Visa

Inc. Fiscal Third Quarter

Financial Results

July 27, 2011

Exhibit 99.2 |

Fiscal Third Quarter 2011 Financial Results

2

Forward-Looking Information

This presentation contains forward-looking statements within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995. These statements can be identified by the terms

“expect,” “ will,” “continue” and similar references to the future. Examples of such forward-looking statements

include, but are not limited to, statements we make about gross and net revenue, incentive

payments, expenses, operating margin, tax rate, earnings per share, capital expenditures,

free cash flow and the growth of those items. By their nature, forward-looking statements: (i) speak only as of the date they are made, (ii) are

neither statements of historical fact nor guarantees of future performance and (iii) are

subject to risks, uncertainties, assumptions and changes in circumstances that are difficult to predict or quantify.

Therefore, actual results could differ materially and adversely from those forward-looking

statements because of a variety of factors, including the following:

the impact of timing and new laws, regulations and marketplace barriers, particularly the rules

promulgated under the Wall Street Reform and Consumer Protection Act, including those

affecting:

–

rules expanding issuers’ and retailers’ choice among debit payment networks; –

rules capping debit interchange rates; –

the spread of regulation of debit payments to credit and other product categories; –

the spread of U.S. regulations to other countries; –

rules about consumer privacy and data use and security; and –

designation as a systemically important payment system; •

developments in current or future disputes and our ability to absorb their impact, including

interchange, currency conversion, and tax;

•

macroeconomic factors such as: –

global economic, political, health, environmental and other conditions; –

cross-border activity and currency exchange rates; and –

material changes in our clients’ performance compared to our estimates; •

industry and systemic developments, such as: –

competitive pressure on client pricing and in the payments industry generally; –

bank and merchant consolidation and their increased focus on payment card costs; –

disintermediation from the payments value stream through government actions or bilateral agreements; –

adverse changes in our relationships and reputation; –

our clients’ failure to fund settlement obligations we have guaranteed; –

disruption of our transaction processing systems or the inability to process transactions

efficiently;

–

rapid technological developments; –

account data breaches and increased fraudulent and other illegal activity involving our cards; and –

issues arising at Visa Europe, including failure to maintain interoperability between our systems; •

costs arising if Visa Europe were to exercise its right to require us to acquire all of its

outstanding stock;

•

loss of organizational effectiveness or key employees; •

failure to integrate successfully CyberSource, PlaySpan, Fundamo or other acquisitions; •

changes in accounting principles or treatment; and the other

factors discussed in our most recent Annual Report on Form 10-K on file with the U.S. Securities and Exchange Commission. You should not

place undue reliance on such statements. Unless required to do so by law, we do not intend to update

or revise any forward-looking statement, because of new information or future developments

or otherwise. |

Solid

Fiscal Third Quarter Results •

Strong operating revenues of $2.3 billion, up 14% over prior year

•

Adjusted quarterly net income of $883 million, up 23%, and adjusted diluted

earnings per share of $1.26, up 29% over prior year

•

Continued positive secular trends and spending momentum contributed to

double-digit growth year over year in key underlying business drivers for the

sixth consecutive quarter

•

Repurchased 13.7 million shares at an average price of $77.36 for a total

cost of $1.1 billion.

Fiscal Third Quarter 2011 Financial Results

3 |

Fiscal Third Quarter 2011 Financial Results

4

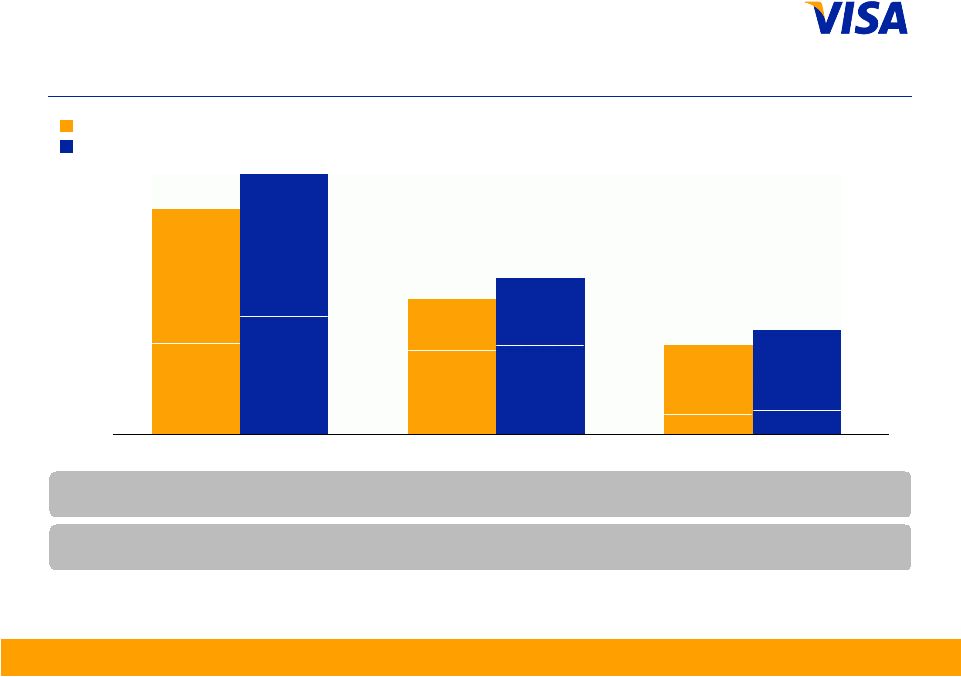

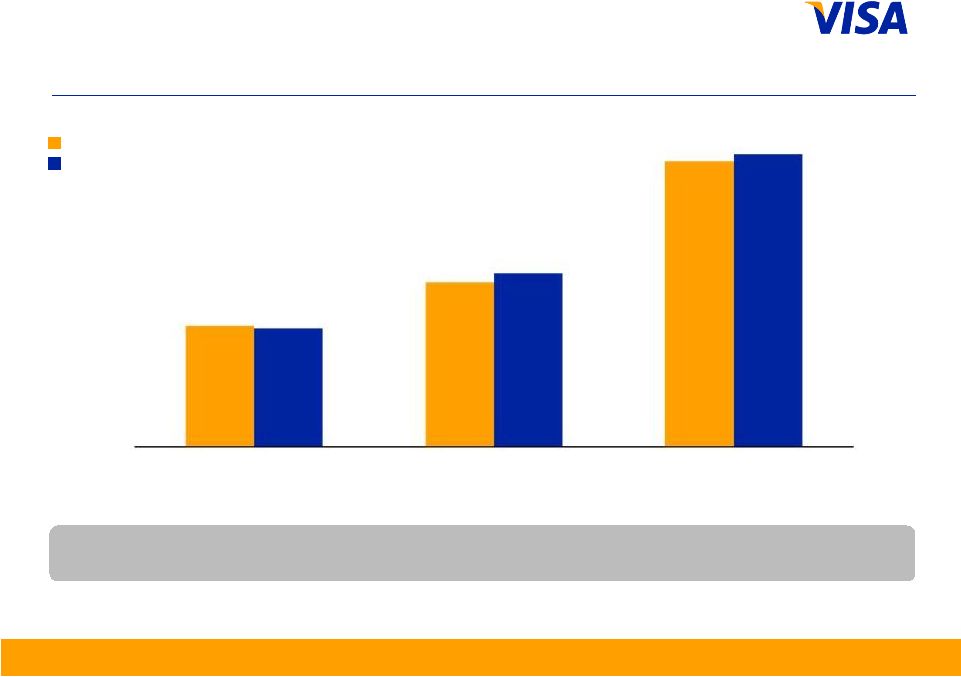

Quarter ended March

US$ in billions, nominal, except percentages

Payments Volume

ROW =

2010

2011

YOY Change

(nominal)

15%

17%

16%

YOY Change

(constant)

13%

11%

16%

Note: Figures may not sum due to rounding. Growth rates calculated based on whole numbers, not rounded

numbers. From time to time, previously submitted volume information may be updated. Prior year

volume information presented has not been updated, as changes made are not material. Constant

dollar growth rates exclude the impact of foreign currency fluctuations against the U.S. dollar in measuring performance.

ROW 51

ROW

318

ROW

318

U.S.

427

U.S.

477

ROW

385

U.S.

182

266

ROW

U.S.

245

U.S.

278

ROW 68

U.S.

199

745

862

449

517

296

345

Total Visa Inc.

Credit

Debit

Rest of World |

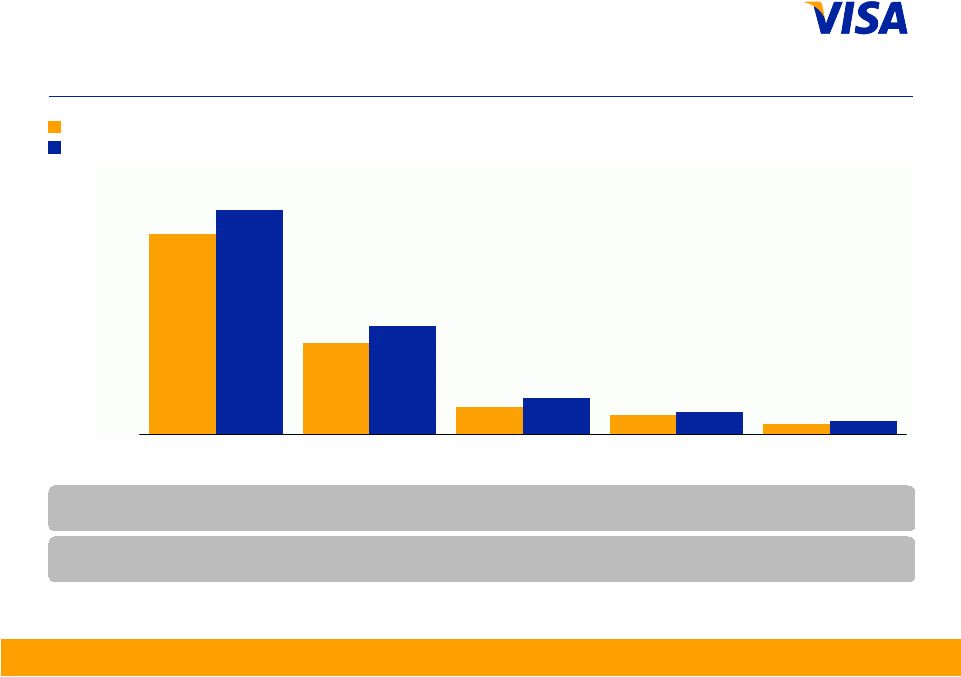

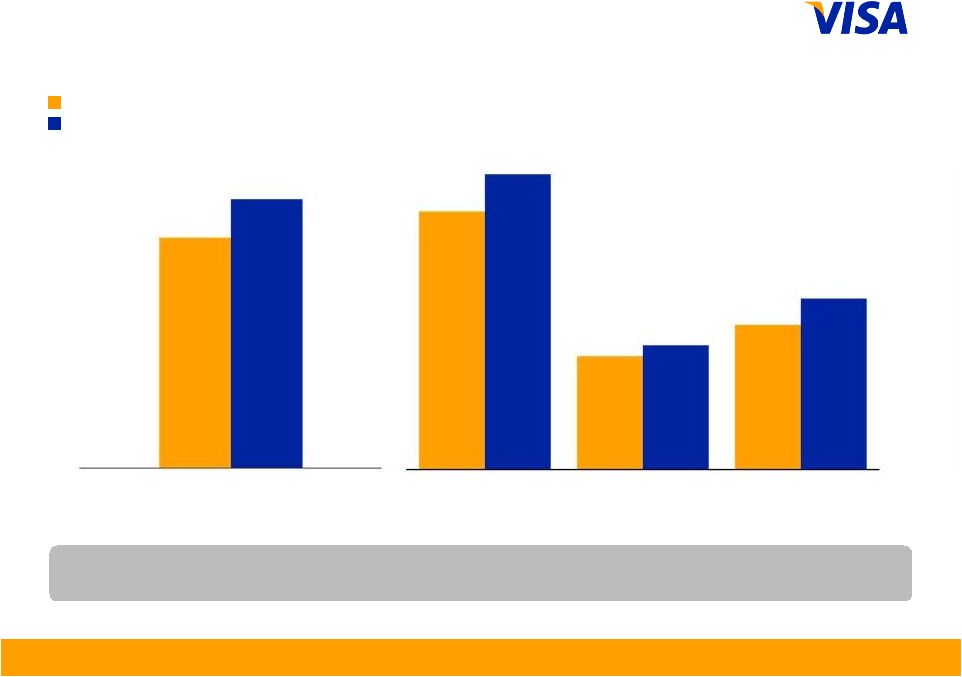

Fiscal Third Quarter 2011 Financial Results

5

ROW 55

Quarter ended June

US$ in billions, nominal, except percentages

Payments Volume

ROW

333

ROW

348

U.S.

469

U.S.

518

ROW

422

U.S.

204

277

ROW

U.S.

224

U.S.

266

U.S.

295

ROW 75

Note: Current quarter payments volume and other select metrics are provided in the

operational performance data supplement to provide more recent operating

data. Service revenues continue to be recognized based on payments volume in the prior quarter. From time to time, reported

payments volume information may be updated to reflect revised client submissions or

other adjustments. Prior year volume information presented has not been

updated, as changes made are not material. Figures may not sum due to rounding.

YOY Change

(nominal)

19%

15%

17%

YOY Change

(constant)

13%

13%

14%

ROW

=

Rest

of

World

2010

2011

Total Visa Inc.

Credit

Debit

802

941

481

571

321

369 |

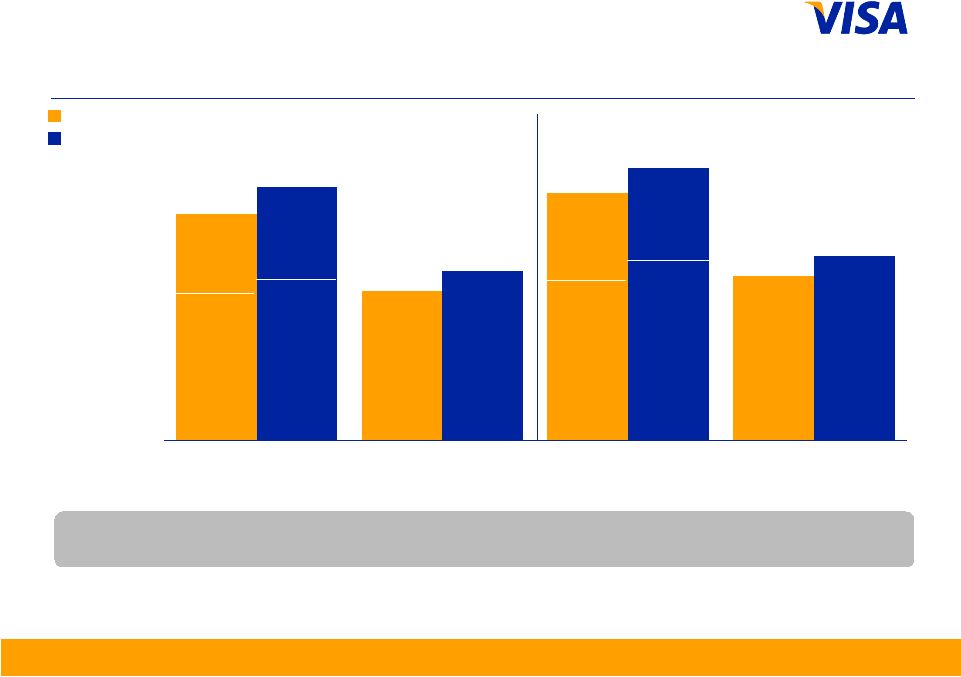

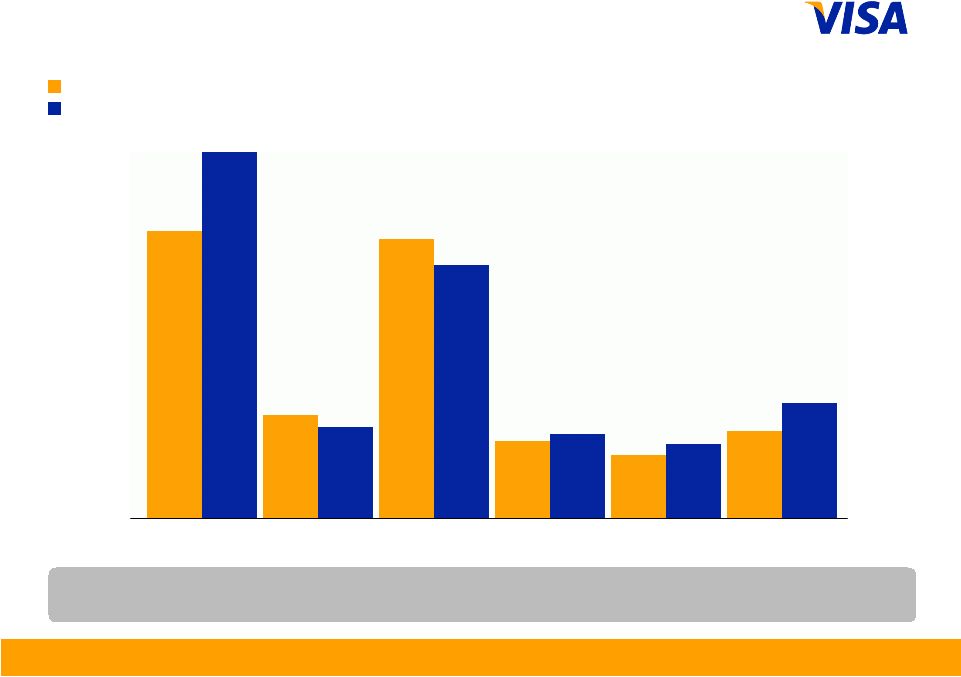

Fiscal Third Quarter 2011 Financial Results

6

Quarter ended March

US$ in billions, nominal, except percentages

Payments Volume

Note: Growth rates calculated based on whole numbers, not rounded numbers. From

time to time, previously submitted volume information may be updated. Prior

year volume information presented has not been updated, as changes made are not material. Constant dollar growth rates exclude

the impact of foreign currency fluctuations against the U.S. dollar in measuring

performance. 2010

2011

YOY Change

(nominal)

12%

18%

32%

11%

34%

YOY Change

(constant)

12%

12%

26%

7%

31%

427

477

195

230

58

77

43

48

23

30

United States

Asia Pacific

Latin America and

Caribbean

Canada

Central and Eastern

Europe, Middle East

and Africa |

Fiscal Third Quarter 2011 Financial Results

7

Quarter ended June

US$ in billions, nominal, except percentages

Payments Volume

YOY Change

(nominal)

10%

24%

38%

14%

43%

YOY Change

(constant)

10%

14%

29%

8%

37%

2010

2011

469

518

198

62

246

86

48

55

24

35

United States

Asia Pacific

Latin America and

Caribbean

Canada

Central and Eastern

Europe, Middle East

and Africa

Note: Current quarter payments volume and other select metrics are provided in the

operational performance data supplement to provide more recent

operating

data.

Service

revenues

continue

to

be

recognized

based

on

payments

volume

in

the

prior

quarter.

From

time

to

time,

reported

payments

volume information may be updated to reflect revised client submissions or other

adjustments. Prior year volume information presented has not been updated,

as changes made are not material. Figures may not sum due to rounding. |

Fiscal Third Quarter 2011 Financial Results

8

11,721

16,118

10,648

17,582

13,038

18,046

12,040

19,400

Total Transactions

Processed

Transactions

Total Transactions

Processed

Transactions

Quarter ended March

in millions, except percentages

Transactions

Note: Processed transactions represent transactions involving Visa, Visa Electron,

Interlink and Plus cards processed on Visa’s networks. Total

transactions represent payments and cash transactions as reported by Visa clients

on their operating certificates. From time to time, previously submitted

transaction information may be updated. Prior year transaction information presented has not been updated, as changes made are not

material.

Quarter ended June

Debit

65%

Credit

35%

Credit

36%

Debit

64%

Credit

35%

Debit

65%

Credit

35%

Debit

65%

YOY

Change

12%

13%

10%

11%

2010

2011 |

Fiscal Third Quarter 2011 Financial Results

9

Quarter ended March

in millions, except percentages

Total Cards

YOY

Change

(2)%

6%

2%

Note: From time to time, previously submitted card information may be updated.

Prior year card information presented has not been updated, as changes made

are not material. 2010

2011

Credit

Debit

Visa Inc.

774

760

1,870

1,825

1,051

1,110 |

Fiscal Third Quarter 2011 Financial Results

10

Revenue –

Q3 2011

US$ in millions, except percentages

Gross

Revenues

Incentives

Net Operating

Revenues

YOY

Change

14%

14%

14%

Note: Growth rates calculated based on whole numbers, not rounded numbers.

Fiscal 2010

Fiscal 2011

2,770

2,422

2,029

2,322

(393)

(448) |

Fiscal Third Quarter 2011 Financial Results

11

Revenue Detail –

Q3 2011

US$ in millions, except percentages

Service

Revenues

Data

Processing

Revenues

International

Transaction

Revenues

Other

Revenues

YOY

Change

21%

12%

15%

(10)%

Note: Growth rates calculated based on whole numbers, not rounded numbers.

Fiscal 2010

Fiscal 2011

873

1,055

792

886

574

662

183

167 |

Fiscal Third Quarter 2011 Financial Results

12

Operating Margin –

Q3 2011

US$ in millions, except percentages

YOY

Change

2 ppt

14%

10%

18%

Note: Growth rates calculated based on whole numbers, not rounded numbers.

Fiscal 2010

Fiscal 2011

58%

56%

Operating Margin

2,029

2,322

892

977

1,137

1,345

Net Operating

Revenues

Operating Income

Total Operating

Expenses |

Fiscal Third Quarter 2011 Financial Results

13

US$ in millions, except percentages

Personnel

Network

and

Processing

Marketing

Professional

Fees

Depreciation

and

Amortization

General

and

Administrative

YOY

Change

27%

(12)%

(9)%

9%

18%

32%

Note: Growth rates calculated based on whole numbers, not rounded numbers.

Fiscal 2010

Fiscal 2011

Operating Expenses –

Q3 2011

285

363

103

277

91

251

77

84

63

74

87

114 |

Fiscal Third Quarter 2011 Financial Results

14

Other Income (Expense)

US$ in millions

The following table presents components of our other income (expense).

Three Months Ended

June 30, 2011

Gain on sale of investment in CBSS

85

$

Revaluation of Visa Europe put option

122

Other

(1)

(9)

Total other income

198

$

(1)

Amount primarily represents interest expense, other investment income and the accretion associated

with litigation settlements to be paid over periods longer than one year.

|

Fiscal Third Quarter 2011 Financial Results

15

Other Financial Results

•

Cash, cash equivalents, restricted cash and available-for-sale

investment securities of $6.7 billion at the end of the fiscal third quarter

which

includes

$2.9

billion

of

restricted

cash

in

the

litigation

escrow

account

•

Total free cash flow of $1.4 billion for the fiscal third quarter and

adjusted free cash flow of $1.3 billion after the Fundamo acquisition

•

Capital expenditures of $89 million during the fiscal third quarter

Note: See appendix for reconciliation of adjusted non-GAAP measures to the

closest comparable GAAP measures. |

Fiscal Third Quarter 2011 Financial Results

16

Less than

$900 million

Marketing expenses

Financial Metrics for Fiscal Year 2011

Annual operating margin

About 60%

Top end of the

16% to 16.5%

range

Client incentives as % of gross revenues

Annual net revenue growth

11% to 15%

range |

Fiscal Third Quarter 2011 Financial Results

17

Financial Metrics for Fiscal Year 2011

Capital expenditures

Moderately

above

$300 million

Annual diluted class A common stock earnings

per share growth

20% +

GAAP tax rate, excluding the revaluation of the

Visa Europe put option

36.5% to 37%

range

Annual free cash flow

$3 billion + |

Fiscal Third Quarter 2011 Financial Results

18

Financial Metrics for Fiscal Year 2012

Mid to high

teens

Annual diluted class A common stock earnings

per share growth

Annual net revenue growth

High single to

low double digit

range |

Appendix

Reconciliation of

Non-GAAP Measures |

Fiscal Third Quarter 2011 Financial Results

Adjusted Net Income and Earnings

US$ in millions, except per share data

Management believes the presentation of adjusted net income and diluted earnings

per share provides a clearer understanding of

our

operating

performance

for

the

periods.

The

revaluation

of

the

Visa

Europe

put

option

resulted

in

non-cash,

non-operating

income during the three months ended June 30, 2011. The reduction in the fair value

of the put option was primarily the result of declines

in

our

estimated

long-term

price-to-earnings

ratio

and

does

not

reflect

any

change

in

the

likelihood

that

Visa

Europe

will exercise its option. Management therefore believes that the resulting

non-operating income recorded during the third quarter of fiscal 2011 is

not indicative of Visa’s performance in the current or future periods.

A1

(1)

Non-cash, non-operating income resulting from the revaluation of this financial instrument is

not subject to tax. (1)

Three Months

Ended June 30,

2011

Nine Months Ended

June 30, 2011

Net income attributable to Visa Inc. (as reported)

1,005

$

2,770

$

Revaluation of Visa Europe Put option

(122)

(122)

Adjusted net income attributable to Visa Inc.

883

$

2,648

$

Weighted average number of diluted shares outstanding (as

reported) 704

712

Adjusted diluted earnings per share

1.26

$

3.72

$

Diluted earnings per share (as reported)

1.43

$

3.89

$

Impact of the revaluation of Visa Europe put option

0.17

$

0.17

$

|

Fiscal Third Quarter 2011 Financial Results

Calculation of Free Cash Flow

US$ in millions

(1) Includes changes in client incentives, trade receivables, settlement

receivable/payable, and personnel incentives. Calculation of Free Cash

Flow US$ in millions

Additions (+) /

Reductions (-) to

Net income

attributable to

Visa Inc.

Net income attributable to Visa Inc. (as reported)

1,005

2,770

Capital Assets

+

Depreciation and amortization

74

211

-

Capital expenditures

(89)

(15)

(236)

(25)

Litigation

+

Litigation provision

-

6

+

Accretion expense

2

9

-

Settlement payments

(70)

(212)

+

Settlement payments funded by litigation escrow

70

2

210

13

Share-based Compensation

+

Share-based compensation

32

122

Pension

+

Pension expense

8

24

-

Pension contribution

-

8

-

24

Taxes

+

Income tax expense

539

1,534

-

Income taxes paid

(236)

303

(1,251)

283

Visa Europe Put Option

-

Fair Value Adjustment

(122)

(122)

Changes in Working Capital

(1)

+/-

Changes in other working capital accounts

206

51

Total Free Cash Flow

1,419

3,116

Less: PlaySpan and Fundamo

Acquisitions

-

Purchase consideration, net of cash received

(106)

(268)

Adjusted Free Cash Flow

1,313

2,848

Three Months Ended

June 30, 2011

Nine Months Ended

June 30, 2011

A2 |

Fiscal Third Quarter 2011 Financial Results

Impact of PlaySpan Acquisition

US$ in millions, except per share data

The following table presents the impact of the PlaySpan acquisition on Visa’s

adjusted diluted earnings per share. A3

(1)

(2)

(3)

Represents tax rate applicable to PlaySpan.

(4)

(5)

Operating revenues recognized by Visa related to PlaySpan transactions. Amount primarily

represents data processing revenues.

Operating expenses incurred by Visa related to PlaySpan. Amounts incurred subsequent to the

acquisition primarily represent personnel, amortization of intangibles and normal operating

expenses. Amount primarily represents professional fees related to closing the transaction and

some minor compensation expense, which are non-deductible for tax purposes.

See slide A1 for a reconciliation of adjusted diluted earnings per share to GAAP diluted earnings per

share. Three Months Ended

June 30, 2011

Net income attributable to Visa Inc. (as reported)

1,005

$

Revaluation of Visa Europe put option

(122)

Adjusted net income attributable to Visa Inc.

883

Taxable PlaySpan adjustments:

Less: Operating revenue

(1)

(6)

Addback: Deductible operating expenses

(2)

15

Subtotal of taxable adjustments

9

Tax rate

(3)

40%

Tax impact of adjustments

(4)

Impact of taxable PlaySpan adjustments

5

Addback: Non-deductible adjustments

(4)

3

Impact of PlaySpan

8

Adjusted net income attributable to Visa Inc.

891

$

Weighted average number of diluted shares outstanding (as reported)

704

Adjusted diluted earnings per share, excluding impact of PlaySpan

acquisition 1.27

$

Adjusted diluted earnings per share

(5)

1.26

$

Impact of PlaySpan acquisition

(0.01)

$

|

Fiscal Third Quarter 2011 Financial Results

Impact of Fundamo Acquisition

US$ in millions, except per share data

The following table presents the impact of the Fundamo acquisition on Visa’s

adjusted diluted earnings per share. (1)

(2)

See slide A1 for a reconciliation of adjusted diluted earnings per share to GAAP diluted earnings per

share. Represents the net operating results of Fundamo recognized by Visa since the acquisition

in June 2011. Three Months Ended

June 30, 2011

Net income attributable to Visa Inc. (as reported)

1,005

$

Revaluation of Visa Europe Put option

(122)

Adjusted net income attributable to Visa Inc.

883

After tax impact of Fundamo

(1)

4

Adjusted net income attributable to Visa Inc.

887

$

Weighted average number of diluted shares outstanding (as reported)

704

Adjusted

diluted

earnings

per

share,

excluding

impact

of

Fundamo

acquisition

1.27

$

Adjusted diluted earnings per share

(2)

1.26

$

Impact of Fundamo acquisition

(0.01)

$

A4 |