Document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2017

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-33977

VISA INC.

(Exact name of Registrant as specified in its charter)

|

| | |

Delaware | | 26-0267673 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| | |

P.O. Box 8999 San Francisco, California | | 94128-8999 |

(Address of principal executive offices) | | (Zip Code) |

(650) 432-3200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Class A common stock, par value $0.0001 per share | | New York Stock Exchange |

(Title of each Class) | | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act:

Class B common stock, par value $0.0001 per share

Class C common stock, par value $0.0001 per share

(Title of each Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

|

| | |

Large accelerated filer þ | Accelerated filer o | Smaller reporting company o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Emerging growth company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the registrant’s class A common stock, par value $0.0001 per share, held by non-affiliates (using the New York Stock Exchange closing price as of March 31, 2017, the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $164.1 billion. There is currently no established public trading market for the registrant’s class B common stock, par value $0.0001 per share, or the registrant’s class C common stock, par value $0.0001 per share.

As of November 10, 2017, there were 1,813,463,251 shares outstanding of the registrant’s class A common stock, par value $0.0001 per share, 245,513,385 shares outstanding of the registrant’s class B common stock, par value $0.0001 per share, and 12,665,935 shares outstanding of the registrant’s class C common stock, par value $0.0001 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2018 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the Registrant’s fiscal year ended September 30, 2017.

TABLE OF CONTENTS

|

| | |

| | |

| | Page |

| | |

Item 1 | | |

Item 1A | | |

Item 1B | | |

Item 2 | | |

Item 3 | | |

Item 4 | | |

| | |

| | |

Item 5 | | |

Item 6 | | |

Item 7 | | |

Item 7A | | |

Item 8 | | |

Item 9 | | |

Item 9A | | |

Item 9B | | |

| | |

| | |

Item 10 | | |

Item 11 | | |

Item 12 | | |

Item 13 | | |

Item 14 | | |

| |

| |

Item 15 | | |

Unless the context indicates otherwise, reference to "Visa," "Company," "we," "us" or "our" refers to Visa Inc. and its subsidiaries.

"Visa" and our other trademarks referenced in this report are Visa's property. This report may contain additional trade names and trademarks of other companies. The use or display of other companies' trade names or trademarks does not imply our endorsement or sponsorship of, or a relationship with these companies.

Forward-Looking Statements:

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that relate to, among other things, our future operations, prospects, developments, strategies and growth of our business; integration of Visa Europe, including the migration of European activity to VisaNet and anticipated benefits for our European clients; anticipated expansion of our products in certain countries; industry developments; expectations regarding litigation matters, investigations and proceedings; timing and amount of stock repurchases; sufficiency of sources of liquidity and funding; effectiveness of our risk management programs; and expectations regarding the impact of recent accounting pronouncements on our consolidated financial statements. Forward-looking statements generally are identified by words such as "believes," "estimates," "expects," "intends," "may," "projects," “could," "should," "will," "continue" and other similar expressions. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in Item 1—Business, Item 1A—Risk Factors, Item 7—Management's Discussion and Analysis of Financial Condition and Results of Operations and elsewhere in this report. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

PART I

ITEM 1. Business

OVERVIEW

Visa is a global payments technology company that enables fast, secure and reliable electronic payments across more than 200 countries and territories. We facilitate global commerce through the transfer of value and information among a global network of consumers, merchants, financial institutions, businesses, strategic partners, and government entities. Our advanced transaction processing network, VisaNet, enables authorization, clearing, and settlement of payment transactions and allows us to provide our financial institution and merchant clients with a wide range of products, platforms, and value-added services.

Our mission is to connect the world through the most innovative, reliable, and secure payment network – enabling individuals, businesses, and economies to thrive. To deliver on this mission, we are focused on seven strategic pillars:

Our focus, expertise, and assets have enabled Visa to become one of the world’s largest retail electronic payments networks based on payments volume and number of transactions.

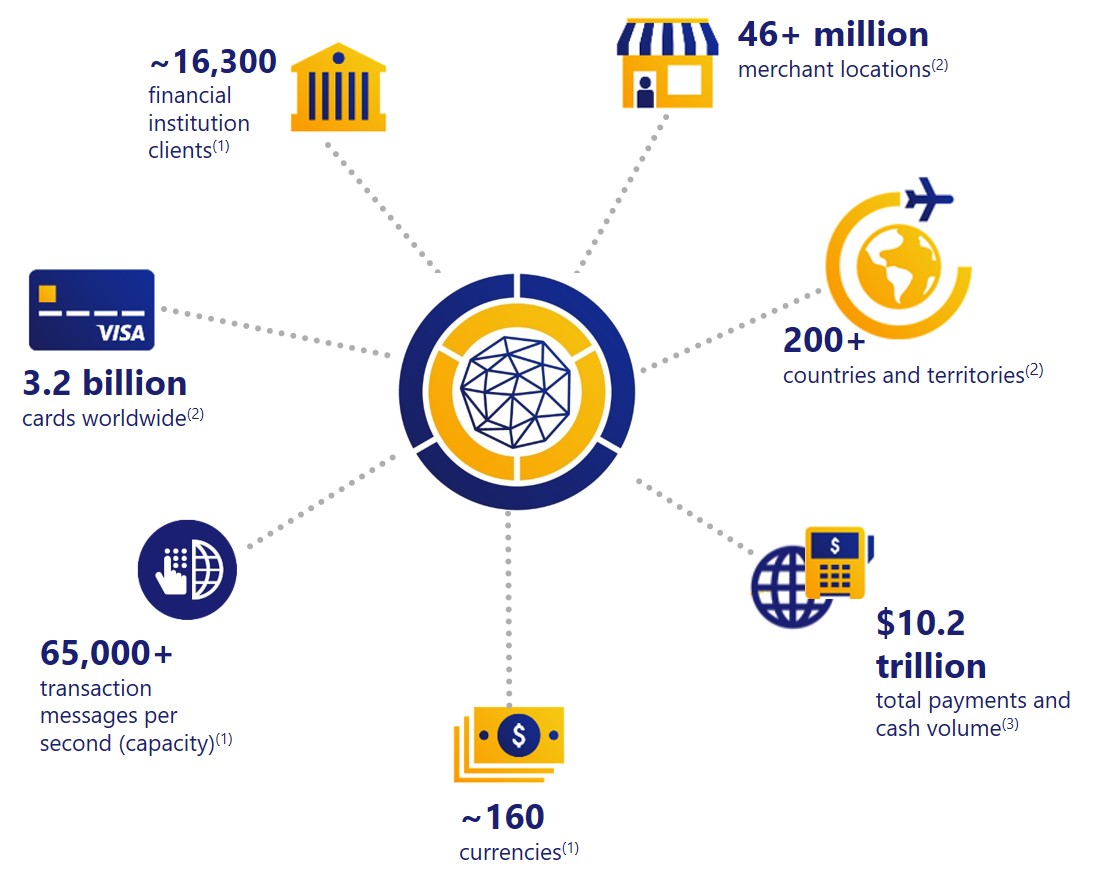

Visa Network

Visa connects millions of consumers and businesses every day through the power of our network.

| |

(1) | As of September 30, 2017 |

| |

(3) | Transacted on our payment products for the 12 months ended June 30, 2017 |

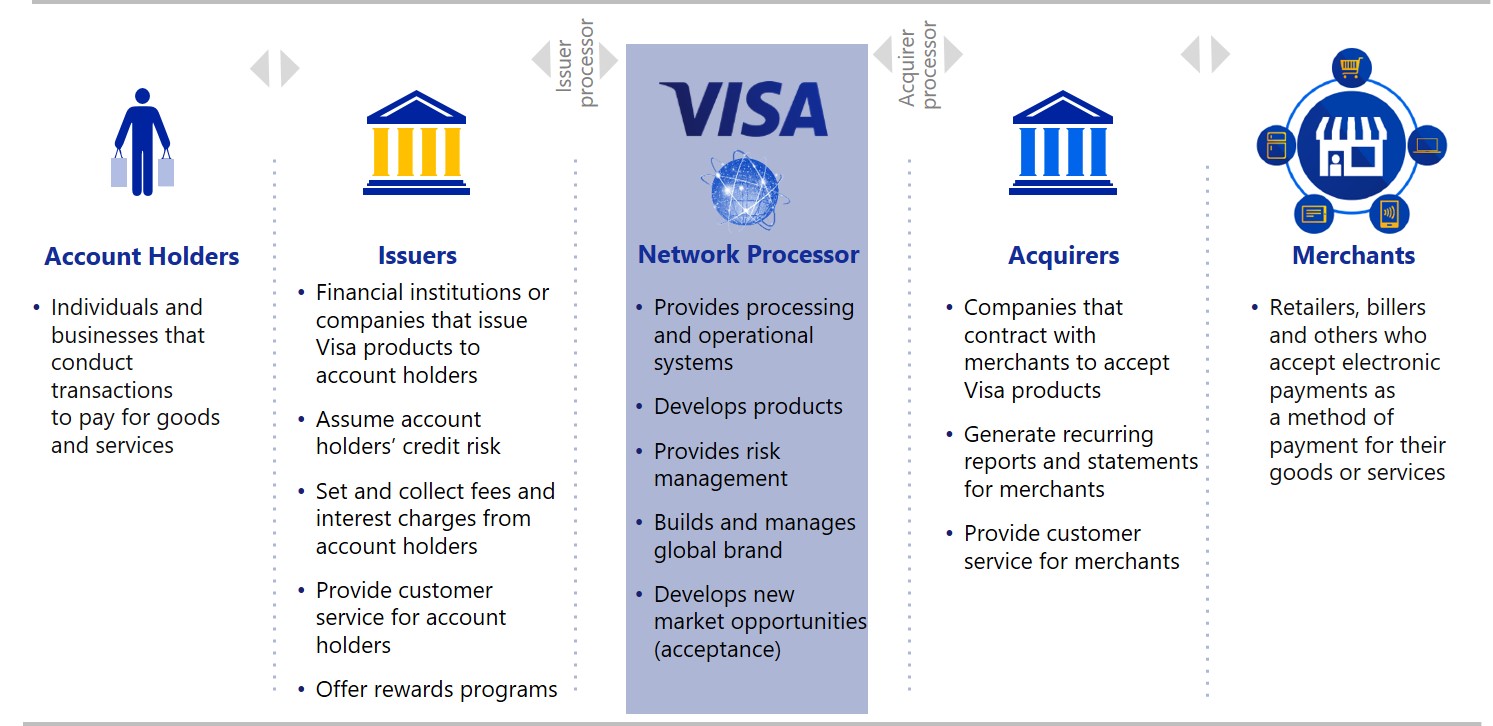

Visa operates in a four party model, which includes card issuing financial institutions, acquirers, and merchants. We are not a bank and do not issue cards, extend credit, or set rates and fees for account holders on Visa products. Generally, our financial institution clients are responsible for managing account holder and merchant relationships.

Visa does not earn revenues from, or bear credit risk with respect to, interest or fees paid by account holders on Visa products. Interchange reimbursement fees represent a transfer of value between the financial institutions participating in our open-loop payments network. We administer the collection and remittance of interchange reimbursement fees through the settlement process, but we generally do not receive any revenue related to interchange reimbursement fees. In addition, we do not receive as revenue the fees that merchants are charged directly for acceptance by their acquirers.

Visa Brand

The Visa brand is one of the world's most recognized, trusted, and valuable brands. Anchored on the notion that Visa is "everywhere you want to be," the brand stands for acceptance, security, convenience, speed, and reliability. In recognition of its strength among clients and consumers, the Visa brand is ranked highly in a number of widely recognized brand studies, including BrandZ Top 100 Most Valuable Global Brands Study, Forbes World’s Most Valuable Brands, Interbrand's Best Global Brands, and YouGov Brand Index. Our brand strength helps us to deliver added value to financial institutions, merchants, and other clients through compelling brand expressions, expanded products and services, and innovative marketing efforts.

Payment Security

Visa has focused its investments, partnerships, and expertise to enhance the security of our network, and to enable consumers and businesses to pay and be paid with confidence. As payments methods evolve, we are focused on four primary areas:

| |

• | Protecting payment data with a payments architecture that complies with industry standards; |

| |

• | Rendering the use of sensitive payment data useless by deploying technologies such as the EMV chip and tokenization; |

| |

• | Using predictive analytics, intelligence, and insights to identify and prevent fraud before it happens; and |

| |

• | Empowering consumers to actively protect their own financial information and transactions. |

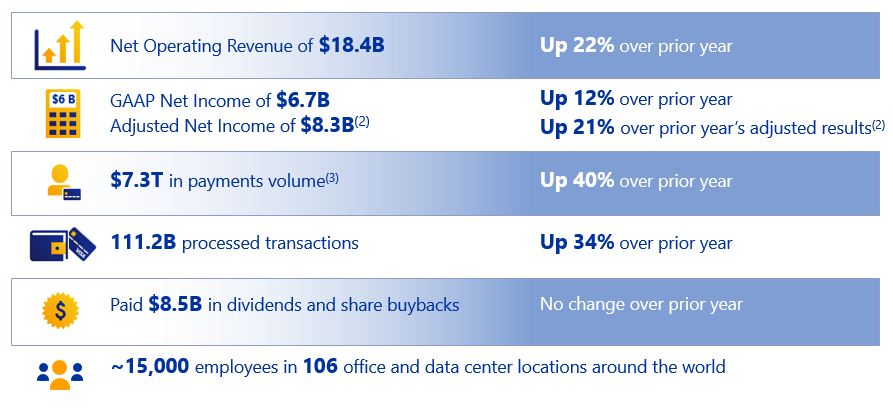

Fiscal 2017 Key Statistics (including Visa Europe)(1)

| |

(1) | Figures and period-over-period percentages reflect the inclusion of Visa Europe for the full year of fiscal 2017. We acquired Visa Europe on June 21, 2016. |

| |

(2) | Please see Item 7—Management's Discussion and Analysis of Financial Condition and Results of Operations for a reconciliation of our adjusted financial results. |

| |

(3) | For the 12 months ended June 30, 2017, upon which fiscal 2017 service revenues are based. |

KEY INITIATIVES

Visa Europe Integration

In fiscal 2017, we made significant progress on integrating Visa Europe into the broader Visa group following our completion of the acquisition in June 2016. We streamlined and integrated our European functions with the global Visa organization and bolstered the European leadership team. We invested in launching a suite of digital products, including Visa Checkout and Visa Commerce Network, and entered into new strategic partnerships, including Klarna and Paypal, to spur innovation and drive usage and acceptance. We made significant progress in our multi-year effort to harmonize our respective technology systems and prepare for European client migrations onto VisaNet beginning in fiscal 2018. Along with our new innovation center in London, we believe these efforts will help bring more enhanced capabilities as well as provide greater scale and additional levels of cybersecurity for our European clients. In addition, we made significant progress in entering into new commercial agreements with our European clients to transition the business from the prior association business model to a for-profit model. These new commercial arrangements have led to an increase in client incentives as we have replaced the rebates in effect under the prior model.

Technology Transformation

Visa is primarily a technology company. In fiscal 2015, we embarked on a multi-year journey to transform our use of technology. We have increased our technology employee footprint by more than 2,000 globally over the past three years, including nearly 1,000 new college graduates, replacing a significant percentage of our contractor and vendor spend. We are making steady progress on our technology strategic roadmap, resulting in enhanced services in the payments ecosystem and positive impacts to our infrastructure. Since the launch of Visa’s Developer Platform (VDP) in fiscal 2016, we have made our application program interfaces (APIs) available to our developers, clients, and partners. VDP offers them access to Visa technology, services, and tools, and provides safe testing environments for the development of new digital payments and commerce solutions. We added new services to enable clients to develop support for tokenized transactions and create new and innovative solutions in mobile, ecommerce, and digital face-to-face transactions.

Cybersecurity remains a top focus, and in fiscal 2016 we launched our Threat Intelligence Fusion Platform, a cyber command and control center that provides integrated cybersecurity operations to further protect our data and assets. In fiscal 2017, we continued to embed security earlier in the software development lifecycle to further strengthen our security posture. New open technologies have been added systematically to our infrastructure and platform components. We continue to bolster the resiliency of our infrastructure and application services to provide high availability of our client services.

How We Work with Partners – Innovation Centers, Visa Developer Program, Certifications, and Startups

To drive new solutions in the payments space and accelerate the proliferation of safe and fast digital payments, we opened a new innovation center in London in fiscal 2017. Our innovation centers foster collaboration with our financial institution clients, merchants, partners, and developers across the regions to spur the creation of the next generation of payments and commerce applications and solutions. By providing access to Visa capabilities through an open network of APIs, the Visa Developer Platform allows global partners to transform ideas into new digital commerce experiences. Visa’s Everywhere Initiative is an innovation program in over 40 countries designed to generate and harness ideas within the start-up community to solve business problems, influence Visa's product development, and support Visa's clients. Visa makes minority investments in companies around the world that we believe will further our vision and strategic objectives, support deeper engagement with key partners, and expand access to payment solutions worldwide. In addition, through the Visa Ready certification program, we provide the structure that allows partners to introduce devices, software, and solutions that can securely initiate or accept Visa payments.

PRODUCTS & SERVICES

Core Products

Debit: Debit cards are issued by financial institutions to allow consumers and small businesses to purchase goods and services using funds held in their demand deposit accounts. Debit cards enable cardholders to transact – in person, online, or via mobile – without needing cash or checks and without accessing a line of credit. Visa provides a strong brand; the network infrastructure and processing; acceptance; product features and support; risk tools and services; and industry expertise to help issuers optimize their debit offerings.

Credit: Credit cards are issued by financial institutions to allow consumers and businesses to access credit to pay for goods and services. Visa does not extend credit; however, we provide combinations of card benefits, including technology, authorization, fraud tools, and brand support that financial institutions use to support and enable their credit products. We also partner with our clients on product design, consumer segmentation, and consumer experience design to help financial institutions better deliver products and services that match their consumers’ needs.

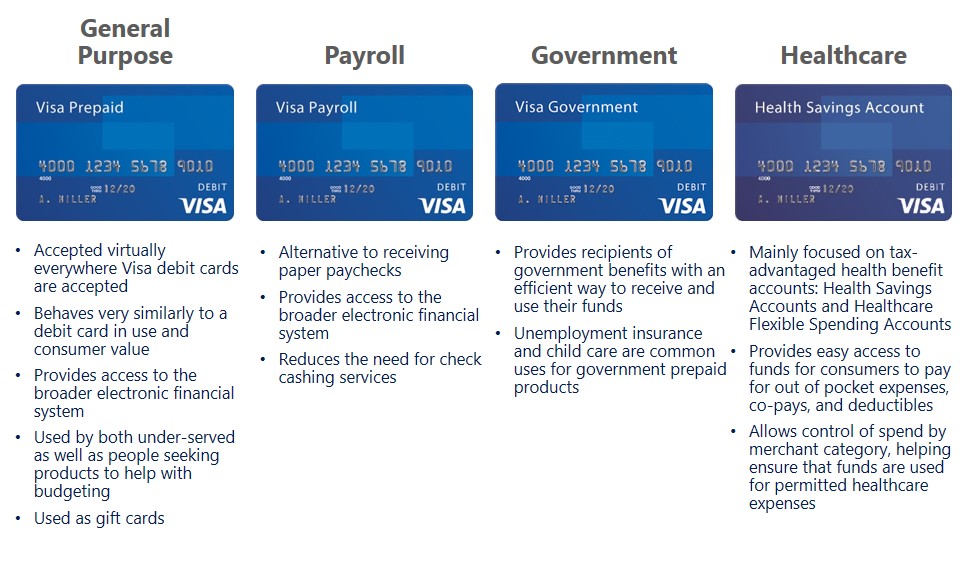

Prepaid: Prepaid products draw from a designated balance funded by individuals, corporations, or governments. Prepaid cards address many consumer-use cases and needs including, general purpose reloadable, payroll, government and corporate disbursements, healthcare, gift, and travel. Prepaid cards also play an important part in financial inclusion, bringing payment solutions to those with limited or no access to traditional banking products.

Commercial: We offer a portfolio of commercial payment solutions including corporate (travel) cards, purchasing cards, virtual accounts, and disbursement accounts covering all major industry segments. The commercial category is a portfolio of solutions designed to bring efficiency, controls, and automation to commercial and government payment processes ranging from employee travel to fully integrated, invoice-based payables. Beyond payment processing, we provide comprehensive data management solutions, consulting and analytics support, and integration capabilities. We support financial institutions, partners in the accounts payable space, and technology companies as they build and expand their commercial payment platforms.

Global ATM: The Visa/PLUS Global ATM network provides account holders with convenient cash access in more than 200 countries and territories worldwide through issuing and acquiring partnerships with both financial institutions and independent ATM operators.

Processing Infrastructure

VisaNet authorizes, clears, and settles transactions processed by Visa, excluding transactions within Europe, which are routed through different software and hardware platforms in the United Kingdom (UK) to perform authorization, clearing, and settlement in Europe. VisaNet consists of multiple synchronized processing centers that are linked by a global telecommunications network and engineered for minimal downtime and uninterrupted connectivity. We are in the process of integrating Visa Europe's processing systems with VisaNet. Until that process is completed, we will continue to maintain the current authorization, clearing, and settlement systems in Europe while ensuring interoperability between such systems and VisaNet.

VisaNet provides secure and reliable payments around the world and is capable of handling more than 65,000 transaction messages a second. VisaNet is built on a centralized architecture, which allows us to analyze each authorization we process in real time and provide value-added processing services such as risk scoring and tokenization. It provides the infrastructure for delivering innovation and other payment system enhancements for domestic payment systems and cross-border international transactions globally. In fiscal 2017, Visa processed over 111.2 billion payment and cash disbursement authorization transactions globally.

A typical Visa transaction begins when an account holder presents his or her Visa product to a merchant as payment for goods or services. The transaction is then sent to the merchant's acquirer and routed to an issuer for an authorization decision. The transaction is either approved or declined and routed back to the acquirer and merchant usually in a matter of seconds.

Transaction Processing Services

Our core transaction processing services involve the routing of payment information and related data to facilitate the authorization, clearing, and settlement of transactions between our issuers and acquirers. Our processing services also address the varied needs of other participants in the evolving payments ecosystem, through such offerings as our merchant gateway and Visa Debit Processing Services (DPS) for issuer processing. Merchant gateway services, provided through CyberSource, enable merchants to accept, process, and reconcile payments, manage fraud and safeguard payment security online and at the physical point of sale. CyberSource additionally enables acquirers and other partners to offer these services to their merchants. Visa DPS provides comprehensive issuer processing services for participating issuers of Visa debit, prepaid, and ATM products. Value-added offerings by Visa DPS to issuer clients include: fraud and risk services, data analytics, marketing campaign management, mobile and digital solutions, back office tools and services, card fulfillment and management, network gateway services, call centers, and web hosting solutions. These and other services support our issuers and acquirers and their use of our products, and promote the growth and security of our payments network.

Digital Products

Visa Checkout: Visa Checkout offers consumers an expedited and secure payment experience for online and mobile transactions wherever Visa Checkout is offered. Visa Checkout helps merchants attain higher rates of completed purchases from their consumers, a particularly important feature as digital commerce shifts from desktop devices to mobile devices, where shoppers have been less likely to complete purchases from their shopping carts. At the end of fiscal 2017, Visa Checkout had over 25 million consumer accounts in 26 countries, seven languages and over 1,600 financial institution partners participating, amounting to $3.8 billion in transaction dollars. More than 350,000 merchants, including some of the largest global retailers, accept Visa Checkout. In fiscal 2017, our product enhancement focus was making Visa Checkout more convenient for consumers to sign in and sign up by enabling biometric sign in. We also successfully piloted a stay-signed-in feature that verifies account holders on their device, allowing a consumer to checkout in as little as two clicks.

Visa Direct: Visa Direct is Visa’s real-time “push” payments platform that allows businesses, governments, and consumers to use the Visa network to transfer funds from an originating account to another via a debit, prepaid, or credit card number. This platform enables faster payments solutions for a range of new use cases, including person-to-person (P2P), disbursements, bill pay, and micro merchant payments. At the end of fiscal 2017, there were over 1 billion Visa debit, prepaid, and credit cards enabled for real-time receipt of funds, providing global scale and reach for partners. Issuers, acquirers, processors, and merchants are able to leverage our existing network connections to build new services, capabilities, and solutions. We have partnered with Adyen, Braintree, Hyperwallet, Ingo Money, OnDeck, PayPal, Stripe and Vantiv to incorporate Visa Direct into their payment solutions. Additionally, in emerging markets, push payments enable mobile applications to allow consumers to use their mobile device to “push” money to a business account via a QR code for payment of goods and services. Visa’s scan-and-pay functionality enables low-cost, low-barrier alternatives for promoting digital payment acceptance for small merchants. Visa has successfully launched merchant-presented QR technology that utilizes Visa Direct in India, Kenya, and Nigeria, and is continuing to work on developing common standards for QR code payments to ensure global interoperability, which is key to the growth of the push payments ecosystem. Work is currently underway to launch QR technology with Visa Direct in 12 additional markets over the next year.

Visa Token Service: The Visa Token Service replaces the card account numbers from the transaction with a token. Tokenization helps to protect consumer financial information and lessen the risk of stolen card credentials, particularly when information regarding a financial instrument is stored on a device, such as a mobile phone or wearable, or is stored on file at an ecommerce merchant. In fiscal 2017, we expanded Visa Token Service to 29 markets and are actively engaged in tokenizing accounts. We also enabled wearables providers FitBit and Garmin to embed Visa tokens in their devices. Finally, we announced a new program to drive acceleration into Internet-of-Things (IoT) payments. Visa Ready for IoT allows certified third-party service providers such as Gemalto, Giesecke & Devrient, FitPay, Infosys, PriNum, and Inside Secure to connect directly to our token service and become Token Service Providers (TSPs). These TSPs will be able to provide a range of services to support Visa tokens for issuers and token requestors, including new account provisioning and life cycle management. By expanding access to the Visa Token Service to new partners, we expect Visa issuers and other partners to be able to more quickly and easily offer secure digital payment services across a wide range of solutions.

Merchant Products

Visa has a suite of products and services to help merchants reduce their payment fraud and improve their customer engagement. Visa Advertising Solutions, Visa Commerce Network, and CyberSource’s product offerings are examples of Visa’s continued investment to deliver industry-leading products and capabilities to our merchant partners.

Visa Advertising Solutions is a service that allows merchants to better target and track the efficacy of their digital campaigns. Visa partners with strategic advertising technology companies to help deliver targeting and measurement capabilities using aggregated and de-identified spend insights. Visa Commerce Network uses Visa’s global payments network to enable merchants to promote relevant offers to acquire new customers, drive loyalty, and increase sales. For example, Uber and Visa Commerce Network have partnered to introduce Visa Local Offers, a card-linked offer program that rewards enrolled U.S. Visa account holders for shopping at thousands of featured merchants in the United States. Uber credits are awarded to the riders’ Uber accounts automatically on qualifying purchases – eliminating the need for coupons or promo codes.

The CyberSource platform enables merchants to manage online, mobile, and in-person payments. CyberSource offers solution packages tailored for merchants, acquirers, and technology partners. CyberSource offers a secure, integrated commerce solution that gives businesses the flexibility to select the ecommerce or point-of-sale platform, financial partner, and hardware of their choice. CyberSource enables businesses to accept payments from over 200 countries and territories across the world through its acquirer and processor connections and its Token Management Service provides a 360 degree view of customer purchases across all sales channels. The CyberSource Decision Manager fraud management service helps businesses minimize fraud losses, maximize revenue, and control costs. The solution combines advanced machine learning methods, a flexible rules engine, and insights derived from billions of CyberSource and Visa transactions. CyberSource's small business solutions are represented by the Authorize.Net brand in North America and the United Kingdom. CyberSource and Authorize.Net capabilities are offered through Visa and our partners.

Risk Products & Payment Security Initiatives

We continue to develop our suite of risk products and services to help clients minimize risk and enable secure commerce. Visa Risk Manager is a decision-making solution that helps issuers improve loss prevention and profitability through enhanced risk evaluation capabilities. Products like Visa Advanced Authorization evaluate the risk associated with every participating VisaNet transaction. In addition to reducing fraud, clients can increase approval rates by utilizing Visa's risk products that provide more insightful, real-time information and accept transactions that were once deemed too risky. For example, Mobile Location Confirmation, a service that enhances Visa Advanced Authorization by adding geolocation intelligence in real time, informs issuers if their participating account holder’s mobile phone is near a purchase location. This new data improves the issuer’s ability to make more informed decisions. Another tool that issuers can utilize across their entire card portfolio is Transaction Controls, which allows account holders to place restrictions on their enrolled cards that define when, where, and how those cards can be used to better manage account spending and security.

We have also extended our fraud prediction capabilities to merchants via Visa Transaction Advisor, which provides real-time analytics and identifies suspicious transactions that require additional verification before the transaction is processed. Visa's use of 3-D Secure technology is designed to make digital transactions safer by using risk-based authorization in real-time. Additionally, in fiscal 2017, Visa acquired CardinalCommerce, an industry leader in digital payment authentication. The acquisition enables Visa to help reduce fraud and support digital commerce.

Beyond our risk products and services, we continue to work with the Payment Card Industry Security Standards Council, EMVCo, and other industry standards organizations to develop and support standards for payment data security, EMV chip payment technology, tokenization, and 3-D Secure 2.0. We also partner with clients, merchants, governments, and law enforcement agencies to help identify fraud and share information about security best practices, threat intelligence, and legal and regulatory developments.

OTHER BUSINESS DEVELOPMENTS

Visa Foundation. In fiscal 2017, we established the Visa Foundation, a nonprofit public benefit corporation, aimed at enabling economic opportunity for the underserved, with a particular focus on helping low-income micro and small enterprises thrive. In February 2017, the foundation was funded with a contribution of 2.2 million shares of Visa class A common stock to advance these goals.

Capital Structure. In September 2017, we issued $2.5 billion of senior notes with maturities ranging between 5 and 30 years. Subsequent to our fiscal year-end, in October 2017, we used the majority of the proceeds from this new debt to redeem the $1.75 billion of senior notes scheduled to mature in December 2017.

INTELLECTUAL PROPERTY

We own and manage the Visa brand, which stands for acceptance, security, convenience, speed, and reliability. Our portfolio of trademarks, in particular our family of Visa marks, our PLUS mark, and our Dove design mark, are important to our business. We give our clients access to these assets through agreements with our issuers and acquirers, which authorize the use of our trademarks in connection with their participation in our payments network. We also own a number of patents, patent applications, and other intellectual property relating to payment solutions, transaction processing, security systems, and other matters. We rely on a combination of patent, trademark, copyright, and trade secret laws in the United States and other jurisdictions, as well as confidentiality procedures and contractual provisions, to protect our proprietary technology.

NET OPERATING REVENUES

Our gross revenues are principally comprised of service revenues, data processing revenues, international transaction revenues, and other revenues. Net operating revenues are gross revenues reduced by costs incurred under client incentive arrangements. We have one reportable segment, Payment Services.

Revenue Details

COMPETITION

The global payments industry continues to undergo dynamic change. Existing and emerging competitors compete with Visa's network and payment solutions for consumers and for participation by financial institutions and merchants. Technology and innovation are shifting consumer habits and driving growth opportunities in ecommerce, mobile payments, block chain technology, and digital currencies. These advances are enabling new entrants, many of which depart from traditional network payment models. In certain countries, the evolving regulatory landscape is changing how we compete, creating local networks, or enabling processing competition.

We compete against all forms of payment. This includes paper-based payments, primarily cash and checks, and all forms of electronic payments. Our electronic payment competitors principally include:

Global or Multi-Regional Networks, which typically offer a range of branded, general purpose card payment products that can be used at millions of merchant locations around the world. Examples include MasterCard, American Express, Discover, JCB, and UnionPay. These competitors may be more concentrated in specific geographic regions, such as JCB in Japan and Discover in the United States, or have a leading position in certain countries. For example, UnionPay operates the sole domestic acceptance mark in China and is expanding into other global markets. See Item 1A—Risk Factors—Regulatory Risks—Government-imposed restrictions on payment systems may prevent us from competing against providers in certain countries, including significant markets such as China and Russia. Based on available data, Visa is one of the largest retail electronic funds transfer networks used throughout the world. The following chart compares our network with these network competitors for calendar year 2016(1):

| |

(1) | UnionPay, which operates primarily within the Chinese domestic market, is not included in this table as Visa currently does not compete in that market under local law. Although we are uncertain how UnionPay reports certain volumes, reportedly its numbers could approach or exceed some of those listed in this chart. |

| |

(2) | The data presented are provided by our financial institution clients, inclusive of Europe for the second half of calendar year 2016. Previously submitted information may be updated and all data are subject to review by Visa. |

| |

(3) | MasterCard, American Express, JCB and Discover/Diners Club data sourced from The Nilson Report issue 1109 (May 2017). Includes all consumer and commercial credit, debit and prepaid cards. Some figures are estimates and currency figures are in U.S. dollars. MasterCard excludes Maestro and Cirrus figures. American Express includes figures for third-party issuers. Discover figures consist of U.S. data only and include third-party issuers. JCB figures include third-party issuers and other payment-related products. |

Local and regional networks, that operate in many countries, often with the support of government influence or mandate. In some cases, they are owned by financial institutions. These networks typically focus on debit payment products, have functionality or their brand marks present with the Visa brand on the card or payment device, and may have strong local acceptance, and recognizable brands. Examples include STAR, NYCE, and Pulse in the United States, Interac in Canada, EFTPOS in Australia and Mir in Russia.

Alternate Payment Providers, which often have a primary focus of enabling payments through ecommerce and mobile channels, but which are expanding or may expand their offerings to the physical point of sale. These companies may process payments using in-house account transfers between parties, electronic funds transfer networks like the Automated Clearing House (ACH), or global or local networks like Visa. In some cases, these entities are both a partner and a competitor to Visa. Examples of alternate payment providers include PayPal, Alipay, and WeChat. Alipay and WeChat Pay are among the fastest growing mobile payment providers in the world and may pose a competitive challenge to Visa and other international networks outside of China.

Other Electronic Payments Networks like the ACH in the United States are often regulated by local governments. Historically focused on interbank transfers, many are adding capabilities that may make them more competitive for retail payments. MasterCard acquired VocaLink Holdings Limited in 2016, which provides faster payments technology that competes with our Visa Direct offering. We also compete with closed-loop payment systems, emerging payments networks like Zelle, wire transfers, and electronic benefit transfers.

Payment Processors, which we compete with for the processing of Visa transactions or which may benefit from mandates requiring them to handle processing under local regulation. For example, as a result of regulation in Europe under the Interchange Fee Regulation (IFR), we may face competition from other networks, processors, and other third-parties who could process Visa transactions directly with issuers and acquirers.

We also face increasingly intense competitive pressure on the prices we charge our financial institution clients. We believe our fundamental value proposition of acceptance, security, convenience, speed, and reliability offers us a key competitive advantage. We succeed in part because we understand the needs of the individual markets in which we operate and partner with local financial institutions, merchants, governments, non-governmental organizations, and business organizations to provide tailored solutions. We believe Visa is well-positioned competitively, due to our global brand, our broad set of Visa-branded payment products, and our proven track record of processing payment transactions securely and reliably through VisaNet.

SEASONALITY

We generally do not experience any pronounced seasonality in our business. No individual quarter of fiscal 2017 or fiscal 2016 accounted for more than 30% of our operating revenues in those years.

WORKING CAPITAL

Payments settlement due to and from our financial institution clients can represent a substantial daily working capital requirement. Most U.S. dollar settlements are settled within the same day and do not result in a receivable or payable balance, while settlement in currencies other than the U.S. dollar generally remain outstanding for one to two business days, which is consistent with industry practice for such transactions.

FINANCIAL INFORMATION ABOUT GEOGRAPHIC AREAS

For more information on the concentration of our operating revenues and other financial information, see Note 12—Enterprise-wide Disclosures and Concentration of Business to our consolidated financial statements included in Item 8—Financial Statements and Supplementary Data of this report.

GOVERNMENT REGULATION

As a global payments technology company, we are subject to complex and evolving global regulations in the various jurisdictions in which our products and services are used. The most significant government regulations that impact our business are discussed below. For further discussion of how global regulations may impact our business, see Item 1A—Risk Factors—Regulatory Risks.

Supervisory Oversight of the Payments Industry. Visa is subject to financial sector oversight and regulation in substantially all of the jurisdictions in which we operate. In the United States, for example, the Federal Financial Institutions Examination Council (FFIEC) has supervisory oversight over Visa under applicable federal banking laws and policies as a technology service provider to U.S. financial institutions. The federal banking agencies comprising the FFIEC are the Federal Reserve Board, the Comptroller of the Currency, the Federal Deposit Insurance Corporation, the National Credit Union Administration, and the Consumer Financial Protection Bureau (CFPB). Visa also may be separately examined by the CFPB as a service provider to the banks that issue Visa-branded consumer credit and debit card products. Central banks in other countries, including Russia, Ukraine, Hong Kong and the United Kingdom (as discussed below), have recognized or designated Visa, for purposes of various degrees of financial stability regulation, as a retail payment system. Visa is also subject to oversight by banking and financial sector authorities in other jurisdictions, such as Brazil, Mexico, Uruguay and Colombia.

Government-imposed Market Participation and Restrictions. Certain governments, including China, Russia, Indonesia, and India, have taken actions to advantage domestic payments systems and/or certain issuers, payments networks, or processors, including by imposing regulations that favor domestic providers, impose local ownership requirements on processors, or mandate domestic processing be done entirely in that country.

Interchange Rates and Fees. An increasing number of jurisdictions around the world regulate or influence debit and credit interchange reimbursement rates in their regions. For example, the Dodd-Frank Wall Street Reform and Consumer Act (Dodd-Frank Act) in the United States limits interchange reimbursement rates for certain debit card transactions, the European Union's (EU) IFR limits interchange rates in Europe (as discussed below) and the Reserve Bank of Australia regulates average permissible levels of interchange.

Network Exclusivity and Routing. In the United States, the Dodd-Frank Act limits network exclusivity and preferred routing arrangements for the debit and prepaid market segments. Other jurisdictions impose similar limitations, such as the IFR’s prohibition on restrictions that prevent multiple payment brands or functionality on the same card.

No-surcharge Rules. We have historically enforced rules that prohibit merchants from charging higher prices to consumers who pay using Visa products instead of other means. However, merchants’ ability to surcharge varies by geographic market as well as Visa product type, and continues to be impacted by litigation, regulation, and legislation.

Privacy and Data Protection. Aspects of our operations or business are subject to privacy, data use and data security regulations, which impact the way we use and handle data, operate our products and services, and even impact our ability to offer a product or service. In addition, regulators are proposing new laws or regulations which could require Visa to adopt certain cybersecurity and data handling practices. In many jurisdictions consumers must be notified in the event of a data breach, and such notification requirements continue to increase in scope and cost. The changing privacy laws in the United States, Europe and elsewhere, including the adoption by the European Union of the General Data Protection Regulation, which will become effective in May 2018, create new individual privacy rights and impose increased obligations on companies handling personal data.

Anti-corruption, Anti-money Laundering, Anti-terrorism, and Sanctions. We are subject to anti-corruption laws and regulations, including the U.S. Foreign Corrupt Practices Act (FCPA), the UK Bribery Act, and other laws that generally prohibit the making or offering of improper payments to foreign government officials and political figures for the purpose of obtaining or retaining business or to gain an unfair business advantage. We are also subject to anti-money laundering and anti-terrorist financing laws and regulations, including the U.S. Bank Secrecy Act and the USA PATRIOT Act. In addition, we are subject to economic and trade sanctions programs administered by the Office of Foreign Assets Control (OFAC) in the United States. Therefore, we do not permit financial institutions or other entities that are domiciled in countries or territories subject to comprehensive OFAC trade sanctions (currently, Cuba, Iran, North Korea, Syria, and Crimea), or that are included on OFAC's list of Specially Designated Nationals and Blocked Persons, to issue or acquire Visa-branded cards or engage in transactions using our services.

Internet Transactions. Many jurisdictions have adopted regulations that require payments system participants to monitor, identify, filter, restrict, or take other actions with regard to certain types of payment transactions on the Internet, such as gambling and the purchase of cigarettes or alcohol.

Additional Regulatory Developments. Various regulatory agencies also continue to examine a wide variety of other issues, including mobile payment transactions, tokenization, access rights for non-financial institutions, money transfer, identity theft, account management guidelines, disclosure rules, security, and marketing that could affect our financial institution clients and us.

European Regulations and Supervisory Oversight. In addition, following the Visa Europe acquisition in June 2016, we are subject to complex and evolving regulation of our business in the European Economic Area. Visa Europe has been designated as a Recognized Payment System in the United Kingdom, bringing it within the scope of the Bank of England’s oversight and subject to various requirements, including on issues such as governance and risk management designed to maintain the stability of the UK financial system. Visa Europe is also subject to the Eurosystem’s oversight, whose main focus is on the functioning of card payments, as well as the security, operational reliability, and business continuity of the schemes and their payment instruments. Furthermore, Visa Europe is regulated by the United Kingdom’s Payment Systems Regulator (PSR), which has wide ranging powers and authority to review our business practices, systems, rules and fees with respect to promoting competition and innovation in the United Kingdom, and ensuring payments meet account holder needs. It also is the regulator responsible for monitoring Visa Europe's compliance with the IFR in the United Kingdom. The IFR regulates interchange rates within Europe, requires Visa Europe to separate its payment card scheme activities from processing activities for accounting, organization, and decision making purposes within the European Union and imposes limitations on network exclusivity and routing. National competent authorities in other EU markets and the European

Central Bank itself have the ability not only to monitor Visa's compliance with the IFR but also to impose their own oversight regimes.

There are other regulations in the European Union that impact our business, as discussed above, including, privacy and data protection, anti-bribery, anti-money laundering, anti-terrorism and sanctions. Other recent regulatory changes in Europe such as the PSD2 require, among other things, that our financial institution clients provide certain customer account access rights to emerging non-financial institution players.

AVAILABLE INFORMATION

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (Exchange Act) and its rules and regulations. The Exchange Act requires us to file periodic reports, proxy statements and other information with the U.S. Securities and Exchange Commission (SEC). Copies of these reports, proxy statements and other information can be viewed at http://www.sec.gov. Our corporate website is accessible at http://corporate.visa.com. We make available, free of charge, on our investor relations website at http://investor.visa.com our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and any amendments to those reports as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. We also may include supplemental financial information on our investor relations website at http://investor.visa.com and may use this website as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor such portions of our investor relations website, in addition to following SEC filings and publicly available conference calls. The information contained on, or accessible through, our corporate website, including the information contained on our investor relations website, is not incorporated by reference into this report or any other report filed with, or furnished to, the SEC.

ITEM 1A. Risk Factors

Regulatory Risks

Increased regulation of the global payments industry, including with respect to interchange reimbursement fees, operating rules, and related practices, could harm our business.

Regulators around the world have been establishing or increasing their authority to regulate certain aspects of the payments industry. See Item 1. Business —Government Regulation for more information. In the United States and many other jurisdictions, we have historically set default interchange reimbursement fees. Even though we generally do not receive any revenue related to interchange reimbursement fees in a payment transaction (those fees are paid by the acquirers to the issuers), interchange reimbursement fees are a factor on which we compete with other payments providers and are therefore an important determinant of the volume of transactions we process. Consequently, changes to these fees, whether voluntarily or by mandate, can substantially affect our overall payments volumes and revenues.

Interchange reimbursement fees, certain operating rules and related practices continue to be subject to increased government regulation globally, and regulatory authorities and central banks in a number of jurisdictions have reviewed or are reviewing these fees, rules, and practices. For example, the U.S. Federal Reserve caps the maximum U.S. debit interchange reimbursement rate received by large financial institutions at 21 cents plus 5 basis points per transaction, plus a possible fraud adjustment of 1 cent. The Dodd-Frank Act also limits issuers' and our ability to adopt network exclusivity and preferred routing in the debit and prepaid area, which also impacts our business. The EU’s IFR places an effective cap on consumer credit and consumer debit interchange fees for both domestic and cross-border transactions within Europe (30 basis points and 20 basis points, respectively). EU member states have the ability to further restrict these interchange levels within their territories. More recently, in March 2017, Argentina's central bank passed regulations that cap interchange fees on credit and debit transactions.

In addition to the regulation of interchange reimbursement fees, a number of regulators impose restrictions on other aspects of our payments business. For example, government regulations or pressure may require us to allow other payments networks to support Visa products or services, or to have the other network's functionality or brand marks on our products. As innovations in payment technology have enabled us to expand into new products and services, they have also expanded the potential scope of regulatory influence. In addition, the European Union’s requirement to separate scheme and processing adds costs and continues to impact the efficient integration of Visa Europe; the execution of our commercial, innovation and product strategies; our ability to provide effective account holder services; the amount of data available for use in fraud and risk systems; and loyalty services.

We are also subject to central bank oversight in some markets, including the United Kingdom and within the European Union. This oversight could result in new governance, reporting, licensing, cybersecurity, processing infrastructure, capital, or credit risk management requirements. We could also be required to adopt policies and practices designed to mitigate settlement and liquidity risks, including increased requirements to maintain sufficient levels of capital and financial resources locally, as well as localized risk management or governance. Increased central bank oversight could also lead to new or different criteria for participation in and access to our payments system, including allowing non-traditional financial technology companies to act as issuers or acquirers. Additionally, regulators in other jurisdictions are considering or adopting approaches based on similar regulatory principles.

Regulators around the world increasingly take note of each other’s approaches to regulating the payments industry. Consequently, a development in one jurisdiction may influence regulatory approaches in another. The risks created by a new law or regulation in one jurisdiction have the potential to be replicated and to negatively affect our business in another jurisdiction or in other product offerings. Similarly, new regulations involving one product offering may prompt regulators to extend the regulations to other product offerings. For example, credit payments could become subject to similar regulation as debit payments. Additionally, regulation in an individual country could expand. For example, the Reserve Bank of Australia initially capped credit interchange, but subsequently capped debit interchange as well.

When we cannot set default interchange reimbursement rates at optimal levels, issuers and acquirers may find our payments system less attractive. This may increase the attractiveness of other payments systems, such as our competitors' closed-loop payments systems with direct connections to both merchants and consumers. We believe some issuers may react to such regulations by charging new or higher fees, or reducing certain benefits to consumers, which make our products less appealing to consumers. Some acquirers may elect to charge higher merchant discount rates regardless of the Visa interchange reimbursement rate, causing merchants not to accept our products or to steer customers to alternate payments systems or forms of payment. In addition, in an effort to reduce the expense of their payment programs, some issuers and acquirers have obtained, and may continue to obtain, incentives from us, including reductions in the fees that we charge, which may directly impact our revenues. For these reasons, increased global regulation of the payments industry may make our products less desirable, diminish our ability to compete, reduce our transaction volumes, and harm our business.

Government-imposed restrictions on payment systems may prevent us from competing against providers in certain countries, including significant markets such as China and Russia.

Governments in a number of jurisdictions shield domestic payment card networks, brands, and processors from international competition by imposing market access barriers and preferential domestic regulations. To varying degrees, these policies and regulations affect the terms of competition in the marketplace and undermine the competitiveness of international payments networks. In the future, public authorities may impose regulatory requirements that favor domestic providers or mandate that domestic payments processing be performed entirely within that country, which would prevent us from managing the end-to-end processing of certain transactions.

In Russia, legislation effectively prevents us from processing domestic transactions. The central bank controlled national payment card system (NSPK) is the only entity allowed to process domestically. In China, UnionPay remains the sole processor of domestic payment card transactions and operates the sole domestic acceptance mark. Although we have filed an application with the People's Bank of China (PBOC) to operate a Bank Card Clearing Institution (BCCI) in China, the timing and the procedural steps remain uncertain. The approval process might require several years, and there is no guarantee that the license to operate a BCCI will be approved or, if we obtain such license, that we will be able to successfully compete with domestic payments networks. Furthermore, due to our inability to manage the end-to-end processing of transactions for cards in certain countries, we depend on our close working relationships with our clients or third-party processors to ensure transactions involving our products are processed effectively. Our ability to do so may be adversely affected by regulatory requirements and policies pertaining to transaction routing or on-shore processing.

Co-badging and co-residency regulations may pose additional challenges in markets where Visa competes with national schemes for issuance and routing. For example, in China, certain banks have issued dual-branded cards for which domestic transactions in China are processed by UnionPay and transactions outside of China are processed by us or other international payments networks. The PBOC is contemplating that dual-branded cards could be phased out over time as new licenses are issued to international companies to participate in China’s domestic payments market. Accordingly, we have been working with Chinese issuers to issue Visa-only branded cards for international travel, and later for domestic transactions after we obtain a BCCI license. However, notwithstanding such efforts, the phase out of dual-branded cards may decrease our payment volumes and impact the revenue we generate in China.

Mir and UnionPay have grown rapidly in Russia and China, respectively, and are actively pursuing international expansion plans. Although regulatory barriers shield Mir and UnionPay from competition in Russia and China, respectively, alternate payment providers such as Alipay and WeChat Pay have rapidly expanded into e-commerce, offline, and cross-border payments, which could make it difficult for us to compete even if our license is approved in China. Earlier this year, with strong backing from China’s government, a new digital transaction routing system known as Netlink was established. The PBOC allowed Alipay and other digital payment providers to invest in Netlink. It and other such systems could have a competitive advantage in comparison with other international payments networks.

In general, national laws that protect domestic processing may increase our costs; decrease our payments volumes and impact the revenue we generate in those countries; decrease the number of Visa products issued or processed; impede us from utilizing our global processing capabilities and controlling the quality of the services supporting our brands; restrict our activities; limit our growth and the ability to introduce new products, services and innovations; force us to leave countries or prevent us from entering new markets; and create new competitors, all of which could harm our business.

We are subject to complex and evolving global regulations that could harm our business and financial results.

As a global payments technology company, we are subject to complex and evolving regulations that govern our operations. See Item 1—Business—Government Regulation for more information on the most significant areas of regulation that affect our business. The impact of these regulations on us, our clients, and other third parties could limit our ability to enforce our payments system rules; require us to adopt new rules or change existing rules; affect our existing contractual arrangements; increase our compliance costs; require us to make our technology or intellectual property available to third parties, including competitors, in an undesirable manner; and reduce our revenue opportunities. We may face differing rules and regulations in matters like interchange reimbursement rates, preferred routing, domestic processing requirements, currency conversion, point-of-sale transaction rules and practices, privacy, data use or protection, and associated product technology. As a result, the Visa rules and our other contractual commitments may differ from country to country or by product offering. Complying with these and other regulations increases our costs and could reduce our revenue opportunities.

If widely varying regulations come into existence worldwide, we may have difficulty rapidly adjusting our product offerings, services, fees, and other important aspects of our business in the various regions where we operate. Our compliance programs and policies are designed to support our compliance with a wide array of regulations and laws, such as anti-money laundering, sanctions and anti-corruption, and we continually enhance our compliance programs as regulations evolve. However, we cannot guarantee that our practices will be deemed compliant by all applicable regulatory authorities. In the event our controls should fail or we are found to be out of compliance for other reasons, we could be subject to monetary damages, civil and criminal penalties, litigation, investigations and proceedings, and damage to our global brands and reputation. Furthermore, the evolving and increased regulatory focus on the payments industry could negatively impact or reduce the number of Visa products our clients issue, the volume of payments we process, our revenues, our brands, our competitive positioning, our ability to use our intellectual property to differentiate our products and services, the quality and types of products and services we offer, the countries in which our products are used, and the types of consumers and merchants who can obtain or accept our products, all of which could harm our business.

Laws and regulations regarding the handling of personal data and information may impede our services or result in increased costs, legal claims, or fines against us.

Our business relies on the processing of data in many jurisdictions and the movement of data across national borders. Legal requirements relating to the collection, storage, handling, use, disclosure, transfer, and security of personal data continue to evolve, and regulatory scrutiny in this area is increasing around the world. Significant uncertainty exists as privacy and data protection laws may be interpreted and applied differently from country to country and may create inconsistent or conflicting requirements. For example, the GDPR, which becomes effective in May 2018, extends the scope of the EU data protection law to all companies processing data of EU residents, regardless of the company’s location. The law requires companies to meet new requirements regarding the handling of personal data, including new rights such as the “portability” of personal data. Although we have an extensive program underway to address GDPR requirements, our efforts to comply with GDPR and other privacy and data protection laws may entail substantial expenses, may divert resources from other initiatives and projects, and could limit the services we are able to offer. Furthermore, enforcement actions and investigations by regulatory authorities related to data security incidents and privacy violations continue to increase. The enactment of more restrictive laws, rules, regulations, or future enforcement actions or investigations could impact us through increased costs or restrictions on our business, and noncompliance could result in regulatory penalties and significant legal liability.

We may be subject to tax examinations or disputes, or changes in tax laws.

We exercise significant judgment in calculating our worldwide provision for income taxes and other tax liabilities. Although we believe our tax estimates are reasonable, many factors may limit their accuracy. We are currently under examination by, or in disputes with, the U.S. Internal Revenue Service, the UK’s HM Revenue & Customs as well as tax authorities in other jurisdictions, and we may be subject to additional examinations or disputes in the future. Relevant tax authorities may disagree with our tax treatment of certain material items and thereby increase our tax liability. Failure to sustain our position in these matters could harm our cash flow and financial position. In addition, changes in existing laws, such as recent proposals for fundamental U.S. and international tax reform or those resulting from the Base Erosion and Profit Shifting project being conducted by the Organization for Economic Cooperation and Development, may also increase our effective tax rate. A substantial increase in our tax payments could have a material, adverse effect on our financial results. See also Note 18—Income Taxes to our consolidated financial statements included in Item 8—Financial Statements and Supplementary Data of this report.

Litigation Risks

We may be adversely affected by the outcome of litigation or investigations, despite certain protections that are in place.

We are involved in numerous litigation matters, investigations, and proceedings asserted by civil litigants, governments, and enforcement bodies alleging violations of competition and antitrust law, consumer protection law, and intellectual property law, among others (these are referred to as "actions" in this section). Details of the most significant actions we face are described more fully in Note 19—Legal Matters to our consolidated financial statements included in Item 8—Financial Statements and Supplementary Data of this report. These actions are inherently uncertain, expensive, and disruptive to our operations. In the event we are found liable in any material action, particularly in a large class action lawsuit or an antitrust claim entitling the plaintiff to treble damages, or arising from a government investigation, we may be required to pay significant awards, settlements, or fines. In addition, settlement terms, judgments, or pressures resulting from actions may harm our business by requiring us to modify the default interchange reimbursement rates we set, revise the Visa rules, or the way in which we enforce our rules, modify our fees or pricing, or modify the way we do business. The outcome of these actions may also influence regulators, investigators, governments, or civil litigants in the same or other jurisdictions, which may lead to the assertion of additional actions against Visa. Finally, we are required by some of our commercial agreements to indemnify other entities for litigation asserted against them, even if Visa is not a defendant.

For certain actions like the U.S. covered litigation and the VE territory covered litigation, which are described in Note 3—U.S. and Europe Retrospective Responsibility Plans and Note 19—Legal Matters to our consolidated financial statements included in Item 8—Financial Statements and Supplementary Data of this report, we have certain protections as provided in the respective retrospective responsibility plans. The two retrospective responsibility plans are different in the protections they provide and the mechanisms by which we are able to either fund settlements or judgments in the case of the U.S. covered litigation or recoup covered losses in the case of the VE territory covered litigation. The failure of one or both of the retrospective responsibility plans to adequately insulate us from the impact of such settlements, judgments, losses, or liabilities could materially harm our financial condition or cash flows, or even cause us to become insolvent.

Business Risks

We face intense competition in our industry.

The global payments space is intensely competitive. As technology evolves, new competitors emerge and existing clients, and competitors assume different roles. Our products compete with cash, checks, electronic funds, virtual currency payments, global or multi-regional networks, other closed-loop payments systems, and alternate payment providers primarily focused on enabling payments through ecommerce and mobile channels. As the global payments space becomes more complex, we face increasing competition from our clients, emerging payment providers, and other digital and technology companies. Many of these providers have developed payments systems enabled through online activity in ecommerce and mobile channels, and are seeking to expand into other channels that compete with or replace our products and services.

Additionally, some of our competitors may develop substantially better technology, more widely adopted delivery channels or have greater financial resources. They may offer more innovative or a wider range of programs, products, and services. They may use more effective advertising and marketing strategies that result in broader brand recognition, and greater issuance and merchant acceptance. They may also develop better security solutions or more favorable pricing arrangements. Moreover, even if we successfully adapt to technological change and the proliferation of alternative types of payment services by developing and offering our own services in these areas, such services may provide less favorable financial terms for us than we currently receive from VisaNet transactions, which could hurt our financial results and prospects.

Certain of our competitors operate with different business models, have different cost structures, or participate in different market segments. Those business models may ultimately prove more successful or more adaptable to regulatory, technological, and other developments. In some cases, these competitors have the support of government mandates that prohibit, limit, or otherwise hinder our ability to compete for transactions within certain countries and regions.

Some of our competitors, including American Express, Discover, private-label card networks, virtual currency providers, technology companies that enable the exchange of digital assets, and certain alternate payments systems, operate closed-loop payments systems, with direct connections to both merchants and consumers. Government actions or initiatives such as the Dodd-Frank Act or the U.S. Federal Reserve’s Faster Payments initiatives may provide them with increased opportunities to derive competitive advantages from these business models. Similarly, regulation in Europe under PSD2 and the IFR, and in the United Kingdom through the PSR, may require us to open up access to, and allow participation in, our network to additional participants, and reduce the infrastructure investment and regulatory burden on potential competitors. We also run the risk of disintermediation due to factors such as emerging technologies, including mobile payments, alternate payment credentials, other ledger technologies or payment forms, and by virtue of increasing bilateral agreements between entities that prefer not to use our payments network for processing transactions. For example, merchants could process transactions directly with issuers, or processors could process transactions directly with issuers and acquirers.

We expect the competitive landscape to continue to shift and evolve. For example:

| |

• | competitors, clients and others are developing alternate payment networks or products that could disintermediate us from the transaction processing or the value-added services we provide to support such processing. Examples include initiatives from The Clearing House, an association comprised of large financial institutions that is developing its own faster payments system, and Early Warning Services, which operates Zelle, a bank-offered alternative network that provides another platform for faster funds or real-time payments across a variety of payment types, including P2P, corporate and government disbursement, bill pay and deposit check transactions; |

| |

• | similarly, multiple countries are developing or promoting real-time payment systems or mandating local networks with clients that also present a risk of disintermediation to our business; |

| |

• | competition may increase from alternate types of payment services, such as mobile payment services, ecommerce payment services, P2P payment services, faster payment initiatives and payment services that permit ACH or direct debits from consumer checking accounts; |

| |

• | parties that process our transactions may try to minimize or eliminate our position in the payments value chain; |

| |

• | parties that access our payment credentials, tokens and technologies, including clients, technology solution providers or others might be able to migrate account holders and other clients to alternate payment methods or use our payment credentials, tokens and technologies to establish or help bolster alternate payment methods and platforms; |

| |

• | we may need to adjust our local rules and practices to remain competitive amidst evolving regulatory landscapes and competitors’ practices; |

| |

• | we may be asked to develop or customize certain aspects of our payment services for use by consumers, processors or other third parties, thereby increasing operational costs; |

| |

• | we may need to agree to business arrangements that may be less protective of Visa’s proprietary technology and interests in order to compete and we may face increasing risk of litigation concerning intellectual property, as more technology companies compete with our offerings; |

| |

• | participants in the payments industry may merge, form joint ventures or enable or enter into other business combinations that strengthen their existing business propositions or create new, competing payment services; |

| |

• | as this landscape is quickly evolving, we may not be able to foresee or respond sufficiently to emerging risks associated with new business, products, services and practices; or |

| |

• | new or revised industry standards related to EMV chip payment technology, cloud-based payments, tokenization or other technologies set by organizations such as the International Organization for Standardization, American National Standards Institute and EMVCo may result in additional costs and expenses for Visa and its clients, or otherwise negatively impact the functionality and competitiveness of our products and services. |

Our failure to compete effectively in light of any such developments could harm our business and prospects for future growth.

Our revenues and profits are dependent on our client and merchant base, which may be costly to win, retain, and maintain.

Our financial institution clients and merchants can reassess their commitments to us at any time or develop their own competitive services. While we have certain contractual protections, our clients, including some of our largest clients, generally have flexibility to issue non-Visa products. Further, in certain circumstances, our financial institution clients may decide to terminate our contractual relationship on relatively short notice without paying significant early termination fees. Because a significant portion of our operating revenues is concentrated among our largest clients, the loss of business from any one of these larger clients could harm our business, results of operations, and financial condition.

In order to stay competitive, we offer incentives to our clients to increase payments volume, enter new market segments, and expand their use and acceptance of Visa products and services. These include up-front cash payments, fee discounts, rebates, credits, performance-based incentives, marketing, and other support payments that impact our revenues and profitability. In addition, we offer incentives to certain merchants or acquirers to win routing preference in situations where other network functionality is enabled on our products and there is a choice of network routing options. Market pressures on providing incentives, fee discounts, and rebates could moderate our growth. If we are not able to implement cost containment and productivity initiatives in other areas of our business or increase our volumes in other ways to offset the financial impact of these incentives, fee discounts, and rebates, it may harm our net revenues and profits.

In addition, it may be difficult or costly for us to acquire or conduct business with financial institutions or merchants that have longstanding exclusive, or nearly exclusive, relationships with our competitors. These financial institutions or merchants may be more successful and may grow more quickly than our existing clients or merchants. In addition, if there is a consolidation or acquisition of one or more of our largest clients or co-brand partners by a financial institution client or merchant with a strong relationship with one of our competitors, it could result in our business shifting to a competitor, which could put us at a competitive disadvantage and harm our business.

Merchants' and processors' continued push to lower acceptance costs and challenge industry practices could harm our business.

We rely in part on merchants and their relationships with our clients to maintain and expand the acceptance of Visa products. Certain large retail merchants have been exercising their influence in the global payments system in certain jurisdictions, such as the United States, to attempt to lower their acceptance costs by lobbying for new legislation, seeking regulatory enforcement, filing lawsuits and in some cases, refusing to accept Visa products. If they are successful in their efforts, we may face increased compliance and litigation expenses and issuers may decrease their issuance of our products. For example, in the United States, the cost of payment card acceptance has emerged in the context of payment security. A number of merchant trade associations claim that EMV cards without PIN cardholder verification are not worth the investment. The October 2015 liability shift and ongoing transition to EMV resulted in calls for a PIN verification mandate. U.S. merchant-affiliated groups and processors have expressed concerns regarding the EMV certification process. Some policymakers have called upon U.S. competition authorities to consider potential