company believes it can currently obtain for similar debt, which is a Level 2 input within the fair value hierarchy.

Accounts Receivable

Accounts receivable are recorded net of allowance for credit losses. The Company evaluates its estimate of expected credit losses based on a combination of factors, including historical experience, assessment of specific customer-related risks, review of outstanding invoices, forecasts about the future, and various other assumptions and estimates. The allowance for credit losses was

6

as of both March 31, 2024 and December 31, 2023 and

Inventories

The Company does not own or operate manufacturing facilities for the production of Gimoti, nor does it plan to develop its own manufacturing operations in the foreseeable future. The Company depends on third-party contract manufacturers for all of its required raw materials, drug substance and finished product for its commercial manufacturing. The Company has agreements with Cosma S.p.A. to supply metoclopramide for the manufacture of Gimoti, and with Thermo Fisher Scientific Inc., through its subsidiary Patheon UK Limited, for the manufacturing of Gimoti. The Company currently utilizes third-party consultants, which it engages on an as-needed, hourly basis, to manage the manufacturing contractors.

The Company's inventories consisted of the following as of March 31, 2024 and December 31, 2023:

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

||

Raw materials |

|

$ |

|

|

$ |

|

||

Work in process |

|

|

|

|

|

— |

|

|

Finished goods |

|

|

|

|

|

|

||

Total inventories |

|

$ |

|

|

$ |

|

||

Inventories are stated at the lower of cost (first-in first-out basis) or net realizable value. The Company’s raw materials inventories are held at its third-party suppliers and its work-in-process and finished goods inventories are held by Eversana. The Company records such inventories as consigned inventories.

Deferred Offering Costs

Deferred offering costs represent legal, accounting and other direct costs related to the public offering that was completed in February 2024. All deferred offering costs were reclassified to additional paid-in capital in February 2024. The Company recorded approximately

Warrants

The Company accounts for warrants as equity-classified instruments based on an assessment of the warrant’s specific terms and applicable authoritative guidance in Accounting Standards Codification (“ASC”) 480, Distinguishing Liabilities from Equity (“ASC 480”) and ASC 815, Derivatives and Hedging (“ASC 815”). The assessment considers whether the warrants are freestanding financial instruments pursuant to ASC 480, meet the definition of a liability pursuant to ASC 480, and whether the warrants meet all of the requirements for equity classification under ASC 815, including whether the warrants are indexed to the Company’s own common stock and whether the warrant holders could potentially require “net cash settlement” in a circumstance outside of the Company’s control, among other conditions for equity classification. This assessment, which requires the use of professional judgment, is conducted at the time of warrant issuance and as of each subsequent quarterly period end date while the warrants are outstanding.

For warrants that meet all criteria for equity classification, the warrants are required to be recorded as a component of additional paid-in capital, on the condensed statement of stockholders’ equity at the time of issuance. The equity-classified warrants are measured at its estimated fair value on its grant date using either the Black-Scholes option pricing model and Monte-Carlo simulation model based on the applicable assumptions, which include the exercise price of the warrants, the Company's stock price and volatility, the expected warrant term, the risk-free interest rate, the expected dividends, and if applicable, the vesting behavior.

Revenue Recognition

In accordance with ASC 606, Revenue from Contracts with Customers (“ASC 606”), the Company recognizes revenue when a customer obtains control of promised goods in an amount that reflects the consideration the Company expects to receive in exchange for the goods provided. Customer control is determined upon the customer’s physical receipt of the product. To determine revenue recognition for arrangements within the scope of ASC 606, the Company performs the following five steps: identify the contracts with the customer; identify the performance obligations in the contract; determine the transaction price; allocate the transaction price to the performance obligations in the contract; and recognize revenue when (or as) it satisfies a performance obligation. At contract inception, the Company assesses the goods promised within each contract and determines those that are performance obligations and assesses whether each promised good is distinct. The Company then recognizes as revenue the amount of the transaction price that is allocated to the respective performance obligation when the customer obtains control of the product.

Product revenues are recorded net of sales-related adjustments, or transaction price, wherever applicable, including patient support programs, rebates, and other sales related discounts. The Company uses judgment to estimate variable consideration. The Company is subject to rebates under Medicaid and Medicare programs. The rebates for these programs are determined based on statutory

7

provisions. The Company estimates Medicaid and Medicare rebates based on the expected number of claims and related cost associated with the customer transaction. Medicaid and Medicare rebates of $

Co-payment assistance is recorded as an offset to gross revenue at the time revenue from the product sale is recognized based on expected and actual program participation. Co-pay liabilities are estimated using prescribing data available from customers. The Company's analysis also contemplated application of the constraint in accordance with the guidance, under which it determined a significant reversal of revenue would not occur in a future period. If actual results in the future vary from estimates, the Company will adjust these estimates, which would affect net product revenue and earnings in the period such variances become known. Liabilities for co-pay assistance of approximately $

Net Loss Per Share

Basic net loss per share is calculated by dividing the net loss by the weighted-average number of common stock outstanding for the period, without consideration for common stock equivalents. Pre-funded warrants issued and sold by the Company to purchase shares of its common stock are included in the calculation of basic net loss per common share if the exercise price of the pre-funded warrants represents de minimis consideration and is non-substantive in relation to the price paid for the warrant, and if the warrants are immediately exercisable with no further vesting conditions or contingencies associated with them. Diluted net loss per share is calculated by dividing the net loss by the weighted-average number of common stock and common stock equivalents outstanding for the period determined using the treasury-stock method. Dilutive common stock equivalents are comprised of warrants to purchase common stock, and options to purchase common stock under the Company’s equity incentive plan.

The following table sets forth the outstanding potentially dilutive securities that have been excluded from the calculation of diluted net loss per share because to do so would be anti-dilutive for the three months ended March 31, 2024 and 2023:

|

|

Three Months Ended March 31, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Warrants to purchase common stock |

|

|

|

|

|

— |

|

|

Common stock options |

|

|

|

|

|

|

||

Total excluded securities |

|

|

|

|

|

|

||

Recent Accounting Pronouncements – Not Yet Adopted

In November 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2023-07, Segment Reporting (Topic 280) Improvements to Reportable Segment Disclosures (“Topic 280”), which modifies the disclosure and presentation requirements of reportable segments (“ASU 2023-07”). The amendments in the update require the disclosure of significant segment expenses that are regularly provided to the chief operating decision maker (the “CODM”) and included within each reported measure of segment profit and loss. The amendments also require disclosure of all other segment items by reportable segment and a description of its composition. Additionally, the amendments require disclosure of the title and position of the CODM and an explanation of how the CODM uses the reported measure(s) of segment profit or loss in assessing segment performance and deciding how to allocate resources. Lastly, the amendment requires that a public entity that has a single reportable segment provide all the disclosures required by ASU 2023-07 and all existing segment disclosures in Topic 280. This update is effective for annual periods beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted. The Company is currently evaluating the impact that this guidance will have on the presentation of its financial statements and accompanying notes.

In December 2023, the FASB issued ASU No. 2023-09 (“ASU 2023-09”), Income Taxes (Topic 740): Improvements to Income Tax Disclosures. ASU 2023-09 requires disaggregated information about a reporting entity’s effective tax rate reconciliation as well as information on income taxes paid. ASU 2023-09 is effective for public entities with annual periods beginning after December 15, 2024 and for private businesses for annual periods beginning after December 15, 2025, with early adoption permitted. The Company is currently evaluating the impact of this guidance on its financial statement disclosures.

3. Stockholders’ Equity

February 2024 Offering

In February 2024, the Company entered into an underwriting agreement (the “Underwriting Agreement”) with Craig-Hallum Capital Group LLC and Laidlaw & Company (UK) Ltd. (collectively, the “Underwriters”), relating to the issuance and sale of

8

and (iv) a Series C Warrant to purchase

Net cash proceeds from the February 2024 Offering was $

Warrant Amendment

In March 2024, the Company entered into an amendment with certain holders (each, a “Holder”) of its Series B Warrants and Series C Warrants (the “Warrant Amendment”). Pursuant to the Warrant Amendment, to the extent a Holder exercised its Series B Warrants before 5:00 p.m. Pacific time on March 27, 2024 (the “Amendment Exercise Deadline”), the Holder’s corresponding Series C Warrants vested and are exercisable for the lesser of (i) three times the number of Series B Warrants exercised by the Holder and (ii) the total number of Series C Warrants outstanding to the Holder. Following the Amendment Exercise Deadline, if such Holder exercised any remaining Series B Warrants, the remaining Series C Warrants, if any, vested and became exercisable on a one-for-one basis as to the same number of Series B Warrants exercised.

The Warrant Amendment also allowed a Holder to elect to receive Pre-Funded Warrants upon exercise of Series B Warrants and Series C Warrants in lieu of shares of the Company’s common stock, at a purchase price of $

Net cash proceeds from the Warrant Amendment were $

The following table is a summary of the Company’s warrants as of March 31, 2024:

|

|

|

|

|

|

|

|

Shares of |

|

|

|

|

|

|

|

|

|

||||

|

|

Number of |

|

|

Number of |

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

||||

|

|

Warrants Outstanding |

|

|

Warrants Exercisable |

|

|

Underlying Warrants |

|

|

Exercise Price |

|

|

Initial Exercise Date |

|

Expiration Date |

|

||||

Pre-Funded Warrants |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

Until Exercised in Full |

|

|||||

Series A Warrants |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

||||||

Series B Warrants |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

||||||

Series C Warrants(1) |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

||||||

Representativesʼ Warrants |

|

|

|

|

|

— |

|

|

|

|

|

$ |

|

|

|

|

|||||

Total warrants |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

9

There were no warrants outstanding as of December 31, 2023.

Stock-Based Compensation

Stock-based compensation expense includes charges related to stock option grants. The Company measures stock-based compensation expense based on the grant date fair value of any awards granted to its employees. Such expense is recognized over the period of time that employees provide service and earn rights to the awards.

There were

The estimated fair value of each stock option award granted was determined on the date of grant using the Black-Scholes option-pricing valuation model with the following assumptions for option grants during the three months ended March 31, 2023:

|

|

Three Months Ended March 31, |

|

|

2023 |

Risk free interest rate |

|

|

Expected option term |

|

|

Expected volatility of common stock |

|

|

Expected dividend yield |

|

The Company recognized stock-based compensation expense to employees and directors in its research and development and its selling, general and administrative functions during the three months ended March 31, 2024 and 2023 as follows:

|

|

Three Months Ended March 31, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Research and development |

|

$ |

|

|

$ |

|

||

Selling, general and administrative |

|

|

|

|

|

|

||

Total stock-based compensation expense |

|

$ |

|

|

$ |

|

||

As of March 31, 2024, there was approximately $

4. Commercial Services and Loan Agreements with Eversana

On January 21, 2020, the Company entered into a commercial services agreement (as amended, the “Eversana Agreement”) with Eversana for the commercialization of Gimoti. Pursuant to the Eversana Agreement, Eversana commercializes and distributes Gimoti in the United States. Eversana also manages the marketing of Gimoti to targeted health care providers, as well as the sales and distribution of Gimoti in the United States.

Under the terms of the Eversana Agreement, the Company maintains ownership of the Gimoti NDA, as well as legal, regulatory, and manufacturing responsibilities for Gimoti. Eversana will utilize its internal sales organization, along with other commercial functions, for market access, marketing, distribution and other related patient support services. The Company will record sales for Gimoti and retain more than

Upon expiration or termination of the agreement, the Company will retain all profits from product sales and assume all corresponding commercialization responsibilities. Within 30 days after each of the first three annual anniversaries of commercial launch, either party may terminate the agreement if net sales of Gimoti do not meet certain annual thresholds. Either party may terminate the agreement: for the material breach of the other party, subject to a 60-day cure period; in the event an insolvency, petition of the other party is

10

pending for more than 60 days; upon 30 days written notice to the other party if Gimoti is subject to a safety recall; the other party is in breach of certain regulatory compliance representations under the agreement; if the Company discontinues the development or production of Gimoti; if the net profit is negative for any two consecutive calendar quarters (the "Net Profit Quarterly Termination Right") beginning with the measurement date of June 30, 2023; if the cumulative net product profits fail to reach certain thresholds in the first three years following launch; or if there is a change in applicable laws that makes operation of the services as contemplated under the agreement illegal or commercially impractical. Either party may also terminate the Eversana Agreement upon a change of control of the Company’s ownership.

The Company's net profits were negative for the two preceding calendar quarters as of March 31, 2024, and therefore Eversana or the Company could have exercised the Net Profit Quarterly Termination Right during the 60-day period after quarter-end. Since the note payable and accrued interest payable could have been accelerated by Eversana by terminating the Eversana Agreement as of March 31, 2024, those payments were recorded as current liabilities as of March 31, 2024. Each party will continue to have the option to exercise the Net Profit Quarterly Termination Right for the 60-day period following the end of future quarters so long as the net profit under the Eversana Agreement remains negative for consecutive quarters.

In the event that the Company initiates such termination, the Company shall pay to Eversana a one-time payment equal to all of Eversana’s unreimbursed cost plus a portion of Eversana’s commercialization costs incurred in the 12 months prior to termination. Such payment amount would be reduced by the amount of previously reimbursed commercialization costs and profit split paid for the related prior twelve-month period and any revenue which occurred prior to the termination yet to be collected. If Eversana terminates the agreement due to an uncured material breach by the Company, or if the Company terminates the Eversana Agreement in certain circumstances, including pursuant to the Net Profit Quarterly Termination Right, the Company has agreed to reimburse Eversana for its unreimbursed commercialization costs for the prior twelve-month period and certain other costs. In addition, Eversana may terminate the Eversana Agreement if the Company withdraws Gimoti from the market for more than 90 days.

In connection with the Eversana Agreement, the Company and Eversana have entered into the Eversana Credit Facility, pursuant to which Eversana has agreed to provide a revolving Credit Facility of up to $

The Company may prepay any amounts borrowed under the Eversana Credit Facility at any time without penalty or premium. The maturity date of all amounts, including interest, borrowed under the Eversana Credit Facility will be 90 days after the expiration or earlier termination of the Eversana Agreement. The Eversana Credit Facility also includes events of default, the occurrence and continuation of which provide Eversana with the right to exercise remedies against the Company and the collateral securing the loans under the Eversana Credit Facility, including the Company’s cash. These events of default include, among other things, the Company’s failure to pay any amounts due under the Eversana Credit Facility, an uncured material breach of the representations, warranties and other obligations under the Eversana Credit Facility, the occurrence of insolvency events and the occurrence of a change in control.

11

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with our financial statements and accompanying notes included in this Quarterly Report on Form 10-Q and the financial statements and accompanying notes thereto for the fiscal year ended December 31, 2023 and the related Management’s Discussion and Analysis of Financial Condition and Results of Operations, both of which are contained in our Annual Report on Form 10-K/A filed with the Securities and Exchange Commission, or SEC, on May 14, 2024. Past operating results are not necessarily indicative of results that may occur in future periods.

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements of historical facts contained in this Quarterly Report on Form 10-Q, including statements regarding our future results of operations and financial position, business strategy, commercial activities to be conducted by Eversana Life Science Services, LLC, or Eversana, the pricing and reimbursement for Gimoti®™ (metoclopramide) nasal spray, future prescribing trends for Gimoti, future regulatory developments, research and development costs, the timing and likelihood of commercial success, the potential to develop future product candidates, plans and objectives of management for future operations, continued compliance with Nasdaq listing requirements, and future results of current and anticipated products, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statement. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. Although we believe the expectations reflected in these forward-looking statements are reasonable, such statements are inherently subject to risk and we can give no assurances that our expectations will prove to be correct. Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements, which speak only as of the date of this Quarterly Report on Form 10-Q. You should read this Quarterly Report on Form 10-Q completely. As a result of many factors, including without limitation those set forth under “Risk Factors” under Item 1A of Part II below, and elsewhere in this Quarterly Report on Form 10-Q, our actual results may differ materially from those anticipated in these forward-looking statements. Except as required by applicable law, we undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this report or to reflect actual outcomes. For all forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

We use our registered trademark, EVOKE PHARMA, and other trademarks, including GIMOTI, in this Quarterly Report on Form 10-Q. This Quarterly Report on Form 10-Q also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this Quarterly Report on Form 10-Q appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

Unless the context requires otherwise, references in this Quarterly Report on Form 10-Q to “Evoke,” “we,” “us” and “our” refer to Evoke Pharma, Inc.

Overview

We are a specialty pharmaceutical company focused primarily on the development and commercialization of drugs to treat gastrointestinal, or GI, disorders and diseases. Since our inception, we have devoted our efforts to developing our sole product, Gimoti (metoclopramide) nasal spray, the first and only nasally-administered product indicated for the relief of symptoms in adults with acute and recurrent diabetic gastroparesis. In June 2020, we received approval from the U.S. Food and Drug Administration, or FDA, for our 505(b)(2) New Drug Application, or NDA, for Gimoti. We launched commercial sales of Gimoti in the United States in October 2020 through our commercial partner Eversana.

Diabetic gastroparesis is a GI disorder affecting millions of patients worldwide, in which food in an individual’s stomach takes too long to empty resulting in a variety of serious GI symptoms and systemic metabolic complications. The gastric delay caused by gastroparesis can compromise absorption of orally administered medications. In May 2023, we reported results from a study conducted by Eversana which showed diabetic gastroparesis patients taking Gimoti had significantly fewer physician office visits, emergency department visits, and inpatient hospitalizations compared to patients taking oral metoclopramide. This overall lower health resource utilization reduced patient and payor costs by approximately $15,000 during a six-month time period for patients taking Gimoti compared to patients taking oral metoclopramide.

12

In January 2020, we entered into a commercial services agreement with Eversana, or the Eversana Agreement, for the commercialization of Gimoti. Pursuant to the Eversana Agreement, Eversana commercializes and distributes Gimoti in the United States. Eversana also manages the marketing of Gimoti to targeted health care providers, as well as the sales and distribution of Gimoti in the United States. Eversana also provided a $5 million revolving credit facility, or the Eversana Credit Facility, that became available upon FDA approval of the Gimoti NDA. In 2020 we borrowed $5 million under the Eversana Credit Facility, which expires on December 31, 2026, unless terminated earlier pursuant to its terms. As of March 31, 2024, there were approximately $67.5 million in cumulative unreimbursed commercialization costs under the agreement, to be payable only as net product profits are recognized, or upon certain termination events.

We have primarily funded our operations through the sale of our convertible preferred stock prior to our initial public offering in September 2013, borrowings from loans and the sale of shares of our common stock on the Nasdaq Capital Market. We launched commercial sales of Gimoti in late October 2020 with Eversana and, to date, have generated modest sales.

We have incurred losses in each year since our inception. These operating losses resulted from expenses incurred in connection with advancing Gimoti through development activities, pre-commercial and commercialization activities, and other general and administrative costs associated with our operations. We expect to continue to incur operating losses until revenues from sales of Gimoti exceed our expenses, if ever. We may never become profitable, or if we do, we may not be able to sustain profitability on a recurring basis.

As of March 31, 2024, we had cash and cash equivalents of approximately $9.7 million. Current cash on hand is intended to fund commercialization activities for Gimoti, including manufacturing Gimoti, conducting the post-marketing commitment single dose pharmacokinetics, or PK, clinical trial of Gimoti to characterize dose proportionality of a lower dose strength of Gimoti and any additional development activities should we seek additional indications, protecting our intellectual property portfolio and for other general and administrative costs to support our operations. We believe, based on our current operating plan, that our existing cash and cash equivalents as of March 31, 2024, as well as cash flows from future net sales of Gimoti, will be sufficient to fund our operations into the first quarter of 2025. This period could be shortened if there are any significant increases in planned spending other than anticipated. We anticipate that we will be required to raise additional funds in order to continue as a going concern. Because our business is entirely dependent on the success of Gimoti, if we are unable to secure additional financing or identify and execute on other development or strategic alternatives for Gimoti or our company, we will be required to curtail all of our activities and may be required to liquidate, dissolve or otherwise wind down our operations. Any of these events could result in a complete loss of your investment in our securities.

Financial Operations Overview

Revenue Recognition

Our ability to generate revenue and become profitable depends on our ability to successfully commercialize Gimoti, which we launched in the United States through prescription in October 2020 through our commercial partner Eversana. If we or Eversana fail to successfully grow sales of Gimoti, we may never generate significant revenues and our results of operations and financial position will be adversely affected.

In accordance with Accounting Standards Codification, or ASC, 606, Revenue from Contracts with Customers, we recognize revenue when a customer obtains control of promised goods in an amount that reflects the consideration we expect to receive in exchange for the goods provided. Customer control is determined upon the customer’s physical receipt of the product. To determine revenue recognition for arrangements within the scope of ASC 606, we perform the following five steps: identify the contracts with the customer; identify the performance obligations in the contract; determine the transaction price; allocate the transaction price to the performance obligations in the contract; and recognize revenue when (or as) it satisfies a performance obligation. At contract inception, we assess the goods promised within each contract and determine those that are performance obligations and assess whether each promised good is distinct. We then recognize as revenue the amount of the transaction price that is allocated to the respective performance obligation when the customer obtains control of the product.

Product revenues are recorded net of sales-related adjustments, wherever applicable, including patient support programs, rebates, and other sales related discounts. The Company uses judgment to estimate variable consideration. The Company is subject to rebates under Medicaid and Medicare programs. The rebates for these programs are determined based on statutory provisions. The Company estimates Medicaid and Medicare rebates based on the expected number of claims and related cost associated with the customer transaction.

The Company also makes estimates about co-payment assistance to commercially insured patients meeting certain eligibility requirements, as well as to uninsured patients. Co-payment assistance is recorded as an offset to gross revenue at the time revenue from the product sale is recognized based on expected and actual program participation. Co-pay liabilities are estimated using prescribing data available from customers. Actual amounts of consideration ultimately received may differ from our estimates. If actual results in the future vary from estimates, we will adjust these estimates, which would affect net product revenue and earnings in

13

the period such variances become known. Liabilities for Medicare and Medicaid rebates, as well as co-pay assistance, are classified as accounts payable and accrued expenses in the balance sheets.

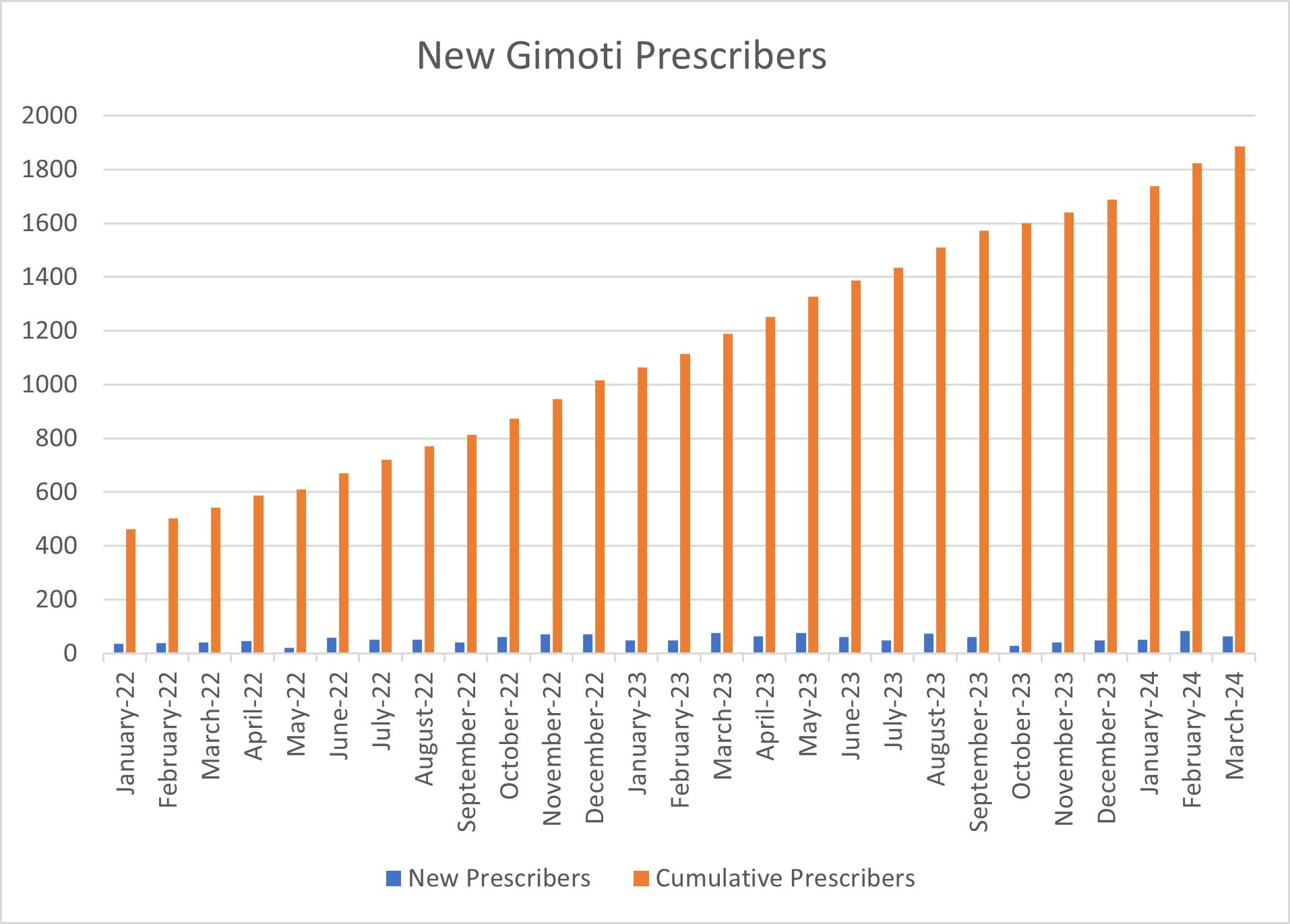

Sales of Gimoti Metrics

Gimoti prescriptions, prescribers, and other metrics revenues continue to increase. Net product sales during the quarter ended March 31, 2024 were approximately $1.7 million, which is a $0.9 million increase compared to net product sales for the quarter ended March 31, 2023. Gimoti pharmacy services were fully transitioned to ASPN Pharmacy ("ASPN") from vitaCare Prescription Services ("vitaCare") during the fourth quarter of 2023. The purpose of this transition was to improve the pharmacy network and reduce the number of the Out-Of-Network prescriptions that were increasing across the platform and in conjunction with a transition away from pharmacy services by vitaCare. Although the transition has created some slowing in managing patients and filling prescriptions, we believe ASPN is now processing inbound prescriptions at a pace that is showing improved patient capture and conversion to reimbursed fills by insurers. The ASPN platform offers a seamless path for filling a prescription, helps patients understand coverage and identify available savings opportunities, and facilitates communications between providers and payors.

There were approximately 1,430 new inbound prescriptions into the ASPN reimbursement center during the quarter ended March 31, 2024, which is a 27% increase compared to the quarter ended March 31, 2023. Patients who have an opportunity to refill the product (that is, patients who have completed their first fill and have additional refills on their prescription) received a refill approximately 71%of the time. We believe some patients choose not to refill their prescriptions due to remission of symptoms. Cumulatively, new prescribers increased 12% during the quarter ended March 31, 2024.

The ASPN team accesses the Medicare and Medicaid systems to facilitate product reimbursement submissions for patients seeking treatment. For the quarter ended March 31, 2024, these government programs made up approximately 35% of the filled prescriptions for Gimoti. From the commercial launch of Gimoti through March 31, 2024, the majority of patients have been between the ages of 31 and 65 years old. The vast majority of patients are female and were being treated by a gastroenterologist.

Key Opinion Leaders, or KOLs, are actively presenting data regarding the safety profile for Gimoti. Data presented at Digestive Disease Week indicated a far lower incidence of tardive dyskinesia, or TD, than previously published. This retrospective data was generated from a US based database with over 80 million patient lives. The outcome showed a 0.1% incidence of TD for gastroparesis patients taking any form of metoclopramide.

At the May 2023 Digestive Disease Week conference, a head-to-head (oral v. nasal metoclopramide), real world evidence data in 514 patients was presented. Gimoti reduced the likelihood of visiting a physician’s office, going to an emergency room (60% reduction), and had fewer inpatient admissions (68% reduction) compared to oral metoclopramide. This was elevated to the top plenary presentation for the conference by the gastroenterology selection committee for the conference. To our knowledge, this study is the

14

first such head-to-head data ever to be presented regarding the product and a clear support for improved outcomes for patients using Gimoti. This data was further validated in October 2023 at the American College of Gastroenterology conference, when the related cost data showed a $15,000 savings for those patients taking Gimoti compared to oral metoclopramide over the six-month index period. This data was also elevated to the plenary presentation by the American College of Gastroenterology selection committee. These data have recently been provided to our commercialization field force to inform physicians and payers of the potential benefits seen in these real-world trials.

Research and Development Expenses

We expense all research and development expenses as they are incurred. Research and development expenses primarily include:

All of our research and development expenses to date have been incurred in connection with the development of Gimoti. Since FDA approval of Gimoti in June 2020, research and development costs have decreased and shifted to commercialization and selling costs. In 2021, we initiated planning, and are in discussion with FDA related to the design, for an FDA post-marketing commitment single dose PK clinical trial of Gimoti to characterize dose proportionality of a lower dose strength of Gimoti to accommodate patients that may require further dosage adjustments. We are unable to estimate with any certainty the costs we will incur related to this trial, or the regulatory review of such lower dose of Gimoti, though such costs may be significant and will substantially increase research and development expenses once this trial is initiated. We may also incur additional costs to the extent we pursue additional clinical trials to expand the indication of Gimoti. Clinical development timelines, the probability of success and development costs can differ materially from expectations.

The costs of clinical trials may vary significantly over the life of a project owing to, but not limited to, the following:

Selling, General and Administrative Expenses

Selling, general and administrative expenses consist primarily of salaries and related benefits, including stock-based compensation. Other selling, general and administrative expenses include professional fees for accounting, tax, patent costs, legal services, insurance, facility costs and costs associated with being a publicly-traded company, including fees associated with investor relations and directors and officers liability insurance premiums. We expect that selling, general and administrative expenses will increase in the future as we continue to progress with the commercialization of Gimoti and we reimburse Eversana from the net profits attained from the sales of Gimoti.

Critical Accounting Policies and Significant Judgments and Estimates

Our management’s discussion and analysis of our financial condition and results of operations is based on our financial statements, which we have prepared in accordance with generally accepted accounting principles in the United States, or GAAP. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported expenses during the reporting periods. We evaluate these estimates and judgments on an ongoing basis. We base our estimates on historical experience and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Our actual results may differ materially from these estimates under different assumptions or conditions.

15

There have been no new or significant changes to our critical accounting policies and estimates discussed in Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Report on Form 10-K/A for the year ended December 31, 2023, filed with the SEC on May 14, 2024, except as it relates to the fair value of warrants as discussed below.

Fair Value of Warrants

Upon issuance of warrants, they are initially measured at fair value and reviewed for the appropriate classification (liability or equity). Warrants are valued using an option pricing model (OPM), such as a Black-Scholes, based on the applicable assumptions, or a Monte-Carlo simulation to model the future stock price as an input to a Black-Scholes model for combined warrants. The Company re-evaluates the classification of its warrants at each subsequent quarterly period end date while the warrants are outstanding to determine the proper balance sheet classification. The assumptions used in the OPM include, but are not limited to, the market price of our common stock, which is a level 1 assumption, the Company’s volatility and the risk-free interest rate, which are level 2 assumptions, and the dividend yield and the expected term the warrants will be held prior to exercise, which are level 3 assumptions.

Results of Operations

Comparison of Three Months Ended March 31, 2024 and 2023

The following table summarizes the results of our operations for the three months ended March 31, 2024 and 2023:

|

|

Three Months Ended March 31, |

|

|||||||||||||

|

|

2024 |

|

|

2023 |

|

|

$ Change |

|

|

% Change |

|

||||

Net product sales |

|

$ |

1,735,490 |

|

|

$ |

810,408 |

|

|

$ |

925,082 |

|

|

|

114 |

% |

Cost of goods sold |

|

$ |

92,529 |

|

|

$ |

50,591 |

|

|

$ |

41,938 |

|

|

|

83 |

% |

Research and development expenses |

|

$ |

4,645 |

|

|

$ |

66,990 |

|

|

$ |

(62,345 |

) |

|

|

-93 |

% |

Selling, general and administrative expenses |

|

$ |

3,139,536 |

|

|

$ |

2,847,940 |

|

|

$ |

291,596 |

|

|

|

10 |

% |

Net Product Sales. Net product sales for the three months ended March 31, 2024 compared to the three months ended March 31, 2023 increased by approximately $925,000. The increase in product sales is due to increased product adoption as commercialization efforts continue, and a greater number of physicians within larger gastroenterology teams prescribing Gimoti after first- physician adoption.

Cost of Goods Sold. Cost of goods sold for the three months ended March 31, 2024 compared to the three months ended March 31, 2023 increased by approximately $42,000. The increase in cost of goods sold was primarily driven by the completion of stability testing activities for commercial lots of Gimoti during the three months ended March 31, 2024.

Research and Development Expenses. Research and development expenses for the three months ended March 31, 2024 compared to the three months ended March 31, 2023 decreased by approximately $62,000. Expenses for ongoing stability testing of batches of Gimoti manufactured prior to receipt of FDA approval of the Gimoti NDA in June 2020 decreased by $55,000 as compared to the three months ended March 31, 2023, and payroll related costs also decreased by $8,000 over the same period.

Selling, General and Administrative Expenses. Selling, general and administrative expenses for the three months ended March 31, 2024 compared to the three months ended March 31, 2023 increased by approximately $292,000. Costs incurred during the three months ended March 31, 2024 primarily included approximately $947,000 for wages, taxes and employee insurance, including approximately $254,000 of stock-based compensation expense, approximately $1,639,000 for marketing and Eversana profit sharing, approximately $475,000 for legal, accounting, directors and officers liability insurance and other costs associated with being a public company, and approximately $29,000 for facility-related expenses. Costs incurred during the three months ended March 31, 2023 primarily included approximately $1.0 million for wages, taxes and employee insurance, including approximately $282,000 of stock-based compensation expense, approximately $931,000 for marketing and Eversana profit sharing, approximately $745,000 for legal, accounting, directors and officers liability insurance and other costs associated with being a public company, and approximately $47,000 for facility-related expenses.

Liquidity and Capital Resources

Since our inception in 2007, we have funded our operations primarily from the sale of equity securities and borrowings under loan and security agreements.

In connection with the Eversana Agreement, we entered into the Eversana Credit Facility, pursuant to which Eversana agreed to provide a revolving credit facility of up to $5 million to us upon FDA approval of the Gimoti NDA, as well as certain other customary conditions. The Eversana Credit Facility terminates on December 31, 2026, unless terminated earlier pursuant to its terms. The Eversana Credit Facility is secured by all of our personal property other than our intellectual property. Under the terms of the Eversana Credit Facility, we cannot grant an interest in our intellectual property to any other person. Each loan under the Eversana Credit Facility will bear interest at an annual rate equal to 10.0%, with such interest due at the end of the loan term. In 2020 we borrowed $5 million from the Eversana Credit Facility.

16

In February 2024, we sold 5,134,731 common stock units (the “Common Stock Units”), at a public offering price of $0.68 per Common Stock Unit and, to certain investors, 5,894,680 pre-funded warrant units (the “PFW Units”), at a public offering price of $0.6799 per PFW Unit. Each Common Stock Unit consists of (i) one share of common stock, (ii) a Series A Warrant to purchase one share of common stock (the “Series A Warrant”), (iii) a Series B Warrant to purchase one share of common stock (the “Series B Warrant”), and (iv) a Series C Warrant to purchase one share of common stock (the “Series C Warrant”). Each PFW Unit consists of (i) a pre-funded warrant to purchase one share of common stock, (ii) a Series A Warrant, (iii) a Series B Warrant, and (iv) a Series C Warrant. After deducting underwriting discounts and commissions and offering expenses paid by us, the estimated net proceeds to us from this offering were approximately $6.2 million.

The Pre-Funded Warrants have an exercise price of $0.0001 per share. The Series A Warrants, Series B Warrants and the Series C Warrants have an exercise price of $0.68 per share. The Pre-Funded Warrants, Series A Warrants and Series B Warrants are exercisable immediately. The Series C Warrants are subject to a vesting schedule and may only be exercised to the extent and in proportion to a holder of the Series C Warrants exercising its corresponding Series B Warrants. The Series A Warrants will expire on February 13, 2029, which is five years from the date of issuance. The Series B Warrants will expire on November 13, 2024, which is nine months from the date of issuance. The Series C Warrants will also expire on November 13, 2024, provided that to the extent and in proportion to a holder of the Series C Warrants exercising its corresponding Series B Warrants included in the applicable unit, such Series C Warrant will expire on February 13, 2029.

We concluded that there is substantial doubt about our ability to continue as a going concern. This doubt about our ability to continue as a going concern for at least twelve months from the date of issuance of the financial statements could materially limit our ability to raise additional funds through the issuance of new debt or equity securities or otherwise. We have incurred significant losses since our inception and have never been profitable, and it is possible we will never achieve profitability. We believe, based on our current operating plan, that our cash and cash equivalents as of March 31, 2024 will be sufficient to fund our operations into the first quarter of 2025. This period could be shortened if there are any significant increases in planned spending on commercialization activities, including for marketing and manufacturing of Gimoti, and our selling, general and administrative costs to support operations, including as a result of any termination of the Eversana Agreement. As of March 31, 2024, Eversana and Evoke each has the right to exercise the Net Profit Quarterly Termination Right, which either party can do until May 30, 2024, which is the end of the 60-day period following the end of the quarter. Each party will continue to have the option to exercise this termination right for the 60-day period following the end of future quarters so long as the net profit under the agreement remains negative for consecutive quarters. If the Net Profit Quarterly Termination Right is exercised, the outstanding principal and interest under the Eversana Credit Facility would be due within 90 days after the effective date of such termination. This would materially and adversely affect our near-term liquidity needs and cash runway. We anticipate we will be required to raise additional funds in order to continue as a going concern. Because our business is entirely dependent on the success of Gimoti, if we are unable to secure additional financing or identify and execute on other development or strategic alternatives for Gimoti or our company, we will be required to curtail all of our activities and may be required to liquidate, dissolve or otherwise wind down our operations. Any of these events could result in a complete loss of your investment in our securities.

There is no assurance that other financing will be available when needed to allow us to continue as a going concern. The perception that we may not be able to continue as a going concern may cause others to choose not to deal with us due to concerns about our ability to meet our contractual obligations.

On May 24, 2023, we received a written notice from Nasdaq indicating that, based on our stockholders’ equity of $2.1 million as of March 31, 2023, as reported in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, we were not in compliance with the minimum stockholders’ equity requirement for continued listing on The Nasdaq Capital Market under Nasdaq Listing Rule 5550(b)(1), or the Minimum Stockholders’ Equity Requirement. As required by Nasdaq, we submitted our plan to regain compliance with the Minimum Stockholders’ Equity Requirement and Nasdaq granted us an extension until November 20, 2023 to regain compliance. Following notice on November 21, 2023 from Nasdaq that we had not met the Minimum Stockholders’ Equity Requirement, we requested a hearing before the Nasdaq Hearings Panel (the “Panel”), and on December 9, 2023, Nasdaq notified the Company that the hearing was scheduled for February 15, 2024. On February 15, 2024, we had the hearing before the Panel.

On March 18, 2024, we announced that the Panel granted our request to continue the Company’s listing on the Nasdaq Capital Market, subject to the filing a Form 10-Q on or before May 15, 2024, demonstrating that, as of March 31, 2024, we are in compliance with the Minimum Stockholders’ Equity Requirement. The Panel noted our steps to maintain compliance with the Minimum Stockholders’ Equity Requirement on a long-term basis, including the equity financing completed in February 2024, which provided the Company net proceeds of $6.2 million, and the potential for additional capital from the exercise of the warrants issued in the February 2024 financing. The Panel also noted that it is a requirement during the exception period that we provide prompt notification to the Panel of any significant events that occur during this time that may affect our compliance with Nasdaq’s requirements. This includes, but is not limited to, any event that may call into question our ability to meet the terms of the exception granted. The Panel reserved the right to reconsider the terms of the granted exception based on any event, condition or circumstance that exists or develops that would, in the opinion of the Panel, make continued listing of our securities on the Nasdaq Capital Market inadvisable or unwarranted.

17

As of March 31, 2024, we remained in compliance with the Minimum Stockholders’ Equity Requirement.

On February 21, 2024, we received a letter from Nasdaq indicating that, for the last thirty consecutive business days, the bid price for our common stock had closed below the minimum $1.00 per share requirement for continued listing on the Nasdaq Capital Market.

In accordance with Nasdaq listing rules, we were provided an initial period of 180 calendar days, or until August 19, 2024, to regain compliance. The letter states that Nasdaq will provide written notification that we have achieved compliance with its rules if at any time before August 19, 2024, the bid price of our common stock closes at $1.00 per share or more for a minimum of ten consecutive business days. The Nasdaq letter had no immediate effect on the listing or trading of our common stock and the common stock continued to trade on The Nasdaq Capital Market.

We expect to continue to incur expenses as we:

The following table summarizes our cash flows for the three months ended March 31, 2024 and 2023:

|

|

Three Months Ended March 31, |

|

|||||||||

|

|

2024 |

|

|

2023 |

|

|

$ Change |

|

|||

Net cash used in operating activities |

|

$ |

(2,579,390 |

) |

|

$ |

(1,630,895 |

) |

|

$ |

(948,495 |

) |

Net cash provided by financing activities |

|

$ |

7,542,719 |

|

|

|

— |

|

|

$ |

7,542,719 |

|

Net increase (decrease) in cash and cash equivalents |

|

$ |

4,963,329 |

|

|

$ |

(1,630,895 |

) |

|

$ |

6,594,224 |

|

Operating Activities. The primary use of our cash has been to fund our clinical research, prepare our NDA, manufacture Gimoti, commercial sales of Gimoti, and other general operations. The cash used in operating activities during the three months ended March 31, 2024 and 2023 was primarily related to commercialization activities for Gimoti and other general operational activities. We expect that cash used in operating activities during the remainder of 2024 will be consistent with cash used during similar periods in 2023 because growing sales will offset commercialization activities, including manufacturing Gimoti, and the planned post-marketing commitment to conduct a single dose PK clinical trial of Gimoti to characterize dose proportionality of a lower dose strength of Gimoti.

Financing Activities. During the three months ended March 31, 2024, cash provided by financing activities was $7.5 million due to the sale of 5,254,335 shares of common stock at $0.68 per share and 7,711,565 pre-funded warrants at $0.6799 per share.

The amount and timing of our future funding requirements will depend on many factors, including but not limited to:

Off-Balance Sheet Arrangements

Through March 31, 2024, we have not entered into and did not have any relationships with unconsolidated entities or financial collaborations, such as entities often referred to as structured finance or special purpose entities, which would have been established for the purpose of facilitating off-balance sheet arrangements or other contractually narrow or limited purpose.

18

Contractual Obligations and Commitments

There were no material changes outside the ordinary course of our business during the three months ended March 31, 2024 to the information regarding our contractual obligations that was disclosed in Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Report on Form 10-K/A for the year ended December 31, 2023, filed with the SEC on May 14, 2024.

Item 3. Quantitative and Qualitative Disclosure about Market Risk

As a smaller reporting company, we are not required to provide the information required by this Item.

Item 4. Controls and Procedures

Conclusions Regarding the Effectiveness of Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our Exchange Act reports is recorded, processed, summarized and reported within the timelines specified in the SEC’s rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer, as appropriate, to allow timely decisions regarding required disclosure. In designing and evaluating the disclosure controls and procedures, management recognized that any controls and procedures, no matter how well designed and operated, can only provide reasonable assurance of achieving the desired control objectives, and in reaching a reasonable level of assurance, management necessarily was required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures. In addition, the design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions; over time, control may become inadequate because of changes in conditions, or the degree of compliance with policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

As required by SEC Rule 13a-15(e), as of March 31, 2024, we carried out an evaluation, under the supervision and with the participation of our management, including our Chief Executive Officer, of the effectiveness of the design and operation of our disclosure controls and procedures, as of the end of the period covered by this report. Management identified a material weakness in our internal control over financial reporting related to ineffectively designed controls over review of the Eversana Credit Facility, ongoing compliance monitoring and the proper application of GAAP for such agreement.

Based on the foregoing, our Chief Executive Officer concluded that our disclosure controls and procedures were not effective at the reasonable assurance level as of March 31, 2024, due to the material weakness described above. The material weakness will not be considered remediated until the enhanced controls operate for a sufficient period of time, and management is able to conclude, through testing, that the related controls are effective. Therefore, the material weakness existed as of March 31, 2024.

Remediation