UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the Fiscal Year Ended | |||||

| or | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| For the transition period from ________ to ________ | |||||

Commission File Number 001-33805

(Exact Name of Registrant as Specified in its Charter)

| (State of Incorporation) | (I.R.S. Employer Identification Number) | |||||||

(Address of Principal Executive Offices)

Registrant’s telephone number: (212 ) 790-0000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbols | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, or “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☑ | Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||||||||

| Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2019 was approximately $459.2 million. As of February 19, 2020, there were 21,911,815 Class A Shares and 29,208,952 Class B Shares outstanding.

Documents Incorporated by Reference

SCULPTOR CAPITAL MANAGEMENT, INC.

TABLE OF CONTENTS

| Page | ||||||||

i

Defined Terms

2007 Offerings | Refers collectively to our IPO and the concurrent private offering of approximately 38.1 million Class A Shares to DIC Sahir Limited, a wholly owned indirect subsidiary of Dubai Holdings LLC | |||||||

active executive managing directors | Executive managing directors who remain active in our business | |||||||

Advisers Act | Investment Advisers Act of 1940, as amended | |||||||

Class A Shares | Our Class A Shares, representing Class A common stock of Sculptor Capital Management, Inc., which are publicly traded and listed on the NYSE | |||||||

Class B Shares | Class B Shares of Sculptor Capital Management, Inc., which are not publicly traded, are currently held solely by our executive managing directors and have no economic rights but entitle the holders thereof to one vote per share together with the holders of our Class A Shares | |||||||

CLOs | Collateralized loan obligations | |||||||

the Company, Sculptor Capital, the firm, we, us, our | Refers, unless the context requires otherwise, to the Registrant and its consolidated subsidiaries, including the Sculptor Operating Group | |||||||

Exchange Act | Securities Exchange Act of 1934, as amended | |||||||

executive managing directors | The current executive managing directors of the Company, and, except where the context requires otherwise, also includes certain executive managing directors who are no longer active in our business | |||||||

funds | The multi-strategy funds, dedicated credit funds, including opportunistic credit funds and Institutional Credit Strategies products, real estate funds and other alternative investment vehicles for which we provide asset management services | |||||||

GAAP | U.S. generally accepted accounting principles | |||||||

Group A Units | Refers collectively to one Class A operating group unit in each of the Sculptor Operating Partnerships. Group A Units are limited partner interests held by our executive managing directors | |||||||

Group A-1 Units | Refers collectively to one Class A-1 operating group unit in each of the Sculptor Operating Partnerships. Group A-1 Units are limited partner interests held by our executive managing directors | |||||||

Group B Units | Refers collectively to one Class B operating group unit in each of the Sculptor Operating Partnerships. Group B Units are limited partner interests held by Sculptor Corp | |||||||

Group D Units | Refers collectively to one Class D operating group unit in each of the Sculptor Operating Partnerships. Group D Units are limited partner interests held by our executive managing directors | |||||||

Group E Units | Refers collectively to one Class E operating group unit in each of the Sculptor Operating Partnerships. Group E Units are limited partner interests held by our executive managing directors | |||||||

1

Group P Units | Refers collectively to one Class P operating group unit in each of the Sculptor Operating Partnerships. Group P Units are limited partner interests held by our executive managing directors | |||||||

Institutional Credit Strategies | Our asset management platform that invests in performing credits, including leveraged loans, high-yield bonds, private credit/bespoke financing and investment grade credit via CLOs, aircraft securitizations, collateralized bond obligations, and other customized solutions | |||||||

IPO | Our initial public offering of 3.6 million Class A Shares that occurred in November 2007 | |||||||

NYSE | New York Stock Exchange | |||||||

Partner Equity Units | Refers collectively to the Group A Units, Group E Units and Group P Units | |||||||

| Preferred Units | One Class A cumulative preferred unit in each of the Sculptor Operating Partnerships collectively represents one “Preferred Unit.” Certain of our executive managing directors collectively own 100% of the Preferred Units. Preferred Units issued in 2016 and 2017 are, collectively, referred to as “2016 Preferred Units.” Preferred Units issued in 2019 are referred to as “2019 Preferred Units.” | |||||||

PSUs | Class A performance-based RSUs | |||||||

Recapitalization | Refers to the recapitalization of our business that occurred in February 2019. As part of the Recapitalization, a portion of the interests held by our active and former executive managing directors were reallocated to existing members of senior management. In addition, we restructured the previously outstanding senior debt and Preferred Units | |||||||

Registrant | Sculptor Capital Management, Inc., a Delaware corporation | |||||||

RSUs | Class A restricted share units | |||||||

Sculptor Corp | Sculptor Capital Holding Corporation, a Delaware corporation | |||||||

Sculptor Operating Group | Refers collectively to the Sculptor Operating Partnerships and their consolidated subsidiaries | |||||||

Sculptor Operating Group Units | Refers collectively to Sculptor Operating Group A, B, D, E, and P Units | |||||||

Sculptor Operating Partnerships | Refers collectively to Sculptor Capital LP, Sculptor Capital Advisors LP and Sculptor Capital Advisors II LP | |||||||

Reorganization | The reorganization of our business that took place prior to the IPO | |||||||

SEC | U.S. Securities and Exchange Commission | |||||||

Securities Act | Securities Act of 1933, as amended | |||||||

Special Investments | Investments that we, as investment manager, believe lack a readily ascertainable market value, are illiquid or should be held until the resolution of a special event or circumstance | |||||||

2

Available Information

We file annual, quarterly and current reports, proxy statements and other information required by the Exchange Act with the SEC. We make available free of charge on our website (www.sculptor.com) our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and any amendments to those filings as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. We also use our website to distribute company information, and such information may be deemed material. Accordingly, investors should monitor our website, in addition to our press releases, SEC filings and public conference calls and webcast. The contents of our website are not, however, a part of this report.

Also posted on our website in the “Public Investors—Governance” section are charters for our Audit Committee; Compensation Committee; Nominating, Corporate Governance and Conflicts Committee and Corporate Responsibility and Compliance Committee, as well as our Corporate Governance Guidelines and Code of Business Conduct and Ethics governing our directors, officers and employees. Information on, or accessible through, our website is not a part of, and is not incorporated into, this report or any other SEC filing. Copies of our SEC filings or corporate governance materials are available without charge upon written request to Sculptor Capital Management, Inc., 9 West 57th Street, New York, New York 10019, Attention: Office of the Secretary. Any materials we file with the SEC are also publicly available through the SEC’s website (www.sec.gov).

No statements herein, available on our website or in any of the materials we file with the SEC constitute, or should be viewed as constituting, an offer of any fund.

Forward-Looking Statements

Some of the statements under “Item 1. Business,” “Item 1A. Risk Factors,” “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which we refer to as “MD&A,” “Item 7A. Quantitative and Qualitative Disclosures About Market Risk” and elsewhere in this annual report may contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act that reflect our current views with respect to, among other things, future events and financial performance. We generally identify forward-looking statements by terminology such as “outlook,” “believe,” “expect,” “potential,” “continue,” “may,” “will,” “should,” “could,” “seek,” “approximately,” “predict,” “intend,” “plan,” “estimate,” “anticipate,” “opportunity,” “comfortable,” “assume,” “remain,” “maintain,” “sustain,” “achieve,” “see,” “think,” “position” or the negative version of those words or other comparable words.

Any forward-looking statements contained herein are based upon historical information and on our current plans, estimates and expectations. The inclusion of this or other forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. We caution that forward-looking statements are subject to numerous assumptions, estimates, risks and uncertainties, including but not limited to the following: global economic, business, market and geopolitical conditions; U.S. and foreign regulatory developments relating to, among other things, financial institutions and markets, government oversight, fiscal and tax policy; the outcome of third-party litigation involving us; the consequences of the Foreign Corrupt Practices Act (the “FCPA”) settlements with the SEC and the U.S. Department of Justice (the “DOJ”) and any claims arising therefrom; whether the Company realizes all or any of the anticipated benefits from the Recapitalization and other related transactions; whether the Recapitalization and other related transactions result in any increased or unforeseen costs, indemnification obligations or have an impact on our ability to retain or compete for professional talent or investor capital; conditions impacting the alternative asset management industry; our ability to retain existing investor capital; our ability to successfully compete for fund investors, assets, professional talent and investment opportunities; our ability to retain our active executive managing directors, managing directors and other investment professionals; our successful formulation and execution of our business and growth strategies; our ability to appropriately manage conflicts of interest and tax and other regulatory factors relevant to our business; the anticipated benefits of changing the Registrant’s tax classification from a partnership to a corporation and subsequently converting from a limited liability company to a corporation; and assumptions relating to our operations, investment performance, financial results, financial condition, business prospects, growth strategy and liquidity.

If one or more of these or other risks or uncertainties materialize, or if our assumptions or estimates prove to be incorrect, our actual results may vary materially from those indicated in these statements. These factors are not and should not be

3

construed as exhaustive and should be read in conjunction with the other cautionary statements and risks that are included in our filings with the SEC, including but not limited to those described in “Item 1A. Risk Factors.”

There may be additional risks, uncertainties and factors that we do not currently view as material or that are not known. The forward-looking statements contained in this report are made only as of the date of this report. We do not undertake to update any forward-looking statement because of new information, future developments or otherwise.

4

PART I

Item 1. Business

Business Description

Sculptor Capital, formerly Och-Ziff Capital Management Group Inc., is a leading global institutional alternative asset manager, with approximately $34.5 billion in assets under management as of February 1, 2020. We provide asset management services through our funds, which pursue a broad range of global investment opportunities, and by developing new, carefully considered investment products. We also offer customized solutions within and across our product platforms to help our fund investors meet their investment objectives. Our funds invest across numerous asset classes and geographies, with a breadth we believe is offered by few alternative asset management firms.

Our approach to asset management is based on the same fundamental elements that we have employed since Sculptor Capital was founded in 1994. Our objectives are to create long-term value for our fund investors through a disciplined investment philosophy that focuses on delivering consistent, positive, risk-adjusted returns across market cycles. We currently manage multi-strategy funds, dedicated credit funds, including opportunistic credit funds and Institutional Credit Strategies products, real estate funds and other alternative investment vehicles.

Multi-Strategy - Our multi-strategy funds invest globally in high-conviction investment ideas across asset classes, regions, and investment strategies with a primary focus on idiosyncratic opportunities where return drivers are less sensitive to the direction of broader financial markets. Through detailed fundamental analysis and due diligence, we aim to identify investment opportunities where intermediate or long-term value is obscured by attributes such as complexity, corporate events, technical dislocations, or market misunderstandings. Our multi-strategy funds allocate capital across strategies and geographies opportunistically based on market conditions, with no predetermined capital allocations by strategy or asset class. Our investment strategies include Fundamental Equities, Merger Arbitrage, Corporate Credit, Structured Credit, and Convertible & Derivative Arbitrage and Private Investments.

Credit - Our credit platform comprises both opportunistic credit and Institutional Credit Strategies. Opportunistic credit focuses on global corporate, structured and private credit markets, including investments in distressed businesses, restructurings and bankruptcies. In many cases, we actively enforce creditor rights or pursue other legal strategies in order to favorably affect outcomes. We may also buy undervalued securities following broader market dislocations. Institutional Credit Strategies invests in performing credit via leveraged loans, high yield bonds, private financing and investment-grade credit and serves clients through CLOs, collateralized bond obligations (“CBOs”), commingled products and customized solutions.

Real Estate - Our real estate funds generally make investments in commercial and residential real estate, including real property, multi-property portfolios, real estate-related joint ventures, real estate operating companies and other real estate-related assets. These funds typically seek to preserve capital and mitigate risk by limiting competitive bidding. The real estate funds focus on proprietary sourcing, discretion in deal selection, thorough due diligence, intensive asset management, multiple defined exit strategies and structured downside protection to seek and manage investments.

We have built an experienced investment management team with a well-established presence in the United States, Europe and Asia. As of December 31, 2019, we had 390 employees worldwide, including 112 investment professionals, 23 active executive managing directors and 52 managing directors working from our offices in New York, London, Hong Kong, and Shanghai. Our New York office was established in 1994 and has been operational for over 26 years. Our London office, established in 1998, houses our European investment team. Our Hong Kong office, established in 2001, houses the majority of our Asian investment team. See “—Employees” for additional information on our global headcount.

Name Change

Effective September 12, 2019, we changed our name to Sculptor Capital Management, Inc. Our Class A Shares now trade on the New York Stock Exchange under the symbol “SCU.” Also, effective September 12, 2019, Och-Ziff Holding Corporation changed its name to Sculptor Capital Holding Corporation, and in its capacity as the general partner of the Sculptor

5

Operating Partnerships, changed the names of OZ Management LP, OZ Advisors LP and OZ Advisors II LP to Sculptor Capital LP, Sculptor Capital Advisors LP and Sculptor Capital Advisors II LP, respectively.

Recapitalization

On February 7, 2019, we completed the Recapitalization, which included a series of transactions that involved the reallocation of certain ownership interests in the Sculptor Operating Group to existing members of senior management, a “Distribution Holiday” on interests held by active and former executive managing directors, an amendment to the tax receivable agreement, a “Cash Sweep” to pay down the 2018 Term Loan and 2019 Preferred Units, and various other related transactions. See Note 3 to our consolidated financial statements included in this annual report for additional information.

Reverse Share Split

At the close of trading on January 3, 2019, we effectuated a 1-for-10 reverse share split (the “Reverse Share Split”) of the Class A Shares. As a result of the Reverse Share Split, every ten issued and outstanding Class A Shares were combined into one Class A Share. In addition, corresponding adjustments were made to the Class B Shares, Group A Units, Group B Units, Group D Units, Group P Units, RSUs and PSUs. All prior period share, unit, per share and per unit amounts have been restated to give retroactive effect to the Reverse Share Split.

Corporate Classification Change

The Registrant changed its tax classification from a partnership to a corporation effective April 1, 2019 (the “Corporate Classification Change”), and subsequently converted from a Delaware limited liability company into a Delaware corporation effective May 9, 2019.

Segments Reporting Change

Prior to the fourth quarter of 2019, we had two operating segments: Sculptor Funds and Real Estate. In the fourth quarter of 2019, we combined these into one operating and reportable segment, which is reflective of how the chief operating decision makers review our operating results and make resource allocation decisions.

Our Assets Under Management

Our primary sources of revenues are management fees, which are based on the amount of our assets under management, and incentive income, which is based on the investment performance of our funds. Accordingly, for any given period, our revenues will be driven by the combination of assets under management and the investment performance of our funds. Our assets under management are a function of the capital that is allocated to us by the investors in our funds and the investment performance of our funds. For additional information regarding assets under management, please see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Assets Under Management and Fund Performance.”

Overview of Our Funds

Multi-Strategy

As of December 31, 2019, assets under management in our multi-strategy funds totaled approximately $9.3 billion, or 27% of our total assets under management. These funds seek to consistently generate strong risk-adjusted returns across market cycles while protecting investor capital. We aim to achieve these objectives by investing in high-conviction investment ideas across asset classes, regions and strategies, with a primary focus on opportunities where return drivers are less sensitive to market direction. Sculptor’s investment process combines expert bottom-up fundamental analysis, a dynamic approach to portfolio construction, and a sophisticated and fully integrated risk management effort. The primary investment strategies we employ in our multi-strategy funds include the following:

•Fundamental Equities seeks to generate returns through both long and short positions across global equity markets by employing a deep fundamental research process that draws on resources and knowledge from across the

6

firm. Our primary focus is on event-driven situations involving corporate actions such as spin-offs, restructurings or recapitalizations, and on securities that may be temporarily undervalued due to a technical event or market misunderstanding.

•Structured Credit invests in a wide breadth of structured products, with a primary focus in several credit categories, including residential, and commercial, corporate, and consumer credit, among others. This strategy aims to provide idiosyncratic and highly differentiated returns by pursuing investments that can be realized through active rights enforcement, litigation, liquidation or restructuring.

•Corporate Credit takes an opportunistic approach to corporate credit investing and includes investments in undervalued or dislocated securities and pursuing process-driven investments including investments in complex distressed businesses, restructurings and bankruptcies. We take a fundamental investment approach to identify investments that may be undervalued due to complexity, market inefficiencies or other investors’ lack of scale, capability or mandate to pursue these investments. Our ability to participate in many of these types of investments is a direct function of our presence in the markets, scale, experience and reputation as a counterparty.

•Convertible and Derivative Arbitrage seeks to exploit the price discrepancies between certain convertible bonds and derivative securities and the underlying equity or other security to generate strong, stable and uncorrelated returns. We explore opportunities in traditional convertible arbitrage, mandatory convertible investments, short convertible strategies and relative value opportunities.

•Merger Arbitrage pursues a wide array of event-driven situations, with a broad focus on mergers and acquisitions as well as corporate actions, including exchange offers, unannounced deals, spin-offs, split-offs and hostile cross-border situations with regulatory and geopolitical complexity. Our flexible approach allows us to pursue strategies on a risk-adjusted basis and size them accordingly.

•Private Investments encompasses investments in a variety of special situations that seek to generate value through realizations, strategic sales or initial public offerings.

The Sculptor Master Fund, our global multi-strategy fund, opportunistically allocates capital to investments in North America, Europe and Asia, with flexibility to cast a wide net and source attractive investments. The key limitations we consider when selecting and sizing investments are related to our fundamental and quantitative view on the risk/reward, liquidity and availability of the specific investment under evaluation. Sculptor Master Fund generally employs every strategy and geography in which our funds invest and constituted approximately 25% of our assets under management as of December 31, 2019. The investment performance for our other funds may vary from those of the Sculptor Master Fund, and that variance may be material.

The table below sets forth, as of December 31, 2019, the net annualized return, volatility and Sharpe Ratio of the Sculptor Master Fund, the Sculptor Multi-Strategy Composite (as defined below), the S&P 500 Index and the MSCI World Index. This table is provided for illustrative purposes only. The performance reflected in the table below is not necessarily indicative of the future results of the Sculptor Master Fund. There can be no assurance that any fund will achieve comparable results. An investment in our Class A Shares is not an investment in any of our funds. See “Item 1A. Risk Factors—Risks Related to Our Business—An investment in our Class A Shares is not an alternative to an investment in any of our funds, and the returns of our funds should not be considered as indicative of any returns expected on our Class A Shares, although poor investment performance of, or lack of capital flows into, the funds we manage could have a materially adverse impact on our revenues and, therefore, the returns on our Class A Shares.”

7

Past performance is no indication or guarantee of future results.

| Net Annualized Return through December 31, 2019 | 1 Year | 3 Years | 5 Years | Since Sculptor Master Fund Inception (January 1, 1998) | Since Sculptor Multi-Strategy Composite Inception (April 1, 1994) | |||||||||||||||||||||||||||

Sculptor Master Fund Composite(1) | 14.8% | 7.5% | 5.2% | 8.6% | n/a | |||||||||||||||||||||||||||

Sculptor Multi-Strategy Composite(2) | 14.8% | 7.5% | 5.2% | 8.6% | 11.3% | |||||||||||||||||||||||||||

S&P 500 Index(3) | 31.5% | 15.3% | 11.7% | 7.6% | 10.1% | |||||||||||||||||||||||||||

MSCI World Index(3) | 28.1% | 12.4% | 9.9% | 6.5% | 7.9% | |||||||||||||||||||||||||||

Volatility - Standard Deviation (Annualized)(4) | ||||||||||||||||||||||||||||||||

Sculptor Master Fund Composite(1) | 6.7% | 5.7% | 5.6% | 5.1% | n/a | |||||||||||||||||||||||||||

Sculptor Multi-Strategy Composite(2) | 6.7% | 5.7% | 5.6% | 5.1% | 5.5% | |||||||||||||||||||||||||||

S&P 500 Index(3) | 12.9% | 12.1% | 12.0% | 14.8% | 14.4% | |||||||||||||||||||||||||||

MSCI World Index(3) | 11.6% | 10.7% | 11.1% | 14.0% | 13.5% | |||||||||||||||||||||||||||

Sharpe Ratio(5) | ||||||||||||||||||||||||||||||||

Sculptor Master Fund Composite(1) | 1.87 | 0.99 | 0.70 | 1.23 | n/a | |||||||||||||||||||||||||||

Sculptor Multi-Strategy Composite(2) | 1.87 | 0.99 | 0.70 | 1.23 | 1.56 | |||||||||||||||||||||||||||

S&P 500 Index(3) | 2.27 | 1.11 | 0.87 | 0.36 | 0.51 | |||||||||||||||||||||||||||

MSCI World Index(3) | 2.22 | 0.99 | 0.77 | 0.30 | 0.38 | |||||||||||||||||||||||||||

_______________

(1)The returns shown represent the composite performance of all feeder funds that comprise the Sculptor Master Fund since the inception of the Sculptor Master Fund on January 1, 1998 (collectively, the “Sculptor Master Fund Composite”). The Sculptor Master Fund Composite is calculated using the total return of all feeder funds net of all fees and expenses, except incentive income on Special Investments that could reduce returns on these investments at the time of realization, and includes the reinvestment of all dividends and other income. Performance includes realized and unrealized gains and losses attributable to Special Investments and initial public offering investments that are not allocated to all investors in the feeder funds. Investors that were not allocated Special Investments and/or initial public offering investments may experience materially different returns. The Sculptor Master Fund Composite is not available for direct investment.

(2)The Sculptor Multi-Strategy Composite is provided as supplemental information to the Sculptor Master Fund Composite. The Sculptor Multi-Strategy Composite represents the composite performance of all accounts that were managed in accordance with our broad multi-strategy mandate that were not subject to portfolio investment restrictions or other factors that limited our investment discretion since our inception on April 1, 1994. Performance is calculated using the total return of all such accounts net of all investment fees and expenses of such accounts, except incentive income on unrealized gains attributable to Special Investments that could reduce returns in these investments at the time of realization, and the returns include the reinvestment of all dividends and other income. For the period from April 1, 1994 through December 31, 1997, the returns are gross of certain overhead expenses that were reimbursed by the accounts. Such reimbursement arrangements were terminated at the inception of the Sculptor Master Fund on January 1, 1998. The size of the accounts comprising the composite during the time period shown vary materially. Such differences impacted our investment decisions and the diversity of the investment strategies we followed. Furthermore, the composition of the investment strategies we follow is subject to our discretion and has varied materially since inception and is expected to vary materially in the future.

(3)These comparisons show the returns of the S&P 500 Index (SPTR) and the MSCI World Index (GDDLWI) (collectively, the “Broader Market Indices”) against the Sculptor Master Fund Composite and the Sculptor Multi-Strategy Composite. These comparisons are intended solely for illustrative purposes to show a historical comparison of the Sculptor Master Fund Composite and the Sculptor Multi-Strategy Composite to the broader equity markets, as represented by the Broader Market Indices, and should not be considered as an indication of how the Sculptor Master Fund or the feeder funds will perform relative to the Broader Market Indices in the future. The Broader Market Indices are not performance benchmarks of the Sculptor Master Fund or the feeder funds. Neither the Sculptor Master Fund nor the feeder funds are managed to correlate in any way with the returns or composition of the Broader Market Indices, which are unmanaged. It is not possible to invest in an unmanaged index. You should not assume that there is any material overlap between the securities underlying the Sculptor Master Fund Composite or the Sculptor Multi-Strategy Composite and those that comprise the Broader Market Indices. The S&P 500 Index is an equity index owned and maintained by Standard & Poor’s, a division of McGraw-Hill, whose value is calculated as the free float-weighted average of the share prices of 500 large-capitalization corporations listed on the NYSE and NASDAQ. The MSCI World Index is a free float-adjusted market capitalization weighted index owned and maintained by MSCI Inc. that is designed to measure the equity market performance of developed markets. Returns of the Broader Market Indices have not been reduced by fees and expenses associated with investing in securities and include the reinvestment of dividends.

(4)Standard Deviation is a statistical measure of volatility that measures the fluctuation of the monthly rates of return against the average return.

(5)Sharpe Ratio represents a measure of the risk-adjusted return of the composite returns, or benchmark returns, as applicable. The Sharpe Ratio is calculated by subtracting the risk-free rate from the composite returns, or benchmark returns, as applicable, and dividing that amount by the standard deviation of the applicable returns. The risk-free rate of return used in computing the Sharpe Ratio is the one-month U.S. dollar London Interbank Offered Rate compounded monthly throughout the periods presented.

8

Credit

As of December 31, 2019, we managed approximately $21.7 billion of assets under management in our dedicated credit funds, or 63% of our total assets under management. Our dedicated credit funds comprise our opportunistic credit funds and Institutional Credit Strategies products.

Opportunistic Credit Funds

As of December 31, 2019, we managed approximately $6.0 billion of assets under management in our opportunistic credit funds. These products seek to generate risk-adjusted returns by capturing value in mispriced investments across disrupted, dislocated and distressed corporate, structured and private credit markets globally. As of December 31, 2019, assets under management in the Sculptor Credit Opportunities Master Fund, our global opportunistic credit fund, totaled $1.6 billion. The remainder of the assets under management in our opportunistic credit products was made up of various open-end and closed-end funds, as well as customized solutions structured to meet our fund investors’ needs.

Institutional Credit Strategies

As of December 31, 2019, we managed approximately $15.7 billion of assets under management in our Institutional Credit Strategies products. Institutional Credit Strategies is our platform that invests in performing credit via leveraged loans, high yield bonds, private financing and investment-grade credit and serves clients through CLOs, CBOs, commingled products and customized solutions.

Real Estate

As of December 31, 2019, we managed approximately $3.4 billion of assets under management in our real estate funds, or 10% of our total assets under management. Our real estate funds employ a situation-specific, opportunistic investment strategy, combined with a disciplined risk assessment process. These funds seek to diversify investments across geography, asset types and transaction structures to actively balance the portfolios within each of the funds.

Investment and Risk Management Process

Our extensive experience and consistent approach to investing and risk management are an essential part of our strong performance history. Risk management is highly integrated with our investment process and the operations of our business. Our investment and risk management processes benefit from our dedicated and experienced teams operating out of our offices worldwide.

Our approach to investing and managing risk is defined by certain common elements:

•Proactive risk management is built on the principles of constant vigilance, frequent dialog, and continuous improvement. We constantly monitor risk and have instituted a formal and consistent process to disseminate information, conduct informed debate, and take proactive or responsive action across our portfolios. Technology is at the core of Sculptor’s risk management efforts, and we leverage our broad capabilities to develop proprietary solutions that fit the exact specifications of our investment approach. In addition to our formalized process, we conduct custom studies and optimizations for various groups on an as-needed, ad hoc basis such as bespoke hedge solutions, pre-trade what-if analysis, and portfolio rebalance alternatives.

•Preservation of capital. Preservation of capital is our top priority and guiding factor in our effort to deliver attractive returns to fund investors. Our goal is to preserve capital during periods of market decline and generate competitive investment performance in rising markets. We use sophisticated risk tools and active portfolio management to govern exposures to market and other risk factors. We adhere strictly to each fund’s mandate and provisions with respect to leverage. We are knowledgeable about the risks of fund leverage, respectful of its limits, and judicious in our application.

9

•Dynamic capital allocation. We allocate to individual investments based on a thorough analysis of the risk/reward for each opportunity under consideration and the investment objectives for each of our funds. This results in an overall capital allocation that is constantly fine-tuned based on our best ideas at each point in time.

•Expertise across strategies and geographies. The considerable expertise, tenure and collaboration among our diverse interdisciplinary investment team forms the basis of our ability to generate attractive risk-adjusted returns for our fund investors. We have fostered a culture that allows us to analyze and scrutinize investment opportunities on a firm-wide basis, focusing on the best ideas and opportunities available.

Our Fund Investors

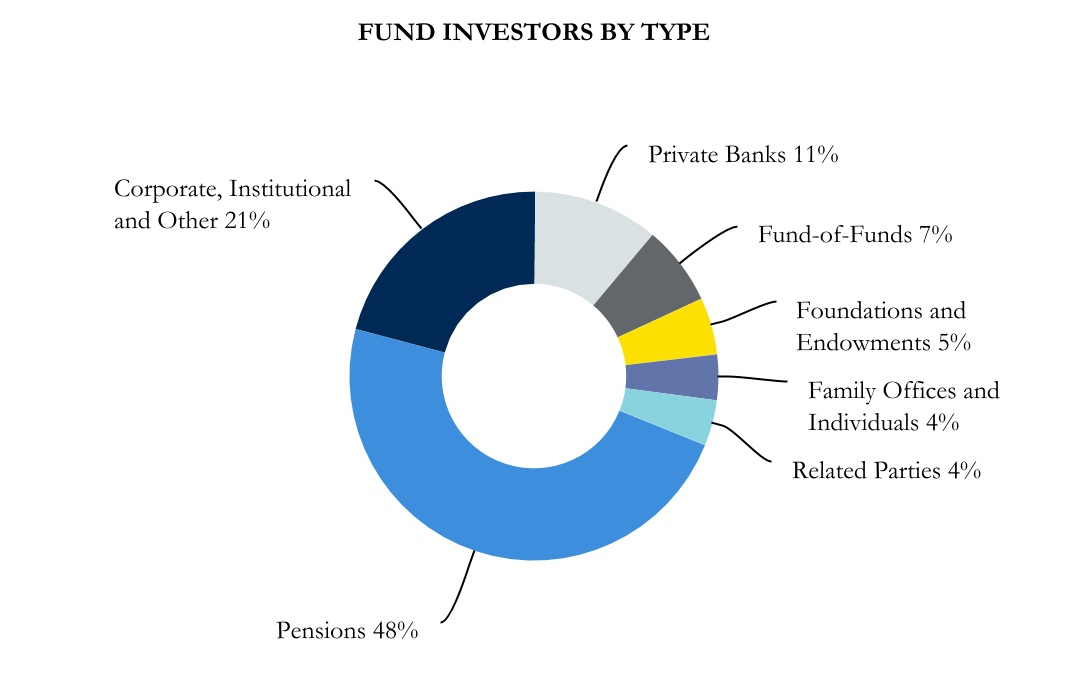

We focus on developing and maintaining long-term relationships with a global base of institutional investors, which includes many of the largest, most sophisticated investors in the world. Excluding our securitization vehicles within Institutional Credit Strategies products, we currently have over 1,000 investors in our funds, including pension funds, private banks, corporates and other institutions, fund-of-funds, foundations and endowments, and family offices and individuals. Our investors value our funds’ consistent performance history, our global investing expertise, our diverse investment strategies and our ability to develop investment capabilities in areas where we see opportunities evolve. As a result, a number of our fund investors invest in more than one of our funds.

Investments by our executive managing directors and employees collectively comprised approximately 4% of our total assets under management as of January 1, 2020. The single largest unaffiliated investor in our funds accounted for approximately 17% of our total assets under management as of January 1, 2020, and the top five unaffiliated fund investors accounted for approximately 39%. Approximately 28% of our assets under management were from investors from outside North America as of January 1, 2020. These percentages, as well as those presented in the chart below, exclude assets under management in our securitization vehicles , which are held by various types of investors.

10

The following chart presents the composition of our fund investors by type across our funds as of January 1, 2020:

Competitive Environment

The asset management industry is intensely competitive, and we expect that it will remain so. We compete globally and regionally with other investment managers, including hedge funds, public and private investment firms, distressed debt funds, mezzanine funds and other CLO issuers, real estate development companies, business development companies, investment banks and other financial institutions worldwide. We compete for both investors in our funds and attractive investment opportunities based on a number of factors, including investment performance, brand recognition, business reputation, pricing, innovation, the quality of services we provide to the investors in our funds, the range of products we offer, and our ability to attract and retain qualified professionals in all aspects of our business while managing our operating costs. We face competitors that are larger than we are and have greater financial, technical and marketing resources. Certain of our competitors may continue to raise capital to pursue investment strategies that may be similar to ours, which may create additional competition for investment opportunities. In addition, some of these competitors may have higher risk tolerances or make different risk assessments than we do, or may have lower return thresholds, allowing them to consider a wider variety of investments and establish broader networks of business relationships. They may also be subject to different regulatory requirements, which may give them greater flexibility to pursue investment opportunities or attract new capital to their funds. For additional information regarding the competitive risks that we face, see “Item 1A. Risk Factors—Risks Related to Our Business—Competitive pressures in the asset management business could materially adversely affect our business, financial condition or results of operations.”

Competitive Strengths

Sculptor Capital is built on certain distinct fundamental elements that we believe are differentiating competitive strengths. We view these elements as a crucial part of our efforts to generate attractive and consistent long-term investment performance and to retain and attract new assets under management.

•Alignment of interests. Sculptor’s structure is designed to align the interests of our executive managing directors and employees with those of investors in our funds and our Class A Shareholders. Our 23 active executive managing directors and 52 managing directors (as of December 31, 2019) have a compensation structure that focuses on both individual and firm-wide performance. This structure includes granting a portion of any bonus compensation in a combination of equity and/or deferred cash interests that vest over time.

11

•One-firm philosophy. Our “one-firm” philosophy promotes a collaborative environment that encourages internal cooperation and cross-functional sharing of information, expertise and transaction experience gained over our 25-year history. We believe this strong collaborative approach is a key differentiator that enhances the success of our firm as a whole.

•Synergies among investment strategies. Our investment model is built off and benefits from full collaboration among our investment team, fostering trust, diverse viewpoints, cross-disciplinary development and critical self-examination. We believe this approach is a central factor in our ability to identify, evaluate and pursue opportunities across a broad range of geographies and capital structures.

•Global presence. We are a global organization with an investment philosophy that opportunistically pursues “best ideas” investment opportunities wherever they arise. Our ability to invest worldwide allows us to evaluate the fullest range of investments by employing both on-the-ground expertise and the support of our global team and infrastructure. Our investment professionals in the US, Europe and Asia are seamlessly integrated with the global team and have a long history of investing on an international scale.

•Experience. Sculptor’s one-firm philosophy and collaborative investment style is enabled by the long tenure and shared experience of our investment and executive teams. We have a history of hiring highly talented employees and developing them into senior roles as managing directors and executive managing directors across the firm.

•Focus on infrastructure. Since inception, Sculptor has been highly committed to building and maintaining a robust infrastructure with an emphasis on strong financial, operational and compliance controls. As of December 31, 2019, of the firm’s 75 active executive managing directors and managing directors, 22 are dedicated to our global infrastructure, illustrating our commitment to this important part of our business. As a public company, we are required to identify and document key processes and controls, which are subject to independent review.

•Transparency. We believe that our fund investors should be provided with qualitative and quantitative information about our investment process, operational procedures and portfolio exposures in order to fully understand and evaluate their partnership with Sculptor. We provide fund investors with comprehensive and transparent reporting on a regular basis, and our senior management and investment staff regularly meet with investors to provide updates and address questions.

Our Structure

Sculptor Capital Management, Inc.

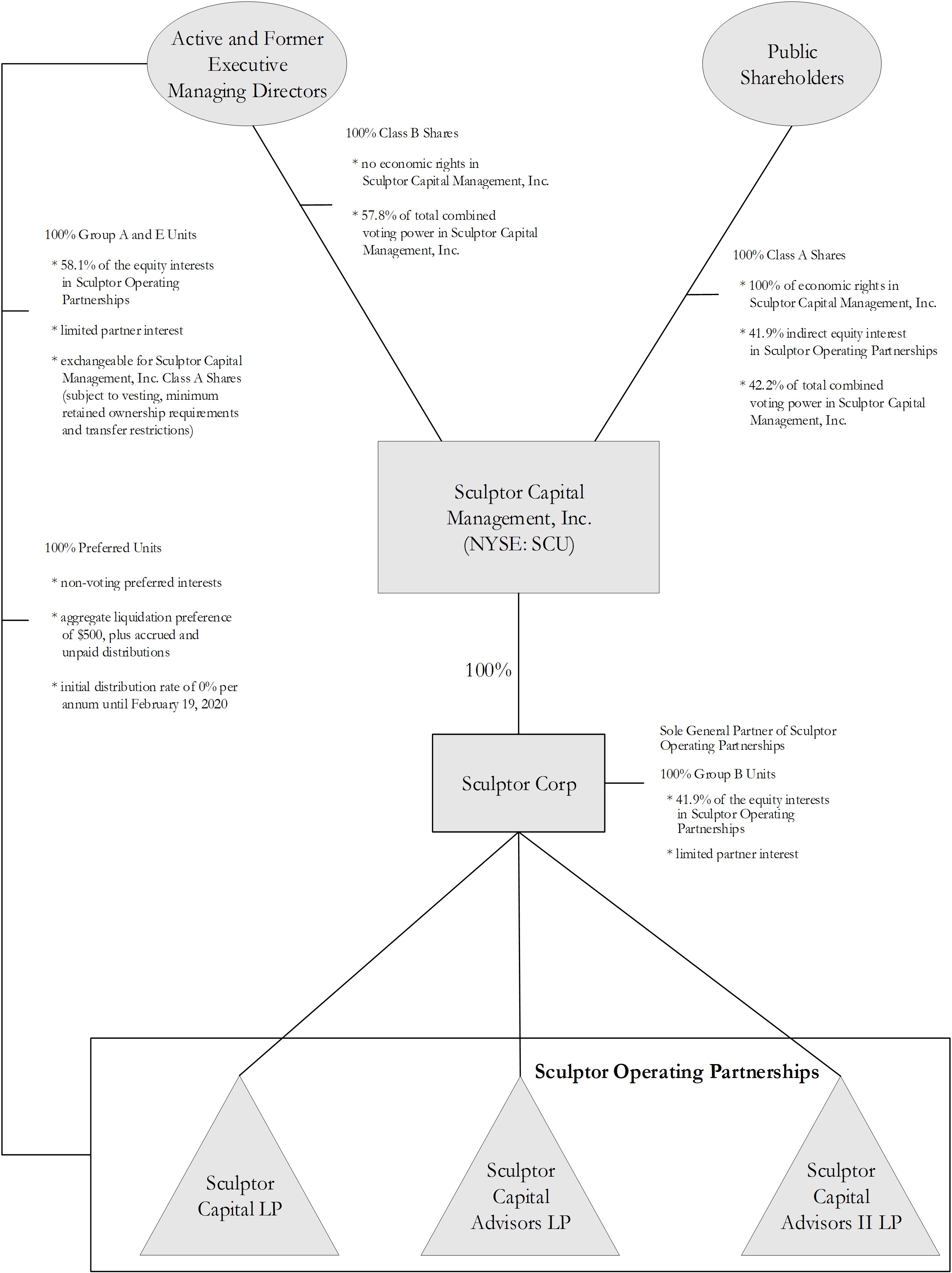

Sculptor Capital Management, Inc. is a publicly traded holding company, and its primary assets are ownership interests in the Sculptor Operating Group entities, which are held indirectly through Sculptor Corp. We conduct our business through the Sculptor Operating Group. Sculptor Capital Management, Inc. currently has two classes of shares outstanding: Class A Shares and Class B Shares.

Class A Shares. Class A Shares represent Class A common stock in Sculptor Capital Management, Inc. The holders of Class A Shares are entitled to one vote per share held of record on all matters submitted to a vote of our shareholders and, as of December 31, 2019, represent 42.2% of our total combined voting power. The holders of Class A Shares are entitled to any distribution declared by our Board of Directors, subject to any statutory or contractual restrictions on the payment of distributions and to any restrictions on the payment of distributions imposed by the terms of any outstanding preferred shares we may issue in the future. Additional Class A Shares are issuable upon exchange of Partner Equity Units, subject to certain vesting and other conditions as discussed below, and upon vesting of equity awards granted under our Amended and Restated 2007 Equity Incentive Plan or 2013 Incentive Plan.

Class B Shares. Class B Shares have no economic rights and are not publicly traded, but rather entitle the holders of record to one vote per share on all matters submitted to a vote of our shareholders and, as of December 31, 2019, the Class B Shares represent 57.8% of our total combined voting power. The Class B Shares are held solely by current and former executive managing directors and provide them with a voting interest in Sculptor Capital Management, Inc. commensurate with their

12

economic interest in the Sculptor Operating Group in the form of Group A Units, Group A-1 Units (until a corresponding number of Group E Units have vested), Group E Units (once such Group E Units have vested) and Group P Units (assuming such Group P Units are participating). Each executive managing director holding Group A Units, Group A-1 Units (until a corresponding number of Group E Units have vested), vested Group E Units or Group P Units holds an equal number of Class B Shares. Upon an issuance of Group A Units or Group P Units to an executive managing director or the vesting of such executive managing director’s Group E Units, an equal number of Class B Shares is also issued to such executive managing director. Upon the exchange by an executive managing director of a Partner Equity Unit for a Class A Share as further discussed below, the corresponding Class B Share is canceled.

Prior to May 29, 2019, (“the Transition Date”), holders of the Class B Shares granted an irrevocable proxy to vote all of their Class B Shares to the Class B Shareholder Committee, the sole member of which was Mr. Och. As a result, Mr. Och was able to control all matters requiring the approval of our shareholders. Following the Transition Date, each Class B Shareholder is entitled to one vote per share held of record on all matters submitted to a vote of our shareholders except that Class B Shares that relate to our Group A-1 Units will be voted pro rata in accordance with the vote of the Class A Shares held by non-affiliates until a corresponding Group E Unit has vested.

Sculptor Operating Group Entities

We conduct our business through the Sculptor Operating Group. Historically, we have used more than one Sculptor Operating Group entity to segregate our operations for business, financial, tax and other reasons. We may increase or decrease the number of our Sculptor Operating Group entities and intermediate holding companies based on our views as to the appropriate balance between administrative convenience and business, financial, tax and other considerations.

The Sculptor Operating Group currently consists of Sculptor Capital LP, Sculptor Capital Advisors LP and Sculptor Capital Advisors II LP, and each of their consolidated subsidiaries (collectively, the “Sculptor Operating Partnerships” and collectively with their consolidated subsidiaries, the “Sculptor Operating Group”). Sculptor Capital Management, Inc. holds its interests in the Sculptor Operating Group indirectly through Sculptor Capital Holding Corporation (“Sculptor Corp”), a wholly owned subsidiary of Sculptor Capital Management, Inc. Sculptor Corp is the sole general partner of each of the Sculptor Operating Partnerships and, therefore, generally controls the business and affairs of such entities. The Sculptor Operating Group currently has the following units outstanding: Group A Units, Group A-1 Units, Group B Units, Group E Units, Group P Units and Preferred Units.

As of December 31, 2019, the Preferred Units had an aggregate liquidation preference of $500 per Preferred Unit, plus accrued and unpaid distributions. After the Preferred Units liquidation preference is satisfied, the Group A Units and Group B Units have no preference or priority over other securities of the Sculptor Operating Group (other than the Group E Units and Group P Units to the extent described below) and, upon liquidation, dissolution or winding up, will be entitled to any assets remaining after payment of all debts and liabilities of the Sculptor Operating Group.

Group A Units. Our current and former executive managing directors own 100% of the Group A Units, which as of December 31, 2019, represent a 31.6% equity interest in the Sculptor Operating Group. Currently, Group A Units are exchangeable for our Class A Shares at the discretion of the Exchange Committee (which consists of the Chief Executive Officer and the Chief Financial Officer of Sculptor Capital Management, Inc.) (or the cash equivalent thereof), on a one-for-one basis, subject to vesting requirements by our executive managing directors, book-up requirements, transfer restrictions and certain exchange rate adjustments for splits, unit distributions and reclassifications. Beginning on the final day of the Distribution Holiday, each of our executive managing directors may exchange his or her vested and booked-up Group A Units over a period of two years in three equal installments commencing upon the final day of the Distribution Holiday and on each of the first and second anniversary thereof (or, for units that become vested and booked-up Group A Units after the final day of the Distribution Holiday, from the later of the date on which they would have been exchangeable in accordance with the foregoing and the date on which they become vested and booked-up Group A Units) (and thereafter such units will remain exchangeable), in each case, subject to certain restrictions (including, among other things, in connection with the Company’s insider trading policy in respect of affiliate holders and in certain circumstances where the exchange would be likely to impact the Company’s ability to use net operating losses). On the date of the Recapitalization, each Group A Unit then outstanding was recapitalized into 0.65 Group A Units and 0.35 Group A-1 Units. Further, as part of the Recapitalization, holders of Group A Units do not receive distributions

13

during the Distribution Holiday. See Note 3 to our consolidated financial statements included in this report for additional information.

Group A-1 Units. Group A-1 Units are interests into which 0.35 of each Group A Unit then outstanding was recapitalized in connection with the Recapitalization. The Group A-1 Units will be canceled at such time and to the extent that the Group E Units granted in connection with the Recapitalization and associated with such Group A-1 Units vest and achieve a book-up. Group A-1 Units are not eligible to receive distributions at any time. However, the holders of Group A-1 Units shall participate in any sale, change of control or other liquidity event. In the Recapitalization, the holders of the 2016 Preferred Units forfeited 749,813 Group A Units, which were also recapitalized into Group A-1 Units.

Group B Units. Sculptor Corp holds a general partner interest and Group B Units in each Sculptor Operating Partnership that it controls. Sculptor Corp owns 100% of the Group B Units, which, as of December 31, 2019, represent a 41.9% equity interest in the Sculptor Operating Group. Except during the Distribution Holiday, the Group B Units are economically identical to the Group A Units and represent common equity interests in our business, but are not exchangeable for Class A Shares and are not subject to vesting, forfeiture or minimum retained ownership requirements.

Group D Units. Prior to the Recapitalization, Group D Units were issued to certain current and former executive managing directors. Group D Units were non-equity, limited partner profits interests that were only entitled to share in residual assets upon liquidation, dissolution or winding up, and would become eligible to participate in any exchange right or tag along right in a change of control transaction or other liquidity event to the extent that there had been a threshold amount of appreciation. The Group D Units converted into Group A Units to the extent they had become economically equivalent to Group A Units. All Group D Units converted to Group E Units in connection with the Recapitalization.

Group E Units. Group E Units are limited partner profits interests issued to certain executive managing directors that are only entitled to future profits and gains. Each Group E Unit converts into a Group A Unit and becomes exchangeable for one Class A Share (or the cash equivalent thereof) to the extent there has been a sufficient amount of appreciation for a Group E Unit to achieve a book-up target and, subject to other conditions contained in the limited partnership agreements of the Sculptor Operating Partnerships, the Distribution Holiday has ended (or an earlier exchange date is established by the Exchange Committee). The Group E Units are entitled to share in residual assets upon liquidation, dissolution or winding up and become eligible to participate in any tag along right, in a change of control transaction or other liquidity event only to the extent of their relative positive capital accounts (if any). One Class B Share will be issued to each holder of Group E Units upon the vesting of each such holder’s Group E Unit, at which time a corresponding number of Class B Shares held by holders of Group A-1 Units will be canceled. The general partner of the Sculptor Operating Partnerships may conditionally issue additional Group E Units to active executive managing directors, in an aggregate number not to exceed the amount described in the Sculptor Operating Partnerships’ limited partnership agreements. The Group E Units convert into Group A Units to the extent they have become economically equivalent to Group A Units. As part of the Recapitalization, holders of Group E Units do not receive distributions during the Distribution Holiday. See Note 3 to our consolidated financial statements included in this report for additional information.

Group P Units. On March 1, 2017, we issued Group P Units to certain executive managing directors. Group P Units entitle holders to receive distributions of future profits of the Sculptor Operating Group, and each Group P Unit becomes exchangeable for one Class A Share (or the cash equivalent thereof), in each case upon satisfaction of certain service and performance conditions at such time and, with respect to exchanges, to the extent there has been sufficient appreciation for a Group P Unit to achieve a book-up target and, subject to other conditions contained in the limited partnership agreements of the Sculptor Operating Partnerships, the Distribution Holiday has ended (or an earlier exchange date is established by the Exchange Committee). The Group P Units are entitled to share in residual assets upon liquidation, dissolution or winding up and become eligible to participate in any tag along right, in a change of control transaction or other liquidity event only to the extent that certain performance conditions are met and to the extent of their relative positive capital accounts (if any). The terms of the Group P Units may be varied for certain executive managing directors. See Note 14 to our consolidated financial statements included in this report for additional information regarding the terms of the Group P Units.

Preferred Units. Preferred Units represent ownership interests in each of the Sculptor Operating Partnerships and are held by certain current and former executive managing directors (the “EMD Purchasers”). Preferred Units are a class of non-voting preferred equity interests in the Sculptor Operating Group entities with an aggregate liquidation preference of $500, plus

14

accrued and unpaid distributions. See Note 10 to our consolidated financial statements included in this report for additional information regarding the terms of the Preferred Units. As part of the Recapitalization, the 2016 Preferred Units were restructured into Debt Securities and 2019 Preferred Units.

Restricted Share Units

We grant RSUs as a form of compensation to our employees and executive managing directors. An RSU entitles the holder to receive a Class A Share, or cash equal to the fair value of a Class A Share at the election of the Board of Directors, upon completion of the requisite service period. All of the RSUs granted to date accrue dividend equivalents equal to the dividend amounts paid on our Class A Shares. To date, these dividend equivalents have been awarded in the form of additional RSUs that also accrue additional dividend equivalents. Delivery of dividend equivalents on outstanding RSUs is contingent upon the vesting of the underlying RSUs. As part of the Recapitalization, certain RSUs held by directors and certain executive managing directors are limited in the amount of dividend equivalents they may receive during the Distribution Holiday. See Note 3 to our consolidated financial statements included in this report for additional information.

In 2018, we began granting PSUs. A PSU entitles the holder to receive a Class A Share, or cash equal to the fair value of a Class A Share at the election of the Board of Directors, upon completion of the requisite service period, as well as satisfying certain performance conditions based on achievement of targeted total shareholder return on Class A Shares. PSUs do not begin to accrue dividend equivalents until the requisite service period has been completed and performance conditions have been achieved.

See Note 14 to our consolidated financial statements included in this report for additional information regarding RSUs and PSUs.

15

The diagram below depicts our organizational structure as of December 31, 2019:

16

This diagram does not give effect to 4,154,388 Class A restricted share units, or “RSUs,” that were outstanding as of December 31, 2019, and were granted to our executive managing directors, managing directors, other employees and the independent members of our Board of Directors. Also not presented in the diagram above are Group P Units and PSUs issued and held by our executive managing directors. The Group P Units and PSUs are not participating in the economics of Sculptor Operating Group, as the applicable Service Condition and Performance Condition (as defined in Note 14 to our consolidated financial statements) have not yet been met as of December 31, 2019. Further, not presented in the diagram above are Class C Non-Equity Interests, which are non-equity interests in the Sculptor Operating Group entities held by our executive managing directors. No holder of Class C Non-Equity Interests will have any right to receive distributions on such interests. Our executive managing directors hold all of the Class C Non-Equity Interests, which may be used for discretionary income allocations, including the cash element of any discretionary annual performance awards paid to our executive managing directors. References to bonuses throughout this annual report include any Class C Non-Equity Interests distributions.

Employees

As of December 31, 2019, our worldwide headcount was 390 (including 46 in the United Kingdom and 20 in Asia), with 112 investment professionals (including 25 in the United Kingdom and 9 in Asia). As of this date, we had 23 active executive managing directors and 52 managing directors.

Regulatory Matters

Our business is subject to extensive regulation, including periodic examinations and regulatory investigations, by governmental and self-regulatory organizations in the jurisdictions in which we operate around the world. Since 1999, we have been registered with the SEC as an investment adviser under the Advisers Act. We are also a company subject to the registration and reporting provisions of the Exchange Act, and therefore subject to regulation and oversight by the SEC. As a company with a class of securities listed on the NYSE, we are subject to the rules and regulations of the NYSE. In addition among other rules and regulations, we are subject to regulation by the Department of Labor under the U.S. Employee Retirement Income Security Act of 1974, which we refer to as “ERISA.” As a registered commodity pool operator and a registered commodity trading advisor, we are subject to regulation and oversight by the Commodity Futures Trading Commission, which we refer to as the “CFTC.” We are also subject to regulation and oversight by the National Futures Association in the U.S., as well as other regulatory bodies.

Our European and Asian operations, and our investment activities around the globe, are subject to a variety of regulatory regimes that vary country by country, including the U.K. Financial Conduct Authority, and the Securities and Futures Commission in Hong Kong. Currently, governmental authorities in the United States and in the other countries in which we operate have proposed additional disclosure requirements and regulation of hedge funds and other alternative asset managers.

See “Item 1A. Risk Factors—Risks Related to Our Business—Extensive regulation of our business affects our activities and creates the potential for significant liabilities and penalties. Our reputation, business, financial condition or results of operations could be materially affected by regulatory issues,” “—Increased regulatory focus in the United States could result in additional burdens on our business” and “—Regulatory changes in jurisdictions outside the United States could adversely affect our business.”

Global Compliance Program

We have implemented a global compliance program to address the legal and regulatory requirements that apply to our company-wide operations. We have structured our global compliance program to address the requirements of each of our regulators, as described above, as well as the requirements necessary to support our global securities, commodities and loan trading operations.

Our compliance program includes comprehensive policies and supervisory procedures that have been designed and implemented to monitor compliance with these requirements. All employees attend mandatory annual compliance training to remain informed of our policies and procedures related to matters such as the handling of material non-public information, conflicts of interest and employee securities trading. Annual training specifically targeted at ensuring the understanding of and compliance with the FCPA and, as applicable, other foreign anti-corruption laws and regulations is mandatory for employees and executives responsible for structuring, supervising, ensuring compliance of and executing accounting functions for private deals,

17

as well as for employees who interact with or provide reporting to investors. In addition to a robust internal compliance framework, we have strong relationships with a global network of local attorneys specializing in compliance matters to help us quickly identify regulatory changes and address compliance issues as they arise.

Information about our Executive Officers

Set forth below is certain information regarding our executive officers as of the date of this filing.

Robert Shafir, 61, is the Chief Executive Officer of Sculptor Capital and a member of Sculptor Capital’s Partner Management Committee. He is also an Executive Managing Director and a member of the Board of Directors. Prior to joining Sculptor Capital in 2018, Mr. Shafir served in various capacities at Credit Suisse Group AG from 2007 to 2016. Most recently, he served as Chairman and CEO of Credit Suisse Americas and Co-Head of Private Banking & Wealth Management, which included oversight of Asset Management. He was a member of the Executive Board of Credit Suisse Group and Credit Suisse. Prior to joining Credit Suisse, in August 2007, Mr. Shafir worked at Lehman Brothers for 17 years, serving as Head of Global Equities, as well as a member of their Executive Board. He also held other senior roles, including Head of European Equities and Global Head of Equities Trading, and played a key role in building Lehman’s equities business into a global, institutionally-focused franchise. Prior to that, he worked at Morgan Stanley in the preferred stock business within the fixed income division. Mr. Shafir received a B.A. in Economics from Lafayette College and an M.B.A. from Columbia Business School.

Thomas M. Sipp, 49, is the Chief Financial Officer of Sculptor Capital. He is also an Executive Managing Director and a member of the Company’s Partner Management Committee. In his role, Mr. Sipp oversees all aspects of Accounting, Tax, Treasury, Financial Operations, Internal Audit and Shareholder Services at Sculptor Capital. Prior to joining Sculptor Capital in 2018, Mr. Sipp was a Managing Partner at Magis Partners. During the prior eight years, Mr. Sipp held several senior executive positions at Credit Suisse, including Chief Financial Officer and Chief Operating Officer for Credit Suisse’s Asset Management division and Global Chief Operating Officer for Credit Suisse’s Wealth & Asset Management division. Prior to joining Credit Suisse, Mr. Sipp served as the COO for the Institutional Investment Division of Fidelity Investments. He also spent eight years with Gartmore Global Investments, serving as the Chief Financial Officer, Head of Product Development and COO for the Investment Division. Mr. Sipp received a B.A. in Finance from Alfred University and an M.B.A from the University of Pittsburgh. He has earned the Chartered Financial Analyst designation and is on the Board of Fiduciary Exchange.

James S. Levin, 37, is Chief Investment Officer for Sculptor Capital. He is also an Executive Managing Director and a member of the Company’s Partner Management Committee. Mr. Levin is also an Executive Managing Director and a member of the Portfolio Committee. Prior to joining Sculptor Capital in 2006, Mr. Levin was an Associate at Dune Capital Management LP. Prior to that, Mr. Levin was an analyst at Sagamore Hill Capital Management, L.P. Mr. Levin holds a B.A. in Computer Science from Harvard University.

Wayne Cohen, 45, is President and Chief Operating Officer for Sculptor Capital. He is also an Executive Managing Director and member of the Company’s Partner Management Committee. In this role, Mr. Cohen has a broad scope of responsibilities managing day-to-day operations of Sculptor Capital, including overseeing non-investment functions and leading strategic initiatives. Mr. Cohen joined the Firm in 2005 working as an Attorney and General Counsel. Prior to joining Sculptor Capital, he was an Attorney at Schulte Roth & Zabel LLP. Mr. Cohen holds a B.A. in International Relations from Tulane University and a J.D. from New York University School of Law.

David M. Levine, 52, is Chief Legal Officer for Sculptor Capital. He is also an Executive Managing Director and a member of the Company’s Partner Management Committee. In this role, Mr. Levine oversees the Company’s legal team and the management of its legal affairs. Mr. Levine has over 20 years practicing securities law. Prior to joining Sculptor Capital in January 2017, Mr. Levine spent 15 years at Deutsche Bank AG, where he served as Global Head of Litigation and Regulatory Enforcement. From 1993 through 2001, Mr. Levine worked at the SEC in both New York and in the Washington headquarters. During this time he served in a variety of roles including as the agency’s Chief of Staff, as well as Senior Adviser to the Director of Enforcement. Mr. Levine holds a B.S. from SUNY Albany, and a J.D. Degree from Hofstra University School of Law where he was valedictorian and an editor of the law review.

18

Item 1A. Risk Factors

Risks Related to Our Business

In the course of conducting our business operations, we are exposed to a variety of risks that are inherent to or otherwise impact the alternative asset management business. Any of the risk factors we describe below have affected or could materially adversely affect our business, results of operations, financial condition and liquidity. The market price of our Class A Shares could decline, possibly significantly or permanently, if one or more of these risks and uncertainties occur. Certain statements in “Risk Factors” are forward-looking statements. See “Forward-Looking Statements.”

Difficult global market, economic or geopolitical conditions may materially adversely affect our business and cause significant volatility in equity and debt prices, interest rates, exchange rates, commodity prices and credit spreads. These factors can materially adversely affect our business in many ways, including by reducing the value or performance of the investments made by our funds and by reducing the ability of our funds to raise or deploy capital, each of which could materially adversely affect our financial condition and results of operations.

The success and growth of our business are highly dependent upon conditions in the global financial markets and economic and geopolitical conditions throughout the world that are outside of our control and difficult to predict. Factors such as equity prices, equity market volatility, asset or market correlations, interest rates, counterparty risks, availability of credit, inflation rates, economic uncertainty, changes in laws or regulation (including laws relating to the financial markets generally or the taxation or regulation of the hedge fund industry), trade barriers and tariffs, disease, commodity prices, currency exchange rates and controls, and national and international political circumstances (including governmental instability or dysfunction, wars, terrorist acts or security operations) can have a material impact on the value of our funds’ portfolio investments or our general ability to conduct business. Difficult market, economic and geopolitical conditions can negatively impact those valuations and our ability to conduct business, which in turn would reduce or even eliminate our revenues and profitability, thereby having a material adverse effect on our business, financial condition or results of operations. As a global alternative asset manager, we seek to generate consistent, positive, absolute returns across all market cycles for the investors in our funds. Our ability to do this has been, and in the future may be, materially impacted by conditions in the global credit or equity financial markets and economic and geopolitical conditions worldwide.

U.S. interest rates generally fell in 2019 as the Federal Reserve reduced its target policy rate and conducted open market operations. Following these actions, the path for interest rates in 2020 remains uncertain. Future changes in interest rates could have an adverse impact on our business, financial condition, or results of operations, through both direct and indirect means. Unpredictable or unstable market, economic or geopolitical conditions have resulted and may in the future result in reduced opportunities to find suitable risk-adjusted investments to deploy capital and make it more difficult to exit and realize value from our existing investments, which could materially adversely affect our ability to raise new funds and increase our assets under management and, therefore, may have a material adverse effect on our business, financial condition or results of operations. In addition, during such periods, financing and merger and acquisition activity may be greatly reduced, making it harder and more competitive for asset managers to find suitable investment opportunities and to obtain funding for such opportunities. If we fail to react appropriately to difficult market, economic and geopolitical conditions, our funds could incur material losses.

Terms of the United Kingdom’s transition in its withdrawal from the European Union.

On January 31, 2020, the United Kingdom’s (the “UK”) formal exit from the European Union (the “EU”), commonly referred to as “Brexit” became effective. During the subsequent transition period, if no trade or extension agreement is reached by December 31, 2020, the UK is expected to withdraw from the EU single market and customs union. Political and economic uncertainty regarding the UK’s future relationship with the EU, including the specific terms of any agreements between the EU and the UK to provide future access to each other’s respective markets, may lead to increased volatility in global financial and foreign exchange markets, including volatility in the value of the Euro and the British Pound, which could materially impair the investment performance of our funds. In addition, increased political, legal and economic uncertainty may result from divergent national laws and regulations, particularly from a tax perspective, as the UK determines which EU laws to replace or replicate. Changes made by the UK to its domestic or international tax system and its implementation of such changes could have a material adverse effect on our business, financial condition or results of operations.

19

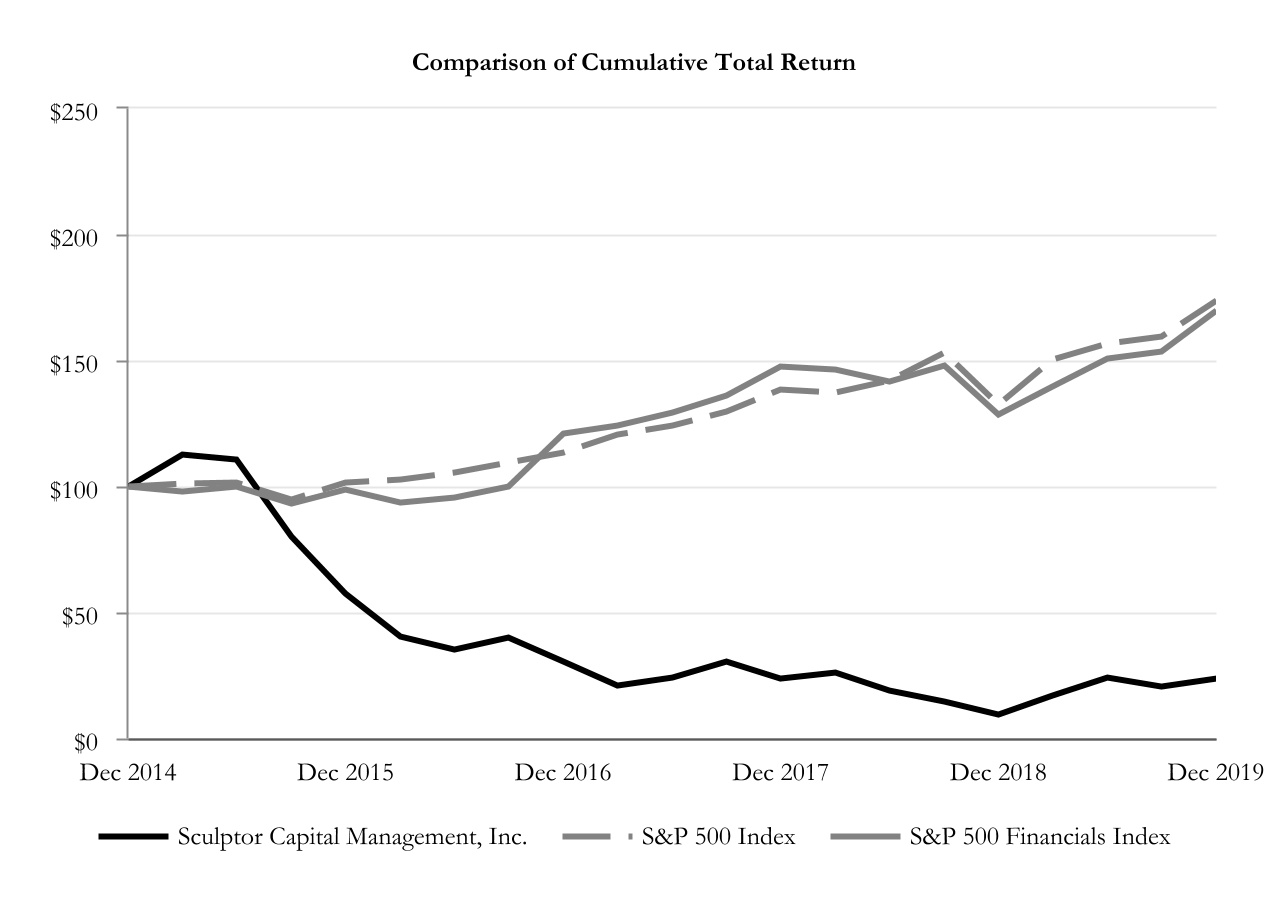

An investment in our Class A Shares is not an alternative to an investment in any of our funds, and the returns of our funds should not be considered as indicative of any returns expected on our Class A Shares, although poor investment performance of, or lack of capital flows into, the funds we manage could have a materially adverse impact on our revenues and, therefore, the returns on our Class A Shares.

The returns on our Class A Shares are not directly linked to the historical or future performance of the funds we manage or the manager of those funds. Even if our funds experience positive performance and our assets under management increase, holders of our Class A Shares may not experience a corresponding positive return on their Class A Shares.

However, poor performance of the funds we manage will cause a decline in our revenues from such funds, and may therefore have a negative effect on our performance and the returns on our Class A Shares. If we fail to meet the expectations of our fund investors or otherwise experience poor investment performance, whether due to difficult economic and financial conditions or otherwise, our ability to retain existing assets under management and attract new investors and capital flows could be materially adversely affected. In turn, the management fees and incentive income that we would earn would be reduced and our business, financial condition or results of operations would suffer, thus negatively impacting the price of our Class A Shares. Furthermore, even if the investment performance of our funds is positive, our business, financial condition or results of operations and the price of our Class A Shares could be materially adversely affected if we are unable to attract and retain additional assets under management consistent with our past experience, industry trends or investor and market expectations.

Investors in our funds have the right to redeem their investments in our funds on a regular basis and could redeem a significant amount of assets under management during any given quarterly period, which would result in significantly decreased revenues.

Subject to any specific redemption provisions applicable to a fund, investors in our multi-strategy hedge funds may generally redeem their investments in our funds on an annual or quarterly basis following the expiration of a specified period of time (typically between one and three years), although certain investors generally may redeem capital during such specified period upon giving proper notice. In a declining market, during periods when the hedge fund industry generally experiences outflows, or in response to specific events that occur at the Company (including any uncertainty related to the Recapitalization and Corporate Classification Change (as defined below)), we could experience increased redemptions and a consequent reduction in our assets under management. Furthermore, investors in our funds may also invest in funds managed by other alternative asset managers that have restricted or suspended redemptions or may in the future do so. Such investors may redeem capital from our funds, even if our performance is superior to such other alternative asset managers’ performance if they are restricted or prevented from redeeming capital from those other managers.