UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3 TO

FORM 10

General Form For Registration of Securities

Pursuant to Section 12(b) or 12(g) of The Securities Exchange Act of 1934

Dominion Minerals Corp.

(Exact Name of Registrant as Specified in Its Charter)

File No. 000-52696

| Delaware | 22-3091075 | |

| (State or Other Jurisdiction

of Incorporation or Organization) |

(I.R.S. Employer

Identification Number) |

| 3171 US Highway 9 North, Suite 324, Old Bridge, NJ | 08857 | |

| (Address of Principal Executive Offices) | (Zip Code) |

(732) 536-1600

Registrant’s Telephone Number

Securities to be registered pursuant to Section 12(b) of the Act:

Title of Each Class Name of Each Exchange on Which

to be so Registered Each Class is to be Registered

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock $0.0001 Per Share Par Value

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (as defined in Rule 12b-2 of the Exchange Act). Check one:

| Large accelerated filer | ☐ | Non-accelerated filer | ☐ |

| Accelerated Filer | ☐ | Smaller reporting company | ☒ |

1

PART I

The Company has two wholly-owned subsidiaries, Empire Minerals Corp., a Nevada corporation (“Nevada Subsidiary”) and Cuprum Resources Corp., a Republic of Panama corporation (“Panamanian Subsidiary” or “Cuprum”). When used herein the terms “we”, “us” and/or “our” shall mean the Company, and/or the Nevada Subsidiary, and/or the Panamanian Subsidiary in the context in which they appear.

This Registration Statement contains forward-looking statements that involve a number of risks and uncertainties. Such forward-looking statements are not historical facts and constitute or rely upon projections, forecasts, assumptions or other forward-looking information. Generally these statements may be identified by the use of forward-looking words or phrases such as “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates”, “may”, and “should”. These statements are inherently subject to known and unknown risks, uncertainties and assumptions. Our future results could differ materially from those expected or anticipated in the forward-looking statements. Specific factors that might cause such differences include factors described and discussed in the Description of Business in Item 1 below.

We are currently considered a “shell company” within the meaning of Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in that we currently have nominal operations and nominal assets other than cash. Accordingly, the ability of holders of our common stock to re-sell their shares may be limited by applicable regulations. Specifically, the securities sold through this offering can only be resold through registration under the Securities Act of 1933, pursuant to Section 4(1) of the Securities Act or by meeting the conditions of Rule 144(i). Until we cease to be a “shell company”, we will not meet the requirements under Rule 144(i) under the Securities Act and our shareholders will not be able to rely on Rule 144 order to sell their securities.

Item 1 Business.

General

Dominion Mineral Corp. (the “Company,” “we” or “us”) was previously engaged in the acquisition, exploration, development and operation of mineral and natural resource properties and prospects. The Company’s only current activity is pursuing a claim against the Republic of Panama, as described below. The following subsections set out information on our history and present and proposed operations and certain of the risk factors associated with us and our securities.

History of the Company

The Company was formed as a Delaware corporation on January 4, 1996 under the name ObjectSoft Corporation. On May 9, 2005, the Company changed its name to Nanergy, Inc. On June 5, 2006, its name was changed to Xacord Corp. On January 3, 2007, the Company changed its name to Empire Minerals Corp. and on November 26, 2007, it was changed to Dominion Minerals Corp.

We were originally formed in January of 1996 to acquire the business of a predecessor company, Object Soft Corporation, a New Jersey Corporation. This acquisition was completed in the form of a corporate business combination effective January 31, 1996. The acquired business involved the provision of retail Kiosks, which were internet-connected, advertising-interactive Kiosks. The Kiosks were public access terminals that offered terminals that offered entertainment information and the ability to execute financial transactions via a touch screen. This business was unsuccessful and in July of 2001, we filed a Bankruptcy Petition in the Bankruptcy Court for the District of New Jersey. None of our present officers, directors or significant employees were associated with us at the time of or involved in any way in our bankruptcy proceeding. In November of 2004, we exited the Bankruptcy case with no assets, one liability in the form of a convertible promissory note with a principal balance of $100,000 and outstanding stock of 195 shares of common stock. We then operated as a shell corporation seeking a new business opportunity either through a corporate business combination or an acquisition of assets.

2

In September of 2005, we were a party to a business combination in which we acquired the ownership of a New Jersey corporation holding licenses, patents and developments to certain photovoltaic processes. In this transaction, the Company issued 99,455 shares of our common stock. The Company also agreed to issue additional shares of common stock and stock options, if certain economic milestones were met by December 31, 2006. These economic milestones were not met. In 2006, we abandoned our efforts to develop the involved processes.

During the period from June 17, 2005 to the date of this Registration Statement, the Company effected three reverse stock splits of its outstanding common stock by amending its Certificate of Incorporation. On June 17, 2005, each outstanding 100 shares were reversed into one share. On August 11, 2006, each 20 outstanding shares were reversed into one share. On January 22, 2007, each 20 outstanding shares were reversed into one share. In all three reverse splits, all fractional shares due to be issued were rounded up to the next full share. Unless otherwise indicated, all references to a number of shares of the Company’s common stock have been adjusted to give effect to the applicable stock splits.

On February 20, 2007 we completed a business combination in which we acquired all of the outstanding stock of the Nevada Subsidiary in exchange for shares of our common stock. The combination was structured as a three-party merger in which the Company acquired all of the outstanding stock of the Nevada Subsidiary, a Nevada corporation named Xacord Acquisitions Sub Corp. formed and wholly-owned by the Company to be used as a vehicle for the transaction and which was merged into the Nevada Subsidiary and the outstanding shares of the common stock of the Nevada Subsidiary as of the Effective Time of the merger were converted into shares of the common stock of the Company on a share for share basis with a total of 26,504,000 shares of the Company’s stock issued in this conversion. The Company assumed four warrants issued by the Nevada Subsidiary to purchase up to a total of 4,050,000 shares of the Company’s Common Stock at $0.10 per share during a three-year term. A warrant to purchase 50,000 shares was exercised on March 2, 2007. The remaining three warrants for 4,000,000 shares were canceled by mutual agreement of the parties on June 1, 2007. The Company acquired the rights of the Nevada Subsidiary under a Letter of Intent to enter into the agreements relating to the acquisition of the majority interest in the Panamanian corporation holding the concession to the copper prospect. The management of the parties at the time of the business combination consisted of: (i) Diego Roca was the sole officer and director of the Company and of Xacord Acquisition Sub Corp.; and (ii) Pinchas Althaus, Diego Roca and Bruce Minsky were the officers and directors of the Nevada Subsidiary. Messrs. Althaus, Roca and Minsky became the three directors and three of the officers of the Company and the Nevada Subsidiary upon completion of the business combination. Mr. Minsky subsequently resigned as a director of the Company.

3

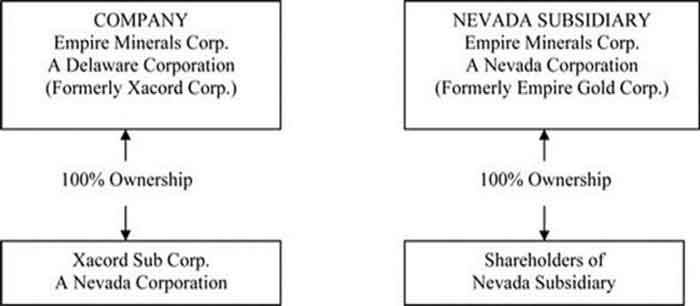

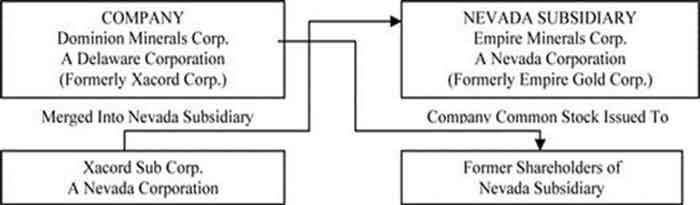

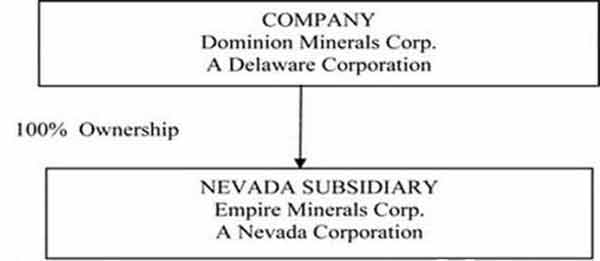

The following diagrams set forth the organizational status of the Company and the Nevada Subsidiary before and after the completion of their business combination.

Status Before Business Combination:

Actions in Business Combination:

4

Status After Business Combination:

On March 6, 2007, the Company entered into an Exploration and Development Agreement with Bellhaven Copper & Gold, Inc. (“Bellhaven”), a corporation organized in British Columbia, Canada and Bellhaven’s then wholly-owned subsidiary, Cuprum Resources Corp. (“Cuprum”), a corporation organized in Panama. Cuprum was the holder of a Mineral Concession from Panama on a copper prospect located in the Guariviara area of Panama. That agreement granted the Company an option to acquire up to 75% of the authorized and outstanding stock of Cuprum. On April 14, 2009, the Company and Bellhaven completed a transaction pursuant to a Stock Purchase Agreement under which the Company acquired 100% of Cuprum’s outstanding stock and the Exploration and Development Agreement entered into on March 6, 2007 was terminated.

Present and Proposed Operations

The Company’s present operations consist solely of pursuing its claims against the Republic of Panama relating to its Mineral Concession from the Republic of Panama on a copper prospect (“Cerro Chorcha”) located in the Guariviara area of Panama.

New Mining Projects

As discussed later in this Form 10, the Company does not expect to recover its Mineral Concession from the Republic of Panama through the legal process. The Company’s proposed operations in the case that the Cerro Chorcha project is not recovered, is to seek out new mining projects. It is anticipated that, at such time, the Company’s full time operations would consist of exploring new and existing mining opportunities throughout the world but preferably in the United States. We anticipate that it would take approximately $500,000 to sustain company operations while seeking a new opportunity.

Panamanian Mineral Concession

On March 6, 2007, the Company entered into an Exploration and Development Agreement with Bellhaven and Bellhaven’s then wholly-owned subsidiary, Cuprum Resources Corp. (“Cuprum”). Cuprum is the holder of a Mineral Concession from the Republic of Panama on a copper prospect (“Cerro Chorcha”) located in the Guariviara area of Panama. This agreement granted the Company an option to acquire up to 75% of the authorized and outstanding stock of Cuprum in exchange for (i) the payment of $2,000,000 to Bellhaven by the Company; (ii) the issuance of 4,000,000 shares of the Company’s common stock to Bellhaven; (iii) the expenditure of no less than $15,000,000 for the exploration and development work on the property covered by the Panamanian Mineral Concession held by Cuprum, of which approximately $5,244,051 had been spent as of April 14, 2009; and (iv) other specific terms and conditions.

5

On April 14, 2009, the Company and Bellhaven completed a transaction under a Stock Purchase Agreement between them pursuant to which (i) the Company acquired 100% interest in all the outstanding stock of Cuprum; (ii) the Company paid Bellhaven $1,500,000 in cash and issued Bellhaven 2,000,000 shares of the Company’s common stock; (iii) the officers and directors of Cuprum were replaced by the officers and directors of the Company; and (iv) the March 6, 2007 Exploration and Development Agreement between the Company, Bellhaven and Cuprum was terminated and the Company and Bellhaven mutually released each other from all obligations and/or liabilities arising thereunder.

The Cerro Chorcha concession consists of 24,241.91 hectares (ha) in five rectangular blocks and is located in Chiriqui and Bocas Del Toro Provinces of Panama straddling the continental divide about 290 km west of Panama City.

Since 2009, the Company has encountered various obstacles which have prevented the Company from commencing Phase 2 of its project.

On December 24, 2009, the Supreme Court of Panama issued an Order of Provisional Suspension in response to a lawsuit filed by Cesar Salazar against the Republic of Panama Ministry of Commerce and Industry (“MICI”). The lawsuit alleges among other things that MICI granted the Concession Agreement to the Cuprum unlawfully. The Company considers the claims frivolous and although the suit did not name the Company or Cuprum as a defendant, in February 2010 the Company exercised its right under Panama Law, as an interested third party, by filing a petition in the Supreme Court of Panama, defending the allegations. Pursuant to the Order of Provisional Suspension, any administrative or operational activities to be performed pursuant to the Concession Agreement by the Company or any Ministry or Office of the Republic of Panama, are indefinitely suspended. To date, the Company has not received a response to its petition. In addition, no final ruling has been issued by the Supreme Court of Panama.

In March 2010, the Company filed an application of extension to its Concession Agreement with MICI. In accordance with the Concession Agreement, the 2-year extension to continue exploration activities shall be granted by MICI with another 2 year extension to be granted after that. Requirements of such extension consist of (i) full compliance of the terms of the Concession Agreement during the initial 4-year period; (ii) proof of ability to perform financially by the Company; and (iii) proof of ability to perform technically by the Company. The Company in its application complied with each requirement. According to MICI, due to the Order of Provisional Suspension issued by the Supreme Court of Panama, MICI was not able to process or respond to the application of extension to the Concession Agreement.

In April 2010, to the contrary of the Order of Provisional Suspension issued by the Supreme Court of Panama, MICI issued and posted a resolution on the Gazeta Oficial of Panama declaring the site of the concession a “Mining Reserve.” Pursuant to the resolution, no further exploration and/or mining activities are to be performed on the site of the concession.

As of December 2013, MICI has provided no response to the lawsuit filed in the Supreme Court in December 2009. The Company has not received a resolution or response to the petition filed by the Company, from the Supreme Court of Panama. Although, the Company never received a “resolution of cancelation” from MICI, the application of extension submitted by the Company to MICI was neither, approved nor rejected. As explained by MICI that the concession remained in a “frozen” status pursuant to the Order of Provisional Suspension issued by the Supreme Court of Panama and the application of extension could not be processed. The Company considers the Concession Agreement active and plans to continue its operations upon resolution of the lawsuit filed in the Supreme Court of Panama and Order of Provisional Suspension being lifted. To date, the Company has not received any updates or response from the Supreme Court of Panama regarding this lawsuit.

On December 5, 2013, the Company notified the Panamanian government of the Company’s intent to initiate arbitration proceedings under the U.S.-Panama Bilateral Investment Treaty (“U.S.-Panama BIT”) and the U.S.-Panama Trade Promotion Agreement (“U.S.-Panama TPA”). As the Panamanian government has not responded to the Company’s requests to discuss a negotiated settlement, The Company filed a formal request for arbitration at the International Centre for Settlement of Investment Disputes (“ICSID”) on March 29, 2016. The Company has determined the amount of relief that it will seek in the arbitration shall be $268,300,000. There can be no assurance that it will be successful or recover any amount.

6

The dispute involves the Panamanian government’s interference with the Company’s investment in the mining concession. Cuprum owns the exploration rights to the Cerro Chorcha concession. As discussed above, the Panamanian Ministry of Commerce and Industry (“MICI”) was named as a defendant in a lawsuit brought by Cesar Salazar in December 2009, which led to the “provisional suspension” on all actions involving the Cerro Chorcha. Awaiting resolution of the lawsuit, the Company filed an application for an extension of its exploration rights in March 2010, one month before the initial exploration concession was to expire. However, despite the provisional suspension placed on the Cerro Chorcha, the Panamanian government designated the Cerro Chorcha as a “mining reserve” in April 2010 without considering the Company’s extension request, with the purpose and intent of reverting ownership of the concession to the Panamanian government. Furthermore, the Panamanian government subsequently passed legislation that annulled existing mining concessions in the area encompassing Cerro Chorcha in March 2013. The Company believes that these actions of the Panamanian government are unlawful and contravene Panama’s international obligations under the U.S.-Panama BIT and the U.S.-Panama TPA.

On March 29, 2016, the Company filed a Request for Arbitration against the Republic of Panama (Panama). This request was filed with the Secretary-General of the International Centre for Settlement of Investment Disputes (ICSID) under the terms of the U.S.-Panama Bilateral Investment Treaty (the U.S.-Panama BIT). The Request for Arbitration is the result of the above-mentioned longstanding dispute arising from Panama’s expropriation of Dominion’s substantial investment in the Cerro Chorcha mining concession.

The Request for Arbitration sets forth Dominion’s claims as follows:

| ● | Panama’s actions amounted to an expropriation of Dominion’s investment within the meaning of Article IV of the U.S.-Panama BIT, as they had the effect of depriving Dominion of all or substantially all of its investment in Cerro Chorcha; and |

| ● | Panama’s actions breached its obligations under Article II of the U.S.-Panama BIT to accord fair and equitable treatment to Dominion with respect to its investment in Cerro Chorcha. |

The closest city to Cerro Chorcha is David, Panama’s third largest city, which is about 40 km to the southwest of the concession site. Travel from Panama City to David requires approximately six hours by car along a paved two-lane highway. There are a number of daily commercial flights between these two cities.

To both the north and south of the concession site there are a number of small towns and villages all connected by a system of roads and trails. A north-south paved road passes within the northwest portion of the Cerro Chorcha concession; however this highway occurs on the opposite side of the Continental divide to the main camp which is accessible only by helicopter or on foot.

Currently helicopter flights to the main Cerro Chorcha camp and work area are out of Rambala a small town 31 kilometers north of the camp. There is a dirt road from Rambala to the village of Soloy. A foot trail leads from Soloy to the Cerro Chorcha camp. This route requires one day and a half to traverse by auto and foot.

Elevations on the property range from about 600 m to 2213 m at the top of Cerro Chorcha and slopes are steep. The higher elevations near the Continental Divide are often cloud covered generated by warm, moist Caribbean air that is lifted daily to cooler heights by air currents. Due to the weather effects, access to the concession site by helicopter is best achieved in the early morning and in the late afternoon.

The mountain terrain is covered in high altitude rain forest with annual rainfall reported to be up to about six meters. Temperatures in this locality average 20(degree) C to 25(degree) C but during some month’s temperatures can dip down to 5(degree)C at night. Work on the concession site can be undertaken at any time of the year.

The main Chorcha exploration camp consists of four large all-weather buildings powered by a diesel generator. Within the region, personnel, supplies, fuel, water and sufficient space for a mining operation are readily available.

7

The Cerro Chorcha Mineral Exploration Concession (Contract # 006,2005) at Cerro Chorcha was granted to Cuprum on April 4, 2006. In March 2010, the Company made its application for the extension of the Concession. As of the date of this Registration Statement, the Company has not received notice of the cancellation of the Concession Contract or any approval or denial of the application for extension.

The area falls under the local jurisdictions of the District of San Lorenzo in Chiriqui Province and the District of Chiriqui Grande in the Province of Betas Del Toro.

Mineral title to Cerro Chorcha was previously held under Exploration Concession 93-71 (Geo-Minas, S.A.). These concessions expired in 1999 and were officially cancelled by publication in the Official Gazette (No. 25,029) on April 15, 2004. An application for a new concession (CRC-EXPL 2004-05) was accepted on May 17, 2004 in the name of Cuprum.

Table 1 lists the coordinates of the corner points of the individual five blocks.

| Block | Longitude | Latitude | Area (hectares) | |||||

| 1 | 82(degree) | 40”’ 8(degree) | 408.61” | 10,302.92 | ||||

| 82(degree) | 47”’ 8(degree) | 408.61” | ||||||

| 82(degree) | 47”’ 8(degree) | 354.2” | ||||||

| 82(degree) | 40”’ 8(degree) | 354.2” | ||||||

| 2 | 82(degree) | 47”’ 8(degree) | 403.5” | 2,250.95 | ||||

| 82(degree) | 003.4”8(degree) | 403.5” | ||||||

| 82(degree) | 03A” 8(degree) | 39’ | 37” | |||||

| 82(degree) | 47”’ 8(degree) | 39’ | 37” | |||||

| 3 | 82(degree) | 003.4”8(degree) | 403.5” | 4,705.87 | ||||

| 82(degree) | 021.4”8(degree) | 403.5” | ||||||

| 82(degree) | 021.4”8(degree) | 354.2” | ||||||

| 82(degree) | 003.4”8(degree) | 354.2” | ||||||

| 4 | 82(degree) | 47”’ 8(degree) | 354.2” | 4,480.77 | ||||

| 82(degree) | 021.4”8(degree) | 354.2” | ||||||

| 82(degree) | 021.4”8(degree) | 327.7” | ||||||

| 82(degree) | 47”’ 8(degree) | 327.7” | ||||||

| 5 | 82(degree) | 47”’ 8(degree) | 337” | 2,501.40 | ||||

| 82(degree) | 0.34” 8(degree) | 337” | ||||||

| 82(degree) | 0.34” 8(degree) | 354.2” | ||||||

| 82(degree) | 47”’ 8(degree) | 354.2” |

The owners of the former concession lodged legal complaints objecting to the cancellation of their concession and the re-application by Cuprum. All legal complaints opposing the cancellation of the concession have been rejected by the Supreme Court of Panama. The new metallic mineral concession at Cerro Chorcha was granted to Cuprum and published in the Official Gazette (No. 25,517) on April 4, 2006. A metallic mineral exploration concession is valid for four years, with extensions available for another four. There are various reporting requirements and a tax on the exploration concessions which begins at US$0.50 per ha the first year and increases to US$1.50 per ha in year five.

The owner of the exploration mineral concession has an exclusive right to the application of an exploitation concession. The terms under which major projects proceed are negotiated with the government.

A portion of the Chorcha concession occurs on an autonomous aboriginal land reserve (Comarca) of the Ngobe-Bugle (see figure 2). There are no permanent habitations in the area of concession.

Cuprum signed an exclusive mineral exploration agreement (the “Agreement”) with the Comarca on July 28, 2004. The Agreement grants Cuprum the exclusive rights to explore for minerals and to negotiate a new agreement with the Comarca for the “next phase of activity” upon completion of the exploration phase. The Agreement is valid until the expiration of the Exploration Concession and strictly follows the Panama Mining Code whereby an exploitation concession is granted once the presence of commercial ore is demonstrated.

8

The Agreement (resolution #1 Feb 12, 2006) was signed by the President of the Regional Congress of the NoKribo Region (Mr. Enrique Pineda), the Chief of the NoKribo Region (Mr. Johnny Bonilla), and the president of the Local Congress of the Kanicintti District of the NoKribo Region (Mr. Julian Palacio) and, for Cuprum, the General Manager and Secretary of the Board of Directors (Mr. Alfredo Burgos).

Among the issues covered by the Agreement are: work progress, budgets and reporting; employment and training; land rentals and leasing; development programs; environment, education and culture; force majeure; settlement of conflicts; notification, continuity and applicable laws.

A joint committee was created by Cuprum and the peoples of the Comarca. During the periods when operations are active, monthly meetings of the committee are held to review development and to ensure continued mutual support. All work planned by the Company and Cuprum to date been formally reviewed by and the approved by the operating committee.

The north western portion of the Concession is in the watershed of the Fortuna Hydroelectric Project. Significant development in the hydra-electric reserve area would require approval from Fortuna S.A. (a corporation composed equally of Americas Generation Corp. and the State of Panama) which purchased the publicly owned Institute deRecursos Hidro-electricos y Electrificacion (IE) in 1998.

The mineralized area, as presently known, is far outside of the reserve, in fact it is on the other side of the Continental Divide from the Fortuna Project and therefore does not affect the catchment area.

Exploration work can be performed within the boundaries of the hydro-electric reserve, as long as we present the plan and procedures that adhere to the respective regulations they will not affect the watershed. A portion of the Palo Seco Reserve Forestal (Forestry Reserve) enters the concession from the north and extends to within about one kilometer north of the main mineralized zone, although legal survey of this has not yet been done.

ANAM (Autoridad Nacional del Ambiente), Panama’s environmental agency, is responsible for the administration of the forest reserve.

The Palo Seco Reserve, Forestal is divided into various sub-zones, each of which has a different level of protection. The current management plan does not specifically address mineral exploration and development, however the portion of the Palo Seco Forest Reserve nearest the Chorcha Project is assigned to a highly protected status with entry permitted only for scientific research. In the past exploration has been permitted within the limits of forest reserves, however damages must be mitigated. In its extension application submitted in March 2010, the Company proposed the Palo Seco Reserve Forestal protected area be removed from the concession.

Prior exploration work on Cerro Chorcha has not resulted in anything that could be considered to be an environmental liability.

Most of Panama consists of island arc assemblages of Cretaceous to Recent age which have resulted from the subduction of the Cocos tectonic plate underneath the Caribbean plate.

In western Panama, where Cerro Chorcha is located, Miocene andesitic to basaltic flows and volcanoclastic rocks of the Caflazas Group have been intruded by Pliocene to Miocene granodiorite and monzonitic rocks of the Tabasara.

The Porphyry copper deposits in Panama are associated with calc-alkaline intrusives. Panama hosts two ‘world class’ mineralized systems at Cerro Colorado and at Petal Pine, each containing in excess of one billion tons of mineralized rock.

At Cerro Chorcha the main area of interest occurs within a composite intrusion, consisting of diorite, quartz diorite, and lesser amounts of monzodiorite. Small bodies and dykes of quartz feldspar porphyry and mafic dykes cut the various intrusive phases and are considered to be post-mineral.

9

The Cerro Chorcha project contains porphyry copper mineralization with related gold and some reported molybdenum. Oxide and hypogene copper zones are present.

Distal propylitic (chlorite, epidote, and actinolite) alteration surrounds proximal phyllic (sericitie and silicic) zones. Much of the chalcopyrite and bornite mineralization occurs in a quartz-magnetite stock work and vein facies within the intrusive.

There is a strong structural component to the more or less east-west trending mineralized body which is cut by conjugate NE-SW and NW-SE trending faults.

By analogy with the Cerro Colorado porphyry copper deposit only 35 km to the ESE it is thought that the porphyry copper mineralization at Cerro Chorcha is between three and five million years old.

There are scattered mineralized showings over the entire 242 square kilometer Cerro Chorcha concession.

Porphyry copper (Cu) mineralization with associated gold, silver and molybdenum occur at the main Cerro Chorcha zone (the Guariviara Zone) over an area measuring 1.1 kilometers by 500 meters.

Much of the mineralization is structurally controlled and is related to quartz-magnetite sulphide veining and stockwork zones within the intrusive rocks. Laterally outward from the quartz-magnetite zones, sericite-altered intrusive rock contain fracture/veinlet controlled sulphides. The alteration outward from the phyllic, sericitic and siliceous material is predominantly propylitic.

Minerals encountered in the hypogene zone consist of magnetite, chalcopyrite, pyrite, bornite and minor sphalerite and molybdenite. Only minor supergene mineralization has been observed.

Exploration by previous operators has included regional stream sediment geochemistry, prospecting, trenching, soil and rock chip sampling, aerial and ground geophysics, and the drilling of 35 drill holes aggregating 7036 in.

ASARCO Exploration Company of Canada Ltd. discovered the Guariviviara Zone during a regional stream sediment program initiated in 1969. In 1976, exploration efforts included sampling, mapping and trenching resulted in defining porphyry copper mineralization grading greater than 0.2% Cu over an area of 600 meters by 300 meters.

ASARCO mobilized a drill onto the property. Negotiations with the Government to improve the terms of the concession agreement failed and the company abandoned the project without drilling. A total of over 400 samples were taken and assayed during the ASARCO tenure.

In the period 1990 to 1992 Consultores Geologicos S.A. obtained a concession and confirmed the importance of the zone discovered by ASARCO.

In 1993 the original concession was grouped together in a land package measuring 24,350 ha in an agreement between Consultores Geologicos and GeoRecursos International S.A. and the concession was transferred to Geo-Minas, S.A.

During 1993 a north-south grid was cut with 200m line spacing. A total of sixty-seven soil, 30 rock and 64 chip samples were taken as part of a regional prospecting program.

In the period 1994 and 1995 GeoRecursos International S.A. and Arlo Resources (Arlo) expanded the grid, performed geochemical, geological, and magnetic surveys and regional prospecting work.

GeoRecursos and Arlo completed 27 helicopter-supported diamond drill holes on the Guariviara Zone for a total of 5,765metres.

10

During 1997 and 1998 Cyprus Minera de Panama (Cyprus) obtained an option on the property. Cyprus expanded the grids, refined the geology of the deposit, mapped and sampled outlying zones, conducted airborne radiometric and magnetic surveys and drilled nine diamond drill holes for a total of 1271 meters. Cyprus left Panama and the concession remained dormant, finally being officially cancelled April 15, 2004.

Following approval of the new Chorcha mineral concession Cuprum and Belhaven undertook the construction of the Chorcha exploration camp and conducted a short program of geologic mapping and one-meter channel samples were collected from several zones of structurally-controlled quartz-magnetite stock work that appears to host the high-grade copper-gold-silver mineralization. Reported grades within the stock work zone, returned a total of 61 meters at an average grade of 1.89% Cu, 1.44 g/t Au, and 23.28 g/t Ag.

Based upon exploration work on the Cerro Chorcha, Bellhaven and the Company have procured a technical report on the property which was prepared in compliance with the National Instrument (NI) 43-101, “Standards of Disclosure For Mineral Projects” adopted by Canadian securities regulatory authorities. However, a company reporting under the U.S. Securities Exchange Act of 1934 may not report resources designated under NI 43-101 based upon a pre-feasibility study. In addition, to designate reserves under the Industry Guide 7 of the U.S. Securities and Exchange Commission a final or bankable feasibility study is required. Accordingly, while Bellhaven, Cuprum and the Company have used the NI 43-101 report in their evaluation of the property, they are not claiming or asserting any reserves for the Cerro Chorcha and it must be considered as an exploration property without any known resources. The proposed program for the Cerro Chorcha is exploratory in nature.

Unless changes are required, the final two phases of a three phase program of geologic investigation will be conducted. Apart from direct geologic work, each phase of the program includes the funding of some social program with the local indigenous groups.

Phase One included surface prospecting, surface geologic mapping, trenching and sampling as well as an 11-hole diamond drill program of 3,615.8 meters. The phase one program was conducted from March 2007 to November 2007, had a budget of $2.1 million dollars and actual costs of $2,100,492.

A contract with Cabo Drilling Corp. (Cabo), of Vancouver, B.C. Canada was signed to perform the drill program on March 14, 2007. In preparation for the drill program, the Company built drill pads and fuel storage facilities. The 3,600-meter drill program was commenced in June 2007 and concluded in November 2007 with eleven drill holes and 3,615.8 meters have been drilled with encouraging results.

The drill program of 3,615.8 meters, confirmed the Company’s geologic model which outlines a structurally controlled mineralized zone with a NE-SW direction. Holes CH-07-01 to CH-07-11 drilled across the higher grade stock work structures, identifying a zone of nearly 900 meters in strike length, which will be further defined by the next drilling campaign. Additionally, the drill program confirmed an envelope of medium grades (ranging from 0.4 to 0.8% Cu) which surround the higher grade stock work zones.

All holes drilled appear to indicate potential for the extension of the higher grade zone at depth as evidenced by dipping mineralized structures observed in drill core and as shown on cross sections. This possibility will be explored to greater extent by an upcoming 10,000-meter drill program to begin if and when the Company is permitted to continue its exploration activities on the project as a form of settlement of the arbitration process mentioned above.

The previous drill program gives better context to the probable continuity of higher grade stock work and porphyry-style mineralization within areas of previously unexplained rock and soil geochemical anomalies surrounding the known Chorcha deposit. These anomalies are located within 0.5 to 1 kilometer to the north, south and east of the drill indicated resource, and will be investigated by field crews to develop drill targets for the next tentative drill program. The updated NI-43-101 report, which was published in August 2008, will serve as the basis for the next 10,000-meter drill program planned for 2017 or later, depending on the Company’s success in negotiations with the Panamanian government or the outcome of arbitration mentioned throughout this report. The purpose of the next drill program will be to provide greater continuity to the geological model and to further define the mineralization at Cerro Chorcha which remains open in almost every direction, and to extend porphyry-style copper and gold mineralization to areas adjacent to and surrounding the known deposit.

11

Phase Two will include the creation of access road into the Chorcha main zone. Phase two will also include surface prospecting, surface geologic mapping, trenching and sampling as well as a 26-hole, 10,000-meter diamond drill program of systematic drilling utilizing several diamond drill rigs. Phase two will have a budget of approximately $6,900,000.

Phase Three will concentrate on the completion of a bankable feasibility study by conducting the appropriate meters of drilling necessary to complete this task. Further details of Phase Three including the estimated costs will not be available until Phase Two has been completed or until significant results of the Phase Two have been assessed.

Throughout the exploration all samples will be prepared and analyzed by an independent 1S0 certified laboratory.

The exploration work on the Cerro Chorcha project is supervised by Michael D. Druecker, Ph.D., P.Geo a Qualified Person as defined in NI 43-101. Mr. Druecker has verified that trench and drill results have been accurately summarized from the official assay certificates provided to the Company.

The Company’s drilling sampling procedures follow the Exploration Best Practices Guidelines outlined by the Mining Standards Task Force and adopted by the Toronto Stock Exchange. Samples have been analyzed by ICP (inductively coupled plasma/mass spectrometry), and gold analysis has been by fire assay with gravimetric finish on a 30gram split.

Quality control measures, including check duplicates and sample standard-assaying are being implemented. A chain of custody review has been completed to ensure the integrity of all sample data. Samples were assayed by Acme Analytical Laboratories, independent of the Company.

The outstanding legal status of the project and the Company’s financial condition will further delay the Company’s ability to fund the commencement of Phase Two and the Company’s operations. The Company plans to fund operations including Phase Two by the sales of shares of the Company’s Common Stock and or Convertible Promissory Notes. However, in order to do so, the legal status of the Company’s Panamanian project must be resolved.

Panamanian Regulations

The operations being conducted on the Cerro Chorcha project by Cuprum are subject to the supervisory and administrative laws of Panama which govern mining activities. In addition, these activities are governed by the terms and conditions of the exclusive mineral exploration agreement between Cuprum and the Regional Congress of the NoKaibo Region, the Chief of the NoKaibo Region and the Local Congress of the Kanicintti District of the NoKaibo Region as set out above. The major Panamanian statutes applicable to these operations are the “Code of Mineral Resources,” the “General Corporation Law” and the “General Environmental Law.” The Company is in compliance with all current regulations pursuant to the General Corporation Law and Code of Mineral Resources in Panama. Other than remining in compliance with such regulations, the Company is not subject to any adverse effects pursuant to the current or probable government regulations.

Environmental Issues

Although our mineral activities are outside the United States of America and not subject to Federal, state or local provisions regarding discharge of material into the environment, they are subject to all the environmental regulations of their respective locales. However, since our proposed activities for the next several years are exploratory in nature, the effect of the regulations regarding the discharge of materials into the environment will not have a material effect upon the capital expenditures, earnings and competitive position of the Company.

SEC Reporting Obligations

In 2012 and 2016, the Company’s registration of securities was revoked by the Securities and Exchange Commission (“SEC”) due to the Company’s delinquent status of their reporting of its financial information. In October 2016, the Company filed a Form 10 Registration Statement with the SEC. The Company anticipates remaining current with its reporting obligations going forward.

12

Plan of Operations

During the 12-month period commencing February 1, 2018, the Company will concentrate its efforts on the resolution of legal issues of the Panamanian copper project. We believe that it is doubtful that the Company will regain the concession. If the Company regains the concession, it would seek to resume operations and concentrate on the further exploration of the project. The Company hired outside counsel and on June 18, 2015, entered into a Litigation Funding Agreement (“LFA”) with Therium Capital Management Limited, to fund its litigation against the Republic of Panama. On December 26, 2016, the Company amended the LFA t. The LFA signed on December 26, 2016 includes the documentation executed in June 2015 with the addition of certain documentation which reflects the new legal firm engaged by the Company as a replacement of prior legal counsel included in the LFA dated June 18, 2015. The terms of the LFA allow for funding of up to approximately $6,000,000 of the Company’s litigation costs. In accordance with the LFA, the repayment of the legal costs advanced by Theriim shall be 2.5 times of the amount funded to the Company if the Company receives a monetary award, as a result of the arbitration process. In addition, the Company will be required to share a percentage of any amount awarded to the Company with Therium. The percentage to be shared shall be determined by the amount of the award as follows; (i) 0% of any award collected up to $70,000,000; (ii) 25% to 35% of any award collected above $70,000,000 up to $100,000,000; (iii) 10% to 25% of any award collected above $100,000,000 up to $300,000,000; and (iv) 2% to 4% of any award collected above $300,000,000. The Company has filed a formal Request for Arbitration at the International Centre for Settlement of Investment Disputes (”ICSID”) on March 30, 2016. The Company is seeking relief in the amount of $268.3 million in the arbitration.

In the event the Company is able to recover the concession in Panama as a form of settlement of the litigation, it would resume exploration work which would require approximately 10,000 meters of drilling at an estimated cost of $6,900,000. The Company would need to raise approximately $8,000,000 for the exploration work and operations and there can be no assurance that such capital will be available to the Company.

As discussed in this Form 10, the Company does not expect to recover its Mineral Concession from the Republic of Panama through the legal process. The Company’s proposed operations in the case that the Cerro Chorcha project is not recovered, is to seek out new mining projects. The Company’s full time operations at that point, would consist of exploring and evaluating new and existing mining opportunities throughout the world but preferably in the United States.

Competition

In the event we recover the Panama concession, we would face competition from other copper mining and producing companies around the world from companies that are more established and better capitalized.

With respect to seeking new mining projects, we would face competition from larger, more established and better capitalized companies seeking profitable projects around the world.

Personnel

The Company presently employs 2 full-time employees, Pinchas Althaus, the Chief Executive Officer, and Diego Roca, the Chief Financial Officer.

Item 1A. Risk Factors

This Registration Statement contains statements concerning our future performance, intentions, objectives, plans and expectations that are or may be deemed to be “forward-looking statements”. Our ability to do this has been fostered by the Private Securities Litigation Reform Act of 1995, which provides a “safe harbor” for forward-looking statements to encourage companies to provide prospective statements identifying important factors that could cause actual results to differ materially from those discussed in the statement. In addition, the Company’s status as an exploration and development company without any present revenue producing operations increases the risks involved in an investment in the Company. These factors affecting us include, but are not limited to, the following:

13

PROPOSED OPERATIONS ARE DEPENDENT UPON OUR ABILITY TO RAISE A MATERIAL AMOUNT OF CAPITAL.

We are involved in the business of locating, acquiring, exploring, developing and operating mineral prospects and properties and have no present revenue producing operations. In the event, that we resolve our legal issues in Panama, the Company will require approximately $8,000,000 to resume exploration activities and operations. There is no assurance that the expenditures of these funds will develop any of our mineral prospects to the point they may become revenue producing. The time and capital required for the exploration and development of production from mineral properties are intensive. Even if the results of our exploration and development activities are successful, we may still face material additional capital requirements to be able to achieve economical operations.

WE HAVE NO PRESENT SOURCE OF REVENUE AND ARE DEPENDENT UPON RAISING ADDITIONAL CAPITAL TO FINANCE CONTINUING OPERATIONS.

We have no present source of revenue. We are dependent upon our ability to raise additional capital to finance our operations including our administrative operating costs which are estimated at $500,000 for the 12 months commencing February 1, 2018. Under our present program, it will likely be several years before we develop any revenue, even if our mineral exploration program is successful, of which there is no assurance.

THE MINERAL INDUSTRY IS SUBJECT TO INTENSIVE AND INCREASING GOVERNMENTAL REGULATION WHICH MAY ADVERSELY AFFECT OUR OPERATIONS.

All of our mineral operations will be subject to intensive and increasing governmental regulations, including those involving environmental, labor, waste management, environmental restoration, property ownership rights, health and safety matters. The operations to be conducted in Panama on the Cerro Chorcha prospect by Cuprum are subject to the laws of Panama relating to mineral activities and to the terms of the exclusive exploration agreement included as part of the Panamanian mineral concession. See Panamanian Regulations above. Compliance with the applicable regulations, which are only likely to increase in the future, may adversely impact mining operations and their results. Since we will be operating in foreign jurisdictions these adverse effects may be magnified.

WE WILL BE DEPENDENT UPON THE SERVICES OF OTHERS IN OUR MINERAL OPERATIONS.

We will be dependent upon the services of others, including independent third parties in our exploration, development and mining operations. Our activities will be limited to supervision of and raising capital for the mineral activities. This diminished control over daily activities may adversely affect our operations.

WE HAVE NO PRESENT ESTABLISHED ECONOMIC ORE RESERVES AND NO ASSURANCE WE CAN DEVELOP ANY.

There are no established economic ore reserves on the Cerro Chorcha project. There is no assurance that we will be able to develop any such reserves; or that, if reserves are developed, we will be able to mine them profitability, due to insufficient capital or otherwise.

IF WE DEFINE AN ECONOMIC ORE RESERVE AND ACHIEVE PRODUCTION, IT WILL DECLINE IN THE FUTURE AS AN ORE RESERVE IS A WASTED ASSET.

Our future ore reserve and production, if any, will decline as a result of the exhaustion of reserves and possible closure of any mine that might be developed. Eventually, at some unknown time in the future, all of the economically extractable ore will be removed from the properties, and there will be no ore remaining. This is called depletion of reserves. Ultimately, we must acquire or operate other properties in order to continue as an ongoing business.

14

MINERAL MARKET PRICES ARE SUBJECT TO FLUCTUATIONS WHICH MAY ADVERSELY EFFECT OUR OPERATIONS.

If we are successful in developing any mineral properties, our ability to operate at a profit will be dependent on the then existing market price of the involved mineral. Declines in the market prices of the involved mineral may render reserves containing relatively low grades of ore uneconomic to exploit, and we may be required to discontinue exploration, development or mining on the properties, or write down our assets. We cannot predict the future market price of minerals and we may not be able to survive in a declining market situation.

WE HAVE NO ASSURANCE THAT WE WILL RECOVER THE CERRO CHORCHA CONCESSION OR RECEIVE ANY MONETARY COMPENSATION.

In March 2013, the Panamanian government passed legislation that annulled existing mining concessions in the area encompassing Cerro Chorcha. The Company believes that these actions of the Panamanian government are unlawful and contravene Panama’s international obligations under the U.S.-Panama BIT and the U.S.-Panama TPA. The Company will concentrate its efforts on the resolution of this and other legal issues mentioned in this report, of the Panamanian copper prospect in order to resume operations and concentrate on the further exploration of the project. There is no assurance that the Company will be successful in resolving such legal issues and that the Cerro Chorcha Concession Agreement will not be canceled.

WE MAY NOT BE SUCCESSFUL OR RECOVER ANY AMOUNT IN ARBITRATION WITH THE REPUBLIC OF PANAMA.

On March 29, 2016, the Company filed a Request for Arbitration against the Republic of Panama (Panama). This request was filed with the Secretary-General of the International Centre for Settlement of Investment Disputes (ICSID) under the terms of the U.S.-Panama Bilateral Investment Treaty (the U.S.-Panama BIT). The Request for Arbitration is the result of the above mentioned longstanding dispute arising from Panama’s expropriation of Dominion’s substantial investment in the Cerro Chorcha mining concession.

The Request for Arbitration sets forth Dominion’s claims as follows:

| ● | Panama’s actions amounted to an expropriation of Dominion’s investment within the meaning of Article IV of the U.S.-Panama BIT, as they had the effect of depriving Dominion of all or substantially all of its investment in Cerro Chorcha; and |

| ● | Panama’s actions breached its obligations under Article II of the U.S.-Panama BIT to accord fair and equitable treatment to Dominion with respect to its investment in Cerro Chorcha. |

There can be no assurance that it will be successful, recover any amount or recover the concession.

IF WE FAIL IN ARBITRATION THE COMPANY IS UNLIKELY TO BE ABLE TO CONTINUE AS A GOING CONCERN.

While the Company believes that it has a strong case and high likelihood of success, there may be certain risks involved should it ultimately not prevail in the arbitration. If Panama prevails in the arbitration, the Tribunal is likely to award Panama a significant portion or all of its arbitration costs, which will normally include legal fees, arbitrator fees, and other direct out-of-pocket costs such as hearing venue expenses, witness accommodations, and the like. As the named party in the dispute, the Company would be liable for any such fees that the Tribunal may award to Panama. In such event, paying such award to Panama would require the Company to raise capital to meet this obligation, of which there can be no assurance as the Company would no longer have a viable project to fund. As a result, a loss in the arbitration would likely result in the Company no longer being a going concern.

15

THE CERRO CHORCHA PROSPECT IS AN EXPLORATION PROSPECT WITHOUT ESTABLISHED RESERVES.

The Cerro Chorcha property is an exploration prospect without any established reserves. We have relied, in part, on various pre-feasibility studies conducted prior to our acquisition of Cuprum. These are significant risks involved in so relying on results of a pre-feasibility study, including:

| ● | The limited amount of drilling work underlying the study; | |

| ● | Any process testing done is limited to small pilot plants and/or bench scale testing; | |

| ● | There are normally difficulties obtaining expected metallurgical recoveries when you are scaling up to production scale from a pilot plant; | |

| ● | The preliminary nature of the sine and processing concepts; | |

| ● | The lack of accuracy in preliminary cost estimates; | |

| ● | The actual metallurgical recoveries made; and | |

| ● | The history of pre-feasibility studies of typically underestimating “vital” and operating costs. |

THE CERRO CHORCHA PROJECT INVOLVES A LARGE EXPLORATION PROPERTY IN AN ISOLATED UNDEVELOPED AREA REQUIRING LARGE TIME EFFORT AND CAPITAL EXPENDITURES.

The Cerro Chorcha property is a large exploration prospect located in an isolated undeveloped area. The exploration program will require the expenditure of large amounts of capital over a period of several years. If the results of the initial exploration work are satisfactory, we will have to build access roads to and on the property to be able to complete the exploration program. If the completed exploration program is successful, we will then be faced with the necessity to complete the planning for the development of the property to the extent necessary to support a final or bankable feasibility study. During this period, we will be subject to the potential adverse impact of factors beyond our control on the project; i.e., the decline in the price of the targeted mineral.

BECAUSE WE ARE CLASSIFIED AS A SHELL COMPANY, INVESTORS MAY NOT RELY UPON EXEMPTIONS FROM REGISTRATION PROVIDED BY RULE 144 UNLESS AND UNTIL CERTAIN RESTRICTIONS ARE COMPLIED WITH.

Rule 144 provides a safe harbor for the public resale of restricted and control securities if a number of conditions are met. Restricted securities are securities acquired in unregistered, private sales from the issuing company or from an affiliate of the issuer. Control securities are those held by an affiliate of the issuing company.

Because we are a shell company as defined in Rule 405 of the Securities Act and Rule 12b-2 of the Exchange Act, investors may not rely upon Rule 144 to sell their shares unless and until: we have ceased being a shell company; we are subject to the reporting requirements of section 13 or 15(d) of the Exchange Act; we have filed all reports and other materials required to be filed by section 13 or 15(d) of the Exchange Act during the preceding 12 months.

16

Item 2. Financial Information

Results of Operations for the three months ended September 30, 2017 and 2016

The following gives a summary of the most recent Statement of Operations data of Dominion Minerals Corp. for the three months ended September 30, 2017 and 2016.

| Three

Months Ended | Three

Months Ended | |||||||

| September

30, 2017 | September

30, 2016 | |||||||

| Statement of Operations | ||||||||

| Revenue | $ | — | $ | — | ||||

| Net Loss | (159,106 | ) | (161,927 | ) | ||||

| Net Loss Per Share | $ | (0.00 | ) | $ | (0.00 | ) | ||

Revenue and Gross Profit

During the three months ended September 30, 2017 and 2016 the Company had no revenue, no costs affiliated with earning revenue and gross profit for the three months ended September 30, 2017 and 2016 was $0.

Operating Expenses

Operating expenses for the three months ended September 30, 2017 and 2016 consisted primarily of professional fees of $1,800 and $4,000, respectively, compensation to officers of $143,750 and general and administrative expenses of $1,965 and $1,026, respectively. Professional fees consisted of fees to the Company’s auditor for the review of the Company’s financial statements and SEC filings. General & administrative expenses consisted of travel, transfer agent, office, telephone, internet and supplies expense to support the day to day operations.

Loss from Operations

Loss from operations for the three months ended September 30, 2017 and 2016 was $147,515 and $148,776, respectively. The losses for the three months ended September 30, 2017 and 2016 were primarily attributable to the professional fees, officer compensation and general and administrative expenses described above of $147,515 and $148,776, respectively.

Net Loss

Net loss from operations for the three months ended September 30, 2017 and 2016 was $159,106 and $161,927, respectively. The net losses were primarily attributable to the loss from operations and interest expense for the Convertible Promissory Notes entered into by the Company and various investors. Inflation did not have a material impact on the Company’s operations for the period. Management knows of no trends, demands, or uncertainties that are reasonably likely to have a material impact on the Company’s results of operations.

17

Results of Operations for the nine months ended September 30, 2017 and 2016

The following gives a summary of the most recent Statement of Operations data of Dominion Minerals Corp. for the nine months ended September 30, 2017 and 2016.

| Nine

Months Ended | Nine

Months Ended | |||||||

| September

30, 2017 | September

30, 2016 | |||||||

| Statement of Operations | ||||||||

| Revenue | $ | — | $ | — | ||||

| Net Loss | (484,848 | ) | (491,849 | ) | ||||

| Net Loss Per Share | $ | (0.00 | ) | $ | (0.00 | ) | ||

Revenue and Gross Profit

During the nine months ended September 30, 2017 and 2016 the Company had no revenue, no costs affiliated with earning revenue and gross profit for the nine months ended September 30, 2017 and 2016 was $0.

Operating Expenses

Operating expenses for the nine months ended September 30, 2017 and 2016 consisted primarily of professional fees of $11,400 and $8,500, respectively, compensation to officers of $431,250 and general and administrative expenses for the nine months ended September 30, 2017 and 2016 of $7,426 and $8,207, respectively. Professional fees consisted of fees to the Company’s auditor for the review of the Company’s financial statements and SEC filings. General and administrative expenses consisted of travel, transfer agent, office, telephone, internet and supplies expense to support the day to day operations.

Loss from Operations

Loss from operations for the nine months ended September 30, 2017 and 2016 was $450,076 and $447,957, respectively. The losses for the nine months ended September 30, 2017 and 2016 were primarily attributable to the professional fees, officer compensation and general and administrative expenses described above of $450,076 and $447,957, respectively.

Net Loss

Net loss from operations for the nine months ended September 30, 2017 and 2016 was $484,848 and $491,849, respectively. The net losses were primarily attributable to the loss from operations and interest expense for the Convertible Promissory Notes entered into by the Company and various investors. Inflation did not have a material impact on the Company’s operations for the period. Management knows of no trends, demands, or uncertainties that are reasonably likely to have a material impact on the Company’s results of operations.

18

Liquidity and Capital Resources

Cash and Working Capital

As of September 30, 2017 and December 31, 2016, we had a working capital deficit of $6,762,221 and $6,277,373, respectively. Our current liabilities as of September 30, 2017 and December 31, 2016 of $6,763,730 and $6,277,373, respectively, exceeded our current assets as of September 30, 2017 and December 31, 2016 of $1,509 and $0, respectively. We had an accumulated deficit of $42,770,620 and 42,285,772 on September 30, 2017 and June 30, 2016, respectively.

We had a cash balance of $1,509 and $0 on September 30, 2017 and December 31, 2016, respectively. Net cash used for operating activities for the nine months ended September 30, 2017 and 2016 was $61,730 and $52,956, respectively. The net loss for the nine months ended September 30, 2017 and 2016 was $484,848 and $491,849, respectively. Cash used in operating activities was for professional fees and general and administrative expenses.

Net cash provided by all financing activities for the nine months ended September 30, 2017 and 2016 was $63,239 and $53,019, respectively. This consisted of $52,625 and $49,750 for the nine months ended September 30, 2017 and 2016, respectively, in proceeds from the litigation funding company recorded as a contingent liability. For the nine months ended September 30, 2017 and 2016, we had net cash flows of $1,509 and $63, respectively.

Results of Operations for the years ended December 31, 2016 and 2015

The following gives a summary of the most recent Statement of Operations data of Dominion Minerals Corp. for the years ended December 31, 2016 and 2015, and the Balance Sheet data of the Company as of December 31, 2016 and 2015.

| Year Ended | Year Ended | |||||||

| December

31, 2016 | December

31, 2015 | |||||||

| Statement of Operations | ||||||||

| Revenue | $ | — | $ | — | ||||

| Net Loss | (649,337 | ) | (641,568 | ) | ||||

| Net Loss Per Share | $ | (0.01 | ) | $ | (0.01 | ) | ||

| Balance Sheet | ||||||||

| Total Assets | $ | — | $ | 64 | ||||

| Total Liabilities | 6,214,998 | 5,657,220 | ||||||

| Shareholders’ Deficit | (6,214,998 | ) | (5,657,156 | ) | ||||

19

Revenue and Gross Profit

During the years ended December 31, 2016, and 2015 the Company had no revenue, no costs affiliated with earning revenue and gross profit for the years ended December 31, 2016 and 2015 was $0.

Operating Expenses

Operating expenses for the year ended December 31, 2016 and 2015 consisted primarily of compensation to officers of $575,000. Other operating expenses for the year ended December 31, 2016 consisted of professional fees and general and administrative expenses of $8,500 and $10,355, respectively. For the year ended December 31, 2015, professional fees and general and administrative expenses incurred were $7,490 and $12,715, respectively. Professional fees were incurred primarily for legal, accounting and consulting costs in connection with the Company’s effort to resume its reporting obligations to the SEC.

20

Loss from Operations

Loss from operations for the year ended December 31, 2016 and 2015 was $593,855 and $595,205, respectively. The losses for the years ended December 31, 2016 and 2015 were primarily attributable to the officer compensation, professional fees and general and administrative expenses described above of $593,854 and $595,205, respectively.

Net Loss

Net loss from operations for the years ended December 31, 2016 and 2015 was $649,337 and $641,568, respectively. The net losses were primarily attributable to the loss from operations and interest expense for the Convertible Promissory Notes entered into by the Company and various investors. Inflation did not have a material impact on the Company’s operations for the period. Management knows of no trends, demands, or uncertainties that are reasonably likely to have a material impact on the Company’s results of operations.

Liquidity and Capital Resources

Cash and Working Capital

As of December 31, 2016 and 2015, we had a working capital deficit of $6,214,998 and $5,657,156, respectively. Our current liabilities as of December 31, 2016 and 2015 of $6,124,998 and $5,657,220, respectively, exceeded our current assets as of December 31, 2016 and 2015 of $0 and $64, respectively. We had an accumulated deficit of $42,285,772 and $41,636,435 on December 31, 2016 and 2015, respectively.

We had a cash balance of $0 and $64 on December 31, 2016 and 2015, respectively. Net cash used for operating activities for the year ended December 31, 2016 and 2015 was $65,708 and $57,324, respectively. The net loss for the year ended December 31, 2016 and 2015 was $649,337 and $641,568, respectively. Cash used in operating activities was for compensation, professional fees and general and administrative expenses.

Net cash obtained through all financing activities for the year ended December 31, 2016 and 2015 was $65,644 and $57,309, respectively. This consisted of $20,000 and $62,375 in proceeds from the sale of a convertible promissory note and the proceeds received for the contingent liability recorded from the litigation funding company, less the repayment of loans to officers in the amount of $16,731, respectively, during the year ended December 31, 2016 and $46,000 and $11,309 in proceeds from the sale and issuance of common stock and from loans obtained from officers, respectively, during the year ended December 31, 2015. For the year ended December 31, 2016 and 2015, we had net cash flows of $(64) and $(15), respectively.

Financings and Sources of Liquidity

For the years ended December 31, 2016 and 2015, we issued 1,941,333 and 3,066,667 shares of the Company’s common stock to an investor for $29,120 and $46,000, respectively.

Over the next 12 months, we plan to continue to fund our operations through the sale of common stock, common stock warrants, convertible promissory notes or a combination thereof.

Convertible Promissory Note in Default

On November 27, 2009, Dominion Minerals Corp. (the “Company”) entered into and closed on a Convertible Loan Agreement (the “Loan Agreement”) to sell to non-US persons the convertible note due 2010 (the “Note”) in the aggregate principal amount of $2,000,000 and warrants to purchase up to 10,000,000 shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), with a term of one year and an exercise price of $0.15 per share for a total purchase price of $2,000,000.

21

The Note matures one year after the date of issuance. The Note pays interest at a rate of 3-Month LIBOR plus 2.0% per annum, which is payable at maturity, and is convertible into shares of Common Stock at a conversion price equal to $0.10 per share (the “Conversion Price”). The Conversion Price is subject to adjustment for certain events, including the dividends, distributions or split of the Company’s Common Stock, or in the event of the Company’s consolidation, merger or reorganization. In the event of a conversion, accrued interest shall be automatically converted into common stock. In addition, the Company has the right to prepay the entire outstanding principal due under the Notes upon a three business day notice.

The Company’s obligations under the Loan Agreement and the Note are secured by the pledge of 5,000,000 shares of Cuprum Resources Corp., a corporation organized under the laws of the Republic of Panama (“Cuprum”), owned by the Company pursuant to a Pledge Agreement dated as of November 30, 2009 by and among the Company, Cuprum and the investor. The pledged shares represent all of the issued and outstanding equity shares of Cuprum.

On May 3, 2010, the Ministry of Commerce and Industry of the Republic of Panama declared the Company’s Mineral Concession as a Mining Reserve by posting a Resolution in the Gaceta Oficial of Panama. Pursuant to the Resolution, no further exploration activities are to be performed on the concession site. The Company has disputed the declaration and Resolution by MICI and has commenced legal action against the Republic of Panama. Accordingly, the Company notified the Note Holder of such events and how it relates to their inability to perform pursuant to the terms of the Concession Agreement and subsequently the terms of the Note, to support its claim of a force majeure and its inability to repay the Note. To date, because of the Company’s inability to resume exploration activities on the Mineral Concession, the Company has been unable to repay the Note and the Note Holder has not converted the Note. The Company incurred interest expense in the amounts of $34,209 for the nine months ended September 30, 2016 and 2015. As of September 30, 2016 and December 31, 2015, the total amount due for the Convertible Note payable is $2,311,759 and $2,277,550, respectively.

Item 3. Description of Property.

The Company has no material physical properties and no assets.

Our present office facilities consist of an office share arrangement at 3171 US Highway 9 North, Suite 324, Old Bridge, New Jersey 08857. As our activities expand, we will lease appropriate space in the New York City area for our administrative offices.

Item 4. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The following table sets forth information with respect to the persons known to the Company to be the beneficial owners of more than 5% of any class of the Company’s voting securities as of January 29, 2018:

| Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Ownership Percent of Class | Voting Rights Percent of Class | ||||||||||

| Series A | Pinchas Althaus | 100 shares | (2) | 50 | % | 50 | % | |||||||

| Preferred Stock(1) | 17 State Street, Suite 4000 | |||||||||||||

| New York, NY 10004 | ||||||||||||||

| Series A | Investment Group (3) | 100 Shares | (4) | 50 | % | 50 | % | |||||||

| Preferred Stock(1) | 17 State Street, Suite 4000 | |||||||||||||

| New York, NY 10004 | ||||||||||||||

| Common Stock | Pinchas Althaus | 8,750,000 | (2) | 8.62 | % | 41.72 | % | |||||||

| 17 State Street, Suite 4000 | ||||||||||||||

| New York, NY 10004 | ||||||||||||||

| Common Stock | Investment Group (3) | 25,916,090 | (4) | 26.04 | % | 45.21 | % | |||||||

| 17 State Street, Suite 4000 | ||||||||||||||

| New York, NY 10004 | ||||||||||||||

| Common Stock | Michael Bernard Silver | 13,066,667 | (5) | 13.13 | % | 13.13 | % | |||||||

| 100 Westminister Bridge Road | ||||||||||||||

| London, UK SE1 7XB | ||||||||||||||

22

| (1) | The Series A Preferred Stock consists of 200 shares which as a class has the right to vote 80% of all votes to be cast on any matter by the combined outstanding Series A Preferred Stock and Common Stock. |

| (2) | Owned of record and beneficially. 41.72% voting rights percentage of Common Stock includes 40% rights through ownership of 100 shares of Series A Preferred Stock plus 1.72% voting rights of Common Stock through ownership of 8,750,000 shares of Common Stock calculated by 8.62% ownership of remaining 20% of Common Stock. |

| (3) | The members of the Investment Group and the percentage ownership of each member in the total holdings of the Investment Group are as follows: |

| (a) | Reytalon Ltd., an Israeli corporation – 30%; Avi Schnur, who had no prior relationship with the Company is the control person of Reytalon, Ltd.; | |

| (b) | Talromit Financial Holdings, Ltd., an Israeli corporation – 10%; Yosef Greenfeld, who had no prior relationship with the Company is the control person of Talromit Financial Holdings, Ltd. |

| (c) | Grantsville Investments Limited (BVI), a British Virgin Islands corporation – 20%; James Lasry, who had no prior relationship with the Company is the control person of Grantsville Investments Limited; | |

| (d) | Graceville, Ltd., an Israeli corporation – 20%; Alexander Reisman, who had no prior relationship with the Company is the control person of Graceville, Ltd.; and | |

| (e) | ACC Holding International Ltd., a British Virgin Islands corporation – 20%. Chaim Lebovits, a director of the Company is the control person of ACC Holding International, Ltd. |

| (4) | Owned of record and beneficially by each member in (3) immediately above. |

| (5) | Includes shares beneficially owned by Mr. Silver individually, 1,000,000 shares, through Mr. Silver’s ownership interest in (i)Project Global Investments, Ltd., 2,066,667 shares; (ii)Advance Conveyors PTY Ltd., 5,000,000 shares; (iii)Fair Choice Ltd., 5,000,000 shares and their ownership of the common stock of the Company. |

23

The following table sets forth information as to the beneficial ownership of each class of the Company’s equity securities beneficially owned by the Company’s directors and executive officers as of January 29, 2018:

| Title of Class | Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Ownership Percent of Class |

Voting Rights Percent of Class | ||||||||||

| Series A | Pinchas Althaus | 100 shares | 50 | % | 50 | % | ||||||||

| Preferred Stock(1) | 410 Park Avenue, 15th Floor | |||||||||||||

| New York, NY 10022 | ||||||||||||||

| Series A | Chaim Lebovits | 20 Shares | (1) | 10 | % | 10 | % | |||||||

| Preferred Stock(1) | 410 Park Avenue, 15th Floor | |||||||||||||

| New York, New York 10022 | ||||||||||||||

| Common Stock | Pinchas Althaus | 8,750,000 | 8.62 | % | 41.72 | % | ||||||||

| 410 Park Avenue, 15th Floor | ||||||||||||||

| New York, NY 10022 | ||||||||||||||

| Common Stock | Chaim Lebovits | 6,383,218 | (1) | 6.29 | % | 9.26 | % | |||||||

| 410 Park Avenue, 15th Floor | ||||||||||||||

| New York, New York 10022 | ||||||||||||||

| Common Stock | Diego Roca | 3,550,000 | 3.50 | % | 3.50 | % | ||||||||

| 410 Park Avenue, 15th Floor | ||||||||||||||

| New York, NY 10022 | ||||||||||||||

| Common Stock | All Officers and Directors of | 18,683,218 | 18.42 | % | 54.48 | % | ||||||||

| The Company as a Group (5 | ||||||||||||||

| Persons) | ||||||||||||||

| (1) | Includes shares beneficially owned through Mr. Lebovits’ ownership interests in ACC Holdings International Ltd’s ownership of the common stock of the Company. |

Item 5. Directors, Executive Officers and Significant Employees.

The following table sets forth information regarding the directors and executive officers of the Company.

| Name | Age | Position | ||

| Pinchas Althaus | 43 | President, Chief Executive Officer and Director | ||

| Diego Roca | 50 | Executive Vice-President, Chief Financial Officer, Treasurer, and Director | ||

| Chaim Lebovits | 45 | Director | ||

| Chaim Schiff | 43 | Director |

Pinchas Althaus has served as a director and as the President of the Nevada Subsidiary since March of 2006. He has been a director and President of the Company since February of 2007. From October 2004 to April of 2006 he was employed as the Chief Operating Officer for Golden River Resources, a mining and mineral exploration company of Melbourne, Australia. From February through October of 2004, he was employed as the Director of Business Development for Golden River Resources. From February of 2003 through December of 2003, he served as the Director of Business Development for Tahera Diamond Corporation of Toronto, Canada. From February of 2000 to February of 2003, he was the Director for Business Development for Ambient Corp. Mr. Althaus attended the Rabbinical College of Israel from which he received Rabbinical Certification in 1994. Mr. Althaus’ prior experience in the mining sector and his role as a founder of the current Company earned him the position as a director of the Company.

24

Diego E. Roca served as a director and the Chief Financial Officer, Executive Vice President and Treasurer of the Nevada Subsidiary from May of 2006 on a part-time basis. In March of 2007, he assumed these positions on a full-time basis for the Company and the Nevada Subsidiary. He has over 15 years of experience in financial management, operations, public (SEC) filings, cash management and internal controls including 9 years ending in 2004 with Digitec 2000, Inc. There he began as Digitec’s Controller, progressing to Chief Operating Officer and Senior Vice President and Chief Financial Officer. From November 2004 until February 2007, Mr. Roca served as a consultant to various companies, including working with Empire Minerals on a part-time basis. He was the Chief Executive Officer and a Director of Trimax Corp. for the month of July 2004 and he was the Chief Financial Officer and a Director of Codesmart Holdings, Inc. from October 31, 2013 to April 23, 2014. Mr. Roca received a Bachelor of Science degree in Accounting from Queens College in 1991. Mr. Roca’s experience as a financial manager and administrator in publicly traded companies earned him the position as a director in the Company.

Chaim Lebovits has served as the Company’s President and a director since July 30, 2008. For over a decade, Mr. Lebovits has been in the business of mining and natural resource management in Africa. In December 2005, Mr. Lebovits, founded ACC Holdings International. ACC Holdings is a company which has been involved actively in offshore E&P projects in West Africa and Israel. Mr. Lebovits has served on the board of several oil and gas companies including Rialto Energy and Shemen Oil and Gas Resources, both of which are public companies. ACC Holdings is also involved in real estate projects and is the controlling shareholder in Brainstorm Cell Therapeutics, a biotechnology company. Mr. Lebovits’ experience in the mining sector including his leadership roles in prior positions held in the mining sector earned him the position as a director of the Company.

Chaim Schiff has served as a board member of the Company since 2010. Mr. Schiff is an Executive Vice President at ACC Holdings since 2008 and has served as a member of the board of directors of Shemen Oil and Gas Resources, an Israeli public company. Prior to joining ACC Holdings, Mr. Schiff was a partner at Ickovics, Neustadter & Co., a Tel Aviv boutique law firm. There are no family relationships between any of the directors, officers or significant employees. Mr. Schiff’s prior experience as an administrator and legal advisor to Mr. Lebovits and the firms Mr. Lebovits managed earned him the position as director of the Company.