UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

(Rule 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant |

Filed by a Party other than the Registrant |

|

Check the appropriate box:

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS AND PROXY STATEMENT

Dear Stockholder:

The annual meeting of stockholders of Evoke Pharma, Inc. will be held by means of remote communication via a live webcast accessible at www.proxydocs.com/EVOK on May 10, 2023 at 8:30 a.m., Pacific Time. The annual meeting will be held exclusively online and you must register in advance as described below.

The annual meeting is being held for the following purposes:

As noted above, our annual meeting will be a virtual meeting of stockholders, which will be conducted solely by remote communication via a live webcast. There will not be a physical meeting location, and stockholders will not be able to attend the annual meeting in person. This means that you can attend the annual meeting online, vote your shares during the online meeting and submit questions for consideration prior to the online meeting. To be admitted to the annual meeting's live webcast, you must register at www.proxydocs.com/EVOK by 2:00 p.m. Pacific Time on May 8, 2023, or the Registration Deadline, as described in the Notice of Internet Availability of Proxy Materials or proxy card. As part of the registration process, you must enter the Control Number shown on your proxy card. After completion of your registration by the Registration Deadline, further instructions, including a unique link to access the annual meeting, will be emailed to you.

The foregoing items of business are more fully described in the attached proxy statement, which forms a part of this notice and is incorporated herein by reference. Our board of directors has fixed the close of business on March 13, 2023 as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting or any adjournment or postponement thereof.

Accompanying this notice is a proxy card. Whether or not you expect to attend our virtual annual meeting, please complete, sign and date the enclosed proxy card and return it promptly, or complete and submit your proxy via phone or the internet in accordance with the instructions provided on the enclosed proxy card. If you plan to attend our annual meeting and wish to vote your shares personally, you may do so at any time before the proxy is voted.

All stockholders are cordially invited to attend the meeting.

|

By Order of the Board of Directors, |

|

David A. Gonyer, R.Ph. Chief Executive Officer and Director |

Solana Beach, California

March 29, 2023

Your vote is important. Please vote your shares whether or not you plan to attend the meeting.

TABLE OF CONTENTS

i

PROXY STATEMENT FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 10, 2023

The board of directors of Evoke Pharma, Inc. is soliciting the enclosed proxy for use at the annual meeting of stockholders to be held by means of remote communication via a live webcast on May 10, 2023 at 8:30 a.m., Pacific Time. You will be able to participate in the annual meeting online and submit your questions in advance of the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on May 10, 2023.

This proxy statement and our annual report are available electronically at http://www.proxydocs.com/EVOK.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why did you send me this proxy statement?

We sent you this proxy statement and the enclosed proxy card because our board of directors is soliciting your proxy to vote at the 2023 annual meeting of stockholders. This proxy statement summarizes information related to your vote at the annual meeting. All stockholders who find it convenient to do so are cordially invited to attend the annual meeting via live webcast. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

We intend to begin mailing this proxy statement, the attached notice of annual meeting and the enclosed proxy card on or about March 31, 2023, to all stockholders of record entitled to vote at the annual meeting. Only stockholders who owned our common stock on March 13, 2023 are entitled to vote at the annual meeting. On this record date, there were 3,343,070 shares of our common stock outstanding. Common stock is our only class of stock entitled to vote.

How can I attend the annual meeting?

This year’s annual meeting will be accessible through the Internet via a live webcast.

You are entitled to participate in the annual meeting if you were a stockholder as of the close of business on our record date of March 13, 2023 or hold a valid proxy for the meeting. To be admitted to the annual meeting’s live webcast, you must register at www.proxydocs.com/EVOK by 2:00 p.m. Pacific Time on May 8, 2023, or the Registration Deadline, as described in the Notice of Internet Availability of Proxy Materials or proxy card. As part of the registration process, you must enter the Control Number shown on your Notice of Internet Availability of Proxy Materials or proxy card. After completion of your registration by the Registration Deadline, further instructions, including a unique link to access the annual meeting, will be emailed to you.

This year’s stockholder question and answer session will include questions submitted in advance of the annual meeting. You may submit a question in advance of the meeting as a part of the registration process. Questions pertinent to meeting matters and that are submitted in accordance with our Rules of Conduct for the annual meeting will be answered during the meeting, subject to applicable time constraints. Questions and answers may be grouped by topic and substantially similar questions may be grouped and answered once. In order to promote fairness, efficient use of time and in order to ensure all stockholders are responded to, we will respond to up to two questions from a single stockholder.

What am I voting on?

There are seven proposals scheduled for a vote:

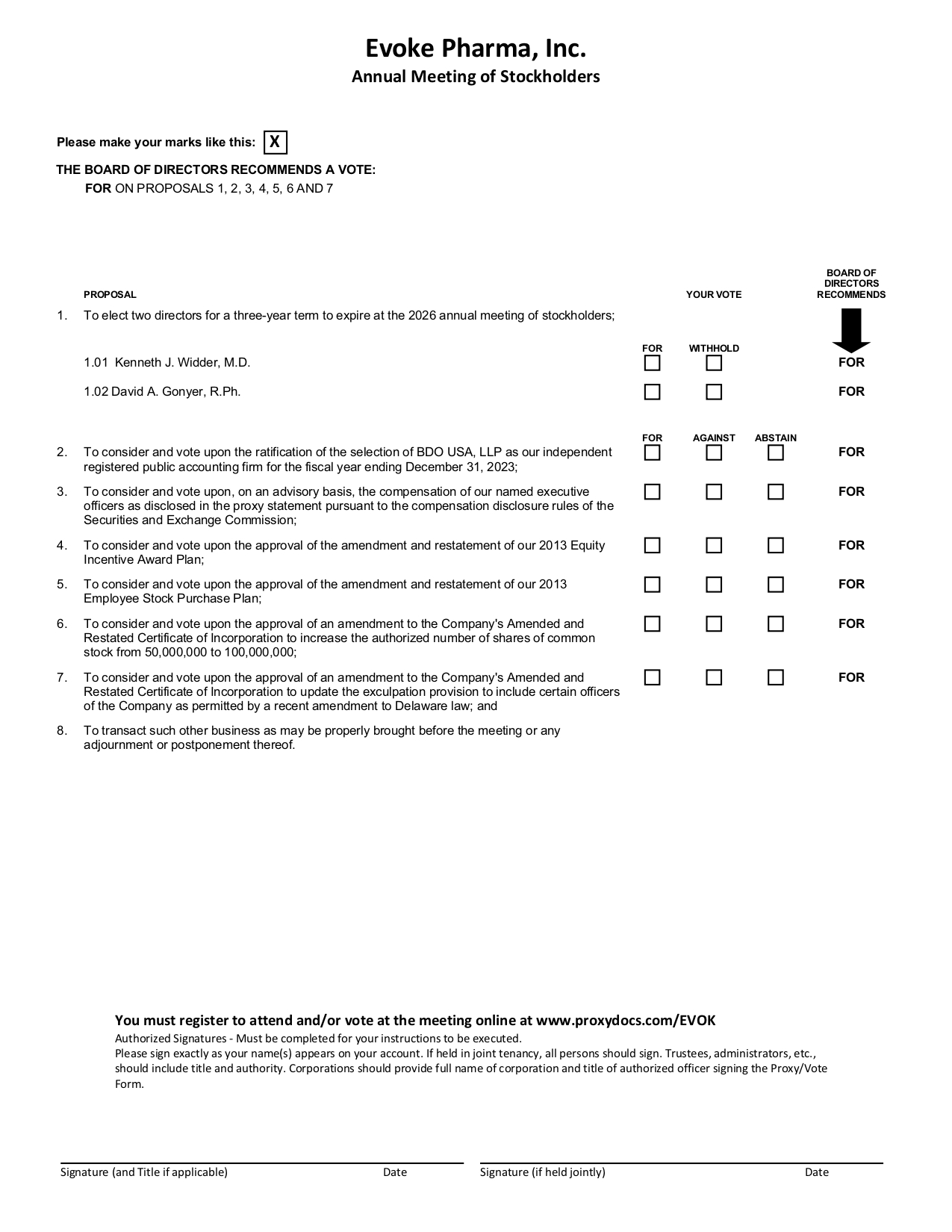

Proposal 1: To elect two directors for a three-year term to expire at the 2026 annual meeting of stockholders;

Proposal 2: Ratification of the appointment of BDO USA, LLP as our independent registered public accountants for the year ending December 31, 2023.

1

Proposal 3: To consider and vote upon, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission, or SEC.

Proposal 4: To consider and vote upon the approval of the amendment and restatement of our 2013 Equity Incentive Award Plan.

Proposal 5: To consider and vote upon the approval of the amendment and restatement of our 2013 Employee Stock Purchase Plan.

Proposal 6: To consider and vote upon the approval of an amendment to the Company's Amended and Restated Certificate of Incorporation to increase the authorized number of shares of common stock from 50,000,000 to 100,000,000.

Proposal 7: To consider and vote upon the approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation to update the exculpation provision to include certain officers of the Company as permitted by a recent amendment to Delaware law.

How many votes do I have?

Each share of our common stock that you own as of March 13, 2023 entitles you to one vote.

How do I vote by proxy?

With respect to Proposal 1 for the election of directors, you may either vote “For” all of the nominees to the board of directors or you may “Withhold” your vote for any nominee you specify. With respect to all other proposals scheduled for a vote at the annual meeting (Proposals 2, 3, 4, 5, 6, and 7), you may vote “For” or “Against” or abstain from voting.

Stockholders of Record: Shares Registered in Your Name

If you are a stockholder of record, there are several ways for you to vote your shares. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure that your vote is counted.

For those stockholders with Internet access, we encourage you to vote by proxy via the Internet, since it is quick, convenient and provides a cost savings to us. When you vote by proxy via the Internet or by telephone prior to the annual meeting date, your vote is recorded immediately and there is no risk that postal delays will cause your vote to arrive late and, therefore, not be counted.

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than directly from us. Simply complete and mail the proxy card to ensure that your vote is counted. You may be eligible to vote your shares

2

electronically over the Internet or by telephone. A large number of banks and brokerage firms offer Internet and telephone voting. If your bank or brokerage firm does not offer Internet or telephone voting information, please complete and return your proxy card in the self-addressed, postage-paid envelope provided. To vote at the annual meeting, you must obtain a valid proxy from your broker, bank or other nominee. Follow the instructions from your broker, bank, or other nominee included with these proxy materials, or contact your broker, bank, or other nominee to request a proxy form.

May I revoke my proxy?

If you give us your proxy, you may revoke it at any time before it is exercised. You may revoke your proxy in any one of the following ways:

What constitutes a quorum?

The presence at the annual meeting, by virtual attendance or by proxy, of holders representing a majority of our outstanding common stock as of March 13, 2023, or 1,671,536 shares, constitutes a quorum at the meeting, permitting us to conduct our business.

What vote is required to approve each proposal?

Proposal 1: Election of Directors. The two nominees who receive the most “For” votes (among votes properly cast at the annual meeting or by proxy) will be elected. Only votes “For” will affect the outcome.

Proposal 2: Ratification of Independent Registered Public Accounting Firm. The ratification of the appointment of BDO USA, LLP must receive “For” votes from the holders of a majority of the shares of common stock present or represented by proxy and entitled to vote at the annual meeting.

Proposal 3: Approval of the Compensation of the Named Executive Officers. The approval, on an advisory basis, of the compensation of the named executive officers must receive “For” votes from the holders of a majority of the shares of common stock present in person or represented by proxy and entitled to vote at the annual meeting.

Proposal 4: Approval of the Amendment and Restatement of our 2013 Equity Incentive Award Plan. The approval of the amendment and restatement of our 2013 Equity Incentive Award Plan must receive “For” votes from the holders of a majority of the shares of common stock present or represented by proxy and entitled to vote at the annual meeting.

Proposal 5: Approval of the Amendment and Restatement of our 2013 Employee Stock Purchase Plan. The approval of the amendment and restatement of our 2013 Employee Stock Purchase Plan must receive “For” votes from the holders of a majority of the shares of common stock present or represented by proxy and entitled to vote at the annual meeting.

Proposal 6: Approval of An Amendment to the Company's Amended and Restated Certificate of Incorporation to Increase the Authorized Number of Shares of Common Stock from 50,000,000 to 100,000,000. The approval of the proposal must receive “For” votes from the holders of a majority of the outstanding shares of common stock.

Proposal 7: Approval of an Amendment to the Company’s Amended and Restated Certificate of Incorporation to Update the Exculpation Provision to Include Certain Officers of the Company as Permitted by a Recent Amendment to Delaware Law. The approval of the proposal must receive “For” votes from the holders of a majority of the outstanding shares of common stock.

Voting results will be tabulated and certified by Mediant Communications LLC ("Mediant").

What is the effect of abstentions?

Shares of common stock held by persons attending the annual meeting but not voting, and shares represented by proxies that reflect abstentions as to a particular proposal, will be counted as present for purposes of determining the presence of a quorum. Because Proposal 1, the election of directors, is determined by a plurality of votes cast, abstentions will not be counted in determining the outcome of such proposal. For all other proposals scheduled for a vote at the annual meeting (Proposals 2, 3, 4, 5, 6, and 7), abstaining has the same effect as a negative vote because abstentions are treated as shares present at the meeting or by proxy and entitled to vote.

What is the effect of broker non-votes?

A “broker non-vote” occurs when a bank, broker or other nominee holding shares for a beneficial owner has not received instructions from the beneficial owner and either chooses not to vote those shares on a routine matter or is not permitted to

3

exercise discretionary voting authority on a non-routine matter. Shares represented by proxies that reflect a “broker non-vote” will be counted for purposes of determining whether a quorum exists.

The following proposals are considered routine matters on which a broker, bank or other nominee has discretionary authority to vote:

· Proposal 2 for the ratification of the appointment of BDO USA, LLP; and

· Proposal 6 for the approval of the amendment to our Amended and Restated Certificate of Incorporation to increase the authorized number of shares of common stock from 50,000,000 to 100,000,000.

No broker non-votes are expected on these proposals. However, if there are any broker non-votes for Proposal 2, the ratification of appointment of BDO USA, LLP, such broker non-votes will have no effect on the result of the vote. Any broker non-votes for Proposal 6, the proposal to approve an amendment to our Amended and Restated Certificate of Incorporation increase the authorized number of shares of common stock, will have the same effect as a negative vote.

All other proposals scheduled for a vote at the annual meeting (Proposals 1, 3, 4, 5 and 7) are considered non-routine, and accordingly, your broker, bank or other nominee may not exercise discretionary voting authority on those proposals. As a result, if you hold your shares with a broker, bank or other nominee and you do not provide timely voting instructions for the non-routine proposals, your shares will not be voted on those proposals at the annual meeting and will be considered “broker non-votes” on those proposals.

Broker non-votes will have no effect on the outcome of:

· Proposal 1, for the election of directors, Proposal 3, the approval, on an advisory basis, of the compensation of our named executive officers;

Broker non-votes on Proposal 7, the approval of an amendment to our Amended and Restated Certification of Incorporation to update the exculpation provision to include certain officers of the Company as permitted by a recent amendment to Delaware law, will have the same effect as a negative vote.

If you have any questions about the proxy voting process, please contact the broker, bank or other nominee that holds your shares.

How are proxies being solicited?

In addition to mailing proxy solicitation materials, our directors, employees or our advisor may also solicit proxies at the annual meeting via live webcast, via the Internet, by telephone or by other electronic means of communication we deem appropriate. Additionally, we have retained Mediant, a proxy solicitation firm, to assist us in the proxy solicitation process.

Who is paying the costs of soliciting these proxies?

We will pay all of the costs of soliciting these proxies. Our directors, officers and other employees may solicit proxies in person or by telephone, fax or email. We will not pay our directors, officers or other employees any additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses. Our costs for soliciting proxies will be approximately $25,000, plus Mediant’s out-of-pocket expenses.

How do I obtain an Annual Report on Form 10-K?

If you would like a copy of our annual report on Form 10-K for the fiscal year ended December 31, 2022 that we filed with the SEC, we will send you one without charge. Please write to:

Evoke Pharma, Inc.

420 Stevens Avenue, Suite 370

Solana Beach, CA 92075

Attn: Corporate Secretary

All of our SEC filings are also available free of charge in the investor relations section of our website at www.evokepharma.com.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in our current report on Form 8-K to be filed with the SEC within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

4

PROPOSAL 1

ELECTION OF DIRECTORS

Our board of directors is divided into three classes, with one class of our directors standing for election each year, generally for a three-year term. The current term of the company’s Class I directors, Kenneth J. Widder, M.D., and David A. Gonyer, R.Ph., will expire at the 2023 annual meeting.

The nominees for Class I director for election at the 2023 annual meeting are Kenneth J. Widder, M.D., and David A. Gonyer, R.Ph. If Dr. Widder and Mr. Gonyer are elected at the 2023 annual meeting, such individuals will be elected to serve for a term of three years that will expire at our 2026 annual meeting of stockholders and until such individual’s successor is elected and qualified.

If no contrary indication is made, proxies in the accompanying form will be voted for the nominees, or in the event that any nominee is not a candidate or is unable to serve as a director at the time of the election (which is not currently expected), for any nominee who is designated by our board of directors to fill the vacancy. Dr. Widder and Mr. Gonyer are currently members of our board of directors.

All of our directors bring to the board of directors significant leadership experience derived from their professional experience and service as executives or board members of other corporations and/or venture capital firms. The process undertaken by the nominating and corporate governance committee in recommending qualified director candidates is described below under “Director Nominations Process.” Certain individual qualifications and skills of our directors that contribute to the board of directors’ effectiveness as a whole are described in the following paragraphs.

Information Regarding Directors

The information set forth below as to the directors and nominees for director has been furnished to us by the directors and nominees for director:

Nominees for Election to the Board of Directors

For a Three-Year Term Expiring at the

2026 Annual Meeting of Stockholders (Class I)

|

|

|

|

|

|

|

Name |

|

Age |

|

|

Present Position with Evoke Pharma, Inc. |

|

Kenneth J. Widder, M.D. |

|

|

70 |

|

|

Director |

David A. Gonyer, R.Ph. |

|

|

59 |

|

|

Chief Executive Officer and Director |

Kenneth J. Widder, M.D. has served as a member of our board of directors since June 2007. Dr. Widder has over 40 years of experience working with biomedical companies. Dr. Widder was a General Partner with Latterell Venture Partners and serves on the boards of QuidelOrtho Corporation, OrphoMed Inc, Sydnexis Inc, and the Vision of Children Foundation. Dr. Widder has founded seven companies and was Chairman and Chief Executive Officer of five of these companies. His last company, Sytera Inc., merged with Sirion Therapeutics, an ophthalmology specialty pharmaceutical company. Prior to Sytera, Dr. Widder co-founded and was the initial Chief Executive Officer of NovaCardia, Inc., a company acquired by Merck & Co., Inc. Prior to NovaCardia, Dr. Widder founded and was Chairman and Chief Executive Officer of Santarus, Inc., which was acquired by Salix Pharmaceuticals in 2013. Additionally, Dr. Widder was Chairman and Chief Executive Officer of Converge Medical, Inc., a medical device company developing a suture-less anastomosis system for vein grafts in coronary bypass surgery. Dr. Widder started his career as a founder, Chairman and Chief Executive Officer of Molecular Biosystems, where he was responsible for the development and approval of AlbunexR and OptisonR, the first two ultrasound contrast agents to be approved in the United States. Dr. Widder is an inventor on over 50 patents and patent applications and has authored or co-authored over 25 publications. Dr. Widder holds an M.D. from Northwestern University and trained in pathology at Duke University. Dr. Widder’s extensive knowledge of our business and history, experience as a board member of multiple publicly-traded and privately-held companies and expertise in developing and financing contributed to our board of directors’ conclusion that he should serve as a director of our company.

David A. Gonyer, R.Ph., is one of our co-founders and has served as our Chief Executive Officer and as a member of our board of directors since March 2007. From 2004 to 2007, Mr. Gonyer served as Vice President, Strategic and Product Development of Medgenex, Inc., a subsidiary of Victory Pharma, Inc., a biopharmaceutical company focused on acquiring, developing and marketing products to treat pain and related conditions. From 2000 to 2004, Mr. Gonyer was a founder and Vice President of Sales and Marketing at Xcel Pharmaceuticals, Inc., a specialty pharmaceutical company focused on neurological disorders. From 1996 to 2000, Mr. Gonyer served as Director of Marketing at Elan/Dura Pharmaceuticals, Inc. From 1987 to 1996, Mr. Gonyer held a broad range of management positions in commercial operations, alliance/partnership management, and regional sales at Eli Lilly & Company. Mr. Gonyer served as a member of the board of directors of Signal Genetics, Inc., a publicly-traded, commercial stage, molecular diagnostic company focused on providing innovative diagnostic services prior to its merger with miRagen Therapeutics in 2017 and Neurelis, Inc., a privately held neurological specialty pharmaceutical company. Mr. Gonyer is a Registered Pharmacist and holds a B.Sc. in Pharmacy from Ferris State University School of Pharmacy. As one of our co-founders and having served as our Chief Executive Officer since March 2007, Mr. Gonyer’s extensive knowledge of our business, as well as 36 years of experience in the pharmaceutical industry, including executive leadership in several pharmaceutical companies, contributed to our board of directors’ conclusion that he should serve as a director of our company

5

Members of the Board of Directors Continuing in Office

Term Expiring at the

2024 Annual Meeting of Stockholders (Class II)

Name |

|

|

Age |

|

|

Present Position with Evoke Pharma, Inc. |

|

Cam L. Garner |

|

|

74 |

|

|

|

Chairman of the Board of Directors |

Todd C. Brady, M.D., Ph.D. |

|

|

51 |

|

|

|

Director |

Cam L. Garner is one of our co-founders and has served as Chairman of our board of directors since June 2007. Mr. Garner has co-founded specialty pharmaceutical companies Zogenix, Inc., Cadence Pharmaceuticals, Inc., Somaxon Pharmaceuticals, Inc., Elevation Pharmaceuticals, Inc., DJ Pharma, Verus Pharmaceuticals, Inc., Xcel Pharmaceuticals, Inc., Meritage Pharma, Inc., Oncternal Therapeutics, Inc., Kalyra Pharmaceuticals, Inc., OrPro Therapeutics, Inc., Alastin Skincare, Inc. and Zavante Therapeutics, Inc. He currently serves as Chairman of Zogenix and OrPro. Mr. Garner served as Chairman of Xcel Pharmaceuticals until it was acquired in March 2005 by Valeant Pharmaceuticals International, DJ Pharma until it was sold to Biovail in 2000, Elevation Pharmaceuticals until it was acquired by Sunovion Pharmaceuticals Inc. in September 2012, Cadence Pharmaceuticals until it was acquired by Mallinckrodt plc in March 2014, Meritage Pharma until it was acquired by Shire plc in February 2015, Zavante Inc. until it was acquired by Nabriva in July 2018 and Alastin until it was acquired by Galderma in November 2021. He also served as a director of Aegis Therapeutics until it was acquired by Neurelis, Inc. in December 2018. Mr. Garner was Chief Executive Officer of Dura Pharmaceuticals, Inc. from 1989 to 1995 and its Chairman and Chief Executive Officer from 1995 until it was sold to Elan in November 2000. Mr. Garner earned his B.A. in Biology from Virginia Wesleyan College and an M.B.A. from Baldwin-Wallace College. As one of our co-founders and having served as our Chairman since June 2007, Mr. Garner’s extensive knowledge of our business and history, experience as a board member of multiple publicly-traded and privately-held companies, and expertise in developing, financing and providing strong executive leadership to numerous biopharmaceutical companies contributed to our board of directors’ conclusion that he should serve as a director of our company.

Todd C. Brady, M.D., Ph.D., has served as a member of our board of directors since June 2007. Dr. Brady currently serves as Chief Executive Officer, President, and Director of Aldeyra Therapeutics, Inc., a publicly-traded biotechnology company. Dr. Brady was appointed President and Chief Executive Officer of Aldeyra Therapeutics in 2012, having been a member of the board of directors since 2005. Prior to Aldeyra, Dr. Brady served as Entrepreneur in Residence at Domain Associates, LLC, a leading healthcare venture capital firm, where he was a Principal from 2004 to 2013. Dr. Brady also serves on the board of directors of F-star Therapeutics, Inc., a publicly-traded biotechnology company. Dr. Brady holds an M.D. from Duke University Medical School, a Ph.D. from Duke University Graduate School, and an A.B. from Dartmouth College. Dr. Brady’s extensive knowledge of our business and history, experience as a board member of multiple companies, and expertise in strategic development contributed to our board of directors’ conclusion that he should serve as a director of our company.

Term Expiring at the

2025 Annual Meeting of the Stockholders (Class III)

|

|

|

|

|

|

|

Name |

|

Age |

|

|

Present Position with Evoke Pharma, Inc. |

|

Malcolm R. Hill, Pharn.D. |

|

|

66 |

|

|

Director |

Vickie W. Reed |

|

|

61 |

|

|

Director |

Malcolm R. Hill, Pharm.D. has served as a member of our board of directors since June 2007. Dr. Hill has more than 30 years of academic and pharmaceutical industry experience in new product assessment and clinical trial design and execution, with a special emphasis in gastroenterology, respiratory medicine, and drug delivery systems. Since September 2020, Dr. Hill has served as Chief Development Officer at Mopac Biologics, a company specializing in development of computationally derived proteins for the treatment of inflammatory conditions of the gastrointestinal system. From June 2016 to March 2020, Dr. Hill served as the Chief Development Officer at PvP Biologics, a biotechnology company which was acquired by Takeda. Prior to joining PvP Biologics, Dr. Hill was Chief Scientific Officer at Meritage Pharma from 2008 through February 2015 focusing on novel treatments for eosinophilic esophagitis, when it was acquired by Shire. Prior to joining Meritage, Dr. Hill was Senior Vice President of Research and Development at Verus Pharmaceuticals, Inc. where he was responsible for various development-stage programs. Dr. Hill was a member of the senior management team at Dura Pharmaceuticals, Inc., where he served as a vice president and corporate officer. Dr. Hill was a Partner at ProPharmaCon, LLC, a product development and regulatory consulting company for clients with pharmaceutical products in every stage of the development cycle. Dr. Hill’s academic career includes his position at the National Jewish Medical and Research Center, and he has also served as an assistant professor in the Schools of Medicine and Pharmacy at the University of Colorado. Dr. Hill has published more than 80 articles on the topics of clinical pharmacology and pharmacokinetics and the treatment of pediatric asthma and related conditions. Dr. Hill earned his Pharm.D. from the University of Southern California and completed a post-doctoral program at the Veterans Administration Medical Center, San Diego, as well as a research fellowship in the Schools of Medicine and Pharmacy at the University of Florida Health Sciences Center. Dr. Hill’s experience as a founder of a private pharmaceutical firms, strong background in clinical and product

6

development and substantial knowledge of the pharmaceutical industry contributed to our board of directors’ conclusion that he should serve as a director of our company.

Vickie W. Reed was appointed to serve as a member of our board of directors in May 2021. Ms. Reed is a healthcare executive with over 25 years of experience in operating and governance roles. Since May 2022, Ms. Reed has served on the board at Adamis Pharmaceuticals Corporation, a publicly-traded biotechnology company. Previously, she served as Senior Vice President, Finance and Chief Accounting Officer at Mirati Therapeutics, and Senior Director, Finance and Controller at Zogenix, Inc., a public biotechnology company in San Diego and Emeryville, California, and held corporate accounting positions at Amylin Pharmaceuticals, Inc., a public biotechnology company acquired by Bristol Myers Squibb in 2012. Prior to joining Amylin, Ms. Reed held financial leadership roles at several biotechnology and telecommunications companies. Ms. Reed began her career with Price Waterhouse, now PricewaterhouseCoopers, in Denver, Colorado. She is a Certified Public Accountant (inactive) in the State of Colorado and received a B.S. in Accounting from University of Colorado, Denver. Ms. Reed’s experience as the chief accounting officer of a publicly-traded biotech company brings to our board of directors and the committees of our board of directors valuable financial skills and expertise, which qualify her to serve as an “audit committee financial expert” on the audit committee, and significant executive management experience and leadership skills, as well as a strong understanding of corporate governance principles, all of which contributed to our board of directors’ conclusion that she should serve as a director of our company.

Board Independence

Our board of directors has determined that all of our directors are independent directors within the meaning of the applicable Nasdaq Stock Market LLC, or Nasdaq, listing standards, except for David A. Gonyer, R.Ph., our Chief Executive Officer.

Board Leadership Structure

Our board of directors is currently led by its chairman, Cam L. Garner. Our board of directors recognizes that it is important to determine an optimal board leadership structure to ensure the independent oversight of management as the company continues to grow. We separate the roles of chief executive officer and chairman of the board in recognition of the differences between the two roles. The chief executive officer is responsible for setting the strategic direction for the company and the day-to-day leadership and performance of the company, while the chairman of the board of directors provides guidance to the chief executive officer and presides over meetings of the full board of directors. We believe that this separation of responsibilities provides a balanced approach to managing the board of directors and overseeing the company.

The Board’s Role in Risk Oversight

Our board of directors has responsibility for the oversight of the company’s risk management processes and, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our business and the steps we take to manage them. The risk oversight process includes receiving regular reports from board committees and members of senior management to enable our board to understand the company’s risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic and reputational risk.

The audit committee reviews information regarding liquidity and operations, and oversees our management of financial risks. Periodically, the audit committee reviews our policies with respect to risk assessment, risk management, loss prevention and regulatory compliance. Oversight by the audit committee includes direct communication with our external auditors, and discussions with management regarding significant risk exposures and the actions management has taken to limit, monitor or control such exposures. The compensation committee is responsible for assessing whether any of our compensation policies or programs has the potential to encourage excessive risk-taking. The nominating and corporate governance committee manages risks associated with the independence of the board, corporate disclosure practices, and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board is regularly informed through committee reports about such risks. Matters of significant strategic risk are considered by our board as a whole.

Board of Directors Meetings

During 2022, our board of directors met five times. In that year, each director attended at least 75% of the total number of meetings held during such director’s term of service by the board of directors and each committee of the board of directors on which such director served.

Committees of the Board of Directors

We have three standing committees: the audit committee, the compensation committee and the nominating and corporate governance committee. Each of these committees has a written charter approved by our board of directors. A copy of each charter can be found under the Corporate Governance section of our website at www.evokepharma.com.

7

Audit Committee

The audit committee’s main function is to oversee our accounting and financial reporting processes, internal systems of control, independent registered public accounting firm relationships and the audits of our financial statements. This committee’s responsibilities include, among other things:

The members of our audit committee are Ms. Reed, Dr. Brady and Dr. Widder. Ms. Reed serves as the chairperson of the committee. All members of our audit committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and the Nasdaq Capital Market. Our board of directors has determined that Ms. Reed is an “audit committee financial expert” as defined by applicable SEC rules and has the requisite financial sophistication as defined under the applicable Nasdaq rules and regulations. Our board of directors has determined each of Ms. Reed, Dr. Brady and Dr. Widder is independent under the applicable rules of the SEC and the Nasdaq Capital Market. The audit committee met four times during 2022. The audit committee is governed by a written charter that satisfies the applicable standards of the SEC and the Nasdaq Capital Market.

Compensation Committee

Our compensation committee reviews and recommends policies relating to compensation and benefits of our officers and employees. The compensation committee reviews and recommends corporate goals and objectives relevant to the compensation of our Chief Executive Officer and other executive officers, evaluates the performance of these officers in light of those goals and objectives and recommends to our board of directors the compensation of these officers based on such evaluations. The compensation committee also recommends to our board of directors the issuance of stock options and other awards under our equity plan. The compensation committee reviews and evaluates, at least annually, the performance of the compensation committee and its members, including compliance by the compensation committee with its charter.

The members of our compensation committee are Mr. Garner, Dr. Brady and Dr. Hill. Mr. Garner serves as the chairman of the committee. Our Board has determined that each of Mr. Garner, Dr. Brady and Dr. Hill is independent under the applicable rules and regulations of the Nasdaq Capital Market, and is a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act. The compensation committee met three times during 2022. The compensation committee is governed by a written charter, which the compensation committee reviews and evaluates at least annually.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee is responsible for making recommendations to our board of directors regarding candidates for directorships and the size and composition of our board of directors. In addition, the nominating and corporate governance committee is responsible for overseeing our corporate governance policies, reporting and making recommendations to our board of directors concerning governance matters and periodically reviewing and evaluating the performance of the Board.

The members of our nominating and corporate governance committee are Drs. Hill and Widder. Dr. Hill serves as the chairman of the committee. Our board has determined that Drs. Hill and Widder are independent under the applicable rules and regulations of the Nasdaq Capital Market relating to nominating and corporate governance committee independence. The nominating and corporate governance committee did not meet during 2022.

8

Report of the Audit Committee of the Board of Directors

The audit committee oversees the company’s financial reporting process on behalf of our board of directors. Management has the primary responsibility for the financial statements, for maintaining effective internal control over financial reporting, and for assessing the effectiveness of internal control over financial reporting. In fulfilling its oversight responsibilities, the audit committee reviewed and discussed the audited financial statements in the company’s annual report with management, including a discussion of any significant changes in the selection or application of accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and the effect of any new accounting policies.

We have reviewed and discussed with BDO USA, LLP our audited financial statements. We discussed with BDO USA, LLP the overall scope and plans of their audits. We met with BDO USA, LLP, with and without management present, to discuss results of its examinations, and the overall quality of the company’s financial reporting.

We have reviewed and discussed with BDO USA, LLP matters required to be discussed pursuant to the Public Company Accounting Oversight Board Auditing Standard 1301 “Communications with Audit Committees.” We have received from BDO USA, LLP the written disclosures and letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding BDO USA, LLP’s communications with the audit committee concerning independence. We have discussed with BDO USA, LLP matters relating to its independence, including a review of both audit and non-audit fees, and considered the compatibility of non-audit services with BDO USA, LLP’s independence. The audit committee is not employed by the company, nor does it provide any expert assurance or professional certification regarding the company’s financial statements. The audit committee relies, without independent verification, on the accuracy and integrity of the information provided and representations made by management and the company’s independent registered public accounting firm.

In reliance on the reviews and discussions referred to above, the audit committee has recommended to the company’s board of directors that the audited financial statements be included in our annual report for the year ended December 31, 2022. The audit committee and the company’s board of directors also have recommended, subject to stockholder approval, the ratification of the appointment of BDO USA, LLP as the company’s independent registered public accounting firm for 2023.

This report of the audit committee is not “soliciting material,” shall not be deemed “filed” with the SEC and shall not be incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

The foregoing report has been furnished by the audit committee.

Respectfully submitted,

The Audit Committee of the Board of Directors

Vickie W. Reed (Chairperson)

Todd C. Brady, M.D., Ph.D.

Kenneth J. Widder, M.D.

Compensation Committee Interlocks and Insider Participation

Mr. Garner, Dr. Brady and Dr. Hill served on our compensation committee during 2022. None of the members of our compensation committee has ever been one of our officers or employees. None of our executive officers currently serves, or has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

Director Nomination Process

Director Qualifications

In evaluating director nominees, the nominating and corporate governance committee will consider, among other things, the following factors:

9

The nominating and corporate governance committee’s goal is to assemble a board of directors that brings to the company a variety of perspectives and skills derived from high quality business and professional experience. Moreover, the nominating and corporate governance committee believes that the background and qualifications of the board of directors, considered as a group, should provide a significant mix of experience, knowledge and abilities that will allow the board of directors to fulfill its responsibilities. Nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability or any other basis proscribed by law.

Other than the foregoing criteria for director nominees, the nominating and corporate governance committee has not adopted a formal policy with respect to a fixed set of specific minimum qualifications for its candidates for membership on the board of directors. The nominating and corporate governance committee may consider such other facts, including, without limitation, diversity, as it may deem are in the best interests of the company and its stockholders. The nominating and corporate governance committee does, however, believe it is appropriate for at least one, and, preferably, several, members of our board of directors to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and that a majority of the members of our board of directors be independent as required under the Nasdaq qualification standards. The nominating and corporate governance committee also believes it is appropriate for our Chief Executive Officer to serve as a member of our board of directors. Our directors’ performance and qualification criteria are reviewed annually by the nominating and corporate governance committee.

Identification and Evaluation of Nominees for Directors

The nominating and corporate governance committee identifies nominees for director by first evaluating the current members of our board of directors willing to continue in service. Current members with qualifications and skills that are consistent with the nominating and corporate governance committee’s criteria for board of directors service and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of our board of directors with that of obtaining a new perspective or expertise.

If any member of our board of directors does not wish to continue in service or if our board of directors decides not to re-nominate a member for re-election, the nominating and corporate governance committee may identify the desired skills and experience of a new nominee in light of the criteria above, in which case, the nominating and corporate governance committee would generally poll our board of directors and members of management for their recommendations. The nominating and corporate governance committee may also review the composition and qualification of the boards of directors of our competitors, and may seek input from industry experts or analysts. The nominating and corporate governance committee reviews the qualifications, experience and background of the candidates. Final candidates are interviewed by the members of the nominating and corporate governance committee and by certain of our other independent directors and executive management. In making its determinations, the nominating and corporate governance committee evaluates each individual in the context of our board of directors as a whole, with the objective of assembling a group that can best contribute to the success of our company and represent stockholder interests through the exercise of sound judgment. After review and deliberation of all feedback and data, the nominating and corporate governance committee makes its recommendation to our board of directors. To date, the nominating and corporate governance committee has not utilized third-party search firms to identify director candidates. The nominating and corporate governance committee may in the future choose to do so in those situations where particular qualifications are required or where existing contacts are not sufficient to identify an appropriate candidate.

The nominating and corporate governance committee evaluates nominees recommended by stockholders in the same manner as it evaluates other nominees. We have not received director candidate recommendations from our stockholders and do not have a formal policy regarding consideration of such recommendations. However, any recommendations received from stockholders will be evaluated in the same manner that potential nominees suggested by board members, management or other parties are evaluated. We do not intend to treat stockholder recommendations in any manner different from other recommendations.

Under our amended and restated bylaws, stockholders wishing to suggest a candidate for director should write to our corporate secretary and provide such information about the stockholder and the proposed candidate as is set forth in our amended and restated bylaws and as would be required by SEC rules to be included in a proxy statement. In addition, the stockholder must include the consent of the candidate and describe any arrangements or undertakings between the stockholder and the candidate regarding the nomination. In order to give the nominating and corporate governance committee sufficient time to evaluate a recommended candidate and/or include the candidate in our proxy statement for the 2023 annual meeting, the recommendation should be received by our corporate secretary at our principal executive offices in accordance with our procedures detailed in the section below entitled “Stockholder Proposals.”

Director Attendance at Annual Meetings

Although our company does not have a formal policy regarding attendance by members of our board of directors at our annual meeting, we encourage all of our directors to attend. All of the board members attended the 2022 annual meeting of stockholders.

10

Communications with our Board of Directors

Stockholders seeking to communicate with our board of directors should submit their written comments to our corporate secretary at Evoke Pharma, Inc., 420 Stevens Avenue, Suite 370, Solana Beach, California 92075. The corporate secretary will forward such communications to each member of our board of directors; provided that, if in the opinion of our corporate secretary it would be inappropriate to send a particular stockholder communication to a specific director, such communication will only be sent to the remaining directors (subject to the remaining directors concurring with such opinion).

Corporate Governance

Our company’s Code of Business Conduct and Ethics, Corporate Governance Guidelines, Audit Committee Charter, Compensation Committee Charter and Nominating and Corporate Governance Committee Charter are available, free of charge, on our website at www.evokepharma.com. Please note, however, that the information contained on the website is not incorporated by reference in, or considered part of, this proxy statement. We will also provide copies of these documents, as well as our company’s other corporate governance documents, free of charge, to any stockholder upon written request to Evoke Pharma, Inc., Attention: Corporate Secretary, 420 Stevens Avenue, Suite 370, Solana Beach, California 92075.

Director Compensation

The following table sets forth information for the year ended December 31, 2022 regarding the compensation awarded to, earned by or paid to our non-employee directors who served on our board of directors during 2022. Employees of our company who also serve as a director do not receive additional compensation for their performance of services as a director.

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Director |

|

Fees Earned or Paid in Cash ($) |

|

|

Option |

|

All Other |

|

Total |

|

|||||

Cam Garner |

|

|

73,000 |

|

|

|

34,040 |

|

(2) |

|

— |

|

|

107,040 |

|

Todd C. Brady, M.D., Ph.D. |

|

|

54,750 |

|

|

|

29,123 |

|

(3) |

|

— |

|

|

83,873 |

|

Malcolm R. Hill, Pharm.D. |

|

|

54,500 |

|

|

|

29,123 |

|

(4) |

|

— |

|

|

83,623 |

|

Vickie W. Reed |

|

|

60,000 |

|

|

|

29,249 |

|

(5) |

|

— |

|

|

89,249 |

|

Kenneth J. Widder, M.D. |

|

|

53,500 |

|

|

|

28,241 |

|

(6) |

|

— |

|

|

81,741 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

11

The table below shows the aggregate numbers of option awards (exercisable and unexercisable) held as of December 31, 2022 by each non-employee director who was serving as of December 31, 2022.

|

|

|

|

|

|

|

||

Director |

|

Options Exercisable at |

|

|

Options Unexercisable at |

|

||

Cam Garner |

|

|

25,333 |

|

|

|

5,625 |

|

Todd C. Brady, M.D., Ph.D. |

|

|

22,706 |

|

|

|

4,812 |

|

Malcolm R. Hill, Pharm.D. |

|

|

21,333 |

|

|

|

4,812 |

|

Vickie W. Reed |

|

|

1,944 |

|

|

|

8,722 |

|

Kenneth J. Widder, M.D. |

|

|

22,414 |

|

|

|

4,666 |

|

|

|

|

|

|

|

|

||

For the year ended December 31, 2022, each non-employee director received $45,000 for his or her service. Additionally, the chair of our board of directors received an annual cash retainer of $20,000, the chair of the audit committee received an additional annual cash retainer of $15,000, the chair of the compensation committee received an additional annual cash retainer of $8,000, and the chair of the nominating and corporate governance committee received an additional annual cash retainer of $5,500. Audit committee members received an additional cash retainer of $5,750, compensation committee members received an additional annual cash retainer of $4,000 and nominating and corporate governance committee members received an additional annual cash retainer of $2,750.

Each non-employee director who is newly elected or appointed to the board of directors will receive an initial grant of options to purchase 5,833 shares of our common stock, vesting in three equal annual installments on each of the first three anniversaries of the date of grant, upon such election or appointment to the board of directors. In addition, non-employee directors receive annual grants of options on the date of each annual meeting of stockholders as follows: each non-employee director, options to purchase 4,166 shares; chair of our board of directors, an additional grant of options to purchase 833 shares; chair of the audit committee, an additional grant of options to purchase 666 shares; chair of the compensation committee, an additional 625 shares; and chair of the nominating and corporate governance committee, an additional grant of options to purchase 333 shares. Audit committee members received an additional grant of options to purchase 333 shares; members of the compensation committee received an additional grant of 312 shares; and the members of the nominating and corporate governance committee received an additional grant of options to purchase 166. All of the annual grants will vest on the first anniversary of the date of grant.

Effective January 2023, our board of directors amended the compensation program for our non-employee directors. Under the amended program, non-employee directors will receive annual grants of options on the date of each annual meeting of stockholders as follows: each non-employee director, options to purchase 12,000 shares; chair of our board of directors, an additional grant of options to purchase 3,500 shares; chair of the audit committee, an additional grant of options to purchase 3,000 shares; chair of the compensation committee, an additional 2,250 shares; and chair of the nominating and corporate governance committee, an additional grant of options to purchase 1,500 shares. Audit committee members received an additional grant of options to purchase 1,500 shares; members of the compensation committee received an additional grant of 1,125 shares; and the members of the nominating and corporate governance committee received an additional grant of options to purchase 750. All of the annual grants will vest on the first anniversary of the date of grant. The remaining terms of the director compensation program as in effect prior to this amendment remain unchanged.

Vote Required; Recommendation of the Board of Directors

If a quorum is present and voting at the annual meeting, the two nominees receiving the highest number of votes will be elected to our board of directors. Votes withheld from any nominee, abstentions and broker non-votes will be counted only for purposes of determining a quorum. Broker non-votes will have no effect on this proposal as brokers or other nominees are not entitled to vote on such proposals in the absence of voting instructions from the beneficial owner.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE ELECTION OF CAM L. GARNER AND TODD C. BRADY, M.D., PH.D. PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE SO VOTED UNLESS YOU SPECIFY OTHERWISE ON YOUR PROXY CARD.

12

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The audit committee has selected BDO USA, LLP as the company’s independent registered public accountants for the year ending December 31, 2023 and has further directed that management submit the selection of independent registered public accountants for ratification by the stockholders at the annual meeting. BDO USA, LLP has audited the company’s financial statements for the years ended December 31, 2013 through December 31, 2022. Representatives of BDO USA, LLP are expected to be present at the annual meeting, will have an opportunity to make a statement if they so desire, and will be available to respond to appropriate questions.

Stockholder ratification of the selection of BDO USA, LLP as the company’s independent registered public accountants is not required by Delaware law, the company’s amended and restated certificate of incorporation, or the company’s amended and restated bylaws. However, the audit committee is submitting the selection of BDO USA, LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the audit committee will reconsider whether to retain the firm. Even if the selection is ratified, the audit committee in its discretion may direct the appointment of different independent registered public accountants at any time during the year if the audit committee determines that such a change would be in the best interests of the company and its stockholders.

The following table represents aggregate fees billed to us for services related to the years ended December 31, 2022 and 2021, by BDO USA, LLP as our independent registered public accounting firm:

|

|

Fiscal Years Ended |

|||||||

|

|

2022 |

|

|

2021 |

|

|

||

Audit Fees(1) |

|

$ |

351,805 |

|

|

$ |

240,736 |

|

|

Audit Related Fees(2) |

|

$ |

- |

|

|

— |

|

|

|

Tax Fees(3) |

|

— |

|

|

— |

|

|

||

All Other Fees |

|

— |

|

|

— |

|

|

||

|

|

$ |

351,805 |

|

|

$ |

240,736 |

|

|

|

|

|

|

|

|

|

|

||

The audit committee has considered whether the provision of non-audit services is compatible with maintaining the independence of BDO USA, LLP, and has concluded that the provision of such services is compatible with maintaining the independence of our auditors.

Pre-Approval Policies and Procedures

Our audit committee has established a policy that all audit and permissible non-audit services provided by our independent registered public accounting firm will be pre-approved by the audit committee, and all such services were pre-approved in accordance with this policy during the fiscal years ended December 31, 2022 and 2021. These services may include audit services, audit-related services, tax services and other services. The audit committee considers whether the provision of each non-audit service is compatible with maintaining the independence of our auditors. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent registered public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date.

Vote Required; Recommendation of the Board of Directors

The affirmative vote of a majority of the shares of common stock present or represented by proxy and entitled to vote at the meeting will be required to ratify the selection of BDO USA, LLP. Abstentions will be counted toward the tabulation of votes cast on this proposal and will have the same effect as negative votes. The approval of Proposal 2 is a routine proposal on which a broker or other nominee has discretionary authority to vote. Accordingly, no broker non-votes will likely result from this proposal.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE TO RATIFY THE SELECTION OF BDO USA, LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2023. PROXIES SOLICITED BY OUR BOARD OF

13

DIRECTORS WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY OTHERWISE ON THEIR PROXY CARDS.

PROPOSAL 3

APPROVAL OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, our stockholders are entitled to vote at the annual meeting to provide advisory approval of the compensation of our named executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the SEC. Pursuant to the Dodd-Frank Act, the stockholder vote on executive compensation is an advisory vote only, and it is not binding on us or our board of directors.

Although the vote is non-binding, our compensation committee and board of directors value the opinions of the stockholders and will consider the outcome of the vote when making future compensation decisions. We urge stockholders to read the Executive Compensation and Other Information section of this proxy statement, which describes in detail our executive compensation.

Consistent with the preference of our stockholders as reflected in our prior non-binding advisory vote on the frequency of future say-on-pay votes, we will hold a say-on-pay advisory vote each year unless otherwise disclosed.

We are asking our stockholders to indicate their support for our named executive officer compensation as described in this proxy statement. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on our named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement. Accordingly, we ask that our stockholders vote “FOR” the following resolution:

“RESOLVED, that Evoke Pharma, Inc.’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in Evoke Pharma, Inc.’s Proxy Statement for the 2022 Annual Meeting of Stockholders, pursuant to the compensation disclosure rules of the SEC, including the Executive Compensation and Other Information, the 2022 Summary Compensation Table and the other related tables and disclosure.”

Vote Required; Recommendation of the Board of Directors

The affirmative vote of a majority of the shares of common stock present or represented by proxy and entitled to vote at the meeting will be required to approve the advisory vote regarding the compensation of the named executive officers. Abstentions will be counted toward the tabulation of votes cast on this proposal and will have the same effect as negative votes. Broker non-votes will have no effect on this proposal as brokers or other nominees are not entitled to vote on such proposals in the absence of voting instructions from the beneficial owner.

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT PURSUANT TO THE COMPENSATION DISCLOSURE RULES OF THE SEC.

14

PROPOSAL 4

APPROVAL OF AMENDMENT AND RESTATEMENT OF

2013 EQUITY INCENTIVE AWARD PLAN

Introduction

Our stockholders are being asked to approve an amendment and restatement of our 2013 Equity Incentive Award Plan, or the 2013 Plan. The amended and restated 2013 Plan is referred to herein as the “Restated Plan.” Our board of directors approved the Restated Plan on March 20, 2023, subject to stockholder approval. The Restated Plan will become effective upon stockholder approval. If the Restated Plan is not approved by our stockholders, the Restated Plan will not become effective, the existing 2013 Plan will continue in full force and effect, and we may continue to grant awards under the 2013 Plan, subject to its terms, conditions and limitations, using the shares available for issuance thereunder.

Overview of Proposed Amendments

Increase in Share Reserve. We strongly believe that an employee equity compensation program is a necessary and powerful incentive and retention tool that benefits all stockholders. As of March 1, 2023, a total of 794,717 shares of our common stock were reserved under the 2013 Plan, the aggregate number of shares of common stock subject to awards under the 2013 Plan was 569,351 and a total of 202,719 shares of common stock remained available under the 2013 Plan for future issuance. In addition, the 2013 Plan contains an “evergreen provision” that allows for an annual increase in the number of shares available for issuance under the 2013 Plan on January 1 of each year during the ten year term of the 2013 Plan. The annual increase in the number of shares under the 2013 Plan is equal to the least of:

The automatic increases pursuant to the evergreen provision of the 2013 Plan on each of January 1, 2019, 2020, 2021, 2022, and 2023 were 58,091 shares, 81,439 shares, 88,739 shares, 108,854 shares, and 133,722 shares respectively, and these increases are included in the total number of shares reserved for issuance under the 2013 Plan as of January 1, 2023 set forth above. Notwithstanding the foregoing, the number of shares of stock that may be issued or transferred pursuant to incentive stock options, or ISOs under the 2013 Plan may not exceed an aggregate of 666,666 shares.

Pursuant to the Restated Plan, an additional 400,000 shares will be reserved for issuance under the Restated Plan and the evergreen provision will provide that, commencing on January 1, 2024, and on each January 1 thereafter during the ten-year term of the Restated Plan, through and including January 1, 2033, the aggregate number of shares available for issuance under the Restated Plan shall be increased by that number of shares of our common stock equal to the lesser of:

All of the foregoing share numbers may be adjusted for changes in our capitalization and certain corporate transactions, as described below under heading “Adjustments.”

Incentive Stock Option Limit. The number of shares of stock that may be issued or transferred pursuant to incentive stock options, or ISOs, under the Restated Plan may not exceed an aggregate of 50,000,000 shares, which may be adjusted for changes in our capitalization and certain corporate transactions, as described below under the heading “Adjustments.”

Extension of Term. The term of the Restated Plan will also be extended so that the Restated Plan will terminate in March 2033.

The Restated Plan is not being amended in any material respect other than to reflect the changes described above.

Equity Incentive Awards Are Critical to Long-Term Stockholder Value Creation

The table below presents information about the number of shares that were subject to outstanding equity awards under the 2013 Plan and the shares remaining available for issuance under the 2013 Plan, each at March 1, 2023 (except as noted below), and the requested increase in shares authorized for issuance under the Restated Plan. The 2013 Plan and our Employee Stock Purchase Plan are the only equity incentive plans we currently have in place pursuant to which awards may still be granted. For more information about our Employee Stock Purchase Plan, please see Proposal 5.

15

|

|

Number |

|

|

As a % of Shares |

|

|

Dollar |

|

|||

|

|

|

|

|

|

|

|

|

|

|||

2013 Plan |

|

|

|

|

|

|

|

|

|

|||

Options outstanding |

|

|

569,351 |

|

|

|

17.03 |

% |

|

$ |

1,616,957 |

|

Weighted average exercise price of outstanding options |

|

$ |

17.06 |

|

|

|

|

|

|

|

||

Weighted average remaining term of outstanding options |

|

|

7.45 |

|

|

|

|

|

|

|

||

Shares remaining available for grant under 2013 Plan (3) |

|

|

202,719 |

|

|

|

6.06 |

% |

|

$ |

575,722 |

|

|

|

|

|

|

|

|

|

|

|

|||

Restated Plan |

|

|

|

|

|

|

|

|

|

|||

Proposed increase in shares available for issuance under |

|

|

400,000 |

|

|

|

12.00 |

% |

|

|

|

|

(1) Based on 3,343,070 shares of our common stock outstanding as of March 1, 2023.

(2) Based on the closing price of our common stock on March 1, 2023, of $2.84 per share.

(3) Does not include possible future increases to the share reserve under the evergreen provision of the 2013 Plan.

(4) Does not include possible future increases to the share reserve under the evergreen provision of the Restated Plan.

In determining whether to approve the Restated Plan, including the requested increase to the share reserve under the Restated Plan over the share reserve under the existing 2013 Plan, our board of directors considered the following:

In light of the factors described above, and the fact that the ability to continue to grant equity compensation is vital to our ability to continue to attract and retain employees in the extremely competitive labor markets in which we compete, our board of directors has determined that the size of the share reserve under the Restated Plan is reasonable and appropriate at this time. Our board of directors will not create a subcommittee to evaluate the risk and benefits for issuing shares under the Restated Plan.

Stockholder Approval Requirement

Stockholder approval of the Restated Plan is necessary in order for us to (1) meet the stockholder approval requirements of Nasdaq, and (2) grant ISOs thereunder. Specifically, approval of the Restated Plan will constitute approval pursuant to the stockholder approval requirements of Section 422 of the Internal Revenue Code (the "Code") relating to ISOs.

If the Restated Plan is not approved by our stockholders, the Restated Plan will not become effective, the existing 2013 Plan will continue in full force and effect, and we may continue to grant awards under the 2013 Plan, subject to its terms, conditions and limitations, using the shares available for issuance thereunder.

Summary of the Restated Plan

16

The principal features of the Restated Plan are summarized below, but the summary is qualified in its entirety by reference to the Restated Plan itself, which is attached as Appendix A to this proxy statement.

Purpose

The purpose of the Restated Plan is to promote our success and enhance our value by linking the individual interests of the members of the board of directors and our employees and consultants to those of our stockholders and by providing such individuals with an incentive for outstanding performance to generate superior returns to our stockholders. The Restated Plan is further intended to provide us flexibility in our ability to motivate, attract, and retain the services of members of the board of directors, our employees and our consultants upon whose judgment, interest, and special effort the successful conduct of our operation is largely dependent.

Securities Subject to the Restated Plan

As of March 1, 2023, a total of 794,717 shares of our common stock were authorized for issuance under the 2013 Plan and will be reserved for issuance under the Restated Plan. In addition, an additional 400,000 shares will be added to the share reserve under the Restated Plan. In addition, commencing on January 1, 2024 and on each January 1 thereafter during the ten-year term of the Restated Plan, through and including January 1, 2033, the aggregate number of shares available for issuance under the Restated Plan shall be increased by that number of shares of our common stock equal to the lesser of:

There will be no limit on the number of shares that may become available for issuance under the Restated Plan pursuant to the foregoing evergreen provisions. The number of shares of stock that may be issued or transferred pursuant to ISOs under the Restated Plan may not exceed an aggregate of 50,000,000 shares. All of the foregoing share numbers may be adjusted for changes in our capitalization and certain corporate transactions, as described below under the heading “Adjustments.”

To the extent that an award lapses, expires, is forfeited or is settled for cash, any shares subject to the award will, to the extent of such lapse, expiration, forfeiture or cash settlement, be available for future grant or sale under the Restated Plan. In addition, shares of common stock which are delivered by the holder or withheld by us in payment of the grant or exercise price or tax withholding obligation of any award under the Restated Plan will again be available for future grant or sale under the Restated Plan. If any shares of restricted stock are forfeited by a participant or repurchased by us pursuant to the Restated Plan, such shares shall again be available for future grant or sale under the Restated Plan. Any shares subject to a Stock Appreciation Right, or a SAR, that are not issued in connection with the stock settlement of the SAR on exercise thereof shall again be available for the grant of an award pursuant to the Restated Plan. The payment of dividend equivalents in cash in conjunction with any outstanding awards shall not be counted against the shares of stock available for issuance under the plan.

Administration

The compensation committee of our board of directors administers the Restated Plan (except with respect to any award granted to non-employee directors, which must be administered by our full board of directors). To administer the Restated Plan, our compensation committee must consist solely of at least two members of our board of directors, each of whom is a “non-employee director” for purposes of Rule 16b-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Subject to the terms and conditions of the Restated Plan, our compensation committee has the authority to select the persons to whom awards are to be made, to determine the type or types of awards to be granted to each person, the number of awards to grant, the number of shares to be subject to such awards, and the terms and conditions of such awards, and to make all other determinations and decisions and to take all other actions necessary or advisable for the administration of the Restated Plan. Our compensation committee is also authorized to establish, adopt, amend or revise rules relating to administration of the Restated Plan. Our board of directors may at any time revest in itself the authority to administer the Restated Plan.

Eligibility