EX-99.1

Exhibit 99.1

SS&C Technologies Releases Q3 2023 Earnings Results

Q3 2023 GAAP revenue $1,365.9 million, up 3.4%, Fully Diluted GAAP Earnings Per Share $0.61, flat

Adjusted revenue $1,366.7 million, up 3.4%, Adjusted Diluted Earnings Per Share $1.17, up 1.7%

WINDSOR, CT, October 26, 2023 (PR Newswire) SS&C Technologies Holdings, Inc. (NASDAQ: SSNC), a global provider of investment, financial and healthcare software-enabled services and software, today announced its financial results for the third quarter ended September 30, 2023.

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

(in millions, except per share data): |

2023 |

2022 |

Change |

2023 |

2022 |

Change |

GAAP Results |

|

|

|

|

|

|

Revenue |

$1,365.9 |

$1,321.0 |

3.4% |

$4,091.2 |

$3,944.7 |

3.7% |

Operating income |

306.4 |

304.2 |

0.7% |

874.7 |

841.6 |

3.9% |

Operating income margin |

22.4% |

23.0% |

(60) bps |

21.4% |

21.3% |

10 bps |

Diluted earnings per share attributable to SS&C |

$0.61 |

$0.61 |

— |

$1.62 |

$1.68 |

(3.6)% |

Net income attributable to SS&C |

156.0 |

160.0 |

(2.5)% |

412.7 |

442.7 |

(6.8)% |

Adjusted Non-GAAP Results (defined in Notes 1 - 4 below) |

|

|

|

Adjusted revenue |

$1,366.7 |

$1,322.0 |

3.4% |

$4,093.5 |

$3,948.2 |

3.7% |

Adjusted operating income attributable to SS&C |

517.4 |

486.1 |

6.4% |

1,496.2 |

1,440.2 |

3.9% |

Adjusted operating income margin |

37.9% |

36.8% |

110 bps |

36.6% |

36.5% |

10 bps |

Adjusted diluted earnings per share attributable to SS&C |

$1.17 |

$1.15 |

1.7% |

$3.35 |

$3.50 |

(4.3)% |

Adjusted consolidated EBITDA attributable to SS&C |

533.9 |

501.7 |

6.4% |

1,545.2 |

1,487.5 |

3.9% |

Adjusted consolidated EBITDA margin |

39.1% |

38.0% |

110 bps |

37.7% |

37.7% |

— |

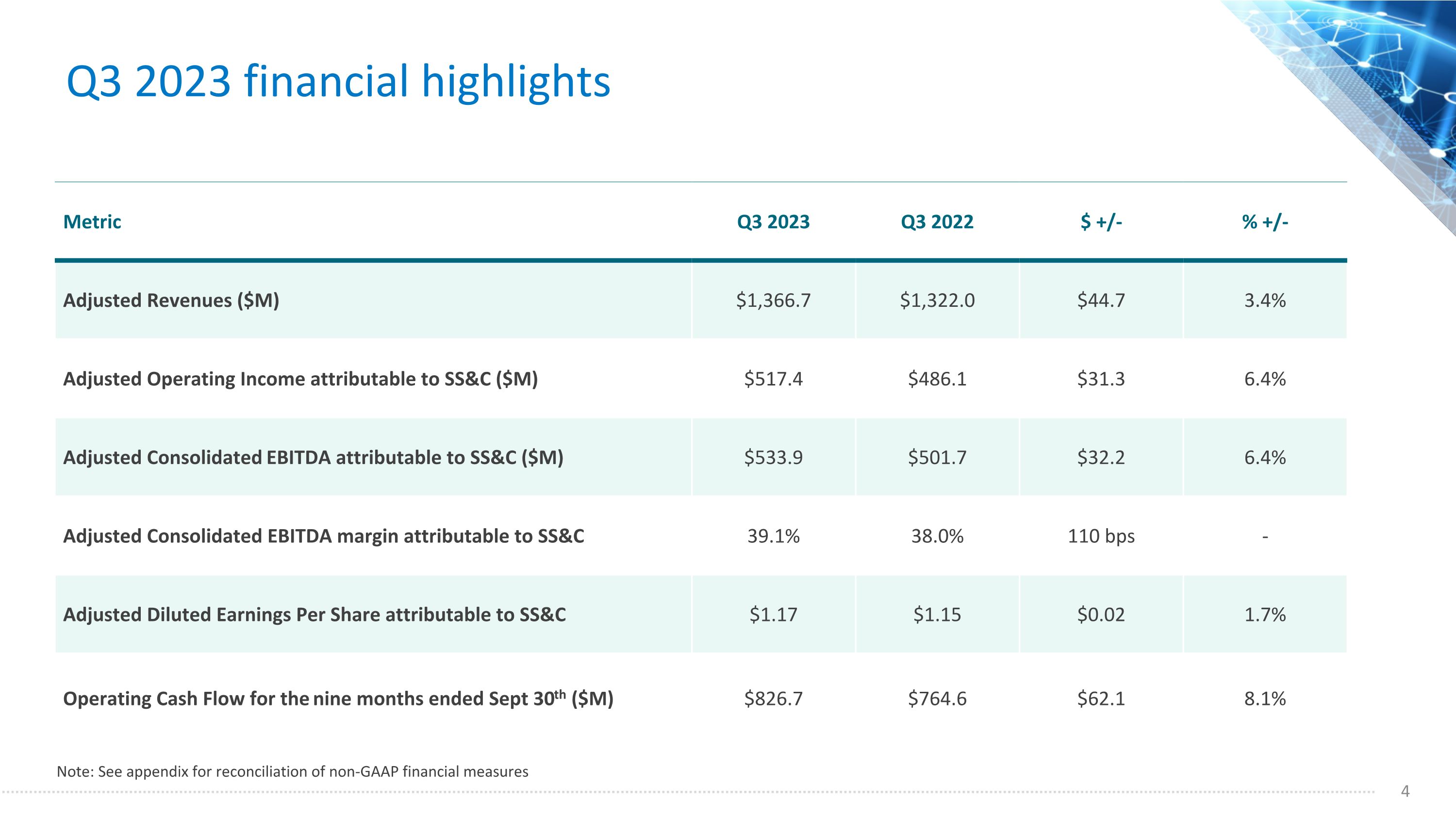

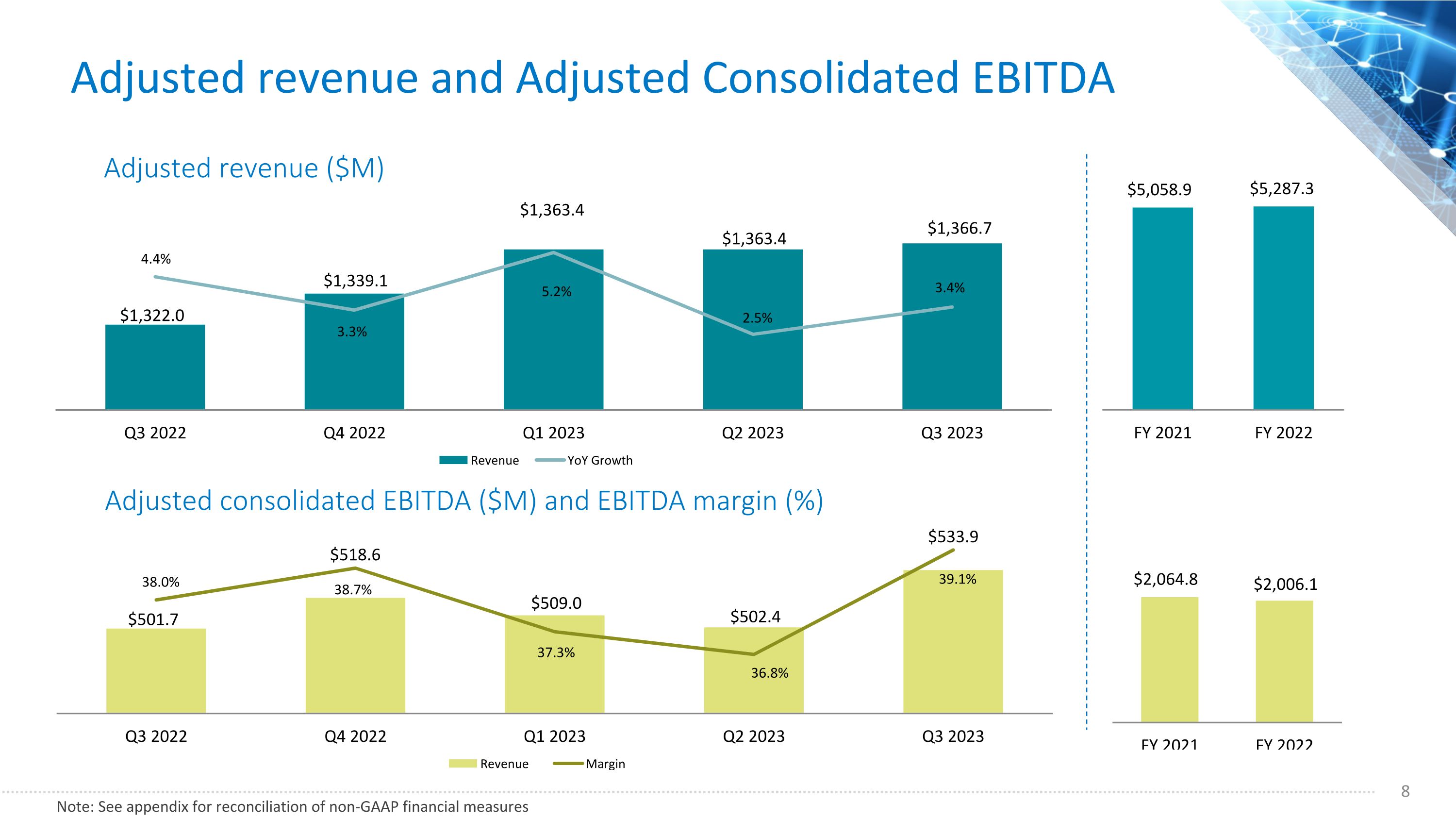

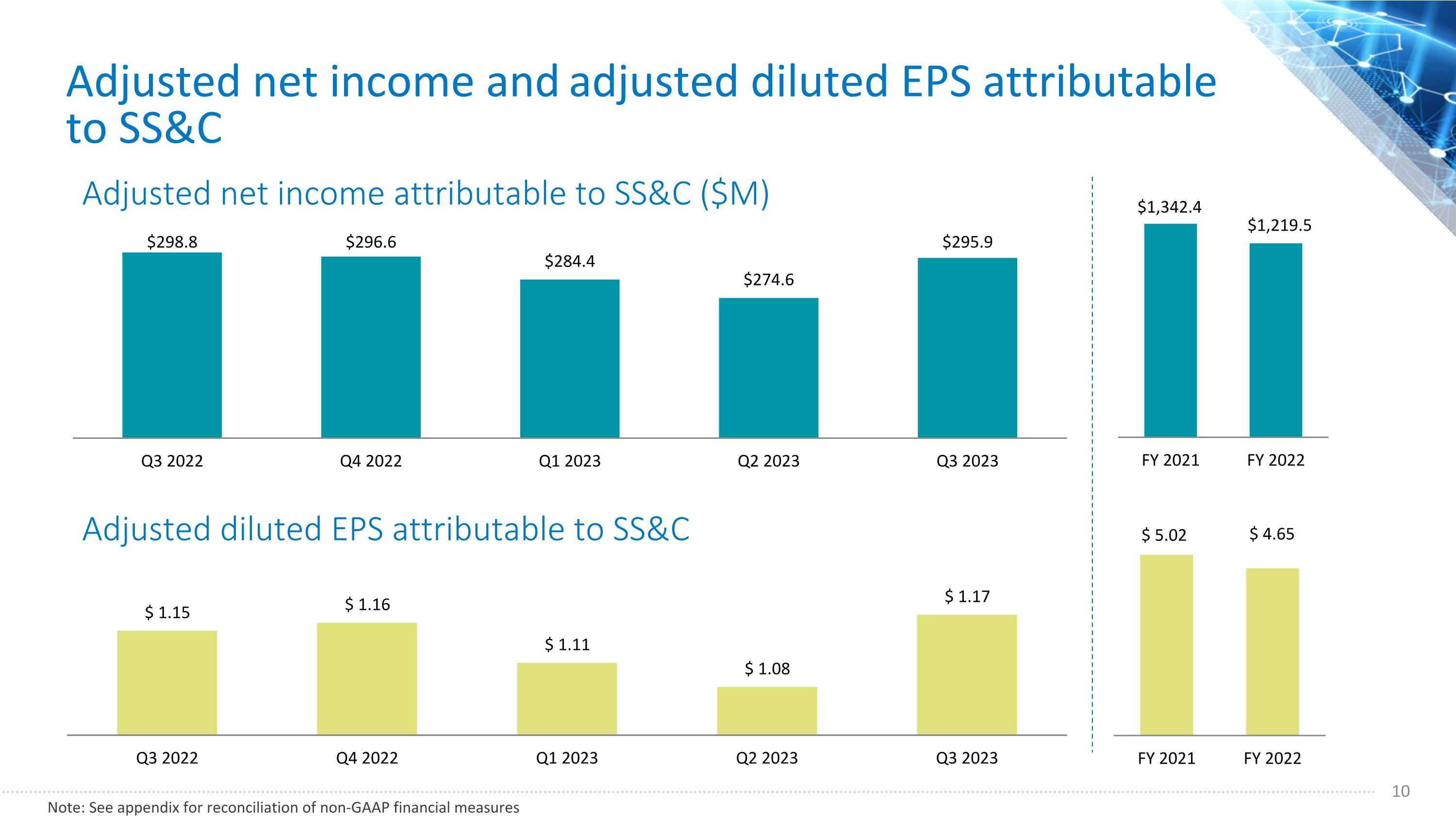

Third Quarter 2023 Highlights:

•Q3 2023 GAAP Revenue growth and Adjusted Revenue growth were 3.4 percent.

•SS&C generated net cash from operating activities of $826.7 million for the nine months ended September 30, 2023, up 8.1 percent compared to the same time period in 2022.

•Q3 2023 we bought back 1.7 million shares for $96.9 million, at an average price of $55.82 per share.

•We paid down $54.7 million in debt in Q3 2023, bringing our net leverage ratio to 3.18 times consolidated EBITDA attributable to SS&C.

•SS&C reported GAAP net income attributable to SS&C of $156.0 million, down 2.5 percent and adjusted consolidated EBITDA attributable to SS&C of $533.9 million for Q3 2023, up 6.4 percent.

•GAAP operating income margin for Q3 2023 was 22.4 percent. Adjusted consolidated EBITDA margin for Q3 2023 was 39.1 percent.

•Revenue retention for the financial services business was the highest in SS&C history at 97.3 percent.

“SS&C delivered strong margins for Q3 2023, with adjusted consolidated EBITDA margins up 230 basis points sequentially and 110 basis points year over year,” says Bill Stone, Chairman and Chief Executive Officer. “Our digital worker initiative is a large part of this margin expansion, as we have seen a 2,000 FTE headcount benefit year to date. We have hit our 2023 target for digital workers, and believe there is more runway ahead.”

1

Operating Cash Flow

SS&C generated net cash from operating activities of $826.7 million for the nine months ended September 30, 2023, compared to $764.6 million for the same period in 2022, a 8.1% increase. SS&C ended the third quarter with $447.6 million in cash and cash equivalents and $6,906.6 million in gross debt. SS&C’s net debt balance as defined in our credit agreement, which excludes cash and cash equivalents of $106.1 million held at DomaniRx, LLC was $6,565.1 million as of September 30, 2023. SS&C’s consolidated net leverage ratio as defined in our credit agreement stood at 3.18 times consolidated EBITDA attributable to SS&C as of September 30, 2023. SS&C’s net secured leverage ratio stood at 2.21 times consolidated EBITDA attributable to SS&C as of September 30, 2023.

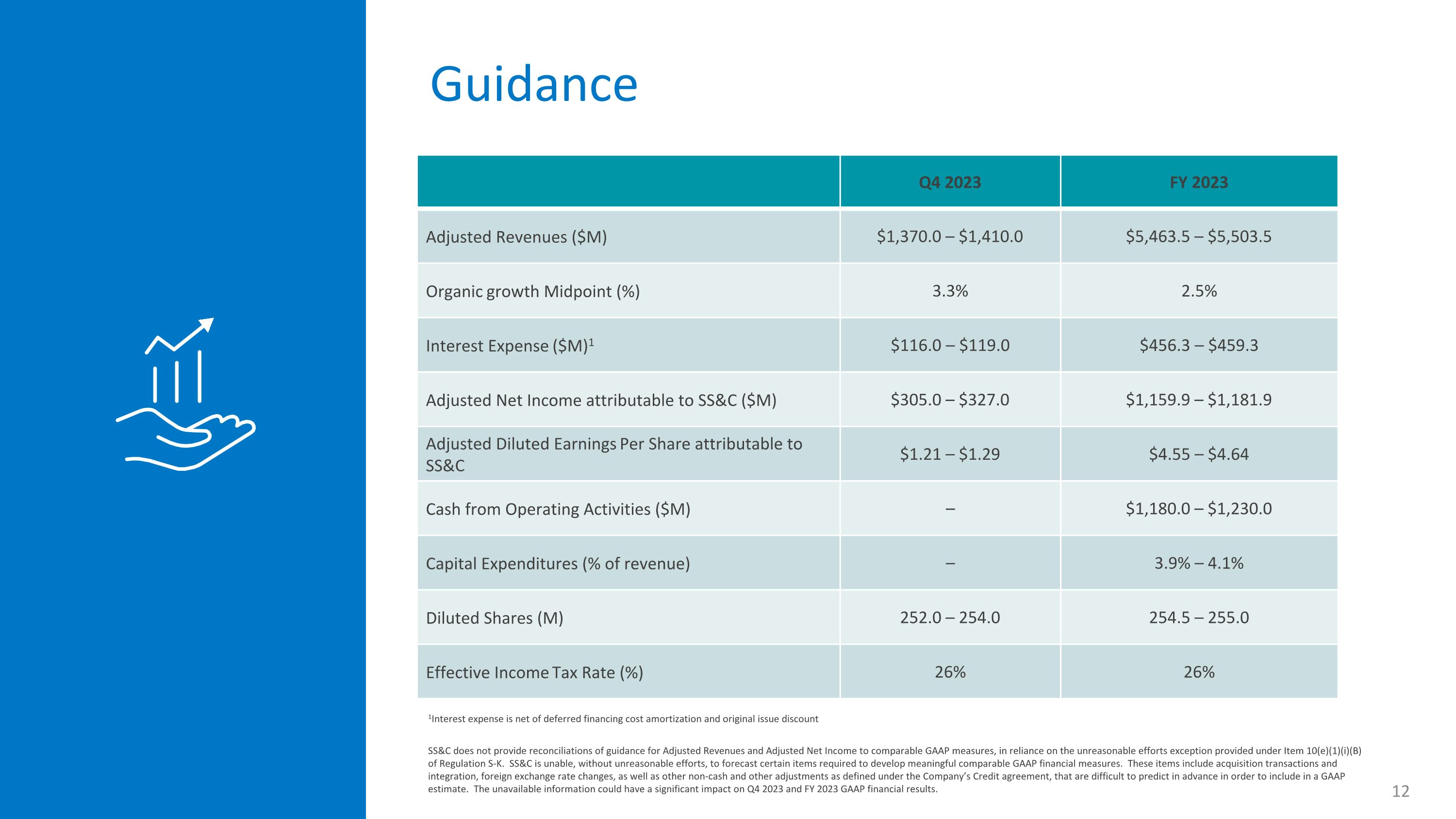

Guidance

|

|

|

|

|

|

|

Q4 2023 |

|

FY 2023 |

Adjusted Revenue ($M) |

|

$1,370.0 – $1,410.0 |

|

$5,463.5 – $5,503.5 |

Adjusted Net Income attributable to SS&C ($M) |

|

$305.0 – $327.0 |

|

$1,159.9 – $1,181.9 |

Interest Expense1 ($M) |

|

$116.0 - $119.0 |

|

$456.3 - $459.3 |

Adjusted Diluted Earnings per Share attributable to SS&C |

|

$1.21 – $1.29 |

|

$4.55 – $4.64 |

Cash from Operating Activities ($M) |

|

– |

|

$1,180.0 – $1,230.0 |

Capital Expenditures (% of revenue) |

|

– |

|

3.9% – 4.1% |

Diluted Shares (M) |

|

252.0 – 254.0 |

|

254.5 – 255.0 |

Effective Income Tax Rate (%) |

|

26% |

|

26% |

1Interest expense is net of deferred financing cost amortization and original issue discount

SS&C does not provide reconciliations of guidance for Adjusted Revenues and Adjusted Net Income to comparable GAAP measures, in reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. SS&C is unable, without unreasonable efforts, to forecast certain items required to develop meaningful comparable GAAP financial measures. These items include acquisition transactions and integration, foreign exchange rate changes, as well as other non-cash and other adjustments as defined under the Company’s Credit agreement, that are difficult to predict in advance in order to include in a GAAP estimate. The unavailable information could have a significant impact on Q4 2023 and FY 2023 GAAP financial results.

Non-GAAP Financial Measures

Adjusted revenue, adjusted operating income, adjusted consolidated EBITDA, adjusted net income and adjusted diluted earnings per share are non-GAAP measures. See the accompanying notes for the reconciliations and definitions for each of these non-GAAP measures and the reasons our management believes these measures provide useful information to investors regarding our financial condition and results of operations.

2

Earnings Call and Press Release

SS&C’s Q3 2023 earnings call will take place at 5:00 p.m. eastern time today, October 26, 2023. The call will discuss Q3 2023 results and business outlook. Interested parties may dial 888-210-4650 (US and Canada) or 646-960-0327 (International), and request the “SS&C Technologies Third Quarter 2023 Earnings Conference Call”; conference ID #4673675. In connection with the earnings call, a presentation will be available on SS&C’s website at www.ssctech.com. A replay will be available after 8:00 p.m. eastern time on October 26, 2023, until midnight on November 2, 2023. The replay dial-in number is 800-770-2030 (US and Canada) or 647-362-9199 (International); access code #4673675. The call will also be available for replay on SS&C’s website after October 26, 2023; access: http://investor.ssctech.com/financials/quarterly-results/default.aspx

Certain information contained in this press release relating to, among other things, the Company’s financial guidance for the fourth quarter and full year of 2023 constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance, underlying assumptions, and other statements that are other than statements of historical facts. Without limiting the foregoing, the words “believes”, “anticipates”, “plans”, “expects”, “estimates”, “projects”, “forecasts”, “may”, “assume”, “intend”, “will”, “continue”, “opportunity”, “predict”, “potential”, “future”, “guarantee”, “likely”, “target”, “indicate”, “would”, “could” and “should” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements are accompanied by such words. Such statements reflect management’s best judgment based on factors currently known but are subject to risks and uncertainties, which could cause actual results to differ materially from those anticipated. Such risks and uncertainties include, but are not limited to, the state of the economy and the financial services industry and other industries in which the Company’s clients operate, the Company’s ability to realize anticipated benefits from its acquisitions, including DST Systems, Inc., the effect of customer consolidation on demand for the Company’s products and services, the increasing focus of the Company’s business on the hedge fund industry, the variability of revenue as a result of activity in the securities markets, the ability to retain and attract clients, fluctuations in customer demand for the Company’s products and services, the intensity of competition with respect to the Company’s products and services, the exposure to litigation and other claims, terrorist activities and other catastrophic events, disruptions, attacks or failures affecting the Company’s software-enabled services, risks associated with the Company’s foreign operations, privacy concerns relating to the collection and storage of personal information, evolving regulations and increased scrutiny from regulators, the Company’s ability to protect intellectual property assets and litigation regarding intellectual property rights, delays in product development, investment decisions concerning cash balances, regulatory and tax risks, risks associated with the Company’s joint ventures, changes in accounting standards, risks related to the Company’s substantial indebtedness, the market price of the Company’s stock prevailing from time to time, and the risks discussed in the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, which are on file with the Securities and Exchange Commission and can also be accessed on our website. Forward-looking statements speak only as of the date on which they are made and, except to the extent required by applicable securities laws, we undertake no obligation to update or revise any forward-looking statements.

3

About SS&C Technologies

SS&C is a global provider of services and software for the financial services and healthcare industries. Founded in 1986, SS&C is headquartered in Windsor, Connecticut, and has offices around the world. Some 20,000 financial services and healthcare organizations, from the world's largest companies to small and mid-market firms, rely on SS&C for expertise, scale, and technology.

Follow SS&C on Twitter, LinkedIn and Facebook.

For more information

Brian Schell

Chief Financial Officer

Tel: +1-816-642-0915

E-mail: InvestorRelations@sscinc.com

Justine Stone

Investor Relations

Tel: +1-212-367-4705

E-mail: InvestorRelations@sscinc.com

4

SS&C Technologies Holdings, Inc. and Subsidiaries

Condensed Consolidated Statements of Comprehensive Income (Loss)

(in millions, except per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Software-enabled services |

|

$ |

1,122.1 |

|

|

$ |

1,049.8 |

|

|

$ |

3,342.8 |

|

|

$ |

3,205.7 |

|

License, maintenance and related |

|

|

243.8 |

|

|

|

271.2 |

|

|

|

748.4 |

|

|

|

739.0 |

|

Total revenues |

|

|

1,365.9 |

|

|

|

1,321.0 |

|

|

|

4,091.2 |

|

|

|

3,944.7 |

|

Cost of revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Software-enabled services |

|

|

617.8 |

|

|

|

605.8 |

|

|

|

1,877.4 |

|

|

|

1,811.6 |

|

License, maintenance and related |

|

|

93.7 |

|

|

|

91.4 |

|

|

|

281.3 |

|

|

|

265.2 |

|

Total cost of revenues |

|

|

711.5 |

|

|

|

697.2 |

|

|

|

2,158.7 |

|

|

|

2,076.8 |

|

Gross profit |

|

|

654.4 |

|

|

|

623.8 |

|

|

|

1,932.5 |

|

|

|

1,867.9 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Selling and marketing |

|

|

134.7 |

|

|

|

120.9 |

|

|

|

411.6 |

|

|

|

371.1 |

|

Research and development |

|

|

117.7 |

|

|

|

107.6 |

|

|

|

355.5 |

|

|

|

331.8 |

|

General and administrative |

|

|

95.6 |

|

|

|

91.1 |

|

|

|

290.7 |

|

|

|

323.4 |

|

Total operating expenses |

|

|

348.0 |

|

|

|

319.6 |

|

|

|

1,057.8 |

|

|

|

1,026.3 |

|

Operating income |

|

|

306.4 |

|

|

|

304.2 |

|

|

|

874.7 |

|

|

|

841.6 |

|

Interest expense, net |

|

|

(120.6 |

) |

|

|

(86.0 |

) |

|

|

(350.5 |

) |

|

|

(203.0 |

) |

Other (expense) income, net |

|

|

(5.0 |

) |

|

|

1.1 |

|

|

|

15.3 |

|

|

|

(28.3 |

) |

Equity in earnings of unconsolidated affiliates, net |

|

|

27.5 |

|

|

|

(5.1 |

) |

|

|

42.6 |

|

|

|

(2.7 |

) |

Loss on extinguishment of debt |

|

|

(0.5 |

) |

|

|

(1.0 |

) |

|

|

(1.1 |

) |

|

|

(4.1 |

) |

Income before income taxes |

|

|

207.8 |

|

|

|

213.2 |

|

|

|

581.0 |

|

|

|

603.5 |

|

Provision for income taxes |

|

|

51.2 |

|

|

|

53.4 |

|

|

|

167.3 |

|

|

|

162.1 |

|

Net income |

|

|

156.6 |

|

|

|

159.8 |

|

|

|

413.7 |

|

|

|

441.4 |

|

Net (income) loss attributable to noncontrolling interest |

|

|

(0.6 |

) |

|

|

0.2 |

|

|

|

(1.0 |

) |

|

|

1.3 |

|

Net income attributable to SS&C common stockholders |

|

$ |

156.0 |

|

|

$ |

160.0 |

|

|

$ |

412.7 |

|

|

$ |

442.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share attributable to SS&C common stockholders |

|

$ |

0.63 |

|

|

$ |

0.63 |

|

|

$ |

1.66 |

|

|

$ |

1.74 |

|

Diluted earnings per share attributable to SS&C common stockholders |

|

$ |

0.61 |

|

|

$ |

0.61 |

|

|

$ |

1.62 |

|

|

$ |

1.68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted-average number of common shares outstanding |

|

|

247.5 |

|

|

|

253.9 |

|

|

|

248.8 |

|

|

|

254.8 |

|

Diluted weighted-average number of common and common equivalent shares outstanding |

|

|

253.9 |

|

|

|

260.9 |

|

|

|

255.3 |

|

|

|

263.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

156.6 |

|

|

$ |

159.8 |

|

|

$ |

413.7 |

|

|

$ |

441.4 |

|

Other comprehensive (loss) income, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

Change in unrealized gain on interest rate swaps |

|

|

— |

|

|

|

3.3 |

|

|

|

— |

|

|

|

4.8 |

|

Foreign currency exchange translation adjustment |

|

|

(113.0 |

) |

|

|

(248.6 |

) |

|

|

(4.8 |

) |

|

|

(512.0 |

) |

Change in defined benefit pension obligation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1.1 |

) |

Total other comprehensive loss, net of tax |

|

|

(113.0 |

) |

|

|

(245.3 |

) |

|

|

(4.8 |

) |

|

|

(508.3 |

) |

Comprehensive income (loss) |

|

|

43.6 |

|

|

|

(85.5 |

) |

|

|

408.9 |

|

|

|

(66.9 |

) |

Comprehensive (income) loss attributable to noncontrolling interest |

|

|

(0.6 |

) |

|

|

0.2 |

|

|

|

(1.0 |

) |

|

|

1.3 |

|

Comprehensive income (loss) attributable to SS&C common stockholders |

|

$ |

43.0 |

|

|

$ |

(85.3 |

) |

|

$ |

407.9 |

|

|

$ |

(65.6 |

) |

5

SS&C Technologies Holdings, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(in millions)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

447.6 |

|

|

$ |

440.1 |

|

Funds receivable and funds held on behalf of clients |

|

|

787.5 |

|

|

|

966.3 |

|

Accounts receivable, net |

|

|

836.2 |

|

|

|

778.6 |

|

Contract asset |

|

|

39.6 |

|

|

|

42.3 |

|

Prepaid expenses and other current assets |

|

|

155.2 |

|

|

|

193.8 |

|

Restricted cash |

|

|

2.3 |

|

|

|

3.3 |

|

Total current assets |

|

|

2,268.4 |

|

|

|

2,424.4 |

|

Property, plant and equipment, net |

|

|

321.5 |

|

|

|

343.9 |

|

Operating lease right-of-use assets |

|

|

231.5 |

|

|

|

260.6 |

|

Investments |

|

|

184.4 |

|

|

|

193.9 |

|

Unconsolidated affiliates |

|

|

286.3 |

|

|

|

266.9 |

|

Contract asset |

|

|

116.1 |

|

|

|

115.9 |

|

Goodwill |

|

|

8,854.9 |

|

|

|

8,863.0 |

|

Intangible and other assets, net |

|

|

3,916.9 |

|

|

|

4,184.7 |

|

Total assets |

|

$ |

16,180.0 |

|

|

$ |

16,653.3 |

|

Liabilities, Redeemable Noncontrolling Interest and Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Current portion of long-term debt |

|

$ |

127.3 |

|

|

$ |

55.7 |

|

Client funds obligations |

|

|

787.5 |

|

|

|

966.3 |

|

Accounts payable |

|

|

46.7 |

|

|

|

49.5 |

|

Income taxes payable |

|

|

18.4 |

|

|

|

34.3 |

|

Accrued employee compensation and benefits |

|

|

212.3 |

|

|

|

235.8 |

|

Interest payable |

|

|

56.0 |

|

|

|

28.4 |

|

Other accrued expenses |

|

|

282.2 |

|

|

|

356.1 |

|

Deferred revenue |

|

|

458.7 |

|

|

|

464.7 |

|

Total current liabilities |

|

|

1,989.1 |

|

|

|

2,190.8 |

|

Long-term debt, net of current portion |

|

|

6,738.7 |

|

|

|

7,023.9 |

|

Operating lease liabilities |

|

|

209.5 |

|

|

|

237.0 |

|

Other long-term liabilities |

|

|

244.0 |

|

|

|

225.8 |

|

Deferred income taxes |

|

|

794.4 |

|

|

|

872.9 |

|

Total liabilities |

|

|

9,975.7 |

|

|

|

10,550.4 |

|

Redeemable noncontrolling interest |

|

|

2.8 |

|

|

|

2.1 |

|

SS&C stockholders' equity |

|

|

6,143.9 |

|

|

|

6,044.2 |

|

Noncontrolling interest |

|

|

57.6 |

|

|

|

56.6 |

|

Total equity |

|

|

6,201.5 |

|

|

|

6,100.8 |

|

Total liabilities, redeemable noncontrolling interest and equity |

|

$ |

16,180.0 |

|

|

$ |

16,653.3 |

|

6

SS&C Technologies Holdings, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(in millions)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

Cash flow from operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

413.7 |

|

|

$ |

441.4 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

500.4 |

|

|

|

494.2 |

|

Equity in earnings of unconsolidated affiliates, net |

|

|

(42.6 |

) |

|

|

2.7 |

|

Distributions received from unconsolidated affiliates |

|

|

21.2 |

|

|

|

2.3 |

|

Stock-based compensation expense |

|

|

117.5 |

|

|

|

93.3 |

|

Net losses on investments |

|

|

0.9 |

|

|

|

14.7 |

|

Amortization and write-offs of loan origination costs and original issue discounts |

|

|

10.2 |

|

|

|

10.2 |

|

Loss on extinguishment of debt |

|

|

1.1 |

|

|

|

4.1 |

|

Loss on sale or disposition of property and equipment |

|

|

7.6 |

|

|

|

1.0 |

|

Deferred income taxes |

|

|

(89.1 |

) |

|

|

(78.6 |

) |

Provision for credit losses |

|

|

9.8 |

|

|

|

9.1 |

|

Changes in operating assets and liabilities, excluding effects from acquisitions: |

|

|

|

|

|

|

Accounts receivable |

|

|

(69.0 |

) |

|

|

(30.3 |

) |

Prepaid expenses and other assets |

|

|

27.6 |

|

|

|

54.8 |

|

Contract assets |

|

|

0.5 |

|

|

|

(41.6 |

) |

Accounts payable |

|

|

(5.3 |

) |

|

|

(4.4 |

) |

Accrued expenses and other liabilities |

|

|

(73.8 |

) |

|

|

(160.5 |

) |

Income taxes prepaid and payable |

|

|

(16.3 |

) |

|

|

12.3 |

|

Deferred revenue |

|

|

12.3 |

|

|

|

(60.1 |

) |

Net cash provided by operating activities |

|

|

826.7 |

|

|

|

764.6 |

|

Cash flow from investing activities: |

|

|

|

|

|

|

Cash paid for business acquisitions, net of cash acquired and asset acquisitions |

|

|

(0.1 |

) |

|

|

(1,629.5 |

) |

Additions to property and equipment |

|

|

(40.7 |

) |

|

|

(53.3 |

) |

Proceeds from sale of property and equipment |

|

|

— |

|

|

|

10.9 |

|

Additions to capitalized software |

|

|

(140.9 |

) |

|

|

(108.2 |

) |

Investments in securities |

|

|

(0.6 |

) |

|

|

(10.0 |

) |

Proceeds from sales / maturities of investments |

|

|

7.7 |

|

|

|

8.6 |

|

Distributions received from unconsolidated affiliates |

|

|

— |

|

|

|

66.2 |

|

Collection of other non-current receivables |

|

|

7.5 |

|

|

|

7.5 |

|

Net cash used in investing activities |

|

|

(167.1 |

) |

|

|

(1,707.8 |

) |

Cash flow from financing activities: |

|

|

|

|

|

|

Cash received from debt borrowings, net of original issue discount |

|

|

275.0 |

|

|

|

1,702.1 |

|

Repayments of debt |

|

|

(499.5 |

) |

|

|

(408.5 |

) |

Payment of deferred financing fees |

|

|

— |

|

|

|

(14.7 |

) |

Net decrease in client funds obligations |

|

|

(163.7 |

) |

|

|

(1,564.5 |

) |

Proceeds from exercise of stock options |

|

|

79.2 |

|

|

|

73.3 |

|

Withholding taxes paid related to equity award net share settlement |

|

|

(1.7 |

) |

|

|

(0.6 |

) |

Purchases of common stock for treasury |

|

|

(341.0 |

) |

|

|

(385.4 |

) |

Dividends paid on common stock |

|

|

(160.9 |

) |

|

|

(153.4 |

) |

Net cash used in financing activities |

|

|

(812.6 |

) |

|

|

(751.7 |

) |

Effect of exchange rate changes on cash, cash equivalents and restricted cash |

|

|

(4.2 |

) |

|

|

(32.9 |

) |

Net decrease in cash, cash equivalents and restricted cash |

|

|

(157.2 |

) |

|

|

(1,727.8 |

) |

Cash, cash equivalents and restricted cash, beginning of period |

|

|

1,337.6 |

|

|

|

3,171.4 |

|

Cash, cash equivalents and restricted cash and cash equivalents, end of period |

|

$ |

1,180.4 |

|

|

$ |

1,443.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of cash, cash equivalents and restricted cash and cash equivalents: |

|

Cash and cash equivalents |

|

$ |

447.6 |

|

|

$ |

401.9 |

|

Restricted cash and cash equivalents |

|

|

2.3 |

|

|

|

3.0 |

|

Restricted cash and cash equivalents included in funds receivable and funds held on behalf of clients |

|

|

730.5 |

|

|

|

1,038.7 |

|

|

|

$ |

1,180.4 |

|

|

$ |

1,443.6 |

|

7

SS&C Technologies Holdings, Inc. and Subsidiaries

Disclosures Relating to Non-GAAP Financial Measures

Note 1. Reconciliation of Revenues to Adjusted Revenues

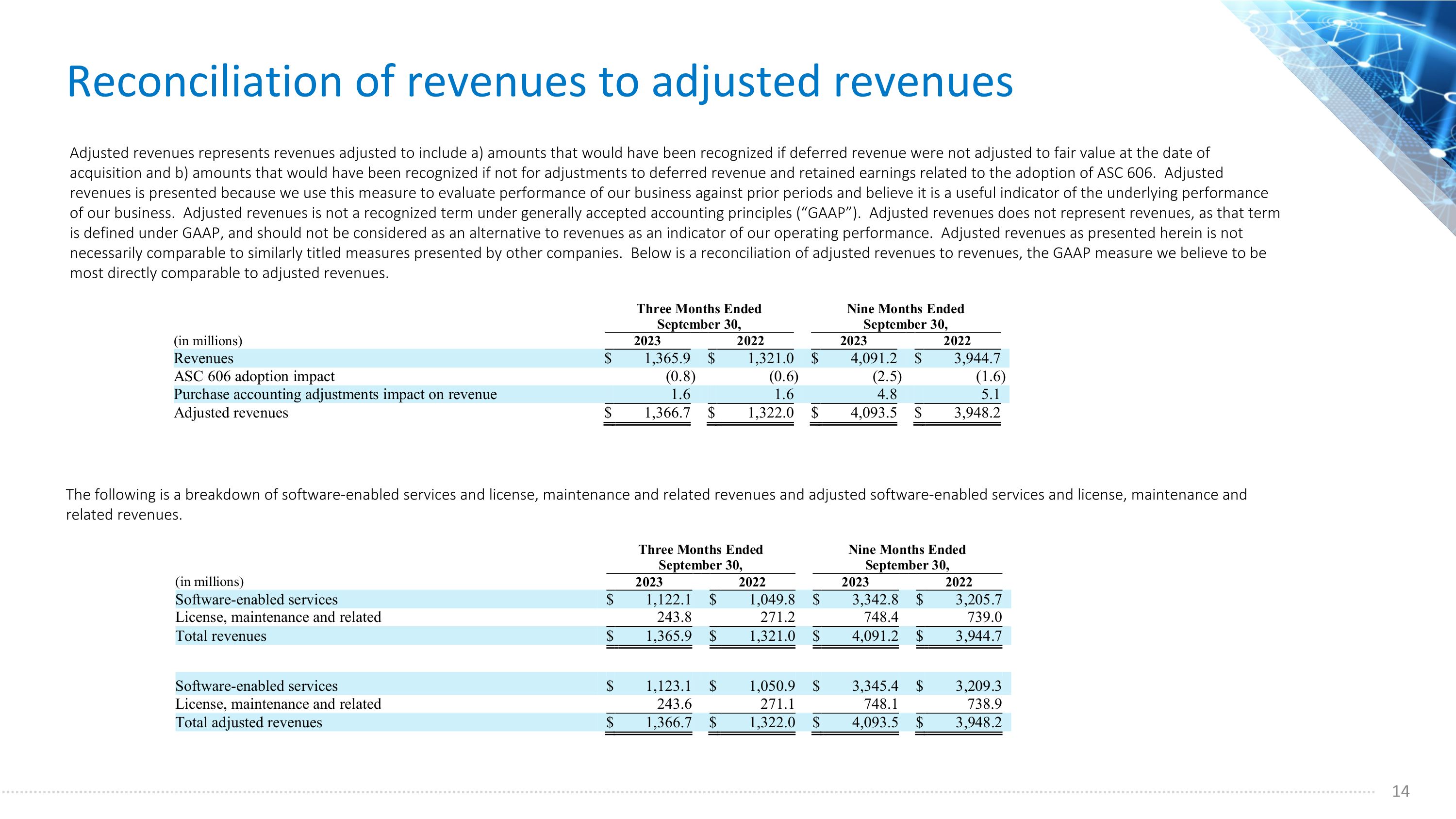

Adjusted revenues represents revenues adjusted to include a) amounts that would have been recognized if deferred revenue were not adjusted to fair value at the date of acquisition and b) amounts that would have been recognized if not for adjustments to deferred revenue and retained earnings related to the adoption of ASC 606. Adjusted revenues is presented because we use this measure to evaluate performance of our business against prior periods and believe it is a useful indicator of the underlying performance of our business. Adjusted revenues is not a recognized term under generally accepted accounting principles (“GAAP”). Adjusted revenues does not represent revenues, as that term is defined under GAAP, and should not be considered as an alternative to revenues as an indicator of our operating performance. Adjusted revenues as presented herein is not necessarily comparable to similarly titled measures presented by other companies. Below is a reconciliation of adjusted revenues to revenues, the GAAP measure we believe to be most directly comparable to adjusted revenues.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

(in millions) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenues |

|

$ |

1,365.9 |

|

|

$ |

1,321.0 |

|

|

$ |

4,091.2 |

|

|

$ |

3,944.7 |

|

ASC 606 adoption impact |

|

|

(0.8 |

) |

|

|

(0.6 |

) |

|

|

(2.5 |

) |

|

|

(1.6 |

) |

Purchase accounting adjustments impact on revenue |

|

|

1.6 |

|

|

|

1.6 |

|

|

|

4.8 |

|

|

|

5.1 |

|

Adjusted revenues |

|

$ |

1,366.7 |

|

|

$ |

1,322.0 |

|

|

$ |

4,093.5 |

|

|

$ |

3,948.2 |

|

The following is a breakdown of software-enabled services and license, maintenance and related revenues and adjusted software-enabled services and license, maintenance and related revenues.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

(in millions) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Software-enabled services |

|

$ |

1,122.1 |

|

|

$ |

1,049.8 |

|

|

$ |

3,342.8 |

|

|

$ |

3,205.7 |

|

License, maintenance and related |

|

|

243.8 |

|

|

|

271.2 |

|

|

|

748.4 |

|

|

|

739.0 |

|

Total revenues |

|

$ |

1,365.9 |

|

|

$ |

1,321.0 |

|

|

$ |

4,091.2 |

|

|

$ |

3,944.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Software-enabled services |

|

$ |

1,123.1 |

|

|

$ |

1,050.9 |

|

|

$ |

3,345.4 |

|

|

$ |

3,209.3 |

|

License, maintenance and related |

|

|

243.6 |

|

|

|

271.1 |

|

|

|

748.1 |

|

|

|

738.9 |

|

Total adjusted revenues |

|

$ |

1,366.7 |

|

|

$ |

1,322.0 |

|

|

$ |

4,093.5 |

|

|

$ |

3,948.2 |

|

8

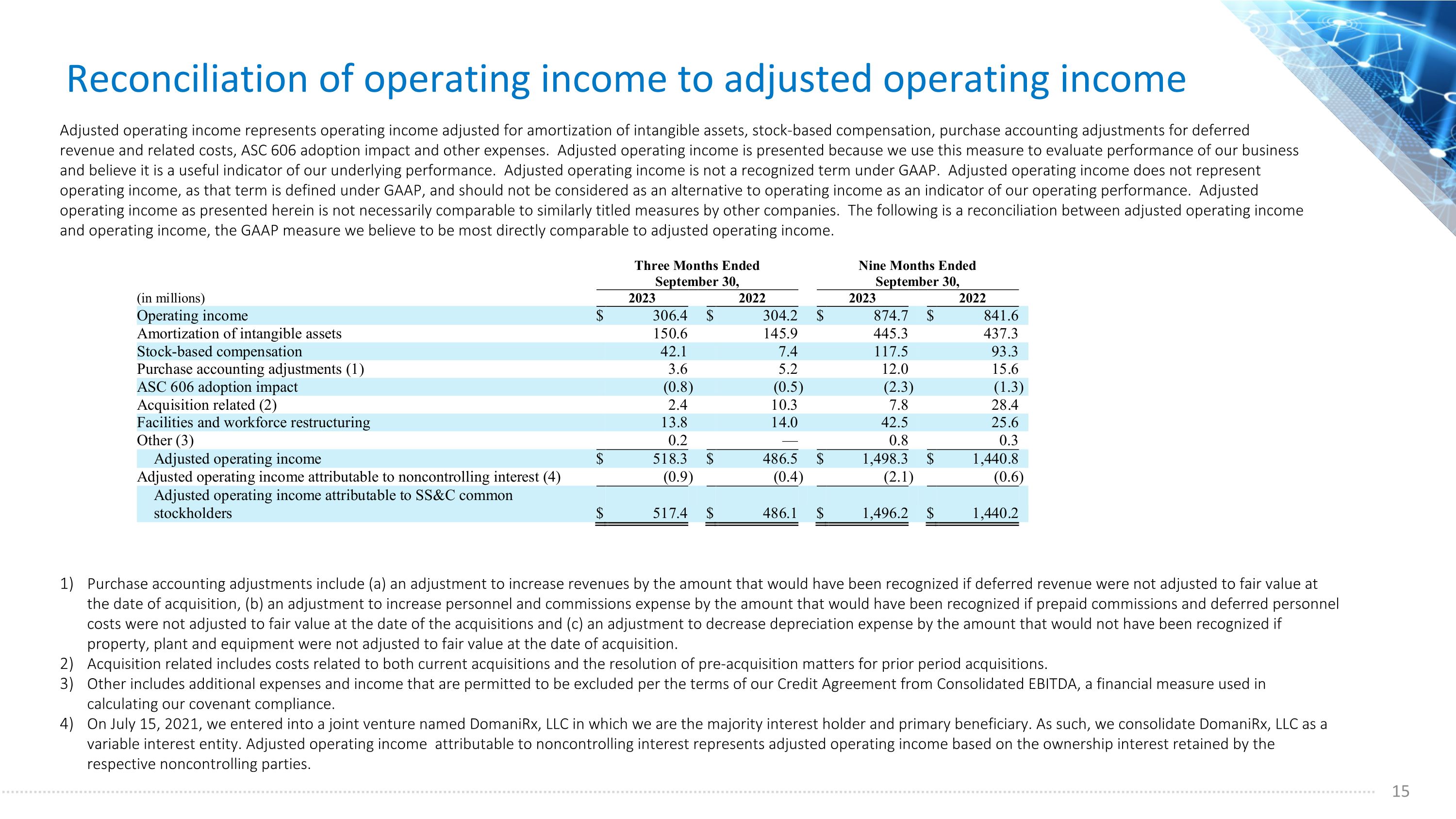

Note 2. Reconciliation of Operating Income to Adjusted Operating Income

Adjusted operating income represents operating income adjusted for amortization of intangible assets, stock-based compensation, purchase accounting adjustments for deferred revenue and related costs, ASC 606 adoption impact and other expenses. Adjusted operating income is presented because we use this measure to evaluate performance of our business and believe it is a useful indicator of our underlying performance. Adjusted operating income is not a recognized term under GAAP. Adjusted operating income does not represent operating income, as that term is defined under GAAP, and should not be considered as an alternative to operating income as an indicator of our operating performance. Adjusted operating income as presented herein is not necessarily comparable to similarly titled measures by other companies. The following is a reconciliation between adjusted operating income and operating income, the GAAP measure we believe to be most directly comparable to adjusted operating income.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

(in millions) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Operating income |

|

$ |

306.4 |

|

|

$ |

304.2 |

|

|

$ |

874.7 |

|

|

$ |

841.6 |

|

Amortization of intangible assets |

|

|

150.6 |

|

|

|

145.9 |

|

|

|

445.3 |

|

|

|

437.3 |

|

Stock-based compensation |

|

|

42.1 |

|

|

|

7.4 |

|

|

|

117.5 |

|

|

|

93.3 |

|

Purchase accounting adjustments (1) |

|

|

3.6 |

|

|

|

5.2 |

|

|

|

12.0 |

|

|

|

15.6 |

|

ASC 606 adoption impact |

|

|

(0.8 |

) |

|

|

(0.5 |

) |

|

|

(2.3 |

) |

|

|

(1.3 |

) |

Acquisition related (2) |

|

|

2.4 |

|

|

|

10.3 |

|

|

|

7.8 |

|

|

|

28.4 |

|

Facilities and workforce restructuring |

|

|

13.8 |

|

|

|

14.0 |

|

|

|

42.5 |

|

|

|

25.6 |

|

Other (3) |

|

|

0.2 |

|

|

|

— |

|

|

|

0.8 |

|

|

|

0.3 |

|

Adjusted operating income |

|

$ |

518.3 |

|

|

$ |

486.5 |

|

|

$ |

1,498.3 |

|

|

$ |

1,440.8 |

|

Adjusted operating income attributable to noncontrolling interest (4) |

|

|

(0.9 |

) |

|

|

(0.4 |

) |

|

|

(2.1 |

) |

|

|

(0.6 |

) |

Adjusted operating income attributable to SS&C common stockholders |

|

$ |

517.4 |

|

|

$ |

486.1 |

|

|

$ |

1,496.2 |

|

|

$ |

1,440.2 |

|

(1)Purchase accounting adjustments include (a) an adjustment to increase revenues by the amount that would have been recognized if deferred revenue were not adjusted to fair value at the date of acquisition, (b) an adjustment to increase personnel and commissions expense by the amount that would have been recognized if prepaid commissions and deferred personnel costs were not adjusted to fair value at the date of the acquisitions and (c) an adjustment to decrease depreciation expense by the amount that would not have been recognized if property, plant and equipment were not adjusted to fair value at the date of acquisition.

(2)Acquisition related includes costs related to both current acquisitions and the resolution of pre-acquisition matters for prior period acquisitions.

(3)Other includes additional expenses and income that are permitted to be excluded per the terms of our Credit Agreement from Consolidated EBITDA, a financial measure used in calculating our covenant compliance.

(4)In 2021, we entered into a joint venture named DomaniRx, LLC in which we are the majority interest holder and primary beneficiary. As such, we consolidate DomaniRx, LLC as a variable interest entity. Adjusted operating income attributable to noncontrolling interest represents adjusted operating income based on the ownership interest retained by the respective noncontrolling parties.

9

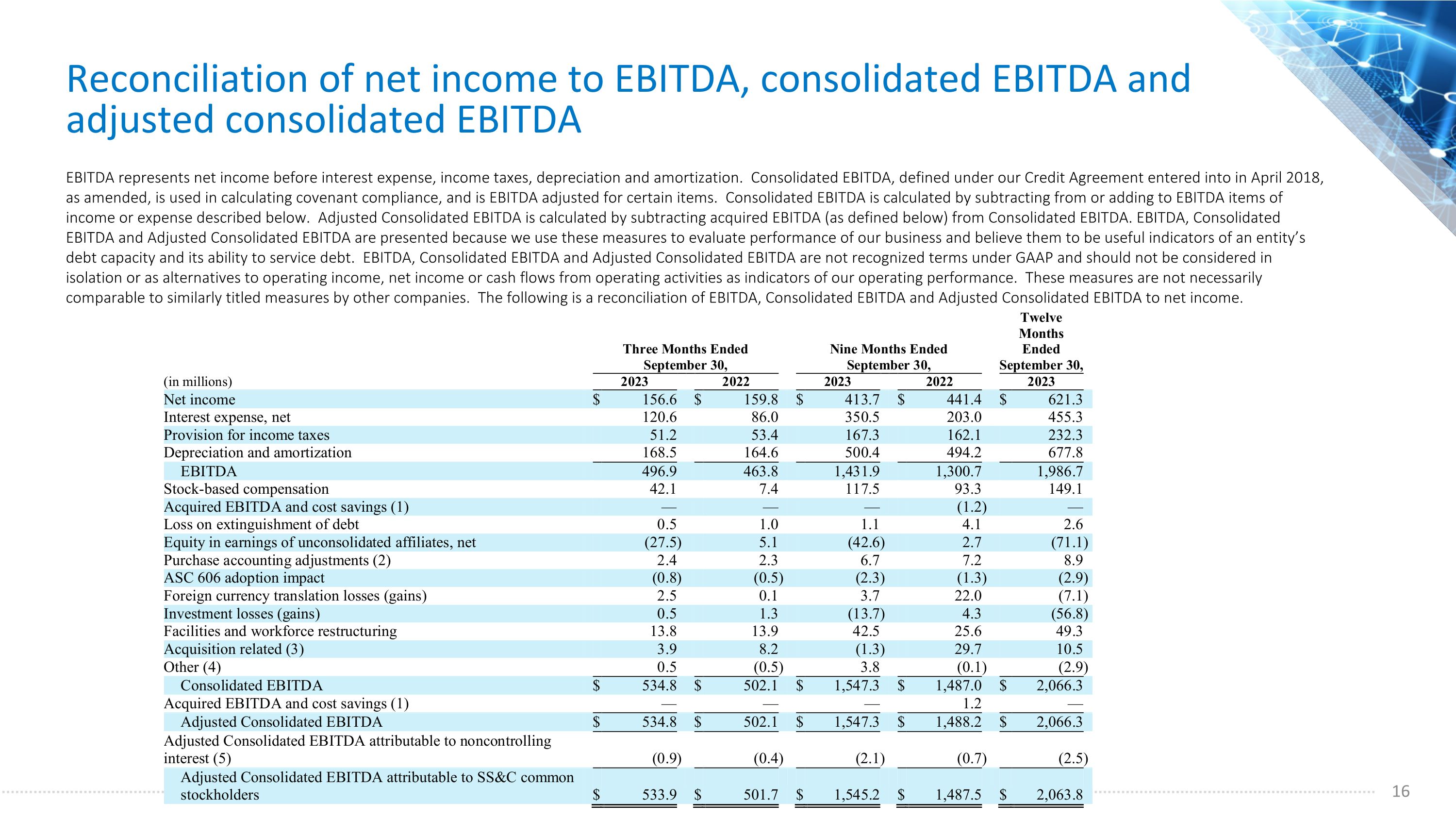

Note 3. Reconciliation of Net Income to EBITDA, Consolidated EBITDA and Adjusted Consolidated EBITDA

EBITDA represents net income before interest expense, income taxes, depreciation and amortization. Consolidated EBITDA, defined under our Credit Agreement entered into in April 2018, as amended, is used in calculating covenant compliance, and is EBITDA adjusted for certain items. Consolidated EBITDA is calculated by subtracting from or adding to EBITDA items of income or expense described below. Adjusted Consolidated EBITDA is calculated by subtracting acquired EBITDA (as defined below) from Consolidated EBITDA. EBITDA, Consolidated EBITDA and Adjusted Consolidated EBITDA are presented because we use these measures to evaluate performance of our business and believe them to be useful indicators of an entity’s debt capacity and its ability to service debt. EBITDA, Consolidated EBITDA and Adjusted Consolidated EBITDA are not recognized terms under GAAP and should not be considered in isolation or as alternatives to operating income, net income or cash flows from operating activities as indicators of our operating performance. These measures are not necessarily comparable to similarly titled measures by other companies. The following is a reconciliation of EBITDA, Consolidated EBITDA and Adjusted Consolidated EBITDA to net income.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

Twelve Months Ended September 30, |

|

(in millions) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

Net income |

|

$ |

156.6 |

|

|

$ |

159.8 |

|

|

$ |

413.7 |

|

|

$ |

441.4 |

|

|

$ |

621.3 |

|

Interest expense, net |

|

|

120.6 |

|

|

|

86.0 |

|

|

|

350.5 |

|

|

|

203.0 |

|

|

|

455.3 |

|

Provision for income taxes |

|

|

51.2 |

|

|

|

53.4 |

|

|

|

167.3 |

|

|

|

162.1 |

|

|

|

232.3 |

|

Depreciation and amortization |

|

|

168.5 |

|

|

|

164.6 |

|

|

|

500.4 |

|

|

|

494.2 |

|

|

|

677.8 |

|

EBITDA |

|

|

496.9 |

|

|

|

463.8 |

|

|

|

1,431.9 |

|

|

|

1,300.7 |

|

|

|

1,986.7 |

|

Stock-based compensation |

|

|

42.1 |

|

|

|

7.4 |

|

|

|

117.5 |

|

|

|

93.3 |

|

|

|

149.1 |

|

Acquired EBITDA and cost savings (1) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1.2 |

) |

|

|

— |

|

Loss on extinguishment of debt |

|

|

0.5 |

|

|

|

1.0 |

|

|

|

1.1 |

|

|

|

4.1 |

|

|

|

2.6 |

|

Equity in earnings of unconsolidated affiliates, net |

|

|

(27.5 |

) |

|

|

5.1 |

|

|

|

(42.6 |

) |

|

|

2.7 |

|

|

|

(71.1 |

) |

Purchase accounting adjustments (2) |

|

|

2.4 |

|

|

|

2.3 |

|

|

|

6.7 |

|

|

|

7.2 |

|

|

|

8.9 |

|

ASC 606 adoption impact |

|

|

(0.8 |

) |

|

|

(0.5 |

) |

|

|

(2.3 |

) |

|

|

(1.3 |

) |

|

|

(2.9 |

) |

Foreign currency translation losses (gains) |

|

|

2.5 |

|

|

|

0.1 |

|

|

|

3.7 |

|

|

|

22.0 |

|

|

|

(7.1 |

) |

Investment losses (gains) |

|

|

0.5 |

|

|

|

1.3 |

|

|

|

(13.7 |

) |

|

|

4.3 |

|

|

|

(56.8 |

) |

Facilities and workforce restructuring |

|

|

13.8 |

|

|

|

13.9 |

|

|

|

42.5 |

|

|

|

25.6 |

|

|

|

49.3 |

|

Acquisition related (3) |

|

|

3.9 |

|

|

|

8.2 |

|

|

|

(1.3 |

) |

|

|

29.7 |

|

|

|

10.5 |

|

Other (4) |

|

|

0.5 |

|

|

|

(0.5 |

) |

|

|

3.8 |

|

|

|

(0.1 |

) |

|

|

(2.9 |

) |

Consolidated EBITDA |

|

$ |

534.8 |

|

|

$ |

502.1 |

|

|

$ |

1,547.3 |

|

|

$ |

1,487.0 |

|

|

$ |

2,066.3 |

|

Acquired EBITDA and cost savings (1) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1.2 |

|

|

|

— |

|

Adjusted Consolidated EBITDA |

|

$ |

534.8 |

|

|

$ |

502.1 |

|

|

$ |

1,547.3 |

|

|

$ |

1,488.2 |

|

|

$ |

2,066.3 |

|

Adjusted Consolidated EBITDA attributable to noncontrolling interest (5) |

|

|

(0.9 |

) |

|

|

(0.4 |

) |

|

|

(2.1 |

) |

|

|

(0.7 |

) |

|

|

(2.5 |

) |

Adjusted Consolidated EBITDA attributable to SS&C common stockholders |

|

$ |

533.9 |

|

|

$ |

501.7 |

|

|

$ |

1,545.2 |

|

|

$ |

1,487.5 |

|

|

$ |

2,063.8 |

|

(1)Acquired EBITDA reflects the EBITDA impact of significant businesses that were acquired during the period as if the acquisition occurred at the beginning of the period, as well as cost savings enacted in connection with acquisitions.

(2)Purchase accounting adjustments include (a) an adjustment to increase revenues by the amount that would have been recognized if deferred revenue were not adjusted to fair value at the date of acquisitions (b) an adjustment to increase personnel and commissions expense by the amount that would have been recognized if prepaid commissions and deferred personnel costs were not adjusted to fair value at the date of the acquisitions and (c) an adjustment to increase or decrease rent expense by the amount that would have been recognized if lease obligations were not adjusted to fair value at the date of acquisitions.

(3)Acquisition related includes costs related to both current acquisitions and the resolution of pre-acquisition matters for prior period acquisitions.

(4)Other includes additional expenses and income that are permitted to be excluded per the terms of our Credit Agreement from Consolidated EBITDA, a financial measure used in calculating our covenant compliance.

(5)In 2021, we entered into a joint venture named DomaniRx, LLC in which we are the majority interest holder and primary beneficiary. As such, we consolidate DomaniRx, LLC as a variable interest entity. Adjusted Consolidated EBITDA attributable to noncontrolling interest represents adjusted Consolidated EBITDA based on the ownership interest retained by the respective noncontrolling parties.

10

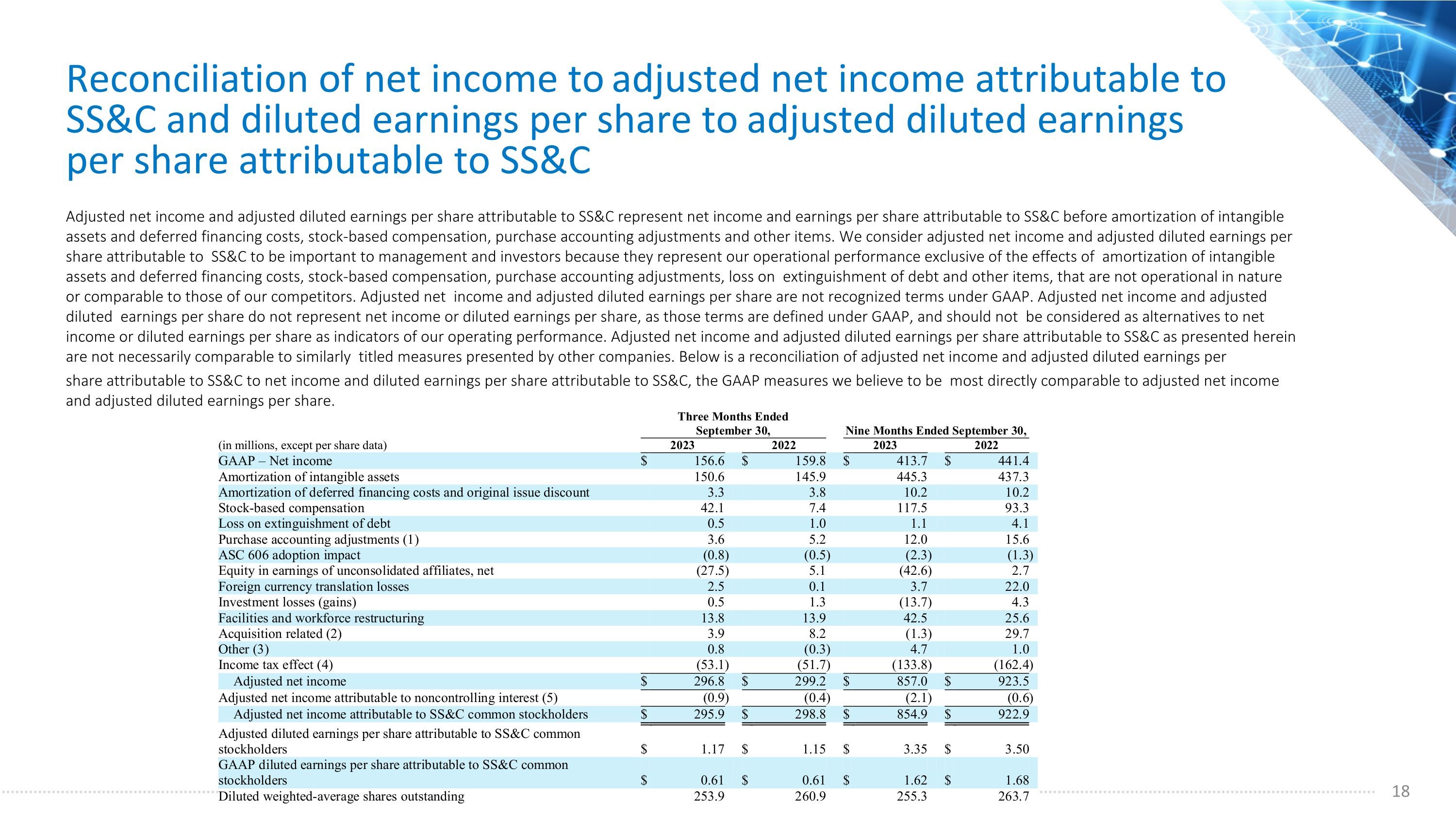

Note 4. Reconciliation of Net Income to Adjusted Net Income and Diluted Earnings Per Share Attributable to SS&C to Adjusted Diluted Earnings Per Share Attributable to SS&C

Adjusted net income and adjusted diluted earnings per share attributable to SS&C represent net income and earnings per share attributable to SS&C before amortization of intangible assets and deferred financing costs, stock-based compensation, purchase accounting adjustments and other items. We consider adjusted net income and adjusted diluted earnings per share attributable to SS&C to be important to management and investors because they represent our operational performance exclusive of the effects of amortization of intangible assets and deferred financing costs, stock-based compensation, purchase accounting adjustments, loss on extinguishment of debt and other items, that are not operational in nature or comparable to those of our competitors. Adjusted net income and adjusted diluted earnings per share are not recognized terms under GAAP. Adjusted net income and adjusted diluted earnings per share do not represent net income or diluted earnings per share, as those terms are defined under GAAP, and should not be considered as alternatives to net income or diluted earnings per share as indicators of our operating performance. Adjusted net income and adjusted diluted earnings per share attributable to SS&C as presented herein are not necessarily comparable to similarly titled measures presented by other companies. Below is a reconciliation of adjusted net income and adjusted diluted earnings per share attributable to SS&C to net income and diluted earnings per share attributable to SS&C, the GAAP measures we believe to be most directly comparable to adjusted net income and adjusted diluted earnings per share.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

(in millions, except per share data) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

GAAP – Net income |

|

$ |

156.6 |

|

|

$ |

159.8 |

|

|

$ |

413.7 |

|

|

$ |

441.4 |

|

Amortization of intangible assets |

|

|

150.6 |

|

|

|

145.9 |

|

|

|

445.3 |

|

|

|

437.3 |

|

Amortization of deferred financing costs and original issue discount |

|

|

3.3 |

|

|

|

3.8 |

|

|

|

10.2 |

|

|

|

10.2 |

|

Stock-based compensation |

|

|

42.1 |

|

|

|

7.4 |

|

|

|

117.5 |

|

|

|

93.3 |

|

Loss on extinguishment of debt |

|

|

0.5 |

|

|

|

1.0 |

|

|

|

1.1 |

|

|

|

4.1 |

|

Purchase accounting adjustments (1) |

|

|

3.6 |

|

|

|

5.2 |

|

|

|

12.0 |

|

|

|

15.6 |

|

ASC 606 adoption impact |

|

|

(0.8 |

) |

|

|

(0.5 |

) |

|

|

(2.3 |

) |

|

|

(1.3 |

) |

Equity in earnings of unconsolidated affiliates, net |

|

|

(27.5 |

) |

|

|

5.1 |

|

|

|

(42.6 |

) |

|

|

2.7 |

|

Foreign currency translation losses |

|

|

2.5 |

|

|

|

0.1 |

|

|

|

3.7 |

|

|

|

22.0 |

|

Investment losses (gains) |

|

|

0.5 |

|

|

|

1.3 |

|

|

|

(13.7 |

) |

|

|

4.3 |

|

Facilities and workforce restructuring |

|

|

13.8 |

|

|

|

13.9 |

|

|

|

42.5 |

|

|

|

25.6 |

|

Acquisition related (2) |

|

|

3.9 |

|

|

|

8.2 |

|

|

|

(1.3 |

) |

|

|

29.7 |

|

Other (3) |

|

|

0.8 |

|

|

|

(0.3 |

) |

|

|

4.7 |

|

|

|

1.0 |

|

Income tax effect (4) |

|

|

(53.1 |

) |

|

|

(51.7 |

) |

|

|

(133.8 |

) |

|

|

(162.4 |

) |

Adjusted net income |

|

$ |

296.8 |

|

|

$ |

299.2 |

|

|

$ |

857.0 |

|

|

$ |

923.5 |

|

Adjusted net income attributable to noncontrolling interest (5) |

|

|

(0.9 |

) |

|

|

(0.4 |

) |

|

|

(2.1 |

) |

|

|

(0.6 |

) |

Adjusted net income attributable to SS&C common stockholders |

|

$ |

295.9 |

|

|

$ |

298.8 |

|

|

$ |

854.9 |

|

|

$ |

922.9 |

|

Adjusted diluted earnings per share attributable to SS&C common stockholders |

|

$ |

1.17 |

|

|

$ |

1.15 |

|

|

$ |

3.35 |

|

|

$ |

3.50 |

|

GAAP diluted earnings per share attributable to SS&C common stockholders |

|

$ |

0.61 |

|

|

$ |

0.61 |

|

|

$ |

1.62 |

|

|

$ |

1.68 |

|

Diluted weighted-average shares outstanding |

|

|

253.9 |

|

|

|

260.9 |

|

|

|

255.3 |

|

|

|

263.7 |

|

(1)Purchase accounting adjustments include (a) an adjustment to increase revenues by the amount that would have been recognized if deferred revenue were not adjusted to fair value at the date of acquisition, (b) an adjustment to increase personnel and commissions expense by the amount that would have been recognized if prepaid commissions and deferred personnel costs were not adjusted to fair value at the date of the acquisitions and (c) an adjustment to decrease depreciation expense by the amount that would not have been recognized if property, plant and equipment were not adjusted to fair value at the date of acquisition.

(2)Acquisition related includes costs related to both current acquisitions and the resolution of pre-acquisition matters for prior period acquisitions.

(3)Other includes additional expenses and income that are permitted to be excluded per the terms of our Credit Agreement from Consolidated EBITDA, a financial measure used in calculating our covenant compliance.

(4)An estimated normalized effective tax rate of approximately 26% for the three and nine months ended September 30, 2023 and 2022 has been used to adjust the provision for income taxes for the purpose of computing adjusted net income.

(5)In 2021, we entered into a joint venture named DomaniRx, LLC in which we are the majority interest holder and primary beneficiary. As such, we consolidate DomaniRx, LLC as a variable interest entity. Adjusted net income attributable to noncontrolling interest represents adjusted net income based on the ownership interest retained by the respective noncontrolling parties.

11