UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

|

|

|

||

|

SS&C TECHNOLOGIES HOLDINGS, INC. |

||

|

(Name of Registrant as Specified in Its Charter) |

||

|

|

||

|

|

||

|

(Name of Person(s) Filing Proxy Statement if Other than the Registrant) |

||

|

|

||

|

Payment of Filing Fee (Check the appropriate box): |

||

|

|

|

|

|

☒ |

No fee required. |

|

|

|

|

|

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

|

|

1) |

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2) |

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4) |

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

5) |

Total fee paid: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

|

|

|

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number or the Form or Schedule and the date of its filing. |

|

|

|

|

|

|

|

1) |

Amount Previously Paid:

|

|

|

|

|

|

|

2) |

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

3) |

Filing Party: |

|

|

|

|

|

|

4) |

Date Filed: |

|

|

|

|

1

SS&C TECHNOLOGIES HOLDINGS, INC.

80 Lamberton Road

Windsor, Connecticut 06095

April 6, 2018

Dear Stockholder:

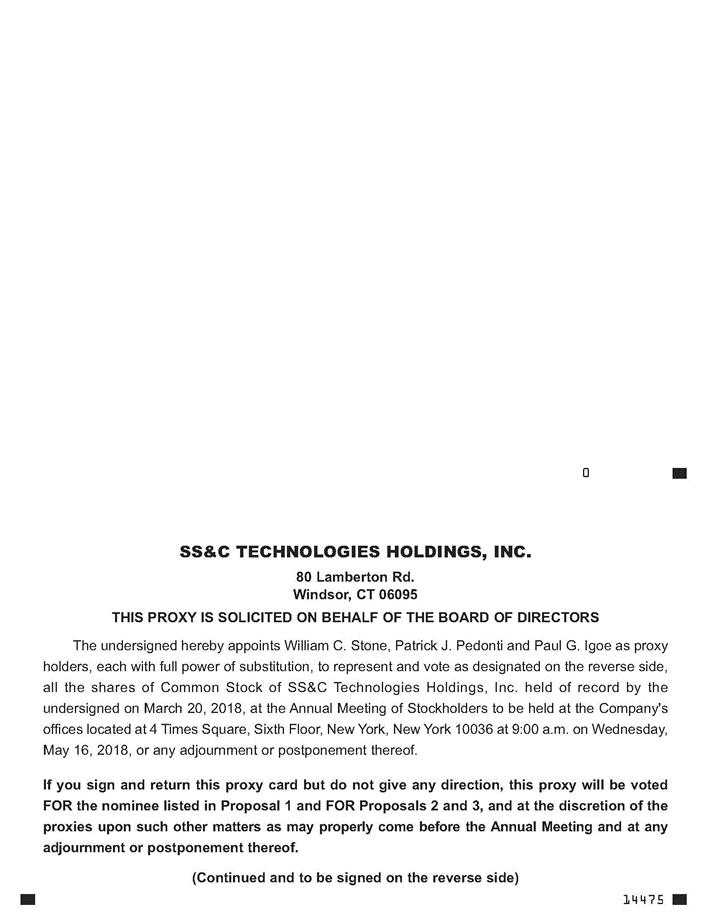

You are cordially invited to attend the 2018 Annual Meeting of Stockholders of SS&C Technologies Holdings, Inc. to be held at 9:00 a.m., local time, on Wednesday, May 16, 2018 at our offices located at 4 Times Square, Sixth Floor, New York, New York 10036.

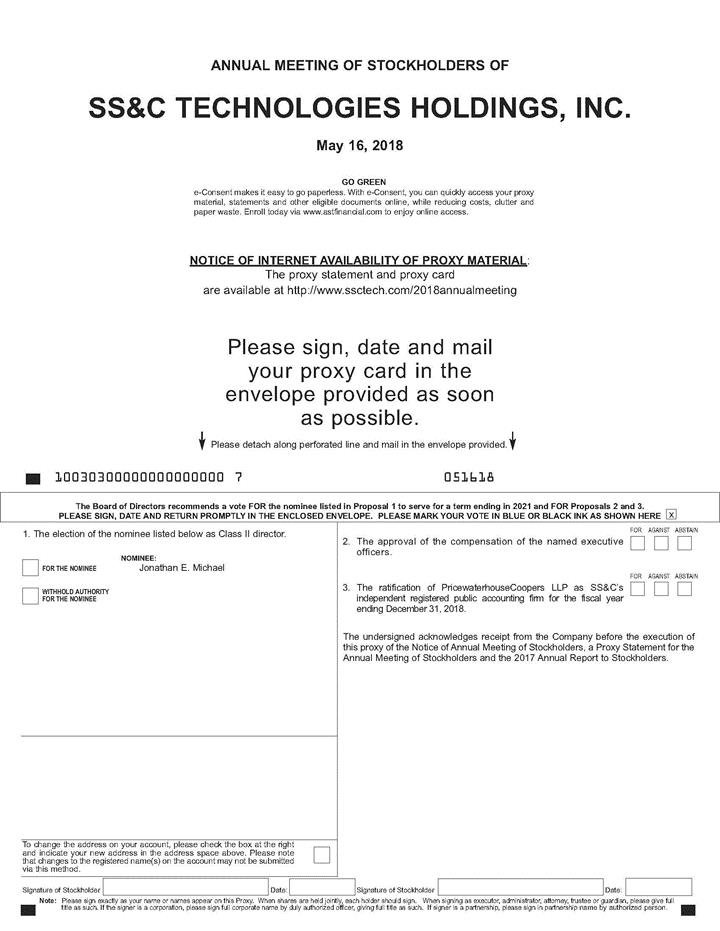

At the 2018 annual meeting, you will be asked to (i) elect one Class II Director to our Board of Directors for the ensuing three years; (ii) approve, in an advisory vote, the compensation of our named executive officers; and (iii) ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm. The Board recommends that you vote: for the director nominee nominated by our Board, to approve the compensation of our named executive officers, and to ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm.

We hope you will be able to attend the 2018 annual meeting. Whether or not you plan to attend the 2018 annual meeting, it is important that your shares are represented. Therefore, we urge you to promptly vote your shares by completing, signing, dating and returning the enclosed proxy card in accordance with the instructions provided or by completing the voting instruction form provided to you by your bank, broker or other nominee.

|

|

|

Sincerely, |

|

|

|

|

|

WILLIAM C. STONE |

|

Chairman of the Board & Chief Executive Officer |

YOUR VOTE IS IMPORTANT

We urge you to promptly vote your shares by completing, signing, dating and returning the enclosed proxy card or by completing the voting instruction form provided to you by your bank, broker or other nominee.

|

|

|

|

2 |

|

|

3 |

|

|

4 |

|

|

4 |

|

|

5 |

|

|

5 |

|

|

7 |

|

|

7 |

|

|

7 |

|

|

7 |

|

|

8 |

|

|

8 |

|

|

8 |

|

|

8 |

|

|

10 |

|

|

10 |

|

|

10 |

|

|

10 |

|

|

10 |

|

|

PROPOSAL 2 ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION |

12 |

|

12 |

|

|

13 |

|

|

13 |

|

|

13 |

|

|

14 |

|

|

14 |

|

|

15 |

|

|

16 |

|

|

16 |

|

|

16 |

|

|

17 |

|

|

18 |

|

|

18 |

|

|

20 |

|

|

20 |

|

|

21 |

|

|

22 |

|

|

23 |

|

|

23 |

|

|

24 |

|

|

25 |

|

|

PROPOSAL 3 RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

26 |

|

27 |

|

|

27 |

|

|

28 |

|

|

29 |

|

|

30 |

|

|

30 |

|

|

31 |

|

|

32 |

|

|

32 |

|

|

32 |

|

|

32 |

|

|

33 |

|

|

33 |

|

|

33 |

|

|

33 |

|

|

33 |

|

|

34 |

-i-

SS&C TECHNOLOGIES HOLDINGS, INC.

80 Lamberton Road

Windsor, Connecticut 06095

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 16, 2018

The 2018 Annual Meeting of Stockholders of SS&C Technologies Holdings, Inc. will be held on Wednesday, May 16, 2018 at 9:00 a.m., local time, at our offices located at 4 Times Square, Sixth Floor, New York, New York 10036, to consider and act upon the following matters:

|

|

1. |

To elect one Class II Director to our Board of Directors, to serve for a term ending at the 2021 annual meeting and until his successor has been duly elected and qualified; |

|

|

2. |

To approve, in an advisory vote, the compensation of our named executive officers; |

|

|

3. |

To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; and |

|

|

4. |

To transact such other business as may properly come before the 2018 annual meeting and any adjournment thereof. |

Stockholders of record at the close of business on March 20, 2018, the record date for the 2018 annual meeting, are entitled to notice of and to vote at the meeting.

Your vote is important, regardless of the number of shares you own. Whether or not you plan to attend the 2018 annual meeting personally, we hope you will take the time to vote your shares. If you are a stockholder of record, you may vote by completing, signing, dating and returning the enclosed proxy card in the envelope provided. If your shares are held in “street name,” meaning they are held for your account by a bank, broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted. Even if you plan to attend the 2018 annual meeting, please vote now using one of the above methods. You can change your vote at the meeting if you choose to do so.

|

|

|

By Order of the Board of Directors, |

|

|

|

|

|

PAUL G. IGOE |

|

Senior Vice President, General Counsel & Secretary |

Dated: April 6, 2018

SS&C TECHNOLOGIES HOLDINGS, INC.

80 Lamberton Road

Windsor, Connecticut 06095

Proxy Statement for the 2018 Annual Meeting of Stockholders

To Be Held on May 16, 2018

Our 2018 Annual Meeting of Stockholders will be held on Wednesday, May 16, 2018, at 9:00 a.m., local time, at our offices located at 4 Times Square, Sixth Floor, New York, New York 10036. For directions to our offices, please visit the 2018 annual meeting page on our website at http://www.ssctech.com/2018annualmeeting. If you have any questions about the 2018 annual meeting, please contact Paul G. Igoe, our Corporate Secretary, by telephone at (860) 298-4832 or by sending a written request for information addressed to Paul G. Igoe at our principal executive offices located at 80 Lamberton Road, Windsor, Connecticut 06095.

See the section of this proxy statement entitled “Information About the 2018 Annual Meeting” beginning on page 32 for details on the voting process and how to attend the 2018 annual meeting.

Information about this Proxy Statement

You have received this proxy statement because the Board of Directors of SS&C Technologies Holdings, Inc., which we refer to as SS&C Holdings, SS&C or the Company, is soliciting your proxy to vote your shares at the 2018 annual meeting and at any adjournment or postponement of the 2018 annual meeting. This proxy statement includes information we are required to provide to you under the rules of the Securities and Exchange Commission, or SEC, and is designed to assist you in voting your shares. Only stockholders of record at the close of business on March 20, 2018 are entitled to receive notice of, and to vote at, the 2018 annual meeting.

Important Notice Regarding Availability of

Proxy Materials for the 2018 Annual Meeting of Stockholders to be Held on May 16, 2018

We are first mailing this proxy statement and the accompanying proxy at no charge on or about April 6, 2018 to our stockholders of record as of March 20, 2018. We are also mailing our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 at no charge to such stockholders concurrently with this proxy statement. We will furnish copies of the exhibits to our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 upon written request of any stockholder and the payment of an appropriate processing fee. Please address all such requests to Investor Relations at 80 Lamberton Road, Windsor, Connecticut 06095.

This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 are available for viewing, printing and downloading at http://www.ssctech.com/2018annualmeeting. This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 are also available on the SEC’s website at http://www.sec.gov.

We believe the Company’s 2017 performance was exceptional, as evidenced by the following results:

|

|

• |

Our total revenues for 2017 were $1,675.3 million, as compared to 2016 total revenues of $1,481.4 million, and 2015 total revenues of $1,000.3 million, an increase of 13% and 48%, respectively. |

|

|

• |

Our 2017 Adjusted Consolidated EBITDA (discussed and reconciled to GAAP net income on page 15) was $695.5 million, as compared to 2016 Adjusted Consolidated EBITDA of $612.5 million and 2015 Adjusted Consolidated EBITDA of $442.0 million, an increase of 14% and 39%, respectively. |

|

|

• |

We acquired two businesses: |

|

|

(i) |

CommonWealth Fund Services Ltd., an award-winning Canadian fund administrator, for approximately $16.4 million on October 13, 2017; and |

|

|

(ii) |

Modestspark, a leading digital service provider to financial advisors and wealth management firms, for approximately $2.8 million on October 31, 2017. |

|

|

• |

We announced the planned acquisition of DST Systems, Inc. for an enterprise value of $5.4 billion; |

2

|

|

• |

Net cash provided by operating activities was $470.4 million in 2017. This is an improvement of $52.0 million or 12.4% from 2016. |

|

|

• |

We paid down $467.5 million of debt in 2017. |

HIGHLIGHTS OF PROPOSALS BEING VOTED UPON

This summary highlights information that is relevant to certain proposals being voted on at the Annual Meeting. Additional discussion of these proposals is contained elsewhere in this proxy statement, which we encourage you to review in its entirety.

Proposal 1:Election of Directors.

The Board recommends that you vote “FOR” the election of Jonathan E. Michael, our Class II Director whose term expires at the 2018 annual meeting. Mr. Michael currently serves as Chair of our Audit Committee and as a member of our Nominating Committee. See the section of this proxy statement entitled “Information Regarding Directors and Director Nominees” beginning on page 5 for additional discussion of our director nominee and his qualifications.

Proposal 2:Advisory Vote to Approve Named Executive Officer Compensation.

The Board recommends that you vote “FOR” the advisory resolution to approve the compensation of our named executive officers (the so-called “say-on-pay”). The Compensation Discussion and Analysis, beginning at page 13 of this proxy statement, describes the Company’s compensation philosophy and programs in place for 2017. We believe the Company’s compensation programs have been effective in motivating and driving our named executive officers to help the Company achieve the strong performance described above.

We encourage you to approve the compensation of our named executive officers because our executive officers have contributed significantly to the Company’s strong performance.

Proposal 3:Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018.

The Audit Committee has appointed the firm of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018, which we refer to as fiscal 2018. This appointment is being presented to the stockholders for ratification at the 2018 annual meeting. We encourage you to vote “FOR” ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm.

3

ELECTION OF DIRECTORS

Our Certificate provides for a classified Board. This means our Board is divided into three classes, with each class having as nearly as possible an equal number of directors. The term of service of each class of directors is staggered so that the term of one class expires at each annual meeting of the stockholders.

Our Board currently consists of seven members, divided into three classes as follows:

|

|

• |

Class I is comprised of Normand A. Boulanger, David A. Varsano and Michael J. Zamkow, each with a term ending at the 2020 annual meeting; |

|

|

• |

Class II is comprised of Jonathan E. Michael, whose term ends at the 2018 annual meeting; and |

|

|

• |

Class III is comprised of Smita Conjeevaram, Michael E. Daniels and William C. Stone, each with a term ending at the 2019 annual meeting. |

At each annual meeting of stockholders, directors are elected for a full term of three years to succeed those directors whose term is expiring. Mr. Michael is a current director whose term expires at the 2018 annual meeting. He has been nominated by the Nominating Committee (and his nomination has been ratified by the Board) for re-election as a Class II director, with a term ending at the 2021 annual meeting.

Unless otherwise instructed in the proxy, all proxies will be voted “FOR” the election of Mr. Michael to a three-year term ending at the 2021 annual meeting, to hold office until his successor has been duly elected and qualified. Stockholders who do not wish their shares to be voted for Mr. Michael may so indicate by striking out his name on the proxy card. Mr. Michael has indicated his willingness to serve on our Board, if elected. If Mr. Michael is unable to serve, the person acting under the proxy may vote the proxy for a substitute nominee designated by our Board. We do not contemplate that Mr. Michael will be unable to serve if elected.

A plurality of the shares of common stock present in person or represented by proxy at the 2018 annual meeting and entitled to vote is required to elect the nominee as a director.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF JONATHAN E. MICHAEL.

4

BOARD OF DIRECTORS AND MANAGEMENT

Information Regarding Directors and Director Nominees

Our Certificate provides for the classification of our Board into three classes, each having as nearly an equal number of directors as possible. The terms of service of the three classes are staggered such that the term of one class expires each year.

Our Board currently consists of seven directors. Class I consists of Normand A. Boulanger, David A. Varsano and Michael J. Zamkow, each with a term ending at the 2020 annual meeting. Class II consists of Jonathan E. Michael, whose term ends at the 2018 annual meeting. Class III consists of Smita Conjeevaram, Michael E. Daniels and William C. Stone, each with a term ending at the 2019 annual meeting. One class is elected each year and members of each class hold office for three-year terms.

Our Nominating Committee has recommended, and the Board has nominated, Mr. Michael for election at the 2018 annual meeting as the Class II director, to serve until the 2021 annual meeting and until his successor has been duly elected and qualified. Mr. Michael is currently a member of our Board.

The following table and biographical descriptions provide information relating to each director and director nominee, including her/his age and period of service as a director of our company, her/his committee memberships, her/his business experience for at least the past five years, including directorships at other public companies, and certain other information.

|

Name |

Age |

Present Principal Employment and Prior Business Experience |

|

Class I Directors (terms expiring at the 2020 annual meeting) |

|

|

|

|

|

|

|

Normand A. Boulanger President and Chief Operating Officer |

56 |

Mr. Boulanger has served as our President and Chief Operating Officer since October 2004. Prior to that, Mr. Boulanger served as our Executive Vice President and Chief Operating Officer from October 2001 to October 2004, Senior Vice President, SS&C Direct from March 2000 to September 2001, Vice President, SS&C Direct from April 1999 to February 2000, Vice President of Professional Services for the Americas, from July 1996 to April 1999, and Director of Consulting from March 1994 to July 1996. Prior to joining SS&C, Mr. Boulanger served as Manager of Investment Accounting for The Travelers from September 1986 to March 1994. Mr. Boulanger was elected as one of our directors in February 2006. The Board has concluded that Mr. Boulanger should serve as a director because he has substantial knowledge and experience regarding our operations, employees, targeted markets, strategic initiatives and competitors. |

|

|

|

|

|

David A. Varsano Audit Committee Nominating Committee (Chair)

|

56 |

Mr. Varsano was elected as one of our directors in March 2011. He is currently the Chairman of the Board and Chief Executive Officer of Pacific Packaging Products, a company specializing in industrial packaging and related solutions and supply chain management services, which he joined in September 1999. Prior to joining Pacific Packaging Products, Mr. Varsano served as the Chief Technology Officer and Vice President, Software Development of SS&C from 1995 to 1999 and as Manager of SS&C Direct from 1998 to 1999. Mr. Varsano currently serves on the Board of Directors of Packaging Distributors of America. Mr. Varsano previously served on the Board of Directors of Aviv Centers for Living. The Board has concluded that Mr. Varsano should serve as a director because he has a broad range of experience relevant to our business and a strong understanding of software architectures. |

|

|

|

|

|

Michael J. Zamkow Compensation Committee

|

62 |

Mr. Zamkow was elected one of our directors in June 2014. He retired—after a 17-year career—from Goldman Sachs in November 2001, where he was a partner from 1994 to 2001. From 1999, Mr. Zamkow was responsible for Goldman Sachs’ fixed income, currency and commodities business. He is currently a member of the Board of Trustees of Northeastern University. Mr. Zamkow previously served on the Boards of Directors of the Futures Industry Association and the London Clearing House. The Board has concluded that Mr. Zamkow should serve as a director because he has extensive experience in the financial services industry. |

|

|

|

|

5

6

We believe that good corporate governance and fostering an environment of high ethical standards are important for us to achieve business success and to create value for our stockholders. Our Board periodically reviews our corporate governance practices in light of regulatory developments and practices at other public companies and makes changes that it believes are in the best interests of the Company and its stockholders.

Board Determination of Independence

Under the applicable rules of the Nasdaq Stock Market, a director will only qualify as an “independent director” if, in the opinion of our Board, that person does not have a relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our Board has determined that none of Ms. Conjeevaram or Messrs. Daniels, Michael, Varsano or Zamkow has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is an “independent director” as defined under Rule 5605(a)(2) of Nasdaq.

The Company is a party to a Stockholders Agreement, as amended, which we refer to as the Stockholders Agreement, with William C. Stone, our Chairman and Chief Executive Officer. The Stockholders Agreement entitles Mr. Stone to nominate two directors, one of whom shall be Mr. Stone for so long as he is our Chief Executive Officer. For more information on the Stockholders Agreement, see the section of this proxy statement entitled “Related Person Transactions—Stockholders Agreement” beginning on page 31.

The process followed by the Nominating Committee to identify and evaluate director candidates may include requesting recommendations from Board members and others, holding meetings from time to time to evaluate biographical information and background material relating to potential candidates, and conducting interviews of selected candidates by members of the Nominating Committee.

The Nominating Committee considers recommendations for director nominees suggested by its members, other directors, management and other interested parties. Stockholders may recommend individuals to the Nominating Committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background material, to the Nominating Committee c/o Corporate Secretary, SS&C Technologies Holdings, Inc., 80 Lamberton Road, Windsor, Connecticut 06095. Assuming that appropriate biographical information and background material is provided on a timely basis, the Nominating Committee will evaluate stockholder-recommended candidates by following substantially the same process and applying substantially the same criteria as it follows for candidates submitted by others.

In addition, stockholders also have the right under our By-laws to directly nominate director candidates, without any action or recommendation on the part of the Nominating Committee or the Board, by following the procedures set forth in our By-laws and described under “Stockholder Proposals and Director Nominations” beginning on page 33 below.

Criteria and Diversity

In considering whether to recommend any particular candidate for inclusion in the Board’s slate of recommended director nominees, the Nominating Committee applies the criteria specified in its charter. These criteria include the candidate’s integrity, honesty, adherence to ethical standards, demonstrated business acumen, experience, ability to exercise sound judgments in matters that relate to the current and long-term objectives of the Company, ability to contribute positively to the decision-making processes of the Company, commitment to understanding the Company and its industry and to regularly attending and participating in meetings of the Board and its committees, ability to understand the sometimes conflicting interests of the various constituencies of the Company and the absence of a conflict of interest. The Nominating Committee does not assign specific weights to particular criterion, and no particular criterion is a prerequisite for any prospective nominee. In terms of criteria for composition of the Board, the Nominating Committee considers the backgrounds and qualifications of the directors as a group with the goal of providing a significant breadth of experience, knowledge and abilities to assist the Board in fulfilling its responsibilities.

Although the Nominating Committee considers the value of diversity on the Board, it has not adopted a written policy with regard to the consideration of diversity when evaluating candidates for director. However, in practice, the Nominating Committee considers diversity of viewpoint, professional experience, education and skill in assessing candidates for the Board to ensure breadth of experience, knowledge and abilities within the Board. Our Board’s priority in the selection of Board members is identification of members who will further the interests of our stockholders through their management experience, knowledge of our business, understanding of the competitive landscape and familiarity with our targeted markets.

7

Mr. Michael’s biography above describes his experience, qualifications, attributes and skills that led the Board to conclude that he should continue to serve as a member of our Board. Our Board believes that Mr. Michael has realized significant professional and personal achievements and possesses the background, talents and experience that are necessary for the Company’s success and the creation of stockholder value.

During the fiscal year ended December 31, 2017, which we refer to as fiscal 2017, our Board met four times and acted by unanimous written consent in lieu of a meeting five times. During fiscal 2017, the Audit Committee held six regular meetings and acted by unanimous written consent in lieu of a meeting twice; the Compensation Committee held one regular meeting and acted by unanimous written consent in lieu of a meeting five times; and the Nominating Committee acted by unanimous written consent in lieu of a meeting once. Each of our current directors attended at least 75% of the aggregate of the total number of meetings of the Board and of the Board committees of which he/she was a member during fiscal 2017.

Director Attendance at Annual Meeting of Stockholders

We do not have a formal policy regarding directors’ attendance at annual meetings, but all of our directors are encouraged to attend our annual meetings. All of our Board members attended our 2017 annual meeting of stockholders.

Mr. Stone has served as Chairman of the Board of Directors and Chief Executive Officer since our inception in 1986, and the provisions of the Stockholders Agreement require that so long as Mr. Stone is a member of our Board and the Chief Executive Officer of the Company, he shall serve as Chairman of the Board. This Board leadership structure is commonly utilized by public companies in the United States, and we believe that this leadership structure has been effective for us. Having one person serve as both Chief Executive Officer and Chairman of the Board shows our employees, customers and other constituencies that we are under strong leadership, with a single person setting the tone and having primary responsibility for managing our operations. We also believe that this leadership structure eliminates the potential for duplication of efforts and inconsistent actions and facilitates open communication between management and our Board. We do not have a lead independent director. We recognize that different board leadership structures may be appropriate for companies with different histories or varying equity ownership structures and percentages. However, we believe our current leadership structure is the optimal board leadership structure for us.

Our Board directs the management of our business and affairs, as provided by Delaware law, and conducts its business through meetings of the Board and three standing committees: the Audit Committee, the Compensation Committee and the Nominating Committee, each of which operates under a charter that has been approved by our Board. Each committee’s charter is posted on our website, at http://investor.ssctech.com/corporate-governance.cfm. In addition, from time to time, special committees may be established under the direction of the Board to address specific issues. The table below shows current membership and indicates the chairperson (*) for each of the standing Board committees.

|

|

|

|

|

Audit

|

Compensation

|

Nominating

|

|

Jonathan E. Michael* |

Michael E. Daniels* |

David A. Varsano* |

|

Smita Conjeevaram |

Michael J. Zamkow |

Michael E. Daniels |

|

David A. Varsano |

|

Jonathan E. Michael |

Our Board has determined that each member of each of the Board’s three standing committees is independent as defined under the rules of Nasdaq, including, in the case of each member of the Audit Committee, the independence requirements contemplated by Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or Exchange Act, and including, in the case of each member of the Compensation Committee, the independence requirements contemplated by Rule 10C-1 under the Exchange Act and Nasdaq rules.

Audit Committee

Our Audit Committee assists our Board in its oversight of the Company’s accounting and financial reporting processes and the audits of the Company’s financial statements. Our Audit Committee’s responsibilities, as set forth in its charter, include:

|

|

• |

appointing, evaluating, retaining and, when necessary, terminating the engagement of our independent registered public accounting firm; |

|

|

• |

overseeing and assessing the independence of our independent registered public accounting firm; |

|

|

• |

setting the compensation of our independent registered public accounting firm and preapproving all audit services to be provided to the Company; |

8

|

|

• |

overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of reports from such firm; |

|

|

• |

reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures before such financial statements are filed with the Securities and Exchange Commission, or SEC; |

|

|

• |

directing the independent registered public accounting firm to use its best efforts to perform all reviews of interim financial information prior to disclosure by the Company; |

|

|

• |

coordinating our Board’s oversight of internal control over financial reporting, disclosure controls and procedures and our code of business conduct and ethics; |

|

|

• |

overseeing our risk assessment and risk management policies; |

|

|

• |

discussing the Company’s policies with respect to risk assessment and risk management; |

|

|

• |

discussing generally the type and presentation of information to be disclosed in the Company’s earnings press releases, as well as financial information and earnings guidance provided to analysts, rating agencies and others; |

|

|

• |

establishing procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or audit matters and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters; |

|

|

• |

reviewing the Company’s policies and procedures for reviewing and approving or ratifying “related person transactions” and conducting appropriate review and oversight of all related person transactions for potential conflict of interest situations; and |

|

|

• |

preparing the Audit Committee report required by SEC rules, which is included on page 27 of this proxy statement. |

Our Board has determined that each of the members of its Audit Committee is an “audit committee financial expert” as that term is defined under the rules and regulations of the SEC.

Compensation Committee

Our Compensation Committee has overall responsibility for the Company’s compensation. Our Compensation Committee’s responsibilities, as set forth in its charter, include:

|

|

• |

reviewing and approving, or making recommendations to our Board with respect to, the compensation of our Chief Executive Officer and our other executive officers; |

|

|

• |

reviewing, and making recommendations to our Board with respect to, incentive-compensation and equity-based plans that are subject to approval by our Board; |

|

|

• |

approving any tax-qualified, non-discriminatory employee benefit plans for which stockholder approval is not sought; |

|

|

• |

administering all of the Company’s stock option, stock incentive, employee stock purchase and other equity-based plans including interpreting the terms of such plans and granting options and making awards under such plans; |

|

|

• |

reviewing and making recommendations to our Board with respect to director compensation; |

|

|

• |

reviewing and discussing with management the Company’s “Compensation Discussion and Analysis” required by Item 402(b) of Regulation S-K, and considering whether it will recommend to our Board that the Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K, proxy statement on Schedule 14A or information statement on Schedule 14C; |

|

|

• |

preparing an annual report required by Item 407(e)(5) of Regulation S-K; and |

|

|

• |

in its discretion, retaining or obtaining the advice of compensation consultants, legal counsel or other advisors, and overseeing their work. |

Nominating Committee

Our Nominating Committee has overall responsibility for developing Board membership. Our Nominating Committee’s responsibilities, as set forth in its charter, include:

|

|

• |

identifying individuals qualified to become members of our Board and recommending to our Board the nominees for election as directors at any annual meeting of stockholders and the persons to be elected by the Board to fill any vacancies on the Board; |

|

|

• |

reviewing with the Board the requisite skills and criteria for new Board members as well as the composition of our Board as a whole; and |

9

The processes and procedures followed by the Nominating Committee in identifying and evaluating director candidates are described above under the heading “Director Nomination Process.” As described above, the Stockholders Agreement provides Mr. Stone with the right to appoint two directors, including himself.

Our management is responsible for risk management on a day-to-day basis. Our Audit Committee is responsible for overseeing our risk management function. While the Audit Committee has primary responsibility for overseeing risk management, our entire Board of Directors is actively involved in overseeing our risk management. Our Board and the Audit Committee fulfill their oversight role by discussing with management the policies and practices utilized by management in assessing and managing the risks and providing input on those policies and practices. We believe that the leadership structure of our Board supports effective risk management oversight due to our Chairman and Chief Executive Officer’s extensive knowledge and understanding of our business and, as noted in “Board Leadership Structure” above, because the combined role of Chairman and Chief Executive Officer facilitates communications between management and our Board.

Our Board welcomes the submission of any comments or concerns from stockholders and any interested parties. Communications should be in writing and addressed to our Corporate Secretary at our principal executive offices and marked to the attention of the Board or any of its committees, individual directors or non-management or independent directors as a group. All correspondence will be forwarded to the intended recipient(s), except that certain items that are unrelated to the duties and responsibilities of our Board (such as product inquiries and comments, new product suggestions, resumes and other forms of job inquiries, surveys, and business solicitations and advertisements) and material that is unduly hostile, threatening, illegal or similarly unsuitable will be excluded.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics, referred to as the SS&C Code of Business Conduct and Ethics, which covers all directors, officers and employees and includes provisions relating to accounting and financial matters. The SS&C Code of Business Conduct and Ethics is available on our website at http://investor.ssctech.com/corporate-governance.cfm. If we make any substantive amendments to, or grant any waivers from, the code of ethics for any director or officer, we will disclose the nature of such amendment or waiver on our website at http://investor.ssctech.com/corporate-governance.cfm or in a Current Report on Form

8-K filed with the SEC.

Compensation Committee Interlocks and Insider Participation

Messrs. Daniels, Varsano and Zamkow served on our Compensation Committee in fiscal 2017, and William A. Etherington served on our Compensation Committee until his retirement as a Director of the Company on May 17, 2017. No member of the Compensation Committee had any related person transaction involving SS&C Holdings or any of its subsidiaries or is or has been a current or former officer or employee of SS&C Holdings, except that Mr. Varsano was an employee of the Company until 1999. Mr. Varsano ceased being a member of the Compensation Committee on May 17, 2017, and for the portion of fiscal 2017 during which he did serve on the Compensation Committee, Mr. Varsano recused himself from any action involving the compensation or grant of equity awards to the executive officers of the Company. None of our executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity, one of whose executive officers served as a director or member of our Compensation Committee during fiscal 2017.

Executive Officers Who Are Not Directors

Certain information regarding our executive officers, who are not also directors, is set forth below. Generally, our Board elects our officers annually, although the Board or an authorized committee of the Board may elect or appoint officers at other times.

|

|

|

|

|

Name |

Age |

Position(s) |

|

Joseph J. Frank |

52 |

Group General Counsel, Chief Legal Officer and Global Head of Mergers & Acquisitions (as of March 9, 2018) |

|

Paul G. Igoe |

55 |

Senior Vice President, General Counsel and Secretary (until July 31, 2018) |

|

Rahul Kanwar |

43 |

Senior Vice President and Managing Director of Alternative Assets |

|

Patrick J. Pedonti |

66 |

Senior Vice President and Chief Financial Officer |

Joseph J. Frank joined the Company in March 2018 as Group General Counsel, Chief Legal Officer and Head of Mergers and Acquisitions. Mr. Frank is succeeding Mr. Igoe who will be leaving the Company on July 31, 2018. Prior to joining the Company,

Mr. Frank was a partner at Shearman & Sterling LLP where he served as global co-head of the firm’s Securities Litigation and

10

Paul G. Igoe joined the Company in January 2013 and has served as our Senior Vice President, General Counsel and Secretary since March 2013. On February 20, 2018, the Company announced that Mr. Igoe will be leaving the Company to pursue other opportunities. Mr. Igoe will continue to be employed by the Company through to July 31, 2018 in order to assist in an orderly transition of his duties. From September 2009 to December 2012, Mr. Igoe was the Vice President, General Counsel and Secretary of Lydall, Inc., a manufacturer of filtration media and thermal/acoustical products. From June 2001 to September 2009, Mr. Igoe was the Associate General Counsel and Assistant Secretary of Teradyne, Inc., a manufacturer of automatic test equipment for the semiconductor industry. Prior to Teradyne, Mr. Igoe was a Junior Partner in the Boston office of Wilmer Cutler Pickering Hale and Dorr LLP (formerly Hale and Dorr LLP). Mr. Igoe is being succeeded by Mr. Frank.

Rahul Kanwar was appointed Executive Vice President and Managing Director, Alternative Assets in September 2017. Prior to that, he served as our Senior Vice President and Managing Director, Alternative Assets, since January 2011 and was designated as an executive officer in March 2013. Prior to that, Mr. Kanwar served as a managing director of SS&C since 2005. Prior to joining SS&C, Mr. Kanwar was employed by Eisner LLP where he was responsible for managing the Eisnerfast LLC fund administration business. Mr. Kanwar started his career in public accounting.

Patrick J. Pedonti has served as our Senior Vice President and Chief Financial Officer since August 2002. Prior to that, Mr. Pedonti served as our Vice President and Treasurer from May 1999 to August 2002. Prior to joining SS&C, from January 1997 to May 1999, Mr. Pedonti was the Vice President and Chief Financial Officer for Accent Color Sciences, Inc., a company specializing in high-speed color printing.

11

ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

We are providing our stockholders the opportunity to vote to approve, on an advisory, non-binding basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the SEC’s rules. This proposal, which is commonly referred to as “say-on-pay,” is required by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, which added Section 14A to the Exchange Act.

Our executive compensation programs are designed to attract, retain and motivate our named executive officers, who are critical to our success. Under these programs, our named executive officers are rewarded for successful performance on our near-term and longer-term financial and strategic goals and for driving corporate financial performance and stability. The programs contain elements of cash and equity-based compensation and are designed to align the interests of our executives with those of our stockholders.

The “Executive and Director Compensation” section of this proxy statement beginning on page 13, including “Compensation Discussion and Analysis,” describes in detail our executive compensation programs and the decisions made by the Compensation Committee and our Board with respect to fiscal 2017.

As we describe in the “2017 Performance Highlights” section of this proxy statement beginning on page 2, our executive compensation program supports our business strategy and aligns the interests of our named executive officers with those of our stockholders. We believe our executive compensation program is working as evidenced by the Company’s strong performance in 2017:

|

|

• |

Our total revenues for 2017 were $1,675.3 million, as compared to 2016 total revenues of $1,481.4 million and 2015 total revenues of $1,000.3 million, an increase of 13% and 48%, respectively. |

|

|

• |

Our 2017 Adjusted Consolidated EBITDA (discussed and reconciled to GAAP net income on page 15) was $695.5 million, as compared to 2016 Adjusted Consolidated EBITDA of $612.5 million and 2015 Adjusted Consolidated EBITDA of $442.0 million, an increase of 14% and 39%, respectively. |

|

|

• |

We acquired two businesses: |

|

|

(i) |

CommonWealth Fund Services Ltd., an award-winning Canadian fund administrator, for approximately $16.4 million on October 13, 2017; and |

|

|

(ii) |

Modestspark, a leading digital service provider to financial advisors and wealth management firms, for approximately $2.8 million on October 31, 2017. |

|

|

• |

We announced the planned acquisition of DST Systems, Inc. for an enterprise value of $5.4 billion. |

|

|

• |

Net cash provided by operating activities was $470.4 million in 2017. This is an improvement of $52.0 million or 12.4% from 2016. |

|

|

• |

We paid down $467.5 million of debt in 2017. |

Accordingly, our Board is asking stockholders to approve a non-binding advisory vote on the following resolution:

RESOLVED, that the compensation paid to our named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the compensation discussion and analysis, the compensation tables and any related narrative disclosures in this proxy statement, is hereby approved.1

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS BY VOTING “FOR” PROPOSAL 2.

|

|

1 |

Unless otherwise indicated on your proxy, your shares will be voted “FOR” the approval of the compensation of our named executive officers. |

12

EXECUTIVE AND DIRECTOR COMPENSATION

Compensation Discussion and Analysis

Our executive compensation program is overseen and administered by our Compensation Committee, which currently consists of Messrs. Daniels and Zamkow. Our Compensation Committee operates under a written charter adopted by our Board and discharges the responsibilities of the Board relating to the compensation of our executive officers. For 2017, our named executive officers were Messrs. Stone, Pedonti, Boulanger, Kanwar and Igoe2.

Executive compensation objectives

The primary objectives of the Compensation Committee with respect to executive compensation are to:

|

|

• |

attract, retain and motivate the best possible executive talent; |

|

|

• |

reward successful performance by the named executive officers and the Company; and |

|

|

• |

align the interests of the named executive officers with those of our stockholders by providing long-term equity compensation. |

To achieve these objectives, our Compensation Committee seeks to compensate our executives at levels it believes are competitive with those of other companies that compete with us for executive talent in our industry and in our region. While we have not retained a compensation consultant to review our executive compensation practices or formally benchmarked our compensation against that of other companies, our Compensation Committee has designed our compensation program to reward our named executive officers based on a number of factors, including the Company’s operating results, the Company’s performance against budget, individual performance, prior-period compensation and prospects for individual growth. Changes in compensation are generally incremental in nature and do not vary widely from year to year, but follow a general trend of increasing compensation as our business and profits grow. Many of the factors that affect compensation are subjective in nature and not tied to peer group analyses, surveys by compensation consultants or other statistical criteria.

Process for administering our executive compensation practices

Our Compensation Committee has overall responsibility for administering our executive officer compensation program. Our Chief Executive Officer typically presents salary, bonus and equity compensation recommendations to the Compensation Committee and the Compensation Committee, in turn, considers his recommendations and exercises ultimate approval authority. Our Chief Executive Officer’s recommendations are based on his years of experience in the financial services and software industries and his desire to motivate the executive officers and ensure their commitment to the Company. For each executive officer, including himself, our Chief Executive Officer prepares a written description for our Compensation Committee of the individual’s performance during the prior year and recommends salary, bonus and equity amounts based upon his responsibilities and contributions to the Company’s performance. For the compensation of our executive officers other than our Chief Executive Officer, our Compensation Committee considers our Chief Executive Officer’s recommendations and discusses his reviews and recommendations with him as part of its deliberations. For our Chief Executive Officer’s compensation, the Compensation Committee considers his recommendations and generally conducts its deliberations without him present. In this determination, as in other compensation matters, the Compensation Committee exercises its independent judgment. After due consideration, the Compensation Committee accepted the Chief Executive Officer’s recommendations for 2017 executive officer base salaries, cash bonuses and stock option awards.

At our 2017 Annual Meeting of Stockholders, stockholders expressed substantial support for the compensation of our named executive officers, with approximately 87% of the votes cast voting for approval of the “say-on-pay” advisory vote on executive compensation. In establishing 2017 executive compensation, the Compensation Committee considered the results of the 2017 advisory vote as well as the other factors described above. The Compensation Committee did not make any changes to our executive compensation program and policies as a result of the 2017 “say-on-pay” advisory vote.

Components of Our Executive Compensation

The primary elements of our annual executive compensation program are:

|

|

• |

base salary; |

|

|

• |

discretionary annual cash bonuses; and |

|

|

• |

stock option awards. |

|

|

2 |

On February 20, 2018, the Company announced that Mr. Igoe would be leaving the Company to pursue other opportunities. Mr. |

|

Igoe will continue to be employed by the Company for an interim period in order to assist in an orderly transition of his duties. The |

|

terms of Mr. Igoe’s separation are described in this Compensation Discussion & Analysis under “Severance and Change of Control |

|

Benefits” below. |

13

We have no formal or informal policy or target for allocating compensation between long-term and short-term compensation, between cash and non-cash compensation or among the different forms of non-cash compensation. Instead, our Compensation Committee (based in part on input from our Chief Executive Officer) determines subjectively what it believes to be the appropriate level and mix of the various compensation components. While we describe below the connection between each element of executive compensation and particular compensation objectives, we believe that each element promotes multiple compensation objectives.

Base salary is used to recognize the experience, skills, knowledge and responsibilities required of all our employees, including our executive officers. In establishing base salaries for 2017, our Compensation Committee considered a variety of factors, including the seniority of the individual, the level of the individual’s responsibility, the ability to replace the individual, the individual’s tenure at the Company, relative pay among the executive officers, and our Chief Executive Officer’s input. Generally, we believe that executive base salaries should grow incrementally over time and that more of the “upside” of compensation should rest with the performance-based components (that is, cash bonuses and long-term equity incentive compensation).

Base salaries are reviewed at least annually by our Compensation Committee and are adjusted from time to time to realign salaries with market levels after taking into account the performance of the Company and each executive officer’s responsibilities, performance and experience. In March 2017, our Compensation Committee established the 2017 base salaries of our executive officers as follows: Mr. Stone, $875,000, Mr. Pedonti, $350,000, Mr. Boulanger, $550,000, Mr. Kanwar, $475,000, and Mr. Igoe, $260,000. These 2017 base salary levels did not increase from 2016. In December 2017, our Compensation Committee adjusted the base salary of Mr. Pedonti to $375,000 and Mr. Igoe to $275,000, each effective retroactive to October 1, 2017. In March 2018, our Compensation Committee evaluated the base salaries of executive officers and decided not to make any changes from the levels described above.

The payment of annual cash bonuses to our executive officers and other employees is discretionary, and for our executive officers, subject to the terms of our Executive Bonus Plan (the “Bonus Plan”). Annual cash bonuses are generally provided to employees whether or not we meet our budgeted results, but the amount available for bonuses to all employees, including the executive officers, varies according to our financial results. Annual cash bonuses are intended to compensate for strategic, operational and financial successes of the Company as a whole, as well as individual performance and growth potential.

For 2017, our Compensation Committee established the overall executive officer bonus pool at 5% of 2017 Adjusted Consolidated EBITDA (as defined below). Our Compensation Committee has overall authority for determining 2017 annual bonus amounts for each executive officer, but considers proposals and recommendations from the Chief Executive Officer. The Compensation Committee made a final decision with respect to 2017 annual bonuses in March 2018. In making bonus recommendations to the Compensation Committee for the executive officers, our Chief Executive Officer, after taking into account the positive or negative impact of events outside the control of management or an individual executive, made a subjective judgment of each executive’s performance in the context of a number of considerations, including the overall economy and our financial performance, revenues and financial position going into the new fiscal year, each executive’s (including his own) work in managing the business, establishing internal controls, mentoring staff, completing and integrating acquisitions, reducing costs, responding to market conditions and maintaining our profitability.

The decisions described below reflect the practice that our Compensation Committee does not fix a target bonus for each year; instead, subject to the terms of the Bonus Plan, it draws on subjective factors and executive officer performance evaluations in arriving at its bonus decisions.

In connection with his separation from the Company, Mr. Igoe did not receive an annual cash bonus under the Bonus Plan for 2017. The terms of his separation are described in more detail in this Compensation Discussion & Analysis under “Severance and Change of Control Benefits” below.

Mr. Stone’s bonus for 2017 was $5,000,000. The Committee’s approval of Mr. Stone’s bonus took into account our profitability, his successful recruitment of new managers, his efforts to increase our revenue from $1.5 billion in 2016 to $1.7 billion in 2017 and our Adjusted Consolidated EBITDA from $613 million in 2016 to $696 million in 2017, his activities regarding acquisitions including the completed acquisitions of CommonWealth and Modestspark in October 2017, the pending acquisition of DST Systems, Inc. which was announced in January 2018, and his maintenance of high-level relationships with our key clients.

Mr. Pedonti’s bonus for 2017 was $1,300,000. The Committee’s approval of Mr. Pedonti’s bonus took into account his solid management skills, his expanded role in personnel and investor relations matters, his role in negotiating and implementing the CommonWealth and Modestspark businesses and negotiating the pending acquisition of DST Systems, Inc., which was announced in January 2018, his responsibility for maintaining our internal controls, and his success in building a strong finance team.

14

Mr. Boulanger’s bonus for 2017 was $1,500,000. The Committee’s approval of Mr. Boulanger’s bonus took into account his responsibility for our day-to-day business operations across the organization, his assumption of responsibility for supervising the Company’s international operations, his contributions to our 2017 financial results, including increasing revenues from fiscal 2016 to fiscal 2017, his role in implementing CommonWealth and Modestspark businesses, and his attention to his overall executive management team.

Mr. Kanwar’s bonus for 2017 was $2,500,000. The Committee’s approval of Mr. Kanwar’s bonus took into account his responsibility for our fund services business, his contributions to our 2017 financial results, his efforts to negotiate and implement the CommonWealth business, his role in negotiating the pending acquisition of DST Systems, Inc., which was announced in January 2018, and his attention to his overall executive management team.

The bonus pool for executive officers is determined under the terms of our Bonus Plan, which, for 2017, was 5% of Adjusted Consolidated EBITDA, or $34,776,000. Adjusted Consolidated EBITDA is a non-GAAP financial measure used in key financial covenants contained in our senior credit facilities, which are material facilities supporting our capital structure and providing liquidity to our business. Adjusted Consolidated EBITDA is defined as earnings before interest, taxes, depreciation and amortization (EBITDA), further adjusted to exclude stock compensation expense, unusual items and other adjustments permitted in calculating covenant compliance under the senior credit facilities, excluding acquired EBITDA. Adjusted Consolidated EBITDA does not represent net income or cash flow from operations as those terms are defined by GAAP and does not necessarily indicate whether cash flows will be sufficient to fund cash needs. The following is a reconciliation of net income to Adjusted Consolidated EBITDA for fiscal 2017.

|

(in thousands) |

|

Year ended December 31, 2017 |

|

|

|

Net income |

|

$ |

328,864 |

|

|

Interest expense, net |

|

|

107,473 |

|

|

(Benefit) provision for income taxes |

|

|

(46,234 |

) |

|

Depreciation and amortization |

|

|

237,189 |

|

|

EBITDA |

|

|

627,292 |

|

|

Stock-based compensation |

|

|

41,487 |

|

|

Capital-based taxes |

|

|

314 |

|

|

Acquired EBITDA and cost savings(1) |

|

|

4,541 |

|

|

Non-cash portion of straight-line rent expense |

|

|

4,385 |

|

|

Loss on extinguishment of debt |

|

|

2,326 |

|

|

Purchase accounting adjustments(2) |

|

|

4,316 |

|

|

Other(3) |

|

|

15,394 |

|

|

Consolidated EBITDA |

|

|

700,055 |

|

|

Less: acquired EBITDA |

|

|

(4,541 |

) |

|

Adjusted Consolidated EBITDA |

|

$ |

695,514 |

|

|

|

(1) |

Acquired EBITDA reflects the EBITDA impact of significant businesses that were acquired during the period as if the acquisition occurred at the beginning of the period, as well as cost savings enacted in connection with acquisitions. |

|

|

(2) |

Purchase accounting adjustments include (a) an adjustment to increase revenues by the amount that would have been recognized if deferred revenue were not adjusted to fair value at the date of acquisitions and (b) an adjustment to increase personnel and commissions expense by the amount that would have been recognized if prepaid commissions and deferred personnel costs were not adjusted to fair value at the date of the acquisitions. |

|

|

(3) |

Other includes expenses and income that are permitted to be excluded per the terms of our Credit Agreement from Consolidated EBITDA, a financial measure used in calculating our covenant compliance. These may include expenses and income related to currency transactions, facilities and workforce restructuring, legal settlements and business combinations. |

Our Compensation Committee believes that equity-based incentive compensation is an important component of executive compensation. In 2017, our named executive officers were granted stock options that vest over four years from the date of grant. The Compensation Committee believes that our stock option program is an appropriate equity incentive vehicle because stock options promote long-term performance by providing rewards only if, and to the extent that, our stock price improves, which both aligns the interests of our named executive officers with those of our stockholders and encourages long-term, sustained growth, while also promoting retention through multi-year vesting.

On September 7, 2017, Mr. Kanwar was awarded time-based stock options to purchase 50,000 shares of our common stock under our Amended and Restated 2014 Stock Incentive Plan in connection with his promotion to Executive Vice President. These options have an exercise price of $38.66 per share, which was equal to the closing price of our common stock as reported on The Nasdaq Global Select Market on the date of the grant, and vest 25% on the first anniversary of grant and 1/36th each month thereafter

15

until fully vested on the fourth anniversary of grant (subject to acceleration of vesting in connection with a change of control event and the other terms and conditions set forth in the plan and the award agreements), subject to Mr. Kanwar’s continued service with the Company on each applicable vesting date.

On December 22, 2017, we awarded our named executive officers long-term incentive compensation under our Amended and Restated 2014 Stock Incentive Plan in the form of stock options to purchase an aggregate of 910,000 shares of our common stock. Of these option grants, Mr. Stone received an option to purchase 350,000 shares of our common stock, Mr. Pedonti received an option to purchase 140,000 shares of our common stock, Mr. Boulanger received an option to purchase 180,000 shares of our common stock, Mr. Kanwar received an option to purchase 180,000 shares of our common stock, and Mr. Igoe received an option to purchase 60,000 shares of our common stock. The number of options was subjectively determined by the Compensation Committee based on an assessment of the relative contributions and efforts of each executive officer and recommendations received from our Chief Executive Officer. These options have an exercise price of $40.44 per share, which was equal to the closing price of our common stock as reported on The Nasdaq Global Select Market on the date of the grant.

The options awarded on December 22, 2017 vest 25% on the first anniversary of grant and 1/36th each month thereafter until fully vested on the fourth anniversary of grant (subject to acceleration of vesting in connection with a change of control event and the other terms and conditions set forth in the plan and the award agreements), subject to the recipient’s continued service with the Company on each applicable vesting date.

We offer a variety of benefit programs to all eligible employees, including our executive officers. Our executive officers generally are eligible for the same benefits on the same basis as other employees, including medical, dental and vision benefits, life insurance coverage and short- and long-term disability coverage. All eligible employees are also able to contribute to our 401(k) plan and receive matching Company contributions under the plan. In addition, our executive officers are entitled to reimbursement for reasonable business travel and other expenses incurred during the performance of their duties in accordance with our expense reimbursement policy.

We limit the use of perquisites as a method of compensation and provide our executive officers with only those perquisites that we believe are reasonable and consistent with our overall compensation program to better enable us to attract and retain talented employees for key positions.

Severance and Change of Control Benefits

Mr. Stone is our only named executive officer with an employment agreement. This agreement, entitles him to specified benefits in the event of the termination of his employment under certain circumstances, as described in detail under the captions “CEO Employment Agreement” and “Potential Payments Upon Termination or Change of Control” below. The Compensation Committee believes the employment agreement continues to be beneficial to the Company in retaining Mr. Stone.

The time-based stock options awarded to our named executive officers each vest in full immediately prior to the effectiveness of a change of control. The Compensation Committee believes this practice is appropriate and reasonable in order to encourage our executives to be open to responding to potential transactions beneficial to our stockholders without focusing on their personal compensation and employment in such transactions, particularly since our named executive officers other than Mr. Stone do not have contractual severance protections.

On March 9, 2018, we entered into a separation agreement and general release with Mr. Igoe in connection with his termination of employment from the Company which provides for his receipt of severance. Under the terms of his separation agreement, Mr. Igoe will continue to be employed by the Company in his role as Senior Vice President, General Counsel and Secretary through July 31, 2018 in order to assist in an orderly transition of his duties. At that time, Mr. Igoe will resign from the Company and continue to provide services to us in a consulting role through December 31, 2018. The separation agreement provides for Mr. Igoe’s receipt of a severance payment equal to $550,000, in lieu of a cash bonus for 2017 (payable at the time that we paid 2017 annual bonuses to our other executive officers), subject to his execution and non-revocation of a release of claims against the Company and compliance with a two-year non-solicitation and no-hire covenant.

Accounting and Tax Implications

The accounting and tax treatment of particular forms of compensation do not materially affect our compensation decisions. However, we evaluate the effect of such accounting and tax treatment on an ongoing basis and will make modifications to compensation policies where we deem it appropriate. For instance, Section 162(m) of the Internal Revenue Code generally disallows a tax deduction for compensation in excess of $1.0 million paid by a public company to its chief executive officer and to each other officer (other than the chief financial officer) whose compensation is required to be reported to our stockholders pursuant to the Exchange Act. However, prior to the enactment of the Tax Cuts and Jobs Act of 2017 (the “TCJA”), certain compensation, including qualified “performance-based compensation,” was not subject to the deduction limit if certain requirements were met.

16

Under the TCJA, the qualified “performance-based compensation” exemption was repealed, effective for taxable years beginning after December 31, 2017, except to the extent that certain contractual arrangements in place prior to November 2, 2017 are the Internal Revenue Code on our compensation programs is not known at this time.

In the exercise of its business judgment, and in accordance with its compensation philosophy, the Compensation Committee continues to have the flexibility to award compensation that is not tax deductible if it determines that such award is in our shareholders’ best interests.

Report of the Compensation Committee

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with our management. Based on this review and discussion, the Compensation Committee recommended to our Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement.

By the Compensation Committee of the Board of SS&C Technologies Holdings, Inc.

Michael E. Daniels

Michael J. Zamkow

17

The following table contains information with respect to the compensation earned by our named executive officers for the fiscal years ended December 31, 2017, 2016 and 2015.

|

Name and Principal Position |

|

Year |

|

Salary ($) |

|

Option awards ($)(1) |

|

Non-equity incentive plan compensation ($)(2) |

|

All other compensation ($)(3) |

|

Total ($) |

|

William C. Stone |

|

2017 |

|

875,000 |

|

2,979,735 |

|

5,000,000 |

|

5,584 |

|

8,860,319 |

|

Chief Executive Officer |

|

2016 |

|

875,000 |

|

1,935,521 |

|

6,500,000 |

|

285,122 |

|

9,595,643 |

|

|

|

2015 |

|

875,000 |

|

2,997,057 |

|

5,500,000 |

|

5,122 |

|

9,377,179 |

|

Patrick J. Pedonti |

|

2017 |

|

356,250 |

|

1,191,894 |

|

1,300,000 |

|

7,048 |

|

2,855,192 |

|

Chief Financial Officer |

|

2016 |

|

350,000 |

|

774,208 |

|

1,300,000 |

|

7,048 |

|

2,431,256 |

|

|

|

2015 |

|

350,000 |

|

1,141,736 |

|

1,050,000 |

|

5,584 |

|

2,547,320 |

|

Normand A. Boulanger |

|

2017 |

|

550,000 |

|

1,532,436 |

|

1,500,000 |

|

5,032 |

|

3,587,468 |

|

Chief Operating Officer |

|

2016 |

|

550,000 |

|

1,000,019 |

|

2,400,000 |

|

4,552 |

|

3,954,571 |

|

|

|

2015 |

|

550,000 |

|

1,427,170 |

|

2,000,000 |

|

4,552 |

|

3,981,722 |

|

Rahul Kanwar |

|

2017 |

|

475,000 |

|

1,929,715 |

|

2,500,000 |

|

4,240 |

|

4,908,955 |

|

Ex. Vice President |

|

2016 |

|

475,000 |

|

967,760 |

|

2,100,000 |

|

4,240 |

|

3,547,000 |

|

|

|

2015 |

|

475,000 |

|

1,355,811 |

|

1,600,000 |

|

4,240 |

|

3,435,051 |

|

Paul G. Igoe |

|

2017 |

|

263,750 |

|

510,812 |

|

— |

|

555,032 |

|

1,329,594 |

|

General Counsel |

|

2016 |

|

260,000 |

|

322,587 |

|

550,000 |

|

4,552 |

|

1,137,139 |

|

|

|

2015 |

|

260,000 |

|

428,151 |

|

400,000 |

|

4,552 |

|

1,092,703 |

|

(1) |

The amounts in this column reflect the aggregate accounting grant date fair value of options granted to our named executive officers during the applicable year, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718. The assumptions used by us in the valuation of the equity awards are set forth in Note 10 of the notes to our audited consolidated financial statements for the year ended December 31, 2017 included in our Annual Report on Form 10-K filed with the SEC on February 28, 2018. |

|

(2) |

Amounts reflected for the applicable year reflect cash bonus awards earned under the Bonus Plan for performance in such year and paid early in the following year, as described in “Executive and Director Compensation – Annual Cash Bonuses” above. |

|

(3) |

The amounts in this column reflect, for each named executive officer, the sum of (1) our contributions of $4,000 in each of 2017, 2016 and 2015 to the SS&C 401(k) savings plan and (2) our payments of life insurance premiums. In addition, it includes (1) an amount equal to $280,000 paid by the Company in 2016 to assist Mr. Stone in the preparation of a Notification and Report Form under the Hart Scott Rodino Antitrust Improvements Act of 1976, as amended (“HSR Filing”) and (2) a severance payment equal to $550,000 paid by the Company to Mr. Igoe pursuant to his separation agreement with the Company described in “Executive and Director Compensation – Severance and Change of Control Benefits” above. |

Mr. Stone’s employment agreement provides for the following:

|

|

• |

The employment of Mr. Stone as the Chief Executive Officer of SS&C Holdings and SS&C; |

|

|

• |

Continuing automatic one-year renewal terms until terminated either by Mr. Stone or us upon 90 days’ notice of non-renewal of his employment; |

|

|

• |

An annual base salary of at least $875,000; |

|

|

• |

An opportunity to receive an annual bonus in an amount to be established by our Board based on Mr. Stone’s and the Company’s performance, as determined by our Compensation Committee; |

18

|

|

perform his duties under the agreement for six consecutive months, Mr. Stone or his representative or heirs, as applicable, will be entitled to receive (1) disability or death benefits (as applicable) in accordance with our programs and arrangements, (2) accelerated vesting as set forth above, and (3) a prorated amount of his average bonus for the three bonus years preceding the year of termination. |

|

|

• |

In the event of a change in control of the Company, if payments to Mr. Stone cause him to incur an excise tax under Section 4999 of the Internal Revenue Code, Mr. Stone will be entitled to an additional payment sufficient to cover such excise tax and any taxes associated with such payments; |

|

|

• |

Restrictive covenants, including non-competition and non-solicitation covenants pursuant to which Mr. Stone will be prohibited from competing with us or our affiliates and from soliciting our employees or customers during the period beginning on the effective date of Mr. Stone’s amended employment agreement (the “Amended Employment Agreement”) and ending on the date that is two years following Mr. Stone’s termination of employment; and |

|

|

• |

Upon notice from Mr. Stone that he intends to file a HSR Filing, in connection with the conversion of all of his Class A Non-Voting Stock, the Company agreed to assist Mr. Stone in the preparation of the HSR filing, use its reasonable best efforts to take all actions necessary to respond to any requests necessary to complete the HSR filing and will pay all reasonable fees and costs associated (including legal fees) related to the HSR Filing. On March 16, 2016, Mr. Stone exercised this right and made a HSR Filing. |

For additional information on the severance and change of control benefits (including estimated costs), see “Potential Payments on Termination” below.

“Cause” means (a) Mr. Stone’s willful and continuing failure (except where due to physical or mental incapacity) to substantially perform his duties; (b) Mr. Stone’s conviction of, or plea of guilty or nolo contendere to, a felony; (c) the commission by Mr. Stone of an act of fraud or embezzlement against us or any of our subsidiaries as determined in good faith by a two-thirds majority of the Board; or (d) Mr. Stone’s breach of any material provision of the Amended Employment Agreement.