UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

2023

Notice

of Annual Meeting

of Stockholders

SS&C Technologies Holdings (NASDAQ: SSNC) provides the global financial services and healthcare industries with a broad range of software and software-enabled services, combining end-to-end expertise across financial services operations with software and solutions to support the most complex and demanding customers in the financial services and healthcare industries.

| #1 | in alternative fund administration and mutual fund transfer agency |

| Investment, Fund, Loan Accounting |

Outsourced Middle and Back Office |

Data Analytics | Transfer Agency | Front Office Trading | ||||||

| Virtual Data Rooms | Reporting Solutions | Regulatory and Risk | Healthcare Administration and Pharmacy |

Intelligent Automation Solutions |

Notice of Annual Meeting of Stockholders

|

May 17, 2023 (Wednesday)

The Annual Meeting will be held online at www.virtualshareholdermeeting.com/SSNC2023

Stockholders as of March 21, 2023 are entitled to vote.

How to Vote Your vote is very important, regardless of the number of shares you own. We urge you to promptly vote by telephone, by using the internet, or, if you received a proxy card or instruction form, by completing, dating, signing and returning it by mail. |

The Board of Directors of SS&C Technologies cordially invites you to attend the 2023 Annual Meeting of Stockholders. | ||||||

| Voting Items | |||||||

| Proposals | Board Vote Recommendation |

For Further Details | |||||

| 1. | To elect three Class I Directors to the Board of Directors, to serve for a term ending at the 2026 annual meeting or until their respective successors have been duly elected and qualified | “FOR” each director nominee | Page 12 | ||||

| 2. | To approve, in an advisory vote, the compensation of our named executive officers | “FOR” | Page 32 | ||||

| 3. | To approve, in an advisory vote, the frequency of advisory votes on executive compensation | “1 YEAR” | Page 63 | ||||

| 4. | To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 | “FOR” | Page 64 | ||||

| 5. | To approve SS&C Technologies Holdings, Inc. 2023 Stock Incentive Plan | “FOR” | Page 66 | ||||

And to transact any other business that is properly presented at the meeting. Your vote is important, regardless of the number of shares you own. Whether or not you plan to attend the 2023 annual meeting virtually, we hope you will take the time to vote your shares. If your shares are held in “street name,” meaning held for your account by a bank, broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted. Even if you plan to attend the 2023 Annual Meeting of Stockholders, please vote. You can change your vote at the meeting if you choose to do so. By Order of the Board of Directors,

Jason White Senior Vice President, General Counsel and Secretary

| |||||||

Important Notice Regarding Availability of Proxy Materials for the 2023 Annual Meeting of Stockholders to be Held on May 17, 2023.

We are first making available and/or mailing this proxy statement and the accompanying proxy at no charge on or about April 6, 2023 to our stockholders of record as of March 21, 2023. Our stockholders will not receive paper copies of our proxy materials, as we will use the internet as our key means of furnishing proxy materials to our stockholders, under the “Notice and Access” method permitted by the SEC. We will send these stockholders a notice with instructions for accessing the proxy materials and voting via the internet. Stockholders may also receive our annual meeting materials in paper form at no charge. You may elect to receive your materials in either format. Please see “How We Use Notice & Access” on page 78 for more information. In addition, we will furnish copies of the exhibits to our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 upon written request of any stockholder. Please address all such requests to SS&C Investor Relations at 80 Lamberton Road, Windsor, Connecticut 06095.

This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 are available for viewing, printing and downloading at http://www.ssctech.com/2023annualmeeting. This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 are also available on the SEC’s website at http://www.sec.gov.

| 2023 PROXY STATEMENT | 1 |

|

April 6, 2023 Dear Fellow Stockholders: Welcome to SS&C Technologies’ virtual 2023 Annual Meeting of Stockholders. 2022’s operating environment, including rising interest rates, the strong dollar and the great resignation, presented challenges. Our focus on our clients and our people proved to be a good strategy and we were able to deliver strong financial performance, exit the year with robust margins and high retention rates, and build momentum. I want to share some of our 2022 performance highlights here, and emphasize the investments made to ensure sound corporate governance. SS&C finished the year with $5,283.0 million in GAAP revenue, $1,142.9 million in GAAP operating income, and $2.48 in GAAP diluted earnings per share. On an adjusted basis, we made $4.65 in diluted earnings per share. We had major client wins across our business, secured key multiyear renewals, and saw success with our most innovative products and services, including Aloha, Singularity, and Genesis. Our robust cash flow of $1,134.3 million for the year enabled us to be flexible in our capital allocation strategy. SS&C’s priority is to maximize stockholder value, and smart capital allocation remains a key driver. In 2022, we repurchased 7.8 million shares of common stock for $476.1 million, and made six acquisitions, including Blue Prism, our first major acquisition since 2018. We are excited about Blue Prism’s prospects, including promising revenue growth and profitability, and the ability to transform SS&C’s existing operations with their intelligent automation technology, which creates “digital workers.” We believe this acquisition will pay dividends well into the future. In 2022, SS&C made instrumental changes to corporate governance. The enhancements to our corporate bylaws and our newly adopted corporate governance guidelines should align us closely with best practices. I am also pleased to announce that Jon Michael has been appointed our Lead Independent Director, and Smita Conjeevaram has been appointed the Chair of our Audit Committee. We believe these governance changes position us to better focus on our stockholders’ priorities. Also in 2022, the SS&C Compensation Committee committed to a fundamental redesign of its program for compensating our executive officers, which involved a thorough feedback process in which we reached out to approximately 64% of our unaffiliated stockholders over the course of 2022. In connection with this redesign, our Compensation Committee has adopted compensation practices to strengthen the link between our executive leadership and long-term value creation. SS&C is committed to our customers and investing in market-leading software and services critical to their success. We look forward to delivering strong stockholder returns as a result of our renewed customer focus. Sincerely,

William C. Stone Chairman of the Board & Chief Executive Officer |

| 2 |  |

|

Dear Fellow Stockholders, I am pleased to be writing my inaugural letter as Lead Independent Director. I joined SS&C’s board of directors in 2010, and served six years as chair of the audit committee, and as a member of the nominating committee. Recently, we have embarked on an extensive effort to enhance our corporate governance practices and redesign our executive compensation program to align SS&C with the high standards expected by our stockholders. In 2022, SS&C amended its corporate bylaws to provide for majority voting for Directors in uncontested elections, and adopted proxy access for stockholders having maintained a certain level of ownership continuously over a three-year period. SS&C also adopted corporate governance guidelines for the Board, which establish a framework covering a range of Board functions, including maintaining a majority of independent Directors on the Board, the adoption of standards to restrict director overboarding, and a mandatory retirement age for Board members reaching the age of 75. SS&C also enhanced our Nominating Committee to be the Nominating and Governance Committee, giving it express oversight of corporate governance matters, and made corresponding changes to the committee’s charter to enhance its role in the oversight of ESG matters. The Compensation Committee’s redesign of our executive compensation program strengthens our commitment to our pay-for-performance philosophy and more closely aligns the key components of the program with prevailing market practice among SS&C’s compensation peer group. Among other things, our Compensation Committee has adopted a rigorous target-based approach to annual cash bonuses payable to our executive officers, commencing with the annual bonuses payable for 2022. Under the new program, each of our executives has a target bonus opportunity for the year, relative to which payouts are determined based on the level of attainment of certain financial performance goals. This change is part of a multi-year effort to more strongly align pay with performance that includes a number of compensation governance changes described in the Compensation Discussion & Analysis section on page 36 of this proxy statement. Our foundational goal is to align our priorities with SS&C’s stockholder base, and to maintain the Board’s focus on maximizing sustainable stockholder value. I look forward to serving you as SS&C’s lead independent director over the next year. Sincerely,

Jonathan E. Michael Lead Independent Director |

| 2023 PROXY STATEMENT | 3 |

Table of Contents

FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “anticipate,” “target,” “expect,” “estimate,” “intend,” “plan,” “goal,” “believe” or other words of similar meaning. Forward-looking statements provide SS&C Technologies Holdings, Inc.’s current expectations or forecasts of future events, circumstances, results or aspirations, and are subject to significant risks and uncertainties. These risks and uncertainties could cause SS&C Technologies Holdings, Inc.’s actual results to differ materially from those set forth in such forward-looking statements. Certain of such risks and uncertainties are described in SS&C Technologies Holdings, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2022. SS&C Technologies Holdings, Inc. does not undertake to update the forward-looking statements included in this proxy statement to reflect the impact of circumstances or events that may arise after the date the forward-looking statements were made.

No reports, documents or websites that are cited or referred to in this proxy statement shall be deemed to form part of, or to be incorporated by reference into, this proxy statement.

| 4 |  |

2023 Proxy Summary

This summary highlights information that is relevant to certain proposals being voted on at the Annual Meeting. Additional discussion of these proposals is contained elsewhere in this proxy statement, which we encourage you to review in its entirety.

Annual Meeting Overview: Matters Being Voted Upon

| 1 | 2 | 3 | 4 | 5 | ||||

| Election of Directors | Advisory Vote to Approve Named Executive Officer Compensation | Advisory Vote on the Frequency of Advisory Votes on Executive Compensation | Ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 | Approval of SS&C Technologies Holdings, Inc. 2023 Stock Incentive Plan | ||||

| FOR | FOR | 1 YEAR | FOR | FOR | ||||

| Page 12 | Page 32 | Page 63 | Page 64 | Page 66 |

2022 Performance Highlights

2022 was a challenging year in the macro operating environment in which we conduct our business. Despite these challenges, we are pleased with the Company’s performance in 2022, as evidenced by the following results:

GAAP Diluted EPS of $2.48

|

Net Income(1) of $650.2M

|

GAAP Revenue of $5,283.0M

| |

Adjusted Diluted EPS of $4.65

|

Adjusted Consolidated EBITDA of $2,006.1M

|

Adjusted Revenue of $5,287.3M

|

Organic Revenue Growth 2.0%

|

Generated net cash of $1,134.3M from operating activities

|

Repurchased $476.1M In treasury stock

|

Completed acquisitions totaling $1,636.2M Including the businesses of Blue Prism, | |

| (1) | Reflects net income attributable to SS&C common stockholders. |

| 2023 PROXY STATEMENT | 5 |

2023 PROXY SUMMARY

Stockholder Engagement

Our Board considers the feedback of our stockholders as critical to our long-term growth and success and values the input provided when making decisions for our company. Over the course of 2022, we reached out to stockholders holding a total of approximately 64% of our outstanding stock, and held discussions with those stockholders holding a total of approximately 30% of our shares, in each case excluding shares held by our CEO. The primary topics covered in these communications related to our executive compensation program and governance matters. After analyzing the feedback we received from our stockholders with our independent compensation advisors at Frederic W. Cook & Co. (“FW Cook”), we adopted substantial changes to our executive compensation program, which are described in “Compensation Discussion & Analysis,” as well as substantial changes to our corporate governance practices, which are described in “Commitment to Strong Corporate Governance Practices.” These changes reflect another step in a multi-year process that commenced in 2020 to align our compensation program with prevailing market practice and strengthen the program’s alignment with the promotion of stockholder value creation. We appreciate our stockholders’ willingness to engage with us and to provide their perspectives, and are committed to maintaining active engagement with our stockholders.

| We reached out

to stockholders representing: |

Primary Topics Covered: | ||

|

● Annual Bonus Plan Design ● LTI Program Design and Award Mix ● Enhanced Disclosure Regarding Incentive Plans ● Corporate Governance Guidelines ● Lead Independent Director | ||

The Compensation Committee believes that our executive compensation program should provide a meaningful and direct link between our executives’ interests and those of our stockholders, and is committed to our ongoing engagement with stockholders to fully understand diverse viewpoints, to demonstrate the important connection between our compensation program, on the one hand, and our business strategy, goals and financial performance, on the other hand, and to be responsive to stockholder concerns.

In 2020, we commenced a comprehensive stockholder engagement process focused on aligning aspects of our executive compensation program and corporate governance practices with prevailing market practices and stockholder preferences. As a result of those efforts, the Compensation Committee made significant changes in 2020 and 2021 to our compensation program, including (among others):

| ● | eliminating any “golden parachute” excise tax gross-ups for our executive officers; |

| ● | eliminating “single-trigger” vesting of equity awards upon a change in control for our named executive officers, beginning with grants made in 2020; |

| ● | enhancing the process for considering competitive data in setting our executive’s compensation; and |

| ● | adopting a compensation clawback policy, stock ownership and retention guidelines for executive officers and non-employee directors and anti-hedging and anti-pledging policies covering our executive officers. |

In 2022, after receiving feedback from initial meetings with stockholders early in the year and following the disappointing results of our “say-on-pay” proposal at our 2022 annual meeting of stockholders, the Compensation Committee, together with its independent compensation consultant, FW Cook, undertook a renewed focus on the initiatives that commenced in 2020 by engaging in a holistic review of our executive compensation program and practices. As a result of that process, the Compensation Committee approved a significant redesign of the short-and long-term incentive compensation components of our executive compensation program, which are focused on providing a meaningful and direct link between our executives’ interests and stockholder value creation. These changes, which were effective in part for the 2022 fiscal year, are described in more detail under “Compensation Discussion and Analysis” below and highlighted in the table below. The Compensation Committee believes these changes are directly responsive to our stockholder’s viewpoints and more closely align certain components of our compensation program with prevailing market practice among our compensation peer group. The Compensation Committee also believes these changes will strengthen our commitment to our pay for performance philosophy by aligning our named executive officers’ pay with achievement against pre-established, financial performance measures.

In addition, as further described in more detail under “Commitment to Strong Corporate Governance Practices” below, in 2022 we amended our Bylaws to provide for majority voting for directors in uncontested elections, as well as proxy access for stockholders having maintained a certain level of ownership continuously over a three-year period. The Board also adopted Corporate Governance Guidelines, which cover matters such as the roles and responsibilities of the Board, the Board’s leadership structure, the responsibilities of the Lead Independent Director, director independence, overboarding, succession planning and retirement, Board membership criteria, Board committees, director orientation and continuing education, and Board and senior management evaluations. SS&C also enhanced the Nominating and Governance Committee’s and Audit Committee charters to reflect prevailing market practices.

| 6 |  |

2023 PROXY SUMMARY

The table below highlights the key areas of feedback relating to our executive compensation program from our stockholders in 2022 and describes the specific actions the Compensation Committee took in 2022 to be responsive to our stockholders.

| WHAT WE HEARD |  |

HOW WE RESPONDED | ||

Annual Bonuses are Discretionary, Not Based on Achievement of Established Metrics ● Executives do not have target annual bonus opportunities set at the beginning of each year ● Annual bonus payouts are entirely based on the Compensation Committee’s holistic evaluation of performance ● Bonuses are not earned based on the achievement of pre-established performance goals or a pre-defined payout calibration |

● Adopted a new formulaic annual bonus program design consistent with leading best practices ● Each executive has a target bonus opportunity for each year, relative to which bonus payouts are determined based on the level of attainment of rigorous pre-established Company financial performance goals (with an up to 25% upward or downward strategic modifier adjustment based on overall business and individual performance against pre-established strategic key performance indicators (“KPIs”)) ● Total payout is capped at 250% of target ● Earned annual bonuses are paid 100% in cash ● New program commenced with annual bonuses payable for the 2022 fiscal year, which were based on the achievement of the following equally-weighted performance metrics: (i) adjusted revenue, (ii) organic revenue growth, (iii) operating cash flow and (iv) adjusted consolidated EBITDA | |||

|

||||

Annual Long-Term Incentive Award Grant Practices Do Not Reflect Market Practice ● Awards are granted only in the form of time-vesting and performance-vesting stock options ● Grants are sized based on a target number of shares, as opposed to a target grant value ● Performance-based awards use a single metric and no relative performance metrics are used |

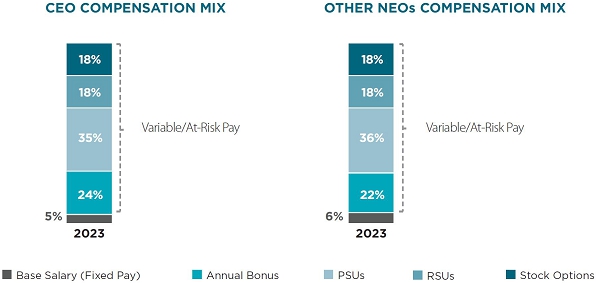

● Adopted a significantly enhanced long-term incentive program that emphasizes pay-for-performance ● Equity incentives are granted based on a target grant date value, which are set by the Compensation Committee after a holistic consideration of competitive data and individual-specific factors ● The annual award mix emphasizes performance-based awards comprised of performance-based restricted stock units (“PSUs”) (50%), time-based restricted stock units (“RSUs”) (25%) and time-vesting stock options (25%) ● PSUs vest between 0% and 200% of target based on our achievement of a three-year average earnings per share (“EPS”) growth performance goal, with an up to 20% upward or downward modifier based on our achievement of a relative total shareholder return (“TSR”) performance goal; however, no upward modifier will be applied to PSUs if the Company’s absolute TSR over the performance period is negative and total payout cannot exceed 200% including the modifier ● New program commenced with annual equity awards made in 2023 | |||

|

||||

Enhanced Disclosure Regarding Incentive Plans ● Disclosure of decisions made regarding our annual cash bonus and long-term equity incentive plans should be more detailed and clear |

● Significantly enhanced our disclosure in the proxy statement of annual cash bonus and long-term equity incentive program decisions, including in connection with the selection of performance goals and payout determinations | |||

In connection with the Compensation Committee’s redesign of our executive compensation program, in the Fall of 2022, we engaged in outreach to our stockholders representing approximately 63% of our voting shares (excluding shares held by our CEO) outstanding to inform and explain to them the changes we made and how we believe these changes will strengthen our pay for performance philosophy, more closely align the interests of our executives with those of our stockholders and promote stockholder value creation over the long term. Of the stockholders to whom we reached out, 25% either indicated their directional support without the need for a further meeting or otherwise declined a further meeting (generally due to not having any additional comments or questions), and 11% requested a subsequent conversation to discuss the redesigned program in further detail (in each case, excluding shares held by our CEO). The stockholders we spoke with were pleased with the changes to the compensation program.

We will continue to maintain an active dialogue with our stockholders and evaluate feedback on issues of importance to them.

| 2023 PROXY STATEMENT | 7 |

2023 PROXY SUMMARY

Commitment to Strong Corporate Governance Practices

2022 Highlights

| ● | Corporate Governance Guidelines. The Board adopted Corporate Governance Guidelines that address matters such as the roles and responsibilities of the Board, the Board’s leadership structure, the responsibilities of the Lead Independent Director, director independence, overboarding, succession planning and retirement (with a mandatory retirement age of 75), Board membership criteria, Board committees, director orientation and continuing education, and Board and senior management evaluations. |

| ● | Lead Independent Director. SS&C appointed Jonathan E. Michael as its Lead Independent Director, based on the recommendation of the Nominating and Governance Committee and unanimously approved by the Board. A Lead Independent Director will be maintained so long as the role of the Board Chairman is combined with that of the Chief Executive Officer. |

| ● | Board Governance Enhancement. The Nominating and Governance Committee undertook a review of the practices and procedures of the Board to enhance its operating efficiency and strategic focus and updated the Company’s governance documents to reflect market practices. |

| ● | Cybersecurity Oversight. The Board amended the Audit Committee charter to formalize the committee’s oversight of information security controls and procedures, material breaches of the Company’s network, as well as potential cybersecurity risk disclosures. |

| ● | ESG Oversight. The Board amended the Nominating and Governance Committee charter to formalize the committee’s oversight of the Company’s practices and processes relating to the management and oversight of environmental, social and governance (“ESG”) matters. |

| ● | Majority Voting. The Board amended our Bylaws to provide that an uncontested election of directors will be decided by a majority in voting power of votes cast with respect to a nominee’s election. In the event of a contested election of directors, directors shall continue to be elected by a plurality of votes cast. |

| ● | Proxy Access. The Board amended our Bylaws to permit a stockholder or group of stockholders (up to 20) who have owned a significant amount of shares of common stock (at least 3%) for at least three years to submit director nominees (up to 20% of the Board or two directors, whichever is greater) for inclusion in our proxy statement if the stockholder(s) and the nominee(s) satisfy the requirements specified in our Bylaws. |

| ● | Director Skills Matrix. This proxy statement includes a table illustrating our directors’ experience and skills to help our stockholders better understand their strengths. |

| 8 |  |

2023 PROXY SUMMARY

Summary of Proposals

| PROPOSAL 1 | Election of Directors |  |

PAGE 12 | ||

The Board recommends that you vote “FOR” the election of our Class I Directors whose terms will expire at the 2026 annual meeting: Normand A. Boulanger, David A. Varsano and Michael J. Zamkow. See the section of this proxy statement entitled “Director Biographies” beginning on page 15 for additional discussion of our director nominees and their qualifications.

Class I Director Nominees to be elected at the 2023 annual meeting

|

|

| ||||

| Normand A. Boulanger, 61 Independent Vice Chair of the Board, SS&C Technologies Director since 2006 |

David A. Varsano, 61 A

|

Michael J. Zamkow, 67

C | ||||

| A Audit Committee | C Compensation Committee | N Nominating and Governance Committee |

Chair |

| 2023 PROXY STATEMENT | 9 |

2023 PROXY SUMMARY

| PROPOSAL 2 | Advisory Vote to Approve Named Executive Officer Compensation |  |

PAGE 32 | ||

The Board recommends that our stockholders vote “FOR” the advisory vote to approve the compensation of our named executive officers as disclosed in this proxy statement (the so-called “say-on-pay” vote). The Compensation Discussion and Analysis, beginning at page 36 of this proxy statement, describes the Company’s compensation philosophy and programs for our named executive officers for 2022, as well as the significant redesign of our executive compensation program we undertook in 2022 in connection with feedback received from our stockholders. As described in more detail throughout this proxy statement, these modifications included the adoption of a new formulaic annual cash bonus program (effective for bonuses paid in respect of 2022 performance) and an enhanced target-based approach to our long-term equity incentive awards that places a significant emphasis on performance-based awards (effective for annual equity awards beginning in 2023). In addition, we have substantially enhanced the disclosure of our executive compensation programs so that our stockholders more clearly understand our decision-making around compensation setting and goal design. These changes reflect another step in a multi-year process that commenced in 2020 to align our compensation program with prevailing market practice and to more closely align our compensation program with promotion of stockholder value creation.

We believe that, with these changes, our executive compensation program strengthens our commitment to our pay for performance philosophy by motivating and driving our executive officers to perform at the highest levels to create long-term value for our stockholders. We encourage you to approve the compensation of our named executive officers for these reasons.

The Board recommends that you vote “FOR” the advisory resolution to approve named executive officer compensation.

| PROPOSAL 3 | Frequency of Advisory Vote on Executive Compensation |  |

PAGE 63 | ||

Section 14A of the Exchange Act requires us, at least once every six years, to allow our stockholders the opportunity to cast an advisory vote on how often we should seek future “say-on-pay” advisory votes on the compensation of the Company’s named executive officers in our proxy materials for future annual meetings. Under this proposal, stockholders may vote to have the “say-on-pay” vote every one year, two years or three years, or may abstain from voting. The Board recommends continuing our current practice of holding an advisory vote to approve executive compensation every one year. We value the opinion of our stockholders. An annual “say-on-pay” vote will best reinforce our desire to communicate with our stockholders and allow them to regularly express a view on the Company’s compensation policies and practices.

The Board recommends that you vote “1 YEAR” on the advisory resolution to approve the frequency of our “say-on-pay” votes.

| 10 |  |

2023 PROXY SUMMARY

| PROPOSAL 4 | Ratification of Selection of Independent Registered Public Accounting Firm |  |

PAGE 64 | ||

The Audit Committee has appointed the firm of PricewaterhouseCoopers LLP, an independent registered public accounting firm, to audit our books, records and accounts for fiscal 2023. This appointment is being presented to our stockholders for ratification at the 2023 annual meeting.

The Board recommends that you vote “FOR” the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm.

| PROPOSAL 5 | Approval of SS&C Technologies Holdings, Inc. 2023 Stock Incentive Plan |  |

PAGE 66 | ||

The Board recommends that you vote “FOR” the approval of SS&C Technologies Holdings, Inc. 2023 Stock Incentive Plan, which has been approved by the Board to replace the Second Amended and Restated 2014 Stock Incentive Plan.

The Board recommends that you vote “FOR” the approval of SS&C Technologies Holdings, Inc. 2023 Stock Incentive Plan.

| 2023 PROXY STATEMENT | 11 |

| PROPOSAL 1 | |

| Election of Directors | |

Our Restated Certificate of Incorporation, or Certificate, provides for a classified Board. This means the Board is divided into three classes, with each class having as nearly as possible an equal number of directors. The term of service of each class of directors is staggered so that the term of one class expires at each annual meeting of our stockholders.

The Board currently consists of seven members, divided into three classes as follows:

| ● | Class I is comprised of Normand A. Boulanger, David A. Varsano and Michael J. Zamkow, each with a term ending at the 2023 annual meeting; |

| ● | Class II is comprised of Jonathan E. Michael, whose term ends at the 2024 annual meeting; and |

| ● | Class III is comprised of Smita Conjeevaram, Michael E. Daniels and William C. Stone, each with a term ending at the 2025 annual meeting. |

At each annual meeting of stockholders, directors are elected for a full term of three years to succeed those directors whose term is expiring. Messrs. Boulanger, Varsano and Zamkow are current directors whose terms expire at the 2023 annual meeting. Each of these directors has been nominated by the Board upon the recommendation of the Nominating and Governance Committee for reelection as a Class I director, with a term ending at the 2026 annual meeting.

Unless otherwise instructed in the proxy, all proxies will be voted “FOR” the election of each of the nominees identified above to a three-year term ending at the 2026 annual meeting, to hold office until his successor has been duly elected and qualified. Stockholders who do not wish their shares to be voted for any or all of these three nominees may so indicate by following the directions set out on the proxy card or in the instructions provided in the Notice of Internet Availability.

Each of the nominees has indicated his willingness to serve on the Board, if elected. If any nominee is unable to serve, the person acting under the proxy may vote the proxy for a substitute nominee designated by the Board or the Board may reduce its size. If a Class I director nominee fails to receive a majority in voting power of the votes cast, the director must immediately tender his resignation to the Board. The Nominating and Governance Committee will consider the resignation and make a recommendation to the Board as to whether to accept or reject the resignation. The Board will act on the resignation, taking into account the Nominating and Governance Committee’s recommendation, and publicly disclose its decision regarding the resignation within 90 days following certification of the election results.

A majority in voting power of the votes cast by holders of all of the shares of common stock present in person or represented by proxy at the 2023 annual meeting is required to elect each nominee as a director.

| THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF NORMAND A. BOULANGER, DAVID A. VARSANO AND MICHAEL J. ZAMKOW |

| 12 |  |

ELECTION OF DIRECTORS

Class I Director Nominees to be Elected at the 2023 Annual Meeting

|

|

| ||||

| Normand A. Boulanger, 61 Independent Vice Chair of the Board, SS&C Technologies Director since 2006 |

David A. Varsano, 61 A

|

Michael J. Zamkow, 67

C | ||||

| KEY | ||||||

| A Audit Committee | C Compensation Committee | N Nominating and Governance Committee |

Chair |

Board Statistics

RANGE OF TENURE 15 Average Years 0-10 years

11-20 years

>20 years

|

BOARD REFRESHMENT 3 New Directors Over |

AGE DISTRIBUTION 65 Average Age of Director |

| 2023 PROXY STATEMENT | 13 |

ELECTION OF DIRECTORS

Board Diversity and Experience Matrix

Our directors collectively possess the expertise, leadership skills, and diversity of experiences and backgrounds to oversee management’s execution of its growth strategy and protect long-term stockholder value. The experience and diversity matrix below summarizes the qualifications of our directors and more detailed information can be found in the director biographies beginning on page 15.

| Director Skills and Experience | Boulanger | Varsano | Zamkow | Michael | Conjeevaram | Daniels | Stone | |

|

Executive Leadership |  |

|

|

|

|

|

|

|

Governance/Public Company Board |  |

|

|

|

|

|

|

|

Industry Experience |  |

|

|

|

|

|

|

|

Investments/Strategy and Corporate Development |  |

|

|

|

|

|

|

|

Financial Expertise |  |

|

|

|

| ||

|

Risk Management |  |

|

|

||||

|

Client Relations/Sales/Marketing |  |

|

|

|

|

|

|

|

Innovation, Data and Technology Services |  |

|

|

| |||

|

Audit and Accounting |  |

|

|

| |||

|

Financial Software |  |

|

|

|

|

|

|

|

Complex Organization Leadership Skills |  |

|

|

|

|

|

|

| Background | ||||||||

| Age/Tenure | ||||||||

| Age | 61 | 61 | 67 | 69 | 62 | 68 | 67 | |

| Years on the Board | 17 | 12 | 9 | 13 | 8 | 10 | 37 | |

| Gender | ||||||||

| Female |  |

|||||||

| Male |  |

|

|

|

|

| ||

| Race | ||||||||

| Asian |  |

|||||||

| White |  |

|

|

|

|

| ||

| 14 |  |

ELECTION OF DIRECTORS

Director Biographies

The Nominating and Governance Committee has recommended, and the Board has nominated, Messrs. Boulanger, Varsano and Zamkow for election at the 2023 annual meeting as the Class I directors, to serve until the 2026 annual meeting and until their successors have been duly elected and qualified. Each of the nominees is currently a member of the Board.

The following table and biographical descriptions provide information relating to each director and director nominee, including her/his age and period of service as a director of the Company, her/his committee memberships, her/his business experience for at least the past five years, including directorships at other public companies, and certain other information.

Class I Directors Nominees to Be Elected at the 2023 Annual Meeting

|

Normand A. Boulanger | |||

| Vice Chair of the Board, SS&C Technologies | ||||

| Age | 61 | Committees | None | |

| Director since | 2006 | Term Expires | 2023 | |

| PRINCIPAL OCCUPATION, BUSINESS EXPERIENCE, AND DIRECTORSHIPS | ||||

| On February 3, 2020, Mr. Boulanger retired as an employee of SS&C, after serving in a number of roles since 1994. Mr. Boulanger continues to serve as a director on our Board. He was elected to serve as a director in 2006 and appointed Vice Board Chair in August 2018. He served as our President and Chief Operating Officer from October 2004 to February 2020, our Executive Vice President and Chief Operating Officer from October 2001 to October 2004, Senior Vice President of SS&C Direct from March 2000 to September 2001, Vice President of SS&C Direct from April 1999 to February 2000, Vice President of Professional Services for the Americas, from July 1996 to April 1999, and Director of Consulting from March 1994 to July 1996. Prior to joining SS&C, Mr. Boulanger served as Manager of Investment Accounting for The Travelers from September 1986 to March 1994. | ||||

| EXPERIENCE, QUALIFICATIONS, ATTRIBUTES, AND SKILLS SUPPORTING DIRECTORSHIP POSITION ON THE COMPANY’S BOARD | ||||

| The Board has concluded that Mr. Boulanger should serve as a director because he has substantial knowledge and experience regarding our operations, employees, target markets, strategic initiatives and competitors. | ||||

|

David A. Varsano | |||

| Chairman of the Board and Chief Executive Officer, Pacific Packaging Products | ||||

| Age | 61 | Committees | Audit Committee Nominating and Governance Committee (Chair) | |

| Director since | 2011 | Term Expires | 2023 | |

| PRINCIPAL OCCUPATION, BUSINESS EXPERIENCE, AND DIRECTORSHIPS | ||||

| Mr. Varsano was elected as one of our directors in March 2011, has served on the Audit Committee since 2011, and was appointed Chair of the Nominating and Governance Committee in 2016. He is currently the Chairman of the Board and Chief Executive Officer of Pacific Packaging Products, a company specializing in industrial packaging and related solutions and supply chain management services, which he joined in September 1999. Prior to joining Pacific Packaging Products, Mr. Varsano served as the Chief Technology Officer and Vice President of Software Development of SS&C from 1995 to 1999 and as Manager of SS&C Direct from 1998 to 1999. Mr. Varsano also currently serves on the Board of Directors of Packaging Distributors of America. | ||||

| EXPERIENCE, QUALIFICATIONS, ATTRIBUTES, AND SKILLS SUPPORTING DIRECTORSHIP POSITION ON THE COMPANY’S BOARD | ||||

| The Board has concluded that Mr. Varsano should serve as a director because he has a broad range of experience relevant to our business and a strong understanding of information technology matters. | ||||

| 2023 PROXY STATEMENT | 15 |

ELECTION OF DIRECTORS

|

Michael J. Zamkow | |||

| Member of the Board of Trustees, Northeastern University | ||||

| Age | 67 | Committees | Compensation Committee | |

| Director since | 2014 | Term Expires | 2023 | |

| PRINCIPAL OCCUPATION, BUSINESS EXPERIENCE, AND DIRECTORSHIPS | ||||

| Mr. Zamkow was elected one of our directors in June 2014 and has served on our Compensation Committee since 2016. He retired from Goldman Sachs in November 2001, where he was a partner for 17 years from 1994 to 2001. From 1999 to 2001, Mr. Zamkow was responsible for Goldman Sachs’ fixed income, currency and commodities business. He is currently a member of the Board of Trustees of Northeastern University. | ||||

| EXPERIENCE, QUALIFICATIONS, ATTRIBUTES, AND SKILLS SUPPORTING DIRECTORSHIP POSITION ON THE COMPANY’S BOARD | ||||

| The Board has concluded that Mr. Zamkow should serve as a director because he has extensive experience in the financial services industry. | ||||

Class II Director

|

Jonathan E. Michael | |||

| Chairman of the Board, RLI Corp. | ||||

| Age | 69 | Committees | Audit Committee Nominating and Governance Committee | |

| Director since | 2010 | Term Expires | 2024 | |

| PRINCIPAL OCCUPATION, BUSINESS EXPERIENCE, AND DIRECTORSHIPS | ||||

| Mr. Michael was elected as one of our directors in April 2010, has served on the Nominating and Governance Committee since 2011, has served as Chair of the Audit Committee for the previous six years, and was appointed as our Lead Independent Director in November 2022. He retired as Chief Executive Officer of RLI Corp., a publicly traded specialty insurance company, at the end of 2021. Mr. Michael held various positions at RLI Corp. since joining in 1982, including President and Chief Operating Officer, Executive Vice President and Chief Financial Officer. He currently serves as Chairman of the RLI Corp. board. Prior to joining RLI Corp., Mr. Michael was associated with the accounting firm Coopers & Lybrand. He currently serves as Chairman of the Board of TADA Cognitive Solutions, LLC. Mr. Michael previously served on the Board of Directors of Maui Jim, Inc. until its acquisition in 2022. He is also a member of the OSF St. Francis Medical Center Community Advisory Board; Vice-Chair of the Bradley University Board of Trustees; the immediate Past Chair of Easterseals Central Illinois; and a member and Past Chair of the Property Casualty Insurers Association of America (now known as American Property Casualty Insurance Association) Board of Governors. | ||||

| EXPERIENCE, QUALIFICATIONS, ATTRIBUTES, AND SKILLS SUPPORTING DIRECTORSHIP POSITION ON THE COMPANY’S BOARD | ||||

| The Board has concluded that Mr. Michael should serve as a director because he has extensive experience in the financial services industry, including companies that we seek to target as clients, as well as extensive operational experience as a director and officer of financial services and insurance companies. | ||||

| 16 |  |

ELECTION OF DIRECTORS

Class III Directors

|

Smita Conjeevaram | |||

| Retired Chief Financial Officer – Credit Hedge Funds and Deputy Chief Financial Officer – Credit Funds, Fortress Investment Group LLC | ||||

| Age | 62 | Committees | Audit Committee (Chair) | |

| Director since | 2015 | Term Expires | 2025 | |

| PRINCIPAL OCCUPATION, BUSINESS EXPERIENCE, AND DIRECTORSHIPS | ||||

| Ms. Conjeevaram joined our board of directors in November 2015, previously served on our Nominating and Governance Committee, has served on the Audit Committee since 2017, and was appointed Chair of the Audit Committee in November 2022. Ms. Conjeevaram retired in 2013 after a 19-year career in the global investment and hedge fund firm industry. Her most recent position was as the Chief Financial Officer – Credit Hedge Funds, and Deputy Chief Financial Officer – Credit Funds, of the Fortress Investment Group LLC, where she served from 2010 to 2013. Prior to that, Ms. Conjeevaram served as the Chief Financial Officer of Everquest Financial LLC from 2006 to 2009 and Strategic Value Partners LLC from 2004 to 2005. Ms. Conjeevaram began her career as a tax specialist at two Big-4 public accounting firms and is a certified public accountant. She currently serves on the Boards of Directors of McGrath RentCorp, SkyWest, Inc. and WisdomTree Investments, Inc. | ||||

| EXPERIENCE, QUALIFICATIONS, ATTRIBUTES, AND SKILLS SUPPORTING DIRECTORSHIP POSITION ON THE COMPANY’S BOARD | ||||

| The Board has concluded that Ms. Conjeevaram should serve as a director because she has extensive experience in the financial services industry and particularly hedge fund operations. | ||||

|

Michael E. Daniels | |||

| Retired Senior Vice President and Group Executive, IBM Global Services | ||||

| Age | 68 | Committees | Compensation Committee (Chair) Nominating and Governance Committee | |

| Director since | 2013 | Term Expires | 2025 | |

| PRINCIPAL OCCUPATION, BUSINESS EXPERIENCE, AND DIRECTORSHIPS | ||||

| Mr. Daniels was elected as one of our directors in October 2013, has served as a member of the Nominating and Governance Committee since 2014, and was appointed Chair of the Compensation Committee in 2017. Mr. Daniels retired after a 36-year career from International Business Machines Corporation in March 2013 as Senior Vice President and Group Executive IBM Global Services. Mr. Daniels currently serves on the Boards of Directors of Johnson Controls International Plc and Thomson Reuters. | ||||

| EXPERIENCE, QUALIFICATIONS, ATTRIBUTES, AND SKILLS SUPPORTING DIRECTORSHIP POSITION ON THE COMPANY’S BOARD | ||||

| The Board has concluded that Mr. Daniels should serve as a director because he brings experience as a board and committee member of a public company, a detailed understanding of the computer and information services industry, and expertise in the management of complex technology organizations. | ||||

| 2023 PROXY STATEMENT | 17 |

ELECTION OF DIRECTORS

|

William C. Stone | |||

| Chairman of the Board and Chief Executive Officer, SS&C Technologies Holdings, Inc. | ||||

| Age | 67 | Committees | None | |

| Director since | 1986 | Term Expires | 2025 | |

| PRINCIPAL OCCUPATION, BUSINESS EXPERIENCE, AND DIRECTORSHIPS | ||||

| Mr. Stone founded SS&C Technologies, Inc., or SS&C, the primary operating company and wholly owned direct subsidiary of SS&C Technologies Holdings, Inc., in 1986 and has served as Chairman of the Board of Directors and Chief Executive Officer since our inception. He also has served as our President from inception through April 1997 and again from March 1999 until October 2004. Prior to founding SS&C, Mr. Stone directed the financial services consulting practice of KPMG LLP, an accounting firm, in Hartford, Connecticut and was Vice President of Administration and Special Investment Services at Advest, Inc., a financial services company. | ||||

| EXPERIENCE, QUALIFICATIONS, ATTRIBUTES, AND SKILLS SUPPORTING DIRECTORSHIP POSITION ON THE COMPANY’S BOARD | ||||

| The Board has concluded that Mr. Stone should serve as a director because, as our founder, Chief Executive Officer, and a principal stockholder, Mr. Stone provides a critical contribution to the Board reflecting his detailed knowledge of the Company, our employees, our client base, our prospects, the strategic marketplace and our competitors. | ||||

Executive Officers Who Are Not Directors

Certain information regarding our executive officers, who are not also directors, is set forth below. Generally, the Board elects our officers annually, although the Board or an authorized committee of the Board may elect or appoint officers at other times.

| Name | Age | Position(s) | ||

| Rahul Kanwar | 48 | President and Chief Operating Officer | ||

| Patrick J. Pedonti | 71 | Senior Vice President, Chief Financial Officer and Treasurer | ||

| Jason White | 53 | Senior Vice President, General Counsel and Secretary |

|

Rahul Kanwar | |||

| President and Chief Operating Officer | ||||

| Age | 48 | |||

| BUSINESS EXPERIENCE | ||||

| Rahul Kanwar has served as our President and Chief Operating Officer since August 2018. Prior to that, he served as our Executive Vice President and Managing Director, Alternative Assets from September 2017 to August 2018, as our Senior Vice President and Managing Director, Alternative Assets, from January 2011 to September 2017. Mr. Kanwar was designated as an executive officer of SS&C in March 2013 and has served as a managing director of SS&C since 2005. Prior to SS&C, Mr. Kanwar was employed by Eisner LLP where he was responsible for managing the Eisnerfast LLC fund administration business. Mr. Kanwar started his career in public accounting. | ||||

| 18 |  |

ELECTION OF DIRECTORS

|

Patrick J. Pedonti | |||

| Senior Vice President, Chief Financial Officer and Treasurer | ||||

| Age | 71 | |||

| BUSINESS EXPERIENCE | ||||

| Patrick J. Pedonti has served as our Senior Vice President, Chief Financial Officer and Treasurer since August 2002. Prior to that, Mr. Pedonti served as our Vice President and Treasurer from May 1999 to August 2002. Prior to joining SS&C, from January 1997 to May 1999, Mr. Pedonti was the Vice President and Chief Financial Officer for Accent Color Sciences, Inc., a company specializing in high-speed color printing. | ||||

|

Jason White | |||

| Senior Vice President, General Counsel and Secretary | ||||

| Age | 53 | |||

| BUSINESS EXPERIENCE | ||||

| Jason White has served as our Senior Vice President, General Counsel and Secretary of SS&C since September 2021. Prior to that, Mr. White served as our Senior Vice President, Group General Counsel and Assistant Secretary from May 2018 to September 2021. Prior to joining SS&C, Mr. White was a New York Finance Partner and Co-Chair of the General Practice Group at Shearman & Sterling LLP from 2014 to 2018. Prior to his partnership at Shearman, he was a New York Finance Partner at Orrick, Herrington & Sutcliffe, LLP from 2011 to 2014. Prior to his partnership at Orrick, Mr. White worked as an attorney at Barclays Capital in New York from 2005 to 2011, where he was head of Finance Legal Americas and a member of the Legal Management Committee. | ||||

Criteria and Diversity of Director Nominees

In considering whether to recommend any particular candidate for inclusion in the Board’s slate of recommended director nominees, the Nominating and Governance Committee applies the criteria specified in its charter. These criteria include the candidate’s:

PROFESSIONALISM Nominees should have a reputation for integrity, honesty and adherence to high ethical standards. |

|

EXPERTISE Nominees should have demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to the current and long-term objectives of the Company, and ability to contribute positively to the decision-making processes of the Company. |

| |

COMMITMENT Nominees should have a commitment to understanding the Company and its industry and to regularly attending and participating in meetings of the Board and its committees. |

|

AWARENESS OF CONSTITUENT INTERESTS Nominees should have the ability to understand the sometimes conflicting interests of stockholders, customers, employees and other constituencies of the Company, and should not have, or appear to have, a conflict of interest. |

|

The Nominating and Governance Committee does not assign specific weights to particular criterion, and no particular criterion is a prerequisite for any prospective nominee. In terms of criteria for composition of the Board and Board committees, the Nominating and Governance Committee considers the diversity, age, skills, background and experience of the directors, with the goal of providing a significant breadth of experience, knowledge and abilities to assist the Board in fulfilling its responsibilities.

| 2023 PROXY STATEMENT | 19 |

ELECTION OF DIRECTORS

The director biographies above describe each nominee’s experience, qualifications, attributes and skills that led the Board to conclude that he or she should continue to serve as a member of the Board. Our Board believes that each of the nominees has realized significant professional and personal achievements and possesses the background, talents and experience that are necessary for the Company’s success and the creation of stockholder value.

Director Nomination Process

The process followed by the Nominating and Governance Committee to identify and evaluate director candidates may include requesting recommendations from Board members and others, holding meetings from time to time to evaluate biographical information and background material relating to potential candidates, and conducting interviews of selected candidates by members of the Nominating and Governance Committee. The Board also retains a third-party search firm from time to time. While all candidates will be considered, the Nominating and Governance Committee is particularly seeking to identify female and other diverse Board candidates.

|

REQUESTING • Board Chair • Other Directors • Management • Stockholders • Third-party search firm • Other Interested Parties |

EVALUATION • Biographical Information • Expertise • Diligence • Ethical Standards |

CONDUCTING • Nominating and Governance Committee • Board Chair • Officers • Advisors |

RECOMMENDATIONS FOR Successful candidates are recommended to the full Board of Directors for a vote, and allocated to the appropriate Class. |

The Nominating and Governance Committee considers recommendations for director nominees suggested by its members, other directors, management and other interested parties. Stockholders may recommend individuals to the Nominating and Governance Committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background material, to the Nominating and Governance Committee via email at CorpLegal@sscinc.com, attention: Corporate Secretary, SS&C Technologies Holdings, Inc.

TO RECOMMEND A DIRECTOR CANDIDATE, SEND AN EMAIL TO:

CorpLegal@sscinc.com, attention: Corporate Secretary, SS&C Technologies Holdings, Inc.

Assuming that appropriate biographical information and background material is provided on a timely basis, the Nominating and Governance Committee will evaluate stockholder-recommended candidates by following substantially the same process and applying substantially the same criteria as it follows for candidates submitted by others.

Stockholders also have the right under our Bylaws to directly nominate director candidates, without any action or recommendation on the part of the Nominating and Governance Committee or the Board, by following the procedures set forth in our Bylaws described under “Stockholder Proposals and Director Nominations” beginning on page 79 below. In addition, in response to stockholder engagement, we amended our Bylaws in 2022 to permit a stockholder, or a group of up to 20 stockholders, owning continuously for at least three years 3% or more of the shares of common stock of the Company, to nominate and include in the Company’s proxy materials for an annual meeting directors constituting up to two individuals or 20% of the Board, whichever is greater, provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in the Bylaws and provided further that so long as the Company has a classified board structure, the maximum number of proxy access nominees in a year shall not exceed one-half of the number of directors to be elected at that annual meeting.

Stockholders Agreement

The Company is a party to a Stockholders Agreement, as amended, with William C. Stone, our Chairman and Chief Executive Officer. The Stockholders Agreement entitles Mr. Stone to nominate two directors, one of whom shall be Mr. Stone for so long as he is our Chief Executive Officer. For more information on the Stockholders Agreement, see the section of this proxy statement entitled “Related Person Transactions–Stockholders Agreement” beginning on page 29.

| 20 |  |

ELECTION OF DIRECTORS

Succession Planning

Succession planning is a top priority for the Board and SS&C’s senior leadership, with the objective of having a pipeline of diverse executives who lead inclusively for today and the future. Our Nominating and Governance Committee oversees the Company’s Board and Chief Executive Officer succession planning process, including in the case of the incapacitation, retirement or removal of the Chief Executive Officer. Our Chief Executive Officer provides the Nominating and Governance Committee with recommendations for, and evaluations of, potential Chief Executive Officer successors. Directors engage with Chief Executive Officer candidates and senior management talent at Board and committee meetings and other forums to enable directors to personally assess candidates.

Board Size

The Board sets the number of directors from time to time by a resolution adopted by the Board. The Board has the flexibility to increase or decrease the size of the Board as circumstances warrant. There are currently seven members of the Board. If all of the Board’s nominees are elected, the Board will be composed of seven members immediately following the annual meeting. If any nominee is unable to serve as a director, or if any director leaves the Board between annual meetings, the Board may reduce the number of directors or elect an individual to fill the resulting vacancy.

Director Service on Other Public Company Boards

The Board recognizes that service on other public company boards provides directors valuable experience that benefits the Company. The Board also believes, however, that it is critical that directors dedicate sufficient time to their service on the Company’s Board. Directors are expected to advise the Chair of the Nominating and Governance Committee in advance of accepting any invitation to serve on another public company’s board, or any private company or non-profit board that is expected to require significant commitments of time. This allows the Nominating and Governance Committee to assess the impact of the director joining another board based on various factors relevant to the specific situation, including the nature and extent of a director’s other professional obligations and the time commitment required by the new position. Directors who are engaged in active, full-time employment, for example, could have less time to devote to board service. Our Corporate Governance Guidelines provide that without obtaining the approval of the Board:

| • | An independent director may not serve on more than four other public company boards, including the Company’s Board; and |

| • | An independent who is also the chief executive officer of another public company may not serve on more than two public company boards, including the Company’s Board. |

Board Determination of Independence

Under the applicable rules of the Nasdaq Stock Market, a director will only qualify as an “independent director” if, in the opinion of the Board, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our Board has determined that none of Ms. Conjeevaram or Messrs. Boulanger, Daniels, Michael, Varsano or Zamkow has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is an “independent director” as defined under Rule 5605(a)(2) of Nasdaq.

Board Meetings and Attendance

During the fiscal year ended December 31, 2022, which we refer to as fiscal 2022, the Board met four times. During fiscal 2022, the Audit Committee held five meetings; the Compensation Committee held six meetings; and the Nominating and Governance Committee held one meeting. Each of our current directors attended at least 75% of the aggregate of the total number of meetings of the Board and of the Board committees of which she/he was a member during fiscal 2022.

| 2023 PROXY STATEMENT | 21 |

ELECTION OF DIRECTORS

Director Attendance at Annual Meeting of Stockholders

We do not have a formal policy regarding directors’ attendance at annual meetings, but all of our directors are encouraged to attend our annual meetings. All of the Board members attended our 2022 Annual Meeting of Stockholders.

Board Leadership Structure and Composition

Mr. Stone has served as Chairman of the Board of Directors and Chief Executive Officer since our inception in 1986, and the provisions of the Stockholders Agreement require that so long as Mr. Stone is a member of the Board and the Chief Executive Officer of the Company, he shall serve as Chairman of the Board. This Board leadership structure is commonly utilized by public companies in the United States, and we believe that this leadership structure has been effective for us. We believe that having one person serve as both Chief Executive Officer and Chairman of the Board shows our employees, customers and other constituencies that we are under strong leadership, with a single person setting the tone and having primary responsibility for managing our operations. In the fourth quarter of 2022, we appointed Mr. Michaels as our Lead Independent Director to act as a strong counterbalance to the combined Chief Executive Officer and Chairman role. We also believe that this leadership structure eliminates the potential for duplication of efforts and inconsistent actions and facilitates open communication between management and the Board. We recognize that different board leadership structures may be appropriate for other companies with different histories or varying ownership structures. However, we believe our current leadership structure is the optimal board leadership structure for us at this time.

| 22 |  |

ELECTION OF DIRECTORS

Role of the Lead Independent Director

The Corporate Governance Guidelines require the Board to designate a Lead Independent Director, based on the recommendation of the Nominating and Governance Committee, if the role of the Chairman is combined with that of the Chief Executive Officer. Mr. Michael currently serves as Lead Independent Director. The Board believes that Mr. Michael’s tenure and extensive experience in the financial services industry and at insurance companies enable him to bring valuable and independent views to the boardroom. Below is a summary of the key duties and responsibilities of our Lead Independent Director as set forth in our Corporate Governance Guidelines:

| • | preside at all meetings of the Board at which the Chair of the Board is not present, including executive sessions of the independent directors; and |

| • | serve as liaison between the Chair of the Board and the independent directors. |

Board Committees

The Board directs the management of our business and affairs, as provided by Delaware law, and conducts its business through meetings of the Board and three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Governance Committee, each of which operates under a charter that has been approved by the Board. Each committee’s charter is posted on our website, at https://investor.ssctech.com/investor-relations/corporate-governance/governance-documents. In addition, from time to time, special committees may be established under the direction of the Board to address specific issues.

The table below shows current membership and indicates the chairperson (*) for each of the standing Board committees.

| AUDIT | COMPENSATION | NOMINATING | |||

| • | Smita Conjeevaram* | • | Michael E. Daniels* | • | David A. Varsano* |

| • | Jonathan E. Michael | • | Michael J. Zamkow | • | Michael E. Daniels |

| • | David A. Varsano | • | Jonathan E. Michael | ||

The Board has determined that each member of each of the Board’s three standing committees is independent as defined under the rules of Nasdaq, including, in the case of each member of the Audit Committee, the independence requirements contemplated by Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or Exchange Act, and including, in the case of each member of the Compensation Committee, the independence requirements contemplated by Rule 10C-1 under the Exchange Act and Nasdaq rules.

| 2023 PROXY STATEMENT | 23 |

ELECTION OF DIRECTORS

(Chair)

Smita Conjeevaram Members: Jonathan E. Michael David A. Varsano Meetings in 2022: 9 Our Audit Committee assists the Board in its oversight of (i) the integrity of Company’s accounting and financial reporting processes; (ii) the Company’s compliance with legal and regulatory requirements; (iii) the independent auditor’s qualifications and independence; (iv) the performance of the Company’s independent auditor; and (v) the performance of the internal audit function. |

Audit Committee The Audit Committee’s responsibilities, as set forth in its charter, include: • appointing, evaluating, retaining and, when necessary, terminating the engagement of our independent registered public accounting firm; • overseeing and assessing the independence of our independent registered public accounting firm; • setting the compensation of our independent registered public accounting firm and preapproving all audit services to be provided to the Company; • overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of reports from such firm; • reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures, including the Company’s specific disclosures under “Management’s Discussion and Analysis of Financial Condition,” before such financial statements and related disclosures are filed with the Securities and Exchange Commission, or SEC; • directing the independent registered public accounting firm to use its best efforts to perform all reviews of interim financial information prior to disclosure by the Company; • coordinating the Board’s oversight of internal control over financial reporting, disclosure controls and procedures and our code of business conduct and ethics; • overseeing our risk assessment and risk management policies; • reviewing assessments of information security controls and procedures, any material breaches of the Company’s network, as well as potential cybersecurity risk disclosures; • discussing the Company’s policies with respect to risk assessment and risk management; • discussing generally the type and presentation of information to be disclosed in the Company’s earnings press releases, as well as financial information and earnings guidance provided to analysts, rating agencies and others; • establishing procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or audit matters and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters; • reviewing the Company’s policies and procedures for approving or ratifying “related person transactions” and conducting appropriate review and oversight of all related person transactions for potential conflict of interest situations; • reviewing management’s compliance program to oversee that management has adequate controls in place to ensure that the Company’s financial statements, reports and other financial information disseminated externally satisfy applicable legal requirements; • reviewing the internal audit function to ensure there are no limitations on the ability of the internal audit function to carry out its duties, reviewing and approving the annual internal audit plan, and reviewing the organizational structure and qualifications of the internal audit function; and • preparing the Audit Committee report required by SEC rules, which is included on page 65 of this proxy statement. The Board has determined that each of the members of its Audit Committee is an “audit committee financial expert” as that term is defined under the rules and regulations of the SEC. |

| 24 |  |

ELECTION OF DIRECTORS

(Chair)

Michael E. Daniels Members: Michael J. Zamkow Meetings in 2022: 10 The Compensation Committee has overall responsibility for the Company’s compensation. |

Compensation Committee The Compensation Committee’s responsibilities, as set forth in its charter, include: • reviewing and approving, or making recommendations to the Board with respect to, the compensation of our Chief Executive Officer and our other executive officers; • reviewing, and making recommendations to the Board with respect to, incentive-compensation and equity-based plans that are subject to approval by the Board; • approving any tax-qualified, nondiscriminatory employee benefit plans for which stockholder approval is not sought; • administering all of the Company’s stock option, stock incentive, employee stock purchase and other equity-based plans including interpreting the terms of such plans and granting options and making awards under such plans; • overseeing the administration of any Company policies regarding the recoupment, repayment or forfeiture of compensation, including any such policies required to be adopted pursuant to applicable law or stock exchange requirement; • reviewing and making recommendations to the Board with respect to director compensation; • reviewing and discussing with management the Company’s “Compensation Discussion and Analysis” required by Item 402(b) of Regulation S-K, and considering whether it will recommend to the Board that the Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K, proxy statement on Schedule 14A or information statement on Schedule 14C; • preparing an annual report required by Item 407(e)(5) of Regulation S-K; • reviewing and assessing risks arising from the Company’s compensation policies and practices and whether any such risks are reasonably likely to have a material adverse effect on the Company; • in its discretion, retaining or obtaining the advice of compensation consultants, legal counsel or other advisors, and overseeing their work; and • monitoring progress toward and compliance with Stock Ownership Guidelines. |

(Chair)

David A. Varsano Members: Michael E. Daniels Jonathan E. Michael Meetings in 2022: 10 Our Nominating and Governance Committee has overall responsibility for developing Board membership. |

Nominating and Governance Committee The Nominating and Governance Committee’s responsibilities, as set forth in its charter, include: • reviewing criteria for the selection of candidates to the Board; • identifying individuals qualified to become members of the Board, consistent with such criteria approved by the Board, and recommending to the Board the nominees for election as directors at any annual meeting of stockholders and the persons to be elected by the Board to fill any vacancies on the Board; • recommending to the Board the directors to be appointed to each committee of the Board, and the directors to be appointed as committee Chairs; • making recommendations to the Board as to determinations of director independence; • overseeing the evaluation of the Board; • reviewing the Company’s Corporate Governance Guidelines and overseeing compliance with such guidelines; and • overseeing the Company’s practices and processes relating to the management and oversight of environmental, social and governance matters. |

| 2023 PROXY STATEMENT | 25 |

ELECTION OF DIRECTORS

Access to Outside Advisors

The Board and each Board Committee can select and retain the services of outside advisors at the Company’s expense.

Board Oversight

The Board is responsible for providing advice and oversight of the strategic and operational direction of the Company to support our and our stockholders’ long-term interests.

Risk Oversight

Our management is responsible for risk management on a day-to-day basis. The Audit Committee is responsible for overseeing our risk management function. While the Audit Committee has primary responsibility for overseeing risk management, the entire Board of Directors is actively involved in overseeing our risk management. The Board and the Audit Committee fulfill their oversight role by discussing with management the policies and practices utilized by management in assessing and managing the risks, including both existing risks and significant emerging risks, and providing input on those policies and practices.

| BOARD | ||

| ● | The entire Board of Directors is actively involved in overseeing our risk management. | |

| ● | The Board and the Audit Committee fulfill their oversight role by discussing with management the policies and practices utilized by management in assessing and managing the risks, including both existing risks and significant emerging risks, and providing input on those policies and practices. | |

| ● | Cybersecurity risk is overseen by the full Board, with additional oversight of the relevant risk framework and controls provided by the Audit Committee. | |

The Compensation Committee also engages in risk assessment as it relates to our compensation practices and policies, as described in “Compensation Discussion & Analysis – Risk Assessment and Compensation Practices” on page 51.

ESG Oversight

In 2022, the Board amended the Nominating and Governance Committee charter to formalize the committee’s oversight of the Company’s practices and processes relating to the management and oversight of ESG matters. As part of such oversight, the Nominating and Governance Committee will periodically review, and make recommendations to the Board regarding, our ESG policies, practices and processes, in coordination with other committees of the Board.

Board Engagement

Our directors meet periodically throughout the year with the Company’s stockholders, employees and other persons interested in our strategy, business practices, governance, culture and performance. For more information, see “Stockholder Engagement” beginning on page 6.

The Board welcomes the submission of any comments or concerns from stockholders and any interested parties. Communications should be in writing and addressed to our Corporate Secretary at our principal executive offices and marked to the attention of the Board or any of its committees, individual directors or non-management or independent directors as a group. All correspondence will be forwarded to the intended recipient(s), except that certain items that are unrelated to the duties and responsibilities of the Board (such as product inquiries and comments, new product suggestions, resumes and other forms of job inquiries, surveys, and business solicitations and advertisements) and material that is unduly hostile, threatening, illegal or similarly unsuitable will be excluded.

| 26 |  |

ELECTION OF DIRECTORS

2022 Engagements

Over the course of 2022, we reached out to stockholders holding a total of approximately 64% of our outstanding stock, and held discussions with those stockholders holding a total of approximately 30% of our shares, in each case excluding shares held by our CEO. The primary topics covered in these communications related to our executive compensation program and governance matters. After analyzing the feedback we received from our stockholders with our independent compensation advisors at Frederic W. Cook & Co., we adopted substantial changes to our executive compensation program, which are described in “Compensation Discussion & Analysis,” as well as substantial changes to our corporate governance practices, which are described in “Commitment to Strong Corporate Governance Practices.” These changes reflect another step in a multi-year process that commenced in 2020 to align our compensation program with prevailing market practice and strengthen the program’s alignment with the promotion of stockholder value creation. We appreciate our stockholders’ willingness to engage with us and to provide their perspectives, and are committed to maintaining active engagement with our stockholders.

| We

reached out to stockholders representing: |

Primary Topics Covered: | ||

|

● Annual Bonus Plan Design ● LTI Program Design and Award Mix ● Enhanced Disclosure Regarding Incentive Plans ● Corporate Governance Guidelines ● Lead Independent Director |

Social Highlights

Workforce Support

We are committed to being an organization that supports its employees in the following ways: