Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

|

| |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2016

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 01-34525

|

| | |

Delaware | | 30-0349798 |

(State or Other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

1330 Post Oak Blvd., Suite 2250, Houston, Texas | | 77056 |

(Address of principal executive offices) | | (Zip Code) |

|

| | |

| (713) 797-2940 (Registrant’s telephone number, including area code) | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer | | ¨ | | Accelerated filer | | ý |

| | | |

Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

At August 1, 2016, there were 212,543,801 shares of common stock, par value $0.001 per share, outstanding.

|

| | | |

PART I | | | |

| | | |

Item 1. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Item 2. | | | |

| | | |

Item 3. | | | |

| | | |

Item 4. | | | |

| | | |

PART II | | | |

| | | |

Item 1. | | | |

| | | |

Item 1A. | | | |

| | | |

Item 2. | | | |

Item 6. | | | |

| | |

| | |

| | |

| | |

PART I. – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

ERIN ENERGY CORPORATION

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except for share and per share amounts)

|

| | | | | | | |

| June 30,

2016 | | December 31, 2015 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 8,759 |

| | $ | 8,363 |

|

Restricted cash | — |

| | 8,661 |

|

Accounts receivable - trade | 3 |

| | 1,029 |

|

Accounts receivable - partners | 667 |

| | 287 |

|

Accounts receivable - related party | 1,732 |

| | 1,186 |

|

Accounts receivable - other | 71 |

| | 28 |

|

Crude oil inventory | 5,895 |

| | 4,789 |

|

Prepaids and other current assets | 1,363 |

| | 684 |

|

Total current assets | 18,490 |

| | 25,027 |

|

| | | |

Property, plant and equipment: | | | |

Oil and gas properties (successful efforts method of accounting), net | 329,371 |

| | 348,331 |

|

Other property, plant and equipment, net | 1,023 |

| | 1,174 |

|

Total property, plant and equipment, net | 330,394 |

| | 349,505 |

|

| |

| | |

|

Other non-current assets

| 76 |

| | 67 |

|

| | | |

Total assets | $ | 348,960 |

| | $ | 374,599 |

|

| | | |

LIABILITIES AND CAPITAL DEFICIENCY | | | |

Current liabilities: | | | |

Accounts payable and accrued liabilities | $ | 242,033 |

| | $ | 213,120 |

|

Accounts payable and accrued liabilities - related party | 29,465 |

| | 30,133 |

|

Short-term note payable | 357 |

| | — |

|

Current portion of long-term debt, net | 3,802 |

| | 96,558 |

|

Total current liabilities | 275,657 |

| | 339,811 |

|

| | | |

Long-term notes payable - related party, net | 127,517 |

| | 120,006 |

|

Term loan facility, net | 83,441 |

| | — |

|

Asset retirement obligations | 21,522 |

| | 20,609 |

|

| | | |

Total liabilities | 508,137 |

| | 480,426 |

|

| | | |

Commitments and contingencies (Note 10) |

|

| |

|

|

| | | |

Capital deficiency: | | | |

Preferred stock $0.001 par value - 50,000,000 shares authorized; none issued and outstanding as of June 30, 2016 and December 31, 2015, respectively | — |

| | — |

|

Common stock $0.001 par value - 416,666,667 shares authorized; 212,517,199 and 211,615,773 shares issued as of June 30, 2016 and December 31, 2015, respectively | 213 |

| | 212 |

|

Additional paid-in capital | 791,453 |

| | 789,615 |

|

Accumulated deficit | (951,434 | ) | | (896,451 | ) |

Treasury stock at cost, 84,185 and -0- shares as of June 30, 2016 and December 31, 2015, respectively | (192 | ) | | — |

|

Total deficit - Erin Energy Corporation | (159,960 | ) | | (106,624 | ) |

Non-controlling interests | 783 |

| | 797 |

|

Total capital deficiency | (159,177 | ) | | (105,827 | ) |

Total liabilities and capital deficiency | $ | 348,960 |

| | $ | 374,599 |

|

See accompanying notes to unaudited consolidated financial statements.

ERIN ENERGY CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share amounts)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2016 | | 2015 | | 2016 | | 2015 |

Revenues: | | | | | | | |

Crude oil sales, net of royalties | $ | 23,151 |

| | $ | — |

| | $ | 28,080 |

| | $ | — |

|

| | | | | | | |

Operating costs and expenses: | | | | | | | |

Production costs | 22,123 |

| | 4,258 |

| | 44,687 |

| | 25,573 |

|

Crude oil inventory (increase) decrease | 729 |

| | (9,874 | ) | | (102 | ) | | (9,861 | ) |

Workover expenses | 7,585 |

| | 618 |

| | 7,585 |

| | 618 |

|

Exploratory expenses | 1,200 |

| | 1,502 |

| | 3,262 |

| | 8,017 |

|

Depreciation, depletion and amortization | 14,856 |

| | 123 |

| | 19,668 |

| | 243 |

|

Accretion of asset retirement obligations | 461 |

| | 299 |

| | 913 |

| | 876 |

|

Loss on settlement of asset retirement obligations | — |

| | 3,454 |

| | 205 |

| | 3,454 |

|

General and administrative expenses | 3,396 |

| | 5,441 |

| | 7,354 |

| | 8,932 |

|

Total operating costs and expenses | 50,350 |

| | 5,821 |

| | 83,572 |

| | 37,852 |

|

| | | | | | | |

Operating loss | (27,199 | ) | | (5,821 | ) | | (55,492 | ) | | (37,852 | ) |

| | | | | | | |

Other income (expense): | | | | | | | |

Currency transaction gain | 10,465 |

| | 555 |

| | 11,328 |

| | 1,991 |

|

Interest expense | (5,954 | ) | | (4,224 | ) | | (11,379 | ) | | (6,835 | ) |

Total other income (expense), net | 4,511 |

| | (3,669 | ) | | (51 | ) | | (4,844 | ) |

| | | | | | | |

Loss before income taxes | (22,688 | ) | | (9,490 | ) | | (55,543 | ) | | (42,696 | ) |

Income tax expense | — |

| | — |

| | — |

| | — |

|

Net loss before non-controlling interest | (22,688 | ) | | (9,490 | ) | | (55,543 | ) | | (42,696 | ) |

| | | | | | | |

Net loss attributable to non-controlling interest | 116 |

| | 328 |

| | 560 |

| | 475 |

|

| | | | | | | |

Net loss attributable to Erin Energy Corporation | $ | (22,572 | ) | | $ | (9,162 | ) | | $ | (54,983 | ) | | $ | (42,221 | ) |

| | | | | | | |

Net loss attributable to Erin Energy Corporation per common share: | | | | | | | |

Basic | $ | (0.11 | ) | | $ | (0.04 | ) | | $ | (0.26 | ) | | $ | (0.20 | ) |

Diluted | $ | (0.11 | ) | | $ | (0.04 | ) | | $ | (0.26 | ) | | $ | (0.20 | ) |

Weighted average common shares outstanding: | | | | | | | |

Basic | 212,290 |

| | 211,108 |

| | 212,067 |

| | 210,791 |

|

Diluted | 212,290 |

| | 211,108 |

| | 212,067 |

| | 210,791 |

|

See accompanying notes to unaudited consolidated financial statements.

ERIN ENERGY CORPORATION

CONSOLIDATED STATEMENT OF CAPITAL DEFICIENCY

For the Six Months Ended June 30, 2016

(Unaudited)

(In thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | Accumulated Deficit | | Treasury Stock | | Non-controlling Interest | | Total Equity |

Balance at December 31, 2015 | $ | 212 |

| | $ | 789,615 |

| | $ | (896,451 | ) | | $ | — |

| | $ | 797 |

| | $ | (105,827 | ) |

Common stock issued | 1 |

| | 166 |

| | — |

| | — |

| | — |

| | 167 |

|

Stock-based compensation | — |

| | 1,619 |

| | — |

| | — |

| | — |

| | 1,619 |

|

Warrants issued with debt | — |

| | 53 |

| | — |

| | — |

| | — |

| | 53 |

|

Transfer to treasury upon vesting of restricted stock | — |

| | — |

| | — |

| | (192 | ) | | — |

| | (192 | ) |

Non-controlling interest | — |

| | — |

| | — |

| | — |

| | 546 |

| | 546 |

|

Net loss | — |

| | — |

| | (54,983 | ) | | — |

| | (560 | ) | | (55,543 | ) |

Balance at June 30, 2016 | $ | 213 |

| | $ | 791,453 |

| | $ | (951,434 | ) | | $ | (192 | ) | | $ | 783 |

| | $ | (159,177 | ) |

See accompanying notes to unaudited consolidated financial statements.

ERIN ENERGY CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

|

| | | | | | | |

| Six Months Ended June 30, |

| 2016 | | 2015 |

Cash flows from operating activities | | | |

Net loss, including non-controlling interest | $ | (55,543 | ) | | $ | (42,696 | ) |

| | | |

Adjustments to reconcile net loss to cash used in operating activities: | | | |

Depreciation, depletion and amortization | 19,668 |

| | 243 |

|

Accretion of asset retirement obligations | 913 |

| | 876 |

|

Amortization of debt discount and debt issuance costs | 1,789 |

| | 1,119 |

|

Loss on settlement of asset retirement obligations | — |

| | 3,454 |

|

Foreign currency transaction gain | (11,328 | ) | | (1,991 | ) |

Share-based compensation | 1,619 |

| | 3,434 |

|

Payments to settle asset retirement obligations | — |

| | (16,441 | ) |

Change in operating assets and liabilities: | | | |

Decrease in accounts receivable | 603 |

| | 470 |

|

Increase in crude oil inventory | (102 | ) | | (9,861 | ) |

Increase in prepaids and other current assets | (688 | ) | | (1,234 | ) |

Increase in accounts payable and accrued liabilities | 41,895 |

| | 34,653 |

|

Net cash used in operating activities | (1,174 | ) | | (27,974 | ) |

| | | |

Cash flows from investing activities | | | |

Capital expenditures | (9,667 | ) | | (56,741 | ) |

Net cash used in investing activities | (9,667 | ) | | (56,741 | ) |

| | | |

Cash flows from financing activities | | | |

Proceeds from exercise of stock options and warrants | 167 |

| | 1,855 |

|

Payments for treasury stock arising from withholding taxes upon restricted stock vesting | (192 | ) | | — |

|

Repayments of term loan facility | (5,981 | ) | | — |

|

Proceeds from short-term notes payable | 504 |

| | — |

|

Proceeds from notes payable - related party, net | 6,129 |

| | 57,815 |

|

Debt issuance costs | (693 | ) | | — |

|

Funds released from restricted cash | 8,661 |

| | — |

|

Funding from non-controlling interest | — |

| | 375 |

|

Net cash provided by financing activities | 8,595 |

| | 60,045 |

|

| | | |

Effect of exchange rate changes on cash and cash equivalents | 2,642 |

| | 568 |

|

| | | |

Net decrease in cash and cash equivalents | 396 |

| | (24,102 | ) |

Cash and cash equivalents at beginning of period | 8,363 |

| | 25,143 |

|

Cash and cash equivalents at end of period | $ | 8,759 |

| | $ | 1,041 |

|

| | | |

Supplemental disclosure of cash flow information | | | |

Cash paid for: | | | |

Interest, net | $ | 5,680 |

| | $ | 4,927 |

|

Supplemental disclosure of non-cash investing and financing activities: | | | |

Issuance of common shares for settlement of liabilities | $ | — |

| | $ | 125 |

|

Discount on notes payable pursuant to issuance of warrants | $ | 53 |

| | $ | 4,484 |

|

Reduction in accounts payable from settlement of Northern Offshore contingency | $ | — |

| | $ | 24,307 |

|

See accompanying notes to unaudited consolidated financial statements.

ERIN ENERGY CORPORATION

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

1. Company Description

Erin Energy Corporation (NYSE MKT: ERN; JSE: ERN) is an independent oil and gas exploration and production company engaged in the acquisition and development of energy resources in Africa. The Company’s asset portfolio consists of nine licenses across four countries covering an area of approximately 10 million acres (approximately 40,000 square kilometers ). The Company owns producing properties and conducts exploration activities offshore Nigeria, conducts exploration activities offshore Ghana and The Gambia, and both onshore and offshore Kenya.

The Company is headquartered in Houston, Texas and has offices in Lagos, Nigeria, Nairobi, Kenya, Banjul, The Gambia, Accra, Ghana and Johannesburg, South Africa.

The Company’s operating subsidiaries include Erin Petroleum Nigeria Limited (“EPNL”), Erin Energy Kenya Limited, Erin Energy Gambia Ltd., and Erin Energy Ghana Limited. The terms “we,” “us,” “our,” “the Company,” and “our Company” refer to Erin Energy Corporation and its subsidiaries.

The Company also conducts certain business transactions with its majority shareholder, CAMAC Energy Holdings Limited (“CEHL”), and its affiliates, which include Allied Energy Plc. (“Allied”). See Note 9 - Related Party Transactions for further information.

In May 2016, Dr. Kase L. Lawal retired from service as a member and Executive Chairman of the Board of Directors and Chief Executive Officer. John Hofmeister, a then current member of our Board of Directors, succeeded Dr. Lawal as the Chairman of the Board of Directors, and Segun Omidele, the Company's then Chief Operating Officer, succeeded Dr. Lawal as the Chief Executive Officer.

2. Basis of Presentation and Recently Issued Accounting Standards

The accompanying unaudited consolidated financial statements include the accounts of the Company and its wholly-owned and majority-owned direct and indirect subsidiaries, and have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”) pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). All significant intercompany transactions and balances have been eliminated in consolidation. The unaudited consolidated financial statements reflect all adjustments that are, in the opinion of management, necessary for a fair presentation of the consolidated financial position and results of operations for the indicated periods. All such adjustments are of a normal recurring nature. This Form 10-Q should be read in conjunction with our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on March 24, 2016.

Use of Estimates

The preparation of the Company's consolidated financial statements in conformity with U.S. GAAP requires management to make estimates based on certain assumptions. Estimates affect the reported amounts of assets and liabilities, disclosure of contingent liabilities, and the reported amounts of revenues and expenses attributable to the reporting periods. Accordingly, accounting estimates in conformity with U.S. GAAP require the exercise of judgment. These estimates and assumptions used in the preparation of the Company’s consolidated financial statements are based on information available as of the date of the consolidated financial statements, and while management believes that the estimates and assumptions are appropriate, actual results could differ from management's estimates.

Estimates that may have a significant effect on the Company’s financial position and results from operations include share-based compensation assumptions, oil and natural gas reserve quantities, impairments, depletion and amortization relating to oil and natural gas properties, asset retirement obligation assumptions, and income taxes. The accounting estimates used in the preparation of the Company's consolidated financial statements may change as new events occur, more experience is acquired, additional information is obtained and our operating environment changes.

Capitalized Interest

The Company capitalizes interest costs for qualifying oil and gas properties. The capitalization period begins when expenditures are incurred on qualified properties, activities begin which are necessary to prepare the property for production, and interest costs have been incurred. The capitalization period continues as long as these events occur. Capitalized interest is added to the cost of

ERIN ENERGY CORPORATION

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

the underlying assets and is depleted using the unit-of-production method in the same manner as the underlying assets.

During the six months ended June 30, 2016 and 2015, the Company capitalized nil and $2.2 million, respectively, in interest cost as additions to property, plant and equipment related to the Oyo field redevelopment campaign.

Treasury Stock

Treasury stock is reported at cost and is included in the accompanying consolidated balance sheets. Pursuant to the Company’s withholding tax policy with respect to vested restricted stock awards, the Company may withhold, on a cashless basis, a number of shares needed to settle statutory withholding tax requirements. During the six months ended June 30, 2016, 84,185 shares were withheld for taxes at a total cost of $0.2 million. The Company had no treasury stock withheld for taxes during the six months ended June 30, 2015.

The following table sets forth certain information with respect to the withholding and related repurchases of our common stock during the quarter ended June 30, 2016.

|

| | | | | | |

| Total Number of

Shares Purchased (1) | | Average Price

Paid Per Share |

January 1 - January 31, 2016 | 3,643 |

| | $ | 4.02 |

|

February 1 - February 29, 2016 | 62,152 |

| | 2.16 |

|

March 1 - March 31, 2016 | 17,318 |

| | 2.31 |

|

May 1 - May 31, 2016 | 1,072 |

| | $ | 2.48 |

|

Total | 84,185 |

| | $ | 2.28 |

|

|

| |

(1) | All shares repurchased were surrendered by employees to settle tax withholding obligations upon the vesting of restricted stock awards. |

Net Earnings (Loss) Per Common Share

Basic net earnings or loss per common share is computed by dividing net earnings or loss by the weighted average number of shares of common stock outstanding at the end of the reporting period. Diluted net earnings or loss per share is computed by dividing net earnings or loss by the fully dilutive common stock equivalent, which consists of shares outstanding, augmented by potentially dilutive shares issuable upon the exercise of the Company's stock options, stock warrants, non-vested restricted stock awards, and conversion of the Convertible Subordinated Note, calculated using the treasury stock method.

The table below sets forth the number of stock options, stock warrants, non-vested restricted stock, and shares issuable upon conversion of the Convertible Subordinated Note that were excluded from dilutive shares outstanding during the three and six months ended June 30, 2016 and 2015, as these securities are anti-dilutive because the Company was in a loss position during each period.

|

| | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

(In thousands) | 2016 | | 2015 | | 2016 | | 2015 |

Stock options | 183 |

| | 1,476 |

| | 250 |

| | 1,119 |

|

Stock warrants | 1 |

| | 1,046 |

| | — |

| | 426 |

|

Unvested restricted stock awards | 1,993 |

| | 1,348 |

| | 1,769 |

| | 1,324 |

|

Convertible note | — |

| | 11,632 |

| | — |

| | — |

|

| 2,177 |

| | 15,502 |

| | 2,019 |

| | 2,869 |

|

Upon the occurrence of certain events, the Company is also contingently liable to make additional payments to Allied, under a Transfer Agreement entered into in November 2013 by the Company, its affiliates and Allied (the “Transfer Agreement”), up to an additional amount totaling $50.0 million in cash, or the equivalent in shares of the Company’s common stock, at Allied’s option. See Note 10 - Commitments and Contingencies for further information.

ERIN ENERGY CORPORATION

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Fair Value Measurements

Fair value is defined as the amount at which an asset (or liability) could be bought (or incurred) or sold (or settled) in an orderly transaction between market participants at the measurement date. The established framework for measuring fair value establishes a fair value hierarchy based on the quality of inputs used to measure fair value, and includes certain disclosure requirements. Fair value estimates are based on either (i) actual market data or (ii) assumptions that other market participants would use in pricing an asset or liability, including estimates of risk.

There are three levels of valuation hierarchy for disclosure of fair value measurements. The valuation hierarchy categorizes assets and liabilities measured at fair value into one of three different levels depending on the observability of the inputs employed in the measurement. The three levels are defined as follows:

| |

Level 1 - | Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities. The Company considers active markets as those in which transactions for the assets or liabilities occur in sufficient frequency and volume to provide pricing information on an on-going basis. |

| |

Level 2 - | Quoted prices in markets that are not active, or inputs which are observable, either directly or indirectly, for substantially the full term of the asset or liability. Substantially all of these inputs are observable in the marketplace throughout the term, can be derived from observable data, or supported by observable levels at which transactions are executed in the marketplace. |

| |

Level 3 - | Inputs that are unobservable and significant to the fair value measurement (including the Company’s own assumptions in determining fair value). |

The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the asset or liability.

Fair Value of Financial Instruments

The carrying amounts of the Company’s financial instruments, which include cash and cash equivalents, restricted cash, accounts receivable, inventory, deposits, accounts payable and accrued liabilities, and debt at floating interest rates, approximate their fair values at June 30, 2016 and December 31, 2015, respectively, principally due to the short-term nature, maturities or nature of interest rates of the above listed items.

Reclassification

Certain reclassifications have been made to the 2015 consolidated financial statements to conform to the 2016 presentation. These reclassifications were not material to the accompanying consolidated financial statements.

Recently Issued Accounting Standards

In February 2016, the FASB issued ASU No. 2016-2, Leases (Topic 842). ASU 2016-2 is aimed at making leasing activities more transparent and comparable, and requires substantially all leases be recognized by lessees on their balance sheet as a right-of-use asset and corresponding lease liability, including leases currently accounted for as operating leases. ASU 2016-2 is effective for the Company in the fiscal year beginning after December 15, 2018, and interim periods within those fiscal years with early adoption permitted. The Company is still evaluating the impact of the adoption of this standard on its financial statements.

In March 2016, the FASB issued ASU No. 2016-07, Investments-Equity Method and Joint Ventures (Topic 323): Simplifying the Transition to the Equity Method of Accounting. ASU No. 2016-07 eliminates the requirement to retroactively adopt the equity method of accounting. ASU No. 2016-07 is effective for interim and annual periods beginning after December 15, 2016, and the Company will adopt this standards update, as required, beginning with the first quarter of 2017. The adoption of this standards update is not expected to have a material impact on the Company’s consolidated financial statements.

In March 2016, the FASB issued ASU No. 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Consideration (Reporting Revenue Gross versus Net). ASU No. 2015-08 requires that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. ASU No. 2016-08 is effective for interim and annual periods beginning after

ERIN ENERGY CORPORATION

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

December 15, 2017, and the Company will adopt this standards update, as required, beginning with the first quarter of 2018. The adoption of this standards update is not expected to have a material impact on the Company’s consolidated financial statements.

In March 2016, the FASB issued ASU No. 2016-09, Compensation-Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting. The areas of simplification in ASU No. 2016-09 involve several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. ASU No. 2016-09 is effective for interim and annual periods beginning after December 15, 2016, and the Company will adopt this standards update, as required, beginning with the first quarter of 2017. The adoption of this standards update is not expected to have a material impact on the Company’s consolidated financial statements.

In April 2016, the FASB issued ASU No. 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing. ASU No. 2016-10 clarifies two aspects of Topic 606: identifying performance obligations and the licensing implementation guidance, while retaining the related principles for those areas. ASU No. 2016-10 is effective for interim and annual periods beginning after December 15, 2017, and the Company will adopt this standards update, as required, beginning with the first quarter of 2018. The adoption of this standards update is not expected to have a material impact on the Company’s consolidated financial statements.

In May 2016, the FASB issued ASU No. 2016-11, Revenue Recognition (Topic 605) and Derivatives and Hedging (Topic 815): Rescission of SEC Guidance Because of Accounting Standards Updates 2014-09 and 2014-16 Pursuant to Staff Announcements at the March 3, 2016 EITF Meeting. ASU No. 2016-11 rescinds SEC Staff Observer comments that are codified in Topic 605, Revenue Recognition, and Topic 932, Extractive Activities - Oil and Gas, effective upon adoption of Topic 606. ASU No. 2016-11 is effective for interim and annual periods beginning after December 15, 2017, and the Company will adopt this standards update, as required, beginning with the first quarter of 2018. The adoption of this standards update is not expected to have a material impact on the Company’s consolidated financial statements.

In May 2016, the FASB issued ASU No. 2016-12, Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients. The core principle of ASU No. 2016-12 is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. ASU No. 2016-12 is effective for interim and annual periods beginning after December 15, 2017, and the Company will adopt this standards update, as required, beginning with the first quarter of 2018. The adoption of this standards update is not expected to have a material impact on the Company’s consolidated financial statements.

Adoption of Previously Issued ASUs

In April 2015, the FASB issued ASU 2015-03, Interest - Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs, which requires that debt issuance costs be presented as a direct deduction from the carrying amount of the related debt liability, consistent with the presentation of debt discounts. Prior to the issuance of ASU 2015-03, the Company recorded and presented debt issuance costs as part of prepaids and other current assets, separate from the related debt liability. ASU 2015-03 does not change the recognition and measurement requirement for debt issuance costs. The adoption of ASU 2015-03 resulted in the reclassification of approximately $1.6 million unamortized debt issuance costs related to the Company's Term Loan Facility (see Note 8 - Debt) from prepaids and other current assets to current portion of long-term debt within its consolidated balance sheets as of December 31, 2015. Other than this reclassification, the adoption of ASU 2015-03 did not have an impact on the Company's consolidated financial statements.

3. Liquidity Matters and Going Concern

The Company incurred losses from operations for the three and six months ended June 30, 2016. As of June 30, 2016, the Company's total current liabilities of $275.7 million exceeded its total current assets of $18.5 million, resulting in a working capital deficit of $257.2 million. As a result of the current low commodity prices and the Company’s low oil production volumes due to the recent mechanical problem which was resolved earlier in the year associated with well Oyo-8, the Company has not been able to generate sufficient cash from operations to satisfy certain obligations as they became due.

Well Oyo-7 is currently shut-in as a result of an emergency shut-in of the Oyo field production that occurred in early July of this year. This has resulted in a loss of approximately 1,400 BOPD. The Company is currently evaluating various technical options to optimize economic results from the Oyo field, including but not limited to, attempting a nitrogen lifting exercise to bring back production on well Oyo-7.

ERIN ENERGY CORPORATION

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

The Company is currently pursuing a number of actions, including (i) obtaining additional funds through public or private financing sources, (ii) restructuring existing debts from lenders, (iii) obtaining forbearance of debt from trade creditors, (iv) reducing ongoing operating costs, (v) minimizing projected capital costs for the 2016 exploration and development campaign and (vi) farming-out a portion of our rights to certain of our oil and gas properties. There can be no assurances that sufficient liquidity can be raised from one or more of these actions or that these actions can be consummated within the period needed to meet certain obligations.

The Company's consolidated financial statements have been prepared under the assumption that it will continue as a going concern, which assumes the continuity of operations, the realization of assets and the satisfaction of liabilities as they come due in the normal course of business. Although the Company believes that it will be able to generate sufficient liquidity from the measures described above, its current circumstances raise substantial doubt about its ability to continue to operate as a going concern. The accompanying consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

4. Property, Plant and Equipment

Property, plant and equipment were comprised of the following:

|

| | | | | | | |

(In thousands) | June 30,

2016 | | December 31, 2015 |

Wells and production facilities | $ | 328,787 |

| | $ | 329,133 |

|

Proved properties | 386,196 |

| | 386,196 |

|

Work in progress and exploration inventory | 66,822 |

| | 65,043 |

|

Oilfield assets | 781,805 |

| | 780,372 |

|

Accumulated depletion | (462,874 | ) | | (442,481 | ) |

Oilfield assets, net | 318,931 |

| | 337,891 |

|

Unevaluated leaseholds | 10,440 |

| | 10,440 |

|

Oil and gas properties, net | 329,371 |

| | 348,331 |

|

| | | |

Other property and equipment | 3,092 |

| | 2,963 |

|

Accumulated depreciation | (2,069 | ) | | (1,789 | ) |

Other property and equipment, net | 1,023 |

| | 1,174 |

|

| | | |

Total property, plant and equipment, net | $ | 330,394 |

| | $ | 349,505 |

|

All of the Company’s oilfield assets are located offshore Nigeria in the Oil Mining Leases 120 and 121 (the "OMLs"). “Work-in-progress and exploration inventory” includes suspended costs for wells that are not yet completed, as well as warehouse inventory items purchased as part of the redevelopment plan of the Oyo field.

The Company’s unevaluated leasehold costs include costs to acquire the rights to the exploration acreage in its various oil and gas properties.

5. Suspended Exploratory Well Costs - Work in Progress

In November 2013, the Company achieved both its primary and secondary drilling objectives for the well Oyo-7. The primary drilling objective was to establish production from the existing Pliocene reservoir. The secondary drilling objective was to confirm the presence of hydrocarbons in the deeper Miocene formation. Hydrocarbons were encountered in three Miocene intervals totaling approximately 65 feet, as interpreted by the logging-while-drilling (“LWD”) data. Plans are underway to secure a rig to drill at least one exploration well in the nearby G-Prospect. The primary objective of the G-Prospect is to target the same Miocene-age sediments as the ones found in the Oyo-7 exploratory drilling objective. Suspended exploratory well costs were $26.5 million at both June 30, 2016 and December 31, 2015 for the costs related to the Miocene exploratory drilling activities.

In August 2014, the Company drilled well Oyo-8 to a total vertical depth of approximately 6,059 feet (approximately 1,847 meters) and successfully encountered four new oil and gas reservoirs in the eastern fault block, with total gross hydrocarbon thickness of 112 feet, based on results from the LWD data, reservoir pressure measurement, and reservoir fluid sampling. Management has completed a detailed evaluation of the results and has future development plans in the area. Suspended exploratory well costs were $6.5 million at both June 30, 2016 and December 31, 2015 for the costs related to the Pliocene exploration drilling activities in the eastern fault block.

ERIN ENERGY CORPORATION

(formerly CAMAC ENERGY INC.)

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

6. Accounts Payable and Accrued Liabilities

The table below sets forth a summary of the Company’s accounts payable and accrued liabilities at June 30, 2016 and December 31, 2015:

|

| | | | | | | |

(In thousands) | June 30, 2016 | | December 31, 2015 |

Accounts payable - vendors | $ | 175,417 |

| | $ | 153,085 |

|

Amounts due to government entities

| 62,059 |

| | 53,119 |

|

Accrued interest | 2,497 |

| | 2,510 |

|

Accrued payroll and benefits | 1,078 |

| | 629 |

|

Other liabilities | 982 |

| | 3,777 |

|

| $ | 242,033 |

| | $ | 213,120 |

|

7. Asset Retirement Obligations

The Company’s asset retirement obligations primarily represent the estimated fair value of the amounts that will be incurred to plug, abandon and remediate its producing properties at the end of their productive lives. Significant inputs used in determining such obligations include, but are not limited to, estimates of plugging and abandonment costs, estimated future inflation rates and changes in property lives. The inputs used in the fair value determination were based on Level 3 inputs, which were essentially management's assumptions.

On a quarterly basis, the Company reviews the assumptions used to estimate the expected cash flows required to settle the asset retirement obligations, including changes in estimated probabilities, amounts and timing of the settlement of the asset retirement obligations, as well as changes in the legal obligation for each of its properties. Changes in any one or more of these assumptions may cause revisions in the estimated liabilities for the corresponding assets. The following summarizes changes in the Company’s asset retirement obligations during the six months ended June 30, 2016 (in thousands):

|

| | | |

Balance at January 1, 2016 | $ | 20,609 |

|

Accretion expense | 913 |

|

Balance at June 30, 2016 | $ | 21,522 |

|

8. Debt

Short-Term Debt:

Short-Term Borrowing - TOTSA Advance

In May 2016, the Company received $4.7 million as an advance under a prepayment agreement with TOTSA Total Oil Trading SA ("TOTSA")(the “May Advance”). Interest accrued on the May Advance at the rate of the 60-day LIBOR plus 5% per annum. Repayment of the May Advance was made from proceeds received from the June crude oil lifting.

Short-Term Note Payable

In June 2016, the Company borrowed approximately $0.5 million under a 30-day Promissory Note agreement entered into with a Nigerian bank (the “2016 Short-Term Note”), and had a facility flat fee of 2.5%. As of June 30, 2016, the Company recognized an unrealized foreign currency gain of $0.1 million, reducing the balance under the 2016 Short-Term Note to $0.4 million. The 2016 Short-Term Note was renewed for another 30 days in July 2016 at a flat fee facility rate of 2.5%, and was fully repaid in July 2016.

Long-Term Debt- Term Loan Facility:

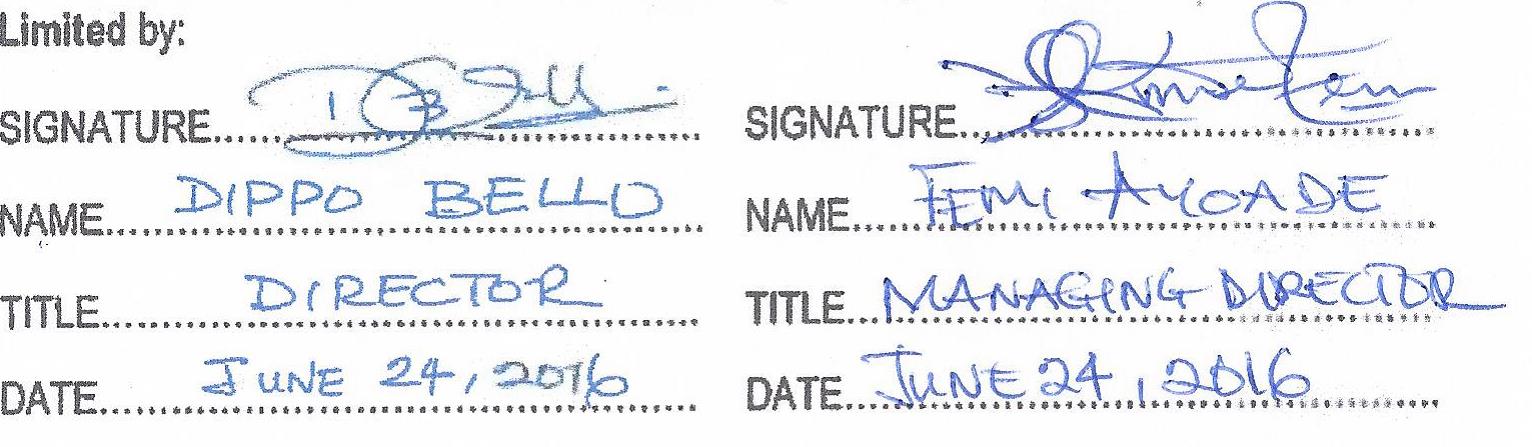

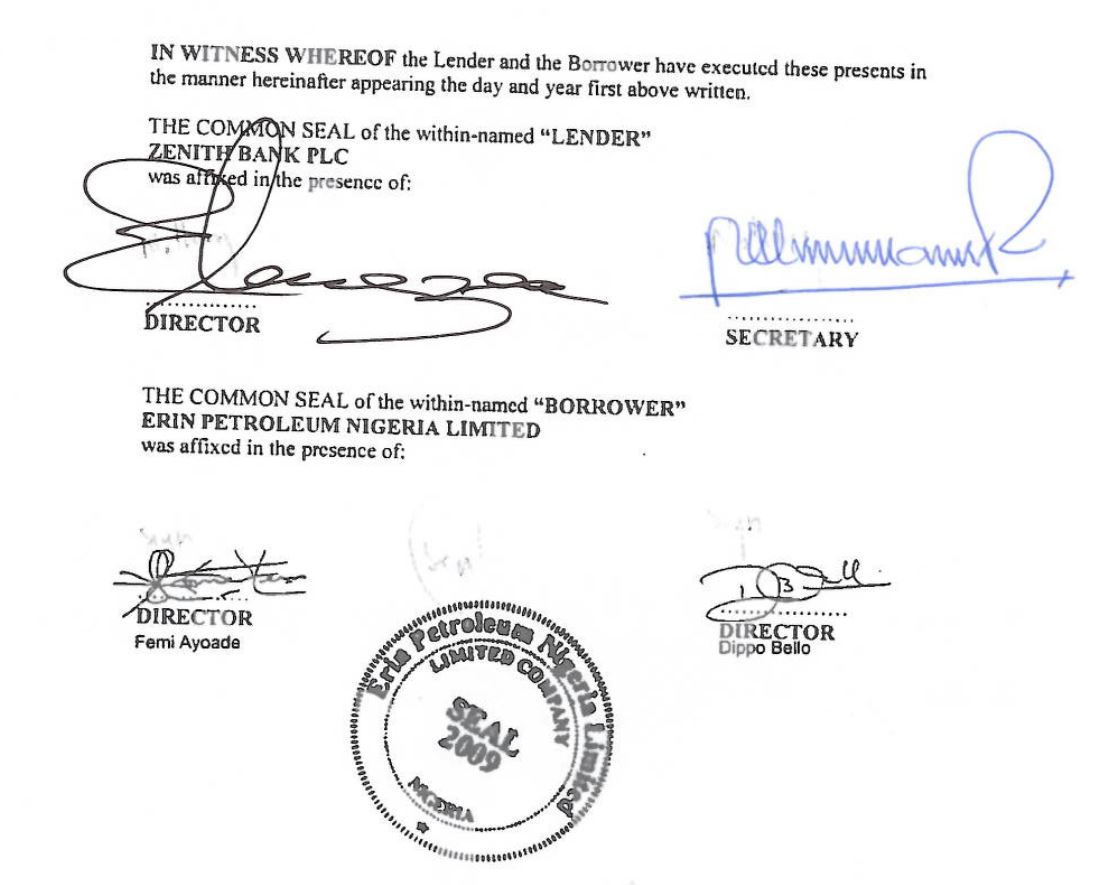

In September 2014, the Company, through its wholly owned subsidiary EPNL, entered into the Term Loan Facility with Zenith Bank PLC ("Zenith"). 90.0% of the Term Loan Facility was available in U.S. dollars, while the remaining 10% was available in

ERIN ENERGY CORPORATION

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Nigerian Naira. U.S. dollar borrowings under the Term Loan Facility currently bear interest at the rate of 11.1%. The obligations under the Term Loan Facility include a legal charge over the OMLs and an assignment of proceeds from oil sales. The obligations of EPNL have been guaranteed by the Company and rank in priority with all its other obligations. Proceeds from the Term Loan Facility were used for the further expansion and development of the Oyo field offshore Nigeria.

In June 2016, the Term Loan Facility was modified contingent upon the signing of a loan agreement, which was signed in August 2016. The modification put in place a twelve month moratorium on principal payments and extended the term of the Term Loan Facility until February 2021. Additionally, it reduced the funding requirement of the debt service reserve account (“DSRA”) to an amount equal to one quarter of interest until the price of oil exceeds $55 per barrel, at which time an amount equal to two quarters of interest will then be required.

Upon executing the Term Loan Facility, the Company paid fees totaling $2.6 million. Upon modification of the Term Loan Facility, additional fees of $1.4 million were incurred. These fees were recorded as debt issuance cost and are being amortized over the life of the Term Loan Facility using the effective interest method. As of June 30, 2016, $2.6 million of the debt issuance costs remained unamortized.

Under the Term Loan Facility, the following events, among others, constitute events of default: EPNL failing to pay any amounts due within thirty days of the due date; bankruptcy, insolvency, liquidation or dissolution of EPNL; a material breach of the Loan Agreement by EPNL that remains unremedied within thirty days of written notice by EPNL; or a representation or warranty of EPNL proves to have been incorrect or materially inaccurate when made. Upon any event of default, all outstanding principal and interest under any loans will become immediately due and payable.

As of June 30, 2016, the Company was out of compliance with the DSRA funding requirement. This was brought into compliance in July 2016 with the Company making the required deposit.

Further, Zenith has the right to review the terms and conditions of the Term Loan Facility.

During the six months ended June 30, 2016, the Company made payments of $0.4 million and $5.6 million for the principal repayment of the Naira portion of the loan due on March 31, 2016 and for the U.S. dollar principal that was due as of December 31, 2015, respectively.

As of June 30, 2016, the Company recognized an unrealized foreign currency gain of $3.9 million on the Naira portion of the loan, reducing the balance under the Term Loan Facility to $87.2 million, net of debt discount. Of this amount, $83.4 million was classified as long-term and $3.8 million as short-term. Accrued interest for the Term Loan Facility was $2.5 million as of June 30, 2016. Scheduled principal repayments on the outstanding balance on the Term Loan Facility are as follows (in thousands):

|

| | | |

Scheduled payments by year | Principal |

2016 | $ | — |

|

2017 | 13,475 |

|

2018 | 19,764 |

|

2019 | 21,561 |

|

2020 and thereafter | 35,036 |

|

Total principal payments | 89,836 |

|

Less: Unamortized debt issuance costs | 2,593 |

|

Total Term Loan Facility, net | $ | 87,243 |

|

Long-Term Debt – Related Party:

As of June 30, 2016, the Company’s long-term related party debt was $127.5 million, consisting of $24.9 million owed under a 2011 Promissory Note, $50.0 million owed under a 2014 Convertible Subordinated Note, $46.9 million, net of discount, owed under a 2015 Convertible Note, and $5.7 million owed under a 2016 Promissory Note.

Allied, a related party, is the holder of each of the 2011 Promissory Note, the 2014 Convertible Subordinated Note, and the 2015 Convertible Note (collectively the "Allied Notes"). Each of the Allied Notes contains certain default and cross-default provisions,

ERIN ENERGY CORPORATION

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

including failure to pay interest and principal amounts when due and default under other indebtedness. As of June 30, 2016, the Company was not in compliance with certain default provisions of the Allied Notes with respect to the payment of quarterly interest. Further, the risk of cross-default exists for each of the Allied Notes if the holder of the Term Loan Facility exercises its right to terminate the Term Loan Facility and accelerate its maturity. Allied has agreed to waive its rights under all default provisions of each of the Allied Notes through July 2017.

2011 Promissory Note

The Company has a $25.0 million borrowing facility under a Promissory Note (the “2011 Promissory Note”) with Allied. Interest accrues on the outstanding principal under the 2011 Promissory Note at a rate of the 30-day LIBOR plus 2% per annum, payable quarterly. In October 2015, the 2011 Promissory Note was amended to extend the maturity date by one year to July 30, 2017. The stock of the Company’s subsidiary that holds the exploration licenses in The Gambia and Kenya were pledged as collateral to secure the 2011 Promissory Note, pursuant to an Equitable Share Mortgage arrangement. The entire $25.0 million facility amount can be utilized for general corporate purposes. As of June 30, 2016, the outstanding principal and accrued interest under the 2011 Promissory Note were $24.9 million and $1.2 million, respectively.

2014 Convertible Subordinated Note

As partial consideration in connection with the February 2014 acquisition of the Allied Assets, the Company issued a $50.0 million Convertible Subordinated Note in favor of Allied (the “2014 Convertible Subordinated Note”). Interest on the 2014 Convertible Subordinated Note accrues at a rate per annum of one-month LIBOR plus 5%, payable quarterly in cash until the maturity of the 2014 Convertible Subordinated Note five years from the closing of the Allied Transaction.

At the election of the holder, the 2014 Convertible Subordinated Note is convertible into shares of the Company’s common stock at an initial conversion price of $4.2984 per share, subject to anti-dilution adjustments. The 2014 Convertible Subordinated Note is subordinated to the Company’s existing and future senior indebtedness and is subject to acceleration upon an Event of Default (as defined in the 2014 Convertible Subordinated Note). The following events, among others, constitute an Event of Default under the 2014 Convertible Subordinated Note: the Company failing to pay interest within thirty days of the due date; the Company failing to pay principal when due; bankruptcy, insolvency, liquidation or dissolution of the Company; a material breach of the 2014 Convertible Subordinated Note by the Company that remains unremedied within ten days of such material breach; or a representation or warranty of the Company proves to have been incorrect or materially inaccurate when made. Upon any event of default, all outstanding principal and interest under any loans will become immediately due and payable. As of June 30, 2016, the Company owed $6.7 million in interest under the 2014 Convertible Subordinated Note.

The Company may, at its option, prepay the 2014 Convertible Subordinated Note in whole or in part, at any time, without premium or penalty. Further, the 2014 Convertible Subordinated Note is subject to mandatory prepayment upon (i) the Company’s issuance of capital stock or incurrence of indebtedness, the proceeds of which the Company does not apply to repayment of senior indebtedness or (ii) any capital markets debt issuance to the extent the net proceeds of such issuance exceed $250.0 million. Allied may assign all or any part of its rights and obligations under the 2014 Convertible Subordinated Note to any person upon written notice to the Company. As of June 30, 2016, the outstanding principal under the 2014 Convertible Subordinated Note was $50.0 million.

2015 Convertible Note

In March 2015, the Company entered into a new borrowing facility with Allied in the form of a Convertible Note (the “2015 Convertible Note”), allowing the Company to borrow up to $50.0 million for general corporate purposes. In March 2016, the maturity date of the 2015 Convertible Note was extended to December 2017. Interest accrues at the rate of LIBOR plus 5%, and is payable quarterly.

The 2015 Convertible Note is convertible into shares of the Company’s common stock upon the occurrence and continuation of an event of default, at the sole option of the holder. The number of shares issuable upon conversion is equal to the sum of the principal amount and the accrued and unpaid interest divided by the conversion price, defined as the volume weighted average of the closing sales prices on the NYSE MKT for a share of common stock for the five complete trading days immediately preceding the conversion date.

ERIN ENERGY CORPORATION

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

During the three months ended June 30, 2016, the Company borrowed an additional $0.5 million under the 2015 Convertible Note and issued to Allied warrants to purchase approximately 48,291 shares of the Company's common stock with an exercise price of ranging from $2.00 to $2.13 per share with a total fair value of approximately $0.1 million.

As of June 30, 2016, the Company had borrowed $48.5 million under the note and issued to Allied warrants to purchase approximately 2.7 million shares of the Company’s common stock at prices ranging from $2.00 to $7.85 per share. The total fair market value of the warrants amounting to $5.0 million based on the Black-Scholes option pricing model was recorded as a debt discount, and is being amortized using the effective interest method over the life of the note. As of June 30, 2016, the unamortized balance of the discount was $1.6 million.

Additional warrants are issuable in connection with future borrowings, with the per share price for those warrants determined based on the market price of the Company’s common stock at the time of such future borrowings. As of June 30, 2016, the outstanding balance of the 2015 Convertible Note, net of discount, was $46.9 million. Accrued interest on the 2015 Convertible Note was $3.4 million as of June 30, 2016.

2016 Promissory Note

In March 2016, the Company borrowed $3.0 million under a short-term Promissory Note agreement entered into with an entity related to the Company's majority shareholder, which accrued interest at a rate of the 30-day LIBOR plus 7% per annum.

In April 2016, the Company borrowed an additional sum of $1.0 million from the same lender, under another short-term Promissory Note, which also accrued interest at a rate of the 30-day LIBOR plus 7% per annum.

In May 2016, the Lender of the two Promissory Notes agreed to combine both notes into a $10.0 million borrowing facility (the "2016 Promissory Note") with a maturity date of September 2017. Interest accrues at a rate of the 30-day LIBOR plus 7% per annum.

During May and June 2016, the Company had additional drawings under the 2016 Promissory Note totaling $1.7 million. As of June 30, 2016, the outstanding balance under the 2016 Promissory Note was $5.7 million. Accrued interest on the 2016 Promissory Note was $0.1 million as of June 30, 2016.

In August 2016, the Company had an additional drawing under the 2016 Promissory Note amounting to $0.5 million.

9. Related Party Transactions

Assets and Liabilities

The Company has transactions in the normal course of business with its shareholders, CEHL and their affiliates. The following table sets forth the related party assets and liabilities as of June 30, 2016 and December 31, 2015:

|

| | | | | | | |

(In thousands) | June 30,

2016 | | December 31, 2015 |

Accounts receivable, CEHL | $ | 1,732 |

| | $ | 1,186 |

|

Accounts payable and accrued liabilities, CEHL | $ | 29,465 |

| | $ | 30,133 |

|

Long-term notes payable - related party, CEHL | $ | 127,517 |

| | $ | 120,006 |

|

As of June 30, 2016 and December 31, 2015, the related party receivable balances of $1.7 million and $1.2 million, respectively, were for advance payments made for certain transactions on behalf of affiliates.

As of June 30, 2016 and December 31, 2015, the Company owed $29.5 million and $30.1 million, respectively, to affiliates primarily for logistical and support services in relation to the Company's oilfield operations in Nigeria, as well as accrued interest on the various related party notes payable. As of June 30, 2016 and December 31, 2015, accrued and unpaid interest on the various related party notes payable were $11.7 million and $8.3 million, respectively.

As of June 30, 2016, the Company had a combined note payable balance of $127.5 million owed to affiliates, consisting of a $50.0 million 2014 Convertible Subordinated Note, $24.9 million in borrowings under the 2011 Promissory Note, a $46.9 million borrowing under the 2015 Convertible Note, net of discount, and $5.7 million under the 2016 Promissory Note. As of December 31, 2015, the Company had a combined note payable balance of $120.0 million owed to an affiliate, consisting of the $50.0 million

ERIN ENERGY CORPORATION

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

2014 Convertible Subordinated Note, $25.0 million in borrowings under the 2011 Promissory Note, and $45.0 million borrowing under the 2015 Convertible Note, net of discount. See Note 8 – Debt for further information relating to the notes payable transactions.

Results from Operations

The table below sets forth a summary of transactions included in the Company's results of operations that were incurred with affiliates during the three and six months ended June 30, 2016 and 2015:

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

(In thousands) | 2016 | | 2015 | | 2016 | | 2015 |

Total operating expenses, CEHL | $ | 2,336 |

| | $ | 2,967 |

| | $ | 4,019 |

| | $ | 4,923 |

|

Interest expense, CEHL | $ | 1,786 |

| | $ | 1,389 |

| | $ | 3,462 |

| | $ | 2,421 |

|

Certain affiliates of the Company provide procurement and logistical support services to the Company’s operations. In connection therewith, during the three months ended June 30, 2016 and 2015, the Company incurred operating costs amounting to approximately $2.3 million and $3.0 million, respectively, and during the six months ended June 30, 2016 and 2015, the Company incurred operating costs amounting to approximately $4.0 million and $4.9 million, respectively

During the three months ended June 30, 2016 and 2015, the Company incurred interest expense, excluding debt discount amortization, totaling approximately $1.8 million and $1.4 million, respectively, in relation to related party notes payable. During the six months ended June 30, 2016 and 2015, the Company incurred interest expense totaling approximately $3.5 million and $2.4 million, respectively.

10. Commitments and Contingencies

Commitments

In February 2014, a long-term contract was signed for the floating, production, storage, and offloading vessel (“FPSO”) Armada Perdana, which is the vessel currently connected to the Company’s productive wells, Oyo-7 and Oyo-8, offshore Nigeria. The contract provides for an initial term of seven years beginning January 1, 2014, with an automatic extension for an additional term of two years unless terminated by the Company with prior notice. The FPSO can process up to 40,000 barrels of liquid per day, with a storage capacity of approximately one million barrels. The annual minimum contractual commitment per the terms of the agreement is approximately $48.4 million per year through 2020.

The Company also has commitments related to four production sharing contracts with the Government of the Republic of Kenya (the “Kenya PSCs”), two Petroleum Exploration, Development & Production Licenses with the Republic of The Gambia (the “Gambia Licenses”), and one Petroleum Agreement with the Republic of Ghana. In all cases, the Company entered into these commitments through a subsidiary. To maintain compliance and ownership, the Company is required to fulfill certain minimum work obligations and to make certain payments as stated in each of the Kenya PSCs, the Gambia Licenses, and the Ghana Petroleum Agreement.

Contingencies

Legal Contingencies and Proceedings

From time to time, the Company may be involved in various legal proceedings and claims in the ordinary course of business. As of June 30, 2016, and through the filing date of this report, the Company does not believe the ultimate resolution of such actions or potential actions of which the Company is currently aware will have a material effect on its consolidated financial position or results of operations.

On January 22, 2016, a request for arbitration was filed with the London Court of International Arbitration by Transocean Offshore Gulf of Guinea VII Limited and Indigo Drilling Limited, as Claimants, against the Company and its Nigerian subsidiary, Erin Petroleum Nigeria Limited (fka CAMAC Petroleum Limited), as Respondents (the “Arbitration”). The Arbitration is in relation to a drilling contract entered into by the Claimants and CAMAC Petroleum Limited, and a parent company guarantee provided by the Company in relation thereto. The Claimants are seeking an order that the Respondents pay the sum of approximately $20.2 million together with interest and costs. The parties are in the process of trying to settle this matter and have agreed to extend deadlines in the Arbitration pending resolution of a settlement.

ERIN ENERGY CORPORATION

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

On February 5, 2016, a class action and derivative complaint was filed in the Delaware Chancery Court purportedly on behalf of the Company and on behalf of a putative class of persons who were stockholders as of the date the Company (1) acquired the Allied Assets pursuant to the Transfer Agreement and (2) issued shares to the PIC in a private placement (collectively the “February 2014 Transactions”). The complaint alleges the February 2014 Transactions were unfair to the Company and purports to assert derivative claims against (1) the seven individuals who served on our Board at the time of the February 2014 Transactions and (2) our majority shareholder, CEHL. The complaint also purports to assert a direct breach of fiduciary duty claim on behalf of the putative class against the seven individuals who served on our Board at the time of the February 2014 Transactions on the grounds that they purportedly caused the Company to disseminate a false and misleading proxy statement in connection with the February 2014 Transactions, and a direct claim for aiding and abetting against Dr. Lawal. The plaintiff is seeking, on behalf of the Company and the putative class, an undisclosed amount of compensatory damages. The Company is named solely as a nominal defendant against whom the plaintiff seeks no recovery. On March 3, 2016, all of the defendants, including the Company, filed motions to dismiss the complaint. A hearing on this motion has been set for September 21, 2016.

On May 13, 2016, CEONA Contracting (UK) Limited initiated arbitration proceedings against the Company for $2.9 million, together with costs, expenses and interest, for work done in relation to the Company's ordinary course of business. The parties are in the process of finalizing a settlement agreement.

On July 29, 2016, a judgment was entered against the Company in the amount of $2.7 million, including $0.3 million interest claimed under contractual terms, in relation to amounts due to a contractor (Polarcus MC Ltd.) in the ordinary course of business.

Unrecognized Loss Contingency

As of June 30, 2016, the Company has not accrued penalty and interest related to certain outstanding transactional tax obligations in Nigeria, including withholding taxes, value-added taxes, Nigerian Oil and Gas Industry Content Development Act (NCD) tax, Cabotage taxes, and Niger Delta Development Corporation taxes (NDDC). As of the date of this report, the Company believes that, based on its experience with local practices in Nigeria, the likelihood of being assessed penalty and interest is reasonably possible, with an estimated liability up to $11.1 million.

Contingency under the Allied Transfer Agreement

As provided for under the Transfer Agreement with Allied, the Company is required to make the following additional payments upon the occurrence of certain future events: (i) $25.0 million cash or the equivalent in shares of the Company’s common stock within fifteen days following the approval of a development plan by the Nigerian Department of Petroleum Resources ("DPR") with respect to a first new discovery of hydrocarbons in a non-Oyo field area; and (ii) $25.0 million cash or the equivalent in shares of the Company’s common stock within fifteen days starting from the commencement of the first hydrocarbon production in commercial quantities in a non-Oyo field area. The number of shares to be issued shall be determined by calculating the average closing price of the Company’s common stock over a period of thirty days, counted back from the first business day immediately prior to the approval of a development plan by DPR or the date of the first hydrocarbon production in commercial quantities, as applicable.

Contingency under the 2015 Convertible Note

As part of the condition to the extension of the maturity date of the 2015 Convertible Note, which extension was entered into in March 2016, the Company is required to (i) pay to Allied an amount equal to ten percent (10%) of any successful debt fundraising event completed during the remaining term of the 2015 Convertible Note; and (ii) pay to Allied an amount equal to twenty percent (20%) of any successful equity fundraising event completed during the remaining term of the 2015 Convertible Note.

11. Stock-Based Compensation

Stock Options

The table below sets forth a summary of stock option activity for the six months ended June 30, 2016.

ERIN ENERGY CORPORATION

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

|

| | | | | | |

| Shares

Underlying

Options

(In Thousands) | | Weighted-Average

Exercise Price | | Weighted-Average

Remaining

Contractual Term

(Years) |

Outstanding at December 31, 2015 | 2,532 |

| | $2.10 | | 1.6 |

Granted | — |

| | $— | | — |

Exercised | (885 | ) | | $1.77 | | — |

Forfeited | (27 | ) | | $3.42 | | — |

Expired | (131 | ) | | $3.76 | | — |

Outstanding at June 30, 2016 | 1,489 |

| | $2.45 | | 2.0 |

Expected to vest | 1,047 |

| | $2.09 | | 1.3 |

Exercisable at June 30, 2016 | 442 |

| | $3.30 | | 3.5 |

During the six months ended June 30, 2016, the Company issued 288,841 shares of common stock as a result of the exercise of stock options, of which 194,643 shares of common stock were issued as a result of the cashless exercise of 791,165 options. Also, during the six months ended June 30, 2016, options to purchase 130,714 shares of common stock expired, and options to purchase 27,052 shares were forfeited.

Stock Warrants

The table below sets forth a summary of stock warrant activity for the six months ended June 30, 2016.

|

| | | | | | |

| Shares

Underlying

Warrants

(In Thousands) | | Weighted-Average

Exercise Price | | Weighted-Average

Remaining

Contractual Term

(Years) |

Outstanding at December 31, 2015 | 2,935 |

| | $3.61 | | 4.2 |

Granted | 48 |

| | $2.07 | | 4.8 |

Exercised | — |

| | $— | | — |

Forfeited | — |

| | $— | | — |

Expired | — |

| | $— | | — |

Outstanding at June 30, 2016 | 2,983 |

| | $3.59 | | 3.7 |

Expected to vest | — |

| | $— | | |

Exercisable at June 30, 2016 | 2,983 |

| | $3.59 | | 3.7 |

During the six months ended June 30, 2016 and in connection with the execution of the 2015 Convertible Note, the Company issued warrants to purchase 48,291 shares of the Company's common stock at exercise prices ranging from $2.00 and $2.13 per share. The warrants are exercisable at any time starting from the date of issuance and have a five-year term.

Restricted Stock Awards

The table below sets forth a summary of restricted stock awards (“RSAs”) activity for the six months ended June 30, 2016.

|

| | | | | | |

| Shares

(In Thousands) | | Weighted-Average

Grant Date Price Per Share |

Restricted Stock | | | |

Non-vested at December 31, 2015 | 1,114 |

| | $ | 3.21 |

|

Granted | 1,717 |

| | $ | 2.16 |

|

Vested | (613 | ) | | $ | 3.54 |

|

Forfeited | (75 | ) | | $ | 2.65 |

|

Non-vested as of June 30, 2016 | 2,143 |

| | $ | 2.29 |

|

During the six months ended June 30, 2016, the Company granted officers, directors, and employees a total of approximately 1.7 million shares of restricted common stock, including 0.5 million performance-based restricted stock awards ("PBRSA"), with vesting periods varying from immediate vesting to 36 months. During the same period, 74,949 shares of restricted common stock were forfeited.

ERIN ENERGY CORPORATION

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

With regards to the PBRSA, each grant will vest if the individuals remain employed three years from the date of grant and the Company achieves specific performance objectives at the end of the designated performance period. Up to 50% additional shares may be awarded if performance objectives are exceeded. None of the PBRSAs will vest if certain minimum performance goals are not met. The performance conditions are based on the Company’s total shareholder return over the performance period compared to an industry peer group of companies. Total estimated compensation expense is $0.4 million over three years.

12. Segment Information

The Company’s current operations are based in Nigeria, Kenya, The Gambia, and Ghana. Management reviews and evaluates the operations of each geographic segment separately. Operations include exploration for and production of hydrocarbons where commercial reserves have been found and developed. Revenues and expenditures are recognized at the relevant geographical location. The Company evaluates each segment based on operating income (loss).

Segment activity for the three and six months ended June 30, 2016 and 2015 are as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | |

(In thousands) | Nigeria | | Kenya | | The Gambia | | Ghana | | Corporate and Other | | Total |

Three months ended June 30, | | | | | | | | | | | |

2016 | | | | | | | | | | | |

Revenues | $ | 23,151 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 23,151 |

|

Operating loss | $ | (23,294 | ) | | $ | (509 | ) | | $ | (249 | ) | | $ | (232 | ) | | $ | (2,915 | ) | | $ | (27,199 | ) |

2015 | | | | | | | | | | | |

Revenues | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Operating income (loss) | $ | 1,211 |

| | $ | (555 | ) | | $ | (291 | ) | | $ | (655 | ) | | $ | (5,531 | ) | | $ | (5,821 | ) |

| | | | | | | | | | | |

Six months ended June 30, | | | | | | | | | | | |

2016 | | | | | | | | | | | |

Revenues | $ | 28,080 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 28,080 |

|

Operating loss | $ | (46,454 | ) | | $ | (1,051 | ) | | $ | (523 | ) | | $ | (1,118 | ) | | $ | (6,346 | ) | | $ | (55,492 | ) |

2015 | | | | | | | | | | | |

Revenues | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Operating loss | $ | (21,025 | ) | | $ | (6,106 | ) | | $ | (662 | ) | | $ | (949 | ) | | $ | (9,110 | ) | | $ | (37,852 | ) |

Total assets by segment as of June 30, 2016 and December 31, 2015, are as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | |

(In thousands) | Nigeria | | Kenya | | The Gambia | | Ghana | | Corporate and Other | | Total |

Total Assets | | | | | | | | | | | |

As of June 30, 2016 | $ | 339,821 |

| | $ | 1,352 |

| | $ | 3,014 |

| | $ | 3,191 |

| | $ | 1,582 |

| | $ | 348,960 |

|

As of December 31, 2015 | $ | 366,766 |

| | $ | 1,399 |

| | $ | 3,016 |

| | $ | 2,447 |

| | $ | 971 |

| | $ | 374,599 |

|

13. Subsequent Events

Subsequent to June 30, 2016, the Company issued 26,602 shares of common stock as a result of the exercise of stock options.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Our Business

Erin Energy Corporation, a Delaware corporation, is an independent oil and gas exploration and production company focused on energy resources in Africa. Our strategy is to acquire and develop high-potential exploration and production assets in Africa, and to explore and develop those assets through strategic partnerships with national oil companies, indigenous local partners and other independent oil companies. We seek to build and operate a strategic portfolio of high-impact exploration and near-term development projects with significant production, reserves and resources growth potential.

We actively manage investments and on-going operations by limiting capital exposure through farm-outs at various stages of exploration and development to share risks and costs. We prioritize on building a strong technical and operational team and place an emphasis on the utilization of modern oil field technologies that mature our assets, reduce the cost of our projects and improve the efficiency of our operations.

Our shares are traded on both the NYSE MKT and on the Johannesburg Stock Exchange ("JSE") under the symbol “ERN.”

Our asset portfolio consists of nine licenses across four countries covering an area of approximately 10 million acres (approximately 40,000 square kilometers). We own producing properties offshore Nigeria and conduct exploration activities as an operator offshore Nigeria and conduct exploration activities as an operator onshore and offshore Kenya, offshore The Gambia, and offshore Ghana.

Our operating subsidiaries include Erin Petroleum Nigeria Limited, Erin Energy Kenya Limited, Erin Energy Gambia Ltd., and Erin Energy Ghana Limited.

We conduct certain business transactions with our majority shareholder, CAMAC Energy Holdings Limited (“CEHL”) and its affiliates, which include CAMAC International Nigeria Limited (“CINL”) and Allied. See Note 9 - Related Party Transactions to the Notes to Unaudited Consolidated Financial Statements for further information.

In May 2016, Dr. Kase L. Lawal retired from service as a member and Executive Chairman of the Board of Directors and Chief Executive Officer. John Hofmeister, a then current member of our Board of Directors, succeeded Dr. Lawal as the Chairman of the Board of Directors, and Segun Omidele, our then Chief Operating Officer, succeeded Dr. Lawal as the Chief Executive Officer.

Nigeria

The Company currently owns 100% of the economic interests in the Oil Mineral Leases ("OMLs"), which include the currently producing Oyo field.

In early May 2016, with the help of a light intervention vessel, the Company successfully completed well repair operations to resolve the mechanical problem related to well Oyo-8 and successfully resumed production from the well. Combined daily production from both the Oyo-7 and Oyo-8 wells during the three months ended June 30, 2016 was approximately 6,200 BOPD (approximately 5,400 BOPD net to the Company after royalty).

Current plans include drilling a development well in the Oyo field, and drilling an exploration well in the Miocene formation of the OMLs, subject to capital and rig availability.

Kenya

In May 2012, the Company, through a wholly owned subsidiary, entered into four production sharing contracts with the Government of the Republic of Kenya, covering onshore exploration blocks L1B and L16, and offshore exploration blocks L27 and L28 (the “Kenya PSCs”). Each block requires specific work commitments to be completed by the end of the respective license periods. The Company is the operator of all blocks with the Government having the right to participate up to 20%, either directly or through an appointee, in any area subsequent to declaration of a commercial discovery. The Company is responsible for all exploration expenditures.

The Company is currently in the First Additional Exploration Period for both onshore blocks, which will last through July 2017. In accordance with the Kenya PSCs, the Company is obligated, for each block, to (i) acquire, process and interpret high density 300 square kilometer 3-D seismic data at a minimum expenditure of $12.0 million and (ii) drill one exploration well to a minimum depth of 3,000 meters at a minimum expenditure of $20.0 million. The Company plans to pursue completion of the work program and is considering the possibility of farming-out a portion of its rights to both blocks to potential partners.

In August 2015, the Company received approval from the Kenya Ministry of Energy and Petroleum for an 18-month extension of the Initial Exploration Period for offshore blocks L27 and L28, which will now last through February 2017. The remaining contractual obligation under the initial exploration period is for the Company to acquire, process and interpret 1,500 square kilometers of 3-D seismic data over both offshore blocks. The Company plans to pursue completion of the work program, and is also considering the possibility of farming-out a portion of its rights to both offshore blocks to potential partners. Upon completion of the work program, the Company has the right to apply for up to two additional two-year exploration periods, with specified additional minimum work obligations, including the acquisition of seismic data and the drilling of one exploratory well on each block during each additional period.

The Gambia

In May 2012, the Company, through a wholly owned subsidiary, signed two Petroleum Exploration, Development & Production Licenses with The Republic of The Gambia, for offshore exploration blocks A2 and A5 (the “Gambia Licenses”). For both blocks, the Company is the operator, with the Gambian National Petroleum Company (“GNPCo”) having the right to elect to participate up to a 15% interest, following approval of a development and production plan. The Company is responsible for all expenditures prior to such approval even if the GNPCo elects to participate.

The term of the initial exploration period for both blocks A2 and A5, now extended through December 2018, require for the Company to (i) complete the processing and interpretation of approximately 1,500 square kilometers of 3-D seismic data that was acquired in September 2015 and (ii) drill one exploration well on either block A2 or A5 and evaluate the drilling results. The 3-D seismic processing by an outside contractor is ongoing and is expected to be completed by the third quarter of 2016. The Company intends to pursue completion of the work program, and is also considering the possibility of farming-out a portion of its rights to both blocks to potential partners.

Ghana

In April 2014, the Company, through an indirect 50%-owned subsidiary, signed a Petroleum Agreement with the Republic of Ghana (the “Petroleum Agreement”) relating to the Expanded Shallow Water Tano block offshore Ghana ("ESWT"). The Contracting Parties, which hold 90% of the participating interest in the block, are Erin Energy Ghana Limited as the operator, GNPC Exploration and Production Company Limited, and Base Energy (collectively the “Contracting Parties”), holding 60%, 25%, and 15% share of the participating interest of the Contracting Parties, respectively. The Ghana National Petroleum Corporation initially has a 10% carried interest through the exploration phase, and will have the option to acquire an additional paying interest of up to 10% following a declaration of commercial discovery. The Company owns 50% of its subsidiary Erin Energy Ghana Limited. The remaining 50% interest is owned by an affiliate of the Company’s majority shareholder.

The ESWT block contains three previously discovered fields (the "Fields") and the work program requires the Contracting Parties to determine, within nine months of the effective date of the Petroleum Agreement, the economic viability of developing the Fields. In addition, the Petroleum Agreement provides for an initial exploration period of two years from the effective date of the Petroleum Agreement, with specified work obligations during that period, including the reprocessing of existing 2-D and 3-D seismic data and the drilling of one exploration well on the ESWT block.