Sculptor Reports Third Quarter 2023 Financial Results November 8, 2023

|2 New York - November 8, 2023 - Sculptor Capital Management, Inc. (NYSE: SCU) today reported its unaudited results for the third quarter of 2023. About Sculptor Sculptor is a leading global alternative asset manager and a specialist in opportunistic investing. For over 25 years, we have pursued consistent outperformance by building an operating model and culture which balance the ability to act swiftly on market opportunity with rigorous diligence that minimizes risk. Our model is driven by a global team that is predominantly home-grown, long tenured and incentivized to put client outcomes first. With offices in New York, London, Hong Kong, and Shanghai, we invest across credit, real estate and multi-strategy platforms in all major geographies. As of November 1, 2023, Sculptor had approximately $32.8 billion in assets under management. For more information, please visit our website (www.sculptor.com). 2 Sculptor Reports Third Quarter 2023 Financial Results Shareholder Services Contact Ellen Conti Head of Corporate Strategy +1-212-719-7381 investorrelations@sculptor.com JIMMY LEVIN CHIEF INVESTMENT OFFICER & CHIEF EXECUTIVE OFFICER

|3 This press release and earnings presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that reflect the Company's current views with respect to, among other things, future events, its operations and its financial performance. The Company generally identifies forward-looking statements by terminology such as "outlook," "believe," "expect," "potential," "continue," "may," "will," "should," "could," "seek," "approximately," "predict," "intend," "plan," "estimate," "anticipate," "opportunity," "comfortable," "assume," "remain," "maintain," "sustain," "achieve," "see," "think," "position" or the negative version of those words or other comparable words. Any forward-looking statements contained in this press release are based upon historical information and on the Company's current plans, estimates and expectations. The inclusion of this or other forward-looking information should not be regarded as a representation by the Company or any other person that the future plans, estimates or expectations contemplated by the Company will be achieved. The Company cautions that forward-looking statements are subject to numerous assumptions, estimates, risks and uncertainties including but not limited to the following: global economic, business, market and geopolitical conditions; poor investment performance of, or lack of capital flows into, the funds the Company manages; the Company’s investors’ right to redeem their investments from the Company’s funds on a regular basis; the highly variable nature of the Company’s revenues, results of operations and cash flows; difficult market conditions that could adversely affect the Company’s funds; counterparty default risks; the United Kingdom’s withdrawal from the European Union; the outcome of third-party litigation involving the Company; or from matters involving the Company’s founding CEO; conditions impacting the alternative asset management industry; the Company's ability to retain existing investor capital; the Company's ability to successfully compete for fund investors, assets, professional talent and investment opportunities; the Company's ability to retain its active executive managing directors, managing directors and other investment professionals; the Company's successful formulation and execution of its business and growth strategies; the Company's ability to appropriately manage conflicts of interest and tax and other regulatory factors relevant to its business; U.S. and foreign regulatory developments relating to, among other things, financial institutions and markets, government oversight, fiscal and tax policy; and assumptions relating to the Company's operations, investment performance, financial results, financial condition, business prospects, growth strategy and liquidity. If one or more of these or other risks or uncertainties materialize, or if the Company’s assumptions or estimates prove to be incorrect, its actual results may vary materially from those indicated in these statements. These factors are not and should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and risks that are included in the Company’s filings with the SEC, including but not limited to the Company’s annual report on Form 10-K for the year ended December 31, 2022, dated March 3, 2023, as well as may be updated from time to time in the Company’s other SEC filings. There may be additional risks, uncertainties and factors that the Company does not currently view as material or that are not known. The forward-looking statements contained in this press release are made only as of the date of this press release. The Company does not undertake to update any forward-looking statement because of new information, future developments or otherwise except as may be required by law. This press release does not constitute an offer of any Sculptor Capital fund. The Company files annual, quarterly and current reports, proxy statements and other information required by the Exchange Act of 1934, as amended, with the SEC. The Company makes available free of charge on its website (www.sculptor.com) its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and any amendment to those filings as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The Company also uses its website to distribute company information, including AUM by investments strategy, and such information may be deemed material. Accordingly, investors should monitor the Company's website, in addition to its press releases, SEC filings and public conference calls and webcast. Forward Looking Statements

Third Quarter 2023 Financial Results

|5 (dollars in millions, except per share amounts) 3Q '23 2Q '23 3Q '22 YTD '23 YTD '22 GAAP Results Net Loss Attributable to Sculptor Capital Management $ (31.1) $ (4.4) $ (22.7) $ (25.8) $ (17.6) Net (Loss) Income Attributable to Class A Shareholders (31.1) 3.6 (22.5) (19.0) (13.7) (Loss) Earnings per Class A Share - basic (1.23) 0.15 (0.91) (0.75) (0.53) Loss per Class A Share - diluted (1.23) (0.12) (0.91) (1.00) (1.79) Non-GAAP Financial Measures Distributable Earnings $ (7.5) $ (0.3) $ 0.6 $ 6.4 $ 61.9 Distributable Earnings Per Fully Diluted Share (0.13) 0.00 0.01 0.11 1.05 Adjusted Distributable Earnings 8.9 5.3 3.0 35.3 65.2 Adjusted Distributable Earnings Per Fully Diluted Share 0.15 0.09 0.05 0.62 1.10 Adjusted Net Assets 283.1 267.8 305.9 283.1 305.9 Accrued but Unrecognized Incentive Income (“ABURI”) 206.0 194.9 194.3 206.0 194.3 Capital Metrics Assets Under Management $ 33,752 $ 34,759 $ 36,112 $ 33,752 $ 36,112 ▪ GAAP Net Loss Attributable to Class A Shareholders of $31.1 million for 3Q, or $(1.23) per basic and $(1.23) per diluted Class A Share ▪ Distributable Earnings were a loss of $7.5 million for 3Q, or $(0.13) per Fully Diluted Share ▪ Adjusted Distributable Earnings were $8.9 million for 3Q, or $0.15 per Fully Diluted Share Please see page 3 of this press release for disclosures on forward-looking statements contained within. This page contains non-GAAP measures, including Distributable Earnings, Adjusted Distributable Earnings, Adjusted Net Assets, and Accrued but Unrecognized Incentive Income. Please reference pages 23-30 for more information and reconciliations of the Company's non-GAAP measures to the most directly comparable respective financial measures presented in accordance with GAAP. Third Quarter 2023 Financial Highlights

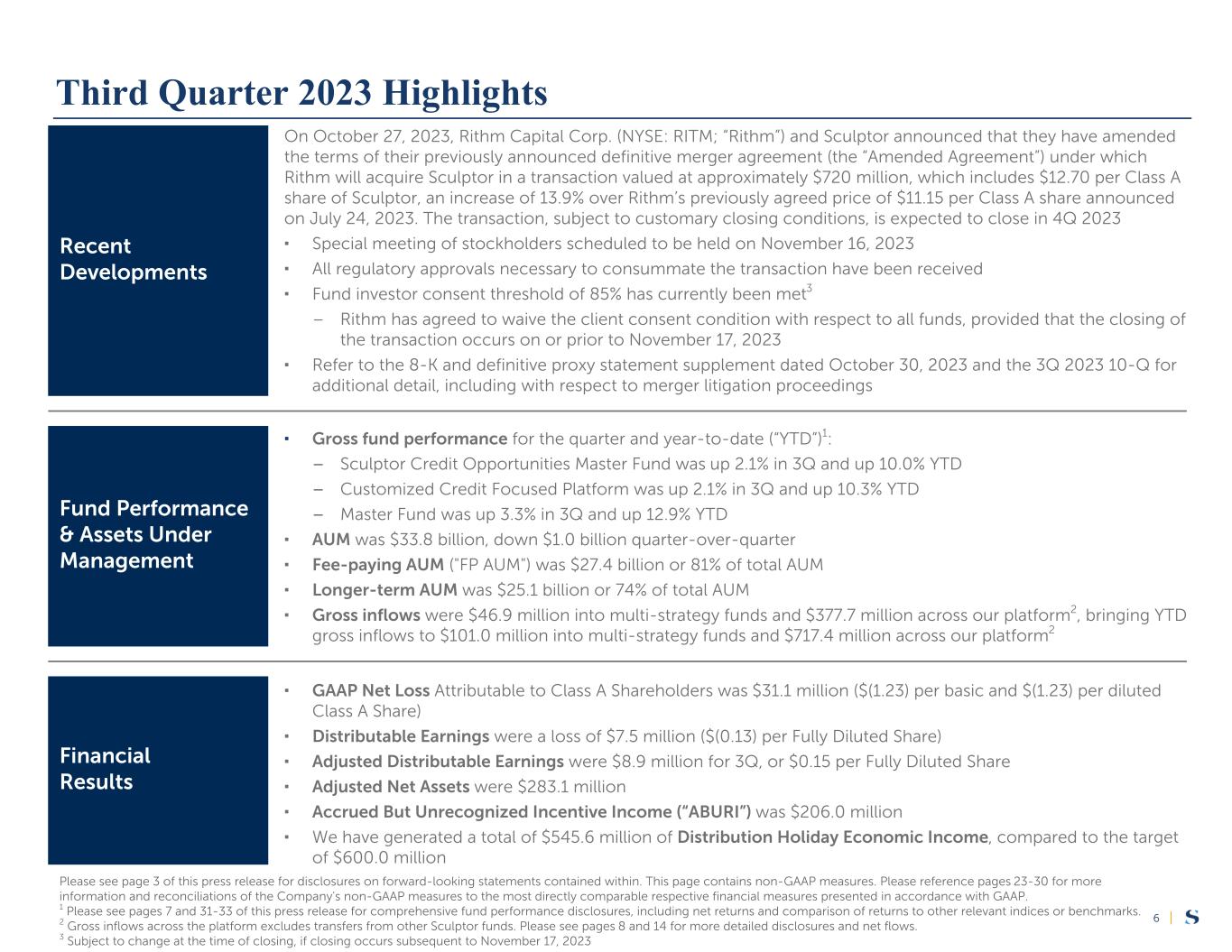

|6 ▪ Gross fund performance for the quarter and year-to-date (“YTD”)1: – Sculptor Credit Opportunities Master Fund was up 2.1% in 3Q and up 10.0% YTD – Customized Credit Focused Platform was up 2.1% in 3Q and up 10.3% YTD – Master Fund was up 3.3% in 3Q and up 12.9% YTD ▪ AUM was $33.8 billion, down $1.0 billion quarter-over-quarter ▪ Fee-paying AUM ("FP AUM") was $27.4 billion or 81% of total AUM ▪ Longer-term AUM was $25.1 billion or 74% of total AUM ▪ Gross inflows were $46.9 million into multi-strategy funds and $377.7 million across our platform2, bringing YTD gross inflows to $101.0 million into multi-strategy funds and $717.4 million across our platform2 Fund Performance & Assets Under Management Financial Results Recent Developments ▪ GAAP Net Loss Attributable to Class A Shareholders was $31.1 million ($(1.23) per basic and $(1.23) per diluted Class A Share) ▪ Distributable Earnings were a loss of $7.5 million ($(0.13) per Fully Diluted Share) ▪ Adjusted Distributable Earnings were $8.9 million for 3Q, or $0.15 per Fully Diluted Share ▪ Adjusted Net Assets were $283.1 million ▪ Accrued But Unrecognized Incentive Income (“ABURI”) was $206.0 million ▪ We have generated a total of $545.6 million of Distribution Holiday Economic Income, compared to the target of $600.0 million On October 27, 2023, Rithm Capital Corp. (NYSE: RITM; “Rithm”) and Sculptor announced that they have amended the terms of their previously announced definitive merger agreement (the “Amended Agreement”) under which Rithm will acquire Sculptor in a transaction valued at approximately $720 million, which includes $12.70 per Class A share of Sculptor, an increase of 13.9% over Rithm’s previously agreed price of $11.15 per Class A share announced on July 24, 2023. The transaction, subject to customary closing conditions, is expected to close in 4Q 2023 ▪ Special meeting of stockholders scheduled to be held on November 16, 2023 ▪ All regulatory approvals necessary to consummate the transaction have been received ▪ Fund investor consent threshold of 85% has currently been met3 – Rithm has agreed to waive the client consent condition with respect to all funds, provided that the closing of the transaction occurs on or prior to November 17, 2023 ▪ Refer to the 8-K and definitive proxy statement supplement dated October 30, 2023 and the 3Q 2023 10-Q for additional detail, including with respect to merger litigation proceedings Please see page 3 of this press release for disclosures on forward-looking statements contained within. This page contains non-GAAP measures. Please reference pages 23-30 for more information and reconciliations of the Company's non-GAAP measures to the most directly comparable respective financial measures presented in accordance with GAAP. 1 Please see pages 7 and 31-33 of this press release for comprehensive fund performance disclosures, including net returns and comparison of returns to other relevant indices or benchmarks. 2 Gross inflows across the platform excludes transfers from other Sculptor funds. Please see pages 8 and 14 for more detailed disclosures and net flows. 3 Subject to change at the time of closing, if closing occurs subsequent to November 17, 2023 Third Quarter 2023 Highlights

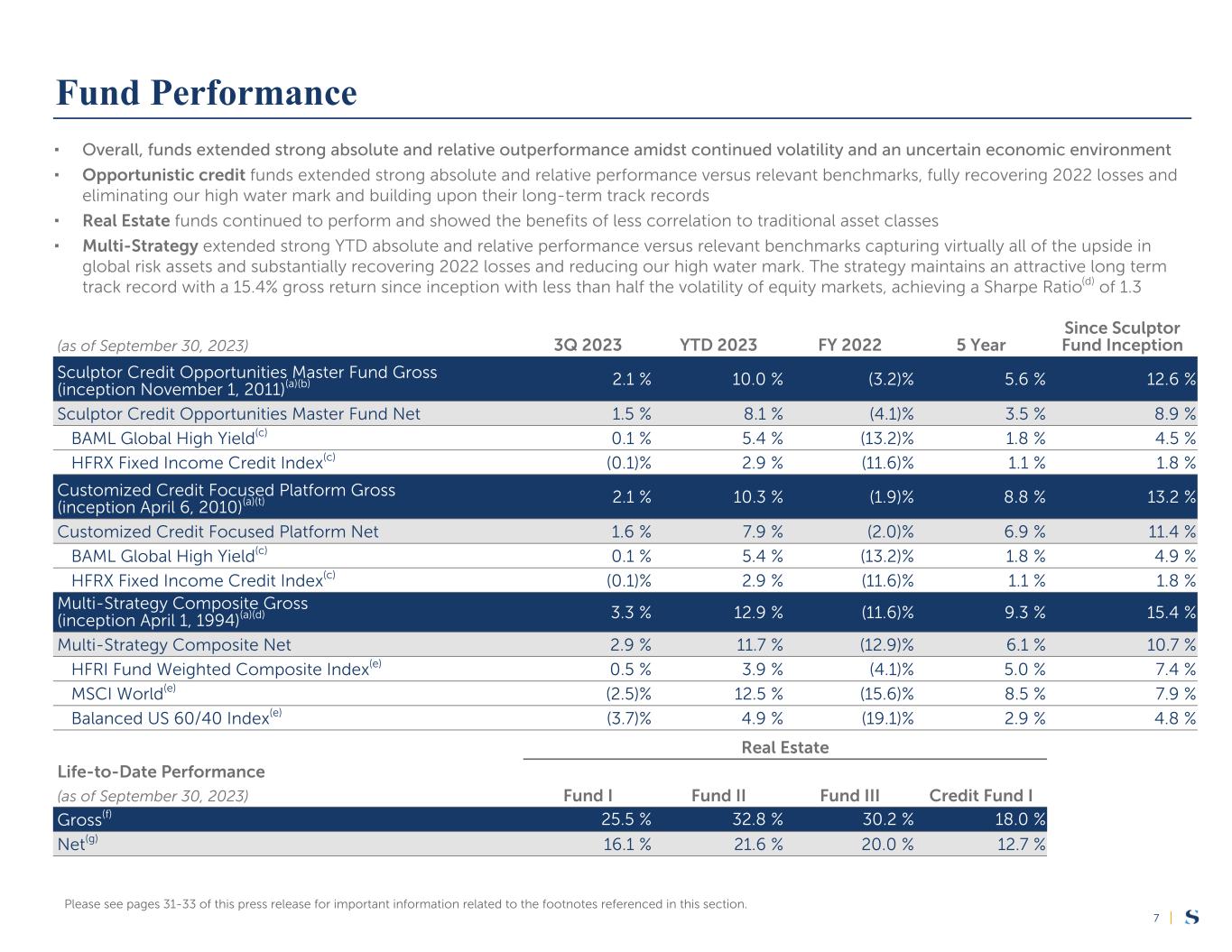

|7 ▪ Overall, funds extended strong absolute and relative outperformance amidst continued volatility and an uncertain economic environment ▪ Opportunistic credit funds extended strong absolute and relative performance versus relevant benchmarks, fully recovering 2022 losses and eliminating our high water mark and building upon their long-term track records ▪ Real Estate funds continued to perform and showed the benefits of less correlation to traditional asset classes ▪ Multi-Strategy extended strong YTD absolute and relative performance versus relevant benchmarks capturing virtually all of the upside in global risk assets and substantially recovering 2022 losses and reducing our high water mark. The strategy maintains an attractive long term track record with a 15.4% gross return since inception with less than half the volatility of equity markets, achieving a Sharpe Ratio(d) of 1.3 Fund Performance (as of September 30, 2023) 3Q 2023 YTD 2023 FY 2022 5 Year Since Sculptor Fund Inception Sculptor Credit Opportunities Master Fund Gross (inception November 1, 2011)(a)(b) 2.1 % 10.0 % (3.2) % 5.6 % 12.6 % Sculptor Credit Opportunities Master Fund Net 1.5 % 8.1 % (4.1) % 3.5 % 8.9 % BAML Global High Yield(c) 0.1 % 5.4 % (13.2) % 1.8 % 4.5 % HFRX Fixed Income Credit Index(c) (0.1) % 2.9 % (11.6) % 1.1 % 1.8 % Customized Credit Focused Platform Gross (inception April 6, 2010)(a)(t) 2.1 % 10.3 % (1.9) % 8.8 % 13.2 % Customized Credit Focused Platform Net 1.6 % 7.9 % (2.0) % 6.9 % 11.4 % BAML Global High Yield(c) 0.1 % 5.4 % (13.2) % 1.8 % 4.9 % HFRX Fixed Income Credit Index(c) (0.1) % 2.9 % (11.6) % 1.1 % 1.8 % Multi-Strategy Composite Gross (inception April 1, 1994)(a)(d) 3.3 % 12.9 % (11.6) % 9.3 % 15.4 % Multi-Strategy Composite Net 2.9 % 11.7 % (12.9) % 6.1 % 10.7 % HFRI Fund Weighted Composite Index(e) 0.5 % 3.9 % (4.1) % 5.0 % 7.4 % MSCI World(e) (2.5) % 12.5 % (15.6) % 8.5 % 7.9 % Balanced US 60/40 Index(e) (3.7) % 4.9 % (19.1) % 2.9 % 4.8 % Real Estate Life-to-Date Performance (as of September 30, 2023) Fund I Fund II Fund III Credit Fund I Gross(f) 25.5 % 32.8 % 30.2 % 18.0 % Net(g) 16.1 % 21.6 % 20.0 % 12.7 % Please see pages 31-33 of this press release for important information related to the footnotes referenced in this section.

|8 37.4 36.8 34.7 32.2 30.1 28.5 24.9 25.1 25.5 11.5 9.7 8.5 11.2 9.5 8.4 0.7 0.5 0.4 6.5 6.0 5.8 6.0 5.5 5.2 4.7 4.6 4.7 15.1 16.5 16.2 11.1 11.2 11.1 15.1 15.6 16.2 4.3 4.6 4.2 3.9 3.9 3.8 4.4 4.4 4.2 Multi-strategy Opportunistic Credit ICS Real Estate 2Q 2022 1Q 2023 2Q 2023 2Q 2022 1Q 2023 2Q 2023 2Q 2022 1Q 2023 2Q 2023 AUM FP AUM Longer-Term AUM $ in billions 36.1 34.8 33.8 6.0 5.8 5.5 16.2 16.2 15.9 4.5 4.2 4.2 9.4 8.5 8.1 3Q 2022 2Q 2023 3Q 2023 % Total AUM 24% 13% 47% 16% 29.4 28.5 27.4 5.3 5.2 4.9 11.0 11.1 10.7 3.8 3.8 3.8 9.2 8.4 8.0 3Q 2022 2Q 2023 3Q 2023 25.9 25.5 25.1 4.7 4.7 4.6 16.2 16.2 15.9 4.5 4.2 4.2 0.4 0.4 0.4 3Q 2022 2Q 2023 3Q 2023 0 5 81% 82% 81% 72% 73% 74%% AUM Opportunistic Credit Institutional Credit Strategies (ICS) Real Estate Multi-Strategy ▪ AUM decreased $1.0 billion during 3Q primarily from net outflows in multi-strategy and opportunistic credit and distributions across credit, partially offset by positive fund performance in multi-strategy and opportunistic credit – Opportunistic Credit decreased from distributions in the Customized Credit Focused Platform and net outflows, partially offset by positive fund performance – ICS decreased as the closing of an additional US CLO was offset by distributions and other changes(j) to AUM – Real Estate relatively flat as modest inflows were offset by return of capital as investments were harvested – Multi-strategy decreased from net outflows, partially offset by positive fund performance Assets Under Management Refer to the Assets Under Management Roll Forwards on page 14 for additional information. This page contains non-GAAP measures. Please reference pages 23-30 for more information and reconciliations of the Company's non-GAAP measures to the most directly comparable respective financial measures presented in accordance with GAAP. Please see pages 31 through 33 of this press release for important information related to the footnotes referenced in this section.

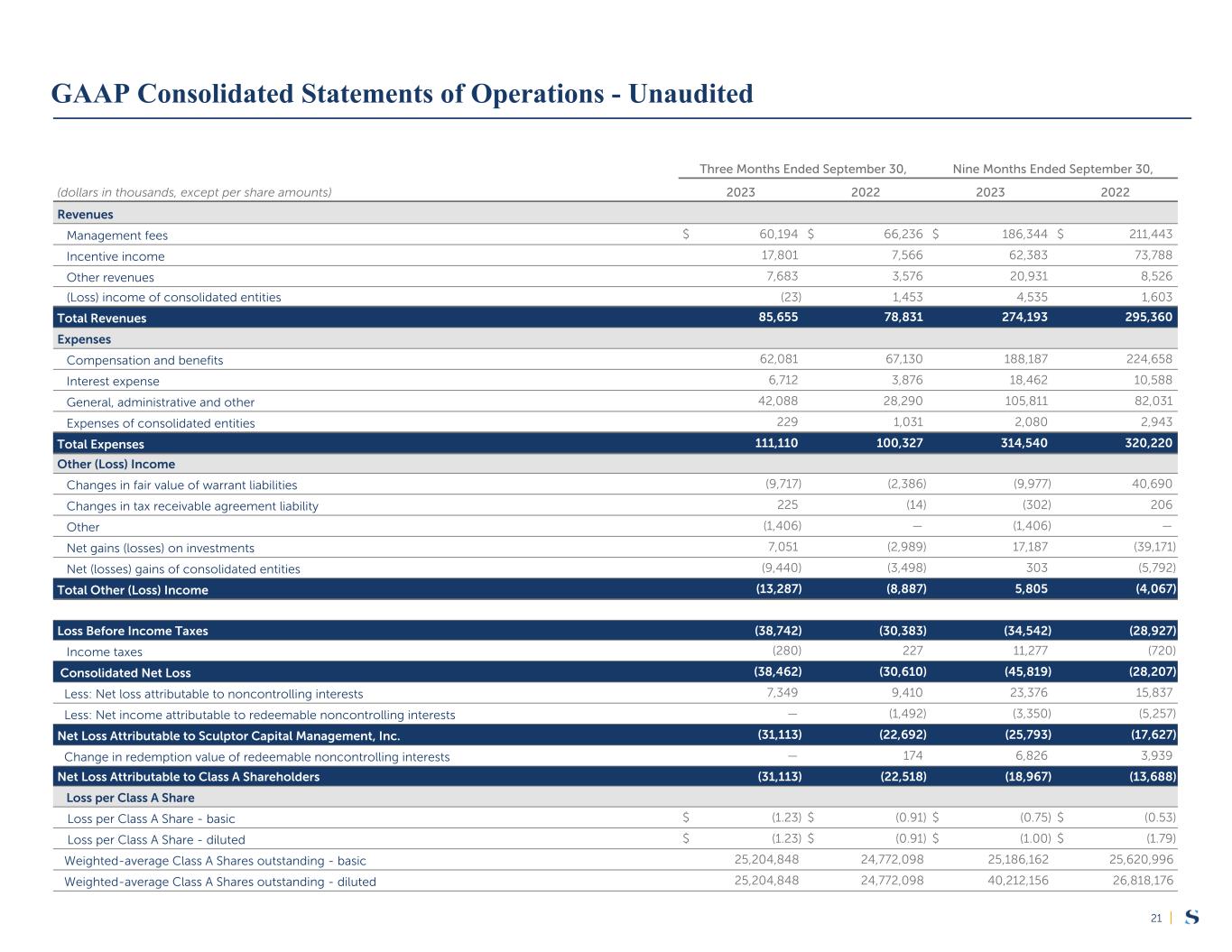

|9 ▪ Revenues were up 9% from 3Q '22, primarily driven by: – Higher incentive income from crystallizations in real estate and opportunistic credit funds – Higher other revenues due to higher interest rates – Lower management fees from lower multi-strategy AUM driven by net outflows ▪ Expenses were up 11% from 3Q '22, primarily driven by: – Higher general, administrative and other expenses from elevated professional services expenses related to the activities of the Special Committee of our Board of Directors and related ongoing litigation – Higher interest expense due to higher interest rates – Lower compensation and benefits expense primarily due to lower equity- based compensation ▪ Other loss increased from 3Q '22, primarily from changes in the fair value of warrant liabilities and net losses of consolidated funds, partially offset by gains on investments ▪ Income tax expense decreased from 3Q '22 due to lower profitability for the period Financial Results - Third Quarter 2023 GAAP For details on the additional underlying drivers of our revenue and expenses, see the Economic Income analysis on page 10. (dollars in millions, except per share amounts) 3Q '23 2Q '23 3Q '22 YTD '23 YTD '22 Revenues $ 85.7 $ 75.3 $ 78.9 $ 274.2 $ 295.4 Management fees 60.2 62.4 66.2 186.3 211.4 Incentive income 17.8 4.3 7.6 62.4 73.8 Other revenues 7.7 6.7 3.6 20.9 8.5 Income of consolidated entities — 1.9 1.5 4.6 1.7 Expenses $ 111.1 $ 94.9 $ 100.3 $ 314.6 $ 320.2 Compensation and benefits 62.1 57.5 67.1 188.2 224.7 Interest expense 6.7 6.3 3.9 18.5 10.6 General, administrative and other 42.1 29.9 28.3 105.8 82.0 Expenses of consolidated entities 0.2 1.3 1.0 2.1 2.9 Other (Loss) Income $ (13.3) $ 6.1 $ (9.0) $ 5.9 $ (4.1) Income taxes (0.2) (1.2) 0.2 11.3 (0.7) Consolidated Net Loss $ (38.5) $ (12.3) $ (30.6) $ (45.8) $ (28.2) Less: Net loss attributable to noncontrolling Interests 7.4 9.8 9.4 23.4 15.9 Less: Net (income) loss attributable to redeemable noncontrolling interests — (1.9) (1.5) (3.4) (5.3) Net Loss Attributable to Sculptor Capital Management, Inc. $ (31.1) $ (4.4) $ (22.7) $ (25.8) $ (17.6) Change in redemption value of redeemable noncontrolling interests — 8.0 0.2 6.8 3.9 Net (Loss) Income Attributable to Class A Shareholders $ (31.1) $ 3.6 $ (22.5) $ (19.0) $ (13.7) (Loss) Earnings per Class A Share - basic $ (1.23) $ 0.15 $ (0.91) $ (0.75) $ (0.53) Loss per Class A Share - diluted $ (1.23) $ (0.12) $ (0.91) $ (1.00) $ (1.79) ▪ Net Loss Attributable to Class A Shareholders was $31.1 million for 3Q 2023, or $(1.23) per basic and $(1.23) per diluted Class A Share ▪ Net Loss Attributable to Class A Shareholders was $19.0 million YTD 2023, or $(0.75) per basic and $(1.00) per diluted Class A Share

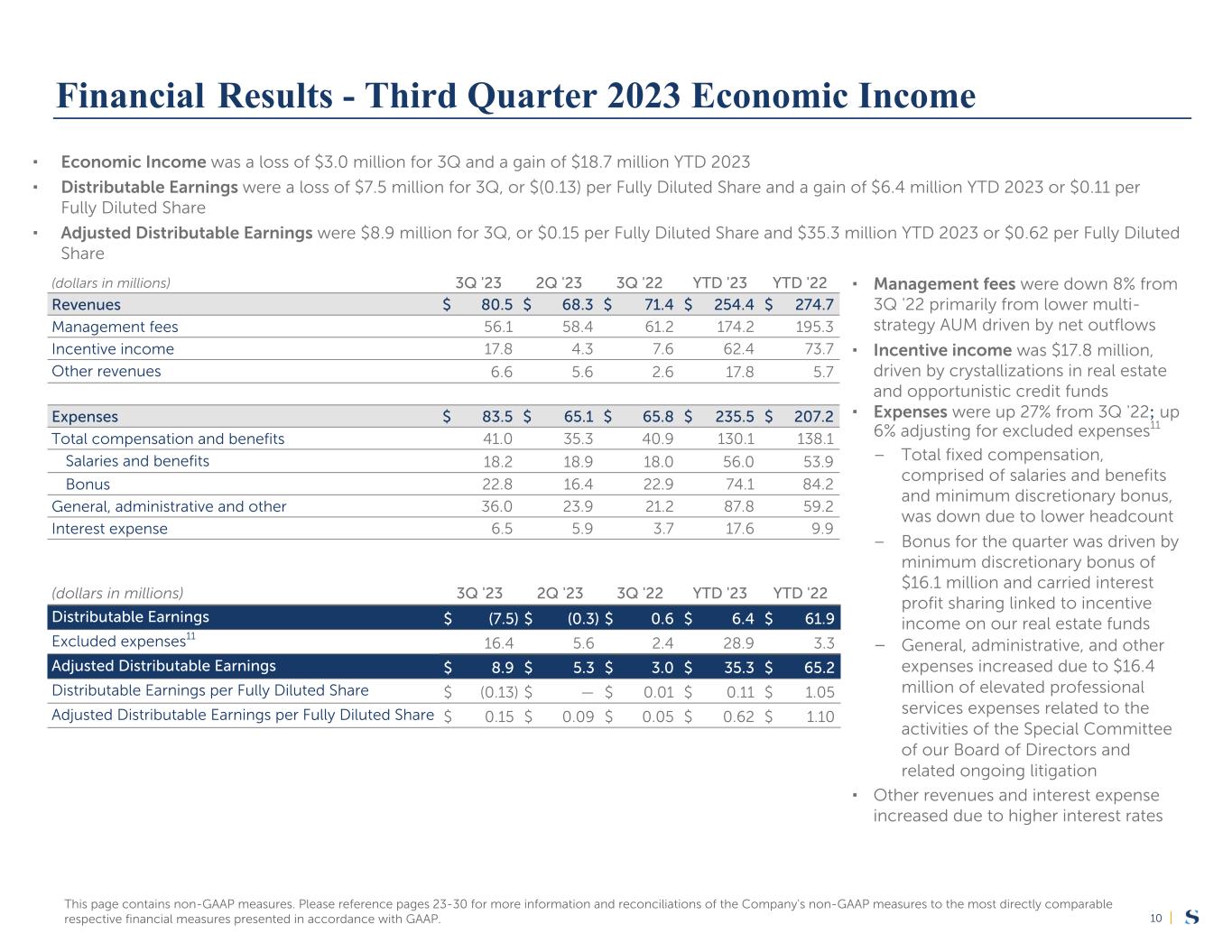

|10 (dollars in millions) 3Q '23 2Q '23 3Q '22 YTD '23 YTD '22 Revenues $ 80.5 $ 68.3 $ 71.4 $ 254.4 $ 274.7 Management fees 56.1 58.4 61.2 174.2 195.3 Incentive income 17.8 4.3 7.6 62.4 73.7 Other revenues 6.6 5.6 2.6 17.8 5.7 Expenses $ 83.5 $ 65.1 $ 65.8 $ 235.5 $ 207.2 Total compensation and benefits 41.0 35.3 40.9 130.1 138.1 Salaries and benefits 18.2 18.9 18.0 56.0 53.9 Bonus 22.8 16.4 22.9 74.1 84.2 General, administrative and other 36.0 23.9 21.2 87.8 59.2 Interest expense 6.5 5.9 3.7 17.6 9.9 This page contains non-GAAP measures. Please reference pages 23-30 for more information and reconciliations of the Company's non-GAAP measures to the most directly comparable respective financial measures presented in accordance with GAAP. (dollars in millions) 3Q '23 2Q '23 3Q '22 YTD '23 YTD '22 Distributable Earnings $ (7.5) $ (0.3) $ 0.6 $ 6.4 $ 61.9 Excluded expenses11 16.4 5.6 2.4 28.9 3.3 Adjusted Distributable Earnings $ 8.9 $ 5.3 $ 3.0 $ 35.3 $ 65.2 Distributable Earnings per Fully Diluted Share $ (0.13) $ — $ 0.01 $ 0.11 $ 1.05 Adjusted Distributable Earnings per Fully Diluted Share $ 0.15 $ 0.09 $ 0.05 $ 0.62 $ 1.10 ▪ Economic Income was a loss of $3.0 million for 3Q and a gain of $18.7 million YTD 2023 ▪ Distributable Earnings were a loss of $7.5 million for 3Q, or $(0.13) per Fully Diluted Share and a gain of $6.4 million YTD 2023 or $0.11 per Fully Diluted Share ▪ Adjusted Distributable Earnings were $8.9 million for 3Q, or $0.15 per Fully Diluted Share and $35.3 million YTD 2023 or $0.62 per Fully Diluted Share Financial Results - Third Quarter 2023 Economic Income ▪ Management fees were down 8% from 3Q '22 primarily from lower multi- strategy AUM driven by net outflows ▪ Incentive income was $17.8 million, driven by crystallizations in real estate and opportunistic credit funds ▪ Expenses were up 27% from 3Q '22; up 6% adjusting for excluded expenses11 – Total fixed compensation, comprised of salaries and benefits and minimum discretionary bonus, was down due to lower headcount – Bonus for the quarter was driven by minimum discretionary bonus of $16.1 million and carried interest profit sharing linked to incentive income on our real estate funds – General, administrative, and other expenses increased due to $16.4 million of elevated professional services expenses related to the activities of the Special Committee of our Board of Directors and related ongoing litigation ▪ Other revenues and interest expense increased due to higher interest rates

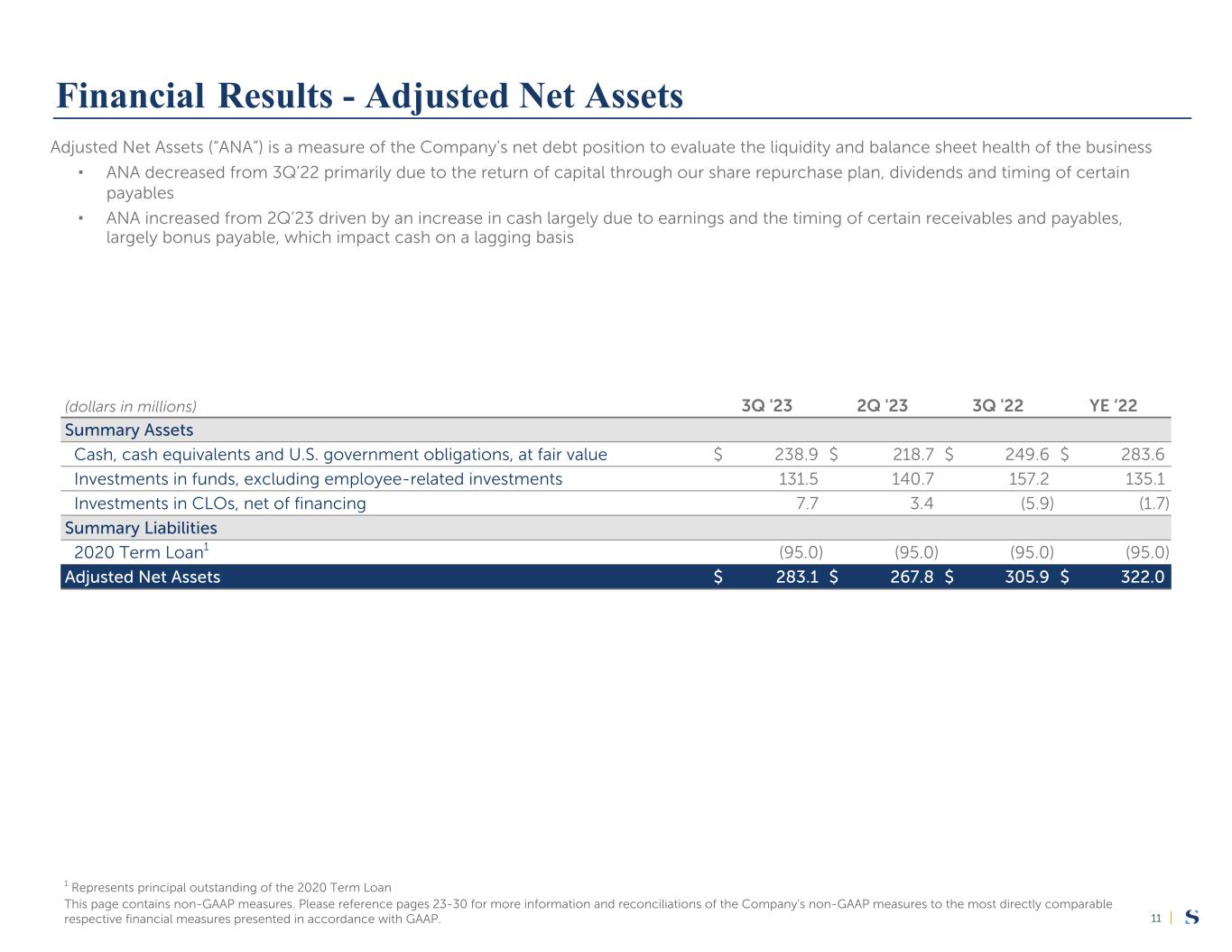

|11 Adjusted Net Assets (“ANA”) is a measure of the Company’s net debt position to evaluate the liquidity and balance sheet health of the business ▪ ANA decreased from 3Q’22 primarily due to the return of capital through our share repurchase plan, dividends and timing of certain payables ▪ ANA increased from 2Q’23 driven by an increase in cash largely due to earnings and the timing of certain receivables and payables, largely bonus payable, which impact cash on a lagging basis (dollars in millions) 3Q '23 2Q '23 3Q '22 YE ‘22 Summary Assets Cash, cash equivalents and U.S. government obligations, at fair value $ 238.9 $ 218.7 $ 249.6 $ 283.6 Investments in funds, excluding employee-related investments 131.5 140.7 157.2 135.1 Investments in CLOs, net of financing 7.7 3.4 (5.9) (1.7) Summary Liabilities 2020 Term Loan1 (95.0) (95.0) (95.0) (95.0) Adjusted Net Assets $ 283.1 $ 267.8 $ 305.9 $ 322.0 1 Represents principal outstanding of the 2020 Term Loan This page contains non-GAAP measures. Please reference pages 23-30 for more information and reconciliations of the Company's non-GAAP measures to the most directly comparable respective financial measures presented in accordance with GAAP. Financial Results - Adjusted Net Assets

|12 (dollars in millions) Opportunistic Credit Funds Real Estate Funds Multi-Strategy Funds Total Quarter-to-Date 2Q '23 $ 76.9 $ 117.2 $ 0.8 $ 194.9 Recognized Incentive Income (4.7) (10.3) (0.1) (15.1) Performance 14.4 11.4 0.4 26.2 3Q '23 $ 86.6 $ 118.3 $ 1.1 $ 206.0 Year-to-Date 4Q '22 $ 37.3 $ 122.8 $ 0.4 $ 160.5 Recognized Incentive Income (18.3) (40.5) (0.8) (59.6) Performance 67.6 36.0 1.5 105.1 3Q '23 $ 86.6 $ 118.3 $ 1.1 $ 206.0 This page contains non-GAAP measures. Please reference pages 23-30 for more information and reconciliations of the Company's non-GAAP measures to the most directly comparable respective financial measures presented in accordance with GAAP. ▪ Accrued but unrecognized incentive income (“ABURI”) is the amount of incentive income accrued at the fund level on longer-term AUM that has not yet been recognized in our revenues – Incentive income, if any, on our longer-term AUM is based on the cumulative investment performance generated over the respective commitment period – ABURI from our real estate funds is structured as carried interest and generally has compensation expense that will reduce the amount realized on a net basis and will be recognized when the related incentive income is recognized ▪ During 3Q, ABURI increased $26.2 million from real estate fund and opportunistic credit performance, partially offset by the crystallization of $15.1 million of ABURI into incentive income – In opportunistic credit, we crystallized $4.7 million of ABURI primarily from the Customized Credit Focused Platform. ABURI increased by $14.4 million from performance largely in the Customized Credit Focused Platform – In real estate, we crystallized $10.3 million ABURI, primarily in Sculptor Real Estate Fund III. ABURI increased by $11.4 million from performance, largely in Sculptor Real Estate Fund IV Financial Results - Accrued but Unrecognized Incentive Income

Supplemental Details

|14 (dollars in millions) Opportunistic Credit Funds Institutional Credit Strategies Real Estate Funds Multi-Strategy Funds Total Quarter-to-Date June 30, 2023 $ 5,169 $ 11,112 $ 3,782 $ 8,390 $ 28,453 Inflows / (Outflows)(h) (194) — 61 (658) (791) Distributions / Other Reductions (220) (164) (41) — (425) Appreciation / (Depreciation)(i) 85 2 7 229 323 Other(j) 20 (228) (6) 18 (196) September 30, 2023 $ 4,860 $ 10,722 $ 3,803 $ 7,979 $ 27,364 Year-to-Date December 31, 2022 $ 5,387 $ 11,158 $ 3,717 $ 9,021 $ 29,283 Inflows / (Outflows)(h) (383) 59 109 (1,964) (2,179) Distributions / Other Reductions (642) (297) (192) — (1,131) Appreciation / (Depreciation)(i) 406 8 18 934 1,366 Other(j) 94 (206) 152 (15) 25 September 30, 2023 $ 4,862 $ 10,722 $ 3,804 $ 7,976 $ 27,364 AUM (dollars in millions) Opportunistic Credit Funds Institutional Credit Strategies Real Estate Funds Multi-Strategy Funds Total Quarter-to-Date June 30, 2023 $ 5,831 $ 16,175 $ 4,233 $ 8,520 $ 34,759 Inflows / (Outflows)(h) (157) 247 62 (667) (515) Distributions / Other Reductions (222) (258) (48) — (528) Appreciation / (Depreciation)(i) 88 4 6 229 327 Other(j) — (286) (5) — (291) September 30, 2023 $ 5,540 $ 15,882 $ 4,248 $ 8,082 $ 33,752 Year-to-Date December 31, 2022 $ 5,971 $ 16,274 $ 4,563 $ 9,174 $ 35,982 Inflows / (Outflows)(h) (199) 339 115 (2,038) (1,783) Distributions / Other Reductions (647) (500) (454) — (1,601) Appreciation / (Depreciation)(i) 415 12 22 946 1,395 Other(j) — (243) 2 — (241) September 30, 2023 $ 5,540 $ 15,882 $ 4,248 $ 8,082 $ 33,752 Please see pages 31 through 33 of this press release for important information related to the footnotes referenced in this section. Assets Under Management Roll Forwards FP AUM

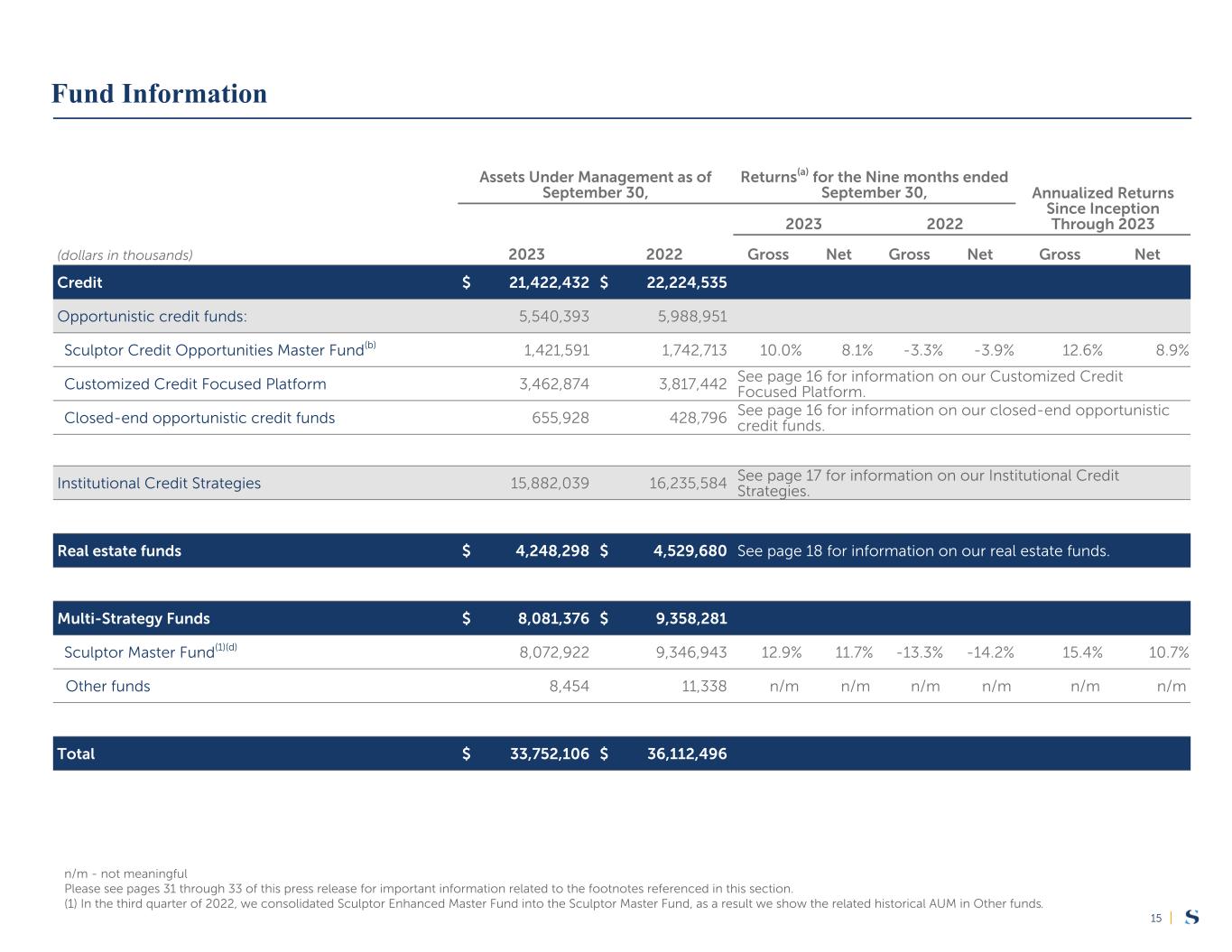

|15 Assets Under Management as of September 30, Returns(a) for the Nine months ended September 30, Annualized Returns Since Inception Through 20232023 2022 (dollars in thousands) 2023 2022 Gross Net Gross Net Gross Net Credit $ 21,422,432 $ 22,224,535 Opportunistic credit funds: 5,540,393 5,988,951 Sculptor Credit Opportunities Master Fund(b) 1,421,591 1,742,713 10.0 % 8.1 % -3.3 % -3.9 % 12.6 % 8.9 % Customized Credit Focused Platform 3,462,874 3,817,442 See page 16 for information on our Customized Credit Focused Platform. Closed-end opportunistic credit funds 655,928 428,796 See page 16 for information on our closed-end opportunistic credit funds. Institutional Credit Strategies 15,882,039 16,235,584 See page 17 for information on our Institutional Credit Strategies. Real estate funds $ 4,248,298 $ 4,529,680 See page 18 for information on our real estate funds. Multi-Strategy Funds $ 8,081,376 $ 9,358,281 Sculptor Master Fund(1)(d) 8,072,922 9,346,943 12.9 % 11.7 % -13.3 % -14.2 % 15.4 % 10.7 % Other funds 8,454 11,338 n/m n/m n/m n/m n/m n/m Total $ 33,752,106 $ 36,112,496 n/m - not meaningful Please see pages 31 through 33 of this press release for important information related to the footnotes referenced in this section. (1) In the third quarter of 2022, we consolidated Sculptor Enhanced Master Fund into the Sculptor Master Fund, as a result we show the related historical AUM in Other funds. Fund Information

|16 Weighted-Average Returns for the Nine Months Ended September 30, Inception to Date as of September 30, 2023 2023 2022 IRR Net Invested Capital MultipleGross Net Gross Net Gross Net Customized Credit Focused Platform(t) Opportunistic Credit Performance 10.3 % 7.9 % -4.0 % -3.6 % 14.3 % 10.8 % 4.5x Assets Under Management as of September 30, Inception to Date as of September 30, 2023 Total Commitments Total Invested Capital(k) IRR Gross MOIC(m)(dollars in thousands) 2023 2022 Gross(l) Net(g) Closed-end Opportunistic Credit Funds (Investment Period) $ 655,928 $ 428,796 $ 2,810,548 $ 2,104,396 Sculptor Tactical Credit Fund (2022 - 2025) 441,822 221,604 470,671 244,582 15.0 % 11.1 % 1.1x Sculptor European Credit Opportunities Fund (2012-2015) — — 459,600 305,487 15.7 % 11.8 % 1.5x Sculptor Structured Products Domestic Fund II (2011-2014) — — 326,850 326,850 19.2 % 15.1 % 2.1x Sculptor Structured Products Offshore Fund II (2011-2014) — — 304,531 304,531 16.5 % 12.9 % 1.9x Sculptor Structured Products Offshore Fund I (2010-2013) — — 155,098 155,098 23.7 % 18.9 % 2.1x Sculptor Structured Products Domestic Fund I (2010-2013) — 3,645 99,986 99,986 22.4 % 17.8 % 2.0x OZ Global Credit Master Fund I (2008-2009) — — 214,141 214,141 5.5 % 4.2 % 1.1x Other funds 214,106 203,547 779,671 453,721 n/m n/m n/m n/m - not meaningful Please see pages 31 through 33 of this press release for important information related to the footnotes referenced in this section. Customized Credit Focused Platform and Closed-end Opportunistic Fund Information

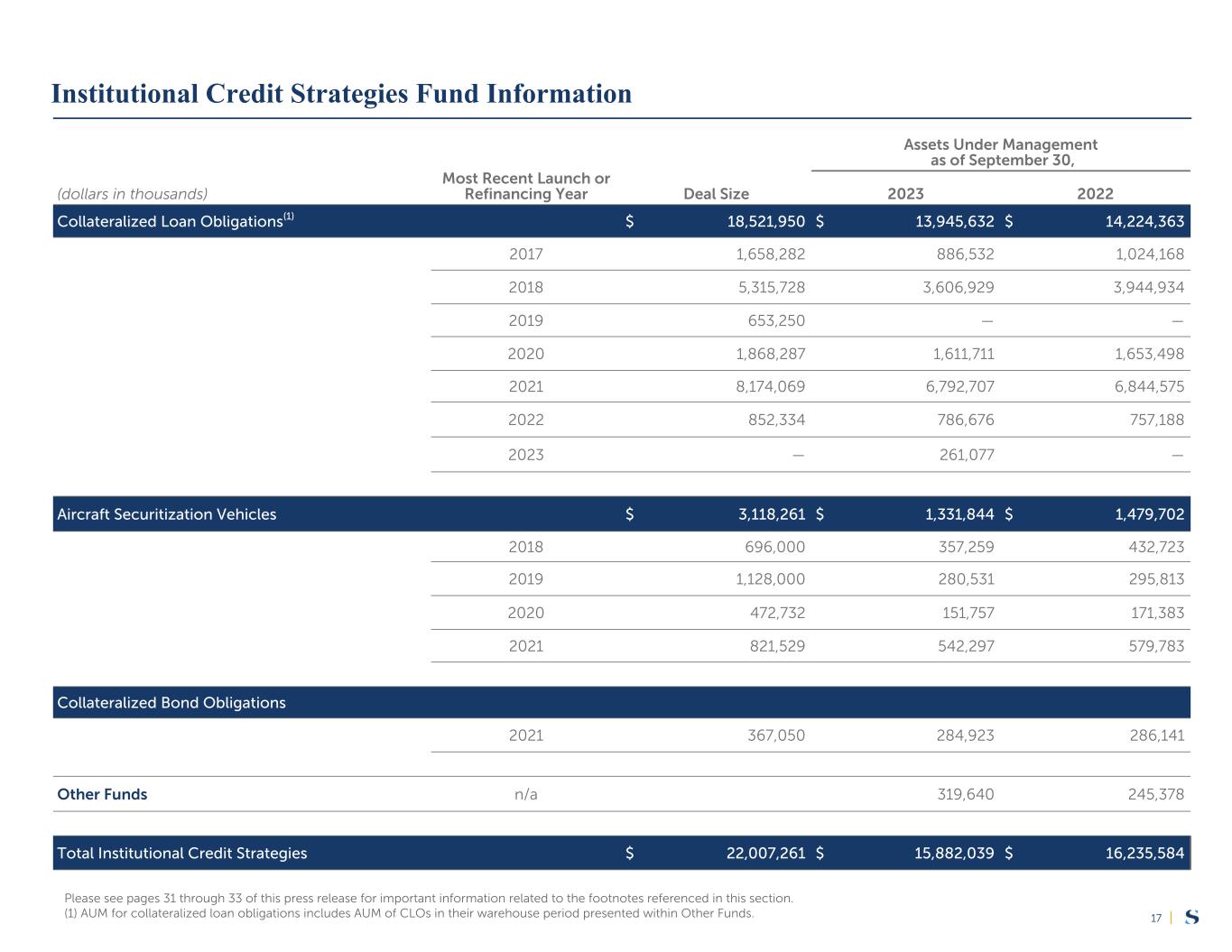

|17 Most Recent Launch or Refinancing Year Assets Under Management as of September 30, (dollars in thousands) Deal Size 2023 2022 Collateralized Loan Obligations(1) $ 18,521,950 $ 13,945,632 $ 14,224,363 2017 1,658,282 886,532 1,024,168 2018 5,315,728 3,606,929 3,944,934 2019 653,250 — — 2020 1,868,287 1,611,711 1,653,498 2021 8,174,069 6,792,707 6,844,575 2022 852,334 786,676 757,188 2023 — 261,077 — Aircraft Securitization Vehicles $ 3,118,261 $ 1,331,844 $ 1,479,702 2018 696,000 357,259 432,723 2019 1,128,000 280,531 295,813 2020 472,732 151,757 171,383 2021 821,529 542,297 579,783 Collateralized Bond Obligations 2021 367,050 284,923 286,141 Other Funds n/a 319,640 245,378 Total Institutional Credit Strategies $ 22,007,261 $ 15,882,039 $ 16,235,584 Please see pages 31 through 33 of this press release for important information related to the footnotes referenced in this section. (1) AUM for collateralized loan obligations includes AUM of CLOs in their warehouse period presented within Other Funds. Institutional Credit Strategies Fund Information

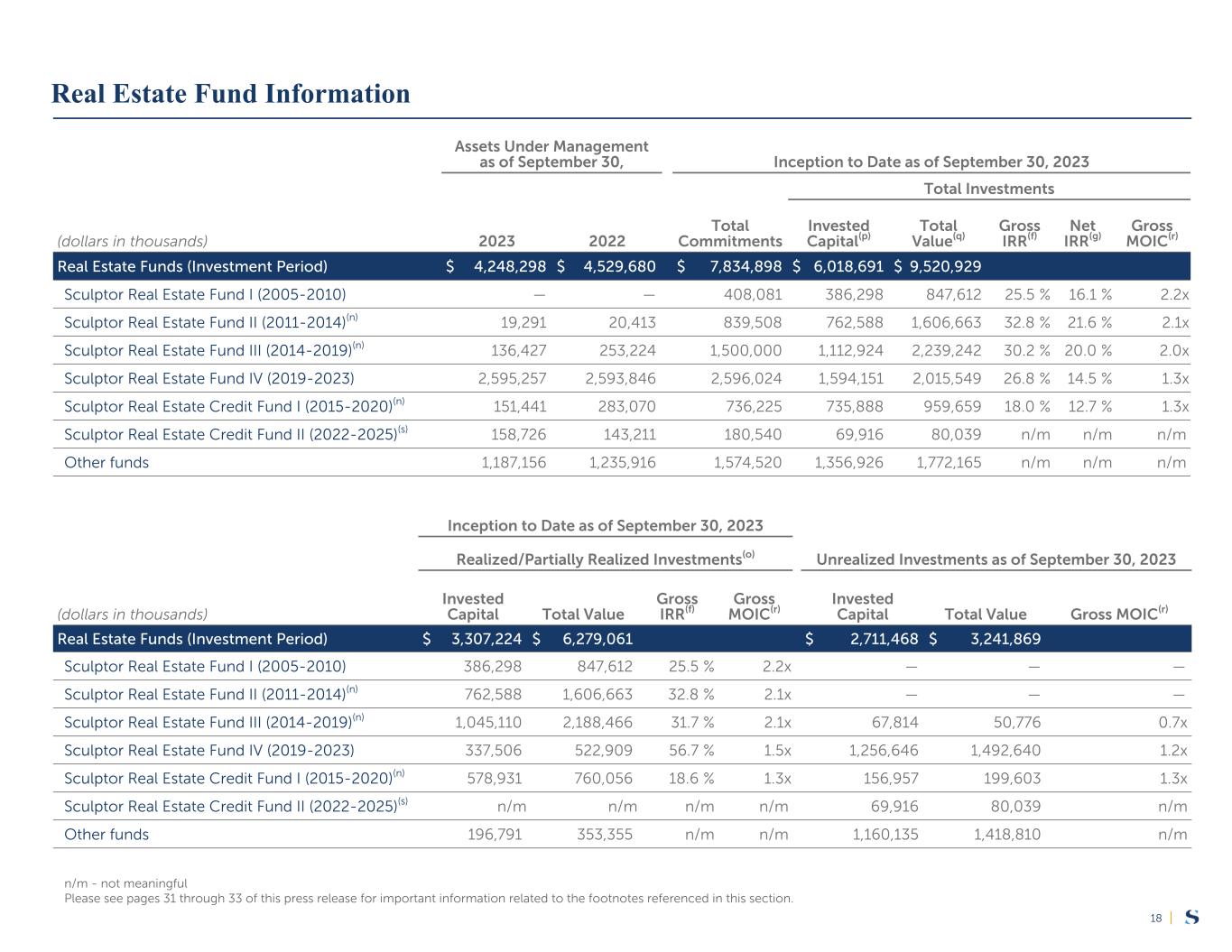

|18 (dollars in thousands) Assets Under Management as of September 30, Inception to Date as of September 30, 2023 Total Investments Total Commitments Invested Capital(p) Total Value(q) Gross IRR(f) Net IRR(g) Gross MOIC(r)2023 2022 Real Estate Funds (Investment Period) $ 4,248,298 $ 4,529,680 $ 7,834,898 $ 6,018,691 $ 9,520,929 Sculptor Real Estate Fund I (2005-2010) — — 408,081 386,298 847,612 25.5 % 16.1 % 2.2x Sculptor Real Estate Fund II (2011-2014)(n) 19,291 20,413 839,508 762,588 1,606,663 32.8 % 21.6 % 2.1x Sculptor Real Estate Fund III (2014-2019)(n) 136,427 253,224 1,500,000 1,112,924 2,239,242 30.2 % 20.0 % 2.0x Sculptor Real Estate Fund IV (2019-2023) 2,595,257 2,593,846 2,596,024 1,594,151 2,015,549 26.8 % 14.5 % 1.3x Sculptor Real Estate Credit Fund I (2015-2020)(n) 151,441 283,070 736,225 735,888 959,659 18.0 % 12.7 % 1.3x Sculptor Real Estate Credit Fund II (2022-2025)(s) 158,726 143,211 180,540 69,916 80,039 n/m n/m n/m Other funds 1,187,156 1,235,916 1,574,520 1,356,926 1,772,165 n/m n/m n/m Inception to Date as of September 30, 2023 (dollars in thousands) Realized/Partially Realized Investments(o) Unrealized Investments as of September 30, 2023 Invested Capital Total Value Gross IRR(f) Gross MOIC(r) Invested Capital Total Value Gross MOIC(r) Real Estate Funds (Investment Period) $ 3,307,224 $ 6,279,061 $ 2,711,468 $ 3,241,869 Sculptor Real Estate Fund I (2005-2010) 386,298 847,612 25.5 % 2.2x — — — Sculptor Real Estate Fund II (2011-2014)(n) 762,588 1,606,663 32.8 % 2.1x — — — Sculptor Real Estate Fund III (2014-2019)(n) 1,045,110 2,188,466 31.7 % 2.1x 67,814 50,776 0.7x Sculptor Real Estate Fund IV (2019-2023) 337,506 522,909 56.7 % 1.5x 1,256,646 1,492,640 1.2x Sculptor Real Estate Credit Fund I (2015-2020)(n) 578,931 760,056 18.6 % 1.3x 156,957 199,603 1.3x Sculptor Real Estate Credit Fund II (2022-2025)(s) n/m n/m n/m n/m 69,916 80,039 n/m Other funds 196,791 353,355 n/m n/m 1,160,135 1,418,810 n/m n/m - not meaningful Please see pages 31 through 33 of this press release for important information related to the footnotes referenced in this section. Real Estate Fund Information

Appendix

|20 (dollars in thousands) September 30, 2023 December 31, 2022 Cash and cash equivalents $ 159,446 $ 258,863 Restricted cash 8,297 7,895 Investments (includes assets measured at fair value of $296,951 and $231,929 including assets sold under agreements to repurchase of $173,156 and $157,107 as of September 30, 2023 and December 31, 2022, respectively) 383,984 299,059 Income and fees receivable 26,569 56,360 Due from related parties 26,706 32,846 Deferred income tax assets 252,911 257,939 Operating lease assets 68,726 75,861 Other assets, net 75,424 106,442 Assets of consolidated entities: Cash and cash equivalents 413 3 Restricted cash and cash equivalents 9,800 9,805 Investments of consolidated entities 322,516 544,554 Other assets of consolidated entities 11,266 2,579 Total Assets 1,346,058 1,652,206 Compensation payable 74,012 127,209 Unearned income and fees 40,510 53,869 Tax receivable agreement liability 173,124 190,245 Operating lease liabilities 83,168 92,045 Debt obligations 115,486 124,176 Warrant liabilities, at fair value 34,140 24,163 Securities sold under agreements to repurchase 177,503 166,632 Other liabilities 43,178 43,049 Liabilities of consolidated entities: Notes payable, at fair value 220,702 196,106 Warrant liabilities, at fair value — 596 Other liabilities of consolidated entities 5,070 9,669 Total Liabilities 966,893 1,027,759 Commitments and Contingencies Redeemable Noncontrolling Interests of Consolidated Entities — 237,864 Shareholders’ Equity Class A Shares, par value $0.01 per share, 100,000,000 shares authorized; 28,033,472 and 26,729,608 shares issued and 25,011,092 and 23,707,228 shares outstanding as of September 30, 2023 and December 31, 2022, respectively 250 238 Class B Shares, par value $0.01 per share, 75,000,000 shares authorized; 33,017,247 and 33,569,188 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively 330 336 Treasury stock, at cost; 3,022,380 as of September 30, 2023 and December 31, 2022 (32,495) (32,495) Additional paid-in capital 294,665 255,293 Accumulated deficit (309,569) (276,149) Accumulated other comprehensive loss (546) (119) Shareholders’ deficit attributable to Class A Shareholders (47,365) (52,896) Shareholders’ equity attributable to noncontrolling interests 426,530 439,479 Total Shareholders’ Equity 379,165 386,583 Total Liabilities and Shareholders’ Equity 1,346,058 1,652,206 GAAP Consolidated Balance Sheets - Unaudited

|21 Three Months Ended September 30, Nine Months Ended September 30, (dollars in thousands, except per share amounts) 2023 2022 2023 2022 Revenues Management fees $ 60,194 $ 66,236 $ 186,344 $ 211,443 Incentive income 17,801 7,566 62,383 73,788 Other revenues 7,683 3,576 20,931 8,526 (Loss) income of consolidated entities (23) 1,453 4,535 1,603 Total Revenues 85,655 78,831 274,193 295,360 Expenses Compensation and benefits 62,081 67,130 188,187 224,658 Interest expense 6,712 3,876 18,462 10,588 General, administrative and other 42,088 28,290 105,811 82,031 Expenses of consolidated entities 229 1,031 2,080 2,943 Total Expenses 111,110 100,327 314,540 320,220 Other (Loss) Income Changes in fair value of warrant liabilities (9,717) (2,386) (9,977) 40,690 Changes in tax receivable agreement liability 225 (14) (302) 206 Other (1,406) — (1,406) — Net gains (losses) on investments 7,051 (2,989) 17,187 (39,171) Net (losses) gains of consolidated entities (9,440) (3,498) 303 (5,792) Total Other (Loss) Income (13,287) (8,887) 5,805 (4,067) Loss Before Income Taxes (38,742) (30,383) (34,542) (28,927) Income taxes (280) 227 11,277 (720) Consolidated Net Loss (38,462) (30,610) (45,819) (28,207) Less: Net loss attributable to noncontrolling interests 7,349 9,410 23,376 15,837 Less: Net income attributable to redeemable noncontrolling interests — (1,492) (3,350) (5,257) Net Loss Attributable to Sculptor Capital Management, Inc. (31,113) (22,692) (25,793) (17,627) Change in redemption value of redeemable noncontrolling interests — 174 6,826 3,939 Net Loss Attributable to Class A Shareholders (31,113) (22,518) (18,967) (13,688) Loss per Class A Share Loss per Class A Share - basic $ (1.23) $ (0.91) $ (0.75) $ (0.53) Loss per Class A Share - diluted $ (1.23) $ (0.91) $ (1.00) $ (1.79) Weighted-average Class A Shares outstanding - basic 25,204,848 24,772,098 25,186,162 25,620,996 Weighted-average Class A Shares outstanding - diluted 25,204,848 24,772,098 40,212,156 26,818,176 GAAP Consolidated Statements of Operations - Unaudited

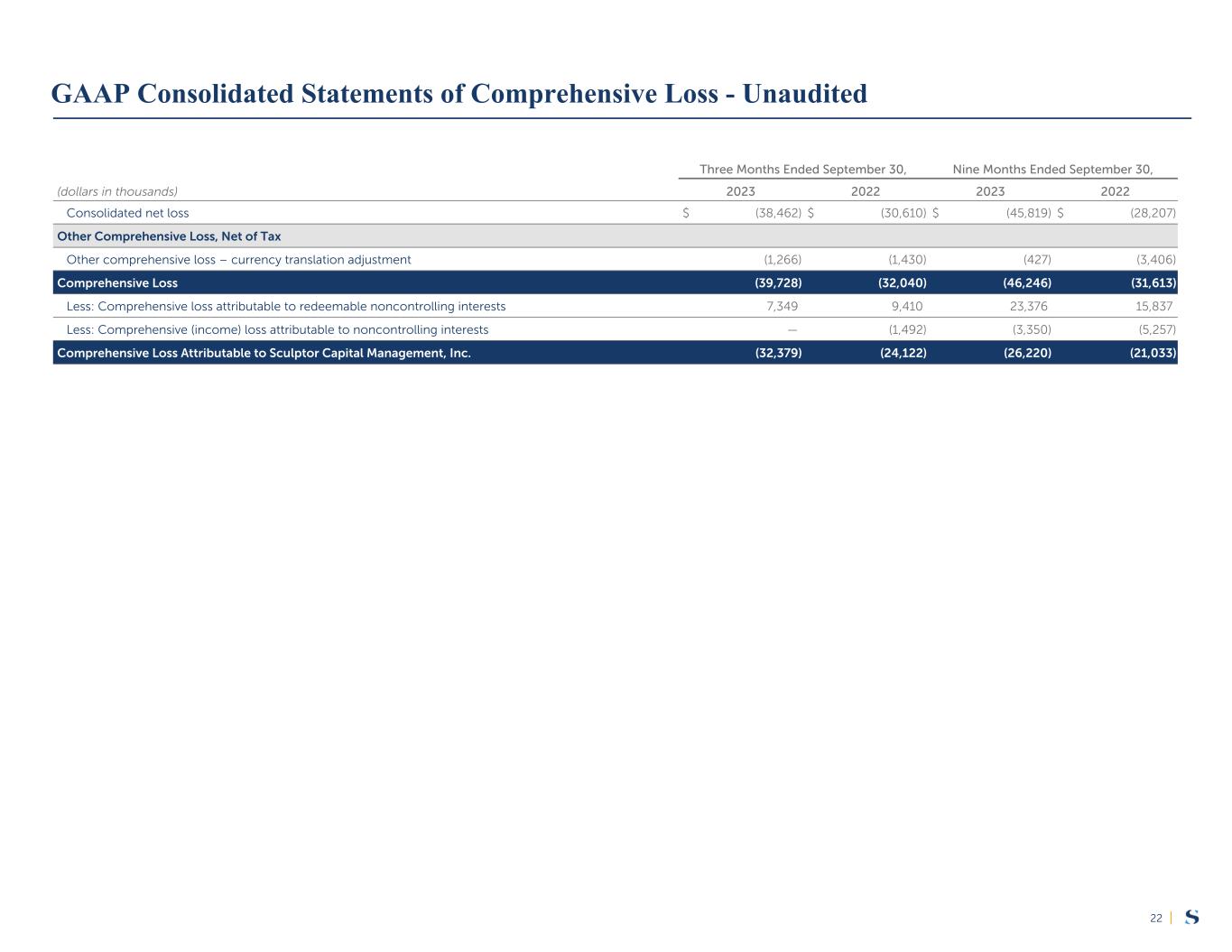

|22 Three Months Ended September 30, Nine Months Ended September 30, (dollars in thousands) 2023 2022 2023 2022 Consolidated net loss $ (38,462) $ (30,610) $ (45,819) $ (28,207) Other Comprehensive Loss, Net of Tax Other comprehensive loss – currency translation adjustment (1,266) (1,430) (427) (3,406) Comprehensive Loss (39,728) (32,040) (46,246) (31,613) Less: Comprehensive loss attributable to redeemable noncontrolling interests 7,349 9,410 23,376 15,837 Less: Comprehensive (income) loss attributable to noncontrolling interests — (1,492) (3,350) (5,257) Comprehensive Loss Attributable to Sculptor Capital Management, Inc. (32,379) (24,122) (26,220) (21,033) GAAP Consolidated Statements of Comprehensive Loss - Unaudited

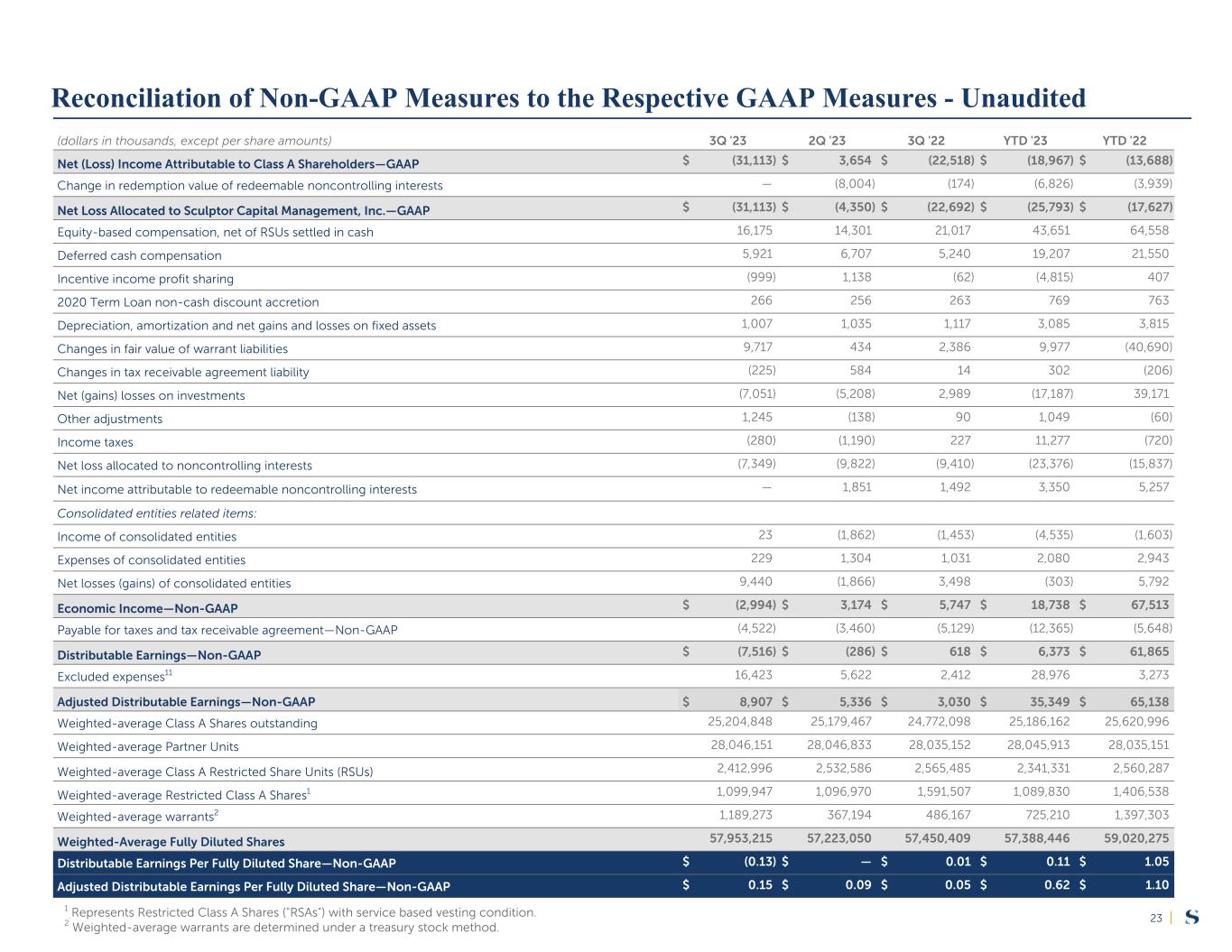

|23 (dollars in thousands, except per share amounts) 3Q '23 2Q '23 3Q '22 YTD '23 YTD '22 Net (Loss) Income Attributable to Class A Shareholders—GAAP $ (31,113) $ 3,654 $ (22,518) $ (18,967) $ (13,688) Change in redemption value of redeemable noncontrolling interests — (8,004) (174) (6,826) (3,939) Net Loss Allocated to Sculptor Capital Management, Inc.—GAAP $ (31,113) $ (4,350) $ (22,692) $ (25,793) $ (17,627) Equity-based compensation, net of RSUs settled in cash 16,175 14,301 21,017 43,651 64,558 Deferred cash compensation 5,921 6,707 5,240 19,207 21,550 Incentive income profit sharing (999) 1,138 (62) (4,815) 407 2020 Term Loan non-cash discount accretion 266 256 263 769 763 Depreciation, amortization and net gains and losses on fixed assets 1,007 1,035 1,117 3,085 3,815 Changes in fair value of warrant liabilities 9,717 434 2,386 9,977 (40,690) Changes in tax receivable agreement liability (225) 584 14 302 (206) Net (gains) losses on investments (7,051) (5,208) 2,989 (17,187) 39,171 Other adjustments 1,245 (138) 90 1,049 (60) Income taxes (280) (1,190) 227 11,277 (720) Net loss allocated to noncontrolling interests (7,349) (9,822) (9,410) (23,376) (15,837) Net income attributable to redeemable noncontrolling interests — 1,851 1,492 3,350 5,257 Consolidated entities related items: Income of consolidated entities 23 (1,862) (1,453) (4,535) (1,603) Expenses of consolidated entities 229 1,304 1,031 2,080 2,943 Net losses (gains) of consolidated entities 9,440 (1,866) 3,498 (303) 5,792 Economic Income—Non-GAAP $ (2,994) $ 3,174 $ 5,747 $ 18,738 $ 67,513 Payable for taxes and tax receivable agreement—Non-GAAP (4,522) (3,460) (5,129) (12,365) (5,648) Distributable Earnings—Non-GAAP $ (7,516) $ (286) $ 618 $ 6,373 $ 61,865 Excluded expenses11 16,423 5,622 2,412 28,976 3,273 Adjusted Distributable Earnings—Non-GAAP $ 8,907 $ 5,336 $ 3,030 $ 35,349 $ 65,138 Weighted-average Class A Shares outstanding 25,204,848 25,179,467 24,772,098 25,186,162 25,620,996 Weighted-average Partner Units 28,046,151 28,046,833 28,035,152 28,045,913 28,035,151 Weighted-average Class A Restricted Share Units (RSUs) 2,412,996 2,532,586 2,565,485 2,341,331 2,560,287 Weighted-average Restricted Class A Shares1 1,099,947 1,096,970 1,591,507 1,089,830 1,406,538 Weighted-average warrants2 1,189,273 367,194 486,167 725,210 1,397,303 Weighted-Average Fully Diluted Shares 57,953,215 57,223,050 57,450,409 57,388,446 59,020,275 Distributable Earnings Per Fully Diluted Share—Non-GAAP $ (0.13) $ — $ 0.01 $ 0.11 $ 1.05 Adjusted Distributable Earnings Per Fully Diluted Share—Non-GAAP $ 0.15 $ 0.09 $ 0.05 $ 0.62 $ 1.10 1 Represents Restricted Class A Shares ("RSAs") with service based vesting condition. 2 Weighted-average warrants are determined under a treasury stock method. Reconciliation of Non-GAAP Measures to the Respective GAAP Measures - Unaudited

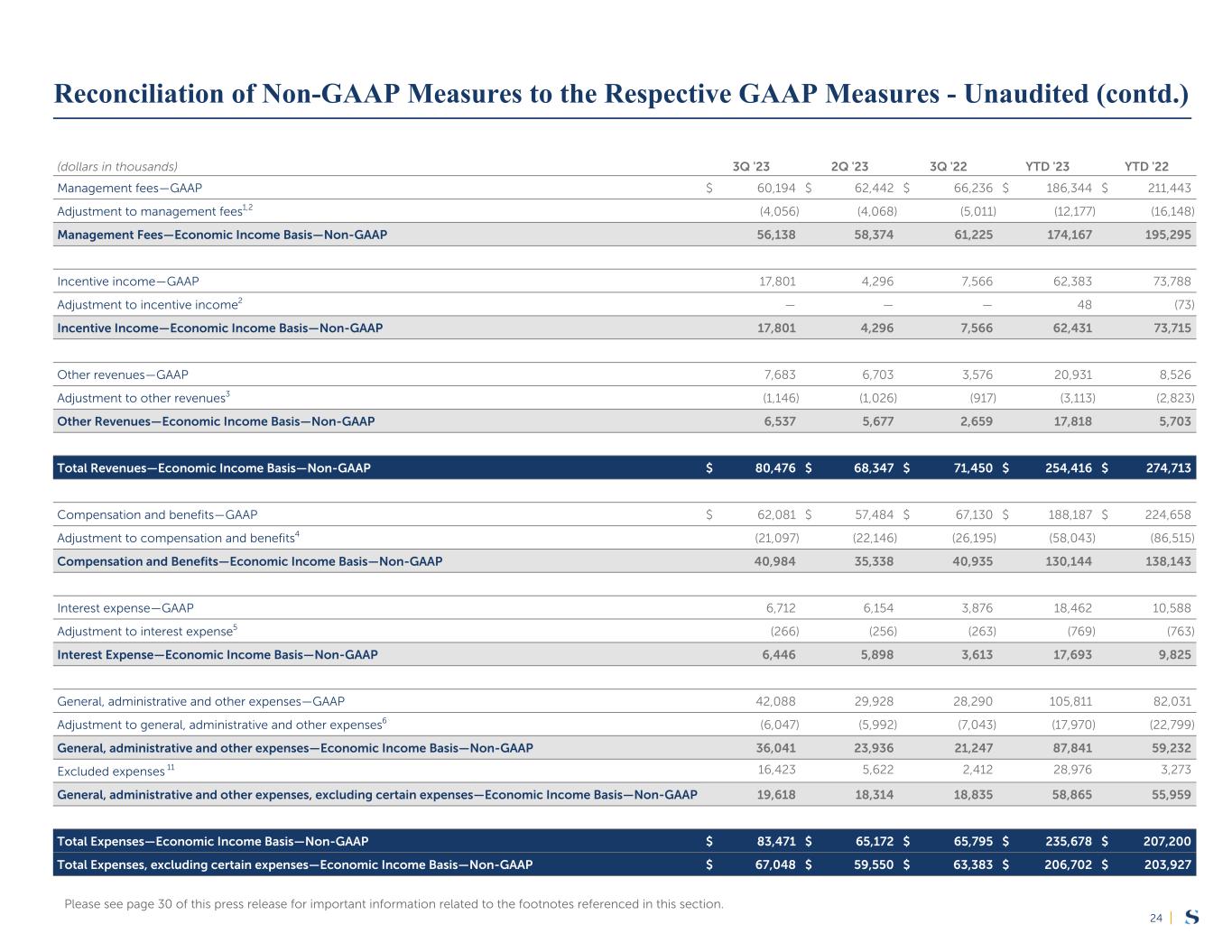

|24 (dollars in thousands) 3Q '23 2Q '23 3Q '22 YTD '23 YTD '22 Management fees—GAAP $ 60,194 $ 62,442 $ 66,236 $ 186,344 $ 211,443 Adjustment to management fees1,2 (4,056) (4,068) (5,011) (12,177) (16,148) Management Fees—Economic Income Basis—Non-GAAP 56,138 58,374 61,225 174,167 195,295 Incentive income—GAAP 17,801 4,296 7,566 62,383 73,788 Adjustment to incentive income2 — — — 48 (73) Incentive Income—Economic Income Basis—Non-GAAP 17,801 4,296 7,566 62,431 73,715 Other revenues—GAAP 7,683 6,703 3,576 20,931 8,526 Adjustment to other revenues3 (1,146) (1,026) (917) (3,113) (2,823) Other Revenues—Economic Income Basis—Non-GAAP 6,537 5,677 2,659 17,818 5,703 Total Revenues—Economic Income Basis—Non-GAAP $ 80,476 $ 68,347 $ 71,450 $ 254,416 $ 274,713 Compensation and benefits—GAAP $ 62,081 $ 57,484 $ 67,130 $ 188,187 $ 224,658 Adjustment to compensation and benefits4 (21,097) (22,146) (26,195) (58,043) (86,515) Compensation and Benefits—Economic Income Basis—Non-GAAP 40,984 35,338 40,935 130,144 138,143 Interest expense—GAAP 6,712 6,154 3,876 18,462 10,588 Adjustment to interest expense5 (266) (256) (263) (769) (763) Interest Expense—Economic Income Basis—Non-GAAP 6,446 5,898 3,613 17,693 9,825 General, administrative and other expenses—GAAP 42,088 29,928 28,290 105,811 82,031 Adjustment to general, administrative and other expenses6 (6,047) (5,992) (7,043) (17,970) (22,799) General, administrative and other expenses—Economic Income Basis—Non-GAAP 36,041 23,936 21,247 87,841 59,232 Excluded expenses 11 16,423 5,622 2,412 28,976 3,273 General, administrative and other expenses, excluding certain expenses—Economic Income Basis—Non-GAAP 19,618 18,314 18,835 58,865 55,959 Total Expenses—Economic Income Basis—Non-GAAP $ 83,471 $ 65,172 $ 65,795 $ 235,678 $ 207,200 Total Expenses, excluding certain expenses—Economic Income Basis—Non-GAAP $ 67,048 $ 59,550 $ 63,383 $ 206,702 $ 203,927 Reconciliation of Non-GAAP Measures to the Respective GAAP Measures - Unaudited (contd.) Please see page 30 of this press release for important information related to the footnotes referenced in this section.

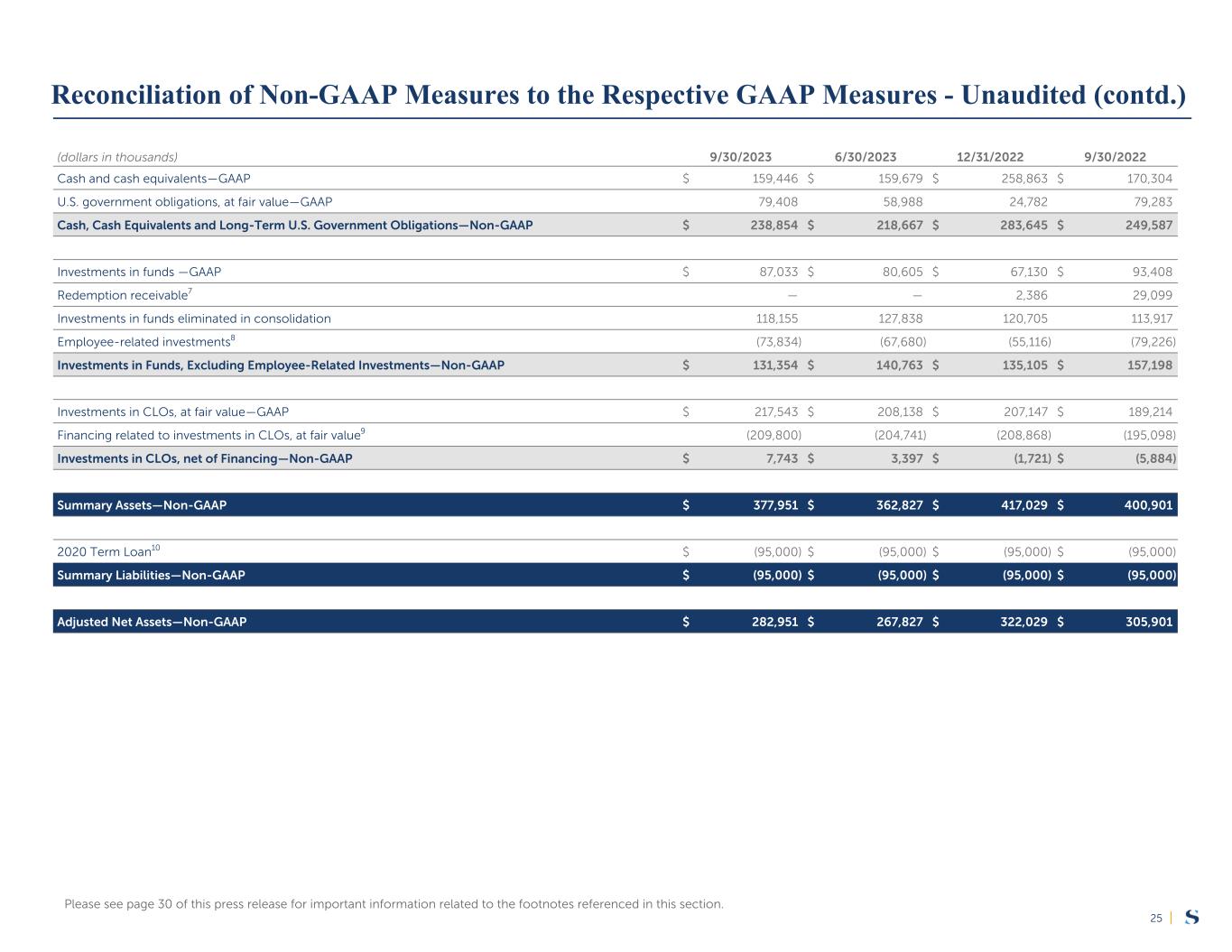

|25 (dollars in thousands) 9/30/2023 6/30/2023 12/31/2022 9/30/2022 Cash and cash equivalents—GAAP $ 159,446 $ 159,679 $ 258,863 $ 170,304 U.S. government obligations, at fair value—GAAP 79,408 58,988 24,782 79,283 Cash, Cash Equivalents and Long-Term U.S. Government Obligations—Non-GAAP $ 238,854 $ 218,667 $ 283,645 $ 249,587 Investments in funds —GAAP $ 87,033 $ 80,605 $ 67,130 $ 93,408 Redemption receivable7 — — 2,386 29,099 Investments in funds eliminated in consolidation 118,155 127,838 120,705 113,917 Employee-related investments8 (73,834) (67,680) (55,116) (79,226) Investments in Funds, Excluding Employee-Related Investments—Non-GAAP $ 131,354 $ 140,763 $ 135,105 $ 157,198 Investments in CLOs, at fair value—GAAP $ 217,543 $ 208,138 $ 207,147 $ 189,214 Financing related to investments in CLOs, at fair value9 (209,800) (204,741) (208,868) (195,098) Investments in CLOs, net of Financing—Non-GAAP $ 7,743 $ 3,397 $ (1,721) $ (5,884) Summary Assets—Non-GAAP $ 377,951 $ 362,827 $ 417,029 $ 400,901 2020 Term Loan10 $ (95,000) $ (95,000) $ (95,000) $ (95,000) Summary Liabilities—Non-GAAP $ (95,000) $ (95,000) $ (95,000) $ (95,000) Adjusted Net Assets—Non-GAAP $ 282,951 $ 267,827 $ 322,029 $ 305,901 Reconciliation of Non-GAAP Measures to the Respective GAAP Measures - Unaudited (contd.) Please see page 30 of this press release for important information related to the footnotes referenced in this section.

|26 (dollars in thousands) From October 1, 2018 to September 30, 2023 Net income attributable to Class A shareholders $ 181,539 Change in redemption value of redeemable noncontrolling interests and Preferred Units (22,516) Net Income Allocated to Sculptor Capital Management, Inc.—GAAP 159,023 Equity-based compensation, net of RSUs settled in cash 374,716 Deferred cash compensation (356) Incentive income profit sharing (13,440) 2020 Term Loan and Debt Securities non-cash discount accretion 21,774 Depreciation, amortization and net gains and losses on fixed assets 35,187 Changes in fair value of warrant liabilities 3,861 Changes in tax receivable agreement liability 16,366 Net losses on retirement of debt 41,584 Net losses on investments (7,721) Impairment of right-of-use asset 11,240 Other adjustments 4,878 Income taxes 140,270 Net income allocated to Group A Units (108,700) Net income attributable to redeemable noncontrolling interests 17,962 Less: Dividends paid on 2019 Preferred Units (6,952) Less: Dividends to Class A Shareholders declared with respect to such periods (128,117) Consolidated entities related items: Income of consolidated entities (23,626) Expenses of consolidated entities 8,659 Net losses of consolidated entities (1,053) Distribution Holiday Economic Income—Non-GAAP $ 545,555 Reconciliation of Distribution Holiday Economic Income Non-GAAP Measures to the Respective GAAP Measures - Unaudited (contd.)

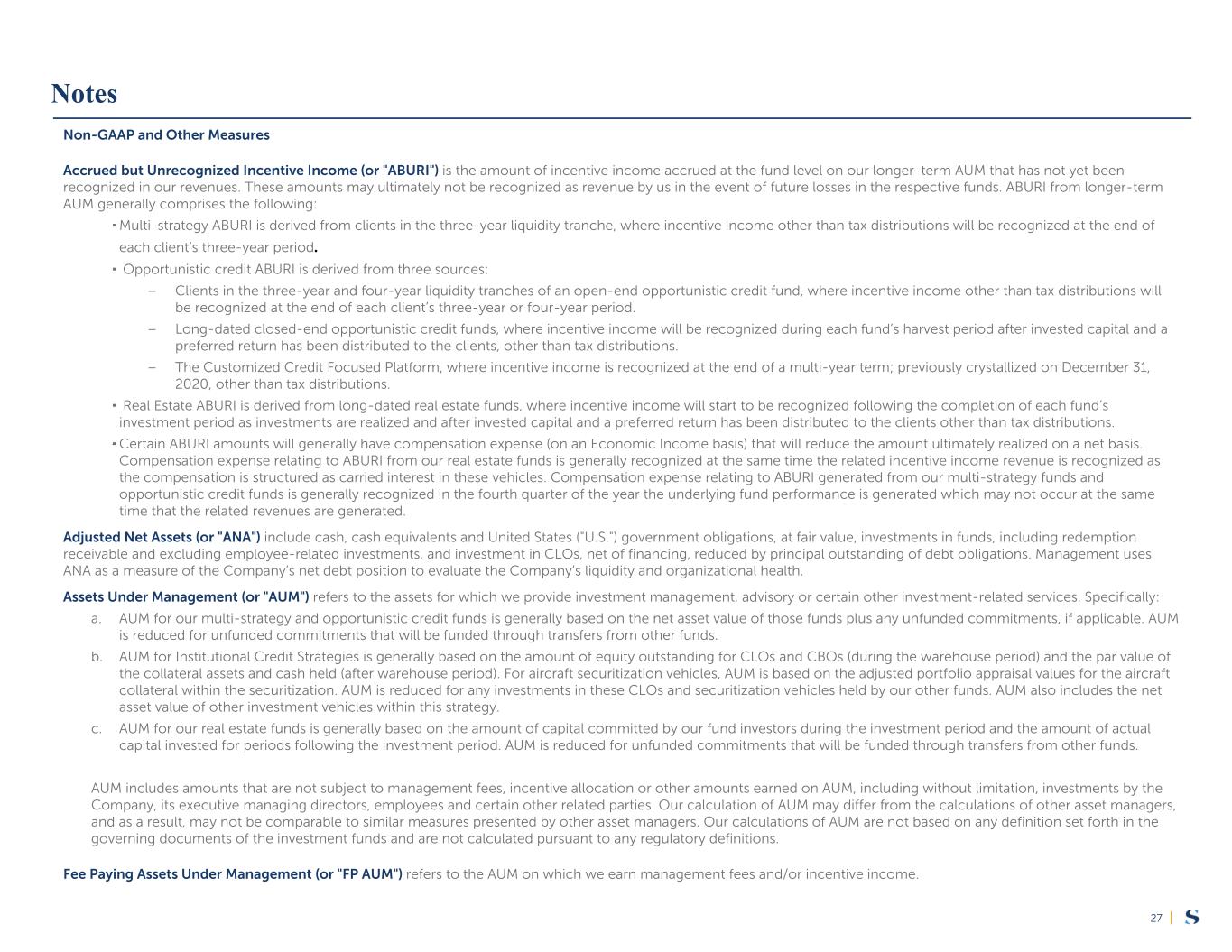

|27 Non-GAAP and Other Measures Accrued but Unrecognized Incentive Income (or "ABURI") is the amount of incentive income accrued at the fund level on our longer-term AUM that has not yet been recognized in our revenues. These amounts may ultimately not be recognized as revenue by us in the event of future losses in the respective funds. ABURI from longer-term AUM generally comprises the following: ▪Multi-strategy ABURI is derived from clients in the three-year liquidity tranche, where incentive income other than tax distributions will be recognized at the end of each client’s three-year period. ▪ Opportunistic credit ABURI is derived from three sources: – Clients in the three-year and four-year liquidity tranches of an open-end opportunistic credit fund, where incentive income other than tax distributions will be recognized at the end of each client’s three-year or four-year period. – Long-dated closed-end opportunistic credit funds, where incentive income will be recognized during each fund’s harvest period after invested capital and a preferred return has been distributed to the clients, other than tax distributions. – The Customized Credit Focused Platform, where incentive income is recognized at the end of a multi-year term; previously crystallized on December 31, 2020, other than tax distributions. ▪ Real Estate ABURI is derived from long-dated real estate funds, where incentive income will start to be recognized following the completion of each fund’s investment period as investments are realized and after invested capital and a preferred return has been distributed to the clients other than tax distributions. ▪Certain ABURI amounts will generally have compensation expense (on an Economic Income basis) that will reduce the amount ultimately realized on a net basis. Compensation expense relating to ABURI from our real estate funds is generally recognized at the same time the related incentive income revenue is recognized as the compensation is structured as carried interest in these vehicles. Compensation expense relating to ABURI generated from our multi-strategy funds and opportunistic credit funds is generally recognized in the fourth quarter of the year the underlying fund performance is generated which may not occur at the same time that the related revenues are generated. Adjusted Net Assets (or "ANA") include cash, cash equivalents and United States ("U.S.") government obligations, at fair value, investments in funds, including redemption receivable and excluding employee-related investments, and investment in CLOs, net of financing, reduced by principal outstanding of debt obligations. Management uses ANA as a measure of the Company’s net debt position to evaluate the Company’s liquidity and organizational health. Assets Under Management (or "AUM") refers to the assets for which we provide investment management, advisory or certain other investment-related services. Specifically: a. AUM for our multi-strategy and opportunistic credit funds is generally based on the net asset value of those funds plus any unfunded commitments, if applicable. AUM is reduced for unfunded commitments that will be funded through transfers from other funds. b. AUM for Institutional Credit Strategies is generally based on the amount of equity outstanding for CLOs and CBOs (during the warehouse period) and the par value of the collateral assets and cash held (after warehouse period). For aircraft securitization vehicles, AUM is based on the adjusted portfolio appraisal values for the aircraft collateral within the securitization. AUM is reduced for any investments in these CLOs and securitization vehicles held by our other funds. AUM also includes the net asset value of other investment vehicles within this strategy. c. AUM for our real estate funds is generally based on the amount of capital committed by our fund investors during the investment period and the amount of actual capital invested for periods following the investment period. AUM is reduced for unfunded commitments that will be funded through transfers from other funds. AUM includes amounts that are not subject to management fees, incentive allocation or other amounts earned on AUM, including without limitation, investments by the Company, its executive managing directors, employees and certain other related parties. Our calculation of AUM may differ from the calculations of other asset managers, and as a result, may not be comparable to similar measures presented by other asset managers. Our calculations of AUM are not based on any definition set forth in the governing documents of the investment funds and are not calculated pursuant to any regulatory definitions. Fee Paying Assets Under Management (or "FP AUM") refers to the AUM on which we earn management fees and/or incentive income. Notes

|28 Notes (contd.) Non-GAAP and Other Measures (contd.) Longer-term AUM (or "LT AUM") is defined as AUM from investors that are subject to initial commitment periods of three years or longer. Investors with longer-term AUM may have less than three years remaining in their commitment period. This excludes AUM that had initial commitment periods of three years or longer and subsequently moved to shorter commitment periods at the end of their initial commitment period. Distributable Earnings is a non-GAAP measure of operating performance that equals Economic Income less amounts payable for taxes and tax receivable agreement. Economic Income excludes certain adjustments described further below that are required for presentation of the Company's results and financial positions on a GAAP basis. Payable for taxes and tax receivable agreement presents the total estimated GAAP provision for current corporate, local and foreign taxes payable, as well as the current payable under the Company’s tax receivable agreement, assuming that all Economic Income was allocated to Sculptor Capital Management, Inc., which would occur following the exchange of all interests held by current and former executive managing directors in the Sculptor Operating Group (collectively, "Partner Units") for Class A Shares. The current tax provision and current payable under the tax receivable agreement reflect the benefit of tax deductions that are excluded when calculating Distributable Earnings, such as equity-based compensation expenses, legal settlements expenses, tax goodwill and various other items impacting the Company’s taxable income. Management believes that using the estimated current tax provision and current payable under the Company’s tax receivable agreement more accurately reflect earnings that are available to be distributed to shareholders. For purposes of calculating Distributable Earnings per Share, the Company assumes that all Partner Units and Class A Restricted Share Units ("RSUs"), except for RSUs that will be settled in cash, and Class A Restricted shares (“RSAs”), subject to service condition only, have been converted on a one-to-one basis into Class A Shares and warrants are included on a treasury stock basis (collectively, "Fully Diluted Shares"). As of September 30, 2023, there were 4,734,286 Group P Units, 3,550,714 RSAs subject to both market and service conditions, and 912,500 performance-based restricted share units ("PSUs") outstanding that were excluded from the Fully Diluted Shares. Group P Units, RSAs subject to both market and service conditions, and PSUs do not participate in the economics of the Company until certain service and market-performance conditions are met; therefore, the Company will not include the Group P Units, RSAs subject to market condition, or PSUs in Fully Diluted Shares until such market-performance conditions are met. As of September 30, 2023, the market-performance conditions for outstanding instruments had not yet been met. These non-GAAP measures should not be considered as alternatives to the Net Loss Attributable to Class A Shareholders. You are encouraged to evaluate each of these adjustments and the reasons the Company considers them appropriate for supplemental analysis. In evaluating the Company's non-GAAP measures, you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the adjustments in such presentations. The Company's non-GAAP measures may not be comparable to similarly titled measures used by other companies. Management uses Economic Income, Distributable Earnings, and Distributable Earnings per Share among other financial information, as the basis on which it evaluates the financial performance of the Company and makes operating decisions, as well as to determine the earnings available to distribute as dividends to holders of the Company's Class A Shares and to the Company's executive managing directors. Management considers it important that investors review the same operating information that it uses. These measures are presented to provide a more comparable view of the Company's operating results year-over-year and the Company believes that providing these measures on a supplemental basis to the Company's GAAP results is helpful to shareholders in assessing the overall performance of the Company's business. Adjusted Distributable Earnings exclude the effects of professional services expenses related to the activities of the Special Committee of our Board of Directors and related ongoing litigation. Management adjusted the calculation of this measure to more closely align with how it assesses the Company’s financial performance. Prior periods in this presentation have been recast to conform to the adjusted presentation. Distribution Holiday refers to the distribution holiday (the “Distribution Holiday”) initiated by the Sculptor Operating Partnerships on the Group A Units, Group E Units and Group P Units and on certain RSUs and RSAs that will terminate on the earlier of (x) 45 days after the last day of the first calendar quarter as of which the achievement of $600.0 million of Distribution Holiday Economic Income is realized and (y) April 1, 2026. Holders of Group A Units, Group E Units and Group P Units and certain RSUs and RSAs, do not receive distributions during the Distribution Holiday.

|29 Notes (contd.) Non-GAAP and Other Measures (contd.) Distribution Holiday Economic Income is the cumulative amount of Economic Income earned since October 1, 2018, less any dividends paid to Class A Shareholders or on the now-retired Preferred Units. Distribution Holiday Economic Income is a non-GAAP measure that is defined in the agreements of limited partnership of the Sculptor Operating Partnerships and is being presented to provide an update on the progress made toward the $600.0 million target required to exit the Distribution Holiday. Economic Income is a measure of pre-tax operating performance that excludes the following from our results on a GAAP basis: • Equity-based compensation expenses, net of cash settled RSUs. When the number of RSUs to be settled in cash is discretionary at the time of the grant, then the fair value of RSUs that are settled in cash is included as an expense at the time of settlement. When the number of RSUs to be settled in cash is certain on the grant date, then the expense is recognized during the performance period to which the award relates. • Amounts related to non-cash interest expense accretion on term debt. Management excludes this non-cash expense from Economic Income, as it does not consider it to be reflective of our economic borrowing costs. • Depreciation and amortization expenses, changes in fair value of warrant liabilities, changes in the tax receivable agreement liability, net losses on retirement of debt, gains and losses on fixed assets, gains and losses on investments in funds, and changes in fair value of derivatives as management does not consider these items to be reflective of operating performance. • Impairment of right-of-use lease assets is excluded from Economic Income at the time the impairment is recognized for GAAP and the impact is then amortized over the lease term for Economic Income, as management evaluates impairment expenses over the life of the related lease asset and considers the impairment charge to be nonrecurring in nature. Additionally, rent expense is offset by subrental income as management evaluates rent expenses on a net basis. • Income allocations to our executive managing directors on their direct interests in the Sculptor Operating Group. Management reviews operating performance at the Sculptor Operating Group level, where our operations are performed, prior to making any income allocations. • Net income (loss) attributable to redeemable noncontrolling interests, which relates to our consolidated SPAC that was liquidated during the second quarter of 2023, is also eliminated as management does not consider this to be reflective of operating performance. • Amounts related to the consolidated entities, as management does not consider these amounts to be representative of our core operating performance. We also exclude the related eliminations of management fees and incentive income, as management reviews the total amount of management fees and incentive income earned in relation to total AUM and fund performance. Additionally, management fees are presented net of recurring placement and related service fees, as management considers these fees a reduction in management fees, not an expense. Expenses related to incentive income profit-sharing arrangements are generally recognized at the same time the related incentive income revenue is recognized, as management reviews the compensation expense related to these arrangements in relation to any incentive income earned from the relevant fund. Further, for Economic Income deferred cash compensation is expensed in full during the performance period to which the award relates, rather than over the service period for GAAP, as management views the compensation expense impact in relation to the performance period. As a result of the adjustments described above, management fees, incentive income, other revenues, compensation and benefits, interest expense, general, administrative and other expenses, net income (loss) attributable to noncontrolling interests and net income (loss) attributable to redeemable noncontrolling interests as presented on an Economic Income basis are also non-GAAP measures. Our non-GAAP financial measures should not be considered alternatives to our GAAP net income allocated to Class A Shareholders or cash flow from operations, or as indicative of liquidity or the cash available to fund operations. Our non-GAAP measures may not be comparable to similarly titled measures used by other companies.

|30 Footnotes to Non-GAAP Reconciliations (1) Adjustment to present management fees net of recurring placement and related service fees, as management considers these fees a reduction in management fees, not an expense. (2) Adjustment to exclude the related eliminations of management fees and incentive income, as management reviews the total amount of management fees and incentive income earned in relation to total AUM and fund performance. (3) Adjustment to offset rent expense by subrental income as management evaluates rent expense on a net basis. (4) Adjustment to exclude equity-based compensation, net of cash settled RSUs. When the number of RSUs to be settled in cash is discretionary at the time of the grant, then the fair value of RSUs that are settled in cash is included as an expense at the time of settlement. When the number of RSUs to be settled in cash is certain on the grant date, then the expense is recognized during the performance period to which the award relates. In addition, expenses related to incentive income profit-sharing arrangements are generally recognized at the same time the related incentive income revenue is recognized, as management reviews the total compensation expense related to these arrangements in relation to any incentive income earned from the relevant fund. For Economic income deferred cash compensation is expensed in full during the performance period to which the award relates to, rather than over the service period for GAAP as management views the compensation expense impact in relation to the performance period. (5) Adjustment to exclude amounts related to non-cash interest expense accretion on debt. The 2020 Term Loan and the Debt Securities, which were issued in connection with the Recapitalization, were each recognized at a significant discount, as proceeds from each borrowing were allocated to warrant liabilities and the 2019 Preferred Units, respectively, resulting in non-cash accretion to par over time through interest expense for GAAP. The Debt Securities and the 2019 Preferred Units were fully redeemed in 2020. Management excludes this non-cash expense from Economic Income, as it does not consider it to be reflective of our economic borrowing costs. (6) Adjustment to exclude amounts related to non-cash interest expense accretion on debt. The 2020 Term Loan and the Debt Securities, which were issued in connection with the Recapitalization, were each recognized at a significant discount, as proceeds from each borrowing were allocated to warrant liabilities and the 2019 Preferred Units, respectively, resulting in non-cash accretion to par over time through interest expense for GAAP. The Debt Securities and the 2019 Preferred Units were fully redeemed in 2020. Management excludes this non-cash expense from Economic Income, as it does not consider it to be reflective of our economic borrowing costs. (7) Adjustment to include short-term receivables from funds included within other assets on the GAAP balance sheet for which the Company has redeemed its investment and will receive cash as management considers these items to be reflective of our Adjusted Net Assets. The amount shown for December 31, 2022 excludes $26.3 million related to a redemption receivable for investments in funds made on behalf of certain employees and executive managing directors, which management does not consider to be reflective of our Adjusted Net Assets, as noted below. (8) Adjustment to exclude investments in funds made on behalf of certain employees and executive managing directors, including deferred compensation arrangements as management does not consider these items to be reflective of our Adjusted Net Assets. (9) Adjustment to reduce the investments in CLOs by related financing, including CLO investments loans and principal outstanding on securities sold under agreements to repurchase as management evaluates these investments on a net basis. (10) Represents principal outstanding of the debt obligations as management evaluates these obligations on a gross basis for liquidity needs. (11) Adjustment to exclude professional services expenses related to the activities of the Special Committee of our Board of Directors and related ongoing litigation Notes (contd.)

|31 Footnotes to Fund Information (a) Past performance is not indicative of future results. The return information reflected in these tables represents, where applicable, the composite performance of all feeder funds that comprise each of the master funds presented. Gross return information is generally calculated using the total return of all feeder funds, net of all fees and expenses except management fees of such feeder funds and master funds and incentive income allocated to the general partner of the funds, and the returns of each feeder fund include the reinvestment of all dividends and other income. Net return information is generally calculated as the gross returns less management fees and incentive income allocated to the general partner of the funds. Return information that includes investments in certain funds that the Company, as investment manager, determines lack a readily ascertainable fair value, are illiquid or should be held until the resolution of a special event or circumstance ("Special Investments") excludes incentive income allocated to the general partner of the funds on unrealized gains attributable to such investments, which could reduce returns on these investments at the time of realization. Special Investments and initial public offering investments are not allocated to all investors in the funds, and investors that were not allocated Special Investments and initial public offering investments may experience materially different returns. The performance calculation for the Sculptor Master Fund excludes realized and unrealized gains and losses attributable to currency hedging specific to certain investors investing in Sculptor Master Fund in currencies other than the U.S. Dollar. (b) The returns for the Sculptor Credit Opportunities Master Fund exclude Special Investments. Special Investments in the Sculptor Credit Opportunities Master Fund are held by investors representing a small percentage of AUM in the fund. Inclusive of these Special Investments, the returns of the Sculptor Credit Opportunities Master Fund for nine months ended September 30, 2023 were 10.1% gross and 8.2% net, for year ended December 31, 2022 were (2.9)% gross and (3.8)%, for the nine months ended September 30, 2022 were (3.3)% gross and (3.9)% net, and annualized since inception through September 30, 2023 were 12.3% gross and 8.7% net. (c) Source: Bloomberg, HFRX. The comparison shows the returns of the ICE BofAML Global High Yield Index (HW00) and HFRX Fixed Income Credit Index (HFRXFIC) (the “Broader Market Indices”) against Sculptor Credit Opportunities Master Fund. The HFRXFIC returns are presented net of fees of the constituent funds. The comparisons are intended solely for illustrative purposes to show a historical comparison of the Sculptor Credit Opportunities Master Fund to the broader credit markets, as represented by the Broader Market Indices, and should not be considered as an indication of how Sculptor Credit Opportunities Master Fund will perform relative to the Index in the future. There can be no assurance any such trends would persist in the future. Assets and securities contained within the Broader Market Indices are different than the assets held in Sculptor Credit Opportunities Master Fund and will therefore have different risk and reward profiles. (d) The annualized returns since inception are those of the Sculptor Multi-Strategy Composite, which represents the composite performance of all accounts that were managed in accordance with the Company's broad multi-strategy mandate that were not subject to portfolio investment restrictions or other factors that limited the Company's investment discretion since inception on April 1, 1994. Performance is calculated using the total return of all such accounts net of all investment fees and expenses of such accounts, and the returns include the reinvestment of all dividends and other income. The performance calculation for the Sculptor Master Fund excludes realized and unrealized gains and losses attributable to currency hedging specific to certain investors investing in Sculptor Master Fund in currencies other than the U.S. Dollar. For the period from April 1, 1994 through December 31, 1997, the returns are gross of certain overhead expenses that were reimbursed by the accounts. Such reimbursement arrangements were terminated at the inception of the Sculptor Master Fund on January 1, 1998. The size of the accounts comprising the composite during the time period shown vary materially. Such differences impacted the Company's investment decisions and the diversity of the investment strategies followed. Furthermore, the composition of the investment strategies the Company follows is subject to its discretion, has varied materially since inception and is expected to vary materially in the future. The returns for the Sculptor Master Fund exclude Special Investments. Special Investments in the Sculptor Master Fund are held by investors representing a small percentage of AUM in the fund. Inclusive of these Special Investments, the returns of the Sculptor Master Fund for nine months ended September 30, 2023 were 13.0% gross and 11.8% net, for year ended December 31, 2022 were (12.0)% gross and (13.3)% net, for the nine months ended September 30, 2022 were (13.3)% gross and (14.2)% net, and annualized since inception through September 30, 2023 were 15.2% gross and 10.5% net. As of September 30, 2023, the annualized returns since the Sculptor Master Fund’s inception on January 1, 1998 were 12.4% gross and 8.3% net excluding Special Investments and 12.1% gross and 8.1% net inclusive of Special Investments. Sharpe Ratio is a measure of the risk-adjusted return of the Fund, or benchmark, as applicable. The Sharpe Ratio is calculated by subtracting the annualized risk-free rate from the annualized portfolio return, and dividing that amount by the standard deviation of the portfolio's monthly returns in excess of the risk-free rate. The risk-free rate of return used in computing the Sharpe Ratio is compounded monthly throughout the periods presented. Unless otherwise noted, all references to the risk-free rate refer to the Secured Overnight Financing Rate (“SOFR”), represented by the 30-day average SOFR (SOFR30A Index), which replaced the use of the London Interbank Offered Rate (“LIBOR”) as the risk-free rate upon the discontinuation of LIBOR, effective June 1, 2023 onward. For all periods prior to June 1, 2023, the risk-free rate is represented by the 1-month LIBOR. Notes (contd.)

|32 Footnotes to Fund Information (e) Source: Bloomberg, HFRI. The comparison shows the returns of the MSCI World Gross Local Index (GDDLWI Index), the Balanced US 60/40 Index (VBINX US Equity) and the HFRI Fund Weighted Composite Index (HFRIFWI Index (the “Broader Market Indices”) against the Multi-Strategy Composite. The HFRIFWI returns are presented net of fees of the constituent funds. This comparison is intended solely for illustrative purposes to show a historical comparison of the Master Fund Composite to the broader markets, as represented by the Broader Market Indices, and should not be considered as an indication of how Sculptor Master Fund or the Feeder Funds will perform relative to the Broader Market Indices in the future. There can be no assurance any such trends would persist in the future. Assets and securities contained within the Broader Market Indices are different than the assets held in the Master Fund Composite and will therefore have different risk and reward profiles. (f) Gross IRR for the Company's real estate funds represents the estimated, unaudited, annualized return based on the timing of cash inflows and outflows for the aggregated investments as of September 30, 2023, including the fair value of unrealized and partially realized investments as of such date, together with any unrealized appreciation or depreciation from related hedging activity. Gross IRR is not adjusted for estimated management fees, incentive income allocated to the general partner of the fund or other fees or expenses to be paid by the fund, which would reduce the return. (g) Net IRR is calculated as described in footnotes (f) and (l), but is reduced by management fees and for the real estate funds other fund-level fees and expenses not adjusted for in the calculation of gross IRR. Net IRR is further reduced by accrued and paid incentive income allocated to the general partner of the fund, which will be payable upon the distribution of each fund's capital in accordance with the terms of the relevant fund. Accrued incentive income allocated to the general partner of the fund may be higher or lower at such time. The net IRR represents a composite rate of return for a fund and does not reflect the net IRR specific to any individual investor. For Sculptor Real Estate Fund IV, the Net IRR presented reflects the effect of proration of management fees and certain expenses based on the portion of committed capital that is reflected in invested capital. Removing the effects of this proration results in a Net IRR of 12.9%. (h) Includes transfers between Sculptor funds. (i) Appreciation (depreciation) reflects the aggregate net capital appreciation (depreciation) for the entire period and is presented on a total return basis, net of all fees and expenses (except incentive income allocated to the general partner of the fund on unrealized Special Investments), and includes the reinvestment of all dividends and other income. Management fees and incentive income allocated to the general partner of the fund vary by product. (j) Includes the effects of changes in the par value of the underlying collateral of the CLOs, foreign currency translation changes in the measurement of AUM of our European CLOs and other funds, and changes in the portfolio appraisal value for aircraft securitization vehicles. For FP AUM, this also includes movements in or out of FP AUM. (k) Represents funded capital commitments net of recallable distribution to investors. (l) Gross internal rate of return ("IRR") for the Company's closed-end opportunistic credit funds represents the estimated, unaudited, annualized return based on the timing of cash inflows and outflows for the fund as of September 30, 2023, including the fair value of unrealized investments as of such date, together with any appreciation or depreciation from related hedging activity. Gross IRR does not include the effects of management fees or incentive income allocated to the general partner of the fund, which would reduce the return, and includes the reinvestment of all fund income. (m) Gross multiple of invested capital ("MOIC") for the Company's closed-end opportunistic credit funds is calculated by dividing the sum of the net asset value of the fund, accrued incentive income allocated to the general partner of the fund, life-to-date incentive income allocated to the general partner of the fund and management fees paid and any non-recallable distributions made from the fund by the invested capital. (n) These funds have concluded their investment periods, and therefore the Company expects AUM for these funds to decrease as investments are sold and the related proceeds are distributed to the investors in these funds. (o) An investment is considered partially realized when the total amount of proceeds received, including dividends, interest or other distributions of income and return of capital, represents at least 50% of invested capital. (p) Invested capital represents total aggregate contributions made for investments by the fund. Notes (contd.)

|33 Footnotes to Fund Information (q) Total value represents the sum of realized distributions and the fair value of unrealized and partially realized investments as of September 30, 2023. Total value will be impacted (either positively or negatively) by future economic and other factors. Accordingly the total value ultimately realized will likely be higher or lower than the amounts presented as of September 30, 2023. (r) Gross MOIC for the Company's real estate funds is calculated by dividing the value of a fund's investments by the invested capital, prior to adjustments for incentive income allocated to the general partner of the fund, management fees or other expenses to be paid by the fund. (s) This fund has not yet invested a level of committed capital that would lead to presentation of meaningful IRR and MOIC information. Therefore, such information is not presented. (t) Customized Credit Focused Platform - Footnotes Weighted Average Returns: Weighted Average Returns reflect the total profit & loss divided by the weighted average capital base for the period. Gross IRR represents estimated, unaudited, annualized pre-tax returns based on the timing of cash inflows and outflows from contributions into and distributions from the Platform to its fee paying investors (excluding management fees incurred by the Platform and incentive income allocated to the general partner of the fund). Net IRR is the gross IRR adjusted to reflect actual management fees incurred by the Platform and incentive income allocated to the general partner of the fund. Net Invested Capital Multiple: Given the Platform has an active liquid investment program, a key element of which includes ramping up and ramping down depending on market conditions - much of which has recently been deployed - this is a multiple measuring the current net asset value over the Net Invested Capital, where Net Invested Capital represents cumulative contributions less cumulative distributions. Notes (contd.)